|

|

市場調査レポート

商品コード

1293053

医療データ収益化の世界市場:種類別 (直接的、間接的)・展開方式別 (オンプレミス、クラウド)・エンドユーザー別 (製薬・バイオテクノロジー企業、医療費支払者、医療提供者、医療技術企業)・地域別の将来予測 (2028年まで)Healthcare Data Monetization Market by Type (Direct, Indirect), Deployment (On-premise, Cloud), End User (Pharmaceutical & Biotechnology Companies, Healthcare Payers, Healthcare Providers, Medical Technology Companies), Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 医療データ収益化の世界市場:種類別 (直接的、間接的)・展開方式別 (オンプレミス、クラウド)・エンドユーザー別 (製薬・バイオテクノロジー企業、医療費支払者、医療提供者、医療技術企業)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月13日

発行: MarketsandMarkets

ページ情報: 英文 283 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の医療データ収益化の市場規模は、2023年の4億米ドルから、2028年には9億米ドルに成長すると予測され、予測期間中のCAGRは18.5%と見込まれています。

同市場は、外部データソースの利用拡大、データ量の急激な増加、大規模で複雑な医療用データセットの生成などの要因により、有望な成長の可能性を秘めています。しかし、データプライバシーの安全性と懸念が、この市場の成長をある程度制限すると予想されます。

"直接的データ収益化:種類別では最も急成長しているセグメント"

医療データ収益化市場では予測期間中、直接的データ収益化分野が最も急成長すると予想されます。医療における直接的データ収益化は、収益を得るために患者データを第三者機関に販売・供与することを含みます。この行為は、医療データに対する需要の増加、技術進歩、規制改変、財政的圧力によって推進されています。組織が医療データを直接販売・交換できるデータ市場やプラットフォームの出現が、この市場の成長を後押ししています。さらに、ブロックチェーン技術が安全で透明性の高いデータ取引のために普及しつつあります。ゲノムやウェアラブルデータなど、非常に特殊で粒度の細かいデータセットに対する需要が、こうしたソリューションの採用を促進しています。

"医療費支払者セグメント:予測期間中にエンドユーザー別で2番目に大きな市場となる"

医療データ収益化市場をエンドユーザー別に見ると、医療費支払者セグメントが第2位のシェアを占めています。医療費支払者は、リスクを予測し、自社データからは得られない行動の考察を通じて、消費者の健康管理を改善するためにデータを利用しています。医療業界は数量ベースのケアから価値ベースの医療へと移行しつつあり、そのため支払者はビジネスモデルの転換という課題に直面しています。支払者は、課題を克服し、より良い収益認識、新たな支払いモデル、患者へのより良い選択肢、不正検出を可能にするデータ分析ツールを必要としています。

"欧州が予測期間中、地域別で第2位のシェアを占める"

医療データ収益化市場では予測期間中、欧州が第2位のシェアを占めています。市場成長の主な促進要因として、AIベースツールの導入増加、有利な政府の取り組み、電子カルテ (EMR) の普及、患者データ量の増加、ベンチャーキャピタルからの資金調達、医療費の増加、高齢者人口の増加などです。さらに、研究開発活動を促進するAIの可能性も、この分野に注目を集めています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- 医療データ収益化ソリューションの種類

- 技術分析

- 関税・規制状況

- サプライチェーン分析

- 市場エコシステム

- 特許分析

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 主要な会議とイベント (2023年~2024年)

- 平均販売価格:データ収益化市場

- 顧客のビジネスに影響を与える動向/混乱

第7章 医療データ収益化市場:種類別

- イントロダクション

- 直接的データ収益化

- ソフトウェア

- サービス

- 間接的データ収益化

第8章 医療データ収益化市場:展開方式別

- イントロダクション

- オンプレミス

- クラウド

第9章 医療データ収益化市場:エンドユーザー別

- イントロダクション

- 製薬・バイオテクノロジー企業

- 医療費支払者

- 医療提供者

- 医療技術企業

- その他のエンドユーザー

第10章 医療データ収益化市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋

- 日本

- 中国

- その他のアジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- 概要

- 主要企業が採用した戦略

- 市場企業の収益シェア分析 (2022年)

- 市場シェア分析

- 主要企業の企業評価クアドラント

- 新興企業/中小企業の企業評価クアドラント

- 医療データ収益化市場:企業のフットプリント

- 競争シナリオと動向

第12章 企業プロファイル

- 主要企業

- ORACLE CORPORATION

- MICROSOFT CORPORATION

- SALESFORCE, INC.

- SAS INSTITUTE INC.

- SAP SE

- TIBCO SOFTWARE INC.

- SNOWFLAKE INC.

- QLIKTECH INTERNATIONAL AB

- HEALTHVERITY, INC.

- SISENSE INC.

- ACCENTURE

- AVAILITY, LLC

- DOMO, INC.

- KOMODO HEALTH, INC.

- THOUGHTSPOT INC.

- DATAVANT

- VERATO

- その他の企業

- INFOR, INC.

- VIRTUSA

- INFOSYS

- PARTICLE HEALTH, INC.

- INNOVACCER, INC.

- H1

- MEDABLE INC.

第13章 付録

The healthcare data monetization market is anticipated to grow from an estimated USD 0.4 billion in 2023 to USD 0.9 billion in 2028, at a CAGR of 18.5% during the forecast period. The market has a promising growth potential due to the increase in use of external data sources and exponentially increasing data volume and generation of large and complex healthcare datasets among other factors. However, data privacy security and concerns are expected to limit the growth of this market to a certain extent.

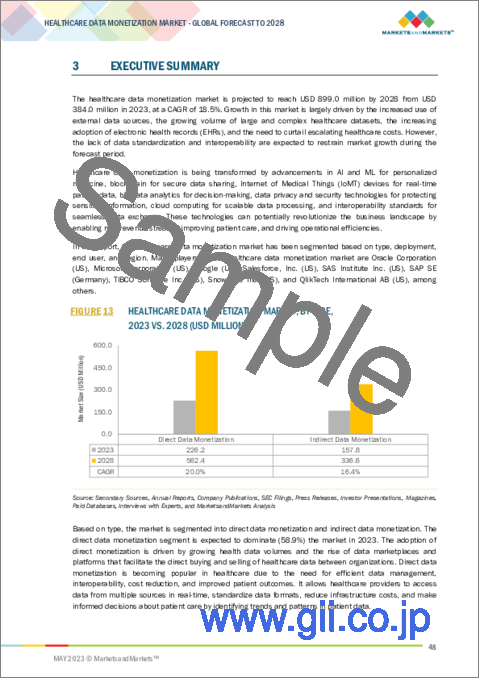

"Direct data monetization: The fastest-growing segment of the healthcare data monetization market, by type"

The direct data monetization segment is expected to witness the fastest growth in the healthcare data monetization market during the forecast. Direct data monetization in healthcare involves selling or licensing patient data to third-party organizations to generate revenue. This practice is driven by increasing demand for healthcare data, advancements in technology, regulatory changes, and financial pressures. The emergence of data marketplaces and platforms, where organizations can directly sell and exchange healthcare data is driving the growth of this market. Furthermore, blockchain technology is gaining traction for secure and transparent data transactions. The demand for highly specific and granular datasets, such as genomics and wearables data, is driving the adoption of these solutions.

"The healthcare payers segment is anticipated to be the second largest healthcare data monetization market, by end-user, during the forecast period"

Based on end user, the market is segmented into pharmaceutical & biotechnology companies, healthcare payers, healthcare providers, medical technology companies, and other end users. The healthcare payers segment accounted for the second-largest share of the healthcare data monetization market. Payers use data to better predict risk and better manage consumers' health through behavioral insights that they may not capture from in-house data. The healthcare industry is moving from volume-based care to value-based care, because of which payers are faced with challenges to shift their business models. Payers need data analytics tools to overcome the challenges and enable better revenue recognition, new payment models, better options to patients, and fraud detection.

"Europe accounted for the second-largest share in the healthcare data monetization market during the forecast period"

Europe accounted for the second-largest share of the healthcare data monetization market during the forecast period. The major drivers of market growth are the increasing adoption of AI-based tools, favorable government initiatives, growing EMR adoption, increasing patient data volume, raising venture capital funding, rising healthcare expenditure, and growing geriatric population. Moreover, the potential for AI in advancing R&D activities has also attracted attention to this sector.

Break of primary participants was as mentioned below:

- By Company Type - Tier 1-40%, Tier 2-35%, and Tier 3-25%

- By Designation - C-level-35%, Director-level-25%, Others-40%

- By Region - North America-45%, Europe-30%, Asia Pacific-20%, Middle East & Africa-3% and Latin America-2%

Key players in the Healthcare data monetization Market

The key players operating in the healthcare data monetization market include Oracle Corporation (US), Microsoft Corporation (US), Google (US), Salesforce, Inc. (US), SAS Institute Inc. (US), SAP SE (Germany), TIBCO Software Inc. (US), Sisense Inc. (US), Snowflake Inc. (US), QlikTech International AB (US), HealthVerity, Inc. (US), Accenture (Ireland), Availity, LLC (US), Domo, Inc. (US), Komodo Health, Inc. (US), ThoughtSpot Inc. (US), Datavant (US), Verato (US), Infor, Inc. (US), Virtusa (US), Infosys (India), Particle Health, Inc. (US), Innovaccer, Inc. (US), H1 (US), and Medoble Inc. (US).

Research Coverage:

The report analyzes the healthcare data monetization market and aims at estimating the market size and future growth potential of this market based on various segments such as type, deployment, end user, and region. The report also includes a product portfolio matrix of various healthcare data monetization products & services available in the market. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, and key market strategies.

Reasons to Buy the Report

The report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which in turn would help them, garner a more significant share of the market. Firms purchasing the report could use one or any combination of the below-mentioned strategies to strengthen their position in the market.

This report provides insights into the following pointers:

- Market Penetration: Comprehensive information on product portfolios offered by the top players in the global healthcare data monetization market. The report analyzes this market by type, deployment, and end user.

- Product Enhancement/Innovation: Detailed insights on upcoming trends and product launches in the global healthcare data monetization market

- Market Development: Comprehensive information on the lucrative emerging markets by type, deployment, and end user

- Market Diversification: Exhaustive information about new products or product enhancements, growing geographies, recent developments, and investments in the global healthcare data monetization market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, competitive leadership mapping, and capabilities of leading players in the global healthcare data monetization market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKET SEGMENTATION

- FIGURE 1 HEALTHCARE DATA MONETIZATION MARKET: MARKET SEGMENTATION

- 1.4.2 REGIONAL SCOPE

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH APPROACH

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 6 APPROACH FOR ASSESSING SUPPLY OF HEALTHCARE DATA MONETIZATION SOLUTIONS

- FIGURE 7 REVENUES GENERATED BY COMPANIES FROM SALES OF HEALTHCARE DATA MONETIZATION SOLUTIONS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION

- FIGURE 9 BOTTOM-UP APPROACH

- FIGURE 10 TOP-DOWN APPROACH

- FIGURE 11 ESTIMATION OF HEALTHCARE DATA MONETIZATION MARKET SIZE BASED ON PARENT MARKET

- TABLE 2 FACTOR ANALYSIS

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS

- TABLE 3 ASSUMPTIONS FOR RESEARCH STUDY

- 2.5 IMPACT OF RECESSION

- 2.6 RISK ASSESSMENT

- TABLE 4 LIMITATIONS AND ASSOCIATED RISKS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 13 HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 HEALTHCARE DATA MONETIZATION MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES IN HEALTHCARE DATA MONETIZATION MARKET

- FIGURE 17 EXPONENTIALLY INCREASING DATA VOLUME AND GENERATION OF LARGE AND COMPLEX HEALTHCARE DATASETS TO DRIVE MARKET

- 4.2 HEALTHCARE DATA MONETIZATION MARKET, BY REGION

- FIGURE 18 NORTH AMERICA TO DOMINATE HEALTHCARE DATA MONETIZATION MARKET DURING FORECAST PERIOD

- 4.3 HEALTHCARE DATA MONETIZATION MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 19 JAPAN TO REGISTER HIGHEST REVENUE GROWTH FROM 2023 TO 2028

- 4.4 NORTH AMERICAN HEALTHCARE DATA MONETIZATION MARKET, BY END USER AND COUNTRY, 2022

- FIGURE 20 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND US DOMINATED MARKET IN NORTH AMERICA IN 2022

- 4.5 HEALTHCARE DATA MONETIZATION MARKET, BY TYPE

- FIGURE 21 DIRECT DATA MONETIZATION SEGMENT TO HOLD LARGER MARKET SHARE IN 2028

- 4.6 HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT

- FIGURE 22 ON-PREMISE DEPLOYMENT SEGMENT TO DOMINATE MARKET IN 2028

- 4.7 HEALTHCARE DATA MONETIZATION MARKET, BY END USER

- FIGURE 23 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: HEALTHCARE DATA MONETIZATION MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growing use of external data sources

- 5.2.1.2 Increasing adoption of electronic health records (EHRs)

- FIGURE 25 US: ADOPTION OF ELECTRONIC HEALTH RECORDS, BY HOSPITAL SERVICE TYPE (2021)

- 5.2.1.3 Growing volume of large and complex healthcare datasets

- 5.2.1.4 Rising need to curtail escalating healthcare costs

- FIGURE 26 US HEALTHCARE SPENDING, 2012-2030 (USD BILLION)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of data standardization and interoperability

- 5.2.2.2 Regulatory constraints

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for real-world evidence

- 5.2.3.2 Emergence of personalized medicine and genomics

- 5.2.4 CHALLENGES

- 5.2.4.1 Security concerns

- FIGURE 27 US: NUMBER OF DATA BREACHES (2009-MAY 2023)

- TABLE 5 LARGEST HEALTHCARE DATA BREACHES (2009-MAY 2023)

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TYPES OF HEALTHCARE DATA MONETIZATION SOLUTIONS

- FIGURE 28 DIRECT VS. INDIRECT DATA MONETIZATION

- 6.2.1 DIRECT DATA MONETIZATION

- 6.2.2 INDIRECT DATA MONETIZATION

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 DATA AS A SERVICE

- 6.3.2 INSIGHT AS A SERVICE

- 6.3.3 ANALYTICS-ENABLED PLATFORM AS A SERVICE

- 6.3.4 EMBEDDED ANALYTICS

- 6.4 TARIFF AND REGULATORY LANDSCAPE

- 6.4.1 REGULATIONS

- 6.4.1.1 North America

- 6.4.1.2 Europe

- 6.4.1.3 Asia Pacific

- 6.4.1.4 Middle East & South Africa

- 6.4.1.5 Latin America

- 6.4.1 REGULATIONS

- 6.5 SUPPLY CHAIN ANALYSIS

- FIGURE 29 HEALTHCARE DATA MONETIZATION MARKET: SUPPLY CHAIN

- 6.6 MARKET ECOSYSTEM

- FIGURE 30 HEALTHCARE DATA MONETIZATION MARKET: MARKET ECOSYSTEM

- 6.7 PATENT ANALYSIS

- 6.7.1 PATENT PUBLICATION TRENDS FOR HEALTHCARE DATA MONETIZATION MARKET

- FIGURE 31 PATENT PUBLICATION TRENDS, JANUARY 2012-APRIL 2023

- 6.7.2 JURISDICTION AND TOP APPLICANT ANALYSIS

- FIGURE 32 TOP PATENT APPLICANTS AND OWNERS (COMPANIES/INSTITUTIONS) FOR HEALTHCARE DATA MONETIZATION SOLUTIONS, JANUARY 2012-APRIL 2023

- FIGURE 33 TOP APPLICANT COUNTRIES/JURISDICTIONS FOR HEALTHCARE DATA MONETIZATION PATENTS, JANUARY 2012-APRIL 2023

- TABLE 6 HEALTHCARE DATA MONETIZATION MARKET: LIST OF PATENTS/PATENT APPLICATIONS, 2020-2023

- 6.8 CASE STUDY ANALYSIS

- 6.8.1 CASE STUDY 1: TO FIND OUT INEFFICIENCIES IN HEALTHCARE CHAIN ON PER PATIENT BASIS

- 6.8.2 CASE STUDY 2: LEADING HEALTHCARE REVENUE MANAGEMENT COMPANY CUTS DEVELOPER COSTS BY 50%

- 6.8.3 CASE STUDY 3: SAKURA FINETEK EUROPE FUTURE-PROOFS ITS BUSINESS WITH ORACLE CLOUD APPLICATIONS

- 6.8.4 CASE STUDY 4: AMERISOURCEBERGEN GAINS FINANCE EFFICIENCIES WITH ORACLE CLOUD EPM

- 6.8.5 CASE STUDY 5: SKYGEN CUTS FINANCIAL CLOSE TO ONLY 10 DAYS USING ORACLE CLOUD ERP AND EPM

- 6.8.6 CASE STUDY 6: HEALTH FIRST USES AZURE SYNAPSE ANALYTICS TO CREATE A DATA MANAGEMENT SOLUTION, IMPROVING REFRESH SPEEDS BY 75%

- 6.8.7 CASE STUDY 7: COMMERCIAL UNDERWRITING

- 6.8.8 CASE STUDY 8: PRAGMATIC CLINICAL TRIALS

- 6.8.9 CASE STUDY 9: VALIDATING AUDIENCE QUALITY

- 6.8.10 CASE STUDY 10: SYNTHETIC CONTROL ARM

- 6.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 HEALTHCARE DATA MONETIZATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 HEALTHCARE DATA MONETIZATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.9.1 THREAT OF NEW ENTRANTS

- 6.9.2 THREAT OF SUBSTITUTES

- 6.9.3 BARGAINING POWER OF SUPPLIERS

- 6.9.4 BARGAINING POWER OF BUYERS

- 6.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- 6.10.2 BUYING CRITERIA

- FIGURE 36 KEY BUYING CRITERIA, BY END USER

- TABLE 9 KEY BUYING CRITERIA, BY END USER (%)

- 6.11 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 10 HEALTHCARE DATA MONETIZATION MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 6.12 AVERAGE SELLING PRICE: DATA MONETIZATION MARKET

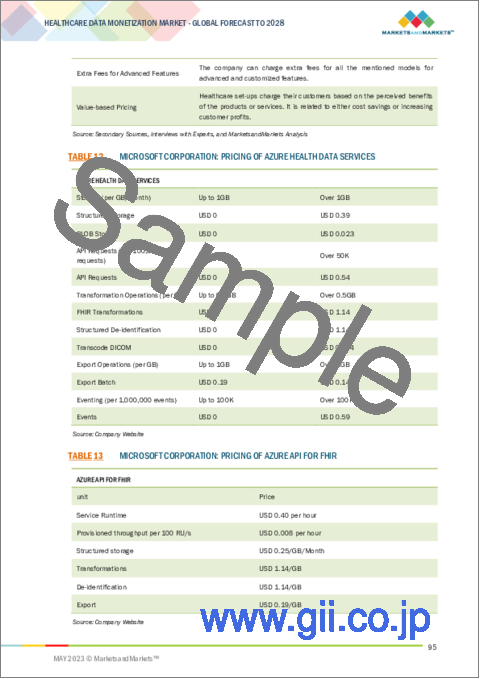

- TABLE 11 COMMONLY ADOPTED PRICING STRATEGIES IN HEALTHCARE DATA MONETIZATION MARKET

- TABLE 12 MICROSOFT CORPORATION: PRICING OF AZURE HEALTH DATA SERVICES

- TABLE 13 MICROSOFT CORPORATION: PRICING OF AZURE API FOR FHIR

- TABLE 14 MICROSOFT CORPORATION: PRICING OF AZURE DATA SHARE

- TABLE 15 MICROSOFT CORPORATION: PRICING OF MEDIA SERVICES

- TABLE 16 SALESFORCE, INC.: PRICING OF HEALTH CLOUD

- TABLE 17 SALESFORCE, INC.: PRICING OF DATA CLOUD FOR HEALTH

- TABLE 18 SALESFORCE, INC.: PRICING OF ADDITIONAL SOLUTIONS

- FIGURE 37 PRICING ANALYSIS: DATA MONETIZATION MARKET

- 6.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.13.1 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR HEALTHCARE DATA MONETIZATION SOLUTION PROVIDERS

- FIGURE 38 REVENUE SHIFT FOR HEALTHCARE DATA MONETIZATION SOLUTION PROVIDERS

7 HEALTHCARE DATA MONETIZATION MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 39 DIRECT DATA MONETIZATION SEGMENT HELD LARGEST MARKET SHARE IN 2022

- TABLE 19 HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 7.2 DIRECT DATA MONETIZATION

- FIGURE 40 DIRECT DATA MONETIZATION SOFTWARE SEGMENT DOMINATED MARKET IN 2022

- TABLE 20 DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 21 DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 22 NORTH AMERICA: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 23 EUROPE: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 24 ASIA PACIFIC: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1 SOFTWARE

- 7.2.1.1 Rising adoption of artificial intelligence, machine learning, and blockchain to drive growth

- TABLE 25 DIRECT HEALTHCARE DATA MONETIZATION SOFTWARE MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 26 NORTH AMERICA: DIRECT HEALTHCARE DATA MONETIZATION SOFTWARE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 27 EUROPE: DIRECT HEALTHCARE DATA MONETIZATION SOFTWARE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 28 ASIA PACIFIC: DIRECT HEALTHCARE DATA MONETIZATION SOFTWARE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.2 SERVICES

- 7.2.2.1 Cloud-based infrastructure, scalability, and cost-effectiveness to improve adoption of direct data monetization services

- TABLE 29 DIRECT HEALTHCARE DATA MONETIZATION SERVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: DIRECT HEALTHCARE DATA MONETIZATION SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 31 EUROPE: DIRECT HEALTHCARE DATA MONETIZATION SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 32 ASIA PACIFIC: DIRECT HEALTHCARE DATA MONETIZATION SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 INDIRECT DATA MONETIZATION

- FIGURE 41 INDIRECT DATA MONETIZATION SOFTWARE SEGMENT DOMINATED MARKET IN 2022

- TABLE 33 INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 34 INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 36 EUROPE: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.1 SOFTWARE

- 7.3.1.1 Growing focus on data analytics and insights to favor market growth

- TABLE 38 INDIRECT HEALTHCARE DATA MONETIZATION SOFTWARE MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: INDIRECT HEALTHCARE DATA MONETIZATION SOFTWARE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 40 EUROPE: INDIRECT HEALTHCARE DATA MONETIZATION SOFTWARE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: INDIRECT HEALTHCARE DATA MONETIZATION SOFTWARE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.2 SERVICES

- 7.3.2.1 Advantages such as interoperability and data integration to boost adoption of indirect data monetization services

- TABLE 42 INDIRECT HEALTHCARE DATA MONETIZATION SERVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: INDIRECT HEALTHCARE DATA MONETIZATION SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 44 EUROPE: INDIRECT HEALTHCARE DATA MONETIZATION SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: INDIRECT HEALTHCARE DATA MONETIZATION SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

8 HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT TYPE

- 8.1 INTRODUCTION

- FIGURE 42 ON-PREMISE DATA MONETIZATION SOLUTIONS ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- TABLE 46 HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT TYPE, 2021-2028 (USD MILLION)

- 8.2 ON-PREMISE

- 8.2.1 SECURITY CONCERNS AND GREATER CONTROL OVER SYSTEM CONFIGURATION TO DRIVE ADOPTION OF ON-PREMISE SOLUTIONS

- TABLE 47 ON-PREMISE HEALTHCARE DATA MONETIZATION SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: ON-PREMISE HEALTHCARE DATA MONETIZATION SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 49 EUROPE: ON-PREMISE HEALTHCARE DATA MONETIZATION SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: ON-PREMISE HEALTHCARE DATA MONETIZATION SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 CLOUD

- 8.3.1 GROWING NEED TO OPTIMIZE DEPLOYMENT COSTS TO FUEL GROWTH

- TABLE 51 CLOUD-BASED HEALTHCARE DATA MONETIZATION SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: CLOUD-BASED HEALTHCARE DATA MONETIZATION SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 53 EUROPE: CLOUD-BASED HEALTHCARE DATA MONETIZATION SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 54 ASIA PACIFIC: CLOUD-BASED HEALTHCARE DATA MONETIZATION SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

9 HEALTHCARE DATA MONETIZATION MARKET, BY END USER

- 9.1 INTRODUCTION

- FIGURE 43 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- TABLE 55 HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 9.2.1 INTEGRATION OF REAL-WORLD DATA (RWD) AND REAL-WORLD EVIDENCE (RWE) TO BOOST MARKET GROWTH

- TABLE 56 HEALTHCARE DATA MONETIZATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 58 EUROPE: HEALTHCARE DATA MONETIZATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 59 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3 HEALTHCARE PAYERS

- 9.3.1 GROWING ADOPTION OF ADVANCED ANALYTICS TO SHAPE HEALTHCARE DATA MONETIZATION ECOSYSTEM FOR PAYERS

- TABLE 60 HEALTHCARE DATA MONETIZATION MARKET FOR HEALTHCARE PAYERS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET FOR HEALTHCARE PAYERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 62 EUROPE: HEALTHCARE DATA MONETIZATION MARKET FOR HEALTHCARE PAYERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 63 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET FOR HEALTHCARE PAYERS, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.4 HEALTHCARE PROVIDERS

- 9.4.1 NEED TO OPTIMIZE CLINICAL WORKFLOWS AND IDENTIFY HIGH-RISK POPULATIONS TO BOOST MARKET

- TABLE 64 HEALTHCARE DATA MONETIZATION MARKET FOR HEALTHCARE PROVIDERS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 66 EUROPE: HEALTHCARE DATA MONETIZATION MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 67 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.5 MEDICAL TECHNOLOGY COMPANIES

- 9.5.1 INCREASING PENETRATION OF CONNECTED MEDICAL DEVICES AND WEARABLES TO PROPEL MARKET GROWTH

- TABLE 68 HEALTHCARE DATA MONETIZATION MARKET FOR MEDICAL TECHNOLOGY COMPANIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET FOR MEDICAL TECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 70 EUROPE: HEALTHCARE DATA MONETIZATION MARKET FOR MEDICAL TECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET FOR MEDICAL TECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.6 OTHER END USERS

- TABLE 72 HEALTHCARE DATA MONETIZATION MARKET FOR OTHER END USERS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 74 EUROPE: HEALTHCARE DATA MONETIZATION MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

10 HEALTHCARE DATA MONETIZATION MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 44 JAPAN TO EMERGE AS NEW HOTSPOT DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA HELD LARGEST SHARE OF HEALTHCARE DATA MONETIZATION MARKET IN 2022

- TABLE 76 HEALTHCARE DATA MONETIZATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 46 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET SNAPSHOT

- TABLE 77 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 US to dominate North American market during forecast period

- TABLE 83 US: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 84 US: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 85 US: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 86 US: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 87 US: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Increasing collaborations and efforts to promote adoption of healthcare data monetization

- TABLE 88 CANADA: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 89 CANADA: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 90 CANADA: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 91 CANADA: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 92 CANADA: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- TABLE 93 EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 94 EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 95 EUROPE: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 96 EUROPE: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 97 EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 98 EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Growing penetration of wearables to fuel market growth

- TABLE 99 UK: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 100 UK: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 101 UK: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 102 UK: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 103 UK: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.3 GERMANY

- 10.3.3.1 Government initiatives to expedite development of digital healthcare ecosystem to enhance market growth

- TABLE 104 GERMANY: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 105 GERMANY: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 106 GERMANY: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 107 GERMANY: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 108 GERMANY: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.4 FRANCE

- 10.3.4.1 eHealth 2022 plan to promote use of digital technologies

- TABLE 109 FRANCE: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 110 FRANCE: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 111 FRANCE: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 112 FRANCE: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 113 FRANCE: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.5 REST OF EUROPE

- TABLE 114 REST OF EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 115 REST OF EUROPE: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 116 REST OF EUROPE: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 117 REST OF EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 118 REST OF EUROPE: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 47 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET SNAPSHOT

- TABLE 119 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 123 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.2 JAPAN

- 10.4.2.1 Growing geriatric population to increase demand for effective patient management solutions

- TABLE 125 JAPAN: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 126 JAPAN: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 127 JAPAN: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 128 JAPAN: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 129 JAPAN: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 High prevalence of chronic diseases to drive implementation of healthcare data monetization

- TABLE 130 CHINA: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 131 CHINA: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 132 CHINA: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 133 CHINA: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 134 CHINA: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.4 REST OF ASIA PACIFIC

- TABLE 135 REST OF ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 138 REST OF ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5 LATIN AMERICA

- 10.5.1 GROWING DIGITAL HEALTH ADOPTION IN REGION TO FAVOR MARKET GROWTH

- 10.5.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 140 LATIN AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 141 LATIN AMERICA: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 142 LATIN AMERICA: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 143 LATIN AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 144 LATIN AMERICA: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 GROWING RECOGNITION OF VALUE OF HEALTHCARE DATA IN MEA REGION TO BOOST GROWTH

- 10.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 145 MIDDLE EAST & AFRICA: HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: DIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: INDIRECT HEALTHCARE DATA MONETIZATION MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: HEALTHCARE DATA MONETIZATION MARKET, BY DEPLOYMENT, 2021-2028 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: HEALTHCARE DATA MONETIZATION MARKET, BY END USER, 2021-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- TABLE 150 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN HEALTHCARE DATA MONETIZATION MARKET, JANUARY 2021-MAY 2023

- 11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS, 2022

- FIGURE 48 REVENUE SHARE ANALYSIS OF KEY MARKET PLAYERS, 2022

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 49 HEALTHCARE DATA MONETIZATION MARKET: MARKET SHARE ANALYSIS, 2022

- 11.5 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS

- 11.5.1 STARS

- 11.5.2 PERVASIVE PLAYERS

- 11.5.3 EMERGING LEADERS

- 11.5.4 PARTICIPANTS

- FIGURE 50 HEALTHCARE DATA MONETIZATION MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- 11.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 DYNAMIC COMPANIES

- 11.6.3 RESPONSIVE COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 51 HEALTHCARE DATA MONETIZATION MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2022

- 11.6.5 HEALTHCARE DATA MONETIZATION MARKET: COMPETITIVE BENCHMARKING

- TABLE 151 HEALTHCARE DATA MONETIZATION MARKET: DETAILED LIST OF KEY SMES/STARTUPS

- TABLE 152 HEALTHCARE DATA MONETIZATION MARKET: COMPETITIVE BENCHMARKING OF KEY SMES SMES/STARTUPS

- 11.7 HEALTHCARE DATA MONETIZATION MARKET: COMPANY FOOTPRINT

- TABLE 153 BY TYPE: COMPANY FOOTPRINT

- TABLE 154 BY END USER: COMPANY FOOTPRINT

- TABLE 155 BY REGION: COMPANY FOOTPRINT

- TABLE 156 COMPANY FOOTPRINT

- 11.8 COMPETITIVE SCENARIOS AND TRENDS

- 11.8.1 PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 157 HEALTHCARE DATA MONETIZATION MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, 2021-2023

- 11.8.2 DEALS

- TABLE 158 HEALTHCARE DATA MONETIZATION MARKET: DEALS, 2021-2023

- 11.8.3 OTHER DEVELOPMENTS

- TABLE 159 HEALTHCARE DATA MONETIZATION MARKET: OTHER DEVELOPMENTS, 2021-2023

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products & Services Offered, Recent Developments, and MnM View)**

- 12.1.1 ORACLE CORPORATION

- TABLE 160 ORACLE CORPORATION: COMPANY OVERVIEW

- FIGURE 52 ORACLE CORPORATION: COMPANY SNAPSHOT (2022)

- TABLE 161 ORACLE CORPORATION: PRODUCT LAUNCHES

- TABLE 162 ORACLE CORPORATION: DEALS

- TABLE 163 ORACLE CORPORATION: OTHER DEVELOPMENTS

- 12.1.2 MICROSOFT CORPORATION

- TABLE 164 MICROSOFT CORPORATION: COMPANY OVERVIEW

- FIGURE 53 MICROSOFT CORPORATION: COMPANY SNAPSHOT (2022)

- TABLE 165 MICROSOFT CORPORATION: PRODUCT ENHANCEMENTS

- TABLE 166 MICROSOFT CORPORATION: DEALS

- 12.1.3 GOOGLE

- TABLE 167 GOOGLE: COMPANY OVERVIEW

- FIGURE 54 GOOGLE: COMPANY SNAPSHOT (2022)

- TABLE 168 GOOGLE: PRODUCT LAUNCHES

- TABLE 169 GOOGLE: DEALS

- TABLE 170 GOOGLE: OTHER DEVELOPMENTS

- 12.1.4 SALESFORCE, INC.

- TABLE 171 SALESFORCE, INC.: COMPANY OVERVIEW

- FIGURE 55 SALESFORCE, INC.: COMPANY SNAPSHOT (2022)

- TABLE 172 SALESFORCE, INC.: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 173 SALESFORCE, INC: DEALS

- TABLE 174 SALESFORCE, INC.: OTHER DEVELOPMENTS

- 12.1.5 SAS INSTITUTE INC.

- TABLE 175 SAS INSTITUTE INC.: COMPANY OVERVIEW

- FIGURE 56 SAS INSTITUTE INC.: COMPANY SNAPSHOT (2022)

- TABLE 176 SAS INSTITUTE INC.: PRODUCT LAUNCHES

- TABLE 177 SAS INSTITUTE INC: DEALS

- TABLE 178 SAS INSTITUTE INC.: OTHER DEVELOPMENTS

- 12.1.6 SAP SE

- TABLE 179 SAP SE: COMPANY OVERVIEW

- FIGURE 57 SAP SE: COMPANY SNAPSHOT (2022)

- TABLE 180 SAP SE: PRODUCT LAUNCHES

- TABLE 181 SAP SE: DEALS

- TABLE 182 SAP SE: OTHER DEVELOPMENTS

- 12.1.7 TIBCO SOFTWARE INC.

- TABLE 183 TIBCO SOFTWARE INC.: COMPANY OVERVIEW

- TABLE 184 TIBCO SOFTWARE INC.: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 185 TIBCO SOFTWARE INC.: DEALS

- 12.1.8 SNOWFLAKE INC.

- TABLE 186 SNOWFLAKE INC.: COMPANY OVERVIEW

- FIGURE 58 SNOWFLAKE INC.: COMPANY SNAPSHOT (2022)

- TABLE 187 SNOWFLAKE INC.: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 188 SNOWFLAKE INC.: DEALS

- 12.1.9 QLIKTECH INTERNATIONAL AB

- TABLE 189 QLIKTECH INTERNATIONAL AB: COMPANY OVERVIEW

- TABLE 190 QLIKTECH INTERNATIONAL AB: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 191 QLIKTECH INTERNATIONAL AB: DEALS

- 12.1.10 HEALTHVERITY, INC.

- TABLE 192 HEALTHVERITY, INC.: COMPANY OVERVIEW

- TABLE 193 HEALTHVERITY, INC.: PRODUCT LAUNCHES

- TABLE 194 HEALTHVERITY, INC.: DEALS

- 12.1.11 SISENSE INC.

- TABLE 195 SISENSE INC.: COMPANY OVERVIEW

- TABLE 196 SISENSE INC.: DEALS

- 12.1.12 ACCENTURE

- TABLE 197 ACCENTURE: COMPANY OVERVIEW

- FIGURE 59 ACCENTURE: COMPANY SNAPSHOT (2022)

- TABLE 198 ACCENTURE: DEALS

- 12.1.13 AVAILITY, LLC

- TABLE 199 AVAILITY, LLC: COMPANY OVERVIEW

- TABLE 200 AVAILITY, LLC: PRODUCT LAUNCHES

- TABLE 201 AVAILITY, LLC: DEALS

- 12.1.14 DOMO, INC.

- TABLE 202 DOMO, INC.: COMPANY OVERVIEW

- FIGURE 60 DOMO, INC.: COMPANY SNAPSHOT (2022)

- TABLE 203 DOMO, INC.: PRODUCT LAUNCHES & ENHANCEMENTS

- 12.1.15 KOMODO HEALTH, INC.

- TABLE 204 KOMODO HEALTH, INC.: COMPANY OVERVIEW

- TABLE 205 KOMODO HEALTH, INC.: PRODUCT LAUNCHES

- TABLE 206 KOMODO HEALTH, INC.: DEALS

- 12.1.16 THOUGHTSPOT INC.

- TABLE 207 THOUGHTSPOT INC.: COMPANY OVERVIEW

- TABLE 208 THOUGHTSPOT INC.: PRODUCT LAUNCHES

- TABLE 209 THOUGHTSPOT INC.: DEALS

- TABLE 210 THOUGHTSPOT INC.: OTHER DEVELOPMENTS

- 12.1.17 DATAVANT

- TABLE 211 DATAVANT: COMPANY OVERVIEW

- TABLE 212 DATAVANT: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 213 DATAVANT: DEALS

- 12.1.18 VERATO

- TABLE 214 VERATO: COMPANY OVERVIEW

- TABLE 215 VERATO: PRODUCT LAUNCHES

- TABLE 216 VERATO: DEALS

- TABLE 217 VERATO: OTHER DEVELOPMENTS

- 12.2 OTHER PLAYERS

- 12.2.1 INFOR, INC.

- 12.2.2 VIRTUSA

- 12.2.3 INFOSYS

- 12.2.4 PARTICLE HEALTH, INC.

- 12.2.5 INNOVACCER, INC.

- 12.2.6 H1

- 12.2.7 MEDABLE INC.

- * Business Overview, Products & Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS