|

|

市場調査レポート

商品コード

1257394

ユーティリティマーカーの世界市場:種類別 (ボールマーカー、ディスクマーカー、テープマーカー、スパイクマーカー)・構成別 (パッシブ、プログラマブル)・ユーティリティの種類別 (ガス、電力、通信、上下水道)・地域別の将来予測 (2028年まで)Utility Markers Market by Type (Ball Markers, Disk Markers, Tape Markers, Spike Markers), Configuration (Passive, Programmable), Utility Type (Gas, Power, Telecommunications, Water & Wastewater) and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ユーティリティマーカーの世界市場:種類別 (ボールマーカー、ディスクマーカー、テープマーカー、スパイクマーカー)・構成別 (パッシブ、プログラマブル)・ユーティリティの種類別 (ガス、電力、通信、上下水道)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年04月03日

発行: MarketsandMarkets

ページ情報: 英文 185 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のユーティリティマーカーの市場規模は、2023年の3億4,100万米ドルから2028年には4億7,100万米ドルへと、6.7%のCAGRで成長すると予測されています。

新しいインフラを開発したり、古いインフラを更新したりする際には、既存の資産を損傷しないようにすることが不可欠です。そのため、地下埋設物の特定は重要な役割を担っています。地下埋設物の正しい位置を把握することで、請負業者はすべてのユーティリティをマッピングして計画を作成し、既存のユーティリティに干渉しない方法で新しいインフラを建設し、事故や損傷のリスクを低減することができます。

"構成別では、パッシブセグメントが予測期間中に最大のシェアを占める"

パッシブマーカーは、アナログマーカーや非IDマーカーとも呼ばれます。このマーカーは、地下埋設物や線路構造物に恒久的にマーキングするために設計されています。パッシブマーカーは、地下構造物の重要なポイントやそうでないポイントに、費用対効果が高く、信頼性の高いマーキングソリューションを提供します。そのため、ガス・電力・通信・水道などの用途で有効なマーキングソリューションとなっています。これらのマーカーは、ガスパイプラインや光ケーブル、通信ケーブル、下水管、電力ケーブル、水道管などの地下埋設物検知に広く使用されています。

"ユーティリティの種類別では、上下水道のセグメントが予測期間中に安定したCAGRで成長する"

地下配水システムは、住宅や産業施設に水を送るための埋設配管で、水道・下水、再生水の輸送に使用されています。ボールマーカーやテープマーカーなどのユーティリティマーカーは、バルブ、プラスチックパイプ、埋設サービスドロップ、ティー、電線管スタブ、メイン/サービスカップリング、クリーンアウトなどのマーキングや位置確認に、上下水道用途で広く使用されています。世界各国では、水の供給を円滑に行うため、上下水道管路網の整備と拡張に絶えず取り組んでいます。このため、上下水道用途でのユーティリティマーカーの採用が進むと予想されます。

"欧州市場は、予測期間中に目覚ましいCAGRで成長する"

ドイツは、欧州でも有数の経済大国であり、欧州におけるユーティリティマーカの最大市場の一つです。高品質なサービスと安全のために公共インフラの整備と維持に力を入れていることが、国内のユーティリティマーカーの需要を牽引しています。ドイツ政府は、発電量全体に占める再生可能エネルギー源の割合を増やすことに注力しており、そのため、再生可能エネルギーインフラを建設するための投資が行われています。ドイツは電力/電気インフラの整備に力を入れており、同国におけるユーティリティマーカーの成長を促進すると期待されています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 主な会議とイベント (2023年~2024年)

- 規制機関、政府機関、その他の組織

第6章 ユーティリティマーカー市場:種類別

- イントロダクション

- ボールマーカー

- ディスクマーカー

- テープマーカー

- その他

第7章 ユーティリティマーカー市場:構成別

- イントロダクション

- パッシブ

- プログラマブル

第8章 ユーティリティマーカー市場:ユーティリティの種類別

- イントロダクション

- ガス

- 電力

- 通信

- 上下水道

第9章 ユーティリティマーカー市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- 他のアジア太平洋諸国

- 他の地域 (RoW)

- 中東

- アフリカ

- 南米

第10章 競合情勢

- イントロダクション

- 主要企業の戦略/有力企業

- 上位5社の収益分析

- 市場シェア分析 (2022年)

- 企業評価クアドラント:主要企業 (2022年)

- 企業評価クアドラント:中小企業 (2022年)

- ユーティリティマーカー市場:企業のフットプリント

- 競合ベンチマーキング

- 競合状況・動向

- ユーティリティマーカー市場:製品の発売

- ユーティリティマーカー市場:取引

第11章 企業プロファイル

- 主要企業

- 3M COMPANY

- TEMPO COMMUNICATIONS, INC.

- KOMPLEX

- HEXATRONIC GROUP AB

- RADIODETECTION LTD.

- BERNTSEN INTERNATIONAL, INC.

- DURA-LINE CORPORATION

- NATIONAL MARKER COMPANY

- RYCOM INSTRUMENTS, INC.

- SETON

- SHENZHEN EEDENG TECHNOLOGY CO., LTD.

- TRIDENT SOLUTIONS

- その他の企業

- CAMPBELL INTERNATIONAL

- DAMAGE PREVENTION SOLUTIONS, LLC

- KELMAPLAST G. KELLERMANN GMBH

- MARKING SERVICES, INC.

- NORTHTOWN COMPANY

- OMEGA MARKING COMPANY

- PROSOLVE

- SAVITRI TELECOM SERVICES

- SVWCI

- SPARCO MULTIPLAST PVT. LTD.

- TRUMBULL MANUFACTURING

- VHL ENGINEERING

第12章 隣接・関連市場

- イントロダクション

- 地中レーダー市場:種類別

第13章 付録

The global utility markers market size is estimated to grow from USD 341 million in 2023 to USD 471 million by 2028, at a CAGR of 6.7%. It is imperative that while developing new infrastructure or upgrading the old infrastructure, the existing assets should not be damaged. Hence, underground utility identification plays a crucial role. The correct location of underground utilities allows contractors to map all the utilities and create a plan, which ensures that new infrastructure is constructed in a way that prevents interfering with existing utilities and reduces the risk of accidents or damage.

" Passive segment to hold the largest share of utility markers market during the forecast period"

Passive markers are also referred to as analog or non-ID markers. These markers are designed to permanently mark underground buried or line structures. Passive markers offer cost-effective and reliable marking solutions for significant and less significant points of underground line structures. Hence, they are a viable marking solution for applications such as gas, power, telecom, and water utilities. These markers are widely used in underground utility detection, such as gas pipelines, optical and telecommunication cables, sewage pipelines, power cables, and water pipelines.

"Water & wastewater utility type is expected to grow at a steady CAGR during the forecast period"

An underground water pipeline distribution system has buried pipes that transport water to residential and industrial structures. These pipelines are used to transport drinking water lines, sewage lines, and reclaimed water lines. Utility markers such as ball and tape markers are increasingly used in water & wastewater applications to mark and locate valves, plastic pipes, buried service drops, tees, conduit stubs, main/service coupling, and clean-outs. Countries worldwide are constantly working on the upgradation and expansion of their water & wastewater pipeline networks for the smooth functioning of water supply. This is expected to drive the adoption of utility markers in water & wastewater applications.

"The market in Europe is expected to grow at an impressive CAGR during the forecast period"

Germany is among the leading economies in Europe and one of the largest markets for utility markers in Europe. The focus on the development and maintenance of public infrastructure for high-quality services and safety drives the domestic demand for utility markers. The government of Germany is focusing on increasing its share of renewable energy sources in its overall electricity generation; hence, investments are being made to construct renewable energy infrastructure. The strong focus of Germany on developing its power/electricity infrastructure is expected to fuel the growth of utility markers in the country.

Breakdown of the profiles of primary participants:

- By Company Type: Tier 1 - 35%, Tier 2 - 30%, and Tier 3 - 35%

- By Designation: C-level Executives - 45%, Directors - 35%, and Others - 20%

- By Region: North America - 35%, Europe - 25%, Asia Pacific - 30%, and RoW - 10%

Major players profiled in this report are as follows: 3M Company (US), Tempo Communications, Inc. (US), Komplex (Slovakia), Hexatronic Group AB (Sweden), Radiodetection Ltd. (UK), Rycom Instruments, Inc. (US), Seton (US), Berntsen International, Inc. (US), and Trident Solutions (US) and others.

Research Coverage

In this report, the utility markers market has been segmented based on type, configuration, utility type, and region. The utility markers market based on type has been segmented into ball markers, disk markers, tape markers and others. Based on configuration, the market has been segmented into passive and programmable. Based on utility type, the market has been segmented into gas, power, telecommunications, and water & wastewater. The study also forecasts the size of the market in four main regions-North America, Europe, Asia Pacific, and RoW.

Key Benefits of Buying the Report:

The report provides insights on the following pointers:

Analysis of key drivers ( Advantages of electronic/ RF markers over traditional marking technologies, Growing importance of utility location techniques to ensure safety of underground assets, Government regulations and mandates for utility location and mapping), restraints (Lack of awareness and standardization in emerging economies), opportunities (Growing significance of real-time data for enhanced utility management, Rapid growth in telecommunications industry) and challenges (Technical issues and availability of other competing solutions) influencing the growth of the utility markers market

Product Development/Innovation: Detailed insights on upcoming products, technologies, research & development activities, funding activities, industry partnerships, and new product launches in the utility markers market

Market Development: Comprehensive information about lucrative markets - the report analyses the utility markers market across regions such as North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Market Diversification: Exhaustive information about new products & technologies, untapped geographies, and recent developments in the utility markers market

Competitive Assessment: In-depth assessment of market ranking/market share, growth strategies, and product offerings of leading players like 3M Company (US), Tempo Communications, Inc. (US), and Komplex (Slovakia), among others in the utility markers market

Strategies: The report also helps stakeholders understand the pulse of the utility markers market and provides them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 UTILITY MARKERS MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- FIGURE 2 UTILITY MARKERS MARKET: REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY AND PRICING

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 UTILITY MARKERS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- FIGURE 4 UTILITY MARKERS MARKET: RESEARCH APPROACH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approaches used to determine market size by bottom-up analysis

- FIGURE 5 UTILITY MARKERS MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approaches used to determine market size by top-down analysis

- FIGURE 6 UTILITY MARKERS MARKER: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY THROUGH SUPPLY-SIDE ANALYSIS

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- TABLE 1 UTILITY MARKERS MARKET: RESEARCH ASSUMPTIONS

- 2.5 APPROACHES TO UNDERSTAND RECESSION IMPACT ON UTILITY MARKERS MARKET

- 2.6 RISK ASSESSMENT

- TABLE 2 UTILITY MARKERS MARKET: RISK ASSESSMENT

- 2.7 UTILITY MARKERS MARKET: IMPACT OF RECESSION

- FIGURE 9 GDP GROWTH PROJECTION FOR MAJOR ECONOMIES, 2023

3 EXECUTIVE SUMMARY

- FIGURE 10 UTILITY MARKERS MARKET, 2019-2028 (USD MILLION)

- FIGURE 11 BALL MARKERS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 12 TELECOMMUNICATIONS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN UTILITY MARKERS MARKET

- FIGURE 14 UPGRADE OF AGING INFRASTRUCTURE AND GROWING TELECOMMUNICATIONS SECTOR TO DRIVE MARKET

- 4.2 UTILITY MARKERS MARKET, BY TYPE

- FIGURE 15 BALL MARKERS TO ACQUIRE LARGEST MARKET SHARE FROM 2023 TO 2028

- 4.3 UTILITY MARKERS MARKET, BY CONFIGURATION

- FIGURE 16 PROGRAMMABLE SEGMENT TO REGISTER HIGHER CAGR BY 2028

- 4.4 UTILITY MARKERS MARKET, BY UTILITY TYPE

- FIGURE 17 TELECOMMUNICATIONS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 NORTH AMERICAN UTILITY MARKERS MARKET, BY UTILITY TYPE AND COUNTRY, 2028

- FIGURE 18 TELECOMMUNICATIONS AND US SEGMENTS TO ACCOUNT FOR LARGEST SHARES

- 4.6 UTILITY MARKERS MARKET, BY COUNTRY

- FIGURE 19 CHINA TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN UTILITY MARKERS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Advantages of electronic/RF markers over traditional marking technologies

- 5.2.1.2 Growing importance of utility location techniques to ensure safety of underground assets

- 5.2.1.3 Government regulations and mandates for utility location and mapping

- 5.2.1.4 Infrastructural developments and upgrades

- FIGURE 21 UTILITY MARKERS MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of awareness and standardization in emerging economies

- FIGURE 22 UTILITY MARKERS MARKET: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing significance of real-time data for enhanced utility management

- 5.2.3.2 Rapid growth in telecommunications industry

- FIGURE 23 UTILITY MARKERS MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical issues and availability of other competing solutions

- FIGURE 24 UTILITY MARKERS MARKET: IMPACT ANALYSIS OF CHALLENGES

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 25 UTILITY MARKERS MARKET: VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 26 UTILITY MARKERS MARKET: ECOSYSTEM ANALYSIS

- TABLE 3 UTILITY MARKERS MARKET: ROLE IN ECOSYSTEM

- 5.5 PRICING ANALYSIS

- FIGURE 27 AVERAGE SELLING PRICE TREND OF UTILITY MARKERS, 2022-2028

- FIGURE 28 AVERAGE SELLING PRICE OF UTILITY MARKERS OFFERED BY KEY PLAYERS

- TABLE 4 AVERAGE SELLING PRICE OF UTILITY MARKERS OFFERED BY KEY PLAYERS (USD)

- TABLE 5 AVERAGE SELLING PRICE OF UTILITY MARKERS, BY REGION (USD)

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN UTILITY MARKERS MARKET

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 ARTIFICIAL INTELLIGENCE

- 5.7.2 INTERNET OF THINGS

- 5.7.3 ELECTRONIC MARKING/MARKER SYSTEM

- 5.7.4 AUGMENTED REALITY

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 IMPACT OF PORTER'S FIVE FORCES ON UTILITY MARKERS MARKET

- FIGURE 30 UTILITY MARKERS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 UTILITY TYPES

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 UTILITY TYPES (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 UTILITY TYPES

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 UTILITY TYPES

- 5.10 CASE STUDY ANALYSIS

- TABLE 9 WATERONE IMPLEMENTED EMS MARKERS FOR LOCATING AND MARKING UTILITIES

- TABLE 10 SACRAMENTO AREA SEWER DISTRICT (SASD) ADOPTED ELECTRONIC MARKING SYSTEMS FOR NEWLY BURIED SEWER FORCE MAINS

- TABLE 11 BP GAS USED BALL MARKERS TO MARK GAS PIPELINES

- TABLE 12 SOUTHWEST GAS CORPORATION ADOPTED BALL MARKERS TO PINPOINT PIPELINE LOCATIONS

- TABLE 13 FEDERAL AVIATION ADMINISTRATION (FAA) MARKED UNDERGROUND FACILITIES AT NEW AIRPORT CONSTRUCTION USING BALL MARKERS

- TABLE 14 US GOVERNMENT LABORATORY INSTALLED BALL MARKERS TO LOCATE UNDERGROUND FACILITIES INSIDE CAMPUS

- 5.11 TRADE ANALYSIS

- FIGURE 33 IMPORT SCENARIO FOR RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS, BY KEY COUNTRY, 2017-2021 (USD MILLION)

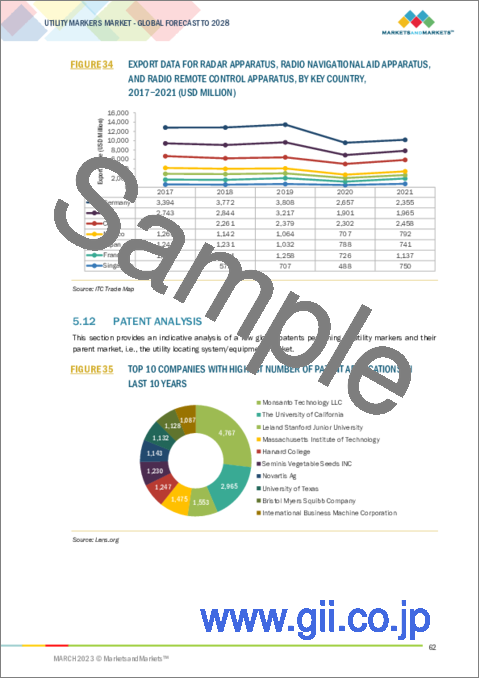

- FIGURE 34 EXPORT DATA FOR RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS, BY KEY COUNTRY, 2017-2021 (USD MILLION)

- 5.12 PATENT ANALYSIS

- FIGURE 35 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 15 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- FIGURE 36 NUMBER OF PATENTS GRANTED FROM 2012 TO 2022

- TABLE 16 LIST OF PATENTS IN UTILITY MARKERS MARKET, 2020-2021

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 17 UTILITY MARKERS MARKET: KEY CONFERENCES AND EVENTS, 2023-2024

- 5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.1 STANDARDS

- TABLE 22 STANDARDS FOR UTILITY MARKERS MARKET

6 UTILITY MARKERS MARKET, BY TYPE

- 6.1 INTRODUCTION

- TABLE 23 COLOR CODING FOR MARKERS, BY APWA

- FIGURE 37 UTILITY MARKERS MARKET, BY TYPE

- FIGURE 38 COMPARISON BETWEEN KEY UTILITY MARKERS

- FIGURE 39 BALL MARKERS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 24 UTILITY MARKERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 25 UTILITY MARKERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 6.2 BALL MARKERS

- 6.2.1 SELF-LEVELING DESIGNS AND PROGRAMMABLE FEATURES TO DRIVE MARKET

- TABLE 26 BALL MARKERS: UTILITY MARKERS MARKET, BY UTILITY TYPE, 2019-2022 (USD MILLION)

- TABLE 27 BALL MARKERS: UTILITY MARKERS MARKET, BY UTILITY TYPE, 2023-2028 (USD MILLION)

- TABLE 28 BALL MARKERS: UTILITY MARKERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 29 BALL MARKERS: UTILITY MARKERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 DISK MARKERS

- 6.3.1 INCREASED USAGE FOR LOCATING FLUSH-MOUNTED FACILITIES TO BOOST MARKET

- TABLE 30 DISK MARKERS: UTILITY MARKERS MARKET, BY UTILITY TYPE, 2019-2022 (USD MILLION)

- TABLE 31 DISK MARKERS: UTILITY MARKERS MARKET, BY UTILITY TYPE, 2023-2028 (USD MILLION)

- TABLE 32 DISK MARKERS: UTILITY MARKERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 33 DISK MARKERS: UTILITY MARKERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 TAPE MARKERS

- 6.4.1 COST-EFFECTIVENESS OF TAPE MARKERS TO PROPEL MARKET

- TABLE 34 TAPE MARKERS: UTILITY MARKERS MARKET, BY UTILITY TYPE, 2019-2022 (USD MILLION)

- TABLE 35 TAPE MARKERS: UTILITY MARKERS MARKET, BY UTILITY TYPE, 2023-2028 (USD MILLION)

- TABLE 36 TAPE MARKERS: UTILITY MARKERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 37 TAPE MARKERS: UTILITY MARKERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.5 OTHERS

- TABLE 38 OTHERS: UTILITY MARKERS MARKET, BY UTILITY TYPE, 2019-2022 (USD MILLION)

- TABLE 39 OTHERS: UTILITY MARKERS MARKET, BY UTILITY TYPE, 2023-2028 (USD MILLION)

- TABLE 40 OTHERS: UTILITY MARKERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 41 OTHERS: UTILITY MARKERS MARKET, BY REGION, 2023-2028 (USD MILLION)

7 UTILITY MARKERS MARKET, BY CONFIGURATION

- 7.1 INTRODUCTION

- FIGURE 40 UTILITY MARKERS MARKET, BY CONFIGURATION

- FIGURE 41 PASSIVE MARKERS TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- TABLE 42 UTILITY MARKERS MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 43 UTILITY MARKERS MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- 7.2 PASSIVE

- 7.2.1 USE IN DIVERSE APPLICATIONS TO CONTRIBUTE TO MARKET GROWTH

- TABLE 44 PASSIVE: UTILITY MARKERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 45 PASSIVE: UTILITY MARKERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 PROGRAMMABLE

- 7.3.1 DEPLOYMENT IN LESS-DEPTH OR NARROW TRENCHES TO FAVOR MARKET GROWTH

- TABLE 46 PROGRAMMABLE: UTILITY MARKERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 47 PROGRAMMABLE: UTILITY MARKERS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 UTILITY MARKERS MARKET, BY UTILITY TYPE

- 8.1 INTRODUCTION

- FIGURE 42 UTILITY MARKERS MARKET, BY UTILITY TYPE

- FIGURE 43 APPLICATIONS OF UTILITY MARKERS, BY UTILITY TYPE

- FIGURE 44 TELECOMMUNICATIONS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 48 UTILITY MARKERS MARKET, BY UTILITY TYPE, 2019-2022 (USD MILLION)

- TABLE 49 UTILITY MARKERS MARKET, BY UTILITY TYPE, 2023-2028 (USD MILLION)

- 8.2 GAS

- 8.2.1 USE OF UTILITY MARKERS IN SAFELY LOCATING BURIED GAS LINES TO HELP MARKET GROWTH

- TABLE 50 GAS: UTILITY MARKERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 51 GAS: UTILITY MARKERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 52 GAS: UTILITY MARKERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 53 GAS: UTILITY MARKERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 POWER

- 8.3.1 INCREASED INVESTMENTS IN POWER INDUSTRY TO DRIVE MARKET

- TABLE 54 POWER: UTILITY MARKERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 55 POWER: UTILITY MARKERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 56 POWER: UTILITY MARKERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 57 POWER: UTILITY MARKERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 TELECOMMUNICATIONS

- 8.4.1 RISING DEMAND FOR TELECOM SERVICES AND INTERNET CONNECTIVITY TO TRIGGER MARKET GROWTH

- TABLE 58 TELECOMMUNICATIONS: UTILITY MARKERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 59 TELECOMMUNICATIONS: UTILITY MARKERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 60 TELECOMMUNICATIONS: UTILITY MARKERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 61 TELECOMMUNICATIONS: UTILITY MARKERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 WATER & WASTEWATER

- 8.5.1 CONTINUOUS UPGRADE AND EXPANSION OF WATER PIPELINE NETWORKS TO DRIVE MARKET

- TABLE 62 WATER & WASTEWATER: UTILITY MARKERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 63 WATER & WASTEWATER: UTILITY MARKERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 64 WATER & WASTEWATER: UTILITY MARKERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 65 WATER & WASTEWATER: UTILITY MARKERS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 UTILITY MARKERS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 45 UTILITY MARKERS MARKET, BY REGION

- FIGURE 46 CHINA TO BE FASTEST-GROWING COUNTRY IN UTILITY MARKERS MARKET BY 2028

- TABLE 66 UTILITY MARKERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 67 UTILITY MARKERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 47 US TO ACCOUNT FOR LARGEST MARKET SHARE IN NORTH AMERICA DURING FORECAST PERIOD

- FIGURE 48 NORTH AMERICA: UTILITY MARKERS MARKET SNAPSHOT

- TABLE 68 NORTH AMERICA: UTILITY MARKERS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: UTILITY MARKERS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: UTILITY MARKERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: UTILITY MARKERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: UTILITY MARKERS MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: UTILITY MARKERS MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: UTILITY MARKERS MARKET, BY UTILITY TYPE, 2019-2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: UTILITY MARKERS MARKET, BY UTILITY TYPE, 2023-2028 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Government initiatives for strengthening domestic infrastructure to drive market

- 9.2.2 CANADA

- 9.2.2.1 Rigorous investments in infrastructure upgrades to boost market

- 9.2.3 MEXICO

- 9.2.3.1 Focus on expansion of fiber optic cable networks to be favorable for market

- 9.3 EUROPE

- FIGURE 49 GERMANY TO REGISTER HIGHEST CAGR IN EUROPE DURING FORECAST PERIOD

- FIGURE 50 EUROPE: UTILITY MARKERS MARKET SNAPSHOT

- TABLE 76 EUROPE: UTILITY MARKERS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 77 EUROPE: UTILITY MARKERS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 78 EUROPE: UTILITY MARKERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 79 EUROPE: UTILITY MARKERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 80 EUROPE: UTILITY MARKERS MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 81 EUROPE: UTILITY MARKERS MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- TABLE 82 EUROPE: UTILITY MARKERS MARKET, BY UTILITY TYPE, 2019-2022 (USD MILLION)

- TABLE 83 EUROPE: UTILITY MARKERS MARKET, BY UTILITY TYPE, 2023-2028 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Emphasis on expansion of domestic power infrastructure to drive market

- 9.3.2 UK

- 9.3.2.1 Continuous investments in public utility networks to influence market

- 9.3.3 FRANCE

- 9.3.3.1 Growth in domestic telecommunications sector to generate positive impact on market

- 9.3.4 REST OF EUROPE

- 9.4 ASIA PACIFIC

- FIGURE 51 CHINA TO REGISTER FASTEST GROWTH IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 52 ASIA PACIFIC: UTILITY MARKERS MARKET SNAPSHOT

- TABLE 84 ASIA PACIFIC: UTILITY MARKERS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 85 ASIA PACIFIC: UTILITY MARKERS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: UTILITY MARKERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 87 ASIA PACIFIC: UTILITY MARKERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: UTILITY MARKERS MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 89 ASIA PACIFIC: UTILITY MARKERS MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: UTILITY MARKERS MARKET, BY UTILITY TYPE, 2019-2022 (USD MILLION)

- TABLE 91 ASIA PACIFIC: UTILITY MARKERS MARKET, BY UTILITY TYPE, 2023-2028 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 Investments in power and water supply projects to drive market

- 9.4.2 JAPAN

- 9.4.2.1 Need to upgrade infrastructure to be major market driver

- 9.4.3 SOUTH KOREA

- 9.4.3.1 Expansion of domestic 5G telecom network to drive market

- 9.4.4 INDIA

- 9.4.4.1 Focus on expanding telecommunications infrastructure to add to market growth

- 9.4.5 REST OF ASIA PACIFIC

- 9.5 ROW

- FIGURE 53 MIDDLE EAST TO LEAD MARKET IN ROW DURING FORECAST PERIOD

- TABLE 92 ROW: UTILITY MARKERS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 93 ROW: UTILITY MARKERS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 94 ROW: UTILITY MARKERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 95 ROW: UTILITY MARKERS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 96 ROW: UTILITY MARKERS MARKET, BY CONFIGURATION, 2019-2022 (USD MILLION)

- TABLE 97 ROW: UTILITY MARKERS MARKET, BY CONFIGURATION, 2023-2028 (USD MILLION)

- TABLE 98 ROW: UTILITY MARKERS MARKET, BY UTILITY TYPE, 2019-2022 (USD MILLION)

- TABLE 99 ROW: UTILITY MARKERS MARKET, BY UTILITY TYPE, 2023-2028 (USD MILLION)

- 9.5.1 MIDDLE EAST

- 9.5.1.1 Large-scale investments in construction projects to drive market

- 9.5.2 AFRICA

- 9.5.2.1 Favorable agreements for economic and industrial growth to drive market

- 9.5.3 SOUTH AMERICA

- 9.5.3.1 Improvements in solar energy infrastructure to aid market growth

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- TABLE 100 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE ANALYSIS OF TOP 5 PLAYERS

- FIGURE 54 UTILITY MARKERS MARKET: REVENUE ANALYSIS OF TOP 5 PLAYERS, 2017-2021

- 10.4 MARKET SHARE ANALYSIS, 2022

- TABLE 101 UTILITY MARKERS MARKET SHARE ANALYSIS, 2022

- FIGURE 55 SHARE OF KEY PLAYERS IN UTILITY MARKERS MARKET, 2022

- 10.5 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 56 UTILITY MARKERS MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- 10.6 COMPANY EVALUATION QUADRANT FOR SMES, 2022

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 57 UTILITY MARKERS MARKET: COMPANY EVALUATION QUADRANT FOR SMES, 2022

- 10.7 UTILITY MARKERS MARKET: COMPANY FOOTPRINT

- TABLE 102 COMPANY FOOTPRINT

- TABLE 103 TYPE: COMPANY FOOTPRINT

- TABLE 104 UTILITY TYPE: COMPANY FOOTPRINT

- TABLE 105 REGION: COMPANY FOOTPRINT

- 10.8 COMPETITIVE BENCHMARKING

- TABLE 106 UTILITY MARKERS MARKET: LIST OF STARTUPS/SMES

- TABLE 107 UTILITY MARKERS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 10.9 COMPETITIVE SITUATIONS AND TRENDS

- 10.9.1 UTILITY MARKERS MARKET: PRODUCT LAUNCHES

- 10.9.2 UTILITY MARKERS MARKET: DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products offered, Recent Developments, MnM View)**

- 11.1.1 3M COMPANY

- TABLE 108 3M COMPANY: COMPANY OVERVIEW

- FIGURE 58 3M COMPANY: COMPANY SNAPSHOT

- TABLE 109 3M COMPANY: PRODUCTS OFFERED

- 11.1.2 TEMPO COMMUNICATIONS, INC.

- TABLE 110 TEMPO COMMUNICATIONS, INC.: COMPANY OVERVIEW

- TABLE 111 TEMPO COMMUNICATIONS, INC.: PRODUCTS OFFERED

- TABLE 112 TEMPO COMMUNICATIONS, INC.: PRODUCT LAUNCHES

- TABLE 113 TEMPO COMMUNICATIONS, INC.: DEALS

- 11.1.3 KOMPLEX

- TABLE 114 KOMPLEX: COMPANY OVERVIEW

- TABLE 115 KOMPLEX: PRODUCTS OFFERED

- 11.1.4 HEXATRONIC GROUP AB

- TABLE 116 HEXATRONIC GROUP AB: COMPANY OVERVIEW

- FIGURE 59 HEXATRONIC GROUP AB: COMPANY SNAPSHOT

- TABLE 117 HEXATRONIC GROUP AB: PRODUCTS OFFERED

- 11.1.5 RADIODETECTION LTD.

- TABLE 118 RADIODETECTION LTD.: COMPANY OVERVIEW

- TABLE 119 RADIODETECTION LTD.: PRODUCTS OFFERED

- TABLE 120 RADIODETECTION LTD.: PRODUCT LAUNCHES

- TABLE 121 RADIODETECTION LTD.: DEALS

- 11.1.6 BERNTSEN INTERNATIONAL, INC.

- TABLE 122 BERNTSEN INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 123 BERNTSEN INTERNATIONAL, INC.: PRODUCTS OFFERED

- 11.1.7 DURA-LINE CORPORATION

- TABLE 124 DURA-LINE CORPORATION: COMPANY OVERVIEW

- TABLE 125 DURA-LINE CORPORATION: PRODUCTS OFFERED

- 11.1.8 NATIONAL MARKER COMPANY

- TABLE 126 NATIONAL MARKER COMPANY: COMPANY OVERVIEW

- TABLE 127 NATIONAL MARKER COMPANY: PRODUCTS OFFERED

- 11.1.9 RYCOM INSTRUMENTS, INC.

- TABLE 128 RYCOM INSTRUMENTS, INC.: COMPANY OVERVIEW

- TABLE 129 RYCOM INSTRUMENTS, INC.: PRODUCTS OFFERED

- 11.1.10 SETON

- TABLE 130 SETON: COMPANY OVERVIEW

- TABLE 131 SETON: PRODUCTS OFFERED

- 11.1.11 SHENZHEN EEDENG TECHNOLOGY CO., LTD.

- TABLE 132 SHENZHEN EEDENG TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 133 SHENZHEN EEDENG TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- 11.1.12 TRIDENT SOLUTIONS

- TABLE 134 TRIDENT SOLUTIONS: COMPANY OVERVIEW

- ABLE 135 TRIDENT SOLUTIONS: PRODUCTS OFFERED

- TABLE 136 TRIDENT SOLUTIONS: DEALS

- *Details on Business Overview, Products offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 CAMPBELL INTERNATIONAL

- 11.2.2 DAMAGE PREVENTION SOLUTIONS, LLC

- 11.2.3 KELMAPLAST G. KELLERMANN GMBH

- 11.2.4 MARKING SERVICES, INC.

- 11.2.5 NORTHTOWN COMPANY

- 11.2.6 OMEGA MARKING COMPANY

- 11.2.7 PROSOLVE

- 11.2.8 SAVITRI TELECOM SERVICES

- 11.2.9 SVWCI

- 11.2.10 SPARCO MULTIPLAST PVT. LTD.

- 11.2.11 TRUMBULL MANUFACTURING

- 11.2.12 VHL ENGINEERING

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 GROUND PENETRATING RADAR MARKET: BY TYPE

- 12.2.1 INTRODUCTION

- TABLE 137 GROUND PENETRATING RADAR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 138 GROUND PENETRATING RADAR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 12.2.2 HANDHELD SYSTEMS

- 12.2.2.1 Concrete investigation to drive demand for handheld ground penetrating radar systems

- TABLE 139 HANDHELD SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 140 HANDHELD SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.2.3 CART-BASED SYSTEMS

- 12.2.3.1 Cart-based systems considered highest-quality ground inspection data providers

- TABLE 141 CART-BASED SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 142 CART-BASED SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 12.2.4 VEHICLE-MOUNTED SYSTEMS

- 12.2.4.1 Transportation infrastructure to drive demand for vehicle-mounted systems

- TABLE 143 VEHICLE-MOUNTED SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 144 VEHICLE-MOUNTED SYSTEMS: GROUND PENETRATING RADAR MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

13 APPENDIX

- 13.1 INSIGHTS OF INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS