|

|

市場調査レポート

商品コード

1740257

配電自動化の世界市場:提供別、通信技術別、ユーティリティ別、地域別 - 予測(~2030年)Distribution Automation Market by Offering, Communication Technology (Wired, Wireless), Utility, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 配電自動化の世界市場:提供別、通信技術別、ユーティリティ別、地域別 - 予測(~2030年) |

|

出版日: 2025年05月20日

発行: MarketsandMarkets

ページ情報: 英文 346 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の配電自動化の市場規模は、2025年の205億6,000万米ドルから2030年までに404億米ドルに達すると予測され、予測期間にCAGRで14.5%の成長が見込まれます。

市場の主な促進要因は、グリッドインフラの改良へのニーズと、電力のラストマイル接続を提供する政府の取り組みです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 金額(100万米ドル/10億米ドル)、数量(1,000台) |

| セグメント | 提供、通信技術、ユーティリティ |

| 対象地域 | 北米、アジア太平洋、欧州、南米、中東・アフリカ |

「提供別では、ソフトウェアが2025年~2030年に第2位の市場となります。」

ソフトウェアは、フィールドデバイスに次ぐ2番目に大きい市場セグメントになります。これは、スマートグリッドの運用、データアナリティクス、迅速な意思決定にソフトウェアが不可欠であるためです。ユーティリティがより多くのフィールドデバイスを利用するようになると、グリッドパフォーマンスをモニターし分析し最適化するためのソフトウェアプラットフォームも必要となります。先進配電管理システム(ADMS)、分析ツール、自動化ソフトウェアは、ユーティリティが故障を検出し、負荷を予測し、資産を管理し、システム全体の運用を向上させるのに役立ちます。現代の電力網の複雑化や、再生可能エネルギーと分散型エネルギー源の統合が、堅牢なソフトウェアソリューションへの需要を高めています。このため、配電網のデジタル化において、ソフトウェアは中核的な要素となっています。

「通信技術別では、無線が2025年~2030年に第2位の市場規模となります。」

無線セグメントが予測期間に2番目に大きいセグメントになると予測されます。柔軟性があり、費用対効果が高く拡張性の高いグリッド通信ソリューションのため、これを選択する人が増えています。有線システムは、その信頼性と稼働台数により、依然としてもっとも利用されています。しかし、無線技術は、特に遠隔モニタリング、移動人員の管理、手の届きにくい場所へのアクセス向けにますます普及しています。5G、LPWAN、メッシュネットワーキングの進歩により、無線通信はより信頼性の高い高速で安全なものとなり、従来の有線ネットワークを補完する魅力的なものとなっています。

「ユーティリティ別では、民間ユーティリティが2025年~2030年に急成長市場となります。」

ユーティリティ別では、民間ユーティリティセグメントが市場でより速く成長すると予測されます。民間ユーティリティは、再生可能エネルギーの利用、送電網の強化、カスタマーサービスをますます重視するようになっています。また、AI、IoT、ビッグデータアナリティクスなどのデジタル技術の採用も進んでいます。また、パートナーシップを結び新たな技術に投資することで、進化するスマートグリッドインフラの最前線の牽引役となりつつあります。

「北米が配電自動化市場で第2位の地域となります。」

北米は配電自動化市場で2番目に大きな地域です。米国とカナダのスマートグリッド技術とインフラ開発への高額な投資によって拡大しています。この地域は良好なインフラを有しており、配電自動化技術を最初に採用した地域の1つであるため、世界市場で突出しています。また、この地域は再生可能エネルギーとリアルタイムグリッド管理に対する需要が高く、自動化の推進を余儀なくされています。加えて、米国エネルギー省がグリッド近代化プロジェクトに105億米ドルを投資したことは、同地域がエネルギーインフラの改良に力を入れていることを示しています。これらはすべて、配電自動化市場において北米を重要な地域としている要因です。

当レポートでは、世界の配電自動化市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- 配電自動化市場の企業にとって魅力的な機会

- 配電自動化市場:地域別

- 配電自動化市場:提供別

- 配電自動化市場:通信技術別

- 配電自動化市場:ユーティリティ別

- アジア太平洋の配電自動化市場:提供別、国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- サプライチェーン分析

- フィールドデバイスメーカー

- ソフトウェアサプライヤー

- サービスプロバイダー

- 通信ネットワークプロバイダー

- グリッド運用者

- エコシステム分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- ケーススタディ分析

- 特許分析

- 貿易分析

- HSコード853641

- HSコード853649

- HSコード853650

- HSコード8532

- 価格分析

- 平均販売価格の動向:地域別

- 価格動向:タイプ別

- 主な会議とイベント(2025年~2026年)

- 規制情勢

- 規制機関、政府機関、その他の組織

- 規制

- 2025年の米国関税の影響 - 概要

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 投資と資金調達のシナリオ

- 配電自動化(DA)市場に対する生成AI/AIの影響

- 配電自動化市場のマクロ経済の見通し

- GDP

- 研究開発費

- 配電自動化への投資

- 電力・ユーティリティ部門の成長

第6章 通信配電自動化市場:技術別

- イントロダクション

- 有線通信技術

- 光ファイバー

- イーサネット

- 電力線搬送

- IP

- 無線通信技術

- RFメッシュ

- セルラーネットワーク

- WiMAX

第7章 配電自動化市場:提供別

- イントロダクション

- フィールドデバイス

- 遠隔故障表示器

- スマートリレー

- 自動フィーダースイッチ/リクローザー

- 自動コンデンサー

- 自動電圧レギュレーター

- 変圧器モニター

- フィーダーモニター

- 遠隔端末装置

- ソフトウェア

- サービス

第8章 配電自動化市場:ユーティリティ別

- イントロダクション

- 公共ユーティリティ

- 民間ユーティリティ

第9章 配電自動化市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 中東・アフリカ

- GCC諸国

- イラン

- 南アフリカ

- その他の中東・アフリカ

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年1月~2025年5月

- 市場シェア分析(2024年)

- 市場の評価フレームワーク(2020年~2024年)

- 収益分析(2020年~2024年)

- 企業の評価と財務指標(2024年)

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- ABB

- SIEMENS

- SCHNEIDER ELECTRIC

- EATON

- GE VERNOVA

- XYLEM

- TOSHIBA CORPORATION

- HITACHI ENERGY LTD.

- LANDIS+GYR

- ITRON INC.

- HUBBELL

- SCHWEITZER ENGINEERING LABORATORIES, INC.

- G&W ELECTRIC CO.

- S&C ELECTRIC COMPANY

- INGETEAM

- ZIV

- その他の企業

- MINSAIT ACS, INC.

- QUALUS

- KALKI COMMUNICATION TECHNOLOGIES PRIVATE LIMITED

- TRILLIANT HOLDINGS INC.

- ALFANAR GROUP

- RTDS TECHNOLOGIES INC AMETEK

- SSPOWER

- PROBUS SMART THINGS PVT. LTD.

- APDS AUTOMATION & POWER DISTRIBUTION SERVICES

第12章 付録

List of Tables

- TABLE 1 DISTRIBUTION AUTOMATION MARKET SNAPSHOT

- TABLE 2 ROLES OF COMPANIES IN DISTRIBUTION AUTOMATION ECOSYSTEM

- TABLE 3 LIST OF MAJOR PATENTS APPLIED/GRANTED, 2022-2024

- TABLE 4 EXPORT DATA FOR HS CODE 853641-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- TABLE 5 IMPORT DATA FOR HS CODE 853641-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- TABLE 6 EXPORT DATA FOR HS CODE 853649-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- TABLE 7 IMPORT DATA FOR HS CODE 853649-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD)

- TABLE 8 EXPORT DATA FOR HS CODE 853650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- TABLE 9 IMPORT DATA FOR HS CODE 853650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- TABLE 10 EXPORT DATA FOR HS CODE 8532-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- TABLE 11 IMPORT DATA FOR HS CODE 8532-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- TABLE 12 AVERAGE SELLING PRICE TREND OF DISTRIBUTION AUTOMATION FIELD DEVICES, BY REGION, 2020-2024 (USD)

- TABLE 13 INDICATIVE PRICING OF DISTRIBUTION AUTOMATION FIELD DEVICES, BY TYPE, 2024 (USD)

- TABLE 14 DISTRIBUTION AUTOMATION MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 DISTRIBUTION AUTOMATION MARKET: REGULATIONS

- TABLE 21 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 22 KEY PRODUCT-RELATED TARIFF EFFECTIVE DISTRIBUTION AUTOMATION

- TABLE 23 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END USER MARKET DUE TO TARIFF IMPACT

- TABLE 24 DISTRIBUTION AUTOMATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY UTILITY (%)

- TABLE 26 KEY BUYING CRITERIA, BY UTILITY

- TABLE 27 DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 28 DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 29 WIRED COMMUNICATION TECHNOLOGY: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 WIRED COMMUNICATION TECHNOLOGY: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 WIRED COMMUNICATION TECHNOLOGY: DISTRIBUTION AUTOMATION MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 32 WIRED COMMUNICATION TECHNOLOGY: DISTRIBUTION AUTOMATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 33 FIBER OPTICS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 FIBER OPTICS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 ETHERNET: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 ETHERNET: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 POWERLINE CARRIER: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 POWERLINE CARRIER: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 IP: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 IP: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 WIRELESS COMMUNICATION TECHNOLOGY: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 WIRELESS COMMUNICATION TECHNOLOGY: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 WIRELESS COMMUNICATION TECHNOLOGY: DISTRIBUTION AUTOMATION MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 44 WIRELESS COMMUNICATION TECHNOLOGY: DISTRIBUTION AUTOMATION MARKET SIZE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 45 RADIO FREQUENCY MESH: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 RADIO FREQUENCY MESH: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 CELLULAR NETWORK: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 CELLULAR NETWORK: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 WIMAX: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 WIMAX: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 DISTRIBUTION AUTOMATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 52 DISTRIBUTION AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 53 APPLICATION OF DIFFERENT FIELD DEVICES

- TABLE 54 FIELD DEVICES: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 FIELD DEVICES: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 FIELD DEVICES: DISTRIBUTION AUTOMATION MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 57 FIELD DEVICES: DISTRIBUTION AUTOMATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 58 FIELD DEVICES: DISTRIBUTION AUTOMATION MARKET, BY TYPE, 2020-2024 (THOUSAND UNITS)

- TABLE 59 FIELD DEVICES: DISTRIBUTION AUTOMATION MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 60 REMOTE FAULT INDICATORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 REMOTE FAULT INDICATORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 REMOTE FAULT INDICATORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (THOUSAND UNITS)

- TABLE 63 REMOTE FAULT INDICATORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 64 SMART RELAYS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 65 SMART RELAYS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 SMART RELAYS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (THOUSAND UNITS)

- TABLE 67 SMART RELAYS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 68 AUTOMATED FEEDER SWITCHES/RECLOSERS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 AUTOMATED FEEDER SWITCHES/RECLOSERS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 AUTOMATED FEEDER SWITCHES/RECLOSERS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (THOUSAND UNITS)

- TABLE 71 AUTOMATED FEEDER SWITCHES/RECLOSERS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 72 AUTOMATED CAPACITORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 AUTOMATED CAPACITORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 AUTOMATED CAPACITORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (THOUSAND UNITS)

- TABLE 75 AUTOMATED CAPACITORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 76 AUTOMATED VOLTAGE REGULATORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 AUTOMATED VOLTAGE REGULATORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 AUTOMATED VOLTAGE REGULATORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (THOUSAND UNITS)

- TABLE 79 AUTOMATED VOLTAGE REGULATORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 80 TRANSFORMER MONITORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 TRANSFORMER MONITORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 TRANSFORMER MONITORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (THOUSAND UNITS)

- TABLE 83 TRANSFORMER MONITORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 84 FEEDER MONITORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 FEEDER MONITORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 FEEDER MONITORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (THOUSAND UNITS)

- TABLE 87 FEEDER MONITORS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 88 REMOTE TERMINAL UNITS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 89 REMOTE TERMINAL UNITS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 REMOTE TERMINAL UNITS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (THOUSAND UNITS)

- TABLE 91 REMOTE TERMINAL UNITS: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 92 SOFTWARE: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 93 SOFTWARE: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 SERVICES: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 95 SERVICES: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 97 DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 98 PUBLIC UTILITIES: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 99 PUBLIC UTILITIES: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 PRIVATE UTILITIES: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 101 PRIVATE UTILITIES: DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 DISTRIBUTION AUTOMATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 103 DISTRIBUTION AUTOMATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 NORTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 105 NORTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 106 NORTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2020-2024 (USD MILLION)

- TABLE 107 NORTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2025-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2020-2024 (THOUSAND UNITS)

- TABLE 109 NORTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2025-2030 (THOUSAND UNITS)

- TABLE 110 NORTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 111 NORTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY WIRED COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 113 NORTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY WIRED COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY WIRELESS COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 115 NORTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY WIRELESS COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 117 NORTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 118 NORTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 119 NORTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 120 US: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 121 US: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 122 US: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 123 US: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 124 CANADA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 125 CANADA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 126 CANADA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 127 CANADA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 128 MEXICO: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 129 MEXICO: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 130 MEXICO: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 131 MEXICO: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 133 ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2020-2024 (USD MILLION)

- TABLE 135 ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2025-2030 (USD MILLION)

- TABLE 136 ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2020-2024 (THOUSAND UNITS)

- TABLE 137 ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2025-2030 (THOUSAND UNITS)

- TABLE 138 ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 139 ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY WIRED COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 141 ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY WIRED COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 142 ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY WIRELESS COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 143 ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY WIRELESS COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 145 ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 146 ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 147 ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 148 CHINA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 149 CHINA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 150 CHINA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 151 CHINA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 152 JAPAN: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 153 JAPAN: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 154 JAPAN: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 155 JAPAN: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 156 INDIA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 157 INDIA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 158 INDIA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 159 INDIA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 160 AUSTRALIA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 161 AUSTRALIA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 162 AUSTRALIA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 163 AUSTRALIA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 164 SOUTH KOREA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 165 SOUTH KOREA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 166 SOUTH KOREA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 167 SOUTH KOREA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 172 EUROPE: DISTRIBUTION AUTOMATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 173 EUROPE: DISTRIBUTION AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 174 EUROPE: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2020-2024 (USD MILLION)

- TABLE 175 EUROPE: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2025-2030 (USD MILLION)

- TABLE 176 EUROPE: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2020-2024 (THOUSAND UNITS)

- TABLE 177 EUROPE: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2025-2030 (THOUSAND UNITS)

- TABLE 178 EUROPE: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 179 EUROPE: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 180 EUROPE: DISTRIBUTION AUTOMATION MARKET, BY WIRED COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 181 EUROPE: DISTRIBUTION AUTOMATION MARKET, BY WIRED COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 182 EUROPE: DISTRIBUTION AUTOMATION MARKET, BY WIRELESS COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 183 EUROPE: DISTRIBUTION AUTOMATION MARKET, BY WIRELESS COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 184 EUROPE: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 185 EUROPE: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 186 EUROPE: DISTRIBUTION AUTOMATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 187 EUROPE: DISTRIBUTION AUTOMATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 188 GERMANY: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 189 GERMANY: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 190 GERMANY: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 191 GERMANY: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 192 FRANCE: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 193 FRANCE: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 194 FRANCE: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 195 FRANCE: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 196 ITALY: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 197 ITALY: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 198 ITALY: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 199 ITALY: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 200 UK: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 201 UK: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 202 UK: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 203 UK: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 204 REST OF EUROPE: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 205 REST OF EUROPE: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 206 REST OF EUROPE: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 207 REST OF EUROPE: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 208 SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 209 SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 210 SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2020-2024 (USD MILLION)

- TABLE 211 SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2025-2030 (USD MILLION)

- TABLE 212 SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2020-2024 (THOUSAND UNITS)

- TABLE 213 SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2025-2030 (THOUSAND UNITS)

- TABLE 214 SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 215 SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 216 SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY WIRED COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 217 SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY WIRED COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 218 SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY WIRELESS COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 219 SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY WIRELESS COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 220 SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 221 SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 222 SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 223 SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 224 BRAZIL: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 225 BRAZIL: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 226 BRAZIL: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 227 BRAZIL: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 228 ARGENTINA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 229 ARGENTINA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 230 ARGENTINA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 231 ARGENTINA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 232 REST OF SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 233 REST OF SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 234 REST OF SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 235 REST OF SOUTH AMERICA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2020-2024 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2025-2030 (USD MILLION)

- TABLE 240 MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2020-2024 (THOUSAND UNITS)

- TABLE 241 MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY FIELD DEVICES, 2025-2030 (THOUSAND UNITS)

- TABLE 242 MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY WIRED COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY WIRED COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 246 MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY WIRELESS COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY WIRELESS COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 251 MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 252 GCC COUNTRIES: DISTRIBUTION AUTOMATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 253 GCC COUNTRIES: DISTRIBUTION AUTOMATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 254 SAUDI ARABIA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 255 SAUDI ARABIA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 256 SAUDI ARABIA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 257 SAUDI ARABIA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 258 UAE: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 259 UAE: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 260 UAE: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 261 UAE: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 262 REST OF GCC COUNTRIES: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 263 REST OF GCC COUNTRIES: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 264 REST OF GCC COUNTRIES: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 265 REST OF GCC COUNTRIES: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 266 IRAN: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 267 IRAN: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 268 IRAN: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 269 IRAN: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 270 SOUTH AFRICA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 271 SOUTH AFRICA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 272 SOUTH AFRICA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 273 SOUTH AFRICA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 274 REST OF MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 275 REST OF MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 276 REST OF MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2020-2024 (USD MILLION)

- TABLE 277 REST OF MIDDLE EAST & AFRICA: DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2025-2030 (USD MILLION)

- TABLE 278 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2019-FEBRUARY 2025

- TABLE 279 DISTRIBUTION AUTOMATION MARKET: DEGREE OF COMPETITION, 2024

- TABLE 280 MARKET EVALUATION FRAMEWORK, 2020-2024

- TABLE 281 DISTRIBUTION AUTOMATION MARKET: REGION FOOTPRINT

- TABLE 282 DISTRIBUTION AUTOMATION MARKET: OFFERING FOOTPRINT

- TABLE 283 DISTRIBUTION AUTOMATION MARKET: COMMUNICATION TECHNOLOGY FOOTPRINT

- TABLE 284 DISTRIBUTION AUTOMATION MARKET: UTILITY FOOTPRINT

- TABLE 285 DISTRIBUTION AUTOMATION MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 286 DISTRIBUTION AUTOMATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 287 DISTRIBUTION AUTOMATION MARKET: PRODUCT LAUNCHES, JANUARY 2020-MAY 2025

- TABLE 288 DISTRIBUTION AUTOMATION MARKET: DEALS, JANUARY 2020-MAY 2025

- TABLE 289 DISTRIBUTION AUTOMATION MARKET: EXPANSIONS, JANUARY 2020-MAY 2025

- TABLE 290 DISTRIBUTION AUTOMATION MARKET: OTHER DEVELOPMENTS, JANUARY 2020-MAY 2025

- TABLE 291 ABB: COMPANY OVERVIEW

- TABLE 292 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 ABB: PRODUCT LAUNCHES

- TABLE 294 ABB: DEALS

- TABLE 295 ABB: OTHER DEVELOPMENTS

- TABLE 296 ABB: EXPANSIONS

- TABLE 297 SIEMENS: COMPANY OVERVIEW

- TABLE 298 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 SIEMENS: PRODUCT LAUNCHES

- TABLE 300 SIEMENS: DEALS

- TABLE 301 SIEMENS: OTHER DEVELOPMENTS

- TABLE 302 SIEMENS: EXPANSIONS

- TABLE 303 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 304 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 306 SCHNEIDER ELECTRIC: DEALS

- TABLE 307 SCHNEIDER ELECTRIC: OTHER DEVELOPMENTS

- TABLE 308 EATON: COMPANY OVERVIEW

- TABLE 309 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 EATON: PRODUCT LAUNCHES

- TABLE 311 EATON: DEALS

- TABLE 312 EATON: EXPANSIONS

- TABLE 313 GE VERNOVA: COMPANY OVERVIEW

- TABLE 314 GE VERNOVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 GE VERNOVA: PRODUCT LAUNCHES

- TABLE 316 GE VERNOVA: OTHER DEVELOPMENTS

- TABLE 317 XYLEM: COMPANY OVERVIEW

- TABLE 318 XYLEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 319 XYLEM: PRODUCT LAUNCHES

- TABLE 320 XYLEM: DEALS

- TABLE 321 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 322 TOSHIBA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 323 TOSHIBA CORPORATION: PRODUCT LAUNCHES

- TABLE 324 TOSHIBA CORPORATION: DEALS

- TABLE 325 TOSHIBA CORPORATION: OTHER DEVELOPMENTS

- TABLE 326 HITACHI ENERGY LTD.: COMPANY OVERVIEW

- TABLE 327 HITACHI ENERGY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 328 HITACHI ENERGY LTD.: PRODUCT LAUNCHES

- TABLE 329 HITACHI ENERGY LTD.: DEALS

- TABLE 330 HITACHI ENERGY LTD.: EXPANSIONS

- TABLE 331 HITACHI ENERGY LTD.: OTHER DEVELOPMENTS

- TABLE 332 LANDIS+GYR: COMPANY OVERVIEW

- TABLE 333 LANDIS+GYR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 LANDIS+GYR: DEALS

- TABLE 335 LANDIS+GYR: OTHER DEVELOPMENTS

- TABLE 336 ITRON INC.: COMPANY OVERVIEW

- TABLE 337 ITRON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 338 ITRON INC.: PRODUCT LAUNCHES

- TABLE 339 ITRON INC.: DEALS

- TABLE 340 ITRON INC.: OTHER DEVELOPMENTS

- TABLE 341 HUBBELL: COMPANY OVERVIEW

- TABLE 342 HUBBELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 343 HUBBELL: DEALS

- TABLE 344 SCHWEITZER ENGINEERING LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 345 SCHWEITZER ENGINEERING LABORATORIES, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 346 SCHWEITZER ENGINEERING LABORATORIES, INC.: PRODUCT LAUNCHES

- TABLE 347 SCHWEITZER ENGINEERING LABORATORIES, INC.: EXPANSIONS

- TABLE 348 G&W ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 349 G&W ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 350 G&W ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 351 G&W ELECTRIC CO.: DEALS

- TABLE 352 G&W ELECTRIC CO.: EXPANSIONS

- TABLE 353 S&C ELECTRIC COMPANY: COMPANY OVERVIEW

- TABLE 354 S&C ELECTRIC COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 355 S&C ELECTRIC COMPANY: DEALS

- TABLE 356 S&C ELECTRIC COMPANY: EXPANSIONS

- TABLE 357 INGETEAM: COMPANY OVERVIEW

- TABLE 358 INGETEAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 359 INGETEAM: OTHER DEVELOPMENTS

- TABLE 360 INGETEAM: EXPANSIONS

- TABLE 361 ZIV: COMPANY OVERVIEW

- TABLE 362 ZIV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 363 ZIV: PRODUCT LAUNCHES

- TABLE 364 ZIV: DEALS

List of Figures

- FIGURE 1 DISTRIBUTION AUTOMATION MARKET: SEGMENTATION

- FIGURE 2 DISTRIBUTION AUTOMATION MARKET: RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM PRIMARY SOURCES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 KEY METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR DISTRIBUTION AUTOMATION DEVICES

- FIGURE 7 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF DISTRIBUTION AUTOMATION DEVICES

- FIGURE 8 DISTRIBUTION AUTOMATION MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 FIELD DEVICES SEGMENT TO DOMINATE MARKET FROM 2025 TO 2030

- FIGURE 11 WIRED COMMUNICATION TECHNOLOGY SEGMENT TO HOLD LARGER MARKET SHARE IN 2025

- FIGURE 12 PUBLIC UTILITIES SEGMENT TO DOMINATE MARKET FROM 2025 TO 2030

- FIGURE 13 ASIA PACIFIC HELD LARGEST MARKET SHARE OF GLOBAL DISTRIBUTION AUTOMATION MARKET IN 2024

- FIGURE 14 NEED FOR IMPROVED GRID INFRASTRUCTURE & GOVERNMENT INITIATIVES TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 15 MIDDLE EAST & AFRICA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 FIELD DEVICES SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 17 WIRED COMMUNICATION TECHNOLOGY SEGMENT TO LEAD MARKET IN 2030

- FIGURE 18 PUBLIC UTILITIES SEGMENT TO COMMAND MARKET IN 2030

- FIGURE 19 FIELD DEVICES SEGMENT AND CHINA HELD LARGEST MARKET SHARES OF ASIA PACIFIC IN 2024

- FIGURE 20 DISTRIBUTION AUTOMATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 22 DISTRIBUTION AUTOMATION MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 DISTRIBUTION AUTOMATION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 NUMBER OF PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 25 EXPORT DATA FOR HS CODE 853641-COMPLIANT PRODUCTS, BY COUNTRY 2020-2024 (USD)

- FIGURE 26 IMPORT DATA FOR HS CODE 853641-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- FIGURE 27 EXPORT DATA FOR HS CODE 853649-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- FIGURE 28 IMPORT DATA FOR HS CODE 853649-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- FIGURE 29 EXPORT DATA FOR HS CODE 853650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- FIGURE 30 IMPORT DATA FOR HS CODE 853650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- FIGURE 31 EXPORT DATA FOR HS CODE 8532-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- FIGURE 32 IMPORT DATA FOR HS CODE 8532-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD)

- FIGURE 33 DISTRIBUTION AUTOMATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY UTILITY

- FIGURE 35 KEY BUYING CRITERIA, BY UTILITY

- FIGURE 36 INVESTMENT AND FUNDING SCENARIO

- FIGURE 37 IMPACT OF AI ON SUPPLY CHAIN OF DISTRIBUTION AUTOMATION MARKET

- FIGURE 38 DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY, 2024

- FIGURE 39 DISTRIBUTION AUTOMATION MARKET, BY OFFERING, 2024

- FIGURE 40 DISTRIBUTION AUTOMATION MARKET, BY UTILITY, 2024

- FIGURE 41 MIDDLE EAST & AFRICA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 DISTRIBUTION AUTOMATION MARKET SHARE, BY REGION, 2024

- FIGURE 43 NORTH AMERICA: DISTRIBUTION AUTOMATION MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: DISTRIBUTION AUTOMATION MARKET SNAPSHOT

- FIGURE 45 DISTRIBUTION AUTOMATION MARKET SHARE ANALYSIS, 2024

- FIGURE 46 DISTRIBUTION AUTOMATION MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 47 DISTRIBUTION AUTOMATION MARKET: COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 48 DISTRIBUTION AUTOMATION MARKET: FINANCIAL METRICS

- FIGURE 49 BRAND/PRODUCT COMPARISON

- FIGURE 50 DISTRIBUTION AUTOMATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 51 DISTRIBUTION AUTOMATION MARKET: PRODUCT FOOTPRINT

- FIGURE 52 DISTRIBUTION AUTOMATION MARKET: MARKET FOOTPRINT

- FIGURE 53 DISTRIBUTION AUTOMATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 54 ABB: COMPANY SNAPSHOT

- FIGURE 55 SIEMENS: COMPANY SNAPSHOT

- FIGURE 56 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 57 EATON: COMPANY SNAPSHOT

- FIGURE 58 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 59 XYLEM: COMPANY SNAPSHOT

- FIGURE 60 TOSHIBA CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 HITACHI ENERGY LTD.: COMPANY SNAPSHOT

- FIGURE 62 LANDIS+GYR: COMPANY SNAPSHOT

- FIGURE 63 ITRON INC.: COMPANY SNAPSHOT

- FIGURE 64 HUBBELL: COMPANY SNAPSHOT

The distribution automation market is estimated to grow from USD 20.56 billion in 2025 to USD 40.40 billion by 2030, at a CAGR of 14.5% during the forecast period. The market is primarily driven by the need for improved grid infrastructure and governmental initiatives to provide last-mile connectivity of electricity.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Segments | By Offering, By Communication Technology, and By Utility |

| Regions covered | North America, Asia Pacific, Europe, South America, and the Middle East & Africa. |

"Software, by offering, to be the second-largest market from 2025 to 2030"

The distribution automation market, by offering, is divided into field devices, software, and services. Software will be the second-largest distribution automation market segment after field devices. This is due to the fact that software is highly essential in the operation of smart grids, data analysis, and quick decision-making. As utility companies make use of more field devices, they also require software platforms to monitor, analyze, and optimize the grid performance. Advanced distribution management systems (ADMS), analysis tools, and automation software help utility companies detect faults, forecast loads, manage assets, and make the whole system operate better. The growing complexity of contemporary power grids and the integration of renewable and distributed energy sources raise the demand for robust software solutions. This makes software a core element in digitizing distribution networks.

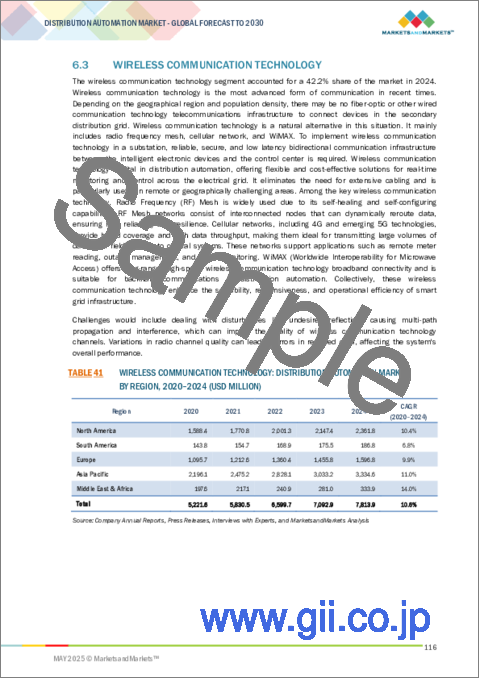

"Wireless, by communication technology, to be the second-largest market from 2025 to 2030"

The distribution automation market, by communication technology, is segmented into wired and wireless. The wireless segment is expected to be the second-largest segment during the forecast period. More people are opting for it due to flexible, cost-effective, and scalable grid communication solutions. Wired systems remain the most utilized due to their reliability and installed base. Wireless technologies are, however, becoming increasingly popular, particularly for remote monitoring, managing mobile personnel, and accessing hard-to-reach locations. Advances in 5G, LPWAN, and mesh networking have made wireless communications more reliable, faster, and secure, and thus an appealing complement to traditional wired networks.

"Private utilities, by utility, to be a faster-growing market from 2025 to 2030"

The distribution automation market, by utility, is bifurcated into public utilities and private utilities. The private utilities segment is expected to grow at a faster rate in the distribution automation market by utility. Private utilities are increasingly emphasizing the use of renewable energy, grid strengthening, and customer service. They are increasingly adopting digital technologies such as AI, IoT, and big data analytics. By forming partnerships and investing in emerging technologies, they are becoming frontline drivers of the evolving smart grid infrastructure.

"North America to be the second-largest region in the distribution automation market"

North America is the second-largest distribution automation market. It is expanding owing to high investments in smart grid technologies and infrastructure development in the US and Canada. The region has good infrastructure and was one of the first regions to adopt distribution automation technologies, thereby making it prominent in the global market. The region also has a high demand for renewable energy and real-time grid management, which is forcing more automation. Moreover, the US Department of Energy's investment of USD 10.5 billion in grid modernization projects indicates the region's efforts towards improving its energy infrastructure. These are all contributing factors making North America an important player in the distribution automation market.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 65%, Tier 2- 24%, and Tier 3- 11%

By Designation: C-Level- 30%, Director Level- 25%, and Others- 45%

By Region: North America - 20%, Europe - 25%, Asia Pacific - 30%, South America - 10%, and Middle East & Africa - 15%

Note: Other designations include sales managers, marketing managers, product managers, and product engineers.

The tier of the companies is defined based on their total revenue as of 2024. Tier 1: USD 1 billion and above, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: <USD 500 million.

The distribution automation market is dominated by a few major players that have a wide regional presence. The leading players in the distribution automation market are ABB (Switzerland), Schneider Electric (France), Siemens (Germany), Eaton (Ireland), and GE Vernova (US).

Research Coverage:

The report defines, describes, and forecasts the distribution automation market by offering, communication technology, utility, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market, which include the analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the distribution automation market.

Key Benefits of Buying the Report

The report provides many valuable insights. A few of them are listed below.

- Governmental initiatives to provide last-mile connectivity of electricity and boost the smart grid infrastructure are a few of the key factors driving the distribution automation market. Factors such as high installation costs of distribution automation systems restrain the growth of the market. The need for greater flexibility and control in electricity supply is expected to present lucrative opportunities for the players operating in the distribution automation market. The threats posed by the lack of skilled personnel and the increasing threat of automated cyber-attacks pose a major challenge for the players, especially for emerging players operating in the distribution automation market.

- Product Development/ Innovation: GE Vernova's Grid Solutions business launched GridBeats, a portfolio of software-defined automation solutions aimed at streamlining grid digitalization and enhancing grid resilience.

- Market Development: ABB announced that it has signed an agreement to acquire the power electronics division of Gamesa Electric in Spain from Siemens Gamesa, aiming to enhance its position in high-power renewable energy conversion technologies. It will expand ABB's engineering depth for power conversion and grid connection.

- Market Diversification: Schneider Electric invests USD 700 million to support the growing US digitalization, automation, and manufacturing demand, marking the company's largest single capital expenditure commitment in its 135-year history.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, including ABB (Switzerland), Schneider Electric (France), Siemens (Germany), Eaton (Ireland), and GE Vernova (US), among others in the distribution automation market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND GEOGRAPHIC SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.2 SECONDARY RESEARCH

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of major secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 List of key primary interview participants

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Breakdown of primaries

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 DEMAND-SIDE ANALYSIS

- 2.4.1 DEMAND-SIDE METRICS

- 2.4.1.1 Assumptions for demand-side analysis

- 2.4.1.2 Calculations for demand-side analysis

- 2.4.1 DEMAND-SIDE METRICS

- 2.5 SUPPLY-SIDE ANALYSIS

- 2.5.1 SUPPLY-SIDE METRICS

- 2.5.1.1 Assumptions for supply-side analysis

- 2.5.1.2 Calculations for supply-side analysis

- 2.5.1 SUPPLY-SIDE METRICS

- 2.6 DATA TRIANGULATION

- 2.7 FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DISTRIBUTION AUTOMATION MARKET

- 4.2 DISTRIBUTION AUTOMATION MARKET, BY REGION

- 4.3 DISTRIBUTION AUTOMATION MARKET, BY OFFERING

- 4.4 DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY

- 4.5 DISTRIBUTION AUTOMATION MARKET, BY UTILITY

- 4.6 DISTRIBUTION AUTOMATION MARKET IN ASIA PACIFIC, BY OFFERING AND COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Reliance on smart grid networks to meet burgeoning energy demand

- 5.2.1.2 Government-led initiatives to ensure universal access to electricity

- 5.2.2 RESTRAINTS

- 5.2.2.1 High upfront and installation costs

- 5.2.2.2 Issues in existing switchgear modernization

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising electrification using renewable energy sources

- 5.2.3.2 Rapid advancement in AI and IoT technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Increased rate of false data injection attacks

- 5.2.4.2 Compatibility issues due to lack of standardized communication protocols

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.4.1 FIELD DEVICE MANUFACTURERS

- 5.4.2 SOFTWARE SUPPLIERS

- 5.4.3 SERVICE PROVIDERS

- 5.4.4 COMMUNICATION NETWORK PROVIDERS

- 5.4.5 GRID OPERATORS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Distribution automation controllers (DACs)

- 5.6.1.2 Advanced metering infrastructure (AMI)

- 5.6.1.3 Distribution management systems (DMS)

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Internet of Things (IoT) sensors and devices

- 5.6.2.2 Cybersecurity solutions

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Artificial intelligence & machine learning (AI/ML)

- 5.6.1 KEY TECHNOLOGIES

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 US DOE GRANTS CHATTANOOGA ELECTRIC POWER BOARD CONTRACT TO DEPLOY SMART GRID TECHNOLOGIES FOR TRANSFORMERS

- 5.7.2 CHATTANOOGA ELECTRIC POWER BOARD IMPLEMENTS DISTRIBUTION AUTOMATION TECHNOLOGIES FOR RAPID FAULT DETECTION AND ISOLATION IN UNDERGROUND DISTRIBUTION SYSTEM

- 5.7.3 TATA POWER DELHI DISTRIBUTION LIMITED ADOPTS AUTOMATED SOLUTIONS TO IMPROVE EFFICIENCY AND REDUCE AGGREGATE TECHNICAL AND COMMERCIAL LOSSES

- 5.7.4 ENHANCING GRID RESILIENCE AND SAFETY: SA POWER NETWORKS' JOURNEY WITH SCHNEIDER ELECTRIC'S ECOSTRUXURE DISTRIBUTION AUTOMATION

- 5.8 PATENT ANALYSIS

- 5.8.1 LIST OF PATENTS

- 5.9 TRADE ANALYSIS

- 5.9.1 HS CODE 853641

- 5.9.1.1 Export scenario

- 5.9.1.2 Import scenario

- 5.9.2 HS CODE 853649

- 5.9.2.1 Export scenario

- 5.9.2.2 Import scenario

- 5.9.3 HS CODE 853650

- 5.9.3.1 Export scenario

- 5.9.3.2 Import scenario

- 5.9.4 HS CODE 8532

- 5.9.4.1 Export scenario

- 5.9.4.2 Import scenario

- 5.9.1 HS CODE 853641

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.10.2 INDICATIVE PRICING TREND, BY TYPE

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATIONS

- 5.13 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.13.1 INTRODUCTION

- 5.13.2 KEY TARIFF RATES

- 5.13.3 PRICE IMPACT ANALYSIS

- 5.13.4 IMPACT ON COUNTRY/REGION

- 5.13.4.1 US

- 5.13.4.2 Europe

- 5.13.4.2.1 European manufacturer strategies

- 5.13.4.3 Asia Pacific

- 5.13.4.3.1 Asia Pacific manufacturer strategies

- 5.13.5 IMPACT ON END-USE INDUSTRY

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF SUBSTITUTES

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF NEW ENTRANTS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 IMPACT OF GENERATIVE AI/AI IN DISTRIBUTION AUTOMATION (DA) MARKET

- 5.18 MACROECONOMIC OUTLOOK FOR DISTRIBUTION AUTOMATION MARKET

- 5.18.1 GDP

- 5.18.2 RESEARCH & DEVELOPMENT EXPENDITURE

- 5.18.3 INVESTMENTS IN DISTRIBUTION AUTOMATION

- 5.18.4 POWER AND UTILITY SECTOR GROWTH

6 DISTRIBUTION AUTOMATION MARKET, BY COMMUNICATION TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 WIRED COMMUNICATION TECHNOLOGY

- 6.2.1 FIBER OPTICS

- 6.2.1.1 Growing implementation in long-distance and high-performance data networks to drive market

- 6.2.2 ETHERNET

- 6.2.2.1 Suitability for Home Area Networks (HANS) for easy communication between smart meters and home central systems to drive market

- 6.2.3 POWERLINE CARRIER

- 6.2.3.1 Ability to operate within low-voltage electrical power distribution network to boost demand

- 6.2.4 IP

- 6.2.4.1 Cost-effectiveness and security for data transfer to boost market

- 6.2.1 FIBER OPTICS

- 6.3 WIRELESS COMMUNICATION TECHNOLOGY

- 6.3.1 RADIOFREQUENCY MESH

- 6.3.1.1 Ability to offer efficient network management and high data security to support utility needs of smart grids to accelerate demand

- 6.3.2 CELLULAR NETWORK

- 6.3.2.1 Growing investments in 5G networks to drive market

- 6.3.3 WIMAX

- 6.3.3.1 Ability to support high-speed data transfer over long distances to propel market

- 6.3.1 RADIOFREQUENCY MESH

7 DISTRIBUTION AUTOMATION MARKET, BY OFFERING

- 7.1 INTRODUCTION

- 7.2 FIELD DEVICES

- 7.2.1 REMOTE FAULT INDICATORS

- 7.2.1.1 Ability to offer continuous monitoring and fault diagnosis from main station to boost demand

- 7.2.2 SMART RELAYS

- 7.2.2.1 Effective management of voltage and power distribution to drive market

- 7.2.3 AUTOMATED FEEDER SWITCHES/RECLOSERS

- 7.2.3.1 Ability to reduce outage time and enhance grid efficiency to fuel market growth

- 7.2.4 AUTOMATED CAPACITORS

- 7.2.4.1 Ease of installation to boost demand

- 7.2.5 AUTOMATED VOLTAGE REGULATORS

- 7.2.5.1 Increasing need to control voltage levels and prevent disruptions in electricity flow to drive market growth

- 7.2.6 TRANSFORMER MONITORS

- 7.2.6.1 Growing need to safeguard and regulate transformers to boost demand

- 7.2.7 FEEDER MONITORS

- 7.2.7.1 Rising need to optimize electricity distribution to propel market growth

- 7.2.8 REMOTE TERMINAL UNITS

- 7.2.8.1 Growing implementation in substations for intelligent I/O collection and processing to drive demand

- 7.2.1 REMOTE FAULT INDICATORS

- 7.3 SOFTWARE

- 7.3.1 GROWING NEED TO INCREASE RELIABILITY AND EFFICIENCY OF GRID OPERATIONS TO BOOST MARKET

- 7.4 SERVICES

- 7.4.1 RISING NEED TO DEVELOP SYSTEM ARCHITECTURE AND HARDWARE AND SOFTWARE DESIGNS TO DRIVE MARKET

8 DISTRIBUTION AUTOMATION MARKET, BY UTILITY

- 8.1 INTRODUCTION

- 8.2 PUBLIC UTILITIES

- 8.2.1 GOVERNMENT-LED INITIATIVES TO ESTABLISH PUBLIC UTILITIES TO BOOST DEMAND

- 8.3 PRIVATE UTILITIES

- 8.3.1 INCREASING PRIVATE INVESTMENTS IN ADVANCED METERING INFRASTRUCTURE, AI, AND SMART GRID INFRASTRUCTURE TO DRIVE MARKET

9 DISTRIBUTION AUTOMATION MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Government-led investments to boost electric grid reliability to drive market

- 9.2.2 CANADA

- 9.2.2.1 Growing electricity demand with rising population to fuel market growth

- 9.2.3 MEXICO

- 9.2.3.1 Increasing need for real-time monitoring of electricity usage to drive market

- 9.2.1 US

- 9.3 ASIA PACIFIC

- 9.3.1 CHINA

- 9.3.1.1 Increasing investments in smart grid infrastructure projects to achieve carbon-neutral energy targets to boost demand

- 9.3.2 JAPAN

- 9.3.2.1 Rising emphasis on developing low-carbon society to drive market

- 9.3.3 INDIA

- 9.3.3.1 Growing focus on smart city initiatives to fuel market growth

- 9.3.4 AUSTRALIA

- 9.3.4.1 Increasing need to replace aging grid infrastructure to ensure high efficiency of power plants to boost market growth

- 9.3.5 SOUTH KOREA

- 9.3.5.1 Growing investment in renewable power generation to boost market growth

- 9.3.6 REST OF ASIA PACIFIC

- 9.3.1 CHINA

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Growing focus on modernizing grids to boost demand

- 9.4.2 FRANCE

- 9.4.2.1 Increasing digitalization of electrical and smart grids to drive market

- 9.4.3 ITALY

- 9.4.3.1 Deployment of IoT and digital twins to support asset management to create lucrative opportunities for market players

- 9.4.4 UK

- 9.4.4.1 Growing collaborations between state-controlled utilities to enhance resilience of grid infrastructure to fuel market growth

- 9.4.5 REST OF EUROPE

- 9.4.1 GERMANY

- 9.5 SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.5.1.1 Growing private investments in renewable energy sector to drive market

- 9.5.2 ARGENTINA

- 9.5.2.1 Increasing investments in upgrading grid infrastructure to accelerate demand

- 9.5.3 REST OF SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

- 9.6.1.1 Saudi Arabia

- 9.6.1.1.1 Integration of AI into smart grids to offer lucrative opportunities for market players

- 9.6.1.2 UAE

- 9.6.1.2.1 Growing focus on achieving net zero emission goals to drive market

- 9.6.1.3 Rest of GCC countries

- 9.6.1.1 Saudi Arabia

- 9.6.2 IRAN

- 9.6.2.1 Rapid consumption of electricity to fuel market growth

- 9.6.3 SOUTH AFRICA

- 9.6.3.1 Initiatives to modernize aging grid infrastructure to accelerate market growth

- 9.6.4 REST OF MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2020-MAY 2025

- 10.3 MARKET SHARE ANALYSIS, 2024

- 10.4 MARKET EVALUATION FRAMEWORK, 2020-2024

- 10.5 REVENUE ANALYSIS, 2020-2024

- 10.6 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 10.7 BRAND/PRODUCT COMPARISON

- 10.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.8.1 STARS

- 10.8.2 EMERGING LEADERS

- 10.8.3 PERVASIVE PLAYERS

- 10.8.4 PARTICIPANTS

- 10.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.8.5.1 Company footprint

- 10.8.5.2 Region footprint

- 10.8.5.3 Offering footprint

- 10.8.5.4 Communication technology footprint

- 10.8.5.5 Utility footprint

- 10.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.9.1 PROGRESSIVE COMPANIES

- 10.9.2 RESPONSIVE COMPANIES

- 10.9.3 DYNAMIC COMPANIES

- 10.9.4 STARTING BLOCKS

- 10.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.9.5.1 List of key startups/SMEs

- 10.9.5.2 Competitive benchmarking of key startups/SMEs

- 10.10 COMPETITIVE SCENARIOS AND TRENDS

- 10.10.1 PRODUCT LAUNCHES

- 10.10.2 DEALS

- 10.10.3 EXPANSIONS

- 10.10.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 ABB

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Other developments

- 11.1.1.3.4 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 SIEMENS

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Other developments

- 11.1.2.3.4 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 SCHNEIDER ELECTRIC

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Other developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses/Competitive threats

- 11.1.4 EATON

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses/Competitive threats

- 11.1.5 GE VERNOVA

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Other developments

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses/Competitive threats

- 11.1.6 XYLEM

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.7 TOSHIBA CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Deals

- 11.1.7.3.3 Other developments

- 11.1.8 HITACHI ENERGY LTD.

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches

- 11.1.8.3.2 Deals

- 11.1.8.3.3 Expansions

- 11.1.8.3.4 Other developments

- 11.1.9 LANDIS+GYR

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.9.3.2 Other developments

- 11.1.10 ITRON INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.3.2 Deals

- 11.1.10.3.3 Other developments

- 11.1.11 HUBBELL

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.12 SCHWEITZER ENGINEERING LABORATORIES, INC.

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product launches

- 11.1.12.3.2 Expansions

- 11.1.13 G&W ELECTRIC CO.

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Product launches

- 11.1.13.3.2 Deals

- 11.1.13.3.3 Expansions

- 11.1.14 S&C ELECTRIC COMPANY

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Deals

- 11.1.14.3.2 Expansions

- 11.1.15 INGETEAM

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions/Services offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Other developments

- 11.1.15.3.2 Expansions

- 11.1.16 ZIV

- 11.1.16.1 Business overview

- 11.1.16.2 Products/Solutions/Services offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Product launches

- 11.1.16.3.2 Deals

- 11.1.1 ABB

- 11.2 OTHER PLAYERS

- 11.2.1 MINSAIT ACS, INC.

- 11.2.2 QUALUS

- 11.2.3 KALKI COMMUNICATION TECHNOLOGIES PRIVATE LIMITED

- 11.2.4 TRILLIANT HOLDINGS INC.

- 11.2.5 ALFANAR GROUP

- 11.2.6 RTDS TECHNOLOGIES INC AMETEK

- 11.2.7 SSPOWER

- 11.2.8 PROBUS SMART THINGS PVT. LTD.

- 11.2.9 APDS AUTOMATION & POWER DISTRIBUTION SERVICES

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS