|

|

市場調査レポート

商品コード

1272860

グミサプリメントの世界市場:タイプ別、でんぷん成分別、流通チャネル別、エンドユーザー別、機能性別、地域別 - 2028年までの予測Gummy Supplements Market by Type, Starch Ingredient, Distribution Channel, End User, Functionality & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| グミサプリメントの世界市場:タイプ別、でんぷん成分別、流通チャネル別、エンドユーザー別、機能性別、地域別 - 2028年までの予測 |

|

出版日: 2023年05月10日

発行: MarketsandMarkets

ページ情報: 英文 320 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のグミサプリメントの市場規模は、2023年の246億米ドルから、2028年までに485億米ドルに達し、金額ベースでは予測期間中にCAGRで14.5%の成長が予測されています。

グミサプリメントは、免疫機能の向上や健康な髪と肌の促進など、特定の健康効果をもたらすものとして販売されています。グミサプリメントは現在、ドラッグストアやスーパーマーケット、オンライン小売店などで広く販売されており、消費者にとってより身近なものとなっています。グミサプリメントは、ビタミンやミネラルを摂取するのに便利な方法で、特に錠剤を飲み込むのが困難な方にとって、便利な方法です。グミサプリメントにはさまざまなフレーバーがあり、従来のサプリメントの味が苦手な方にも魅力的な商品です。企業は、必要な栄養素を簡単に摂取できるグミサプリメントを大々的に宣伝しています。

"タイプ別では、ビタミングミが予測期間中に高い需要が見込まれる"

ビタミングミは、苦みや不快な味を持つことがある従来のビタミンサプリメントよりも、口当たりが良いことが多いです。グミの甘くフルーティーな味は、子供や大人まで魅力的なものです。また、グミは飲みやすく、水や食べ物を必要としないので、外出先でも手軽に摂取することができます。この利便性により、1日に必要なビタミンを確実に摂取したい忙しい人々に人気のある選択肢となっています。ビタミングミは、食事に必要なビタミンをおいしく補う方法として、盛んに宣伝されています。カラフルなパッケージと広告キャンペーンは、サプリメントとしてのグミの人気に貢献しています。グミは美味しくて飲みやすいので、従来のサプリメントよりも効果的だと考える人もいます。さらに、栄養不足の人々の増加により、ビタミングミ市場は急速に拡大しています。FAOによると、栄養不足人口は2021年に8億2,800万人に上るとされています。栄養不足に陥った人口は、成長に必要な栄養素や食料を得ることができません。ビタミングミを栄養源として活用することで、栄養の需要を満たし、栄養不足の人々に健康上のメリットを提供することができます。したがって、栄養不足の人々の増加は、ビタミングミ市場を牽引すると思われます。全体として、味、利便性、マーケティング、栄養不足の人々の増加、効果に対する認識などの組み合わせにより、ビタミングミは需要の高いサプリメントとなっています。

"流通チャネル別では、利便性と競合価格のため、オンライン小売店が広く利用されている"

オンライン小売店は、消費者が自宅に居ながらにしてグミサプリメントを購入できる便利な方法を提供します。消費者は、店舗に足を運ぶことなく、幅広い商品を簡単に閲覧し、価格を比較したり、レビューを読んだりすることができます。オンライン小売店では、一般的な店舗と比較して、より多くの種類のグミサプリメントを提供している場合があります。これは、オンライン小売店が複数のサプライヤーやメーカーから製品を調達し、消費者に幅広い選択肢を提供するためです。多くのオンライン小売店では、グミサプリメントのカスタマイズオプションを提供しており、例えば、個人用のビタミンパックや定期購入サービスなどがあります。これにより、消費者はサプリメントの摂取量を自分のニーズや好みに合わせて調整することができます。オンライン小売店は、一般的な店舗よりも諸経費が少ないため、競合他社に負けない価格設定が可能な場合があります。このため、グミサプリメントは消費者にとってより手頃な価格となっています。

"地域別では、ビタミンやサプリメントの需要増加により、米国が北米のグミサプリメント市場を牽引している"

米国におけるグミサプリメント市場は、より多くの消費者が総合的な健康と幸福をサポートする方法を求めているため、より便利な方法でビタミンやサプリメントを摂取したいという消費者の需要の増加によって牽引されています。米国におけるグミサプリメント市場の成長を促進する主な要因としては、子供や若年層におけるグミサプリメントの人気の高まり、栄養補助食品の健康効果に関する意識の高まり、オンライン小売店、スーパーマーケット、健康食品店など様々な流通チャネルで幅広い種類のグミサプリメント製品が入手可能であることなどが挙げられます。健康的なライフスタイルを維持することの重要性に対する消費者の意識の高まり、米国の人口の高齢化、慢性疾患の蔓延が、米国におけるグミサプリメント市場を牽引しています。また、消費者は健康管理に積極的になり、健康全般をサポートする自然でホリスティックな方法を求めるようになっています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- 顧客のビジネスに影響を与える動向

- バリューチェーン分析

- 貿易データ:グミサプリメント市場

- グミサプリメントの市場マッピングとエコシステム

- 価格分析

- ポーターのファイブフォース分析

- 技術分析

- ケーススタディ

- 特許分析

- 関税と規制状況

- 主要な利害関係者と購入基準

- 主な会議とイベント(2023年~2024年)

第7章 グミサプリメント市場:タイプ別

- イントロダクション

- ビタミングミ

- オメガ脂肪酸グミ

- コラーゲングミ

- CBDグミ

- その他

第8章 グミサプリメント市場:でんぷん成分別

- イントロダクション

- でんぷんが含まれる

- でんぷんが含まれない

第9章 グミサプリメント市場:機能性別

- イントロダクション

- 免疫

- 皮膚・髪・爪

- 不妊治療

- 骨の健康

- その他

第10章 グミサプリメント市場:エンドユーザー別

- イントロダクション

- 子供

- 成人

- 高齢者

第11章 グミサプリメント市場:流通チャネル別

- イントロダクション

- ハイパーマーケット・スーパーマーケット

- 薬局・ドラッグストア

- コンビニエンスストア

- オンライン小売店

- その他

第12章 グミサプリメント市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- オランダ

- その他の欧州

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア・ニュージーランド

- その他のアジア太平洋地域

- その他の地域

- 南米

- 中東

- アフリカ

第13章 競合情勢

- 概要

- 主要企業の収益分析

- 市場シェア分析

- 上位企業5社が採用した主な戦略

- 企業評価象限(主要企業)

- グミサプリメント市場:スタートアップ/中小企業の評価象限

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- GSK PLC

- CHURCH & DWIGHT CO., INC.

- H&H GROUP

- AMWAY

- PROCAPS GROUP

- THE CLOROX COMPANY

- BAYER AG

- HALEON GROUP OF COMPANIES

- CATALENT, INC.

- NESTLE

- UNILEVER

- OTSUKA HOLDINGS CO., LTD.

- PHARMACARE LABORATORIES AUSTRALIA

- SWANSON

- GLOBAL WIDGET, LLC

- IM HEALTHCARE

- SMP NUTRA

- NATURE'S TRUTH

- HERBALAND NATURALS INC.

- その他の企業

- ZANONVITAMEC.COM

- HERO NUTRITIONALS

- NUTRA SOLUTIONS USA

- VITAKEM NUTRACEUTICAL INC.

- BOSCOGEN, INC.

- MAKERS NUTRITION, LLC

- ERNEST JACKSON

- SCN BESTCO

- NATURE'S WAY BRANDS

- THE HUT.COM LTD

第15章 隣接市場・関連市場

- イントロダクション

- 制限事項

- 栄養補助食品市場

- ビタミングミ市場

- 骨・関節の健康サプリメント市場

第16章 付録

The global gummy supplements market is projected to reach USD 48.5 USD Billion by 2028 from USD 24.6 Billion by 2023, at a CAGR of 14.5% during the forecast period in terms of value. Gummy supplements are marketed as providing specific health benefits, such as boosting immune function or promoting healthy hair and skin. Gummy supplements are now widely available at drugstores, supermarkets, and online retailers, making them more accessible to consumers. Gummy supplements are a convenient way to consume vitamins and minerals, especially for people who have difficulty swallowing pills. Gummy supplements come in a variety of flavors, making them more appealing to people who don't like the taste of traditional supplements. Companies have been heavily marketing gummy supplements as an easy way to get essential nutrients.

"By type, Vitamin Gummies is projected in high demand during the forecast period."

Vitamin gummies are often more palatable than traditional vitamin supplements, which can have a bitter or unpleasant taste. The sweet and fruity flavor of gummies makes them more appealing to children and adults. Vitamin gummies are easy to take and can be consumed on-the-go without the need for water or food. This convenience makes them a popular choice for busy people who want to ensure they get their daily dose of vitamins. Vitamin gummies have been heavily marketed as a tasty way to supplement in diet with essential vitamins. The colorful packaging and advertising campaigns have contributed to the popularity of gummies as a supplement. Some people believe that gummies are more effective than traditional supplements because they taste good and are easier to take. Moreover, the gummy vitamin market is expanding rapidly as a result of the rising number of undernourished people. According to FAO, the number of undernourished people rose to 828 million in 2021. The population that is undernourished does not get the essential nutrients and food needed for growth. The gummy vitamins can be utilized as a nutritional source to meet the demand for nourishment and provide the undernourished population with health advantages. Thus, the rise in number of undernourished people is likely to drive the market for gummy vitamins. Overall, the combination of taste, convenience, marketing, rise in number of undernourished people and perception of effectiveness has made vitamin gummies a highly demanding supplement.

"By Distribution Channel, Online Retail Stores is widely used due to convenience and competitive pricing."

Online retail stores provide a convenient way for consumers to purchase gummy supplements from the comfort of their homes. Consumers are able to easily browse through a wide range of products, compare prices, and read reviews without having to physically visit a store. Online retail stores often offer a greater variety of gummy supplements compared to general stores. This is because online retailers source products from multiple suppliers and manufacturers, providing consumers with a wider selection to choose from. Many online retailers offer customization options for gummy supplements, such as personalized vitamin packs or subscription services. This allows consumers to tailor their supplement intake to their specific needs and preferences. Online retailers are often able to offer competitive pricing due to lower overhead costs than general stores. This makes gummy supplements more affordable for consumers.

"By Region, US is driving the market in North America in gummy supplements due to increasing demand of vitamins and supplements."

The gummy supplement market in the US is driven by increasing consumer demand for more convenient ways to take vitamins and supplements as more consumers are looking for ways to support their overall health and well-being. Some of the key factors driving the growth of the gummy supplement market in the US include the increasing popularity of gummy supplements among children and young adults, the rising awareness about the health benefits of dietary supplements, and the availability of a wide range of gummy supplement products across various distribution channels such as online stores, supermarkets, and health food stores. The growing awareness among consumers about the importance of maintaining a healthy lifestyle, the aging of the US population, and the increasing prevalence of chronic diseases is driving the gummy supplements market in US. In addition, consumers are becoming more proactive in managing their health, and are looking for natural and holistic ways to support their overall wellness.

Break-up of Primaries:

By Value Chain Side: Tier 1-45%, Tier 2-33% and Tier 3-22%

By Designation: C-level-45%, D-level - 33%, and Others- 22%

By Region: Europe - 30%, Asia Pacific - 30%, North America - 15% and RoW-25%

Leading players profiled in this report:

- GSK plc (UK)

- Church & Dwight Co., Inc (US)

- Unilever (Uk)

- Nestle (Switzerland)

- Amway (US)

- Otsuka Holding (Japan)

- The Clorox Company (US)

- Haleon Group of Companies (UK)

Research Coverage:

The report segments the gummy supplements market on the basis on product type, distribution channel, end user, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global gummy supplements, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, and agreements. new product launches, mergers and acquisitions, and recent developments associated with the gummy supplements market. Competitive analysis of upcoming startups in the gummy supplements market ecosystem is covered in this report.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- FIGURE 2 REGIONAL SEGMENTATION

- 1.4 YEARS CONSIDERED

- FIGURE 3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019-2022

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 4 GUMMY SUPPLEMENTS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- FIGURE 5 KEY DATA FROM SECONDARY SOURCES

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Key industry insights

- FIGURE 6 KEY INDUSTRY INSIGHTS

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.4 Primary sources

- FIGURE 8 PRIMARY SOURCES

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 GUMMY SUPPLEMENTS MARKET SIZE ESTIMATION: SUPPLY SIDE

- FIGURE 9 SUPPLY-SIDE ANALYSIS

- 2.2.2 GUMMY SUPPLEMENTS MARKET SIZE ESTIMATION: DEMAND SIDE

- FIGURE 10 DEMAND-SIDE ANALYSIS

- 2.2.3 GUMMY SUPPLEMENTS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 11 GUMMY SUPPLEMENTS MARKET SHARE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.4 GUMMY SUPPLEMENTS MARKET SIZE ESTIMATION : TOP-DOWN APPROACH

- FIGURE 12 GUMMY SUPPLEMENTS MARKET SHARE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 13 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 14 ASSUMPTIONS

- 2.5 LIMITATIONS

- FIGURE 15 STUDY LIMITATIONS AND RISK ASSESSMENT

- 2.6 RECESSION IMPACT ANALYSIS

- FIGURE 16 RECESSION INDICATORS AND THEIR IMPACT ON GUMMY SUPPLEMENTS MARKET

- FIGURE 17 GUMMY SUPPLEMENTS MARKET: PREVIOUS FORECAST VS. RECESSION FORECAST

3 EXECUTIVE SUMMARY

- TABLE 2 GUMMY SUPPLEMENTS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 18 GUMMY SUPPLEMENTS MARKET SIZE, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 19 GUMMY SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2023 VS. 2028 (USD MILLION)

- FIGURE 20 GUMMY SUPPLEMENTS MARKET SIZE, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 21 GUMMY SUPPLEMENTS MARKET SHARE AND GROWTH RATE, BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF GUMMY SUPPLEMENTS MARKET

- FIGURE 22 GROWING PREFERENCE FOR NATURAL AND ORGANIC INGREDIENTS TO DRIVE MARKET

- 4.2 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY END USER AND COUNTRY

- FIGURE 23 ADULTS ACCOUNTED FOR LARGEST SHARE IN 2022

- 4.3 GUMMY SUPPLEMENTS MARKET: REGIONAL SUBMARKETS

- FIGURE 24 US HELD LARGEST SHARE IN GUMMY SUPPLEMENTS MARKET, 2022

- 4.4 GUMMY SUPPLEMENTS MARKET, BY TYPE AND REGION

- FIGURE 25 NORTH AMERICA TO DOMINATE GUMMY SUPPLEMENTS MARKET ACROSS ALL TYPES, 2023 VS. 2028

- 4.5 GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL AND REGION

- FIGURE 26 HYPERMARKETS & SUPERMARKETS TO DOMINATE GUMMY SUPPLEMENTS MARKET ACROSS ALL DISTRIBUTION CHANNELS, 2023 VS. 2028

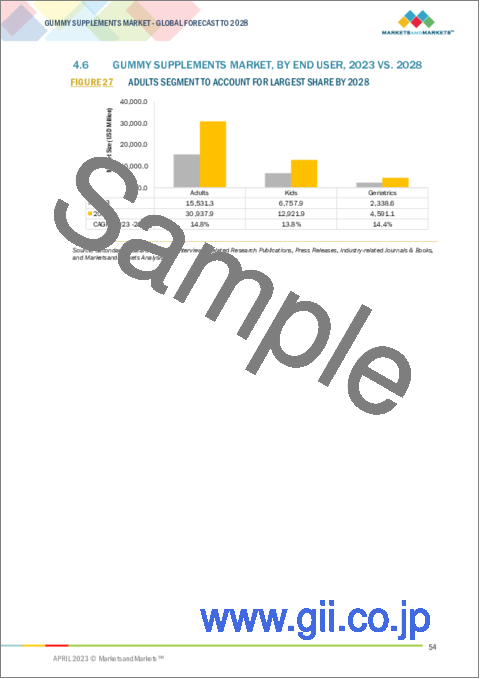

- 4.6 GUMMY SUPPLEMENTS MARKET, BY END USER, 2023 VS. 2028

- FIGURE 27 ADULTS SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 28 GUMMY SUPPLEMENTS MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising rate of vitamin-deficiency diseases and undernutrition

- 5.2.1.2 Soaring burden of metabolic diseases

- 5.2.1.3 Increasing rates of infertility

- 5.2.1.4 Growing consumer interest in beauty and wellness

- 5.2.1.5 Increase in product innovations

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of gummy supplements

- 5.2.2.2 High sugar content in gummy supplements

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising health awareness among consumers and demand for plant-based products

- 5.2.3.2 Increase in aging population

- FIGURE 29 RISING AGING POPULATION WORLDWIDE

- 5.2.4 CHALLENGES

- 5.2.4.1 Risks associated with overconsumption of gummy supplements

- 5.2.4.2 Formulation challenges of gummy supplements

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 30 REVENUE SHIFT FOR GUMMY SUPPLEMENTS MARKET

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.3.2 RAW MATERIAL SOURCING

- 6.3.3 PRODUCTION AND PROCESSING

- 6.3.4 QUALITY AND SAFETY CONTROLLERS

- 6.3.5 MARKETING & DISTRIBUTION

- 6.3.6 END USERS

- FIGURE 31 VALUE CHAIN ANALYSIS OF GUMMY SUPPLEMENTS MARKET: MANUFACTURING AND QUALITY & SAFETY CONTROLLERS TO BE KEY CONTRIBUTORS

- 6.4 TRADE DATA: GUMMY SUPPLEMENTS MARKET

- 6.4.1 IMPORT ANALYSIS: PROVITAMINS AND VITAMINS

- TABLE 3 TOP IMPORTERS OF PROVITAMINS AND VITAMINS, 2022

- 6.4.2 EXPORT ANALYSIS: PROVITAMINS AND VITAMINS

- TABLE 4 TOP EXPORTERS OF PROVITAMINS AND VITAMINS, 2022 (USD THOUSAND)

- 6.5 MARKET MAPPING AND ECOSYSTEM OF GUMMY SUPPLEMENTS

- 6.5.1 DEMAND SIDE

- 6.5.2 SUPPLY SIDE

- FIGURE 32 GUMMY SUPPLEMENTS MARKET MAP

- TABLE 5 GUMMY SUPPLEMENTS MARKET: SUPPLY CHAIN (ECOSYSTEM)

- 6.6 PRICING ANALYSIS

- TABLE 6 AVERAGE SELLING PRICE (ASP) OF GUMMY SUPPLEMENTS, BY TYPE, 2019-2023 (USD/KG)

- TABLE 7 AVERAGE SELLING PRICE (ASP) OF GUMMY SUPPLEMENTS, BY REGION, 2019-2023 (USD/KG)

- TABLE 8 AVERAGE SELLING PRICE (ASP) OF GUMMY SUPPLEMENTS, BY KEY PLAYER, 2023, (USD/UNIT)

- 6.7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 GUMMY SUPPLEMENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.7.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.7.2 BARGAINING POWER OF SUPPLIERS

- 6.7.3 BARGAINING POWER OF BUYERS

- 6.7.4 THREAT OF SUBSTITUTES

- 6.7.5 THREAT OF NEW ENTRANTS

- 6.8 TECHNOLOGY ANALYSIS

- 6.9 CASE STUDY

- TABLE 10 PECTIN IMPROVED PRODUCTION LINE FOR PLANT-BASED CONSUMER HEALTH PRODUCTS

- 6.10 PATENT ANALYSIS

- FIGURE 33 NUMBER OF PATENTS GRANTED BETWEEN 2019 AND 2023

- TABLE 11 PATENTS PERTAINING TO GUMMY SUPPLEMENTS, 2019-2023

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 DEFINITIONS AND REGULATIONS FOR DIETARY SUPPLEMENTS GLOBALLY

- 6.11.1 NORTH AMERICA

- 6.11.1.1 Canada

- 6.11.1.2 US

- 6.11.1.3 Mexico

- 6.11.2 EUROPEAN UNION (EU)

- 6.11.2.1 France

- 6.11.2.2 Spain

- 6.11.3 ASIA PACIFIC

- 6.11.3.1 Japan

- 6.11.3.2 China

- 6.11.3.3 India

- 6.11.3.4 Australia & New Zealand

- 6.11.4 REST OF THE WORLD (ROW)

- 6.11.4.1 Brazil

- 6.11.4.2 Argentina

- 6.11.4.3 Israel

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING FOR KEY TYPES

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TYPES

- 6.12.2 BUYING CRITERIA

- FIGURE 35 KEY BUYING CRITERIA FOR TOP TYPES

- TABLE 18 KEY BUYING CRITERIA FOR GUMMY SUPPLEMENT TYPES

- 6.13 KEY CONFERENCES & EVENTS IN 2023-2024

- TABLE 19 KEY CONFERENCES & EVENTS IN GUMMY SUPPLEMENTS MARKET, 2023-2024

7 GUMMY SUPPLEMENTS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 36 GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 20 GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 21 GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 22 GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 23 GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (KT)

- 7.2 VITAMIN GUMMIES

- 7.2.1 RISING INSTANCES OF VITAMIN DEFICIENCIES TO DRIVE SEGMENT

- TABLE 24 VITAMIN GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 25 VITAMIN GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 26 VITAMIN GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 27 VITAMIN GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (KT)

- 7.3 OMEGA FATTY ACID GUMMIES

- 7.3.1 SOARING CASES OF CVD AND BENEFITS OF OMEGA-3 FATTY ACIDS TO FOSTER SEGMENT'S GROWTH

- TABLE 28 OMEGA FATTY ACID GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 29 OMEGA FATTY ACID GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 30 OMEGA FATTY ACID GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 31 OMEGA FATTY ACID GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (KT)

- 7.4 COLLAGEN GUMMIES

- 7.4.1 INCREASED INTEREST IN SKIN CARE AMONG CONSUMERS TO BOOST MARKET

- TABLE 32 COLLAGEN GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 33 COLLAGEN GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 34 COLLAGEN GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 35 COLLAGEN GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (KT)

- 7.5 CBD GUMMIES

- 7.5.1 RISING CASES OF INSOMNIA COUPLED WITH STRESS AND ANXIETY TO CONTRIBUTE TO MARKET GROWTH

- TABLE 36 CBD GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 37 CBD GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 38 CBD GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 39 CBD GUMMIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (KT)

- 7.6 OTHER TYPES

- 7.6.1 HEALTH-PROMOTING PROPERTIES TO AUGMENT SEGMENT'S GROWTH

- TABLE 40 OTHER TYPES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 41 OTHER TYPES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 42 OTHER TYPES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 43 OTHER TYPES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (KT)

8 GUMMY SUPPLEMENTS MARKET, BY STARCH INGREDIENT

- 8.1 INTRODUCTION

- 8.2 SUPPLEMENTS WITH STARCH

- 8.2.1 RISING DEMAND FOR FUNCTIONAL PRODUCTS TO MEET NUTRITIONAL REQUIREMENTS

- 8.3 STARCHLESS SYSTEMS

- 8.3.1 COST-EFFECTIVENESS AND REDUCED PRODUCTION TIME OF STARCHLESS SYSTEMS TO FOSTER MARKET GROWTH

9 GUMMY SUPPLEMENTS MARKET, BY FUNCTIONALITY

- 9.1 INTRODUCTION

- 9.2 IMMUNITY

- 9.2.1 RISING AWARENESS ABOUT IMPROVING IMMUNITY TO DRIVE MARKET

- 9.3 SKIN, HAIR, AND NAILS

- 9.3.1 INCREASED SKIN AND HAIR DAMAGE OWING TO ENVIRONMENTAL FACTORS TO DRIVE MARKET

- 9.4 FERTILITY

- 9.4.1 INCREASING RATES OF INFERTILITY WORLDWIDE TO FUEL MARKET GROWTH

- 9.5 BONE HEALTH

- 9.5.1 RISING CASES OF OSTEOPOROSIS TO PROPEL MARKET GROWTH

- 9.6 OTHER FUNCTIONALITIES

- 9.6.1 INCREASING RATES OF OBESITY TO AUGMENT SEGMENT GROWTH

10 GUMMY SUPPLEMENTS MARKET, BY END USER

- 10.1 INTRODUCTION

- FIGURE 37 GUMMY SUPPLEMENTS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- TABLE 44 GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 45 GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.2 KIDS

- 10.2.1 HIGH NUTRIENT DEMAND FOR KIDS TO AUGMENT GROWTH OF GUMMY SUPPLEMENTS

- TABLE 46 KIDS: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 47 KIDS: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 ADULTS

- 10.3.1 RISING RATES OF NUTRIENT DEFICIENCY IN ADULTS TO INCREASE USAGE OF GUMMY SUPPLEMENTS

- TABLE 48 ADULTS: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 49 ADULTS: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 GERIATRICS

- 10.4.1 SWALLOWING DIFFICULTIES AND NUTRITIONAL DEFICIENCIES TO INCREASE DEMAND FOR GUMMY SUPPLEMENTS

- TABLE 50 GERIATRICS: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 51 GERIATRICS: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

11 GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL

- 11.1 INTRODUCTION

- FIGURE 38 GUMMY SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2023 VS. 2028 (USD MILLION)

- TABLE 52 GUMMY SUPPLEMENTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019-2022 (USD MILLION)

- TABLE 53 GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (USD MILLION)

- 11.2 HYPERMARKETS & SUPERMARKETS

- 11.2.1 PREFERRED PURCHASING DESTINATION AND AVAILABILITY OF VARIANTS TO DRIVE GROWTH

- TABLE 54 HYPERMARKETS & SUPERMARKETS: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 55 HYPERMARKETS & SUPERMARKETS: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 PHARMACIES & DRUGSTORES

- 11.3.1 WIDE PRESENCE AND AROUND-THE-CLOCK SERVICES TO DRIVE GROWTH

- TABLE 56 DRUG STORES/PHARMACIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 57 DRUG STORES/PHARMACIES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.4 CONVENIENCE STORES

- 11.4.1 PREFERENCE TOWARD SPECIALIZED HEALTHCARE PRODUCTS TO FUEL GROWTH

- TABLE 58 CONVENIENCE STORES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 59 CONVENIENCE STORES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.5 ONLINE RETAIL STORES

- 11.5.1 PREFERENCE FOR BUYING HEALTH-RELATED PRODUCTS THROUGH ONLINE STORES TO DRIVE MARKET

- TABLE 60 ONLINE RETAIL STORES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 61 ONLINE RETAIL STORES: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.6 OTHER DISTRIBUTION CHANNELS

- TABLE 62 OTHER DISTRIBUTION CHANNELS: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 63 OTHER DISTRIBUTION CHANNELS: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

12 GUMMY SUPPLEMENTS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 39 CHINA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD (IN TERMS OF VALUE)

- TABLE 64 GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 65 GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 66 GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 67 GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (KT)

- 12.2 NORTH AMERICA

- FIGURE 40 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET SNAPSHOT

- 12.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 41 NORTH AMERICAN GUMMY SUPPLEMENTS MARKET: RECESSION IMPACT ANALYSIS

- TABLE 68 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 71 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 72 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 75 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 76 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2019-2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 Presence of key players and various health trends to boost market

- TABLE 80 US: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 81 US: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 82 US: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 83 US: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 Convenience, taste, and health benefits of gummy supplements to drive market

- TABLE 84 CANADA: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 85 CANADA: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 86 CANADA: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 87 CANADA: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.2.4 MEXICO

- 12.2.4.1 Rising health-conscious and vegan population to drive gummy supplements market in Mexico

- TABLE 88 MEXICO: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 89 MEXICO: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 90 MEXICO: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 91 MEXICO: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- TABLE 92 EUROPE: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 93 EUROPE: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 94 EUROPE: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 95 EUROPE: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 96 EUROPE: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 97 EUROPE: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 98 EUROPE: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 99 EUROPE: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 100 EUROPE: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2019-2022 (USD MILLION)

- TABLE 101 EUROPE: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (USD MILLION)

- TABLE 102 EUROPE: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 103 EUROPE: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.3.2 GERMANY

- 12.3.2.1 Growing interest in health & wellness to drive gummy supplements market

- TABLE 104 GERMANY: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 105 GERMANY: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 106 GERMANY: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 107 GERMANY: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.3.3 UK

- 12.3.3.1 Rising prevalence of diseases to drive gummy supplements market

- TABLE 108 UK: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 109 UK: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 110 UK: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 111 UK: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.3.4 FRANCE

- 12.3.4.1 High healthcare costs and increased demand for dietary supplements to drive market

- TABLE 112 FRANCE: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 113 FRANCE: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 114 FRANCE: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 115 FRANCE: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.3.5 SPAIN

- 12.3.5.1 Adoption of healthy lifestyles to drive market

- TABLE 116 SPAIN: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 117 SPAIN: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 118 SPAIN: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 119 SPAIN: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.3.6 ITALY

- 12.3.6.1 Strong e-commerce system and geriatric population to drive market

- TABLE 120 ITALY: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 121 ITALY: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 122 ITALY: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 123 ITALY: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.3.7 NETHERLANDS

- 12.3.7.1 Rising awareness about health benefits of gummy supplements to drive market

- TABLE 124 NETHERLANDS: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 125 NETHERLANDS: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 126 NETHERLANDS: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 127 NETHERLANDS: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.3.8 REST OF EUROPE

- 12.3.8.1 Changes in consumer lifestyles, convenience, and health benefits to drive growth

- TABLE 128 REST OF EUROPE: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 129 REST OF EUROPE: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 130 REST OF EUROPE: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 131 REST OF EUROPE: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 42 ASIA PACIFIC GUMMY SUPPLEMENTS MARKET: RECESSION IMPACT ANALYSIS

- TABLE 132 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2019-2022 (KT)

- TABLE 135 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 136 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 139 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 140 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2019-2022 (USD MILLION)

- TABLE 141 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 143 ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.4.2 CHINA

- 12.4.2.1 Large population and increase in prevalence of diseases to drive gummy supplements market growth

- TABLE 144 CHINA: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 145 CHINA: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 146 CHINA: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 147 CHINA: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.4.3 JAPAN

- 12.4.3.1 Rising awareness and shift in preferences toward dietary supplements to drive market

- TABLE 148 JAPAN: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 149 JAPAN: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 150 JAPAN: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 151 JAPAN: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.4.4 INDIA

- 12.4.4.1 Vitamin deficiency among consumers to drive market

- TABLE 152 INDIA: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 153 INDIA: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 154 INDIA: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 155 INDIA: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Increase in health consciousness and attractive marketing campaigns to drive market

- TABLE 156 SOUTH KOREA: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 157 SOUTH KOREA: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 158 SOUTH KOREA: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 159 SOUTH KOREA: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.4.6 AUSTRALIA & NEW ZEALAND

- 12.4.6.1 High demand for dietary supplements, particularly in new formats, to drive market growth

- TABLE 160 AUSTRALIA & NEW ZEALAND: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 161 AUSTRALIA & NEW ZEALAND: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 162 AUSTRALIA & NEW ZEALAND: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 163 AUSTRALIA & NEW ZEALAND: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.4.7 REST OF ASIA PACIFIC

- TABLE 164 REST OF ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.5 REST OF THE WORLD (ROW)

- 12.5.1 ROW: RECESSION IMPACT

- TABLE 168 ROW: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 169 ROW: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 170 ROW: GUMMY SUPPLEMENTS MARKET, BY REGION, 2019-2022 (KT)

- TABLE 171 ROW: GUMMY SUPPLEMENTS MARKET, BY REGION, 2023-2028 (KT)

- TABLE 172 ROW: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 173 ROW: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 174 ROW: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (KT)

- TABLE 175 ROW: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 176 ROW: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2019-2022 (USD MILLION)

- TABLE 177 ROW: GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL, 2023-2028 (USD MILLION)

- TABLE 178 ROW: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 179 ROW: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.5.2 SOUTH AMERICA

- 12.5.2.1 Wide availability of raw materials and awareness of health benefits to drive market

- TABLE 180 SOUTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 181 SOUTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 182 SOUTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 183 SOUTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.5.3 MIDDLE EAST

- 12.5.3.1 Rising disposable incomes and healthcare costs to drive market

- TABLE 184 MIDDLE EAST: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 185 MIDDLE EAST: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 186 MIDDLE EAST: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 187 MIDDLE EAST: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

- 12.5.4 AFRICA

- 12.5.4.1 Increase in vitamin deficiency and consumer awareness about health supplements to fuel market growth

- TABLE 188 AFRICA: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 189 AFRICA: GUMMY SUPPLEMENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 190 AFRICA: GUMMY SUPPLEMENTS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 191 AFRICA: GUMMY SUPPLEMENTS MARKET, BY END USER, 2023-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 43 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2020-2022 (USD MILLION)

- 13.3 MARKET SHARE ANALYSIS

- TABLE 192 GUMMY SUPPLEMENTS MARKET: DEGREE OF COMPETITION

- 13.4 KEY STRATEGIES ADOPTED BY TOP FIVE PLAYERS

- 13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 EMERGING COMPANIES

- FIGURE 44 GUMMY SUPPLEMENTS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2023

- 13.5.5 PRODUCT FOOTPRINT

- TABLE 193 KEY PLAYER FOOTPRINT, BY TYPE

- TABLE 194 KEY PLAYER FOOTPRINT, BY END USER

- TABLE 195 KEY PLAYER FOOTPRINT, BY FUNCTIONALITY

- TABLE 196 KEY PLAYER FOOTPRINT, BY REGION

- TABLE 197 OVERALL KEY PLAYER FOOTPRINT

- 13.6 GUMMY SUPPLEMENTS MARKET: START-UP/SME EVALUATION QUADRANT

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- FIGURE 45 GUMMY SUPPLEMENTS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS, 2023

- 13.6.5 COMPETITIVE BENCHMARKING

- TABLE 198 GUMMY SUPPLEMENTS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 199 START-UP/SME FOOTPRINT, BY TYPE

- 13.7 COMPETITIVE SCENARIO

- 13.7.1 PRODUCT LAUNCHES

- TABLE 200 GUMMY SUPPLEMENTS MARKET: PRODUCT LAUNCHES, JANUARY 2019-APRIL 2023

- 13.7.2 DEALS

- TABLE 201 GUMMY SUPPLEMENTS MARKET: DEALS, OCTOBER 2019-JANUARY 2023

- 13.7.3 OTHER DEVELOPMENTS

- TABLE 202 GUMMY SUPPLEMENTS MARKET: OTHER DEVELOPMENTS, 2019-2023

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

(Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 14.1.1 GSK PLC

- TABLE 203 GSK PLC: BUSINESS OVERVIEW

- FIGURE 46 GSK PLC: COMPANY SNAPSHOT

- TABLE 204 GSK PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 205 GSK PLC: PRODUCT LAUNCHES

- 14.1.2 CHURCH & DWIGHT CO., INC.

- TABLE 206 CHURCH & DWIGHT CO., INC.: BUSINESS OVERVIEW

- FIGURE 47 CHURCH & DWIGHT CO., INC.: COMPANY SNAPSHOT

- TABLE 207 CHURCH & DWIGHT CO., INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 208 CHURCH & DWIGHT CO., INC.: PRODUCT LAUNCHES

- 14.1.3 H&H GROUP

- TABLE 209 H&H GROUP: BUSINESS OVERVIEW

- FIGURE 48 H&H GROUP: COMPANY SNAPSHOT

- TABLE 210 H&H GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 211 H&H GROUP: DEALS

- TABLE 212 H&H GROUP: OTHER DEVELOPMENTS

- 14.1.4 AMWAY

- TABLE 213 AMWAY: BUSINESS OVERVIEW

- FIGURE 49 AMWAY: COMPANY SNAPSHOT

- TABLE 214 AMWAY: PRODUCTS OFFERED

- TABLE 215 AMWAY: PRODUCT LAUNCHES

- TABLE 216 AMWAY: DEALS

- 14.1.5 PROCAPS GROUP

- TABLE 217 PROCAPS GROUP: BUSINESS OVERVIEW

- FIGURE 50 PROCAPS GROUP: COMPANY SNAPSHOT

- TABLE 218 PROCAPS GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 219 PROCAPS GROUP: OTHER DEVELOPMENTS

- 14.1.6 THE CLOROX COMPANY

- TABLE 220 THE CLOROX COMPANY: BUSINESS OVERVIEW

- FIGURE 51 THE CLOROX COMPANY: COMPANY SNAPSHOT

- TABLE 221 THE CLOROX COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.7 BAYER AG

- TABLE 222 BAYER AG: BUSINESS OVERVIEW

- FIGURE 52 BAYER AG: COMPANY SNAPSHOT

- TABLE 223 BAYER AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 224 BAYER AG: PRODUCT LAUNCHES

- 14.1.8 HALEON GROUP OF COMPANIES

- TABLE 225 HALEON GROUP OF COMPANIES: BUSINESS OVERVIEW

- FIGURE 53 HALEON GROUP OF COMPANIES: COMPANY SNAPSHOT

- TABLE 226 HALEON GROUP OF COMPANIES: PRODUCT LAUNCHES

- TABLE 227 HALEON GROUP OF COMPANIES: DEALS

- 14.1.9 CATALENT, INC.

- TABLE 228 CATALENT, INC.: BUSINESS OVERVIEW

- FIGURE 54 CATALENT, INC.: COMPANY SNAPSHOT

- TABLE 229 CATALENT, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 230 CATALENT, INC.: DEALS

- 14.1.10 NESTLE

- TABLE 231 NESTLE: BUSINESS OVERVIEW

- FIGURE 55 NESTLE: COMPANY SNAPSHOT

- TABLE 232 NESTLE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 233 NESTLE: PRODUCT LAUNCHES

- TABLE 234 NESTLE: DEALS

- TABLE 235 NESTLE: OTHER DEVELOPMENTS

- 14.1.11 UNILEVER

- TABLE 236 UNILEVER: BUSINESS OVERVIEW

- FIGURE 56 UNILEVER: COMPANY SNAPSHOT

- TABLE 237 UNILEVER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 238 UNILEVER: PRODUCT LAUNCHES

- TABLE 239 UNILEVER PLC: DEALS

- TABLE 240 UNILEVER: OTHER DEVELOPMENTS

- 14.1.12 OTSUKA HOLDINGS CO., LTD.

- TABLE 241 OTSUKA PHARMACEUTICAL CO., LTD.: BUSINESS OVERVIEW

- FIGURE 57 OTSUKA PHARMACEUTICAL CO., LTD.: COMPANY SNAPSHOT

- TABLE 242 OTSUKA PHARMACEUTICAL CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.13 PHARMACARE LABORATORIES AUSTRALIA

- TABLE 243 PHARMACARE LABORATORIES AUSTRALIA: BUSINESS OVERVIEW

- TABLE 244 PHARMACARE LABORATORIES AUSTRALIA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 245 PHARMACARE LABORATORIES AUSTRALIA: OTHER DEVELOPMENTS

- 14.1.14 SWANSON

- TABLE 246 SWANSON: BUSINESS OVERVIEW

- TABLE 247 SWANSON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 248 SWANSON: PRODUCT LAUNCHES

- 14.1.15 GLOBAL WIDGET, LLC

- TABLE 249 GLOBAL WIDGET, LLC: BUSINESS OVERVIEW

- TABLE 250 GLOBAL WIDGET, LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 251 GLOBAL WIDGET, LLC: PRODUCT LAUNCHES

- TABLE 252 GLOBAL WIDGET, LLC: OTHER DEVELOPMENTS

- 14.1.16 IM HEALTHCARE

- TABLE 253 IM HEALTHCARE: BUSINESS OVERVIEW

- TABLE 254 IM HEALTHCARE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.17 SMP NUTRA

- TABLE 255 SMP NUTRA: BUSINESS OVERVIEW

- TABLE 256 SMP NUTRA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.18 NATURE'S TRUTH

- TABLE 257 NATURE'S TRUTH: BUSINESS OVERVIEW

- TABLE 258 NATURE'S TRUTH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.1.19 HERBALAND NATURALS INC.

- TABLE 259 HERBALAND NATURALS INC.: BUSINESS OVERVIEW

- TABLE 260 HERBALAND NATURALS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 14.2 OTHER PLAYERS

- 14.2.1 ZANONVITAMEC.COM

- 14.2.2 HERO NUTRITIONALS

- 14.2.3 NUTRA SOLUTIONS USA

- 14.2.4 VITAKEM NUTRACEUTICAL INC.

- 14.2.5 BOSCOGEN, INC.

- 14.2.6 MAKERS NUTRITION, LLC

- 14.2.7 ERNEST JACKSON

- 14.2.8 SCN BESTCO

- 14.2.9 NATURE'S WAY BRANDS

- 14.2.10 THE HUT.COM LTD

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- TABLE 261 MARKETS ADJACENT TO GUMMY SUPPLEMENTS MARKET

- 15.2 LIMITATIONS

- 15.3 DIETARY SUPPLEMENTS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- TABLE 262 DIETARY SUPPLEMENTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 263 DIETARY SUPPLEMENTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 15.4 GUMMY VITAMINS MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- TABLE 264 GUMMY VITAMINS MARKET, BY SOURCE, 2018-2025 (USD MILLION)

- 15.5 BONE & JOINT HEALTH SUPPLEMENTS MARKET

- 15.5.1 MARKET DEFINITION

- 15.5.2 MARKET OVERVIEW

- TABLE 265 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

- TABLE 266 BONE & JOINT HEALTH SUPPLEMENTS MARKET, BY TYPE, 2018-2025 (KT)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS