|

|

市場調査レポート

商品コード

1298020

自動車用サイバーセキュリティの世界市場:形態の種類別 (車載、外部クラウドサービス)・提供別 (ハードウェア、ソフトウェア)・セキュリティの種類別・車種別・用途の種類別・推進方式別・車両の自動運転機能別・アプローチ別・EV向け用途別・地域別の将来予測 (2028年まで)Automotive Cybersecurity Market by Form (In-Vehicle, External Cloud Services), Offering (Hardware & Software), Security, Vehicle Type, Application, Propulsion, Vehicle Autonomy, Approach, EV Application and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用サイバーセキュリティの世界市場:形態の種類別 (車載、外部クラウドサービス)・提供別 (ハードウェア、ソフトウェア)・セキュリティの種類別・車種別・用途の種類別・推進方式別・車両の自動運転機能別・アプローチ別・EV向け用途別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月23日

発行: MarketsandMarkets

ページ情報: 英文 350 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の自動車用サイバーセキュリティの市場規模は、2023年の25億米ドルから、2028年には60億米ドルに達し、18.5%のCAGRで成長すると予測されています。

コネクテッドカーの需要増大により、自動車1台当たりの電子機器の搭載台数が増加しています。これにより、サイバー攻撃に対する車両の脆弱性が高まり、自動車用サイバーセキュリティソリューションに対する需要が世界中で高まっています。さらに、ソフトウェア定義型車両の出現や、電気自動車の販売台数の増加も、世界の自動車用サイバーセキュリティ市場の収益拡大を今後数年間にわたり促進すると予想されています。また自動車用サイバーセキュリティ市場は、世界各国での自動車生産の増加、UNECE WP.29規制の開始、より良い安全のために自動車に追加の安全システムをインストールすることを自動車OEMに強制している様々な政府規制のために、今後数年間で大幅な成長を遂げると期待されています。

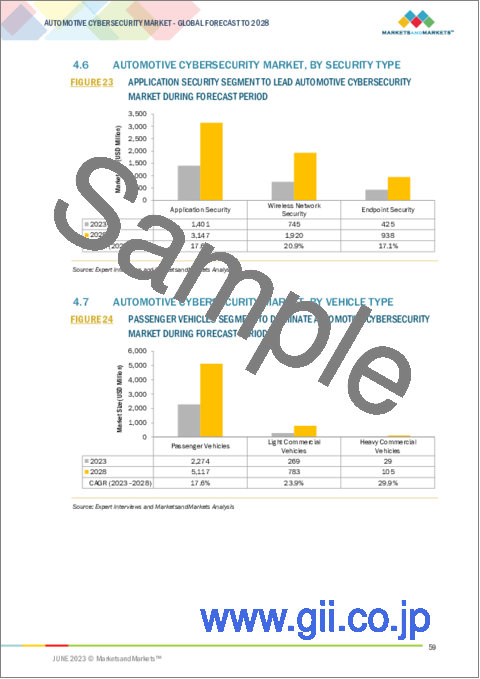

"ワイヤレスネットワークセキュリティ分野が予測期間中により高いCAGRで成長する"

セキュリティの種類別では予測期間中、ワイヤレスネットワークセキュリティ分野が最も急成長すると予測されえいます。これは、自動車にV2X技術が搭載され、コネクテッドカーの需要が高まっているためです。無線ネットワークセキュリティソリューションは、各無線ネットワークを不正アクセスから保護するのに役立ちます。ワイヤレスネットワークセキュリティは通常、ワイヤレス通信を暗号化して保護するワイヤレススイッチやワイヤレスルーターなどのワイヤレス機器を通じて提供されます。そうした要因が全て、予測期間中にワイヤレスネットワークセキュリティ分野の収益成長を促進すると予想されます。

"ADAS・安全性システム分野が予測期間中、市場を独占する"

用途の種類別では予測期間中、ADAS・セーフティ分野が大きな成長機会をもたらすと予想されます。ADASの需要は、特にインドや中国などの新興国で、交通安全基準の改善、法規制の支援、消費者の意識向上などを背景に急速に増加しています。欧州、北米、アジア太平洋のいくつかの国では、乗用車や商用車にさまざまなタイプのADASを組み込むことを義務付ける規制を導入しています。例えば、2022年7月から欧州委員会は新しい「自動車一般安全規則」を導入しました。同規則は、欧州連合 (EU) における交通安全の向上と完全な無人車両の実現を目的として、さまざまなADASの義務化を導入しました。そのため、政府による義務付けと自動車の安全性に対する意識の高まりが、ADAS・安全性システムの需要を促進すると予想されます。自動車用サイバーセキュリティソリューションのニーズも、予測期間中に世界的に急成長すると予想されます。

"アジア太平洋:自動車用サイバーセキュリティ市場での高い成長の可能性"

アジア太平洋は予測期間中、世界の自動車用サイバーセキュリティ市場で最大のシェアを占めると予測されています。アジア太平洋 (中国、日本、韓国など) では今後数年間、自律走行技術で主導権を握ると予想されています。この地域の大手自動車メーカー (Toyota、Honda、Hyundaiなど) は、安全システムの利点を活用し、各モデルで必要不可欠な安全機能を標準装備しています。自律走行車の普及が予想され、ADAS搭載車の採用が増加していることも、アジア太平洋地域の自動車用サイバーセキュリティ市場の成長を支えると思われます。その結果、自動車用サイバーセキュリティのエコシステムにおける利害関係者にビジネスチャンスが生まれると期待されています。これらすべての前述の要因は、予測期間中にアジア太平洋地域における自動車用サイバーセキュリティ市場の収益成長を強化すると予想されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 市場力学の影響

- エコシステム分析

- サプライチェーン分析

- 市場に影響を与える動向と混乱

- 規制状況

- 特許分析

- ケーススタディ分析

- 自動車用サイバーセキュリティ市場のシナリオ (2023年~2028年)

- 主な会議とイベント (2023年~2024年)

第6章 技術分析

- イントロダクション

- 自動車用サイバーセキュリティの脅威とソリューション

- 高度道路交通システム (ITS) 用サイバーセキュリティ

- SoC (システムオンチップ) と自動車用サイバーセキュリティ

第7章 自動車用サイバーセキュリティ市場:用途の種類別

- イントロダクション

- テレマティクス

- 通信システム

- ADAS・安全性

- インフォテインメント

- ボディコントロール・快適性

- パワートレインシステム

- 主要な洞察

第8章 自動車用サイバーセキュリティ市場:セキュリティの種類別

- イントロダクション

- アプリケーションセキュリティ

- ワイヤレスネットワークセキュリティ

- エンドポイントセキュリティ

- 主要な洞察

第9章 自動車用サイバーセキュリティ市場:車両の自動運転機能別

- イントロダクション

- 非自動運転車

- 半自動運転車

- 自動運転車

- 主要な洞察

第10章 自動車用サイバーセキュリティ市場:車種別

- イントロダクション

- 乗用車

- 小型商用車

- 大型商用車

- 主要な洞察

第11章 自動車用サイバーセキュリティ市場:推進方式別

- イントロダクション

- 内燃機関車 (ICE)

- 電気自動車 (EV)

- 主要な洞察

第12章 自動車用サイバーセキュリティ市場:形態の種類別

- イントロダクション

- 車載

- 外部クラウドサービス

- 主要な洞察

第13章 自動車用サイバーセキュリティ市場:提供別

- イントロダクション

- ハードウェア

- ソフトウェア

- 主要な洞察

第14章 自動車用サイバーセキュリティ市場:EV向け用途別

- イントロダクション

- 充電管理

- テレマティクス

- 通信システム

- バッテリー管理・パワートレインシステム

- インフォテインメント

- ADAS・安全性

- ボディコントロール・快適性

- 主要な洞察

第15章 自動車用サイバーセキュリティ市場:アプローチ別

- 侵入検知システム

- セキュリティオペレーションセンター

- 主要な洞察

第16章 自動車用サイバーセキュリティ市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- 欧州

- ドイツ

- フランス

- 英国

- ロシア

- トルコ

- その他の欧州

- 北米

- 景気後退の影響分析

- 米国

- カナダ

- メキシコ

- その他の地域 (ROW)

- ブラジル

- 南アフリカ

- その他

第17章 競合情勢

- 概要

- 市場ランキング分析

- 上位5社の収益分析

- 市場シェア分析

- 企業評価クアドラント

- 新興企業/中小企業の評価クアドラント

- スタートアップ/中小企業のフットプリント

- 競合シナリオ

第18章 企業プロファイル

- 主要企業

- CONTINENTAL AG

- ROBERT BOSCH GMBH

- HARMAN INTERNATIONAL

- DENSO CORPORATION

- APTIV PLC

- GARRETT MOTION INC.

- RENESAS ELECTRONICS CORPORATION

- NXP SEMICONDUCTORS

- LEAR CORPORATION

- VECTOR INFORMATIK GMBH

- その他の主な企業

- KARAMBA SECURITY

- SHEELDS

- SAFERIDE TECHNOLOGIES

- GUARDKNOX CYBER TECHNOLOGIES LTD.

- UPSTREAM SECURITY LTD.

- BROADCOM INC.

- AIRBIQUITY INC.

- GREEN HILLS SOFTWARE

- BLACKBERRY CERTICOM

- REAL-TIME INNOVATIONS

- IRDETO

- STMICROELECTRONICS N.V.

- ID QUANTIQUE

- ATOS SE

- AVL SOFTWARE AND FUNCTIONS GMBH

- COMBITECH AB

- AUTOCRYPT CO., LTD.

- AUTOTALKS

- CYBELLUM

- C2A-SEC LTD

- CYMOTIVE TECHNOLOGIES

- THALES GROUP

第19章 MarketsandMarketsによる提言

第20章 付録

The global automotive cybersecurity market size is projected to grow from USD 2.5 billion in 2023 to USD 6.0 billion by 2028, at a CAGR of 18.5%. Rising demand for connected vehicles has increased the electronic content per vehicle. This raised a vehicle's vulnerability against a cyber-attack, which has increased the demand for automotive cybersecurity solutions across the globe. Moreover, the advent of software-defined vehicles and rising sales of electric vehicles are also expected to bolster the revenue growth of the automotive cybersecurity market in the coming years globally. The automotive cybersecurity market, however, is expected to witness a significant boost in the coming years owing to the increase in vehicle production in different countries, the launch of UNECE WP.29 regulation as well as various government regulations that have compelled automotive OEMs to install additional safety systems in vehicles for better safety.

The wireless network security segment is estimated to grow at a higher CAGR during the forecast period

During the forecast period, the wireless network security segment is anticipated to be the fastest-growing security type segment of the global automotive cybersecurity market. This segment will likely witness significant growth in the Asia Pacific region, followed by Europe and North America regions. . This is owing to the incorporation of V2X technology in vehicles and the rising demand for connected vehicles. Wireless network security solutions help to protect respective wireless networks from unauthorized access attempts. Wireless network security is typically delivered through wireless devices such as wireless switches and wireless routers that encrypt and secure wireless communications. All these factors above are expected to bolster the revenue growth for wireless network security segment of the automotive cybersecurity market during the forecast period.

ADAS & safety system segment is likely to dominate the automotive cybersecurity market during the forecast period

The ADAS & safety segment is expected to have significant growth opportunities in the automotive cybersecurity market during the forecast period. The demand for ADAS is increasing rapidly, particularly in emerging economies such as India and China, driven by improving road safety standards, supporting legislation, and consumer awareness. Several countries in Europe, North America, and Asia Pacific have introduced regulations that mandate incorporating various types of ADAS in passenger cars and commercial vehicles. For instance, from July 2022, European Commission introduced new "Vehicle General Safety Regulation". It introduced a range of mandatory advanced driver assistant systems to improve road safety and enable fully driverless vehicles in the European Union. Therefore, government mandates and increasing awareness of vehicle safety are expected to fuel the demand for ADAS & safety systems. The need for automotive cybersecurity solutions is also anticipated to grow globally rapidly during the forecast period.

Asia Pacific shows high growth potential for automotive cybersecurity market

Asia Pacific is projected to have largest share in the global automotive cybersecurity market during the forecast period. In Asia Pacific region, countries such as China, Japan, and South Korea are expected to take the lead in autonomous driving technology in the coming years. Leading automotive manufacturers in this region, such as Toyota, Honda, and Hyundai, leverage the advantages of safety systems and have made essential safety features a standard across their models. The anticipated rise in the penetration of autonomous vehicles coupled with increasing adoption of ADAS equipped vehicles would also support the growth of the automotive cybersecurity market in Asia Pacific region. This in turn is expected to create opportunities for stakeholders in the automotive cybersecurity ecosystem. All these aforementioned factors are expected to bolster the revenue growth of the automotive cybersecurity market in Asia Pacific region during the forecast period.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in the automotive cybersecurity market. The break-up of the primaries is as follows:

- By Company Type: Automotive Cybersecurity Solution Providers - 40%, OEMs - 35%, Tier 1 - 15%, and Tier 2 -10%,

- By Designation: C Level Executives - 23%, Manager - 43%, and Executives - 34%

- By Region: Europe - 30%, North America - 25%, Asia Pacific - 25%, and RoW - 20%

The automotive cybersecurity market comprises major manufacturers such as Continental AG (Germany), Robert Bosch GmbH (Germany), Harman International (US), DENSO Corporation (Japan), Aptiv PLC (Ireland), Garrett Motion Inc. (Switzerland), Renesas Electronics Corporation (Japan), Karamba Security (Israel), SafeRide Technologies (Israel), Arilou Technologies (Israel), GuardKnox Cyber Technologies Ltd. (Israel), Upstream Security Ltd. (Israel),etc.

Research Coverage:

The study covers the automotive cybersecurity market across various segments. It aims at estimating the market size and future growth potential of this market across different segments such as application, offering, form type, security type, vehicle type, propulsion type, vehicle autonomy, EV application, and region. The study also includes an in-depth competitive analysis of key market players, their company profiles, key observations related to product and business offerings, recent developments, and acquisitions.

This research report categorizes Automotive Cybersecurity Market by Application (Telematics, Communication Systems, ADAS & Safety, Infotainment, Body Control & Comfort, and Powertrain Systems), Form Type (In-Vehicle, and External Cloud Services), Security Type (Application Security, Wireless Network Security, and Endpoint Security), Vehicle Type (Passenger Vehicles, Light Commercial Vehicles, and Heavy Commercial Vehicles), Offering (Hardware, and Software), Vehicle Autonomy (Non-Autonomous Vehicles, Semi-Autonomous Vehicles, and Autonomous Vehicles), Propulsion Type (ICE vehicles and Electric Vehicles), EV Application (Charging Management, Telematics, Battery Management & Powertrain Systems, Infotainment, ADAS & Safety, Communication Systems, and Body Control & Comfort), Approach (Intrusion Detection System, and Security Operation Center), and Region (Asia Pacific, Europe, North America and Rest of the World).

The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the automotive cybersecurity market. A detailed analysis of the key industry players provides insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, and recent developments associated with the automotive cybersecurity market. Competitive analysis of SMEs/startups in the automotive cybersecurity market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall automotive cybersecurity market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increased use of electronics per vehicle & growing number of connected cars, rising sales of electric vehicles, significantly growing global automotive V2X market), restraints (High costs of automotive cybersecurity solutions, growing complexity in vehicle electronic system, complex ecosystem with multiple stakeholders), opportunities (Advent of software-defined vehicles, growing cloud-based applications in automotive industry, exceptional technological development in autonomous vehicle space, introduction of electric vehicle wireless battery management system), and challenges (Discrepancies related to pricing strategies among stakeholders, time lag in delivery of cybersecurity updates) influencing the growth of the automotive cybersecurity market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive cybersecurity market

- Market Development: Comprehensive information about lucrative markets - the report analyses the automotive cybersecurity market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive cybersecurity market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Continental AG (Germany), Robert Bosch GmbH (Germany), Harman International (US), DENSO Corporation (Japan), and Aptiv PLC (Ireland), among others in the automotive cybersecurity market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 AUTOMOTIVE CYBERSECURITY MARKET DEFINITION, BY ICE AND EV APPLICATIONS

- TABLE 2 AUTOMOTIVE CYBERSECURITY MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 3 AUTOMOTIVE CYBERSECURITY MARKET DEFINITION, BY SECURITY TYPE

- TABLE 4 AUTOMOTIVE CYBERSECURITY MARKET DEFINITION, BY VEHICLE AUTONOMY

- TABLE 5 AUTOMOTIVE CYBERSECURITY MARKET DEFINITION, BY OFFERING

- TABLE 6 AUTOMOTIVE CYBERSECURITY MARKET DEFINITION, BY FORM TYPE

- TABLE 7 AUTOMOTIVE CYBERSECURITY MARKET DEFINITION, BY PROPULSION TYPE

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 8 AUTOMOTIVE CYBERSECURITY MARKET: INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 AUTOMOTIVE CYBERSECURITY MARKET SEGMENTATION

- 1.4.1 REGIONS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 9 USD EXCHANGE RATES

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AUTOMOTIVE CYBERSECURITY MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.2.1 List of primary participants

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 RECESSION IMPACT ANALYSIS

- 2.2.2 DEMAND-SIDE APPROACH

- FIGURE 6 AUTOMOTIVE CYBERSECURITY MARKET: DEMAND-SIDE APPROACH

- 2.2.3 BOTTOM-UP APPROACH

- FIGURE 7 AUTOMOTIVE CYBERSECURITY MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 AUTOMOTIVE CYBERSECURITY MARKET SIZE ESTIMATION APPROACH

- 2.2.4 TOP-DOWN APPROACH

- FIGURE 9 AUTOMOTIVE CYBERSECURITY MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 10 AUTOMOTIVE CYBERSECURITY MARKET: RESEARCH DESIGN AND METHODOLOGY

- 2.3 DATA TRIANGULATION

- FIGURE 11 AUTOMOTIVE CYBERSECURITY MARKET: DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- FIGURE 12 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 13 AUTOMOTIVE CYBERSECURITY MARKET OVERVIEW

- FIGURE 14 KEY PLAYERS OPERATING IN AUTOMOTIVE CYBERSECURITY MARKET, BY REGION

- FIGURE 15 AUTOMOTIVE CYBERSECURITY MARKET, BY REGION, 2023-2028

- FIGURE 16 AUTOMOTIVE CYBERSECURITY MARKET, BY VEHICLE TYPE, 2023-2028

- FIGURE 17 AUTOMOTIVE CYBERSECURITY MARKET, BY APPLICATION TYPE, 2023-2028

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN AUTOMOTIVE CYBERSECURITY MARKET

- FIGURE 18 INCREASING INCLINATION TOWARD ADAS TECHNOLOGY AND AUTONOMOUS MOBILITY TO DRIVE MARKET

- 4.2 AUTOMOTIVE CYBERSECURITY MARKET, BY REGION

- FIGURE 19 ASIA PACIFIC TO DOMINATE AUTOMOTIVE CYBERSECURITY MARKET IN 2023

- 4.3 AUTOMOTIVE CYBERSECURITY MARKET, BY APPLICATION

- FIGURE 20 ADAS & SAFETY SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.4 AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING

- FIGURE 21 SOFTWARE SEGMENT TO DOMINATE AUTOMOTIVE CYBERSECURITY MARKET DURING FORECAST PERIOD

- 4.5 AUTOMOTIVE CYBERSECURITY MARKET, BY FORM TYPE

- FIGURE 22 IN-VEHICLE SEGMENT TO LEAD AUTOMOTIVE CYBERSECURITY MARKET DURING FORECAST PERIOD

- 4.6 AUTOMOTIVE CYBERSECURITY MARKET, BY SECURITY TYPE

- FIGURE 23 APPLICATION SECURITY SEGMENT TO LEAD AUTOMOTIVE CYBERSECURITY MARKET DURING FORECAST PERIOD

- 4.7 AUTOMOTIVE CYBERSECURITY MARKET, BY VEHICLE TYPE

- FIGURE 24 PASSENGER VEHICLES SEGMENT TO DOMINATE AUTOMOTIVE CYBERSECURITY MARKET DURING FORECAST PERIOD

- 4.8 AUTOMOTIVE CYBERSECURITY MARKET, BY VEHICLE AUTONOMY

- FIGURE 25 SEMI-AUTONOMOUS VEHICLES SEGMENT TO DOMINATE AUTOMOTIVE CYBERSECURITY MARKET DURING FORECAST PERIOD

- 4.9 AUTOMOTIVE CYBERSECURITY MARKET, BY PROPULSION TYPE

- FIGURE 26 ELECTRIC VEHICLES SEGMENT TO GROW AT HIGHER RATE THAN ICE VEHICLES SEGMENT DURING FORECAST PERIOD

- 4.10 AUTOMOTIVE CYBERSECURITY MARKET, BY EV APPLICATION

- FIGURE 27 CHARGING MANAGEMENT SEGMENT TO GROW AT HIGHEST RATE FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 28 AUTOMOTIVE CONNECTIVITY ECOSYSTEM

- 5.2 MARKET DYNAMICS

- FIGURE 29 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AUTOMOTIVE CYBERSECURITY MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increased use of electronics per vehicle and growing number of connected cars

- FIGURE 30 DATA FROM AUTONOMOUS VEHICLES

- 5.2.1.2 Electric vehicles more vulnerable to cyberattacks

- FIGURE 31 GLOBAL BEV AND PHEV SALES, 2018-2022

- FIGURE 32 MONETARY EV INCENTIVES IN WESTERN EUROPE

- TABLE 10 MAJOR ANNOUNCEMENTS ON ELECTRIFICATION, 2021-2022

- 5.2.1.3 Reinforcement of mandates by regulatory bodies for vehicle data protection

- FIGURE 33 CYBER VULNERABILITIES IN VEHICULAR ECOSYSTEM

- TABLE 11 BASE STANDARDS FOR SECURITY AND PRIVACY DEVELOPED BY EUROPEAN TELECOMMUNICATIONS STANDARDS INSTITUTE

- FIGURE 34 LEVEL OF COMMITMENT FOR CYBERSECURITY, BY COUNTRY (2022)

- 5.2.1.4 Rapidly growing automotive V2X market

- FIGURE 35 KEY ELEMENTS OF V2X

- FIGURE 36 COMPARISON BETWEEN 4G AND 5G NETWORKS FOR CONNECTED CARS

- TABLE 12 THREATS AND COUNTERMEASURES FOR DIFFERENT OSI LAYERS FOR V2X COMMUNICATION

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of automotive cybersecurity solutions

- TABLE 13 MAJOR VEHICLE RECALLS, BY OEM, 2015-2021

- 5.2.2.2 Complex ecosystem with multiple stakeholders

- 5.2.2.3 Growing complexity in vehicle electronic systems

- FIGURE 37 COMPLEXITY DRIVERS IN CAR ELECTRONIC SYSTEMS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advent of software-defined vehicles

- FIGURE 38 CONVENTIONAL VEHICLES VS. SOFTWARE-DEFINED VEHICLES

- 5.2.3.2 Growing cloud-based applications in automotive sector

- 5.2.3.3 Exceptional technological developments in autonomous vehicle space

- FIGURE 39 LEVELS OF AUTONOMOUS DRIVING

- TABLE 14 VEHICLES WITH LEVEL-2 AND LEVEL-3 AUTONOMY (2019-2022)

- 5.2.3.4 Introduction of wireless battery management systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Discrepancies related to pricing strategies among stakeholders

- 5.2.4.2 Time lag in delivery of cybersecurity updates

- 5.2.5 IMPACT OF MARKET DYNAMICS

- TABLE 15 AUTOMOTIVE CYBERSECURITY MARKET: IMPACT OF MARKET DYNAMICS

- 5.3 ECOSYSTEM ANALYSIS

- FIGURE 40 AUTOMOTIVE CYBERSECURITY MARKET: ECOSYSTEM ANALYSIS

- TABLE 16 AUTOMOTIVE CYBERSECURITY MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 41 AUTOMOTIVE CYBERSECURITY MARKET: SUPPLY CHAIN ANALYSIS

- 5.4.1 AUTOMOTIVE CYBERSECURITY SOLUTION PROVIDERS

- 5.4.2 TIER 2 SUPPLIERS

- 5.4.3 TIER 1 SUPPLIERS

- 5.4.4 OEMS

- 5.4.5 END USERS

- 5.5 TRENDS AND DISRUPTIONS IMPACTING MARKET

- FIGURE 42 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 REGULATORY LANDSCAPE

- FIGURE 43 AUTOMOTIVE CYBERSECURITY MARKET: SAFETY AND SECURITY STANDARDS

- TABLE 17 AUTOMOTIVE CYBERSECURITY STANDARDS

- 5.6.1 UNECE WP.29 REGULATION

- FIGURE 44 UNECE'S 1958 AGREEMENT

- TABLE 18 WP.29 REGULATION APPROVAL PARTS

- 5.6.2 ISO/SAE DIS 21434 STANDARD

- 5.6.3 AIS 140 STANDARD

- FIGURE 45 GUIDELINES AND BENEFITS OF AIS 140 STANDARD

- TABLE 19 IMPORTANT REQUIREMENTS OF AIS 140 STANDARD

- 5.6.4 LIST OF KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7 PATENT ANALYSIS

- 5.7.1 INTRODUCTION

- FIGURE 46 PUBLICATION TRENDS (2015-2022)

- 5.7.2 LEGAL STATUS OF PATENTS (2012-2022)

- FIGURE 47 LEGAL STATUS OF PATENTS FILED IN AUTOMOTIVE CYBERSECURITY MARKET (2012-2022)

- 5.7.3 TOP PATENT APPLICANTS (2012-2022)

- FIGURE 48 AUTOMOTIVE CYBERSECURITY MARKET: TOP 10 PATENT APPLICANTS

- TABLE 23 AUTOMOTIVE CYBERSECURITY MARKET: PATENT ANALYSIS (COMPLETED PATENTS)

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 GUARDKNOX DEMONSTRATED HOW HACKER COULD TAKE CONTROL OF VEHICLE

- 5.8.2 MICROSAR EVALUATION PACKAGE HELPED RENESAS RUN SOFTWARE SAFELY

- 5.8.3 VECTOR INFORMATIK GMBH DEVELOPED FIRMWARE FOR SECURED COMMUNICATION

- 5.8.4 VECTOR INFORMATIK GMBH'S OTA HELPED WM MOTOR FOR SOFTWARE UPDATES

- 5.8.5 ARGUS CYBER SECURITY COLLABORATED WITH ERICSSON TO DELIVER BIG DATA-ENABLED CYBERSECURITY SOLUTIONS FOR CONNECTED VEHICLES

- 5.8.6 VECTOR INFORMATIK, ALONG WITH INFINEON TECHNOLOGIES, PROVIDED SOLUTIONS FOR CYBERATTACKS

- 5.8.7 INCREASING SECURITY AND EFFICIENCY OF TRUST FRAMEWORK FOR V2X OF SAVARI

- 5.9 AUTOMOTIVE CYBERSECURITY MARKET, SCENARIOS (2023-2028)

- TABLE 24 AUTOMOTIVE CYBERSECURITY MARKET SCENARIO, BY REGION, 2023-2028 (USD MILLION)

- 5.9.1 MOST LIKELY SCENARIO

- TABLE 25 MOST LIKELY SCENARIO, BY REGION, 2023-2028 (USD MILLION)

- 5.9.2 OPTIMISTIC SCENARIO

- TABLE 26 OPTIMISTIC SCENARIO, BY REGION, 2023-2028 (USD MILLION)

- 5.9.3 PESSIMISTIC SCENARIO

- TABLE 27 PESSIMISTIC SCENARIO, BY REGION, 2023-2028 (USD MILLION)

- 5.10 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 28 AUTOMOTIVE CYBERSECURITY MARKET: KEY CONFERENCES AND EVENTS

6 TECHNOLOGY ANALYSIS

- 6.1 INTRODUCTION

- FIGURE 49 MAJOR AUTOMOTIVE CYBERATTACKS, 2010-2025

- FIGURE 50 AUTOMOTIVE CYBERSECURITY DEFENSE FRAMEWORK

- 6.2 AUTOMOTIVE CYBERSECURITY THREATS AND SOLUTIONS

- TABLE 29 AUTOMOTIVE CYBERSECURITY THREATS AND SOLUTIONS ACROSS APPLICATIONS UNDER STRIDE MODEL

- TABLE 30 COMPARISON OF AUTOMOTIVE SECURITY MODELS

- 6.3 CYBERSECURITY FOR INTELLIGENT TRANSPORTATION SYSTEMS

- 6.3.1 COOPERATIVE INTELLIGENT TRANSPORT SYSTEMS

- FIGURE 51 ELEMENTS OF COOPERATIVE INTELLIGENT TRANSPORT SYSTEMS

- 6.3.1.1 Stakeholders

- TABLE 31 ROLE OF STAKEHOLDERS IN COOPERATIVE INTELLIGENT TRANSPORT SYSTEMS

- 6.3.1.2 Standards

- TABLE 32 STANDARDS OF COOPERATIVE INTELLIGENT TRANSPORT SYSTEMS

- TABLE 33 TEST SPECIFICATION FOR COOPERATIVE INTELLIGENT TRANSPORT SYSTEMS

- 6.3.1.3 Services

- TABLE 34 SERVICES UNDER COOPERATIVE INTELLIGENT TRANSPORT SYSTEMS

- 6.3.1.4 Security policies

- FIGURE 52 COOPERATIVE INTELLIGENT TRANSPORT SYSTEM SECURITY MODEL

- 6.3.1.5 Data protection policies

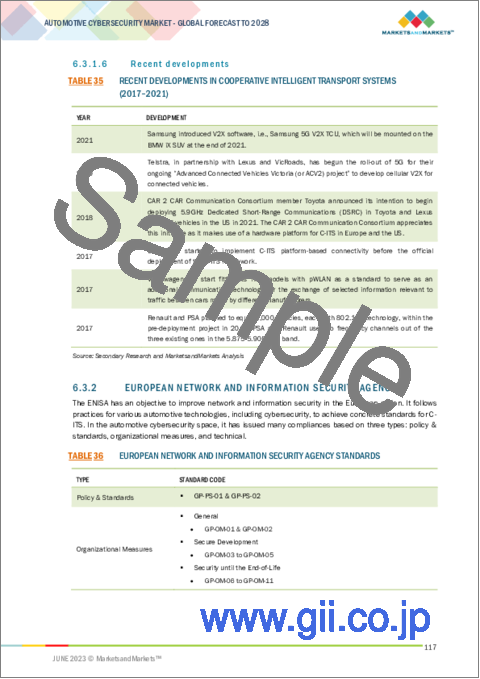

- 6.3.1.6 Recent developments

- TABLE 35 RECENT DEVELOPMENTS IN COOPERATIVE INTELLIGENT TRANSPORT SYSTEMS (2017-2021)

- 6.3.2 EUROPEAN NETWORK AND INFORMATION SECURITY AGENCY

- TABLE 36 EUROPEAN NETWORK AND INFORMATION SECURITY AGENCY STANDARDS

- 6.3.3 EUROPEAN TELECOMMUNICATIONS STANDARDS INSTITUTE

- TABLE 37 EUROPEAN TELECOMMUNICATIONS STANDARDS

- 6.4 SYSTEM-ON-CHIP AND AUTOMOTIVE CYBERSECURITY

- FIGURE 53 AUTOMOTIVE SYSTEM-ON-CHIP ARCHITECTURE FOR HUMAN-MACHINE INTERFACE

- 6.4.1 AUTOMOTIVE SYSTEM-ON-CHIP: USE CASES

- 6.4.1.1 Integrated platform for integrated solutions

- 6.4.1.2 Advanced connectivity technologies

- 6.4.1.3 CVSoC with cognitive computing capabilities

- 6.4.1.4 Cryptography for V2X communications

- 6.4.2 KEY FOCUS AREAS, CURRENT CONCERNS, AND FUTURE OUTLOOK

- TABLE 38 AUTOMOTIVE CYBERSECURITY MARKET: KEY FOCUS AREAS, CURRENT CONCERNS, AND FUTURE OUTLOOK, 2019 AND BEYOND

7 AUTOMOTIVE CYBERSECURITY MARKET, BY APPLICATION TYPE

- 7.1 INTRODUCTION

- 7.1.1 OPERATIONAL DATA

- FIGURE 54 CYBERSECURITY FROM ECU CONSOLIDATION PERSPECTIVE

- FIGURE 55 DOMAIN CENTRALIZATION ARCHITECTURE

- FIGURE 56 ADAS & SAFETY SEGMENT TO LEAD AUTOMOTIVE CYBERSECURITY MARKET IN 2023-2028

- TABLE 39 AUTOMOTIVE CYBERSECURITY MARKET, BY APPLICATION TYPE, 2018-2022 (USD MILLION)

- TABLE 40 AUTOMOTIVE CYBERSECURITY MARKET, BY APPLICATION TYPE, 2023-2028 (USD MILLION)

- FIGURE 57 COMPARISON OF CODING REQUIRED FOR VARIOUS VEHICLES

- 7.2 TELEMATICS

- 7.2.1 GROWING DEMAND FROM COMMERCIAL VEHICLES TO DRIVE MARKET

- TABLE 41 TELEMATICS CYBERSECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 42 TELEMATICS CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 COMMUNICATION SYSTEMS

- 7.3.1 INCREASING DEMAND FOR HIGH-END COMMUNICATION PLATFORMS TO CONTRIBUTE TO MARKET GROWTH

- TABLE 43 DIFFERENT IN-VEHICLE AND EXTERNAL NETWORKS

- FIGURE 58 EXAMPLE OF REMOTE DIAGNOSTIC SERVICE

- TABLE 44 COMMUNICATION SYSTEMS CYBERSECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 45 COMMUNICATION SYSTEMS CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 ADAS & SAFETY

- 7.4.1 GOVERNMENT FOCUS ON VEHICLE SAFETY TO DRIVE MARKET

- TABLE 46 VEHICLES WITH ADAS FEATURES IN INDIA

- TABLE 47 ADAS & SAFETY CYBERSECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 48 ADAS & SAFETY CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 INFOTAINMENT

- 7.5.1 GROWING DEMAND FROM PASSENGER AND COMMERCIAL VEHICLES TO DRIVE MARKET

- TABLE 49 INFOTAINMENT CYBERSECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 INFOTAINMENT CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 BODY CONTROL & COMFORT

- 7.6.1 RISING DEMAND FOR PREMIUM AND LUXURY CARS TO DRIVE DEMAND

- TABLE 51 BODY CONTROL & COMFORT CYBERSECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 52 BODY CONTROL & COMFORT CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 53 TOP 25 COUNTRIES WITH HIGHEST LUXURY CAR DENSITY

- TABLE 54 TOP 20 LUXURY CARS IN INDIA

- 7.7 POWERTRAIN SYSTEMS

- 7.7.1 RISING DEMAND FOR BETTER FUEL ECONOMY AND LESS VEHICLE EMISSION TO DRIVE MARKET

- TABLE 55 POWERTRAIN SYSTEM CYBERSECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 56 POWERTRAIN SYSTEM CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.8 KEY PRIMARY INSIGHTS

8 AUTOMOTIVE CYBERSECURITY MARKET, BY SECURITY TYPE

- 8.1 INTRODUCTION

- FIGURE 59 APPLICATION SECURITY TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- TABLE 57 AUTOMOTIVE CYBERSECURITY MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 58 AUTOMOTIVE CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- 8.1.1 OPERATIONAL DATA

- TABLE 59 ATTACK VECTORS AND SECURITY TYPE REQUIREMENTS

- 8.2 APPLICATION SECURITY

- 8.2.1 GROWING PENETRATION OF ADAS FEATURES AND IN-CAR ELECTRONICS TO SUPPORT MARKET

- FIGURE 60 SECURITY RISKS OF AUTOMOTIVE ELECTRONIC SYSTEMS

- TABLE 60 AUTOMOTIVE APPLICATION CYBERSECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 61 AUTOMOTIVE APPLICATION CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 WIRELESS NETWORK SECURITY

- 8.3.1 ADVANCEMENTS IN INFORMATION TECHNOLOGY TO DRIVE MARKET

- TABLE 62 ATTACK FEASIBILITY RATING BASED ON INTERFACE

- TABLE 63 AUTOMOTIVE WIRELESS NETWORK CYBERSECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 64 AUTOMOTIVE WIRELESS NETWORK CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 ENDPOINT SECURITY

- 8.4.1 DEPLOYMENT OF SOFTWARE IN VEHICLES AND INCREASING SAFETY CONCERNS AMONG OEMS TO INCREASE DEMAND

- TABLE 65 AUTOMOTIVE ENDPOINT CYBERSECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 66 AUTOMOTIVE ENDPOINT CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 KEY PRIMARY INSIGHTS

9 AUTOMOTIVE CYBERSECURITY MARKET, BY VEHICLE AUTONOMY

- 9.1 INTRODUCTION

- 9.1.1 OPERATIONAL DATA

- TABLE 67 DIFFERENT LEVELS OF VEHICLE AUTONOMY

- FIGURE 61 AUTOMATION LEVELS OF AUTONOMOUS CARS

- FIGURE 62 VARIOUS ATTACK SURFACES OF CONNECTED VEHICLES

- TABLE 68 ATTACK SURFACES AND POSSIBLE THREATS

- FIGURE 63 SEMI-AUTONOMOUS VEHICLES TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 69 AUTOMOTIVE CYBERSECURITY MARKET, BY VEHICLE AUTONOMY, 2018-2022 (USD MILLION)

- TABLE 70 AUTOMOTIVE CYBERSECURITY MARKET, BY VEHICLE AUTONOMY, 2023-2028 (USD MILLION)

- 9.2 NON-AUTONOMOUS VEHICLES

- 9.2.1 RISING FOCUS ON DEVELOPING HARDWARE SECURITY MODULES AND NETWORK SECURITY TO DRIVE MARKET

- 9.3 SEMI-AUTONOMOUS VEHICLES

- 9.3.1 INCREASING ADOPTION OF ADAS, V2P, AND V2V TECHNOLOGIES TO RESULT IN SOARING DEMAND FOR CYBERSECURITY SOLUTIONS AMONG OEMS

- TABLE 71 ACCIDENTAL ASSISTANCE PROVIDED BY ADAS FEATURES

- FIGURE 64 EVOLUTION OF AUTOMATED SAFETY TECHNOLOGIES

- 9.4 AUTONOMOUS VEHICLES

- 9.4.1 GROWING AUTONOMY LEVELS TO INCREASE VEHICLE VULNERABILITY

- TABLE 72 LIST OF SOME POPULAR SELF-DRIVING VEHICLES BY GLOBAL COMPANIES

- TABLE 73 EXPECTED TECHNOLOGY VS. CURRENT TECHNOLOGY READINESS LEVEL OF AUTONOMOUS VEHICLES

- FIGURE 65 AUTOMOTIVE SYSTEM AND HIERARCH ICAL CLASSIFICATION OF AUTONOMOUS VEHICLE FROM SECURITY VIEWPOINT

- TABLE 74 AUTOMOTIVE SYSTEM ARCHITECTURE VS. SECURITY OF EACH LEVEL

- 9.5 KEY PRIMARY INSIGHTS

10 AUTOMOTIVE CYBERSECURITY MARKET, BY VEHICLE TYPE

- 10.1 INTRODUCTION

- TABLE 75 L2: LAUNCH OF NEW SELF-DRIVING CARS, 2021-2022

- FIGURE 66 PASSENGER VEHICLES TO CAPTURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 76 AUTOMOTIVE CYBERSECURITY MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 77 AUTOMOTIVE CYBERSECURITY MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 10.2 PASSENGER VEHICLES

- 10.2.1 GROWING FOCUS ON ADAS, V2V, AND V2I TECHNOLOGIES TO ACCELERATE MARKET GROWTH

- TABLE 78 POPULAR PASSENGER CAR MODELS EQUIPPED WITH V2X

- TABLE 79 SYSTEMATIC DERIVATION AND COMPARISON OF CYBERSECURITY RISKS FOR PASSENGER VEHICLES

- TABLE 80 AUTOMOTIVE CYBERSECURITY MARKET IN PASSENGER VEHICLES, BY REGION, 2018-2022 (USD MILLION)

- TABLE 81 AUTOMOTIVE CYBERSECURITY MARKET IN PASSENGER VEHICLES, BY REGION, 2023-2028 (USD MILLION)

- 10.3 LIGHT COMMERCIAL VEHICLES

- 10.3.1 GROWING SALES OF HIGH-END LIGHT COMMERCIAL VEHICLES TO DRIVE MARKET

- TABLE 82 AUTOMOTIVE CYBERSECURITY MARKET IN LIGHT COMMERCIAL VEHICLES, BY REGION, 2018-2022 (USD MILLION)

- TABLE 83 AUTOMOTIVE CYBERSECURITY MARKET IN LIGHT COMMERCIAL VEHICLES, BY REGION, 2023-2028 (USD MILLION)

- 10.4 HEAVY COMMERCIAL VEHICLES

- 10.4.1 GROWING PENETRATION OF V2X TECHNOLOGY TO DRIVE DEMAND FOR AUTOMOTIVE CYBERSECURITY SOLUTIONS

- FIGURE 67 EXAMPLE OF ELEMENTS REQUIRED TO AUTOMATE TRUCK

- FIGURE 68 DEPLOYMENT ROAD MAP FOR AUTONOMOUS TRUCKS

- TABLE 84 SYSTEMATIC DERIVATION AND COMPARISON OF CYBERSECURITY RISKS FOR HEAVY-DUTY VEHICLES

- TABLE 85 AUTOMOTIVE CYBERSECURITY MARKET IN HEAVY COMMERCIAL VEHICLES, BY REGION, 2018-2022 (USD MILLION)

- TABLE 86 AUTOMOTIVE CYBERSECURITY MARKET IN HEAVY COMMERCIAL VEHICLES, BY REGION, 2023-2028 (USD MILLION)

- 10.5 KEY PRIMARY INSIGHTS

11 AUTOMOTIVE CYBERSECURITY MARKET, BY PROPULSION TYPE

- 11.1 INTRODUCTION

- 11.1.1 OPERATIONAL DATA

- FIGURE 69 NEW PASSENGER CAR REGISTRATIONS IN EUROPE, BY FUEL TYPE

- TABLE 87 CARS EQUIPPED WITH V2X (BY PROPULSION)

- FIGURE 70 ICE VEHICLES TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 88 AUTOMOTIVE CYBERSECURITY MARKET, BY PROPULSION TYPE, 2018-2022 (USD MILLION)

- TABLE 89 AUTOMOTIVE CYBERSECURITY MARKET, BY PROPULSION TYPE, 2023-2028 (USD MILLION)

- 11.2 ICE VEHICLES

- 11.2.1 INCREASING ADOPTION OF ADAS AND OTHER CONNECTED FEATURES TO PROPEL DEMAND FOR AUTOMOTIVE CYBERSECURITY SOLUTIONS IN CONVENTIONAL VEHICLES

- 11.3 ELECTRIC VEHICLES

- 11.3.1 INCREASING SALES OF ELECTRIC VEHICLES TO DRIVE MARKET

- 11.4 KEY PRIMARY INSIGHTS

12 AUTOMOTIVE CYBERSECURITY MARKET, BY FORM TYPE

- 12.1 INTRODUCTION

- FIGURE 71 IN-VEHICLE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 90 AUTOMOTIVE CYBERSECURITY MARKET, BY FORM TYPE, 2018-2022 (USD MILLION)

- TABLE 91 AUTOMOTIVE CYBERSECURITY MARKET, BY FORM TYPE, 2023-2028 (USD MILLION)

- 12.1.1 OPERATIONAL DATA

- FIGURE 72 CLOUD SERVICE IMPLICATIONS

- 12.2 IN-VEHICLE

- 12.2.1 GROWING PENETRATION OF CONNECTED VEHICLES AND AUTONOMOUS MOBILITY TO DRIVE MARKET

- TABLE 92 ATTACKER PROFILE VS. SERIOUSNESS OF THREATS

- FIGURE 73 SAMPLE ARCHITECTURE OF IN-VEHICLE NETWORK

- TABLE 93 AUTOMOTIVE IN-VEHICLE CYBERSECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 94 AUTOMOTIVE IN-VEHICLE CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.3 EXTERNAL CLOUD SERVICES

- 12.3.1 INCREASING CLOUD CONNECTIVITY FEATURES TO DRIVE DEMAND

- TABLE 95 AUTOMOTIVE EXTERNAL CLOUD SERVICE CYBERSECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 96 AUTOMOTIVE EXTERNAL CLOUD SERVICE CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.4 KEY PRIMARY INSIGHTS

13 AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING

- 13.1 INTRODUCTION

- FIGURE 74 AUTOMOTIVE SOFTWARE AND E/E MARKET, 2020-2030 (USD BILLION)

- 13.1.1 OPERATIONAL DATA

- TABLE 97 SUPPLIERS OF HARDWARE AND SOFTWARE

- FIGURE 75 SOFTWARE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 98 AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 99 AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 13.2 HARDWARE

- 13.2.1 CAPABILITY TO PROTECT VEHICLES FROM UNAUTHORIZED ACCESS TO DRIVE MARKET

- FIGURE 76 ECU/DCU MARKET, BY DOMAIN REVENUE SHARE, 2020-2030 (USD BILLION)

- TABLE 100 AUTOMOTIVE CYBERSECURITY HARDWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 101 AUTOMOTIVE CYBERSECURITY HARDWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.3 SOFTWARE

- 13.3.1 GROWING COMPLEXITY OF IN-VEHICLE ARCHITECTURE TO INCREASE VEHICLE'S VULNERABILITY AGAINST CYBERATTACKS

- FIGURE 77 GLOBAL AUTOMOTIVE SOFTWARE MARKET, 2020-2030 (USD BILLION)

- TABLE 102 AUTOMOTIVE CYBERSECURITY SOFTWARE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 103 AUTOMOTIVE CYBERSECURITY SOFTWARE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.4 KEY PRIMARY INSIGHTS

14 AUTOMOTIVE CYBERSECURITY MARKET, BY EV APPLICATION

- 14.1 INTRODUCTION

- FIGURE 78 AUTOMOTIVE CYBERSECURITY MARKET, BY EV APPLICATION, 2023 VS. 2028

- TABLE 104 AUTOMOTIVE CYBERSECURITY MARKET, BY EV APPLICATION, 2018-2022 (USD MILLION)

- TABLE 105 AUTOMOTIVE CYBERSECURITY MARKET, BY EV APPLICATION, 2023-2028 (USD MILLION)

- 14.2 CHARGING MANAGEMENT

- 14.3 TELEMATICS

- 14.4 COMMUNICATION SYSTEMS

- 14.5 BATTERY MANAGEMENT & POWERTRAIN SYSTEMS

- 14.6 INFOTAINMENT

- 14.7 ADAS & SAFETY

- 14.8 BODY CONTROL & COMFORT

- 14.9 KEY PRIMARY INSIGHTS

15 AUTOMOTIVE CYBERSECURITY MARKET, BY APPROACH

- 15.1 INTRUSION DETECTION SYSTEM

- FIGURE 79 SPOOFING MESSAGE INSERTED BY ATTACKER ELECTRONIC CONTROL UNIT

- FIGURE 80 INTRUSION DETECTION SYSTEM FOR AUTOMOTIVE CONTROLLER AREA NETWORK BUS SYSTEM

- FIGURE 81 STRUCTURE OF AUTOMOTIVE IDS

- TABLE 106 COMPANIES AND THEIR IDS SOLUTIONS

- 15.2 SECURITY OPERATION CENTER

- 15.2.1 KEY FUNCTIONS OF SECURITY OPERATION CENTER

- 15.2.2 USE CASES OF SECURITY OPERATION CENTER

- FIGURE 82 ESCRYPT SECURITY OPERATION CENTER PLATFORM

- 15.3 KEY PRIMARY INSIGHTS

16 AUTOMOTIVE CYBERSECURITY MARKET, BY REGION

- 16.1 INTRODUCTION

- FIGURE 83 ASIA PACIFIC TO BE LARGEST AND FASTEST-GROWING MARKET DURING FORECAST PERIOD

- TABLE 107 AUTOMOTIVE CYBERSECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 108 AUTOMOTIVE CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 16.2 ASIA PACIFIC

- 16.2.1 RECESSION IMPACT ANALYSIS

- FIGURE 84 ASIA PACIFIC: AUTOMOTIVE CYBERSECURITY MARKET SNAPSHOT

- TABLE 109 ASIA PACIFIC: AUTOMOTIVE CYBERSECURITY MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: AUTOMOTIVE CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 16.2.2 CHINA

- 16.2.2.1 Developed V2X networking to drive market

- TABLE 111 C-V2X-EQUIPPED VEHICLES LAUNCHED IN CHINA

- TABLE 112 CHINA: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 113 CHINA: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 114 NEW L2 LAUNCHES IN CHINA, 2021-2022

- TABLE 115 VEHICLE LAUNCHES WITH ADAS FEATURES IN CHINA, 2021-2022

- 16.2.3 INDIA

- 16.2.3.1 Government initiatives regarding intelligent transport systems and electric mobility to drive demand for cybersecurity solutions

- TABLE 116 INDIA: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 117 INDIA: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 16.2.4 JAPAN

- 16.2.4.1 Introduction of cybersecurity supply-chain risk management and mandate on Cyber-Physical Security Framework to propel market

- TABLE 118 NEW L2 LAUNCHES IN JAPAN, 2021-2022

- TABLE 119 JAPAN: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 120 JAPAN: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 16.2.5 SOUTH KOREA

- 16.2.5.1 Stepwise approach to implement UNECE WP.29 regulations to propel market

- TABLE 121 SOUTH KOREA: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 122 SOUTH KOREA: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 123 VEHICLE LAUNCHES WITH ADAS FEATURES IN SOUTH KOREA, 2021-2022

- 16.2.6 REST OF ASIA PACIFIC

- TABLE 124 REST OF ASIA PACIFIC: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 16.3 EUROPE

- 16.3.1 RECESSION IMPACT ANALYSIS

- FIGURE 85 EUROPE: AUTOMOTIVE CYBERSECURITY MARKET, 2023 VS. 2028 (USD MILLION)

- TABLE 126 EUROPE: AUTOMOTIVE CYBERSECURITY MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 127 EUROPE: AUTOMOTIVE CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 16.3.2 GERMANY

- 16.3.2.1 High demand for premium cars to drive market

- TABLE 128 SEMI-AUTONOMOUS CARS LAUNCHED/UNDER DEVELOPMENT IN EUROPE, 2021-2022

- TABLE 129 VEHICLE LAUNCHES WITH ADAS FEATURES IN GERMANY, 2021-2022

- TABLE 130 GERMANY: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 131 GERMANY: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 16.3.3 FRANCE

- 16.3.3.1 Focus on deployment of ADAS features by OEMs to drive market

- TABLE 132 SEMI-AUTONOMOUS CARS LAUNCHED/UNDER DEVELOPMENT IN FRANCE, 2021-2023

- TABLE 133 VEHICLE LAUNCHES WITH ADAS FEATURES IN FRANCE, 2021-2022

- TABLE 134 FRANCE: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 135 FRANCE: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 16.3.4 UK

- 16.3.4.1 Rising demand for connected vehicles to catalyze demand for automotive cybersecurity solutions

- TABLE 136 VEHICLE LAUNCHES WITH ADAS FEATURES IN UK, 2020-2022

- TABLE 137 UK: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 138 UK: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 16.3.5 RUSSIA

- 16.3.5.1 Investments in automotive sector by major manufacturers to drive market

- TABLE 139 RUSSIA: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 140 RUSSIA: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 16.3.6 TURKEY

- 16.3.6.1 Implementation of UN regulations to boost market

- TABLE 141 TURKEY: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 142 TURKEY: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 16.3.7 REST OF EUROPE

- TABLE 143 REST OF EUROPE: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 144 REST OF EUROPE: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 16.4 NORTH AMERICA

- 16.4.1 RECESSION IMPACT ANALYSIS

- FIGURE 86 NORTH AMERICA: AUTOMOTIVE CYBERSECURITY MARKET SNAPSHOT

- TABLE 145 NORTH AMERICA: AUTOMOTIVE CYBERSECURITY MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 146 NORTH AMERICA: AUTOMOTIVE CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 16.4.2 US

- 16.4.2.1 Increasing adoption of connected cars to support market

- TABLE 147 US: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 148 US: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 149 LAUNCH OF SEMI-AUTONOMOUS CARS IN US, 2021-2023

- 16.4.3 CANADA

- 16.4.3.1 Focus on autonomous driving to favor market growth

- TABLE 150 CANADA: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 151 CANADA: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 16.4.4 MEXICO

- 16.4.4.1 Growth in export sales of LCVs with connectivity features to boost market

- TABLE 152 MEXICO: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 153 MEXICO: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 16.5 REST OF THE WORLD (ROW)

- 16.5.1 RECESSION IMPACT ANALYSIS

- FIGURE 87 ROW: AUTOMOTIVE CYBERSECURITY MARKET, 2023 VS. 2028

- TABLE 154 ROW: AUTOMOTIVE CYBERSECURITY MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 155 ROW: AUTOMOTIVE CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 16.5.2 BRAZIL

- 16.5.2.1 Adoption of advanced technologies to drive market

- TABLE 156 BRAZIL: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 157 BRAZIL: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 16.5.3 SOUTH AFRICA

- 16.5.3.1 Government initiatives for increasing electric vehicle sales to propel market

- TABLE 158 SOUTH AFRICA: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 159 SOUTH AFRICA: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 16.5.4 OTHERS

- TABLE 160 OTHERS: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 161 OTHERS: AUTOMOTIVE CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

17 COMPETITIVE LANDSCAPE

- 17.1 OVERVIEW

- 17.2 MARKET RANKING ANALYSIS

- FIGURE 88 AUTOMOTIVE CYBERSECURITY MARKET: MARKET RANKING 2022

- 17.3 REVENUE ANALYSIS OF TOP 5 PLAYERS

- FIGURE 89 AUTOMOTIVE CYBERSECURITY MARKET: REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020-2022

- 17.4 MARKET SHARE ANALYSIS

- FIGURE 90 AUTOMOTIVE CYBERSECURITY MARKET SHARE ANALYSIS, 2022

- 17.5 COMPANY EVALUATION QUADRANT

- 17.5.1 STARS

- 17.5.2 EMERGING LEADERS

- 17.5.3 PERVASIVE PLAYERS

- 17.5.4 PARTICIPANTS

- FIGURE 91 AUTOMOTIVE CYBERSECURITY MARKET: COMPANY EVALUATION QUADRANT, 2022

- TABLE 162 AUTOMOTIVE CYBERSECURITY MARKET: COMPANY FOOTPRINT, 2022

- TABLE 163 AUTOMOTIVE CYBERSECURITY MARKET: SOLUTION TYPE FOOTPRINT, 2022

- TABLE 164 AUTOMOTIVE CYBERSECURITY MARKET: REGIONAL FOOTPRINT, 2022

- 17.6 START-UP/SME EVALUATION QUADRANT

- 17.6.1 PROGRESSIVE COMPANIES

- 17.6.2 RESPONSIVE COMPANIES

- 17.6.3 DYNAMIC COMPANIES

- 17.6.4 STARTING BLOCKS

- FIGURE 92 AUTOMOTIVE CYBERSECURITY MARKET: START-UP/SME EVALUATION QUADRANT, 2022

- 17.7 START-UP/SME FOOTPRINT

- TABLE 165 START-UPS/SMES: REGIONAL FOOTPRINT

- TABLE 166 START-UPS/SMES: COMPANY SOLUTION TYPE FOOTPRINT

- TABLE 167 START-UPS/SMES: COMPANY FOOTPRINT

- 17.8 COMPETITIVE SCENARIO

- TABLE 168 PRODUCT LAUNCHES, 2021-2023

- 17.8.1 DEALS

- TABLE 169 DEALS, 2021-2023

- 17.8.2 EXPANSIONS

- TABLE 170 EXPANSIONS, 2021-2023

- TABLE 171 AUTOMOTIVE CYBERSECURITY MARKET: LIST OF KEY START-UPS/SMES

- TABLE 172 AUTOMOTIVE CYBERSECURITY MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

18 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 18.1 KEY PLAYERS

- 18.1.1 CONTINENTAL AG

- TABLE 173 CONTINENTAL AG: COMPANY OVERVIEW

- FIGURE 93 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 94 CONTINENTAL AG: BUSINESS LOCATIONS AND EMPLOYEES (AS OF DECEMBER 2022)

- TABLE 174 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 175 CONTINENTAL AG: MAJOR SUPPLY AGREEMENTS

- TABLE 176 CONTINENTAL AG: KEY CUSTOMERS

- TABLE 177 CONTINENTAL AG: PRODUCT DEVELOPMENTS

- TABLE 178 CONTINENTAL AG: DEALS

- TABLE 179 CONTINENTAL AG: OTHERS

- 18.1.2 ROBERT BOSCH GMBH

- TABLE 180 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- FIGURE 95 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- TABLE 181 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 182 ROBERT BOSCH GMBH: PRODUCT DEVELOPMENTS

- TABLE 183 ROBERT BOSCH GMBH: DEALS

- TABLE 184 ROBERT BOSCH GMBH: OTHERS

- 18.1.3 HARMAN INTERNATIONAL

- TABLE 185 HARMAN INTERNATIONAL: COMPANY OVERVIEW

- FIGURE 96 HARMAN INTERNATIONAL: COMPANY SNAPSHOT

- TABLE 186 HARMAN INTERNATIONAL: MAJOR SUPPLY AGREEMENTS

- TABLE 187 HARMAN INTERNATIONAL: KEY CUSTOMERS

- TABLE 188 HARMAN INTERNATIONAL: PRODUCTS OFFERED

- TABLE 189 HARMAN INTERNATIONAL: PRODUCT DEVELOPMENTS

- TABLE 190 HARMAN INTERNATIONAL: DEALS

- TABLE 191 HARMAN INTERNATIONAL: OTHERS

- 18.1.4 DENSO CORPORATION

- TABLE 192 DENSO CORPORATION: COMPANY OVERVIEW

- FIGURE 97 DENSO CORPORATION: COMPANY SNAPSHOT

- TABLE 193 DENSO CORPORATION: PRODUCTS OFFERED

- TABLE 194 DENSO CORPORATION: KEY CUSTOMERS

- TABLE 195 DENSO CORPORATION: SALES BREAKDOWN BY OEMS (AS OF MARCH 2022)

- TABLE 196 DENSO CORPORATION: MAJOR SUBSIDIARIES AND AFFILIATES

- TABLE 197 DENSO CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 198 DENSO CORPORATION: DEALS

- TABLE 199 DENSO CORPORATION: OTHERS

- 18.1.5 APTIV PLC

- TABLE 200 APTIV PLC: COMPANY OVERVIEW

- FIGURE 98 APTIV PLC: COMPANY SNAPSHOT

- TABLE 201 APTIV PLC: KEY CUSTOMERS

- TABLE 202 APTIV PLC: SALES RATIO TO MAJOR CUSTOMER (AS OF DECEMBER 2022)

- TABLE 203 APTIV PLC: MAJOR SUPPLY AGREEMENTS

- TABLE 204 APTIV PLC: COMPETITORS IN OPERATING BUSINESS SEGMENTS

- TABLE 205 APTIV PLC: PRODUCTS OFFERED

- TABLE 206 APTIV PLC: PRODUCT DEVELOPMENTS

- TABLE 207 APTIV PLC: DEALS

- TABLE 208 APTIV PLC: OTHERS

- 18.1.6 GARRETT MOTION INC.

- FIGURE 99 GARRETT MOTION INC.: EMPLOYEES PER COUNTRY (AS OF DECEMBER 2022)

- TABLE 209 GARRETT MOTION INC.: COMPANY OVERVIEW

- FIGURE 100 GARRETT MOTION INC.: COMPANY SNAPSHOT

- TABLE 210 GARRETT MOTION INC.: PRODUCTS OFFERED

- TABLE 211 GARRETT MOTION INC.: PRODUCT DEVELOPMENTS

- TABLE 212 GARRETT MOTION INC.: DEALS

- TABLE 213 GARRETT MOTION INC.: OTHERS

- 18.1.7 RENESAS ELECTRONICS CORPORATION

- TABLE 214 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- FIGURE 101 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- TABLE 215 RENESAS ELECTRONICS CORPORATION: PRODUCTS OFFERED

- TABLE 216 RENESAS ELECTRONICS CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 217 RENESAS ELECTRONICS CORPORATION: DEALS

- 18.1.8 NXP SEMICONDUCTORS

- TABLE 218 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- FIGURE 102 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- TABLE 219 NXP SEMICONDUCTORS: MAJOR SUPPLY AGREEMENTS

- TABLE 220 NXP SEMICONDUCTORS: KEY CUSTOMERS

- TABLE 221 NXP SEMICONDUCTORS: PRODUCTS OFFERED

- TABLE 222 NXP SEMICONDUCTORS: PRODUCT DEVELOPMENTS

- TABLE 223 NXP SEMICONDUCTORS: DEALS

- TABLE 224 NXP SEMICONDUCTORS: OTHERS

- 18.1.9 LEAR CORPORATION

- TABLE 225 LEAR CORPORATION: COMPANY OVERVIEW

- FIGURE 103 LEAR CORPORATION: COMPANY SNAPSHOT

- TABLE 226 LEAR CORPORATION: MAJOR SUPPLY AGREEMENTS

- TABLE 227 LEAR CORPORATION: KEY CUSTOMERS

- TABLE 228 LEAR CORPORATION: PRODUCTS OFFERED

- TABLE 229 LEAR CORPORATION: DEALS

- 18.1.10 VECTOR INFORMATIK GMBH

- TABLE 230 VECTOR INFORMATIK GMBH: COMPANY OVERVIEW

- TABLE 231 VECTOR INFORMATIK GMBH: PRODUCTS OFFERED

- TABLE 232 VECTOR INFORMATIK GMBH: PRODUCT DEVELOPMENTS

- TABLE 233 VECTOR INFORMATIK GMBH: DEALS

- TABLE 234 VECTOR INFORMATIK GMBH: OTHERS

- 18.2 OTHER KEY PLAYERS

- 18.2.1 KARAMBA SECURITY

- TABLE 235 KARAMBA SECURITY: COMPANY OVERVIEW

- 18.2.2 SHEELDS

- TABLE 236 SHEELDS: COMPANY OVERVIEW

- 18.2.3 SAFERIDE TECHNOLOGIES

- TABLE 237 SAFERIDE TECHNOLOGIES: COMPANY OVERVIEW

- 18.2.4 GUARDKNOX CYBER TECHNOLOGIES LTD.

- TABLE 238 GUARDKNOX CYBER TECHNOLOGIES LTD.: COMPANY OVERVIEW

- 18.2.5 UPSTREAM SECURITY LTD.

- TABLE 239 UPSTREAM SECURITY LTD.: COMPANY OVERVIEW

- 18.2.6 BROADCOM INC.

- TABLE 240 BROADCOM INC.: COMPANY OVERVIEW

- 18.2.7 AIRBIQUITY INC.

- TABLE 241 AIRBIQUITY INC.: COMPANY OVERVIEW

- 18.2.8 GREEN HILLS SOFTWARE

- TABLE 242 GREEN HILLS SOFTWARE: COMPANY OVERVIEW

- 18.2.9 BLACKBERRY CERTICOM

- TABLE 243 BLACKBERRY CERTICOM: COMPANY OVERVIEW

- 18.2.10 REAL-TIME INNOVATIONS

- TABLE 244 REAL-TIME INNOVATIONS: COMPANY OVERVIEW

- 18.2.11 IRDETO

- TABLE 245 IRDETO: COMPANY OVERVIEW

- 18.2.12 STMICROELECTRONICS N.V.

- TABLE 246 STMICROELECTRONICS N.V.: COMPANY OVERVIEW

- 18.2.13 ID QUANTIQUE

- TABLE 247 ID QUANTIQUE: COMPANY OVERVIEW

- 18.2.14 ATOS SE

- TABLE 248 ATOS SE: COMPANY OVERVIEW

- 18.2.15 AVL SOFTWARE AND FUNCTIONS GMBH

- TABLE 249 AVL SOFTWARE AND FUNCTIONS GMBH: COMPANY OVERVIEW

- 18.2.16 COMBITECH AB

- TABLE 250 COMBITECH AB: COMPANY OVERVIEW

- 18.2.17 AUTOCRYPT CO., LTD.

- TABLE 251 AUTOCRYPT CO., LTD.: COMPANY OVERVIEW

- 18.2.18 AUTOTALKS

- TABLE 252 AUTOTALKS: COMPANY OVERVIEW

- 18.2.19 CYBELLUM

- TABLE 253 CYBELLUM: COMPANY OVERVIEW

- 18.2.20 C2A-SEC LTD

- TABLE 254 C2A-SEC LTD: COMPANY OVERVIEW

- 18.2.21 CYMOTIVE TECHNOLOGIES

- TABLE 255 CYMOTIVE TECHNOLOGIES: COMPANY OVERVIEW

- 18.2.22 THALES GROUP

- TABLE 256 THALES GROUP: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

19 RECOMMENDATIONS BY MARKETSANDMARKETS

- 19.1 ASIA PACIFIC TO BE MAJOR MARKET FOR AUTOMOTIVE CYBERSECURITY SOLUTIONS

- 19.2 INCREASING FOCUS ON SEMI-AUTONOMOUS VEHICLES TO DRIVE DEMAND FOR AUTOMOTIVE CYBERSECURITY SOLUTIONS

- 19.3 ADAS AND SAFETY DRIVING TO EMERGE AS KEY APPLICATION SEGMENT

- 19.4 CONCLUSION

20 APPENDIX

- 20.1 KEY INSIGHTS OF INDUSTRY EXPERTS

- 20.2 DISCUSSION GUIDE

- 20.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.4 CUSTOMIZATION OPTIONS

- 20.5 RELATED REPORTS

- 20.6 AUTHOR DETAILS