|

|

市場調査レポート

商品コード

1228978

自動車用OS (オペレーティングシステム) の世界市場:OSの種類別 (QNX、Android、Linux、Windows)・ICEの種類別 (PC、LCV、HCV)・EVの用途別 (バッテリー管理、充電管理)・地域別の将来予測 (2030年まで)Automotive Operating System Market by OS Type (QNX, Android, Linux, Windows), ICE Vehicle Type (PCs, LCVs, and HCVs), EV Application (Battery Management and Charging Management), Application and Region - Global Forecast to 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 自動車用OS (オペレーティングシステム) の世界市場:OSの種類別 (QNX、Android、Linux、Windows)・ICEの種類別 (PC、LCV、HCV)・EVの用途別 (バッテリー管理、充電管理)・地域別の将来予測 (2030年まで) |

|

出版日: 2023年02月22日

発行: MarketsandMarkets

ページ情報: 英文 291 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の自動車用OS (オペレーティングシステム) の市場規模は、2022年の127億米ドルから2030年には258億米ドルへと、9.2%のCAGRで成長する、と予測されています。

プレミアムカーへの需要増大やインフォテインメントシステムの進化が、予測期間中の市場成長を後押しすると期待されています。また、電気自動車 (EV) の販売台数の増加や、ソフトウェア定義縣自動車への関心増大は、今後の自動車用OS市場に新たな機会をもたらすでしょう。

用途別では、ADAS・セーフティシステム分野が予測期間中に最大のセグメントになると予想されます。特に北米・欧州では、政府の強力な設置義務により普及率が高くなっています。

地域別に見ると、北米は予測期間中に大きな成長を遂げると予想されます。その要因として、NAFTAによる貿易促進や、ビッグスリーなどの大手自動車メーカーの存在、高級車の販売台数の増加などが挙げられます。

OSの種類別では、予測期間中にLinux分野が有望な分野となることが予測されます。近い将来、エンジン制御ユニット、計器クラスター、組み込みテレマティクスシステム、先進運転支援システム (ADAS) など、幅広い分野でLinuxベースのOSが活用されると考えられています。

当レポートでは、世界の自動車用OSの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、OSの種類別・ICEの種類別・EVの用途別・用途別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 市場力学の影響

- 市場に影響を与える動向と混乱

- ポーターのファイブフォース分析

- 自動車用OS市場のエコシステム

- サプライチェーン分析

- マクロ経済指標

- 主要国のGDPの動向と予測

- 世界の自動車生産統計 (2021年)

- 特許分析

- ケーススタディ

- 規制の概要 (車載ソフトウェア)

- 主な会議とイベント (2023年)

第6章 業界動向

- テクノロジー

- イントロダクション

- 自動車ソフトウェア開発

- ECUとドメインコントローラー機能の統合

- 無線 (OTA) アップデート

- 自動車におけるAI

- 車載ソフトウェアのサイバーセキュリティ

- 自動運転におけるソフトウェアの必要性

- APIによる自動車業界の変革

- 自動車におけるOSS (オープンソースソフトウェア) の使用

- 自動車ソフトウェアのコンソーシアム

- 自動車用OSの市場シナリオ (2022年~2030年)

- 最も可能性の高いシナリオ

- 楽観的シナリオ

- 悲観的なシナリオ

- 自動車用OS市場に対する景気後退の影響:シナリオ分析

- 自動車業界への影響

第7章 自動車用OS市場:OSの種類別

- イントロダクション

- QNX

- Linux

- Android

- Windows

- その他

- 主な洞察

第8章 自動車用OS市場:ICE (内燃機関車) の種類別

- イントロダクション

- 乗用車

- 小型商用車

- 大型商用車

- 主な洞察

第9章 自動車用OS市場:EV (電気自動車) の用途別

- イントロダクション

- 充電管理システム

- バッテリー管理システム

- V2G

- 主な洞察

第10章 自動車用OS市場:用途別

- イントロダクション

- ADAS・安全システム

- 車体制御・快適性システム

- エンジン管理・パワートレイン

- インフォテインメントシステム

- 通信システム

- 車両管理・テレマティクス

- 自動運転

- コネクテッドサービス

- 主な洞察

第11章 自動車用OS市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- タイ

- 他のアジア太平洋諸国

- 欧州

- ドイツ

- イタリア

- フランス

- 英国

- スペイン

- 他の欧州諸国

- 北米

- 米国

- カナダ

- メキシコ

- ラテンアメリカ

- ブラジル

- アルゼンチン

- 他のラテンアメリカ諸国

- 他の国々 (RoW)

- イラン

- 南アフリカ

- その他

第12章 競合情勢

- 概要

- 市場ランキング分析

- 競合シナリオ

- 競合リーダーシップマッピング

- 競合リーダーシップマッピング (OEM)

第13章 企業プロファイル

- 主要企業

- BLACKBERRY LIMITED

- AUTOMOTIVE GRADE LINUX

- MICROSOFT CORPORATION

- APPLE INC.

- ALPHABET INC.

- GREEN HILLS SOFTWARE

- NVIDIA CORPORATION

- SIEMENS

- RED HAT, INC.

- WIND RIVER SYSTEMS, INC.

- その他の企業

- FORD MOTOR COMPANY

- TOYOTA MOTOR CORPORATION

- MERCEDES-BENZ GROUP AG

- VOLKSWAGEN AG

- BMW AG

- HONDA MOTOR CO., LTD.

- GENERAL MOTORS

- NISSAN MOTOR CO., LTD.

- TESLA, INC.

- TATA MOTORS

- SUZUKI MOTOR CORPORATION

- MAHINDRA & MAHINDRA LTD.

- STELLANTIS N.V.

- SAIC MOTOR CORPORATION LTD.

- VOLVO GROUP

第14章 MarketsandMarketsの提言

第15章 付録

The global automotive operating system market is projected to grow from USD 12.7 billion in 2022 to USD 25.8 billion by 2030, at a CAGR of 9.2%. Parameters such as increased demand for premium vehicles, along with growing advancement in infotainment systems are expected to bolster the revenue growth of the automotive operating system market during the forecast period. In addition, increasing sales of electric vehicles, paired with increasing focus inclination towards software-defined vehicles will create new opportunities for automotive operating system market during the forecast period.

"ADAS & safety system segment is expected to be the largest market during the forecast period, by application."

The ADAS & safety systems segment has the largest market share among all the applications in the automotive operating system market. According to primary inputs, ADAS & safety systems have higher penetration rates in North America and Europe due to the improved infrastructure and strong government mandates towards safety systems in these regions. Government mandates and increasing awareness about vehicle safety are expected to fuel the demand for ADAS & safety systems across the globe. The implementation of regulations regarding the safety of vehicles, such as the UN Regulation on Advanced Emergency Braking Systems (AEBS) for cars, is expected to significantly improve road safety. The regulation has laid down technical requirements for the approval of vehicle-to-vehicle (V2V) and vehicle-to-pedestrian AEBS fitted on cars. Furthermore, in March 2022, the National Highway Traffic Safety Administration (NHTSA) issued a final rule amending the Federal Motor Vehicle Safety Standards for accounting vehicles equipped with automated driving systems. The rule is limited to crashworthiness standards.

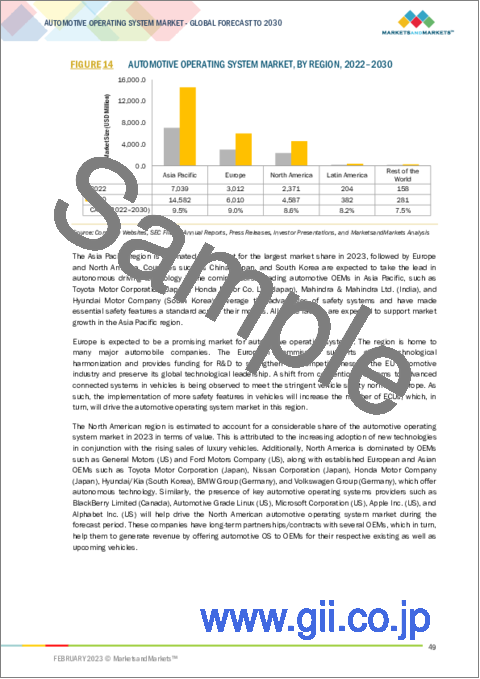

"North America is expected to have significant growth during the forecast period."

The North American region is expected to have significant growth during the forecast period. The countries considered for the North American region include the US, Canada, and Mexico. The North American automotive industry is one of the most advanced in the world. The North American Free Trade Agreement (NAFTA) has fostered the growth of the automotive industry in the region. Home to the big three-Ford Motors, General Motors, and Fiat Chrysler Automobiles, the automotive market in the US has favored passenger cars with advanced comfort and safety technologies. The consistent increase in the sales of luxury vehicles is likely to positively impact the demand for self-driving cars in North America. The large customer base and high disposable income levels in the region have fueled the demand for premium passenger cars. The increasing demand for autonomous driving and cruise control in premium vehicles would boost the market for automotive operating systems in this region.

"Linux segment is estimated to be the promising segment in the automotive operating system market during the forecast period"

Linux is expected to be the promising segment by operating system type during the forecast period. Linux is estimated to maintain its market position and witness steady growth in the automotive operating system market. Key automobile players using Linux include Baidu Inc. (China), Lyft (US), Mercedes-Benz (Germany), Honda Motor Co., Ltd. (Japan), Chevrolet (US), Toyota Motor Corporation (Japan), Volkswagen Group (Germany), General Motors (US), and BMW AG (Germany). As per automotive experts, automotive manufacturers/OEMs will be running Linux-based OS on several applications, such as engine-control units, instrument clusters, embedded telematics systems, and Advanced Driver-Assistance Systems (ADAS), in the near future. In May 2022, General Motors (US) collaborated with Red Hat Inc. (US), which is a well-known Linux company, to work on vehicle operating systems. With this collaboration, both companies intend to bring the era of open source to the automotive world, benefiting automotive manufacturers, ecosystem partners, and consumers, among others. All the aforementioned factors are expected to drive the demand for Linux-based operating systems during the forecast period.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 21%, Tier I - 31%, and Tier II - 48%

- By Designation: CXOs - 40%, Directors - 35%, and Others - 25%

- By Region: North America - 30%, Europe - 50%, Asia Pacific - 15%, and Rest of the World - 5%

The automotive operating system market is dominated by major players including BlackBerry Limited (Canada), Automotive Grade Linux (US), Microsoft Corporation (US), Apple Inc. (US), and Alphabet Inc. (US). These companies have strong product portfolio as well as strong distribution networks at the global level.

Research Coverage:

The report covers the automotive operating system market, in terms of Operating System Type (QNX, Linux, Windows, Android, and Others), ICE Vehicle Type (Passenger Cars, Light Commercial Vehicles and Heavy Commercial Vehicles), EV Application (Charging Management Systems, and Battery Management Systems), Application (ADAS & Safety Systems, Autonomous Driving, Body Control & Comfort Systems, Communication Systems, Connected Services, Infotainment Systems, Engine Management & Powertrain, and Vehicle Management & Telematics) and Region (Asia Pacific, Europe, North America, Latin America, and Rest of the World). It covers the competitive landscape and company profiles of the major players in the automotive operating system market ecosystem.

The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants in this market with information on the closest approximations of revenue numbers for the overall automotive operating system market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the pulse of the market and provides them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 AUTOMOTIVE OPERATING SYSTEM MARKET DEFINITION, BY OPERATING SYSTEM TYPE

- TABLE 2 AUTOMOTIVE OPERATING SYSTEM MARKET DEFINITION, BY ICE VEHICLE TYPE

- TABLE 3 AUTOMOTIVE OPERATING SYSTEM MARKET DEFINITION, BY APPLICATION

- TABLE 4 AUTOMOTIVE OPERATING SYSTEM MARKET DEFINITION, BY EV APPLICATION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 5 AUTOMOTIVE OPERATING SYSTEM MARKET: INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 MARKETS COVERED

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY & PRICING

- TABLE 6 USD EXCHANGE RATES

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AUTOMOTIVE OPERATING SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.2.1 List of primary participants

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 RECESSION IMPACT ANALYSIS

- 2.2.2 BOTTOM-UP APPROACH

- FIGURE 6 AUTOMOTIVE OPERATING SYSTEM MARKET SIZE: BOTTOM-UP APPROACH

- 2.2.3 TOP-DOWN APPROACH

- FIGURE 7 TOP-DOWN APPROACH: AUTOMOTIVE OPERATING SYSTEM MARKET

- FIGURE 8 MARKET ESTIMATION NOTES

- 2.2.4 GROWTH FORECAST

- FIGURE 9 AUTOMOTIVE OPERATING SYSTEM MARKET: RESEARCH DESIGN AND METHODOLOGY FOR ICE VEHICLES - DEMAND SIDE

- FIGURE 10 AUTOMOTIVE OPERATING SYSTEM MARKET: RESEARCH DESIGN AND METHODOLOGY FOR ELECTRIC VEHICLES - DEMAND SIDE

- 2.3 DATA TRIANGULATION

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- 2.4 FACTOR ANALYSIS

- FIGURE 12 FACTOR ANALYSIS: AUTOMOTIVE OPERATING SYSTEM MARKET

- 2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 7 VEHICLES WITH ADAS FEATURES IN INDIA

- FIGURE 13 AUTOMOTIVE OPERATING SYSTEM MARKET OVERVIEW

- FIGURE 14 AUTOMOTIVE OPERATING SYSTEM MARKET, BY REGION, 2022-2030

- FIGURE 15 AUTOMOTIVE OPERATING SYSTEM MARKET, BY OPERATING SYSTEM, 2022-2030

- FIGURE 16 KEY PLAYERS IN AUTOMOTIVE OPERATING SYSTEM MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE OPERATING SYSTEM MARKET

- FIGURE 17 INCREASING INCLINATION TOWARD ADAS TECHNOLOGY AND AUTONOMOUS MOBILITY TO DRIVE MARKET GROWTH

- 4.2 AUTOMOTIVE OPERATING SYSTEM MARKET, BY REGION

- FIGURE 18 ASIA PACIFIC PROJECTED TO BE LEADING MARKET (USD MILLION)

- 4.3 AUTOMOTIVE OPERATING SYSTEM MARKET, BY OPERATING SYSTEM TYPE

- FIGURE 19 QNX ESTIMATED TO BE DOMINANT SEGMENT (USD MILLION)

- 4.4 AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION

- FIGURE 20 ADAS & SAFETY SYSTEMS TO BE LARGEST SEGMENT (USD MILLION)

- 4.5 AUTOMOTIVE OPERATING SYSTEM MARKET, BY EV APPLICATION

- FIGURE 21 BATTERY MANAGEMENT SYSTEMS TO REMAIN DOMINANT SEGMENT (USD MILLION)

- 4.6 AUTOMOTIVE OPERATING SYSTEM MARKET, BY ICE VEHICLE TYPE

- FIGURE 22 PASSENGER CARS TO HOLD MAJOR SHARE, 2022 VS. 2030 (USD MILLION)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 AUTOMOTIVE OPERATING SYSTEM MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing advancements in infotainment systems

- 5.2.1.2 Increasing demand for rear-seat entertainment

- 5.2.1.3 Rising adoption of ADAS features

- FIGURE 24 ROAD TRAFFIC DEATHS FACT

- FIGURE 25 AUTONOMOUS LEVELS WITH REQUIRED ADAS FEATURES

- 5.2.1.4 Growing number of ECUs/domain controllers in vehicles

- TABLE 8 REQUIREMENT FOR AUTOMOTIVE OS

- FIGURE 26 DOMAIN CONTROLLER FUNCTIONALITY

- 5.2.1.5 Rising sales of luxury vehicles

- FIGURE 27 HNWI AND UHNWI, BY GEOGRAPHY

- FIGURE 28 LUXURY CAR MARKET GROWTH

- TABLE 9 TOP 25 COUNTRIES WITH HIGHEST LUXURY CAR DENSITY

- TABLE 10 LUXURY CAR SALES WORLDWIDE (THOUSAND UNITS) BY GERMAN BRANDS IN 2018, 2019, AND 2020

- TABLE 11 TOP 20 LUXURY CARS IN INDIA

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of seamless connectivity

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advent of software-defined vehicles

- FIGURE 29 DOMAIN EXPANSION IN AUTOMOTIVE SECTOR

- FIGURE 30 CONVENTIONAL VEHICLES VS SOFTWARE-DEFINED VEHICLES

- 5.2.3.2 Increasing focus on autonomous driving technology

- FIGURE 31 LEVELS OF AUTONOMOUS DRIVING

- TABLE 12 AUTONOMOUS DRIVING ATTEMPTS BY AUTOMAKERS

- TABLE 13 VEHICLES WITH LEVEL-2 & LEVEL-3 AUTONOMY (2017-2022)

- 5.2.3.3 Growing penetration of electric vehicles

- TABLE 14 BATTERY ELECTRIC VEHICLE SALES, BY COUNTRY, 2018-2021 (THOUSAND UNITS)

- TABLE 15 MAJOR AUTOMAKER ANNOUNCEMENTS ON ELECTRIFICATION, 2021-2022

- TABLE 16 PLUG-IN HYBRID ELECTRIC VEHICLE SALES, BY COUNTRY, 2018-2021 (THOUSAND UNITS)

- FIGURE 32 GLOBAL PHEV CAR STOCK, 2017-2021, BY REGION/COUNTRY

- TABLE 17 TESLA EV PRICES FOR 2023 (NEW PRICES)

- 5.2.4 CHALLENGES

- 5.2.4.1 Cybersecurity risk

- 5.2.5 IMPACT OF MARKET DYNAMICS

- TABLE 18 AUTOMOTIVE OPERATING SYSTEM MARKET: IMPACT OF MARKET DYNAMICS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING MARKET

- FIGURE 33 REVENUE SHIFT DRIVING AUTOMOTIVE OPERATING SYSTEM MARKET

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 PORTER'S FIVE FORCES: AUTOMOTIVE OPERATING SYSTEM MARKET

- TABLE 19 AUTOMOTIVE OPERATING SYSTEM MARKET: IMPACT OF PORTER'S FIVE FORCES

- 5.4.1 THREAT OF SUBSTITUTES

- 5.4.2 THREAT OF NEW ENTRANTS

- 5.4.3 BARGAINING POWER OF BUYERS

- 5.4.4 BARGAINING POWER OF SUPPLIERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 AUTOMOTIVE OPERATING SYSTEM MARKET ECOSYSTEM

- FIGURE 35 AUTOMOTIVE OPERATING SYSTEM MARKET: ECOSYSTEM ANALYSIS

- TABLE 20 AUTOMOTIVE OPERATING SYSTEM MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 36 SUPPLY CHAIN ANALYSIS OF AUTOMOTIVE OPERATING SYSTEM MARKET FOR AUTOMOTIVE OS

- 5.7 MACROECONOMIC INDICATORS

- 5.7.1 GDP TRENDS AND FORECASTS FOR MAJOR ECONOMIES

- TABLE 21 GDP TRENDS AND FORECASTS, BY MAJOR ECONOMIES, 2018-2026 (USD BILLION)

- 5.7.2 WORLD MOTOR VEHICLE PRODUCTION STATISTICS IN 2021

- TABLE 22 WORLD MOTOR VEHICLE PRODUCTION STATISTICS IN 2021 (THOUSAND UNITS)

- 5.8 PATENT ANALYSIS

- 5.8.1 INTRODUCTION

- TABLE 23 IMPORTANT PATENT REGISTRATIONS RELATED TO AUTOMOTIVE OPERATING SYSTEMS

- 5.9 CASE STUDY

- 5.9.1 QNX AND FREESCALE: DRIVING AUTOMOTIVE INFOTAINMENT

- 5.9.2 GREEN HILLS SOFTWARE DELIVERS SAFETY AND SECURITY FOR MAHINDRA RACING'S ALL-ELECTRIC FORMULA E RACE CAR

- 5.9.3 GREEN HILLS SOFTWARE'S INTEGRITY MULTI-VISOR POWERS MULTI-OS AUTOMOTIVE COCKPIT FOR MARELLI

- 5.10 REGULATORY OVERVIEW (AUTOMOTIVE SOFTWARE)

- 5.10.1 INTERNATIONAL STANDARDS FOR AUTOMOTIVE SOFTWARE QUALITY

- 5.10.1.1 Systems and software engineering: ISO/IEC 12207

- 5.10.1.2 Automotive SPICE: ISO/IEC 15504 and ISO/IEC 33001

- 5.10.1.3 Software engineering-product quality: ISO/IEC 9126 and ISO/IEC 25010:2011

- 5.10.1.4 Functional safety road vehicles: ISO 26262 and IEC 61508

- 5.10.2 LIST OF KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1 INTERNATIONAL STANDARDS FOR AUTOMOTIVE SOFTWARE QUALITY

- 5.11 KEY CONFERENCES AND EVENTS IN 2023

- TABLE 27 AUTOMOTIVE OPERATING SYSTEM MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 INDUSTRY TRENDS

- 6.1 TECHNOLOGY

- 6.1.1 INTRODUCTION

- 6.1.2 AUTOMOTIVE SOFTWARE DEVELOPMENT

- FIGURE 37 V-MODEL OF AUTOMOTIVE SOFTWARE DEVELOPMENT

- 6.1.2.1 Requirements analysis

- 6.1.2.2 System design

- 6.1.2.3 Component design

- 6.1.2.4 Implementation

- 6.1.2.5 Unit testing

- 6.1.2.6 Integration testing

- 6.1.2.7 System testing

- 6.1.3 CONSOLIDATION OF ECU AND DOMAIN-CONTROLLER FUNCTIONALITY

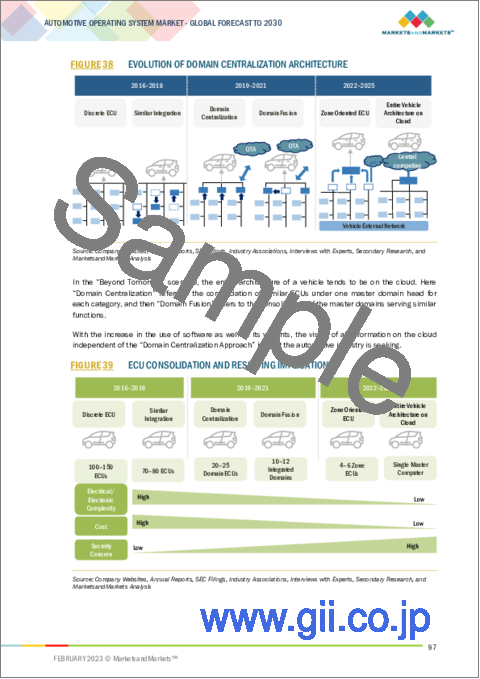

- FIGURE 38 EVOLUTION OF DOMAIN CENTRALIZATION ARCHITECTURE

- FIGURE 39 ECU CONSOLIDATION AND RESULTING IMPLICATIONS

- 6.1.4 OVER-THE-AIR (OTA) UPDATES

- 6.1.5 AI IN AUTOMOTIVE

- 6.1.6 CYBERSECURITY FOR IN-VEHICLE SOFTWARE

- FIGURE 40 DATA FROM AN AUTONOMOUS VEHICLE

- 6.1.7 NEED FOR SOFTWARE IN AUTONOMOUS DRIVING

- FIGURE 41 SOCIETY OF AUTOMOTIVE ENGINEERS AUTOMATION LEVELS

- 6.1.8 CHANGING AUTOMOTIVE INDUSTRY WITH APPLICATION PROGRAM INTERFACE (API)

- 6.1.9 USE OF OPEN SOURCE SOFTWARE (OSS) IN AUTOMOTIVE

- 6.2 AUTOMOTIVE SOFTWARE CONSORTIUMS

- 6.2.1 AUTOSAR

- FIGURE 42 3-LAYERED AUTOSAR SOFTWARE ARCHITECTURE

- 6.2.1.1 Basic software (BSW)

- 6.2.1.2 AUTOSAR runtime environment (RTE)

- 6.2.1.3 Application layer

- TABLE 28 BENEFITS OF AUTOSAR FOR CONSORTIUMS

- 6.3 AUTOMOTIVE OPERATING SYSTEM MARKET SCENARIOS (2022-2030)

- FIGURE 43 AUTOMOTIVE OPERATING SYSTEM MARKET - FUTURE TRENDS AND SCENARIOS, 2022-2030 (USD MILLION)

- 6.3.1 MOST LIKELY SCENARIO

- TABLE 29 MOST LIKELY SCENARIO, BY REGION, 2022-2030 (USD MILLION)

- 6.3.2 OPTIMISTIC SCENARIO

- TABLE 30 OPTIMISTIC SCENARIO, BY REGION, 2022-2030 (USD MILLION)

- 6.3.3 PESSIMISTIC SCENARIO

- TABLE 31 PESSIMISTIC SCENARIO, BY REGION, 2022-2030 (USD MILLION)

- 6.4 RECESSION IMPACT ON AUTOMOTIVE OPERATING SYSTEM MARKET - SCENARIO ANALYSIS

- 6.4.1 INTRODUCTION

- 6.4.2 REGIONAL MACRO-ECONOMIC OVERVIEW

- 6.4.3 ANALYSIS OF KEY ECONOMIC INDICATORS

- TABLE 32 KEY ECONOMIC INDICATORS FOR SELECT COUNTRIES, 2021-2022

- 6.4.4 ECONOMIC STAGFLATION (SLOWDOWN) VS. ECONOMIC RECESSION

- 6.4.4.1 Europe

- TABLE 33 EUROPE: KEY ECONOMIC INDICATORS, 2021-2023

- 6.4.4.2 Asia Pacific

- TABLE 34 ASIA PACIFIC: KEY ECONOMIC INDICATORS, 2021-2023

- 6.4.4.3 Americas

- TABLE 35 AMERICAS: KEY ECONOMIC INDICATORS, 2021-2023

- 6.4.5 ECONOMIC OUTLOOK/PROJECTIONS

- TABLE 36 GDP GROWTH PROJECTIONS FOR KEY COUNTRIES, 2024-2027 (% GROWTH)

- 6.5 IMPACT ON AUTOMOTIVE SECTOR

- 6.5.1 ANALYSIS OF AUTOMOTIVE VEHICLE SALES

- 6.5.1.1 Europe

- FIGURE 44 EUROPE: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021-2022

- 6.5.1.2 Asia Pacific

- FIGURE 45 ASIA PACIFIC: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021-2022

- 6.5.1.3 Americas

- FIGURE 46 AMERICAS: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021-2022

- 6.5.2 AUTOMOTIVE SALES OUTLOOK

- FIGURE 47 PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE PRODUCTION FORECAST, 2022 VS. 2027 (UNITS)

- 6.5.1 ANALYSIS OF AUTOMOTIVE VEHICLE SALES

7 AUTOMOTIVE OPERATING SYSTEM MARKET, BY OPERATING SYSTEM TYPE

- 7.1 INTRODUCTION

- FIGURE 48 QNX SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE, BY VALUE, IN 2022

- TABLE 37 AUTOMOTIVE OPERATING SYSTEM MARKET, BY OPERATING SYSTEM TYPE, 2018-2021 (USD MILLION)

- TABLE 38 AUTOMOTIVE OPERATING SYSTEM MARKET, BY OPERATING SYSTEM TYPE, 2022-2030 (USD MILLION)

- 7.1.1 ASSUMPTIONS

- TABLE 39 ASSUMPTIONS: OPERATING SYSTEM TYPE

- 7.1.2 RESEARCH METHODOLOGY

- 7.2 QNX

- 7.2.1 INCREASED ADOPTION OF QNX SOFTWARE BY OEMS TO SUPPORT MARKET GROWTH

- TABLE 40 QNX OPERATING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 41 QNX OPERATING SYSTEM MARKET, BY REGION, 2022-2030 (USD MILLION)

- 7.3 LINUX

- 7.3.1 OPEN SOURCE, EASY AVAILABILITY, AND COST-SAVING FEATURES TO DRIVE SEGMENT

- TABLE 42 LINUX OPERATING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 43 LINUX OPERATING SYSTEM MARKET, BY REGION, 2022-2030 (USD MILLION)

- 7.4 ANDROID

- 7.4.1 EASY AVAILABILITY AND ACCESS TO APPLICATIONS TO DRIVE SEGMENT

- TABLE 44 ANDROID OPERATING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 45 ANDROID OPERATING SYSTEM MARKET, BY REGION, 2022-2030 (USD MILLION)

- 7.5 WINDOWS

- 7.5.1 GROWING LINUX AND ANDROID OS PENETRATION EXPECTED TO LIMIT SEGMENT GROWTH

- TABLE 46 WINDOWS OPERATING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 47 WINDOWS OPERATING SYSTEM MARKET, BY REGION, 2022-2030 (USD MILLION)

- 7.6 OTHERS

- TABLE 48 OTHER OPERATING SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 49 OTHER OPERATING SYSTEMS MARKET, BY REGION, 2022-2030 (USD MILLION)

- 7.7 KEY PRIMARY INSIGHTS

8 AUTOMOTIVE OPERATING SYSTEM MARKET, BY ICE VEHICLE TYPE

- 8.1 INTRODUCTION

- FIGURE 49 PASSENGER CARS SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE, BY VALUE, IN 2022

- TABLE 50 AUTOMOTIVE OPERATING SYSTEM MARKET, BY ICE VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 51 AUTOMOTIVE OPERATING SYSTEM MARKET, BY ICE VEHICLE TYPE, 2022-2030 (USD MILLION)

- 8.1.1 ASSUMPTIONS

- TABLE 52 ASSUMPTIONS: ICE VEHICLE TYPE

- 8.1.2 RESEARCH METHODOLOGY

- 8.2 PASSENGER CARS

- 8.2.1 INCREASED INVESTMENT IN ADVANCED TECHNOLOGY TO AID GROWTH

- TABLE 53 PASSENGER CARS: AUTOMOTIVE OPERATING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 54 PASSENGER CARS: AUTOMOTIVE OPERATING SYSTEM MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 55 L2: LAUNCH OF NEW SELF-DRIVING CARS, 2021-2022

- 8.3 LIGHT COMMERCIAL VEHICLES

- 8.3.1 GROWING SALES OF HIGH-END LCVS TO DRIVE MARKET

- TABLE 56 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE OPERATING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 57 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE OPERATING SYSTEM MARKET, BY REGION, 2022-2030 (USD MILLION)

- 8.4 HEAVY COMMERCIAL VEHICLES

- 8.4.1 GROWING DEMAND FOR INFOTAINMENT SYSTEMS TO SUPPORT SEGMENT GROWTH

- TABLE 58 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE OPERATING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 59 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE OPERATING SYSTEM MARKET, BY REGION, 2022-2030 (USD MILLION)

- 8.5 KEY PRIMARY INSIGHTS

9 AUTOMOTIVE OPERATING SYSTEM MARKET, BY EV APPLICATION

- 9.1 INTRODUCTION

- FIGURE 50 BATTERY MANAGEMENT SYSTEMS SEGMENT ESTIMATED TO HOLD LARGER MARKET SHARE, BY VALUE, IN 2022

- TABLE 60 AUTOMOTIVE OPERATING SYSTEM MARKET, BY EV APPLICATION, 2018-2021 (USD MILLION)

- TABLE 61 AUTOMOTIVE OPERATING SYSTEM MARKET, BY EV APPLICATION, 2022-2030 (USD MILLION)

- 9.1.1 ASSUMPTIONS

- TABLE 62 ASSUMPTIONS: EV APPLICATION

- 9.1.2 RESEARCH METHODOLOGY

- 9.2 CHARGING MANAGEMENT SYSTEMS

- 9.2.1 GROWING NUMBER OF BEVS TO DRIVE SEGMENT

- TABLE 63 LEVEL 2 BEV CAR LAUNCHES, 2020-2022

- TABLE 64 CHARGING MANAGEMENT OPERATING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 65 CHARGING MANAGEMENT OPERATING SYSTEM MARKET, BY REGION, 2022-2030 (USD MILLION)

- 9.3 BATTERY MANAGEMENT SYSTEMS

- 9.3.1 NEED TO MAINTAIN RELIABILITY AND SAFETY TO DRIVE SEGMENT

- TABLE 66 BATTERY MANAGEMENT OPERATING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 67 BATTERY MANAGEMENT OPERATING SYSTEM MARKET, BY REGION, 2022-2030 (USD MILLION)

- 9.4 V2G

- 9.4.1 EMERGING TECHNOLOGY AND INCREASED EFFICIENCY TO DRIVE SEGMENT

- 9.5 KEY PRIMARY INSIGHTS

10 AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 51 ADAS & SAFETY SYSTEMS SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE, BY VALUE, IN 2022

- TABLE 68 AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 69 AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 10.1.1 OPERATIONAL DATA

- TABLE 70 EUROPEAN COMMISSION NEW SAFETY FEATURES IN CARS

- 10.1.2 ASSUMPTIONS

- TABLE 71 ASSUMPTIONS: APPLICATION

- 10.1.3 RESEARCH METHODOLOGY

- 10.2 ADAS & SAFETY SYSTEMS

- 10.2.1 GOVERNMENT FOCUS ON VEHICLE SAFETY TO DRIVE MARKET

- FIGURE 52 ADAS FEATURE OFFERING BY VEHICLE HARDWARE

- TABLE 72 ADAS & SAFETY OPERATING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 73 ADAS & SAFETY OPERATING SYSTEM MARKET, BY REGION, 2022-2030 (USD MILLION)

- 10.3 BODY CONTROL & COMFORT SYSTEMS

- 10.3.1 FOCUS ON PROVIDING COMFORT AND CONVENIENCE TO CONSUMERS TO BOOST MARKET

- TABLE 74 BODY CONTROL & COMFORT OPERATING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 75 BODY CONTROL & COMFORT OPERATING SYSTEM MARKET, BY REGION, 2022-2030 (USD MILLION)

- 10.4 ENGINE MANAGEMENT & POWERTRAIN

- 10.4.1 INCREASING EMISSION CONCERNS TO FUEL MARKET

- TABLE 76 ENGINE MANAGEMENT & POWERTRAIN OPERATING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 77 ENGINE MANAGEMENT & POWERTRAIN OPERATING SYSTEM MARKET, BY REGION, 2022-2030 (USD MILLION)

- 10.5 INFOTAINMENT SYSTEMS

- 10.5.1 GROWING ADOPTION OF INFOTAINMENT SYSTEMS IN PASSENGER AND COMMERCIAL VEHICLES

- TABLE 78 INFOTAINMENT OPERATING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 79 INFOTAINMENT OPERATING SYSTEM MARKET, BY REGION, 2022-2030 (USD MILLION)

- 10.6 COMMUNICATION SYSTEMS

- 10.6.1 INCREASING DEMAND FOR HIGH-END COMMUNICATION PLATFORMS TO RAISE MARKET GROWTH

- TABLE 80 COMMUNICATION OPERATING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 81 COMMUNICATION OPERATING SYSTEM MARKET, BY REGION, 2022-2030 (USD MILLION)

- 10.7 VEHICLE MANAGEMENT & TELEMATICS

- 10.7.1 INCREASING DEMAND FOR FLEET MANAGEMENT AND VEHICLE MONITORING TO DRIVE MARKET

- TABLE 82 VEHICLE MANAGEMENT & TELEMATICS OPERATING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 83 VEHICLE MANAGEMENT & TELEMATICS OPERATING SYSTEM MARKET, BY REGION, 2022-2030 (USD MILLION)

- 10.8 AUTONOMOUS DRIVING

- 10.8.1 RISING DEMAND FOR SELF-DRIVING CARS TO DRIVE MARKET

- TABLE 84 AUTONOMOUS DRIVING OPERATING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 85 AUTONOMOUS DRIVING OPERATING SYSTEM MARKET, BY REGION, 2022-2030 (USD MILLION)

- 10.9 CONNECTED SERVICES

- 10.9.1 OPTIMIZING VEHICLE MANAGEMENT AND FOCUS ON REAL-TIME SAFETY TO AMPLIFY MARKET

- TABLE 86 CONNECTED SERVICES OPERATING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 87 CONNECTED SERVICES OPERATING SYSTEM MARKET, BY REGION, 2022-2030 (USD MILLION)

- 10.10 KEY PRIMARY INSIGHTS

11 AUTOMOTIVE OPERATING SYSTEM MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 53 AUTOMOTIVE OPERATING SYSTEM MARKET, BY REGION, 2022 VS. 2030

- TABLE 88 AUTOMOTIVE OPERATING SYSTEM MARKET (ICE), BY REGION, 2018-2021 (USD MILLION)

- TABLE 89 AUTOMOTIVE OPERATING SYSTEM MARKET (ICE), BY REGION, 2022-2030 (USD MILLION)

- TABLE 90 AUTOMOTIVE OPERATING SYSTEM MARKET (EV), BY REGION, 2018-2021 (USD MILLION)

- TABLE 91 AUTOMOTIVE OPERATING SYSTEM MARKET (EV), BY REGION, 2022-2030 (USD MILLION)

- 11.2 ASIA PACIFIC

- FIGURE 54 ASIA PACIFIC: AUTOMOTIVE OPERATING SYSTEM MARKET SNAPSHOT

- TABLE 92 ASIA PACIFIC: AUTOMOTIVE OPERATING SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 93 ASIA PACIFIC: AUTOMOTIVE OPERATING SYSTEM MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- 11.2.1 CHINA

- 11.2.1.1 Developed V2X networking to drive market

- TABLE 94 C-V2X EQUIPPED VEHICLES LAUNCHED IN CHINA

- TABLE 95 NEW L2 LAUNCHES IN CHINA, 2021-2022

- TABLE 96 CHINA: VEHICLE LAUNCHES WITH ADAS FEATURES (2021-2022)

- TABLE 97 CHINA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 98 CHINA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.2.2 JAPAN

- 11.2.2.1 Standardization of ADAS features by Japanese OEMs to drive market

- TABLE 99 NEW L2 LAUNCHES IN JAPAN, 2021-2022

- TABLE 100 JAPAN: VEHICLE LAUNCHES WITH ADAS FEATURES (2021-2022)

- TABLE 101 JAPAN: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 102 JAPAN: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.2.3 SOUTH KOREA

- 11.2.3.1 Increasing adoption of L2 autonomous vehicles to support market growth

- TABLE 103 NEW L2 LAUNCHES IN SOUTH KOREA, 2020-2022

- TABLE 104 SOUTH KOREA: VEHICLE LAUNCHES WITH ADAS FEATURES (2021-2022)

- TABLE 105 SOUTH KOREA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 106 SOUTH KOREA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.2.4 INDIA

- 11.2.4.1 Increasing demand for connected services to support market growth

- TABLE 107 INDIA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 108 INDIA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.2.5 THAILAND

- 11.2.5.1 Increasing focus on ADAS to support market growth

- TABLE 109 THAILAND: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 110 THAILAND: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.2.6 REST OF ASIA PACIFIC

- TABLE 111 REST OF ASIA PACIFIC: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 112 REST OF ASIA PACIFIC: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.3 EUROPE

- FIGURE 55 EUROPE: AUTOMOTIVE OPERATING SYSTEM MARKET, 2022 VS. 2030 (USD MILLION)

- TABLE 113 EUROPE: AUTOMOTIVE OPERATING SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 114 EUROPE: AUTOMOTIVE OPERATING SYSTEM MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- 11.3.1 GERMANY

- 11.3.1.1 Strong demand for premium cars to drive market

- TABLE 115 LAUNCH/UNDERDEVELOPMENT OF SEMI-AUTONOMOUS CARS, 2021-2022

- TABLE 116 GERMANY: VEHICLE LAUNCHES WITH ADAS FEATURES (2021-2022)

- TABLE 117 GERMANY: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 118 GERMANY: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.3.2 ITALY

- 11.3.2.1 Focus on deployment of ADAS features by OEMs to drive market

- TABLE 119 ITALY: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 120 ITALY: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.3.3 FRANCE

- 11.3.3.1 Investments on autonomous mobility to support market growth

- TABLE 121 LAUNCH/UNDERDEVELOPMENT OF SEMI-AUTONOMOUS CARS, 2021-2023

- TABLE 122 FRANCE: VEHICLE LAUNCHES WITH ADAS FEATURES (2021-2022)

- TABLE 123 FRANCE: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 124 FRANCE: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.3.4 UK

- 11.3.4.1 Government focus on connected and autonomous vehicles to drive market

- TABLE 125 UK: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 126 UK: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 127 UK: VEHICLE LAUNCHES WITH ADAS FEATURES (2020-2022)

- 11.3.5 SPAIN

- 11.3.5.1 Growing traffic and safety concerns to drive market growth

- TABLE 128 SPAIN: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 129 SPAIN: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.3.6 REST OF EUROPE

- TABLE 130 REST OF EUROPE: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 131 REST OF EUROPE: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.4 NORTH AMERICA

- FIGURE 56 NORTH AMERICA: AUTOMOTIVE OPERATING SYSTEM MARKET SNAPSHOT

- TABLE 132 NORTH AMERICA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 133 NORTH AMERICA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- 11.4.1 US

- 11.4.1.1 Developments in autonomous driving to drive market

- TABLE 134 NORTH AMERICA: AUTONOMOUS VEHICLE EFFORTS

- TABLE 135 LAUNCH OF SEMI-AUTONOMOUS CARS, 2021-2023

- TABLE 136 US: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 137 US: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.4.2 CANADA

- 11.4.2.1 Focus on autonomous driving to support market growth

- TABLE 138 CANADA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 139 CANADA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.4.3 MEXICO

- 11.4.3.1 Increasing production of light trucks with telematics to drive market

- TABLE 140 MEXICO: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 141 MEXICO: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.5 LATIN AMERICA

- FIGURE 57 LATIN AMERICA: AUTOMOTIVE OPERATING SYSTEM MARKET SNAPSHOT

- TABLE 142 LATIN AMERICA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 143 LATIN AMERICA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- 11.5.1 BRAZIL

- 11.5.1.1 Adoption of advanced technologies to drive market growth

- TABLE 144 BRAZIL: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 145 BRAZIL: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.5.2 ARGENTINA

- 11.5.2.1 Rise in internet infrastructure to support market growth

- TABLE 146 ARGENTINA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 147 ARGENTINA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.5.3 REST OF LATIN AMERICA

- TABLE 148 REST OF LATIN AMERICA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 149 REST OF LATIN AMERICA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.6 REST OF THE WORLD

- FIGURE 58 REST OF THE WORLD: AUTOMOTIVE OPERATING SYSTEM MARKET SNAPSHOT

- TABLE 150 REST OF THE WORLD: AUTOMOTIVE OPERATING SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 151 REST OF THE WORLD: AUTOMOTIVE OPERATING SYSTEM MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- 11.6.1 IRAN

- 11.6.1.1 Penetration of ADAS and safety features to drive market

- TABLE 152 IRAN: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 153 IRAN: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.6.2 SOUTH AFRICA

- 11.6.2.1 Focus on autonomous driving to support market growth

- TABLE 154 SOUTH AFRICA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 155 SOUTH AFRICA: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- 11.6.3 OTHERS

- TABLE 156 OTHERS: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 157 OTHERS: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MARKET RANKING ANALYSIS

- FIGURE 59 AUTOMOTIVE OPERATING SYSTEM MARKET: MARKET RANKING 2022

- 12.3 COMPETITIVE SCENARIO

- TABLE 158 NEW PRODUCT LAUNCHES, 2022

- 12.3.1 DEALS

- TABLE 159 DEALS, 2021-2022

- 12.3.2 EXPANSIONS

- TABLE 160 EXPANSIONS, 2018

- 12.4 COMPETITIVE LEADERSHIP MAPPING

- 12.4.1 STARS

- 12.4.2 EMERGING LEADERS

- 12.4.3 PERVASIVE PLAYERS

- 12.4.4 PARTICIPANTS

- FIGURE 60 AUTOMOTIVE OPERATING SYSTEM MARKET: COMPETITIVE LEADERSHIP MAPPING, 2022

- TABLE 161 AUTOMOTIVE OPERATING SYSTEM MARKET: COMPANY FOOTPRINT, 2022

- TABLE 162 AUTOMOTIVE OPERATING SYSTEM MARKET: ICE VEHICLE TYPE FOOTPRINT, 2022

- TABLE 163 AUTOMOTIVE OPERATING SYSTEM MARKET: REGIONAL FOOTPRINT, 2022

- 12.5 COMPETITIVE LEADERSHIP MAPPING (OEMS)

- 12.5.1 PROGRESSIVE COMPANIES

- 12.5.2 RESPONSIVE COMPANIES

- 12.5.3 DYNAMIC COMPANIES

- 12.5.4 STARTING BLOCKS

- FIGURE 61 AUTOMOTIVE OPERATING SYSTEM MARKET: OEM EVALUATION QUADRANT, 2022

13 COMPANY PROFILES

- (Business overview, Products/Solutions offered, Recent Developments, MNM view)**

- 13.1 KEY PLAYERS

- 13.1.1 BLACKBERRY LIMITED

- TABLE 164 BLACKBERRY LIMITED: BUSINESS OVERVIEW

- FIGURE 62 BLACKBERRY LIMITED: COMPANY SNAPSHOT

- TABLE 165 BLACKBERRY LIMITED: PRODUCTS OFFERED

- TABLE 166 BLACKBERRY LIMITED: KEY CUSTOMERS

- TABLE 167 BLACKBERRY LIMITED: NEW PRODUCT DEVELOPMENTS

- TABLE 168 BLACKBERRY LIMITED: DEALS

- 13.1.2 AUTOMOTIVE GRADE LINUX

- TABLE 169 AUTOMOTIVE GRADE LINUX: BUSINESS OVERVIEW

- TABLE 170 AUTOMOTIVE GRADE LINUX: PRODUCTS OFFERED

- TABLE 171 AUTOMOTIVE GRADE LINUX: KEY CUSTOMERS

- TABLE 172 AUTOMOTIVE GRADE LINUX: DEALS

- 13.1.3 MICROSOFT CORPORATION

- TABLE 173 MICROSOFT CORPORATION: BUSINESS OVERVIEW

- FIGURE 63 MICROSOFT CORPORATION: COMPANY SNAPSHOT

- TABLE 174 MICROSOFT CORPORATION: PRODUCTS OFFERED

- TABLE 175 MICROSOFT CORPORATION: KEY CUSTOMERS/PARTNERS

- TABLE 176 MICROSOFT CORPORATION: DEALS

- 13.1.4 APPLE INC.

- TABLE 177 APPLE INC.: BUSINESS OVERVIEW

- FIGURE 64 APPLE INC.: COMPANY SNAPSHOT

- TABLE 178 APPLE INC.: PRODUCTS OFFERED

- TABLE 179 APPLE INC.: KEY CUSTOMERS

- TABLE 180 APPLE INC.: NEW PRODUCT DEVELOPMENTS

- 13.1.5 ALPHABET INC.

- TABLE 181 ALPHABET INC.: BUSINESS OVERVIEW

- FIGURE 65 ALPHABET INC.: COMPANY SNAPSHOT

- FIGURE 66 GOOGLE SERVICES REVENUE SHARE, BY TYPE (2021)

- TABLE 182 ALPHABET INC.: KEY AUTOMOTIVE CUSTOMERS

- TABLE 183 ALPHABET INC.: PRODUCTS OFFERED

- TABLE 184 ALPHABET INC.: DEALS

- 13.1.6 GREEN HILLS SOFTWARE

- TABLE 185 GREEN HILLS SOFTWARE: BUSINESS OVERVIEW

- TABLE 186 GREEN HILLS SOFTWARE: PRODUCTS OFFERED

- TABLE 187 GREEN HILLS SOFTWARE: THIRD-PARTY PARTNERS

- TABLE 188 GREEN HILLS SOFTWARE: NEW PRODUCT DEVELOPMENTS

- TABLE 189 GREEN HILLS SOFTWARE: DEALS

- TABLE 190 GREEN HILLS SOFTWARE: OTHERS

- 13.1.7 NVIDIA CORPORATION

- TABLE 191 NVIDIA CORPORATION: BUSINESS OVERVIEW

- FIGURE 67 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 NVIDIA CORPORATION'S REVENUE SHARE, BY SPECIALIZED MARKETS (2020)

- TABLE 192 NVIDIA CORPORATION: KEY AUTOMOTIVE CUSTOMERS

- FIGURE 69 NVIDIA DRIVE PARTNER ECOSYSTEM

- TABLE 193 NVIDIA CORPORATION: PRODUCTS OFFERED

- TABLE 194 NVIDIA CORPORATION: NEW PRODUCT DEVELOPMENTS

- TABLE 195 NVIDIA CORPORATION: DEALS

- 13.1.8 SIEMENS

- TABLE 196 SIEMENS: BUSINESS OVERVIEW

- FIGURE 70 SIEMENS: COMPANY SNAPSHOT

- TABLE 197 SIEMENS: PRODUCTS OFFERED

- 13.1.9 RED HAT, INC.

- TABLE 198 RED HAT, INC.: BUSINESS OVERVIEW

- TABLE 199 RED HAT, INC.: PRODUCTS OFFERED

- TABLE 200 RED HAT, INC.: DEALS

- 13.1.10 WIND RIVER SYSTEMS, INC.

- TABLE 201 WIND RIVER SYSTEMS, INC.: BUSINESS OVERVIEW

- TABLE 202 WIND RIVER SYSTEMS, INC.: PRODUCTS OFFERED

- TABLE 203 WIND RIVER SYSTEMS, INC.: DEALS

- 13.2 OTHER PLAYERS

- 13.2.1 FORD MOTOR COMPANY

- TABLE 204 FORD MOTOR COMPANY: BUSINESS OVERVIEW

- 13.2.2 TOYOTA MOTOR CORPORATION

- TABLE 205 TOYOTA MOTOR CORPORATION: BUSINESS OVERVIEW

- 13.2.3 MERCEDES-BENZ GROUP AG

- TABLE 206 MERCEDES-BENZ GROUP AG: BUSINESS OVERVIEW

- 13.2.4 VOLKSWAGEN AG

- TABLE 207 VOLKSWAGEN AG: BUSINESS OVERVIEW

- 13.2.5 BMW AG

- TABLE 208 BMW AG: BUSINESS OVERVIEW

- 13.2.6 HONDA MOTOR CO., LTD.

- TABLE 209 HONDA MOTOR CO., LTD.: BUSINESS OVERVIEW

- 13.2.7 GENERAL MOTORS

- TABLE 210 GENERAL MOTORS: BUSINESS OVERVIEW

- 13.2.8 NISSAN MOTOR CO., LTD.

- TABLE 211 NISSAN MOTOR CO., LTD.: BUSINESS OVERVIEW

- 13.2.9 TESLA, INC.

- TABLE 212 TESLA, INC.: BUSINESS OVERVIEW

- 13.2.10 TATA MOTORS

- TABLE 213 TATA MOTORS: BUSINESS OVERVIEW

- 13.2.11 SUZUKI MOTOR CORPORATION

- TABLE 214 SUZUKI MOTOR CORPORATION: BUSINESS OVERVIEW

- 13.2.12 MAHINDRA & MAHINDRA LTD.

- TABLE 215 MAHINDRA & MAHINDRA LTD.: BUSINESS OVERVIEW

- 13.2.13 STELLANTIS N.V.

- TABLE 216 STELLANTIS N.V.: BUSINESS OVERVIEW

- 13.2.14 SAIC MOTOR CORPORATION LTD.

- TABLE 217 SAIC MOTOR CORPORATION LTD.: BUSINESS OVERVIEW

- 13.2.15 VOLVO GROUP

- TABLE 218 VOLVO GROUP: BUSINESS OVERVIEW

- *Details on Business overview, Products/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 RECOMMENDATIONS BY MARKETSANDMARKETS

- 14.1 ASIA PACIFIC TO BE SIGNIFICANT MARKET FOR AUTOMOTIVE OPERATING SYSTEMS

- 14.2 ANDROID EXPECTED TO BE PROMISING SEGMENT

- 14.3 AUTONOMOUS DRIVING TO EMERGE AS KEY APPLICATION SEGMENT

- 14.4 CONCLUSION

15 APPENDIX

- 15.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS