|

|

市場調査レポート

商品コード

1280001

血漿分画用コールドチェーン製品の世界市場:種類別 (超低温冷凍庫、プラズマ冷凍庫、温度モニタリング装置、血漿用コンタクトショックフリーザー、血液輸送ボックス、アイスライニング式冷凍庫)・エンドユーザー別の将来予測 (2027年まで)Cold Chain Products Market for Plasma Fractionation by Type (Ultra-low temperature freezer, Plasma freezer, Temperature monitoring devices, Plasma contact shock freezer, Blood transport boxes, Ice-lined refrigerator), End User - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 血漿分画用コールドチェーン製品の世界市場:種類別 (超低温冷凍庫、プラズマ冷凍庫、温度モニタリング装置、血漿用コンタクトショックフリーザー、血液輸送ボックス、アイスライニング式冷凍庫)・エンドユーザー別の将来予測 (2027年まで) |

|

出版日: 2023年05月22日

発行: MarketsandMarkets

ページ情報: 英文 186 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の血漿分画用コールドチェーン製品の市場規模は、2022年の5億6,900万米ドルから、予測期間中に4.5%のCAGRで成長し、2027年には7億1,100万米ドルに達すると予測されています。

コールドチェーン製品市場の拡大は、人獣共通感染症に対する懸念の高まり、多様な治療領域における免疫グロブリンやその他の血漿製品の利用拡大、血漿由来の医薬品に対する需要の高まりなど、さまざまな要因によってもたらされます。また、コールドチェーン製品の業界は、プラズマ冷凍庫やその他のコールドチェーン製品へのニーズの高まりや、高度な低温保存装置の採用により進展すると予想されます。これらの技術の進歩は、コールドチェーン製品分野全体の成長・発展に寄与しています。

"血漿分画用コールドチェーン製品市場において超低温冷凍庫分野が最も高いシェアを獲得する"

種類別では、2021年に超低温冷凍庫のセグメントが最も高いシェアを占めています。血漿由来医薬品に対する需要の増加、血漿分画技術の進歩、コールドチェーンインフラに対するニーズの高まりは、予測期間を通じて市場拡大を促進すると予想される要因の一部です。

"2021年の血漿分画用コールドチェーン製品市場では、採血センターと血液成分提供者が最も急速に成長する"

エンドユーザー別に見ると、2021年には採血センターと血液成分提供者が最もシェアが高くなっています。血漿分画の需要拡大、血液を媒介とする疾患に対する意識の高まりとスクリーニング、医療インフラの拡大などが、この市場の大きな割合を占める要因となっています。

"予測期間中、ラテンアメリカが最も速い成長を遂げる"

地域別に見ると、予測期間にはラテンアメリカが最も速い成長率で成長を遂げるでしょう。病院や医療施設の数が多いこと、免疫不全・血友病・自己免疫疾患などの慢性疾患が蔓延していることが、市場成長を促す主な要因となっています。ラテンアメリカでは、これらの疾病の増加により、重要な医療資源を保存するための血漿凍結器や冷蔵庫の要求が高まっています。医療ニーズの高まり、医療処置の進歩、血漿ベースの製品の利点に対する理解の高まりを受けて、ラテンアメリカの血漿分画セグメントは拡大しています。この拡大が、血漿冷凍庫や冷蔵庫などの適切な保存装置の必要性を高めています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 機会

- 課題

- 価格分析

- サプライチェーン分析

- エコシステム分析

- 特許分析

- バリューチェーン分析

- 技術分析

- 規制状況

- ポーターのファイブフォース分析

- 主要な会議とイベント (2023年~2024年)

- 主要な利害関係者と購入基準

- 貿易分析

- 血漿分画用コールドチェーン製品市場:不況の影響

第6章 血漿分画用コールドチェーン製品市場:種類別

- イントロダクション

- 超低温冷凍庫

- プラズマ冷凍庫

- 温度モニタリング装置

- 血漿用コンタクトショックフリーザー

- 血液輸送ボックス

- アイスライニング式冷蔵庫

- その他の製品

第7章 血漿分画用コールドチェーン製品市場:エンドユーザー別

- イントロダクション

- 採血センターと血液成分提供者

- 病院と輸血センター

- CRO (医薬品開発業務受託機関)

- その他のエンドユーザー

第8章 血漿分画用コールドチェーン製品市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他のアジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第9章 競合情勢

- 概要

- 主要企業の戦略

- 血漿分画用コールドチェーン製品市場:主要企業の収益シェア分析

- 市場シェア分析

- 企業評価クアドラント (主要企業、2021年)

- 競合ベンチマーキング

- 競合シナリオ

第10章 企業プロファイル

- 主要企業

- THERMO FISHER SCIENTIFIC, INC.

- HAIER BIOMEDICAL (HAIER GROUP)

- EPPENDORF SE

- B MEDICAL SYSTEMS (AZENTA)

- BLUE STAR LIMITED

- AVANTOR, INC.

- GODREJ AND BOYCE MANUFACTURING CO. LTD.

- BIOLIFE SOLUTIONS

- HELMER SCIENTIFIC

- VESTFROST SOLUTIONS A/S

- JEIO TECH INC.

- DEEPEE COOLING PRODUCTS

- BERLINGER & CO. AG

- MONNIT CORPORATION

- ZHEJIANG HELI REFRIGERATION EQUIPMENT CO. LTD.

- その他の企業

- QINGDAO CAREBIOS BIOLOGICAL TECHNOLOGY CO., LTD

- EBAC CO., LTD.

- BIOTECNO

- ZHONGKE MEILING CRYOGENICS CO., LTD.

- BIONICS SCIENTIFIC TECHNOLOGIES (P) LTD.

- STERICOX INDIA PRIVATE LIMITED

- ENVIRO TECHNOLOGIES

- WITHNELL SENSORS

- TECNOSOFT SRL

- PHILIPP KIRSCH GMBH

第11章 付録

The global market for cold chain products in plasma fractionation is estimated to grow significantly. By 2027, it is projected to reach a value of USD 711 million, showing a compound annual growth rate (CAGR) of 4.5% during the forecast period, starting from USD 569 million in 2022. The expansion of the cold chain products market is driven by various factors, including increasing concerns regarding zoonotic diseases, growing utilization of immunoglobulins and other plasma products in diverse therapeutic areas, and a rising demand for plasma-derived medicinal products. The industry for cold chain products is expected to progress due to the increasing need for plasma freezers and other cold chain products, as well as the adoption of advanced cold storage devices. These advancements in technology contribute to the overall growth and development of the cold chain products sector.

"Ultra-low temperature freezer segment was dominated by the highest share in Cold Chain Products Market for Plasma Fractionation" The market for Cold Chain Products for Plasma Fractionation is divided into seven types such as Ultra-low temperature freezer, Plasma freezer, Temperature monitoring devices, Plasma contact shock freezer, Blood transport boxes, Ice-lined refrigerator, and Others. The Ultra-low temperature freezer segment accounted for the highest share of the global Cold Chain Products for Plasma Fractionation in 2021. Increasing Demand for Plasma-Derived Medicinal Products, Advancements in Plasma Fractionation Technologies, and Growing Need for Cold Chain Infrastructure all some of the factors that are anticipated to promote market expansion throughout the projected period.

"Blood collection centers and blood component providers accounted for the fastest growing segment of the Cold Chain Products Market for Plasma Fractionation in 2021."

The Cold Chain Products Market for Plasma Fractionation is divided into Blood collection centers and blood component providers, Hospitals and transfusion centers, Clinical research laboratories, and Others based on end users. In 2021, Blood collection centers and blood component providers held the highest market share for cold chain products for plasma fractionation. Growing demand for plasma fractionation, rising awareness and screening for blood-borne diseases, and expansion of healthcare infrastructure are some of the factors that contribute to the big proportion of this market.

"Latin America is expected to witness the fastest growth in the forecast period." In the forecast period, Latin America in the Cold Chain Products Market for Plasma Fractionation will have the fastest rising regional growth. Large number of hospitals and healthcare facilities, increasing spread of chronic diseases such as immune deficiencies, hemophilia, and autoimmune disorders are the main factors driving market growth. The rise of these illnesses in Latin America has resulted in a higher requirement for plasma freezers and refrigerators to preserve vital medical resources. In response to growing healthcare needs, advancements in medical treatments, and a growing understanding of the advantages of plasma-based products, the plasma fractionation sector in Latin America has been expanding. This expansion drives the need for suitable storage devices, such as plasma freezers and refrigerators.

Following is a list of the major players (supply-side) in the Cold Chain Products Market for Plasma Fractionation that this study refers to: By Company Type: Tier 1- 34%, Tier 2- 46%, and Tier 3- 20% By Designation: C-level- 35%, Director Level-25%, and Others- 40% By Region: North America-30%, Europe-45%, Asia Pacific-20%, Latin America- 3%, and Middle East and Africa-2% Several of the major companies in the market for Cold Chain Products for Plasma Fractionation include B Medical Systems (US), Blue Star Limited (India), Thermo Fisher Scientific (US), Godrej and Boyce Manufacturing Co. Ltd. (India), Haier Biomedical (China), Eppendorf SE (Germany), Avantor, Inc. (US), Biolife Solutions Inc. (US), and Helmer Scientific Inc. (US)

Research Coverage:

The market study analyzes the main market segments for cold chain products. The objective of this study is to estimate the market's size and growth potential across several categories according to type, end user, and region. The report also provides a thorough competition analysis of the major market participants, together with company profiles, major insights regarding their product and service offerings, recent advancements, and key market strategies.

Key Benefits of Buying the Report:

The study provides data regarding the cold chain products market's closest approximations and its segments, which will benefit market leaders and new entrants. This study will assist stakeholders in comprehending the competitive environment, obtaining insights to better position of their businesses, and developing appropriate go-to-market strategies. The research will also assist stakeholders in obtaining insights into the market's pulse and learning about its major drivers, inhibitors, opportunities, and problems.

The report provides insights on the following pointers:

Analysis of key drivers (Rising use of immunoglobulins and other plasma products in a range of therapeutic area, Increasing demand for Plasma-derived medicinal products, and Technological advancements in refrigeration equipment and systems), opportunities (Demand for Plasma Fractionation Centre and Government support for cold chain infrastructure development), and challenges (Shortage of trained manpower & limited resources to maintain the equipment, Stringent government regulations, and Environmental concerns regarding greenhouse gas emissions) influencing the growth of the Cold Chain Products Market for Plasma Fractionation.

Product Development/innovation:

Comprehensive details on new technologies, R&D initiatives, and product and service launches for Cold Chain Products Market for Plasma Fractionation

Market Development:

Comprehensive data on attractive markets, and the research analyzes the global Cold Chain Products Market for Plasma Fractionation

Market Diversification:

Detailed information on emerging products and services, unexplored regions, current trends, and investments in the Cold Chain Products Market for Plasma Fractionation.

Competitive Assessment:

Comprehensive analysis of market shares, growth plans, and service offerings of major companies operating in the Cold Chain Products Market for Plasma Fractionation like B Medical Systems (US), Blue Star Limited (India), Thermo Fisher Scientific (US), Godrej and Boyce Manufacturing Co. Ltd. (India), Haier Biomedical (China), Eppendorf SE (Germany), Avantor, Inc. (US), Biolife Solutions Inc. (US), and Helmer Scientific Inc. (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION SEGMENTATION

- FIGURE 2 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY REGION

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 6 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION: THERMO FISHER SCIENTIFIC (US)

- FIGURE 8 SUPPLY-SIDE ANALYSIS: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION (2021)

- FIGURE 9 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION: BOTTOM-UP APPROACH

- FIGURE 10 DRIVERS, OPPORTUNITIES, AND CHALLENGES (2022-2027): IMPACT ON MARKET GROWTH AND CAGR

- FIGURE 11 CAGR PROJECTIONS

- FIGURE 12 TOP-DOWN APPROACH

- 2.3 LIMITATIONS

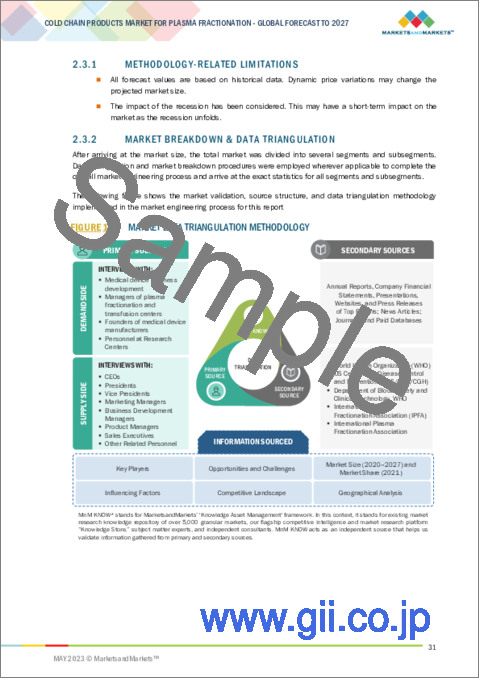

- 2.3.1 METHODOLOGY-RELATED LIMITATIONS

- 2.3.2 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 13 MARKET DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 14 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 15 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 16 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION: GEOGRAPHIC SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 COLD CHAIN PRODUCTS FOR PLASMA FRACTIONATION: MARKET OVERVIEW

- FIGURE 17 RISING USE OF IMMUNOGLOBULINS AND OTHER PLASMA PRODUCTS TO DRIVE MARKET GROWTH

- 4.2 ASIA PACIFIC: COLD CHAIN PRODUCTS FOR PLASMA FRACTIONATION, BY TYPE & COUNTRY (2021)

- FIGURE 18 ULTRA-LOW-TEMPERATURE FREEZERS TO HOLD LARGEST MARKET SHARE

- 4.3 COLD CHAIN PRODUCTS FOR PLASMA FRACTIONATION: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 19 CHINA TO REGISTER HIGHEST GROWTH OVER FORECAST PERIOD

- 4.4 COLD CHAIN PRODUCTS FOR PLASMA FRACTIONATION: GEOGRAPHIC MIX

- FIGURE 20 NORTH AMERICA TO DOMINATE MARKET OVER FORECAST PERIOD

- 4.5 COLD CHAIN PRODUCTS FOR PLASMA FRACTIONATION: DEVELOPING VS. DEVELOPED COUNTRIES

- FIGURE 21 DEVELOPING COUNTRIES TO PRESENT GROWTH OPPORTUNITIES TO MARKET PLAYERS DURING THE FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising use of immunoglobulins and other plasma products

- FIGURE 23 WORLDWIDE POLYVALENT IMMUNE GLOBULIN SALES FROM 2010 TO 2026

- 5.2.1.2 Increasing demand for plasma-derived medicinal products to treat chronic diseases

- TABLE 1 PLASMA-DERIVED MEDICINAL PRODUCTS AND THEIR CLINICAL INDICATIONS

- 5.2.1.3 Technological advancements in refrigeration equipment and systems

- 5.2.2 OPPORTUNITIES

- 5.2.2.1 Demand for plasma fractionation centers

- FIGURE 24 PLASMA FRACTIONATION PLANTS WORLDWIDE (2018)

- 5.2.2.2 Government support for cold chain infrastructure development

- 5.2.3 CHALLENGES

- 5.2.3.1 Shortage of trained manpower and limited resources to maintain equipment

- 5.2.3.2 Stringent government regulations

- 5.2.3.3 Environmental concerns regarding greenhouse gas emissions

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE OF COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE

- TABLE 2 AVERAGE SELLING PRICE OF COLD CHAIN PRODUCTS, BY TYPE (USD)

- 5.3.2 AVERAGE SELLING PRICE TRENDS

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 25 SUPPLY CHAIN ANALYSIS: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 26 ECOSYSTEM ANALYSIS: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION

- 5.6 PATENT ANALYSIS

- FIGURE 27 PATENT PUBLICATION TRENDS (JANUARY 2013-MARCH 2023)

- FIGURE 28 TOP APPLICANTS (COMPANIES/INSTITUTES) FOR COLD CHAIN PRODUCTS FOR PLASMA FRACTIONATION PATENTS (2013-2023)

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 29 VALUE CHAIN ANALYSIS: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGY

- 5.8.1.1 Ultra-low freezer technology

- 5.8.2 ADJACENT TECHNOLOGY

- 5.8.2.1 Cryopreservation

- 5.8.1 KEY TECHNOLOGY

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY ANALYSIS

- 5.9.1.1 North America

- 5.9.1.2 Europe

- 5.9.1.3 Asia Pacific

- 5.9.1.4 Latin America

- 5.9.1.5 Middle East and Africa

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATION

- TABLE 3 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC AND ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.1 REGULATORY ANALYSIS

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 PORTER'S FIVE FORCES ANALYSIS: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION

- 5.10.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.10.2 BARGAINING POWER OF SUPPLIERS

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 THREAT OF NEW ENTRANTS

- 5.10.5 THREAT OF SUBSTITUTES

- 5.11 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 7 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION: KEY CONFERENCES AND EVENTS, 2023-2024

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF COLD CHAIN PRODUCTS FOR PLASMA FRACTIONATION

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TYPES OF COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION

- 5.12.2 BUYING CRITERIA

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE TYPES OF COLD CHAIN PRODUCTS FOR PLASMA FRACTIONATION

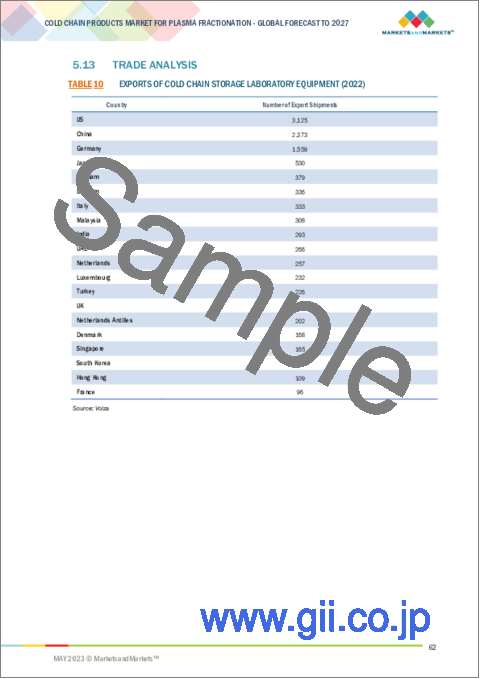

- 5.13 TRADE ANALYSIS

- TABLE 10 EXPORTS OF COLD CHAIN STORAGE LABORATORY EQUIPMENT (2022)

- TABLE 11 IMPORTS OF COLD CHAIN STORAGE LABORATORY EQUIPMENT (2022)

- 5.14 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION: RECESSION IMPACT

6 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE

- 6.1 INTRODUCTION

- TABLE 12 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 13 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.2 ULTRA-LOW-TEMPERATURE FREEZERS

- 6.2.1 RISING DEMAND IN PLASMA STORAGE APPLICATIONS TO DRIVE MARKET GROWTH

- TABLE 14 ULTRA-LOW-TEMPERATURE FREEZERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.3 PLASMA FREEZERS

- 6.3.1 RISING DEMAND IN SCIENTIFIC AND THERAPEUTIC APPLICATIONS TO BOOST GROWTH

- TABLE 15 PLASMA FREEZERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.4 TEMPERATURE MONITORING DEVICES

- 6.4.1 ADOPTION OF NOVEL TECHNOLOGIES IN TEMPERATURE MONITORING DEVICES TO PROPEL MARKET

- TABLE 16 TEMPERATURE MONITORING DEVICES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.5 PLASMA CONTACT SHOCK FREEZERS

- 6.5.1 NEED FOR RAPID FREEZING IN PLASMA TRANSPORT TO DRIVE MARKET

- TABLE 17 PLASMA CONTACT SHOCK FREEZERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.6 BLOOD TRANSPORT BOXES

- 6.6.1 RISING ADOPTION OF TEMPERATURE-CONTROLLED BOXES TO TRANSPORT PLASMA FRACTIONATED COMPOUNDS TO DRIVE MARKET

- TABLE 18 BLOOD TRANSPORT BOXES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.7 ICE-LINED REFRIGERATORS

- 6.7.1 COST-EFFECTIVENESS TO PROPEL END-USER ADOPTION

- TABLE 19 ICE-LINED REFRIGERATORS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 6.8 OTHER PRODUCTS

- TABLE 20 OTHER COLD CHAIN PRODUCTS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

7 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER

- 7.1 INTRODUCTION

- TABLE 21 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 7.2 BLOOD COLLECTION CENTERS & BLOOD COMPONENT PROVIDERS

- 7.2.1 RISING DEMAND FOR PLASMA-DERIVED PRODUCTS TO DRIVE MARKET GROWTH

- TABLE 22 COLD CHAIN PRODUCTS MARKET FOR BLOOD COLLECTION CENTERS & BLOOD COMPONENT PROVIDERS, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.3 HOSPITALS & TRANSFUSION CENTERS

- 7.3.1 NEED TO ENSURE SAFE COLLECTION, STORAGE, AND COLD CHAIN MANAGEMENT OF PLASMA TO DRIVE MARKET GROWTH

- TABLE 23 COLD CHAIN PRODUCTS MARKET FOR HOSPITALS & TRANSFUSION CENTERS, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.4 CLINICAL RESEARCH LABORATORIES

- 7.4.1 ROLE OF LABS IN PLASMA FRACTIONATION AND COLD CHAIN PRODUCT DEVELOPMENT TO BOOST MARKET GROWTH

- TABLE 24 COLD CHAIN PRODUCTS MARKET FOR CLINICAL RESEARCH LABORATORIES, BY COUNTRY, 2020-2027 (USD MILLION)

- 7.5 OTHER END USERS

- TABLE 25 COLD CHAIN PRODUCTS MARKET FOR OTHER END USERS, BY COUNTRY, 2020-2027 (USD MILLION)

8 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY REGION

- 8.1 INTRODUCTION

- FIGURE 31 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION: GEOGRAPHIC GROWTH OPPORTUNITIES

- TABLE 26 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY REGION, 2020-2027 (USD MILLION)

- 8.2 NORTH AMERICA

- 8.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 32 NORTH AMERICA: LABORATORY FREEZERS MARKET SNAPSHOT

- TABLE 27 NORTH AMERICA: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 28 NORTH AMERICA: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 29 NORTH AMERICA: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.2.2 US

- 8.2.2.1 US to hold largest share of North American market

- TABLE 30 US: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 31 US: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.2.3 CANADA

- 8.2.3.1 Growing pharma R&D and increasing use of plasma-derived compounds to boost market

- TABLE 32 CANADA: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 33 CANADA: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.3 EUROPE

- 8.3.1 EUROPE: RECESSION IMPACT

- TABLE 34 EUROPE: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 35 EUROPE: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 36 EUROPE: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.3.2 GERMANY

- 8.3.2.1 Germany to dominate European market

- TABLE 37 GERMANY: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 38 GERMANY: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.3.3 FRANCE

- 8.3.3.1 Growing biotech & pharma industry and high prevalence of bleeding disorders to drive market

- TABLE 39 FRANCE: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 40 FRANCE: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.3.4 UK

- 8.3.4.1 Rising incidence of hemophilia and growing consumption of coagulation factors to propel market

- TABLE 41 UK: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 42 UK: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.3.5 ITALY

- 8.3.5.1 Strong pharma sector and rising geriatric population to support market

- TABLE 43 ITALY: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 44 ITALY: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.3.6 SPAIN

- 8.3.6.1 Rising chronic disease prevalence to boost demand

- TABLE 45 SPAIN: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 46 SPAIN: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.3.7 REST OF EUROPE

- TABLE 47 REST OF EUROPE: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 48 REST OF EUROPE: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.4 ASIA PACIFIC

- 8.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 33 APAC: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION SNAPSHOT

- TABLE 49 ASIA PACIFIC: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 50 ASIA PACIFIC: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 51 ASIA PACIFIC: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.4.2 CHINA

- 8.4.2.1 China to dominate Asia Pacific market

- TABLE 52 CHINA: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 53 CHINA: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.4.3 JAPAN

- 8.4.3.1 Growing aging population and rising prevalence of neurological disorders to propel growth

- TABLE 54 JAPAN: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 55 JAPAN: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.4.4 INDIA

- 8.4.4.1 Growing pharma-biotech industry to drive demand

- TABLE 56 INDIA: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 57 INDIA: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.4.5 SOUTH KOREA

- 8.4.5.1 Rising awareness, advancements in medical treatments, and aging population to drive market

- TABLE 58 SOUTH KOREA: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 59 SOUTH KOREA: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.4.6 AUSTRALIA

- 8.4.6.1 Rising demand for plasma products to treat chronic diseases to propel market

- TABLE 60 AUSTRALIA: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 61 AUSTRALIA: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.4.7 REST OF ASIA PACIFIC

- TABLE 62 REST OF ASIA PACIFIC: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 63 REST OF ASIA PACIFIC: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.5 LATIN AMERICA

- 8.5.1 RISING INVESTMENTS IN BRAZIL AND GROWING DISEASE PREVALENCE ACROSS LATAM TO BOOST MARKET

- 8.5.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 64 LATIN AMERICA: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 65 LATIN AMERICA: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

- 8.6 MIDDLE EAST & AFRICA

- 8.6.1 INFRASTRUCTURAL DEVELOPMENT IN HEALTHCARE TO OFFER GROWTH OPPORTUNITIES

- 8.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 66 MIDDLE EAST & AFRICA: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 67 MIDDLE EAST & AFRICA: COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION, BY END USER, 2020-2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 KEY PLAYER STRATEGIES

- TABLE 68 OVERVIEW OF STRATEGIES ADOPTED BY MAJOR PLAYERS IN COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION

- 9.3 REVENUE SHARE ANALYSIS FOR KEY PLAYERS IN COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION

- FIGURE 34 REVENUE ANALYSIS FOR KEY PLAYERS IN COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION MARKET

- 9.4 MARKET SHARE ANALYSIS

- FIGURE 35 COLD CHAIN PRODUCTS FOR PLASMA FRACTIONATION: MARKET SHARE ANALYSIS, BY KEY PLAYER, 2021

- TABLE 69 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION: DEGREE OF COMPETITION

- FIGURE 36 R&D ASSESSMENT OF KEY PLAYERS

- 9.5 COMPANY EVALUATION QUADRANT (KEY COMPANIES), 2021

- 9.5.1 STARS

- 9.5.2 PERVASIVE PLAYERS

- 9.5.3 EMERGING LEADERS

- 9.5.4 PARTICIPANTS

- FIGURE 37 COLD CHAIN PRODUCTS MARKET FOR PLASMA FRACTIONATION: COMPANY EVALUATION MATRIX, 2021

- 9.6 COMPETITIVE BENCHMARKING

- TABLE 70 OVERALL COMPANY FOOTPRINT

- TABLE 71 COMPANY FOOTPRINT ANALYSIS, BY TYPE

- TABLE 72 COMPANY FOOTPRINT ANALYSIS, BY END USER

- TABLE 73 COMPANY FOOTPRINT ANALYSIS, BY REGION

- 9.7 COMPETITIVE SCENARIO

- 9.7.1 PRODUCT LAUNCHES & APPROVALS

- TABLE 74 PRODUCT LAUNCHES & APPROVALS, JANUARY 2019-MARCH 2023

- 9.7.2 DEALS

- TABLE 75 DEALS, JANUARY 2021-MARCH 2023

- 9.7.3 OTHER DEVELOPMENTS

- TABLE 76 OTHER DEVELOPMENTS, JANUARY 2019- MARCH 2023

10 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 10.1 KEY PLAYERS

- 10.1.1 THERMO FISHER SCIENTIFIC, INC.

- TABLE 77 THERMO FISHER SCIENTIFIC: BUSINESS OVERVIEW

- FIGURE 38 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT

- 10.1.2 HAIER BIOMEDICAL (HAIER GROUP)

- TABLE 78 HAIER BIOMEDICAL: BUSINESS OVERVIEW

- FIGURE 39 HAIER BIOMEDICAL (HAIER GROUP): COMPANY SNAPSHOT (2021)

- 10.1.3 EPPENDORF SE

- TABLE 79 EPPENDORF AG: BUSINESS OVERVIEW

- FIGURE 40 EPPENDORF AG: COMPANY SNAPSHOT

- 10.1.4 B MEDICAL SYSTEMS (AZENTA)

- TABLE 80 B. MEDICAL SYSTEM (AZENTA): BUSINESS OVERVIEW

- FIGURE 41 B MEDICAL SYSTEMS (AZENTA): COMPANY SNAPSHOT (2021)

- 10.1.5 BLUE STAR LIMITED

- TABLE 81 BLUE STAR LIMITED: BUSINESS OVERVIEW

- FIGURE 42 BLUE STAR LIMITED: COMPANY SNAPSHOT

- TABLE 82 BLUE STAR LIMITED: PRODUCTS OFFERED

- 10.1.6 AVANTOR, INC.

- TABLE 83 AVANTOR, INC.: BUSINESS OVERVIEW

- FIGURE 43 AVANTOR, INC.: COMPANY SNAPSHOT

- 10.1.7 GODREJ AND BOYCE MANUFACTURING CO. LTD.

- TABLE 84 GODREJ AND BOYCE MANUFACTURING CO. LTD.: BUSINESS OVERVIEW

- FIGURE 44 GODREJ AND BOYCE MANUFACTURING CO. LTD.: COMPANY SNAPSHOT

- 10.1.8 BIOLIFE SOLUTIONS

- TABLE 85 BIOLIFE SOLUTIONS: BUSINESS OVERVIEW

- FIGURE 45 BIOLIFE SOLUTIONS: COMPANY SNAPSHOT

- 10.1.9 HELMER SCIENTIFIC

- TABLE 86 HELMER SCIENTIFIC: BUSINESS OVERVIEW

- 10.1.10 VESTFROST SOLUTIONS A/S

- TABLE 87 VESTFROST SOLUTIONS A/S: BUSINESS OVERVIEW

- 10.1.11 JEIO TECH INC.

- TABLE 88 JEIO TECH INC.: BUSINESS OVERVIEW

- 10.1.12 DEEPEE COOLING PRODUCTS

- TABLE 89 DEEPEE COOLING PRODUCTS: BUSINESS OVERVIEW

- 10.1.13 BERLINGER & CO. AG

- TABLE 90 BERLINGER & CO. AG: BUSINESS OVERVIEW

- 10.1.14 MONNIT CORPORATION

- TABLE 91 MONNIT CORPORATION: BUSINESS OVERVIEW

- 10.1.15 ZHEJIANG HELI REFRIGERATION EQUIPMENT CO. LTD.

- TABLE 92 ZHEJIANG HELI REFRIGERATION EQUIPMENT CO. LTD.: BUSINESS OVERVIEW

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 10.2 OTHER PLAYERS

- 10.2.1 QINGDAO CAREBIOS BIOLOGICAL TECHNOLOGY CO., LTD

- 10.2.2 EBAC CO., LTD.

- 10.2.3 BIOTECNO

- 10.2.4 ZHONGKE MEILING CRYOGENICS CO., LTD.

- 10.2.5 BIONICS SCIENTIFIC TECHNOLOGIES (P) LTD.

- 10.2.6 STERICOX INDIA PRIVATE LIMITED

- 10.2.7 ENVIRO TECHNOLOGIES

- 10.2.8 WITHNELL SENSORS

- 10.2.9 TECNOSOFT SRL

- 10.2.10 PHILIPP KIRSCH GMBH

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 RELATED REPORTS

- 11.4 AUTHOR DETAILS