|

|

市場調査レポート

商品コード

1614458

医薬品製造装置市場:最終製品タイプ別、装置タイプ別、地域別 - 2029年までの予測Pharmaceutical Manufacturing Equipment Market by Machine (Mixing & Blending, Milling, Spray Drying, Granulation, Extrusion, Tablet Compression, Sterilization, and Inspection), Process (Encapsulation, Formulation, Aseptic) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 医薬品製造装置市場:最終製品タイプ別、装置タイプ別、地域別 - 2029年までの予測 |

|

出版日: 2024年12月10日

発行: MarketsandMarkets

ページ情報: 英文 247 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の医薬品製造装置の市場規模は、2024年の194億1,000万米ドルから2029年には269億4,000万米ドルに成長し、予測期間中のCAGRは6.8%になると予測されています。

ジェネリック医薬品需要の増加が医薬品製造装置市場の成長を牽引しています。一方、再生機器の需要が医薬品製造機器市場の成長を抑制しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | 最終製品タイプ別、装置タイプ別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

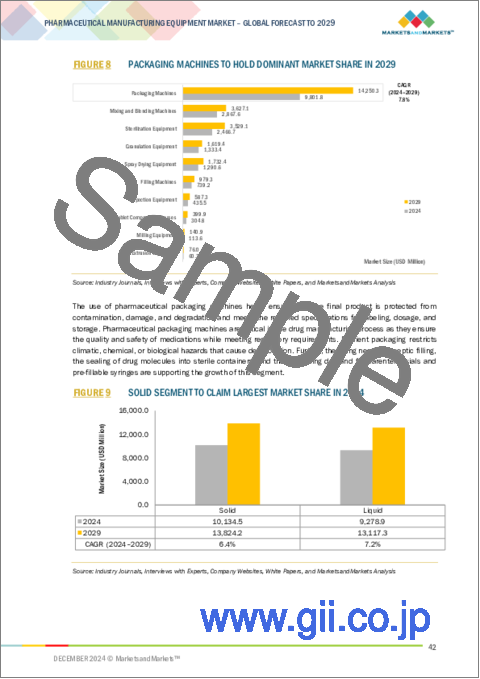

包装機セグメントは、いくつかの重要な要因により、医薬品製造装置市場で最も高いCAGRが見込まれています。プレフィルドシリンジ、単回投与バイアル、ブリスターパックなどの革新的なドラッグデリバリー形態は製薬業界で重要性を増しており、高度で洗練されたパッケージングソリューションが必要とされています。さらに、シリアル化や改ざん防止ソリューションなどの高度な包装技術の採用は、医薬品の安全性とトレーサビリティに関する厳しい規制要件に対応しています。また、患者中心のヘルスケアという動向の高まりも背景にあり、包装はユーザーの利便性とコンプライアンスの向上に重要な役割を果たしています。生物製剤、個別化医薬品、ワクチンの成長もまた、高精度で無菌のパッケージング環境を必要とするため、先進パッケージングマシンの需要をさらに押し上げています。

液体セグメントは、小児用製剤に対する規制の重点によりCAGRが伸びると予測されます。米国食品医薬品局(FDA)などの規制機関は、小児が錠剤やカプセルのような固形剤を飲み込む際に直面する課題に対処するため、年齢に応じた液体医薬品の必要性を強調しています。この後押しにより、小児治療におけるコンプライアンス、安全性、有効性が向上し、液体剤形に対する需要が大きく伸びています。さらに、液剤は正確な投与が可能であるため、小児やその他の患者に合わせた投与が必要な場合に理想的です。小児医療への関心の高まりにより、製薬企業は液体製剤の技術革新を進め、新たな市場機会を開拓しています。

この地域は、大手製薬会社と中小企業の両方が支配する非常に競合情勢に特徴付けられ、その結果、製品の革新と多様化が促進されています。新しい製造技術のための研究開発への多大な投資が、この地域におけるこの市場の優位性を支えています。バイオ医薬品は業界の大きなシフトを形成し、欧州全域に変革をもたらしました。ドイツは、EUで承認されたバイオ医薬品物質の最大の生産国となっています。この成長は、生物製剤からの収益の増加と一致しており、欧州の医薬品製造装置市場をさらに強化しています。

当レポートでは、世界の医薬品製造装置市場について調査し、最終製品タイプ別、装置タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- AI/生成AIが医薬品製造装置市場に与える影響

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ

- 規制の情勢

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

第6章 医薬品製造装置サプライヤーとアフターマーケットサプライヤー

- イントロダクション

- OEM

- アフターマーケットサプライヤー

第7章 医薬品機器の主な製造工程

- イントロダクション

- 配合プロセス

- 錠剤化およびカプセル化プロセス

- 無菌プロセス

- 包装工程

- 品質管理プロセス

第8章 医薬品製造装置のエンドユーザー

- イントロダクション

- 医薬品メーカー

- CMO

第9章 医薬品製造装置市場、最終製品タイプ別

- イントロダクション

- 固体

- 液体

第10章 医薬品製造装置市場、装置タイプ別

- イントロダクション

- 包装機械

- 充填機

- スプレー乾燥装置

- 混合・ブレンド機

- フライス加工設備

- 押出装置

- 錠剤圧縮機

- 検査装置

- 造粒装置

- 滅菌装置

第11章 医薬品製造装置市場、地域別

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- アフリカ

- 南米

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2022年~2024年

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- 企業評価と財務指標、2024年

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- GEA GROUP AKTIENGESELLSCHAFT

- I.M.A INDUSTRIA MACCHINE AUTOMATICHE S.P.A.

- SYNTEGON TECHNOLOGY GMBH

- ACG

- THERMO FISHER SCIENTIFIC INC.

- ROMACO GROUP

- KORBER AG

- MARCHESINI GROUP S.P.A.

- MG2 S.R.L.

- GLATT GMBH

- その他の企業

- BAUSCH+STROBEL SE+CO. KG

- COPERION GMBH

- ELIZABETH COMPANIES

- FETTE COMPACTING

- FREUND

- KORSCH AG

- L.B. BOHLE MASCHINEN UND VERFAHREN GMBH

- LFA MACHINES

- CVC TECHNOLOGIES, INC.

- OHARA TECHNOLOGIES

- PRISM PHARMA MACHINERY

- SAINTYCO

- SILVERSON

- YENCHEN MACHINERY CO., LTD

- QUALICAPS

- COESIA S.P.A.

- UHLMANN

- AUTOMATED SYSTEMS OF TACOMA, LLC

第14章 付録

List of Tables

- TABLE 1 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: RISK ANALYSIS

- TABLE 2 INDICATIVE PRICING OF PHARMACEUTICAL MANUFACTURING EQUIPMENT OFFERED BY KEY PLAYERS, BY EQUIPMENT TYPE, 2023 (USD)

- TABLE 3 AVERAGE SELLING PRICE TREND OF PHARMACEUTICAL PACKAGING MACHINES, 2019-2023 (USD)

- TABLE 4 AVERAGE SELLING PRICE TREND OF PHARMACEUTICAL PACKAGING MACHINES, BY REGION, 2019-2023 (USD)

- TABLE 5 ROLES OF COMPANIES IN PHARMACEUTICAL MANUFACTURING EQUIPMENT ECOSYSTEM

- TABLE 6 LIST OF MAJOR PATENTS

- TABLE 7 IMPORT DATA FOR HS CODE 842230-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 8 EXPORT DATA FOR HS CODE 842230-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 9 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 STANDARDS PERTAINING TO PHARMACEUTICAL MANUFACTURING EQUIPMENT

- TABLE 15 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END-PRODUCT TYPES

- TABLE 17 KEY BUYING CRITERIA FOR END-PRODUCT TYPES

- TABLE 18 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 19 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 20 SOLID: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 21 SOLID: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 22 LIQUID: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 23 LIQUID: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 24 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 25 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 26 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 27 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 28 PACKAGING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 29 PACKAGING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 30 PACKAGING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 31 PACKAGING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 32 PACKAGING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 33 PACKAGING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 34 PACKAGING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 35 PACKAGING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 36 PACKAGING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 37 PACKAGING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 38 FILLING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 39 FILLING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 40 FILLING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 41 FILLING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 42 FILLING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 43 FILLING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 44 FILLING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 45 FILLING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 46 FILLING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 47 FILLING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 48 SPRAY DRYING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 49 SPRAY DRYING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 50 SPRAY DRYING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 51 SPRAY DRYING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 52 SPRAY DRYING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 53 SPRAY DRYING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 54 SPRAY DRYING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 55 SPRAY DRYING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 56 SPRAY DRYING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 57 SPRAY DRYING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 58 MIXING AND BLENDING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 59 MIXING AND BLENDING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 60 MIXING AND BLENDING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 61 MIXING AND BLENDING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 62 MIXING AND BLENDING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 63 MIXING AND BLENDING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 64 MIXING AND BLENDING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 65 MIXING AND BLENDING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 66 MIXING AND BLENDING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 67 MIXING AND BLENDING MACHINES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 68 MILLING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 69 MILLING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 70 MILLING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 71 MILLING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 72 MILLING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 73 MILLING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 74 MILLING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 75 MILLING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 76 MILLING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 77 MILLING EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 78 EXTRUSION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 79 EXTRUSION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 80 EXTRUSION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 81 EXTRUSION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 82 EXTRUSION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 83 EXTRUSION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 84 EXTRUSION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 85 EXTRUSION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 86 EXTRUSION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 87 EXTRUSION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 88 TABLET COMPRESSION PRESSES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 89 TABLET COMPRESSION PRESSES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 90 TABLET COMPRESSION PRESSES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 91 TABLET COMPRESSION PRESSES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 92 TABLET COMPRESSION PRESSES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 93 TABLET COMPRESSION PRESSES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 94 TABLET COMPRESSION PRESSES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 95 TABLET COMPRESSION PRESSES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 96 TABLET COMPRESSION PRESSES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 97 TABLET COMPRESSION PRESSES: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 98 INSPECTION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 99 INSPECTION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 100 INSPECTION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 101 INSPECTION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 102 INSPECTION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 103 INSPECTION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 104 INSPECTION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 105 INSPECTION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 106 INSPECTION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 107 INSPECTION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 108 GRANULATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 109 GRANULATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 110 GRANULATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 111 GRANULATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 112 GRANULATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 113 GRANULATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 114 GRANULATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 115 GRANULATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 116 GRANULATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 117 GRANULATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 118 STERILIZATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 119 STERILIZATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 120 STERILIZATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 121 STERILIZATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 122 STERILIZATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 123 STERILIZATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 124 STERILIZATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 125 STERILIZATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 126 STERILIZATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 127 STERILIZATION EQUIPMENT: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 128 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 129 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 130 NORTH AMERICA: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 131 NORTH AMERICA: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 132 NORTH AMERICA: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 133 NORTH AMERICA: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 134 US: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 135 US: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 136 CANADA: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 137 CANADA: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 138 MEXICO: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 139 MEXICO: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 140 EUROPE: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 141 EUROPE: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 142 UK: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 143 UK: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 144 GERMANY: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 145 GERMANY: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 146 FRANCE: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 147 FRANCE: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 148 ITALY: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 149 ITALY: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 150 REST OF EUROPE: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 151 REST OF EUROPE: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 152 ASIA PACIFIC: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 153 ASIA PACIFIC: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 154 ASIA PACIFIC: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 155 ASIA PACIFIC: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 156 CHINA: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 157 CHINA: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 158 JAPAN: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 159 JAPAN: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 160 INDIA: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 161 INDIA: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 162 SOUTH KOREA: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 163 SOUTH KOREA: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 166 ROW: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 167 ROW: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 168 ROW: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 169 ROW: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 170 MIDDLE EAST: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 171 MIDDLE EAST: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 172 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2022-2024

- TABLE 173 PHARMACEUTICAL PACKAGING MACHINES MARKET: DEGREE OF COMPETITION, 2023

- TABLE 174 PHARMACEUTICAL PACKAGING MACHINES MARKET: REGION FOOTPRINT

- TABLE 175 PHARMACEUTICAL PACKAGING MACHINES MARKET: PRIMARY PACKAGING EQUIPMENT FOOTPRINT

- TABLE 176 PHARMACEUTICAL PACKAGING MACHINES MARKET: SECONDARY PACKAGING EQUIPMENT FOOTPRINT

- TABLE 177 PHARMACEUTICAL PACKAGING MACHINES MARKET: TYPE FOOTPRINT

- TABLE 178 PHARMACEUTICAL PACKAGING MACHINES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 179 PHARMACEUTICAL PACKAGING MACHINES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 180 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: PRODUCT LAUNCHES, JANUARY 2022-OCTOBER 2024

- TABLE 181 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: DEALS, JANUARY 2022-OCTOBER 2024

- TABLE 182 GEA GROUP AKTIENGESELLSCHAFT: COMPANY OVERVIEW

- TABLE 183 GEA GROUP AKTIENGESELLSCHAFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT LAUNCHES

- TABLE 185 GEA GROUP AKTIENGESELLSCHAFT: DEALS

- TABLE 186 I.M.A INDUSTRIA MACCHINE AUTOMATICHE S.P.A.: COMPANY OVERVIEW

- TABLE 187 I.M.A INDUSTRIA MACCHINE AUTOMATICHE S.P.A.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 188 I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A.: DEALS

- TABLE 189 SYNTEGON TECHNOLOGY GMBH: COMPANY OVERVIEW

- TABLE 190 SYNTEGON TECHNOLOGY GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 SYNTEGON TECHNOLOGY GMBH: PRODUCT LAUNCHES

- TABLE 192 SYNTEGON TECHNOLOGY GMBH: DEALS

- TABLE 193 SYNTEGON TECHNOLOGY GMBH: EXPANSIONS

- TABLE 194 ACG: COMPANY OVERVIEW

- TABLE 195 ACG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 ACG: DEALS

- TABLE 197 ACG: EXPANSIONS

- TABLE 198 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 199 THERMO FISHER SCIENTIFIC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 THERMO FISHER SCIENTIFIC INC.: DEALS

- TABLE 201 THERMO FISHER SCIENTIFIC INC.: EXPANSIONS

- TABLE 202 ROMACO GROUP: COMPANY OVERVIEW

- TABLE 203 ROMACO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 ROMACO GROUP: PRODUCT LAUNCHES

- TABLE 205 ROMACO GROUP: DEALS

- TABLE 206 KORBER AG: COMPANY OVERVIEW

- TABLE 207 KORBER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 KORBER AG: DEALS

- TABLE 209 KORBER AG: EXPANSIONS

- TABLE 210 MARCHESINI GROUP S.P.A.: COMPANY OVERVIEW

- TABLE 211 MARCHESINI GROUP S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 MARCHESINI GROUP S.P.A.: PRODUCT LAUNCHES

- TABLE 213 MARCHESINI GROUP S.P.A.: DEALS

- TABLE 214 MG2 S.R.L.: COMPANY OVERVIEW

- TABLE 215 MG2 S.R.L.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 MG2 S.R.L.: PRODUCT LAUNCHES

- TABLE 217 GLATT GMBH: COMPANY OVERVIEW

- TABLE 218 GLATT GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 BAUSCH+STROBEL SE + CO. KG: COMPANY OVERVIEW

- TABLE 220 COPERION GMBH: COMPANY OVERVIEW

- TABLE 221 ELIZABETH COMPANIES: COMPANY OVERVIEW

- TABLE 222 FETTE COMPACTING: COMPANY OVERVIEW

- TABLE 223 FREUND: COMPANY OVERVIEW

- TABLE 224 KORSCH AG: COMPANY OVERVIEW

- TABLE 225 L.B. BOHLE MASCHINEN UND VERFAHREN GMBH: COMPANY OVERVIEW

- TABLE 226 LFA MACHINES: COMPANY OVERVIEW

- TABLE 227 CVC TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 228 OHARA TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 229 PRISM PHARMA MACHINERY: COMPANY OVERVIEW

- TABLE 230 SAINTYCO: COMPANY OVERVIEW

- TABLE 231 SILVERSON: COMPANY OVERVIEW

- TABLE 232 YENCHEN MACHINERY CO., LTD: COMPANY OVERVIEW

- TABLE 233 QUALICAPS: COMPANY OVERVIEW

- TABLE 234 COESIA S.P.A.: COMPANY OVERVIEW

- TABLE 235 UHLMANN: COMPANY OVERVIEW

- TABLE 236 AUTOMATED SYSTEMS OF TACOMA, LLC: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET SEGMENTATION

- FIGURE 2 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED FROM PHARMACEUTICAL PACKAGING MACHINES

- FIGURE 4 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: BOTTOM-UP APPROACH

- FIGURE 5 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: TOP-DOWN APPROACH

- FIGURE 6 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: DATA TRIANGULATION

- FIGURE 7 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: RESEARCH ASSUMPTIONS

- FIGURE 8 PACKAGING MACHINES TO HOLD DOMINANT MARKET SHARE IN 2029

- FIGURE 9 SOLID SEGMENT TO CLAIM LARGEST MARKET SHARE IN 2024

- FIGURE 10 ASIA PACIFIC DOMINATED MARKET IN 2023

- FIGURE 11 GROWING DEMAND FOR FLEXIBLE PHARMACEUTICAL MANUFACTURING TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- FIGURE 12 PACKAGING MACHINES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 LIQUID SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 14 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 15 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 17 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 18 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 19 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 20 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 AVERAGE SELLING PRICE TREND OF PHARMACEUTICAL PACKAGING MACHINES, 2019-2023

- FIGURE 22 AVERAGE SELLING PRICE TREND OF PHARMACEUTICAL PACKAGING MACHINES, BY REGION, 2019-2023

- FIGURE 23 VALUE CHAIN ANALYSIS

- FIGURE 24 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET ECOSYSTEM ANALYSIS

- FIGURE 25 IMPACT OF AI/GENERATIVE AI ON PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET

- FIGURE 26 PATENTS APPLIED AND GRANTED, 2014-2023

- FIGURE 27 IMPORT DATA FOR HS CODE 842230-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 28 EXPORT DATA FOR HS CODE 842230-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 29 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS IN PHARMACEUTICAL MANUFACTURING EQUIPMENT FOR END-PRODUCT TYPE

- FIGURE 31 KEY BUYING CRITERIA FOR PHARMACEUTICAL MANUFACTURING EQUIPMENT FOR END-PRODUCT TYPES

- FIGURE 32 SOLID SEGMENT TO HOLD LARGER MARKET SHARE IN 2024

- FIGURE 33 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE

- FIGURE 34 PACKAGING MACHINES TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION

- FIGURE 36 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 37 NORTH AMERICA: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET SNAPSHOT

- FIGURE 38 EUROPE: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET SNAPSHOT

- FIGURE 40 SOUTH AMERICA TO DOMINATE MARKET IN ROW REGION IN 2024

- FIGURE 41 PHARMACEUTICAL PACKAGING MACHINES MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023

- FIGURE 42 MARKET SHARE ANALYSIS OF KEY PLAYERS OFFERING PHARMACEUTICAL PACKAGING MACHINES, 2023

- FIGURE 43 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: COMPANY VALUATION, 2024

- FIGURE 44 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET: FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 45 PHARMACEUTICAL PACKAGING MACHINES MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 46 PHARMACEUTICAL PACKAGING MACHINES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 47 PHARMACEUTICAL PACKAGING MACHINES MARKET: COMPANY FOOTPRINT

- FIGURE 48 PHARMACEUTICAL PACKAGING MACHINES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 49 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 50 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- FIGURE 51 KORBER AG: COMPANY SNAPSHOT

The global pharmaceutical manufacturing equipment market size is projected to grow from USD 19.41 billion in 2024 to USD 26.94 billion in 2029, recording a CAGR of 6.8% during the forecast period. Rising demand for generic drugs is driving the growth of the pharmaceutical manufacturing equipment market. Whereas the demand for refurbished equipments is restraining the growth of the pharmaceutical manufacturing equipment market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By equipment type, end-product type, process, end user, supplier type, and region |

| Regions covered | North America, Europe, APAC, RoW |

"Packaging machines segment is expected to witness highest CAGR during the forecasted period in pharmaceutical manufacturing equipment market."

The packaging machines segment is expected to have the highest CAGR in the pharmaceutical manufacturing equipment market due to a few critical factors. Innovative drug delivery formats such as pre-filled syringes, single-dose vials, and blister packs are gaining much importance in the pharmaceutical industry, which requires advanced and sophisticated packaging solutions. In addition, adoption of sophisticated packaging technologies, such as serialization and tamper-evident solutions, is stringent regulatory requirements for drug safety and traceability. It is also due to the growing trend of patient-centric healthcare, where packaging is playing an important role in enhancing user convenience and compliance. The growth in biologics, personalized medicines, and vaccines also requires highly precise and sterile packaging environments, thereby further driving demand for advanced packaging machines.

"Liquid segment is likely to witness highest CAGR in pharmaceutical manufacturing equipment market during forecasted period ."

The liquid segment is witnessing the CAGR due to regulatory emphasis on pediatric formulations. Regulatory bodies such as the US Food and Drug Administration (FDA) have stressed the need for age-appropriate liquid medications to address the challenges children face with swallowing solid forms like tablets and capsules. This push ensures better compliance, safety, and efficacy in pediatric treatments, significantly driving demand for liquid dosage forms. Additionally, liquid medications allow precise dosing, making them ideal for children and other patients requiring tailored administration. The growing focus on pediatric health has led pharmaceutical companies to innovate in liquid formulations, opening new market opportunities.

"Europe is expected to hold the second largest market share of the pharmaceutical manufacturing equipment market during forecasted period".

The region is marked by a very competitive landscape, dominated by both large pharmaceutical companies and SMEs, thus facilitating innovation and diversification in terms of products. A tremendous investment in R&D for new manufacturing technologies supports the region's dominance in this market. Biopharmaceuticals form a great shift in the industry and have transformed it across Europe; Germany has emerged to be the largest producer of EU-approved biopharmaceutical substances. This growth is matched by increasing revenues from biologics, which further strengthens the the pharmaceutical manufacturing equipment market in Europe.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 40%, Tier 2 - 35%, Tier 3 - 25%

- By Designation- C-level Executives - 45%, Directors - 35%, Others - 20%

- By Region-North America - 30%, Europe - 25%, Asia Pacific - 40%, RoW - 5%

The pharmaceutical manufacturing equipment market is dominated by a few globally established players such as GEA Group Aktiengesellschaft (Germany), I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A. (Italy), Syntegon Technology GmbH (Germany), Romaco Group (Germany), ACG (India), Korber AG (Germany), Thermo Fisher Scientific Inc. (US), Marchesini Group (Italy), MG2 s.r.l (Italy), Glatt GmbH (Germany). The study includes an in-depth competitive analysis of these key players in the pharmaceutical manufacturing equipment market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the pharmaceutical manufacturing equipment and forecasts its size by equipment type, end product type, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. Supply chain analysis has been included in the report, along with the key players and their competitive analysis in the pharmaceutical manufacturing equipment ecosystem.

Key Benefits to Buy the Report:

- Analysis of key drivers (Rising demand for pharmaceuticals, technological advancements in equipment and growing implementation & adoption of regulatory guidelines). Restraint (Demand for refurbished equipment), Opportunity (Growth in personalized medicines), Challenges (Rising costs and expenditures related to usage of pharmaceutical manufacturing equipment).

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the pharmaceutical manufacturing equipment market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the pharmaceutical manufacturing equipment market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the pharmaceutical manufacturing equipment market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players GEA Group Aktiengesellschaft (Germany), I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A. (Italy), Syntegon Technology GmbH (Germany), Romaco Group (Germany), ACG (India) among others in the pharmaceutical manufacturing equipment market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 LIMITATIONS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size through bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size through top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET

- 4.2 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE

- 4.3 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE

- 4.4 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing rate of chronic diseases

- 5.2.1.2 Adoption of modular manufacturing setups

- 5.2.1.3 Increasing implementation and adoption of regulatory guidelines

- 5.2.2 RESTRAINTS

- 5.2.2.1 Rising adoption of refurbished equipment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for personalized medicines

- 5.2.3.2 Rising demand for biopharmaceuticals

- 5.2.4 CHALLENGES

- 5.2.4.1 Adherence to multiple regulations and standards

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 INDICATIVE PRICING OF KEY PLAYERS, BY EQUIPMENT TYPE, 2023

- 5.4.2 AVERAGE SELLING PRICE TREND OF PHARMACEUTICAL PACKAGING MACHINES, 2019-2023

- 5.4.3 AVERAGE SELLING PRICE TREND, BY REGION, 2019-2023

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 IMPACT OF AI/GENERATIVE AI ON PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Digital twin

- 5.8.1.2 Automation and robotics

- 5.8.1.3 IoT

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 3D printing

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 CAD and CAM

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA (HS CODE 842230)

- 5.10.2 EXPORT DATA (HS CODE 842230)

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDIES

- 5.12.1 ZAMBON COMPANY S.P.A. AND IMA ACTIVE COLLABORATED ON PROCESS OPTIMIZATION PROJECT TO ENHANCE BATCH CONSISTENCY AND QUALITY

- 5.12.2 ACG HELPED INDIAN PHARMACEUTICAL COMPANY RETROFIT B MAX MACHINE WITH NITROGEN-ENHANCED PURGING SYSTEM

- 5.12.3 SYNTEGON PROVIDED JIANGSU WITH AIM 5022S PLATFORM TO ENHANCE INSPECTION EFFICIENCY AND ACCURACY

- 5.13 REGULATIONS LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 BARGAINING POWER OF SUPPLIERS

- 5.14.2 BARGAINING POWER OF BUYERS

- 5.14.3 THREAT OF NEW ENTRANTS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

6 PHARMACEUTICAL MANUFACTURING EQUIPMENT SUPPLIERS AND AFTERMARKET SUPPLIERS

- 6.1 INTRODUCTION

- 6.2 ORIGINAL EQUIPMENT MANUFACTURERS

- 6.3 AFTERMARKET SUPPLIERS

7 MAJOR PHARMACEUTICAL EQUIPMENT MANUFACTURING PROCESSES

- 7.1 INTRODUCTION

- 7.2 FORMULATION PROCESS

- 7.3 TABLETING AND ENCAPSULATION PROCESS

- 7.4 ASEPTIC PROCESS

- 7.5 PACKAGING PROCESS

- 7.6 QUALITY CONTROL PROCESS

8 END USERS OF PHARMACEUTICAL MANUFACTURING EQUIPMENT

- 8.1 INTRODUCTION

- 8.2 PHARMACEUTICAL MANUFACTURING COMPANIES

- 8.3 CONTRACT MANUFACTURING ORGANIZATIONS

9 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY END-PRODUCT TYPE

- 9.1 INTRODUCTION

- 9.2 SOLID

- 9.2.1 ONGOING TECHNOLOGICAL INNOVATIONS TO DRIVE MARKET

- 9.3 LIQUID

- 9.3.1 RISING APPLICATION FOR UNSTABLE DRUGS IN SOLID FORM TO BOOST DEMAND

10 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE

- 10.1 INTRODUCTION

- 10.2 PACKAGING MACHINES

- 10.2.1 RISING NEED TO ENSURE PROTECTION AGAINST DAMAGE AND CONTAMINATION TO FUEL MARKET GROWTH

- 10.3 FILLING MACHINES

- 10.3.1 GROWING NEED FOR COMPLIANCE WITH STRINGENT REGULATORY STANDARDS TO FOSTER MARKET GROWTH

- 10.4 SPRAY DRYING EQUIPMENT

- 10.4.1 PRESSING NEED TO PRODUCE HIGH-QUALITY DRUG PRODUCTS TO FUEL MARKET GROWTH

- 10.5 MIXING AND BLENDING MACHINES

- 10.5.1 ABILITY TO PROVIDE CONTROLLED AND CONSISTENT AGITATION AND SHEAR FORCES TO ENSURE HOMOGENEITY OF DRUG FORMULATION TO BOOST DEMAND

- 10.6 MILLING EQUIPMENT

- 10.6.1 RISING NEED TO REDUCE PARTICLE SIZE OF DRUG FORMULATIONS TO FOSTER MARKET GROWTH

- 10.7 EXTRUSION EQUIPMENT

- 10.7.1 ELEVATING USE TO PRODUCE VARIOUS DOSAGE FORMS TO FUEL MARKET GROWTH

- 10.8 TABLET COMPRESSION PRESSES

- 10.8.1 INCREASING PREFERENCE FOR SOLID DOSAGE FORMS TO DRIVE MARKET

- 10.9 INSPECTION EQUIPMENT

- 10.9.1 SURGING NEED TO ENSURE QUALITY AND INTEGRITY OF DRUG PRODUCTS TO FOSTER MARKET GROWTH

- 10.10 GRANULATION EQUIPMENT

- 10.10.1 ABILITY TO IMPROVE OVERALL STABILITY AND BIOAVAILABILITY OF DRUGS TO BOOST DEMAND

- 10.11 STERILIZATION EQUIPMENT

- 10.11.1 GROWING DEMAND FOR CONTAMINATION-FREE DRUGS AND PRODUCTS TO DRIVE MARKET

11 PHARMACEUTICAL MANUFACTURING EQUIPMENT MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Government-led initiatives to advance pharmaceutical manufacturing capacity to drive market

- 11.2.3 CANADA

- 11.2.3.1 Rising emphasis on strengthening domestic manufacturing capabilities to foster market growth

- 11.2.4 MEXICO

- 11.2.4.1 Increasing focus on streamlining pharmaceutical regulatory processes to fuel market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 UK

- 11.3.2.1 Rising emphasis on developing advanced manufacturing equipment to offer lucrative growth opportunities

- 11.3.3 GERMANY

- 11.3.3.1 Escalating demand for branded and generic drugs to foster market growth

- 11.3.4 FRANCE

- 11.3.4.1 Government-led policies to encourage investment and innovation in pharmaceutical manufacturing industry to accelerate demand

- 11.3.5 ITALY

- 11.3.5.1 Growing focus on establishing pharmaceutical manufacturing facilities to create significant growth opportunities

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Surging FDIs and regulatory reforms to streamline drug approvals to offer lucrative growth opportunities

- 11.4.3 JAPAN

- 11.4.3.1 Increasing demand for innovative pharmaceutical manufacturing solutions to fuel market growth

- 11.4.4 INDIA

- 11.4.4.1 Government-led initiatives to strengthen domestic manufacturing to boost demand

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Low import tariffs and enhanced regulatory transparency to attract foreign investments to foster market growth

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 MIDDLE EAST

- 11.5.2.1 Expanding pharmaceutical manufacturing infrastructure to offer growth opportunities

- 11.5.2.2 GCC

- 11.5.2.3 Rest of Middle East

- 11.5.3 AFRICA

- 11.5.3.1 Rising investment in local pharmaceutical manufacturing to fuel market growth

- 11.5.4 SOUTH AMERICA

- 11.5.4.1 Introduction of tax incentives to strengthen pharmaceutical manufacturing to support market growth

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- 12.3 REVENUE ANALYSIS, 2019-2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Primary packaging equipment footprint

- 12.7.5.4 Secondary packaging equipment footprint

- 12.7.5.5 Type footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 GEA GROUP AKTIENGESELLSCHAFT

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 I.M.A INDUSTRIA MACCHINE AUTOMATICHE S.P.A.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 SYNTEGON TECHNOLOGY GMBH

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 ACG

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 THERMO FISHER SCIENTIFIC INC.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 ROMACO GROUP

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.7 KORBER AG

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.3.2 Expansions

- 13.1.8 MARCHESINI GROUP S.P.A.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.9 MG2 S.R.L.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.10 GLATT GMBH

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.1 GEA GROUP AKTIENGESELLSCHAFT

- 13.2 OTHER PLAYERS

- 13.2.1 BAUSCH+STROBEL SE + CO. KG

- 13.2.2 COPERION GMBH

- 13.2.3 ELIZABETH COMPANIES

- 13.2.4 FETTE COMPACTING

- 13.2.5 FREUND

- 13.2.6 KORSCH AG

- 13.2.7 L.B. BOHLE MASCHINEN UND VERFAHREN GMBH

- 13.2.8 LFA MACHINES

- 13.2.9 CVC TECHNOLOGIES, INC.

- 13.2.10 OHARA TECHNOLOGIES

- 13.2.11 PRISM PHARMA MACHINERY

- 13.2.12 SAINTYCO

- 13.2.13 SILVERSON

- 13.2.14 YENCHEN MACHINERY CO., LTD

- 13.2.15 QUALICAPS

- 13.2.16 COESIA S.P.A.

- 13.2.17 UHLMANN

- 13.2.18 AUTOMATED SYSTEMS OF TACOMA, LLC

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS