|

|

市場調査レポート

商品コード

1300946

乳房画像診断の世界市場:技術別 (電離性、非電離性)・製品別 (乳房画像診断システム、ソフトウェア・サービス、付属品)・エンドユーザー別 (病院・診療所、画像診断センター、乳房治療センター)・地域別の将来予測 (2028年まで)Breast Imaging Market by Technology (Ionizing, Non-ionizing), Product (Breast Imaging Systems, Software and Services, Accessories), End User (Hospitals and Clinics, Diagnostic Imaging Centers, Breast Care Centers) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 乳房画像診断の世界市場:技術別 (電離性、非電離性)・製品別 (乳房画像診断システム、ソフトウェア・サービス、付属品)・エンドユーザー別 (病院・診療所、画像診断センター、乳房治療センター)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月28日

発行: MarketsandMarkets

ページ情報: 英文 267 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の乳房画像診断の市場規模は、2023年の44億米ドルから、2028年には66億米ドルに達すると予測され、2023年から2028年までのCAGRは8.5%と見込まれています。

乳がん研究を支援する資金や助成金の増加、有利な償還シナリオなどの要因が、この市場の成長を高めています。

"電離性乳房画像技術のセグメントが、2022年に最大の市場シェアを占める"

技術別に見ると、電離性乳房画像技術のセグメントが2022年に最大の市場シェアを占めました。その要因として、技術的に先進的なシステムの発売や、エンドユーザーによる乳房画像診断システムの使用増加などが挙げられます。

"ソフトウェア・サービスのセグメントが、予測期間中に最も高いCAGRで成長する"

製品別に見ると、ソフトウェア・サービスのセグメントが2023年から2028年にかけて、最も高いCAGRで成長すると予測されています。乳房画像診断装置の使用増加、がん研究への注目の高まり、研究支援のための資金提供の増加などの要因が、市場成長を促進しています。

"アジア太平洋地域の市場は、予測期間中に最も高い成長率を達成する"

アジア太平洋地域の乳房画像診断市場は、同地域における医療インフラの進化や主要企業の注力度の高まりなどにより、予測期間中に高いCAGRを達成すると予測されています。中国・インド・韓国などの新興国の医療インフラは急速なペースで進化しており、病院や診断センターによる高度画像システム (MRI、3D乳房トモシンセシス、自動全乳房超音波検査などの高度乳房画像システムを含む) への大規模な投資につながっています。これらの要因は、この地域における乳房画像診断市場の成長を促進すると予想されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 乳房画像診断の貿易分析

- 特許分析

- エコシステムの範囲:親市場

- バリューチェーン分析

- サプライチェーン分析

- 価格動向分析

- 技術分析

- 規制状況

- 償還シナリオ

- ケーススタディ

- 主要な会議とイベント (2023年~2024年)

第6章 乳房画像診断市場:技術別

- イントロダクション

- 電離性乳房画像診断技術

- マンモグラフィー

- 陽電子放出マンモグラフィー (PEM)

- 陽電子放出断層撮影・コンピュータ断層撮影 (PET-CT)

- 分子乳房画像/乳房特異的ガンマイメージング (MBI/BSGI)

- コーンビームコンピュータ断層撮影法 (CBCT)

- 非電離性乳房画像技術

- 乳房超音波検査

- 乳房MRI

- 自動全乳房超音波検査 (AWBU)

- 乳房サーモグラフィー

- 電気インピーダンストモグラフィー

- 光学画像

第7章 乳房画像診断市場:製品別

- イントロダクション

- 乳房画像診断システム

- ソフトウェア・サービス

- 付属品

第8章 乳房画像診断市場:エンドユーザー別

- イントロダクション

- 病院・診療所

- 画像診断センター

- 乳房治療センター

- その他のエンドユーザー

第9章 乳房画像診断市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

第10章 競合情勢

- 概要

- 有力企業

- 主要企業の戦略

- 収益シェア分析

- 市場シェア分析

- 企業評価マトリックス (2022年)

- 企業評価マトリックス:スタートアップ/中小企業 (2022年)

- 競合ベンチマーキング

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- GE HEALTHCARE (PART OF GENERAL ELECTRIC COMPANY)

- HOLOGIC, INC.

- SIEMENS HEALTHCARE GMBH

- KONINKLIJKE PHILIPS N.V.

- FUJIFILM HOLDINGS CORPORATION

- CANON INC.

- AURORA HEALTHCARE US CORP.

- ALLENGERS

- DILON TECHNOLOGIES, INC.

- PLANMED OY

- DELPHINUS MEDICAL TECHNOLOGIES, INC.

- MICRIMA LIMITED

- CMR NAVISCAN

- METALTRONICA S.P.A.

- CAPERAY

- その他の企業

- KUB TECHNOLOGIES

- SONOCINE

- NP JSC AMICO

- QT IMAGING, INC.

- IMAGING DIAGNOSTIC SYSTEMS, INC.

- SENO MEDICAL

- ONCOVISION

- VILLA SISTEMI MEDICALI SPA

- TRIVITRON HEALTHCARE

- ISONO HEALTH, INC.

第12章 付録

The global breast imaging market is projected to reach USD 6.6 billion by 2028 from USD 4.4 billion in 2023, at a CAGR of 8.5% from 2023 to 2028. Factors such as increasing funding and grants supporting breast cancer research and favorable reimbursement scenario are responsible for the increasing growth of this market.

"The ionizing breast imaging technologies segment held the largest share of the market in 2022"

Based on technology, the breast imaging market is segmented into ionizing breast imaging technologies and non-ionizing breast imaging technologies. The ionizing breast imaging technologies segment held the largest market share in 2022. The large share of this segment can be attributed to the launch of technologically advanced systems and rising use of breast imaging systems by the end users.

"The software & services segment is projected to register the highest CAGR during the forecast period"

Based on product, the breast imaging market is segmented into breast imaging systems, software & services, and accessories. The software & services segment is projected to register the highest CAGR from 2023 to 2028. Factors such as the increasing use of breast imaging equipment, rising focus on cancer research, and increasing fundings to support research are driving the market growth.

"The market in the Asia Pacific region is expected to witness the highest growth during the forecast period."

The breast imaging market in the APAC region is expected to register a CAGR during the forecast period, primarily due to evolving healthcare infrastructure and increasing focus of major players in the region. The healthcare infrastructure in emerging economies, such as China, India, and South Korea, is evolving at a rapid pace, leading to major investments in advanced imaging systems (including advanced breast imaging systems such as MRI, 3D breast tomosynthesis, and automated whole-breast ultrasound) by hospitals and diagnostic centers. These factors are anticipated to fuel the growth of breast imaging market in this region.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-48%, Tier 2-36%, and Tier 3- 16%

- By Designation: C-level-10%, Director-level-14%, and Others-76%

- By Region: North America-40%, Europe-32%, Asia Pacific-20%, Latin America-5%, and the Middle East & Africa-3%

The prominent players in the breast imaging market are GE Healthcare (US), Hologic, inc. (US), Siemens Healthcare GmbH (Germany), Koninklijke Philips N.V. (Netherlands), FUJIFILM Holdings Corporation (Japan), Canon Inc. (Japan), Aurora Healthcare US Corp. (US), Planmed Oy (Finland), and Allengers (India) among others.

Research Coverage

This report studies the breast imaging market based on technology, product, end user, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets with respect to their growth trends and forecasts the revenue of the market segments with respect to five main regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall breast imaging market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

This report provides insights on the following pointers:

- Analysis of key drivers (growing incidence of breast cancer, increasing awareness on early detection of breast cancer, increasing public-private investments, funds, and grants, technological advancements in breast imaging modalities, growing geriatric population), restraints (stringent regulatory approval procedures, high cost of instruments), opportunities (contract-based diagnostic soluions and mobile solutions, and rising opportunities in emerging countries), and challenges (errors in breast cancer screening and diagnosis, side effects of radition exposure, increasing adoption of refurbished imaging systems) influencing the growth of the breast imaging market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the breast imaging market

- Market Development: Comprehensive information about lucrative markets-the report analyses the breast imaging market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the breast imaging market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like GE Healthcare (US), Hologic, inc. (US), Siemens Healthcare GmbH (Germany), Koninklijke Philips N.V. (Netherlands), FUJIFILM Holdings Corporation (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SEGMENTATION

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 1 BREAST IMAGING MARKET: RESEARCH DESIGN METHODOLOGY

- 2.1.1 SECONDARY RESEARCH

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 RECESSION IMPACT ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach 1: Company revenue estimation approach

- FIGURE 5 MARKET SIZE ESTIMATION FOR BREAST IMAGING MARKET: APPROACH 1 (COMPANY REVENUE ESTIMATION)

- FIGURE 6 REVENUE SHARE ANALYSIS: ILLUSTRATIVE EXAMPLE OF HOLOGIC, INC.

- 2.3.1.2 Approach 2: Customer-based market estimation

- FIGURE 7 BOTTOM-UP APPROACH FOR MARKET SIZE ESTIMATION: BREAST IMAGING MARKET

- 2.3.1.3 Growth forecast

- 2.3.1.4 CAGR projections

- FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.4 DATA TRIANGULATION APPROACH

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- 2.5 MARKET SHARE ESTIMATION

- 2.6 ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- 2.7.1 RISK ASSESSMENT: BREAST IMAGING MARKET

- 2.8 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 10 BREAST IMAGING MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 BREAST IMAGING MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 BREAST IMAGING MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 BREAST IMAGING MARKET: GEOGRAPHIC SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 BREAST IMAGING MARKET OVERVIEW

- FIGURE 14 RISING PREVALENCE OF BREAST CANCER TO DRIVE GROWTH

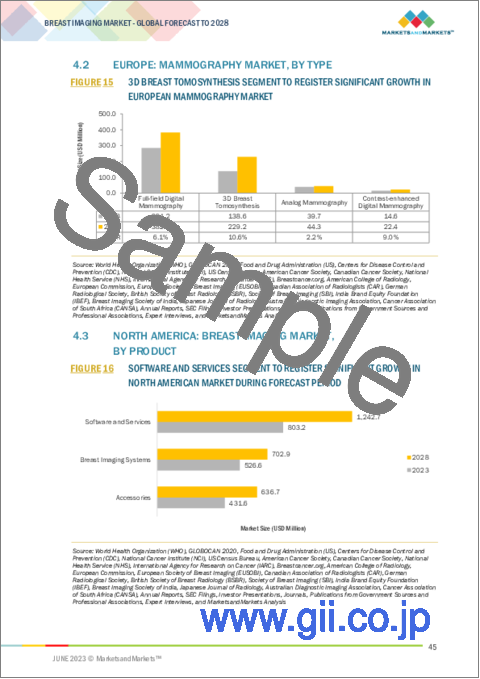

- 4.2 EUROPE: MAMMOGRAPHY MARKET, BY TYPE

- FIGURE 15 3D BREAST TOMOSYNTHESIS SEGMENT TO REGISTER SIGNIFICANT GROWTH IN EUROPEAN MAMMOGRAPHY MARKET

- 4.3 NORTH AMERICA: BREAST IMAGING MARKET, BY PRODUCT

- FIGURE 16 SOFTWARE AND SERVICES SEGMENT TO REGISTER SIGNIFICANT GROWTH IN NORTH AMERICAN MARKET DURING FORECAST PERIOD

- 4.4 ASIA PACIFIC: BREAST IMAGING MARKET, BY END USER

- FIGURE 17 HOSPITALS AND CLINICS SEGMENT TO CONTINUE TO HOLD LARGEST SHARE IN ASIA PACIFIC MARKET

- 4.5 GEOGRAPHIC SNAPSHOT OF BREAST IMAGING MARKET

- FIGURE 18 CHINA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 BREAST IMAGING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing incidence of breast cancer

- FIGURE 20 NUMBER OF NEW BREAST CANCER CASES IN 2020, BY KEY COUNTRY

- 5.2.1.2 Increasing public-private investments, funding, and grants

- 5.2.1.3 Growing awareness of early breast cancer detection

- 5.2.1.4 Technological advancements in breast imaging modalities

- 5.2.1.5 Growing geriatric population

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of breast imaging systems

- 5.2.2.2 Stringent regulatory approval procedures

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth potential in emerging economies

- 5.2.3.2 Contract-based diagnostic solutions and mobile solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Side effects of radiation exposure

- 5.2.4.2 Errors in breast cancer screening and diagnosis

- 5.2.4.3 Increasing adoption of refurbished imaging systems

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 1 BREAST IMAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 TRADE ANALYSIS FOR BREAST IMAGING EQUIPMENT

- TABLE 2 IMPORT DATA FOR BREAST IMAGING/MAMMOGRAPHY, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 3 EXPORT DATA FOR BREAST IMAGING/MAMMOGRAPHY, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.5 PATENT ANALYSIS

- FIGURE 21 TOP 10 PATENT APPLICANTS FOR BREAST IMAGING (JANUARY 2012-DECEMBER 2022)

- FIGURE 22 TOP 10 PATENT APPLICANTS FOR MAMMOGRAPHY (JANUARY 2012-DECEMBER 2022)

- 5.6 ECOSYSTEM COVERAGE: PARENT MARKET

- 5.7 VALUE CHAIN ANALYSIS

- 5.7.1 RESEARCH & DEVELOPMENT

- 5.7.2 MANUFACTURING & ASSEMBLY

- 5.7.3 DISTRIBUTION, MARKETING & SALES, AND POST-SALES SERVICES

- FIGURE 23 BREAST IMAGING MARKET: VALUE CHAIN ANALYSIS

- 5.8 SUPPLY CHAIN ANALYSIS

- 5.8.1 PROMINENT COMPANIES

- 5.8.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.8.3 END USERS

- FIGURE 24 BREAST IMAGING MARKET: SUPPLY CHAIN ANALYSIS

- 5.9 PRICING TREND ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE FOR MAJOR BREAST IMAGING EQUIPMENT

- 5.10 TECHNOLOGY ANALYSIS

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 NORTH AMERICA

- 5.11.1.1 US

- TABLE 5 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 6 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- 5.11.1.2 Canada

- TABLE 7 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- 5.11.2 EUROPE

- 5.11.3 ASIA PACIFIC

- 5.11.3.1 Japan

- TABLE 8 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- 5.11.3.2 China

- TABLE 9 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- 5.11.3.3 India

- 5.11.1 NORTH AMERICA

- 5.12 REIMBURSEMENT SCENARIO

- TABLE 10 MEDICAL REIMBURSEMENT CODES FOR MAMMOGRAPHY IMAGING PROCEDURES IN US (AS OF 2022)

- 5.13 CASE STUDIES

- 5.13.1 TECHNOLOGICAL CHALLENGES

- TABLE 11 CASE STUDY 1: BETTER VISUALIZATION OF BREAST IMAGES IN WOMEN WITH DENSE BREAST TISSUE

- 5.14 KEY CONFERENCES AND EVENTS (2023-2024)

- TABLE 12 BREAST IMAGING MARKET: LIST OF MAJOR CONFERENCES AND EVENTS

6 BREAST IMAGING MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- TABLE 13 BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 6.2 IONIZING BREAST IMAGING TECHNOLOGIES

- TABLE 14 IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.2.1 MAMMOGRAPHY

- TABLE 15 MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 16 MAMMOGRAPHY MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 17 NORTH AMERICA: MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 18 EUROPE: MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 19 ASIA PACIFIC: MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 20 LATIN AMERICA: MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 21 MAMMOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 22 MAMMOGRAPHY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2.1.1 Full-field digital mammography (FFDM)

- 6.2.1.1.1 Use of lower radiation doses to drive growth

- 6.2.1.1 Full-field digital mammography (FFDM)

- TABLE 23 FULL-FIELD DIGITAL MAMMOGRAPHY MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 24 NORTH AMERICA: FULL-FIELD DIGITAL MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 25 EUROPE: FULL-FIELD DIGITAL MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 26 ASIA PACIFIC: FULL-FIELD DIGITAL MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 27 LATIN AMERICA: FULL-FIELD DIGITAL MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 28 FULL-FIELD DIGITAL MAMMOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 29 FULL-FIELD DIGITAL MAMMOGRAPHY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2.1.2 Analog mammography

- 6.2.1.2.1 High spatial resolution and low installation cost to boost adoption

- 6.2.1.2 Analog mammography

- TABLE 30 ANALOG MAMMOGRAPHY MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: ANALOG MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 32 EUROPE: ANALOG MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: ANALOG MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 34 LATIN AMERICA: ANALOG MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 35 ANALOG MAMMOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 36 ANALOG MAMMOGRAPHY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2.1.3 3D breast tomosynthesis

- 6.2.1.3.1 3D breast tomosynthesis to witness highest growth in mammography market

- 6.2.1.3 3D breast tomosynthesis

- TABLE 37 3D BREAST TOMOSYNTHESIS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: 3D BREAST TOMOSYNTHESIS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 39 EUROPE: 3D BREAST TOMOSYNTHESIS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 40 ASIA PACIFIC: 3D BREAST TOMOSYNTHESIS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 41 LATIN AMERICA: 3D BREAST TOMOSYNTHESIS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 42 3D BREAST TOMOSYNTHESIS MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 43 3D BREAST TOMOSYNTHESIS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2.1.4 Contrast-enhanced mammography (CEM)

- 6.2.1.4.1 Affordability over breast MRI and improved diagnostic accuracy to drive growth

- 6.2.1.4 Contrast-enhanced mammography (CEM)

- TABLE 44 CONTRAST-ENHANCED MAMMOGRAPHY MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: CONTRAST-ENHANCED MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

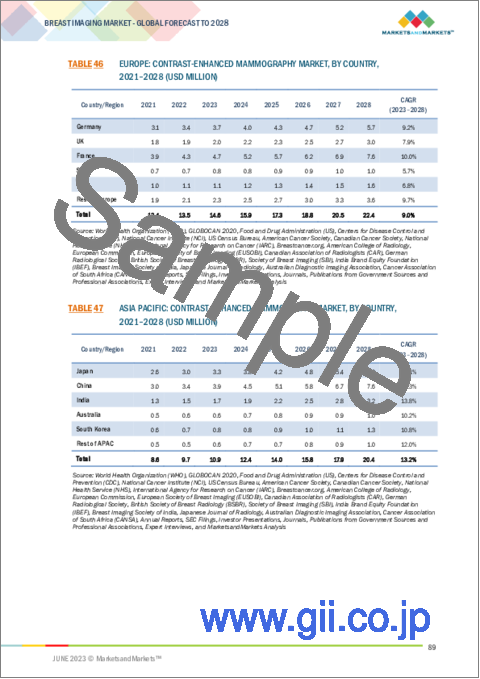

- TABLE 46 EUROPE: CONTRAST-ENHANCED MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: CONTRAST-ENHANCED MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 48 LATIN AMERICA: CONTRAST-ENHANCED MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 49 CONTRAST-ENHANCED MAMMOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 50 CONTRAST-ENHANCED MAMMOGRAPHY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2.2 POSITRON EMISSION MAMMOGRAPHY (PEM)

- 6.2.2.1 Higher sensitivity and accuracy to drive adoption

- TABLE 51 POSITRON EMISSION MAMMOGRAPHY MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: POSITRON EMISSION MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 53 EUROPE: POSITRON EMISSION MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 54 ASIA PACIFIC: POSITRON EMISSION MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 55 LATIN AMERICA: POSITRON EMISSION MAMMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 56 POSITRON EMISSION MAMMOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 57 POSITRON EMISSION MAMMOGRAPHY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2.3 POSITRON EMISSION TOMOGRAPHY AND COMPUTED TOMOGRAPHY (PET-CT)

- 6.2.3.1 Combined scans from PET and CT offer more accurate results

- TABLE 58 POSITRON EMISSION TOMOGRAPHY AND COMPUTED TOMOGRAPHY MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: POSITRON EMISSION TOMOGRAPHY AND COMPUTED TOMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 60 EUROPE: POSITRON EMISSION TOMOGRAPHY AND COMPUTED TOMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 61 ASIA PACIFIC: POSITRON EMISSION TOMOGRAPHY AND COMPUTED TOMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 62 LATIN AMERICA: POSITRON EMISSION TOMOGRAPHY AND COMPUTED TOMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 63 POSITRON EMISSION TOMOGRAPHY AND COMPUTED TOMOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 64 POSITRON EMISSION TOMOGRAPHY AND COMPUTED TOMOGRAPHY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2.4 MOLECULAR BREAST IMAGING/BREAST-SPECIFIC GAMMA IMAGING (MBI/BSGI)

- 6.2.4.1 High sensitivity to drive growth

- TABLE 65 MOLECULAR BREAST IMAGING/BREAST-SPECIFIC GAMMA IMAGING MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: MOLECULAR BREAST IMAGING/BREAST-SPECIFIC GAMMA IMAGING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 67 EUROPE: MOLECULAR BREAST IMAGING/BREAST-SPECIFIC GAMMA IMAGING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 68 ASIA PACIFIC: MOLECULAR BREAST IMAGING/BREAST-SPECIFIC GAMMA IMAGING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 69 LATIN AMERICA: MOLECULAR BREAST IMAGING/BREAST-SPECIFIC GAMMA IMAGING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 70 MOLECULAR BREAST IMAGING/BREAST-SPECIFIC GAMMA IMAGING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 71 MOLECULAR BREAST IMAGING/BREAST-SPECIFIC GAMMA IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2.5 CONE-BEAM COMPUTED TOMOGRAPHY (CBCT)

- 6.2.5.1 CBCT segment to witness stable growth during forecast period

- TABLE 72 CONE-BEAM COMPUTED TOMOGRAPHY MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: CONE-BEAM COMPUTED TOMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 74 EUROPE: CONE-BEAM COMPUTED TOMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: CONE-BEAM COMPUTED TOMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 76 LATIN AMERICA: CONE-BEAM COMPUTED TOMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 77 CONE-BEAM COMPUTED TOMOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 78 CONE-BEAM COMPUTED TOMOGRAPHY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.3 NON-IONIZING BREAST IMAGING TECHNOLOGIES

- TABLE 79 NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.3.1 BREAST ULTRASOUND

- 6.3.1.1 Rising awareness and easy availability of ultrasound devices for breast imaging to drive growth

- TABLE 80 BREAST ULTRASOUND MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: BREAST ULTRASOUND MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 82 EUROPE: BREAST ULTRASOUND MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: BREAST ULTRASOUND MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 84 LATIN AMERICA: BREAST ULTRASOUND MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 85 BREAST ULTRASOUND MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 86 BREAST ULTRASOUND MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.3.2 BREAST MRI

- 6.3.2.1 Technological advancements in breast MRI to drive growth

- TABLE 87 BREAST MRI MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: BREAST MRI MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 89 EUROPE: BREAST MRI MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: BREAST MRI MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 91 LATIN AMERICA: BREAST MRI MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 92 BREAST MRI MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 93 BREAST MRI MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.3.3 AUTOMATED WHOLE-BREAST ULTRASOUND (AWBU)

- 6.3.3.1 AWBU helps spot small cancers in mammograms of dense breasts

- TABLE 94 AUTOMATED WHOLE-BREAST ULTRASOUND MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: AUTOMATED WHOLE-BREAST ULTRASOUND MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 96 EUROPE: AUTOMATED WHOLE-BREAST ULTRASOUND MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: AUTOMATED WHOLE-BREAST ULTRASOUND MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 98 LATIN AMERICA: AUTOMATED WHOLE-BREAST ULTRASOUND MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 99 AUTOMATED WHOLE-BREAST ULTRASOUND MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 100 AUTOMATED WHOLE-BREAST ULTRASOUND MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.3.4 BREAST THERMOGRAPHY

- 6.3.4.1 Rising popularity due to reduced exposure to harmful radiation to boost adoption

- TABLE 101 BREAST THERMOGRAPHY MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: BREAST THERMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 103 EUROPE: BREAST THERMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: BREAST THERMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 105 LATIN AMERICA: BREAST THERMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 106 BREAST THERMOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 107 BREAST THERMOGRAPHY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.3.5 ELECTRIC IMPEDANCE TOMOGRAPHY

- 6.3.5.1 Affordability and quick results to drive growth

- TABLE 108 ELECTRIC IMPEDANCE TOMOGRAPHY MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 109 NORTH AMERICA: ELECTRIC IMPEDANCE TOMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 110 EUROPE: ELECTRIC IMPEDANCE TOMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: ELECTRIC IMPEDANCE TOMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 112 LATIN AMERICA: ELECTRIC IMPEDANCE TOMOGRAPHY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 113 ELECTRIC IMPEDANCE TOMOGRAPHY MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 114 ELECTRIC IMPEDANCE TOMOGRAPHY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.3.6 OPTICAL IMAGING

- 6.3.6.1 High sensitivity, easy accessibility, and lower cost to support growth

- TABLE 115 OPTICAL IMAGING MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 116 NORTH AMERICA: OPTICAL IMAGING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 117 EUROPE: OPTICAL IMAGING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: OPTICAL IMAGING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 119 LATIN AMERICA: OPTICAL IMAGING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 120 OPTICAL IMAGING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 121 OPTICAL IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

7 BREAST IMAGING MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- TABLE 122 BREAST IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 7.2 BREAST IMAGING SYSTEMS

- 7.2.1 SIGNIFICANT TECHNOLOGICAL DEVELOPMENTS TO FUEL GROWTH

- TABLE 123 BREAST IMAGING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3 SOFTWARE AND SERVICES

- 7.3.1 INTRODUCTION OF NOVEL IMAGING SOFTWARE TO SUPPORT GROWTH

- TABLE 124 BREAST IMAGING SOFTWARE AND SERVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.4 ACCESSORIES

- 7.4.1 INCREASING ADOPTION OF BREAST IMAGING EQUIPMENT TO BOOST GROWTH

- TABLE 125 BREAST IMAGING ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

8 BREAST IMAGING MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 126 BREAST IMAGING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2 HOSPITALS AND CLINICS

- 8.2.1 RISING DEMAND FOR QUICK AND ACCURATE DIAGNOSIS TO BOOST GROWTH

- TABLE 127 BREAST IMAGING MARKET FOR HOSPITALS AND CLINICS, BY REGION, 2021-2028 (USD MILLION)

- 8.3 DIAGNOSTIC IMAGING CENTERS

- 8.3.1 RISING NUMBER OF PRIVATE IMAGING CENTERS CONTRIBUTING TO GROWTH

- TABLE 128 BREAST IMAGING MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY REGION, 2021-2028 (USD MILLION)

- 8.4 BREAST CARE CENTERS

- 8.4.1 INCREASING INCLINATION TOWARD BREAST CARE CENTERS OBSERVED IN DEVELOPED COUNTRIES

- TABLE 129 BREAST IMAGING MARKET FOR BREAST CARE CENTERS, BY REGION, 2021-2028 (USD MILLION)

- 8.5 OTHER END USERS

- TABLE 130 BREAST IMAGING MARKET FOR OTHER END USERS, BY REGION, 2021-2028 (USD MILLION)

9 BREAST IMAGING MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 131 BREAST IMAGING MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 25 NORTH AMERICA: BREAST IMAGING MARKET SNAPSHOT

- TABLE 132 NORTH AMERICA: BREAST IMAGING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 133 NORTH AMERICA: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 134 NORTH AMERICA: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 135 NORTH AMERICA: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 137 NORTH AMERICA: BREAST IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 138 NORTH AMERICA: BREAST IMAGING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 US to dominate North American breast imaging market during forecast period

- TABLE 139 US: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 140 US: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 141 US: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 142 US: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 Increasing incidence of breast cancer and favorable government guidelines to support growth

- TABLE 143 CANADA: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 144 CANADA: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 145 CANADA: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 146 CANADA: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3 EUROPE

- TABLE 147 EUROPE: BREAST IMAGING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 148 EUROPE: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 149 EUROPE: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 150 EUROPE: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 151 EUROPE: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 152 EUROPE: BREAST IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 153 EUROPE: BREAST IMAGING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Rising utilization of ionizing and non-ionizing imaging technologies to boost growth

- TABLE 154 GERMANY: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 155 GERMANY: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 156 GERMANY: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 157 GERMANY: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3.2 FRANCE

- 9.3.2.1 Growing government initiatives and modernization of healthcare infrastructure fueling growth

- TABLE 158 FRANCE: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 159 FRANCE: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 160 FRANCE: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 161 FRANCE: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Growing funding opportunities for supporting cancer research to drive growth

- TABLE 162 UK: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 163 UK: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 164 UK: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 165 UK: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 Evolving regulatory scenario for breast imaging and rising incidence of cancer to drive growth

- TABLE 166 ITALY: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 167 ITALY: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 168 ITALY: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 169 ITALY: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Growing geriatric population to drive growth

- TABLE 170 SPAIN: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 171 SPAIN: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 172 SPAIN: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 173 SPAIN: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 174 REST OF EUROPE: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 175 REST OF EUROPE: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 176 REST OF EUROPE: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 177 REST OF EUROPE: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 26 ASIA PACIFIC: BREAST IMAGING MARKET SNAPSHOT

- TABLE 178 ASIA PACIFIC: BREAST IMAGING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 181 ASIA PACIFIC: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 182 ASIA PACIFIC: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 183 ASIA PACIFIC: BREAST IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 184 ASIA PACIFIC: BREAST IMAGING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.1 JAPAN

- 9.4.1.1 Rising breast cancer cases and presence of universal healthcare reimbursement scenario to fuel growth

- TABLE 185 JAPAN: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 186 JAPAN: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 187 JAPAN: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 188 JAPAN: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Government initiatives for healthcare development to fuel growth

- TABLE 189 CHINA: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 190 CHINA: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 191 CHINA: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 192 CHINA: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4.3 INDIA

- 9.4.3.1 Rising government initiatives focused on improving female health to drive growth

- TABLE 193 INDIA: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 194 INDIA: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 195 INDIA: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 196 INDIA: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4.4 AUSTRALIA

- 9.4.4.1 Rising research funding and awareness campaigns to support growth

- TABLE 197 AUSTRALIA: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 198 AUSTRALIA: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 199 AUSTRALIA: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 200 AUSTRALIA: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Rising government initiatives to drive growth

- TABLE 201 SOUTH KOREA: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 202 SOUTH KOREA: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 203 SOUTH KOREA: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 204 SOUTH KOREA: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4.6 REST OF ASIA PACIFIC

- TABLE 205 REST OF ASIA PACIFIC: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 207 REST OF ASIA PACIFIC: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.5 LATIN AMERICA

- TABLE 209 LATIN AMERICA: BREAST IMAGING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 210 LATIN AMERICA: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 211 LATIN AMERICA: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 212 LATIN AMERICA: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 213 LATIN AMERICA: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 214 LATIN AMERICA: BREAST IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 215 LATIN AMERICA: BREAST IMAGING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.1 BRAZIL

- 9.5.1.1 Rising modernization of healthcare facilities to drive growth

- TABLE 216 BRAZIL: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 217 BRAZIL: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 218 BRAZIL: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 219 BRAZIL: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.5.2 MEXICO

- 9.5.2.1 Availability of advanced care and increasing awareness programs to fuel growth

- TABLE 220 MEXICO: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 221 MEXICO: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 222 MEXICO: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 223 MEXICO: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.5.3 REST OF LATIN AMERICA

- TABLE 224 REST OF LATIN AMERICA: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 225 REST OF LATIN AMERICA: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 226 REST OF LATIN AMERICA: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 227 REST OF LATIN AMERICA: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 IMPROVING HEALTHCARE INFRASTRUCTURE AND INCREASING PUBLIC-PRIVATE INVESTMENTS TO DRIVE GROWTH

- TABLE 228 MIDDLE EAST & AFRICA: BREAST IMAGING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: MAMMOGRAPHY MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: NON-IONIZING BREAST IMAGING TECHNOLOGIES MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: BREAST IMAGING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: BREAST IMAGING MARKET, BY END USER, 2021-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 RIGHT TO WIN

- 10.3 STRATEGIES OF KEY PLAYERS

- FIGURE 27 KEY DEVELOPMENTS IN BREAST IMAGING MARKET

- 10.4 REVENUE SHARE ANALYSIS

- FIGURE 28 REVENUE SHARE ANALYSIS OF TOP FIVE PLAYERS IN BREAST IMAGING MARKET (2020-2022)

- 10.5 MARKET SHARE ANALYSIS

- FIGURE 29 GE HEALTHCARE HELD LEADING POSITION IN BREAST IMAGING MARKET IN 2022

- TABLE 234 BREAST IMAGING MARKET: DEGREE OF COMPETITION

- 10.6 COMPANY EVALUATION MATRIX (2022)

- 10.6.1 VENDOR INCLUSION CRITERIA

- 10.6.2 STARS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 EMERGING LEADERS

- 10.6.5 PARTICIPANTS

- FIGURE 30 BREAST IMAGING MARKET: COMPANY EVALUATION MATRIX, 2022

- 10.7 COMPANY EVALUATION MATRIX FOR START-UPS/SMES (2022)

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 STARTING BLOCKS

- 10.7.3 RESPONSIVE COMPANIES

- 10.7.4 DYNAMIC COMPANIES

- FIGURE 31 BREAST IMAGING MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2022

- 10.8 COMPETITIVE BENCHMARKING

- TABLE 235 PRODUCT AND REGIONAL FOOTPRINT ANALYSIS OF TOP PLAYERS IN BREAST IMAGING MARKET

- 10.9 COMPETITIVE SCENARIO AND TRENDS

- 10.9.1 PRODUCT LAUNCHES

- TABLE 236 BREAST IMAGING MARKET: PRODUCT LAUNCHES, JANUARY 2020-MAY 2023

- 10.9.2 DEALS

- TABLE 237 BREAST IMAGING MARKET: DEALS, JANUARY 2020-MAY 2023

- 10.9.3 OTHER DEVELOPMENTS

- TABLE 238 BREAST IMAGING MARKET: OTHER DEVELOPMENTS, JANUARY 2020-MAY 2023

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 11.1.1 GE HEALTHCARE (PART OF GENERAL ELECTRIC COMPANY)

- TABLE 239 GE HEALTHCARE: COMPANY OVERVIEW

- FIGURE 32 GE HEALTHCARE: COMPANY SNAPSHOT (2022)

- 11.1.2 HOLOGIC, INC.

- TABLE 240 HOLOGIC, INC.: COMPANY OVERVIEW

- FIGURE 33 HOLOGIC, INC.: COMPANY SNAPSHOT (2022)

- 11.1.3 SIEMENS HEALTHCARE GMBH

- TABLE 241 SIEMENS HEALTHCARE GMBH: COMPANY OVERVIEW

- FIGURE 34 SIEMENS HEALTHCARE GMBH: COMPANY SNAPSHOT (2022)

- 11.1.4 KONINKLIJKE PHILIPS N.V.

- TABLE 242 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- FIGURE 35 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2022)

- 11.1.5 FUJIFILM HOLDINGS CORPORATION

- TABLE 243 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

- FIGURE 36 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2022)

- 11.1.6 CANON INC.

- TABLE 244 CANON INC.: COMPANY OVERVIEW

- FIGURE 37 CANON INC.: COMPANY SNAPSHOT (2022)

- 11.1.7 AURORA HEALTHCARE US CORP.

- 11.1.8 ALLENGERS

- 11.1.9 DILON TECHNOLOGIES, INC.

- 11.1.10 PLANMED OY

- 11.1.11 DELPHINUS MEDICAL TECHNOLOGIES, INC.

- 11.1.12 MICRIMA LIMITED

- 11.1.13 CMR NAVISCAN

- 11.1.14 METALTRONICA S.P.A.

- 11.1.15 CAPERAY

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 KUB TECHNOLOGIES

- 11.2.2 SONOCINE

- 11.2.3 NP JSC AMICO

- 11.2.4 QT IMAGING, INC.

- 11.2.5 IMAGING DIAGNOSTIC SYSTEMS, INC.

- 11.2.6 SENO MEDICAL

- 11.2.7 ONCOVISION

- 11.2.8 VILLA SISTEMI MEDICALI SPA

- 11.2.9 TRIVITRON HEALTHCARE

- 11.2.10 ISONO HEALTH, INC.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS