|

|

市場調査レポート

商品コード

1301538

インサーキットテストの世界市場:種類別・可搬性別・用途別・地域別の将来予測 (2028年まで)In-Circuit Test Market by Type, Portability, Application, Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| インサーキットテストの世界市場:種類別・可搬性別・用途別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月30日

発行: MarketsandMarkets

ページ情報: 英文 235 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のインサーキットテストの市場規模は、2023年の12億米ドルから、2028年には14億米ドルに成長すると予測され、予測期間中のCAGRは3.6%に達する見込みです。

インサーキットテスト市場の成長には、テレビ、ノートPC、スマートフォンなどの家電製品の販売増加が含まれます。また、医療分野で使用されるスマート医療機器は、高精度の試験・測定プロセスを必要とするため、インサーキットテストの需要が増加しています。

"アナログ・インサーキットテスト:種類別で最大のセグメント"

種類別に見ると、予測期間中はアナログ・インサーキットテストが最大のセグメントとなる見込みです。アナログ・インサーキットテスターは、使いやすさと複数のパラメーターを正確に測定できることから、市場全体で大きなシェアを占めています。アナログ・インサーキットテスト市場の成長は、低コストとその応用範囲の広さに起因しています。特に中国は生産・設置台数の点で世界有数の民生用電子機器市場であるため、アナログ・インサーキットテストの需要が大きくなっています。

"可搬性別では、卓上型が予測期間中に最も急成長する"

可搬性別に見ると卓上型が、スマートフォンやテレビ、その他の家電製品向けの小型プリント基板(PCB)の需要が増加していることから、予測期間中にインサーキットテスト市場をリードすると予想されます。卓上型インサーキットテスターは、車載エレクトロニクスや産業用エレクトロニクス、民生用・軍事用・通信用などの用途で使用されています。卓上型セグメントの成長は、高度な民生用電子機器に対する需要の増加に起因しています。

"用途別では、民生用電子機器が予測期間中に最大セグメントとなる"

医療機器分野は、血糖モニター・インスリン補給装置・ネブライザー・酸素濃縮器などの家庭用機器の急速な技術進歩により、予測期間中、インサーキットテスト市場において2番目に大きなセグメントになると予想されます。医療専門家が遠隔通信技術を利用して在宅患者をサポートできることが、在宅ケアやセルフケアの選択に寄与しています。こうした動向は、今後の医療機器・検査市場を押し上げると予測されます。

"北米はインサーキットテスト市場で第2位の地域となる"

北米は予測期間中、インサーキットテスト市場で第2位の市場になると予想されます。この地域の市場は、無線通信と航空宇宙・防衛分野からの需要が牽引すると予測されています。北米では、インサーキットテスターは無線通信やネットワーク用途で広く使用され、導入されると予測されています。また、電気分野の台頭により、回路内試験装置の売上が増加するため、北米地域がインサーキットテスト市場全体の最大シェアを占めています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- エコシステムマッピング

- サプライチェーン分析

- 技術分析

- 特許分析

- 貿易分析

- 関税・法規・規制

- ポーターのファイブフォース分析

- ケーススタディ分析

- 主要な利害関係者と購入基準

- 主要な会議とイベント (2023年~2024年)

第6章 インサーキットテスト市場:種類別

- イントロダクション

- アナログ

- 混合

第7章 インサーキットテスト市場:可搬性別

- イントロダクション

- コンパクト型

- 卓上型

第8章 インサーキットテスト市場:用途別

- イントロダクション

- 民生用電子機器・家電製品

- 航空宇宙・防衛・政府サービス

- 医療機器製造

- 無線通信

- 自動車

- エネルギー

第9章 インサーキットテスト市場:地域別

- イントロダクション

- 北米

- アジア太平洋

- 欧州

- 中東・アフリカ

- 南米

第10章 競合情勢

- 概要

- 主要企業の市場シェア分析 (2022年)

- 市場評価フレームワーク (2018年~2023年)

- 上位企業の収益分析:セグメント別 (2018年~2022年)

- 競争シナリオと動向

- 企業評価マトリックス

第11章 企業プロファイル

- 主要企業

- TERADYNE INC.

- TEST RESEARCH, INC.

- KEYSIGHT TECHNOLOGIES

- HIOKI E.E. CORPORATION

- KYORITSU ELECTRIC CORPORATION

- DIGITALTEST GMBH

- SPEA S.P.A.

- KONRAD GMBH

- TESTRONICS

- CONCORD TECHNOLOGY LIMITED

- OKANO ELECTRIC CO., LTD

- S.E.I.C.A. S.P.A.

- CHECKSUM

- REINHARDT SYSTEM-UND MESSELECTRONIC GMBH

- ACCULOGIC

- その他の企業

- TEST COACH COMPANY, LLC

- SHENZHEN PTI TECHNOLOGY CO. LTD.

- VITAL ELECTRONICS & MANUFACTURING CO.

- KUTTIG ELECTRONIC GMBH

- TELIGENTEMS

第12章 付録

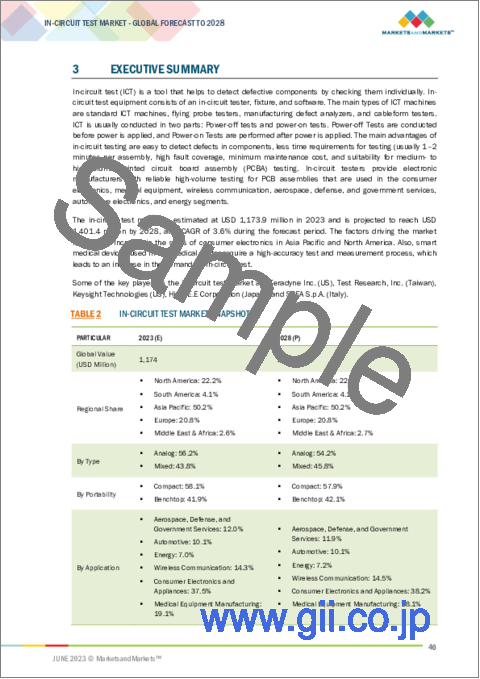

The global in-circuit test market is estimated to grow from USD 1.2 Billion in 2023 to USD 1.4 Billion by 2028; it is expected to record a CAGR of 3.6% during the forecast period. The growth of the in-circuit test market is attributed to the include the increase in the sales of consumer electronics for consumer electronics appliances such as televisions, laptops, smartphones. Also, smart medical devices used in the medical sector requires test & measurement process with high accuracy, which leads to an increase in the demand for in-circuit test.

"Analog In-Circuit Test: The largest segment of the in-circuit test market, by type "

Based on type, the in-circuit test market has been split into two types: analog in-circuit test and mixed in-circuit test. The analog in-circuit test segment is expected to be the largest segment during the forecast period. Analog in-circuit testers account for a greater share of the total in-circuit test market due to the ease of use and the accurate measurement of multiple parameters. The growth in the analog in-circuit test market is attributed to the low cost and the wide area of its application. China is the major consumer electronics industry in terms of production and deployment, thus there is significant demand of analog in-circuit test.

"Benchtop segment is expected to be the fastest growing segment during forecast period based on portability"

By portability, the in-circuit test market has been segmented into compact and benchtop. The benchtop segment is expected to lead the in-circuit test market during the forecast period owing to increasing demand for compact printed circuit boards (PCBs) for smart phones, TVs, and other home appliances. The benchtop in-circuit testers are used in applications such as automotive electronics, industrial electronics, consumer, military, and communication. The growth in the benchtop segment can be attributed to the increased demand for advanced consumer electronics.

"By application, the consumer electronics segment is expected to be the largest segment during the forecast period."

Based on application, the in-circuit test market is segmented into consumer electronics, aerospace, defense, and government services, medical equipment manufacturing, automotive, and energy sector. The Medical equipment segment is expected to be the second largest segment the in-circuit test market during the forecast period owing to the rapid technological advancements in home-use devices such as glucose monitors, insulin delivery devices, nebulizers, and oxygen concentrators. The ability of healthcare professionals to support home-based patients through the use of remote communication technologies contributes to the choice for home and self-care. These trends are projected to boost the medical equipment and testing markets in the future.

North America is expected to be the second-largest region in the in-circuit test market

North America is expected to be the second-largest in-circuit test market during the forecast period. The market in this region is expected to be driven by the demand from the wireless communications and aerospace & defense sectors. In North America, it is projected that in circuit test equipment will be widely used and implemented in wireless communication and network applications. Also, because of the rise of the electrical sector, which will increase sales of in circuit test devices, the North American area controls the largest share of the total in circuit test market.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 55%, Tier 2- 25%, and Tier 3- 20%

By Designation: C-Level- 35%, Director Levels- 30%, and Others- 35%

By Region: Europe- 35%, North America- 25%, Asia-Pacific - 25 %, South America - 10%, Middle East & Africa - 5%.

Note: Others include sales managers, engineers, and regional managers.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2022. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The in-circuit test market is dominated by a few major players that have a wide regional presence. The leading players in the in-circuit test market are Teradyne Inc. (US), Test Research Inc. (TRI) (Taiwan), Keysight Technologies (US), Hioki E.E Corporation (Japan), Kyoritsu Electric Corporation (Japan) and SPEA S.p.A. (Italy). The major strategy adopted by the players includes new product launches, contracts & agreements and, investments & expansions.

Research Coverage:

The report defines, describes, and forecasts the global in-circuit test market by type, portability, application, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the in-circuit test market.

Key Benefits of Buying the Report

- Increasing investments in the modernization of printed circuit boards projects owing to increasing demand for in circuit test is the main factor driving the in-circuit test market. Moreover, rising 5G technology and increasing adoption of cloud computing and IoT devices are expected to create lucrative opportunities for the players operating in the in-circuit test market. Testing of high-speed interfaces and reducing size of PCB are major challenges for the players, especially for emerging players, operating in the in-circuit test market.

- Product Development/ Innovation: The in-circuit test market is witnessing significant product development and innovation, driven by the growing demand for consumer electronics. Companies are investing in developing advanced in-circuit tests such as machine learning technology in in-circuit test systems. Machine Learning (ML) has made significant contributions to test pattern generation in the field of in-circuit testing. These technologies leverage the power of data analysis and intelligent algorithms to optimize test patterns, improve test coverage, and reduce test time.

- Market Development: Test data analytics and visualization are becoming increasingly important in the in-circuit test. Advancements in test data analytics and visualization techniques have transformed the interpretation and utilization of test results. These advancements enable comprehensive analysis of large datasets, identification of trends, detection of anomalies, and provision of actionable insights to improve the overall testing process.

- Market Diversification: Test Research, Inc. (Taiwan) introduced TR8100H SII high-density pin count In-Circuit Tester (ICT) with vacuum fixture for full coverage testing. The TR8100H SII is the latest version of the high-performance board test system designed for low-voltage testing and complex PCBAs.

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, like include Teradyne Inc. (US), Test Research Inc. (TRI) (Taiwan), Keysight Technologies (US), Hioki E.E Corporation (Japan), Kyoritsu Electric Corporation (Japan), and SPEA S.p.A. (Italy) among others in the in-circuit test market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- 1.4.2 REGIONAL SCOPE

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 IN-CIRCUIT TEST MARKET: RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key industry insights

- 2.2.2.2 Breakdown of primaries

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4 DEMAND-SIDE METRICS

- FIGURE 6 MAIN METRICS CONSIDERED TO CONSTRUCT AND ASSESS DEMAND FOR IN-CIRCUIT TEST

- TABLE 1 IN-CIRCUIT TEST MARKET: INDUSTRY/COUNTRY ANALYSIS

- 2.4.1 KEY PARAMETERS/TRENDS IN APPLICATIONS OF IN-CIRCUIT TESTS

- 2.5 SUPPLY-SIDE ANALYSIS

- FIGURE 7 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF IN-CIRCUIT TEST

- FIGURE 8 IN-CIRCUIT TEST MARKET: SUPPLY-SIDE ANALYSIS, 2022

- 2.5.1 CALCULATIONS FOR SUPPLY SIDE

- 2.5.2 ASSUMPTIONS FOR SUPPLY SIDE

- FIGURE 9 COMPANY REVENUE ANALYSIS, 2022

- 2.6 FORECAST

- 2.7 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- TABLE 2 IN-CIRCUIT TEST MARKET SNAPSHOT

- FIGURE 10 ANALOG SEGMENT TO ACCOUNT FOR LARGER SIZE OF IN-CIRCUIT TEST MARKET, BY TYPE, DURING FORECAST PERIOD

- FIGURE 11 BENCHTOP SEGMENT TO EXHIBIT HIGHER CAGR, BY PORTABILITY, DURING FORECAST PERIOD

- FIGURE 12 CONSUMER ELECTRONICS AND APPLIANCES SEGMENT TO AMASS LARGEST SHARE OF IN-CIRCUIT TEST MARKET, BY APPLICATION, DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC DOMINATED IN-CIRCUIT TEST MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN IN-CIRCUIT TEST MARKET

- FIGURE 14 INCREASING INVESTMENTS IN HVDC TRANSMISSION SYSTEMS TO DRIVE IN-CIRCUIT TEST MARKET DURING 2023-2028

- 4.2 IN-CIRCUIT TEST MARKET, BY REGION

- FIGURE 15 IN-CIRCUIT TEST MARKET TO REGISTER HIGHEST CAGR IN MIDDLE EAST AND AFRICA DURING FORECAST PERIOD

- 4.3 IN-CIRCUIT TEST MARKET, BY TYPE

- FIGURE 16 ANALOG SEGMENT DOMINATED IN-CIRCUIT TEST MARKET IN 2022

- 4.4 IN-CIRCUIT TEST MARKET, BY PORTABILITY

- FIGURE 17 COMPACT SEGMENT ACCOUNTED FOR LARGER SHARE OF IN-CIRCUIT TEST MARKET IN 2022

- 4.5 IN-CIRCUIT TEST MARKET, BY APPLICATION

- FIGURE 18 CONSUMER ELECTRONICS AND APPLIANCES SEGMENT DOMINATED IN-CIRCUIT TEST MARKET IN 2022

- 4.6 ASIA PACIFIC: IN-CIRCUIT TEST MARKET, BY TYPE AND COUNTRY

- FIGURE 19 ANALOG AND CHINA DOMINATED ASIA PACIFIC IN-CIRCUIT TEST MARKET IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 IN-CIRCUIT TEST MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for automotive electronics

- FIGURE 21 GLOBAL EV SALES VOLUME, 2017-2022

- 5.2.1.2 Rising demand from consumer electronics industry

- FIGURE 22 GLOBAL SALES OF SMARTPHONES, TVS, AND PCS, 2018-2021

- 5.2.1.3 Increasing adoption of high-density interconnect (HDI) technology for PCB assembly

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs associated with testing processes

- 5.2.2.2 Lack of standardization in connectivity protocols and increasing complexity of PCB designs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising use of 5G technology

- FIGURE 23 5G SUBSCRIPTION IN ASIA PACIFIC, 2019-2024

- 5.2.3.2 Increasing adoption of cloud computing and IoT devices

- 5.2.4 CHALLENGES

- 5.2.4.1 Testing of high-speed interfaces

- 5.2.4.2 Difficulties in testing miniaturized PCBs

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR IN-CIRCUIT TEST PROVIDERS

- FIGURE 24 REVENUE SHIFTS FOR IN-CIRCUIT TEST MARKET PLAYERS

- 5.4 ECOSYSTEM MAPPING

- FIGURE 25 IN-CIRCUIT TEST MARKET MAP

- 5.4.1 MARKET MAP

- TABLE 3 IN-CIRCUIT TEST MARKET: ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 26 IN-CIRCUIT TEST MARKET: SUPPLY CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL/COMPONENT PROVIDERS

- 5.5.2 IN-CIRCUIT TEST EQUIPMENT MANUFACTURERS

- 5.5.3 DISTRIBUTORS AND AFTER-SALES SERVICE PROVIDERS

- 5.5.4 END USERS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 MACHINE LEARNING (ML) TECHNOLOGY USED IN-CIRCUIT TESTING

- 5.6.2 TEST DATA ANALYTICS AND VISUALIZATION USED IN IN-CIRCUIT TESTING

- 5.6.3 ADVANCED TEST EQUIPMENT AND PROBING TECHNIQUES

- 5.7 PATENT ANALYSIS

- TABLE 4 IN-CIRCUIT TEST MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2018-2022

- 5.8 TRADE ANALYSIS

- 5.8.1 HS CODE 853400

- 5.8.1.1 Export scenario

- TABLE 5 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 853400, BY COUNTRY, 2019-2021 (USD)

- FIGURE 27 EXPORT DATA FOR TOP 5 COUNTRIES, 2020-2022

- 5.8.1.2 Import scenario

- TABLE 6 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 853400, BY COUNTRY, 2020-2022 (USD)

- FIGURE 28 IMPORT DATA FOR TOP 5 COUNTRIES, 2020-2022 (USD)

- 5.8.1 HS CODE 853400

- 5.9 TARIFFS, CODES, AND REGULATIONS

- 5.9.1 TARIFFS APPLICABLE TO PRINTED CIRCUITS

- TABLE 7 IMPORT TARIFF FOR PRODUCTS COVERED UNDER HS 853400

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.3 CODES AND REGULATIONS RELATED TO IN-CIRCUIT TEST MARKET

- TABLE 14 IN-CIRCUIT TEST MARKET: CODES AND REGULATIONS

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 IN-CIRCUIT TEST MARKET: PORTER'S FIVE FORCES ANALYSIS, 2022

- TABLE 15 IN-CIRCUIT TEST MARKET: PORTER'S FIVE FORCES ANALYSIS, 2022

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 BARGAINING POWER OF SUPPLIERS

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 THREAT OF SUBSTITUTES

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 TBG SOLUTIONS DEVELOPED VERSATILE PXI-BASED AUTOMATED TEST SYSTEM

- 5.11.2 DELSERRO ENGINEERING SOLUTIONS HELPED CUSTOMER IDENTIFY DESIGN-RELATED ISSUES TO ENHANCE PRODUCT RELIABILITY

- 5.11.3 ELETTRONICA ENHANCED TEST COVERAGE FOR COMPLEX BOARDS WITH XJTAG'S BOUNDARY SCAN SYSTEM

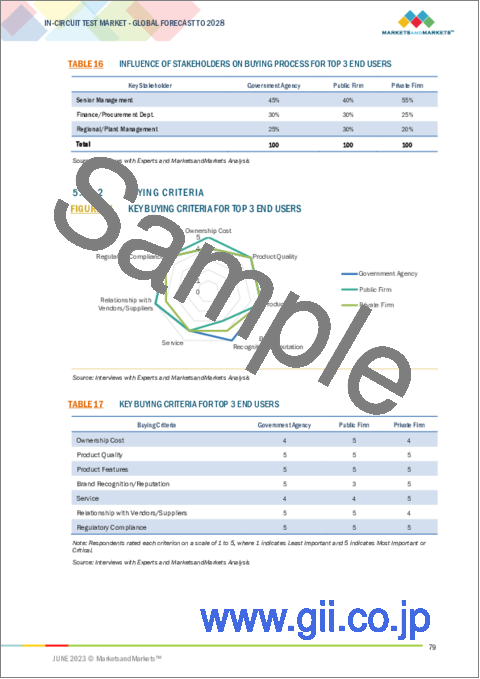

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS

- 5.12.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA FOR TOP 3 END USERS

- TABLE 17 KEY BUYING CRITERIA FOR TOP 3 END USERS

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 18 IN-CIRCUIT TEST MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 IN-CIRCUIT TEST MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 32 IN-CIRCUIT TEST MARKET, BY TYPE, 2022

- TABLE 19 IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 20 IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- 6.2 ANALOG

- 6.2.1 EASY TO USE AND COVERS BROAD APPLICATION SPECTRUM

- TABLE 21 ANALOG: IN-CIRCUIT TEST MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 22 ANALOG: IN-CIRCUIT TEST MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 6.3 MIXED

- 6.3.1 TESTS CIRCUITS THAT CONTAIN BOTH ANALOG AND DIGITAL COMPONENTS

- TABLE 23 MIXED: IN-CIRCUIT TEST MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 24 MIXED: IN-CIRCUIT TEST MARKET, BY REGION, 2023-2028 (USD THOUSAND)

7 IN-CIRCUIT TEST MARKET, BY PORTABILITY

- 7.1 INTRODUCTION

- FIGURE 33 IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2022

- TABLE 25 IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 26 IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- 7.2 COMPACT

- 7.2.1 RISING ADOPTION OF AUTOMOTIVE ELECTRONICS AND CONSUMER ELECTRONIC DEVICES TO BOOST DEMAND FOR COMPACT IN-CIRCUIT TEST

- TABLE 27 COMPACT: IN-CIRCUIT TEST MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 28 COMPACT: IN-CIRCUIT TEST MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 7.3 BENCHTOP

- 7.3.1 WIDE APPLICATION SCOPE TO FUEL SEGMENTAL GROWTH

- TABLE 29 BENCHTOP: IN-CIRCUIT TEST MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 30 BENCHTOP: IN-CIRCUIT TEST MARKET, BY REGION, 2023-2028 (USD THOUSAND)

8 IN-CIRCUIT TEST MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 34 IN-CIRCUIT TEST MARKET, BY APPLICATION, 2022

- TABLE 31 IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 32 IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 8.2 CONSUMER ELECTRONICS AND APPLIANCES

- 8.2.1 INCREASING CONSUMER ELECTRONICS SALES IN ASIA PACIFIC AND NORTH AMERICA TO DRIVE MARKET

- TABLE 33 CONSUMER ELECTRONICS AND APPLIANCES: IN-CIRCUIT TEST MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 34 CONSUMER ELECTRONICS AND APPLIANCES: IN-CIRCUIT TEST MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 8.3 AEROSPACE, DEFENSE, AND GOVERNMENT SERVICES

- 8.3.1 INCREASED SPENDING ON AEROSPACE, DEFENSE, AND GOVERNMENT SECTORS TO DRIVE DEMAND FOR IN-CIRCUIT TEST EQUIPMENT

- TABLE 35 AEROSPACE, DEFENSE, AND GOVERNMENT SERVICES: IN-CIRCUIT TEST MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 36 AEROSPACE, DEFENSE, AND GOVERNMENT SERVICES: IN-CIRCUIT TEST MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 8.4 MEDICAL EQUIPMENT MANUFACTURING

- 8.4.1 RISING DEMAND FOR HIGH-DENSITY INTERCONNECT PCBS IN MEDICAL INDUSTRY TO DRIVE MARKET

- TABLE 37 MEDICAL EQUIPMENT MANUFACTURING: IN-CIRCUIT TEST MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 38 MEDICAL EQUIPMENT MANUFACTURING: IN-CIRCUIT TEST MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 8.5 WIRELESS COMMUNICATION

- 8.5.1 INCREASING DEMAND FOR WIRELESS TECHNOLOGIES TO DRIVE MARKET

- TABLE 39 WIRELESS COMMUNICATION: IN-CIRCUIT TEST MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 40 WIRELESS COMMUNICATION: IN-CIRCUIT TEST MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 8.6 AUTOMOTIVE

- 8.6.1 VEHICLE ELECTRIFICATION AND RIGOROUS QUALITY STANDARDS TO PROPEL DEMAND FOR IN-CIRCUIT TESTING

- TABLE 41 AUTOMOTIVE: IN-CIRCUIT TEST MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 42 AUTOMOTIVE: IN-CIRCUIT TEST MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 8.7 ENERGY

- 8.7.1 INTEGRATION OF DIGITAL COMMUNICATION SYSTEMS INTO POWER NETWORKS TO ACCELERATE MARKET GROWTH

- TABLE 43 ENERGY: IN-CIRCUIT TEST MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 44 ENERGY: IN-CIRCUIT TEST MARKET, BY REGION, 2023-2028 (USD THOUSAND)

9 IN-CIRCUIT TEST MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 35 IN-CIRCUIT TEST MARKET IN MIDDLE EAST & AFRICA MARKET TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 IN-CIRCUIT TEST MARKET SHARE, BY REGION, 2022

- 9.1.1 RECESSION IMPACT: INTRODUCTION

- TABLE 45 IN-CIRCUIT TEST MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 46 IN-CIRCUIT TEST MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 9.2 NORTH AMERICA

- FIGURE 37 NORTH AMERICA: IN-CIRCUIT TEST MARKET SNAPSHOT

- 9.2.1 NORTH AMERICA: RECESSION IMPACT

- 9.2.2 BY TYPE

- TABLE 47 NORTH AMERICA: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 48 NORTH AMERICA: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- 9.2.3 BY PORTABILITY

- TABLE 49 NORTH AMERICA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 50 NORTH AMERICA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- 9.2.4 BY APPLICATION

- TABLE 51 NORTH AMERICA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 52 NORTH AMERICA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.2.5 BY COUNTRY

- TABLE 53 NORTH AMERICA: IN-CIRCUIT TEST MARKET, BY COUNTRY, 2017-2022 (USD THOUSAND)

- TABLE 54 NORTH AMERICA: IN-CIRCUIT TEST MARKET, BY COUNTRY, 2023-2028 (USD THOUSAND)

- 9.2.5.1 US

- 9.2.5.1.1 Presence of key players to drive market

- 9.2.5.1 US

- TABLE 55 US: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 56 US: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 57 US: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 58 US: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 59 US: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 60 US: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.2.5.2 Canada

- 9.2.5.2.1 Increasing demand from telecommunications industry to drive market

- 9.2.5.2 Canada

- TABLE 61 CANADA: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 62 CANADA: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 63 CANADA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 64 CANADA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 65 CANADA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 66 CANADA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.2.5.3 Mexico

- 9.2.5.3.1 Demand from automobile manufacturing industry to boost market

- 9.2.5.3 Mexico

- TABLE 67 MEXICO: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 68 MEXICO: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 69 MEXICO: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 70 MEXICO: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 71 MEXICO: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 72 MEXICO: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.3 ASIA PACIFIC

- FIGURE 38 ASIA PACIFIC: IN-CIRCUIT TEST MARKET SNAPSHOT

- 9.3.1 ASIA PACIFIC: RECESSION IMPACT

- 9.3.2 BY TYPE

- TABLE 73 ASIA PACIFIC: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 74 ASIA PACIFIC: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- 9.3.3 BY PORTABILITY

- TABLE 75 ASIA PACIFIC: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 76 ASIA PACIFIC: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- 9.3.4 BY APPLICATION

- TABLE 77 ASIA PACIFIC: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 78 ASIA PACIFIC: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.3.5 BY COUNTRY

- TABLE 79 ASIA PACIFIC: IN-CIRCUIT TEST MARKET, BY COUNTRY, 2017-2022 (USD THOUSAND)

- TABLE 80 ASIA PACIFIC: IN-CIRCUIT TEST MARKET, BY COUNTRY, 2023-2028 (USD THOUSAND)

- 9.3.5.1 China

- 9.3.5.1.1 Growing automotive industry to boost demand for in-circuit test equipment

- 9.3.5.1 China

- TABLE 81 CHINA: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 82 CHINA: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 83 CHINA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 84 CHINA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 85 CHINA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 86 CHINA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.3.5.2 Australia

- 9.3.5.2.1 Rising investments in renewables, distribution infrastructure, and connectivity to drive market

- 9.3.5.2 Australia

- TABLE 87 AUSTRALIA: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 88 AUSTRALIA: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 89 AUSTRALIA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 90 AUSTRALIA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 91 AUSTRALIA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 92 AUSTRALIA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.3.5.3 India

- 9.3.5.3.1 Semiconductor Fabless Accelerator Lab (SFAL) initiative to support market growth

- 9.3.5.3 India

- TABLE 93 INDIA: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 94 INDIA: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 95 INDIA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 96 INDIA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 97 INDIA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 98 INDIA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.3.5.4 South Korea

- 9.3.5.4.1 Increase in investments in electric vehicles to induce demand for in-circuit test equipment

- 9.3.5.4 South Korea

- TABLE 99 SOUTH KOREA: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 100 SOUTH KOREA: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 101 SOUTH KOREA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 102 SOUTH KOREA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 103 SOUTH KOREA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 104 SOUTH KOREA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.3.5.5 Japan

- 9.3.5.5.1 Demand from consumer electronics industry to drive market

- 9.3.5.5 Japan

- TABLE 105 JAPAN: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 106 JAPAN: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 107 JAPAN: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 108 JAPAN: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 109 JAPAN: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 110 JAPAN: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.3.5.6 Rest of Asia Pacific

- TABLE 111 REST OF ASIA PACIFIC: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 112 REST OF ASIA PACIFIC: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 113 REST OF ASIA PACIFIC: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 114 REST OF ASIA PACIFIC: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 115 REST OF ASIA PACIFIC: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 116 REST OF ASIA PACIFIC: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.4 EUROPE

- FIGURE 39 EUROPE: IN-CIRCUIT TEST MARKET SNAPSHOT

- 9.4.1 EUROPE: RECESSION IMPACT

- 9.4.2 BY TYPE

- TABLE 117 EUROPE: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 118 EUROPE: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- 9.4.3 BY PORTABILITY

- TABLE 119 EUROPE: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 120 EUROPE: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- 9.4.4 BY APPLICATION

- TABLE 121 EUROPE: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 122 EUROPE: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.4.5 BY COUNTRY

- TABLE 123 EUROPE: IN-CIRCUIT TEST MARKET, BY COUNTRY, 2017-2022 (USD THOUSAND)

- TABLE 124 EUROPE: IN-CIRCUIT TEST MARKET, BY COUNTRY, 2023-2028 (USD THOUSAND)

- 9.4.5.1 UK

- 9.4.5.1.1 Investments in wireless communication and automotive sectors to boost market

- 9.4.5.1 UK

- TABLE 125 UK: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 126 UK: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 127 UK: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 128 UK: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 129 UK: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 130 UK: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.4.5.2 Germany

- 9.4.5.2.1 Demand from automotive sector to favor market growth

- 9.4.5.2 Germany

- TABLE 131 GERMANY: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 132 GERMANY: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 133 GERMANY: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 134 GERMANY: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 135 GERMANY: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 136 GERMANY: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.4.5.3 France

- 9.4.5.3.1 Increase in renewable power generation to drive market

- 9.4.5.3 France

- TABLE 137 FRANCE: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 138 FRANCE: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 139 FRANCE: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 140 FRANCE: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 141 FRANCE: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 142 FRANCE: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.4.5.4 Italy

- 9.4.5.4.1 Transition toward 5G network to create conducive environment for market growth

- 9.4.5.4 Italy

- TABLE 143 ITALY: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 144 ITALY: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 145 ITALY: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 146 ITALY: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 147 ITALY: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 148 ITALY: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.4.5.5 Russia

- 9.4.5.5.1 Increasing investments in defense sector to drive market

- 9.4.5.5 Russia

- TABLE 149 RUSSIA: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 150 RUSSIA: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 151 RUSSIA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 152 RUSSIA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 153 RUSSIA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 154 RUSSIA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.4.5.6 Spain

- 9.4.5.6.1 Increasing R&D expenditure on energy sector to create opportunities for market players

- 9.4.5.6 Spain

- TABLE 155 SPAIN: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 156 SPAIN: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 157 SPAIN: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 158 SPAIN: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 159 SPAIN: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 160 SPAIN: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.4.5.7 Rest of Europe

- TABLE 161 REST OF EUROPE: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 162 REST OF EUROPE: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 163 REST OF EUROPE: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 164 REST OF EUROPE: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 165 REST OF EUROPE: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 166 REST OF EUROPE: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST AND AFRICA: RECESSION IMPACT

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Increasing investments in defense sector to drive market

- 9.5.2.2 By country

- 9.5.2.2.1 Israel

- 9.5.2.2.2 Saudi Arabia

- 9.5.2.2.3 UAE

- 9.5.2.2.4 Qatar

- 9.5.2.3 By type

- TABLE 167 MIDDLE EAST: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 168 MIDDLE EAST: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- 9.5.2.4 By portability

- TABLE 169 MIDDLE EAST: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 170 MIDDLE EAST: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- 9.5.2.5 By application

- TABLE 171 MIDDLE EAST: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 172 MIDDLE EAST: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.5.3 AFRICA

- 9.5.3.1 Rising investments in communication, infrastructure, and network applications to drive market

- 9.5.3.2 By type

- TABLE 173 AFRICA: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 174 AFRICA: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- 9.5.3.3 By portability

- TABLE 175 AFRICA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 176 AFRICA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- 9.5.3.4 By application

- TABLE 177 AFRICA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 178 AFRICA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.6 SOUTH AMERICA

- FIGURE 40 SOUTH AMERICA: IN-CIRCUIT TEST MARKET SNAPSHOT

- 9.6.1 SOUTH AMERICA: RECESSION IMPACT

- 9.6.2 BY TYPE

- TABLE 179 SOUTH AMERICA: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 180 SOUTH AMERICA: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- 9.6.3 BY PORTABILITY

- TABLE 181 SOUTH AMERICA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 182 SOUTH AMERICA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- 9.6.4 BY APPLICATION

- TABLE 183 SOUTH AMERICA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 184 SOUTH AMERICA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.6.5 BY COUNTRY

- TABLE 185 SOUTH AMERICA: IN-CIRCUIT TEST MARKET, BY COUNTRY, 2017-2022 (USD THOUSAND)

- TABLE 186 SOUTH AMERICA: IN-CIRCUIT TEST MARKET, BY COUNTRY, 2023-2028 (USD THOUSAND)

- 9.6.5.1 Brazil

- 9.6.5.1.1 Increasing investments in medical equipment manufacturing to drive market

- 9.6.5.1 Brazil

- TABLE 187 BRAZIL: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 188 BRAZIL: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 189 BRAZIL: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 190 BRAZIL: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 191 BRAZIL: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 192 BRAZIL: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.6.5.2 Argentina

- 9.6.5.2.1 Rising investments in renewable energy generation to create demand for in-circuit testing

- 9.6.5.2 Argentina

- TABLE 193 ARGENTINA: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 194 ARGENTINA: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 195 ARGENTINA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 196 ARGENTINA: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 197 ARGENTINA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 198 ARGENTINA: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.6.5.3 Chile

- 9.6.5.3.1 Increasing investments in wireless communication to drive market

- 9.6.5.3 Chile

- TABLE 199 CHILE: IN-CIRCUIT TEST MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 200 CHILE: IN-CIRCUIT TEST MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 201 CHILE: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2017-2022 (USD THOUSAND)

- TABLE 202 CHILE: IN-CIRCUIT TEST MARKET, BY PORTABILITY, 2023-2028 (USD THOUSAND)

- TABLE 203 CHILE: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 204 CHILE: IN-CIRCUIT TEST MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- FIGURE 41 KEY DEVELOPMENTS IN IN-CIRCUIT TEST MARKET, 2018-2023

- 10.2 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- TABLE 205 IN-CIRCUIT TEST MARKET: COMPETITIVE ANALYSIS

- FIGURE 42 MARKET SHARE ANALYSIS OF TOP PLAYERS IN IN-CIRCUIT TEST MARKET, 2022

- 10.3 MARKET EVALUATION FRAMEWORK, 2018-2023

- TABLE 206 MARKET EVALUATION FRAMEWORK, 2018-2023

- 10.4 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2018-2022

- FIGURE 43 SEGMENTAL REVENUE ANALYSIS, 2018-2022

- 10.5 COMPETITIVE SCENARIOS AND TRENDS

- 10.5.1 PRODUCT LAUNCHES

- TABLE 207 IN-CIRCUIT TEST MARKET: OTHERS, 2022

- 10.5.2 DEALS

- TABLE 208 IN-CIRCUIT TEST MARKET: DEALS, 2018-2023

- 10.6 COMPANY EVALUATION MATRIX

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- FIGURE 44 IN-CIRCUIT TEST MARKET: COMPANY EVALUATION MATRIX, 2022

- TABLE 209 COMPANY TYPE FOOTPRINT

- TABLE 210 COMPANY PORTABILITY FOOTPRINT

- TABLE 211 COMPANY END-USER FOOTPRINT

- TABLE 212 COMPANY REGION FOOTPRINT

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

(Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 11.1.1 TERADYNE INC.

- TABLE 213 TERADYNE INC.: COMPANY OVERVIEW

- FIGURE 45 TERADYNE INC.: COMPANY SNAPSHOT

- TABLE 214 TERADYNE INC.: PRODUCTS OFFERED

- TABLE 215 TERADYNE INC.: DEALS

- 11.1.2 TEST RESEARCH, INC.

- TABLE 216 TEST RESEARCH, INC.: COMPANY OVERVIEW

- FIGURE 46 TEST RESEARCH, INC.: COMPANY SNAPSHOT

- TABLE 217 TEST RESEARCH, INC.: PRODUCTS OFFERED

- TABLE 218 TEST RESEARCH, INC.: PRODUCT LAUNCHES

- TABLE 219 TEST RESEARCH, INC.: OTHERS

- 11.1.3 KEYSIGHT TECHNOLOGIES

- TABLE 220 KEYSIGHT TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 47 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 221 KEYSIGHT TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 222 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 223 KEYSIGHT TECHNOLOGIES: DEALS

- TABLE 224 KEYSIGHT TECHNOLOGIES: OTHERS

- 11.1.4 HIOKI E.E. CORPORATION

- TABLE 225 HIOKI E.E. CORPORATION: COMPANY OVERVIEW

- FIGURE 48 HIOKI E.E. CORPORATION: COMPANY SNAPSHOT

- TABLE 226 HIOKI E.E. CORPORATION: PRODUCTS OFFERED

- TABLE 227 HIOKI E.E. CORPORATION: PRODUCT LAUNCHES

- TABLE 228 HIOKI E.E. CORPORATION: OTHERS

- 11.1.5 KYORITSU ELECTRIC CORPORATION

- TABLE 229 KYORITSU ELECTRIC CORPORATION: COMPANY OVERVIEW

- FIGURE 49 KYORITSU ELECTRIC CORPORATION: COMPANY SNAPSHOT

- TABLE 230 KYORITSU ELECTRIC CORPORATION: PRODUCTS OFFERED

- 11.1.6 DIGITALTEST GMBH

- TABLE 231 DIGITALTEST GMBH: COMPANY OVERVIEW

- TABLE 232 DIGITALTEST GMBH: PRODUCTS OFFERED

- TABLE 233 DIGITALTEST GMBH: DEALS

- TABLE 234 DIGITALTEST GMBH: OTHERS

- 11.1.7 SPEA S.P.A.

- TABLE 235 SPEA S.P.A.: COMPANY OVERVIEW

- TABLE 236 SPEA S.P.A.: PRODUCTS OFFERED

- TABLE 237 SPEA S.P.A.: DEALS

- TABLE 238 SPEA S.P.A.: OTHERS

- 11.1.8 KONRAD GMBH

- TABLE 239 KONRAD GMBH: COMPANY OVERVIEW

- TABLE 240 KONRAD GMBH: PRODUCTS OFFERED

- TABLE 241 KONRAD GMBH: DEALS

- TABLE 242 KONRAD GMBH: OTHERS

- 11.1.9 TESTRONICS

- TABLE 243 TESTRONICS: COMPANY OVERVIEW

- TABLE 244 TESTRONICS: PRODUCTS OFFERED

- 11.1.10 CONCORD TECHNOLOGY LIMITED

- TABLE 245 CONCORD TECHNOLOGY LIMITED: COMPANY OVERVIEW

- TABLE 246 CONCORD TECHNOLOGY LIMITED: PRODUCTS OFFERED

- 11.1.11 OKANO ELECTRIC CO., LTD

- TABLE 247 OKANO ELECTRIC CO., LTD: COMPANY OVERVIEW

- TABLE 248 OKANO ELECTRIC CO., LTD: PRODUCTS OFFERED

- 11.1.12 S.E.I.C.A. S.P.A.

- TABLE 249 S.E.I.C.A. S.P.A.: COMPANY OVERVIEW

- TABLE 250 S.E.I.C.A. S.P.A.: PRODUCTS OFFERED

- TABLE 251 S.E.I.C.A. S.P.A.: DEALS

- 11.1.13 CHECKSUM

- TABLE 252 CHECKSUM: COMPANY OVERVIEW

- TABLE 253 CHECKSUM: PRODUCTS OFFERED

- 11.1.14 REINHARDT SYSTEM- UND MESSELECTRONIC GMBH

- TABLE 254 REINHARDT SYSTEM- UND MESSELECTRONIC GMBH: COMPANY OVERVIEW

- TABLE 255 REINHARDT SYSTEM- UND MESSELECTRONIC GMBH: PRODUCTS OFFERED

- 11.1.15 ACCULOGIC

- TABLE 256 ACCULOGIC: COMPANY OVERVIEW

- TABLE 257 ACCULOGIC: PRODUCTS OFFERED

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 TEST COACH COMPANY, LLC

- 11.2.2 SHENZHEN PTI TECHNOLOGY CO. LTD.

- 11.2.3 VITAL ELECTRONICS & MANUFACTURING CO.

- 11.2.4 KUTTIG ELECTRONIC GMBH

- 11.2.5 TELIGENTEMS

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS