|

|

市場調査レポート

商品コード

1881285

電動三輪車の世界市場:モーター出力別、バッテリー容量別、バッテリータイプ別、最終用途別、モータータイプ別、積載量別、航続距離別、地域別 - 2032年までの予測Electric 3 Wheeler Market by End Use, Range, Battery Type, Battery Capacity, Motor Type, Motor Power, Payload Capacity, and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 電動三輪車の世界市場:モーター出力別、バッテリー容量別、バッテリータイプ別、最終用途別、モータータイプ別、積載量別、航続距離別、地域別 - 2032年までの予測 |

|

出版日: 2025年11月26日

発行: MarketsandMarkets

ページ情報: 英文 300 Pages

納期: 即納可能

|

概要

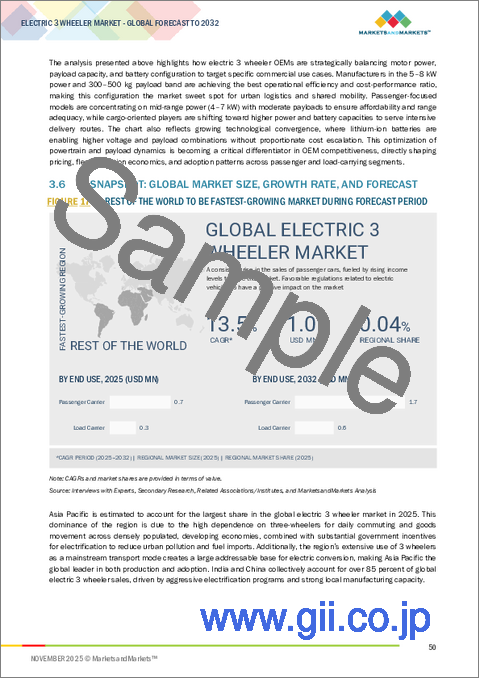

電気三輪車の市場規模は、2025年の26億8,000万米ドルから2032年までに38億5,000万米ドルに達すると予測されており、CAGRは5.3%と見込まれています。

低コストなラストマイル移動手段への需要の高まりと、アジア全域での強力な政策支援を背景に、世界市場は急速に大規模導入へと向かっています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 対象単位 | 価値(10億/100万米ドル)および数量(単位) |

| セグメント | モーター出力別、バッテリー容量別、バッテリータイプ別、最終用途別、モータータイプ別、積載量別、航続距離別、地域別 |

| 対象地域 | アジア太平洋、東南アジア、欧州、北米、その他の地域 |

フリート運営会社は、バッテリー交換技術の進歩、コネクテッドフリート管理、積載効率の向上により、運用コストの低減と稼働率の向上を実現する車両を優先的に導入しております。総所有コスト(TCO)が内燃機関(ICE)モデルと比較して30~40%低いと推定される電気三輪車は、物流、配送、旅客輸送における主流資産となりつつあります。政府の補助金、支援的な融資、そして既存OEMメーカーと新規参入企業による車両モデルの拡充が相まって、フリートの移行が加速しています。この変化により、新興市場における電動モビリティエコシステムの中で、電動三輪車は最も急速に商業化が進むセグメントとして位置づけられています。

積載容量は、電気三輪車の所有者にとって極めて重要な指標です。これは、過積載による車両損傷を防ぐためです。車両の積載容量を超えると、整備や修理に関連する費用が発生する可能性があり、これは避けるべきです。したがって、積載容量は電動三輪車調達における重要な検討事項となります。最終配送段階における電動三輪車の利用増加に伴い、300~500kgセグメントはキロメートル当たりのコスト削減と稼働停止時間の短縮を実現し、電動三輪車の性能向上に寄与します。Mahindra & Mahindra Ltd.、Atul Auto Ltd.、Piaggio Group、Lohia Auto Industries、Kinetic Greenなどの企業は、積載量300~500kgの電動三輪車を販売しております。例えば、江蘇金鵬グループは、積載量400kgの電動リキシャ(X3)と332kgの電動三輪車(TL)を提供しております。したがって、積載量300~500kgの電動三輪車市場は、予測期間中も引き続き主流となる見込みです。

様々な小売、物流、宅配企業が既に小規模ながら電動三輪車の導入を開始しております。商業利用の観点からこれらの車両の性能が向上するにつれ、電動三輪貨物運搬車の導入率は飛躍的に増加すると予想されます。電気三輪車は貨物分野で広く利用されており、キロメートル当たりの運用コストが大幅に低いため、コスト効率が収益性に直結する高頻度ラストマイル配送に最適です。OEMメーカーは物流・ラストマイル配送事業者との提携を通じ、業界における電気三輪車の導入拡大を推進しています。例えば、2024年1月には、オメガ精機モビリティがキッサンモビリティと提携し、ラストマイル配送向けに500台の電動三輪車を導入しました。この提携は240万米ドル規模で、電子商取引、消費財、耐久消費財など、複数のセクターにわたる様々な用途を網羅しています。

予測期間中、アジア太平洋が電動三輪車最大の市場となる見込みです。インドではラストマイル配送とシェアリングモビリティサービスが急速に拡大しており、運営コスト削減のため電動三輪車の採用が増加しています。日本政府も排出量削減プログラムの一環として国内でのEV普及促進策を講じており、日本の電動三輪車市場の成長につながっています。同様に、バングラデシュでは2030年までに登録車両の少なくとも15%を環境に優しい電力で駆動するよう求める自動車産業政策を策定しました。これによりバングラデシュの電動三輪車市場が促進されると予想されます。さらにフィリピンでは、公共交通機関の一形態として、全国的に電動三輪車の利用を推進しています。主要都市では、住民や出稼ぎ労働者の輸送に電動三輪車の導入が始まっています。ビジネス地区や都市部でも電動三輪車が活用されています。これらの要因が相まって、アジア太平洋は電動三輪車市場の主導的地位を確立すると見込まれます。

当レポートでは、世界の電動三輪車市場について調査し、モーター出力別、バッテリー容量別、バッテリータイプ別、最終用途別、モータータイプ別、積載量別、航続距離別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- アンメットニーズと空白

第6章 顧客情勢と購買行動

- 意思決定プロセス

- 主要な利害関係者と購入基準

- 採用障壁と内部課題

- さまざまな最終用途におけるアンメットニーズ

- 市場収益性

第7章 技術、特許、デジタル、AIの導入別戦略的破壊

- 技術分析

- 技術/製品ロードマップ

- 特許分析

- 将来の応用

第8章 持続可能性と規制状況

- 規制状況

- 持続可能性への取り組み

第9章 業界動向

- マクロ経済指標

- エコシステム分析

- バリューチェーン分析

- 電動三輪車市場における新たなビジネスモデル

- 電動三輪車市場における地域レベル準備指数

- 価格分析

- 顧客ビジネスに影響を与える動向と混乱

- 投資と資金調達のシナリオ

- 電動三輪車市場の総所有コスト

- 部品表(BOM)分析

- HSコード

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- MNM、電動三輪車市場におけるEVバッテリー要件に関する洞察

第10章 電動三輪車市場(モーター出力別)

- イントロダクション

- 1,500W以下

- 1,500~3,500W

- 3,500W以上

- 主要な洞察

第11章 電動三輪車市場(バッテリー容量別)

- イントロダクション

- 5KWH未満

- 5~8KWH

- 8KWH以上

- 主要な洞察

第12章 電動三輪車市場(バッテリータイプ別)

- イントロダクション

- 鉛蓄電池

- リチウムイオン

- その他

- 主要な洞察

第13章 電動三輪車市場(最終用途別)

- イントロダクション

- 旅客輸送

- ロードキャリア

- 主要な洞察

第14章 電動三輪車市場(モータータイプ別)

- イントロダクション

- ハブモーター

- ミッドモーター

- 主要な洞察

第15章 電動三輪車市場(積載量別)

- イントロダクション

- 300kg未満

- 300~500キログラム

- 500kg以上

- 主要な洞察

第16章 電動三輪車市場(航続距離別)

- イントロダクション

- 50マイル未満

- 50マイル以上

- 主要な洞察

第17章 電動三輪車市場(地域別)

- イントロダクション

- アジア太平洋

- インド

- 日本

- バングラデシュ

- ネパール

- スリランカ

- 中国

- 韓国

- 欧州

- ドイツ

- フランス

- スペイン

- イタリア

- 英国

- 北米

- 米国

- カナダ

- その他の地域

- 南アフリカ

- ケニア

- 東南アジア

- タイ

- インドネシア

- フィリピン

- ベトナム

第18章 競合情勢

- イントロダクション

- 主要参入企業の戦略概要(2023年~2025年)

- 市場シェア分析

- 収益分析

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第19章 企業プロファイル

- 主要参入企業

- MAHINDRA&MAHINDRA LTD.

- YATRI ELECTRIC VEHICLE

- BAJAJ AUTO LTD.

- SAERA ELECTRIC AUTO LIMITED

- PIAGGIO & C. SPA

- CITYLIFE ELECTRIC VEHICLES

- KINETIC

- MINI METRO

- ATUL AUTO LIMITED

- TERRA MOTORS

- LOHIA AUTO INDUSTRIES(ZUPERIA AUTO PRIVATE LIMITED)

- OMEGA SEIKI MOBILITY

- その他の企業

- JIANGSU JINPENG GROUP CO., LTD.

- SKYRIDE E RICKSHAW

- SHADO GROUP INTERNATIONAL PTE. LTD.(DATANYZE)

- XIANGHE QIANGSHENG ELECTRIC TRICYCLE FACTORY

- KYBURZ

- PROZZA HIROSE MANUFACTURING INC.

- GAYAM MOTOR WORKS PVT. LTD.

- BEMAC CORPORATION

- J.S. AUTO(P)LTD.

- SAARTHI E-RICKSHAW

- UNIQUE INTERNATIONAL

- EULER MOTORS

- LECTRIX E-VEHICLE PVT. LTD.