|

|

市場調査レポート

商品コード

1287805

イソ酪酸の世界市場:種類別 (合成、再生可能)・エンドユーザー別 (動物飼料、化学中間体、食品・フレーバー、医薬品)・地域別 (アジア太平洋、欧州、北米、その他の地域) の将来予測 (2028年まで)Isobutyric Acid Market by Type (Synthetic, Renewable), End-Use (Animal Feed, Chemical Intermediates, Food & Flavors, Pharmaceuticals), and Region (Asia Pacific, Europe, North America, Rest of the World) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| イソ酪酸の世界市場:種類別 (合成、再生可能)・エンドユーザー別 (動物飼料、化学中間体、食品・フレーバー、医薬品)・地域別 (アジア太平洋、欧州、北米、その他の地域) の将来予測 (2028年まで) |

|

出版日: 2023年06月01日

発行: MarketsandMarkets

ページ情報: 英文 178 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のイソ酪酸の市場規模は、2023年の1億8,000万米ドルから、2028年には2億6,900万米ドルに達し、2023年から2028年までの間に8.3%のCAGRで成長すると予測されています。

イソ酪酸市場は、動物飼料、食品・フレーバー、医薬品、化学中間体など、さまざまな最終用途に使用されるため、激しい成長を遂げつつあります。

"種類別では、再生可能イソ酪酸が2023年から2028年の間、金額で2番目に大きなセグメントになる"

種類別では、再生可能イソ酪酸が2番目に大きな市場シェアを占めると予想されます。再生可能なイソ酪酸は、化石燃料の代わりに再生可能な原料や持続可能な原料から得られます。グルコースやデンプンの生合成によって生産されます。再生可能イソ酪酸は、コストが高いため、合成イソ酪酸に比べ生産量が少なくなっています。また、原料として使用される石油原料が容易に入手できることから、合成イソ酪酸の方が主に製造されています。しかし、バイオベースの製品に対する顧客の嗜好が高まるにつれ、再生可能なイソ酪酸の市場も成長していくと考えられます。

"最終用途別では、2023年から2028年にかけて、化学中間体が金額ベースで2番目に大きなセグメントになる"

化学中間体分野は、様々な化学物質の製造に広く使用されていることから、2番目に大きな市場シェアを占めると予想されます。化学中間体とは、より複雑な化学物質を製造する際の原材料や構成要素として機能する物質です。化学中間体としてのイソ酪酸の使用に影響を与える要因として、その優れた特質や、標的となる化合物、所定の用途に必要な特定の要件などが挙げられます。

"地域別では、2023年から2028年にかけて、欧州が金額ベースで2番目に大きなセグメントとなる"

欧州は、2023年から2028年にかけて、2番目に大きな市場シェアを獲得すると予測されます。この地域は、世界的に見ても最大規模の飼料産業の本拠地となっています。同地域では、肉や肉製品の消費が増加しているため、動物の健康や性能を高めるための優れた飼料添加物に対するニーズが高まっています。このため、イソ酪酸を動物飼料に使用する機会が生まれています。また、欧州諸国における加工食品需要の高まりと医薬品分野の成長は、イソ酪酸の需要を促進すると期待されています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- エコシステム

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- ポーターのファイブフォース分析

- ケーススタディ分析

- 技術分析

- 主要な利害関係者と購入基準

- 関税・規制状況

- 特許分析

- 主要な会議とイベント (2023年~2024年)

- 価格分析

- 貿易データ

第7章 イソ酪酸市場:グレード別

- イントロダクション

- 試薬グレード

- 工業グレード

第8章 イソ酪酸市場:純度別

- イントロダクション

- 98%超

- 98%未満

第9章 イソ酪酸市場:種類別

- イントロダクション

- 合成イソ酪酸

- 再生可能イソ酪酸

第10章 イソ酪酸市場:最終用途別

- イントロダクション

- 動物飼料

- 化学中間体

- 食品・フレーバー

- 医薬品

- その他

第11章 イソ酪酸市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- その他の欧州

- 北米

- 米国

- カナダ

- メキシコ

- その他の地域

- 中東・アフリカ

- 南米

第12章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 市場シェア分析

- 企業の製品フットプリント分析

- 企業評価クアドラント (ティア1)

- 競合ベンチマーキング

- スタートアップ/中小企業の評価クアドラント

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- OQ CHEMICALS GMBH

- EASTMAN CHEMICAL COMPANY

- TOKYO CHEMICAL INDUSTRY CO., LTD.

- SNOWCO

- SHANGHAI ALADDIN BIOCHEMICAL TECHNOLOGY CO., LTD.

- AFYREN

- LYGOS, INC.

- DOW INC.

- JIANGSU DYNAMIC CHEMICAL CO., LTD.

- WEIFANG QIYI CHEMICAL CO., LTD.

- YUFENG INTERNATIONAL GROUP CO., LTD.

- NANJING CHEMICAL MATERIAL CORP.

- FUJIFILM WAKO PURE CHEMICAL CORPORATION

- HUBEI JUSHENG TECHNOLOGY CO., LTD.

- その他の企業

- YANCHENG CITY CHUNZHU AROMA CO., LTD.

- WEN INTERNATIONAL, INC.

- CENTRAL DRUG HOUSE

- KUNSHAN ODOWELL CO., LTD

- SISCO RESEARCH LABORATORIES PVT. LTD.

第14章 隣接・関連市場

- イントロダクション

- 制限事項

- 酪酸市場

第15章 付録

The isobutyric acid market is projected to grow from USD 180 million in 2023 to USD 269 million by 2028, at a CAGR of 8.3% from 2023 to 2028. The isobutyric acid market is on the way to intense growth due to different end-uses including animal feed, food & flavor, pharmaceutical, chemical intermediate, and others.

"By type, renewable isobutyric acid is expected to be the second-larger segment during 2023 to 2028, by value."

Based on type, renewable isobutyric acid is expected to account for the second-larger market share. Renewable isobutyric acid is derived from renewable or sustainable feedstocks instead of fossil fuels. It is produced through biosynthesis of glucose or starch. There is less production of renewable isobutyric acid as compared to synthetic one due to high cost. Also, synthetic isobutyric acid is majorly manufactured due to easy availability of petroleum feedstocks used as raw materials. But with the increasing customer preference towards bio-based products, the market for renewable isobutyric acid will grow.

"By end-use, chemical intermediate is expected to be the second-largest segment during 2023 to 2028, by value."

The chemical intermediate segment is expected to account for the second-largest market share owing to its wide usage in the production of various chemicals. Chemical intermediates are substances that act as raw materials or building blocks in the production of more complicated chemicals. The factors influencing the use of isobutyric acid as a chemical intermediate are desired properties, the target compound, and the specific requirements of the desired application.

"By region, Europe is expected to be the second-largest segment during 2023 to 2028, by value."

Europe is projected to account for the second-largest market share from 2023 to 2028. The region is home to one of the largest feed industries globally. There is a rising need for good feed additives to boost animal health and performance due to the growing consumption of meat and meat products in the region. This creates opportunity for potential use of isobutyric acid in animal feed. Also, the rising demand for processed food and growth in pharmaceutical sectors in European countries are expected to propel the demand for isobutyric acid.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: C-level Executives - 25%, Directors - 30%, and Others - 45%

- By Region: North America - 20%, Europe - 15%, Asia Pacific - 55%, Middle East & Africa - 3%, South America - 7%

The isobutyric acid report is dominated by players, such as OQ Chemicals GmbH (Germany), Eastman Chemical Company (US), Tokyo Chemical Industry Co., Ltd. (Japan), Snowco (China), Shanghai Aladdin Biochemical Technology Co., Ltd. (China), Afyren (France), Lygos, Inc. (US), Dow Inc. (US), Jiangsu Dynamic Chemical Co., Ltd. (China), Weifang Qiyi Chemical Co., Ltd. (China), Yufeng International Group Co., Ltd. (China), Nanjing Chemical Material Corp. (China), FUJIFILM Wako Pure Chemical Corporation (Japan), Hubei Jusheng Technology Co., Ltd. (China), and others.

Research Coverage:

The report defines, segments, and projects the size of the isobutyric acid market based on type, end-use, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as mergers, investments, acquisitions, expansions, partnerships, contracts, agreements, and joint ventures undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants in the market by providing them with the closest approximations of revenue numbers of the isobutyric acid market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the competitive landscape of the market, gain insights to improve the position of their businesses and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provide them information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (use of isobutyric acid in food & flavor, and animal feed industries), restraints (health concerns associated with handling and storage of isobutyric acid), opportunities (recent developments in the pharmaceutical industry, and growing demand for bio-based isobutric acid), and challenges (price volatility of raw materials) influencing the growth of the isobutyric acid market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the isobutyric acid market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the isobutyric acid market across varied regions.

- Market Diversification: Exhaustive information about new products, various production technologies, untapped geographies, recent developments, and investments in the isobutyric acid market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as OQ Chemicals GmbH (Germany), Eastman Chemical Company (US), Tokyo Chemical Industry Co., Ltd. (Japan), Snowco (China), Shanghai Aladdin Biochemical Technology Co., Ltd. (China), among others in the isobutyric acid market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 1 ISOBUTYRIC ACID MARKET: INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 ISOBUTYRIC ACID MARKET SEGMENTATION

- 1.3.1 REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 ISOBUTYRIC ACID MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Companies participating in primary research

- 2.1.2.3 Breakdown of primary interviews

- 2.2 DEMAND-SIDE MATRIX CONSIDERED

- FIGURE 3 MAIN MATRIX CONSIDERED TO CONSTRUCT AND ASSESS DEMAND FOR ISOBUTYRIC ACID

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.4 METHODOLOGY FOR SUPPLY-SIDE SIZING OF ISOBUTYRIC ACID MARKET (1/2)

- 2.5 METHODOLOGY FOR SUPPLY-SIDE SIZING OF ISOBUTYRIC ACID MARKET (2/2)

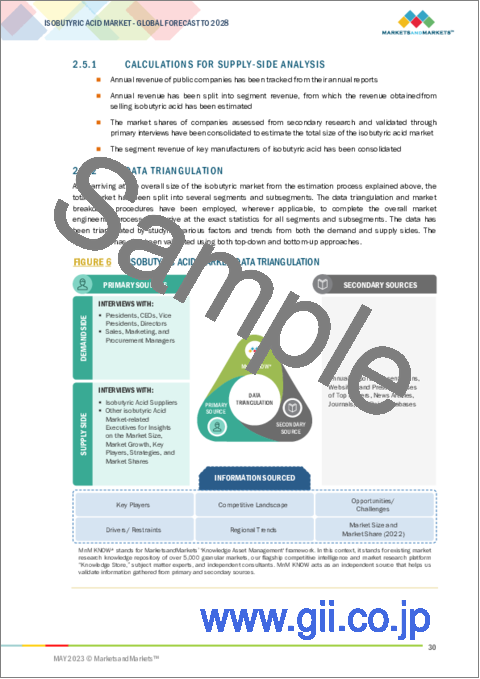

- 2.5.1 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS

- 2.5.2 DATA TRIANGULATION

- FIGURE 6 ISOBUTYRIC ACID MARKET: DATA TRIANGULATION

- 2.5.3 GROWTH FORECAST

- 2.5.4 GROWTH RATE ASSUMPTIONS

- 2.5.5 RESEARCH ASSUMPTIONS

- 2.5.6 RESEARCH LIMITATIONS

- 2.5.7 RISK ANALYSIS

- 2.6 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- TABLE 2 ISOBUTYRIC ACID MARKET

- FIGURE 7 SYNTHETIC ISOBUTYRIC ACID SEGMENT TO DOMINATE MARKET BETWEEN 2023 AND 2028

- FIGURE 8 ANIMAL FEED SEGMENT TO LEAD MARKET BETWEEN 2023 AND 2028

- FIGURE 9 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ISOBUTYRIC ACID MARKET

- FIGURE 10 MARKET TO WITNESS SIGNIFICANT GROWTH BETWEEN 2023 AND 2028

- 4.2 ISOBUTYRIC ACID MARKET, BY REGION

- FIGURE 11 ASIA PACIFIC MARKET TO RECORD HIGHEST CAGR BETWEEN 2023 AND 2028

- 4.3 ISOBUTYRIC ACID MARKET, BY END USE

- FIGURE 12 PHARMACEUTICALS SEGMENT TO REGISTER SIGNIFICANT CAGR BETWEEN 2023 AND 2028

- 4.4 ISOBUTYRIC ACID MARKET, BY TYPE

- FIGURE 13 SYNTHETIC SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 ISOBUTYRIC ACID MARKET, BY COUNTRY

- FIGURE 14 INDIA TO RECORD HIGHEST CAGR BETWEEN 2023 AND 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ISOBUTYRIC ACID MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand from major end-use industries

- 5.2.1.1.1 Use of isobutyric acid in food & flavors industry

- 5.2.1.1 Rising demand from major end-use industries

- TABLE 3 AVERAGE USUAL USE LEVELS/AVERAGE MAXIMUM USE LEVELS

- 5.2.1.1.2 Rising demand from animal feed segment

- FIGURE 16 GLOBAL ANIMAL FEED PRODUCTION, 2020 (MT)

- 5.2.1.1.3 Growing utility of isobutyric acid as chemical intermediate

- 5.2.2 RESTRAINTS

- 5.2.2.1 Health concerns associated with handling and storage

- TABLE 4 HAZARDS IDENTIFICATION

- TABLE 5 HANDLING & STORAGE

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Potential use of SFCAs in liver disease treatment

- FIGURE 17 BREAKDOWN OF GLOBAL SALES OF PHARMACEUTICALS, 2020

- 5.2.3.2 Growing preference for bio-based isobutyric acid over petroleum-based chemicals

- 5.2.4 CHALLENGES

- 5.2.4.1 Price volatility of raw materials

6 INDUSTRY TRENDS

- 6.1 ECOSYSTEM

- FIGURE 18 ECOSYSTEM MAP OF ISOBUTYRIC ACID MARKET

- TABLE 6 ISOBUTYRIC ACID MARKET: ECOSYSTEM

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RAW MATERIALS

- 6.2.2 MANUFACTURE OF ISOBUTYRIC ACID

- 6.2.3 DISTRIBUTION TO END USERS

- FIGURE 19 ISOBUTYRIC ACID MARKET: VALUE CHAIN

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 6.3.1 REVENUE SHIFT & POCKETS FOR ISOBUTYRIC ACID

- FIGURE 20 ISOBUTYRIC ACID MARKET: FUTURE REVENUE MIX

- 6.4 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 ISOBUTYRIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 ISOBUTYRIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.4.1 BARGAINING POWER OF SUPPLIERS

- 6.4.2 THREAT OF SUBSTITUTES

- 6.4.3 BARGAINING POWER OF BUYERS

- 6.4.4 THREAT OF NEW ENTRANTS

- 6.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.5 CASE STUDY ANALYSIS

- 6.5.1 AGILE BIOFOUNDRY ASSISTS LYGOS, INC. TO SCALE UP PRODUCTION

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 INTRODUCTION

- 6.6.1.1 Koch synthesis

- 6.6.1.2 Liquid-phase oxidation of isobutyraldehyde

- 6.6.1.3 Biosynthesis

- 6.6.1 INTRODUCTION

- 6.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES (%)

- 6.7.2 BUYING CRITERIA

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE END USES

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE END USES

- 6.8 TARIFF AND REGULATORY LANDSCAPE

- TABLE 10 REGULATIONS AND STANDARDS RELATED TO ISOBUTYRIC ACID MARKET

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.9 PATENT ANALYSIS

- 6.9.1 INTRODUCTION

- 6.9.2 METHODOLOGY

- 6.9.3 DOCUMENT TYPE

- FIGURE 24 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

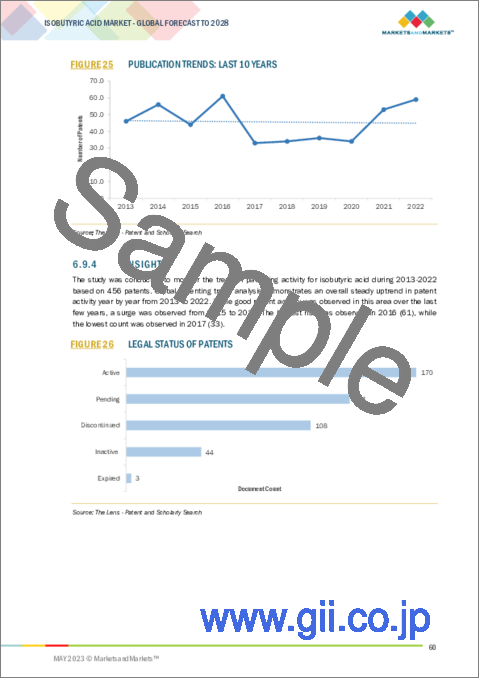

- FIGURE 25 PUBLICATION TRENDS: LAST 10 YEARS

- 6.9.4 INSIGHTS

- FIGURE 26 LEGAL STATUS OF PATENTS

- 6.9.5 JURISDICTION ANALYSIS

- FIGURE 27 TOP JURISDICTION, BY DOCUMENT

- 6.9.6 TOP COMPANIES/APPLICANTS

- FIGURE 28 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- TABLE 15 PATENTS: EASTMAN CHEMICAL COMPANY

- TABLE 16 PATENTS: DOW AGROSCIENCES LLC

- TABLE 17 TOP 10 PATENT OWNERS DURING LAST 10 YEARS

- 6.10 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 18 ISOBUTYRIC ACID MARKET: CONFERENCES & EVENTS

- 6.11 PRICING ANALYSIS

- 6.11.1 AVERAGE SELLING PRICE, BY REGION

- FIGURE 29 AVERAGE SELLING PRICE OF ISOBUTYRIC ACID, BY TYPE, IN DIFFERENT REGIONS

- 6.11.2 AVERAGE SELLING PRICE OF KEY PLAYERS, BY END USE

- FIGURE 30 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE END USES

- 6.12 TRADE DATA

- TABLE 19 IMPORT DATA FOR ISOBUTYRIC ACID, 2021

- TABLE 20 EXPORT DATA FOR ISOBUTYRIC ACID, 2021

7 ISOBUTYRIC ACID MARKET, BY GRADE

- 7.1 INTRODUCTION

- 7.2 REAGENT GRADE

- 7.2.1 GROWING USE IN LAB ENVIRONMENTS TO FUEL MARKET

- 7.3 INDUSTRIAL GRADE

- 7.3.1 WIDESPREAD USE IN INDUSTRIAL APPLICATIONS TO DRIVE DEMAND

8 ISOBUTYRIC ACID MARKET, BY PURITY

- 8.1 INTRODUCTION

- 8.2 MORE THAN 98%

- 8.2.1 HIGH DEMAND FROM PHARMACEUTICAL INDUSTRY TO FUEL GROWTH

- 8.3 LESS THAN 98%

- 8.3.1 INCREASING USE IN INDUSTRIAL CLEANING ACTIVITIES TO PROPEL GROWTH

9 ISOBUTYRIC ACID MARKET, BY TYPE

- 9.1 INTRODUCTION

- FIGURE 31 SYNTHETIC ISOBUTYRIC ACID SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 21 ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 22 ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 23 ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 24 ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- 9.2 SYNTHETIC ISOBUTYRIC ACID

- 9.2.1 LOW MANUFACTURING COST TO DRIVE DEMAND

- 9.3 RENEWABLE ISOBUTYRIC ACID

- 9.3.1 RISING INTEREST IN ORGANIC AND NATURAL PRODUCTS TO BOOST MARKET

10 ISOBUTYRIC ACID MARKET, BY END USE

- 10.1 INTRODUCTION

- FIGURE 32 ANIMAL FEED PROJECTED TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- TABLE 25 ISOBUTYRIC ACID MARKET, BY END USE, 2018-2020 (USD MILLION)

- TABLE 26 ISOBUTYRIC ACID MARKET, BY END USE, 2021-2028 (USD MILLION)

- TABLE 27 ISOBUTYRIC ACID MARKET, BY END USE, 2018-2020 (KILOTONS)

- TABLE 28 ISOBUTYRIC ACID MARKET, BY END USE, 2021-2028 (KILOTONS)

- 10.2 ANIMAL FEED

- 10.2.1 GROWING USE AS FEED SUPPLEMENT TO DRIVE MARKET

- 10.3 CHEMICAL INTERMEDIATES

- 10.3.1 WIDESPREAD USE OF ISOBUTYRIC ACID ESTERS TO PROPEL DEMAND

- 10.4 FOOD & FLAVORS

- 10.4.1 INCREASING CONSUMPTION OF PROCESSED FOOD & BEVERAGES TO FUEL MARKET

- 10.5 PHARMACEUTICALS

- 10.5.1 POTENTIAL USE IN DISEASE TREATMENT TO DRIVE MARKET

- 10.6 OTHERS

11 ISOBUTYRIC ACID MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 33 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 29 ISOBUTYRIC ACID MARKET, BY REGION, 2018-2020 (KILOTONS)

- TABLE 30 ISOBUTYRIC ACID MARKET, BY REGION, 2021-2028 (KILOTONS)

- TABLE 31 ISOBUTYRIC ACID MARKET, BY REGION, 2018-2020 (USD MILLION)

- TABLE 32 ISOBUTYRIC ACID MARKET, BY REGION, 2021-2028 (USD MILLION)

- 11.2 ASIA PACIFIC

- 11.2.1 IMPACT OF RECESSION

- FIGURE 34 ASIA PACIFIC: ISOBUTYRIC ACID MARKET SNAPSHOT

- TABLE 33 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 34 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 35 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 36 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY END USE, 2018-2020 (KILOTONS)

- TABLE 38 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY END USE, 2021-2028 (KILOTONS)

- TABLE 39 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY END USE, 2018-2020 (USD MILLION)

- TABLE 40 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY END USE, 2021-2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2018-2020 (KILOTONS)

- TABLE 42 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2021-2028 (KILOTONS)

- TABLE 43 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2018-2020 (USD MILLION)

- TABLE 44 ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 11.2.2 CHINA

- 11.2.2.1 Increasing demand from animal feed industry to drive market

- TABLE 45 CHINA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 46 CHINA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 47 CHINA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 48 CHINA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.2.3 INDIA

- 11.2.3.1 Growing consumer awareness and demand for environment-friendly products to boost market

- TABLE 49 INDIA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 50 INDIA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 51 INDIA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 52 INDIA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.2.4 JAPAN

- 11.2.4.1 Rising consumption of packaged food to drive market

- TABLE 53 JAPAN: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 54 JAPAN: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 55 JAPAN: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 56 JAPAN: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.2.5 SOUTH KOREA

- 11.2.5.1 Growing food and petrochemical sectors to boost demand

- TABLE 57 SOUTH KOREA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 58 SOUTH KOREA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 59 SOUTH KOREA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 60 SOUTH KOREA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.2.6 REST OF ASIA PACIFIC

- TABLE 61 REST OF ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 62 REST OF ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 63 REST OF ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 64 REST OF ASIA PACIFIC: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 IMPACT OF RECESSION

- FIGURE 35 EUROPE: ISOBUTYRIC ACID MARKET SNAPSHOT

- TABLE 65 EUROPE: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 66 EUROPE: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 67 EUROPE: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 68 EUROPE: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 69 EUROPE: ISOBUTYRIC ACID MARKET, BY END USE, 2018-2020 (KILOTONS)

- TABLE 70 EUROPE: ISOBUTYRIC ACID MARKET, BY END USE, 2021-2028 (KILOTONS)

- TABLE 71 EUROPE: ISOBUTYRIC ACID MARKET, BY END USE, 2018-2020 (USD MILLION)

- TABLE 72 EUROPE: ISOBUTYRIC ACID MARKET, BY END USE, 2021-2028 (USD MILLION)

- TABLE 73 EUROPE: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2018-2020 (KILOTONS)

- TABLE 74 EUROPE: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2021-2028 (KILOTONS)

- TABLE 75 EUROPE: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2018-2020 (USD MILLION)

- TABLE 76 EUROPE: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 11.3.2 GERMANY

- 11.3.2.1 Increased pharmaceutical R&D spending to drive market

- TABLE 77 GERMANY: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 78 GERMANY: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 79 GERMANY: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 80 GERMANY: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.3.3 FRANCE

- 11.3.3.1 Growing demand for poultry products to boost market

- TABLE 81 FRANCE: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 82 FRANCE: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 83 FRANCE: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 84 FRANCE: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.3.4 ITALY

- 11.3.4.1 Increasing consumption of consumer-ready food to drive market

- TABLE 85 ITALY: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 86 ITALY: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 87 ITALY: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 88 ITALY: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.3.5 UK

- 11.3.5.1 Booming pharmaceutical sector to fuel market

- TABLE 89 UK: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 90 UK: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 91 UK: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 92 UK: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.3.6 REST OF EUROPE

- TABLE 93 REST OF EUROPE: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 94 REST OF EUROPE: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 95 REST OF EUROPE: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 96 REST OF EUROPE: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.4 NORTH AMERICA

- 11.4.1 IMPACT OF RECESSION

- FIGURE 36 NORTH AMERICA: ISOBUTYRIC ACID MARKET SNAPSHOT

- TABLE 97 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 98 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 99 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 100 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 101 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY END USE, 2018-2020 (KILOTONS)

- TABLE 102 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY END USE, 2021-2028 (KILOTONS)

- TABLE 103 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY END USE, 2018-2020 (USD MILLION)

- TABLE 104 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY END USE, 2021-2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2018-2020 (KILOTONS)

- TABLE 106 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2021-2028 (KILOTONS)

- TABLE 107 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2018-2020 (USD MILLION)

- TABLE 108 NORTH AMERICA: ISOBUTYRIC ACID MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 11.4.2 US

- 11.4.2.1 Growth of feed industry to boost consumption of isobutyric acid

- TABLE 109 US: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 110 US: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 111 US: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 112 US: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.4.3 CANADA

- 11.4.3.1 Growth in pharmaceutical sector to drive market

- TABLE 113 CANADA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 114 CANADA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 115 CANADA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 116 CANADA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.4.4 MEXICO

- 11.4.4.1 Rising demand for processed foods to fuel market

- TABLE 117 MEXICO: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 118 MEXICO: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 119 MEXICO: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 120 MEXICO: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.5 REST OF THE WORLD

- 11.5.1 IMPACT OF RECESSION

- TABLE 121 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 122 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 123 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 124 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 125 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY END USE, 2018-2020 (KILOTONS)

- TABLE 126 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY END USE, 2021-2028 (KILOTONS)

- TABLE 127 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY END USE, 2018-2020 (USD MILLION)

- TABLE 128 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY END USE, 2021-2028 (USD MILLION)

- TABLE 129 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY REGION, 2018-2020 (KILOTONS)

- TABLE 130 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY REGION, 2021-2028 (KILOTONS)

- TABLE 131 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY REGION, 2018-2020 (USD MILLION)

- TABLE 132 REST OF THE WORLD: ISOBUTYRIC ACID MARKET, BY REGION, 2021-2028 (USD MILLION)

- 11.5.2 MIDDLE EAST & AFRICA

- 11.5.2.1 Increasing demand due to expansion of food & flavor sector

- TABLE 133 MIDDLE EAST & AFRICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 134 MIDDLE EAST & AFRICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 135 MIDDLE EAST & AFRICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Growth in animal feed industry to propel demand

- TABLE 137 SOUTH AMERICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 138 SOUTH AMERICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (KILOTONS)

- TABLE 139 SOUTH AMERICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 140 SOUTH AMERICA: ISOBUTYRIC ACID MARKET, BY TYPE, 2021-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

- 12.3 MARKET SHARE ANALYSIS

- 12.3.1 RANKING OF KEY MARKET PLAYERS, 2022

- FIGURE 37 TOP FIVE PLAYERS IN ISOBUTYRIC ACID MARKET, 2022

- 12.3.2 MARKET SHARE OF KEY PLAYERS

- FIGURE 38 ISOBUTYRIC ACID MARKET SHARE ANALYSIS

- TABLE 141 ISOBUTYRIC ACID MARKET: DEGREE OF COMPETITION

- 12.3.2.1 OQ Chemicals GmbH

- 12.3.2.2 Eastman Chemical Company

- 12.3.2.3 Tokyo Chemical Industry Co., Ltd.

- 12.3.2.4 Snowco

- 12.3.2.5 Shanghai Aladdin Biochemical Technology Co., Ltd.

- 12.3.3 REVENUE ANALYSIS OF TOP 5 PLAYERS

- FIGURE 39 REVENUE ANALYSIS OF KEY COMPANIES, 2018-2022

- 12.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

- FIGURE 40 ISOBUTYRIC ACID MARKET: COMPANY FOOTPRINT

- TABLE 142 ISOBUTYRIC ACID MARKET: TYPE FOOTPRINT

- TABLE 143 ISOBUTYRIC ACID MARKET: END USE FOOTPRINT

- TABLE 144 ISOBUTYRIC ACID MARKET: COMPANY REGION FOOTPRINT

- 12.5 COMPANY EVALUATION QUADRANT (TIER 1)

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 41 COMPANY EVALUATION QUADRANT: ISOBUTYRIC ACID MARKET (TIER 1 COMPANIES)

- 12.6 COMPETITIVE BENCHMARKING

- TABLE 145 ISOBUTYRIC ACID MARKET: KEY START-UPS/SMES

- TABLE 146 ISOBUTYRIC ACID MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 12.7 START-UP/SME EVALUATION QUADRANT

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 42 START-UP/SME EVALUATION QUADRANT: ISOBUTYRIC ACID MARKET

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 DEALS

- TABLE 147 ISOBUTYRIC ACID MARKET: DEALS, 2019-2023

- 12.8.2 OTHER DEVELOPMENTS

- TABLE 148 ISOBUTYRIC ACID MARKET: EXPANSIONS AND INVESTMENTS, 2019-2023

13 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 13.1 MAJOR PLAYERS

- 13.1.1 OQ CHEMICALS GMBH

- TABLE 149 OQ CHEMICALS GMBH: COMPANY OVERVIEW

- FIGURE 43 OQ CHEMICALS GMBH: COMPANY SNAPSHOT

- TABLE 150 OQ CHEMICALS GMBH: PRODUCTS OFFERED

- TABLE 151 OQ CHEMICALS GMBH: DEALS

- TABLE 152 OQ CHEMICALS GMBH: OTHERS

- 13.1.2 EASTMAN CHEMICAL COMPANY

- TABLE 153 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- FIGURE 44 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- TABLE 154 EASTMAN CHEMICAL COMPANY: PRODUCTS OFFERED

- TABLE 155 EASTMAN CHEMICAL COMPANY: DEALS

- 13.1.3 TOKYO CHEMICAL INDUSTRY CO., LTD.

- TABLE 156 TOKYO CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 157 TOKYO CHEMICAL INDUSTRY CO., LTD: PRODUCTS OFFERED

- 13.1.4 SNOWCO

- TABLE 158 SNOWCO: COMPANY OVERVIEW

- TABLE 159 SNOWCO: PRODUCTS OFFERED

- TABLE 160 SNOWCO: OTHERS

- 13.1.5 SHANGHAI ALADDIN BIOCHEMICAL TECHNOLOGY CO., LTD.

- TABLE 161 SHANGHAI ALADDIN BIOCHEMICAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- FIGURE 45 SHANGHAI ALADDIN BIOCHEMICAL TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- TABLE 162 SHANGHAI ALADDIN BIOCHEMICAL TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- 13.1.6 AFYREN

- TABLE 163 AFYREN: COMPANY OVERVIEW

- FIGURE 46 AFYREN: COMPANY SNAPSHOT

- TABLE 164 AFYREN: PRODUCTS OFFERED

- TABLE 165 AFYREN: DEALS

- TABLE 166 AFYREN: OTHERS

- 13.1.7 LYGOS, INC.

- TABLE 167 LYGOS, INC.: COMPANY OVERVIEW

- TABLE 168 LYGOS, INC.: PRODUCTS OFFERED

- TABLE 169 LYGOS, INC.: DEALS

- TABLE 170 LYGOS, INC.: OTHERS

- 13.1.8 DOW INC.

- TABLE 171 DOW INC.: COMPANY OVERVIEW

- FIGURE 47 DOW INC.: COMPANY SNAPSHOT

- TABLE 172 DOW INC.: PRODUCTS OFFERED

- 13.1.9 JIANGSU DYNAMIC CHEMICAL CO., LTD.

- TABLE 173 JIANGSU DYNAMIC CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 174 JIANGSU DYNAMIC CHEMICAL CO., LTD.: PRODUCTS OFFERED

- 13.1.10 WEIFANG QIYI CHEMICAL CO., LTD.

- TABLE 175 WEIFANG QIYI CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 176 WEIFANG QIYI CHEMICAL CO., LTD.: PRODUCTS OFFERED

- 13.1.11 YUFENG INTERNATIONAL GROUP CO., LTD.

- TABLE 177 YUFENG INTERNATIONAL GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 178 YUFENG INTERNATIONAL GROUP CO., LTD.: PRODUCTS OFFERED

- 13.1.12 NANJING CHEMICAL MATERIAL CORP.

- TABLE 179 NANJING CHEMICAL MATERIAL CORP.: COMPANY OVERVIEW

- TABLE 180 NANJING CHEMICAL MATERIAL CORP.: PRODUCTS OFFERED

- 13.1.13 FUJIFILM WAKO PURE CHEMICAL CORPORATION

- TABLE 181 FUJIFILM WAKO PURE CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 182 FUJIFILM WAKO PURE CHEMICAL CORPORATION: PRODUCTS OFFERED

- 13.1.14 HUBEI JUSHENG TECHNOLOGY CO., LTD.

- TABLE 183 HUBEI JUSHENG TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 184 HUBEI JUSHENG TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- 13.2 OTHER PLAYERS

- 13.2.1 YANCHENG CITY CHUNZHU AROMA CO., LTD.

- TABLE 185 YANCHENG CITY CHUNZHU AROMA CO., LTD.: COMPANY OVERVIEW

- 13.2.2 WEN INTERNATIONAL, INC.

- TABLE 186 WEN INTERNATIONAL, INC.: COMPANY OVERVIEW

- 13.2.3 CENTRAL DRUG HOUSE

- TABLE 187 CENTRAL DRUG HOUSE: COMPANY OVERVIEW

- 13.2.4 KUNSHAN ODOWELL CO., LTD

- TABLE 188 KUNSHAN ODOWELL CO., LTD: COMPANY OVERVIEW

- 13.2.5 SISCO RESEARCH LABORATORIES PVT. LTD.

- TABLE 189 SISCO RESEARCH LABORATORIES PVT. LTD.: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 BUTYRIC ACID MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.3 BUTYRIC ACID MARKET, BY TYPE

- TABLE 190 BUTYRIC ACID MARKET, BY TYPE, 2018-2020 (USD MILLION)

- TABLE 191 BUTYRIC ACID MARKET, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 192 BUTYRIC ACID MARKET, BY TYPE, 2018-2020 (KILOTONS)

- TABLE 193 BUTYRIC ACID MARKET, BY TYPE, 2021-2027 (KILOTONS)

- TABLE 194 BUTYRIC ACID MARKET, BY END USE, 2018-2020 (USD MILLION)

- TABLE 195 BUTYRIC ACID MARKET, BY END USE, 2021-2027 (USD MILLION)

- TABLE 196 BUTYRIC ACID MARKET, BY END USE, 2018-2020 (KILOTONS)

- TABLE 197 BUTYRIC ACID MARKET, BY END USE, 2021-2027 (KILOTONS)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.1 AUTHORS DETAILS