|

|

市場調査レポート

商品コード

1277588

AutoML(自動機械学習)の世界市場:提供別(ソリューション、サービス)、アプリケーション別(データ処理、モデル選定、ハイパーパラメーター最適化・チューニング、特徴量エンジニアリング、アンサンブルモデル)、業種別、地域別 - 2028年までの予測Automated Machine Learning (AutoML) Market by Offering (Solutions & Services), Application (Data Processing, Model Selection, Hyperparameter Optimization & Tuning, Feature Engineering, Model Ensembling), Vertical and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| AutoML(自動機械学習)の世界市場:提供別(ソリューション、サービス)、アプリケーション別(データ処理、モデル選定、ハイパーパラメーター最適化・チューニング、特徴量エンジニアリング、アンサンブルモデル)、業種別、地域別 - 2028年までの予測 |

|

出版日: 2023年05月12日

発行: MarketsandMarkets

ページ情報: 英文 349 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のAutoML(自動機械学習)の市場規模は、2023年の10億米ドルから、2028年までに64億米ドルまで拡大し、予測期間中にCAGRで44.6%の成長が予測されています。

説明可能なAIは、機械学習モデルがどのように予測を行うかについて透明性を提供することを目的とした、AutoMLの重要な側面です。特徴量の重要度や意思決定ツリーなどの説明可能なAI技術を使用することで、企業はモデルがどのように機能するかについての洞察を得ることができ、より多くの情報に基づいた意思決定を行うことができます。

業種別では、予測期間中、BFSIが最大の市場になると予測される

AutoMLは、反復的で時間のかかる作業を自動化し、生産性、効率性、高いスケールで機械学習モデルを構築し、機械学習モデルの実装とトレーニングに必要な知識ベースのリソースを最小限に抑えるために、BFSI部門で使用されている新しいテクノロジーです。AutoMLは、クレジットカードの不正利用検知、リスク評価、投資のリアルタイム損益予測などに活用することができます。また、AutoMLは、データ抽出やアルゴリズムを自動化し、分析の手作業部分をなくし、導入時間を大幅に短縮することができます。例えば、Consensus Corporationは、AutoMLを使用することで、導入時間を3~4週間から8時間まで短縮しました。AutoMLは、BFSI部門におけるエラーやバイアスの可能性を最小限に抑えることで、企業が洞察を高め、モデルの精度を向上させることを支援します。AutoMLは、BFSI業界にいくつかのメリットを提供します。複雑で時間のかかる手作業のデータサイエンスプロセスの必要性を低減し、データサイエンティストの作業を加速させることができるのです。また、AutoMLはデータに基づくビジネスパフォーマンスの最適化を支援し、ビジネスリーダーがリアルタイム分析で意思決定を行うことを可能にします。

アプリケーション別では、アンサンブルモデルセグメントが予測期間中に最も高いCAGRで成長すると予測される

アンサンブルモデル向けAutoMLには、予測精度を向上させるために組み合わせることができるモデルのコレクションを作成するための、自動化された技術の使用が含まれます。アンサンブルは、機械学習における一般的な手法で、複数のモデルの予測を組み合わせて、より正確な最終予測を生成するものです。AutoMLでは、バギング、ブースティング、スタッキングなど、様々な手法でアンサンブルモデルを行うことができます。AutoMLは、異なるアルゴリズムやハイパーパラメーターを用いて複数のモデルを自動的に作成し、アンサンブル技術を使ってそれらを組み合わせることができます。これにより、過剰適合のリスクを低減し、異なるアルゴリズムの長所を活用できるため、最終モデルの堅牢性と精度を向上させることができます。AutoMLをアンサンブルモデルに使用するメリットは、モデル選定と結合のプロセスを自動化できるため、データサイエンティストの時間と労力を節約できることです。また、AutoMLは、さまざまなアンサンブル手法の性能を評価し、特定のデータセットで最も優れた性能を発揮するものを選定することができます。

サービス別では、コンサルティングサービスセグメントが予測期間中に最大の市場規模を占めると予想される

コンサルティングサービスは、通常、サードパーティーベンダーやコンサルティング会社によって提供され、機械学習の戦略や実装に関する専門知識やガイダンスを提供します。コンサルティングサービスは、組織がデータの準備状況を評価し、ユースケースを特定し、組織内で機械学習を実装するためのロードマップを作成するのに役立ちます。AutoMLのコンサルティングサービスは、組織が機械学習ツールやプラットフォームの複雑な状況を把握し、特定のニーズや目標に基づき、どのツールやテクノロジーを使用するかについて、情報に基づいた意思決定を行うことを支援します。また、データの準備、モデル選定、ハイパーパラメーターのチューニングを指導し、機械学習モデルのパフォーマンスと有効性を評価することも可能です。コンサルタントは、オンサイトまたはリモートで作業し、機械学習のライフサイクルを通じて継続的なサポートとガイダンスを提供することができます。専門知識、ガイダンス、教育を提供することで、コンサルタントは、企業が十分な情報に基づいた意思決定を行い、機械学習イニシアチブでより良い結果を得るのを支援することができます。

予測期間中、北米が最大の市場規模を占める見込み

北米は、AutoML市場で最大のシェアを占めると推定されます。AutoMLの世界市場は、北米が支配しています。北米は、世界のAutoML市場において最も高い収益を生み出している地域であり、米国が最も高い市場シェアを占め、次いでカナダが続きます。この地域は、医療、金融、小売など様々な業界で機械学習や人工知能技術の導入率が高く、これがAutoMLソリューションの需要を促進すると予想されます。さらに、この地域にはデータ主導型のスタートアップや企業が数多く存在することも、北米のAutoML市場の成長をさらに後押ししています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- エコシステム分析

- AutoMLの歴史

- AutoMLパイプラインフレームワーク

- バリューチェーン分析

- 価格モデル分析

- 特許分析

- AutoML技術

- AutoAIとAutoMLソリューションの比較

- AutoMLのビジネスモデル

- 技術分析

- ポーターのファイブフォース分析

- 主要な会議とイベント

- 規制状況

- 主要な利害関係者と購入基準

- AutoML市場におけるベストプラクティス

- AutoML市場の購入者/クライアントに影響を与える混乱

- AutoML情勢の将来の方向性

第6章 AutoML市場:提供別

- イントロダクション

- ソリューション

- サービス

- コンサルティングサービス

- 展開・統合

- トレーニング・サポート・メンテナンス

第7章 AutoML市場:アプリケーション別

- イントロダクション

- データ処理

- クリーニング

- トランスフォーメーション

- 視覚化

- モデル選定

- スケーリング

- モニタリング

- バージョン管理

- ハイパーパラメーター最適化・チューニング

- グリッド検索

- ランダム検索

- ベイジアン検索

- 特徴量エンジニアリング

- アンサンブルモデル

- インフラ・フォーマット

- 統合

- メンテナンス

- その他

第8章 AutoML市場:業種別

- イントロダクション

- 銀行・金融サービス・保険(BFSI)

- 医療・ライフサイエンス

- 小売・Eコマース

- 製造

- 政府・防衛

- 通信

- IT/ITES

- 自動車・輸送・物流

- メディア・エンターテインメント

- その他

第9章 AutoML市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- イタリア

- スペイン

- 北欧諸国

- その他の欧州

- アジア太平洋地域

- 中国

- 日本

- 韓国

- ASEAN

- オーストラリア・ニュージーランド

- その他のアジア太平洋地域

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- イスラエル

- トルコ

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- その他のラテンアメリカ

第10章 競合情勢

- 概要

- 主要企業が採用した戦略

- 収益分析

- 市場シェア分析

- 主要企業の評価象限マトリックス

- 中小企業/新興企業の評価象限マトリックス

- 競合ベンチマーキング

- AutoML製品情勢

- 競合シナリオ

- 主要なAutoMLベンダーの評価と財務指標

- 主要なAutoMLベンダーの年初来価格の総収益と株価ベータ

第11章 企業プロファイル

- 主要企業

- IBM

- ORACLE

- MICROSOFT

- SERVICENOW

- BAIDU

- AWS

- ALTERYX

- HPE

- SALESFORCE

- ALTAIR

- TERADATA

- H2O.AI

- DATAROBOT

- BIGML

- DATABRICKS

- DATAIKU

- MATHWORKS

- SPARKCOGNITION

- QLIK

- その他の企業

- ALIBABA CLOUD

- APPIER

- SQUARK

- AIBLE

- DATAFOLD

- BOOST.AI

- TAZI AI

- AKKIO

- VALOHAI

- DOTDATA

第12章 隣接市場・関連市場

- ジェネレーティブAI市場

- AI市場

第13章 付録

The market for Automated Machine Learning is projected to grow from USD 1.0 billion in 2023 to USD 6.4 billion by 2028, at a CAGR of 44.6% during the forecast period. Explainable AI is a crucial aspect of AutoML that aims to provide transparency into how machine learning models make predictions. By using explainable AI techniques, such as feature importance and decision trees, businesses can gain insights into how their models work and make more informed decisions.

The BFSI vertical is projected to be the largest market during the forecast period

AutoML is an emerging technology used in the BFSI sectors to automate iterative and time-consuming tasks, build machine learning models with productivity, efficiency, and high scale, and minimize the knowledge-based resources needed to implement and train machine learning models. AutoML can be used for credit card fraud detection, risk assessment, and real-time gain and loss prediction for investments. AutoML can also help reduce deployment time by automating data extraction and algorithms, eliminating manual parts of the analyses, and significantly reducing deployment time. For instance, the Consensus Corporation reduced its deployment time from 3-4 weeks to eight hours using AutoML. AutoML can help enterprises boost insights and enhance model accuracy by minimizing the chances of error or bias in the BFSI sector. AutoML provides several benefits to the BFSI industry. It helps to reduce the need for manual data science processes, which can be complex and time-consuming, and can accelerate the work of data scientists. AutoML can also help optimize business performance driven by data, enabling business leaders to make decisions with real-time analytics.

Among Application, model ensembling segment is registered to grow at the highest CAGR during the forecast period

AutoML for model ensembling involves the use of automated techniques to create a collection of models that can be combined to improve prediction accuracy. Ensembling is a popular technique in machine learning that involves combining the predictions of multiple models to generate a more accurate final prediction. AutoML can use various techniques for model ensembling, such as bagging, boosting, and stacking. AutoML can automatically create multiple models using different algorithms and hyperparameters and then combine them using ensembling techniques. This can improve the robustness and accuracy of the final model, as it reduces the risk of overfitting and leverages the strengths of different algorithms. The benefit of using AutoML for model ensembling is that it can automate the process of selecting and combining models, which can save time and effort for data scientists. AutoML can also evaluate the performance of different ensembling methods and select the one that performs the best on the given dataset.

Among services, consulting services segment is anticipated to account for the largest market size during the forecast period

Consulting services are typically offered by third-party vendors or consulting firms, providing expertise and guidance on machine learning strategy and implementation. Consulting services can help organizations evaluate their data readiness, identify use cases, and develop a roadmap for implementing machine learning within their organization. AutoML consulting services can help organizations navigate the complex landscape of machine learning tools and platforms and make informed decisions about which tools and technologies to use based on their specific needs and goals. Consultants can also guide data preparation, model selection, and hyperparameter tuning and can help organizations evaluate the performance and effectiveness of their machine learning models. Consultants may work onsite or remotely and provide ongoing support and guidance throughout the machine learning lifecycle. By providing expertise, guidance, and education, consultants can help organizations make informed decisions and achieve better results with their machine learning initiatives.

North America to account for the largest market size during the forecast period

North America is estimated to account for the largest share of the Automated Machine Learning market. The global market for Automated Machine Learning is dominated by North America. North America is the highest revenue-generating region in the global Automated Machine Learning market, with the US constituting the highest market share, followed by Canada. The region has a high adoption rate of machine learning and artificial intelligence technologies across various industries, including healthcare, finance, and retail, which is expected to drive the demand for AutoML solutions. Moreover, the presence of a large number of data-driven startups and companies in the region is further fueling the growth of the AutoML market in North America.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the Automated Machine Learning market.

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, Directors: 25%, and Others: 40%

- By Region: APAC: 30%, Europe: 20%, North America: 40%, MEA: 5%, Latin America: 5%

Major vendors offering Automted Machine Learning solutions and services across the globe are IBM (US), Oracle (US), Microsoft (US), ServiceNow (US), Google (US), Baidu (China), AWS (US), Alteryx (US), Salesforce (US), Altair (US), Teradata (US), H2O.ai (US), DataRobot (US), BigML (US), Databricks (US), Dataiku (France), Alibaba Cloud (China), Appier (Taiwan), Squark (US), Aible (US), Datafold (US), Boost.ai (Norway), Tazi.ai (US), Akkio (US), Valohai (Finland), dotData (US), Qlik (US), Mathworks (US), HPE (US), and SparkCognition (US).

Research Coverage

The market study covers Automated Machine Learning across segments. It aims at estimating the market size and the growth potential across different segments, such as offering, application, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market for Automated Machine Learning and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing demand for improved customer satisfaction and personalized product recommendations through AutoML, Increasing need for accurate fraud detection, Growing data volume and complexity, Rising need to transform businesses with Intelligent automation using AutoML), restraints (Machine learning tools are being slowly adopted, Lack of standardization and regulations), opportunities (Capitalizing on growing demand for AI-enabled solutions, Integration with complementary technologies, Seizing opportunities for faster decision-making and cost savings ), and challenges (Increasing shortage of skilled talent, Difficulty in Interpreting and explaining AutoML models, Data privacy in AutoML) influencing the growth of the Automated Machine Learning market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Automated Machine Learning market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Automated Machine Learning market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in Automated Machine Learning market strategies; the report also helps stakeholders understand the pulse of the Automated Machine Learning market and provides them with information on key market drivers, restraints, challenges, and opportunities

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as IBM (US), Google (US), AWS(US), Microsoft (US), Salesforce (US), among others in the Automated Machine Learning market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 AUTOMATED MACHINE LEARNING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary interview participants

- 2.1.2.3 Breakup of primary profiles

- 2.1.2.4 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 2 AUTOMATED MACHINE LEARNING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 3 APPROACH 1 (SUPPLY SIDE): REVENUE FROM OFFERINGS OF AUTOMATED MACHINE LEARNING MARKET PLAYERS

- FIGURE 4 APPROACH 2 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM OFFERINGS OF AUTOMATED MACHINE LEARNING MARKET PLAYERS

- FIGURE 5 APPROACH 3 - BOTTOM-UP (SUPPLY SIDE): REVENUE AND SUBSEQUENT MARKET ESTIMATION FROM AUTOMATED MACHINE LEARNING MARKET OFFERINGS

- FIGURE 6 APPROACH 4 - BOTTOM-UP (DEMAND SIDE): SHARE OF AUTOMATED MACHINE LEARNING MARKET OFFERINGS THROUGH OVERALL AUTOMATED MACHINE LEARNING SPENDING

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT

- 2.7 IMPACT OF RECESSION ON GLOBAL AUTOMATED MACHINE LEARNING MARKET

- TABLE 3 IMPACT OF RECESSION ON GLOBAL AUTOMATED MACHINE LEARNING MARKET

3 EXECUTIVE SUMMARY

- TABLE 4 GLOBAL AUTOMATED MACHINE LEARNING MARKET SIZE AND GROWTH RATE, 2017-2022 (USD MILLION, Y-O-Y%)

- TABLE 5 GLOBAL AUTOMATED MACHINE LEARNING MARKET SIZE AND GROWTH RATE, 2023-2028 (USD MILLION, Y-O-Y%)

- FIGURE 7 SOLUTIONS SEGMENT TO LEAD MARKET IN 2023

- FIGURE 8 PLATFORMS SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 9 OM-PREMISES SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- FIGURE 10 CONSULTING SERVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 11 DATA PROCESSING SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 12 BFSI SEGMENT TO LEAD MARKET IN 2023

- FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE MARKET OPPORTUNITIES FOR PLAYERS IN AUTOMATED MACHINE LEARNING MARKET

- FIGURE 14 RISING DEMAND FOR PLATFORMS TO TRANSFER DATA FROM ON-PREMISES TO CLOUD TO DRIVE AUTOMATED MACHINE LEARNING MARKET

- 4.2 AUTOMATED MACHINE LEARNING MARKET, BY VERTICAL

- FIGURE 15 RETAIL & ECOMMERCE SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- 4.3 AUTOMATED MACHINE LEARNING MARKET, BY REGION

- FIGURE 16 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE BY 2028

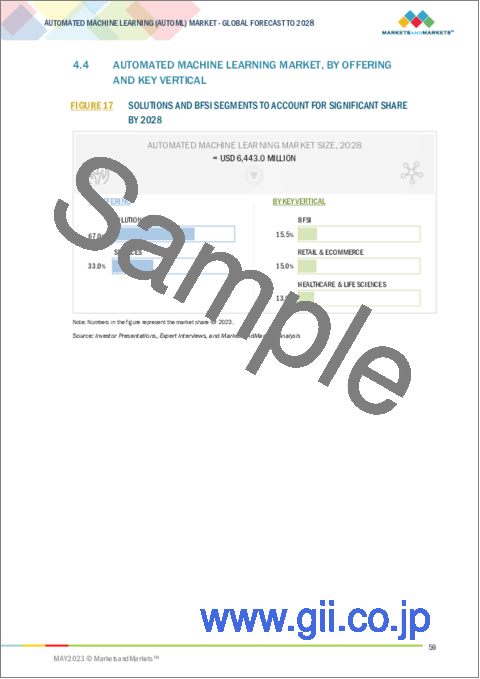

- 4.4 AUTOMATED MACHINE LEARNING MARKET, BY OFFERING AND KEY VERTICAL

- FIGURE 17 SOLUTIONS AND BFSI SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE BY 2028

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 AUTOMATED MACHINE LEARNING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for improved customer satisfaction and personalized product recommendations through AutoML

- 5.2.1.2 Increasing need for accurate fraud detection

- 5.2.1.3 Growing data volume and complexity

- 5.2.1.4 Rising need to transform businesses with intelligent automation using AutoML

- 5.2.2 RESTRAINTS

- 5.2.2.1 Slow adoption of machine learning tools

- 5.2.2.2 Lack of standardization and regulations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for AI-enabled solutions across industries

- 5.2.3.2 Seamless integration between technologies

- 5.2.3.3 Increased accessibility of machine learning solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Growing shortage of skilled workforce

- 5.2.4.2 Difficulty in interpreting and explaining AutoML models

- 5.2.4.3 Rising threat to data privacy

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 REAL ESTATE

- 5.3.1.1 Case Study 1: Ascendas Singbridge Group improved real estate decision-making by leveraging DataRobot's AutoML platform

- 5.3.1.2 Case Study 2: G5 employed H2O.AI's driverless AI platform to address challenges in identifying productive leads

- 5.3.2 BFSI

- 5.3.2.1 Case Study 1: Robotica helped Avant automate key processes and streamline lending operations

- 5.3.2.2 Case Study 2: Domestic and General partnered with DataRobot to improve customer service capabilities

- 5.3.2.3 Case Study 3: H2O.AI's machine learning platform enabled PayPal to strengthen fraud detection capabilities

- 5.3.3 RETAIL & ECOMMERCE

- 5.3.3.1 Case Study 1: California Design Den partnered with Google Cloud Platform to implement machine learning solutions

- 5.3.4 IT/ITES

- 5.3.4.1 Case Study 1: Contentree helped Consensus simplify data wrangling process and make it efficient

- 5.3.4.2 Case Study 2: DataRobot's automated machine learning platform helped Demyst automate data science processes

- 5.3.5 HEALTHCARE & LIFESCIENCES

- 5.3.5.1 Case Study 1: DataRobot helped Evariant automate patient risk stratification and readmission prediction

- 5.3.6 MEDIA & ENTERTAINMENT

- 5.3.6.1 Case Study 1: Meredith Corporation worked with Google Cloud to build data analytics platform to handle large volumes of data

- 5.3.7 TRANSPORTATION & LOGISTICS

- 5.3.7.1 Case Study 1: DMWay enabled PGL to integrate and analyze data from multiple sources

- 5.3.8 ENERGY & UTILITIES

- 5.3.8.1 Case Study 1: SparkCognition helped oil & gas industry to build predictive models by leveraging automated machine learning solutions

- 5.3.1 REAL ESTATE

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 19 ECOSYSTEM ANALYSIS

- TABLE 6 AUTOMATED MACHINE LEARNING MARKET: PLATFORM PROVIDERS

- TABLE 7 AUTOMATED MACHINE LEARNING MARKET: SERVICE PROVIDERS

- TABLE 8 AUTOMATED MACHINE LEARNING MARKET: TECHNOLOGY PROVIDERS

- TABLE 9 AUTOMATED MACHINE LEARNING MARKET: REGULATORY BODIES

- 5.5 HISTORY OF AUTOMATED MACHINE LEARNING

- 5.6 AUTOMATED MACHINE LEARNING PIPELINE FRAMEWORK

- FIGURE 20 AUTOMATED MACHINE LEARNING PIPELINE FRAMEWORK

- TABLE 10 AUTOMATED MACHINE LEARNING PIPELINE FRAMEWORK

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS

- 5.7.1 DATA COLLECTION & PREPARATION

- 5.7.2 ALGORITHM DEVELOPMENT

- 5.7.3 MODEL TRAINING

- 5.7.4 MODEL TESTING AND VALIDATION

- 5.7.5 DEPLOYMENT AND INTEGRATION

- 5.7.6 MAINTENANCE AND SUPPORT

- 5.8 PRICING MODEL ANALYSIS

- TABLE 11 AUTOMATED MACHINE LEARNING MARKET: PRICING LEVELS

- 5.9 PATENT ANALYSIS

- 5.9.1 METHODOLOGY

- 5.9.2 DOCUMENT TYPE

- TABLE 12 PATENTS FILED, 2018-2021

- 5.9.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 22 TOTAL NUMBER OF PATENTS GRANTED, 2021-2023

- 5.9.3.1 Top applicants

- FIGURE 23 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2018-2021

- TABLE 13 TOP 20 PATENT OWNERS, 2018-2021

- TABLE 14 LIST OF PATENTS IN AUTOMATED MACHINE LEARNING MARKET, 2021-2023

- 5.10 AUTOMATED MACHINE LEARNING TECHNIQUES

- 5.10.1 BAYESIAN OPTIMIZATION

- 5.10.2 REINFORCEMENT LEARNING

- 5.10.3 EVOLUTIONARY ALGORITHM

- 5.10.4 GRADIENT APPROACHES

- 5.11 COMPARISON OF AUTOAI AND AUTOML SOLUTIONS

- TABLE 15 COMPARISON BETWEEN AUTOAI AND AUTOML SOLUTIONS

- 5.12 BUSINESS MODELS OF AUTOML

- 5.12.1 API MODELS

- 5.12.2 AS-A-SERVICE MODEL

- 5.12.3 CLOUD MODEL

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 RELATED TECHNOLOGIES

- 5.13.1.1 Supervised learning

- 5.13.1.2 Unsupervised learning

- 5.13.1.3 Natural language processing

- 5.13.1.4 Computer vision

- 5.13.1.5 Transfer learning

- 5.13.2 ALLIED TECHNOLOGIES

- 5.13.2.1 Cloud computing

- 5.13.2.2 Robotics

- 5.13.2.3 Federated learning

- 5.13.1 RELATED TECHNOLOGIES

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT FROM NEW ENTRANTS

- 5.14.2 THREAT FROM SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY CONFERENCES & EVENTS

- TABLE 17 DETAILED LIST OF CONFERENCES & EVENTS, 2023-2024

- 5.16 REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.1.1 North America

- 5.16.1.1.1 US

- 5.16.1.1.2 Canada

- 5.16.1.2 Europe

- 5.16.1.3 Asia Pacific

- 5.16.1.3.1 South Korea

- 5.16.1.3.2 China

- 5.16.1.3.3 India

- 5.16.1.4 Middle East & Africa

- 5.16.1.4.1 UAE

- 5.16.1.4.2 KSA

- 5.16.1.4.3 Bahrain

- 5.16.1.5 Latin America

- 5.16.1.5.1 Brazil

- 5.16.1.5.2 Mexico

- 5.16.1.1 North America

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.17.2 BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 23 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.18 BEST PRACTICES IN AUTOMATED MACHINE LEARNING MARKET

- 5.19 DISRUPTIONS IMPACTING BUYERS/CLIENTS IN AUTOMATED MACHINE LEARNING MARKET

- FIGURE 27 AUTOMATED MACHINE LEARNING MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

- 5.20 FUTURE DIRECTIONS OF AUTOMATED MACHINE LEARNING LANDSCAPE

- TABLE 24 SHORT-TERM ROADMAP, 2023-2025

- TABLE 25 MID-TERM ROADMAP, 2026-2028

- TABLE 26 LONG-TERM ROADMAP, 2029-2030

6 AUTOMATED MACHINE LEARNING MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: AUTOMATED MACHINE LEARNING MARKET DRIVERS

- FIGURE 28 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 27 AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 28 AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- TABLE 29 SOLUTIONS: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 30 SOLUTIONS: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.1 AUTOMATED MACHINE LEARNING SOLUTIONS, BY TYPE

- FIGURE 29 PLATFORMS SEGMENT TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

- TABLE 31 SOLUTIONS: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 32 SOLUTIONS: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 6.2.1.1 Platforms

- 6.2.1.1.1 Ease of use and deployment to drive adoption of automated machine learning platforms

- 6.2.1.1 Platforms

- TABLE 33 PLATFORMS: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 34 PLATFORMS: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.1.2 Software

- 6.2.1.2.1 Ease of integration into existing machine learning workflows to boost deployment of automated machine learning software solutions

- 6.2.1.2 Software

- TABLE 35 SOFTWARE: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 36 SOFTWARE: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2 AUTOMATED MACHINE LEARNING SOLUTIONS, BY DEPLOYMENT

- FIGURE 30 ON-PREMISES SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- TABLE 37 SOLUTIONS: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 38 SOLUTIONS: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- 6.2.2.1 On-premises

- 6.2.2.1.1 Increased control over data and infrastructure to drive on-premises deployment of automated machine learning solutions

- 6.2.2.1 On-premises

- TABLE 39 ON-PREMISES: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 40 ON-PREMISES: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2.2 Cloud

- 6.2.2.2.1 Flexibility and scalability of cloud-based AutoML solutions to boost market growth

- 6.2.2.2 Cloud

- TABLE 41 CLOUD: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 42 CLOUD: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

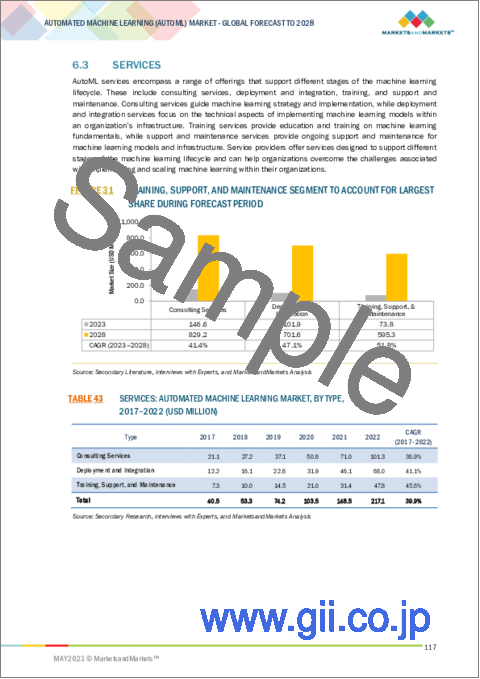

- 6.3 SERVICES

- FIGURE 31 TRAINING, SUPPORT, AND MAINTENANCE SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- TABLE 43 SERVICES: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 44 SERVICES: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 45 SERVICES: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 46 SERVICES: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1 CONSULTING SERVICES

- 6.3.1.1 Rising demand for expert guidance on machine learning strategies to drive growth of automated machine learning consulting services

- TABLE 47 CONSULTING SERVICES: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 48 CONSULTING SERVICES: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 DEPLOYMENT AND INTEGRATION

- 6.3.2.1 Rising demand for integrating machine learning models into existing workflows and applications to boost adoption of AutoML deployment and integration services

- TABLE 49 DEPLOYMENT AND INTEGRATION: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 50 DEPLOYMENT AND INTEGRATION: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3 TRAINING, SUPPORT, AND MAINTENANCE

- 6.3.3.1 Rising preference for optimal model performance and accuracy to drive use of AutoML training, support, and maintenance services

- TABLE 51 TRAINING, SUPPORT, AND MAINTENANCE: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 52 TRAINING, SUPPORT, AND MAINTENANCE: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

7 AUTOMATED MACHINE LEARNING MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 APPLICATIONS: AUTOMATED MACHINE LEARNING MARKET DRIVERS

- FIGURE 32 DATA PROCESSING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 53 AUTOMATED MACHINE LEARNING MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 54 AUTOMATED MACHINE LEARNING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 7.2 DATA PROCESSING

- 7.2.1 GROWING NEED TO DETECT AND CORRECT DATA ERRORS TO DRIVE ADOPTION OF AUTOML SOLUTIONS FOR DATA PROCESSING

- TABLE 55 DATA PROCESSING: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 56 DATA PROCESSING: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.2 CLEANING

- 7.2.3 TRANSFORMATION

- 7.2.4 VISUALIZATION

- 7.3 MODEL SELECTION

- 7.3.1 RISING DEMAND FOR AUTOMATED TECHNIQUES TO HANDLE COMPLEX DATA TO BOOST GROWTH OF AUTOML SOLUTIONS FOR MODEL SELECTION

- TABLE 57 MODEL SELECTION: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 58 MODEL SELECTION: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.2 SCALING

- 7.3.3 MONITORING

- 7.3.4 VERSIONING

- 7.4 HYPERPARAMETER OPTIMIZATION & TUNING

- 7.4.1 INCREASED ADOPTION OF AUTOML ALGORITHMS FOR HYPERPARAMETER OPTIMIZATION TO DRIVE MARKET GROWTH

- TABLE 59 HYPERPARAMETER TUNING & OPTIMIZATION: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 60 HYPERPARAMETER TUNING & OPTIMIZATION: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4.2 GRID SEARCH

- 7.4.3 RANDOM SEARCH

- 7.4.4 BAYESIAN SEARCH

- 7.5 FEATURE ENGINEERING

- 7.5.1 RISING NEED TO TRANSFORM RAW DATA INTO SET OF FEATURES FOR USE IN MACHINE LEARNING MODELS TO BOOST ADOPTION OF AUTOML SOLUTIONS IN FEATURE ENGINEERING

- TABLE 61 FEATURE ENGINEERING: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 62 FEATURE ENGINEERING: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 MODEL ENSEMBLING

- 7.6.1 GROWING IMPORTANCE OF IMPROVING PREDICTION ACCURACY TO PROPEL GROWTH OF AUTOML SOLUTIONS FOR MODEL ENSEMBLING

- 7.6.2 INFRASTRUCTURE & FORMAT

- 7.6.3 INTEGRATION

- 7.6.4 MAINTENANCE

- 7.7 OTHER APPLICATIONS

- TABLE 65 OTHER APPLICATIONS: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 66 OTHER APPLICATIONS: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

8 AUTOMATED MACHINE LEARNING MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.1.1 VERTICALS: AUTOMATED MACHINE LEARNING MARKET DRIVERS

- FIGURE 33 BFSI SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- TABLE 67 AUTOMATED MACHINE LEARNING MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 68 AUTOMATED MACHINE LEARNING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 8.2.1 NEED TO OPTIMIZE BUSINESS PERFORMANCE WITH REAL-TIME ANALYTICS TO DRIVE USE OF AUTOML SOLUTIONS IN BFSI SECTOR

- TABLE 69 BFSI: USE CASES

- TABLE 70 BFSI: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 71 BFSI: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 72 BFSI: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2017-2022 (USD MILLION)

- TABLE 73 BFSI: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2023-2028 (USD MILLION)

- 8.2.2 CREDIT SCORING

- 8.2.3 FRAUD DETECTION

- 8.2.4 RISK ANALYSIS & MANAGEMENT

- 8.2.5 OTHER BFSI SUB-VERTICALS

- 8.3 HEALTHCARE & LIFE SCIENCES

- 8.3.1 DEMAND FOR IMPROVED DIAGNOSES AND PERSONALIZED TREATMENT PLANS TO DRIVE MARKET FOR AI AND ML SOLUTIONS FOR HEALTHCARE & LIFE SCIENCES INDUSTRY

- TABLE 74 HEALTHCARE & LIFESCIENCES: USE CASES

- TABLE 75 HEALTHCARE & LIFE SCIENCES: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 76 HEALTHCARE & LIFE SCIENCES: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 77 HEALTHCARE & LIFE SCIENCES: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2017-2022 (USD MILLION)

- TABLE 78 HEALTHCARE & LIFE SCIENCES: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2023-2028 (USD MILLION)

- 8.3.2 ANOMALY DETECTION

- 8.3.3 DISEASE DIAGNOSIS

- 8.3.4 DRUG DISCOVERY

- 8.3.5 OTHER HEALTHCARE SUB-VERTICALS

- 8.4 RETAIL & ECOMMERCE

- 8.4.1 GROWING NEED FOR PERSONALIZATION AND OPTIMIZATION IN HIGHLY COMPETITIVE INDUSTRIES TO BOOST MARKET GROWTH

- TABLE 79 RETAIL & ECOMMERCE: USE CASES

- TABLE 80 RETAIL & ECOMMERCE: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 81 RETAIL & ECOMMERCE: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 82 RETAIL & ECOMMERCE: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2017-2022 (USD MILLION)

- TABLE 83 RETAIL & ECOMMERCE: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2023-2028 (USD MILLION)

- 8.4.2 DEMAND FORECASTING

- 8.4.3 PRICE OPTIMIZATION

- 8.4.4 RECOMMENDATION ENGINES

- 8.4.5 SENTIMENT ANALYSIS

- 8.4.6 SOCIAL MEDIA ANALYTICS

- 8.4.7 CHATBOTS FOR CUSTOMER SERVICE & SUPPORT

- 8.4.8 OTHER RETAIL & ECOMMERCE SUB-VERTICALS

- 8.5 MANUFACTURING

- 8.5.1 AUTOML SOLUTIONS TO OPTIMIZE MANUFACTURING PROCESS AND IMPROVE EFFICIENCY

- TABLE 84 MANUFACTURING: USE CASES

- TABLE 85 MANUFACTURING: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 86 MANUFACTURING: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 87 MANUFACTURING: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2017-2022 (USD MILLION)

- TABLE 88 MANUFACTURING: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2023-2028 (USD MILLION)

- 8.5.2 PREDICTIVE MAINTENANCE

- 8.5.3 QUALITY CONTROL

- 8.5.4 ROBOTIC PROCESS AUTOMATION

- 8.5.5 SUPPLY CHAIN OPTIMIZATION

- 8.5.6 OTHER MANUFACTURING SUB-VERTICALS

- 8.6 GOVERNMENT & DEFENSE

- 8.6.1 RISING NEED TO EMPOWER NATIONAL SECURITY AND PUBLIC SERVICES TO DRIVE ADOPTION OF AUTOML PLATFORMS IN GOVERNMENT & DEFENSE SECTOR

- TABLE 89 GOVERNMENT & DEFENSE: USE CASES

- TABLE 90 GOVERNMENT & DEFENSE: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 91 GOVERNMENT & DEFENSE: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 92 GOVERNMENT & DEFENSE: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2017-2022 (USD MILLION)

- TABLE 93 GOVERNMENT & DEFENSE: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2023-2028 (USD MILLION)

- 8.6.2 CYBERSECURITY THREAT DETECTION

- 8.6.3 FRAUD DETECTION & PREVENTION

- 8.6.4 NATURAL DISASTER MANAGEMENT

- 8.6.5 CUSTOMER SERVICE CHATBOTS

- 8.6.6 OTHER GOVERNMENT & DEFENSE SUB-VERTICALS

- 8.7 TELECOMMUNICATIONS

- 8.7.1 NEED FOR ENHANCED CUSTOMER SERVICE TO BOOST USE OF AUTOML SOLUTIONS IN TELECOMMUNICATIONS INDUSTRY

- TABLE 94 TELECOMMUNICATIONS: USE CASES

- TABLE 95 TELECOMMUNICATIONS: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 96 TELECOMMUNICATIONS: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 97 TELECOMMUNICATIONS: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2017-2022 (USD MILLION)

- TABLE 98 TELECOMMUNICATIONS: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2023-2028 (USD MILLION)

- 8.7.2 CYBERSECURITY THREAT DETECTION

- 8.7.3 NETWORK OPTIMIZATION

- 8.7.4 PREDICTIVE MAINTENANCE

- 8.7.5 FRAUD DETECTION & PREVENTION

- 8.7.6 CHATBOTS & VIRTUAL ASSISTANCE

- 8.7.7 OTHER TELECOMMUNICATIONS SUB-VERTICALS

- 8.8 IT/ITES

- 8.8.1 NEED TO OPTIMIZE PROCESSES AND ENHANCE CYBERSECURITY TO PROPEL GROWTH OF AUTOMATED MACHINE LEARNING MARKET FOR IT/ITES SECTOR

- TABLE 99 IT/ITES: USE CASES

- TABLE 100 IT/ITES: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 101 IT/ITES: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 102 IT/ITES: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2017-2022 (USD MILLION)

- TABLE 103 IT/ITES: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2023-2028 (USD MILLION)

- 8.8.2 PREDICTIVE MAINTENANCE

- 8.8.3 VIRTUAL ASSISTANTS FOR CUSTOMER SUPPORT

- 8.8.4 NETWORK OPTIMIZATION

- 8.8.5 OTHER IT/ITES SUB-VERTICALS

- 8.9 AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS

- 8.9.1 AUTOMATED MACHINE LEARNING SOLUTIONS TO ENABLE ORGANIZATIONS TO LEVERAGE DATA AND GAIN INSIGHTS FOR BETTER BUSINESS DECISIONS

- TABLE 104 AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS: USE CASES

- TABLE 105 AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 106 AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 107 AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2017-2022 (USD MILLION)

- TABLE 108 AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2023-2028 (USD MILLION)

- 8.9.2 AUTONOMOUS VEHICLES

- 8.9.3 ROUTE OPTIMIZATION

- 8.9.4 FUEL EFFICIENCY PREDICTION & OPTIMIZATION

- 8.9.5 HUMAN MACHINE INTERFACE (HMI)

- 8.9.6 SEMI-AUTONOMOUS DRIVING

- 8.9.7 ROBOTIC PROCESS AUTOMATION

- 8.9.8 OTHER AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS SUB-VERTICALS

- 8.10 MEDIA & ENTERTAINMENT

- 8.10.1 USE OF AUTOML SOLUTIONS TO ENSURE IMPROVED CONTENT DISCOVERY

- TABLE 109 MEDIA & ENTERTAINMENT: USE CASES

- TABLE 110 MEDIA & ENTERTAINMENT: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 111 MEDIA & ENTERTAINMENT: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 112 MEDIA & ENTERTAINMENT: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2017-2022 (USD MILLION)

- TABLE 113 MEDIA & ENTERTAINMENT: AUTOMATED MACHINE LEARNING MARKET, BY SUB-VERTICAL, 2023-2028 (USD MILLION)

- 8.10.2 IMAGE & SPEECH RECOGNITION

- 8.10.3 RECOMMENDATION SYSTEMS

- 8.10.4 SENTIMENT ANALYSIS

- 8.10.5 OTHER MEDIA & ENTERTAINMENT SUB-VERTICALS

- 8.11 OTHER VERTICALS

- TABLE 114 OTHER VERTICALS: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 115 OTHER VERTICALS: AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

9 AUTOMATED MACHINE LEARNING MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 34 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 116 AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 117 AUTOMATED MACHINE LEARNING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: AUTOMATED MACHINE LEARNING MARKET DRIVERS

- 9.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 118 NORTH AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 119 NORTH AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 120 NORTH AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 121 NORTH AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 122 NORTH AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 123 NORTH AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 124 NORTH AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 125 NORTH AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 126 NORTH AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 127 NORTH AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 128 NORTH AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 129 NORTH AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 130 NORTH AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 131 NORTH AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.2.3 US

- 9.2.3.1 Growing demand for efficient ways to build and deploy machine learning models to drive market growth

- TABLE 132 US: AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 133 US: AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 134 US: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 135 US: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 136 US: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 137 US: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 138 US: AUTOMATED MACHINE LEARNING MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 139 US: AUTOMATED MACHINE LEARNING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 9.2.4 CANADA

- 9.2.4.1 Rising adoption of machine learning applications in various industries across Canada to fuel market growth

- 9.3 EUROPE

- 9.3.1 EUROPE: AUTOMATED MACHINE LEARNING MARKET DRIVERS

- 9.3.2 EUROPE: RECESSION IMPACT

- TABLE 140 EUROPE: AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 141 EUROPE: AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 142 EUROPE: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 143 EUROPE: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 144 EUROPE: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 145 EUROPE: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 146 EUROPE: AUTOMATED MACHINE LEARNING MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 147 EUROPE: AUTOMATED MACHINE LEARNING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 148 EUROPE: AUTOMATED MACHINE LEARNING MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 149 EUROPE: AUTOMATED MACHINE LEARNING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 150 EUROPE: AUTOMATED MACHINE LEARNING MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 151 EUROPE: AUTOMATED MACHINE LEARNING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 152 EUROPE: AUTOMATED MACHINE LEARNING MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 153 EUROPE: AUTOMATED MACHINE LEARNING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 154 UK: AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 155 UK: AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 156 UK: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 157 UK: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 158 UK: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 159 UK: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 160 UK: AUTOMATED MACHINE LEARNING MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 161 UK: AUTOMATED MACHINE LEARNING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 9.3.4 GERMANY

- 9.3.4.1 Strong IT infrastructure and robust regulatory framework to drive AutoML market in Germany

- 9.3.5 FRANCE

- 9.3.5.1 Country's thriving startup ecosystem to boost adoption of automated machine learning solutions

- 9.3.6 ITALY

- 9.3.6.1 Significant initiatives taken by government to promote use of automated machine learning platforms to boost market growth

- 9.3.7 SPAIN

- 9.3.7.1 Rising technological investments by major players to boost popularity of AutoML platforms and solutions in Spain

- 9.3.8 NORDIC

- 9.3.8.1 Increasing research and development in AI and machine learning in Nordic countries to drive market growth

- 9.3.9 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: AUTOMATED MACHINE LEARNING MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 162 ASIA PACIFIC: AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 163 ASIA PACIFIC: AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 164 ASIA PACIFIC: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 165 ASIA PACIFIC: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 166 ASIA PACIFIC: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 167 ASIA PACIFIC: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: AUTOMATED MACHINE LEARNING MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 169 ASIA PACIFIC: AUTOMATED MACHINE LEARNING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 170 ASIA PACIFIC: AUTOMATED MACHINE LEARNING MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 171 ASIA PACIFIC: AUTOMATED MACHINE LEARNING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: AUTOMATED MACHINE LEARNING MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 173 ASIA PACIFIC: AUTOMATED MACHINE LEARNING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: AUTOMATED MACHINE LEARNING MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 175 ASIA PACIFIC: AUTOMATED MACHINE LEARNING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.4.3 CHINA

- 9.4.3.1 Heavy investments made in machine learning technology to drive growth of automated machine learning solutions in China

- TABLE 176 CHINA: AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 177 CHINA: AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 178 CHINA: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 179 CHINA: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 180 CHINA: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 181 CHINA: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 182 CHINA: AUTOMATED MACHINE LEARNING MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 183 CHINA: AUTOMATED MACHINE LEARNING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 9.4.4 JAPAN

- 9.4.4.1 Growing need for technological enhancements to boost growth of AutoML solutions and services in Japan

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Strong focus on developing cutting-edge technologies to boost use of AutoML solutions across sectors in South Korea

- 9.4.6 ASEAN

- 9.4.6.1 Rising demand to leverage machine learning solutions for competitive advantage to boost growth of automated machine learning market

- 9.4.7 AUSTRALIA & NEW ZEALAND

- 9.4.7.1 Increased innovations by major companies specializing in machine learning to drive adoption of AutoML solutions across industries

- 9.4.8 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: AUTOMATED MACHINE LEARNING MARKET DRIVERS

- 9.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 184 MIDDLE EAST & AFRICA: AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: AUTOMATED MACHINE LEARNING MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: AUTOMATED MACHINE LEARNING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: AUTOMATED MACHINE LEARNING MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: AUTOMATED MACHINE LEARNING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: AUTOMATED MACHINE LEARNING MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: AUTOMATED MACHINE LEARNING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: AUTOMATED MACHINE LEARNING MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: AUTOMATED MACHINE LEARNING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.5.3 SAUDI ARABIA

- 9.5.3.1 Saudi Arabia's commitment to leveraging AI and ML technologies to drive market growth

- 9.5.4 UAE

- 9.5.4.1 Rising growth of advanced technologies to drive market for AI and ML solutions and services

- 9.5.5 ISRAEL

- 9.5.5.1 Growing investments in AI and ML research by major players to boost growth of automated machine learning market in Israel

- 9.5.6 TURKEY

- 9.5.6.1 Growing ecosystem and adoption of machine learning technology across industries to boost market growth in Turkey

- 9.5.7 SOUTH AFRICA

- 9.5.7.1 Increasing investments and initiatives from governments and private sector to drive popularity of AI and ML solutions

- 9.5.8 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: AUTOMATED MACHINE LEARNING MARKET DRIVERS

- 9.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 198 LATIN AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 199 LATIN AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 200 LATIN AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 201 LATIN AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 202 LATIN AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 203 LATIN AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 204 LATIN AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 205 LATIN AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 206 LATIN AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 207 LATIN AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 208 LATIN AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 209 LATIN AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 210 LATIN AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 211 LATIN AMERICA: AUTOMATED MACHINE LEARNING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.6.3 BRAZIL

- 9.6.3.1 Significant government support to drive adoption of AI and ML technologies across industries

- 9.6.4 MEXICO

- 9.6.4.1 Rapid growth in country's technology sector to drive market for automated machine learning

- 9.6.5 ARGENTINA

- 9.6.5.1 Government incentives to foreign companies for investments in country's technology sector to boost AutoML market growth

- 9.6.6 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 212 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE ANALYSIS

- FIGURE 38 REVENUE ANALYSIS FOR KEY PLAYERS, 2018-2022

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 39 MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2022

- TABLE 213 AUTOMATED MACHINE LEARNING MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 10.5 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 40 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS, 2023

- 10.6 EVALUATION QUADRANT MATRIX FOR SMES/STARTUPS

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 41 EVALUATION QUADRANT MATRIX FOR SMES/STARTUPS, 2023

- 10.7 COMPETITIVE BENCHMARKING

- TABLE 214 COMPETITIVE BENCHMARKING FOR KEY PLAYERS, 2023

- TABLE 215 DETAILED LIST OF KEY SMES/STARTUPS

- TABLE 216 COMPETITIVE BENCHMARKING FOR SMES/STARTUPS, 2023

- 10.8 AUTOMATED MACHINE LEARNING PRODUCT LANDSCAPE

- 10.8.1 COMPARATIVE ANALYSIS OF AUTOMATED MACHINE LEARNING PRODUCTS

- TABLE 217 COMPARATIVE ANALYSIS OF AUTOMATED MACHINE LEARNING PRODUCTS

- FIGURE 42 COMPARATIVE ANALYSIS OF AUTOMATED MACHINE LEARNING PRODUCTS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- TABLE 218 AUTOMATED MACHINE LEARNING MARKET: PRODUCT LAUNCHES, 2020-2023

- 10.9.2 DEALS

- TABLE 219 AUTOMATED MACHINE LEARNING MARKET: DEALS, 2020-2023

- 10.9.3 OTHERS

- TABLE 220 AUTOMATED MACHINE LEARNING MARKET: OTHERS, 2020-2022

- 10.10 VALUATION AND FINANCIAL METRICS OF KEY AUTOMATED MACHINE LEARNING VENDORS

- FIGURE 43 VALUATION AND FINANCIAL METRICS OF KEY AUTOMATED MACHINE LEARNING VENDORS

- 10.11 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY AUTOMATED MACHINE LEARNING VENDORS

- FIGURE 44 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY AUTOMATED MACHINE LEARNING VENDORS

11 COMPANY PROFILES

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS

- (Business Overview, Products/Solutions offered, Recent Developments, MnM View)**

- 11.2.1 IBM

- TABLE 221 IBM: BUSINESS OVERVIEW

- FIGURE 45 IBM: COMPANY SNAPSHOT

- TABLE 222 IBM: PRODUCTS/SOLUTIONS OFFERED

- TABLE 223 IBM: PRODUCT LAUNCHES

- TABLE 224 IBM: DEALS

- 11.2.2 ORACLE

- TABLE 225 ORACLE: BUSINESS OVERVIEW

- FIGURE 46 ORACLE: COMPANY SNAPSHOT

- TABLE 226 ORACLE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 227 ORACLE: PRODUCT LAUNCHES

- TABLE 228 ORACLE: DEALS

- TABLE 229 ORACLE: OTHERS

- 11.2.3 MICROSOFT

- TABLE 230 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 47 MICROSOFT: COMPANY SNAPSHOT

- TABLE 231 MICROSOFT: PRODUCTS/SOLUTIONS OFFERED

- TABLE 232 MICROSOFT: PRODUCT LAUNCHES

- TABLE 233 MICROSOFT: DEALS

- 11.2.4 SERVICENOW

- TABLE 234 SERVICENOW: BUSINESS OVERVIEW

- FIGURE 48 SERVICENOW: COMPANY SNAPSHOT

- TABLE 235 SERVICENOW: PRODUCTS/SOLUTIONS OFFERED

- TABLE 236 SERVICENOW: PRODUCT LAUNCHES

- TABLE 237 SERVICENOW: DEALS

- 11.2.5 GOOGLE

- TABLE 238 GOOGLE: BUSINESS OVERVIEW

- FIGURE 49 GOOGLE: COMPANY SNAPSHOT

- TABLE 239 GOOGLE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 240 GOOGLE: PRODUCT LAUNCHES

- TABLE 241 GOOGLE: DEALS

- 11.2.6 BAIDU

- TABLE 242 BAIDU: BUSINESS OVERVIEW

- FIGURE 50 BAIDU: COMPANY SNAPSHOT

- TABLE 243 BAIDU: PRODUCTS OFFERED

- TABLE 244 BAIDU: PRODUCT LAUNCHES

- TABLE 245 BAIDU: DEALS

- 11.2.7 AWS

- TABLE 246 AWS: BUSINESS OVERVIEW

- FIGURE 51 AWS: COMPANY SNAPSHOT

- TABLE 247 AWS: PRODUCTS/SERVICES OFFERED

- TABLE 248 AWS: PRODUCT LAUNCHES

- TABLE 249 AWS: DEALS

- TABLE 250 AWS: OTHERS

- 11.2.8 ALTERYX

- TABLE 251 ALTERYX: BUSINESS OVERVIEW

- FIGURE 52 ALTERYX: COMPANY SNAPSHOT

- TABLE 252 ALTERYX: PRODUCTS OFFERED

- TABLE 253 ALTERYX: PRODUCT LAUNCHES

- TABLE 254 ALTERYX: DEALS

- 11.2.9 HPE

- TABLE 255 HPE: BUSINESS OVERVIEW

- FIGURE 53 HPE: COMPANY SNAPSHOT

- TABLE 256 HPE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 257 HPE: PRODUCT LAUNCHES

- TABLE 258 HPE: DEALS

- 11.2.10 SALESFORCE

- TABLE 259 SALESFORCE: BUSINESS OVERVIEW

- FIGURE 54 SALESFORCE: COMPANY SNAPSHOT

- TABLE 260 SALESFORCE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 261 SALESFORCE: PRODUCT LAUNCHES

- TABLE 262 SALESFORCE: DEALS

- 11.2.11 ALTAIR

- TABLE 263 ALTAIR: BUSINESS OVERVIEW

- FIGURE 55 ALTAIR: COMPANY SNAPSHOT

- TABLE 264 ALTAIR: PRODUCTS/SOLUTIONS OFFERED

- TABLE 265 ALTAIR: PRODUCT LAUNCHES

- TABLE 266 ALTAIR: DEALS

- 11.2.12 TERADATA

- TABLE 267 TERADATA: BUSINESS OVERVIEW

- FIGURE 56 TERADATA: COMPANY SNAPSHOT

- TABLE 268 TERADATA: PRODUCTS/SOLUTIONS OFFERED

- TABLE 269 TERADATA: DEALS

- 11.2.13 H2O.AI

- TABLE 270 H2O.AI: BUSINESS OVERVIEW

- TABLE 271 H2O.AI: PRODUCTS/SOLUTIONS OFFERED

- TABLE 272 H2O.AI: PRODUCT LAUNCHES

- TABLE 273 H2O.AI: DEALS

- 11.2.14 DATAROBOT

- TABLE 274 DATAROBOT: BUSINESS OVERVIEW

- TABLE 275 DATAROBOT: PRODUCTS/SERVICES OFFERED

- TABLE 276 DATAROBOT: DEALS

- 11.2.15 BIGML

- TABLE 277 BIGML: BUSINESS OVERVIEW

- TABLE 278 BIGML: PRODUCTS/SOLUTIONS OFFERED

- TABLE 279 BIGML: PRODUCT LAUNCHES

- TABLE 280 BIGML: DEALS

- 11.2.16 DATABRICKS

- TABLE 281 DATABRICKS: BUSINESS OVERVIEW

- TABLE 282 DATABRICKS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 283 DATABRICKS: PRODUCT LAUNCHES

- TABLE 284 DATABRICKS: DEALS

- 11.2.17 DATAIKU

- TABLE 285 DATAIKU: BUSINESS OVERVIEW

- TABLE 286 DATAIKU: PRODUCTS/SOLUTIONS OFFERED

- TABLE 287 DATAIKU: PRODUCT LAUNCHES

- TABLE 288 DATAIKU: DEALS

- 11.2.18 MATHWORKS

- TABLE 289 MATHWORKS: BUSINESS OVERVIEW

- TABLE 290 MATHWORKS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 291 MATHWORKS: PRODUCT LAUNCHES

- TABLE 292 MATHWORKS: DEALS

- 11.2.19 SPARKCOGNITION

- TABLE 293 SPARKCOGNITION: BUSINESS OVERVIEW

- TABLE 294 SPARKCOGNITION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 295 SPARKCOGNITION: PRODUCT LAUNCHES

- TABLE 296 SPARKCOGNITION: DEALS

- 11.2.20 QLIK

- TABLE 297 QLIK: BUSINESS OVERVIEW

- TABLE 298 QLIK: PRODUCTS/SOLUTIONS OFFERED

- TABLE 299 QLIK: PRODUCT LAUNCHES

- TABLE 300 QLIK: DEALS

- *Details on Business Overview, Products/Solutions offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 11.3 OTHER PLAYERS

- 11.3.1 ALIBABA CLOUD

- 11.3.2 APPIER

- 11.3.3 SQUARK

- 11.3.4 AIBLE

- 11.3.5 DATAFOLD

- 11.3.6 BOOST.AI

- 11.3.7 TAZI AI

- 11.3.8 AKKIO

- 11.3.9 VALOHAI

- 11.3.10 DOTDATA

12 ADJACENT AND RELATED MARKETS

- 12.1 GENERATIVE AI MARKET

- 12.1.1 MARKET DEFINITION

- 12.1.2 MARKET OVERVIEW

- TABLE 301 GLOBAL GENERATIVE AI MARKET SIZE AND GROWTH RATE, 2019-2022 (USD MILLION, Y-O-Y %)

- TABLE 302 GLOBAL GENERATIVE AI MARKET SIZE AND GROWTH RATE, 2023-2028 (USD MILLION, Y-O-Y %)

- 12.1.3 GENERATIVE AI MARKET, BY OFFERING

- TABLE 303 GENERATIVE AI MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 304 GENERATIVE AI MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.1.4 GENERATIVE AI MARKET, BY APPLICATION

- TABLE 305 GENERATIVE AI MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 306 GENERATIVE AI MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.1.5 GENERATIVE AI MARKET, BY VERTICAL

- TABLE 307 GENERATIVE AI MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 308 GENERATIVE AI MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.1.6 GENERATIVE AI MARKET, BY REGION

- TABLE 309 GENERATIVE AI MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 310 GENERATIVE AI MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.2 ARTIFICIAL INTELLIGENCE MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING

- TABLE 311 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2016-2021 (USD BILLION)

- TABLE 312 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2022-2027 (USD BILLION)

- 12.2.4 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY

- TABLE 313 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2016-2021 (USD BILLION)

- TABLE 314 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2022-2027 (USD BILLION)

- 12.2.5 ARTIFICIAL INTELLIGENCE MARKET, BY DEPLOYMENT MODE

- TABLE 315 ARTIFICIAL INTELLIGENCE MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD BILLION)

- TABLE 316 ARTIFICIAL INTELLIGENCE MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD BILLION)

- 12.2.6 ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION SIZE

- TABLE 317 ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD BILLION)

- TABLE 318 ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD BILLION)

- 12.2.7 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION

- TABLE 319 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2016-2021 (USD BILLION)

- TABLE 320 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2022-2027 (USD BILLION)

- 12.2.8 ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL

- TABLE 321 ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2016-2021 (USD BILLION)

- TABLE 322 ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2022-2027 (USD BILLION)

- 12.2.9 ARTIFICIAL INTELLIGENCE MARKET, BY REGION

- TABLE 323 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2016-2021 (USD BILLION)

- TABLE 324 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2022-2027 (USD BILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS