|

|

市場調査レポート

商品コード

1250875

衛星打ち上げロケットの世界市場:ロケット別 (小型 (35万kg未満)、中型・大型 (35万kg以上))・ペイロード別 (500kg未満、500~2500kg、2500kg以上)・軌道別・打ち上げ方式別・サブシステム別・サービス別・地域別の将来予測 (2027年まで)Satellite Launch Vehicle Market by Vehicle (Small (<350,000 Kg), Medium to Heavy (>350,000 Kg)), Payload (<500 Kg, 500-2,500 Kg, >2,500 Kg), Orbit, Launch, Stage, Subsystem, Service and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 衛星打ち上げロケットの世界市場:ロケット別 (小型 (35万kg未満)、中型・大型 (35万kg以上))・ペイロード別 (500kg未満、500~2500kg、2500kg以上)・軌道別・打ち上げ方式別・サブシステム別・サービス別・地域別の将来予測 (2027年まで) |

|

出版日: 2023年03月24日

発行: MarketsandMarkets

ページ情報: 英文 212 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の衛星打ち上げロケットの市場規模は、2022年の157億米ドルから2027年には291億米ドルへと、予測期間中に13.1%のCAGRで成長すると予測されています。

市場の主な促進要因として、より効果的でコスト効率の高い打ち上げサービスに対する需要の増加などが挙げられます。他方、ロケットの信頼性と安全性、宇宙打ち上げによる二酸化炭素排出量の増加が、市場全体の成長を制限しています。

"3段式:ステージ別では2022年に最大のシェアを獲得"

ステージ別に見ると、2022年には3段式のセグメントが最大となっています。重いペイロード貨物を少ない二酸化炭素排出量で迅速に輸送できる重量衛星用ロケットの需要の増加が、衛星ロケット市場におけるこのセグメントの成長を牽引しています。

"500~2,500kg:ペイロード別で2022年に第2位"

500kg未満の衛星は、一般に中型衛星に分類されます。中型衛星は、燃料を含む質量が500kgから2,500kgのものです。中型衛星は、小型衛星に比べて運用コストや製造コストが高くなります。これらの衛星は、気候・環境モニタリング、地球観測・気象学、科学調査・探査、監視・セキュリティなどの用途に使用されます。これらの用途で中型衛星の利用が増加することで、衛星打上げロケット市場の牽引役となることが期待されます。

"アジア太平洋:予測期間中に地域別で最大のシェアを占める"

衛星打ち上げロケットの市場規模は、アジア太平洋が予測期間中に最大のシェアを占める見通しです。インドのロケット市場は、商業用と政府用の両方で衛星打ち上げの需要が増加しているため、急速に成長している新興産業です。インド宇宙研究機関 (ISRO) が市場の主要企業で、極地衛星打上げロケット (PSLV) と静止衛星打上げロケット (GSLV) が宇宙ミッションに用いられる主要なロケットです。

当レポートでは、世界の衛星打ち上げロケットの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、打ち上げ方式別・軌道別・ペイロード別・ステージ別・サブシステム別・ロケット別・サービス別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 衛星打ち上げ車両市場のエコシステム

- 顧客ビジネスに影響を与える混乱

- 衛星打ち上げロケット市場:不況の影響の分析

- 技術分析

- 価格分析

- ボリュームデータ

- ポーターのファイブフォース分析

- 貿易データ分析

- 関税・規制状況

- 主な会議とイベント (2023年)

- 主な利害関係者と購入基準

第6章 業界動向

- イントロダクション

- 技術動向

- 空中発射ロケット

- 電気推進

- 3Dプリント

- 自律システム

- 半極低温エンジン

- 軌道加速器

- ユースケース:衛星打ち上げロケット市場

- 特許分析

- メガトレンドの影響

第7章 衛星打ち上げロケット市場:打ち上げ方式別

- イントロダクション

- 単回利用型/使い捨て型

- 再利用型

第8章 衛星打ち上げロケット市場:軌道別

- イントロダクション

- 低軌道 (LEO)

- 中軌道 (MEO)

- 静止軌道 (GEO)

第9章 衛星打ち上げロケット市場:ペイロード別

- イントロダクション

- 500kg未満

- 500kg~2,500kg

- 2,500kg以上

第10章 衛星打ち上げロケット市場:ステージ別

- イントロダクション

- 単段式

- 2段式

- 3段式

第11章 衛星打ち上げロケット市場:サブシステム別

- イントロダクション

- 構造

- GNC (誘導、航行、制御システム)

- 推進システム

- 遠隔計測・追跡・指令システム

- 電力システム

- 分離システム

第12章 衛星打ち上げロケット市場:ロケット別

- イントロダクション

- 小型 (35万kg以下)

- 中型・大型 (35万kg以上)

第13章 衛星打ち上げロケット市場:サービス別

- エンジニアリング・設計サービス

- 試験・認証サービス

- 製造・組立サービス

- ロジスティクス・サプライチェーン管理サービス

第14章 衛星打ち上げロケット市場:地域別

- イントロダクション

- 不況の影響分析:地域別

- 北米

- 米国

- カナダ

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- ニュージーランド

- オーストラリア

- 欧州

- ロシア

- フランス

- ドイツ

- 英国

- イタリア

- 他の国々 (RoW)

- 中東・アフリカ

- ラテンアメリカ

第15章 競合情勢

- イントロダクション

- 競争力の概要

- 衛星打ち上げロケット市場:主要企業の主な動向 (2018年~2022年)

- 主要企業のランキング分析 (2021年)

- 主要企業の収益分析 (2021年)

- 市場シェア分析 (2021年)

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- 競合シナリオ

- 新製品の発売

- 契約・パートナーシップ・合意

第16章 企業プロファイル

- イントロダクション

- 主要企業

- SPACE EXPLORATION TECHNOLOGIES CORP.

- UNITED LAUNCH ALLIANCE, LLC

- NORTHROP GRUMMAN CORPORATION

- MITSUBISHI HEAVY INDUSTRIES

- BLUE ORIGIN

- ABL SPACE SYSTEMS

- INDIAN SPACE RESEARCH ORGANIZATION

- THE BOEING COMPANY

- FIREFLY AEROSPACE

- ROCKET LAB

- RELATIVITY SPACE

- ISRAEL AEROSPACE INDUSTRY LTD.

- ARIANESPACE SA

- ONE SPACE TECHNOLOGY INC.

- VIRGIN ORBIT

- その他の企業

- SKYROOT AEROSPACE

- AGNIKUL COSMOS PRIVATE LIMITED

- GALACTIC ENERGY AEROSPACE TECHNOLOGY CO. LTD.

- I-SPACE

- SKYRORA LIMITED

- GILMOUR SPACE TECHNOLOGIES

- C6 LAUNCH SYSTEMS

- ROCKET FACTORY AUGSBURG

- HYIMPULSE TECHNOLOGIES GMBH

- ISAR AEROSPACE

第17章 付録

The satellite launch vehicle market size is projected to grow from USD 15.7 billion in 2022 to USD 29.1 billion by 2027, at a CAGR of 13.1% during the forecast period. The market for satellite launch vehicle is driven by various factors, such as increasing demand for more effective, cost efficient launch services . However, Reliability and safety of launch vehicles, increasing Carbon footprint due to space launches are limiting the overall growth of the market.

" Three Stage: The largest share of the satellite launch vehicle market by stage in 2022." The three stage segment has the largest segment of the satellite launch vehicle market by stage in 2022. The increasing demand for heavy lift satellite launch vehicle to transport heavy payload cargo quickly with less carbon emissions is driving the growth of this segment in the satellite launch vehicle market.

" 500 - 2,500 Kg: The second largest segment of the satellite launch vehicle market by payload in 2022"

Satellite payloads that weigh less than 500 kg are generally classified as medium satellites. Medium satellites have a wet mass (including fuel) between 500 kg and 2,500 kg. The operational and manufacturing costs of medium satellites are higher than those of small satellites. These satellites are used for applications, such as climate & environment monitoring, Earth observation & meteorology, scientific research & exploration, and surveillance & security. The increased use of medium satellites in these applications is expected to drive the satellite launch vehicle market.

"Asia Pacific to account for the largest share in the satellite launch vehicle market in forecasted year"

Asia Pacific is estimated to account for the largest share in the satellite launch vehicle in the forecasted year. India The Indian launch vehicle market is an emerging industry that is rapidly growing due to the increasing demand for satellite launches for both commercial and government applications. The Indian Space Research Organisation (ISRO) is the primary player in the market, with its Polar Satellite Launch Vehicle (PSLV) and Geosynchronous Satellite Launch Vehicle (GSLV) being the main launch vehicles used for space missions.

Break-up of profiles of primary participants in the satellite launch vehicle market: By Company Type: Tier 1 - 55%, Tier 2 - 20%, and Tier 3 - 25% By Designation: C-Level Executives - 10%, Managers- 50%, and Academic Experts - 40% By Region: North America - 10%, Europe - 20%, Asia Pacific - 40%, Rest of the World - 30%

Prominent companies in the satellite launch vehicle market are SpaceX (US), United Launch Alliance, LLC (US), Northrop Grumman Corporation (US), and Blue Origin (US), Mitsubishi Heavy Industries (Japan), among others. Research Coverage: The market study covers the satellite launch vehicle market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as Vehicle, Payload, Orbit, Launch, Stage, Subsystem, Service and Region. The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies. Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall satellite launch vehicle market and its subsegments. The report covers the entire ecosystem of the satellite launch vehicle industry and will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing use of small satellite launch vehicles, The Rise of Space Tourism), restraints (Oversaturation of launch companies), opportunities (Advancements in satellite launch vehicles design, Increased outsourcing manufacturing in the launch vehicle industry), and challenges (Reliability and safety of launch vehicles, Carbon footprint due to space launches) influencing the growth of the satellite launch vehicle market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Satellite launch vehicle market

- Market Development: Comprehensive information about lucrative markets - the report analyses the Satellite launch vehicle market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Satellite launch vehicle market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like SpaceX (US), United Launch Alliance, LLC (US), Northrop Grumman Corporation (US), and Blue Origin (US), Mitsubishi Heavy Industries (Japan), among others in the Satellite launch vehicle market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 SATELLITE LAUNCH VEHICLE MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- TABLE 1 USD EXCHANGE RATES

- 1.5 LIMITATIONS

- 1.6 INCLUSIONS AND EXCLUSIONS

- TABLE 2 INCLUSIONS AND EXCLUSIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.4 RECESSION IMPACT ANALYSIS

- 2.3 RESEARCH APPROACH AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation & methodology

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.1.2 Regional split of satellite launch vehicle market

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

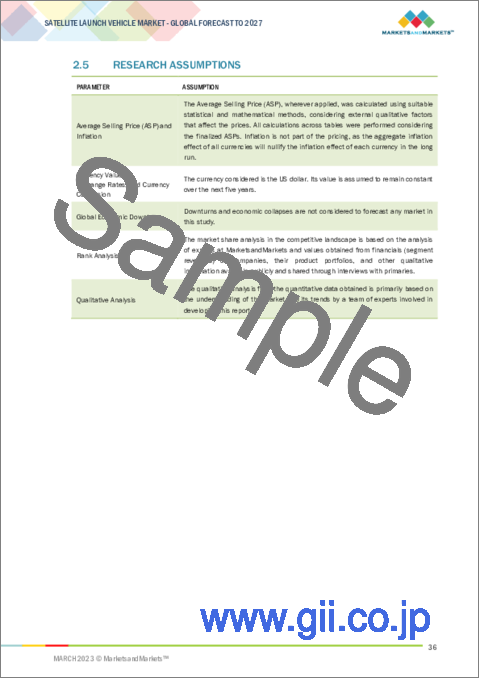

- 2.5 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 SINGLE-USE/EXPENDABLE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 MEDIUM AND HEAVY (>350,000 KG) SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 9 THREE STAGE TO BE LARGEST SEGMENT OF MARKET DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO LEAD SATELLITE LAUNCH VEHICLE MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN SATELLITE LAUNCH VEHICLE MARKET

- FIGURE 11 RISING DEPLOYMENT OF SMALL SATELLITES TO DRIVE MARKET

- 4.2 SATELLITE LAUNCH VEHICLE MARKET, BY SUBSYSTEM

- FIGURE 12 PROPULSION SYSTEMS SEGMENT TO LEAD MARKET FROM 2022 TO 2027

- 4.3 SATELLITE LAUNCH VEHICLE MARKET, BY ORBIT

- FIGURE 13 GEOSTATIONARY ORBIT SEGMENT TO DOMINATE MARKET FROM 2022 TO 2027

- 4.4 SATELLITE LAUNCH VEHICLE MARKET, BY PAYLOAD

- FIGURE 14 >2,500 KG SEGMENT TO DOMINATE MARKET FROM 2022 TO 2027

- 4.5 SATELLITE LAUNCH VEHICLE MARKET, BY COUNTRY

- FIGURE 15 UK TO BE FASTEST-GROWING MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 MARKET DYNAMICS OF SATELLITE LAUNCH VEHICLE MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in demand for small satellites across various applications

- 5.2.1.2 Increased space tourism

- FIGURE 17 GLOBAL REVENUE OF SPACE TRAVEL AND TOURISM, 2021 -2030

- 5.2.2 RESTRAINTS

- 5.2.2.1 Oversaturation in launch vehicle market

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in satellite launch vehicle designs

- 5.2.3.2 Increased outsourcing of manufacturing activities

- TABLE 3 OUTSOURCING COMPANIES FOR NASA

- 5.2.4 CHALLENGES

- 5.2.4.1 Reliability and safety of launch vehicles

- 5.2.4.2 Increased carbon footprint due to space launches

- TABLE 4 PROPELLANTS USED AND EMISSIONS FROM LAUNCH VEHICLES

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 18 VALUE CHAIN ANALYSIS: SATELLITE LAUNCH VEHICLE MARKET

- 5.3.1 UPSTREAM PLAYERS

- 5.3.2 LAUNCH VEHICLE MANUFACTURERS

- 5.3.3 LAUNCH SERVICE PROVIDERS

- 5.3.4 DOWNSTREAM PLAYERS

- 5.3.5 GOVERNMENT AGENCIES

- 5.3.6 SATELLITE OPERATORS

- 5.4 SATELLITE LAUNCH VEHICLE MARKET ECOSYSTEM

- FIGURE 19 SATELLITE LAUNCH VEHICLE MARKET ECOSYSTEM MAP

- TABLE 5 SATELLITE LAUNCH VEHICLE MARKET ECOSYSTEM

- 5.5 DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN SATELLITE LAUNCH VEHICLE MARKET

- FIGURE 20 REVENUE SHIFT IN SATELLITE LAUNCH VEHICLE MARKET

- 5.6 RECESSION IMPACT ANALYSIS OF SATELLITE LAUNCH VEHICLE MARKET

- FIGURE 21 RECESSION IMPACT ANALYSIS OF SATELLITE LAUNCH VEHICLE MARKET

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 SYNERGETIC AIR-BREATHING ROCKET ENGINE

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICES

- TABLE 6 AVERAGE SELLING PRICES OF LAUNCH VEHICLES (USD MILLION)

- 5.9 VOLUME DATA

- TABLE 7 SATELLITE LAUNCH VEHICLE MARKET: VOLUME DATA (UNITS)

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 SATELLITE LAUNCH VEHICLE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 SATELLITE LAUNCH VEHICLE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 TRADE DATA ANALYSIS

- TABLE 9 COUNTRY-WISE IMPORTS, 2020-2021 (USD THOUSAND)

- TABLE 10 COUNTRY-WISE EXPORTS, 2020-2021 (USD THOUSAND)

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 NORTH AMERICA

- 5.12.2 EUROPE

- 5.12.3 ASIA PACIFIC

- 5.12.4 MIDDLE EAST

- 5.13 KEY CONFERENCES AND EVENTS IN 2023

- TABLE 11 SATELLITE LAUNCH VEHICLE MARKET CONFERENCES AND EVENTS, 2023

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR END USERS

- TABLE 13 KEY BUYING CRITERIA FOR END USERS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 AIR-LAUNCHED ROCKETS

- 6.2.2 ELECTRIC PROPULSION

- 6.2.3 3D PRINTING

- 6.2.4 AUTONOMOUS SYSTEMS

- 6.2.5 SEMI CRYOGENIC ENGINES

- 6.2.6 ORBITAL ACCELERATOR

- 6.3 USE CASES: SATELLITE LAUNCH VEHICLE MARKET

- 6.3.1 AUTONOMOUS SPACEPORT DRONE SHIP

- TABLE 14 AUTONOMOUS SPACEPORT DRONE SHIP

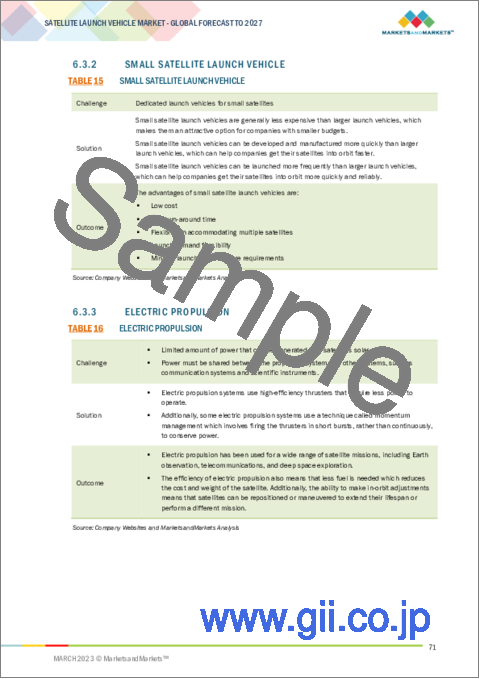

- 6.3.2 SMALL SATELLITE LAUNCH VEHICLE

- TABLE 15 SMALL SATELLITE LAUNCH VEHICLE

- 6.3.3 ELECTRIC PROPULSION

- TABLE 16 ELECTRIC PROPULSION

- 6.4 PATENT ANALYSIS

- TABLE 17 PATENTS RELATED TO SATELLITE LAUNCH VEHICLES, 2019-2022

- 6.5 IMPACT OF MEGATRENDS

- 6.5.1 REUSABLE ROCKETS SIGNIFICANTLY REDUCE LAUNCH COSTS

- 6.5.2 INCREASED NUMBER OF SMALL SATELLITE LAUNCHES TO LEAD TO CREATION OF SATELLITE CONSTELLATIONS

- 6.5.3 SPACE TOURISM SUPPORTS GROWTH OF SPACE LAUNCH SERVICES

7 SATELLITE LAUNCH VEHICLE MARKET, BY LAUNCH

- 7.1 INTRODUCTION

- FIGURE 25 REUSABLE SEGMENT TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 18 SATELLITE LAUNCH VEHICLE MARKET, BY LAUNCH, 2018-2021 (USD MILLION)

- TABLE 19 SATELLITE LAUNCH VEHICLE MARKET, BY LAUNCH, 2022-2027 (USD MILLION)

- 7.2 SINGLE-USE/EXPENDABLE

- 7.2.1 EXTENSIVE USE TO LAUNCH LIGHTER PAYLOADS TO DRIVE SEGMENT

- 7.3 REUSABLE

- 7.3.1 INCREASED PREFERENCE DUE TO LOWER LAUNCH COSTS TO PROPEL SEGMENT

8 SATELLITE LAUNCH VEHICLE MARKET, BY ORBIT

- 8.1 INTRODUCTION

- FIGURE 26 LOW EARTH ORBIT (LEO) SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- TABLE 20 SATELLITE LAUNCH VEHICLE MARKET, BY ORBIT, 2018-2021 (USD MILLION)

- TABLE 21 SATELLITE LAUNCH VEHICLE MARKET, BY ORBIT, 2022-2027 (USD MILLION)

- 8.2 LOW EARTH ORBIT (LEO)

- 8.2.1 EXTENSIVE DEPLOYMENT OF COMMUNICATION SATELLITES TO PROPEL SEGMENT

- 8.3 MEDIUM EARTH ORBIT (MEO)

- 8.3.1 RISE IN NUMBER OF SATELLITE NAVIGATION SYSTEMS TO DRIVE SEGMENT

- 8.4 GEOSTATIONARY EARTH ORBIT (GEO)

- 8.4.1 RISE IN NUMBER OF WEATHER MONITORING SATELLITES TO DRIVE SEGMENT

9 SATELLITE LAUNCH VEHICLE MARKET, BY PAYLOAD

- 9.1 INTRODUCTION

- FIGURE 27 <500 KG SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- TABLE 22 SATELLITE LAUNCH VEHICLE MARKET, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 23 SATELLITE LAUNCH VEHICLE MARKET, BY PAYLOAD, 2022-2027 (USD MILLION)

- 9.2 <500 KG

- 9.2.1 RISE IN NUMBER OF SMALL SATELLITE CONSTELLATIONS TO FUEL SEGMENT

- 9.3 500 KG-2,500 KG

- 9.3.1 INCREASED APPLICATIONS IN CLIMATE & ENVIRONMENTAL MONITORING, EARTH OBSERVATION & METEOROLOGY TO DRIVE SEGMENT

- 9.4 >2,500 KG

- 9.4.1 RISE IN DEMAND FOR COMMUNICATION SUBSYSTEMS TO PROPEL SEGMENT

10 SATELLITE LAUNCH VEHICLE MARKET, BY STAGE

- 10.1 INTRODUCTION

- FIGURE 28 THREE STAGE SATELLITE LAUNCH VEHICLE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 24 SATELLITE LAUNCH VEHICLE MARKET, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 25 SATELLITE LAUNCH VEHICLE MARKET, BY STAGE, 2022-2027 (USD MILLION)

- 10.2 SINGLE STAGE

- 10.2.1 SIMPLE AND LESS EXPENSIVE DESIGN TO DRIVE SEGMENT

- 10.3 TWO STAGE

- 10.3.1 ABILITY TO ACHIEVE HIGHER SPEEDS AND ALTITUDES TO BOOST SEGMENT

- 10.4 THREE STAGE

- 10.4.1 INCREASED USE IN DEEP SPACE MISSIONS TO PROPEL SEGMENT

11 SATELLITE LAUNCH VEHICLE MARKET, BY SUBSYSTEM

- 11.1 INTRODUCTION

- FIGURE 29 PROPULSION SYSTEMS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 26 SATELLITE LAUNCH VEHICLE MARKET, BY SUBSYSTEM, 2018-2021 (USD MILLION)

- TABLE 27 SATELLITE LAUNCH VEHICLE MARKET, BY SUBSYSTEM, 2022-2027 (USD MILLION)

- 11.2 STRUCTURE

- 11.2.1 USE OF ADVANCED MATERIALS TO SPUR SEGMENT GROWTH

- 11.3 GUIDANCE, NAVIGATION & CONTROL SYSTEMS (GN&C)

- 11.3.1 INCREASED USE OF AUTOMATED GUIDANCE, NAVIGATION, AND CONTROL (GN&C) SYSTEMS TO PROPEL SEGMENT

- 11.4 PROPULSION SYSTEMS

- 11.4.1 RISE IN DEMAND FOR ELECTRIC PROPULSION SYSTEMS TO DRIVE SEGMENT

- 11.5 TELEMETRY, TRACKING & COMMAND SYSTEMS

- 11.5.1 IMPROVED AND FULLY REDUNDANT TELEMETRY SYSTEMS TO BOOST SEGMENT

- 11.6 ELECTRICAL POWER SYSTEMS

- 11.6.1 INTRODUCTION OF EFFICIENT POWER GENERATION SYSTEMS TO DRIVE SEGMENT

- 11.7 SEPARATION SYSTEMS

- 11.7.1 USE OF PYROTECHNIC DEVICES AND ACTIVE SEPARATION SYSTEMS TO DRIVE SEGMENT

12 SATELLITE LAUNCH VEHICLE MARKET, BY VEHICLE

- 12.1 INTRODUCTION

- FIGURE 30 SMALL (<350,000 KG) SEGMENT TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 28 SATELLITE LAUNCH VEHICLE MARKET, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 29 SATELLITE LAUNCH VEHICLE MARKET, BY VEHICLE, 2022-2027 (USD MILLION)

- 12.2 SMALL (<350,000 KG)

- 12.2.1 RAPID DEPLOYMENT AND TARGETED PAYLOAD DELIVERY TO DRIVE SEGMENT

- 12.3 MEDIUM TO HEAVY (>350,000 KG)

- 12.3.1 INCREASED PAYLOAD CAPACITY AT REDUCED LAUNCH COSTS TO DRIVE SEGMENT

13 SATELLITE LAUNCH VEHICLE MARKET, BY SERVICE

- 13.1 ENGINEERING AND DESIGN SERVICES

- 13.2 TESTING AND CERTIFICATION SERVICES

- 13.3 MANUFACTURING AND ASSEMBLY SERVICES

- 13.4 LOGISTICS AND SUPPLY CHAIN MANAGEMENT SERVICES

14 SATELLITE LAUNCH VEHICLE MARKET, BY REGION

- 14.1 INTRODUCTION

- FIGURE 31 NORTH AMERICA PROJECTED TO LEAD SATELLITE LAUNCH VEHICLE MARKET DURING FORECAST PERIOD

- TABLE 30 SATELLITE LAUNCH VEHICLE MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 31 SATELLITE LAUNCH VEHICLE MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 14.2 REGIONAL RECESSION IMPACT ANALYSIS

- FIGURE 32 GLOBAL PESSIMISTIC AND REALISTIC VIEW ON RECESSION IMPACT

- TABLE 32 REGIONAL RECESSION IMPACT ANALYSIS

- 14.3 NORTH AMERICA

- 14.3.1 PESTLE ANALYSIS: NORTH AMERICA

- FIGURE 33 NORTH AMERICA: SATELLITE LAUNCH VEHICLE MARKET SNAPSHOT

- TABLE 33 NORTH AMERICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 34 NORTH AMERICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY COUNTRY, 2022-2027(USD MILLION)

- TABLE 35 NORTH AMERICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 36 NORTH AMERICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027(USD MILLION)

- TABLE 37 NORTH AMERICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 38 NORTH AMERICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027(USD MILLION)

- TABLE 39 NORTH AMERICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 40 NORTH AMERICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

- 14.3.2 US

- 14.3.2.1 Presence of major companies manufacturing launch vehicles to boost market

- TABLE 41 US: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 42 US: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027 (USD MILLION)

- TABLE 43 US: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 44 US: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027 (USD MILLION)

- TABLE 45 US: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 46 US: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027 (USD MILLION)

- 14.3.3 CANADA

- 14.3.3.1 New regulations pertaining to satellite launches to drive market

- TABLE 47 CANADA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 48 CANADA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027 (USD MILLION)

- TABLE 49 CANADA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 50 CANADA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027 (USD MILLION)

- TABLE 51 CANADA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 52 CANADA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

- 14.4 ASIA PACIFIC

- 14.4.1 PESTLE ANALYSIS: ASIA PACIFIC

- FIGURE 34 ASIA PACIFIC: SATELLITE LAUNCH VEHICLE MARKET SNAPSHOT

- TABLE 53 ASIA PACIFIC: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 54 ASIA PACIFIC: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY COUNTRY, 2022-2027(USD MILLION)

- TABLE 55 ASIA PACIFIC: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 56 ASIA PACIFIC: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027(USD MILLION)

- TABLE 57 ASIA PACIFIC: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 58 ASIA PACIFIC: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027(USD MILLION)

- TABLE 59 ASIA PACIFIC: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 60 ASIA PACIFIC: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

- 14.4.2 CHINA

- 14.4.2.1 Ambitious space programs to drive market

- TABLE 61 CHINA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 62 CHINA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027(USD MILLION)

- TABLE 63 CHINA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 64 CHINA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027(USD MILLION)

- TABLE 65 CHINA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 66 CHINA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

- 14.4.3 INDIA

- 14.4.3.1 Increased demand for satellite launches for both commercial and government applications to propel market

- TABLE 67 INDIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 68 INDIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027(USD MILLION)

- TABLE 69 INDIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 70 INDIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027(USD MILLION)

- TABLE 71 INDIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 72 INDIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

- 14.4.4 JAPAN

- 14.4.4.1 Well-planned space launch programs to drive market

- TABLE 73 JAPAN: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 74 JAPAN: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027(USD MILLION)

- TABLE 75 JAPAN: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 76 JAPAN: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027(USD MILLION)

- TABLE 77 JAPAN: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 78 JAPAN: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

- 14.4.5 SOUTH KOREA

- 14.4.5.1 Significant investments by government to boost market

- TABLE 79 SOUTH KOREA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 80 SOUTH KOREA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027(USD MILLION)

- TABLE 81 SOUTH KOREA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 82 SOUTH KOREA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027(USD MILLION)

- TABLE 83 SOUTH KOREA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 84 SOUTH KOREA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

- 14.4.6 NEW ZEALAND

- 14.4.6.1 Increased small satellite launches to drive market

- TABLE 85 NEW ZEALAND: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 86 NEW ZEALAND: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027(USD MILLION)

- TABLE 87 NEW ZEALAND: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 88 NEW ZEALAND: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027(USD MILLION)

- TABLE 89 NEW ZEALAND: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 90 NEW ZEALAND: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

- 14.4.7 AUSTRALIA

- 14.4.7.1 Efforts by government and private sectors to propel market

- TABLE 91 AUSTRALIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 92 AUSTRALIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027(USD MILLION)

- TABLE 93 AUSTRALIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 94 AUSTRALIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027(USD MILLION)

- TABLE 95 AUSTRALIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 96 AUSTRALIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

- 14.5 EUROPE

- 14.5.1 PESTLE ANALYSIS: EUROPE

- FIGURE 35 EUROPE: SATELLITE LAUNCH VEHICLE MARKET SNAPSHOT

- TABLE 97 EUROPE: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 98 EUROPE: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY COUNTRY, 2022-2027(USD MILLION)

- TABLE 99 EUROPE: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 100 EUROPE: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027(USD MILLION)

- TABLE 101 EUROPE: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 102 EUROPE: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027(USD MILLION)

- TABLE 103 EUROPE: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 104 EUROPE: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

- 14.5.2 RUSSIA

- 14.5.2.1 Dominance in space industry to drive market

- TABLE 105 RUSSIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 106 RUSSIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027(USD MILLION)

- TABLE 107 RUSSIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 108 RUSSIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027(USD MILLION)

- TABLE 109 RUSSIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 110 RUSSIA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

- 14.5.3 FRANCE

- 14.5.3.1 Increased investments in space programs to propel market

- TABLE 111 FRANCE: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 112 FRANCE: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027(USD MILLION)

- TABLE 113 FRANCE: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 114 FRANCE: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027(USD MILLION)

- TABLE 115 FRANCE: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 116 FRANCE: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

- 14.5.4 GERMANY

- 14.5.4.1 Major contributions to European Space Agency's R&D budget to propel market

- TABLE 117 GERMANY: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 118 GERMANY: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027(USD MILLION)

- TABLE 119 GERMANY: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 120 GERMANY: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027(USD MILLION)

- TABLE 121 GERMANY: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 122 GERMANY: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

- 14.5.5 UK

- 14.5.5.1 Space Innovation and Growth Strategy by government to drive market

- TABLE 123 UK: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 124 UK: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027(USD MILLION)

- TABLE 125 UK: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 126 UK: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027(USD MILLION)

- TABLE 127 UK: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 128 UK: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

- 14.5.6 ITALY

- 14.5.6.1 Rise in demand for communication and remote sensing small satellites to propel market

- TABLE 129 ITALY: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 130 ITALY: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027(USD MILLION)

- TABLE 131 ITALY: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 132 ITALY: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027(USD MILLION)

- TABLE 133 ITALY: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 134 ITALY: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

- 14.6 REST OF WORLD

- 14.6.1 PESTLE ANALYSIS: REST OF THE WORLD

- TABLE 135 REST OF THE WORLD: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 136 REST OF THE WORLD: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY COUNTRY, 2022-2027(USD MILLION)

- TABLE 137 REST OF THE WORLD: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 138 REST OF THE WORLD: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027(USD MILLION)

- TABLE 139 REST OF THE WORLD: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 140 REST OF THE WORLD: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027(USD MILLION)

- TABLE 141 REST OF THE WORLD: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 142 REST OF THE WORLD: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

- 14.6.2 MIDDLE EAST & AFRICA

- TABLE 143 MIDDLE EAST & AFRICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027(USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027(USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

- 14.6.3 LATIN AMERICA

- TABLE 149 LATIN AMERICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2018-2021 (USD MILLION)

- TABLE 150 LATIN AMERICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY VEHICLE, 2022-2027(USD MILLION)

- TABLE 151 LATIN AMERICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2018-2021 (USD MILLION)

- TABLE 152 LATIN AMERICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY PAYLOAD, 2022-2027(USD MILLION)

- TABLE 153 LATIN AMERICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2018-2021 (USD MILLION)

- TABLE 154 LATIN AMERICA: SATELLITE LAUNCH VEHICLE MARKET SIZE, BY STAGE, 2022-2027(USD MILLION)

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 COMPETITIVE OVERVIEW

- 15.2.1 KEY DEVELOPMENTS OF LEADING PLAYERS IN SATELLITE LAUNCH VEHICLE MARKET, 2018-2022

- TABLE 155 KEY DEVELOPMENTS OF LEADING PLAYERS: SATELLITE LAUNCH VEHICLE MARKET

- 15.3 RANKING ANALYSIS OF KEY PLAYERS, 2021

- FIGURE 36 RANKING ANALYSIS OF TOP FIVE PLAYERS IN SATELLITE LAUNCH VEHICLE MARKET, 2021

- 15.4 REVENUE ANALYSIS OF KEY PLAYERS, 2021

- FIGURE 37 SATELLITE LAUNCH VEHICLE MARKET: REVENUE ANALYSIS OF KEY COMPANIES (2019-2021)

- 15.5 MARKET SHARE ANALYSIS, 2021

- FIGURE 38 MARKET SHARE ANALYSIS OF KEY COMPANIES, 2021

- TABLE 156 SATELLITE LAUNCH VEHICLE MARKET: DEGREE OF COMPETITION

- 15.6 COMPANY EVALUATION QUADRANT

- 15.6.1 STARS

- 15.6.2 EMERGING LEADERS

- 15.6.3 PERVASIVE PLAYERS

- 15.6.4 PARTICIPANTS

- FIGURE 39 SATELLITE LAUNCH VEHICLE MARKET, KEY COMPANY EVALUATION QUADRANT, 2022

- 15.6.5 COMPETITIVE BENCHMARKING

- TABLE 157 SATELLITE LAUNCH VEHICLE MARKET: COMPETITIVE BENCHMARKING

- 15.7 STARTUPS/SMES EVALUATION QUADRANT

- 15.7.1 PROGRESSIVE COMPANIES

- 15.7.2 RESPONSIVE COMPANIES

- 15.7.3 STARTING BLOCKS

- 15.7.4 DYNAMIC COMPANIES

- FIGURE 40 SATELLITE LAUNCH VEHICLE MARKET, STARTUPS/SMES COMPANY EVALUATION QUADRANT, 2022

- TABLE 158 SATELLITE LAUNCH VEHICLE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 15.8 COMPETITIVE SCENARIO

- 15.8.1 NEW PRODUCT LAUNCHES

- TABLE 159 NEW PRODUCT LAUNCHES, 2021-2023

- 15.8.2 CONTRACTS, PARTNERSHIPS, AND AGREEMENTS

- TABLE 160 CONTRACTS, PARTNERSHIPS, AND AGREEMENTS, FEBRUARY 2022- JANUARY 2023

16 COMPANY PROFILE

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

- 16.1 INTRODUCTION

- 16.2 KEY PLAYERS

- 16.2.1 SPACE EXPLORATION TECHNOLOGIES CORP.

- TABLE 161 SPACE EXPLORATION TECHNOLOGIES CORP.: BUSINESS OVERVIEW

- TABLE 162 SPACE EXPLORATION TECHNOLOGIES CORP.: PRODUCTS OFFERED

- TABLE 163 SPACE EXPLORATION TECHNOLOGIES CORP.: DEALS

- 16.2.2 UNITED LAUNCH ALLIANCE, LLC

- TABLE 164 UNITED LAUNCH ALLIANCE, LLC: BUSINESS OVERVIEW

- TABLE 165 UNITED LAUNCH ALLIANCE, LLC.: PRODUCTS OFFERED

- TABLE 166 UNITED LAUNCH ALLIANCE, LLC: DEALS

- 16.2.3 NORTHROP GRUMMAN CORPORATION

- TABLE 167 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- FIGURE 41 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- TABLE 168 NORTHROP GRUMMAN CORPORATION: PRODUCTS OFFERED

- TABLE 169 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 170 NORTHROP GRUMMAN CORPORATION: DEALS

- 16.2.4 MITSUBISHI HEAVY INDUSTRIES

- TABLE 171 MITSUBISHI HEAVY INDUSTRIES: BUSINESS OVERVIEW

- FIGURE 42 MITSUBISHI HEAVY INDUSTRIES: COMPANY SNAPSHOT

- TABLE 172 MITSUBISHI HEAVY INDUSTRIES: PRODUCTS OFFERED

- TABLE 173 MITSUBISHI HEAVY INDUSTRIES: DEALS

- 16.2.5 BLUE ORIGIN

- TABLE 174 BLUE ORIGIN: BUSINESS OVERVIEW

- TABLE 175 BLUE ORIGIN: PRODUCTS OFFERED

- TABLE 176 BLUE ORIGIN: DEALS

- 16.2.6 ABL SPACE SYSTEMS

- TABLE 177 ABL SPACE SYSTEMS: BUSINESS OVERVIEW

- TABLE 178 ABL SPACE SYSTEMS: PRODUCTS OFFERED

- TABLE 179 ABL SPACE SYSTEMS: DEALS

- 16.2.7 INDIAN SPACE RESEARCH ORGANIZATION

- TABLE 180 INDIAN SPACE RESEARCH ORGANIZATION: BUSINESS OVERVIEW

- TABLE 181 INDIAN SPACE RESEARCH ORGANIZATION: PRODUCTS OFFERED

- TABLE 182 INDIAN SPACE RESEARCH ORGANIZATION: PRODUCT LAUNCHES

- TABLE 183 INDIAN SPACE RESEARCH ORGANIZATION: DEALS

- 16.2.8 THE BOEING COMPANY

- TABLE 184 THE BOEING COMPANY: BUSINESS OVERVIEW

- FIGURE 43 THE BOEING COMPANY: COMPANY SNAPSHOT

- TABLE 185 THE BOEING COMPANY: PRODUCTS OFFERED

- TABLE 186 THE BOEING COMPANY: DEALS

- 16.2.9 FIREFLY AEROSPACE

- TABLE 187 FIREFLY AEROSPACE INC.: BUSINESS OVERVIEW

- TABLE 188 FIREFLY AEROSPACE INC.: PRODUCTS OFFERED

- TABLE 189 FIREFLY AEROSPACE INC.: DEALS

- 16.2.10 ROCKET LAB

- TABLE 190 ROCKET LAB: BUSINESS OVERVIEW

- FIGURE 44 ROCKET LAB: COMPANY SNAPSHOT

- TABLE 191 ROCKET LAB: PRODUCTS OFFERED

- TABLE 192 ROCKET LAB: DEALS

- 16.2.11 RELATIVITY SPACE

- TABLE 193 RELATIVITY SPACE: BUSINESS OVERVIEW

- TABLE 194 RELATIVITY SPACE: PRODUCTS OFFERED

- TABLE 195 RELATIVITY SPACE: DEALS

- 16.2.12 ISRAEL AEROSPACE INDUSTRY LTD.

- TABLE 196 ISRAEL AEROSPACE INDUSTRY LTD.: BUSINESS OVERVIEW

- TABLE 197 ISRAEL AEROSPACE INDUSTRY LTD.: PRODUCTS OFFERED

- TABLE 198 ISRAEL AEROSPACE INDUSTRY: DEALS

- 16.2.13 ARIANESPACE SA

- TABLE 199 ARIANESPACE SA: BUSINESS OVERVIEW

- TABLE 200 ARIANESPACE SA: PRODUCTS OFFERED

- TABLE 201 ARIANESPACE SA: DEALS

- 16.2.14 ONE SPACE TECHNOLOGY INC.

- TABLE 202 ONE SPACE TECHNOLOGY INC.: BUSINESS OVERVIEW

- TABLE 203 ONE SPACE TECHNOLOGY INC.: PRODUCTS OFFERED

- 16.2.15 VIRGIN ORBIT

- TABLE 204 VIRGIN ORBIT: BUSINESS OVERVIEW

- TABLE 205 VIRGIN ORBIT: PRODUCTS OFFERED

- TABLE 206 VIRGIN ORBIT: DEALS

- 16.3 OTHER PLAYERS

- 16.3.1 SKYROOT AEROSPACE

- TABLE 207 SKYROOT AEROSPACE: COMPANY OVERVIEW

- 16.3.2 AGNIKUL COSMOS PRIVATE LIMITED

- TABLE 208 AGNIKUL COSMOS PRIVATE LIMITED: COMPANY OVERVIEW

- 16.3.3 GALACTIC ENERGY AEROSPACE TECHNOLOGY CO. LTD.

- TABLE 209 GALACTIC ENERGY AEROSPACE TECHNOLOGY CO. LTD.: COMPANY OVERVIEW

- 16.3.4 I-SPACE

- TABLE 210 I-SPACE: COMPANY OVERVIEW

- 16.3.5 SKYRORA LIMITED

- TABLE 211 SKYRORA LIMITED: COMPANY OVERVIEW

- 16.3.6 GILMOUR SPACE TECHNOLOGIES

- TABLE 212 GILMOUR SPACE TECHNOLOGIES: COMPANY OVERVIEW

- 16.3.7 C6 LAUNCH SYSTEMS

- TABLE 213 C6 LAUNCH SYSTEMS: COMPANY OVERVIEW

- 16.3.8 ROCKET FACTORY AUGSBURG

- TABLE 214 ROCKET FACTORY AUGSBURG: COMPANY OVERVIEW

- 16.3.9 HYIMPULSE TECHNOLOGIES GMBH

- TABLE 215 HYIMPULSE TECHNOLOGIES GMBH: COMPANY OVERVIEW

- 16.3.10 ISAR AEROSPACE

- TABLE 216 ISAR AEROSPACE: COMPANY OVERVIEW

- Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS