|

|

市場調査レポート

商品コード

1290726

ポリビニルアルコール (PVOH) の世界市場:種類別 (完全加水分解型、部分加水分解型、PVOHハイドロゲル)・用途別 (PVB樹脂、接着剤・シーラント、繊維、製紙、建築・建設業、包装)・地域別の将来予測 (2028年まで)Polyvinyl Alcohol (PVOH) Market by Type (Fully hydrolyzed, partially hydrolyzed, PVOH hydrogels), application(PVB Resin, Adhesives and sealants, Textile, Paper, Builllding & construction, Packaging), and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ポリビニルアルコール (PVOH) の世界市場:種類別 (完全加水分解型、部分加水分解型、PVOHハイドロゲル)・用途別 (PVB樹脂、接着剤・シーラント、繊維、製紙、建築・建設業、包装)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月08日

発行: MarketsandMarkets

ページ情報: 英文 202 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のポリビニルアルコール (PVOH) の市場規模は、予測期間中に6.1%のCAGRで成長し、2028年に50億米ドルに達すると予測されています。

ポリビニルアルコールは、さまざまな産業での加工向け利用が増えており、またパーソナルケア製品の製造には、特定のグレードのポリビニルアルコールが使用されます。PVOHは、個人の衛生を高める日用品に含まれています。PVOHは髪や皮膚に優れた保湿効果を発揮するため、シャンプー、コンディショナー、ヘアジェルなど多くのパーソナルケア製品に利用されています。保湿剤やクレンジング剤など、さまざまなスキンケア製品に使用される場合、ポリビニルアルコールは活性物質の送達を改善します。アレルギーや刺激を起こすことなく、皮膚に素早く浸透することで、各成分の効果を高めます。さらに、ヘアカラーやピールオフマスクの結合効果もあり、密着性の高い化粧品の接着を強化します。

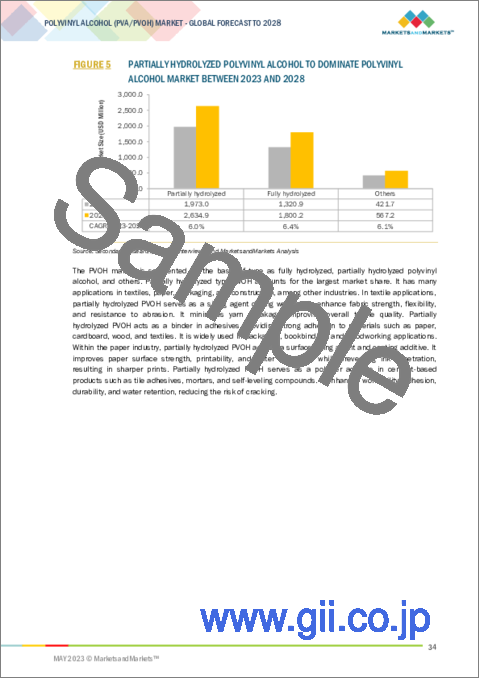

"種類別では、部分加水分解型が予測期間中に金額ベースで最も急成長する"

接着剤業界では、部分加水分解型PVOHは耐水性と接着強度のバランスを必要とする接着剤の配合に利用されています。これらの接着剤は木材接着や包装などの用途で使用されています。部分加水分解型PVOHは、耐水性が必要なコーティング剤やフィルムの製造にも利用されています。さらに繊維産業では、経糸のサイジングや繊維処理などの用途に部分加水分解型PVOHが利用されています。これらの要因がポリビニルアルコール市場での需要を牽引しています。

"地域別では、2023年にはアジア太平洋が金額ベースで最大となる"

アジア太平洋はポリビニルアルコールの最大かつ急成長市場です。この地域の市場は、中国、日本、インド、韓国、その他のアジア太平洋の4地域に区分されます。アジア太平洋では、中国・日本・インドが主要消費国であり、ポリビニルアルコール市場としては最大級の規模を誇っています。これは、同地域の急速な発展と消費者需要の高まりに関連しています。特に包装・建築・繊維といった産業が域内のポリビニルアルコール需要を押し上げています。アジア太平洋地域は廃棄物も多く、世界のプラスチック廃棄物の半分以上を排出しています。他のプラスチックに比べ、ポリビニルアルコールは持続可能性が高く、生分解性があります。そのため、さまざまな産業への応用も進んでいます。アジア太平洋地域のいくつかの国では、持続可能性と環境に優しい慣行を促進するための政策やイニシアチブを実施しています。PVOHは水溶性で生分解性という特徴を持ち、こうした取り組みや規制に合致しています。政府からの支援と持続可能な素材に対する意識の高まりが、さまざまな用途でのPVOHの採用を後押ししています。アジア太平洋には、農業生産性と作物収量の向上を重視する農業部門が多く存在します。部分加水分解型PVOHは、肥料や農作物保護製剤など、放出制御型農業製品の担体として役立っています。効率的で持続可能な農法が重視されていることが、アジア太平洋地域のPVOH需要を牽引しています。アジア太平洋は大幅な工業化と経済成長を遂げており、繊維・包装・製紙・接着剤・建設業などの分野でPVOHの需要増につながっています。このような産業セクターの成長がPVOHベースの製品や用途の需要を押し上げ、市場の成長を促しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- サプライチェーン分析

- ポーターのファイブフォース分析

- ポリビニルアルコール市場:エコシステムマッピング

- 規制状況

- 特許分析

- 価格分析

- 購入決定に影響を与える主な要因

- 貿易分析

- 顧客のビジネスに影響を与える動向/混乱

- マクロ経済指標

第7章 ポリビニルアルコール市場:種類別

- イントロダクション

- 完全加水分解型ポリビニルアルコール

- 部分加水分解型ポリビニルアルコール

- その他

- ポリビニルアルコールハイドロゲル

- 変性ポリビニルアルコール

- フォームグレードのポリビニルアルコール

第8章 ポリビニルアルコール市場:用途別

- イントロダクション

- PVB樹脂

- 接着剤・シーラント

- 繊維

- 製紙

- 建築・建設業

- 包装

- 医療・パーソナルケア

- その他

- 農業

- インク

第9章 ポリビニルアルコール市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- スペイン

- その他の欧州

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- チリ

- その他の南米

- 中東・アフリカ

- トルコ

- 南アフリカ

- その他の中東・アフリカ

第10章 競合情勢

- 概要

- 市場シェア分析

- 市場評価の枠組み

- 最近の動向

- 競合リーダーシップとマッピング

- スタートアップ/中小企業の評価クアドラント

第11章 企業プロファイル

- 主要企業

- KURARAY CO., LTD.

- SEKISUI SPECIALTY CHEMICALS

- SINOPEC SICHUAN VINYLON WORKS

- MITSUBISHI CHEMICAL CORPORATION

- JAPAN VAM AND POVAL CO., LTD.

- CHANG CHUN PETROCHEMICAL CO. LTD.

- ANHUI WANWEI GROUP CO., LTD.

- MERCK KGAA

- DENKA COMPANY LTD.

- WACKER CHEMIE AG

- NINGXIA DADI CIRCULAR DEVELOPMENT CORP. LTD.

- その他の主な企業

- HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

- TOKYO CHEMICAL INDUSTRY CO. LTD (TCI CHEMICALS)

- ASTRRA CHEMICALS

- INNER MONGOLIA SHUANGXIN ENVIRONMENT-FRIENDLY MATERIAL CO. LTD.,

- SYNTHOMER PLC

- PON PURE CHEMICALS GROUP

- ALFA AESAR

- EASTHONY

- SNP, INC.

- SPECTRUM CHEMICAL MANUFACTURING GROUP

- QUINDAO SANHUAN COLORCHEM CO. LTD.

- SHANGHAI CHEMEX GROUP LTD.

- HAREX

- LIWEI CHEMICAL CO. LTD.

- TANG ZHI TECHNOLOGY (HEBEI) CO. LTD.

第12章 付録

The polyvinyl alcohol market is projected to reach USD 5.0 billion in 2028 at a CAGR of 6.1% during the forecast period. The increasing use of polyvinyl alcohol in processing different industries drives the market. In addition, for the production of personal care products, particular grades of polyvinyl alcohol are used. PVOH can be found in everyday products that enhance personal hygiene. PVOH offers excellent moisturizing effects to hair and skin, which is why it is utilized in a number of personal care products such shampoos, conditioners, and hair gels. When used in different skincare products like moisturizers and cleansers, polyvinyl alcohol improves the delivery of active substances. By permitting rapid skin penetration through the skin without creating allergies or irritation, it enhances the effectiveness of each ingredient. Additionally, it has a binding effect on hair color and peel-off masks, and it strengthens the adhesion of tight-grip cosmetics.

"Partially hydrolyzed is expected to be the fastest growing type for polyvinyl alcohol in the market during the forecast period, in terms of value."

In the adhesive industry, partially hydrolyzed PVOH is utilized in the formulation of adhesives that require a balance between water resistance and adhesive strength. These adhesives find use in applications such as wood bonding and packaging. Partially hydrolyzed PVOH is also utilized in the production of coatings and films that necessitate water resistance. Additionally, the textile industry finds value in partially hydrolyzed PVOH for applications like warp sizing and fiber treatments, as it provides desired levels of water resistance and adhesion properties. These factors are driving its demand in the Polyvinyl alcohol market.

"Based on region, Asia Pacific was the largest market for polyvinyl alcohol in 2023, in terms of value."

Asia Pacific is the largest and fastest-growing market for polyvinyl alcohol. The market for this region is segmented into four regions China, Japan, India, South Korea, and Rest of Asia Pacific Region. The Asia Pacific area has one of the largest Polyvinyl Alcohol markets, with China, Japan, and India being the key consumers. This can be linked to the region's rapid development and rising consumer demand. Industries like packaging, building, and textiles boost Polyvinyl Alcohol demand in the Asia Pacific regions. Asia Pacific regions are also generating a lot of waste, it produces more than half of the world's plastic waste. Compared to other plastics Polyvinyl Alcohol has a higher sustainability factor and is biodegradable. This is also leading to its application in various industries. Several countries in the Asia-Pacific region have implemented policies and initiatives to promote sustainability and environmentally friendly practices. PVOH, with its water-soluble and biodegradable characteristics, aligns with these initiatives and regulations. The support from governments and the growing awareness of sustainable materials are encouraging the adoption of PVOH in various applications. The Asia-Pacific region has a substantial agricultural sector that places emphasis on improving agricultural productivity and crop yields. Partially hydrolyzed PVOH serves as a carrier for controlled-release agricultural products, including fertilizers and crop protection formulations. The emphasis on efficient and sustainable agricultural practices is driving the demand for PVOH in the region. he Asia-Pacific region is experiencing substantial industrialization and economic growth, leading to increased demand for PVOH in sectors such as textiles, packaging, paper, adhesives, and construction. This growing industrial sector is driving the demand for PVOH-based products and applications, fostering market growth.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees are as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-Level - 20%, Director Level - 10%, and Others - 70%

- By Region: Asia Pacific - 30%, Europe - 30%, North America - 20%, Middle East & Africa-10%, and South America-10%

The key players in this market are Kuraray Co Ltd ( Japan), Anhui Wanwei Group Co Ltd (China), Chang Chun Petrochemicals Co Ltd (Taiwan), Ningxia Dadi Circular Development Corp Ltd (China), Sinopec Sichuan Vinylon Works (China), Sekisui Specialty Chemicals (Japan), Mitsubishi Chemical Corporation (Japan), Japan Vam and Poval Co Ltd (Japan), Merck Kgaa (Germany), Wacker Chemie AG (Germany), Denka Company Ltd (Japan).

Research Coverage

This report segments the market for polyvinyl alcohol market on the basis of type, application, and region. It provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisition associated with the market for polyvinyl alcohol market.

Key benefits of buying this report

This research report is focused on various levels of analysis of key drivers(PVB resins, cosmetics and personal care industry along with the growth of end use industries like paper, packaging and textile) and oppertunities(Medical applications which is creating new revenue pockets for the PVOH markets) - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the polyvinyl alcohol market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on polyvinyl alcohol market offered by top players in the global polyvinyl alcohol market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the polyvinyl alcohol market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for the polyvinyl alcohol market across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global polyvinyl alcohol market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the polyvinyl alcohol market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 POLYVINYL ALCOHOL MARKET SEGMENTATION

- 1.4.1 REGIONS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 POLYVINYL ALCOHOL MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews - Top polyvinyl alcohol manufacturers

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key industry insights

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.2.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.3 FORECAST NUMBER CALCULATION

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- FIGURE 3 POLYVINYL ALCOHOL MARKET: DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 4 PVB RESIN APPLICATION TO LEAD POLYVINYL ALCOHOL MARKET BETWEEN 2023 AND 2028

- FIGURE 5 PARTIALLY HYDROLYZED POLYVINYL ALCOHOL TO DOMINATE POLYVINYL ALCOHOL MARKET BETWEEN 2023 AND 2028

- FIGURE 6 ASIA PACIFIC TO DOMINATE POLYVINYL ALCOHOL MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN POLYVINYL ALCOHOL MARKET

- FIGURE 7 INCREASING DEMAND FROM VARIOUS APPLICATION SEGMENTS TO DRIVE MARKET

- 4.2 POLYVINYL ALCOHOL MARKET, BY APPLICATION

- FIGURE 8 PVB RESIN TO BE LARGEST APPLICATION OF POLYVINYL ALCOHOL DURING FORECAST PERIOD

- 4.3 POLYVINYL ALCOHOL MARKET, BY TYPE

- FIGURE 9 PARTIALLY HYDROLYZED TYPE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.4 POLYVINYL ALCOHOL MARKET, BY REGION

- FIGURE 10 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN POLYVINYL ALCOHOL MARKET DURING FORECAST PERIOD

- 4.5 POLYVINYL ALCOHOL MARKET, BY TYPE

- FIGURE 11 FULLY HYDROLYZED POLYVINYL ALCOHOL TO BE FASTEST GROWING SEGMENT DURING FORECAST PERIOD

- 4.6 POLYVINYL ALCOHOL MARKET, BY APPLICATION

- FIGURE 12 MEDICAL & PERSONAL CARE TO BE FASTEST GROWING APPLICATION DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 13 POLYVINYL ALCOHOL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand from polyvinyl butyral (PVB) application

- 5.2.1.2 Growing demand from textile industry

- 5.2.1.3 Growth of packaging industry owing to rapidly growing e-commerce industry

- 5.2.1.4 Rising applications in paper industry

- 5.2.1.5 Cosmetics & personal care industry to drive demand

- 5.2.2 RESTRAINTS

- 5.2.2.1 Moisture sensitivity and limited chemical compatibility

- 5.2.2.2 Stringent regulations on use of PVOH in detergents due to environmental concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging applications in medical industry to create new revenue pockets

- 5.2.4 CHALLENGES

- 5.2.4.1 Fluctuating raw material prices affecting profitability of manufacturers

- 5.2.4.2 Technological advancement in end-use industries

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 14 POLYVINYL ALCOHOL MARKET: SUPPLY CHAIN ANALYSIS

- 6.2.1 RAW MATERIAL SOURCING

- 6.2.2 PVOH MANUFACTURING

- 6.2.3 PACKAGING AND DISTRIBUTION

- 6.2.4 APPLICATION IN END-USE INDUSTRIES

- 6.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 POLYVINYL ALCOHOL MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.3.1 THREAT OF NEW ENTRANTS

- 6.3.2 THREATS OF SUBSTITUTES

- 6.3.3 BARGAINING POWER OF SUPPLIERS

- 6.3.4 BARGAINING POWER OF BUYERS

- 6.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.4 POLYVINYL ALCOHOL MARKET: ECOSYSTEM MAPPING

- 6.5 REGULATORY LANDSCAPE

- 6.5.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 1 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 2 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.6 PATENT ANALYSIS

- 6.6.1 INTRODUCTION

- 6.6.2 METHODOLOGY

- 6.6.2.1 Document Type

- TABLE 6 TOTAL PATENT COUNT IN LAST 10 YEARS

- 6.6.2.2 Publication trends over last 10 years

- FIGURE 16 PATENT PUBLICATION OVER LAST 10 YEARS

- 6.6.3 INSIGHTS

- 6.6.4 LEGAL STATUS OF PATENTS

- 6.6.5 JURISDICTION ANALYSIS

- FIGURE 17 TOP JURISDICTION-BY DOCUMENT

- 6.6.6 TOP PATENT APPLICANTS

- 6.7 PRICING ANALYSIS

- FIGURE 18 AVERAGE SELLING PRICE BASED ON REGION (USD/KG)

- 6.8 KEY FACTORS AFFECTING BUYING DECISIONS

- 6.8.1 QUALITY

- 6.8.2 SERVICE

- FIGURE 19 SUPPLIER SELECTION CRITERION

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT SCENARIO

- TABLE 7 IMPORT SCENARIO FOR POLYVINYL ALCOHOL: WHETHER OR NOT CONTAINING UNHYDROLYZED ACETATE GROUP, HS CODE: 390530, BY KEY COUNTRIES, 2022 (USD MILLION)

- 6.9.2 EXPORT SCENARIO

- TABLE 8 EXPORT SCENARIO FOR POLYVINYL ALCOHOL: WHETHER OR NOT CONTAINING UNHYDROLYZED ACETATE GROUP, HS CODE: 390530, BY KEY COUNTRIES, 2022 (USD MILLION)

- 6.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.10.1 EMERGING TECHNOLOGIES AND ENVIRONMENTAL CONCERNS FOR POLYVINYL ALCOHOL MANUFACTURERS

- FIGURE 20 REVENUE SHIFT FOR POLYVINYL ALCOHOL MANUFACTURERS

- 6.11 MACROECONOMIC INDICATORS

- 6.11.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

- TABLE 9 GDP TRENDS AND FORECASTS, BY KEY COUNTRIES, 2019-2028

7 POLYVINYL ALCOHOL MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 21 PARTIALLY HYDROLYZED POLYVINYL ALCOHOL TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 22 PARTIALLY HYDROLYZED POLYVINYL ALCOHOL TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 10 POLYVINYL ALCOHOL MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 11 POLYVINYL ALCOHOL MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 12 POLYVINYL ALCOHOL MARKET, BY TYPE, 2020-2022 (TON)

- TABLE 13 POLYVINYL ALCOHOL MARKET, BY TYPE, 2023-2028 (TON)

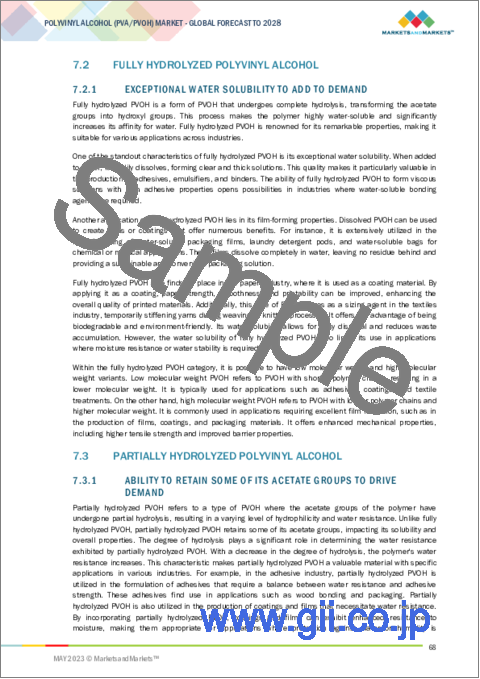

- 7.2 FULLY HYDROLYZED POLYVINYL ALCOHOL

- 7.2.1 EXCEPTIONAL WATER SOLUBILITY TO ADD TO DEMAND

- 7.3 PARTIALLY HYDROLYZED POLYVINYL ALCOHOL

- 7.3.1 ABILITY TO RETAIN SOME OF ITS ACETATE GROUPS TO DRIVE DEMAND

- 7.4 OTHERS

- 7.4.1 POLYVINYL ALCOHOL HYDROGELS

- 7.4.2 MODIFIED POLYVINYL ALCOHOL

- 7.4.2.1 Crosslinked polyvinyl alcohol

- 7.4.2.2 Grafted polyvinyl alcohol

- 7.4.2.3 Composite polyvinyl alcohol

- 7.4.2.4 Blended polyvinyl alcohol

- 7.4.2.5 Functionalized polyvinyl alcohol

- 7.4.3 FOAM-GRADE POLYVINYL ALCOHOL

- 7.4.3.1 High foam-grade polyvinyl alcohol

- 7.4.3.2 Low foam-grade polyvinyl alcohol

8 POLYVINYL ALCOHOL MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 23 PVB RESIN TO LEAD POLYVINYL ALCOHOL MARKET DURING FORECAST PERIOD

- FIGURE 24 PVB RESIN TO LEAD POLYVINYL ALCOHOL MARKET DURING FORECAST PERIOD

- TABLE 14 POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 15 POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 16 POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 17 POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 8.2 PVB RESIN

- 8.2.1 EXTENSIVE USE OF PVOH FOR LAMINATED SAFETY GLASS

- 8.3 ADHESIVE & SEALANTS

- 8.3.1 PVOH USED IN ADHESIVES AND SEALANTS DUE TO ITS FILM FORMING AND SUPERIOR ADHESIVE QUALITIES

- 8.4 TEXTILE

- 8.4.1 PVOH WIDELY USED FOR WARP SIZING IN TEXTILE INDUSTRY

- 8.5 PAPER

- 8.5.1 PVOH USED AS DEPENDABLE AND DURABLE SUBSTITUTE FOR STARCH IN PAPER PRODUCTION

- 8.6 BUILDING & CONSTRUCTION

- 8.6.1 PVOH USED AS SURFACE SEALANT TO PREVENT WATER DAMAGE

- 8.7 PACKAGING

- 8.7.1 PVOH USEFUL FOR MAKING BIODEGRADABLE PACKAGING

- 8.8 MEDICAL & PERSONAL CARE

- 8.8.1 PVOH WIDELY USED IN PERSONAL CARE PRODUCTS FOR ITS HIGH WATER ABSORPTION AND RETENTION QUALITIES

- 8.9 OTHERS

- 8.9.1 AGRICULTURE

- 8.9.2 INKS

9 POLYVINYL ALCOHOL MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 18 POLYVINYL ALCOHOL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 19 POLYVINYL ALCOHOL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 20 POLYVINYL ALCOHOL MARKET, BY REGION, 2020-2022 (TON)

- TABLE 21 POLYVINYL ALCOHOL MARKET, BY REGION, 2023-2028 (TON)

- 9.2 ASIA PACIFIC

- FIGURE 25 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET SNAPSHOT

- 9.2.1 RECESSION IMPACT

- TABLE 22 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 23 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 24 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2020-2022 (TON)

- TABLE 25 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 26 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 27 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 28 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 29 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.2.2 CHINA

- 9.2.2.1 World leader in capacity, production, and exports of PVOH

- TABLE 30 CHINA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 31 CHINA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 32 CHINA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 33 CHINA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.2.3 JAPAN

- 9.2.3.1 40% of total PVOH production utilized by textile industry

- TABLE 34 JAPAN: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 35 JAPAN: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 36 JAPAN: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 37 JAPAN: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.2.4 INDIA

- 9.2.4.1 Prominent importer of PVOH

- TABLE 38 INDIA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 39 INDIA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 40 INDIA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 41 INDIA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.2.5 SOUTH KOREA

- 9.2.5.1 Well-established industrial base boosting PVOH production

- TABLE 42 SOUTH KOREA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 43 SOUTH KOREA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 44 SOUTH KOREA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 45 SOUTH KOREA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.2.6 REST OF ASIA PACIFIC

- TABLE 46 REST OF ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 47 REST OF ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 48 REST OF ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 49 REST OF ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.3 EUROPE

- FIGURE 26 EUROPE: POLYVINYL ALCOHOL MARKET SNAPSHOT

- 9.3.1 RECESSION IMPACT

- TABLE 50 EUROPE: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 51 EUROPE: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 52 EUROPE: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2020-2022 (TON)

- TABLE 53 EUROPE: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 54 EUROPE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 55 EUROPE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 56 EUROPE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 57 EUROPE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.3.2 GERMANY

- 9.3.2.1 Strong automotive sector to favor market growth

- TABLE 58 GERMANY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 59 GERMANY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 60 GERMANY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 61 GERMANY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.3.3 FRANCE

- 9.3.3.1 Focus on waste management and sustainability

- TABLE 62 FRANCE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 63 FRANCE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 64 FRANCE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 65 FRANCE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.3.4 ITALY

- 9.3.4.1 Growing chemical and pharmaceutical industries to drive demand

- TABLE 66 ITALY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 67 ITALY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 68 ITALY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 69 ITALY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.3.5 UK

- 9.3.5.1 Vast manufacturing sector to support market

- TABLE 70 UK: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 71 UK: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 72 UK: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 73 UK: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.3.6 SPAIN

- 9.3.6.1 Automobile, food & beverage, and textile industries to drive demand

- TABLE 74 SPAIN: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 75 SPAIN: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 76 SPAIN: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 77 SPAIN: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.3.7 REST OF EUROPE

- TABLE 78 REST OF EUROPE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 79 REST OF EUROPE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 80 REST OF EUROPE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 81 REST OF EUROPE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.4 NORTH AMERICA

- FIGURE 27 NORTH AMERICA: POLYVINYL ALCOHOL MARKET SNAPSHOT

- 9.4.1 RECESSION IMPACT

- TABLE 82 NORTH AMERICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY 2020-2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY 2023-2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2020-2022 (TON)

- TABLE 85 NORTH AMERICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 86 NORTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 89 NORTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.4.2 US

- 9.4.2.1 Growing focus on sustainability and eco-friendly solutions

- TABLE 90 US: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 91 US: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 92 US: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 93 US: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.4.3 CANADA

- 9.4.3.1 High demand from construction industry

- TABLE 94 CANADA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 95 CANADA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 96 CANADA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022(TON)

- TABLE 97 CANADA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028(TON)

- 9.4.4 MEXICO

- 9.4.4.1 Growing manufacturing and agricultural industries to drive demand

- TABLE 98 MEXICO: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 99 MEXICO: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 100 MEXICO: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 101 MEXICO: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.5 SOUTH AMERICA

- 9.5.1 RECESSION IMPACT

- TABLE 102 SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 103 SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 104 SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2020-2022 (TON)

- TABLE 105 SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 106 SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 107 SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 108 SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 109 SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.5.2 BRAZIL

- 9.5.2.1 PVOH used in various packaging applications

- TABLE 110 BRAZIL: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 111 BRAZIL: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 112 BRAZIL: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 113 BRAZIL: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.5.3 CHILE

- 9.5.3.1 Growth of mining and manufacturing industries to drive demand

- TABLE 114 CHILE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 115 CHILE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 116 CHILE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 117 CHILE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.5.4 REST OF SOUTH AMERICA

- TABLE 118 REST OF SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 119 REST OF SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 120 REST OF SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 121 REST OF SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 RECESSION IMPACT

- TABLE 122 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2020-2022 (TON)

- TABLE 125 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023-2028(TON)

- TABLE 126 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 129 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.6.2 TURKEY

- 9.6.2.1 Construction, automobile, and chemical industries to drive market

- TABLE 130 TURKEY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 131 TURKEY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 132 TURKEY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 133 TURKEY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.6.3 SOUTH AFRICA

- 9.6.3.1 Agriculture sector to drive market

- TABLE 134 SOUTH AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 135 SOUTH AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 136 SOUTH AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 137 SOUTH AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

- 9.6.4 REST OF MIDDLE EAST & AFRICA

- TABLE 138 REST OF MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION 2020-2022 (USD MILLION)

- TABLE 139 REST OF MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 140 REST OF MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020-2022 (TON)

- TABLE 141 REST OF MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023-2028 (TON)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- TABLE 142 STRATEGIES ADOPTED BY KEY MANUFACTURERS OF POLYVINYL ALCOHOL

- 10.2 MARKET SHARE ANALYSIS

- FIGURE 28 MARKET RANKING OF TOP 5 PLAYERS, 2023

- FIGURE 29 MARKET SHARE ANALYSIS, 2023

- TABLE 143 POLYVINYL ALCOHOL MARKET: DEGREE OF COMPETITION

- 10.3 MARKET EVALUATION FRAMEWORK

- TABLE 144 MARKET EVALUATION FRAMEWORK, 2020-2023

- 10.4 RECENT DEVELOPMENTS

- 10.4.1 DEALS

- 10.4.1.1 Polyvinyl Alcohol Market: Deals, 2020-2023

- 10.4.1 DEALS

- 10.5 COMPETITIVE LEADERSHIP AND MAPPING

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 30 POLYVINYL ALCOHOL MARKET: COMPETITIVE LEADERSHIP MAPPING, 2023

- 10.6 STARTUP/SME EVALUATION QUADRANT

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 31 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES, 2023

- TABLE 145 SME TYPE FOOTPRINT

- TABLE 146 SME APPLICATION FOOTPRINT

- TABLE 147 SME REGION FOOTPRINT

- TABLE 148 KEY COMPANY TYPE FOOTPRINT

- TABLE 149 KEY COMPANY APPLICATION FOOTPRINT

- TABLE 150 KEY COMPANY REGION FOOTPRINT

11 COMPANY PROFILES

- (Business overview, Production capacity, Products offered, Recent Developments, MNM view)**

- 11.1 KEY PLAYERS

- 11.1.1 KURARAY CO., LTD.

- TABLE 151 KURARAY CO., LTD.: COMPANY OVERVIEW

- FIGURE 32 KURARAY CO., LTD.: COMPANY SNAPSHOT

- TABLE 152 KURARAY CO., LTD.: PRODUCTS OFFERED

- TABLE 153 KURARAY CO., LTD.: DEALS

- 11.1.2 SEKISUI SPECIALTY CHEMICALS

- TABLE 154 SEKISUI SPECIALTY CHEMICALS: COMPANY OVERVIEW

- FIGURE 33 SEKISUI SPECIALTY CHEMICALS: COMPANY SNAPSHOT

- TABLE 155 SEKISUI SPECIALTY CHEMICALS: PRODUCTS OFFERED

- TABLE 156 SEKISUI SPECIALTY CHEMICALS: DEALS

- 11.1.3 SINOPEC SICHUAN VINYLON WORKS

- TABLE 157 SINOPEC SICHUAN VINYLON WORKS: COMPANY OVERVIEW

- TABLE 158 SINOPEC SICHUAN VINYLON WORKS: PRODUCTS OFFERED

- TABLE 159 SINOPEC SICHUAN VINYLON WORKS: OTHERS

- 11.1.4 MITSUBISHI CHEMICAL CORPORATION

- TABLE 160 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

- FIGURE 34 MITSUBISHI CHEMICAL CORPORATION: COMPANY SNAPSHOT

- TABLE 161 MITSUBISHI CHEMICAL CORPORATION: PRODUCTS OFFERED

- TABLE 162 MITSUBISHI CHEMICAL CORPORATION: DEALS

- 11.1.5 JAPAN VAM AND POVAL CO., LTD.

- TABLE 163 JAPAN VAM AND POVAL CO., LTD.: COMPANY OVERVIEW

- TABLE 164 JAPAN VAM AND POVAL CO. LTD.: PRODUCTS OFFERED

- 11.1.6 CHANG CHUN PETROCHEMICAL CO. LTD.

- TABLE 165 CHANG CHUN PETROCHEMICAL CO. LTD.: COMPANY OVERVIEW

- TABLE 166 CHANG CHUN PETROCHEMICAL CO. LTD.: PRODUCTS OFFERED

- TABLE 167 CHANG CHUN PETROCHEMICAL CO. LTD.: OTHERS

- 11.1.7 ANHUI WANWEI GROUP CO., LTD.

- TABLE 168 ANHUI WANWEI GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 169 ANHUI WANWEI GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 170 ANHUI WANWEI GROUP CO., LTD.: PRODUCT LAUNCHES

- TABLE 171 ANHUI WANWEI GROUP CO., LTD.: DEALS

- TABLE 172 ANHUI WANWEI GROUP CO., LTD.: OTHERS

- 11.1.8 MERCK KGAA

- TABLE 173 MERCK KGAA: COMPANY OVERVIEW

- FIGURE 35 MERCK KGAA: COMPANY SNAPSHOT

- TABLE 174 MERCK KGAA: PRODUCTS OFFERED

- TABLE 175 MERCK KGAA: DEALS

- TABLE 176 MERCK KGAA: OTHERS

- 11.1.9 DENKA COMPANY LTD.

- TABLE 177 DENKA COMPANY LTD.: COMPANY OVERVIEW

- FIGURE 36 DENKA COMPANY LTD.: COMPANY SNAPSHOT

- TABLE 178 DENKA COMPANY LTD.: PRODUCTS OFFERED

- TABLE 179 DENKA COMPANY LTD.: OTHERS

- 11.1.10 WACKER CHEMIE AG

- TABLE 180 WACKER CHEMIE AG: COMPANY OVERVIEW

- FIGURE 37 WACKER CHEMIE AG: COMPANY SNAPSHOT

- TABLE 181 WACKER CHEMIE AG: PRODUCTS OFFERED

- TABLE 182 WACKER CHEMIE AG: OTHERS

- 11.1.11 NINGXIA DADI CIRCULAR DEVELOPMENT CORP. LTD.

- TABLE 183 NINGXIA DADI CIRCULAR DEVELOPMENT CORP. LTD.: COMPANY OVERVIEW

- TABLE 184 NINGXIA DADI CIRCULAR DEVELOPMENT CORP. LTD.: PRODUCTS OFFERED

- TABLE 185 NINGXIA DADI CIRCULAR DEVELOPMENT CORP. LTD.: OTHERS

- 11.2 OTHER KEY PLAYERS

- 11.2.1 HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.

- 11.2.2 TOKYO CHEMICAL INDUSTRY CO. LTD (TCI CHEMICALS)

- 11.2.3 ASTRRA CHEMICALS

- 11.2.4 INNER MONGOLIA SHUANGXIN ENVIRONMENT-FRIENDLY MATERIAL CO. LTD.,

- 11.2.5 SYNTHOMER PLC

- 11.2.6 PON PURE CHEMICALS GROUP

- 11.2.7 ALFA AESAR

- 11.2.8 EASTHONY

- 11.2.9 SNP, INC.

- 11.2.10 SPECTRUM CHEMICAL MANUFACTURING GROUP

- 11.2.11 QUINDAO SANHUAN COLORCHEM CO. LTD.

- 11.2.12 SHANGHAI CHEMEX GROUP LTD.

- 11.2.13 HAREX

- 11.2.14 LIWEI CHEMICAL CO. LTD.

- 11.2.15 TANG ZHI TECHNOLOGY (HEBEI) CO. LTD.

- *Details on Business overview, Production capacity, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS