|

|

市場調査レポート

商品コード

1287806

没入型アナリティクスの世界市場:提供別 (ハードウェア、ソリューション、サービス)・最終用途産業別 (医療、建設、自動車・輸送、メディア・エンターテインメント)・用途別・地域別の将来予測 (2028年まで)Immersive Analytics Market by Offering (Hardware, Solutions, Services), End-use Industry (Healthcare, Construction, Automotive & Transportation, Media & Entertainment), Application, and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 没入型アナリティクスの世界市場:提供別 (ハードウェア、ソリューション、サービス)・最終用途産業別 (医療、建設、自動車・輸送、メディア・エンターテインメント)・用途別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月01日

発行: MarketsandMarkets

ページ情報: 英文 199 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の没入型アナリティクスの市場規模は、2023年の8億米ドルから2028年には67億米ドルまで、予測期間中に51.7%のCAGRで成長すると予測します。

データ可視化ツールで異種データを分析・理解する需要の高まりが、没入型アナリティクス市場の成長を促進します。異種データの分析は、複雑なシステムや問題をより包括的に理解することができ、より良い意思決定や洞察につながるという利点もあります。

"ハードウェア別では、センサー・コントローラー分野が予測期間中に最も高いCAGRで成長する"

センサー・コントローラーは、没入型アナリティクスを強化する上で重要な役割を果たします。センサーはユーザーの周囲や身体状態に関する情報を収集し、コントローラーはユーザーが没入型環境と対話することを可能にします。収集したデータとインタラクションを活用することで、ユーザーの体験を向上させ、より魅力的で有益なアナリティクスを作成することができます。位置追跡センサーはユーザーの動きと位置を追跡し、ハンドヘルドコントローラーはユーザーが仮想オブジェクトを操作したり選択したりすることを可能にします。ジェスチャー認識技術は、手のジェスチャーや体の動きを解釈し、アイトラッキングはユーザーの視線を監視します。音声認識により、音声コマンドによるインタラクションが可能です。

"サービス別では、マネージドサービス分野が予測期間中に最も高いCAGRで成長する"

マネージドサービスは、特に顧客体験に関連するため重要です。技術的な領域では、十分に提供されたマネージドサービスが必要です。提供されるサービスは、クライアントの環境に完全に適合していなければなりません。マネージドサービスプロバイダーは、顧客の所在地に関係なく、技術的な専門知識、一貫性、柔軟性を提供します。マネージドサービスプロバイダーは、顧客の導入前と導入後のすべての質問とニーズに対応します。

"予測期間中、アジア太平洋地域が最大の市場シェアを占める"

この地域で活動する企業は、柔軟な経済状況、産業化とグローバライゼーションを動機とする政府の政策、デジタル化と技術導入の拡大などの恩恵を受けることができます。没入型アナリティクス市場の成長は、同地域の都市化の急増によって促進されると予測されます。アジア太平洋は技術導入率が著しく、今後数年間、没入型アナリティクス市場で最も高い成長率を記録すると予想されています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 没入型アナリティクスの歴史

- エコシステム分析

- バリューチェーン分析

- 価格分析

- 技術分析

- 業界での使用事例

- 特許分析

- ポーターのファイブフォース分析

- 規制状況

- 主要な利害関係者と購入基準

- 主要な会議とイベント (2023年~2024年)

- 没入型アナリティクス市場のベストプラクティス

- 没入型アナリティクスの市場情勢:将来の方向性

第6章 没入型アナリティクス市場:提供別

- イントロダクション

- ハードウェア

- AR/VR/MRヘッドセット

- ディスプレイ

- センサー・コントローラー

- その他のハードウェア

- ソリューション

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 没入型アナリティクス市場:用途別

- イントロダクション

- 教育・訓練

- 販売・マーケティング

- デザイン・ビジュアライゼーション

- 戦略計画

- その他の用途

第8章 没入型アナリティクス市場:最終用途産業別

- イントロダクション

- メディア・エンターテインメント

- 医療

- 自動車・輸送

- 建設

- 政府・防衛

- その他の最終用途産業

第9章 没入型アナリティクス市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋

- 中国

- シンガポール

- インド

- 日本

- オーストラリア・ニュージーランド (ANZ)

- その他のアジア太平洋

- その他の地域 (ROW)

- 中東・アフリカ

- ラテンアメリカ

第10章 競合情勢

- 概要

- 主要企業が採用した戦略

- 競合シナリオ

- トップ企業の市場シェア分析

- 競合ベンチマーキング

- 没入型アナリティクス市場の主要企業:市場ランキング (2023年)

- 企業評価クアドラント

- スタートアップ/中小企業の評価マトリックス:分析手法と定義

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- IBM

- MICROSOFT

- HTC

- META

- TIBCO

- HEWLETT PACKARD ENTERPRISE (HPE)

- MAGIC LEAP

- SAP

- ACCENTURE

- TABLEAU

- REPLY

- 中小企業/スタートアップ

- KOGNITIV SPARK

- AVENTIOR

- IMMERSION ANALYTICS

- BADVR

- VIRTUALITICS

- SOFTCARE STUDIOS

- JUJU IMMERSIVE LIMITED

- ARSOME TECHNOLOGY

- VARJO

- COGNITIVE3D

- SENSEGLOVE

- DPVR

- PICO

第12章 隣接/関連市場

- 高度分析市場

- ソリューション

- サービス

- 拡張現実 (AR)・仮想現実 (VR) 市場

- ハードウェア

- ソフトウェア

第13章 付録

MarketsandMarkets forecasts the immersive analytics market size is projected to grow from USD 0.8 billion in 2023 to USD 6.7 billion by 2028, at a CAGR of 51.7% during the forecast period. The rising demand for analyzing and understanding heterogeneous data with data visualization tools will drive the growth of the immersive analytics market. Analyzing heterogeneous data can also offer advantages as it can provide a more comprehensive understanding of a complex system or issue, leading to better decision-making and insights.

"By Hardware, the Sensors & Controllers segment is expected to grow with the highest CAGR during the forecast period"

Sensors and controllers play vital roles in enhancing immersive analytics. Sensors gather information about the user's surroundings and physical state, while controllers enable users to interact with the immersive environment. The collected data and interaction can be leveraged to enhance the user's experience and create more engaging and informative analytics. Positional tracking sensors track the user's movements and position, while handheld controllers enable users to manipulate and select virtual objects. Gesture recognition technology interprets hand gestures and body movements, while eye tracking monitors the user's gaze. Voice recognition allows for interaction through voice commands.

"By service, the managed services segment is expected to grow with the highest CAGR during the forecast period"

Managed services are important as they are specifically related to client experiences. A technological domain requires well-delivered managed services. The services offered must fit perfectly into the client's environment. Technical expertise, service consistency, and flexibility must be provided by vendors regardless of the client's location. Managed service providers offer technical expertise, consistency, and flexibility, regardless of the client's location. They deal with all the pre-and post-deployment questions and needs of clients.

"Asia Pacific is expected to have the largest market share during the forecast period"

Companies operating in this region will benefit from flexible economic conditions, the industrialization-and globalization-motivated policies of governments, and the expanding digitalization and technological adoption, all of which are expected to have a huge impact on the business community in the region. The growth of the immersive analytics market is anticipated to be fueled by the surge in urbanization in the region. Asia Pacific has a significant technology adoption rate and is expected to record the highest growth rate in the immersive analytics market over the next few years.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 39%, and Tier 3 - 26%

- By Designation: C-level -25%, D-level - 35%, and Others - 40%

- By Region: North America - 38%, Europe - 40%, Asia Pacific - 21%, RoW- 1%

The major players in the immersive analytics market are IBM (US), Microsoft (US), SAP (Germany), Google (US), TIBCO (US), HPE (US), Magic Leap (US), Accenture (Ireland), HTC (Taiwan), Meta (US), Tableau (US), Kognitiv Spark (Canada), Aventior (US), Immersion Analytics (US), BadVR (US), Virtualitics (US), Softcare Studios (Italy), JuJu Immersive (UK), ARSOME Technology (US), Varjo (Finland), Cognitive3D (Canada), SenseGlove (Netherlands), DPVR (China), PICO (US), Reply (Italy). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the immersive analytics market.

Research Coverage

The market study covers the immersive analytics market size across different segments. It aims at estimating the market size and the growth potential across different segments, including offering, end-use industry, and region. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the immersive analytics market's revenue numbers and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Advancement in immersive technology and increasing digitalization, the large amount and complexity of the data available for analysis will increase the demand of immersive analytics market, the rising demand to analyze and understand heterogeneous data with data visualization tools, growing adoption of Head-Mounted Displays (HMDs) for 3D data visualization), restraints (High cost to deploy infrastructure required for immersive analytics), opportunities (Immersive analytics will help to generate new revenue streams for businesses, increasing demand of IoT and will create huge potential for immersive analytics, adoption of immersive analytics will enable firms to provide more personalized customer experience), and challenges (Complex data ecosystem leading to data breaches and security issues, lack of analytical knowledge among the workforces) influencing the growth of the immersive analytics market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the immersive analytics market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the immersive analytics market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the immersive analytics market.

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like IBM (US), Microsoft (US), SAP (Germany), Google (US), TIBCO (US), HPE (US), Magic Leap (US), Accenture (Ireland), HTC (Taiwan), Meta (US), Tableau (US), Kognitiv Spark (Canada), Aventior (US), Immersion Analytics (US), BadVR (US), Virtualitics (US), Softcare Studios (Italy), JuJu Immersive (UK), ARSOME Technology (US), Varjo (Finland), Cognitive3D (Canada), SenseGlove (Netherlands), DPVR (China), PICO (US), Reply (Italy).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATE, 2020-2022

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 IMMERSIVE ANALYTICS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Primary sources

- 2.1.2.5 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 APPROACH USED FOR MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 1): SUPPLY-SIDE ANALYSIS OF REVENUE FROM PLATFORMS AND SERVICES

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 1), BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF IMMERSIVE ANALYTICS VENDORS

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- 2.2.3 MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- TABLE 2 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT

- FIGURE 10 LIMITATIONS

- 2.7 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 11 IMMERSIVE ANALYTICS MARKET, 2023-2028 (USD MILLION)

- FIGURE 12 IMMERSIVE ANALYTICS MARKET, BY OFFERING, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 IMMERSIVE ANALYTICS MARKET, BY END-USE INDUSTRY, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 IMMERSIVE ANALYTICS MARKET, BY REGION, 2023

4 PREMIUM INSIGHTS

- 4.1 IMMERSIVE ANALYTICS MARKET OVERVIEW

- FIGURE 15 INCREASING USE OF DIGITALIZED PLATFORMS TO DRIVE MARKET GROWTH

- 4.2 NORTH AMERICA: IMMERSIVE ANALYTICS MARKET, BY SERVICE AND END-USE INDUSTRY (2023)

- FIGURE 16 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE

- 4.3 ASIA PACIFIC: IMMERSIVE ANALYTICS MARKET, BY OFFERING AND END-USE INDUSTRY (2023)

- FIGURE 17 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE

- 4.4 EUROPE: IMMERSIVE ANALYTICS MARKET, BY OFFERING AND END-USE INDUSTRY (2023)

- FIGURE 18 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE

- 4.5 GEOGRAPHICAL SNAPSHOT OF IMMERSIVE ANALYTICS MARKET

- FIGURE 19 ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 MARKET OVERVIEW

- 5.2 MARKET DYNAMICS

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IMMERSIVE ANALYTICS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Advancements in immersive technology and increasing digitalization

- 5.2.1.2 Large amount and complexity of data available for analysis to increase demand

- 5.2.1.3 Rising demand to analyze and understand heterogeneous data with data visualization tools

- 5.2.1.4 Growing adoption of head-mounted displays for 3D data visualization

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost to deploy infrastructure required for immersive analytics

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Immersive analytics to generate new revenue streams for businesses

- 5.2.3.2 Increasing demand for IoT to create huge potential for immersive analytics

- 5.2.3.3 Adoption of immersive analytics to enable firms to provide more personalized customer experience

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex data ecosystem to lead to data breaches and security issues

- 5.2.4.2 Lack of analytical knowledge in workforce

- 5.3 HISTORY OF IMMERSIVE ANALYTICS

- FIGURE 21 EVOLUTION OF IMMERSIVE ANALYTICS

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 22 IMMERSIVE MARKET: ECOSYSTEM

- TABLE 3 IMMERSIVE ANALYTICS MARKET: ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 23 IMMERSIVE ANALYTICS MARKET: VALUE CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY OFFERING

- TABLE 4 PRICING MODELS AND INDICATIVE PRICE POINTS, 2022-2023

- 5.6.2 AVERAGE SELLING PRICE TREND

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 RELATED TECHNOLOGIES

- 5.7.1.1 Virtual reality

- 5.7.1.2 Augmented reality

- 5.7.1.3 Mixed reality

- 5.7.1.4 Haptic technology

- 5.7.1.5 Machine learning and artificial intelligence

- 5.7.1.6 3D modeling and animation

- 5.7.2 IMPACT OF IMMERSIVE ANALYTICS ON ADJACENT TECHNOLOGIES

- 5.7.1 RELATED TECHNOLOGIES

- 5.8 INDUSTRY USE CASES

- 5.8.1 USE CASE 1: TOYOTA COLLABORATED WITH MICROSOFT TO CREATE IMMERSIVE AND ENGAGING WORKING EXPERIENCE

- 5.8.2 USE CASE 2: AUDI TO PROVIDE NEW DRIVING EXPERIENCE TO PASSENGERS WITH IMMERSIVE TOOLS

- 5.8.3 USE CASE 4: REMOTESPARK TO HELP WORKERS TO RESOLVE REPAIR AND MAINTENANCE ISSUES REMOTELY

- 5.8.4 USE CASE 6: CANNON DESIGN SELECTED VIVE AND NVIDIA TO ENABLE REMOTE MEETINGS WITH COLLABORATIVE MULTI-USER SUPPORT

- 5.9 PATENT ANALYSIS

- 5.9.1 DOCUMENT OF PATENTS

- TABLE 5 PATENTS FILED, 2018-2023

- 5.9.2 INNOVATION AND PATENT APPLICATIONS

- FIGURE 24 TOTAL NUMBER OF PATENTS GRANTED, 2018-2023

- FIGURE 25 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

- TABLE 6 TOP 10 PATENT OWNERS IN IMMERSIVE ANALYTICS MARKET, 2018-2023

- TABLE 7 LIST OF FEW PATENTS IN IMMERSIVE ANALYTICS MARKET, 2018-2023

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF IMMERSIVE ANALYTICS MARKET

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 IMMERSIVE ANALYTICS MARKET: PORTER'S FIVE FORCES MODEL

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUES

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 BARGAINING POWER OF SUPPLIERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 REGULATORY LANDSCAPE

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1 ISO/TC 184/SC 4

- 5.11.2 ISO/ TC 184

- 5.11.3 GENERAL PERSONAL DATA PROTECTION LAW (GPDP)

- 5.11.4 AUSTRALIAN DIGITAL CURRENCY COMMERCE ASSOCIATION (ADCCA)

- 5.11.5 DIGITAL SIGNATURE ACT

- 5.11.6 GDPR

- 5.11.7 FINANCIAL SERVICES MODERNIZATION ACT

- 5.11.8 SOX ACT

- 5.11.9 PAYMENT CARD INDUSTRY-DATA SECURITY STANDARD

- 5.11.10 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

- 5.11.11 FEDERAL INFORMATION SECURITY MANAGEMENT ACT

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA

- TABLE 15 KEY BUYING CRITERIA

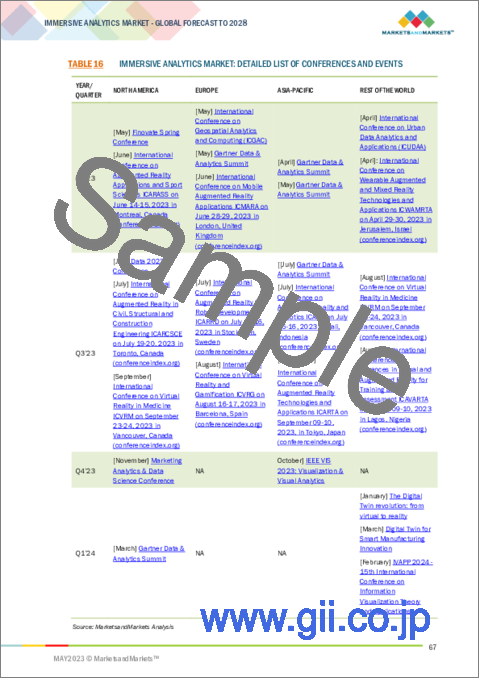

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 16 IMMERSIVE ANALYTICS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.14 BEST PRACTICES IN IMMERSIVE ANALYTICS MARKET

- 5.15 FUTURE DIRECTIONS OF IMMERSIVE ANALYTICS MARKET LANDSCAPE

- 5.15.1 IMMERSIVE TECHNOLOGY ROADMAP TILL 2030

- 5.15.1.1 Short-term roadmap (2023-2025)

- 5.15.1.2 Mid-term roadmap (2026-2028)

- 5.15.1.3 Long-term roadmap (2029-2030)

- 5.15.1 IMMERSIVE TECHNOLOGY ROADMAP TILL 2030

6 IMMERSIVE ANALYTICS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: IMMERSIVE ANALYTICS MARKET DRIVERS

- FIGURE 29 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 17 IMMERSIVE ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 HARDWARE

- 6.2.1 ORGANIZATIONS TO ADOPT NEW HARDWARE DEVICES TO IMPROVE DATA VISUALIZATION IN 3D

- TABLE 18 IMMERSIVE ANALYTICS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- 6.2.2 AR/VR/MR HEADSETS

- 6.2.2.1 Viewing medical scans while performing surgery to drive need for MR headsets

- TABLE 19 AR/VR/MR HEADSETS: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3 DISPLAYS

- 6.2.3.1 Use of HMDs to display images in immersive environment to drive market

- TABLE 20 DISPLAYS: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.4 SENSORS & CONTROLLERS

- 6.2.4.1 Sensors to capture user inputs and interactions within immersive environment

- TABLE 21 SENSORS & CONTROLLERS: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.5 OTHER HARDWARE

- TABLE 22 OTHER HARDWARE: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SOLUTIONS

- 6.3.1 VISUALIZATION OF DATA IN 3D TO GAIN MORE COMPETITIVE ADVANTAGE AND DRIVE DEMAND FOR IMMERSIVE ANALYTICAL SOLUTIONS

- 6.4 SERVICES

- 6.4.1 NEED FOR PROFESSIONAL CONSULTANT TO PROVIDE 24/7 SERVICE RESPONSE

- TABLE 23 IMMERSIVE ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 6.4.2 PROFESSIONAL SERVICES

- TABLE 24 PROFESSIONAL SERVICES: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.3 MANAGED SERVICES

- TABLE 25 MANAGED SERVICES: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

7 IMMERSIVE ANALYTICS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 APPLICATION: IMMERSIVE ANALYTICS MARKET DRIVERS

- 7.2 EDUCATION & TRAINING

- 7.2.1 IMMERSIVE ANALYTICS TOOLS TO ENABLE EMPLOYEES TO ENGAGE WITH SIMULATED ENVIRONMENTS AND TRAINING SCENARIOS

- 7.3 SALES & MARKETING

- 7.3.1 MARKETING STRATEGIES, SUCH AS ADJUSTING INVENTORY LEVELS AND OFFERING DISCOUNTS TO DRIVE MARKET

- 7.4 DESIGN & VISUALIZATION

- 7.4.1 REVOLUTIONIZATION OF USER INTERACTION WITH DATA TO INCREASE DEMAND FOR IMMERSIVE ANALYTICS TOOLS

- 7.5 STRATEGY PLANNING

- 7.5.1 TESTING AND ANALYZING DATA SETS AND SYSTEM BEHAVIOR IN COMPLEX SITUATIONS

- 7.6 OTHER APPLICATIONS

8 IMMERSIVE ANALYTICS MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.1.1 END-USE INDUSTRY: IMMERSIVE ANALYTICS MARKET DRIVERS

- FIGURE 30 MEDIA & ENTERTAINMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 26 IMMERSIVE ANALYTICS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 8.2 MEDIA & ENTERTAINMENT

- 8.2.1 GROWING NEED TO IMPROVE CUSTOMER EXPERIENCE

- TABLE 27 MEDIA & ENTERTAINMENT: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.1.1 Use Cases

- 8.2.1.1.1 Taking theme parks to next level by enriching experience of viewers

- 8.2.1.1.2 Creating engaging and immersive experiences with AR, VR, and XR technologies

- 8.2.1.1 Use Cases

- 8.2.2 HEALTHCARE

- 8.2.2.1 Revolutionization of medical education, clinical care, and medical research with immersive analytical tools

- TABLE 28 HEALTHCARE: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.2.2 Use Cases

- 8.2.2.2.1 Company to drive innovation in training process by leveraging power of virtual and augmented reality

- 8.2.2.2 Use Cases

- 8.2.3 AUTOMOTIVE & TRANSPORTATION

- 8.2.3.1 Visualizing and analyzing data from sensors and other sources to identify potential issues

- TABLE 29 AUTOMOTIVE & TRANSPORTATION: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.3.2 Use Cases

- 8.2.3.2.1 Improving driving skills and preparing drivers for challenges

- 8.2.3.2 Use Cases

- 8.2.4 CONSTRUCTION

- TABLE 30 CONSTRUCTION: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.4.1 Use Cases

- 8.2.4.1.1 FMT AB to use near eye-based AR technology to assist efficient construction activities

- 8.2.4.1 Use Cases

- 8.2.5 GOVERNMENT & DEFENSE

- 8.2.5.1 Solutions to provide training on usage of equipment and perform complex construction tasks

- TABLE 31 GOVERNMENT & DEFENSE: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.5.2 Use Cases

- 8.2.5.2.1 Use of VR technology for training on simulators in aerospace applications

- 8.2.5.2.2 Use of immersive technology such as AR for military training and development programs

- 8.2.5.2 Use Cases

- 8.2.6 OTHER END-USE INDUSTRIES

- TABLE 32 OTHER END-USE INDUSTRIES: IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 IMMERSIVE ANALYTICS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 31 IMMERSIVE ANALYTICS MARKET: REGIONAL SNAPSHOT (2023)

- FIGURE 32 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 33 IMMERSIVE ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

- 9.2.1 NORTH AMERICA: IMMERSIVE ANALYTICS MARKET DRIVERS

- 9.2.2 NORTH AMERICA: RECESSION IMPACT

- TABLE 34 NORTH AMERICA: IMMERSIVE ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: IMMERSIVE ANALYTICS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: IMMERSIVE ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: IMMERSIVE ANALYTICS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: IMMERSIVE ANALYTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.2.3 US

- 9.2.3.1 Strong presence of AR/VR companies to drive market

- TABLE 39 US: IMMERSIVE ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 40 US: IMMERSIVE ANALYTICS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 41 US: IMMERSIVE ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 42 US: IMMERSIVE ANALYTICS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.2.4 CANADA

- 9.3 EUROPE

- 9.3.1 EUROPE: IMMERSIVE ANALYTICS MARKET DRIVERS

- 9.3.2 EUROPE: RECESSION IMPACT

- TABLE 43 EUROPE: IMMERSIVE ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 44 EUROPE: IMMERSIVE ANALYTICS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 45 EUROPE: IMMERSIVE ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 46 EUROPE: IMMERSIVE ANALYTICS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 47 EUROPE: IMMERSIVE ANALYTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Continued transition toward online services due to relative ease and speed to drive market

- TABLE 48 UK: IMMERSIVE ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 49 UK: IMMERSIVE ANALYTICS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 50 UK: IMMERSIVE ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 51 UK: IMMERSIVE ANALYTICS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.3.4 GERMANY

- 9.3.4.1 Surging adoption of new technologies to drive market

- 9.3.5 FRANCE

- 9.3.5.1 Key focus on online advertisement and adoption of digital display

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

- 9.4.1 ASIA PACIFIC: IMMERSIVE ANALYTICS MARKET DRIVERS

- 9.4.2 RECESSION IMPACT: ASIA PACIFIC

- TABLE 52 ASIA PACIFIC: IMMERSIVE ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 53 ASIA PACIFIC: IMMERSIVE ANALYTICS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 54 ASIA PACIFIC: IMMERSIVE ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 55 ASIA PACIFIC: IMMERSIVE ANALYTICS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 56 ASIA PACIFIC: IMMERSIVE ANALYTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.4.3 CHINA

- 9.4.3.1 Presence of video gaming companies and high internet penetration to impact growth

- 9.4.4 SINGAPORE

- 9.4.4.1 Rapid adoption of innovative digital technologies to provide more intuitive and engaging data experiences

- 9.4.5 INDIA

- 9.4.5.1 New start-ups involved in extensive research and development of AR and VR technology to support growth

- TABLE 57 INDIA: IMMERSIVE ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 58 INDIA: IMMERSIVE ANALYTICS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 59 INDIA: IMMERSIVE ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 60 INDIA: IMMERSIVE ANALYTICS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 9.4.6 JAPAN

- 9.4.6.1 Advancements in innovative technologies, coupled with strong IT infrastructure to drive growth

- 9.4.7 AUSTRALIA AND NEW ZEALAND (ANZ)

- 9.4.7.1 Rising demand for immersive analytics to analyze data in e-commerce and education sector

- 9.4.8 REST OF ASIA PACIFIC

- 9.5 ROW

- 9.5.1 ROW: IMMERSIVE ANALYTICS MARKET DRIVERS

- 9.5.2 RECESSION IMPACT: ROW

- TABLE 61 ROW: IMMERSIVE ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 62 ROW: IMMERSIVE ANALYTICS MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 63 ROW: IMMERSIVE ANALYTICS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 64 ROW: IMMERSIVE ANALYTICS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 65 ROW: IMMERSIVE ANALYTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.5.3 MIDDLE EAST AND AFRICA

- 9.5.3.1 Saudi Arabia

- 9.5.3.1.1 Adoption of technology and transformation to data-driven economy to drive growth

- 9.5.3.2 South Africa

- 9.5.3.2.1 Rising government support to drive growth

- 9.5.3.3 UAE

- 9.5.3.3.1 Visualization of trade data of oil and gas assets in real-time to make informed decision making

- 9.5.3.4 Rest of Middle East and Africa

- 9.5.3.1 Saudi Arabia

- 9.5.4 LATIN AMERICA

- 9.5.4.1 Brazil

- 9.5.4.1.1 Increasing initiatives to promote adoption of industry 4.0 technologies

- 9.5.4.2 Mexico

- 9.5.4.2.1 Visualization and analyzation of data received from sensors to drive market

- 9.5.4.3 Rest of Latin America

- 9.5.4.1 Brazil

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 66 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN IMMERSIVE ANALYTICS MARKET

- 10.3 COMPETITIVE SCENARIO

- 10.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

- TABLE 67 IMMERSIVE ANALYTICS MARKET: DEGREE OF COMPETITION

- 10.5 COMPETITIVE BENCHMARKING

- TABLE 68 PRODUCT FOOTPRINT WEIGHTAGE

- TABLE 69 IMMERSIVE ANALYTICS MARKET: COMPETITIVE BENCHMARKING OF PLAYERS BY OFFERING, INDUSTRY, AND REGION

- TABLE 70 IMMERSIVE ANALYTICS MARKET: DETAILED LIST OF KEY STARTUP/SME

- 10.6 MARKET RANKING OF KEY PLAYERS IN IMMERSIVE ANALYTICS MARKET, 2023

- FIGURE 35 MARKET RANKING OF KEY PLAYERS, 2023

- 10.7 COMPANY EVALUATION QUADRANT

- FIGURE 36 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- FIGURE 37 IMMERSIVE ANALYTICS MARKET COMPANY EVALUATION MATRIX, 2023

- 10.8 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

- FIGURE 38 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- FIGURE 39 STARTUP/SME IMMERSIVE ANALYTICS MARKET EVALUATION MATRIX, 2023

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- TABLE 71 PRODUCT LAUNCHES, JANUARY 2019-MARCH 2023

- 10.9.2 DEALS

- TABLE 72 DEALS, JANUARY 2019-MARCH 2023

11 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent developments & MnM View)**

- 11.1 MAJOR PLAYERS

- 11.1.1 IBM

- TABLE 73 IBM: BUSINESS OVERVIEW

- FIGURE 40 IBM: COMPANY SNAPSHOT

- TABLE 74 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 75 IBM: PRODUCT LAUNCHES

- TABLE 76 IBM: DEALS

- 11.1.2 MICROSOFT

- TABLE 77 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 41 MICROSOFT: COMPANY SNAPSHOT

- TABLE 78 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 79 MICROSOFT: PRODUCT LAUNCHES

- 11.1.3 GOOGLE

- TABLE 80 GOOGLE: BUSINESS OVERVIEW

- FIGURE 42 GOOGLE: COMPANY SNAPSHOT

- TABLE 81 GOOGLE: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 82 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 83 GOOGLE: DEALS

- 11.1.4 HTC

- TABLE 84 HTC: BUSINESS OVERVIEW

- FIGURE 43 HTC: COMPANY SNAPSHOT

- TABLE 85 HTC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 86 HTC: PRODUCT LAUNCHES

- TABLE 87 HTC: DEALS

- 11.1.5 META

- TABLE 88 META: BUSINESS OVERVIEW

- FIGURE 44 META: COMPANY SNAPSHOT

- TABLE 89 META: SOLUTIONS/SERVICES OFFERED

- TABLE 90 META: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 91 META: DEALS

- 11.1.6 TIBCO

- TABLE 92 TIBCO: BUSINESS OVERVIEW

- TABLE 93 TIBCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 94 TIBCO: PRODUCT LAUNCHES

- TABLE 95 TIBCO: DEALS

- 11.1.7 HEWLETT PACKARD ENTERPRISE(HPE)

- TABLE 96 HPE: BUSINESS OVERVIEW

- FIGURE 45 HPE: COMPANY SNAPSHOT

- TABLE 97 HPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 98 HPE: PRODUCT LAUNCHES

- TABLE 99 HPE: DEALS

- 11.1.8 MAGIC LEAP

- TABLE 100 MAGIC LEAP: BUSINESS OVERVIEW

- TABLE 101 MAGIC LEAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 102 MAGIC LEAP: PRODUCT LAUNCHES

- TABLE 103 MAGIC LEAP: DEALS

- 11.1.9 SAP

- TABLE 104 SAP: BUSINESS OVERVIEW

- FIGURE 46 SAP: COMPANY SNAPSHOT

- TABLE 105 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 106 SAP: PRODUCT LAUNCHES

- 11.1.10 ACCENTURE

- TABLE 107 ACCENTURE: BUSINESS OVERVIEW

- FIGURE 47 ACCENTURE: COMPANY SNAPSHOT

- TABLE 108 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.11 TABLEAU

- TABLE 109 TABLEAU: BUSINESS OVERVIEW

- TABLE 110 TABLEAU: SOLUTIONS/SERVICES OFFERED

- TABLE 111 TABLEAU: DEALS

- 11.1.12 REPLY

- *Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 11.2 SMES/START-UPS

- 11.2.1 KOGNITIV SPARK

- 11.2.2 AVENTIOR

- 11.2.3 IMMERSION ANALYTICS

- 11.2.4 BADVR

- 11.2.5 VIRTUALITICS

- 11.2.6 SOFTCARE STUDIOS

- 11.2.7 JUJU IMMERSIVE LIMITED

- 11.2.8 ARSOME TECHNOLOGY

- 11.2.9 VARJO

- 11.2.10 COGNITIVE3D

- 11.2.11 SENSEGLOVE

- 11.2.12 DPVR

- 11.2.13 PICO

12 ADJACENT/RELATED MARKETS

- 12.1 ADVANCED ANALYTICS MARKET

- 12.1.1 MARKET DEFINITION

- 12.1.2 MARKET OVERVIEW

- 12.1.3 ADVANCED ANALYTICS MARKET, BY COMPONENT

- TABLE 112 ADVANCED ANALYTICS MARKET, BY COMPONENT, 2016-2020 (USD MILLION)

- TABLE 113 ADVANCED ANALYTICS MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

- 12.2 SOLUTION

- TABLE 114 SOLUTION: ADVANCED ANALYTICS MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 115 SOLUTION: ADVANCED ANALYTICS MARKET, BY REGION, 2021-2026 (USD MILLION)

- 12.3 SERVICES

- TABLE 116 ADVANCED ANALYTICS MARKET, BY SERVICE, 2016-2020 (USD MILLION)

- TABLE 117 ADVANCED ANALYTICS MARKET, BY SERVICE, 2021-2026 (USD MILLION)

- TABLE 118 SERVICES: ADVANCED ANALYTICS MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 119 SERVICES: ADVANCED ANALYTICS MARKET, BY REGION, 2021-2026 (USD MILLION)

- 12.3.1 PROFESSIONAL SERVICES

- 12.3.2 MANAGED SERVICES

- 12.4 AUGMENTED REALITY AND VIRTUAL REALITY MARKET

- 12.4.1 MARKET DEFINITION

- 12.4.2 MARKET OVERVIEW

- TABLE 120 AUGMENTED REALITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 121 AUGMENTED REALITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 12.5 HARDWARE

- TABLE 122 AUGMENTED REALITY MARKET, BY HARDWARE COMPONENT, 2018-2021 (USD MILLION)

- TABLE 123 AUGMENTED REALITY MARKET, BY HARDWARE COMPONENT, 2022-2027 (USD MILLION)

- TABLE 124 VIRTUAL REALITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 125 VIRTUAL REALITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 126 VIRTUAL REALITY MARKET, BY HARDWARE, 2018-2021 (USD MILLION)

- TABLE 127 VIRTUAL REALITY MARKET, HARDWARE, 2022-2027 (USD MILLION)

- 12.6 SOFTWARE

- 12.6.1 SOFTWARE DEVELOPMENT KITS

- 12.6.1.1 Case study: Arcore for Tendar

- 12.6.2 CLOUD-BASED SERVICES

- 12.6.2.1 Case study: VR Group boosts cloud application performance and reduces costs

- TABLE 128 AUGMENTED REALITY MARKET FOR SOFTWARE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 129 AUGMENTED REALITY MARKET FOR SOFTWARE, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.6.1 SOFTWARE DEVELOPMENT KITS

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS