|

|

市場調査レポート

商品コード

1300113

高圧ケーブル・付属品の世界市場:製品種類別 (ケーブル (XLPE、EPR、HEPR、MI)、付属品 (ジョイント、終端、継手・固定具))・導体の種類別 (アルミニウム、銅)・設置方法別・電圧別・エンドユーザー別・地域別の将来予測 (2028年まで)High Voltage Cables and Accessories Market by Product Type (Cables (XLPE, EPR, HEPR, MI), Accessories (Joints, Termination, Fittings & Fixtures), Conductor Type (Aluminum, Copper), Installation, Voltage, End User & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 高圧ケーブル・付属品の世界市場:製品種類別 (ケーブル (XLPE、EPR、HEPR、MI)、付属品 (ジョイント、終端、継手・固定具))・導体の種類別 (アルミニウム、銅)・設置方法別・電圧別・エンドユーザー別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月23日

発行: MarketsandMarkets

ページ情報: 英文 249 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の高圧ケーブル・付属品の市場規模は、2023年の400億米ドルから2028年には525億米ドルに達し、予測期間中の5.6%のCAGRで成長すると予測されています。

電力需要の増加に伴う発電能力の増加と送電電力損失の減少が、高圧ケーブルおよび付属品市場を牽引しています。

"245kV:定格電圧別でで2番目に速いセグメント"

245kVケーブルが、長距離で効率よく高い送電能力を発揮するため、市場規模が拡大しています。このケーブルは、送電網・変電所、産業用途、再生可能エネルギープロジェクトで使用されています。このケーブルは、その優れた絶縁特性により漏電を防止します。

"架空セグメント:設置方法別で最大のセグメントとして台頭"

架空ケーブルは配電効率が高く、また地下ケーブルや海底ケーブルに比べてコスト効率が高いため、最大のセグメントとなる見通しです。架空ケーブルは、送電・配電、通信、高速道路、輸送網などのさまざまな用途で使用されており、配備や保守が容易であることが証明されています。

"エンドユーザー別では、再生可能エネルギーが最速のセグメントとなる"

将来的には再生可能エネルギーへの投資が拡大し、高圧ケーブル・付属品の需要を牽引すると予想されています。再生可能エネルギー発電所への投資の増加は、政府の政策、インセンティブ、気候変動対策が原動力となっています。再生可能エネルギープロジェクトは、持続可能性の目標と責任に沿ったものです。

"欧州は2番目に大きな地域になる"

世界の高圧ケーブル・付属品市場では予測期間中 (2023年~2028年)、アジア太平洋に次いで欧州が第2位の地域になると予想されています。同地域では、エネルギー需要の増加により送電用途が拡大しており、これが高圧ケーブル・付属品市場の拡大を促しています。さらに、この地域の国々はインフラ整備と相互接続プロジェクトに注力しています。さらに、これらの国の政府は、送電部門への外国投資を誘致するための規制と政策を実施しています。これらは、欧州の高圧ケーブル・付属品市場の成長を促進する主な要因です。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- マーケットマップ

- バリューチェーン分析

- 平均販売価格分析

- 規制分析

- 関税・規制状況

- 特許分析

- 主要な会議とイベント (2023年~2024年)

- 貿易分析

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

第6章 高圧ケーブル・付属品市場:導体の種類別

- イントロダクション

- アルミニウム

- 銅

第7章 高圧ケーブル・付属品市場:電圧別

- イントロダクション

- 72.5KV

- 123KV

- 145KV

- 170KV

- 245KV

- 400KV以上

第8章 高圧ケーブル・付属品市場:製品種類別

- イントロダクション

- ケーブル

- 架橋ポリエチレン (XLPE)

- エチレンプロピレンゴム (EPR)

- 高弾性エチレンプロピレン (HEPR)

- マス含浸 (MI)

- 付属品

- ケーブルジョイント

- ケーブル終端

- 継手・固定具

- その他

第9章 高圧ケーブル・付属品市場:エンドユーザー別

- イントロダクション

- 電力企業

- 再生可能エネルギー

- 産業用

- 石油・ガス

- 化学製品・石油化学製品

- 鉱業・金属

- その他

第10章 高圧ケーブル・付属品市場:設置方法別

- イントロダクション

- 架空

- 地下

- 海底

第11章 高圧ケーブル・付属品市場:地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

第12章 競合情勢

- 主要企業の戦略

- 上位5社の市場シェア分析

- 上位5社の収益シェア分析

- 企業評価マトリックス (2022年)

- 高圧ケーブル・付属品市場:企業のフットプリント

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- SUMITOMO ELECTRIC INDUSTRIES

- PRYSMIAN GROUP

- NEXANS

- NKT A/S

- LS CABLE & SYSTEM LTD.

- TE CONNECTIVITY

- EL SEWEDY ELECTRIC COMPANY

- WUXI JIANGNAN CABLE CO., LTD.

- ZTT

- FURUKAWA ELECTRIC CO., LTD.

- KEI INDUSTRIES LIMITED

- TAIHAN CABLE & SOLUTION CO., LTD.

- TELE-FONIKA KABLE SA

- RIYADH CABLES

- TRATOS

- その他の企業

- SYNERGY CABLES

- PFISTERER HOLDING AG

- DUCAB HV

- SOUTHWIRE COMPANY, LLC

- BRUGG KABEL AG

第14章 付録

The high voltage cables and accessories market is estimated to grow from USD 40.0 Billion in 2023 to USD 52.5 Billion by 2028; it is expected to record a CAGR of 5.6% during the forecast period. Increasing power generation capacity with growing power demand coupled with decreased transmission power loss drives the high voltage cables and accessories market.

"245kV: The second-fastest segment of the high voltage cables and accessories market, by voltage rating"

Based on end user, the high voltage cables and accessories market has been split into six types: 72.5kV, 123kV, 145kV, 170kV, 245kV, and 400kV and above. The adoption of 245kV cables is growing in the high voltage cables and accessories market due to their high power transmission ability with efficiency over long distances. These cables are used in power grids, substations, industrial applications and renewable energy projects. These cables prevent electrical leakages due to their exceptional insulation properties.

"Overhead segment is expected to emerge as the largest segment based on installation"

Based on installation, the high voltage cables and accessories market has been segmented into overhead, underground, and submarine. The overhead segment is expected to be the largest segment owing to its efficiency in distribution of power. It is cost effective as compared to underground and submarine cables. Being used in different applications like power transmission and distribution, telecommunication, highways and transportation networks and much more, overhead cables has proved to be easily deployed and maintained.

"Renewables is expected to emerge as fastest segment based on end user"

By end user, the high voltage cables and accessories market has been segmented into power utilities, renewables, and industrials. Increasing investments in the renewables are anticipated to drive the demand for high voltage cables and accessories. The rising investment in renewable energy plants is driven by government policies, incentives and climate change converns. Renewable energy projects align with sustainability goals and responsibility.

Europe is expected to be the second-largest region in the high voltage cables and accessories market

Europe is expected to be the second-largest region in the high voltage cables and accessories market between 2023-2028, preceded by Asia Pacific. The power transmission applications in the region due to the increasing demand for energy, which has prompted the expansion of the high voltage cables and accessories market. Moreover, countries in this region have been focusing on the infrastructure development and interconnection projects. Additionally, the governments of these countries have implemented regulations, policies and incentives to attract foreign investments in the power transmission sector. These are the key factors fostering the growth of the high voltage cables and accessories market in the Europe.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 45%, Tier 2- 30%, and Tier 3- 25%

By Designation: C-Level- 35%, Director Levels- 25%, and Others- 40%

By Region: Asia Pacific- 33%, North America- 27%, Europe- 20%, the Middle East & Africa- 12%, and South America- 8%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The high voltage cables and accessories market is dominated by a few major players that have a wide regional presence. The leading players in the high voltage cables and accessories market are Prysmian Group (Italy), Sumitomo Electric Industries Ltd. (Japan), Nexans (France), LS Cable & System Ltd. (Korea), and NKT A/S (Denmark).

Research Coverage:

The report defines, describes, and forecasts the high voltage cables and accessories market, by product type, conductor type, voltage rating, installation, end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the high voltage cables and accessories market.

Key Benefits of Buying the Report

- Increased investments in electricity grids, decrease in the power losses, and growing focus on environmental mandates drive the demand. Factors such as complicated regulatory process, and high prices installation and maintenance hinder market growth. Rise in the power generation scope couples with more adoption of HVDC submarine power cables offer lucrative opportunities in this market. Dynamic prices of raw materials and need of expertise in deployment and development are major challenges faced by countries in this market.

- Product Development/ Innovation: The trends such as P-laser insulation, XLPE insulation, dry and self supporting DOC termination, have led to more efficient, reliable, durable, and high power transmission. The focus on underground cables has also led to the expectation that it would minimize the land usage and will contribute more safety and security.

- Market Development: The global scenario of high voltage cables and accessories in power transmission applications is evolving rapidly, with trends towards underground and submarine cables from overhead cables to minimize environmental impact and enhance reliability. XLPE cables are used due to their exceptional electrical properties, including high insulation strength, low dielectric loss, and resistance to moisture.

- Market Diversification: PFISTERER Holding AG introduced first dry and self supporting dry outdoor cable termination with voltage upto 170kV. This new launch saves installation time and has decreased it from hours to minutes. It is reliable and efficient.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Prysmian Group (Italy), Sumitomo Electric Industries Ltd. (Japan), Nexans (France), LS Cable & System Ltd. (Korea), and NKT A/S (Denmark) among others in the high voltage cables and accessories market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.1.1 High voltage cables and accessories market, by product type

- 1.2.1.2 High voltage cables and accessories market, by installation

- 1.2.1.3 High voltage cables and accessories market, by voltage

- 1.2.1.4 High voltage cables and accessories market, by conductor type

- 1.2.1.5 High voltage cables and accessories market, by end user

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 IMPACT OF RECESSION

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 1 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primaries

- FIGURE 3 BREAKDOWN OF PRIMARIES

- 2.3 STUDY SCOPE

- FIGURE 4 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR HIGH VOLTAGE CABLES AND ACCESSORIES

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- 2.4.3.1 Regional analysis

- 2.4.3.2 Country-level analysis

- 2.4.3.3 Assumptions for demand-side analysis

- 2.4.3.4 Calculations for demand-side analysis

- 2.4.4 SUPPLY-SIDE ANALYSIS

- FIGURE 7 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF HIGH VOLTAGE CABLES AND ACCESSORIES

- FIGURE 8 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: SUPPLY-SIDE ANALYSIS

- 2.4.4.1 Calculations for supply-side analysis

- 2.4.4.2 Assumptions for supply-side analysis

- FIGURE 9 COMPANY REVENUE ANALYSIS, 2022

- 2.4.5 MARKET FORECAST

- 2.5 RISK ASSESSMENT

- 2.6 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- TABLE 1 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET SNAPSHOT

- FIGURE 10 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 11 OVERHEAD SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 CABLE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 POWER UTILITIES SEGMENT TO CLAIM LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 400 KV AND ABOVE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 COPPER SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN HIGH VOLTAGE CABLES AND ACCESSORIES MARKET

- FIGURE 16 RISING POWER CONSUMPTION TO DRIVE HIGH VOLTAGE CABLES AND ACCESSORIES MARKET

- 4.2 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION

- FIGURE 17 ASIA PACIFIC MARKET TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET IN NORTH AMERICA, BY END USER AND COUNTRY

- FIGURE 18 POWER UTILITIES AND US DOMINATED NORTH AMERICA IN 2022

- 4.4 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION

- FIGURE 19 OVERHEAD SEGMENT TO LEAD MARKET IN 2028

- 4.5 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY END USER

- FIGURE 20 POWER UTILITIES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2028

- 4.6 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE

- FIGURE 21 CABLE SEGMENT TO SECURE LARGER MARKET SHARE IN 2028

- 4.7 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE

- FIGURE 22 COPPER SEGMENT TO PROCURE LARGER MARKET SHARE IN 2028

- 4.8 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE

- FIGURE 23 400 KV AND ABOVE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 24 HIGH VOLTAGE CABLES & ACCESSORIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing number offshore wind farms

- FIGURE 25 GLOBAL OFFSHORE WIND INSTALLATIONS, 2012-2021

- 5.2.1.2 Rising investments in electricity grids

- FIGURE 26 INVESTMENTS IN ELECTRICITY NETWORKS, BY REGION (2015-2021)

- TABLE 2 T&D INFRASTRUCTURE EXPANSION PLANS

- 5.2.1.3 Reduction of transmission power losses in high voltage cables

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complex regulatory and environmental authorization procedures

- 5.2.2.2 High cost of installation and repair of underground and submarine cables

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Continuous increase in power generation capacity

- FIGURE 27 ANNUAL RENEWABLE ELECTRICITY CAPACITY ADDITIONS WORLDWIDE (GW) (2015-2026)

- 5.2.3.2 Increasing adoption of HVDC submarine power cables

- 5.2.4 CHALLENGES

- 5.2.4.1 Volatile prices of raw materials

- 5.2.4.2 Requirement of technical expertise for development and installation

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR HIGH VOLTAGE CABLES AND ACCESSORIES MANUFACTURERS

- FIGURE 28 REVENUE SHIFTS FOR HIGH VOLTAGE CABLES AND ACCESSORIES MANUFACTURERS

- 5.4 MARKET MAP

- TABLE 3 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: MARKET MAP/ECOSYSTEM ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 30 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL PROVIDERS/SUPPLIERS

- 5.5.2 HIGH VOLTAGE CABLES AND ACCESSORIES MANUFACTURERS

- 5.5.3 DISTRIBUTORS/END USERS

- 5.6 AVERAGE SELLING PRICE ANALYSIS

- FIGURE 31 AVERAGE SELLING PRICE OF HIGH VOLTAGE CABLES AND ACCESSORIES, BY CABLE TYPE (USD MILLION PER KILOMETER)

- TABLE 4 AVERAGE SELLING PRICE OF HIGH VOLTAGE CABLES AND ACCESSORIES, BY CABLES (USD MILLION PER KILOMETER)

- TABLE 5 AVERAGE SELLING PRICE ANALYSIS, BY REGION (USD MILLION PER KILOMETER), 2021 AND 2028

- FIGURE 32 AVERAGE SELLING PRICE ANALYSIS, BY REGION (USD MILLION PER KILOMETER), 2021 AND 2028

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 TECHNOLOGY TRENDS RELATED TO HIGH VOLTAGE CABLES AND ACCESSORIES

- 5.8 TARIFF AND REGULATORY LANDSCAPE

- 5.8.1 TARIFF FOR HIGH VOLTAGE ACCESSORIES AND CABLES

- 5.8.2 REGULATIONS RELATED TO HIGH VOLTAGE CABLES AND ACCESSORIES

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.3 CODES AND REGULATIONS RELATED TO HIGH VOLTAGE CABLES AND ACCESSORIES

- TABLE 10 NORTH AMERICA: CODES AND REGULATIONS

- TABLE 11 SOUTH AMERICA: CODES AND REGULATIONS

- TABLE 12 GLOBAL: CODES AND REGULATIONS

- 5.9 PATENT ANALYSIS

- TABLE 13 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: PATENT REGISTRATIONS

- 5.10 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 14 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: LIST OF CONFERENCES AND EVENTS

- 5.11 TRADE ANALYSIS

- FIGURE 33 IMPORT AND EXPORT SCENARIO FOR HS CODE: 8544, 2018-2022 (USD THOUSAND)

- TABLE 15 TRADE DATA FOR HS CODE: 8544, 2018-2022 (USD THOUSAND)

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 345 KV TRANSMISSION RELIABILITY PROJECT ENHANCES ELECTRICAL CAPABILITIES OF BOSTON AND EASTERN MASSACHUSETTS

- 5.12.2 BRUGG CABLES PROVIDES HIGH VOLTAGE CABLES AND COMPREHENSIVE RANGE OF ACCESSORIES FOR POWER SUPPLY PROJECTS DURING BEIJING OLYMPIC GAMES

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- 5.14.2 BUYING CRITERIA

- FIGURE 36 KEY BUYING CRITERIA, BY END USER

- TABLE 18 KEY BUYING CRITERIA, BY END USER

6 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE

- 6.1 INTRODUCTION

- FIGURE 37 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE, 2022

- TABLE 19 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE, 2021-2028 (USD MILLION)

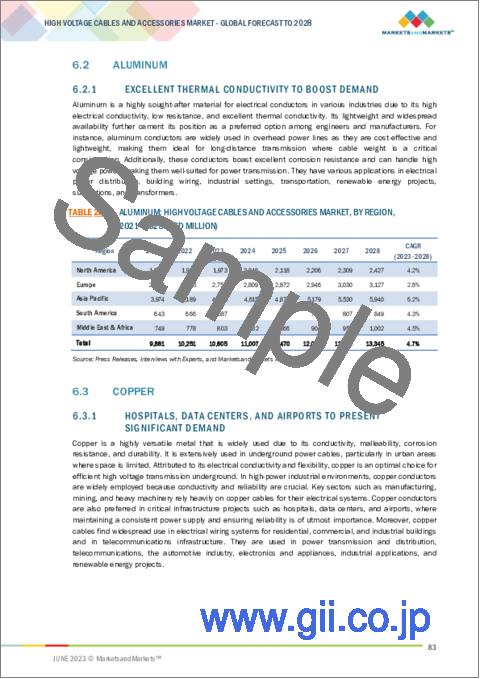

- 6.2 ALUMINUM

- 6.2.1 EXCELLENT THERMAL CONDUCTIVITY TO BOOST DEMAND

- TABLE 20 ALUMINUM: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3 COPPER

- 6.3.1 HOSPITALS, DATA CENTERS, AND AIRPORTS TO PRESENT SIGNIFICANT DEMAND

- TABLE 21 COPPER: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

7 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE

- 7.1 INTRODUCTION

- FIGURE 38 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE, 2022

- TABLE 22 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 7.2 72.5 KV

- 7.2.1 ADVANCEMENTS IN CABLE TECHNOLOGY AND INSULATION MATERIALS TO BOOST DEMAND

- TABLE 23 72.5 KV: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3 123 KV

- 7.3.1 EXPANSION OF SMART GRID INITIATIVES TO DRIVE MARKET

- TABLE 24 123KV: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.4 145 KV

- 7.4.1 GROWING NEED FOR LONG-DISTANCE POWER TRANSMISSION TO DRIVE MARKET

- TABLE 25 145KV: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.5 170 KV

- 7.5.1 INITIATIVES TO MODERNIZE GRID TO DRIVE MARKET

- TABLE 26 170KV: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.6 245 KV

- 7.6.1 REDUCED POWER LOSSES AND SUPERIOR EFFICIENCY TO BOOST MARKET

- TABLE 27 245KV: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.7 400KV AND ABOVE

- 7.7.1 RENEWABLE ENERGY PROJECTS AND INFRASTRUCTURE DEVELOPMENT TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- TABLE 28 400KV AND ABOVE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

8 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- FIGURE 39 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE, 2022

- TABLE 29 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 30 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CABLE TYPE, 2021-2028 (USD MILLION)

- TABLE 31 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY ACCESSORY TYPE, 2021-2028 (USD MILLION)

- 8.2 CABLES

- 8.2.1 ABILITY TO CARRY LARGE AMOUNTS OF ELECTRICAL POWER AT HIGH VOLTAGES TO BOOST DEMAND

- TABLE 32 CABLES: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.2.2 CROSS-LINKED POLYETHYLENE

- 8.2.2.1 Excellent thermal endurance to drive market

- TABLE 33 XLPE CABLES: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.2.3 ETHYLENE-PROPYLENE RUBBER

- 8.2.3.1 Flexibility and ease of installation to drive market

- TABLE 34 EPR CABLES: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.2.4 HIGH MODULUS ETHYLENE-PROPYLENE

- 8.2.4.1 Improved resistance to electrical and thermal stresses to enhance demand

- TABLE 35 HEPR CABLES: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.2.5 MASS IMPREGNATED

- 8.2.5.1 High mechanical durability in challenging environments to drive market

- TABLE 36 MI CABLES: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.3 ACCESSORIES

- 8.3.1 ENHANCES SAFETY AND PERFORMANCE WITH LOWER MAINTENANCE COST

- TABLE 37 ACCESSORIES: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.3.2 CABLE JOINTS

- 8.3.2.1 Lesser downtime and cost-saving attributes to boost demand

- TABLE 38 CABLE JOINTS: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.3.3 CABLE TERMINATION

- 8.3.3.1 Safety features, improved performance, and durability to strengthen market

- TABLE 39 CABLE TERMINATION: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.3.4 FITTINGS AND FIXTURES

- 8.3.4.1 Reduction of power loss and maintenance of optimal electrical characteristics to drive market

- TABLE 40 FITTINGS AND FIXTURES: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.3.5 OTHERS

- 8.3.5.1 Maintains critical safety as per regulations set by regulatory bodies

- TABLE 41 OTHERS: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

9 HIGH VOLTAGE CABLES AND ACCESSORIES, BY END USER

- 9.1 INTRODUCTION

- FIGURE 40 HIGH VOLTAGE CABLES AND ACCESSORIES SHARE, BY END USER, 2022

- TABLE 42 HIGH VOLTAGE CABLES AND ACCESSORIES, BY END USER, 2021-2028 (USD MILLION)

- TABLE 43 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INDUSTRIAL END USER, 2021-2028 (USD MILLION)

- 9.2 POWER UTILITIES

- 9.2.1 TRANSMISSION OF ELECTRICITY OVER LONG DISTANCES WITH MINIMAL LOSSES TO BOOST DEMAND

- TABLE 44 POWER UTILITIES: HIGH VOLTAGE CABLES AND ACCESSORIES, BY REGION, 2021-2028 (USD MILLION)

- 9.3 RENEWABLES

- 9.3.1 REDUCED RELIANCE ON FOSSIL FUELS AND PROMOTION OF ECO-FRIENDLY SOLUTIONS TO BOOST DEMAND

- TABLE 45 RENEWABLES: HIGH VOLTAGE CABLES AND ACCESSORIES, BY REGION, 2021-2028 (USD MILLION)

- 9.4 INDUSTRIAL

- 9.4.1 ABILITY TO WITHSTAND HARSH INDUSTRIAL CONDITIONS TO DRIVE MARKET

- TABLE 46 INDUSTRIAL: HIGH VOLTAGE CABLES AND ACCESSORIES, BY REGION, 2021-2028 (USD MILLION)

- 9.4.2 OIL & GAS

- 9.4.2.1 Cost savings by minimizing power losses during transmission to strengthen market

- TABLE 47 OIL & GAS: HIGH VOLTAGE CABLES AND ACCESSORIES, BY REGION, 2021-2028 (USD MILLION)

- 9.4.3 CHEMICALS & PETROCHEMICALS

- 9.4.3.1 Safety features to counter electrical risks to boost market

- TABLE 48 CHEMICALS & PETROCHEMICALS: HIGH VOLTAGE CABLES AND ACCESSORIES, BY REGION, 2021-2028 (USD MILLION)

- 9.4.4 MINING & METALS

- 9.4.4.1 Ability to handle high-power needs of mining equipment to drive market

- TABLE 49 MINING & METALS: HIGH VOLTAGE CABLES AND ACCESSORIES, BY REGION, 2021-2028 (USD MILLION)

- 9.4.5 OTHERS

- TABLE 50 OTHERS: HIGH VOLTAGE CABLES AND ACCESSORIES, BY REGION, 2021-2028 (USD MILLION)

10 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION

- 10.1 INTRODUCTION

- FIGURE 41 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2022

- TABLE 51 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 10.2 OVERHEAD

- 10.2.1 HIGHWAYS, TRANSPORTATION NETWORKS, AND RAILWAYS TO OFFER LUCRATIVE OPPORTUNITIES

- TABLE 52 OVERHEAD: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.3 UNDERGROUND

- 10.3.1 RESIDENTIAL AREAS AND COMMERCIAL AND INDUSTRIAL ZONES TO PRESENT SIGNIFICANT DEMAND

- TABLE 53 UNDERGROUND: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.4 SUBMARINE

- 10.4.1 NEED TO ENSURE STABLE AND RESILIENT ELECTRICITY SUPPLY TO DRIVE MARKET

- TABLE 54 SUBMARINE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

11 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 42 ASIA PACIFIC HIGH VOLTAGE CABLES AND ACCESSORIES MARKET TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 43 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2022 (%)

- TABLE 55 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 56 CABLE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY REGION, 2021-2028 (KILOMETER)

- 11.2 NORTH AMERICA

- FIGURE 44 NORTH AMERICA: SNAPSHOT OF HIGH VOLTAGE CABLES AND ACCESSORIES MARKET

- 11.2.1 RECESSION IMPACT: NORTH AMERICA

- 11.2.2 BY PRODUCT TYPE

- TABLE 57 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CABLE TYPE, 2021-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY ACCESSORY TYPE, 2021-2028 (USD MILLION)

- 11.2.3 BY INSTALLATION

- TABLE 60 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.2.4 BY CONDUCTOR TYPE

- TABLE 61 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE, 2021-2028 (USD MILLION)

- 11.2.5 BY VOLTAGE RATING TYPE

- TABLE 62 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE RATING TYPE, 2021-2028 (USD MILLION)

- 11.2.6 BY END USER

- TABLE 63 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INDUSTRY, 2021-2028 (USD MILLION)

- 11.2.7 BY COUNTRY

- TABLE 65 NORTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 11.2.7.1 US

- 11.2.7.1.1 Increasing infrastructure and renewable projects investments to drive market

- 11.2.7.1 US

- TABLE 66 US: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.2.7.2 CANADA

- 11.2.7.2.1 Manufacturing capabilities and involvement in renewable energy projects to strengthen market

- 11.2.7.2 CANADA

- TABLE 67 CANADA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.2.7.3 Mexico

- 11.2.7.3.1 Growing investment to enhance power transmission capacity to augment market size

- 11.2.7.3 Mexico

- TABLE 68 MEXICO: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.3 EUROPE

- FIGURE 45 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET SNAPSHOT

- 11.3.1 RECESSION IMPACT: EUROPE

- 11.3.2 BY INSTALLATION

- TABLE 69 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.3.3 BY PRODUCT TYPE

- TABLE 70 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 71 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CABLE TYPE, 2021-2028 (USD MILLION)

- TABLE 72 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY ACCESSORY TYPE, 2021-2028 (USD MILLION)

- 11.3.4 BY VOLTAGE

- TABLE 73 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 11.3.5 BY END USER

- TABLE 74 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 75 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INDUSTRIAL END USER TYPE, 2021-2028 (USD MILLION)

- 11.3.6 BY CONDUCTOR TYPE

- TABLE 76 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE, 2021-2028 (USD MILLION)

- 11.3.7 BY COUNTRY

- TABLE 77 EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 11.3.7.1 Germany

- 11.3.7.1.1 Established electrical infrastructure to boost demand for high voltage cables and accessories

- 11.3.7.1 Germany

- TABLE 78 GERMANY: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.3.7.2 UK

- 11.3.7.2.1 Modernization of power grid to drive market

- 11.3.7.2 UK

- TABLE 79 UK: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.3.7.3 France

- 11.3.7.3.1 Expansion of renewable energy sector to offer lucrative opportunities

- 11.3.7.3 France

- TABLE 80 FRANCE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.3.7.4 Italy

- 11.3.7.4.1 Underground power transmission initiatives to strengthen market

- 11.3.7.4 Italy

- TABLE 81 ITALY: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.3.7.5 Spain

- 11.3.7.5.1 Investments in cross-border power transmission to drive market

- 11.3.7.5 Spain

- TABLE 82 SPAIN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.3.7.6 Denmark

- 11.3.7.6.1 Investments to develop power transmission infrastructure to benefit regional market

- 11.3.7.6 Denmark

- TABLE 83 DENMARK: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.3.7.7 Netherlands

- 11.3.7.7.1 Power transmission grid development projects to boost market

- 11.3.7.7 Netherlands

- TABLE 84 NETHERLANDS: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.3.7.8 Switzerland

- 11.3.7.8.1 Growing investments to enhance underground power transmission systems to boost market

- 11.3.7.8 Switzerland

- TABLE 85 SWITZERLAND: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.3.7.9 Belgium

- 11.3.7.9.1 Cross-border electricity exchange projects to boost market growth

- 11.3.7.9 Belgium

- TABLE 86 BELGIUM: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.3.7.10 Ireland

- 11.3.7.10.1 Investment in submarine interconnectors to offer lucrative opportunities

- 11.3.7.10 Ireland

- TABLE 87 IRELAND: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.3.7.11 Russia

- 11.3.7.11.1 Modernizing existing extensive power infrastructure to widen market size

- 11.3.7.11 Russia

- TABLE 88 RUSSIA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.3.7.12 Poland

- 11.3.7.12.1 Investment in offshore wind farms and expansion of transmission infrastructure to drive market

- 11.3.7.12 Poland

- TABLE 89 POLAND: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.3.7.13 Romania

- 11.3.7.13.1 Commitment to strengthen cross-border cooperation to benefit market

- 11.3.7.13 Romania

- TABLE 90 ROMANIA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.3.7.14 Rest of EUROPE

- 11.3.7.14.1 Significant investments in development of renewable energy to drive market

- 11.3.7.14 Rest of EUROPE

- TABLE 91 REST OF EUROPE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- FIGURE 46 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET SNAPSHOT

- 11.4.1 RECESSION IMPACT: ASIA PACIFIC

- 11.4.2 BY INSTALLATION

- TABLE 92 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.4.3 BY PRODUCT TYPE

- TABLE 93 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CABLE TYPE, 2021-2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY ACCESSORY TYPE, 2021-2028 (USD MILLION)

- 11.4.4 BY VOLTAGE

- TABLE 96 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 11.4.5 BY END USER

- TABLE 97 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INDUSTRIAL END USER, 2021-2028 (USD MILLION)

- 11.4.6 BY CONDUCTOR TYPE

- TABLE 99 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE, 2021-2028 (USD MILLION)

- 11.4.7 BY COUNTRY

- TABLE 100 ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 11.4.7.1 China

- 11.4.7.1.1 Investment in wind, solar, and hydroelectric power projects to drive market

- 11.4.7.1 China

- TABLE 101 CHINA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.4.7.2 India

- 11.4.7.2.1 Increasing focus on solar renewable energy initiatives to offer lucrative opportunities

- 11.4.7.2 India

- TABLE 102 INDIA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.4.7.3 Japan

- 11.4.7.3.1 Adoption of HVDC transmission systems to boost market

- 11.4.7.3 Japan

- TABLE 103 JAPAN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 104 JAPAN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 105 JAPAN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INDUSTRIAL END USER, 2021-2028 (USD MILLION)

- TABLE 106 JAPAN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 107 JAPAN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 108 JAPAN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CABLES PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 109 JAPAN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY ACCESSORY TYPE, 2021-2028 (USD MILLION)

- TABLE 110 JAPAN: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE, 2021-2028 (USD MILLION)

- 11.4.7.4 Australia

- 11.4.7.4.1 Grid development initiative to propel market

- 11.4.7.4 Australia

- TABLE 111 AUSTRALIA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.4.7.5 South Korea

- 11.4.7.5.1 Growing investment in undersea power transmission network to benefit market

- 11.4.7.5 South Korea

- TABLE 112 SOUTH KOREA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.4.7.6 Indonesia

- 11.4.7.6.1 Shift toward cleaner sources of energy to drive market

- 11.4.7.6 Indonesia

- TABLE 113 INDONESIA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.4.7.7 Malaysia

- 11.4.7.7.1 Growing emphasis on transmission grid to augment market size

- 11.4.7.7 Malaysia

- TABLE 114 MALAYSIA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.4.7.8 Rest of Asia Pacific

- 11.4.7.8.1 Expansion of power grids, substations, and interconnections to drive market

- 11.4.7.8 Rest of Asia Pacific

- TABLE 115 REST OF ASIA PACIFIC: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.5 SOUTH AMERICA

- 11.5.1 RECESSION IMPACT: SOUTH AMERICA

- 11.5.2 BY INSTALLATION

- TABLE 116 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.5.3 BY PRODUCT TYPE

- TABLE 117 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 118 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CABLE PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 119 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY ACCESSORY TYPE, 2021-2028 (USD MILLION)

- 11.5.4 BY VOLTAGE

- TABLE 120 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 11.5.5 BY END USER

- TABLE 121 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 122 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INDUSTRIAL END USER, 2021-2028 (USD MILLION)

- 11.5.6 BY CONDUCTOR TYPE

- TABLE 123 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE, 2021-2028 (USD MILLION)

- 11.5.7 BY COUNTRY

- TABLE 124 SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 11.5.7.1 Brazil

- 11.5.7.1.1 Modernization of power transmission infrastructure to offer lucrative opportunities

- 11.5.7.1 Brazil

- TABLE 125 BRAZIL: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.5.7.2 Argentina

- 11.5.7.2.1 Inter-country transmission projects to bolster market

- 11.5.7.2 Argentina

- TABLE 126 ARGENTINA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.5.7.3 Colombia

- 11.5.7.3.1 Investment in renewable energy projects to drive market

- 11.5.7.3 Colombia

- TABLE 127 COLOMBIA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.5.7.4 Rest of South America

- 11.5.7.4.1 Growing demand for reliable electricity supply to benefit market

- 11.5.7.4 Rest of South America

- TABLE 128 REST OF SOUTH AMERICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.6 MIDDLE EAST AND AFRICA

- 11.6.1 RECESSION IMPACT: MIDDLE EAST AND AFRICA

- 11.6.2 BY PRODUCT TYPE

- TABLE 129 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CABLE TYPE 2021-2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, ACCESSORY TYPE, 2021-2028 (USD MILLION)

- 11.6.3 BY INSTALLATION

- TABLE 132 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.6.4 BY CONDUCTOR TYPE

- TABLE 133 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY CONDUCTOR TYPE, 2021-2028 (USD MILLION)

- 11.6.5 BY VOLTAGE

- TABLE 134 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 11.6.6 BY END USER

- TABLE 135 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY END USER 2021-2028 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INDUSTRIAL END USER, 2021-2028 (USD MILLION)

- 11.6.7 BY COUNTRY

- TABLE 137 MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 11.6.7.1 Saudi Arabia

- 11.6.7.1.1 Infrastructure investments and collaborations with international companies to drive market

- 11.6.7.1 Saudi Arabia

- TABLE 138 SAUDI ARABIA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.6.7.2 UAE

- 11.6.7.2.1 Favorable policies by government to boost market

- 11.6.7.2 UAE

- TABLE 139 UAE: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.6.7.3 Egypt

- 11.6.7.3.1 Supportive government policies to drive market

- 11.6.7.3 Egypt

- TABLE 140 EGYPT: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.6.7.4 South Africa

- 11.6.7.4.1 Industrial advancements and favorable government policies to benefit market

- 11.6.7.4 South Africa

- TABLE 141 SOUTH AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- 11.6.7.5 Rest of Middle East & Africa

- 11.6.7.5.1 Increasing energy demand and growing investments to drive market

- 11.6.7.5 Rest of Middle East & Africa

- TABLE 142 REST OF MIDDLE EAST & AFRICA: HIGH VOLTAGE CABLES AND ACCESSORIES MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 KEY PLAYERS STRATEGIES

- TABLE 143 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018-2022

- 12.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- TABLE 144 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: DEGREE OF COMPETITION

- FIGURE 47 HIGH VOLTAGE CABLES & ACCESSORIES MARKET SHARE ANALYSIS, 2022

- 12.3 REVENUE SHARE ANALYSIS OF TOP FIVE MARKET PLAYERS

- FIGURE 48 TOP PLAYERS IN HIGH VOLTAGE CABLES & ACCESSORIES MARKET FROM 2018 TO 2022

- 12.4 COMPANY EVALUATION MATRIX, 2022

- 12.4.1 STARS

- 12.4.2 PERVASIVE PLAYERS

- 12.4.3 EMERGING LEADERS

- 12.4.4 PARTICIPANTS

- FIGURE 49 COMPANY EVALUATION MATRIX, 2022

- 12.5 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: COMPANY FOOTPRINT

- TABLE 145 PRODUCT TYPE FOOTPRINT: HIGH VOLTAGE CABLES AND ACCESSORIES

- TABLE 146 END USE FOOTPRINT: HIGH VOLTAGE CABLES AND ACCESSORIES

- TABLE 147 VOLTAGE FOOTPRINT: HIGH VOLTAGE CABLES AND ACCESSORIES

- TABLE 148 INSTALLATION FOOTPRINT: HIGH VOLTAGE CABLES AND ACCESSORIES

- TABLE 149 CONDUCTOR TYPE FOOTPRINT: HIGH VOLTAGE CABLES AND ACCESSORIES

- TABLE 150 REGION FOOTPRINT: HIGH VOLTAGE CABLES AND ACCESSORIES

- TABLE 151 COMPANY FOOTPRINT: HIGH VOLTAGE CABLES AND ACCESSORIES

- 12.6 COMPETITIVE SCENARIO

- TABLE 152 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: NEW PRODUCT LAUNCHES, 2019-2023

- TABLE 153 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: DEALS, 2019-2023

- TABLE 154 HIGH VOLTAGE CABLES AND ACCESSORIES MARKET: OTHERS, 2019-2023

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 13.1.1 SUMITOMO ELECTRIC INDUSTRIES

- TABLE 155 SUMITOMO ELECTRIC INDUSTRIES LTD.: COMPANY OVERVIEW

- FIGURE 50 SUMITOMO ELECTRIC INDUSTRIES LTD.: COMPANY SNAPSHOT

- TABLE 156 SUMITOMO ELECTRIC INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 SUMITOMO ELECTRIC INDUSTRIES LTD.: DEALS

- TABLE 158 SUMITOMO ELECTRIC INDUSTRIES LTD.: OTHERS

- 13.1.2 PRYSMIAN GROUP

- TABLE 159 PRYSMIAN GROUP: BUSINESS OVERVIEW

- FIGURE 51 PRYSMIAN GROUP: COMPANY SNAPSHOT

- TABLE 160 PRYSMIAN GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 PRYSMIAN GROUP: PRODUCT LAUNCHES

- TABLE 162 PRYSMIAN GROUP: DEALS

- TABLE 163 PRYSMIAN GROUP: OTHERS

- 13.1.3 NEXANS

- TABLE 164 NEXANS: COMPANY OVERVIEW

- FIGURE 52 NEXANS: COMPANY SNAPSHOT

- TABLE 165 NEXANS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 NEXANS: DEALS

- TABLE 167 NEXANS: OTHERS

- 13.1.4 NKT A/S

- TABLE 168 NKT A/S: COMPANY OVERVIEW

- FIGURE 53 NKT A/S: COMPANY SNAPSHOT

- TABLE 169 NKT A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 NKT A/S : PRODUCT LAUNCHES

- TABLE 171 NKT A/S: DEALS

- TABLE 172 NKT A/S: OTHERS

- 13.1.5 LS CABLE & SYSTEM LTD.

- TABLE 173 LS CABLE & SYSTEM LTD.: COMPANY OVERVIEW

- FIGURE 54 LS CABLE & SYSTEM LTD.: COMPANY SNAPSHOT

- TABLE 174 LS CABLE & SYSTEM LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 LS CABLE & SYSTEM LTD: DEALS

- 13.1.6 TE CONNECTIVITY

- TABLE 176 TE CONNECTIVITY: COMPANY OVERVIEW

- FIGURE 55 TE CONNECTIVITY: COMPANY SNAPSHOT

- TABLE 177 TE CONNECTIVITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.7 EL SEWEDY ELECTRIC COMPANY

- TABLE 178 EL SEWEDY ELECTRIC COMPANY: COMPANY OVERVIEW

- FIGURE 56 EL SEWEDY ELECTRIC COMPANY: COMPANY SNAPSHOT

- TABLE 179 EL SEWEDY ELECTRIC COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 EL SEWEDY ELECTRIC COMPANY: OTHERS

- 13.1.8 WUXI JIANGNAN CABLE CO., LTD.

- TABLE 181 WUXI JIANGNAN CABLE CO., LTD.: BUSINESS OVERVIEW

- FIGURE 57 WUXI JIANGNAN CABLE CO., LTD.: COMPANY SNAPSHOT

- TABLE 182 WUXI JIANGNAN CABLE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 WUXI JIANGNAN CABLE CO., LTD.: OTHERS

- 13.1.9 ZTT

- TABLE 184 ZTT: COMPANY OVERVIEW

- FIGURE 58 ZTT: COMPANY SNAPSHOT

- TABLE 185 ZTT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 ZTT: OTHERS

- 13.1.10 FURUKAWA ELECTRIC CO., LTD.

- TABLE 187 FURUKAWA ELECTRIC CO., LTD.: COMPANY OVERVIEW

- FIGURE 59 FURUKAWA ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- TABLE 188 FURUKAWA ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 FURUKAWA ELECTRIC CO., LTD.: OTHER DEVELOPMENT

- 13.1.11 KEI INDUSTRIES LIMITED

- TABLE 190 KEI INDUSTRIES LIMITED: COMPANY OVERVIEW

- FIGURE 60 KEI INDUSTRIES LIMITED: COMPANY SNAPSHOT

- TABLE 191 KEI INDUSTRIES LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 KEI INDUSTRIES LIMITED: DEALS

- 13.1.12 TAIHAN CABLE & SOLUTION CO., LTD.

- TABLE 193 TAIHAN CABLE & SOLUTION CO., LTD.: COMPANY OVERVIEW

- FIGURE 61 TAIHAN CABLE & SOLUTION CO., LTD.: COMPANY SNAPSHOT

- TABLE 194 TAIHAN CABLE & SOLUTION CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 TAIHAN CABLE & SOLUTION CO., LTD.: OTHER DEVELOPMENT

- 13.1.13 TELE-FONIKA KABLE SA

- TABLE 196 TELE-FONIKA KABLE SA: COMPANY OVERVIEW

- TABLE 197 TELE-FONIKA KABLE SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.14 RIYADH CABLES

- TABLE 198 RIYADH CABLES: COMPANY OVERVIEW

- FIGURE 62 RIYADH CABLES: COMPANY SNAPSHOT

- TABLE 199 RIYADH CABLES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.15 TRATOS

- TABLE 200 TRATOS: COMPANY OVERVIEW

- TABLE 201 TRATOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2 OTHER PLAYERS

- 13.2.1 SYNERGY CABLES

- 13.2.2 PFISTERER HOLDING AG

- 13.2.3 DUCAB HV

- 13.2.4 SOUTHWIRE COMPANY, LLC

- 13.2.5 BRUGG KABEL AG

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS