|

|

市場調査レポート

商品コード

1282761

教育向けメタバースの世界市場:コンポーネント別 (ハードウェア (ARデバイス、VRデバイス、MRデバイス、インタラクティブディスプレイ・プロジェクター)、ソフトウェア、プロフェッショナルサービス)・エンドユーザー別 (教育機関、企業)・地域別の将来予測 (2028年まで)Metaverse in Education Market by Component (Hardware (AR devices, VR devices, MR devices, and interactive displays and projectors), Software, Professional Services), End User (Academic and Corporate) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 教育向けメタバースの世界市場:コンポーネント別 (ハードウェア (ARデバイス、VRデバイス、MRデバイス、インタラクティブディスプレイ・プロジェクター)、ソフトウェア、プロフェッショナルサービス)・エンドユーザー別 (教育機関、企業)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年05月29日

発行: MarketsandMarkets

ページ情報: 英文 231 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の教育向けメタバースの市場規模は、2023年の39億米ドルから2028年には193億米ドルまで、予測期間中に37.7%のCAGRで成長すると予測されています。

「メタバース」という用語は、3D仮想空間のネットワーク化されたシステムを表し、VR・ARなどの没入型技術を含む様々なデジタル環境を取り入れた集合的な仮想共有空間です。現在の教育システムが現実世界と切り離されていると批判されているとき、メタバースは、教師が地理的な制約に関係なく生徒とコミュニケーションできる仮想世界の創造に役立ちます。また、メタバースは、生徒、講師、スタッフがコンセプトやシナリオを探求し、相互作用できる没入型の学習環境の提供にも役立ちます。

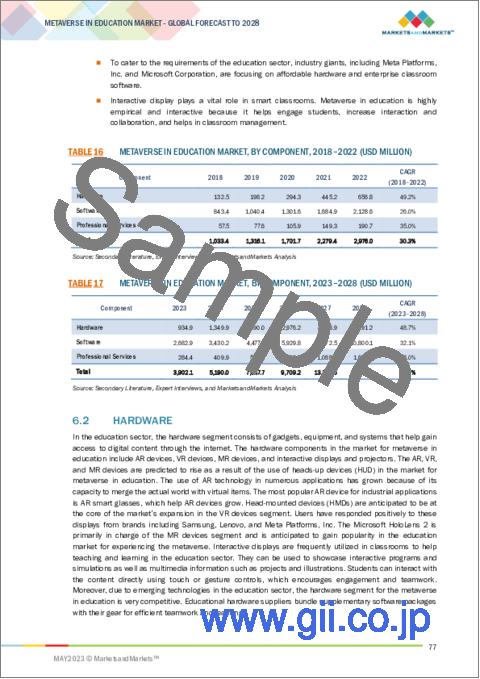

"コンポーネント別では、ハードウェア分野が予測期間中に最も高いCAGRを維持する"

世界の教育向けメタバース市場をコンポーネント別に見ると、ハードウェアセグメントが最も高いCAGRで成長すると推定されます。なかでもAR・VR・MRデバイスは、教育市場におけるメタバースでのヘッドアップデバイス (HUD) の使用により上昇すると予測されます。AR技術は、現実の世界と仮想のアイテムを融合させることができるため、数多くの用途で利用が拡大しています。産業用途で最も人気のあるARデバイスはARスマートグラスであり、ARデバイスの成長を支えています。さらに、VRデバイス分野では、ヘッドマウントデバイス (HMD) が市場拡大の中核を担うと予想されています。Samsung Electronics、Lenovo、Meta Platforms, Inc.などのブランドから発売されているこれらのディスプレイは、ユーザーから好評を得ています。Microsoft HoloLens 2は、主にMR機器分野を担当し、メタバースを体験する教育市場で人気を集めると予想されます。

"プロフェッショナルサービス別では、アプリケーション開発・システムインテグレーション分野が予測期間中に最も高いCAGRを維持する"

教育向けメタバース市場をプロフェッショナルサービス別に見ると、アプリケーション開発・システムインテグレーションのセグメントが予測期間中に最も高いCAGRを維持します。教育関係者はこれらのサービスを必要とし、販売前の要件評価から販売後の製品展開と実行まで、さまざまな段階で協力することで、クライアントが最大のRoIを獲得できるようになります。メタバース教育開発プラットフォーム、メタバースアプリ開発、メタバースNFTマーケットプレース開発、メタバース不動産プラットフォーム開発、メタバースソーシャルメディアプラットフォーム開発、メタバースイベントプラットフォーム開発などは、メタバースアプリケーション開発事業で提供されるサービスの一部です。メタバースを既存または新規のシステムにシームレスに統合するため、システム統合サービスのニーズは、教育市場におけるメタバースの企業や教育関係者から求められています。

"地域別では、欧州地域が予測期間中に2番目に高いCAGRを維持する"

教育向けメタバース市場を地域別に見ると、欧州地域が予測期間中、2番目に高いCAGRを維持すると予想されます。英国、ドイツ、フランス、その他欧州のような欧州地域の経済が著しく拡大しているため、教育におけるメタバースの企業および学術ユーザーの市場が形成されると予想されます。さらに、メタバースは継続的な専門的成長と将来に関連するスキル開発のためのプラットフォームを提供するため、継続的な学習とスキル開発に対する欧州の献身が需要を牽引しています。全体として、欧州の教育におけるメタバースの能力は、学習を改善し、包括性を促進し、世界につながり、技術的に進歩した未来に向けて学生を準備するものです。さらに、生徒と教師の対面での交流を促進するために、欧州の教育機関では、バーチャルコラボレーションやコミュニケーションソリューションを導入しています。グループプロジェクト、オンライン会話、バーチャルクラスルームは、これらのツールによって実現され、メタバースプラットフォームの助けを借りて、より活発で興味深い学習環境を作り出しているため、この地域の市場は飛躍的に成長すると予想されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- エコシステム

- バリューチェーン分析

- 価格分析

- 特許分析

- 技術分析

- 規制状況

- ポーターのファイブフォースモデル

- 主要な会議とイベント

- バイヤーに影響を与える動向/混乱

- 主要な利害関係者と購入基準

第6章 教育向けメタバース市場:コンポーネント別

- イントロダクション

- ハードウェア

- ARデバイス

- VRデバイス

- MRデバイス

- インタラクティブディスプレイ・プロジェクター

- ソフトウェア

- XR (extended reality) ソフトウェア

- ゲームエンジン

- メタバースプラットフォーム

- 3Dマッピング、モデリング、再構築

- プロフェッショナルサービス

- アプリケーション開発・システムインテグレーション

- 戦略・ビジネスコンサルティングサービス

第7章 教育向けメタバース市場:エンドユーザー別

- イントロダクション

- 教育機関

- K-12

- 高等教育

- 企業

第8章 教育向けメタバース市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他のアジア太平洋

- 中東・アフリカ

- サウジアラビア王国

- アラブ首長国連邦

- その他の中東・アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

第9章 競合情勢

- イントロダクション

- 有力企業

- 市場シェア分析

- 上位ベンダーの過去の収益分析

- 主要企業の評価クアドラント

- その他の企業および新興企業/中小企業の評価クアドラント

- 企業の財務指標

- 世界の主要な市場参入企業:スナップショット

- 主要市場の動向

第10章 企業プロファイル

- イントロダクション

- 主要企業

- META PLATFORMS, INC.

- MICROSOFT CORPORATION

- ADOBE INC.

- HP INC.

- UNITY SOFTWARE INC.

- SAMSUNG ELECTRONICS

- LENOVO

- ROBLOX CORPORATION

- EPIC GAMES

- BAIDU, INC.

- その他の企業

- AVANTIS SYSTEMS LTD.

- AXON PARK

- TOMORROW'S EDUCATION

- NEXTMEET

- CLASSVR

- METABLE GMBH

- VIRBELA

- LABSTER

- VICTORYXR

- ENGAGE PLC

- VEDX SOLUTIONS

- STEMULI

- NETEASE

- HTC

- SANDBOX

- スタートアップ/中小企業

- MEDROOM

- MARVRUS

- FOTONVR

- IBENTOS

- LEGEND OF LEARNING

- SOPHIA

- DEVDEN

- IMMERSE

- KWARK EDUCATION

- HATCHXR

- METAVERSE LEARNING LIMITED

第11章 隣接/関連市場

- イントロダクション

- XR (extended reality) 市場

- 拡張現実 (AR)・仮想現実 (VR) 市場

- メタバース市場

第12章 付録

The metaverse in the education market is expected to grow from USD 3.9 billion in 2023 to USD 19.3 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 37.7% during the forecast period. The term "metaverse" can describe a networked system of 3D virtual spaces. It is a collective virtual shared space incorporating various digital environments, including VR, AR, and other immersive technologies. When the current educational system is criticized for being disconnected from the real world, the metaverse can help create virtual worlds that enable teachers to communicate with students regardless of geographic restrictions. Metaverse also helps provide immersive learning environments where students, instructors, and staff can explore and interact with concepts and scenarios.

By component, the hardware segment holds the highest CAGR during the forecast period.

The metaverse in the education market by component is divided into hardware, software, and professional services. The hardware segment is estimated to hold the highest CAGR during the forecasted metaverse in the education market. The hardware components in the metaverse in the education market include VR, AR, MR, and interactive displays and projectors. The AR, VR, and MR devices are predicted to rise due to the use of heads-up devices (HUD) in the metaverse in the education market. The use of AR technology in numerous applications has grown because of its capacity to merge the actual world with virtual items. The most popular AR device for industrial applications is AR smart glasses, which help AR devices grow. Furthermore, head-mounted devices (HMDs) are anticipated to be at the core of the market's expansion in the VR devices segment. Users have responded positively to these displays from brands including Samsung Electronics, Lenovo, and Meta Platforms, Inc. Microsoft HoloLens 2 is primarily in charge of the MR devices segment and is anticipated to gain popularity in the education market for experiencing the metaverse.

By professional services, the application development and system integration segment held the highest CAGR during the forecast period.

The metaverse in the education market, by professional services, is segmented into application development, system integration, strategy, and business consulting. The application development and system integration segment will hold the highest CAGR during the forecast period. Educators require these services and cooperate at various stages, from pre-sales requirement assessment to post-sales product deployment and execution, thus enabling the client to get maximum RoI. Metaverse education development platform, metaverse app development, metaverse NFT marketplace development, metaverse real estate platform development, metaverse social media platform development, and metaverse event platform development are a few services offered in the metaverse application development business. To seamlessly integrate the metaverse within existing or new systems, the need for system integration services is demanded by corporators and educators in the metaverse in the education market.

Based on region, the Europe region holds the second-highest CAGR during the forecast period.

The metaverse in the education market, by region, is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. The Europe region is expected to hold the second-highest CAGR during the forecast period. Europe has dominated the deployment of metaverse in education market. Significantly expanding economies in the European region, such as in the UK, Germany, France, and the rest of Europe, is anticipated to create a market for corporate and academic users of the metaverse in education. Further, the demand is driven by Europe's dedication to continuous learning and skill development, as the metaverse offers a platform for ongoing professional growth and the development of skills relevant to the future. Overall, the ability of the metaverse in education in Europe to improve learning, promote inclusivity, and prepare students for a globally connected and technologically advanced future. Moreover, in order to facilitate in-person interactions between students and teachers, European educational institutions are implementing virtual collaboration and communication solutions. Group projects, online conversations, and virtual classrooms are made possible by these tools, which creates a more active and interesting learning environment with the help of metaverse platform therefore the market in the region is expected to grow exponentially.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the metaverse in the education market.

- By Company: Tier I: 30%, Tier II: 45%, and Tier III: 25%

- By Designation: C-Level Executives: 40%, Director Level: 25%, and Others: 35%

- By Region: Asia Pacific: 20%, Europe: 30%, North America: 45%, Rest of World: 5%

Some of the significant metaverse in education market vendors are Meta Platforms, Inc. (US), Microsoft Corporation (US), Adobe Inc. (US), HP Inc. (US), Unity Software Inc. (US), Samsung Electronics (South Korea), Lenovo (China), Roblox Corporation (US), Epic Games (US), Baidu, Inc. (China), Avantis Systems Ltd (UK), Axon Park (US), Tomorrow's Education (Germany), NextMeet (India), ClassVR (England), Metable GmbH (Switzerland), Virbela (US), Labster (Denmark), VictoryXR (US), ENGAGE Plc (US), VEDX Solutions (US), Stimuli (US), NetEase (China), HTC (Taiwan), and Sandbox (US).

Research coverage:

The market study covers the metaverse in the education market across segments. It aims at estimating the market size and the growth potential across different segments, such as components, end users, and regions. It includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall metaverse in the education market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increased industry training and deployment in the education sector, Rapid adoption of virtual technologies boosts the market growth, Decreasing price of VR headsets drives the market growth), restraints (Requires a reliable and scalable technology infrastructure, Health and mental issues from excessive use, High installation and maintenance costs of high-end metaverse components), opportunities (Students can study through an immersive experience offered by metaverse, Covid-19 pandemic promoted a significant infusion of educational technology, 5G technology is constantly evolving), and challenges (Fear of content development, digital inequality, and access issues, To discover innovative ways to transform the education ecosystem) influencing the growth of the metaverse in the education market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the metaverse in the education market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the metaverse in the education market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the metaverse in the education market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, including Meta Platforms, Inc. (US), Microsoft Corporation (US), Adobe Inc. (US), HP Inc. (US), Unity Software Inc. (US), among others in the metaverse in the education market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2019-2022

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 METAVERSE IN EDUCATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- TABLE 2 LIST OF KEY SECONDARY SOURCES

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primaries

- 2.1.2.2 Primary respondents

- TABLE 3 METAVERSE IN EDUCATION MARKET: PRIMARY RESPONDENTS

- 2.1.2.3 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 2 METAVERSE IN EDUCATION MARKET: TOP-DOWN AND BOTTOM-UP APPROACH

- 2.3.1 SUPPLY-SIDE APPROACH

- FIGURE 3 APPROACH 1 (SUPPLY-SIDE): REVENUE OF METAVERSE IN EDUCATION FROM VENDORS

- FIGURE 4 BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF METAVERSE IN EDUCATION VENDORS

- FIGURE 5 MARKET PROJECTIONS FROM SUPPLY SIDE

- 2.3.2 DEMAND-SIDE APPROACH

- FIGURE 6 APPROACH 2 (DEMAND SIDE): REVENUE OF VENDORS FROM VARIOUS SEGMENTS

- FIGURE 7 MARKET PROJECTIONS FROM DEMAND SIDE

- 2.4 MARKET FORECAST

- TABLE 4 FACTOR ANALYSIS

- 2.4.1 RECESSION IMPACT ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- TABLE 5 ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 METAVERSE IN EDUCATION MARKET SNAPSHOT, 2020-2028

- FIGURE 9 TOP MARKET SEGMENTS IN TERMS OF GROWTH RATE

- FIGURE 10 METAVERSE SOFTWARE IN EDUCATION TO ACCOUNT FOR LARGEST MARKET BY 2028

- FIGURE 11 AR DEVICES TO ACCOUNT FOR LARGEST HARDWARE MARKET BY 2028

- FIGURE 12 STRATEGY & BUSINESS CONSULTING SERVICES TO ACCOUNT FOR LARGEST MARKET BY 2028

- FIGURE 13 ACADEMIC END USERS TO ACCOUNT FOR LARGEST MARKET BY 2028

- FIGURE 14 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN METAVERSE IN EDUCATION MARKET

- FIGURE 15 DRASTIC GEOGRAPHIC CHANGE AND TECHNOLOGICAL EVOLUTION TO DRIVE METAVERSE IN EDUCATION'S ARCHIVING GROWTH

- 4.2 METAVERSE IN EDUCATION MARKET, BY COMPONENT

- FIGURE 16 SOFTWARE COMPONENT TO ACCOUNT FOR LARGEST SHARE IN 2023 AND 2028

- 4.3 METAVERSE IN EDUCATION MARKET, BY HARDWARE

- FIGURE 17 AR DEVICES TO BECOME LARGEST HARDWARE MARKET BY 2028

- 4.4 METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE

- FIGURE 18 STRATEGY & BUSINESS CONSULTING SEGMENT TO ACCOUNT FOR LARGER SHARE AMONG PROFESSIONAL SERVICES IN 2023

- 4.5 METAVERSE IN EDUCATION MARKET, BY END USER

- FIGURE 19 ACADEMIC END USERS TO ACCOUNT FOR LARGER SHARE THAN CORPORATE END USERS

- 4.6 METAVERSE IN EDUCATION MARKET, BY REGION

- FIGURE 20 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: METAVERSE IN EDUCATION MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in industrial training and deployment in education sector

- 5.2.1.2 Rapid adoption of virtual technologies

- FIGURE 22 STAGES OF VR ADOPTION IN COMPANIES

- 5.2.1.3 Decrease in price of VR headsets

- 5.2.2 RESTRAINTS

- 5.2.2.1 Requirement of reliable and scalable technology infrastructure

- 5.2.2.2 Health and mental issues from excessive use

- 5.2.2.3 High installation and maintenance costs of high-end metaverse components

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Immersive experience offered to students

- 5.2.3.2 Major infusion of educational technology prompted by COVID-19 pandemic

- 5.2.3.3 Constantly evolving 5G technology

- 5.2.4 CHALLENGES

- 5.2.4.1 Fear of content development, digital inequality, and access issues

- 5.2.4.2 Innovation in transforming education ecosystem

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 STEVENS INSTITUTE OF TECHNOLOGY UTILIZED SAMSUNG INTERACTIVE BOARDS FOR DISTANT CLASSROOMS

- 5.3.2 ECNU XIPING BILINGUAL SCHOOL SUPPORTED SUPERIOR EDUCATIONAL EXPERIENCES WITH LENOVO THINKAGILE VX SERIES

- 5.3.3 ONTARIO COLLEGE TURNED TO MICROSOFT'S MIXED REALITY FOR FUTURE OF TRAINING

- 5.3.4 KATHERINE WARINGTON SCHOOL ENHANCED CLASSROOM ENGAGEMENT WITH CLASSVR

- 5.3.5 UNITY PREPARES TAFE QUEENSLAND STUDENTS FOR IN-DEMAND CAREERS WITH UAA

- 5.4 ECOSYSTEM

- FIGURE 23 METAVERSE IN EDUCATION MARKET ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 24 METAVERSE IN EDUCATION MARKET: VALUE CHAIN

- 5.6 PRICING ANALYSIS

- 5.6.1 INTRODUCTION

- 5.6.2 AVERAGE SELLING PRICE TRENDS

- 5.6.3 AVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY TYPE

- TABLE 6 METAVERSE IN EDUCATION MARKET: PRICING ANALYSIS, BY VENDOR

- 5.7 PATENT ANALYSIS

- FIGURE 25 NUMBER OF PATENTS PUBLISHED, 2012-2022

- FIGURE 26 TOP TEN GLOBAL PATENT APPLICANTS IN 2022

- TABLE 7 TOP PATENT OWNERS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 AI AND ML

- 5.8.2 5G NETWORK

- 5.8.3 INTERNET OF THINGS

- 5.8.4 VIRTUAL REALITY

- 5.8.5 AUGMENTED REALITY

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 REGULATIONS, BY REGION

- 5.9.2.1 North America

- 5.9.2.2 Europe

- 5.9.2.3 Asia Pacific

- 5.9.2.4 Middle East & South Africa

- 5.9.2.5 Latin America

- 5.9.3 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

- 5.9.3.1 General Data Protection Regulation

- 5.9.3.2 SEC Rule 17a-4

- 5.9.3.3 ISO/IEC 27001

- 5.9.3.4 System and Organization Controls 2 Type II Compliance

- 5.9.3.5 Financial Industry Regulatory Authority

- 5.9.3.6 Freedom of Information Act

- 5.9.3.7 Health Insurance Portability and Accountability Act

- 5.10 PORTER'S FIVE FORCES MODEL

- FIGURE 27 METAVERSE IN EDUCATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 METAVERSE IN EDUCATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.10.2 BARGAINING POWER OF SUPPLIERS

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 THREAT OF NEW ENTRANTS

- 5.10.5 THREAT OF SUBSTITUTES

- 5.11 KEY CONFERENCES AND EVENTS

- TABLE 13 METAVERSE IN EDUCATION MARKET: KEY CONFERENCES AND EVENTS, 2023-2024

- 5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 28 METAVERSE IN EDUCATION MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP HARDWARE

- TABLE 14 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP HARDWARE

- 5.13.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE HARDWARE

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE HARDWARE

6 METAVERSE IN EDUCATION MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- FIGURE 31 METAVERSE SOFTWARE IN EDUCATION TO ACCOUNT FOR LARGEST MARKET SIZE

- 6.1.1 COMPONENT: METAVERSE IN EDUCATION MARKET DRIVERS

- TABLE 16 METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 17 METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 6.2 HARDWARE

- FIGURE 32 AR DEVICES TO ACCOUNT FOR LARGEST METAVERSE HARDWARE MARKET IN EDUCATION

- TABLE 18 HARDWARE: METAVERSE IN EDUCATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 19 HARDWARE: METAVERSE IN EDUCATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 20 METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 21 METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- 6.2.1 AR DEVICES

- 6.2.1.1 Facilitating more efficient and interactive engagement with subjects

- TABLE 22 AR DEVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 23 AR DEVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2 VR DEVICES

- 6.2.2.1 Allowing students to manipulate virtual objects using natural hand gestures

- TABLE 24 VR DEVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 25 VR DEVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3 MR DEVICES

- 6.2.3.1 High-performance graphics to experience enhanced learning

- TABLE 26 MR DEVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 27 MR DEVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.4 INTERACTIVE DISPLAYS & PROJECTORS

- 6.2.4.1 Enhanced students' cognitive learning capabilities

- TABLE 28 INTERACTIVE DISPLAYS & PROJECTORS: METAVERSE IN EDUCATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 29 INTERACTIVE DISPLAYS & PROJECTORS: METAVERSE IN EDUCATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SOFTWARE

- TABLE 30 SOFTWARE: METAVERSE IN EDUCATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 31 SOFTWARE: METAVERSE IN EDUCATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1 EXTENDED REALITY SOFTWARE

- 6.3.1.1 Improved learning capabilities and reduction in learning time

- 6.3.2 GAMING ENGINES

- 6.3.2.1 Creating fun and engaging ways for students

- 6.3.3 METAVERSE PLATFORM

- 6.3.3.1 More engaging experience than traditional classroom lectures or online courses

- 6.3.4 3D MAPPING, MODELING, AND RECONSTRUCTION

- 6.3.4.1 Creating natural-looking spaces to enhance student engagement

- 6.4 PROFESSIONAL SERVICES

- FIGURE 33 STRATEGY & BUSINESS CONSULTING SERVICES TO ACCOUNT FOR LARGEST PROFESSIONAL SERVICES MARKET

- TABLE 32 PROFESSIONAL SERVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 33 PROFESSIONAL SERVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 34 METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 35 METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- 6.4.1 APPLICATION DEVELOPMENT & SYSTEM INTEGRATION

- 6.4.1.1 Deep understanding of various components involved and ability to implement interfaces

- TABLE 36 APPLICATION DEVELOPMENT & SYSTEM INTEGRATION: METAVERSE IN EDUCATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 37 APPLICATION DEVELOPMENT & SYSTEM INTEGRATION: METAVERSE IN EDUCATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.2 STRATEGY & BUSINESS CONSULTING SERVICES

- 6.4.2.1 Helping clients identify and solve problems, achieve their goals, and improve their overall performance

- TABLE 38 STRATEGY & BUSINESS CONSULTING SERVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 39 STRATEGY & BUSINESS CONSULTING SERVICES: METAVERSE IN EDUCATION MARKET, BY REGION, 2023-2028 (USD MILLION)

7 METAVERSE IN EDUCATION MARKET, BY END USER

- 7.1 INTRODUCTION

- FIGURE 34 ACADEMIC END USERS TO ACCOUNT FOR LARGEST MARKET

- 7.1.1 END USER: METAVERSE IN EDUCATION MARKET DRIVERS

- TABLE 40 METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 41 METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- 7.2 ACADEMIC

- 7.2.1 INCREASED USAGE OF HANDHELD DEVICES FOR LEARNING

- TABLE 42 ACADEMIC: METAVERSE IN EDUCATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 43 ACADEMIC: METAVERSE IN EDUCATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 44 METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2018-2022 (USD MILLION)

- TABLE 45 METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2023-2028 (USD MILLION)

- 7.2.2 K-12

- 7.2.2.1 Multiple innovative resources to access metaverse in schools

- TABLE 46 K-12: METAVERSE IN EDUCATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 47 K-12: METAVERSE IN EDUCATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.3 HIGHER EDUCATION

- 7.2.3.1 Students offered benefits of learning from anywhere

- TABLE 48 HIGHER EDUCATION: METAVERSE IN EDUCATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 49 HIGHER EDUCATION: METAVERSE IN EDUCATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 CORPORATE

- 7.3.1 COLLABORATION AND SOCIAL LEARNING FOR EMPLOYEES WITHIN VIRTUAL ENVIRONMENT

- TABLE 50 CORPORATE: METAVERSE IN EDUCATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 51 CORPORATE: METAVERSE IN EDUCATION MARKET, BY REGION, 2023-2028 (USD MILLION)

8 METAVERSE IN EDUCATION MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 35 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- TABLE 52 METAVERSE IN EDUCATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 METAVERSE IN EDUCATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2 NORTH AMERICA

- 8.2.1 NORTH AMERICA: METAVERSE IN EDUCATION MARKET DRIVERS

- 8.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 54 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 55 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 57 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 61 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2018-2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2023-2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.2.3 US

- 8.2.3.1 Adoption of advanced technologies such as AR and VR

- TABLE 66 US: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 67 US: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.2.4 CANADA

- 8.2.4.1 Combination of games and education offered in institutions

- TABLE 68 CANADA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 69 CANADA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.3 EUROPE

- 8.3.1 EUROPE: METAVERSE IN EDUCATION MARKET DRIVERS

- 8.3.2 EUROPE: RECESSION IMPACT

- TABLE 70 EUROPE: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 71 EUROPE: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 72 EUROPE: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 73 EUROPE: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 76 EUROPE: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 77 EUROPE: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 78 EUROPE: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2018-2022 (USD MILLION)

- TABLE 79 EUROPE: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2023-2028 (USD MILLION)

- TABLE 80 EUROPE: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 81 EUROPE: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.3.3 UK

- 8.3.3.1 Growth in use of VR headsets

- TABLE 82 UK: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 83 UK: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.3.4 GERMANY

- 8.3.4.1 Increase in digitalization and effective management of metaverse in education through various stages

- TABLE 84 GERMANY: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 85 GERMANY: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.3.5 FRANCE

- 8.3.5.1 Strong support from French government for adoption of metaverse in education sector

- TABLE 86 FRANCE: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 87 FRANCE: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.3.6 REST OF EUROPE

- TABLE 88 REST OF EUROPE: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 89 REST OF EUROPE: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.4 ASIA PACIFIC

- 8.4.1 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET DRIVERS

- 8.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 37 ASIA PACIFIC: REGIONAL SNAPSHOT

- TABLE 90 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 91 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 93 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 95 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 97 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2018-2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2023-2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 101 ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.4.3 CHINA

- 8.4.3.1 Presence of innovative technologies

- TABLE 102 CHINA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 103 CHINA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.4.4 JAPAN

- 8.4.4.1 Increased R&D investments and skilled professionals

- TABLE 104 JAPAN: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 105 JAPAN: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.4.5 INDIA

- 8.4.5.1 Continuous upgrades to metaverse IT infrastructure and applications

- TABLE 106 INDIA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 107 INDIA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.4.6 REST OF ASIA PACIFIC

- TABLE 108 REST OF ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.5 MIDDLE EAST & AFRICA

- 8.5.1 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET DRIVERS

- 8.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 110 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2018-2022 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2023-2028 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.5.3 KINGDOM OF SAUDI ARABIA

- 8.5.3.1 Commitment to collaborating with educational institutions and policymakers

- TABLE 122 KINGDOM OF SAUDI ARABIA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 123 KINGDOM OF SAUDI ARABIA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.5.4 UAE

- 8.5.4.1 Rise in government investments and economic development

- TABLE 124 UAE: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 125 UAE: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.5.5 REST OF THE MIDDLE EAST & AFRICA

- TABLE 126 REST OF THE MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 127 REST OF THE MIDDLE EAST & AFRICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.6 LATIN AMERICA

- 8.6.1 LATIN AMERICA: METAVERSE IN EDUCATION MARKET DRIVERS

- 8.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 128 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 129 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 130 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 131 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 132 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 133 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 134 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 135 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 136 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2018-2022 (USD MILLION)

- TABLE 137 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY ACADEMIC END USER, 2023-2028 (USD MILLION)

- TABLE 138 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 139 LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.6.3 BRAZIL

- 8.6.3.1 Promotion of creativity and innovation among students through latest software

- TABLE 140 BRAZIL: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 141 BRAZIL: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.6.4 MEXICO

- 8.6.4.1 Major digital transformation in education sector

- TABLE 142 MEXICO: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 143 MEXICO: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.6.5 REST OF LATIN AMERICA

- TABLE 144 REST OF LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2018-2022 (USD MILLION)

- TABLE 145 REST OF LATIN AMERICA: METAVERSE IN EDUCATION MARKET, BY END USER, 2023-2028 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 RIGHT TO WIN

- TABLE 146 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

- 9.3 MARKET SHARE ANALYSIS

- TABLE 147 MARKET SHARE OF KEY VENDORS, 2022

- FIGURE 38 METAVERSE IN EDUCATION MARKET SHARE ANALYSIS

- 9.4 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

- FIGURE 39 HISTORICAL REVENUE ANALYSIS, 2018-2022 (USD MILLION)

- 9.5 KEY COMPANY EVALUATION QUADRANT

- FIGURE 40 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- 9.5.1 STARS

- 9.5.2 EMERGING LEADERS

- 9.5.3 PERVASIVE PLAYERS

- 9.5.4 PARTICIPANTS

- FIGURE 41 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS

- TABLE 148 OVERALL COMPANY FOOTPRINT FOR KEY PLAYERS

- 9.6 OTHER PLAYER AND STARTUP/SME EVALUATION QUADRANT

- FIGURE 42 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- 9.6.1 RESPONSIVE COMPANIES

- 9.6.2 PROGRESSIVE COMPANIES

- 9.6.3 DYNAMIC COMPANIES

- 9.6.4 STARTING BLOCKS

- FIGURE 43 COMPANY EVALUATION QUADRANT FOR OTHER PLAYERS AND STARTUPS/SMES

- TABLE 149 OVERALL COMPANY FOOTPRINT FOR STARTUPS/SMES

- 9.6.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 150 KEY STARTUPS/SMES

- 9.7 COMPANY FINANCIAL METRICS

- FIGURE 44 COMPANY FINANCIAL METRICS, 2022

- 9.8 BAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 45 GLOBAL SNAPSHOT OF KEY METAVERSE IN EDUCATION MARKET PARTICIPANTS, 2022

- 9.9 KEY MARKET DEVELOPMENTS

- TABLE 151 METAVERSE IN EDUCATION MARKET: PRODUCT LAUNCHES AND ENHANCEMENT, 2020-2023

- TABLE 152 METAVERSE IN EDUCATION MARKET: DEALS, 2020-2023

10 COMPANY PROFILES

- 10.1 INTRODUCTION

- (Business overview, Products/Services offered, Recent developments & MnM View)**

- 10.2 KEY PLAYERS

- 10.2.1 META PLATFORMS, INC.

- TABLE 153 META PLATFORMS, INC.: BUSINESS OVERVIEW

- FIGURE 46 META PLATFORMS, INC.: COMPANY SNAPSHOT

- TABLE 154 META PLATFORMS, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 155 META PLATFORMS, INC.: PRODUCT LAUNCHES & ENHANCEMENT

- TABLE 156 META PLATFORMS, INC.: DEALS

- 10.2.2 MICROSOFT CORPORATION

- TABLE 157 MICROSOFT CORPORATION: BUSINESS OVERVIEW

- FIGURE 47 MICROSOFT CORPORATION: COMPANY SNAPSHOT

- TABLE 158 MICROSOFT CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 159 MICROSOFT CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 160 MICROSOFT CORPORATION: DEALS

- 10.2.3 ADOBE INC.

- TABLE 161 ADOBE INC.: BUSINESS OVERVIEW

- FIGURE 48 ADOBE INC.: COMPANY SNAPSHOT

- TABLE 162 ADOBE INC.: PRODUCT/SERVICES OFFERED

- TABLE 163 ADOBE INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 164 ADOBE INC.: DEALS

- 10.2.4 HP INC.

- TABLE 165 HP INC.: BUSINESS OVERVIEW

- FIGURE 49 HP INC.: COMPANY SNAPSHOT

- TABLE 166 HP INC.: PRODUCTS/SERVICES OFFERED

- TABLE 167 HP INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 168 HP INC.: DEALS

- 10.2.5 UNITY SOFTWARE INC.

- TABLE 169 UNITY SOFTWARE INC.: BUSINESS OVERVIEW

- FIGURE 50 UNITY SOFTWARE INC.: COMPANY SNAPSHOT

- TABLE 170 UNITY SOFTWARE INC.: PRODUCTS/SERVICES OFFERED

- TABLE 171 UNITY SOFTWARE INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 172 UNITY SOFTWARE INC.: DEALS

- 10.2.6 SAMSUNG ELECTRONICS

- TABLE 173 SAMSUNG ELECTRONICS: BUSINESS OVERVIEW

- FIGURE 51 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

- TABLE 174 SAMSUNG ELECTRONICS: PRODUCTS/SERVICES OFFERED

- TABLE 175 SAMSUNG ELECTRONICS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 176 SAMSUNG ELECTRONICS: DEALS

- 10.2.7 LENOVO

- TABLE 177 LENOVO: BUSINESS OVERVIEW

- FIGURE 52 LENOVO: COMPANY SNAPSHOT

- TABLE 178 LENOVO: PRODUCTS/SERVICES OFFERED

- TABLE 179 LENOVO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 180 LENOVO: DEALS

- 10.2.8 ROBLOX CORPORATION

- TABLE 181 ROBLOX CORPORATION: BUSINESS OVERVIEW

- FIGURE 53 ROBLOX CORPORATION: COMPANY SNAPSHOT

- TABLE 182 ROBLOX CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 183 ROBLOX CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 184 ROBLOX CORPORATION: DEALS

- 10.2.9 EPIC GAMES

- TABLE 185 EPIC GAMES: BUSINESS OVERVIEW

- TABLE 186 EPIC GAMES: PRODUCTS/SERVICES OFFERED

- TABLE 187 EPIC GAMES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 188 EPIC GAMES: DEALS

- 10.2.10 BAIDU, INC.

- TABLE 189 BAIDU, INC.: BUSINESS OVERVIEW

- FIGURE 54 BAIDU, INC.: COMPANY SNAPSHOT

- TABLE 190 BAIDU, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 191 BAIDU, INC.: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 192 BAIDU, INC.: DEALS

- *Details on Business overview, Products/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 10.3 OTHER PLAYERS

- 10.3.1 AVANTIS SYSTEMS LTD.

- 10.3.2 AXON PARK

- 10.3.3 TOMORROW'S EDUCATION

- 10.3.4 NEXTMEET

- 10.3.5 CLASSVR

- 10.3.6 METABLE GMBH

- 10.3.7 VIRBELA

- 10.3.8 LABSTER

- 10.3.9 VICTORYXR

- 10.3.10 ENGAGE PLC

- 10.3.11 VEDX SOLUTIONS

- 10.3.12 STEMULI

- 10.3.13 NETEASE

- 10.3.14 HTC

- 10.3.15 SANDBOX

- 10.4 STARTUPS/SMES

- 10.4.1 MEDROOM

- 10.4.2 MARVRUS

- 10.4.3 FOTONVR

- 10.4.4 IBENTOS

- 10.4.5 LEGEND OF LEARNING

- 10.4.6 SOPHIA

- 10.4.7 DEVDEN

- 10.4.8 IMMERSE

- 10.4.9 KWARK EDUCATION

- 10.4.10 HATCHXR

- 10.4.11 METAVERSE LEARNING LIMITED

11 ADJACENT/RELATED MARKETS

- 11.1 INTRODUCTION

- 11.1.1 RELATED MARKETS

- 11.1.2 LIMITATIONS

- 11.2 EXTENDED REALITY MARKET

- TABLE 193 EXTENDED REALITY MARKET, 2019-2022 (USD MILLION)

- TABLE 194 EXTENDED REALITY MARKET, 2023-2028 (USD MILLION)

- 11.3 AUGMENTED REALITY AND VIRTUAL REALITY MARKET

- TABLE 195 AUGMENTED REALITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 196 AUGMENTED REALITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 197 VIRTUAL REALITY MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 198 VIRTUAL REALITY MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 11.4 METAVERSE MARKET

- TABLE 199 METAVERSE MARKET, BY COMPONENT, 2018-2021 (USD BILLION)

- TABLE 200 METAVERSE MARKET, BY COMPONENT, 2022-2027 (USD BILLION)

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS