|

|

市場調査レポート

商品コード

1269629

アプリケーション統合の世界市場:提供別(プラットフォーム、サービス)、統合タイプ別、アプリケーション別(CRM、ERP)、業種別(BFSI、小売・Eコマース、自動車)、地域別 - 2028年までの予測Application Integration Market by Offering (Platforms and Services), Integration Type, Application (Customer Relationship Management, Enterprise Resource Planning), Vertical (BFSI, Retail & eCommerce, Automotive) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| アプリケーション統合の世界市場:提供別(プラットフォーム、サービス)、統合タイプ別、アプリケーション別(CRM、ERP)、業種別(BFSI、小売・Eコマース、自動車)、地域別 - 2028年までの予測 |

|

出版日: 2023年05月04日

発行: MarketsandMarkets

ページ情報: 英文 266 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のアプリケーション統合の市場規模は、2023年の154億米ドルから、2028年までに384億米ドルまで拡大し、予測期間中のCAGRで20.0%の成長が予測されています。

市場投入までの時間を短縮し、ROIを向上させるニーズの高まりが、アプリケーション統合市場の成長を後押ししています。

予測期間中、顧客関係管理(CRM)セグメントが大きな市場シェアを占める

顧客関係管理(CRM)は、顧客のライフサイクル全体を通じて、顧客との接点からデータを収集・分析し、顧客との相互作用を管理する戦略と技術を組み合わせたものです。加入者やリードとの最初の接触から、販売後のやりとり、加入者や顧客の維持活動まで、すべてがこのサイクルに含まれます。CRMシステムは、他のアプリケーションやソフトウェアと連携することで、その可能性を最大限に発揮します。

予測期間中、CAGRが最も高いのはコンサルティングサービスセグメント

コンサルティングサービスは、セキュリティの専門家、高度な資格を持つ業界専門家、財務・技術分析、経済モデリング、ビジネスケース開発などの分野の専門家の助けを借りて、製品の詳細な説明を通じて顧客に知識とアドバイスを提供します。統合コンサルティングサービスは、統合のアプローチをより深く理解し、関連する使用事例を発見できるよう支援します。統合コンサルティングサービスの目的は、製品やサービスの向上、運用コストの削減、作業環境の改善、ビジネスプロセスの再構築など、企業をサポートすることです。

予測期間中、BFSIセグメントがより大きな市場シェアを占める

銀行は、顧客口座、ローン申請サービス、その他のバックエンドシステムをモバイルアプリに統合することで、新しいデジタルチャネルを通じてサービスを提供し、新規顧客にアピールすることができます。BFSI業界では、銀行や金融機関の物理的な存在を期待する消費者からの需要が高まっています。しかし、マルチチャネルでの取引、口座開設、ローンや請求書の支払いなどが好まれます。こうした複数の銀行取引方法の中核には、何千ものビジネスクリティカルな機能を支えるさまざまなデジタルアプリケーションが存在します。これらのアプリケーションは、銀行や金融機関の重要な差別化要因として、優れた顧客体験を提供する必要があります。

予測期間中、アジア太平洋地域が最も高いCAGRを記録する見込み

アジア太平洋地域は、予測期間中に最も高いCAGRを記録すると予想されています。クラウドやモバイル技術の普及が進み、ワークダイナミクスが変化していることから、この地域の国々では、製造、エネルギー・ユーティリティ、小売・消費財、BFSI、通信などの業種全体でアプリケーション統合の導入が進んでいます。Boomi、SAP、Oracle、Microsoft、IBMなどの主要企業が、アジア太平洋地域のアプリケーション統合市場への参入に注力しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 業界動向

- ケーススタディ分析

- 特許分析

- 価格分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 技術分析

- 主要な会議とイベント(2023年~2024年)

- 規制状況

- アプリケーション統合の歴史

- バリューチェーン分析

- エコシステム分析

- アプリケーション統合のアプローチ

- アプリケーション統合の標準レベル

- アプリケーション統合のベストプラクティス

- バイヤー/クライアントに影響を与える動向/混乱

第6章 アプリケーション統合市場:提供別

- イントロダクション

- プラットフォーム

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 アプリケーション統合市場:統合タイプ別

- イントロダクション

- P2P統合

- エンタープライズアプリケーション統合(EAI)

- エンタープライズサービスバス(ESB)

- IPaaS (Integration Platform as a Service)

- ハイブリッド統合

第8章 アプリケーション統合市場:アプリケーション別

- イントロダクション

- 顧客関係管理(CRM)

- エンタープライズリソースプランニング(ERP)

- 人事管理システム(HRMS)

- サプライチェーン管理(SCM)

- ビジネスインテリジェンス(BI)

- 電子カルテ(EHR)管理

- その他

第9章 アプリケーション統合市場:業種別

- イントロダクション

- 銀行・金融サービス・保険(BFSI)

- 小売・Eコマース

- 製造

- 医療・ライフサイエンス

- エネルギー・ユーティリティ

- 自動車

- 輸送・物流

- 政府・公共部門

- その他

第10章 アプリケーション統合市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- 北欧地域

- その他の欧州

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- 東南アジア

- その他のアジア太平洋地域

- 中東・アフリカ

- 中東

- アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

第11章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 主要企業の過去の収益分析

- 主要企業の市場シェア分析

- 競合ベンチマーキング

- 主要企業の評価象限マトリックス手法

- 主要企業の評価象限マトリックス

- スタートアップ/中小企業向けの評価象限マトリックス手法

- スタートアップ/中小企業向けの評価象限マトリックス

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- SALESFORCE

- IBM

- ORACLE

- MICROSOFT

- SAP

- INFORMATICA

- TIBCO SOFTWARE

- SOFTWARE AG

- TALEND

- SNAPLOGIC

- BOOMI

- INTERSYSTEMS

- SEEBURGER

- MAGIC SOFTWARE

- CELONIS

- スタートアップ/中小企業

- CELIGO

- WSO2

- ZAPIER

- WORKATO

- JITTERBIT

- OPENLEGACY

- ELASTIC.IO

- TRAY.IO

- DBSYNC

- CYCLR SYSTEMS

- FLOWGEAR

- APIFUSE

- ADEPTIA

第13章 隣接/関連市場

- イントロダクション

- データ統合市場

- IPaaS(Integration Platform as a Service)市場

第14章 付録

The global application integration market is projected to grow from 15.4 billion in 2023 to USD 38.4 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 20.0% during the forecast period. The rising need to improve time-to-market and boost ROI is driving the application integration market growth.

Customer Relationship Management segment to account for larger market share during the forecast period

Customer relationship management combines strategies and technologies to manage interactions with customers by collecting and analyzing data from contact points with customers throughout the customer life cycle. Everything from initial contact with prospects and leads to post-sale interactions and the subscriber or client retention efforts are included in this cycle. The fullest potential of the CRM system is reached when it is connected to other applications and software.

Consulting services segment to account for the highest CAGR during the forecast period

Consulting services provide knowledge and advice to clients through in-depth product descriptions with the help of security professionals, highly qualified industry experts, and domain experts in sectors of financial and technical analysis, economic modeling, and business case development. Integration consulting services assist businesses with a better understanding of integration approaches to discover possible relevant use cases. The aim of the integration consultancy services is to support companies in boosting products and services, reducing operational costs, improving the working environment, and restructuring business processes.

BFSI segment to account for larger market share during the forecast period

A bank will offer services through a new digital channel and appeal to new customers by integrating customer accounts, loan application services, and other back-end systems with their mobile app. The BFSI industry is experiencing increased demand from consumers expecting the physical presence of banks and financial institutions. But they prefer multi-channel transactions, opening accounts, and paying loans and bills. At the core of these multiple ways of banking, there are various digital applications powering thousands of business-critical functions. These applications must provide exceptional customer experience to act as the key differentiator for banking and financial institutions.

Asia Pacific to record the highest CAGR during the forecast period

Asia Pacific is expected to witness the highest CAGR during the forecast period. The increasing proliferation of cloud and mobile technologies and changing work dynamics have led to the adoption across verticals, such as manufacturing, energy & utilities, retail & consumer goods, BFSI, and telecommunications of application integration in countries of the region. Major players such as Boomi, SAP, Oracle, Microsoft, and IBM are the top players focusing on serving the Asia Pacific application integration market.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the application integration market.

- By Company: Tier I: 35%, Tier II: 39%, and Tier III: 26%

- By Designation: C-Level Executives: 25%, Directors: 35%, and Others: 40%

- By Region: North America: 38%, Europe: 40%, Asia Pacific: 21%, and RoW: 1%

The major players in the smart transportation market are Salesforce (US), Informatica (US), SAP (Germany), Oracle (US), SnapLogic (US), Software AG (Germany), IBM (US), Microsoft (US), TIBCO Software (US), Celigo (US), Boomi (US), Adeptia (US), WSO2 (US), DBSync (US), Flowgear (South Africa), InterSystems (US), SEEBURGER (Germany), Workato (US), Magic Software (Israel), OpenLegacy (US), Jitterbit (US), Elastic.io (Germany), Talend (US), Tray.io (US), Cyclr Systems (UK), APIFuse (US), and Zapier (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the application integration market.

Research Coverage

The market study covers the application integration market across segments. It aims at estimating the market size and the growth potential of this market across segments, such as offering, integration type, application, vertical, and region. It includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall application integration market and its subsegments. It would help stakeholders understand the competitive landscape and gain better insights to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rising need to eliminate data silos and improve productivity

, growing need for automation of mission-critical business processes, rising need to improve time-to-market and boost ROI), restraints (limited knowledge of Enterprise Application Integration (EAI) within organizations, high initial investment), opportunities (growing demand for B2B integration), and challenges (data inaccessibility because of its widespread storage, integrating new application software with traditional IT infrastructure, incompatibility between third-party integration and product interface) influencing the growth of the application integration market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the application integration market

- Market Development: Comprehensive information about lucrative markets - the report analyses the application integration market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the application integration market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Salesforce (US), Informatica (US), SAP (Germany), Oracle (US), SnapLogic (US), Software AG (Germany), IBM (US), Microsoft (US), TIBCO Software (US), Celigo (US), Boomi (US), Adeptia (US), WSO2 (US), DBSync (US), Flowgear (South Africa), InterSystems (US), SEEBURGER (Germany), Workato (US), Magic Software (Israel), OpenLegacy (US), Jitterbit (US), Elastic.io (Germany), Talend (US), Tray.io (US), Cyclr Systems (UK), APIFuse (US), and Zapier (US), in the application integration market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATE, 2020-2022

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 APPLICATION INTEGRATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Key primary interview participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Primary sources

- 2.1.2.5 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 2 APPROACHES USED FOR MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 1): SUPPLY-SIDE ANALYSIS OF REVENUE FROM PLATFORMS AND SERVICES

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 1), BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF APPLICATION INTEGRATION VENDORS

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- 2.2.3 MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- TABLE 2 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT

- 2.7 RECESSION IMPACT

- FIGURE 9 APPLICATION INTEGRATION MARKET TO WITNESS DIP IN Y-O-Y IN 2022

3 EXECUTIVE SUMMARY

- TABLE 3 APPLICATION INTEGRATION MARKET AND GROWTH RATE, 2023-2028 (USD MILLION) (Y-O-Y GROWTH)

- FIGURE 10 APPLICATION INTEGRATION MARKET, BY REGION, 2023

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN APPLICATION INTEGRATION MARKET

- FIGURE 11 GROWING ADOPTION OF ERP, CRM, AND SCM SYSTEMS TO DRIVE GROWTH OF APPLICATION INTEGRATION MARKET DURING FORECAST PERIOD

- 4.2 APPLICATION INTEGRATION MARKET, BY OFFERING

- FIGURE 12 PLATFORMS SEGMENT TO LEAD MARKET IN 2023

- 4.3 APPLICATION INTEGRATION MARKET, BY SERVICE

- FIGURE 13 MANAGED SERVICES SEGMENT TO ACHIEVE HIGHER CAGR DURING FORECAST PERIOD

- 4.4 APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE

- FIGURE 14 INTEGRATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE

- FIGURE 15 HYBRID INTEGRATION SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- 4.6 APPLICATION INTEGRATION MARKET, BY VERTICAL

- FIGURE 16 BFSI SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.7 NORTH AMERICA: APPLICATION INTEGRATION MARKET, BY KEY APPLICATION AND VERTICAL

- FIGURE 17 CUSTOMER RELATIONSHIP MANAGEMENT AND BFSI SEGMENTS TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 APPLICATION INTEGRATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising need to eliminate data silos and improve productivity

- 5.2.1.2 Growing demand for automation of mission-critical business processes

- 5.2.1.3 Rapid adoption of integration tools to boost ROI

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited awareness regarding Enterprise Application Integration (EAI) within organizations

- 5.2.2.2 Need for high initial investments

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth in B2B integration

- 5.2.4 CHALLENGES

- 5.2.4.1 Data inaccessibility due to widespread storage

- 5.2.4.2 Difficulty in integrating new application software with traditional IT infrastructure

- 5.2.4.3 Incompatibility between third-party integration and product interface

- 5.3 INDUSTRY TRENDS

- 5.3.1 CASE STUDY ANALYSIS

- 5.3.1.1 Case study 1: Clal automated life and pension insurance process in Israel through API integration

- 5.3.1.2 Case study 2: Nextdoor integrated applications with Workato platform and automated processes

- 5.3.1.3 Case study 3: Major international investment banks implemented InterSystems IRIS data platform

- 5.3.1.4 Case study 4: Bayer deployed MuleSoft's Anypoint platform to integrate Salesforce' Sales and Service Cloud using API-led connectivity

- 5.3.1.5 Case study 5: Basecom used Celigo to reduce integration estimates and boost customer experience

- 5.3.2 PATENT ANALYSIS

- 5.3.2.1 Methodology

- 5.3.2.2 Document types

- TABLE 4 PATENTS FILED, 2020-2023

- 5.3.2.3 Innovation and patent applications

- FIGURE 19 NUMBER OF PATENTS GRANTED ANNUALLY, 2020-2023

- 5.3.2.3.1 Top applicants

- FIGURE 20 TOP TEN PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2020-2023

- TABLE 5 PATENTS GRANTED IN APPLICATION INTEGRATION MARKET, 2020-2023

- 5.3.3 PRICING ANALYSIS

- 5.3.4 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 PORTER'S FIVE FORCES MODEL

- 5.3.4.1 Threat from new entrants

- 5.3.4.2 Threat from substitutes

- 5.3.4.3 Bargaining power of buyers

- 5.3.4.4 Bargaining power of suppliers

- 5.3.4.5 Intensity of competitive rivalry

- 5.3.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.5.1 Key stakeholders in buying process

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.3.5.2 Buying criteria

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.3.6 TECHNOLOGY ANALYSIS

- 5.3.6.1 Adjacent technologies

- 5.3.6.1.1 Cloud computing

- 5.3.6.1.2 Blockchain

- 5.3.6.2 Related technologies

- 5.3.6.2.1 ML

- 5.3.6.2.2 AI

- 5.3.6.1 Adjacent technologies

- 5.3.7 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 9 KEY CONFERENCES & EVENTS, 2023-2024

- 5.3.8 REGULATORY LANDSCAPE

- 5.3.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.8.1.1 North America

- 5.3.8.1.2 Europe

- 5.3.8.1.3 Asia Pacific

- 5.3.8.1.4 Middle East & Africa

- 5.3.8.1.5 Latin America

- 5.3.9 HISTORY OF APPLICATION INTEGRATION

- FIGURE 23 HISTORY OF APPLICATION INTEGRATION

- 5.3.9.1 1990s

- 5.3.9.2 2000s

- 5.3.9.3 2010s

- 5.3.9.4 2020s

- 5.3.10 VALUE CHAIN ANALYSIS

- FIGURE 24 VALUE CHAIN ANALYSIS

- 5.3.11 ECOSYSTEM ANALYSIS

- TABLE 14 ECOSYSTEM ANALYSIS

- 5.3.11.1 Application integration platform/software providers

- 5.3.11.2 Application integration service providers

- 5.3.11.3 Application integration system integrators

- 5.3.11.4 Application integration end users/applications

- 5.3.12 APPLICATION INTEGRATION APPROACHES

- 5.3.12.1 API integration

- 5.3.12.2 Middleware integration

- 5.3.12.3 Database integration

- 5.3.12.4 Message-based integration

- 5.3.13 STANDARD LEVELS OF APPLICATION INTEGRATION

- 5.3.13.1 Presentation-level integration

- 5.3.13.2 Business process integration

- 5.3.13.3 Data integration

- 5.3.13.4 Communication-level integration

- 5.3.14 BEST PRACTICES IN APPLICATION INTEGRATION

- 5.3.14.1 Deploying right integration plans

- 5.3.14.1.1 Monitoring

- 5.3.14.1.2 Accountability

- 5.3.14.1.3 Service level agreements

- 5.3.14.1.4 Upfront deployment plan

- 5.3.14.2 Using pre-built application connectors

- 5.3.14.3 Maintaining data quality

- 5.3.14.1 Deploying right integration plans

- 5.3.15 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS IN APPLICATION INTEGRATION MARKET

- 5.3.1 CASE STUDY ANALYSIS

6 APPLICATION INTEGRATION MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: APPLICATION INTEGRATION MARKET DRIVERS

- FIGURE 26 SERVICES SEGMENT TO GROW AT HIGHER CAGR BY 2028

- TABLE 15 APPLICATION INTEGRATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 16 APPLICATION INTEGRATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 PLATFORMS

- 6.2.1 GROWING NEED TO DEVELOP AND SECURE DATA INTEGRATION FLOWS

- TABLE 17 PLATFORMS: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 18 PLATFORMS: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- FIGURE 27 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 19 SERVICES: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 20 SERVICES: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 21 APPLICATION INTEGRATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 22 APPLICATION INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 6.3.1 PROFESSIONAL SERVICES

- FIGURE 28 CONSULTING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 23 APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 24 APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 25 PROFESSIONAL SERVICES: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 26 PROFESSIONAL SERVICES: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.1 Consulting

- 6.3.1.1.1 Integration consultancy services help businesses reduce operational costs

- 6.3.1.1 Consulting

- TABLE 27 CONSULTING: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 28 CONSULTING: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.2 Integration

- 6.3.1.2.1 Rising adoption of integration services for IT management

- 6.3.1.2 Integration

- TABLE 29 INTEGRATION: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 30 INTEGRATION: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.3 Support and maintenance

- 6.3.1.3.1 Growing demand for operational efficiency and low costs to boost growth of support and maintenance services

- 6.3.1.3 Support and maintenance

- TABLE 31 SUPPORT AND MAINTENANCE: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 32 SUPPORT AND MAINTENANCE: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Increasing use of managed services to help businesses focus on mission-critical processes

- TABLE 33 MANAGED SERVICES: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 34 MANAGED SERVICES: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

7 APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE

- 7.1 INTRODUCTION

- 7.1.1 INTEGRATION TYPES: APPLICATION INTEGRATION MARKET DRIVERS

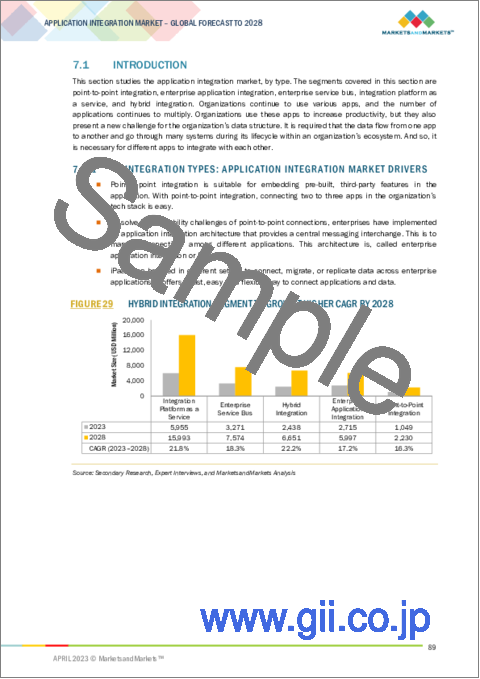

- FIGURE 29 HYBRID INTEGRATION SEGMENT TO GROW AT HIGHER CAGR BY 2028

- TABLE 35 APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2017-2022 (USD MILLION)

- TABLE 36 APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2023-2028 (USD MILLION)

- 7.2 POINT-TO-POINT INTEGRATION

- 7.2.1 POINT-TO-POINT INTEGRATION ELIMINATES USE OF HUNDREDS OF APPS TO MANAGE LARGE VOLUMES OF DATA

- TABLE 37 POINT-TO-POINT INTEGRATION: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 38 POINT-TO-POINT INTEGRATION: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 ENTERPRISE APPLICATION INTEGRATION (EAI)

- 7.3.1 ENTERPRISE APPLICATION INTEGRATION ENABLES IT COMPANIES AUTOMATE BUSINESS PROCESSES

- TABLE 39 ENTERPRISE APPLICATION INTEGRATION: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 40 ENTERPRISE APPLICATION INTEGRATION: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 ENTERPRISE SERVICE BUS (ESB)

- 7.4.1 BUS-BASED EAI MODEL APPROACH SUITABLE FOR INTEGRATING ON-PREMISES APPLICATIONS

- TABLE 41 ENTERPRISE SERVICE BUS: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 42 ENTERPRISE SERVICE BUS: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 INTEGRATION PLATFORM AS A SERVICE

- 7.5.1 CLOUD-BASED IPAAS SOLUTIONS HELP ORGANIZATIONS ACHIEVE FLEXIBILITY AND ROBUSTNESS

- TABLE 43 INTEGRATION PLATFORM AS A SERVICE: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 44 INTEGRATION PLATFORM AS A SERVICE: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 HYBRID INTEGRATION

- 7.6.1 GROWING NEED FOR EASIER INTEGRATION OF DATA AND APPLICATIONS ACROSS ON-PREMISES AND MULTI-CLOUD SETTINGS

- TABLE 45 HYBRID INTEGRATION: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 46 HYBRID INTEGRATION: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

8 APPLICATION INTEGRATION MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 APPLICATIONS: APPLICATION INTEGRATION MARKET DRIVERS

- FIGURE 30 BUSINESS INTELLIGENCE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 47 APPLICATION INTEGRATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 48 APPLICATION INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 CUSTOMER RELATIONSHIP MANAGEMENT (CRM)

- 8.2.1 CRM INTEGRATION TO LEAD TO HIGH PRODUCTIVITY AND EFFICIENCY

- TABLE 49 CUSTOMER RELATIONSHIP MANAGEMENT: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 50 CUSTOMER RELATIONSHIP MANAGEMENT: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 ENTERPRISE RESOURCE PLANNING (ERP)

- 8.3.1 GROWING DEMAND FOR AUTOMATED BUSINESS PROCESSES TO DRIVE ADOPTION OF ERP SYSTEMS

- TABLE 51 ENTERPRISE RESOURCE PLANNING: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 52 ENTERPRISE RESOURCE PLANNING: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 HUMAN RESOURCE MANAGEMENT SYSTEM (HRMS)

- 8.4.1 GROWING NEED TO ENHANCE EMPLOYEE EXPERIENCE TO LEAD TO ADOPTION OF HRM SYSTEMS

- TABLE 53 HUMAN RESOURCE MANAGEMENT SYSTEM: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 54 HUMAN RESOURCE MANAGEMENT SYSTEM: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 SUPPLY CHAIN MANAGEMENT (SCM)

- 8.5.1 INCREASING NEED TO BOOST EFFICIENCY TO DRIVE ADOPTION OF SUPPLY CHAIN INTEGRATION SOLUTIONS

- TABLE 55 SUPPLY CHAIN MANAGEMENT: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 56 SUPPLY CHAIN MANAGEMENT: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6 BUSINESS INTELLIGENCE

- 8.6.1 DATA INTEGRATION OF BI TOOLS TO HELP DELIVER VALUABLE INSIGHTS

- TABLE 57 BUSINESS INTELLIGENCE: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 58 BUSINESS INTELLIGENCE: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.7 ELECTRONIC HEALTH RECORDS (EHR) MANAGEMENT

- 8.7.1 NEED FOR SEAMLESS ACCESS TO MEDICAL RECORDS ACROSS SOFTWARE SOLUTIONS TO DRIVE ADOPTION OF EHRM SYSTEMS

- TABLE 59 ELECTRONIC HEALTH RECORDS: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 60 ELECTRONIC HEALTH RECORDS: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.8 OTHER APPLICATIONS

- TABLE 61 OTHER APPLICATIONS: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 62 OTHER APPLICATIONS: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

9 APPLICATION INTEGRATION MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.1.1 VERTICALS: APPLICATION INTEGRATION MARKET DRIVERS

- FIGURE 31 GOVERNMENT & PUBLIC SECTOR SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 63 APPLICATION INTEGRATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 64 APPLICATION INTEGRATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

- 9.2.1 GROWING DEMAND FOR INTEGRATION SOLUTIONS TO BOOST CUSTOMER EXPERIENCE

- 9.2.2 BFSI: APPLICATION INTEGRATION USE CASES

- 9.2.2.1 Payment processing

- 9.2.2.2 CRM

- 9.2.2.3 Fraud detection and prevention

- 9.2.2.4 Loan processing

- 9.2.2.5 Account and financial reporting

- TABLE 65 BFSI: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 66 BFSI: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 RETAIL & E-COMMERCE

- 9.3.1 DATA INTEGRATION SOLUTIONS TO OPTIMIZE RETAIL PROCESSES AND STREAMLINE OPERATIONS

- 9.3.2 RETAIL & E-COMMERCE: APPLICATION INTEGRATION USE CASES

- 9.3.2.1 Inventory management

- 9.3.2.2 Marketing automation

- 9.3.2.3 Shipping and logistics

- 9.3.2.4 Payment processing

- 9.3.2.5 Business intelligence

- TABLE 67 RETAIL & E-COMMERCE: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 68 RETAIL & E-COMMERCE: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 MANUFACTURING

- 9.4.1 RISING NEED TO AUTOMATE MANUFACTURING PROCESSES TO DRIVE USE OF INTEGRATION SOLUTIONS

- 9.4.2 MANUFACTURING: APPLICATION INTEGRATION USE CASES

- 9.4.2.1 Enterprise resource planning (ERP)

- 9.4.2.2 Supply chain management (SCM)

- 9.4.2.3 Human resource management (HRM)

- 9.4.2.4 Anomaly detection

- TABLE 69 MANUFACTURING: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 70 MANUFACTURING: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 HEALTHCARE & LIFE SCIENCES

- 9.5.1 DATA INTEGRATION SOFTWARE TO SIMPLIFY RETRIEVAL OF HEALTHCARE INFORMATION

- 9.5.2 HEALTHCARE & LIFE SCIENCES: APPLICATION INTEGRATION USE CASES

- 9.5.2.1 Electronic health records (EHRs)

- 9.5.2.2 Telehealth integration

- 9.5.2.3 Medical device integration

- 9.5.2.4 Clinical trial management

- TABLE 71 HEALTHCARE & LIFE SCIENCES: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 72 HEALTHCARE & LIFE SCIENCES: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 ENERGY & UTILITIES

- 9.6.1 RELIANCE OF ENERGY AND UTILITY COMPANIES ON DATA INTEGRATION SOLUTIONS TO ACHIEVE HIGH GROWTH

- 9.6.2 ENERGY & UTILITIES: APPLICATION INTEGRATION USE CASES

- 9.6.2.1 Meter data management

- 9.6.2.2 Geographic information system (GIS) integration

- TABLE 73 ENERGY & UTILITIES: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 74 ENERGY & UTILITIES: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7 AUTOMOTIVE

- 9.7.1 GROWING DEMAND FOR USER-FRIENDLY SYSTEMS AND SOFTWARE TO BOOST GROWTH OF INTEGRATION SOLUTIONS

- 9.7.2 AUTOMOTIVE: APPLICATION INTEGRATION USE CASES

- 9.7.2.1 Infotainment system integration

- 9.7.2.2 Smart device integration

- TABLE 75 AUTOMOTIVE: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 76 AUTOMOTIVE: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8 TRANSPORTATION & LOGISTICS

- 9.8.1 DATA INTEGRATION SOLUTIONS TO IMPROVE OPERATIONAL EFFICIENCY FOR TRANSPORTATION AND LOGISTICS COMPANIES

- 9.8.2 TRANSPORTATION & LOGISTICS: APPLICATION INTEGRATION USE CASES

- 9.8.2.1 Warehouse management

- 9.8.2.2 Route optimization

- 9.8.2.3 Freight audit and payment

- TABLE 77 TRANSPORTATION & LOGISTICS: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 78 TRANSPORTATION & LOGISTICS: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.9 GOVERNMENT & PUBLIC SECTOR

- 9.9.1 RISING USE OF MOBILE AND WEB APPLICATIONS IN GOVERNMENT INSTITUTIONS TO DRIVE USE OF INTEGRATION SOLUTIONS

- 9.9.2 GOVERNMENT & PUBLIC SECTOR: APPLICATION INTEGRATION USE CASES

- 9.9.2.1 Citizen engagement

- 9.9.2.2 Data integration

- 9.9.2.3 Emergency response

- TABLE 79 GOVERNMENT & PUBLIC SECTOR: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 80 GOVERNMENT & PUBLIC SECTOR: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.10 OTHER VERTICALS

- 9.10.1 OTHER VERTICALS: APPLICATION INTEGRATION USE CASES

- 9.10.1.1 Social media integration

- 9.10.1.2 Learning management system integration

- TABLE 81 OTHER VERTICALS: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 82 OTHER VERTICALS: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.10.1 OTHER VERTICALS: APPLICATION INTEGRATION USE CASES

10 APPLICATION INTEGRATION MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 83 APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 84 APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: APPLICATION INTEGRATION MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 85 NORTH AMERICA: APPLICATION INTEGRATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: APPLICATION INTEGRATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: APPLICATION INTEGRATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: APPLICATION INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2017-2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2023-2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: APPLICATION INTEGRATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: APPLICATION INTEGRATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Presence of major players contributing to growth of application integration market in US

- TABLE 99 US: APPLICATION INTEGRATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 100 US: APPLICATION INTEGRATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 101 US: APPLICATION INTEGRATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 102 US: APPLICATION INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 103 US: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 104 US: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 105 US: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2017-2022 (USD MILLION)

- TABLE 106 US: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2023-2028 (USD MILLION)

- TABLE 107 US: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 108 US: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 109 US: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 110 US: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 Presence of mega-vendors to prove lucrative for growth of application integration market

- 10.3 EUROPE

- 10.3.1 EUROPE: APPLICATION INTEGRATION MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- TABLE 111 EUROPE: APPLICATION INTEGRATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 112 EUROPE: APPLICATION INTEGRATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 113 EUROPE: APPLICATION INTEGRATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 114 EUROPE: APPLICATION INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 115 EUROPE: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 116 EUROPE: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 117 EUROPE: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2017-2022 (USD MILLION)

- TABLE 118 EUROPE: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2023-2028 (USD MILLION)

- TABLE 119 EUROPE: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 120 EUROPE: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 121 EUROPE: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 122 EUROPE: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 123 EUROPE: APPLICATION INTEGRATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 124 EUROPE: APPLICATION INTEGRATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Digital transformation initiatives by enterprises to support automation in businesses

- TABLE 125 UK: APPLICATION INTEGRATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 126 UK: APPLICATION INTEGRATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 127 UK: APPLICATION INTEGRATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 128 UK: APPLICATION INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 129 UK: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 130 UK: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 131 UK: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2017-2022 (USD MILLION)

- TABLE 132 UK: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2023-2028 (USD MILLION)

- TABLE 133 UK: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 134 UK: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 135 UK: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 136 UK: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 Growing adoption of AIoT and data analytics to boost digital transformation

- TABLE 137 GERMANY: APPLICATION INTEGRATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 138 GERMANY: APPLICATION INTEGRATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 139 GERMANY: APPLICATION INTEGRATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 140 GERMANY: APPLICATION INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 141 GERMANY: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 142 GERMANY: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 143 GERMANY: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2017-2022 (USD MILLION)

- TABLE 144 GERMANY: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2023-2028 (USD MILLION)

- TABLE 145 GERMANY: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 146 GERMANY: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 147 GERMANY: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 148 GERMANY: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3.5 FRANCE

- 10.3.5.1 Increased spending by French government to boost adoption of application integration

- 10.3.6 ITALY

- 10.3.6.1 Rising demand for various application integration approaches

- 10.3.7 SPAIN

- 10.3.7.1 Boost in investments by Spanish government to create opportunities for application integration market

- 10.3.8 NORDIC REGION

- 10.3.8.1 Partnerships between local and international cloud providers to drive adoption of application integration

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: APPLICATION INTEGRATION MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 149 ASIA PACIFIC: APPLICATION INTEGRATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 150 ASIA PACIFIC: APPLICATION INTEGRATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 151 ASIA PACIFIC: APPLICATION INTEGRATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 152 ASIA PACIFIC: APPLICATION INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 154 ASIA PACIFIC: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 155 ASIA PACIFIC: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2017-2022 (USD MILLION)

- TABLE 156 ASIA PACIFIC: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2023-2028 (USD MILLION)

- TABLE 157 ASIA PACIFIC: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 158 ASIA PACIFIC: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 159 ASIA PACIFIC: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 160 ASIA PACIFIC: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 161 ASIA PACIFIC: APPLICATION INTEGRATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 162 ASIA PACIFIC: APPLICATION INTEGRATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Spread of IoT and big data to boost growth of application integration

- TABLE 163 CHINA: APPLICATION INTEGRATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 164 CHINA: APPLICATION INTEGRATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 165 CHINA: APPLICATION INTEGRATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 166 CHINA: APPLICATION INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 167 CHINA: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 168 CHINA: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 169 CHINA: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2017-2022 (USD MILLION)

- TABLE 170 CHINA: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2023-2028 (USD MILLION)

- TABLE 171 CHINA: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 172 CHINA: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 173 CHINA: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 174 CHINA: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Rise in investments to fuel adoption of latest technologies

- 10.4.5 JAPAN

- 10.4.5.1 Rapid technological advancements and increased R&D activities to present opportunities for growth of application integration solutions

- TABLE 175 JAPAN: APPLICATION INTEGRATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 176 JAPAN: APPLICATION INTEGRATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 177 JAPAN: APPLICATION INTEGRATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 178 JAPAN: APPLICATION INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 179 JAPAN: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 180 JAPAN: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 181 JAPAN: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2017-2022 (USD MILLION)

- TABLE 182 JAPAN: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2023-2028 (USD MILLION)

- TABLE 183 JAPAN: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 184 JAPAN: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 185 JAPAN: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 186 JAPAN: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.4.6 AUSTRALIA & NEW ZEALAND

- 10.4.6.1 Growing demand for technologies at affordable prices to drive adoption of application integration services

- TABLE 187 AUSTRALIA & NEW ZEALAND: APPLICATION INTEGRATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 188 AUSTRALIA & NEW ZEALAND: APPLICATION INTEGRATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 189 AUSTRALIA & NEW ZEALAND: APPLICATION INTEGRATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 190 AUSTRALIA & NEW ZEALAND: APPLICATION INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 191 AUSTRALIA & NEW ZEALAND: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 192 AUSTRALIA & NEW ZEALAND: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 193 AUSTRALIA & NEW ZEALAND: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2017-2022 (USD MILLION)

- TABLE 194 AUSTRALIA & NEW ZEALAND: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2023-2028 (USD MILLION)

- TABLE 195 AUSTRALIA & NEW ZEALAND: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 196 AUSTRALIA & NEW ZEALAND: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 197 AUSTRALIA & NEW ZEALAND: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 198 AUSTRALIA & NEW ZEALAND: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.4.7 SOUTHEAST ASIA

- 10.4.7.1 Increasing adoption of cloud services to boost market growth

- 10.4.8 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: APPLICATION INTEGRATION MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 199 MIDDLE EAST & AFRICA: APPLICATION INTEGRATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: APPLICATION INTEGRATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: APPLICATION INTEGRATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: APPLICATION INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2017-2022 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2023-2028 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: APPLICATION INTEGRATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: APPLICATION INTEGRATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5.3 MIDDLE EAST

- 10.5.3.1 Increasing demand for digital transformation in changing network ecosystem to drive application integration market

- TABLE 213 MIDDLE EAST: APPLICATION INTEGRATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 214 MIDDLE EAST: APPLICATION INTEGRATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.3.1.1 Kingdom of Saudi Arabia (KSA)

- TABLE 215 KSA: APPLICATION INTEGRATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 216 KSA: APPLICATION INTEGRATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 217 KSA: APPLICATION INTEGRATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 218 KSA: APPLICATION INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 219 KSA: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION

- TABLE 220 KSA: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 221 KSA: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2017-2022 (USD MILLION)

- TABLE 222 KSA: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2023-2028 (USD MILLION)

- TABLE 223 KSA: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 224 KSA: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 225 KSA: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 226 KSA: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.5.3.1.2 UAE

- 10.5.3.1.3 Rest of Middle East

- 10.5.4 AFRICA

- 10.5.4.1 Gradual shift of African businesses toward cloud-based technologies to drive application integration market

- TABLE 227 AFRICA: APPLICATION INTEGRATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 228 AFRICA: APPLICATION INTEGRATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 229 AFRICA: APPLICATION INTEGRATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 230 AFRICA: APPLICATION INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 231 AFRICA: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 232 AFRICA: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 233 AFRICA: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2017-2022 (USD MILLION)

- TABLE 234 AFRICA: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2023-2028 (USD MILLION)

- TABLE 235 AFRICA: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 236 AFRICA: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 237 AFRICA: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 238 AFRICA: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: APPLICATION INTEGRATION MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 239 LATIN AMERICA: APPLICATION INTEGRATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 240 LATIN AMERICA: APPLICATION INTEGRATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 241 LATIN AMERICA: APPLICATION INTEGRATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 242 LATIN AMERICA: APPLICATION INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 243 LATIN AMERICA: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 244 LATIN AMERICA: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 245 LATIN AMERICA: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2017-2022 (USD MILLION)

- TABLE 246 LATIN AMERICA: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2023-2028 (USD MILLION)

- TABLE 247 LATIN AMERICA: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 248 LATIN AMERICA: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 249 LATIN AMERICA: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 250 LATIN AMERICA: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 251 LATIN AMERICA: APPLICATION INTEGRATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 252 LATIN AMERICA: APPLICATION INTEGRATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 Growing adoption of IT solutions despite declining economic performance to drive market growth

- TABLE 253 BRAZIL: APPLICATION INTEGRATION MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 254 BRAZIL: APPLICATION INTEGRATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 255 BRAZIL: APPLICATION INTEGRATION MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 256 BRAZIL: APPLICATION INTEGRATION MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 257 BRAZIL: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 258 BRAZIL: APPLICATION INTEGRATION MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 259 BRAZIL: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2017-2022 (USD MILLION)

- TABLE 260 BRAZIL: APPLICATION INTEGRATION MARKET, BY INTEGRATION TYPE, 2023-2028 (USD MILLION)

- TABLE 261 BRAZIL: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 262 BRAZIL: APPLICATION INTEGRATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 263 BRAZIL: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 264 BRAZIL: APPLICATION INTEGRATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.6.4 MEXICO

- 10.6.4.1 Increasing adoption of application integration solutions to protect critical customer data to drive market growth

- 10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 265 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 34 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022 (USD MILLION)

- 11.4 MARKET SHARE ANALYSIS OF KEY PLAYERS

- TABLE 266 APPLICATION INTEGRATION MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 11.5 COMPETITIVE BENCHMARKING

- TABLE 267 DETAILED LIST OF STARTUPS/SMES

- TABLE 268 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- TABLE 269 COMPETITIVE BENCHMARKING FOR KEY PLAYERS

- 11.6 EVALUATION QUADRANT MATRIX METHODOLOGY FOR KEY PLAYERS

- FIGURE 35 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- 11.7 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- FIGURE 36 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS, 2023

- 11.8 EVALUATION QUADRANT MATRIX METHODOLOGY FOR STARTUPS/SMES

- FIGURE 37 EVALUATION QUADRANT MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- 11.9 EVALUATION QUADRANT MATRIX FOR STARTUPS/SMES

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- FIGURE 38 EVALUATION QUADRANT MATRIX FOR STARTUPS/SMES, 2023

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES

- TABLE 270 PRODUCT LAUNCHES, 2021-2023

- 11.10.2 DEALS

- TABLE 271 DEALS, 2021-2023

- TABLE 272 OTHERS, 2021

12 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 12.1 MAJOR PLAYERS

- 12.1.1 SALESFORCE

- TABLE 273 SALESFORCE: BUSINESS OVERVIEW

- FIGURE 39 SALESFORCE: COMPANY SNAPSHOT

- TABLE 274 SALESFORCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 276 SALESFORCE: DEALS

- 12.1.2 IBM

- TABLE 277 IBM: BUSINESS OVERVIEW

- FIGURE 40 IBM: COMPANY SNAPSHOT

- TABLE 278 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 280 IBM: DEALS

- 12.1.3 ORACLE

- TABLE 281 ORACLE: BUSINESS OVERVIEW

- FIGURE 41 ORACLE: COMPANY SNAPSHOT

- TABLE 282 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 ORACLE: DEALS

- 12.1.4 MICROSOFT

- TABLE 284 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 42 MICROSOFT: COMPANY SNAPSHOT

- TABLE 285 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 286 MICROSOFT: DEALS

- 12.1.5 SAP

- TABLE 287 SAP: BUSINESS OVERVIEW

- FIGURE 43 SAP: COMPANY SNAPSHOT

- TABLE 288 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 SAP: DEALS

- 12.1.6 INFORMATICA

- TABLE 290 INFORMATICA: BUSINESS OVERVIEW

- FIGURE 44 INFORMATICA: COMPANY SNAPSHOT

- TABLE 291 INFORMATICA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 INFORMATICA: DEALS

- 12.1.7 TIBCO SOFTWARE

- TABLE 293 TIBCO SOFTWARE: BUSINESS OVERVIEW

- TABLE 294 TIBCO SOFTWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 TIBCO SOFTWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.1.8 SOFTWARE AG

- TABLE 296 SOFTWARE AG: BUSINESS OVERVIEW

- FIGURE 45 SOFTWARE AG: COMPANY SNAPSHOT

- TABLE 297 SOFTWARE AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 SOFTWARE AG: PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.1.9 TALEND

- TABLE 299 TALEND: BUSINESS OVERVIEW

- TABLE 300 TALEND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 TALEND: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 302 TALEND: DEALS

- 12.1.10 SNAPLOGIC

- TABLE 303 SNAPLOGIC: BUSINESS OVERVIEW

- TABLE 304 SNAPLOGIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 SNAPLOGIC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 306 SNAPLOGIC: DEALS

- TABLE 307 SNAPLOGIC: OTHERS

- 12.1.11 BOOMI

- 12.1.12 INTERSYSTEMS

- 12.1.13 SEEBURGER

- 12.1.14 MAGIC SOFTWARE

- 12.1.15 CELONIS

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 12.2 STARTUPS/SMES

- 12.2.1 CELIGO

- 12.2.2 WSO2

- 12.2.3 ZAPIER

- 12.2.4 WORKATO

- 12.2.5 JITTERBIT

- 12.2.6 OPENLEGACY

- 12.2.7 ELASTIC.IO

- 12.2.8 TRAY.IO

- 12.2.9 DBSYNC

- 12.2.10 CYCLR SYSTEMS

- 12.2.11 FLOWGEAR

- 12.2.12 APIFUSE

- 12.2.13 ADEPTIA

13 ADJACENT/RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 DATA INTEGRATION MARKET

- 13.2.1 MARKET DEFINITION

- 13.2.2 MARKET OVERVIEW

- 13.2.3 DATA INTEGRATION MARKET, BY COMPONENT

- TABLE 308 DATA INTEGRATION MARKET, BY COMPONENT, 2015-2020 (USD MILLION)

- TABLE 309 DATA INTEGRATION MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

- 13.2.4 DATA INTEGRATION MARKET, BY BUSINESS APPLICATION

- TABLE 310 DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2015-2020 (USD MILLION)

- TABLE 311 DATA INTEGRATION MARKET, BY BUSINESS APPLICATION, 2021-2026 (USD MILLION)

- 13.2.5 DATA INTEGRATION MARKET, BY DEPLOYMENT MODE

- TABLE 312 DATA INTEGRATION MARKET, BY DEPLOYMENT MODE, 2015-2020 (USD MILLION)

- TABLE 313 DATA INTEGRATION MARKET, BY DEPLOYMENT MODE, 2021-2026 (USD MILLION)

- 13.2.6 DATA INTEGRATION MARKET, BY ORGANIZATION SIZE

- TABLE 314 DATA INTEGRATION MARKET, BY ORGANIZATION SIZE, 2015-2020 (USD MILLION)

- TABLE 315 DATA INTEGRATION MARKET, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- 13.2.7 DATA INTEGRATION MARKET, BY VERTICAL

- TABLE 316 DATA INTEGRATION MARKET, BY VERTICAL, 2015-2020 (USD MILLION)

- TABLE 317 DATA INTEGRATION MARKET, BY VERTICAL, 2021-2026 (USD MILLION)

- 13.2.8 DATA INTEGRATION MARKET, BY REGION

- TABLE 318 DATA INTEGRATION MARKET, BY REGION, 2015-2020 (USD MILLION)

- TABLE 319 DATA INTEGRATION MARKET, BY REGION, 2021-2026 (USD MILLION)

- 13.3 INTEGRATION PLATFORM AS A SERVICE MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.3 INTEGRATION PLATFORM AS A SERVICE MARKET, BY SERVICE TYPE

- TABLE 320 INTEGRATION PLATFORM AS A SERVICE MARKET, BY SERVICE TYPE, 2016-2020 (USD MILLION)

- TABLE 321 INTEGRATION PLATFORM AS A SERVICE MARKET, BY SERVICE TYPE, 2021-2026 (USD MILLION)

- 13.3.4 INTEGRATION PLATFORM AS A SERVICE MARKET, BY DEPLOYMENT MODE

- TABLE 322 INTEGRATION PLATFORM AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2016-2020 (USD MILLION)

- TABLE 323 INTEGRATION PLATFORM AS A SERVICE MARKET, BY DEPLOYMENT MODE, 2021-2026 (USD MILLION)

- 13.3.5 INTEGRATION PLATFORM AS A SERVICE MARKET, BY ORGANIZATION SIZE

- TABLE 324 INTEGRATION PLATFORM AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 325 INTEGRATION PLATFORM AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- 13.3.6 INTEGRATION PLATFORM AS A SERVICE MARKET, BY VERTICAL

- TABLE 326 INTEGRATION PLATFORM AS A SERVICE MARKET, BY VERTICAL, 2016-2020 (USD MILLION)

- TABLE 327 INTEGRATION PLATFORM AS A SERVICE MARKET, BY VERTICAL, 2021-2026 (USD MILLION)

- 13.3.7 INTEGRATION PLATFORM AS A SERVICE MARKET, BY REGION

- TABLE 328 INTEGRATION PLATFORM AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 329 INTEGRATION PLATFORM AS A SERVICE MARKET, BY REGION, 2021-2026 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS