|

|

市場調査レポート

商品コード

1247341

石油・ガス産業向けフローコンピューターの世界市場:提供製品/サービス別 (ハードウェア、ソフトウェア、サポートサービス)・操業工程別 (上流/中流/下流工程)・用途別 (管理輸送、パイプラインフロー監視、杭口監視)・地域別の将来予測 (2028年まで)Flow Computer Market in Oil & Gas by Offering (Hardware, Software, Support Services), by Operation (Upstream, Midstream and Downstream), Application (Custody Transfer, Pipeline Flow Monitoring, Wellhead Monitoring) and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 石油・ガス産業向けフローコンピューターの世界市場:提供製品/サービス別 (ハードウェア、ソフトウェア、サポートサービス)・操業工程別 (上流/中流/下流工程)・用途別 (管理輸送、パイプラインフロー監視、杭口監視)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年03月17日

発行: MarketsandMarkets

ページ情報: 英文 177 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の石油・ガス産業向けフローコンピューターの市場規模は、2023年の7億9,800万米ドルから、2028年までに10億6,700万米ドル拡大し、予測期間中に6.0%のCAGRで成長すると予想されています。

石油・ガス産業における技術進歩や、石油・ガス産業の多くの機能への適合性、プロセスオートメーションの普及浸透が、石油・ガス産業向けフローコンピューター市場に機会を提供しています。

"予測期間中、ハードウェアコンポーネントがより大きな市場シェアを獲得する"

フローコンピューターは、流量計、圧力伝送器、温度伝送器からの信号に基づいて、液体や気体の正しい流量を計算する流量計測装置です。フローコンピューターには様々な種類があり、用途に応じた機能、必要な精度、I/O接続の必要性などを考慮して製造されています。液体・気体計測、坑口計測・最適化、管理輸送・制御、燃料監視、取引用流量計測、流量計証明、パイプライン輸送・流通、船舶・鉄道・道路積載など、さまざまな用途で使用されています。

"予測期間中、中流・下流工程がより大きな市場シェアを占める"

フローコンピューターは、計量・メーター証明・発券・バルブ制御・バッチ処理、製品インターフェイス・管理輸送など、中流・下流工程の多くの機能で使用されています。これらのフローコンピューターは、中流パイプライン、流通ポイント、製油所、課金ポイントに設置されています。そのため、上流業務に比べ、中流・下流工程におけるフローコンピューターの市場規模は大きくなっています。

"予測期間中、北米市場がより大きな市場シェアを獲得する"

2022年に、北米諸国 (米国・カナダ・メキシコ) は世界の石油・ガス産業向けフローコンピューター市場で最も高い市場シェアを獲得しています。米国は世界最大の石油・ガス生産国であるため、生産拠点や坑口へのフローコンピューターの設置件数が多くなっています。米国はまた、石油・ガスの中流パイプラインの長さや石油・ガスの精製能力も大きくなっています。同様に、カナダは世界第3位の石油埋蔵量を持ち、巨大な石油生産業を有しています。天然ガスの生産量は世界第5位、原油の生産量は世界第6位です。その生産量の拡大が、石油・天然ガスプラントへのフローコンピューターの導入を可能にしています。そのため、フローコンピューターは上流・中流・下流の各工程で大量に導入されています。

当レポートでは、世界の石油・ガス産業向けフローコンピューターの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、用途別・提供製品/サービス別・操業工程別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ

- 貿易分析

- 特許分析

- 主な会議とイベント (2023年~2024年)

- 規制機関、政府機関、その他の組織

第6章 石油・ガス産業におけるフローコンピューターの活用領域

- イントロダクション

- 管理輸送 (カストディトランスファー)

- パイプラインフロー監視

- 坑口監視

第7章 石油・ガス産業向けフローコンピューター市場:提供製品/サービス別

- イントロダクション

- ハードウェア

- プロセッサー

- メモリー

- 入力/出力 (I/O) モジュール

- 電源

- 通信インターフェース

- 筐体

- ディスプレイ

- ソフトウェア

- サポートサービス

- システムインテグレーション

- カスタマイズ

- フィールドサービス

- コンサルティングサービス

第8章 石油・ガス産業向けフローコンピューター市場:操業工程別

- イントロダクション

- 上流工程

- 中流・下流工程

第9章 石油・ガス産業向けフローコンピューター市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ノルウェー

- カザフスタン

- 英国

- 他の欧州諸国

- 中東

- サウジアラビア

- イラン

- カタール

- 他の中東・アフリカ諸国

- アジア太平洋

- 中国

- インド

- インドネシア

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 南米

- アフリカ

第10章 競合情勢

- イントロダクション

- 上位5社の収益分析

- 上位5社の市場シェア分析 (2022年)

- 企業評価クアドラント (2022年)

- 石油・ガス産業向けフローコンピューター市場:製品フットプリント

- 中小企業 (SME) の評価マトリックス (2022年)

- 競合状況・動向

- 石油・ガス産業向けフローコンピューター市場:製品の発売 (2021年9月~2023年1月)

- 石油・ガス産業向けフローコンピューター市場:資本取引 (2022年6月)

- 石油・ガス産業向けフローコンピューター市場:その他 (2021年2月)

第11章 企業プロファイル

- 主要企業

- EMERSON ELECTRIC CO.

- HONEYWELL INTERNATIONAL, INC.

- ABB

- THERMO FISHER SCIENTIFIC INC.

- SCHNEIDER ELECTRIC

- KROHNE MESSTECHNIK GMBH

- TECHNIPFMC PLC

- OMNI FLOW COMPUTERS, INC.

- DYNAMIC FLOW COMPUTERS, INC.

- CONTREC LIMITED

- KESSLER-ELLIS PRODUCTS (KEP) CO, INC.

- SENSIA

- その他の企業

- PROSOFT TECHNOLOGY, INC.

- FLOWMETRICS, INC.

- SPIRAX SARCO LIMITED

- SICK AG

- BADGER METER, INC.

- QUORUM BUSINESS SOLUTIONS, INC.

- ENDRESS+HAUSER AG

- PLUM SP. Z O.O

- FLUIDWELL BV

- OVAL CORPORATION

- SENECA SRL

- HOFFER FLOW CONTROLS, INC.

第12章 隣接・関連市場

- イントロダクション

- 分析の限界

- プロセス自動化・計装市場:計器別

- フィールド機器

- プロセス分析計

第13章 付録

The flow computer market in oil & gas is projected to grow from USD 798 million in 2023 to USD 1,067 million in 2028; it is expected to grow at a CAGR of 6.0% during the forecasted period. The technological advancements in oil & gas industry and suitability in many functions of the oil & gas industry and increasing adoption of process automation providing opportunities for flow computer market in oil & gas.

"Hardware component is expected to register larger market share during the forecast period"

In the flow computer hardware market, the market size of the actual flow computer device is considered. The flow computer is a flow measurement device that calculates the correct flow of liquid and gas based on the signals from the flow meter, pressure transmitter, and temperature transmitters. These flow computers are of different types and are manufactured considering their functions in different applications, accuracy needs, and I/O connection needs. They are used in liquid & gas measurement, wellhead measurement and optimization, custody transfer and control, fuel monitoring, fiscal flow metering, flow meter proving, pipeline transmission and distribution, ship/rail/road loading, and many others

"Midstream & Downstream is expected to register larger market share during the forecast period"

Flow computers are used in many midstream and downstream functions such as metering, meter proving, ticketing, valve control, batching, product interfacing, and custody transfer. These flow computers are installed in midstream pipelines, distribution points, refineries, and billing points. As a result, the market size of flow computers in midstream and downstream operations is large compared to upstream operations.. Midstream enables processing, storing, and transportation of oil & gas. It is a process that falls between upstream and downstream operation whereas downstream is a process in which oil & gas is converted into finished products.

"Market in North America is expected to register larger market share during the forecast period"

In 2022, North America accounted highest market share of the flow computer market in oil & gas. The regional market here has been segmented into US, Canada and Mexico. US was the largest oil & gas-producing country in the world. Consequently, the installation of flow computers at production sites or wellheads is large in US. The midstream oil & gas pipeline length and installed oil and gas refining capacity are also large in US. Similarly, Canada has the third-largest oil reserve in the world, with a major petroleum production industry. It is the fifth-largest producer of natural gas and the sixth-largest producer of crude oil worldwide. Its expanding production enables the adoption of flow computers in oil and natural gas plants. Hence, Flow computers are installed in large quantities in the upstream, midstream, and downstream operations.

Breakdown of the profiles of primary participants:

- By Company Type: Tier 1 - 45%, Tier 2 - 35%, and Tier 3 - 20%

- By Designation: C-level Executives - 35%, Directors - 43%, and others - 22%

- By Region: North America - 31%, Europe - 19%, Asia Pacific - 27%, and RoW - 15%

Major players profiled in this report are as follows: Emerson Electric Co. (US), Honeywell International, Inc. (US), ABB (Switzerland), Thermo Fisher Scientific Inc. (US), Schneider Electric (France), Krohne Messtechnik GmbH (Germany), Yokogawa Electric Corporation (Japan), TechnipFMC plc (US), OMNI Flow Computers, Inc. (US), Dynamic Flow Computers, Inc. (US), Contrec Limited (UK), Kessler-Ellis Products (KEP) Co, Inc. (US), Sensia (US). Prosoft Technology, Inc.(US), Flowmetric, Inc.(US), Spirax Sarco Limited (UK), SICK AG (Germany), Badger Meter, Inc.(US), Quorum Business Solution, Inc.(US), Endress+Hauser AG (Switzerland), PLUM Sp. Zo. O (Poland), Fluidwell BV (Netherlands), Oval Corporation (Japan), Seneca srl (Italy), and Hoffer Flow Controls, Inc. (US).

Research Coverage

This research report categorizes the flow computer market in oil & gas on the basis of components, operation, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the flow computer market in oil & gas and forecasts the same till 2028. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the flow computer ecosystem.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall flow computer market in oil & gas and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 SEGMENTATION OF FLOW COMPUTER MARKET IN OIL & GAS

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 FLOW COMPUTER MARKET IN OIL & GAS: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.1.1 Key industry insights

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Breakdown of primaries

- 2.1.3.3 Key data from primary sources

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

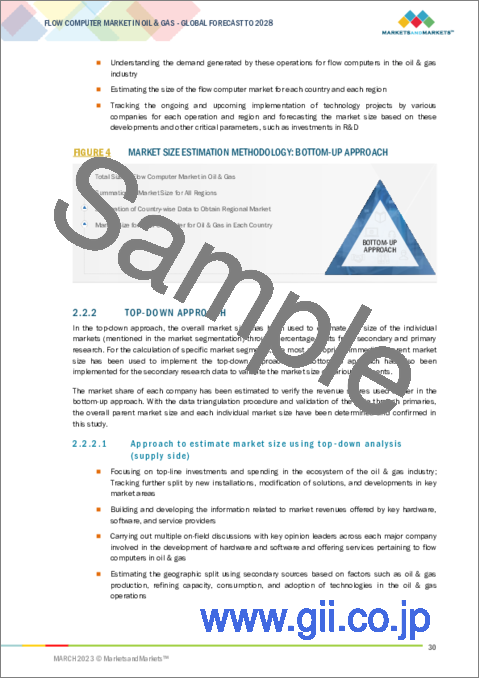

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 7 RESEARCH STUDY ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON FLOW COMPUTER MARKET IN OIL & GAS

3 EXECUTIVE SUMMARY

- FIGURE 8 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF FLOW COMPUTER MARKET IN OIL & GAS IN 2028

- FIGURE 9 UPSTREAM OPERATIONS TO CREATE HIGH-GROWTH OPPORTUNITIES FOR FLOW COMPUTER MARKET DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 3.1 ANALYSIS OF RECESSION IMPACT ON FLOW COMPUTER MARKET IN OIL & GAS

- FIGURE 11 GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES (PERCENTAGE CHANGE)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FLOW COMPUTER MARKET IN OIL & GAS

- FIGURE 12 ADOPTION OF PROCESS AUTOMATION IN OIL & GAS INDUSTRY TO PROVIDE OPPORTUNITIES FOR MARKET PLAYERS

- 4.2 FLOW COMPUTER MARKET IN OIL & GAS, BY OFFERING

- FIGURE 13 SOFTWARE SEGMENT TO REGISTER HIGHEST CAGR IN FLOW COMPUTER MARKET IN OIL & GAS BETWEEN 2023 AND 2028

- 4.3 FLOW COMPUTER MARKET IN OIL & GAS IN NORTH AMERICA, BY COUNTRY AND OPERATION

- FIGURE 14 US AND MIDSTREAM AND DOWNSTREAM TO ACCOUNT FOR LARGEST SHARE OF FLOW COMPUTER MARKET IN OIL & GAS IN NORTH AMERICA IN 2028

- 4.4 REGION-WISE GROWTH RATE OF FLOW COMPUTER MARKET IN OIL & GAS

- FIGURE 15 NORTH AMERICA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Technological advancements in oil & gas industry

- 5.2.1.2 Need to maximize production potential from mature wells

- 5.2.1.3 Suitability in oil & gas industry

- FIGURE 16 FLOW COMPUTER MARKET IN OIL & GAS: IMPACT ANALYSIS OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Cybersecurity threats

- 5.2.2.2 High cost of flow computer and regular maintenance

- FIGURE 17 FLOW COMPUTER MARKET IN OIL & GAS: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for offshore/ultra-deep discoveries

- 5.2.3.2 Increasing adoption of process automation

- FIGURE 18 FLOW COMPUTER MARKET IN OIL & GAS: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Interoperability of multiple components from different solution providers

- FIGURE 19 FLOW COMPUTER MARKET IN OIL & GAS: IMPACT ANALYSIS OF CHALLENGES

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 20 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDITION DURING MANUFACTURING AND SYSTEM INTEGRATION PHASE

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 21 FLOW COMPUTER MARKET IN OIL & GAS: ECOSYSTEM ANALYSIS

- TABLE 1 FLOW COMPUTER MARKET IN OIL & GAS: ECOSYSTEM

- 5.5 PRICING ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE TREND OF FLOW COMPUTER

- TABLE 2 INDICATIVE PRICES OF FLOW COMPUTER

- 5.5.1 AVERAGE SELLING PRICE OF FLOW COMPUTERS OFFERED BY KEY PLAYERS

- FIGURE 23 AVERAGE SELLING PRICES OF FLOW COMPUTERS OFFERED BY KEY PLAYERS

- TABLE 3 AVERAGE SELLING PRICES OF FLOW COMPUTERS OFFERED BY KEY PLAYERS (USD)

- TABLE 4 AVERAGE SELLING PRICES OF FLOW COMPUTER BY REGION (USD)

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN FLOW COMPUTER MARKET IN OIL & GAS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 IMPACT OF IIOT ON FLOW COMPUTER MARKET IN OIL & GAS

- 5.7.2 INTEGRATION OF ARTIFICIAL INTELLIGENCE INTO FLOW COMPUTERS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 FLOW COMPUTER MARKET IN OIL & GAS: PORTER'S FIVE FORCES ANALYSIS

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 COMPONENTS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 COMPONENTS (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA FOR TOP 3 COMPONENTS

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 COMPONENTS

- 5.10 CASE STUDIES

- TABLE 7 TURKSTREAM GAS PIPELINE USED CONTREC'S 515 GAS FLOW COMPUTERS FOR FLOW MEASUREMENT SOLUTION

- TABLE 8 INSTALLATION OF E-CHART FLOW COMPUTERS FOR ACCURATE MONITOR MEASUREMENTS FOR GAS LIFT OPERATION

- TABLE 9 HUSKY ENERGY UPGRADED ITS LIMA REFINERY WITH MICRO MVL FLOW COMPUTER FOR RELIABLE MEASUREMENT

- TABLE 10 INSTALLATION OF EMERSON'S FB1200 FLOW COMPUTER BY WATERBRIDGE TO ACHIEVE ACCURATE AND LOW MAINTENANCE METER PERFORMANCE

- 5.11 TRADE ANALYSIS

- FIGURE 28 IMPORT DATA, BY COUNTRY, 2017-2021 (USD MILLION)

- FIGURE 29 EXPORT DATA, BY COUNTRY, 2017-2021 (USD MILLION)

- 5.12 PATENT ANALYSIS

- FIGURE 30 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

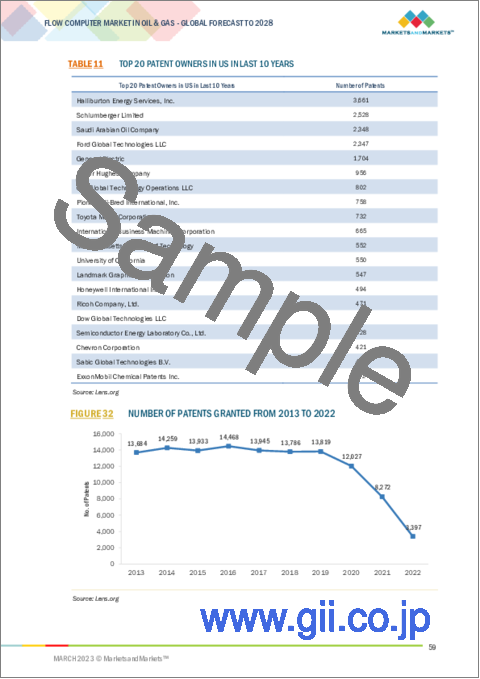

- TABLE 11 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- FIGURE 31 NUMBER OF PATENTS GRANTED FROM 2013 TO 2022

- TABLE 12 LIST OF FEW PATENTS IN FLOW COMPUTER MARKET IN OIL & GAS, 2020-2023

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 13 FLOW COMPUTER MARKET IN OIL & GAS: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.1 STANDARDS

- TABLE 18 STANDARDS FOR FLOW COMPUTER MARKET IN OIL & GAS

6 APPLICATIONS OF FLOW COMPUTERS IN OIL & GAS INDUSTRY

- 6.1 INTRODUCTION

- 6.2 CUSTODY TRANSFER

- 6.3 PIPELINE FLOW MONITORING

- 6.4 WELLHEAD MONITORING

7 FLOW COMPUTER MARKET IN OIL & GAS, BY OFFERING

- 7.1 INTRODUCTION

- FIGURE 32 HARDWARE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 19 FLOW COMPUTER MARKET IN OIL & GAS, BY OFFERING,

- 2019-2022 (USD MILLION)

- TABLE 20 FLOW COMPUTER MARKET IN OIL & GAS, BY OFFERING,

- 2023-2028 (USD MILLION)

- 7.2 HARDWARE

- 7.2.1 USED IN WELLHEAD MEASUREMENT, CUSTODY TRANSFER, AND FUEL MONITORING

- 7.2.2 PROCESSOR

- 7.2.3 MEMORY

- 7.2.4 INPUT/OUTPUT (I/O) MODULE

- 7.2.5 POWER SUPPLY

- 7.2.6 COMMUNICATION INTERFACE

- 7.2.7 ENCLOSURE

- 7.2.8 DISPLAY

- 7.3 SOFTWARE

- 7.3.1 ENABLES ACCURATE MEASUREMENT, MONITORING, AND FLOW OF MEDIUM

- 7.4 SUPPORT SERVICES

- 7.4.1 MINIMIZES ECONOMIC LOSSES AND TECHNICAL ISSUES POST INSTALLATION

- 7.4.2 SYSTEM INTEGRATION

- 7.4.3 CUSTOMIZATION

- 7.4.4 FIELD SERVICES

- 7.4.5 CONSULTING SERVICES

8 FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION

- 8.1 INTRODUCTION

- FIGURE 33 MIDSTREAM AND UPSTREAM OPERATION TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 21 FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION,

- 2019-2022 (USD MILLION)

- TABLE 22 FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION,

- 2023-2028 (USD MILLION)

- 8.2 UPSTREAM

- 8.2.1 ENGAGES IN EXPLORATION, DRILLING, AND PRODUCTION

- TABLE 23 UPSTREAM FLOW COMPUTER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 24 UPSTREAM FLOW COMPUTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 25 NORTH AMERICA: UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 26 NORTH AMERICA: UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 27 EUROPE: UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 28 EUROPE: UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 29 MIDDLE EAST: UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 30 MIDDLE EAST: UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 31 ASIA PACIFIC: UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 32 ASIA PACIFIC: UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 33 REST OF THE WORLD: UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 34 REST OF THE WORLD: UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.3 MIDSTREAM AND DOWNSTREAM

- 8.3.1 APPLICATIONS IN CUSTODY TRANSFER, PIPELINE FLOW MONITORING, ALLOCATION, BLENDING, AND BATCHING

- TABLE 35 MIDSTREAM AND DOWNSTREAM FLOW COMPUTER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 36 MIDSTREAM AND DOWNSTREAM FLOW COMPUTER MARKET, BY REGION , BY REGION, 2023-2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: MIDSTREAM AND UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 38 NORTH AMERICA: MIDSTREAM AND UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 39 EUROPE: MIDSTREAM AND UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 40 EUROPE: MIDSTREAM AND UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 41 MIDDLE EAST: MIDSTREAM AND UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 42 MIDDLE EAST: MIDSTREAM AND UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: MIDSTREAM AND UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 44 ASIA PACIFIC: MIDSTREAM AND UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 45 REST OF THE WORLD: MIDSTREAM AND UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 46 REST OF THE WORLD: MIDSTREAM AND UPSTREAM FLOW COMPUTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

9 FLOW COMPUTER MARKET IN OIL & GAS, BY REGION

- 9.1 INTRODUCTION

- FIGURE 34 US TO EXHIBIT HIGHEST CAGR IN FLOW COMPUTER MARKET IN OIL & GAS DURING FORECAST PERIOD

- TABLE 47 FLOW COMPUTER MARKET IN OIL & GAS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 48 FLOW COMPUTER MARKET IN OIL & GAS, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 35 NORTH AMERICA: SNAPSHOT OF FLOW COMPUTER MARKET IN OIL & GAS

- TABLE 49 NORTH AMERICA: FLOW COMPUTER MARKET IN OIL & GAS, BY COUNTRY, 2019-2022(USD MILLION)

- TABLE 50 NORTH AMERICA: FLOW COMPUTER MARKET IN OIL & GAS, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 52 NORTH AMERICA: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Contributes highest market share in region

- TABLE 53 US: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 54 US: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 Significant oil reserves and expanding production

- TABLE 55 CANADA: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 56 CANADA: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.2.3 MEXICO

- 9.2.3.1 Moderate market growth

- TABLE 57 MEXICO: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 58 MEXICO: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.3 EUROPE

- FIGURE 36 EUROPE: SNAPSHOT OF FLOW COMPUTER MARKET IN OIL & GAS

- TABLE 59 EUROPE: FLOW COMPUTER MARKET IN OIL & GAS, BY COUNTRY, 2019-2022(USD MILLION)

- TABLE 60 EUROPE: FLOW COMPUTER MARKET IN OIL & GAS, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 61 EUROPE: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 62 EUROPE: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.3.1 NORWAY

- 9.3.1.1 Growing investments in oil & gas projects

- TABLE 63 NORWAY: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 64 NORWAY: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.3.2 KAZAKHSTAN

- 9.3.2.1 Exports 80% of oil produced

- TABLE 65 KAZAKHSTAN: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 66 KAZAKHSTAN: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Presence of several technology providers

- TABLE 67 UK: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 68 UK: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.3.4 REST OF EUROPE

- TABLE 69 REST OF EUROPE: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 70 REST OF EUROPE: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.4 MIDDLE EAST

- TABLE 71 MIDDLE EAST: FLOW COMPUTER MARKET IN OIL & GAS, BY COUNTRY, 2019-2022(USD MILLION)

- TABLE 72 MIDDLE EAST: FLOW COMPUTER MARKET IN OIL & GAS, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 73 MIDDLE EAST: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 74 MIDDLE EAST: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.4.1 SAUDI ARABIA

- 9.4.1.1 Continuous oil exploration and development by Saudi Aramco

- TABLE 75 SAUDI ARABIA: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 76 SAUDI ARABIA: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.4.2 IRAN

- 9.4.2.1 Increased production activities

- TABLE 77 IRAN: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 78 IRAN: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.4.3 QATAR

- 9.4.3.1 Depleting oil production

- TABLE 79 QATAR: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 80 QATAR: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.4.4 REST OF MIDDLE EAST

- TABLE 81 REST OF MIDDLE EAST: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 82 REST OF MIDDLE EAST: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.5 ASIA PACIFIC

- FIGURE 37 ASIA PACIFIC: SNAPSHOT OF FLOW COMPUTER MARKET IN OIL & GAS

- TABLE 83 ASIA PACIFIC: FLOW COMPUTER MARKET IN OIL & GAS, BY COUNTRY, 2019-2022(USD MILLION)

- TABLE 84 ASIA PACIFIC: FLOW COMPUTER MARKET IN OIL & GAS, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 86 ASIA PACIFIC: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.5.1 CHINA

- 9.5.1.1 Expected to dominate market in Asia Pacific

- TABLE 87 CHINA: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 88 CHINA: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.5.2 INDIA

- 9.5.2.1 Redevelopment of legacy oilfields and government initiatives

- TABLE 89 INDIA: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 90 INDIA: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.5.3 INDONESIA

- 9.5.3.1 Government plans to boost oil & gas production

- TABLE 91 INDONESIA: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 92 INDONESIA: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.5.4 REST OF ASIA PACIFIC

- TABLE 93 REST OF ASIA PACIFIC: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.6 REST OF THE WORLD

- TABLE 95 REST OF THE WORLD: FLOW COMPUTER MARKET IN OIL & GAS, BY REGION, 2019-2022(USD MILLION)

- TABLE 96 REST OF THE WORLD: FLOW COMPUTER MARKET IN OIL & GAS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 97 REST OF THE WORLD: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 98 REST OF THE WORLD: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.6.1 SOUTH AMERICA

- 9.6.1.1 Digitalization in oilfields

- TABLE 99 SOUTH AMERICA: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 100 SOUTH AMERICA: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

- 9.6.2 AFRICA

- 9.6.2.1 Governments plans to expand energy segment

- TABLE 101 AFRICA: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2019-2022 (USD MILLION)

- TABLE 102 AFRICA: FLOW COMPUTER MARKET IN OIL & GAS, BY OPERATION, 2023-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 TOP 5 COMPANY REVENUE ANALYSIS

- FIGURE 38 FLOW COMPUTER MARKET IN OIL & GAS: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2018-2022

- 10.3 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2022

- FIGURE 39 SHARE OF MAJOR PLAYERS IN FLOW COMPUTER MARKET IN OIL & GAS, 2022

- TABLE 103 MARKET SHARE OF TOP FIVE PLAYERS IN FLOW COMPUTER MARKET IN OIL & GAS, 2022

- 10.4 COMPANY EVALUATION QUADRANT, 2022

- 10.4.1 STARS

- 10.4.2 EMERGING LEADERS

- 10.4.3 PERVASIVE PLAYERS

- 10.4.4 PARTICIPANTS

- FIGURE 40 FLOW COMPUTER MARKET IN OIL & GAS: COMPANY EVALUATION QUADRANT, 2022

- 10.5 FLOW COMPUTER MARKET IN OIL & GAS: PRODUCT FOOTPRINT

- TABLE 104 COMPANY FOOTPRINT

- TABLE 105 PRODUCT TYPE FOOTPRINT OF COMPANIES

- TABLE 106 OPERATION FOOTPRINT OF COMPANIES

- TABLE 107 REGIONAL FOOTPRINT OF COMPANIES

- 10.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX, 2022

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 41 FLOW COMPUTER MARKET IN OIL & GAS, SME EVALUATION QUADRANT, 2022

- 10.6.5 STARTUPS/SMES EVALUATION MATRIX

- TABLE 108 FLOW COMPUTER MARKET IN OIL & GAS: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 109 FLOW COMPUTER MARKET IN OIL & GAS: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.7 COMPETITIVE SITUATIONS AND TRENDS

- 10.7.1 FLOW COMPUTER MARKET IN OIL & GAS: PRODUCT LAUNCHES, SEPTEMBER 2021-JANUARY 2023

- TABLE 110 FLOW COMPUTER MARKET IN OIL & GAS: PRODUCT LAUNCHES, SEPTEMBER 2021-JANUARY 2023

- 10.7.2 FLOW COMPUTER MARKET IN OIL & GAS: DEALS, JUNE 2022

- TABLE 111 FLOW COMPUTER MARKET IN OIL & GAS: DEALS, JUNE 2022

- 10.7.3 FLOW COMPUTER MARKET IN OIL & GAS: OTHERS, FEBRUARY 2021

- TABLE 112 FLOW COMPUTER MARKET IN OIL & GAS: OTHERS, FEBRUARY 2021

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

- 11.1.1 EMERSON ELECTRIC CO.

- TABLE 113 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- FIGURE 42 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- TABLE 114 EMERSON ELECTRIC CO.: PRODUCTS OFFERED

- TABLE 115 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- 11.1.2 HONEYWELL INTERNATIONAL, INC.

- TABLE 116 HONEYWELL INTERNATIONAL, INC.: COMPANY OVERVIEW

- FIGURE 43 HONEYWELL INTERNATIONAL, INC.: COMPANY SNAPSHOT

- TABLE 117 HONEYWELL INTERNATIONAL, INC.: PRODUCTS OFFERED

- 11.1.3 ABB

- TABLE 118 ABB: COMPANY OVERVIEW

- FIGURE 44 ABB: COMPANY SNAPSHOT

- TABLE 119 ABB: PRODUCTS OFFERED

- TABLE 120 ABB: DEALS

- TABLE 121 ABB: OTHERS

- 11.1.4 THERMO FISHER SCIENTIFIC INC.

- TABLE 122 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- FIGURE 45 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- TABLE 123 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED

- TABLE 124 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES

- 11.1.5 SCHNEIDER ELECTRIC

- TABLE 125 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- FIGURE 46 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 126 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

- 11.1.6 KROHNE MESSTECHNIK GMBH

- TABLE 127 KROHNE MESSTECHNIK GMBH: COMPANY OVERVIEW

- TABLE 128 KROHNE MESSTECHNIK GMBH: PRODUCTS OFFERED

- TABLE 129 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- FIGURE 47 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- TABLE 130 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS OFFERED

- 11.1.8 TECHNIPFMC PLC

- TABLE 131 TECHNIPFMC PLC: COMPANY OVERVIEW

- FIGURE 48 TECHNIPFMC PLC: COMPANY SNAPSHOT

- TABLE 132 TECHNIPFMC PLC: PRODUCTS OFFERED

- 11.1.9 OMNI FLOW COMPUTERS, INC.

- TABLE 133 OMNI FLOW COMPUTERS, INC.: COMPANY OVERVIEW

- TABLE 134 OMNI FLOW COMPUTERS, INC.: PRODUCTS OFFERED

- 11.1.10 DYNAMIC FLOW COMPUTERS, INC.

- TABLE 135 DYNAMIC FLOW COMPUTERS, INC.: COMPANY OVERVIEW

- TABLE 136 DYNAMIC FLOW COMPUTERS, INC.: PRODUCTS OFFERED

- 11.1.11 CONTREC LIMITED

- TABLE 137 CONTREC LIMITED: COMPANY OVERVIEW

- TABLE 138 CONTREC LIMITED: PRODUCTS OFFERED

- 11.1.12 KESSLER-ELLIS PRODUCTS (KEP) CO, INC.

- TABLE 139 KESSLER-ELLIS PRODUCTS CO, INC.: COMPANY OVERVIEW

- TABLE 140 KESSLER-ELLIS PRODUCTS CO, INC.: PRODUCTS OFFERED

- 11.1.13 SENSIA

- TABLE 141 SENSIA: COMPANY OVERVIEW

- TABLE 142 SENSIA: PRODUCTS OFFERED

- 11.2 OTHER KEY PLAYERS

- 11.2.1 PROSOFT TECHNOLOGY, INC.

- 11.2.2 FLOWMETRICS, INC.

- 11.2.3 SPIRAX SARCO LIMITED

- 11.2.4 SICK AG

- 11.2.5 BADGER METER, INC.

- 11.2.6 QUORUM BUSINESS SOLUTIONS, INC.

- 11.2.7 ENDRESS+HAUSER AG

- 11.2.8 PLUM SP. Z O.O

- 11.2.9 FLUIDWELL BV

- 11.2.10 OVAL CORPORATION

- 11.2.11 SENECA SRL

- 11.2.12 HOFFER FLOW CONTROLS, INC.

Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 STUDY LIMITATIONS

- 12.3 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY INSTRUMENT

- TABLE 143 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 144 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 145 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY INSTRUMENT, 2018-2021 (USD MILLION)

- TABLE 146 PROCESS AUTOMATION AND INSTRUMENTATION MARKET, BY INSTRUMENT, 2022-2027 (USD MILLION)

- 12.3.1 FIELD INSTRUMENTS

- 12.3.1.1 Level transmitters

- 12.3.1.1.1 Accurate measurements in water & wastewater treatment industry

- 12.3.1.2 Pressure transmitters

- 12.3.1.2.1 Widespread use in oil & gas industry

- 12.3.1.3 Temperature transmitters

- 12.3.1.3.1 Simplify operations

- 12.3.1.4 Others

- 12.3.1.4.1 Humidity transmitters

- 12.3.1.5 Vibration level switches

- 12.3.1.1 Level transmitters

- 12.3.2 PROCESS ANALYZERS

- 12.3.2.1 High demand from pharmaceutical industry

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS