|

|

市場調査レポート

商品コード

1277587

PVCリサイクルの世界市場:供給源別(ポストコンシューマー廃棄物、プレコンシューマー廃棄物)、タイプ別(硬質、軟質、塩素化)、プロセス別(メカニカル、ケミカル)、用途別、最終用途産業別(建築・建設)、地域別 - 2028年までの予測PVC Recycling Market by Source (Pre-consumer Waste, Post-consumer Waste), Type (Rigid, Flexible, Chlorinated), Process (Mechanical, Chemicals), Application, End-use Industry (Building, construction), and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| PVCリサイクルの世界市場:供給源別(ポストコンシューマー廃棄物、プレコンシューマー廃棄物)、タイプ別(硬質、軟質、塩素化)、プロセス別(メカニカル、ケミカル)、用途別、最終用途産業別(建築・建設)、地域別 - 2028年までの予測 |

|

出版日: 2023年05月12日

発行: MarketsandMarkets

ページ情報: 英文 242 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のPVCリサイクルの市場規模は、2023年の33億米ドルから、2028年までに49億米ドルに達し、CAGRで8.0%の成長が予測されています。

アジア太平洋地域には、製造業が急成長している新興国がいくつかあり、これがPVCリサイクルの需要をさらに高めています。この地域は過去10年間に著しい成長を遂げ、世界のGDPの3分の1以上を占めています。高度経済成長と人口の増加により、この地域の産業部門が活性化し、産業界からのPVCプラスチックの需要が増加すると予想されます。

"塩素化セグメントが、2022年に第2位のシェアを占めると予想される"

塩素化PVC(CPVC)は、PVC樹脂に塩素を添加して作られるプラスチックの一種です。この工程により、耐熱性や耐薬品性が向上し、パイプ、継手、電気ケーブルなど様々な用途に適した材料となります。建設業界では、屋根材、ドア・窓枠、サイディング、壁材などに使用されています。また、チューブ、バルブ、パイプ・継手など、医療や工業のさまざまな用途に使用されています。

"電線溝は、予測期間中、PVCリサイクル市場において、金額ベースで2番目に急成長する用途タイプになると予想される"

電線溝は、電線路や電線ダクトとも呼ばれ、商業や工業の現場で電線やケーブルを収め、保護するために使用される筐体や経路です。電線を整理・管理して安全性を確保し、電気工事法に適合させるために使用されます。

"地域別では、2022年のPVCリサイクル市場は、アジア太平洋地域が金額ベースで最大"

アジア太平洋地域は、2022年の世界のPVCリサイクル市場において、金額ベースでトップの地位を占めました。この成長は、この地域が技術革新、技術の進歩、産業の拡大を重視し、PVCの消費量の増加につながったことに起因すると考えられます。世界経済の全体的な改善は、市場の成長をさらに促進すると予想されます。

アジア太平洋地域では、中国が支配的な市場ですが、日本は、この地域の複数の最終用途産業でPVCが広く使用されているため、予測期間中に大きな成長を遂げると予測されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- バリューチェーン分析

- 貿易分析

- 技術動向

- 平均販売価格の動向

- エコシステム

- 規制状況

- 規制機関・政府機関・その他の組織

- 主な会議とイベント(2023年~2024年)

- ケーススタディ

- 特許分析

- 購入決定に影響を与える主な要因

第6章 PVCリサイクル市場:タイプ別

- イントロダクション

- 硬質PVC

- 軟質PVC

- 塩素化PVC

第7章 PVCリサイクル市場:供給源別

- イントロダクション

- ポストコンシューマー廃棄物

- プレコンシューマー廃棄物

第8章 PVCリサイクル市場:プロセス別

- イントロダクション

- メカニカルリサイクル

- 破砕

- 洗浄

- 乾燥

- ペレット化

- ケミカルリサイクル

- 解重合

- 熱分解

- 水素化分解

- ガス化

- その他

第9章 PVCリサイクル市場:用途別

- イントロダクション

- 窓枠・ドア

- パイプ・継手

- ファサードクラッディング/サイディング

- 雨樋

- PVCオーニング

- 電線溝

- 屋根用メンブレン

- ワイヤー・ケーブル

- 自動車内装

- 自動車用アンダーボディプロテクション

- トラフィックコーン

- 屋外ガーデン

- その他

第10章 PVCリサイクル市場:最終用途産業別

- イントロダクション

- 建築・建設・インフラ

- 電気

- 自動車

- 消費財

- 農業

- その他

第11章 PVCリサイクル市場:地域別

- イントロダクション

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋地域

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- ベルギー

- オランダ

- ポーランド

- その他の欧州

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- アラブ首長国連邦

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第12章 競合情勢

- イントロダクション

- 主要市場企業のランキング分析

- 市場シェア分析

- 市場評価マトリックス

- 競合評価象限(ティア1)

- 企業タイプのフットプリント

- その他の企業の競合評価象限

- 競合ベンチマーキング

- 競合状況・動向

第13章 企業プロファイル

- 主要企業

- SUEZ

- VEOLIA

- DS SMITH

- SIKA SARNAFIL

- ADAMS PLASTICS

- WRC RECYCLING

- RECLAIM PLASTICS

- SIMPLAS PVC RECYCLING

- VEKA RECYCLING

- GD ENVIRONMENTAL

- その他

- POWER PLASTIC RECYCLING LTD.

- B. SCHOENBERG & CO., INC.

- RECYPLAST CZ S.R.O.

- LIGHT BROTHERS LIMITED

- D.C.L. PLASTIC CO., LTD.

- REKUPLAST S.R.O.

- WESPACK

- CPE ENTOSORGUNG

- ECOPLAS

- PWR TRADING AND EXTRUSION BV

- NORWICH PLASTICS

- PVC ENTERPRISE LTD.

- PT. REJEKI ADIGRAHA

- RECOVINYL

- PLASTIC EXPERT

第14章 付録

The PVC recycling market is projected to reach USD 4.9 billion by 2028, with a CAGR of 8.0% from USD 3.3 billion in 2023. Asia Pacific is home to several emerging economies with rapidly growing manufacturing sectors, which further drives the demand for PVC recycling. The region has experienced significant growth in the last decade and accounts for over a third of the world's GDP. The high economic growth, coupled with the mounting population, is expected to boost the industrial sector in the region, which will increase the demand for PVC plastics from industries.

"Chlorinated segment is expected to account for the second-largest share in 2022."

Chlorinated PVC (CPVC) is a type of plastic made by adding chlorine to PVC resin. This process creates a material that has improved heat and chemical resistance, making it suitable for various applications, including pipes, fittings, and electrical cables. CPVC is used in the construction industry for roofing membranes, door and window profiles, siding, and wall cladding. It is also used in a variety of medical and industrial applications, including tubing, valves, and pipes and fittings.

"Electric wire gutter is expected to be the second-fastest growing application type for PVC recycling market during the forecast period, in terms of value."

An electrical wire gutter, also known as a wireway or wire duct, is an enclosure or channel used to contain and protect electrical wires and cables in commercial and industrial settings. It is used to organize and manage electrical wires to ensure safety and compliance with electrical codes.

"Based on region, Asia Pacific region was the largest market for PVC recycling in 2022, in terms of value."

The Asia Pacific held the top position in terms of value in the global PVC recycling market in 2022. The Growth cant be attributed to the regions emphasis on innovation, technology advancement, and industrial expansion which have led to an increase in the consumption of PVC. The Global economy's overall improvement is expected to further drive the markets growth.

China is a dominant market in the Asia Pacific region, However, Japan is projected to experience significant growth during the forecast period due to the widespread use of PVC in multiple end -use industries in the region.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviews are as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-Level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 30%, Europe - 20%, Asia Pacific - 40%, Middle East & Africa-5%, and Latin America-5%

The key global players in the PVC recycling market include DS Smith (UK), Adams Plastics (US), Reclaim Plastics (Canada), Suez (France), Veolia (France), Veka Recycling (UK), Simplas PVC Recycling (UK), WRC Recycling (Scotland), Morris Recycling (UK), and Dekura (Germany) are the key players in the PVC recycling market.

Research Coverage

This report segments the PVC recycling market on the basis of source, application, type, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products and services, key strategies, product launches, expansions, and mergers and acquisitions associated with the PVC recycling market.

Key benefits of buying this report

This research report focuses on various levels of analysis, including industry analysis (industry trends), market ranking analysis of top players, and company profiles. These levels of analysis provide an overall view of the competitive landscape, emerging and high-growth segments of the PVC recycling market, high-growth regions, and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Negative environmental & economic impact of PVC plastics, Growing awareness regarding energy savings and government responses, Increasing use of PVC in various end-use industries, Chemical recycling process to drive the market demand), restraints (Technical limitation of the PVC recycling process, effects of downcycling), opportunities (Favorable initiatives to promote the use of recycled PVC in developed countries, Demand for sustainable solution from the construction and packaging industry, New recycling technologies, Opportunities for chemical industries ), and challenges ( Quality issue of recycled PVC plastic, Difficulty in the collection of raw materials, High cost of recycling, Pigmented plastics are not accepted by many recycling facilities)

- Market Penetration: Comprehensive information on the PVC recycling market offered by top players in the global PVC recycling market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the PVC recycling market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for PVC recycling market across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global PVC recycling market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the PVC recycling market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 PVC RECYCLING: MARKET SEGMENTATION

- 1.3.1 YEARS CONSIDERED

- 1.3.2 REGIONAL SCOPE

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 IMPACT OF SLOWDOWN/RECESSION

- 2.2 RESEARCH DATA

- FIGURE 2 PVC RECYCLING MARKET: RESEARCH DESIGN

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of major secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.3 PRIMARY INTERVIEWS

- 2.2.3.1 Demand and supply sides

- 2.2.3.2 Key industry insights

- 2.2.3.3 Breakdown of primary interviews

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION APPROACH

- 2.3.1 TOP-DOWN APPROACH

- 2.3.1.1 Approach for arriving at market size using top-down approach

- FIGURE 4 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.3.2.1 Approach for arriving at market size using bottom-up approach

- FIGURE 5 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 6 PVC RECYCLING MARKET: DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS AND RISKS

3 EXECUTIVE SUMMARY

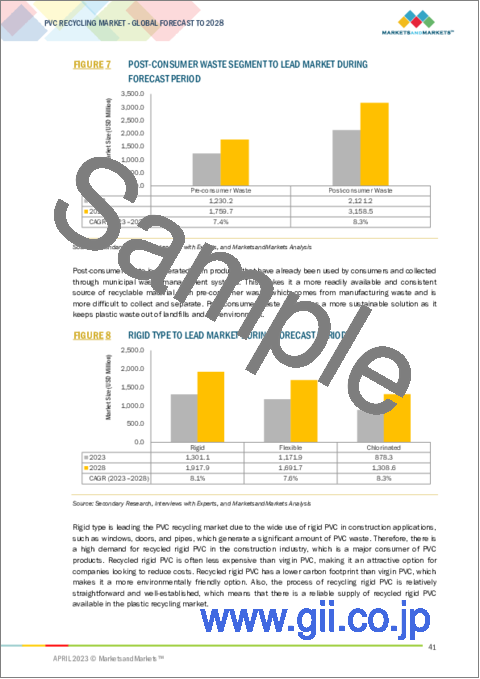

- FIGURE 7 POST-CONSUMER WASTE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 RIGID TYPE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 CHEMICAL PROCESS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 BUILDING & CONSTRUCTION TO BE LARGEST SEGMENT OF PVC RECYCLING MARKET

- FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF PVC RECYCLING MARKET

4 PREMIUM INSIGHTS

- 4.1 EMERGING ECONOMIES TO WITNESS HIGH GROWTH IN PVC RECYCLING MARKET

- FIGURE 12 ASIA PACIFIC TO OFFER ATTRACTIVE OPPORTUNITIES IN PVC RECYCLING MARKET DURING FORECAST PERIOD

- 4.2 PVC RECYCLING MARKET, BY TYPE

- FIGURE 13 FLEXIBLE PVC MATERIAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 PVC RECYCLING MARKET, BY SOURCE

- FIGURE 14 POST-CONSUMER SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 PVC RECYCLING MARKET, BY PROCESS

- FIGURE 15 MECHANICAL PROCESS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 PVC RECYCLING MARKET, BY END-USE INDUSTRY

- FIGURE 16 BUILDING & CONSTRUCTION TO LEAD MARKET BY 2027

- 4.6 PVC RECYCLING MARKET IN ASIA PACIFIC, BY TYPE AND COUNTRY, 2022

- FIGURE 17 FLEXIBLE PVC AND CHINA ACCOUNTED FOR LARGEST SHARES

- 4.7 PVC RECYCLING MARKET, BY REGION

- FIGURE 18 MARKET IN GERMANY TO GROW AT HIGHEST CAGR

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PVC RECYCLING MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Reduce environmental & economic impact of PVC plastics

- 5.2.1.2 Growing awareness of energy savings and government responses

- 5.2.1.3 Increasing use of PVC in various end-use industries

- 5.2.1.4 Chemical recycling process to drive market

- 5.2.2 RESTRAINTS

- 5.2.2.1 Technical limitations of PVC recycling process

- 5.2.2.2 Effects of downcycling

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Favorable initiatives to promote use of recycled PVC in developed countries

- 5.2.3.2 Demand for sustainable solutions from construction and packaging industries

- 5.2.3.3 New recycling technologies

- 5.2.3.4 Opportunities for chemical industries

- 5.2.4 CHALLENGES

- 5.2.4.1 Quality issues of recycled PVC plastics

- 5.2.4.2 Difficulty in collection of raw materials

- 5.2.4.3 High cost of recycling

- 5.2.4.4 Recycling facilities not accepting pigmented plastics

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 PVC RECYCLING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS

- 5.4.1 COLLECTION

- 5.4.2 SORTING

- 5.4.3 SHREDDING

- 5.4.4 RECYCLING

- 5.4.5 END USERS

- 5.5 TRADE ANALYSIS

- 5.5.1 IMPORT-EXPORT SCENARIO OF PVC RECYCLING MARKET

- TABLE 1 IMPORT TRADE DATA FOR PLATES, SHEETS, FILM, FOIL, AND STRIPS, OF NON-CELLULAR PLASTICS, NOT REINFORCED, AND LAMINATED

- TABLE 2 EXPORT TRADE DATA FOR PLATES, SHEETS, FILM, FOIL, AND STRIPS, OF NON-CELLULAR PLASTICS, NOT REINFORCED, AND LAMINATED

- 5.6 TECHNOLOGY TRENDS

- 5.6.1 MECHANICAL RECYCLING

- 5.6.2 CHEMICAL RECYCLING

- 5.6.3 BIODEGRADABLE ADDITIVES

- 5.6.4 DIGITALIZATION AND AUTOMATION

- 5.7 AVERAGE SELLING PRICE TRENDS

- 5.7.1 AVERAGE SELLING PRICE OF RECYCLED PVC, BY REGION

- FIGURE 22 AVERAGE SELLING PRICE (2021-2028), BY REGION

- 5.7.2 AVERAGE SELLING PRICE OF RECYCLED PVC, BY TYPE

- FIGURE 23 AVERAGE SELLING PRICE (2021-2028), BY TYPE

- 5.8 ECOSYSTEM

- TABLE 3 PVC RECYCLING: ECOSYSTEM

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 GOVERNMENT REGULATIONS AND POLICIES TO PROMOTE RECYCLING AND REDUCE PVC WASTE

- 5.9.2 REGULATIONS TO RESTRICT HAZARDOUS SUBSTANCES IN PVC PRODUCTS AND WASTE

- 5.9.3 INDUSTRY STANDARDS AND CERTIFICATIONS FOR SAFE AND ENVIRONMENTALLY RESPONSIBLE PVC RECYCLING

- 5.9.4 TRADE REGULATIONS AND AGREEMENTS IMPACTING PVC RECYCLING MARKET: IMPLICATIONS FOR GLOBAL SUPPLY CHAIN

- 5.10 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 5 PVC RECYCLING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.12 CASE STUDIES

- 5.12.1 TESCO WORKED WITH DS SMITH ON ITS ZERO WASTE AMBITIONS BY BACKHAULING CARDS, PLASTICS, ANIMAL BY-PRODUCTS, AND METALS

- 5.12.2 CLOSED-LOOP PLASTIC RECYCLING

- 5.13 PATENT ANALYSIS

- 5.13.1 METHODOLOGY

- 5.13.2 DOCUMENT TYPE

- FIGURE 24 GRANTED PATENTS

- 5.13.3 PATENT PUBLICATION TRENDS

- FIGURE 25 NUMBER OF PATENTS YEAR-WISE DURING LAST 10 YEARS

- 5.13.4 INSIGHTS

- 5.13.5 JURISDICTION ANALYSIS

- FIGURE 26 CHINA ACCOUNTED FOR HIGHEST NUMBER OF PATENTS

- 5.13.6 TOP COMPANIES/APPLICANTS

- FIGURE 27 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- 5.13.6.1 List of major patents

- 5.13.7 TOP 10 PATENT OWNERS IN LAST 10 YEARS

- 5.14 KEY FACTORS AFFECTING BUYING DECISION

- 5.14.1 QUALITY

- 5.14.2 PRICING

- 5.14.3 AVAILABILITY AND SUPPLY CHAIN

- 5.14.4 SUSTAINABILITY

- 5.14.5 REGULATIONS AND COMPLIANCE

- 5.14.6 CUSTOMER RELATIONSHIPS

- FIGURE 28 SUPPLIER SELECTION CRITERION

6 PVC RECYCLING MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 29 PVC RECYCLING MARKET SIZE, BY TYPE (USD MILLION)

- TABLE 6 PVC RECYCLING MARKET, BY TYPE, 2020-2022 (KILOTON)

- TABLE 7 PVC RECYCLING MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 8 EUROPE: PVC RECYCLING MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 9 EUROPE: PVC RECYCLING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 6.2 RIGID PVC

- 6.3 FLEXIBLE PVC

- 6.4 CHLORINATED PVC

7 PVC RECYCLING MARKET, BY SOURCE

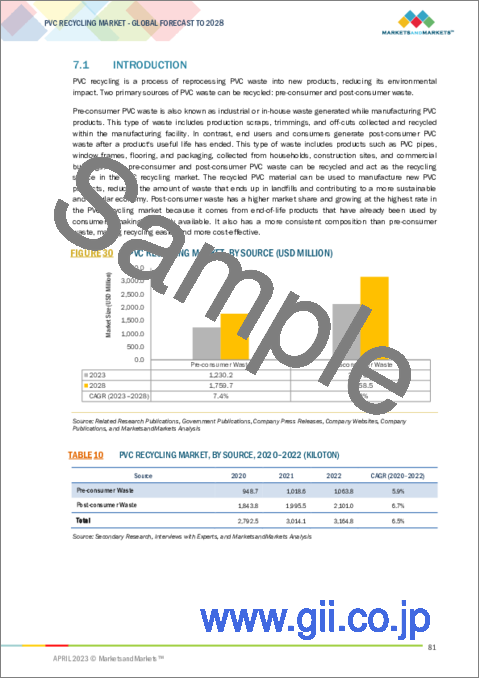

- 7.1 INTRODUCTION

- FIGURE 30 PVC RECYCLING MARKET, BY SOURCE (USD MILLION)

- TABLE 10 PVC RECYCLING MARKET, BY SOURCE, 2020-2022 (KILOTON)

- TABLE 11 PVC RECYCLING MARKET, BY SOURCE, 2023-2028 (KILOTON)

- TABLE 12 PVC RECYCLING MARKET, BY SOURCE, 2020-2022 (USD MILLION)

- TABLE 13 PVC RECYCLING MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 7.1.1 POST-CONSUMER WASTE

- 7.1.2 PRE-CONSUMER WASTE

8 PVC RECYCLING MARKET, BY PROCESS

- 8.1 INTRODUCTION

- TABLE 14 PVC RECYCLING MARKET, BY PROCESS, 2020-2022 (KILOTON)

- TABLE 15 PVC RECYCLING MARKET, BY PROCESS, 2023-2028 (KILOTON)

- TABLE 16 PVC RECYCLING MARKET, BY PROCESS, 2020-2022 (USD MILLION)

- TABLE 17 PVC RECYCLING MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- 8.2 MECHANICAL RECYCLING

- 8.2.1 SHREDDING

- 8.2.2 WASHING

- 8.2.3 DRYING

- 8.2.4 PELLETIZING

- 8.3 CHEMICAL RECYCLING

- 8.3.1 DEPOLYMERIZATION

- 8.3.2 PYROLYSIS

- 8.3.3 HYDRO-CRACKING

- 8.3.4 GASIFICATION

- 8.4 OTHERS RECYCLING PROCESSES

9 PVC RECYCLING MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 31 ELECTRIC GUTTER TO BE FASTEST-GROWING APPLICATION SEGMENT OF PVC RECYCLING MARKET

- TABLE 18 PVC RECYCLING MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 19 PVC RECYCLING MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 20 PVC RECYCLING MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 21 PVC RECYCLING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2 WINDOW PROFILE & DOORS

- 9.3 PIPE & FITTINGS

- 9.4 FACADE CLADDING/SIDING

- 9.5 RAINWATER GUTTER

- 9.6 PVC AWNINGS

- 9.7 ELECTRICAL WIRE GUTTER

- 9.8 ROOFING MEMBRANES

- 9.9 WIRE & CABLES

- 9.10 AUTOMOTIVE INTERIOR

- 9.11 AUTOMOTIVE UNDERBODY PROTECTION

- 9.12 TRAFFIC CONES

- 9.13 EXTERIOR GARDENS

- 9.14 OTHERS

10 PVC RECYCLING MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- FIGURE 32 PVC RECYCLING MARKET, BY END-USE INDUSTRY (USD MILLION)

- TABLE 22 PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 23 PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 24 PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 25 PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.2 BUILDING, CONSTRUCTION, AND INFRASTRUCTURE

- 10.3 ELECTRICAL

- 10.4 AUTOMOTIVE

- 10.5 CONSUMER GOODS

- 10.6 AGRICULTURE

- 10.7 OTHERS

11 PVC RECYCLING MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 33 ASIA PACIFIC AND NORTH AMERICA TO EMERGE AS NEW STRATEGIC DESTINATIONS FOR PVC RECYCLING MARKET

- TABLE 26 PVC RECYCLING MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 27 PVC RECYCLING MARKET, BY REGION, 2023-2028 (KILOTON)

- TABLE 28 PVC RECYCLING MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 29 PVC RECYCLING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 ASIA PACIFIC

- FIGURE 34 ASIA PACIFIC: PVC RECYCLING MARKET SNAPSHOT

- TABLE 30 ASIA PACIFIC: PVC RECYCLING MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 31 ASIA PACIFIC: PVC RECYCLING MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 32 ASIA PACIFIC: PVC RECYCLING MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 33 ASIA PACIFIC: PVC RECYCLING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 34 ASIA PACIFIC: PVC RECYCLING MARKET, BY SOURCE, 2020-2022 (KILOTON)

- TABLE 35 ASIA PACIFIC: PVC RECYCLING MARKET, BY SOURCE, 2023-2028 (KILOTON)

- TABLE 36 ASIA PACIFIC: PVC RECYCLING MARKET, BY SOURCE, 2020-2022 (USD MILLION)

- TABLE 37 ASIA PACIFIC: PVC RECYCLING MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: PVC RECYCLING MARKET, BY TYPE, 2020-2022 (KILOTON)

- TABLE 39 ASIA PACIFIC: PVC RECYCLING MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 40 ASIA PACIFIC: PVC RECYCLING MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 41 ASIA PACIFIC: PVC RECYCLING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: PVC RECYCLING MARKET, BY PROCESS, 2020-2022 (KILOTON)

- TABLE 43 ASIA PACIFIC: PVC RECYCLING MARKET, BY PROCESS, 2023-2028 (KILOTON)

- TABLE 44 ASIA PACIFIC: PVC RECYCLING MARKET, BY PROCESS, 2020-2022 (USD MILLION)

- TABLE 45 ASIA PACIFIC: PVC RECYCLING MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 46 ASIA PACIFIC: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 47 ASIA PACIFIC: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 48 ASIA PACIFIC: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 49 ASIA PACIFIC: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: PVC RECYCLING MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 51 ASIA PACIFIC: PVC RECYCLING MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 52 ASIA PACIFIC: PVC RECYCLING MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 53 ASIA PACIFIC: PVC RECYCLING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.1 CHINA

- 11.2.1.1 Potential increase in domestic plastic recycling to drive market

- TABLE 54 CHINA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 55 CHINA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 56 CHINA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 57 CHINA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.2.2 JAPAN

- 11.2.2.1 Government initiatives to recycling PVC to reduce waste and conserve resources to drive market

- TABLE 58 JAPAN: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 59 JAPAN: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 60 JAPAN: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 61 JAPAN: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.2.3 INDIA

- 11.2.3.1 Favorable government rules to create demand

- TABLE 62 INDIA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 63 INDIA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 64 INDIA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 65 INDIA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Government initiatives promoting PVC recycling to drive market

- TABLE 66 SOUTH KOREA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 67 SOUTH KOREA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 68 SOUTH KOREA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 69 SOUTH KOREA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.2.5 REST OF ASIA PACIFIC

- TABLE 70 REST OF ASIA PACIFIC: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 71 REST OF ASIA PACIFIC: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 72 REST OF ASIA PACIFIC: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 73 REST OF ASIA PACIFIC: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- TABLE 74 EUROPE: PVC RECYCLING MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 75 EUROPE: PVC RECYCLING MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 76 EUROPE: PVC RECYCLING MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 77 EUROPE: PVC RECYCLING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 78 EUROPE: PVC RECYCLING MARKET, BY SOURCE, 2020-2022 (KILOTON)

- TABLE 79 EUROPE: PVC RECYCLING MARKET, BY SOURCE, 2023-2028 (KILOTON)

- TABLE 80 EUROPE: PVC RECYCLING MARKET, BY SOURCE, 2020-2022 (USD MILLION)

- TABLE 81 EUROPE: PVC RECYCLING MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 82 EUROPE: PVC RECYCLING MARKET, BY TYPE, 2020-2022 (KILOTON)

- TABLE 83 EUROPE: PVC RECYCLING MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 84 EUROPE: PVC RECYCLING MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 85 EUROPE: PVC RECYCLING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 86 EUROPE: PVC RECYCLING MARKET, BY PROCESS, 2020-2022 (KILOTON)

- TABLE 87 EUROPE: PVC RECYCLING MARKET, BY PROCESS, 2023-2028 (KILOTON)

- TABLE 88 EUROPE: PVC RECYCLING MARKET, BY PROCESS, 2020-2022 (USD MILLION)

- TABLE 89 EUROPE: PVC RECYCLING MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 90 EUROPE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 91 EUROPE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 92 EUROPE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 93 EUROPE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 94 EUROPE: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 95 EUROPE: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 96 EUROPE: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 97 EUROPE: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.1 GERMANY

- 11.3.1.1 Well-established recycling infrastructure to drive market

- TABLE 98 GERMANY: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 99 GERMANY: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 100 GERMANY: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 101 GERMANY: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Increasing demand in construction applications to support market growth

- TABLE 102 UK: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 103 UK: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 104 UK: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 105 UK: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.3 ITALY

- 11.3.3.1 Regulations to reduce PVC waste to drive market

- TABLE 106 ITALY: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 107 ITALY: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 108 ITALY: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 109 ITALY: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.4 FRANCE

- 11.3.4.1 Government initiatives fostering PVC recycling to drive market

- TABLE 110 FRANCE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 111 FRANCE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 112 FRANCE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 113 FRANCE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.5 SPAIN

- 11.3.5.1 Comprehensive framework to regulate production and use of recycled PVC products to boost market

- TABLE 114 SPAIN: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 115 SPAIN: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 116 SPAIN: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 117 SPAIN: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.6 BELGIUM

- 11.3.6.1 Construction industry to increase demand for recycled PVC products

- TABLE 118 BELGIUM: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 119 BELGIUM: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 120 BELGIUM: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 121 BELGIUM: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.7 NETHERLANDS

- 11.3.7.1 Well-established circular economy framework to support market

- TABLE 122 NETHERLANDS: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 123 NETHERLANDS: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 124 NETHERLANDS: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 125 NETHERLANDS: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.8 POLAND

- 11.3.8.1 Goal to achieve recycling rate of 55% by 2025 to drive market

- TABLE 126 POLAND: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 127 POLAND: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 128 POLAND: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 129 POLAND: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.9 REST OF EUROPE

- TABLE 130 REST OF EUROPE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 131 REST OF EUROPE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 132 REST OF EUROPE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 133 REST OF EUROPE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.4 NORTH AMERICA

- TABLE 134 NORTH AMERICA: PVC RECYCLING MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 135 NORTH AMERICA: PVC RECYCLING MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 136 NORTH AMERICA: PVC RECYCLING MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 137 NORTH AMERICA: PVC RECYCLING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 138 NORTH AMERICA: PVC RECYCLING MARKET, BY SOURCE, 2020-2022 (KILOTON)

- TABLE 139 NORTH AMERICA: PVC RECYCLING MARKET, BY SOURCE, 2023-2028 (KILOTON)

- TABLE 140 NORTH AMERICA: PVC RECYCLING MARKET, BY SOURCE, 2020-2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: PVC RECYCLING MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: PVC RECYCLING MARKET, BY TYPE, 2020-2022 (KILOTON)

- TABLE 143 NORTH AMERICA: PVC RECYCLING MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 144 NORTH AMERICA: PVC RECYCLING MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 145 NORTH AMERICA: PVC RECYCLING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 146 NORTH AMERICA: PVC RECYCLING MARKET, BY PROCESS, 2020-2022 (KILOTON)

- TABLE 147 NORTH AMERICA: PVC RECYCLING MARKET, BY PROCESS, 2023-2028 (KILOTON)

- TABLE 148 NORTH AMERICA: PVC RECYCLING MARKET, BY PROCESS, 2020-2022 (USD MILLION)

- TABLE 149 NORTH AMERICA: PVC RECYCLING MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 150 NORTH AMERICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 151 NORTH AMERICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 152 NORTH AMERICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 153 NORTH AMERICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 154 NORTH AMERICA: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 155 NORTH AMERICA: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 156 NORTH AMERICA: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 157 NORTH AMERICA: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.1 US

- 11.4.1.1 Focus on sustainable practices to drive market

- TABLE 158 US: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 159 US: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 160 US: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 161 US: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.2 CANADA

- 11.4.2.1 Development of new recycling technologies to boost market growth

- TABLE 162 CANADA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 163 CANADA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 164 CANADA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 165 CANADA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.3 MEXICO

- 11.4.3.1 Focus on creating effective recycling practices to support market growth

- TABLE 166 MEXICO: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 167 MEXICO: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 168 MEXICO: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 169 MEXICO: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.5 MIDDLE EAST & AFRICA

- TABLE 170 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 171 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 172 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY SOURCE, 2020-2022 (KILOTON)

- TABLE 175 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY SOURCE, 2023-2028 (KILOTON)

- TABLE 176 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY SOURCE, 2020-2022 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY TYPE, 2020-2022 (KILOTON)

- TABLE 179 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 180 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY PROCESS, 2020-2022 (KILOTON)

- TABLE 183 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY PROCESS, 2023-2028(KILOTON)

- TABLE 184 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY PROCESS, 2020-2022 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 187 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 188 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 191 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 192 MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 193 SOUTH AMERICA: PVC RECYCLING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.1 SAUDI ARABIA

- 11.5.1.1 Construction and packaging industries to support market growth

- TABLE 194 SAUDI ARABIA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 195 SAUDI ARABIA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 196 SAUDI ARABIA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 197 SAUDI ARABIA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Government regulations to promote and regulate recycling of PVC to drive market

- TABLE 198 SOUTH AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 199 SOUTH AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 200 SOUTH AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 201 SOUTH AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.5.3 UAE

- 11.5.3.1 Conducive environment to increase demand

- TABLE 202 UAE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 203 UAE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 204 UAE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 205 UAE: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 206 REST OF MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 207 REST OF MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 209 REST OF MIDDLE EAST & AFRICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.6 SOUTH AMERICA

- TABLE 210 SOUTH AMERICA: PVC RECYCLING MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 211 SOUTH AMERICA: PVC RECYCLING MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 212 SOUTH AMERICA: PVC RECYCLING MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 213 SOUTH AMERICA: PVC RECYCLING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 214 SOUTH AMERICA: PVC RECYCLING MARKET, BY SOURCE, 2020-2022 (KILOTON)

- TABLE 215 SOUTH AMERICA: PVC RECYCLING MARKET, BY SOURCE, 2023-2028 (KILOTON)

- TABLE 216 SOUTH AMERICA: PVC RECYCLING MARKET, BY SOURCE, 2020-2022 (USD MILLION)

- TABLE 217 SOUTH AMERICA: PVC RECYCLING MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 218 SOUTH AMERICA: PVC RECYCLING MARKET, BY TYPE, 2020-2022 (KILOTON)

- TABLE 219 SOUTH AMERICA: PVC RECYCLING MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 220 SOUTH AMERICA: PVC RECYCLING MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 221 SOUTH AMERICA: PVC RECYCLING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 222 SOUTH AMERICA: PVC RECYCLING MARKET, BY PROCESS, 2020-2022 (KILOTON)

- TABLE 223 SOUTH AMERICA: PVC RECYCLING MARKET, BY PROCESS, 2023-2028 (KILOTON)

- TABLE 224 SOUTH AMERICA: PVC RECYCLING MARKET, BY PROCESS, 2020-2022 (USD MILLION)

- TABLE 225 SOUTH AMERICA: PVC RECYCLING MARKET, BY PROCESS, 2023-2028 (USD MILLION)

- TABLE 226 SOUTH AMERICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 227 SOUTH AMERICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 228 SOUTH AMERICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 229 SOUTH AMERICA: PVC RECYCLING MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 230 SOUTH AMERICA: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 231 SOUTH AMERICA: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 232 SOUTH AMERICA: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 233 SOUTH AMERICA: PVC RECYCLING MARKET SIZE, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6.1 BRAZIL

- 11.6.1.1 Improved use of recycled PVC to drive market

- TABLE 234 BRAZIL: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 235 BRAZIL: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 236 BRAZIL: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 237 BRAZIL: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.6.2 ARGENTINA

- 11.6.2.1 Initiatives to increase sustainability and promote circular economy to drive market

- TABLE 238 ARGENTINA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 239 ARGENTINA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 240 ARGENTINA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 241 ARGENTINA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.6.3 REST OF SOUTH AMERICA

- TABLE 242 REST OF SOUTH AMERICA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 243 REST OF SOUTH AMERICA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 244 REST OF SOUTH AMERICA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 245 REST OF SOUTH AMERICA: PVC RECYCLING MARKET SIZE, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.1.1 PVC RECYCLING MARKET, KEY DEVELOPMENTS

- TABLE 246 OVERVIEW OF STRATEGIES ADOPTED BY SOME KEY MARKET PLAYERS

- 12.2 RANKING ANALYSIS OF KEY MARKET PLAYERS

- 12.2.1 SUEZ

- 12.2.2 VEOLIA

- 12.2.3 DS SMITH

- 12.2.4 SIKA

- 12.2.5 ADAMS PLASTICS

- 12.3 MARKET SHARE ANALYSIS

- FIGURE 35 PVC RECYCLING: MARKET SHARE ANALYSIS

- TABLE 247 PVC RECYCLING MARKET: DEGREE OF COMPETITION

- 12.4 MARKET EVALUATION MATRIX

- TABLE 248 MARKET EVALUATION MATRIX

- 12.5 COMPETITIVE EVALUATION QUADRANT (TIER 1)

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 36 PVC RECYCLING MARKET: GLOBAL COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES

- 12.6 COMPANY TYPE FOOTPRINT

- 12.7 COMPETITIVE EVALUATION QUADRANT, OTHER PLAYERS

- 12.7.1 STARTING BLOCKS

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 PROGRESSIVE COMPANIES

- 12.7.4 DYNAMIC COMPANIES

- FIGURE 37 PVC RECYCLING MARKET (GLOBAL): COMPANY EVALUATION MATRIX FOR SMES

- 12.8 COMPETITIVE BENCHMARKING

- TABLE 249 PVC RECYCLING MARKET: DETAILED LIST OF SMES

- TABLE 250 PVC RECYCLING MARKET: COMPETITIVE BENCHMARKING OF SMES

- 12.9 COMPETITIVE SITUATIONS AND TRENDS

- 12.9.1 DEALS

- TABLE 251 PVC RECYCLING MARKET: DEALS, 2020-2023

- 12.9.2 OTHERS

- TABLE 252 PVC RECYCLING MARKET: OTHERS, 2020-2022

13 COMPANY PROFILES

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 13.1 KEY PLAYERS

- 13.1.1 SUEZ

- TABLE 253 SUEZ: COMPANY OVERVIEW

- FIGURE 38 SUEZ: COMPANY SNAPSHOT

- TABLE 254 SUEZ: PRODUCT OFFERINGS

- TABLE 255 SUEZ: DEALS

- TABLE 256 SUEZ: OTHER DEVELOPMENTS

- 13.1.2 VEOLIA

- TABLE 257 VEOLIA: COMPANY OVERVIEW

- FIGURE 39 VEOLIA: COMPANY SNAPSHOT

- TABLE 258 VEOLIA: PRODUCT OFFERINGS

- TABLE 259 VEOLIA: DEALS

- 13.1.3 DS SMITH

- TABLE 260 DS SMITH: COMPANY OVERVIEW

- FIGURE 40 DS SMITH: COMPANY SNAPSHOT

- TABLE 261 DS SMITH: PRODUCT OFFERINGS

- 13.1.4 SIKA SARNAFIL

- TABLE 262 SIKA SARNAFIL: COMPANY OVERVIEW

- TABLE 263 SIKA SARNAFIL: DEALS

- 13.1.5 ADAMS PLASTICS

- TABLE 264 ADAMS PLASTICS: COMPANY OVERVIEW

- TABLE 265 ADAMS PLASTICS: PRODUCT OFFERINGS

- 13.1.6 WRC RECYCLING

- TABLE 266 WRC RECYCLING: COMPANY OVERVIEW

- TABLE 267 WRC RECYCLING: PRODUCT OFFERINGS

- 13.1.7 RECLAIM PLASTICS

- TABLE 268 RECLAIM PLASTICS: COMPANY OVERVIEW

- TABLE 269 RECLAIM PLASTICS: PRODUCT OFFERINGS

- 13.1.8 SIMPLAS PVC RECYCLING

- TABLE 270 SIMPLAS PVC RECYCLING: COMPANY OVERVIEW

- TABLE 271 SIMPLAS PVC RECYCLING: PRODUCT OFFERINGS

- 13.1.9 VEKA RECYCLING

- TABLE 273 VEKA RECYCLING: PRODUCT OFFERINGS

- 13.1.10 GD ENVIRONMENTAL

- TABLE 274 GD ENVIRONMENTAL: COMPANY OVERVIEW

- TABLE 275 GD ENVIRONMENTAL: PRODUCT OFFERINGS

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 13.2 OTHERS

- 13.2.1 POWER PLASTIC RECYCLING LTD.

- TABLE 276 POWER PLASTIC RECYCLING LTD.: COMPANY OVERVIEW

- 13.2.2 B. SCHOENBERG & CO., INC.

- TABLE 277 B. SCHOENBERG & CO., INC.: COMPANY OVERVIEW

- 13.2.3 RECYPLAST CZ S.R.O.

- TABLE 278 RECYPLAST S.R.O.: COMPANY OVERVIEW

- 13.2.4 LIGHT BROTHERS LIMITED

- TABLE 279 LIGHT BROTHERS LIMITED: COMPANY OVERVIEW

- 13.2.5 D.C.L. PLASTIC CO., LTD.

- TABLE 280 D.C.L. PLASTIC CO., LTD.: COMPANY OVERVIEW

- 13.2.6 REKUPLAST S.R.O.

- TABLE 281 REKUPLAST S.R.O.: COMPANY OVERVIEW

- 13.2.7 WESPACK

- TABLE 282 WESPACK: COMPANY OVERVIEW

- 13.2.8 CPE ENTOSORGUNG

- TABLE 283 CPE ENTOSORGUNG: COMPANY OVERVIEW

- 13.2.9 ECOPLAS

- TABLE 284 ECOPLAS: COMPANY OVERVIEW

- 13.2.10 PWR TRADING AND EXTRUSION BV

- TABLE 285 PWR TRADING AND EXTRUSION BV: COMPANY OVERVIEW

- 13.2.11 NORWICH PLASTICS

- TABLE 286 NORWICH PLASTICS: COMPANY OVERVIEW

- 13.2.12 PVC ENTERPRISE LTD.

- TABLE 287 PVC ENTERPRISE LTD.: COMPANY OVERVIEW

- 13.2.13 PT. REJEKI ADIGRAHA

- TABLE 288 PT. REJEKI ADIGRAHA: COMPANY OVERVIEW

- 13.2.14 RECOVINYL

- TABLE 289 RECOVINYL: COMPANY OVERVIEW

- 13.2.15 PLASTIC EXPERT

- TABLE 290 PLASTIC EXPERT: COMPANY OVERVIEW

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS