|

|

市場調査レポート

商品コード

1290720

AC回路遮断器の世界市場:絶縁の種類別 (空気、ガス、真空)・電圧別 (中電圧、高電圧、超高電圧)・設置別 (屋内、屋外)・用途別 (送配電事業、発電、産業用)・地域別の将来予測 (2028年まで)AC Circuit Breaker Market by Insulation Type (Air, Gas, Vacuum), Voltage (Medium, High, Very-high), Installation (Indoor, Outdoor), End-Use Industry (Transmission & Distribution Utilities, Power Generation, Industrial) & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| AC回路遮断器の世界市場:絶縁の種類別 (空気、ガス、真空)・電圧別 (中電圧、高電圧、超高電圧)・設置別 (屋内、屋外)・用途別 (送配電事業、発電、産業用)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月08日

発行: MarketsandMarkets

ページ情報: 英文 266 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のAC回路遮断器の市場規模は、2023年の推定41億米ドルから2028年には53億米ドルに成長すると予測されており、予測期間中のCAGRは5.3%を記録すると予測されています。

工業生産への投資の増加がAC回路遮断器市場の需要を牽引しています。

"送配電事業:AC回路遮断器市場で最大の成長分野"

用途別では、産業用が2023年から2028年にかけて最大の成長市場になると推定されます。電力需要の増加により、送配電インフラへの投資が増加しています。最新のサブステーションはデータのハブであるため、データのフィルタリング・分析・対応が重要です。そのため、企業は現在、スマートユーティリティ用のソリューションの統合に注力しており、これにより、従来の機器の運用効率の低さによるエネルギー損失を減らして保護を強化しようとしています。AC回路遮断器にセンサーを使用することで、電力品質の測定、停電の減少、二次機器の保護、簡単で安全なメンテナンス、遠隔監視と制御、貴重な原材料の使用削減などが可能になります。送配電は、世界のAC回路遮断器市場で最も成長しているエンドユーザー分野です。これは、電力会社の老朽化したインフラの更新と電力需要の増加によるものです。

"空気絶縁:絶縁の種類別で第3位の分野"

絶縁の種類別では、空気絶縁の分野が予測期間中に第3位の市場規模を維持すると予測されています。空気式AC回路遮断器は、電気回路の過電流および短絡保護に使用されます。AC回路遮断器は通常、低電圧・中電圧用途で使用されます。一般に、通常の動作電流が数百アンペアまでの場所に配置されます。このような大電流で動作する回路が切断されると、端子の周りの空気のイオン化により、切断端の間に電気アークが形成されます。このアークの発生は、回路だけでなく動作中の端子にも有害です。そこで、このアークを最短時間で消火するために、アーク消火媒体が必要となります。この場合、媒体は空気であり、端子の真ん中を吹き抜けることでアークを消します。

"超高電圧:種類別で第3位の分野"

種類別では、空気絶縁型分野が予測期間中2番目に大きな市場規模を維持すると予測されています。欧州の空気絶縁型AC回路遮断器市場は、2022年の5億5,400万米ドルから2028年には7億2,600万米ドルに成長すると予測されており、2023年から2028年までのCAGRは4.7%と予測されています。

超高電圧回路のトリップやスイッチング動作に不具合が生じることは非常にまれであり、ほとんどの場合、これらの回路遮断器はオン状態のままであり、長期間にわたって動作することがあります。この電圧範囲の開閉器システムは、再生可能電力送電や中電圧変電所でも使用されています。電化の進展と再生可能エネルギーの国内送電網への統合に伴い、送配電インフラの迅速なアップグレードが求められています。自動化されたスマートなAC回路遮断器は、効率を高めるためにスマートグリッド技術とともに使用されます。したがって、超高圧AC回路遮断器の需要は、予測期間中に拡大すると予想されます。

"北米:2番目に急成長、3番目に大きな成長地域"

北米はAC回路遮断器市場において第3位に大きいシェアを占め、第2位に急成長すると推定されます。特に北米のAC回路遮断器市場は、いくつかの要因によって一貫した成長を遂げています。重要な要因の1つは、住宅、商業、産業部門全体で信頼性が高く効果的な配電システムに対するニーズが高まっていることです。安全で信頼性の高い電気インフラに対する需要と厳しい規制や規格が相まって、回路遮断器が広く受け入れられ、利用されるようになっています。都市化と人口拡大による建設業界の継続的な成長により、住宅用途における回路遮断器の需要は増加すると予想されます。同様に、北米の回路遮断器市場には、商業部門と産業部門が大きく貢献しています。これらの分野では、オフィスビル、小売スペース、製造施設、データセンターなど、多様な業務をサポートする堅牢な電気システムが必要とされています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- バリューチェーン分析

- マーケットマップ

- 技術分析

- 特許分析

- AC回路遮断器市場:料金、規定、規制

- ポーターのファイブフォース分析

- ケーススタディ分析

- 平均販売価格の傾向

- 主要な利害関係者と購入基準

- 購入基準

- 主な会議とイベント (2023年~2024年)

第6章 AC回路遮断器市場:電圧別

- イントロダクション

- 中電圧

- 高電圧

- 超高電圧

第7章 AC回路遮断器市場:絶縁の種類別

- イントロダクション

- 真空

- 空気

- ガス

- 油

第8章 AC回路遮断器市場:設置別

- イントロダクション

- 屋内設置

- 屋外設置

第9章 AC回路遮断器市場:用途別

- イントロダクション

- 送配電事業

- 発電

- 産業用

- その他

第10章 AC回路遮断器市場:地域別

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- 南米

- 中東・アフリカ

第11章 競合情勢

- 概要

- 主要企業が採用した戦略

- 上位5社の市場シェア分析

- 上位5社の収益分析

- 主要企業の評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- AC回路遮断器市場:企業のフットプリント

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- ABB LTD.

- SIEMENS LIMITED

- SCHNEIDER ELECTRIC

- EATON

- MITSUBISHI ELECTRIC

- GENERAL ELECTRIC

- ROCKWELL AUTOMATION

- BRUSH GROUP

- HD HYUNDAI ELECTRIC CO., LTD.

- CHINT ELECTRICS

- SUNTREE ELECTRIC GROUP CO., LTD.

- TOSHIBA CORPORATION

- SHANGHAI LIANGXIN ELECTRIC CO., LTD.

- SECHERON HASLER GROUP

- PANASONIC CORPORATION

- その他の企業

- FUJI ELECTRIC

- POWELL INDUSTRIES

- LEGRAND

- ALSTOM

- TE CONNECTIVITY

第13章 付録

The global ac circuit breaker market is estimated to grow from USD 5.3 billion by 2028 from an estimated of USD 4.1 billion in 2023; it is expected to record a CAGR of 5.3% during the forecast period. Increased investment in industrial production is driving the demand of ac circuit breaker market.

"T&D Utilities: The largest- growing segment of the AC circuit breaker market"

Based on by application of AC circuit breaker , the industrial type segment is estimated to be the largest-growing market from 2023 to 2028. The increase in demand for electric power has led to increased investments in transmission and distribution infrastructures. The modern sub-station is the hub for data; therefore, filtering, analyzing, and responding to the data is critical. Hence, companies are now focusing on integrating solutions for smart utilities, which would enhance protection by decreasing energy losses due to the poor operational efficiency of traditional equipment. The use of sensors in AC circuit breakers helps in power quality measurements, fewer interruptions, the protection of secondary equipment, easy and safe maintenance, remote monitoring and control, and less use of highly valuable raw materials. T&D is the largest growing end-user segment in the global AC circuit breaker market due to the replacement of aging infrastructure in power utilities and the increasing electricity demand.

"Air-insulated: The third-largest segment by insulation type in AC circuit breaker market"

The air segment, by insulation type, is projected to hold the third-largest market size during the forecast period. An air AC circuit breaker is used to provide overcurrent and short circuit protection for electric circuits. Air AC circuit breakers are usually used in low- and medium-voltage applications. They are commonly deployed at places where the normal operating current ranges up to a few hundred amperes. When circuits working on such high currents are disconnected, an electric arc is formed between the disconnecting ends due to the air ionization around the terminals. This arc formation is harmful to the circuit as well as the terminals under operation. So, to extinguish this arc in minimum time, an arc quenching medium is required. In this case, the medium is air, which blows through the middle of the terminals quenching the arc.

"Very-high Voltage: The third-largest segment by type in AC circuit breaker market"

The air-insulated segment, by type, is projected to hold the second largest market size during the forecast period. The European air-insulated AC circuit breaker market is projected to grow from USD 554 million in 2022 to USD 726 million by 2028; it is expected to grow at a CAGR of 4.7% from 2023 to 2028.

Faulty tripping and switching operations of very high-voltage circuits are very rare; most times, these circuit breakers remain in ON condition and may be operated after long periods. The switchgear systems in this voltage range are also used in renewable power transmission and medium-voltage substations. The growing electrification and the integration of renewables in the national grid require rapid upgrade of transmission and distribution infrastructure. Automated and smart AC circuit breakers are used with smart grid technology to enhance efficiency. Hence, the demand for very high-voltage AC circuit breakers is expected to swell during the forecast period.

"North America: The second fastest and third largest-growing region in AC circuit breaker market"

North America is estimated to hold the third largest and second fastest market share in the AC circuit breaker market. North America is segmented into US, Canada, and Mexico. The AC circuit breaker market in North America has experienced consistent growth due to several contributing factors. One significant factor is the rising need for dependable and effective electrical distribution systems across residential, commercial, and industrial sectors. The demand for secure and reliable electrical infrastructure, combined with strict regulations and standards, has resulted in the widespread acceptance and utilization of circuit breakers. With the ongoing growth of the construction industry, fuelled by urbanization and population expansion, the demand for circuit breakers in residential applications is anticipated to increase. Similarly, the commercial and industrial sectors make substantial contributions to the circuit breaker market in North America. These sectors necessitate robust electrical systems to support diverse operations, including office buildings, retail spaces, manufacturing facilities, and data centres..

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 35%, Tier 2- 45%, and Tier 3- 20%

By Designation: C-Level- 35%, Director Levels- 25%, and Others- 40%

By Region: North America- 40%, Asia Pacific- 30%, Europe- 20%, the Middle East & Africa- 5%, and South America- 5%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The AC circuit breaker market is dominated by a few major players that have a wide regional presence. The leading players in the AC circuit breaker market are Eaton (Ireland), ABB (Switzerland), Schneider Electric (France), Siemens (Germany), and Mitsubishi Electric (Japan).

Research Coverage:

The report defines, describes, and forecasts the global AC circuit breaker market, by voltage, insulation type, installation, end-use industry, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value and volume, and future trends in the AC circuit breaker market.

Key Benefits of Buying the Report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the relay market and provides them information on key market drivers, restraints, challenges, and opportunities.

- Analysis of key drivers (growing investments in power generation from renewable energy sources, increasing capacity additions and enhancements for t&d networks, strengthening of power distribution infrastructure, increased investments in industrial production), restraints (regulations restricting SF6 gas emissions, competition from unorganized sector), opportunities (emerging smart technologies and digitalization, growing usage of high-voltage direct current systems, replacement of aging grid infrastructure and need for reliable T&D networks), and challenges (risk of cybersecurity attacks and installation of modernized circuit breakers, high temperature, arc flashing, and overpressure during operation) influencing the growth of the ac circuit breaker market.

- Product Development/ Innovation: The future of the ac circuit breaker market looks bright. Companies like Mitsubishi Electric announced the acquisition of Scibreak AB. Mitsubishi Electric announced that it entered into an acquisition on February 16 to wholly acquire Scibreak AB, a Swedish company that develops DC circuit breakers (DCCBs). The two firms aim to strengthen the competitiveness of their unified business by working closely on developing DCCB technologies for high-voltage direct current (HVDC) systems to support the increasing global deployment of renewable energy.

- Market Development: The progress in rising power distribution networks is due to the rising per capita income, growing middle-class population, expanding urbanization, and increasing access to electricity in remotely located areas. Rural electrification in some developing countries is expected to bypass large national grids in favor of distributed power generation. For instance, the Indian Government is focusing on increasing the penetration of power supply in villages with the help of schemes such as the Restructured Accelerated Power Development and Reforms Program (R-APDRP) and Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY). These schemes are providing an excellent opportunity for the AC circuit breaker market.

- Market Diversification: Mitsubishi Electric offers technologically integrated products and mainly focuses on high-voltage circuit breakers. The company's 160 kV high-voltage DC circuit breaker prototype has passed the DC interruption test in a research project that was carried out by the European Commission. It also focuses on investments and expansion as one of its key strategies to increase market presence.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Eaton (Ireland), ABB (Switzerland), Schneider Electric (France), Siemens (Germany), and Mitsubishi Electric (Japan) among others in the ac circuit breaker market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.3.1 AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE

- 1.3.2 AC CIRCUIT BREAKER MARKET, BY INSTALLATION

- 1.3.3 AC CIRCUIT BREAKER MARKET, BY VOLTAGE

- 1.3.4 AC CIRCUIT BREAKER MARKET, BY APPLICATION

- 1.3.5 AC CIRCUIT BREAKER MARKET, BY REGION

- 1.4 MARKET SCOPE

- FIGURE 1 AC CIRCUIT BREAKER MARKET SEGMENTATION

- 1.5 REGIONAL SCOPE

- 1.6 YEARS CONSIDERED

- 1.7 CURRENCY CONSIDERED

- 1.8 LIMITATIONS

- 1.9 STAKEHOLDERS

- 1.10 SUMMARY OF CHANGES

- 1.11 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AC CIRCUIT BREAKER MARKET: RESEARCH DESIGN

- 2.2 SECONDARY AND PRIMARY RESEARCH

- FIGURE 3 AC CIRCUIT BREAKER MARKET: RESEARCH DATA

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key insights from primary sources

- 2.2.2.2 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARIES

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 5 AC CIRCUIT BREAKER MARKET: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 AC CIRCUIT BREAKER MARKET: TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE METRICS

- FIGURE 7 METRICS CONSIDERED FOR ANALYZING DEMAND FOR AC CIRCUIT BREAKERS

- 2.3.3.1 Assumptions for demand-side analysis

- 2.3.3.2 Calculations for demand-side analysis

- 2.3.4 SUPPLY-SIDE METRICS

- FIGURE 8 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF AC CIRCUIT BREAKERS

- FIGURE 9 AC CIRCUIT BREAKER MARKET: SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Assumptions for supply-side analysis

- 2.3.4.2 Calculations for supply-side analysis

- 2.3.4.3 Assumptions and calculations for AC circuit breaker market

- 2.4 MARKET FORECAST

- 2.5 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- TABLE 1 SNAPSHOT OF AC CIRCUIT BREAKER MARKET

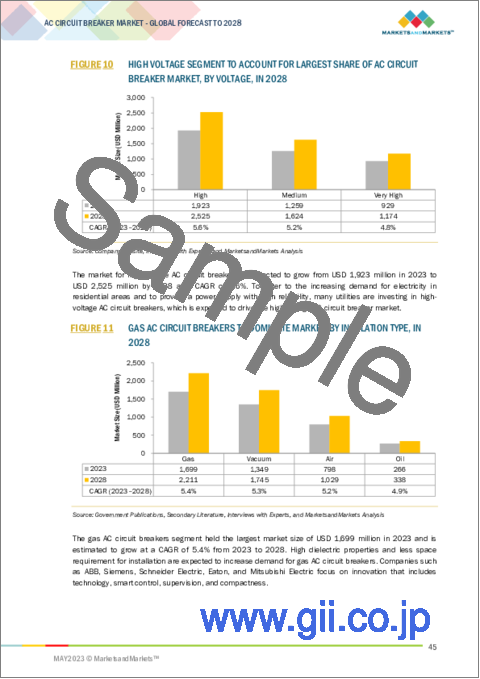

- FIGURE 10 HIGH VOLTAGE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF AC CIRCUIT BREAKER MARKET, BY VOLTAGE, IN 2028

- FIGURE 11 GAS AC CIRCUIT BREAKERS TO DOMINATE MARKET, BY INSULATION TYPE, IN 2028

- FIGURE 12 OUTDOOR SEGMENT TO EXHIBIT HIGHER CAGR IN AC CIRCUIT BREAKER MARKET, BY INSTALLATION, DURING FORECAST PERIOD

- FIGURE 13 INDUSTRIAL APPLICATIONS TO GROW AT FASTEST RATE IN AC CIRCUIT BREAKER MARKET, BY APPLICATION, DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF AC CIRCUIT BREAKER MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AC CIRCUIT BREAKER MARKET

- FIGURE 15 GROWING EMPHASIS ON UPGRADING AGING INFRASTRUCTURE TO DRIVE AC CIRCUIT BREAKER MARKET FROM 2023 TO 2028

- 4.2 AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY INSULATION TYPE AND COUNTRY

- FIGURE 16 CHINA AND GAS AC CIRCUIT BREAKERS HELD LARGEST SHARES OF ASIA PACIFIC MARKET IN 2022

- 4.3 AC CIRCUIT BREAKER MARKET, BY VOLTAGE

- FIGURE 17 HIGH-VOLTAGE SEGMENT HELD LARGEST SHARE OF GLOBAL AC CIRCUIT BREAKER MARKET IN 2022

- 4.4 AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE

- FIGURE 18 GAS AC CIRCUIT BREAKERS CAPTURED MAJOR MARKET SHARE IN 2022

- 4.5 AC CIRCUIT BREAKER MARKET, BY INSTALLATION

- FIGURE 19 OUTDOOR AC CIRCUIT BREAKERS ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.6 AC CIRCUIT BREAKER MARKET, BY APPLICATION

- FIGURE 20 TRANSMISSION & DISTRIBUTION UTILITIES ACCOUNTED FOR LARGEST SHARE OF AC CIRCUIT BREAKER MARKET IN 2022

- 4.7 AC CIRCUIT BREAKER MARKET, BY REGION

- FIGURE 21 ASIA PACIFIC TO RECORD HIGHEST CAGR IN AC CIRCUIT BREAKER MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 AC CIRCUIT BREAKER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing investments in power generation from renewable energy sources

- FIGURE 23 INSTALLED RENEWABLE ENERGY CAPACITY (2016-2021)

- 5.2.1.2 Increasing capacity additions and enhancements for T&D networks

- 5.2.1.3 Strengthening of power distribution infrastructure

- 5.2.1.4 Increased investments in industrial production

- FIGURE 24 GLOBAL GDP GROWTH (2010-2022)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulations restricting SF6 gas emissions

- TABLE 2 GLOBAL WARMING POTENTIAL OF GREENHOUSE GASES (100-YEAR TIME HORIZON)

- 5.2.2.2 Competition from unorganized sector

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging smart technologies and digitalization

- FIGURE 25 INVESTMENTS IN DIGITAL INFRASTRUCTURE IN TRANSMISSION & DISTRIBUTION ELECTRICITY GRIDS, 2015-2021 (USD BILLION)

- 5.2.3.2 Growing usage of high-voltage direct current systems

- 5.2.3.3 Replacement of aging grid infrastructure and need for reliable T&D networks

- 5.2.4 CHALLENGES

- 5.2.4.1 Risk of cybersecurity attacks and installation of modernized circuit breakers

- 5.2.4.2 High temperature, arc flashing, and overpressure during operation

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AC CIRCUIT BREAKER PROVIDERS

- FIGURE 26 REVENUE SHIFT FOR AC CIRCUIT BREAKER PROVIDERS

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 27 AC CIRCUIT BREAKER MARKET: VALUE CHAIN ANALYSIS

- 5.4.1 RAW MATERIAL PROVIDERS/SUPPLIERS

- 5.4.2 COMPONENT MANUFACTURERS

- 5.4.3 AC CIRCUIT BREAKER MANUFACTURERS/ASSEMBLERS

- 5.4.4 DISTRIBUTORS (BUYERS)/END USERS

- 5.4.5 POST-SALES SERVICE PROVIDERS

- 5.5 MARKET MAP

- FIGURE 28 AC CIRCUIT BREAKER MARKET MAP

- TABLE 3 AC CIRCUIT BREAKER MARKET: ROLE IN ECOSYSTEM

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 TECHNOLOGY TRENDS FOR VARIOUS CIRCUIT BREAKER TECHNOLOGIES

- 5.7 PATENT ANALYSIS

- TABLE 4 AC CIRCUIT BREAKER MARKET: INNOVATIONS AND PATENT REGISTRATIONS, APRIL 2020-MAY 2023

- 5.8 AC CIRCUIT BREAKER MARKET: TARIFFS, CODES, AND REGULATIONS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 PORTER'S FIVE FORCES ANALYSIS FOR AC CIRCUIT BREAKERS

- TABLE 5 AC CIRCUIT BREAKER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF SUBSTITUTES

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF NEW ENTRANTS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 CIRCUIT BREAKERS FOR ENERGY MARKET

- 5.10.1.1 ABB introduced SACE Emax (low voltage air and molded-case circuit breakers) to transform energy market

- 5.10.1.2 Schneider engineers shrank their design by 25% with Enventive concept

- 5.10.1 CIRCUIT BREAKERS FOR ENERGY MARKET

- 5.11 AVERAGE SELLING PRICE TREND

- FIGURE 30 AVERAGE SELLING PRICE TREND (2020-2023)

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- 5.13 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 7 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- 5.14 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 8 AC CIRCUIT BREAKER MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 AC CIRCUIT BREAKER MARKET, BY VOLTAGE

- 6.1 INTRODUCTION

- FIGURE 33 HIGH VOLTAGE SEGMENT TO DOMINATE AC CIRCUIT BREAKER MARKET IN 2022

- TABLE 9 AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 10 AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (UNITS)

- TABLE 11 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 12 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (UNITS)

- TABLE 13 POWER GENERATION: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 14 POWER GENERATION: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (UNITS)

- TABLE 15 INDUSTRIAL: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 16 INDUSTRIAL: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (UNITS)

- TABLE 17 OTHERS: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 18 OTHERS: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (UNITS)

- 6.2 MEDIUM VOLTAGE

- 6.2.1 GROWING POWER DISTRIBUTION INFRASTRUCTURES TO DRIVE MARKET

- TABLE 19 MEDIUM VOLTAGE: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 20 MEDIUM VOLTAGE: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (UNITS)

- 6.3 HIGH VOLTAGE

- 6.3.1 INVESTMENTS IN ELECTRICAL TRANSMISSION NETWORKS TO PROPEL DEMAND

- TABLE 21 HIGH VOLTAGE: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 22 HIGH VOLTAGE: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (UNITS)

- 6.4 VERY HIGH VOLTAGE

- 6.4.1 STRENGTHENING OF TRANSMISSION AND DISTRIBUTION INFRASTRUCTURE TO BOOST MARKET GROWTH

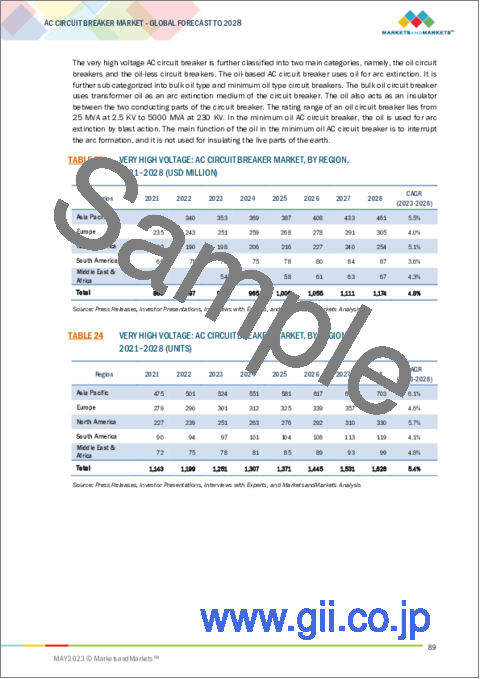

- TABLE 23 VERY HIGH VOLTAGE: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 24 VERY HIGH VOLTAGE: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (UNITS)

7 AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE

- 7.1 INTRODUCTION

- FIGURE 34 GAS AC CIRCUIT BREAKERS DOMINATED AC CIRCUIT BREAKER MARKET IN 2022

- TABLE 25 AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 26 AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 27 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 28 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 29 POWER GENERATION: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 30 POWER GENERATION: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 31 INDUSTRIAL: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 32 INDUSTRIAL: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 33 OTHERS: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 34 OTHERS: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (UNITS)

- 7.2 VACUUM

- 7.2.1 ENVIRONMENT-FRIENDLINESS AND LONG SERVICE LIFE TO INCREASE DEMAND

- TABLE 35 VACUUM: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 36 VACUUM: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (UNITS)

- 7.3 AIR

- 7.3.1 RISING DEMAND FOR ENERGY STORAGE TO DRIVE MARKET

- TABLE 37 AIR: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 38 AIR: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (UNITS)

- 7.4 GAS

- 7.4.1 HIGH DIELECTRIC PROPERTY AND LESS SPACE REQUIREMENT FOR INSTALLATION TO INCREASE DEMAND

- TABLE 39 GAS: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 40 GAS: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (UNITS)

- 7.5 OIL

- 7.5.1 HIGH DIELECTRIC STRENGTH AND INSULATION TO BOOST MARKET GROWTH

- TABLE 41 OIL: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 42 OIL: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (UNITS)

8 AC CIRCUIT BREAKER MARKET, BY INSTALLATION

- 8.1 INTRODUCTION

- FIGURE 35 OUTDOOR SEGMENT DOMINATED AC CIRCUIT BREAKER MARKET IN 2022

- TABLE 43 AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 44 AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 45 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 46 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 47 POWER GENERATION: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 48 POWER GENERATION: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 49 INDUSTRIAL: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 50 INDUSTRIAL: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 51 OTHERS: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 52 OTHERS: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (UNITS)

- 8.2 INDOOR INSTALLATION

- 8.2.1 GROWING INDUSTRIAL AND COMMERCIAL SECTORS IN EMERGING ECONOMIES TO BOOST MARKET GROWTH

- TABLE 53 INDOOR INSTALLATION: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 54 INDOOR INSTALLATION: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (UNITS)

- 8.3 OUTDOOR INSTALLATION

- 8.3.1 INCREASING INSTALLATIONS OF SOLAR AND WIND POWER PLANTS TO DRIVE MARKET

- TABLE 55 OUTDOOR INSTALLATION: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 56 OUTDOOR INSTALLATION: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (UNITS)

9 AC CIRCUIT BREAKER MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 36 TRANSMISSION & DISTRIBUTION UTILITIES SEGMENT DOMINATED AC CIRCUIT BREAKER MARKET IN 2022

- TABLE 57 AC CIRCUIT BREAKER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 58 AC CIRCUIT BREAKER MARKET, BY APPLICATION, 2021-2028 (UNITS)

- 9.2 TRANSMISSION & DISTRIBUTION UTILITIES

- 9.2.1 INCREASING DEMAND FOR ELECTRICITY AND REPLACEMENT OF AGING INFRASTRUCTURE TO DRIVE MARKET

- TABLE 59 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 60 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (UNITS)

- 9.3 POWER GENERATION

- 9.3.1 RISING SAFETY AND RELIABILITY REQUIREMENTS OF POWER PLANTS TO PROPEL MARKET GROWTH

- TABLE 61 POWER GENERATION: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 62 POWER GENERATION: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (UNITS)

- 9.4 INDUSTRIAL

- 9.4.1 STRENGTHENING OF TRANSMISSION AND DISTRIBUTION INFRASTRUCTURE TO DRIVE DEMAND

- TABLE 63 INDUSTRIAL: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 64 INDUSTRIAL: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (UNITS)

- 9.5 OTHERS

- TABLE 65 OTHERS: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 66 OTHERS: AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (UNITS)

10 AC CIRCUIT BREAKER MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 37 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 AC CIRCUIT BREAKER MARKET SHARE (VALUE), BY REGION, 2022

- TABLE 67 AC CIRCUIT BREAKER MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.2 ASIA PACIFIC

- 10.2.1 RECESSION IMPACT ON ASIA PACIFIC AC CIRCUIT BREAKER MARKET

- FIGURE 39 ASIA PACIFIC: AC CIRCUIT BREAKER MARKET SNAPSHOT

- 10.2.2 BY VOLTAGE

- TABLE 68 ASIA PACIFIC: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 69 ASIA PACIFIC: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (UNITS)

- 10.2.3 BY INSULATION TYPE

- TABLE 70 ASIA PACIFIC: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (UNITS)

- 10.2.4 BY INSTALLATION

- TABLE 72 ASIA PACIFIC: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (UNITS)

- 10.2.5 BY APPLICATION

- TABLE 74 ASIA PACIFIC: AC CIRCUIT BREAKER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: AC CIRCUIT BREAKER MARKET, BY APPLICATION, 2021-2028 (UNITS)

- 10.2.5.1 By voltage

- TABLE 76 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 77 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY VOLTAGE, 2021-2028 (UNITS)

- TABLE 78 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 79 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY VOLTAGE, 2021-2028 (UNITS)

- TABLE 80 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 81 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY VOLTAGE, 2021-2028 (UNITS)

- TABLE 82 OTHERS: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 83 OTHERS: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY VOLTAGE, 2021-2028 (UNITS)

- 10.2.5.2 By insulation type

- TABLE 84 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 85 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 86 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 87 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 88 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 89 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 90 OTHERS: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 91 OTHERS: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY INSULATION TYPE, 2021-2028 (UNITS)

- 10.2.5.3 By installation

- TABLE 92 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 93 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 94 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 95 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 96 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 97 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 98 OTHERS: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 99 OTHERS: AC CIRCUIT BREAKER MARKET IN ASIA PACIFIC, BY INSTALLATION, 2021-2028 (UNITS)

- 10.2.6 BY COUNTRY

- TABLE 100 ASIA PACIFIC: AC CIRCUIT BREAKER MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.2.6.1 China

- 10.2.6.1.1 Rapid urbanization, infrastructure development, and increasing demand for electricity to lead market growth

- 10.2.6.1 China

- TABLE 101 CHINA: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.2.6.2 India

- 10.2.6.2.1 Rising electrification to drive AC circuit breaker market

- 10.2.6.2 India

- TABLE 102 INDIA: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.2.6.3 Japan

- 10.2.6.3.1 Replacement of aging power infrastructure to achieve higher efficiency and security to drive market

- 10.2.6.3 Japan

- TABLE 103 JAPAN: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.2.6.4 Rest of Asia Pacific

- TABLE 104 REST OF ASIA PACIFIC: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 RECESSION IMPACT ON EUROPEAN AC CIRCUIT BREAKER MARKET

- FIGURE 40 EUROPE: AC CIRCUIT BREAKER MARKET SNAPSHOT

- 10.3.2 BY VOLTAGE

- TABLE 105 EUROPE: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 106 EUROPE: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (UNITS)

- 10.3.3 BY INSULATION TYPE

- TABLE 107 EUROPE: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 108 EUROPE: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (UNITS)

- 10.3.4 BY INSTALLATION

- TABLE 109 EUROPE: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 110 EUROPE: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (UNITS)

- 10.3.5 BY APPLICATION

- TABLE 111 EUROPE: AC CIRCUIT BREAKER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 112 EUROPE: AC CIRCUIT BREAKER MARKET, BY APPLICATION, 2021-2028 (UNITS)

- 10.3.5.1 By voltage

- TABLE 113 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN EUROPE, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 114 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN EUROPE, BY VOLTAGE, 2021-2028 (UNITS)

- TABLE 115 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN EUROPE, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 116 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN EUROPE, BY VOLTAGE, 2021-2028 (UNITS)

- TABLE 117 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN EUROPE, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 118 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN EUROPE, BY VOLTAGE, 2021-2028 (UNITS)

- TABLE 119 OTHERS: AC CIRCUIT BREAKER MARKET IN EUROPE, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 120 OTHERS: AC CIRCUIT BREAKER MARKET IN EUROPE, BY VOLTAGE, 2021-2028 (UNITS)

- 10.3.5.2 By insulation type

- TABLE 121 TRANSMISSION & DISTRIBUTION UTILITIES AC CIRCUIT BREAKER MARKET IN EUROPE, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 122 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN EUROPE, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 123 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN EUROPE, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 124 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN EUROPE, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 125 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN EUROPE, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 126 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN EUROPE, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 127 OTHERS: AC CIRCUIT BREAKER MARKET IN EUROPE, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 128 OTHERS: AC CIRCUIT BREAKER MARKET IN EUROPE, BY INSULATION TYPE, 2021-2028 (UNITS)

- 10.3.5.3 By installation

- TABLE 129 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN EUROPE, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 130 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN EUROPE, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 131 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN EUROPE, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 132 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN EUROPE, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 133 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN EUROPE, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 134 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN EUROPE, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 135 OTHERS: AC CIRCUIT BREAKER MARKET IN EUROPE, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 136 OTHERS: AC CIRCUIT BREAKER MARKET IN EUROPE, BY INSTALLATION, 2021-2028 (UNITS)

- 10.3.6 BY COUNTRY

- TABLE 137 EUROPE: AC CIRCUIT BREAKER MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.3.6.1 Germany

- 10.3.6.1.1 Increasing focus on energy efficiency and grid expansion to drive market

- 10.3.6.1 Germany

- TABLE 138 GERMANY: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.3.6.2 UK

- 10.3.6.2.1 Growing integration of renewables in grids to drive market

- 10.3.6.2 UK

- TABLE 139 UK: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.3.6.3 Italy

- 10.3.6.3.1 Interconnection of grids to drive market

- 10.3.6.3 Italy

- TABLE 140 ITALY: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.3.6.4 France

- 10.3.6.4.1 Strengthening of power generation and transmission and distribution infrastructure to favor market growth

- 10.3.6.4 France

- TABLE 141 FRANCE: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.3.6.5 Spain

- 10.3.6.5.1 Increased efficiency of power generation and transmission and distribution infrastructure to drive market

- 10.3.6.5 Spain

- TABLE 142 SPAIN: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.3.6.6 Rest of Europe

- TABLE 143 REST OF EUROPE: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.4 NORTH AMERICA

- 10.4.1 RECESSION IMPACT ON NORTH AMERICAN AC CIRCUIT BREAKER MARKET

- 10.4.2 BY VOLTAGE

- TABLE 144 NORTH AMERICA: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 145 NORTH AMERICA: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (UNITS)

- 10.4.3 BY INSULATION TYPE

- TABLE 146 NORTH AMERICA: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 147 NORTH AMERICA: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (UNITS)

- 10.4.4 BY INSTALLATION

- TABLE 148 NORTH AMERICA: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 149 NORTH AMERICA: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (UNITS)

- 10.4.5 BY APPLICATION

- TABLE 150 NORTH AMERICA: AC CIRCUIT BREAKER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 151 NORTH AMERICA: AC CIRCUIT BREAKER MARKET, BY APPLICATION, 2021-2028 (UNITS)

- 10.4.5.1 By voltage

- TABLE 152 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 153 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY VOLTAGE, 2021-2028 (UNITS)

- TABLE 154 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 155 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY VOLTAGE, 2021-2028 (UNITS)

- TABLE 156 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 157 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY VOLTAGE, 2021-2028 (UNITS)

- TABLE 158 OTHERS: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 159 OTHERS: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY VOLTAGE, 2021-2028 (UNITS)

- 10.4.5.2 By insulation type

- TABLE 160 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 161 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 162 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 163 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 164 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 165 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 166 OTHERS: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 167 OTHERS: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY INSULATION TYPE, 2021-2028 (UNITS)

- 10.4.5.3 By installation

- TABLE 168 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 169 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 170 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 171 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 172 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 173 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 174 OTHERS: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 175 OTHERS: AC CIRCUIT BREAKER MARKET IN NORTH AMERICA, BY INSTALLATION, 2021-2028 (UNITS)

- 10.4.6 BY COUNTRY

- TABLE 176 NORTH AMERICA: AC CIRCUIT BREAKER MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.4.6.1 US

- 10.4.6.1.1 Upgrades to power infrastructure to drive market growth

- 10.4.6.1 US

- TABLE 177 US: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.4.6.2 Canada

- 10.4.6.2.1 Significant hydropower resources to boost market growth

- 10.4.6.2 Canada

- TABLE 178 CANADA: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.4.6.3 Mexico

- 10.4.6.3.1 Strengthening of electric power infrastructure through smart grids to drive market growth

- 10.4.6.3 Mexico

- TABLE 179 MEXICO: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.5 SOUTH AMERICA

- 10.5.1 RECESSION IMPACT ON SOUTH AMERICAN AC CIRCUIT BREAKER MARKET

- 10.5.2 BY VOLTAGE

- TABLE 180 SOUTH AMERICA: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 181 SOUTH AMERICA: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (UNITS)

- 10.5.3 BY INSULATION TYPE

- TABLE 182 SOUTH AMERICA: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 183 SOUTH AMERICA: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (UNITS)

- 10.5.4 BY INSTALLATION

- TABLE 184 SOUTH AMERICA: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 185 SOUTH AMERICA: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (UNITS)

- 10.5.5 BY APPLICATION

- TABLE 186 SOUTH AMERICA: AC CIRCUIT BREAKER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 187 SOUTH AMERICA: AC CIRCUIT BREAKER MARKET, BY APPLICATION, 2021-2028 (UNITS)

- 10.5.5.1 By voltage

- TABLE 188 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 189 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY VOLTAGE, 2021-2028 (UNITS)

- TABLE 190 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 191 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY VOLTAGE, 2021-2028 (UNITS)

- TABLE 192 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 193 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY VOLTAGE, 2021-2028 (UNITS)

- TABLE 194 OTHERS: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 195 OTHERS: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY VOLTAGE, 2021-2028 (UNITS)

- 10.5.5.2 By insulation type

- TABLE 196 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 197 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 198 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 199 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 200 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 201 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 202 OTHERS: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 203 OTHERS: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY INSULATION TYPE, 2021-2028 (UNITS)

- 10.5.5.3 By installation

- TABLE 204 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 205 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 206 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 207 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 208 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 209 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 210 OTHERS: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 211 OTHERS: AC CIRCUIT BREAKER MARKET IN SOUTH AMERICA, BY INSTALLATION, 2021-2028 (UNITS)

- 10.5.6 BY COUNTRY

- TABLE 212 SOUTH AMERICA: AC CIRCUIT BREAKER MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.5.6.1 Brazil

- 10.5.6.1.1 Strict regulations and standards to drive market

- 10.5.6.1 Brazil

- TABLE 213 BRAZIL: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.5.6.2 Argentina

- 10.5.6.2.1 Achieving set renewable energy targets to propel market growth

- 10.5.6.2 Argentina

- TABLE 214 ARGENTINA: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.5.6.3 Rest of South America

- TABLE 215 REST OF SOUTH AMERICA: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 RECESSION IMPACT ON MIDDLE EAST & AFRICAN AC CIRCUIT BREAKER MARKET

- 10.6.2 BY VOLTAGE

- TABLE 216 MIDDLE EAST & AFRICA: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (UNITS)

- 10.6.3 BY INSULATION TYPE

- TABLE 218 MIDDLE EAST & AFRICA: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: AC CIRCUIT BREAKER MARKET, BY INSULATION TYPE, 2021-2028 (UNITS)

- 10.6.4 BY INSTALLATION

- TABLE 220 MIDDLE EAST & AFRICA: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: AC CIRCUIT BREAKER MARKET, BY INSTALLATION, 2021-2028 (UNITS)

- 10.6.5 BY APPLICATION

- TABLE 222 MIDDLE EAST & AFRICA: AC CIRCUIT BREAKER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: AC CIRCUIT BREAKER MARKET, BY APPLICATION, 2021-2028 (UNITS)

- 10.6.5.1 By voltage

- TABLE 224 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 225 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY VOLTAGE, 2021-2028 (UNITS)

- TABLE 226 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 227 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY VOLTAGE, POWER GENERATION, 2021-2028 (UNITS)

- TABLE 228 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 229 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY VOLTAGE, INDUSTRIAL, 2021-2028 (UNITS)

- TABLE 230 OTHERS: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY VOLTAGE, 2021-2028 (USD MILLION)

- TABLE 231 OTHERS: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY VOLTAGE, 2021-2028 (UNITS)

- 10.6.5.2 By insulation type

- TABLE 232 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 233 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 234 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 235 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY INSULATION TYPE, POWER GENERATION, 2021-2028 (UNITS)

- TABLE 236 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 237 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY INSULATION TYPE, 2021-2028 (UNITS)

- TABLE 238 OTHERS: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY INSULATION TYPE, 2021-2028 (USD MILLION)

- TABLE 239 OTHERS: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY INSULATION TYPE, 2021-2028 (UNITS)

- 10.6.5.3 By installation

- TABLE 240 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 241 TRANSMISSION & DISTRIBUTION UTILITIES: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 242 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 243 POWER GENERATION: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 244 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 245 INDUSTRIAL: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY INSTALLATION, 2021-2028 (UNITS)

- TABLE 246 OTHERS: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY INSTALLATION, 2021-2028 (USD MILLION)

- TABLE 247 OTHERS: AC CIRCUIT BREAKER MARKET IN MIDDLE EAST & AFRICA, BY INSTALLATION, 2021-2028 (UNITS)

- 10.6.6 BY COUNTRY

- TABLE 248 MIDDLE EAST & AFRICA: AC CIRCUIT BREAKER MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.6.6.1 Saudi Arabia

- 10.6.6.1.1 Increasing production of clean energy to boost market growth

- 10.6.6.1 Saudi Arabia

- TABLE 249 SAUDI ARABIA: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.6.6.2 South Africa

- 10.6.6.2.1 Government intervention programs to drive market

- 10.6.6.2 South Africa

- TABLE 250 SOUTH AFRICA: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.6.6.3 UAE

- 10.6.6.3.1 Significant investment in power generation projects to favor market growth

- 10.6.6.3 UAE

- TABLE 251 UAE: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

- 10.6.6.4 Rest of Middle East & Africa

- TABLE 252 REST OF MIDDLE EAST & AFRICA: AC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 253 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, APRIL 2018-APRIL 2022

- 11.3 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS

- TABLE 254 AC CIRCUIT BREAKER MARKET: DEGREE OF COMPETITION

- FIGURE 41 AC CIRCUIT BREAKER MARKET SHARE ANALYSIS, 2022

- 11.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

- FIGURE 42 TOP PLAYERS IN AC CIRCUIT BREAKER MARKET, 2018-2022

- 11.5 KEY COMPANY EVALUATION QUADRANT

- 11.5.1 STARS

- 11.5.2 PERVASIVE PLAYERS

- 11.5.3 EMERGING LEADERS

- 11.5.4 PARTICIPANTS

- FIGURE 43 COMPETITIVE LEADERSHIP MAPPING OF KEY PLAYERS: AC CIRCUIT BREAKER MARKET, 2022

- 11.6 STARTUP/SME EVALUATION QUADRANT

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 STARTING BLOCKS

- 11.6.4 DYNAMIC COMPANIES

- FIGURE 44 COMPETITIVE LEADERSHIP MAPPING OF STARTUPS/SMES: AC CIRCUIT BREAKER MARKET, 2022

- 11.6.5 COMPETITIVE BENCHMARKING

- TABLE 255 AC CIRCUIT BREAKER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 256 AC CIRCUIT BREAKER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 11.7 AC CIRCUIT BREAKER MARKET: COMPANY FOOTPRINT

- TABLE 257 COMPANY FOOTPRINT: BY VOLTAGE

- TABLE 258 COMPANY FOOTPRINT: BY APPLICATION

- TABLE 259 COMPANY FOOTPRINT: BY REGION

- TABLE 260 OVERALL COMPANY FOOTPRINT

- 11.8 COMPETITIVE SCENARIO

- TABLE 261 AC CIRCUIT BREAKER MARKET: PRODUCT LAUNCHES, AUGUST 2020-MARCH 2022

- TABLE 262 AC CIRCUIT BREAKER MARKET: DEALS, OCTOBER 2021-APRIL 2022

12 COMPANY PROFILE

- 12.1 KEY PLAYERS

- (Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)**

- 12.1.1 ABB LTD.

- TABLE 263 ABB: COMPANY OVERVIEW

- FIGURE 45 ABB: COMPANY SNAPSHOT

- TABLE 264 ABB: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 265 ABB: PRODUCT LAUNCHES

- 12.1.2 SIEMENS LIMITED

- TABLE 266 SIEMENS LIMITED: COMPANY OVERVIEW

- FIGURE 46 SIEMENS LIMITED: COMPANY SNAPSHOT

- TABLE 267 SIEMENS LIMITED: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 268 SIEMENS LIMITED: PRODUCT LAUNCHES

- 12.1.3 SCHNEIDER ELECTRIC

- TABLE 269 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- FIGURE 47 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 270 SCHNEIDER ELECTRIC: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 271 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- 12.1.4 EATON

- TABLE 272 EATON: COMPANY OVERVIEW

- FIGURE 48 EATON: COMPANY SNAPSHOT

- TABLE 273 EATON: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 274 EATON: PRODUCT LAUNCHES

- 12.1.5 MITSUBISHI ELECTRIC

- TABLE 275 MITSUBISHI ELECTRIC: COMPANY OVERVIEW

- FIGURE 49 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

- TABLE 276 MITSUBISHI ELECTRIC: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 277 MITSUBISHI ELECTRIC: PRODUCT LAUNCHES

- TABLE 278 MITSUBISHI ELECTRIC: DEALS

- 12.1.6 GENERAL ELECTRIC

- TABLE 279 GENERAL ELECTRIC: COMPANY OVERVIEW

- FIGURE 50 GENERAL ELECTRIC: COMPANY SNAPSHOT

- TABLE 280 GENERAL ELECTRIC: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 281 GENERAL ELECTRIC: PRODUCT LAUNCHES

- 12.1.7 ROCKWELL AUTOMATION

- TABLE 282 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- FIGURE 51 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- TABLE 283 ROCKWELL AUTOMATION: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 284 ROCKWELL AUTOMATION: PRODUCT LAUNCHES

- 12.1.8 BRUSH GROUP

- TABLE 285 BRUSH GROUP: COMPANY OVERVIEW

- TABLE 286 BRUSH GROUP: PRODUCT/SERVICE/SOLUTION OFFERINGS

- 12.1.9 HD HYUNDAI ELECTRIC CO., LTD.

- TABLE 287 HD HYUNDAI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- FIGURE 52 HD HYUNDAI ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- TABLE 288 HD HYUNDAI ELECTRIC CO., LTD.: PRODUCT/SERVICE/SOLUTION OFFERINGS

- 12.1.10 CHINT ELECTRICS

- TABLE 289 CHINT ELECTRICS: COMPANY OVERVIEW

- TABLE 290 CHINT ELECTRIC: PRODUCT/SERVICE/SOLUTION OFFERINGS

- 12.1.11 SUNTREE ELECTRIC GROUP CO., LTD.

- TABLE 291 SUNTREE ELECTRIC GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 292 SUNTREE ELECTRIC GROUP CO., LTD.: PRODUCT/SERVICE/SOLUTION OFFERINGS

- 12.1.12 TOSHIBA CORPORATION

- TABLE 293 TOSHIBA CORPORATION: COMPANY OVERVIEW

- FIGURE 53 TOSHIBA CORPORATION: COMPANY SNAPSHOT

- TABLE 294 TOSHIBA CORPORATION: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 295 TOSHIBA CORPORATION: DEALS

- 12.1.13 SHANGHAI LIANGXIN ELECTRIC CO., LTD.

- TABLE 296 SHANGHAI LIANGXIN ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 297 SHANGHAI LIANGXIN ELECTRIC CO., LTD.: PRODUCT/SERVICE/SOLUTION OFFERINGS

- 12.1.14 SECHERON HASLER GROUP

- TABLE 298 SECHERON HASLER GROUP: COMPANY OVERVIEW

- TABLE 299 SECHERON HAZLER GROUP: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 300 SECHERON HASLER GROUP: PRODUCT LAUNCHES

- 12.1.15 PANASONIC CORPORATION

- TABLE 301 PANASONIC CORPORATION: COMPANY OVERVIEW

- FIGURE 54 PANASONIC CORPORATION: COMPANY SNAPSHOT

- TABLE 302 PANASONIC CORPORATION: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 303 PANASONIC CORPORATION: PRODUCT LAUNCHES

- *Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 FUJI ELECTRIC

- 12.2.2 POWELL INDUSTRIES

- 12.2.3 LEGRAND

- 12.2.4 ALSTOM

- 12.2.5 TE CONNECTIVITY

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS