|

|

市場調査レポート

商品コード

1269632

回路監視の世界市場:タイプ別(モジュール回路監視、その他)、エンドユーザー別、地域別 - 2028年までの予測Circuit Monitoring Market by Type (Modular Circuit Monitoring, Others ), End Use, & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 回路監視の世界市場:タイプ別(モジュール回路監視、その他)、エンドユーザー別、地域別 - 2028年までの予測 |

|

出版日: 2023年05月02日

発行: MarketsandMarkets

ページ情報: 英文 164 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の回路監視の市場規模は、2023年の6億5,900万米ドルから、2028年までに8億2,900万米ドルまで拡大し、予測期間中にCAGRで4.7%の成長が予測されています。

データセンターにおけるカーボンフットプリントを削減するための厳しい基準の施行やデータセンター数の増加とともに、膨大な投資が回路監視の市場を牽引すると予想されます。

"モジュール回路監視":回路監視市場のタイプ別では、急成長セグメント"

タイプ別では、回路監視市場を2つのタイプ、モジュール回路監視、その他に分類しています。予測期間中は、モジュール回路監視セグメントが最も急成長する市場となる見込みです。モジュール回路監視市場は、精度や容易な設置・接続性などの利点によって牽引されています。

"エンドユーザー別では、第2位のセグメントとして商業セグメントが台頭すると予想される"

エンドユーザー別では、回路監視市場を、データセンター、商業、工業、住宅の4つのセグメントに分類しています。予測期間中、商業セグメントは2番目に大きなセグメントになると予想されます。銀行・金融サービス・保険、医療、政府・防衛など、商業分野での回路モニターへの需要が市場を牽引しています。

北米が、回路監視市場の最大地域となる見込み

北米は、予測期間中、最大の回路監視市場になると予想されます。この地域は、新しいデータセンターの大幅な成長を示しており、回路監視市場で活動するプレーヤーに有利な機会を提供しています。例えば、世界有数のITインフラ・サービス企業であるNTTは、バージニア州北部に336MWの容量を持つ新しい大規模なデータセンターキャンパスを建設し、ポートフォリオの拡大を計画しています。これらが、北米における回路監視の市場を拡大する要因になると予想されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- マーケットマップ

- バリューチェーン分析

- 平均販売価格(ASP)分析

- 関税と規制状況

- 貿易分析

- 主要な会議とイベント(2023年~2024年)

- 特許分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 技術分析

- コロケーション・ハイパースケールデータセンターの動向

第6章 回路監視市場:タイプ別

- イントロダクション

- モジュール回路監視

- その他

第7章 回路監視市場:エンドユーザー別

- イントロダクション

- 住宅

- 商業

- データセンター

- 工業

第8章 回路監視市場:地域別

- イントロダクション

- アジア太平洋地域

- 北米

- 欧州

- 南米

- 中東・アフリカ

第9章 競合情勢

- 主要企業の戦略

- 上位5社の市場シェア分析

- 市場企業上位5社の収益分析

- 企業評価象限

- 回路監視市場:企業のフットプリント

- 競合シナリオと動向

第10章 企業プロファイル

- 主要企業

- SCHNEIDER ELECTRIC

- EATON

- ABB

- TOSHIBA INTERNATIONAL CORPORATION

- LEGRAND

- ANORD MARDIX

- PACKET POWER

- SENVA INC

- SOCOMEC

- OMRON CORPORATION

- ACREL-ELECTRIC CO

- MPL TECHNOLOGIES

- DAXTEN

- NHP

- ACCUENERGY

- その他の企業

- CET INC.

- BAY POWER INC.

- NLYTE SOFTWARE

- ELMEASURE

- CIRCUITMETER

第11章 付録

The global circuit monitoring market is estimated to grow from USD 659 Million in 2023 to USD 829 Million by 2028; it is expected to record a CAGR of 4.7% during the forecast period. Huge investments, along with enforcement of stringent standards, to reduce carbon footprint in data centers, and increasing number of data centers is expected to drive the market for circuit monitoring.

"Modular Circuit Monitoring": The fastest growing segment of the circuit monitoring market, by type "

This report segments the circuit monitoring market based on type into two types: Modular circuit monitoring, and others. The Modular Circuit Monitoring segment is expected to be the fastest growing market during the forecast period. The market for modular circuit monitoring is driven by their advantages such as accuracy and easy installation and connectivity

"Commercial segment is expected to emerge as the second largest segment based on end users"

This report segments the circuit monitoring market based on end users into four segments: data centers, commercial, industrial, and residential. The commercial segment is expected to be the second largest segment during the forecast period. The demand for circuit monitors in commercial areas like banking, financial services, insurance, healthcare, and government and defense is driving the market.

North America is expected to be the largest region in the circuit monitoring market

North America is expected to be the largest circuit monitoring market during the forecast period. The region is witnessing substantial growth for new data centers and provides lucrative opportunities for the players operating in the circuit monitoring market. For instance, NTT Ltd., a world-leading IT infrastructure and services company planning to expand its portfolio by constructing a new, sizable data center campus in Northern Virginia, with a planned capacity of 336MW. These are the factors expected to increase the market for circuit monitoring in North America.

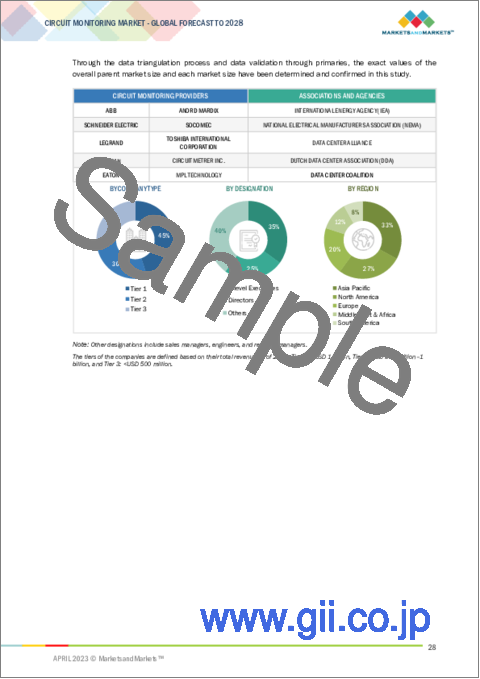

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 35%, Tier 2- 45%, and Tier 3- 20%

By Designation: C-Level- 35%, Director Levels- 25%, and Others- 40%

By Region: North America- 40%, Asia Pacific- 30%, Europe- 20%, the Middle East & Africa- 5%, and South America- 5%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The circuit monitoring market is dominated by a few major players that have a wide regional presence. The leading players in the circuit monitoring market are ABB (Switzerland), Schneider Electric (France), Eaton (Ireland), Toshiba International Corporation (Japan), and Legrand (Ireland).

Research Coverage:

The report defines, describes, and forecasts the global circuit monitoring market, by type, end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the circuit monitoring market.

Key Benefits of Buying the Report

- Increasing number of data centers, and rising concern overpower stability for uninterrupted business operation are some of the main factors driving the circuit monitoring market.

- Product Development/ Innovation: The trends such as intelligent power distribution units are being developed in the field of data centers, majorly for the power distribution side of the facility.

- Market Development: The global scenario of circuit monitoring in data centers is evolving rapidly, with trends toward the increased use of intelligent power distribution units (PDUs) that can provide real-time monitoring and analytics capabilities. One major trend is the deployment of scalable modular data centers.

- Market Diversification: Schneider Electric has launched EM4000 series, multi-circuit energy meters that can monitor up to 24-meter points with a single device. It also offers low installation costs.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players ABB (Switzerland), Schneider Electric (France), Eaton (Ireland), Toshiba International Corporation (Japan), and Legrand (Ireland) among others in the circuit monitoring market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.3.1 CIRCUIT MONITORING MARKET, BY TYPE

- 1.3.2 CIRCUIT MONITORING MARKET, BY END USER

- 1.4 MARKET SCOPE

- 1.4.1 MARKET SEGMENTATION

- 1.4.2 REGIONAL SCOPE

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 CIRCUIT MONITORING MARKET: RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primaries

- 2.3 STUDY SCOPE

- FIGURE 3 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR CIRCUIT MONITORING

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- 2.4.3.1 Regional analysis

- 2.4.3.2 Country-level analysis

- 2.4.3.3 Assumptions for demand-side analysis

- 2.4.3.4 Calculations for demand-side analysis

- 2.4.4 SUPPLY-SIDE ANALYSIS

- FIGURE 6 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF CIRCUIT MONITORING

- FIGURE 7 CIRCUIT MONITORING MARKET: SUPPLY-SIDE ANALYSIS

- 2.4.4.1 Calculations for supply-side analysis

- 2.4.4.2 Assumptions for supply-side analysis

- FIGURE 8 COMPANY REVENUE ANALYSIS, 2021

- 2.4.5 FORECAST

- 2.5 RISK ASSESSMENT

- 2.6 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- TABLE 1 CIRCUIT MONITORING MARKET SNAPSHOT

- FIGURE 9 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN CIRCUIT MONITORING MARKET DURING 2023-2028

- FIGURE 10 OTHERS SEGMENT TO LEAD CIRCUIT MONITORING MARKET DURING FORECAST PERIOD

- FIGURE 11 DATA CENTERS SEGMENT TO LEAD CIRCUIT MONITORING MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR CIRCUIT MONITORING MARKET PLAYERS

- FIGURE 12 RISING ADOPTION OF POWER DISTRIBUTION SOURCES TO DRIVE CIRCUIT MONITORING MARKET

- 4.2 CIRCUIT MONITORING MARKET, BY REGION

- FIGURE 13 CIRCUIT MONITORING MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 NORTH AMERICA: CIRCUIT MONITORING MARKET, BY TYPE AND COUNTRY

- FIGURE 14 DATA CENTERS AND US WERE LARGEST SHAREHOLDERS OF CIRCUIT MONITORING MARKET IN NORTH AMERICA IN 2022

- 4.4 CIRCUIT MONITORING MARKET, BY TYPE

- FIGURE 15 OTHERS SEGMENT TO ACCOUNT FOR LARGER SHARE OF CIRCUIT MONITORING MARKET IN 2028

- 4.5 CIRCUIT MONITORING MARKET, BY END USER

- FIGURE 16 DATA CENTERS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF CIRCUIT MONITORING MARKET IN 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 CIRCUIT MONITORING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising concerns over power stability for uninterrupted business operations

- FIGURE 18 GLOBAL ELECTRICITY CONSUMPTION, BY END USER

- 5.2.1.2 Increasing number of data centers

- TABLE 2 MAJOR COUNTRIES WITH COLOCATION DATA CENTERS, 2022

- FIGURE 19 GLOBAL DATA CENTER CAPACITY GROWTH

- 5.2.1.3 Intensifying need to monitor energy consumption to achieve carbon neutrality

- 5.2.2 RESTRAINTS

- 5.2.2.1 Decline in adoption of circuit monitoring due to advancements in energy monitoring systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Enforcement of stringent regulations to reduce carbon footprint of data centers

- TABLE 3 DATA CENTER SUSTAINABILITY TARGETS AND INVESTMENTS BY MAJOR COMPANIES

- 5.2.3.2 Shift toward cloud-based data centers

- FIGURE 20 GLOBAL DATA CENTER CAPACITY GROWTH, IN TERMS OF CLOUD INFRASTRUCTURE SERVICES AND DATA CENTER HARDWARE & SOFTWARE, 2009-2020

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain constraints and disruptions

- FIGURE 21 GLOBAL NOMINAL PRICES FOR ALUMINUM AND COPPER, 2020-2023

- 5.2.4.2 Complexities involved in integrating circuit monitoring systems into operational data centers

- FIGURE 22 COST OF CIRCUIT MONITORING SYSTEM PER CABINET

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR CIRCUIT MONITORING SYSTEM PROVIDERS

- FIGURE 23 REVENUE SHIFTS FOR CIRCUIT MONITORING SYSTEM MANUFACTURERS

- 5.4 MARKET MAP

- TABLE 4 CIRCUIT MONITORING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 MARKET MAP/ECOSYSTEM ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 25 CIRCUIT MONITORING MARKET: VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL SUPPLIERS

- 5.5.2 COMPONENT MANUFACTURERS

- 5.5.3 CIRCUIT MONITORING SYSTEM MANUFACTURERS

- 5.5.4 DISTRIBUTORS AND END USERS

- 5.5.5 POST-SALES SERVICE PROVIDERS

- 5.6 AVERAGE SELLING PRICE (ASP) ANALYSIS

- FIGURE 26 AVERAGE SELLING PRICE OF CIRCUIT MONITORING SYSTEMS, BY TYPE, 2021

- TABLE 5 AVERAGE SELLING PRICE OF CIRCUIT MONITORING SYSTEMS, BY TYPE, 2021

- TABLE 6 PRICING ANALYSIS OF CIRCUIT MONITORING SYSTEMS, BY REGION, 2021

- FIGURE 27 PRICING ANALYSIS OF CIRCUIT MONITORING SYSTEMS, BY REGION, 2021

- 5.7 TARIFF AND REGULATORY LANDSCAPE

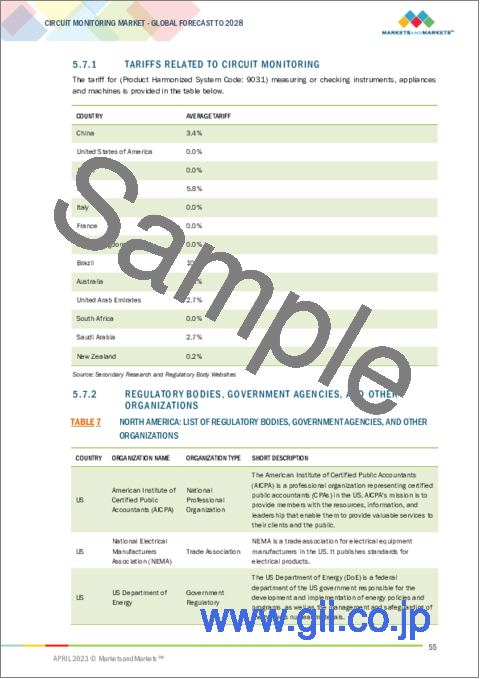

- 5.7.1 TARIFFS RELATED TO CIRCUIT MONITORING

- 5.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.3 CODES AND REGULATIONS RELATED TO CIRCUIT MONITORING

- TABLE 12 NORTH AMERICA: CODES AND REGULATIONS

- TABLE 13 ASIA PACIFIC: CODES AND REGULATIONS

- TABLE 14 EUROPE: CODES AND REGULATIONS

- TABLE 15 GLOBAL: CODES AND REGULATIONS

- 5.8 TRADE ANALYSIS

- 5.8.1 EXPORT SCENARIO

- TABLE 16 EXPORT SCENARIO FOR HS CODE: 8537, BY COUNTRY, 2020-2022 (USD THOUSAND)

- 5.8.2 IMPORT SCENARIO

- TABLE 17 IMPORT SCENARIO FOR HS CODE: 8537, BY COUNTRY, 2020-2022 (USD THOUSAND)

- 5.9 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 18 CIRCUIT MONITORING MARKET: LIST OF CONFERENCES AND EVENTS

- 5.10 PATENT ANALYSIS

- TABLE 19 CIRCUIT MONITORING MARKET: INNOVATIONS AND PATENT REGISTRATION

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 CIRCUIT MONITORING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 CIRCUIT MONITORING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF SUBSTITUTES

- 5.11.2 BARGAINING POWER OF SUPPLIERS

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 THREAT OF NEW ENTRANTS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- 5.12.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA, BY END USER

- TABLE 22 KEY BUYING CRITERIA, BY END USER

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 PACKET POWER PROVIDED CUSTOMIZED POWER MONITORS FOR DATA REALTY

- 5.13.2 NREL REDUCED DATA CENTER LOAD AT ITS FACILITY

- 5.14 TECHNOLOGY ANALYSIS

- 5.14.1 TECHNOLOGY TRENDS RELATED TO CIRCUIT MONITORING

- 5.15 TRENDS IN COLOCATION AND HYPERSCALE DATA CENTERS

6 CIRCUIT MONITORING MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 31 CIRCUIT MONITORING MARKET, BY TYPE, 2022 (%)

- TABLE 23 CIRCUIT MONITORING MARKET, BY TYPE, 2016-2020 (USD MILLION)

- TABLE 24 CIRCUIT MONITORING MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.2 MODULAR CIRCUIT MONITORING

- 6.2.1 OFFERS ADVANTAGES OF ACCURACY AND EASY INSTALLATION

- TABLE 25 MODULAR CIRCUIT MONITORING: CIRCUIT MONITORING MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3 OTHERS

- TABLE 26 OTHERS: CIRCUIT MONITORING MARKET, BY REGION, 2021-2028 (USD MILLION)

7 CIRCUIT MONITORING MARKET, BY END USER

- 7.1 INTRODUCTION

- FIGURE 32 CIRCUIT MONITORING MARKET, BY END USER, 2022 (%)

- TABLE 27 CIRCUIT MONITORING MARKET, BY END USER, 2016-2020 (USD MILLION)

- TABLE 28 CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2016-2020 (USD MILLION)

- TABLE 29 CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 30 CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 7.2 RESIDENTIAL

- 7.2.1 USE CIRCUIT MONITORING TO GAIN ACTUAL PICTURE OF POWER CONSUMPTION

- TABLE 31 RESIDENTIAL: CIRCUIT MONITORING MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3 COMMERCIAL

- 7.3.1 USE CIRCUIT MONITORING TO IMPROVE CAPACITY PLANNING AND POWER CONSUMPTION

- TABLE 32 COMMERCIAL: CIRCUIT MONITORING MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.4 DATA CENTERS

- 7.4.1 USE CIRCUIT MONITORING TO TRACK POWER CONSUMPTION OF ALL IT DEVICES

- TABLE 33 DATA CENTERS: CIRCUIT MONITORING MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.5 INDUSTRIAL

- 7.5.1 DEPLOY CIRCUIT MONITORING TO MAXIMIZE MACHINE UPTIME, INCREASE EFFICIENCY, AND LOWER COSTS

- TABLE 34 INDUSTRIAL: CIRCUIT MONITORING MARKET, BY REGION, 2021-2028 (USD MILLION)

8 CIRCUIT MONITORING MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 33 ASIA PACIFIC CIRCUIT MONITORING MARKET TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 34 CIRCUIT MONITORING MARKET, BY REGION, 2022

- TABLE 35 CIRCUIT MONITORING MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 36 CIRCUIT MONITORING MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 37 CIRCUIT MONITORING MARKET, BY REGION, 2021-2028 (MILLION UNITS)

- 8.2 ASIA PACIFIC

- FIGURE 35 ASIA PACIFIC: SNAPSHOT OF CIRCUIT MONITORING MARKET

- 8.2.1 RECESSION IMPACT ON CIRCUIT MONITORING MARKET IN ASIA PACIFIC

- 8.2.2 BY TYPE

- TABLE 38 ASIA PACIFIC: CIRCUIT MONITORING MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 8.2.3 BY END USER

- TABLE 39 ASIA PACIFIC: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 40 ASIA PACIFIC: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: MODULAR CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: CIRCUIT MONITORING MARKET FOR MODULAR, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: CIRCUIT MONITORING MARKET FOR OTHERS, BY END USER, 2021-2028 (USD MILLION)

- TABLE 44 ASIA PACIFIC: CIRCUIT MONITORING MARKET FOR OTHERS, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.2.4 BY COUNTRY

- TABLE 45 ASIA PACIFIC: CIRCUIT MONITORING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.2.4.1 China

- 8.2.4.1.1 Rising investments in data centers

- 8.2.4.1 China

- TABLE 46 CHINA: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 47 CHINA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.2.4.2 Japan

- 8.2.4.2.1 Growing need to manage power usage at data centers

- 8.2.4.2 Japan

- TABLE 48 JAPAN: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 49 JAPAN: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.2.4.3 India

- 8.2.4.3.1 Government support to build data centers

- 8.2.4.3 India

- TABLE 50 INDIA: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 51 INDIA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.2.4.4 South Korea

- 8.2.4.4.1 Plans to expand number of data centers

- 8.2.4.4 South Korea

- TABLE 52 SOUTH KOREA: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 53 SOUTH KOREA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.2.4.5 Rest of Asia Pacific

- TABLE 54 REST OF ASIA PACIFIC: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 55 REST OF ASIA PACIFIC: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.3 NORTH AMERICA

- 8.3.1 RECESSION IMPACT ON CIRCUIT MONITORING MARKET IN NORTH AMERICA

- FIGURE 36 NORTH AMERICA: CIRCUIT MONITORING MARKET SNAPSHOT

- 8.3.2 BY TYPE

- TABLE 56 NORTH AMERICA: CIRCUIT MONITORING MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 8.3.3 BY END USER

- TABLE 57 NORTH AMERICA: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: CIRCUIT MONITORING MARKET FOR MODULAR, BY END USER, 2021-2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: CIRCUIT MONITORING MARKET FOR MODULAR, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: CIRCUIT MONITORING MARKET FOR OTHERS, BY END USER, 2021-2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: CIRCUIT MONITORING MARKET FOR OTHERS, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.3.4 BY COUNTRY

- TABLE 63 NORTH AMERICA: CIRCUIT MONITORING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3.4.1 US

- 8.3.4.1.1 Increasing demand for circuit monitoring in commercial sector

- 8.3.4.1 US

- TABLE 64 US: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 65 US: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.3.4.2 Canada

- 8.3.4.2.1 Growing demand for power distribution components at data centers

- 8.3.4.2 Canada

- TABLE 66 CANADA: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 67 CANADA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.4 EUROPE

- 8.4.1 RECESSION IMPACT ON CIRCUIT MONITORING MARKET IN EUROPE

- 8.4.2 BY TYPE

- TABLE 68 EUROPE: CIRCUIT MONITORING MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 8.4.3 BY END USER

- TABLE 69 EUROPE: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 70 EUROPE: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- TABLE 71 EUROPE: CIRCUIT MONITORING MARKET FOR MODULAR, BY END USER, 2021-2028 (USD MILLION)

- TABLE 72 EUROPE: CIRCUIT MONITORING MARKET FOR MODULAR, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- TABLE 73 EUROPE: CIRCUIT MONITORING MARKET FOR OTHERS, BY END USER, 2021-2028 (USD MILLION)

- TABLE 74 EUROPE: CIRCUIT MONITORING MARKET FOR OTHERS, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.4.4 BY COUNTRY

- TABLE 75 EUROPE: CIRCUIT MONITORING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.4.4.1 UK

- 8.4.4.1.1 Expansion of data center networks by major players

- 8.4.4.1 UK

- TABLE 76 UK: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 77 UK: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.4.4.2 Germany

- 8.4.4.2.1 Increasing emphasis on reducing energy consumption

- 8.4.4.2 Germany

- TABLE 78 GERMANY: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 79 GERMANY: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.4.4.3 France

- 8.4.4.3.1 Expansion of cloud-based services

- 8.4.4.3 France

- TABLE 80 FRANCE: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 81 FRANCE: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.4.4.4 Italy

- 8.4.4.4.1 Rising investments in data centers

- 8.4.4.4 Italy

- TABLE 82 ITALY: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 83 ITALY: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.4.4.5 Rest of Europe

- TABLE 84 REST OF EUROPE: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 85 REST OF EUROPE: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.5 SOUTH AMERICA

- 8.5.1 RECESSION IMPACT ON CIRCUIT MONITORING MARKET IN SOUTH AMERICA

- 8.5.2 BY TYPE

- TABLE 86 SOUTH AMERICA: CIRCUIT MONITORING MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 8.5.3 BY END USER

- TABLE 87 SOUTH AMERICA: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 88 SOUTH AMERICA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- TABLE 89 SOUTH AMERICA: CIRCUIT MONITORING MARKET FOR MODULAR, BY END USER, 2021-2028 (USD MILLION)

- TABLE 90 SOUTH AMERICA: CIRCUIT MONITORING MARKET FOR MODULAR, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- TABLE 91 SOUTH AMERICA: CIRCUIT MONITORING MARKET FOR OTHERS, BY END USER, 2021-2028 (USD MILLION)

- TABLE 92 SOUTH AMERICA: CIRCUIT MONITORING MARKET FOR OTHERS, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.5.4 BY COUNTRY

- TABLE 93 SOUTH AMERICA: CIRCUIT MONITORING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.5.4.1 Brazil

- 8.5.4.1.1 Ongoing industrialization and rising environmental concerns

- 8.5.4.1 Brazil

- TABLE 94 BRAZIL: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 95 BRAZIL: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.5.4.2 Argentina

- 8.5.4.2.1 Rising adoption of big data and IoT

- 8.5.4.2 Argentina

- TABLE 96 ARGENTINA: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 97 ARGENTINA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.5.4.3 Rest of South America

- TABLE 98 REST OF SOUTH AMERICA: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 99 REST OF SOUTH AMERICA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.6 MIDDLE EAST & AFRICA

- 8.6.1 RECESSION IMPACT ON CIRCUIT MONITORING MARKET IN MIDDLE EAST & AFRICA

- 8.6.2 BY TYPE

- TABLE 100 MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 8.6.3 BY END USER

- TABLE 101 MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET FOR MODULAR, BY END USER, 2021-2028 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET FOR MODULAR, BY DATA CENTER, 2021-2028 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET FOR OTHERS, BY END USER, 2021-2028 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET FOR OTHERS, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.6.4 BY COUNTRY

- TABLE 107 MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.6.4.1 South Africa

- 8.6.4.1.1 Rising investments in data centers and infrastructure development

- 8.6.4.1 South Africa

- TABLE 108 SOUTH AFRICA: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 109 SOUTH AFRICA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.6.4.2 Saudi Arabia

- 8.6.4.2.1 Rising focus on renewable power generation

- 8.6.4.2 Saudi Arabia

- TABLE 110 SAUDI ARABIA: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 111 SAUDI ARABIA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.6.4.3 UAE

- 8.6.4.3.1 Increasing government expenditure on data centers

- 8.6.4.3 UAE

- TABLE 112 UAE: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 113 UAE: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

- 8.6.4.4 Rest of Middle East & Africa

- TABLE 114 REST OF MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 115 REST OF MIDDLE EAST & AFRICA: CIRCUIT MONITORING MARKET, BY DATA CENTER TYPE, 2021-2028 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 KEY PLAYERS STRATEGIES

- TABLE 116 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2019-2023

- 9.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- TABLE 117 CIRCUIT MONITORING MARKET: DEGREE OF COMPETITION

- FIGURE 37 CIRCUIT MONITORING MARKET SHARE ANALYSIS, 2021

- 9.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

- FIGURE 38 TOP PLAYERS IN CIRCUIT MONITORING MARKET, 2017-2021

- 9.4 COMPANY EVALUATION QUADRANT

- 9.4.1 STARS

- 9.4.2 PERVASIVE PLAYERS

- 9.4.3 EMERGING LEADERS

- 9.4.4 PARTICIPANTS

- FIGURE 39 CIRCUIT MONITORING MARKET: COMPANY EVALUATION QUADRANT, 2021

- 9.5 CIRCUIT MONITORING MARKET: COMPANY FOOTPRINT

- TABLE 118 COMPANY TYPE FOOTPRINT

- TABLE 119 COMPANY END USER FOOTPRINT

- TABLE 120 COMPANY REGION FOOTPRINT

- TABLE 121 COMPANY FOOTPRINT

- 9.6 COMPETITIVE SCENARIOS AND TRENDS

- TABLE 122 CIRCUIT MONITORING MARKET: DEALS, 2019-2023

- TABLE 123 CIRCUIT MONITORING MARKET: OTHERS, 2019-2023

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats)**

- 10.1.1 SCHNEIDER ELECTRIC

- TABLE 124 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- FIGURE 40 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 125 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 SCHNEIDER ELECTRIC: OTHERS

- 10.1.2 EATON

- TABLE 127 EATON: BUSINESS OVERVIEW

- FIGURE 41 EATON: COMPANY SNAPSHOT

- TABLE 128 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 EATON: DEALS

- TABLE 130 EATON: OTHERS

- 10.1.3 ABB

- TABLE 131 ABB: BUSINESS OVERVIEW

- FIGURE 42 ABB: COMPANY SNAPSHOT

- TABLE 132 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.4 TOSHIBA INTERNATIONAL CORPORATION

- TABLE 133 TOSHIBA INTERNATIONAL CORPORATION: BUSINESS OVERVIEW

- FIGURE 43 TOSHIBA INTERNATIONAL CORPORATION: COMPANY SNAPSHOT

- TABLE 134 TOSHIBA INTERNATIONAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.5 LEGRAND

- TABLE 135 LEGRAND: BUSINESS OVERVIEW

- FIGURE 44 LEGRAND: COMPANY SNAPSHOT

- TABLE 136 LEGRAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.6 ANORD MARDIX

- TABLE 137 ANORD MARDIX: BUSINESS OVERVIEW

- TABLE 138 ANORD MARDIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 ANORD MARDIX: DEALS

- TABLE 140 ANORD MARDIX: OTHERS

- 10.1.7 PACKET POWER

- TABLE 141 PACKET POWER: BUSINESS OVERVIEW

- TABLE 142 PACKET POWER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.8 SENVA INC

- TABLE 143 SENVA INC: BUSINESS OVERVIEW

- TABLE 144 SENVA INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.9 SOCOMEC

- TABLE 145 SOCOMEC: BUSINESS OVERVIEW

- TABLE 146 SOCOMEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 SOCOMEC: DEALS

- TABLE 148 SOCOMEC: OTHERS

- 10.1.10 OMRON CORPORATION

- TABLE 149 OMRON CORPORATION: BUSINESS OVERVIEW

- FIGURE 45 OMRON CORPORATION: COMPANY SNAPSHOT

- TABLE 150 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.11 ACREL - ELECTRIC CO

- TABLE 151 ACREL - ELECTRIC CO: BUSINESS OVERVIEW

- TABLE 152 ACREL - ELECTRIC CO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 ACREL - ELECTRIC CO: DEALS

- 10.1.12 MPL TECHNOLOGIES

- TABLE 154 MPL TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 155 MPL TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.13 DAXTEN

- TABLE 156 DAXTEN: BUSINESS OVERVIEW

- TABLE 157 DAXTEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 DAXTEN: DEALS

- 10.1.14 NHP

- TABLE 159 NHP: BUSINESS OVERVIEW

- TABLE 160 NHP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.15 ACCUENERGY

- TABLE 161 ACCUENERGY: BUSINESS OVERVIEW

- TABLE 162 ACCUENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.2 OTHER PLAYERS

- 10.2.1 CET INC.

- 10.2.2 BAY POWER INC.

- 10.2.3 NLYTE SOFTWARE

- 10.2.4 ELMEASURE

- 10.2.5 CIRCUITMETER

- *Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 INSIGHTS FROM INDUSTRY EXPERTS

- 11.2 DISCUSSION GUIDE

- 11.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.4 CUSTOMIZATION OPTIONS

- 11.5 RELATED REPORTS

- 11.6 AUTHOR DETAILS