|

|

市場調査レポート

商品コード

1259449

有機凝集剤の世界市場:種類別 (ポリアミン、PolyDADMAC)・用途別 (都市用水処理、工業用水処理)・地域別 (アジア太平洋、北米、欧州、中東・アフリカ、南米) の将来予測 (2027年まで)Organic Coagulant Market by Type (Polyamine, Polydadmac), Application (Municipal Water Treatment, Industrial Water Treatment), and Region (Asia Pacific, North America, Europe, Middle East & Africa, South America) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 有機凝集剤の世界市場:種類別 (ポリアミン、PolyDADMAC)・用途別 (都市用水処理、工業用水処理)・地域別 (アジア太平洋、北米、欧州、中東・アフリカ、南米) の将来予測 (2027年まで) |

|

出版日: 2023年04月12日

発行: MarketsandMarkets

ページ情報: 英文 227 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の有機凝集剤の市場規模は、2022年の20億米ドルから2027年には29億米ドルに達すると予測され、予測期間中のCAGRは8.1%となります。

2022年の市場シェアは、ポリアミンが最大となっています。無機凝集剤の有害性への関心増大や淡水資源の減少により、新興国での有機凝集剤に対する需要がますます高まっています。さらに、アジア太平洋、南米、中東・アフリカなどの新興国では、人口の増加と急速な都市化により、安全で清潔な水への需要が高まっているため、有機凝集剤への需要が高まっています。このため、効果的な水処理ソリューションが必要となり、予測期間中に有機凝集剤市場を牽引することになるでしょう。

種類別に見ると、2027年にはポリアミンのセグメントが金額ベースで最も急速に成長する

ポリアミン系有機凝集剤は、水処理工程で不純物や浮遊物を除去するために使用される有機凝集剤の一種です。ポリアミン系有機凝集剤は、アミン官能基を持つ高分子量の水溶性高分子で構成されています。この官能基がポリアミン凝集剤にプラスの電荷を与え、マイナスに帯電した水粒子を引き寄せて中和します。ポリアミン系凝集剤は、廃水、工業用水、飲料水など、さまざまな水源を処理するのに有効です。水中の有機物、濁り、色、重金属を除去する効果があり、往々にしてろ過や沈殿など他の処理工程と組み合わせて使われています。

用途別では、都市用水処理が金額ベースで最も急速に成長する

都市用水処理とは、河川・湖沼・地下水などの自然水源を処理・浄化して、人間が安全に消費できるようにするプロセスです。これらの水源からの水は汚染されていることが多く、汚れの原因となる溶存鉄やマンガンが多量に含まれています。これらの汚染物質を処理するために、水処理プロセスの一部として有機凝集剤が使用され、水から不純物や汚染物質を除去しています。これらの凝集剤は、水中の粒子の電荷を中和して、粒子同士を凝集させ、ろ過によってより容易に除去できる大きな粒子を形成させる働きをします。

予測期間中、南米が3番目に速いスピードで成長する

南米は、2022年の有機凝集剤市場において、金額・数量両面で3番目に急成長する地域と予測されており、特にブラジルとアルゼンチンが牽引役となっています。この地域は、水処理に大きな可能性を持っています。人口の多さ、都市化の進展、急速な工業化などが市場を牽引する要因となっています。また、人口増加や都市化の進展により、電力需要も増加しています。また、水処理に関するインフラ整備が進んでいることも、同地域の有機凝集剤市場の主要な促進要因となっています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 不況の影響

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- ポーターのファイブフォース分析

- マクロ経済指標

- 関税と規制

- 技術分析

- 特許分析

- 原材料の分析

- 貿易分析

- 価格分析

- エコシステムマッピング

- 顧客のビジネスに影響を与える動向/混乱

- 主な会議とイベント (2023年~2024年)

- 購入決定に影響を与える主な要因

- ケーススタディ分析

第6章 有機凝集剤市場:種類別

- イントロダクション

- ポリアミン

- PolyDADMAC (ポリジアリルジメチルアンモニウムクロライド)

- その他の種類

第7章 有機凝集剤市場:用途別

- イントロダクション

- 都市用水処理

- 工業用水処理

- 繊維

- 食品・飲料

- パルプ・製紙

- 化学薬品・肥料

- 石油・ガス

- 鉱業・鉱物処理

- その他の用途

第8章 有機凝集剤市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- インドネシア

- その他のアジア太平洋

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- アラブ首長国連邦

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第9章 競合情勢

- 概要

- 主要企業が採用した戦略

- 市場評価フレームワーク

- 収益分析

- 主要企業のランキング

- 市場シェア分析

- 企業評価マトリックス (ティア1企業)

- ティア1企業の製品ポートフォリオの強み (2022年)

- ティア1企業の事業戦略の優秀性 (2022年)

- スタートアップ・中小企業の評価マトリックス

- 製品ポートフォリオの強み (スタートアップ・中小企業)

- スタートアップ・中小企業の事業戦略の優秀性

- 競合ベンチマーキング

- 競合シナリオ

第10章 企業プロファイル

- KEMIRA OYJ

- SNF GROUP

- BASF SE

- ECOLAB

- VEOLIA

- KURITA WATER INDUSTRIES LTD.

- BAKER HUGHES COMPANY

- SOLENIS

- USALCO

- BUCKMAN

- その他の企業

- ARIES CHEMICAL, INC.

- CINETICA QUIMICA

- GEO SPECIALTY CHEMICALS INC.

- HYDRITE CHEMICAL

- ZINKAN ENTERPRISES, INC.

- AMCON EUROPE S.R.O.

- BLACK ROSE INDUSTRIES LTD.

- CHEMBOND WATER TECHNOLOGIES LIMITED

- AOS TREATMENT SOLUTIONS, LLC

- CHEMTREAT, INC.

- WUXI LANSEN CHEMICALS CO., LTD.

- AQUACHEM INDUSTRIES LLC

- AULICK CHEMICAL SOLUTIONS INC.

- CROMOGENIA UNITS S.A.

- DELTA CHEMICAL CORP

第11章 付録

The global organic coagulant market size is projected to reach USD 2.9 billion by 2027 from USD 2.0 billion in 2022, at a CAGR of 8.1% during the forecast period. Polyamine has the largest market share in 2022. The ever increasing demand for organic coagulants in emerging markets owing to rising awareness of the harmful effects of inorganic coagulants and declining freshwater resources. Additionally, the demand for organic coagulants in emerging countries such as Asia Pacific, South America, and Middle East & Africa, is increasing due to the rising population and rapid urbanization that increases the demand for safe and clean water. This requires effective water treatment solutions that will drive the market for organic coagulants during the forecast period.

Polyamine segment is estimated to be the fastest growing in terms of value amongst other types in the organic coagulant market, in 2027

Polyamine organic coagulants are a type of organic coagulant used in water treatment processes to help remove impurities and suspended solids. They are composed of amine functional group-containing high molecular weight, water-soluble polymers. These functional groups provide polyamine coagulants with a positive charge that enables them to attract and neutralize negatively charged water particles. Polyamine coagulants are effective in treating a variety of water sources, including wastewater, industrial process water, and potable water. They can help remove organic matter, turbidity, color, and heavy metals from water, and are often used in conjunction with other treatment processes such as filtration or sedimentation.

Municipal water treatment is projected to grow into the fastest growing application in the organic coagulant, in terms of value.

Municipal water treatment is the process by which water from natural sources such as rivers, lakes, or groundwater is treated and purified to make it safe for human consumption. Water from these sources is often polluted and contains a large amount of stain-producing dissolved iron and manganese. To treat these pollutants, organic coagulants are used as a part of the water treatment process to remove impurities and contaminants from the water. These coagulants work by neutralizing the electrical charge of particles in the water, causing them to clump together and form larger particles that can be more easily removed by filtration.

South America is projected to be the third fastest in the organic coagulant market during the forecast period.

South America is predicted to be the third fastest growing region amongst others in the organic coagulant market in 2022, in terms of value and volume, Brazil and Argentina is the key countries driving the South American organic coagulant market. The region has considerable scope for water treatment. Large population size, growing urbanization, and rapid industrialization are some of the factors driving the market. Electricity demand in the region is also increasing due to the growing population and urbanization. The increasing infrastructural development in water treatment is also a major driver for the organic coagulant market in the region.

Extensive primary interviews were conducted in the process of determining and verifying the sizes of several segments and subsegments of the organic coagulant market gathered through secondary research.

The breakdown of primary interviews has been given below.

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level Executives - 20%, Director Level - 10%, Others - 70%

- By Region: North America - 20%, Asia Pacific - 30%, Europe - 30%, Middle East & Africa - 10%, South America-10%.

The key players in the organic coagulant market are Kemira Oyj (Finland), SNF Group (France), BASF SE (Germany), Veolia (France), ECOLAB (US), Kurita Water Industries Ltd (Japan), Baker Hughes Company (US), Solenis (US), USALCO (US) and Buckman (US). The organic coagulant market report analyzes the key growth strategies, such as new product launches, investments & expansions, agreements, partnerships, and mergers & acquisitions to strengthen their market positions.

Research Coverage

This report provides detailed segmentation of the organic coagulant market and forecasts its market size until 2027. The market has been segmented based on by type (polyamine, polyDADMAC, and others), by application (municipal water treatment and industrial water treatment), and by region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisition associated with the market for organic coagulant market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the organic coagulant market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Stringent regulatory and sustainability mandates for protecting environment, Declining freshwater resources, Harmful effects of inorganic coagulants), restraints (Availability of alternative technologies), opportunities (Rising population and rapid urbanization in emerging economies), and challenges (Sensitivity to pH and temperature) influencing the growth of the organic coagulants market

- Market Penetration: Comprehensive information on organic coagulant market offered by top players in the global organic coagulant market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the organic coagulant market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for organic coagulant market across regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the organic coagulant market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 ORGANIC COAGULANTS MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 INCLUSIONS & EXCLUSIONS

- TABLE 1 INCLUSIONS & EXCLUSIONS

2 RESEARCH METHODOLOGY

- 2.1 IMPACT OF SLOWDOWN/RECESSION

- 2.2 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of major secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.3 PRIMARY LIST

- 2.2.3.1 Demand and supply sides

- 2.2.3.2 Key data from primary sources

- 2.2.3.3 Key industry insights

- 2.2.3.4 Breakdown of primary interviews

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 3 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION

- 2.5 ASSUMPTIONS

- 2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.6.1 SUPPLY SIDE

- 2.6.2 DEMAND SIDE

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 6 POLYDADMAC SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 7 INDUSTRIAL SEGMENT TO ACCOUNT FOR LARGER SHARE OF ORGANIC COAGULANTS MARKET

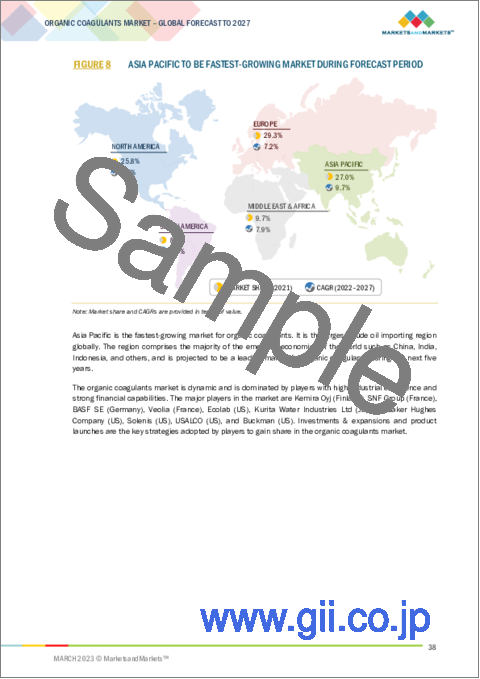

- FIGURE 8 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 EMERGING ECONOMIES TO WITNESS HIGH GROWTH IN ORGANIC COAGULANTS MARKET

- FIGURE 9 ASIA PACIFIC TO OFFER ATTRACTIVE OPPORTUNITIES IN ORGANIC COAGULANTS MARKET DURING FORECAST PERIOD

- 4.2 ORGANIC COAGULANTS MARKET, BY TYPE

- FIGURE 10 POLYAMINE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 ORGANIC COAGULANTS MARKET, BY APPLICATION

- FIGURE 11 INDUSTRIAL SEGMENT TO LEAD MARKET BY 2027

- 4.4 ORGANIC COAGULANTS MARKET, BY COUNTRY

- FIGURE 12 MARKET IN INDIA TO GROW AT HIGHEST CAGR

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 IMPACT OF RECESSION

- 5.3 MARKET DYNAMICS

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ORGANIC COAGULANTS MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Stringent regulatory and sustainability mandates for protecting environment

- 5.3.1.2 Declining freshwater resources

- 5.3.1.3 Harmful effects of inorganic coagulants

- 5.3.2 RESTRAINTS

- 5.3.2.1 Availability of alternative technologies

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Rising population and rapid urbanization in emerging economies

- 5.3.4 CHALLENGES

- 5.3.4.1 Sensitivity to pH and temperature

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 14 OVERVIEW OF VALUE CHAIN OF ORGANIC COAGULANTS MARKET

- 5.4.1 RAW MATERIAL SUPPLIERS

- 5.4.2 ORGANIC COAGULANT MANUFACTURERS

- 5.4.3 DISTRIBUTORS

- 5.4.4 END-USE INDUSTRIES

- TABLE 2 STAKEHOLDERS IN VALUE CHAIN OF ORGANIC COAGULANTS

- 5.5 PORTER'S FIVE FORCE ANALYSIS

- FIGURE 15 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 BARGAINING POWER OF SUPPLIERS

- 5.5.2 BARGAINING POWER OF BUYERS

- 5.5.3 THREAT OF NEW ENTRANTS

- 5.5.4 THREAT OF SUBSTITUTES

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 3 PORTER'S FIVE FORCES ANALYSIS

- 5.6 MACROECONOMIC INDICATORS

- 5.6.1 GLOBAL GDP TRENDS

- TABLE 4 TRENDS OF PER CAPITA GDP (USD), 2020-2022

- TABLE 5 GDP GROWTH ESTIMATE AND PROJECTION FOR KEY COUNTRIES, 2023-2027

- 5.7 TARIFFS AND REGULATIONS

- 5.7.1 REGULATIONS

- 5.7.1.1 North America

- 5.7.1.1.1 Clean Water Act (CWA)

- 5.7.1.1.2 Safe Drinking Water Act (SDWA)

- 5.7.1.2 European Union (EU)

- 5.7.1.2.1 The Drinking Water Directive (1998)

- 5.7.1.2.2 The Urban Wastewater Treatment Directive (1991)

- 5.7.1.2.3 The European Chemicals Agency

- 5.7.1.3 CHINA

- 5.7.1.3.1 Water Pollution Prevention & Control Law (WPL)

- 5.7.1.3.2 The Water Resources Law

- 5.7.1.1 North America

- 5.7.1 REGULATIONS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 NEW TECHNOLOGIES - ORGANIC COAGULANTS

- 5.9 PATENT ANALYSIS

- 5.9.1 INTRODUCTION

- 5.9.2 METHODOLOGY

- 5.9.3 DOCUMENT TYPE

- FIGURE 16 PATENTS REGISTERED (2012 TO 2022)

- 5.9.4 PUBLICATION TRENDS - LAST 10 YEARS

- FIGURE 17 NUMBER OF PATENTS DURING LAST 10 YEARS

- 5.9.5 INSIGHTS

- 5.9.6 JURISDICTION ANALYSIS

- FIGURE 18 TOP JURISDICTIONS

- 5.9.7 TOP COMPANIES/APPLICANTS

- FIGURE 19 TOP APPLICANTS' ANALYSIS

- TABLE 6 LIST OF PATENTS BY SHANXI BEIQUAN ENVIRONMENTAL PROTECTION TECHNOLOGY CO., LTD.

- TABLE 7 LIST OF PATENTS BY KEMIRA OYJ

- TABLE 8 LIST OF PATENTS BY DEXERIALS CORP.

- TABLE 9 LIST OF PATENTS BY SANYO CHEMICAL IND. LTD.

- TABLE 10 TOP 10 PATENT OWNERS (US) DURING LAST 10 YEARS

- 5.10 RAW MATERIAL ANALYSIS

- 5.10.1 CHITIN

- 5.10.2 BROWN SEAWEED

- 5.10.3 ETHYLENEDIAMINE

- 5.10.4 DIALLYL DIMETHYL AMMONIUM CHLORIDE (DADMAC)

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT TRADE ANALYSIS

- TABLE 11 REGION-WISE IMPORT TRADE (USD THOUSAND)

- FIGURE 20 REGION-WISE IMPORT TRADE (USD THOUSAND)

- 5.11.2 EXPORT TRADE ANALYSIS

- TABLE 12 REGION-WISE EXPORT TRADE (USD THOUSAND)

- FIGURE 21 REGION-WISE EXPORT TRADE (USD THOUSAND)

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE, BY REGION

- FIGURE 22 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- 5.12.2 AVERAGE SELLING PRICE, BY TYPE

- TABLE 13 AVERAGE SELLING PRICE, BY TYPE (USD/KG)

- 5.12.3 AVERAGE SELLING PRICE, BY COMPANY

- TABLE 14 AVERAGE SELLING PRICE, BY COMPANY (USD/KG)

- 5.13 ECOSYSTEM MAPPING

- FIGURE 23 ORGANIC COAGULANTS MARKET ECOSYSTEM

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 NATURE-BASED ORGANIC COAGULANTS TO DRIVE GROWTH

- 5.15 KEY CONFERENCES & EVENTS DURING 2023-2024

- TABLE 15 DETAILED LIST OF CONFERENCES & EVENTS

- 5.16 KEY FACTORS AFFECTING BUYING DECISIONS

- 5.16.1 QUALITY

- 5.16.2 SERVICE

- FIGURE 25 SUPPLIER SELECTION CRITERIA

- 5.17 CASE STUDY ANALYSIS

- 5.17.1 MUNICIPAL WASTEWATER TREATMENT PLANT IN US

- 5.17.2 INDUSTRIAL WASTEWATER TREATMENT PLANT IN US

6 ORGANIC COAGULANTS MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 26 POLYDADMAC SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 16 ORGANIC COAGULANTS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 17 ORGANIC COAGULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 18 ORGANIC COAGULANTS MARKET, BY TYPE, 2018-2021 (KILOTON)

- TABLE 19 ORGANIC COAGULANTS MARKET, BY TYPE, 2022-2027 (KILOTON)

- 6.1.1 POLYAMINE

- 6.1.2 POLYDADMAC

- 6.1.3 OTHER TYPES

7 ORGANIC COAGULANTS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 27 ORGANIC COAGULANTS MARKET SEGMENTATION, BY APPLICATION

- TABLE 20 ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 21 ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 22 ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 23 ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 7.2 MUNICIPAL WATER TREATMENT

- 7.3 INDUSTRIAL WATER TREATMENT

- 7.3.1 TEXTILE

- 7.3.1.1 Household

- 7.3.1.2 Fashion & clothing

- 7.3.1.3 Technical textiles

- 7.3.2 FOOD & BEVERAGE

- 7.3.2.1 Food

- 7.3.2.1.1 Fruits & vegetables

- 7.3.2.1.2 Dairy

- 7.3.2.1.3 Meat, poultry, and seafood

- 7.3.2.1.4 Frozen and processed food

- 7.3.2.1.5 Bakery & confectionary

- 7.3.2.2 Beverages

- 7.3.2.2.1 Alcoholic beverages

- 7.3.2.2.2 Carbonated soft drinks

- 7.3.2.2.3 Sports & energy drinks

- 7.3.2.1 Food

- 7.3.3 PULP & PAPER

- 7.3.3.1 Wrapping & packaging

- 7.3.3.2 Printing

- 7.3.4 CHEMICALS & FERTILIZERS

- 7.3.4.1 Chemical manufacturing

- 7.3.4.2 Fertilizers

- 7.3.5 OIL& GAS

- 7.3.5.1 Upstream

- 7.3.5.2 Midstream

- 7.3.5.3 Downstream

- 7.3.6 MINING & MINERAL PROCESSING

- 7.3.6.1 Metal processing

- 7.3.6.2 Mining

- 7.3.7 OTHER APPLICATIONS

- 7.3.1 TEXTILE

8 ORGANIC COAGULANTS MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 28 INDIA TO BE FASTEST-GROWING ORGANIC COAGULANTS MARKET BETWEEN 2022 & 2027

- TABLE 24 ORGANIC COAGULANTS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 25 ORGANIC COAGULANTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 26 ORGANIC COAGULANTS MARKET, BY REGION, 2018-2021 (KILOTON)

- TABLE 27 ORGANIC COAGULANTS MARKET, BY REGION, 2022-2027 (KILOTON)

- 8.2 ASIA PACIFIC

- FIGURE 29 ASIA PACIFIC: ORGANIC COAGULANTS MARKET SNAPSHOT

- TABLE 28 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 29 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 30 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 31 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 32 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 33 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 34 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY TYPE, 2018-2021 (KILOTON)

- TABLE 35 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY TYPE, 2022-2027 (KILOTON)

- TABLE 36 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 37 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 38 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 39 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.2.1 CHINA

- 8.2.1.1 Focus on water treatment industry to drive market

- TABLE 40 CHINA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 41 CHINA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 42 CHINA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 43 CHINA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.2.2 JAPAN

- 8.2.2.1 Promotion of public-private partnerships to accelerate wastewater treatment

- TABLE 44 JAPAN: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 45 JAPAN: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 46 JAPAN: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 47 JAPAN: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.2.3 INDIA

- 8.2.4 PROVISION OF SAFE AND ADEQUATE DRINKING WATER THROUGH INDIVIDUAL HOUSEHOLD TAP CONNECTIONS TO DRIVE MARKET

- TABLE 48 INDIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 49 INDIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 50 INDIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 51 INDIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.2.5 SOUTH KOREA

- 8.2.5.1 Rising need for domestic and industrial wastewater treatment to drive market

- TABLE 52 SOUTH KOREA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 53 SOUTH KOREA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 54 SOUTH KOREA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 55 SOUTH KOREA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.2.6 INDONESIA

- 8.2.6.1 Boosting access to treated water to increase demand for organic coagulants

- TABLE 56 INDONESIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 57 INDONESIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 58 INDONESIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 59 INDONESIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.2.7 REST OF ASIA PACIFIC

- TABLE 60 REST OF ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 61 REST OF ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 62 REST OF ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 63 REST OF ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.3 EUROPE

- FIGURE 30 EUROPE: ORGANIC COAGULANTS MARKET SNAPSHOT

- TABLE 64 EUROPE: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 65 EUROPE: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 66 EUROPE: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 67 EUROPE: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 68 EUROPE: ORGANIC COAGULANTS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 69 EUROPE: ORGANIC COAGULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 70 EUROPE: ORGANIC COAGULANTS MARKET, BY TYPE, 2018-2021 (KILOTON)

- TABLE 71 EUROPE: ORGANIC COAGULANTS MARKET, BY TYPE, 2022-2027 (KILOTON)

- TABLE 72 EUROPE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 73 EUROPE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 74 EUROPE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 75 EUROPE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.3.1 GERMANY

- 8.3.1.1 Municipal and industrial water treatment applications to drive market

- TABLE 76 GERMANY: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 77 GERMANY: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 78 GERMANY: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 79 GERMANY: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.3.2 UK

- 8.3.2.1 Commercial, domestic, and municipal sectors to increase demand for water and wastewater treatment

- TABLE 80 UK: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 81 UK: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 82 UK: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 83 UK: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.3.3 FRANCE

- 8.3.3.1 Creation of new networks and water treatment and decontamination facilities to increase demand for organic coagulants

- TABLE 84 FRANCE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 85 FRANCE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 86 FRANCE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 87 FRANCE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.3.4 ITALY

- 8.3.4.1 Stringent environmental policies and increase in tourism to propel demand for organic coagulants

- TABLE 88 ITALY: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 89 ITALY: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 90 ITALY: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 91 ITALY: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.3.5 SPAIN

- 8.3.5.1 Upgradation of water treatment utilities, revised directives and laws, and investments by foreign companies to drive market

- TABLE 92 SPAIN: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 93 SPAIN: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 94 SPAIN: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 95 SPAIN: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.3.6 REST OF EUROPE

- TABLE 96 REST OF EUROPE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 97 REST OF EUROPE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 98 REST OF EUROPE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 99 REST OF EUROPE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.4 NORTH AMERICA

- FIGURE 31 NORTH AMERICA: ORGANIC COAGULANTS MARKET SNAPSHOT

- TABLE 100 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 101 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 102 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 103 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 104 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 105 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 106 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2018-2021 (KILOTON)

- TABLE 107 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2022-2027 (KILOTON)

- TABLE 108 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 109 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 110 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 111 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.4.1 US

- 8.4.1.1 Municipal, mining, food & beverage, and oil & gas to drive market

- TABLE 112 US: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 113 US: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 114 US: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 115 US: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.4.2 CANADA

- 8.4.2.1 Municipal, oil & gas, water utilities, food & beverage, and mining sectors to drive market

- TABLE 116 CANADA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 117 CANADA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 118 CANADA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 119 CANADA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.4.3 MEXICO

- 8.4.3.1 Significant growth of water and wastewater sector to drive market

- TABLE 120 MEXICO: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 121 MEXICO: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 122 MEXICO: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 123 MEXICO: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.5 MIDDLE EAST & AFRICA

- TABLE 124 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 127 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 128 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2018-2021 (KILOTON)

- TABLE 131 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2022-2027 (KILOTON)

- TABLE 132 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 135 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.5.1 SAUDI ARABIA

- 8.5.1.1 Launch of various initiatives to improve wastewater treatment services and reduce water scarcity to drive growth

- TABLE 136 SAUDI ARABIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 137 SAUDI ARABIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 138 SAUDI ARABIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 139 SAUDI ARABIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.5.2 SOUTH AFRICA

- 8.5.2.1 Rising demand for freshwater due to rapid increase in industrialization and population to drive market

- TABLE 140 SOUTH AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 141 SOUTH AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 142 SOUTH AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 143 SOUTH AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.5.3 UAE

- 8.5.3.1 National water reuse policy, 2020 requiring industries to treat and reuse a certain percentage of wastewater to drive market

- TABLE 144 UAE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 145 UAE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 146 UAE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 147 UAE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 148 REST OF MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 149 REST OF MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 150 REST OF MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 151 REST OF MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.6 SOUTH AMERICA

- TABLE 152 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 153 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 154 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 155 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 156 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 157 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 158 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2018-2021 (KILOTON)

- TABLE 159 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2022-2027 (KILOTON)

- TABLE 160 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 161 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 162 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 163 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.6.1 BRAZIL

- 8.6.1.1 Reduced freshwater sources, adverse climate conditions, and regulatory measures to support growth of market

- TABLE 164 BRAZIL: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 165 BRAZIL: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 166 BRAZIL: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 167 BRAZIL: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.6.2 ARGENTINA

- 8.6.2.1 National Water Plan to improve access to drinking water and sanitation

- TABLE 168 ARGENTINA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 169 ARGENTINA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 170 ARGENTINA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 171 ARGENTINA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

- 8.6.3 REST OF SOUTH AMERICA

- TABLE 172 REST OF SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 173 REST OF SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 174 REST OF SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 175 REST OF SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022-2027 (KILOTON)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 32 COMPANIES ADOPTED INVESTMENTS & EXPANSIONS AND PRODUCT DEVELOPMENTS AS KEY GROWTH STRATEGIES BETWEEN 2018 AND 2022

- 9.3 MARKET EVALUATION FRAMEWORK

- TABLE 176 MARKET EVALUATION FRAMEWORK

- 9.4 REVENUE ANALYSIS

- TABLE 177 REVENUE ANALYSIS OF KEY COMPANIES, 2019-2021 (USD BILLION)

- 9.5 RANKING OF KEY PLAYERS

- FIGURE 33 RANKING OF TOP FIVE PLAYERS IN ORGANIC COAGULANTS MARKET

- 9.5.1 SNF GROUP

- 9.5.2 KEMIRA OYJ

- 9.5.3 BASF SE

- 9.5.4 VEOLIA

- 9.5.5 ECOLAB

- 9.6 MARKET SHARE ANALYSIS

- FIGURE 34 ORGANIC COAGULANTS MARKET SHARE, BY COMPANY, 2022

- TABLE 178 DEGREE OF COMPETITION

- 9.7 COMPANY EVALUATION MATRIX, TIER 1

- 9.7.1 STARS

- 9.7.2 PERVASIVE PLAYERS

- 9.7.3 EMERGING LEADERS

- 9.7.4 PARTICIPANTS

- FIGURE 35 COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES, 2022

- 9.8 STRENGTH OF PRODUCT PORTFOLIO FOR TIER 1 COMPANIES, 2022

- 9.9 BUSINESS STRATEGY EXCELLENCE FOR TIER 1 COMPANIES, 2022

- 9.10 STARTUP AND SME COMPANY EVALUATION MATRIX

- 9.10.1 PROGRESSIVE COMPANIES

- 9.10.2 RESPONSIVE COMPANIES

- 9.10.3 STARTING BLOCKS

- 9.10.4 DYNAMIC COMPANIES

- FIGURE 36 COMPANY EVALUATION MATRIX FOR STARTUPS AND SMES, 2022

- 9.11 STRENGTH OF PRODUCT PORTFOLIO (STARTUPS AND SMES)

- 9.12 STARTUP AND SME BUSINESS STRATEGY EXCELLENCE

- 9.13 COMPETITIVE BENCHMARKING

- TABLE 179 DETAILED LIST OF COMPANIES

- 9.13.1 COMPANY TYPE FOOTPRINT

- TABLE 180 OVERALL TYPE FOOTPRINT

- 9.13.2 COMPANY APPLICATION FOOTPRINT

- TABLE 181 OVERALL APPLICATION FOOTPRINT

- 9.13.3 COMPANY REGION FOOTPRINT

- TABLE 182 OVERALL REGION FOOTPRINT

- 9.13.4 COMPANY FOOTPRINT

- TABLE 183 OVERALL COMPANY FOOTPRINT

- 9.14 COMPETITIVE SCENARIO

- 9.14.1 DEALS

- TABLE 184 DEALS, 2018-2022

- 9.14.2 OTHERS

- TABLE 185 OTHERS, 2018-2022

10 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 10.1 KEMIRA OYJ

- TABLE 186 KEMIRA OYJ: COMPANY OVERVIEW

- FIGURE 37 KEMIRA OYJ: COMPANY SNAPSHOT

- TABLE 187 KEMIRA OYJ: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 188 KEMIRA OYJ: DEALS

- TABLE 189 KEMIRA OYJ: OTHER DEVELOPMENTS

- 10.2 SNF GROUP

- TABLE 190 SNF GROUP: COMPANY OVERVIEW

- FIGURE 38 SNF GROUP: COMPANY SNAPSHOT

- TABLE 191 SNF GROUP: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 192 SNF GROUP: DEALS

- TABLE 193 SNF GROUP: OTHER DEVELOPMENTS

- 10.3 BASF SE

- TABLE 194 BASF SE: COMPANY OVERVIEW

- FIGURE 39 BASF SE: COMPANY SNAPSHOT

- TABLE 195 BASF SE: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 196 BASF SE: OTHER DEVELOPMENTS

- 10.4 ECOLAB

- TABLE 197 ECOLAB: COMPANY OVERVIEW

- FIGURE 40 ECOLAB: COMPANY SNAPSHOT

- TABLE 198 ECOLAB: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 199 ECOLAB: DEALS

- TABLE 200 ECOLAB: OTHER DEVELOPMENTS

- 10.5 VEOLIA

- TABLE 201 VEOLIA: COMPANY OVERVIEW

- FIGURE 41 VEOLIA: COMPANY SNAPSHOT

- TABLE 202 VEOLIA: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 203 VEOLIA: DEALS

- TABLE 204 VEOLIA: OTHER DEVELOPMENTS

- 10.6 KURITA WATER INDUSTRIES LTD.

- TABLE 205 KURITA WATER INDUSTRIES LTD.: COMPANY OVERVIEW

- FIGURE 42 KURITA WATER INDUSTRIES LTD.: COMPANY SNAPSHOT

- TABLE 206 KURITA WATER INDUSTRIES LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 207 KURITA WATER INDUSTRIES LTD.: DEALS

- TABLE 208 KURITA WATER INDUSTRIES LTD.: OTHER DEVELOPMENTS

- 10.7 BAKER HUGHES COMPANY

- FIGURE 43 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

- TABLE 209 BAKER HUGHES COMPANY: COMPANY OVERVIEW

- TABLE 210 BAKER HUGHES COMPANY: PRODUCT/SOLUTION/SERVICE OFFERINGS

- 10.8 SOLENIS

- TABLE 211 SOLENIS: COMPANY OVERVIEW

- TABLE 212 SOLENIS: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 213 SOLENIS: DEALS

- 10.9 USALCO

- TABLE 214 USALCO: COMPANY OVERVIEW

- TABLE 215 USALCO: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 216 USALCO: DEALS

- 10.10 BUCKMAN

- TABLE 217 BUCKMAN: COMPANY OVERVIEW

- TABLE 218 BUCKMAN: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 219 BUCKMAN: OTHER DEVELOPMENTS

- 10.11 OTHER PLAYERS

- 10.11.1 ARIES CHEMICAL, INC.

- TABLE 220 ARIES CHEMICAL, INC.: COMPANY OVERVIEW

- 10.11.2 CINETICA QUIMICA

- TABLE 221 CINETICA QUIMICA: COMPANY OVERVIEW

- 10.11.3 GEO SPECIALTY CHEMICALS INC.

- TABLE 222 GEO SPECIALTY CHEMICALS INC: COMPANY OVERVIEW

- 10.11.4 HYDRITE CHEMICAL

- TABLE 223 HYDRITE CHEMICAL: COMPANY OVERVIEW

- 10.11.5 ZINKAN ENTERPRISES, INC.

- TABLE 224 ZINKAN ENTERPRISES, INC.: COMPANY OVERVIEW

- 10.11.6 AMCON EUROPE S.R.O.

- TABLE 225 AMCON EUROPE S.R.O.: COMPANY OVERVIEW

- 10.11.7 BLACK ROSE INDUSTRIES LTD.

- TABLE 226 BLACK ROSE INDUSTRIES LTD.: COMPANY OVERVIEW

- 10.11.8 CHEMBOND WATER TECHNOLOGIES LIMITED

- TABLE 227 CHEMBOND WATER TECHNOLOGIES LIMITED: COMPANY OVERVIEW

- 10.11.9 AOS TREATMENT SOLUTIONS, LLC

- TABLE 228 AOS TREATMENT SOLUTIONS, LLC: COMPANY OVERVIEW

- 10.11.10 CHEMTREAT, INC.

- TABLE 229 CHEMTREAT, INC.: COMPANY OVERVIEW

- 10.11.11 WUXI LANSEN CHEMICALS CO., LTD.

- TABLE 230 WUXI LANSEN CHEMICALS CO., LTD.: COMPANY OVERVIEW

- 10.11.12 AQUACHEM INDUSTRIES LLC

- TABLE 231 AQUACHEM INDUSTRIES LLC: COMPANY OVERVIEW

- 10.11.13 AULICK CHEMICAL SOLUTIONS INC.

- TABLE 232 AULICK CHEMICAL SOLUTIONS INC.: COMPANY OVERVIEW

- 10.11.14 CROMOGENIA UNITS S.A.

- TABLE 233 CROMOGENIA UNITS S.A.: COMPANY OVERVIEW

- 10.11.15 DELTA CHEMICAL CORP

- TABLE 234 DELTA CHEMICAL CORP: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS