|

|

市場調査レポート

商品コード

1274197

HLAタイピングの世界市場:製品・サービス別(試薬・消耗品、機器、ソフトウェア・サービス)、技術別(分子アッセイ技術、非分子アッセイ技術)、用途別(診断用途、研究用途)、エンドユーザー別、地域別 - 2028年までの予測HLA Typing Market by Technology (PCR (SSO, SSP, Real Time), Sequencing (NGS, Sanger)), Product (Instrument, Reagent, Software), Application (Chimerism, Antibody Screening), End User (Hospital, Diagnolab, Academia) & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| HLAタイピングの世界市場:製品・サービス別(試薬・消耗品、機器、ソフトウェア・サービス)、技術別(分子アッセイ技術、非分子アッセイ技術)、用途別(診断用途、研究用途)、エンドユーザー別、地域別 - 2028年までの予測 |

|

出版日: 2023年05月10日

発行: MarketsandMarkets

ページ情報: 英文 217 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のHLAタイピングの市場規模は、2022年の14億米ドルから、2028年には21億米ドルに達し、予測期間中のCAGRで6.5%の成長が予測されています。

感染症、移植片拒絶反応、自己免疫疾患、がんの早期診断が可能な臨床診断法の必要性と強い需要が、研究活動の高まりを支えています。Journal of Human Genetics(2015)によると、(免疫に関与する)ヒト白血球抗原(HLA)分子の研究は、NGS技術から大きな恩恵を受けています。このように、NGS技術によって完全なHLAシーケンスのメカニズムが可能になり、転写、遺伝子発現の制御、エピジェネティクスなどのHLA遺伝子変調の理解が容易になったため、NGSを用いたハイスループットのHLAタイピング法がいくつか開発されました。このため、政府機関や民間企業は、被験者候補の遺伝子プロファイリングやクロスマッチングを目的とした研究活動を支援するようになっています。

"2022年、分子アッセイ技術セグメントが市場で最大のシェアを占める"

2022年、分子アッセイ技術セグメントが最も高いシェアを占めると予測されています。同分野の高い市場シェアは、リアルタイムサンプル分析、多検体検査機能、高い手順有効性、短い所要時間など、分子アッセイ技術がもたらす利益に起因しています。

"2022年、試薬・消耗品が最大のシェアを占める"

製品・サービスタイプ別では、2022年のHLAタイピング市場において、消耗品・試薬セグメントが3つの中で最も高いシェアを占めると報告されています。HLAタイピングにおける試薬・消耗品の利用拡大、研究における試薬・消耗品の受け入れ拡大、主要地域における早期かつ効果的な治療計画や移植診断に対する患者の重要性の高まりが、予測期間中にこのセグメントの市場成長を決定付けると予測されます。

"北米地域のHLAタイピング市場は、予測期間中に最も高い成長を遂げると予測される"

北米は、2022年のHLAタイピング市場において45.0%の最大シェアを報告しました。この北米の最高シェアは、開発された診断ツールの採用増加、カナダと米国における慢性疾患の発生率と有病率の上昇、技術開発の進展に起因しています。

一方、アジア太平洋地域は今後数年間で大きな成長が見込まれます。アジア太平洋地域のHLAタイピング市場は、主にアジア諸国の病院数の増加や政府の積極的な取り組みにより、予測期間中に7.5%のCAGRを記録すると予想されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 規制分析

- HLAタイピング市場:エコシステムマッピング

- バリューチェーン分析

- サプライチェーン分析

- 主要な利害関係者と購入基準

- 特許分析

- HLAタイピング市場に対する不況の影響

第6章 HLAタイピング市場:製品・サービス別

- イントロダクション

- 試薬・消耗品

- 機器

- ソフトウェア・サービス

第7章 HLAタイピング市場:技術別

- イントロダクション

- 分子アッセイ技術

- 非分子アッセイ技術

第8章 HLAタイピング市場:用途別

- イントロダクション

- 診断用途

- ドナー・レシピエントのクロスマッチング

- 感染症検査

- がん診断・予防

- 輸血療法

- その他

- 研究用途

第9章 HLAタイピング市場:エンドユーザー別

- イントロダクション

- 商用サービスプロバイダー

- 病院・移植センター

- 研究所・学術機関

第10章 HLAタイピング市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- その他のアジア太平洋地域

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 市場シェア分析

- 競合リーダーシップマッピング

- スタートアップ/中小企業の企業評価マトリックス(2021年)

- 競合ベンチマーキング

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- BD

- BIO-RAD LABORATORIES, INC.

- F. HOFFMAN-LA ROCHE LTD.

- CAREDX, INC.

- HOLOGIC, INC.

- ILLUMINA, INC.

- IMMUCOR, INC.

- OMIXON INC.

- QIAGEN N.V.

- TAKARA BIO INC.

- THERMO FISHER SCIENTIFIC

- BIOFORTUNA LIMITED

- GENDX

- その他の企業

- FUJIREBIO

- CREATIVE BIOLABS

- ALPHA BIOTECH LIMITED

- BAG DIAGNOSTICS GMBH

- HANSA BIOPHARMA AB

- HISTOGENETICS LLC

- PACBIO

- TBG DIAGNOSTICS LIMITED

- INNO-TRAIN DIAGNOSTIK GMBH

- KRISHGEN BIOSYSTEMS

第13章 付録

The HLA typing market is projected to reach USD 2.1 billion in 2028 from USD 1.4 billion in 2022 with a CAGR of 6.5% during the forecast period. The need and strong demand for clinical diagnostic procedures that can provide early diagnosis of infectious diseases, graft rejections, autoimmune diseases, and cancer have supported rising research activities. According to the Journal of Human Genetics (2015), research on the human leukocyte antigen (HLA) molecule (involved in immunity) has benefitted greatly from NGS technologies. Thus, several high-throughput HLA-typing methods using NGS have been developed, as NGS technology enables complete HLA sequencing mechanisms, facilitating the understanding of HLA gene modulation, including transcription, regulation of gene expression, and epigenetics. Thus, government organizations and private players increasingly support research activities that target gene profiling and cross-matching in prospective subjects.

"The molecular assay technologies segment to hold the largest share of the market in 2022"

In 2022, he molecular assay technologies segment was projected to account for the highest share. The high market share of the segment is credited to the profits of molecular assay technologies like real-time sample analysis multi-sample study capabilities, high procedural efficacy, , and low turnaround times.

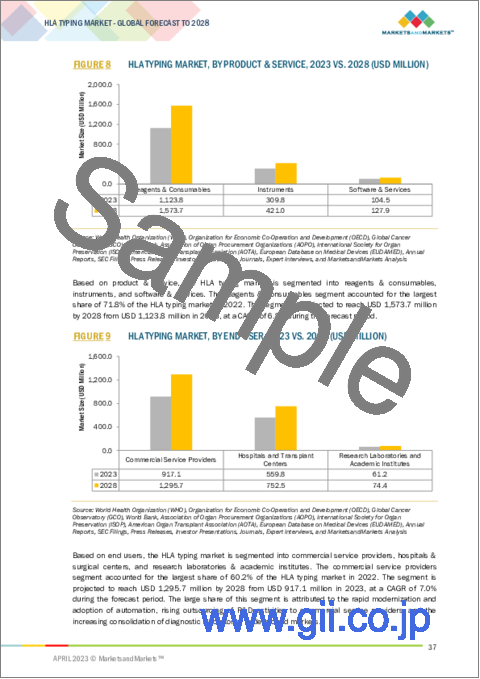

"The reagents & consumables is holding the largest share of the market in 2022"

Based on product & service, The consumables & reagents segment reported for the highest share among all the three of the HLA typing market in 2022. The increasing use of reagents & consumables in HLA typing; the increasing acceptance of reagents & consumables in research studies; growing patient importance on early and effective treatment planning transplantation diagnosis over major geographies are predictable to determine market growth for this segment over the forecast period.

"The HLA Typing market in North America region is projected to witness the highest growth over the forecast period."

North America reported the largest share of 45.0% of the HLA typing market in 2022. This highest share of North America is credited to the increased adoption of developed diagnostics tools, rising incidence and prevalence of chronic disorders in Canada and the US and growing technological developments.

While APAC is expected to witness significant growth in the coming years. The HLA typing market in the APAC region is expected to register a CAGR of 7.5% during the forecast period, primarily due to the growing number of hospitals in Asian countries and favorable government initiatives.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-40%, Tier 2-30%, and Tier 3- 30%

- By Designation: C-level-27%, Director-level-18and Others-55%

- By Region: North America-35.3%, Europe-20%, Asia Pacific-15%, Latin America-10%, and the Middle East & Africa-5%

The prominent player in HLA typing market are Bio-Rad Laboratories, Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), QIAGEN N.V. (Netherlands), Thermo Fisher Scientific Inc. (US), and bioMerieux S.A. (France). Other players in the market are Immucor, Inc. (US), Illumina, Inc. (US), Luminex Corporation (US), CareDx (US), Becton, Dickinson and Company (US), Hologic (US), GenDx (Netherlands), and Biofortuna (UK), among others

Research Coverage

This report studies the in HLA typing market based on product & service, technology, application, end user, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five main regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established and entrants/smaller firms to gauge the market's pulse, which, in turn, would help them garner a larger market share. Firms purchasing the report could use one or a combination of the below-mentioned strategies for strengthening their market presence.

This report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the microcatheter market.

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the microcatheter market..

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the microcatheter market.

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 GEOGRAPHIES COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 HLA TYPING MARKET: RESEARCH METHODOLOGY

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 2 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Insights from primary experts

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 5 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ESTIMATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

- TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

- 2.8 HLA TYPING MARKET: RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 7 HLA TYPING MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 8 HLA TYPING MARKET, BY PRODUCT & SERVICE, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 HLA TYPING MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 HLA TYPING MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 ASIA PACIFIC REGION TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 HLA TYPING MARKET OVERVIEW

- FIGURE 12 INCREASING NUMBER OF ORGAN TRANSPLANTATIONS AND RISING ADOPTION OF DONOR RECIPIENT CROSS-MATCHING TO DRIVE MARKET

- 4.2 HLA TYPING MARKET, BY DIAGNOSTIC APPLICATIONS, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 DONOR RECIPIENT CROSS-MATCHING SEGMENT TO DOMINATE DIAGNOSTIC APPLICATIONS DURING FORECAST PERIOD

- 4.3 HLA TYPING MARKET: ASIA PACIFIC, BY PRODUCT & SERVICE (2022)

- FIGURE 14 REAGENTS & CONSUMABLES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN CHINA

- 4.4 HLA TYPING MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 15 CHINA TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 HLA TYPING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising number of organ transplantation procedures

- 5.2.1.2 Rising technological advancements in HLA typing

- 5.2.1.3 Increasing funding investments for research activities

- TABLE 2 PUBLIC-PRIVATE INVESTMENTS AND RESEARCH GRANTS FOR HLA TYPING PRODUCTS, 2019-2022

- 5.2.1.4 Growing prevalence of infectious diseases

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of HLA typing products

- TABLE 3 COST OF ASSAYS FOR KEY NGS AND PCR-BASED GENOMIC TESTS IN EUROPE (AS OF 2020)

- 5.2.2.2 Limited reimbursements for target procedures

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising adoption of cross-matching and chimerism testing procedures

- 5.2.3.2 Growing awareness of organ donations

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited number of organ donations and long waiting lists for transplantations

- 5.2.4.2 Shortage of skilled professionals

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 HLA TYPING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 REGULATORY ANALYSIS

- 5.4.1 NORTH AMERICA

- 5.4.1.1 US

- TABLE 5 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 6 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- 5.4.1.2 Canada

- TABLE 7 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- 5.4.2 EUROPE

- 5.4.3 ASIA PACIFIC

- 5.4.3.1 Japan

- TABLE 8 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PHARMACEUTICAL AND MEDICAL DEVICE AGENCY (PMDA)

- 5.4.3.2 China

- TABLE 9 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- 5.4.3.3 India

- 5.4.1 NORTH AMERICA

- 5.5 HLA TYPING MARKET: ECOSYSTEM MAPPING

- FIGURE 17 ECOSYSTEM COVERAGE

- 5.6 VALUE CHAIN ANALYSIS

- 5.6.1 RESEARCH AND DEVELOPMENT

- 5.6.2 MANUFACTURING AND ASSEMBLY

- 5.6.3 DISTRIBUTION, MARKETING & SALES, AND POST-SALES SERVICES

- FIGURE 18 VALUE CHAIN ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.7.1 PROMINENT COMPANIES

- 5.7.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- FIGURE 19 SUPPLY CHAIN ANALYSIS

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF HLA TYPING PRODUCTS

- 5.8.2 BUYING CRITERIA

- FIGURE 21 KEY BUYING CRITERIA FOR HLA TYPING PRODUCTS

- TABLE 11 KEY BUYING CRITERIA FOR HLA TYPING PRODUCTS

- 5.9 PATENT ANALYSIS

- FIGURE 22 TOP 10 PATENT APPLICANTS FOR HLA TYPING

- 5.10 IMPACT OF RECESSION ON HLA TYPING MARKET

6 HLA TYPING MARKET, BY PRODUCT & SERVICE

- 6.1 INTRODUCTION

- TABLE 12 HLA TYPING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- 6.2 REAGENTS & CONSUMABLES

- 6.2.1 WIDE APPLICATIONS OF MOLECULAR ASSAY TECHNIQUES TO DRIVE MARKET

- TABLE 13 HLA TYPING MARKET FOR REAGENTS & CONSUMABLES, BY REGION, 2021-2028 (USD MILLION)

- 6.3 INSTRUMENTS

- 6.3.1 GROWING ADOPTION OF PCR AND NGS INSTRUMENTS AMONG CROS AND HOSPITALS TO FUEL MARKET

- TABLE 14 HLA TYPING MARKET FOR INSTRUMENTS, BY REGION, 2021-2028 (USD MILLION)

- 6.4 SOFTWARE & SERVICES

- 6.4.1 RISING DEMAND FOR AUTOMATION AND DIGITALIZATION IN LAB PROCEDURES TO DRIVE MARKET

- TABLE 15 HLA TYPING MARKET FOR SOFTWARE & SERVICES, BY REGION, 2021-2028 (USD MILLION)

7 HLA TYPING MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- TABLE 16 HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 7.2 MOLECULAR ASSAY TECHNOLOGIES

- TABLE 17 HLA TYPING MARKET FOR MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 18 HLA TYPING MARKET FOR MOLECULAR ASSAY TECHNOLOGIES, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 19 HLA TYPING MARKET FOR MOLECULAR ASSAY TECHNOLOGIES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 20 HLA TYPING MARKET FOR MOLECULAR ASSAY TECHNOLOGIES, BY END USER, 2021-2028 (USD MILLION)

- TABLE 21 HLA TYPING MARKET FOR MOLECULAR ASSAY TECHNOLOGIES, BY REGION, 2021-2028 (USD MILLION)

- 7.2.1 PCR-BASED MOLECULAR ASSAYS

- TABLE 22 HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 23 HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY PRODUCT & SERVICE, 2021-2028(USD MILLION)

- TABLE 24 HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 25 HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY END USER, 2021-2028 (USD MILLION)

- TABLE 26 HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAYS, BY REGION, 2021-2028 (USD MILLION)

- 7.2.1.1 Sequence-specific Primer-PCR

- 7.2.1.1.1 Expanding distribution channels of key PCR manufacturers to support market growth

- 7.2.1.1 Sequence-specific Primer-PCR

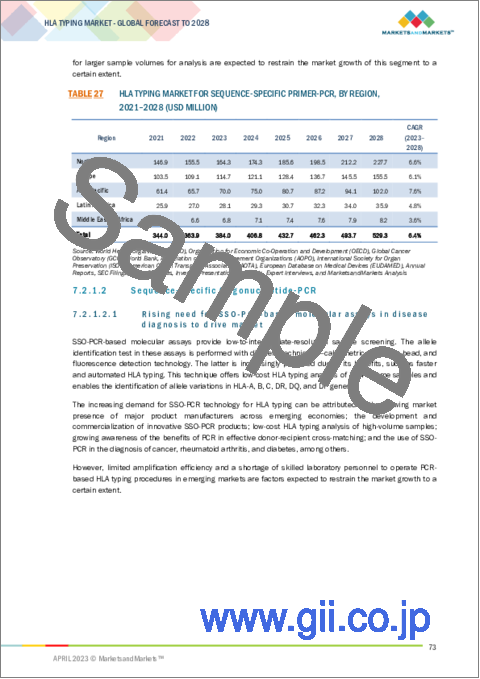

- TABLE 27 HLA TYPING MARKET FOR SEQUENCE-SPECIFIC PRIMER-PCR, BY REGION, 2021-2028 (USD MILLION)

- 7.2.1.2 Sequence-specific Oligonucleotide-PCR

- 7.2.1.2.1 Rising need for SSO-PCR-based molecular assays in disease diagnosis to drive market

- 7.2.1.2 Sequence-specific Oligonucleotide-PCR

- TABLE 28 HLA TYPING MARKET FOR SEQUENCE-SPECIFIC OLIGONUCLEOTIDE-PCR, BY REGION, 2021-2028 (USD MILLION)

- 7.2.1.3 Real-time PCR

- 7.2.1.3.1 Increasing preference for genome-based molecular diagnostics to support market growth

- 7.2.1.3 Real-time PCR

- TABLE 29 HLA TYPING MARKET FOR REAL-TIME PCR, BY REGION, 2021-2028 (USD MILLION)

- 7.2.1.4 Other PCR-based molecular assays

- TABLE 30 HLA TYPING MARKET FOR OTHER PCR-BASED MOLECULAR ASSAYS, BY REGION, 2021-2028 (USD MILLION)

- 7.2.2 SEQUENCING-BASED MOLECULAR ASSAYS

- TABLE 31 HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 32 HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 33 HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 34 HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY END USER, 2021-2028 (USD MILLION)

- TABLE 35 HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAYS, BY REGION, 2021-2028 (USD MILLION)

- 7.2.2.1 Sanger sequencing

- 7.2.2.1.1 Rising end-user preference for low-cost and efficient DNA sequencing technology to drive segment growth

- 7.2.2.1 Sanger sequencing

- TABLE 36 HLA TYPING MARKET FOR SANGER SEQUENCING, BY REGION, 2021-2028 (USD MILLION)

- 7.2.2.2 Next-generation Sequencing

- 7.2.2.2.1 High scalability, low turnaround time, and high throughput capabilities to drive segment growth

- 7.2.2.2 Next-generation Sequencing

- TABLE 37 HLA TYPING MARKET FOR NEXT-GENERATION SEQUENCING, BY REGION, 2021-2028 (USD MILLION)

- 7.2.2.3 Other sequencing-based molecular assays

- TABLE 38 HLA TYPING MARKET FOR OTHER SEQUENCING-BASED MOLECULAR ASSAYS, BY REGION, 2021-2028 (USD MILLION)

- 7.3 NON-MOLECULAR ASSAY TECHNOLOGIES

- 7.3.1 HIGH PREFERENCE OF MOLECULAR-BASED TECHNIQUES TO RESTRAIN MARKET

- TABLE 39 HLA TYPING MARKET FOR NON-MOLECULAR ASSAY TECHNOLOGIES, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 40 HLA TYPING MARKET FOR NON-MOLECULAR ASSAY TECHNOLOGIES, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 41 HLA TYPING MARKET FOR NON-MOLECULAR ASSAY TECHNOLOGIES, BY END USER, 2021-2028 (USD MILLION)

- TABLE 42 HLA TYPING MARKET FOR NON-MOLECULAR ASSAY TECHNOLOGIES, BY REGION, 2021-2028 (USD MILLION)

8 HLA TYPING MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- TABLE 43 HLA TYPING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.2 DIAGNOSTIC APPLICATIONS

- TABLE 44 HLA TYPING MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 45 HLA TYPING MARKET FOR DIAGNOSTIC APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 8.2.1 DONOR-RECIPIENT CROSS-MATCHING

- 8.2.1.1 Rising need for histocompatibility cross-matching in organ transplantation to drive market

- TABLE 46 HLA TYPING MARKET FOR DONOR-RECIPIENT CROSS-MATCHING, BY REGION, 2021-2028 (USD MILLION)

- 8.2.2 INFECTIOUS DISEASE TESTING

- 8.2.2.1 Rising burden of infectious diseases to drive adoption of HLA antigen screening

- TABLE 47 HLA TYPING MARKET FOR INFECTIOUS DISEASE TESTING, BY REGION, 2021-2028 (USD MILLION)

- 8.2.3 CANCER DIAGNOSIS & PREVENTION

- 8.2.3.1 Wide availability of advanced NGS techniques to drive adoption of HLA typing in cancer diagnostics

- TABLE 48 HLA TYPING MARKET FOR CANCER DIAGNOSIS & PREVENTION, BY REGION, 2021-2028 (USD MILLION)

- 8.2.4 TRANSFUSION THERAPY

- 8.2.4.1 Minimal risk of fatal disorders during blood transfusions to drive adoption of HLA typing

- TABLE 49 HLA TYPING MARKET FOR TRANSFUSION THERAPY, BY REGION, 2021-2028(USD MILLION)

- 8.2.5 OTHER DIAGNOSTIC APPLICATIONS

- TABLE 50 HLA TYPING MARKET FOR OTHER DIAGNOSTIC APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 8.3 RESEARCH APPLICATIONS

- 8.3.1 RISING FUNDING FOR RESEARCH AND EXPANDING APPLICATIONS OF HLA TYPING TO DRIVE MARKET

- TABLE 51 HLA TYPING MARKET FOR RESEARCH APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

9 HLA TYPING MARKET, BY END USER

- 9.1 INTRODUCTION

- TABLE 52 HLA TYPING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2 COMMERCIAL SERVICE PROVIDERS

- 9.2.1 RISING ESTABLISHMENT OF REFERENCE LABORATORIES IN EMERGING ECONOMIES TO DRIVE MARKET

- TABLE 53 HLA TYPING MARKET FOR COMMERCIAL SERVICE PROVIDERS, BY REGION, 2021-2028 (USD MILLION)

- 9.3 HOSPITALS AND TRANSPLANT CENTERS

- 9.3.1 INCREASING DEMAND FOR ADVANCED EQUIPMENT IN HOSPITALS TO DRIVE MARKET

- TABLE 54 HLA TYPING MARKET FOR HOSPITALS AND TRANSPLANT CENTERS, BY REGION, 2021-2028 (USD MILLION)

- 9.4 RESEARCH LABORATORIES AND ACADEMIC INSTITUTES

- 9.4.1 RISING GOVERNMENT SUPPORT FOR CANCER RESEARCH TO BOOST MARKET GROWTH

- TABLE 55 HLA TYPING MARKET FOR RESEARCH LABORATORIES AND ACADEMIC INSTITUTES, BY REGION, 2021-2028(USD MILLION)

10 HLA TYPING MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 56 HLA TYPING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 23 HLA TYPING MARKET: NORTH AMERICA SNAPSHOT

- TABLE 57 NORTH AMERICA: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: HLA TYPING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: HLA TYPING MARKET, BY APPLICATION 2021-2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: HLA TYPING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 High volume of stem cell and bone marrow transplantation procedures to drive market

- TABLE 63 SOLID-ORGAN TRANSPLANTATIONS PERFORMED IN US, 2021-2022

- TABLE 64 NEW CANCER CASES IN US, 2021

- TABLE 65 US: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 66 US: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 67 US: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- 10.2.2 CANADA

- 10.2.2.1 High prevalence of cancer to drive adoption of HLA typing

- TABLE 68 CANADA: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 69 CANADA: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 70 CANADA: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- 10.3 EUROPE

- TABLE 71 EUROPE: HLA TYPING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 72 EUROPE: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 73 EUROPE: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 74 EUROPE: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 75 EUROPE: HLA TYPING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 76 EUROPE: HLA TYPING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 77 EUROPE: HLA TYPING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.1 GERMANY

- 10.3.1.1 Strong presence of established manufacturers for HLA typing products to drive market

- TABLE 78 SOLID-ORGAN TRANSPLANTATIONS PERFORMED IN GERMANY, BY TYPE, 2020-2021

- TABLE 79 TARGET DISEASE INCIDENCE IN GERMANY (2021)

- TABLE 80 NEW CANCER CASES IN GERMANY, BY ORGAN (2021)

- TABLE 81 GERMANY: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 82 GERMANY: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 83 GERMANY: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Rising prevalence of autoimmune diseases to drive market

- TABLE 84 SOLID-ORGAN TRANSPLANTATIONS PERFORMED IN UK, 2021-2022

- TABLE 85 TARGET DISEASE INCIDENCE IN UK, 2021

- TABLE 86 NEW CANCER CASES IN UK, 2021

- TABLE 87 UK: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 88 UK: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 89 UK: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Rising organ rejection rate to drive market

- TABLE 90 SOLID-ORGAN TRANSPLANTATIONS PERFORMED IN FRANCE, 2021-2022

- TABLE 91 NEW CANCER CASES IN FRANCE, 2021

- TABLE 92 FRANCE: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 93 FRANCE: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, 2021-2028 (USD MILLION)

- TABLE 94 FRANCE: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES ASSAYS, BY TYPE, 2021-2028 (USD MILLION)

- 10.3.4 ITALY

- 10.3.4.1 Increasing acceptance of molecular assay technologies for personalized medicine to drive market

- TABLE 95 ITALY: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 96 ITALY: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 97 ITALY: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- 10.3.5 SPAIN

- 10.3.5.1 Rising number of solid-organ transplantation procedures to support market growth

- TABLE 98 SPAIN: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 99 SPAIN: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 100 SPAIN: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 101 REST OF EUROPE: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 102 REST OF EUROPE: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 103 REST OF EUROPE: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES ASSAYS, BY TYPE, 2021-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- FIGURE 24 HLA TYPING MARKET: ASIA PACIFIC SNAPSHOT

- TABLE 104 ASIA PACIFIC: HLA TYPING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: HLA TYPING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: HLA TYPING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: HLA TYPING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Rising adoption of HLA typing for donor-recipient screening to drive market

- TABLE 111 SOLID-ORGAN TRANSPLANTATIONS PERFORMED IN CHINA, 2021-2022

- TABLE 112 NEW CANCER CASES IN CHINA, 2021

- TABLE 113 CHINA: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 114 CHINA: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 115 CHINA: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- 10.4.2 INDIA

- 10.4.2.1 Government initiatives to provide free availability of HLA typing products to drive market

- TABLE 116 SOLID-ORGAN TRANSPLANTATIONS PERFORMED IN INDIA, 2021-2022

- TABLE 117 NEW CANCER CASES IN INDIA, 2021

- TABLE 118 INDIA: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 119 INDIA: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 120 INDIA: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- 10.4.3 JAPAN

- 10.4.3.1 Increasing budgetary allocations for healthcare to support market growth

- TABLE 121 SOLID-ORGAN TRANSPLANTATIONS PERFORMED IN JAPAN, 2021-2022

- TABLE 122 NEW CANCER CASES IN JAPAN, 2021

- TABLE 123 JAPAN: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 124 JAPAN: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 125 JAPAN: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- 10.4.4 AUSTRALIA

- 10.4.4.1 Rising prevalence of coeliac disease to drive adoption of HLA typing

- TABLE 126 SOLID-ORGAN TRANSPLANTATIONS PERFORMED IN AUSTRALIA, 2021-2022

- TABLE 127 NEW CANCER CASES IN AUSTRALIA, 2021

- TABLE 128 AUSTRALIA: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 129 AUSTRALIA: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 130 AUSTRALIA: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Rising adoption of next-generation exome sequencing to drive market

- TABLE 131 SOUTH KOREA: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 132 SOUTH KOREA: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 133 SOUTH KOREA: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES ASSAYS, BY TYPE, 2021-2028 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 134 REST OF ASIA PACIFIC: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 135 REST OF ASIA PACIFIC: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES ASSAYS, BY TYPE, 2021-2028 (USD MILLION)

- 10.5 LATIN AMERICA

- TABLE 137 LATIN AMERICA: HLA TYPING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 138 LATIN AMERICA: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 139 LATIN AMERICA: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 140 LATIN AMERICA: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 141 LATIN AMERICA: HLA TYPING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 142 LATIN AMERICA: HLA TYPING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 143 LATIN AMERICA: HLA TYPING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.1 BRAZIL

- 10.5.1.1 Supportive government regulations for adoption of advanced technologies to drive market

- TABLE 144 SOLID-ORGAN TRANSPLANTATIONS PERFORMED IN BRAZIL, 2021-2022

- TABLE 145 NEW CANCER CASES IN BRAZIL, 2021

- TABLE 146 BRAZIL: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 147 BRAZIL: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 148 BRAZIL: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- 10.5.2 MEXICO

- 10.5.2.1 Improving accessibility and affordability of healthcare services to support market growth

- TABLE 149 SOLID-ORGAN TRANSPLANTATIONS PERFORMED IN MEXICO, 2021-2022

- TABLE 150 NEW CANCER CASES IN MEXICO, 2021

- TABLE 151 MEXICO: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 152 MEXICO: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 153 MEXICO: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- 10.5.3 REST OF LATIN AMERICA

- TABLE 154 REST OF LATIN AMERICA: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 155 REST OF LATIN AMERICA: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 156 REST OF LATIN AMERICA: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- 10.6 MIDDLE EAST AND AFRICA

- 10.6.1 RISING PREVALENCE OF INFECTIOUS DISEASES TO FUEL MARKET

- TABLE 157 MIDDLE EAST & AFRICA: HLA TYPING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: HLA TYPING MARKET FOR PCR-BASED MOLECULAR ASSAY TECHNOLOGIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: HLA TYPING MARKET FOR SEQUENCING-BASED MOLECULAR ASSAY TECHNOLOGIES ASSAYS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: HLA TYPING MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: HLA TYPING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: HLA TYPING MARKET, BY END USER, 2021-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 163 HLA TYPING MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS

- FIGURE 25 HLA TYPING MARKET SHARE ANALYSIS, BY KEY PLAYER (2021)

- 11.4 COMPETITIVE LEADERSHIP MAPPING

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 26 HLA TYPING MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

- 11.5 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2021)

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 RESPONSIVE COMPANIES

- 11.5.3 DYNAMIC COMPANIES

- 11.5.4 STARTING BLOCKS

- FIGURE 27 HLA TYPING MARKET: COMPANY EVALUATION MATRIX FOR SMES/STARTUPS, 2021

- 11.6 COMPETITIVE BENCHMARKING

- TABLE 164 HLA TYPING MARKET: PRODUCT ANALYSIS FOR KEY PLAYERS

- TABLE 165 HLA TYPING MARKET: APPLICATION FOOTPRINT ANALYSIS FOR KEY PLAYERS

- TABLE 166 HLA TYPING MARKET: REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES

- TABLE 167 HLA TYPING MARKET: PRODUCT LAUNCHES (2019-2022)

- 11.7.2 DEALS

- TABLE 168 HLA TYPING MARKET: DEALS (2019-2022)

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1.1 BD

- TABLE 169 BD: COMPANY OVERVIEW (2021)

- FIGURE 28 BD: COMPANY SNAPSHOT (2021)

- 12.1.2 BIO-RAD LABORATORIES, INC.

- TABLE 170 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW (2021)

- FIGURE 29 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2021)

- 12.1.3 F. HOFFMAN-LA ROCHE LTD.

- TABLE 171 F. HOFFMAN-LA ROCHE LTD: COMPANY OVERVIEW (2021)

- FIGURE 30 F. HOFFMAN-LA ROCHE LTD: COMPANY SNAPSHOT (2021)

- 12.1.4 CAREDX, INC.

- TABLE 172 CAREDX, INC.: COMPANY OVERVIEW (2021)

- FIGURE 31 CAREDX, INC.: COMPANY SNAPSHOT (2021)

- 12.1.5 HOLOGIC, INC.

- TABLE 173 HOLOGIC, INC.: COMPANY OVERVIEW (2021)

- FIGURE 32 HOLOGIC, INC.: COMPANY SNAPSHOT (2021)

- 12.1.6 ILLUMINA, INC.

- TABLE 174 ILLUMINA, INC.: COMPANY OVERVIEW (2021)

- FIGURE 33 ILLUMINA, INC.: COMPANY SNAPSHOT (2021)

- 12.1.7 IMMUCOR, INC.

- TABLE 175 IMMUCOR, INC.: COMPANY OVERVIEW (2021)

- FIGURE 34 IMMUCOR, INC.: COMPANY SNAPSHOT (2021)

- 12.1.8 OMIXON INC.

- TABLE 176 OMIXON INC.: COMPANY OVERVIEW (2021)

- 12.1.9 QIAGEN N.V.

- TABLE 177 QIAGEN N.V.: COMPANY OVERVIEW (2021)

- FIGURE 35 QIAGEN N.V.: COMPANY SNAPSHOT (2021)

- 12.1.10 TAKARA BIO INC.

- TABLE 178 TAKARA BIO INC.: COMPANY OVERVIEW (2021)

- FIGURE 36 TAKARA BIO, INC: COMPANY SNAPSHOT (2021)

- 12.1.11 THERMO FISHER SCIENTIFIC

- TABLE 179 THERMO FISHER SCIENTIFIC: COMPANY OVERVIEW (2021)

- FIGURE 37 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2021)

- 12.1.12 BIOFORTUNA LIMITED

- 12.1.13 GENDX

- TABLE 180 GENDX: COMPANY OVERVIEW (2021)

- 12.2 OTHER PLAYERS

- 12.2.1 FUJIREBIO

- 12.2.2 CREATIVE BIOLABS

- 12.2.3 ALPHA BIOTECH LIMITED

- 12.2.4 BAG DIAGNOSTICS GMBH

- 12.2.5 HANSA BIOPHARMA AB

- 12.2.6 HISTOGENETICS LLC

- 12.2.7 PACBIO

- 12.2.8 TBG DIAGNOSTICS LIMITED

- 12.2.9 INNO-TRAIN DIAGNOSTIK GMBH

- 12.2.10 KRISHGEN BIOSYSTEMS

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS