|

|

市場調査レポート

商品コード

1234202

衛星用IoTの世界市場:サービスの種類別 (衛星用IoTバックホール、DTS)・周波数帯域別 (Lバンド、Ku・Kaバンド、Sバンド)・組織規模別 (大企業、中小企業)・業種別・地域別の将来予測 (2027年まで)Satellite IoT Market by Service Type (Satellite IoT Backhaul, Direct-to-satellite), Frequency Band (L-Band, Ku and Ka-Band, S-band), Organization Size (Large Enterprises, Small and Medium Sized Enterprises), Vertical & Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 衛星用IoTの世界市場:サービスの種類別 (衛星用IoTバックホール、DTS)・周波数帯域別 (Lバンド、Ku・Kaバンド、Sバンド)・組織規模別 (大企業、中小企業)・業種別・地域別の将来予測 (2027年まで) |

|

出版日: 2023年02月23日

発行: MarketsandMarkets

ページ情報: 英文 189 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の衛星用IoTの市場規模は、2022年の11億米ドルから2027年には29億米ドルへと、予測期間中に21.9%のCAGRで成長すると予測されています。

LEO (低軌道) 衛星ベース・サービスに対する需要、資金調達の可能性、高速ブロードバンド、先進国の政府の成長、後発国の消費者の低コストのブロードバンドに対する需要が、衛星用IoTの市場を牽引しています。

周波数帯別では、Ku・Kaバンドが予測期間中に最も速い成長率で成長すると予想されます。衛星通信用のKuバンド周波数スペクトルは、主に海上VSATサービスに使用されています。この帯域は、容量が広く可用性が高いため、小型の反射鏡アンテナで高いスループットを得るには、より経済的で柔軟な手段です。

組織規模別では、予測期間中、大企業が最大の市場シェアを占めると予想されます。大企業は、衛星用IoTソリューションとサービスのアーリーアダプターです。大企業における衛星用IoTの採用は、今後数年間で増加すると予想されます。

地域別に見ると、欧州が最も高いCAGRを記録します。衛星用IoTエコシステムにおける技術革新とその展開の拡大が、欧州市場の成長を促進すると予想されます。

当レポートでは、世界の衛星用IoTの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、サービスの種類別・周波数帯域別・組織規模別・業種別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界の動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 累積成長分析

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 技術分析

- 特許分析

- 価格分析

- ケーススタディ分析

- 主な会議とイベント (2022年~2023年)

- 関税と規制の影響

第6章 衛星用IoT市場:サービスの種類別

- イントロダクション

- 衛星用IoTバックホール

- DTS (Direct-to-Satellite:衛星間直接通信)

第7章 衛星用IoT市場:周波数帯域別

- イントロダクション

- Lバンド

- Ku・Kaバンド

- Sバンド

- その他の帯域

第8章 衛星用IoT市場:組織規模別

- イントロダクション

- 大企業

- 中小企業

第9章 衛星用IoT市場:業種別

- イントロダクション

- 海運

- 石油・ガス

- 輸送・物流

- エネルギー・ユーティリティ

- 農業

- 医療

- 軍事・防衛

- その他の業種

第10章 衛星用IoT市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- ノルディック

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- 東南アジア

- 他のアジア太平洋諸国

- 中東・アフリカ

- 中東

- アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第11章 競合情勢

- 概要

- 大手企業の市場シェア分析 (2022年)

- 過去の収益分析

- 主要企業のランキング

- 主要企業の評価クアドラント (2022年)

- 企業の製品フットプリント分析

- スタートアップ/中小企業の評価クアドラント (2022年)

- 中小企業/新興企業向け競合ベンチマーキング

- 競合シナリオと動向

- 製品の発売

- 資本取引

第12章 企業プロファイル

- 主要企業

- ORBCOMM

- IRIDIUM COMMUNICATIONS

- ASTROCAST

- GLOBALSTAR

- INMARSAT GLOBAL

- AIRBUS

- INTELSAT

- THALES

- EUTELSAT

- NORTHROP GRUMMAN

- THURAYA

- VODAFONE

- SURREY SATELLITE TECHNOLOGY

- HEAD AEROSPACE

- IMT SRL

- スタートアップ/中小企業

- FLEET SPACE TECHNOLOGIES

- ALEN SPACE

- SWARM TECHNOLOGIES

- OQ TECHNOLOGY

- FOSSA SYSTEMS

- KEPLER COMMUNICATIONS

- SATELIOT

- MYRIOTA

- KINEIS

- NANOAVIONICS

第13章 隣接/関連市場

- イントロダクション

- 制限事項

- 小型衛星市場

- 衛星通信 (SATCOM) 機器市場

第14章 付録

The satellite IoT market is projected to grow from USD 1.1 billion in 2022 to USD 2.9 billion by 2027, at a CAGR of 21.9% during the forecast period. The demand for LEO-based services, availability of funding, high-speed broadband, growth of governments in industrialized countries, and demand for low-cost broadband among consumers in less developed countries are driving the market for satellite IoT.

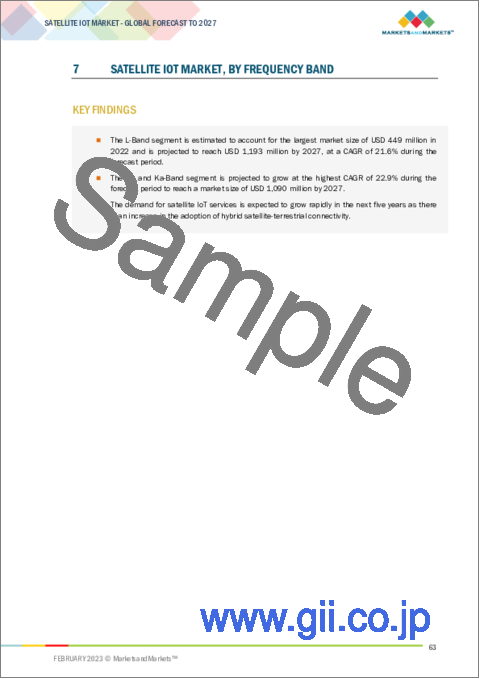

By frequency band, Ku-and Ka-band is expected to register the fastest growth rate during the forecast period.

The Ku-band frequency operates in a range between 10.7 GHz and 12.75 GHz and Ka-band frequency operates between 18GHz-40GHz. The Ku-band has a short-range and high-resolution imaging capabilities and is mainly used for satellite communications, especially downlink. The Ku-band frequency spectrum for satellite communication is primarily used for maritime VSAT services. This band is a more economical and flexible means for obtaining a high throughput on smaller reflector dishes due to its wider capacity and high availability. Eutelsat Communications Paris launched a satellite-based IoT connectivity service named 'Eutelsat IoT FIRST' operating in Ku-band via Eutelsat's geostationary satellites.

By organization size, large enterprises are to account for the largest market share during the forecast period.

Large enterprises are the early adopters of satellite IoT solutions and services. The adoption of satellite IoT among large enterprises is expected to increase in the coming years. With advancements in miniaturized technology, these satellites are useful for high precision and complex space missions, such as remote sensing and navigation, maritime and transport management, space and earth observations, disaster management, military intelligence, telecommunication, and other academic purposes. Constant innovation and technological advances in the miniaturization of electronics are expected to significantly boost large enterprises' growth in the proportion of satellite IoT launches.

Europe to register the highest CAGR during the forecast period.

Technological innovations in the satellite IoT ecosystem and their increased deployment are expected to fuel European market growth. The number of space exploration projects in the region is expected to increase over the next five years and is anticipated to trigger the demand for small satellites during the forecast period. The government is putting forth efforts to hasten the adoption of emerging technologies like AI, ML, automation, IoT, mobile and online applications, cloud-based services, and other technologies. The adoption of remote work practices by businesses has led to an increase in the need for cloud-based solutions and IoT devices, which is anticipated to fuel the expansion of the region's satellite IoT market.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the satellite IoT market.

- By Company Type: Tier I: 35%, Tier II: 40%, and Tier III: 25%

- By Designation: C-Level Executives: 35%, Directors: 25%, and Managers: 40%

- By Region: North America: 30%, Europe: 35%, Asia Pacific: 25%, Middle East & Africa: 5%, and Latin America: 5%

The report includes the study of key players offering satellite IoT services. It profiles major vendors in the satellite IoT market. The major vendors in the satellite IoT market include Orbcomm (US), Iridium Communication (US), Globalstar (US), Astrocast (Switzerland), Inmarsat Global (UK), Airbus (Netherlands), Intelsat (US), Thales (France), Eutelsat (France), Northrop Grumman (US), Thuraya (Singapore), Vodafone (UK), Surrey Satellite Technology (UK), Head Aerospace (China), I.M.T. SRL (Italy), Fleetspace Technologies (Australia), Swarm Technologies (US), Alenspace (Spain), OQ Technology (Luxembourg), Fossa Systems (Spain), Kepler Communications (Canada), Sateliot (Spain), Myriota (Australia), Kineis (France), and Nanoavionics (Lithuania).

Research Coverage

The market study covers the satellite IoT market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as by service type, frequency band, organization size, vertical, and regions. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall satellite IoT market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- FIGURE 1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2019-2021

- 1.6 STAKEHOLDERS

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key opinion leaders

- 2.1.2.2 Key participants

- 2.1.2.3 Breakup of primary interviews

- 2.1.2.4 Market data

- 2.1.2.5 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OFFERED BY SATELLITE IOT VENDORS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS AND SERVICES OFFERED BY SATELLITE IOT VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 3, TOP-DOWN APPROACH: DEMAND-SIDE ANALYSIS

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- TABLE 2 FACTOR ANALYSIS

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 8 SATELLITE IOT MARKET, 2020-2027

- FIGURE 9 SATELLITE IOT MARKET, REGIONAL SHARE, 2022

- FIGURE 10 EUROPE TO BE BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SATELLITE IOT MARKET

- FIGURE 11 GROWING DEMAND FOR HYBRID SATELLITE-TERRESTRIAL CONNECTIVITY AND DEVELOPMENT OF SATELLITE NETWORKS

- 4.2 SATELLITE IOT MARKET, BY KEY REGIONS AND VERTICALS

- FIGURE 12 NORTH AMERICA AND TRANSPORTATION AND LOGISTICS SEGMENT TO ACCOUNT FOR SIGNIFICANT SHARE IN 2022

- 4.3 EUROPE: SATELLITE IOT MARKET, BY ORGANIZATION SIZE AND COUNTRY

- FIGURE 13 UK AND LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR SIGNIFICANT SHARE IN 2022

- FIGURE 14 EUROPE TO WITNESS HIGHEST GROWTH BY 2027

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 SATELLITE IOT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising proliferation of LEO-based services to connect remote regions

- FIGURE 16 NUMBER OF SATELLITE IOT SUBSCRIBERS (MILLION), 2021-2027

- 5.2.1.2 Increasing development in satellite networks

- 5.2.1.3 Growing fleet of autonomous and connected vehicles

- 5.2.1.4 Increasing demand for hybrid satellite-terrestrial connectivity

- TABLE 3 KEY INFORMATION ON SATELLITE AND TERRESTRIAL CONNECTIVITY

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs associated with development and maintenance of satellite IoT

- 5.2.2.2 Stringent government regulations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising technological advancements

- 5.2.3.2 Growing use of small satellites for various applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Vulnerability of satellite IoT devices to cybersecurity attacks

- 5.2.4.2 High capital requirements

- 5.4 CUMULATIVE GROWTH ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 17 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- TABLE 4 ECOSYSTEM ANALYSIS

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 PORTER'S FIVE FORCES MODEL

- 5.7.1 THREAT FROM NEW ENTRANTS

- 5.7.2 THREAT FROM SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- 5.8.2 BUYING CRITERIA

- FIGURE 19 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 ARTIFICIAL INTELLIGENCE

- 5.9.2 INTERNET OF THINGS

- 5.9.3 DYNAMIC SPECTRUM ACCESS TECHNOLOGIES

- 5.9.4 ULTRA-HIGH FREQUENCY (UHF)

- 5.9.5 VERY HIGH FREQUENCY (VHF)

- 5.9.6 TRENDS AND DISRUPTIONS IMPACTING BUYERS

- FIGURE 20 REVENUE SHIFT FOR SATELLITE IOT MARKET

- 5.10 PATENT ANALYSIS

- 5.10.1 METHODOLOGY

- 5.10.2 DOCUMENT TYPE

- TABLE 8 PATENTS FILED, 2019-2022

- 5.10.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 21 NUMBER OF PATENTS GRANTED, 2019-2022

- 5.10.4 TOP APPLICANTS

- FIGURE 22 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019-2022

- 5.11 PRICING ANALYSIS

- TABLE 9 AVERAGE SELLING PRICING MODEL

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 CASE STUDY 1: PONCE UTILIZED ORBCOMM'S SOLUTIONS TO ACHIEVE EFFECTIVE IRRIGATION

- 5.12.2 CASE STUDY 2: ORATEK BROUGHT SATELLITE IOT CONNECTIVITY TO SENEGAL CLEAN WATER PROJECT

- 5.12.3 CASE STUDY 3: INMARSAT ENABLED REAL-TIME MONITORING FOR RWE'S HYDROELECTRIC POWER-GENERATING FACILITIES IN WALES

- 5.13 KEY CONFERENCES & EVENTS, 2022-2023

- TABLE 10 KEY CONFERENCES & EVENTS, 2022-2023

- 5.14 TARIFF AND REGULATORY IMPACT

- 5.14.1 SATCOM POLICY

- 5.14.2 ITU RADIO REGULATIONS

- 5.14.3 CENTRE NATIONAL D'ETUDES SPATIALES (CNES)

- 5.14.4 ASIA-PACIFIC SPACE COOPERATION ORGANIZATION

- 5.14.5 BRAZILIAN TELECOMMUNICATIONS AGENCY

- 5.14.6 FEDERAL COMMUNICATIONS COMMISSION (FCC)

- 5.14.7 SOUTH AFRICAN NATIONAL SPACE AGENCY (SANSA)

6 SATELLITE IOT MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- 6.1.1 SERVICE TYPES: SATELLITE IOT MARKET DRIVERS

- 6.1.2 SATELLITE IOT MARKET: RECESSION IMPACT

- FIGURE 23 DIRECT-TO-SATELLITE SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- TABLE 11 SATELLITE IOT MARKET, BY SERVICE TYPE, 2017-2021 (USD MILLION)

- TABLE 12 SATELLITE IOT MARKET, BY SERVICE TYPE, 2022-2027 (USD MILLION)

- 6.2 SATELLITE IOT BACKHAUL

- 6.2.1 RISING PREFERENCE FOR IOT GATEWAY BACKHAUL AS NEW SATCOM APPLICATION

- TABLE 13 SATELLITE IOT BACKHAUL: SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 14 SATELLITE IOT BACKHAUL: SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 DIRECT-TO-SATELLITE

- 6.3.1 GROWING NEED FOR ENHANCED SAFETY

- TABLE 15 DIRECT-TO-SATELLITE: SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 16 DIRECT-TO-SATELLITE: SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

7 SATELLITE IOT MARKET, BY FREQUENCY BAND

- 7.1 INTRODUCTION

- 7.1.1 FREQUENCY BANDS: SATELLITE IOT MARKET DRIVERS

- 7.1.2 SATELLITE IOT MARKET: RECESSION IMPACT

- FIGURE 24 KU AND KA-BAND SEGMENT TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 17 SATELLITE IOT MARKET, BY FREQUENCY BAND, 2017-2021 (USD MILLION)

- TABLE 18 SATELLITE IOT MARKET, BY FREQUENCY BAND, 2022-2027 (USD MILLION)

- 7.2 L-BAND

- 7.2.1 GROWING DEMAND FOR L-BAND FREQUENCY IN SPACE-BASED PLATFORMS

- TABLE 19 L-BAND: SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 20 L-BAND: SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 KU AND KA-BAND

- 7.3.1 RISING DEMAND FOR SHORT-RANGE AND HIGH-RESOLUTION IMAGING CAPABILITIES

- TABLE 21 KU AND KA-BAND: SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 22 KU AND KA-BAND: SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4 S-BAND

- 7.4.1 GROWING AWARENESS REGARDING COST-EFFECTIVE TRANSMISSION FREQUENCY BAND

- TABLE 23 S-BAND: SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 24 S-BAND: SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.5 OTHER BANDS

- TABLE 25 OTHER BANDS: SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 26 OTHER BANDS: SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

8 SATELLITE IOT MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- 8.1.1 ORGANIZATION SIZES: SATELLITE IOT MARKET DRIVERS

- 8.1.2 SATELLITE IOT MARKET: RECESSION IMPACT

- FIGURE 25 SMES SEGMENT TO ACCOUNT FOR HIGHER SHARE DURING FORECAST PERIOD

- TABLE 27 SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 28 SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 8.2 LARGE ENTERPRISES

- 8.2.1 RISING ADVANCEMENTS IN MINIATURIZED TECHNOLOGY

- TABLE 29 LARGE ENTERPRISES: SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 30 LARGE ENTERPRISES: SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 SMALL & MEDIUM-SIZED ENTERPRISES

- 8.3.1 RISING ADOPTION OF IOT TO REDUCE OPERATIONAL COSTS

- TABLE 31 SMES: SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 32 SMES: SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

9 SATELLITE IOT MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.1.1 VERTICALS: SATELLITE IOT MARKET DRIVERS

- 9.1.2 SATELLITE IOT MARKET: RECESSION IMPACT

- FIGURE 26 AGRICULTURE SEGMENT TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 33 SATELLITE IOT MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 34 SATELLITE IOT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 9.2 MARITIME

- 9.2.1 GROWING USE OF SATELLITE IOT TO TRACK SHIPPING CONTAINERS

- TABLE 35 MARITIME: SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 36 MARITIME: SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 OIL & GAS

- 9.3.1 INCREASING NEED TO IMPROVE SAFETY AND GUARANTEE FLEET COMPLIANCE

- TABLE 37 OIL & GAS: SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 38 OIL & GAS: SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4 TRANSPORTATION & LOGISTICS

- 9.4.1 LACK OF CONNECTIVITY IN TRANSPORTATION AND LOGISTICS

- TABLE 39 TRANSPORTATION & LOGISTICS: SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 40 TRANSPORTATION & LOGISTICS: SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5 ENERGY & UTILITIES

- 9.5.1 INSTALLATION OF SUSTAINABLE ENERGY SYSTEMS BY GOVERNMENT AND UTILITY COMPANIES

- TABLE 41 ENERGY & UTILITIES: SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 42 ENERGY & UTILITIES: SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.6 AGRICULTURE

- 9.6.1 GROWING NEED TO BOOST PRODUCTIVITY AND CROP YIELD

- TABLE 43 AGRICULTURE: SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 44 AGRICULTURE: SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.7 HEALTHCARE

- 9.7.1 SATELLITE IOT CONNECTIVITY FACILITATES EFFECTIVE DIAGNOSIS AND TREATMENT

- TABLE 45 HEALTHCARE: SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 46 HEALTHCARE: SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.8 MILITARY & DEFENSE

- 9.8.1 IOT TO IMPROVE SUCCESS RATES OF DEFENSE DUTIES

- TABLE 47 MILITARY & DEFENSE: SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 48 MILITARY & DEFENSE: SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.9 OTHER VERTICALS

- TABLE 49 OTHER VERTICALS: SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 50 OTHER VERTICALS: SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

10 SATELLITE IOT MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 27 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 28 EUROPE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 51 SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 52 SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- 10.2.2 NORTH AMERICA: PESTLE ANALYSIS

- FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 53 NORTH AMERICA: SATELLITE IOT MARKET, BY SERVICE TYPE, 2017-2021 (USD MILLION)

- TABLE 54 NORTH AMERICA: SATELLITE IOT MARKET, BY SERVICE TYPE, 2022-2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2017-2021 (USD MILLION)

- TABLE 56 NORTH AMERICA: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2022-2027 (USD MILLION)

- TABLE 57 NORTH AMERICA: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 58 NORTH AMERICA: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 59 NORTH AMERICA: SATELLITE IOT MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 60 NORTH AMERICA: SATELLITE IOT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: SATELLITE IOT MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 62 NORTH AMERICA: SATELLITE IOT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Growing use of satellite IoT in agriculture, maritime, transportation, and logistics

- TABLE 63 US: SATELLITE IOT MARKET, BY SERVICE TYPE, 2017-2021 (USD MILLION)

- TABLE 64 US: SATELLITE IOT MARKET, BY SERVICE TYPE, 2022-2027 (USD MILLION)

- TABLE 65 US: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2017-2021 (USD MILLION)

- TABLE 66 US: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2022-2027 (USD MILLION)

- TABLE 67 US: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 68 US: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 69 US: SATELLITE IOT MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 70 US: SATELLITE IOT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 Increased government funding and initiatives

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- 10.3.2 EUROPE: PESTLE ANALYSIS

- FIGURE 30 EUROPE: MARKET SNAPSHOT

- TABLE 71 EUROPE: SATELLITE IOT MARKET, BY SERVICE TYPE, 2017-2021 (USD MILLION)

- TABLE 72 EUROPE: SATELLITE IOT MARKET, BY SERVICE TYPE, 2022-2027 (USD MILLION)

- TABLE 73 EUROPE: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2017-2021 (USD MILLION)

- TABLE 74 EUROPE: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2022-2027 (USD MILLION)

- TABLE 75 EUROPE: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 76 EUROPE: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 77 EUROPE: SATELLITE IOT MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 78 EUROPE: SATELLITE IOT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 79 EUROPE: SATELLITE IOT MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 80 EUROPE: SATELLITE IOT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Government support to encourage development of satellite IoT

- TABLE 81 UK: SATELLITE IOT MARKET, BY SERVICE TYPE, 2017-2021 (USD MILLION)

- TABLE 82 UK: SATELLITE IOT MARKET, BY SERVICE TYPE, 2022-2027 (USD MILLION)

- TABLE 83 UK: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2017-2021 (USD MILLION)

- TABLE 84 UK: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2022-2027 (USD MILLION)

- TABLE 85 UK: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 86 UK: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 87 UK: SATELLITE IOT MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 88 UK: SATELLITE IOT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 Increase in demand for CubeSats

- 10.3.5 FRANCE

- 10.3.5.1 Governments' support for satellite IoT solutions

- 10.3.6 SPAIN

- 10.3.6.1 Increasing development through partnerships and contracts

- 10.3.7 ITALY

- 10.3.7.1 Active involvement of satellite IoT in Italian space agencies

- 10.3.8 NORDICS

- 10.3.8.1 Growing use of space infrastructure in promoting high-quality research

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- 10.4.2 ASIA PACIFIC: PESTLE ANALYSIS

- TABLE 89 ASIA PACIFIC: SATELLITE IOT MARKET, BY SERVICE TYPE, 2017-2021 (USD MILLION)

- TABLE 90 ASIA PACIFIC: SATELLITE IOT MARKET, BY SERVICE TYPE, 2022-2027 (USD MILLION)

- TABLE 91 ASIA PACIFIC: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2017-2021 (USD MILLION)

- TABLE 92 ASIA PACIFIC: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2022-2027 (USD MILLION)

- TABLE 93 ASIA PACIFIC: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 94 ASIA PACIFIC: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 95 ASIA PACIFIC: SATELLITE IOT MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 96 ASIA PACIFIC: SATELLITE IOT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 97 ASIA PACIFIC: SATELLITE IOT MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 98 ASIA PACIFIC: SATELLITE IOT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Government policies to attract satellite operators

- 10.4.4 JAPAN

- 10.4.4.1 Role of private space industry in government space programs

- 10.4.5 INDIA

- 10.4.5.1 Rising demand for observation and navigation satellites

- 10.4.6 AUSTRALIA & NEW ZEALAND

- 10.4.6.1 Government initiatives and supportive policies to defend against cybercrime

- 10.4.7 SOUTHEAST ASIA

- 10.4.7.1 Increasing investments in smart network infrastructure

- 10.4.8 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.5.2 MIDDLE EAST & AFRICA: PESTLE ANALYSIS

- TABLE 99 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY SERVICE TYPE, 2017-2021 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY SERVICE TYPE, 2022-2027 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2017-2021 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2022-2027 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5.3 MIDDLE EAST

- 10.5.3.1 Increasing private investments in space technology

- TABLE 109 MIDDLE EAST: SATELLITE IOT MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 110 MIDDLE EAST: SATELLITE IOT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.5.3.2 UAE

- 10.5.3.3 Saudi Arabia

- 10.5.3.4 Rest of Middle East

- 10.5.4 AFRICA

- 10.5.4.1 Emergence of small and easy-to-construct nanosatellites

- TABLE 111 AFRICA: SATELLITE IOT MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 112 AFRICA: SATELLITE IOT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.5.4.2 South Africa

- 10.5.4.3 Egypt

- 10.5.4.4 Nigeria

- 10.5.4.5 Rest of Africa

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: RECESSION IMPACT

- 10.6.2 LATIN AMERICA: PESTLE ANALYSIS

- TABLE 113 LATIN AMERICA: SATELLITE IOT MARKET, BY SERVICE TYPE, 2017-2021 (USD MILLION)

- TABLE 114 LATIN AMERICA: SATELLITE IOT MARKET, BY SERVICE TYPE, 2022-2027 (USD MILLION)

- TABLE 115 LATIN AMERICA: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2017-2021 (USD MILLION)

- TABLE 116 LATIN AMERICA: SATELLITE IOT MARKET, BY FREQUENCY BAND, 2022-2027 (USD MILLION)

- TABLE 117 LATIN AMERICA: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 118 LATIN AMERICA: SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 119 LATIN AMERICA: SATELLITE IOT MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 120 LATIN AMERICA: SATELLITE IOT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 121 LATIN AMERICA: SATELLITE IOT MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 122 LATIN AMERICA: SATELLITE IOT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 Rising need to deepen cooperation with India in space technologies

- 10.6.4 MEXICO

- 10.6.4.1 Collaborative studies and CubeSat launch initiatives by universities

- 10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2022

- TABLE 123 INTENSITY OF COMPETITIVE RIVALRY

- FIGURE 31 MARKET SHARE ANALYSIS, 2022

- 11.3 HISTORICAL REVENUE ANALYSIS

- FIGURE 32 HISTORICAL REVENUE ANALYSIS, 2019-2021

- 11.4 RANKING OF KEY PLAYERS

- FIGURE 33 RANKING OF KEY PLAYERS, 2022

- 11.5 EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 34 EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- 11.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 124 COMPANY FOOTPRINT, BY SERVICE TYPE

- TABLE 125 COMPANY FOOTPRINT, BY FREQUENCY BAND

- TABLE 126 COMPANY FOOTPRINT, BY REGION

- 11.7 EVALUATION QUADRANT FOR STARTUPS/SMES, 2022

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 35 EVALUATION QUADRANT FOR STARTUPS/SMES, 2022

- 11.8 COMPETITIVE BENCHMARKING FOR SMES/STARTUPS

- TABLE 127 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 128 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- 11.9 COMPETITIVE SCENARIO AND TRENDS

- 11.9.1 PRODUCT LAUNCHES

- TABLE 129 PRODUCT LAUNCHES, 2020-2022

- 11.9.2 DEALS

- TABLE 130 DEALS, 2020-2023

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

(Business overview, Solutions offered, Recent developments, MnM view, Key strengths, Strategic choices made, and Weaknesses and competitive threats)*

- 12.1.1 ORBCOMM

- TABLE 131 ORBCOMM: BUSINESS OVERVIEW

- TABLE 132 ORBCOMM: SOLUTIONS OFFERED

- TABLE 133 ORBCOMM: PRODUCT LAUNCHES

- TABLE 134 ORBCOMM: DEALS

- 12.1.2 IRIDIUM COMMUNICATIONS

- TABLE 135 IRIDIUM COMMUNICATIONS: BUSINESS OVERVIEW

- FIGURE 36 IRIDIUM COMMUNICATIONS: COMPANY SNAPSHOT

- TABLE 136 IRIDIUM COMMUNICATIONS: PRODUCTS/SERVICES OFFERED

- TABLE 137 IRIDIUM COMMUNICATIONS: PRODUCT LAUNCHES

- TABLE 138 IRIDIUM COMMUNICATIONS: DEALS

- 12.1.3 ASTROCAST

- TABLE 139 ASTROCAST: BUSINESS OVERVIEW

- TABLE 140 ASTROCAST: SOLUTIONS/SERVICES OFFERED

- TABLE 141 ASTROCAST: PRODUCT LAUNCHES

- TABLE 142 ASTROCAST: DEALS

- 12.1.4 GLOBALSTAR

- TABLE 143 GLOBALSTAR: BUSINESS OVERVIEW

- FIGURE 37 GLOBALSTAR: COMPANY SNAPSHOT

- TABLE 144 GLOBALSTAR: SOLUTIONS OFFERED

- TABLE 145 GLOBALSTAR: PRODUCT LAUNCHES

- TABLE 146 GLOBALSTAR: DEALS

- 12.1.5 INMARSAT GLOBAL

- TABLE 147 INMARSAT GLOBAL: BUSINESS OVERVIEW

- FIGURE 38 INMARSAT GLOBAL: COMPANY SNAPSHOT

- TABLE 148 INMARSAT GLOBAL: SOLUTIONS/SERVICES OFFERED

- TABLE 149 INMARSAT GLOBAL: DEALS

- 12.1.6 AIRBUS

- TABLE 150 AIRBUS: BUSINESS OVERVIEW

- FIGURE 39 AIRBUS: COMPANY SNAPSHOT

- TABLE 151 AIRBUS: SERVICES OFFERED

- TABLE 152 AIRBUS: DEALS

- 12.1.7 INTELSAT

- TABLE 153 INTELSAT: BUSINESS OVERVIEW

- FIGURE 40 INTELSAT: COMPANY SNAPSHOT

- TABLE 154 INTELSAT: SERVICES OFFERED

- TABLE 155 INTELSAT: DEALS

- 12.1.8 THALES

- TABLE 156 THALES: BUSINESS OVERVIEW

- FIGURE 41 THALES: COMPANY SNAPSHOT

- TABLE 157 THALES: PRODUCTS/SERVICES OFFERED

- TABLE 158 THALES: DEALS

- 12.1.9 EUTELSAT

- TABLE 159 EUTELSAT: BUSINESS OVERVIEW

- FIGURE 42 EUTELSAT: COMPANY SNAPSHOT

- TABLE 160 EUTELSAT: SOLUTIONS OFFERED

- TABLE 161 EUTELSAT: DEALS

- 12.1.10 NORTHROP GRUMMAN

- TABLE 162 NORTHROP GRUMMAN: BUSINESS OVERVIEW

- FIGURE 43 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- TABLE 163 NORTHROP GRUMMAN: PRODUCTS OFFERED

- TABLE 164 NORTHROP GRUMMAN: DEALS

- 12.1.11 THURAYA

- 12.1.12 VODAFONE

- 12.1.13 SURREY SATELLITE TECHNOLOGY

- 12.1.14 HEAD AEROSPACE

- 12.1.15 IMT SRL

- 12.2 STARTUPS/SMES

- 12.2.1 FLEET SPACE TECHNOLOGIES

- 12.2.2 ALEN SPACE

- 12.2.3 SWARM TECHNOLOGIES

- 12.2.4 OQ TECHNOLOGY

- 12.2.5 FOSSA SYSTEMS

- 12.2.6 KEPLER COMMUNICATIONS

- 12.2.7 SATELIOT

- 12.2.8 MYRIOTA

- 12.2.9 KINEIS

- 12.2.10 NANOAVIONICS

Details on Business overview, Solutions offered, Recent developments, MnM view, Key strengths, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 SMALL SATELLITE MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 SMALL SATELLITE MARKET, BY MASS

- TABLE 165 SMALL SATELLITE MARKET, BY MASS, 2018-2020 (USD MILLION)

- TABLE 166 SMALL SATELLITE MARKET, BY MASS, 2021-2026 (USD MILLION)

- 13.3.3 SMALL SATELLITE MARKET, BY SUBSYSTEM

- TABLE 167 SMALL SATELLITE MARKET, BY SUBSYSTEM, 2018-2020 (USD MILLION)

- TABLE 168 SMALL SATELLITE MARKET, BY SUBSYSTEM, 2021-2026 (USD MILLION)

- 13.4 SATELLITE COMMUNICATION (SATCOM) EQUIPMENT MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 SATELLITE COMMUNICATION (SATCOM) EQUIPMENT MARKET, BY SOLUTION

- TABLE 169 SATCOM EQUIPMENT MARKET, BY SOLUTION, 2017-2020 (USD MILLION)

- TABLE 170 SATCOM EQUIPMENT MARKET, BY SOLUTION, 2021-2026 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS