|

|

市場調査レポート

商品コード

1648503

航空燃料の世界市場:燃料タイプ別、エンドユーザー別、航空機タイプ別、地域別 - 予測(~2030年)Aviation Fuel Market by Fuel Type (Jet Fuel, Avgas, Biofuel, Hydrogen Fuel, Power-To-Liquid, Gas-To-Liquid), End User (Airline, Government & Military, Non-Scheduled Operators), Aircraft Type and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 航空燃料の世界市場:燃料タイプ別、エンドユーザー別、航空機タイプ別、地域別 - 予測(~2030年) |

|

出版日: 2025年01月22日

発行: MarketsandMarkets

ページ情報: 英文 429 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の航空燃料の市場規模は、2024年に2,002億1,000万米ドル、2030年までに3,259億8,000万米ドルに達すると推定され、CAGRで8.5%の成長が見込まれます。

数量では2024年に862億ガロン、2030年までに1,328億ガロンに達すると予測され、CAGRで7.5%の成長が推定されます。市場は、航空需要の増加、政府・軍隊の航空輸送ニーズ、厳しい環境規制などの要因により成長を示しています。Exxon Mobil Corporation(米国)、Chevron Corporation(米国)、BP P.l.C(英国)、Shell(英国)、TotalEnergies(フランス)は、航空燃料市場で活動する主要企業の一部です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 燃料タイプ、航空機タイプ、エンドユーザー |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「持続可能な航空燃料(SAF)のPower-to-Liquidセグメントが、予測期間に航空燃料市場でもっとも市場シェアを伸ばします。」

持続可能な航空燃料(SAF)セグメントは、予測期間の2024年~2030年にもっとも高い市場シェアで成長すると予測されます。持続可能な航空燃料(SAF)セグメントでは、Power-to-Liquidセグメントがもっとも急成長する市場となる見込みです。Power-to-Liquidは、風力や太陽光などの再生可能エネルギー源から生成されるグリーン水素を、回収した二酸化炭素と結合させて液体燃料を合成するプロセスです。この革新的なプロセスは、航空機の脱炭素化に向けた持続可能でスケーラブルな道を開き、世界的に厳しいネットゼロエミッション目標さえも達成します。また、Power-to-Liquidセグメントは、根本的な改良を加えることなく現行の航空インフラやエンジンとの幅広い互換性があるため、特に魅力的です。高額の投資、政府のインセンティブ、エネルギー企業と他の航空ステークホルダーとの協力など、多くの要因がPtLの普及を後押ししています。また、再生可能エネルギーの低コスト化と電解技術の向上により、Power-to-Liquid燃料は経済的に実行可能性が高まっています。航空産業における持続可能なソリューションに対する需要の高まりにより、Power-to-Liquidセグメントは、航空産業の持続可能性目標を達成し、化石燃料からの脱却を支援する上で極めて重要なものとなっています。

「政府・軍隊セグメントが予測期間に航空燃料市場で最大の市場シェアを占める見込みです。」

軍用航空は、兵員輸送、偵察、訓練任務、戦闘活動などのさまざまな作戦に使用されるため、燃料集約度が非常に高いです。このため、各国政府は航空機の整備と近代化を進め、与えられた任務を可能な限り効率的に遂行するための準備を確保するため、世界的に多額の予算を計上しています。政府・軍隊は、二酸化炭素排出を削減し、エネルギー安全保障ポートフォリオを強化する手段を提供するSAFの受け入れの最前線にいます。

「北米市場が市場をリードすると推定されます。」

北米は発達した強力な航空産業を有しています。そのため、米国やカナダのような国々には、世界有数の利用者の多い空港や大手航空企業が存在しています。カナダは北米の航空燃料市場でもっとも急成長している国です。航空交通量の増加、貨物業務、防衛航空活動などのさまざまな要因がこの地域の優位性に寄与しています。北米はまた、好調な経済業績と高い貿易網を有しており、商業用・軍用ともに航空燃料の必要性を高めています。

当レポートでは、世界の航空燃料市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 航空燃料市場の企業にとって魅力的な機会

- 航空燃料市場:燃料タイプ別

- 航空燃料市場:エンドユーザー別

- 航空燃料市場:航空機タイプ別

- 航空燃料市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向と混乱

- バリューチェーン分析

- エコシステム分析

- 著名な企業

- 民間企業と中小企業

- エンドユーザー

- 規制情勢

- 取引データ

- 技術分析

- 主要技術

- 補完技術

- 主なステークホルダーと購入基準

- ユースケース分析

- BOEINGの燃料効率と環境持続可能性の取り組み

- AIR NEW ZEALANDのカーボンフットプリント削減への取り組み

- INERATEC GMBHのPower-to-Liquid技術向け化学プラント

- 主な会議とイベント(2025年)

- 価格分析

- 主要企業が提供する航空燃料の参考価格分析

- 航空燃料の参考価格分析:地域別

- 航空燃料の価格に影響を与える要因

- ジェット燃料 vs. 持続可能な航空燃料

- 運用データ

- 売上数量:燃料メーカー別

- 製油所処理数量:燃料メーカー別

- 投資と資金調達のシナリオ

- マクロ経済の見通し

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東

- ラテンアメリカ

- アフリカ

- 総所有コスト

- ビジネスモデル

- 技術ロードマップ

第6章 産業動向

- イントロダクション

- 技術動向

- 炭素回収・貯蔵によるバイオエネルギー

- ドロップイン燃料

- 極低温水素混合

- ナノテクノロジー

- バイオ炭の共処理

- メガトレンドの影響

- ビッグデータアナリティクス

- 持続可能性への取り組み

- AI

- サプライチェーン分析

- 特許分析

第7章 燃料処理航空燃料市場:技術別

- イントロダクション

- 従来の処理技術

- 合成燃料処理技術

- バイオ燃料処理技術

第8章 航空燃料市場:航空機タイプ別

- イントロダクション

- 固定翼

- 回転翼

- UAV

第9章 航空燃料市場:燃料タイプ別

- イントロダクション

- 従来の航空燃料

- 持続可能な航空燃料

第10章 航空燃料市場:エンドユーザー別

- イントロダクション

- 航空企業

- 政府・軍隊

- 不定期運行業者

第11章 航空燃料市場:地域別

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- 欧州

- PESTLE分析

- 英国

- フランス

- スペイン

- ドイツ

- イタリア

- その他の欧州

- アジア太平洋

- PESTLE分析

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- その他のアジア太平洋

- ラテンアメリカ

- PESTLE分析

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東

- PESTLE分析

- GCC

- カタール

- トルコ

- その他の中東

- アフリカ

- PESTLE分析

- エジプト

- 南アフリカ

- その他のアフリカ

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み(2020年~2024年)

- 収益分析(2020年~2023年)

- 市場シェア分析(2023年)

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- ブランド/製品の比較

- 企業の評価と財務指標

- 航空燃料市場の主要企業のリスト:地域別

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- EXXON MOBIL CORPORATION

- CHEVRON CORPORATION

- BP P.L.C.

- SHELL

- TOTALENERGIES

- NESTE

- INDIAN OIL CORPORATION LTD.

- VALERO ENERGY CORPORATION

- PHILLIPS 66 COMPANY

- BHARAT PETROLEUM CORPORATION LIMITED

- LANZAJET

- WORLD ENERGY, LLC

- GEVO, INC.

- PETROBRAS

- OMV AKTIENGESELLSCHAFT

- ALDER ENERGY, LLC

- CHINA PETROCHEMICAL CORPORATION

- VITOL

- ESSAR

- WORLD KINECT CORPORATION

- その他の企業

- PROMETHEUS FUELS

- RED ROCK BIOFUELS

- WASTEFUEL

- AEMETIS, INC.

- VIRENT, INC.

- NORTHWEST ADVANCED BIO-FUELS, LLC

- ROSNEFT DEUTSCHLAND GMBH

- AIR COMPANY

- SKYNRG

- VELOCYS PLC

第14章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 POLICY AND REGULATION IMPACT ON BUSINESS, 2023

- TABLE 4 LIST OF ALTERNATIVE ENERGY SOURCES

- TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 IMPORT DATA FOR HS CODE 2711, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 12 EXPORT DATA FOR HS CODE 2711, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- TABLE 14 KEY BUYING CRITERIA, BY END USER

- TABLE 15 KEY CONFERENCES AND EVENTS, 2025

- TABLE 16 INDICATIVE PRICING OF JET FUEL, BY MANUFACTURER (USD/GALLON)

- TABLE 17 INDICATIVE PRICING OF AVGAS, BY MANUFACTURER (USD/GALLON)

- TABLE 18 INDICATIVE PRICING OF SAF, BY MANUFACTURER (USD/GALLON)

- TABLE 19 COMPARISON BETWEEN JET FUEL AND SUSTAINABLE AVIATION FUEL

- TABLE 20 FUEL CONSUMPTION AND EMISSION, BY FUEL TYPE (USD/LITER)

- TABLE 21 AVIATION FUEL SALES VOLUME, BY FUEL MANUFACTURER (MILLION GALLONS)

- TABLE 22 EXXON MOBIL CORPORATION: REFINERY THROUGHPUT, BY REGION (MILLION GALLONS)

- TABLE 23 SHELL: REFINERY THROUGHPUT, BY REGION (MILLION GALLONS)

- TABLE 24 TOTALENERGIES: REFINERY THROUGHPUT, BY REGION (MILLION GALLONS)

- TABLE 25 COMPARISON BETWEEN BUSINESS MODELS

- TABLE 26 RATE OF EMISSION REDUCTION

- TABLE 27 COMPARISON BETWEEN BIO-CRUDES AND TRADITIONAL PETROLEUM FEEDSTOCK

- TABLE 28 PATENT ANALYSIS

- TABLE 29 AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 30 AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 31 AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 32 AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 33 AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 34 AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 35 AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 36 AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 37 CONVENTIONAL AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 38 CONVENTIONAL AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 39 SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 40 SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 41 AVIATION FUEL MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 42 AVIATION FUEL MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 43 AVIATION FUEL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 44 AVIATION FUEL MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 45 AVIATION FUEL MARKET, BY REGION, 2020-2023 (MILLION GALLONS)

- TABLE 46 AVIATION FUEL MARKET, BY REGION, 2024-2030 (MILLION GALLONS)

- TABLE 47 AVIATION FUEL INITIATIVES IN NORTH AMERICA

- TABLE 48 NORTH AMERICA: AVIATION FUEL MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 49 NORTH AMERICA: AVIATION FUEL MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 51 NORTH AMERICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 52 NORTH AMERICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 53 NORTH AMERICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 54 NORTH AMERICA: AVIATION FUEL MARKET, BY COUNTRY, 2020-2023 (MILLION GALLONS)

- TABLE 55 NORTH AMERICA: AVIATION FUEL MARKET, BY COUNTRY, 2024-2030 (MILLION GALLONS)

- TABLE 56 NORTH AMERICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 57 NORTH AMERICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 58 NORTH AMERICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 59 NORTH AMERICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 60 US: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 61 US: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 62 US: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 63 US: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 64 US: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 65 US: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 66 US: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 67 US: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 68 CANADA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 69 CANADA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 70 CANADA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 71 CANADA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 72 CANADA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 73 CANADA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 74 CANADA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 75 CANADA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 76 AVIATION FUEL INITIATIVES IN EUROPE

- TABLE 77 EUROPE: AVIATION FUEL MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 78 EUROPE: AVIATION FUEL MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 79 EUROPE: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 80 EUROPE: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 81 EUROPE: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 82 EUROPE: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 83 EUROPE: AVIATION FUEL MARKET, BY COUNTRY, 2020-2023 (MILLION GALLONS)

- TABLE 84 EUROPE: AVIATION FUEL MARKET, BY COUNTRY, 2024-2030 (MILLION GALLONS)

- TABLE 85 EUROPE: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 86 EUROPE: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 87 EUROPE: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 88 EUROPE: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 89 UK: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 90 UK: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 91 UK: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 92 UK: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 93 UK: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 94 UK: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 95 UK: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 96 UK: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 97 FRANCE: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 98 FRANCE: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 99 FRANCE: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 100 FRANCE: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 101 FRANCE: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 102 FRANCE: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 103 FRANCE: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 104 FRANCE: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 105 SPAIN: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 106 SPAIN: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 107 SPAIN: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 108 SPAIN: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 109 SPAIN: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 110 SPAIN: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 111 SPAIN: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 112 SPAIN: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 113 GERMANY: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 114 GERMANY: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 115 GERMANY: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 116 GERMANY: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 117 GERMANY: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 118 GERMANY: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 119 GERMANY: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 120 GERMANY: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 121 ITALY: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 122 ITALY: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 123 ITALY: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 124 ITALY: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 125 ITALY: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 126 ITALY: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 127 ITALY: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 128 ITALY: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 129 REST OF EUROPE: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 130 REST OF EUROPE: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 131 REST OF EUROPE: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 132 REST OF EUROPE: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 133 REST OF EUROPE: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 134 REST OF EUROPE: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 024-2030 (MILLION GALLONS)

- TABLE 135 REST OF EUROPE: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 136 REST OF EUROPE: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 137 AVIATION FUEL INITIATIVES IN ASIA PACIFIC

- TABLE 138 ASIA PACIFIC: AVIATION FUEL MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 139 ASIA PACIFIC: AVIATION FUEL MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 141 ASIA PACIFIC: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 142 ASIA PACIFIC: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 143 ASIA PACIFIC: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: AVIATION FUEL MARKET, BY COUNTRY, 2020-2023 (MILLION GALLONS)

- TABLE 145 ASIA PACIFIC: AVIATION FUEL MARKET, BY COUNTRY, 2024-2030 (MILLION GALLONS)

- TABLE 146 ASIA PACIFIC: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 147 ASIA PACIFIC: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 148 ASIA PACIFIC: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 149 ASIA PACIFIC: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 150 CHINA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 151 CHINA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 152 CHINA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 153 CHINA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 154 CHINA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 155 CHINA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 156 CHINA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 157 CHINA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 158 INDIA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 159 INDIA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 160 INDIA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 161 INDIA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 162 INDIA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 163 INDIA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 164 INDIA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 165 INDIA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 166 JAPAN: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 167 JAPAN: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 168 JAPAN: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 169 JAPAN: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 170 JAPAN: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 171 JAPAN: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 172 JAPAN: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 173 JAPAN: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 174 SOUTH KOREA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 175 SOUTH KOREA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 176 SOUTH KOREA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 177 SOUTH KOREA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 178 SOUTH KOREA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 179 SOUTH KOREA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 180 SOUTH KOREA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 181 SOUTH KOREA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 182 AUSTRALIA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 183 AUSTRALIA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 184 AUSTRALIA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 185 AUSTRALIA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 186 AUSTRALIA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 187 AUSTRALIA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 188 AUSTRALIA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 189 AUSTRALIA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 190 REST OF ASIA PACIFIC: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 191 REST OF ASIA PACIFIC: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 192 REST OF ASIA PACIFIC: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 193 REST OF ASIA PACIFIC: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 194 REST OF ASIA PACIFIC: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 195 REST OF ASIA PACIFIC: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 196 REST OF ASIA PACIFIC: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 197 REST OF ASIA PACIFIC: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 198 AVIATION FUEL INITIATIVES IN LATIN AMERICA

- TABLE 199 LATIN AMERICA: AVIATION FUEL MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 200 LATIN AMERICA: AVIATION FUEL MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 201 LATIN AMERICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 202 LATIN AMERICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 203 LATIN AMERICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 204 LATIN AMERICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 205 LATIN AMERICA: AVIATION FUEL MARKET, BY COUNTRY, 2020-2023 (MILLION GALLONS)

- TABLE 206 LATIN AMERICA: AVIATION FUEL MARKET, BY COUNTRY, 2024-2030 (MILLION GALLONS)

- TABLE 207 LATIN AMERICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 208 LATIN AMERICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 209 LATIN AMERICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 210 LATIN AMERICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 211 BRAZIL: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 212 BRAZIL: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 213 BRAZIL: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 214 BRAZIL: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 215 BRAZIL: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 216 BRAZIL: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 217 BRAZIL: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 218 BRAZIL: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 219 MEXICO: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 220 MEXICO: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 221 MEXICO: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 222 MEXICO: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 223 MEXICO: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 224 MEXICO: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 225 MEXICO: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 226 MEXICO: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 227 REST OF LATIN AMERICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 228 REST OF LATIN AMERICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 229 REST OF LATIN AMERICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 230 REST OF LATIN AMERICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 231 REST OF LATIN AMERICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 232 REST OF LATIN AMERICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 233 REST OF LATIN AMERICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 234 REST OF LATIN AMERICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 235 AVIATION FUEL INITIATIVES IN MIDDLE EAST

- TABLE 236 MIDDLE EAST: AVIATION FUEL MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 237 MIDDLE EAST: AVIATION FUEL MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 238 MIDDLE EAST: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 239 MIDDLE EAST: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 240 MIDDLE EAST: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 241 MIDDLE EAST: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 242 MIDDLE EAST: AVIATION FUEL MARKET, BY COUNTRY, 2020-2023 (MILLION GALLONS)

- TABLE 243 MIDDLE EAST: AVIATION FUEL MARKET, BY COUNTRY, 2024-2030 (MILLION GALLONS)

- TABLE 244 MIDDLE EAST: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 245 MIDDLE EAST: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 246 MIDDLE EAST: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 247 MIDDLE EAST: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 248 UAE: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 249 UAE: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 250 UAE: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 251 UAE: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 252 UAE: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 253 UAE: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 254 UAE: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 255 UAE: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 256 SAUDI ARABIA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 257 SAUDI ARABIA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 258 SAUDI ARABIA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 259 SAUDI ARABIA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 260 SAUDI ARABIA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 261 SAUDI ARABIA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 262 SAUDI ARABIA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 263 SAUDI ARABIA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 264 QATAR: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 265 QATAR: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 266 QATAR: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 267 QATAR: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 268 QATAR: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 269 QATAR: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 270 QATAR: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 271 QATAR: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 272 TURKEY: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 273 TURKEY: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 274 TURKEY: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 275 TURKEY: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 276 TURKEY: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 277 TURKEY: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 278 TURKEY: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 279 TURKEY: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 280 REST OF MIDDLE EAST: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 281 REST OF MIDDLE EAST: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 282 REST OF MIDDLE EAST: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 283 REST OF MIDDLE EAST: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 284 REST OF MIDDLE EAST: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 285 REST OF MIDDLE EAST: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 286 REST OF MIDDLE EAST: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 287 REST OF MIDDLE EAST: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 288 AVIATION FUEL INITIATIVES IN AFRICA

- TABLE 289 AFRICA: AVIATION FUEL MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 290 AFRICA: AVIATION FUEL MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 291 AFRICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 292 AFRICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 293 AFRICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 294 AFRICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 295 AFRICA: AVIATION FUEL MARKET, BY COUNTRY, 2020-2023 (MILLION GALLONS)

- TABLE 296 AFRICA: AVIATION FUEL MARKET, BY COUNTRY, 2024-2030 (MILLION GALLONS)

- TABLE 297 AFRICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 298 AFRICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 299 AFRICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 300 AFRICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 301 EGYPT: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 302 EGYPT: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 303 EGYPT: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 304 EGYPT: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 305 EGYPT: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 306 EGYPT: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 307 EGYPT: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 308 EGYPT: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 309 SOUTH AFRICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 310 SOUTH AFRICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 311 SOUTH AFRICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 312 SOUTH AFRICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 313 SOUTH AFRICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 314 SOUTH AFRICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 315 SOUTH AFRICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 316 SOUTH AFRICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 317 REST OF AFRICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (USD MILLION)

- TABLE 318 REST OF AFRICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- TABLE 319 REST OF AFRICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (USD MILLION)

- TABLE 320 REST OF AFRICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 321 REST OF AFRICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 322 REST OF AFRICA: AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 323 REST OF AFRICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2023 (MILLION GALLONS)

- TABLE 324 REST OF AFRICA: AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (MILLION GALLONS)

- TABLE 325 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 326 AVIATION FUEL MARKET: DEGREE OF COMPETITION

- TABLE 327 FUEL TYPE FOOTPRINT

- TABLE 328 AIRCRAFT TYPE FOOTPRINT

- TABLE 329 END USER FOOTPRINT

- TABLE 330 REGION FOOTPRINT

- TABLE 331 LIST OF START-UPS/SMES

- TABLE 332 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 333 TOP PLAYERS IN AVIATION FUEL MARKET, BY REGION

- TABLE 334 AVIATION FUEL MARKET: PRODUCT LAUNCHES, 2020-2024

- TABLE 335 AVIATION FUEL MARKET: DEALS, 2020-2024

- TABLE 336 AVIATION FUEL MARKET: OTHERS, 2020-2024

- TABLE 337 EXXON MOBIL CORPORATION: COMPANY OVERVIEW

- TABLE 338 EXXON MOBIL CORPORATION: PRODUCTS OFFERED

- TABLE 339 EXXON MOBIL CORPORATION: DEALS

- TABLE 340 CHEVRON CORPORATION: COMPANY OVERVIEW

- TABLE 341 CHEVRON CORPORATION: PRODUCTS OFFERED

- TABLE 342 CHEVRON CORPORATION: DEALS

- TABLE 343 BP P.L.C.: COMPANY OVERVIEW

- TABLE 344 BP P.L.C.: PRODUCTS OFFERED

- TABLE 345 BP P.L.C.: PRODUCT LAUNCHES

- TABLE 346 BP P.L.C.: DEALS

- TABLE 347 BP P.L.C.: OTHERS

- TABLE 348 SHELL: COMPANY OVERVIEW

- TABLE 349 SHELL: PRODUCTS OFFERED

- TABLE 350 SHELL: PRODUCT LAUNCHES

- TABLE 351 SHELL: DEALS

- TABLE 352 TOTALENERGIES: COMPANY OVERVIEW

- TABLE 353 TOTALENERGIES: PRODUCTS OFFERED

- TABLE 354 TOTALENERGIES: DEALS

- TABLE 355 NESTE: COMPANY OVERVIEW

- TABLE 356 NESTE: PRODUCTS OFFERED

- TABLE 357 NESTE: DEALS

- TABLE 358 INDIAN OIL CORPORATION LTD.: COMPANY OVERVIEW

- TABLE 359 INDIAN OIL CORPORATION LTD.: PRODUCTS OFFERED

- TABLE 360 INDIAN OIL CORPORATION LTD.: DEALS

- TABLE 361 VALERO ENERGY CORPORATION: COMPANY OVERVIEW

- TABLE 362 VALERO ENERGY CORPORATION: PRODUCTS OFFERED

- TABLE 363 VALERO ENERGY CORPORATION: DEALS

- TABLE 364 PHILLIPS 66 COMPANY: COMPANY OVERVIEW

- TABLE 365 PHILLIPS 66 COMPANY: PRODUCTS OFFERED

- TABLE 366 PHILLIPS 66 COMPANY: DEALS

- TABLE 367 BHARAT PETROLEUM CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 368 BHARAT PETROLEUM CORPORATION LIMITED: PRODUCTS OFFERED

- TABLE 369 LANZAJET: COMPANY OVERVIEW

- TABLE 370 LANZAJET: PRODUCTS OFFERED

- TABLE 371 LANZAJET: DEALS

- TABLE 372 WORLD ENERGY, LLC: COMPANY OVERVIEW

- TABLE 373 WORLD ENERGY, LLC: PRODUCTS OFFERED

- TABLE 374 WORLD ENERGY, LLC: DEALS

- TABLE 375 GEVO, INC.: COMPANY OVERVIEW

- TABLE 376 GEVO, INC.: PRODUCTS OFFERED

- TABLE 377 GEVO, INC.: DEALS

- TABLE 378 PETROBRAS: COMPANY OVERVIEW

- TABLE 379 PETROBRAS: PRODUCTS OFFERED

- TABLE 380 OMV AKTIENGESELLSCHAFT: COMPANY OVERVIEW

- TABLE 381 OMV AKTIENGESELLSCHAFT: PRODUCTS OFFERED

- TABLE 382 OMV AKTIENGESELLSCHAFT: DEALS

- TABLE 383 ALDER ENERGY, LLC: COMPANY OVERVIEW

- TABLE 384 ALDER ENERGY, LLC: PRODUCTS OFFERED

- TABLE 385 ALDER ENERGY, LLC: DEALS

- TABLE 386 CHINA PETROCHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 387 CHINA PETROCHEMICAL CORPORATION: PRODUCTS OFFERED

- TABLE 388 CHINA PETROCHEMICAL CORPORATION: DEALS

- TABLE 389 VITOL: COMPANY OVERVIEW

- TABLE 390 VITOL: PRODUCTS OFFERED

- TABLE 391 ESSAR: COMPANY OVERVIEW

- TABLE 392 ESSAR: PRODUCTS OFFERED

- TABLE 393 ESSAR: DEALS

- TABLE 394 WORLD KINECT CORPORATION: COMPANY OVERVIEW

- TABLE 395 WORLD KINECT CORPORATION: PRODUCTS OFFERED

- TABLE 396 PROMETHEUS FUELS: COMPANY OVERVIEW

- TABLE 397 RED ROCK BIOFUELS: COMPANY OVERVIEW

- TABLE 398 WASTEFUEL: COMPANY OVERVIEW

- TABLE 399 AEMETIS, INC.: COMPANY OVERVIEW

- TABLE 400 VIRENT, INC.: COMPANY OVERVIEW

- TABLE 401 NORTHWEST ADVANCED BIO-FUELS, LLC: COMPANY OVERVIEW

- TABLE 402 ROSNEFT DEUTSCHLAND GMBH: COMPANY OVERVIEW

- TABLE 403 AIR COMPANY: COMPANY OVERVIEW

- TABLE 404 SKYNRG: COMPANY OVERVIEW

- TABLE 405 VELOCYS PLC: COMPANY OVERVIEW

- TABLE 406 LAUNDRY LIST OF MAPPED COMPANIES

List of Figures

- FIGURE 1 AVIATION FUEL MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 SUSTAINABLE AVIATION FUEL TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 8 UNMANNED AERIAL VEHICLE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 9 GOVERNMENT & MILITARY SEGMENT TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO BE LARGEST MARKET FOR AVIATION FUELS DURING FORECAST PERIOD

- FIGURE 11 INCREASING DEMAND FOR SUSTAINABLE FUELS TO DRIVE MARKET

- FIGURE 12 CONVENTIONAL AVIATION FUEL SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 13 AIRLINE TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 14 FIXED WING SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 15 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 16 AVIATION FUEL MARKET DYNAMICS

- FIGURE 17 REGIONAL PASSENGER TRAFFIC, 2023 VS. 2043

- FIGURE 18 AVIATION FUEL CARBON EMISSIONS (GALLONS)

- FIGURE 19 VOLATILITY OF CRUDE OIL PRICES, 2019-2024

- FIGURE 20 US ANNUAL JET FUEL CONSUMPTION, 2018-2023 (MILLION BARRELS/DAY)

- FIGURE 21 GROWTH AND PROJECTION OF SAF PRODUCTION CAPACITY AND PRODUCTION RATIOS, 2020-2032

- FIGURE 22 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 VALUE CHAIN ANALYSIS

- FIGURE 24 ECOSYSTEM ANALYSIS

- FIGURE 25 IMPORT DATA FOR HS CODE 2711, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 26 EXPORT DATA FOR HS CODE 2711, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 27 HYDROTHERMAL LIQUEFACTION

- FIGURE 28 PYROLYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 30 KEY BUYING CRITERIA, BY END USER

- FIGURE 31 INDICATIVE PRICING ANALYSIS OF AVIATION FUEL, BY REGION

- FIGURE 32 JET FUEL VS. SUSTAINABLE AVIATION FUEL (VOLUME VS. PRICE)

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 34 MACROECONOMICS INFOGRAPHICS

- FIGURE 35 TOTAL COST OF OWNERSHIP OF AVIATION FUEL

- FIGURE 36 COMPARISON BETWEEN TOTAL COST OF OWNERSHIP OF AVIATION FUEL

- FIGURE 37 BUSINESS MODELS IN AVIATION FUEL MARKET

- FIGURE 38 EVOLUTION OF TECHNOLOGY

- FIGURE 39 TECHNOLOGY ROADMAP

- FIGURE 40 OPERATIONAL AND PLANNED BECCS CAPTURE CAPACITY BY APPLICATION VS. NET ZERO SCENARIO, 2022-2030

- FIGURE 41 SUPPLY CHAIN ANALYSIS

- FIGURE 42 AVIATION FUEL DISTRIBUTION

- FIGURE 43 PATENT ANALYSIS

- FIGURE 44 FRACTIONAL DISTILLATION

- FIGURE 45 HYDROTREATING

- FIGURE 46 CATALYTIC CRACKING

- FIGURE 47 DIRECT AIR CAPTURE

- FIGURE 48 REVERSE WATER-GAS SHIFT

- FIGURE 49 HYDRO-PROCESSED ESTERS AND FATTY ACIDS

- FIGURE 50 ALCOHOL-TO-JET CONVERSION

- FIGURE 51 FISCHER-TROPSCH SYNTHESIS

- FIGURE 52 AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2024-2030 (USD MILLION)

- FIGURE 53 AVIATION FUEL MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- FIGURE 54 COMPREHENSIVE OVERVIEW OF JET A FUEL

- FIGURE 55 COMPREHENSIVE OVERVIEW OF JET A-1 FUEL

- FIGURE 56 COMPREHENSIVE OVERVIEW OF AVGAS FUEL

- FIGURE 57 COMPREHENSIVE OVERVIEW OF BIO FUEL

- FIGURE 58 COMPREHENSIVE OVERVIEW OF HYDROGEN FUEL

- FIGURE 59 COMPREHENSIVE OVERVIEW OF POWER-TO-LIQUID

- FIGURE 60 COMPREHENSIVE OVERVIEW OF GAS-TO-LIQUID

- FIGURE 61 AVIATION FUEL MARKET, BY END USER, 2024-2030 (USD MILLION)

- FIGURE 62 AVIATION FUEL MARKET, BY REGION, 2024-2030

- FIGURE 63 NORTH AMERICA: AVIATION FUEL MARKET SNAPSHOT

- FIGURE 64 EUROPE: AVIATION FUEL MARKET SNAPSHOT

- FIGURE 65 ASIA PACIFIC: AVIATION FUEL MARKET SNAPSHOT

- FIGURE 66 LATIN AMERICA: AVIATION FUEL MARKET SNAPSHOT

- FIGURE 67 MIDDLE EAST: AVIATION FUEL MARKET SNAPSHOT

- FIGURE 68 AFRICA: AVIATION FUEL MARKET SNAPSHOT

- FIGURE 69 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2023 (USD MILLION)

- FIGURE 70 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 71 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 72 COMPANY FOOTPRINT

- FIGURE 73 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 74 BRAND/PRODUCT COMPARISON

- FIGURE 75 FINANCIAL METRICS OF PROMINENT MARKET PLAYERS

- FIGURE 76 VALUATION OF PROMINENT MARKET PLAYERS

- FIGURE 77 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

- FIGURE 78 CHEVRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 79 BP P.L.C.: COMPANY SNAPSHOT

- FIGURE 80 SHELL: COMPANY SNAPSHOT

- FIGURE 81 TOTALENERGIES: COMPANY SNAPSHOT

- FIGURE 82 NESTE: COMPANY SNAPSHOT

- FIGURE 83 INDIAN OIL CORPORATION LTD.: COMPANY SNAPSHOT

- FIGURE 84 VALERO ENERGY CORPORATION: COMPANY SNAPSHOT

- FIGURE 85 PHILLIPS 66 COMPANY: COMPANY SNAPSHOT

- FIGURE 86 BHARAT PETROLEUM CORPORATION LIMITED: COMPANY SNAPSHOT

- FIGURE 87 GEVO, INC.: COMPANY SNAPSHOT

- FIGURE 88 PETROBRAS: COMPANY SNAPSHOT

- FIGURE 89 OMV AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 90 WORLD KINECT CORPORATION: COMPANY SNAPSHOT

The Aviation fuel Market is estimated in terms of market size to be USD 200.21 billion in 2024 to USD 325.98 billion by 2030, at a CAGR of 8.5% and in terms of volume to be 86.20 billion gallons in 2024 to 132.80 billion gallons by 2030 at a CAGR of 7.5% t during the forecast period. The aviation fuel market is experiencing growth due to factors such as increasing air travel demand, government and military air transportation needs, and stringent environmental regulations. Exxon Mobil Corporation (US), Chevron Corporation (US), BP P.l.C (UK), Shell (UK), and TotalEnergies (France) are some of the leading players operating in the aviation fuel market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | Fuel Type, Aircraft Type, End User |

| Regions covered | North America, Europe, APAC, RoW |

"The Power-to-Liquid of Sustainable Aviation Fuel (SAF) segment will account for the fastest growing market share in the aviation fuel market during the forecast period."

The aviation fuel market has been segmented into Conventional and Sustainable Aviation Fuel (SAF) based on Fuel type. The Sustainable Aviation Fuel (SAF) segment is projected to grow at the highest market share during the forecast period 2024 to 2030. The Power-to-Liquid segment is expected to account for the fastest-growing market under Sustainable Aviation Fuel (SAF). Power-to-liquid is the process of synthesis of liquid fuels by combining green hydrogen, which is generated from renewable sources such as wind and solar, with captured carbon dioxide. This innovative process opens up a sustainable and scalable pathway towards decarbonizing aviation and meets even the stringent global net-zero emissions targets. The Power-to-Liquid segment is also particularly attractive due to its compatibility with current aviation infrastructure and engines through broad compatibility without fundamental modification. A number of factors are driving the uptake of PtL, including high investments, government incentives, and the collaboration of energy companies with other aviation stakeholders. Also, the low cost of renewable energy and improvements in electrolysis technology are making Power-to-Liquid fuels economically more viable. The increasing demand for sustainable solutions in aviation makes the Power-to-Liquid segment crucial in meeting the sustainability goals of the industry and helping it move away from fossil-based fuels.

"The Government & Military segment will account for the largest market share in the aviation fuel market during the forecast period."

The aviation fuel has been segmented into Airline, Non-Scheduled Operator, and Government & Military based on the end user. The Government & Military segment is expected to hold the maximum market share from 2024 to 2030. Military aviation is very fuel-intensive as it is used for many different operations, such as troop transport, reconnaissance, training missions, and combat activities. This end contributes to a larger budget allocated globally by governments towards the maintenance and modernization of air fleets and ensuring readiness to perform their assigned missions as efficiently as possible. The government and Military are at the forefront of the acceptance of SAF, which provides a means for reducing carbon emissions and enhancing the energy security portfolio.

"The North American market is estimated to lead the market."

The North American aviation fuel market is expected to lead the market during the forecast period of 2024-2030. The region has a strong and developed aviation industry in place. As such, some of the world's busiest airports, as well as the leading airlines, exist in countries like the United States and Canada. Canada is the fastest-growing country in the North American aviation fuel market. Various factors, like increasing air traffic, cargo operations, and defense aviation activities, contribute to the region's dominance. North America also has a strong economic performance and high trade networks which increases the need for both commercial and military aviation fuel need.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-40%; Tier 2-40%; and Tier 3-20%

- By Designation: C Level-35%; Directors-25%; and Others-40%

- By Region: North America-30%; Europe-10%; Asia Pacific-40%; Middle East-15; Latin America-3% Africa -2%

Exxon Mobil Corporation (US), Chevron Corporation (US), BP P.l.C (UK), Shell (UK), and TotalEnergies (France) are some of the leading players operating in the aviation fuel market.

Research Coverage

The study covers the aviation fuel market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different segments based on propulsion, capacity, operation, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report:

This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall aviation fuel market and its subsegments. The report covers the entire ecosystem of the aviation fuel market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers and factors, such as increasing air travel demand, modernization of aircrafts, and high use of low emission fuel like SAF could contribute to an increase in the aviation fuel market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the aviation fuel market across varied regions.

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in aviation fuel market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Valero Energy Corporation (US), Bharat Petroleum Corporation Limited (India), World Energy, LLC (US), Petrobras (Brazil) and Indian Oil Corporation Ltd (India) among others in the aviation fuel market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AVIATION FUEL MARKET

- 4.2 AVIATION FUEL MARKET, BY FUEL TYPE

- 4.3 AVIATION FUEL MARKET, BY END USER

- 4.4 AVIATION FUEL MARKET, BY AIRCRAFT TYPE

- 4.5 AVIATION FUEL MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in global air passenger and cargo traffic

- 5.2.1.2 Rapid adoption of sustainable aviation fuels to reduce carbon emissions

- 5.2.1.3 Expansion of military and defense aviation activities

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increased volatility in crude oil prices

- 5.2.2.2 Stringent environmental regulations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Surge in demand for renewable and circular solutions

- 5.2.3.2 Emergence of new fuel production techniques

- 5.2.3.3 Modernization of airline fleets

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain disruptions

- 5.2.4.2 Threat from alternative energy sources

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- 5.6 REGULATORY LANDSCAPE

- 5.7 TRADE DATA

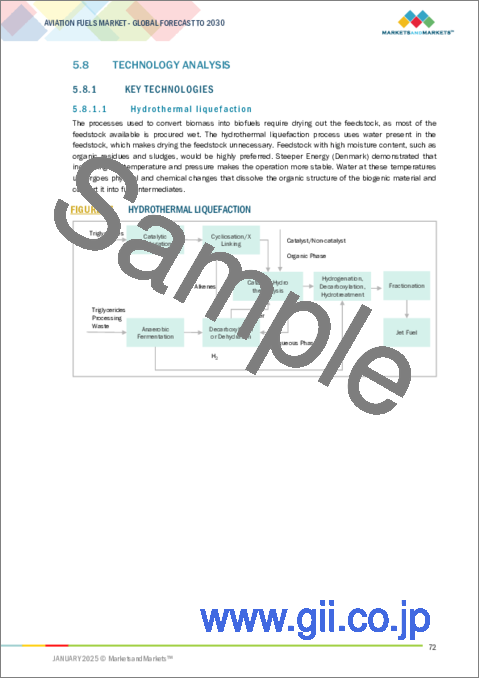

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Hydrothermal liquefaction

- 5.8.1.2 Pyrolysis

- 5.8.1.3 Catalytic refining

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Emission monitoring and reduction technologies

- 5.8.2.2 In-line blending systems

- 5.8.1 KEY TECHNOLOGIES

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 USE CASE ANALYSIS

- 5.10.1 BOEING'S FUEL EFFICIENCY AND ENVIRONMENTAL SUSTAINABILITY INITIATIVE

- 5.10.2 AIR NEW ZEALAND'S EFFORTS TO REDUCE CARBON FOOTPRINT

- 5.10.3 INERATEC GMBH'S CHEMICAL PLANT FOR POWER-TO-LIQUID TECHNOLOGY

- 5.11 KEY CONFERENCES AND EVENTS, 2025

- 5.12 PRICING ANALYSIS

- 5.12.1 INDICATIVE PRICING ANALYSIS OF AVIATION FUEL OFFERED BY KEY PLAYERS

- 5.12.2 INDICATIVE PRICING ANALYSIS OF AVIATION FUEL, BY REGION

- 5.12.3 FACTORS AFFECTING PRICING OF AVIATION FUEL

- 5.13 JET FUEL VS. SUSTAINABLE AVIATION FUEL

- 5.14 OPERATIONAL DATA

- 5.14.1 SALES VOLUME, BY FUEL MANUFACTURER

- 5.14.2 REFINERY THROUGHPUT VOLUME, BY FUEL MANUFACTURER

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 MACROECONOMIC OUTLOOK

- 5.16.1 INTRODUCTION

- 5.16.2 NORTH AMERICA

- 5.16.3 EUROPE

- 5.16.4 ASIA PACIFIC

- 5.16.5 MIDDLE EAST

- 5.16.6 LATIN AMERICA

- 5.16.7 AFRICA

- 5.17 TOTAL COST OF OWNERSHIP

- 5.18 BUSINESS MODELS

- 5.19 TECHNOLOGY ROADMAP

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 BIOENERGY WITH CARBON CAPTURE AND STORAGE

- 6.2.2 DROP-IN FUELS

- 6.2.3 CRYOGENIC HYDROGEN BLENDING

- 6.2.4 NANOTECHNOLOGY

- 6.2.5 BIOCHAR CO-PROCESSING

- 6.3 IMPACT OF MEGA TRENDS

- 6.3.1 BIG DATA ANALYTICS

- 6.3.2 SUSTAINABILITY INITIATIVES

- 6.3.3 ARTIFICIAL INTELLIGENCE

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 PATENT ANALYSIS

7 AVIATION FUEL MARKET, BY FUEL PROCESSING TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 CONVENTIONAL PROCESSING TECHNOLOGIES

- 7.2.1 FRACTIONAL DISTILLATION

- 7.2.2 HYDROTREATING

- 7.2.3 CATALYTIC CRACKING

- 7.2.4 ISOMERIZATION

- 7.2.5 BLENDING

- 7.3 SYNTHETIC FUEL PROCESSING TECHNOLOGIES

- 7.3.1 DIRECT AIR CAPTURE

- 7.3.2 WATER ELECTROLYSIS

- 7.3.3 REVERSE WATER-GAS SHIFT

- 7.3.4 HYDROCRACKING AND FRACTIONATION

- 7.4 BIOFUEL PROCESSING TECHNOLOGIES

- 7.4.1 HYDRO-PROCESSED ESTERS AND FATTY ACIDS

- 7.4.1.1 Liquid hydroprocessing

- 7.4.1.2 Cracking and isomerization

- 7.4.1.3 Polishing hydrocracking

- 7.4.2 ALCOHOL-TO-JET CONVERSION

- 7.4.2.1 Alcohol dehydration

- 7.4.2.2 Oligomerization

- 7.4.2.3 Hydroprocessing

- 7.4.3 BIOMASS-TO-LIQUID

- 7.4.3.1 Gasification

- 7.4.3.2 Fischer-Tropsch synthesis

- 7.4.3.3 Hydrocracking and fractionation

- 7.4.1 HYDRO-PROCESSED ESTERS AND FATTY ACIDS

8 AVIATION FUEL MARKET, BY AIRCRAFT TYPE

- 8.1 INTRODUCTION

- 8.2 FIXED WING

- 8.2.1 RAPID EXPANSION OF AIRLINE FLEETS TO DRIVE MARKET

- 8.2.2 COMMERCIAL AVIATION

- 8.2.2.1 Narrow-body aircraft

- 8.2.2.2 Wide-body aircraft

- 8.2.2.3 Regional transport aircraft

- 8.2.3 MILITARY AVIATION

- 8.2.3.1 Fighter aircraft

- 8.2.3.2 Transport aircraft

- 8.2.3.3 Special mission aircraft

- 8.2.4 BUSINESS & GENERAL AVIATION

- 8.2.4.1 Business jet

- 8.2.4.2 Light aircraft

- 8.3 ROTARY WING

- 8.3.1 EXTENSIVE USE IN SHORT- AND MEDIUM-RANGE FLIGHTS TO DRIVE MARKET

- 8.3.2 CIVIL HELICOPTER

- 8.3.3 MILITARY HELICOPTER

- 8.4 UNMANNED AERIAL VEHICLE

- 8.4.1 HIGH DEMAND FROM SURVEILLANCE AND DEFENSE OPERATIONS TO DRIVE MARKET

- 8.4.2 CIVIL & COMMERCIAL

- 8.4.3 DEFENSE & MILITARY

9 AVIATION FUEL MARKET, BY FUEL TYPE

- 9.1 INTRODUCTION

- 9.2 CONVENTIONAL AVIATION FUEL

- 9.2.1 ELEVATED DEMAND DUE TO GROWING AIR TRAVEL TO DRIVE MARKET

- 9.2.2 AVIATION TURBINE FUEL

- 9.2.2.1 Jet A

- 9.2.2.2 Jet A-1

- 9.2.3 AVGAS

- 9.2.3.1 AVGAS 100 LL

- 9.2.3.2 AVGAS 100

- 9.2.3.3 AVGAS 82UL

- 9.3 SUSTAINABLE AVIATION FUEL

- 9.3.1 GOVERNMENT PUSH FOR DECARBONIZATION TO DRIVE MARKET

- 9.3.2 BIOFUEL

- 9.3.3 HYDROGEN FUEL

- 9.3.3.1 Grey hydrogen

- 9.3.3.2 Blue hydrogen

- 9.3.3.3 Green hydrogen

- 9.3.4 POWER-TO-LIQUID

- 9.3.5 GAS-TO-LIQUID

10 AVIATION FUEL MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 AIRLINE

- 10.2.1 GROWTH IN GLOBAL AIR TRAVEL TO DRIVE MARKET

- 10.2.2 USE CASE 1: UNITED AIRLINES ADOPTS SAF TO REDUCE GREENHOUSE GAS EMISSIONS

- 10.2.3 USE CASE 2: EMIRATES AIRLINES OPERATES 100% SAF-POWERED DEMONSTRATION FLIGHT TO PROMOTE SUSTAINABILITY

- 10.3 GOVERNMENT & MILITARY

- 10.3.1 SURGE IN DEFENSE BUDGETS TO DRIVE MARKET

- 10.3.2 USE CASE 1: ROYAL AIR FORCE COMPLETES WORLD'S FIRST SAF MILITARY TRANSPORTER FLIGHT TO CURB ENVIRONMENTAL IMPACT

- 10.3.3 USE CASE 2: AIR BP AND CNAF JOIN FORCES TO SUPPORT DEVELOPMENT OF CHINA'S AVIATION INDUSTRY

- 10.3.4 USE CASE 3: INDIAN AIR FORCE CONDUCTS DEMONSTRATION FLIGHT USING BLENDED BIOJET FUEL TO REDUCE RELIANCE ON FOSSIL FUEL

- 10.4 NON-SCHEDULED OPERATOR

- 10.4.1 RISE OF E-COMMERCE AND AIR CARGO SERVICES TO DRIVE MARKET

- 10.4.2 USE CASE 1: NETJETS EUROPE COMMENCES OPERATIONS OF SAF-POWERED FLEET TO ENCOURAGE SUSTAINABILITY

- 10.4.3 USE CASE 2: EMBRAER'S PHENOM 300E AND PRAETOR 600 COMPLETE 100% SAF FLIGHT TESTS TO BOOST GREEN AVIATION

- 10.4.4 USE CASE 3: BOMBARDIER EMPLOYS VARIOUS MEASURES TO LOWER CARBON FOOTPRINT

11 AVIATION FUEL MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 PESTLE ANALYSIS

- 11.2.2 US

- 11.2.2.1 Need to address environmental challenges to drive market

- 11.2.3 CANADA

- 11.2.3.1 Innovations focused on lowering carbon footprint to drive market

- 11.3 EUROPE

- 11.3.1 PESTLE ANALYSIS

- 11.3.2 UK

- 11.3.2.1 Well-established fuel supply routes and advanced storage infrastructure to drive market

- 11.3.3 FRANCE

- 11.3.3.1 Favorable government policies and support to drive market

- 11.3.4 SPAIN

- 11.3.4.1 Airline fleet expansion and modernization to drive market

- 11.3.5 GERMANY

- 11.3.5.1 Advancements in fuel processing technology to drive market

- 11.3.6 ITALY

- 11.3.6.1 Increasing initiatives for green aviation to drive market

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 PESTLE ANALYSIS

- 11.4.2 CHINA

- 11.4.2.1 Emphasis on achieving carbon neutrality to drive market

- 11.4.3 INDIA

- 11.4.3.1 Rapid adoption of alcohol-to-jet technology for aviation fuel processing to drive market

- 11.4.4 JAPAN

- 11.4.4.1 Ongoing initiatives to replace jet fuel with SAF to drive market

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Rapid growth in air cargo and e-commerce to drive market

- 11.4.6 AUSTRALIA

- 11.4.6.1 Strategic location and presence of advanced refineries to drive market

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 PESTLE ANALYSIS

- 11.5.2 BRAZIL

- 11.5.2.1 Expanding international connectivity to drive market

- 11.5.3 MEXICO

- 11.5.3.1 Strong trade ties and well-integrated fuel supply chain to drive market

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST

- 11.6.1 PESTLE ANALYSIS

- 11.6.2 GCC

- 11.6.2.1 UAE

- 11.6.2.1.1 High private aircraft usage to drive market

- 11.6.2.2 Saudi Arabia

- 11.6.2.2.1 Domestic rise in air travel to drive market

- 11.6.2.1 UAE

- 11.6.3 QATAR

- 11.6.3.1 Increasing government investments in aviation infrastructure to drive market

- 11.6.4 TURKEY

- 11.6.4.1 Growing focus on sustainability and environmental responsibility to drive market

- 11.6.5 REST OF MIDDLE EAST

- 11.7 AFRICA

- 11.7.1 PESTLE ANALYSIS

- 11.7.2 EGYPT

- 11.7.2.1 Rising demand for aviation fuel from tourism industry to drive market

- 11.7.3 SOUTH AFRICA

- 11.7.3.1 Focus on operational efficiency to drive market

- 11.7.4 REST OF AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 12.3 REVENUE ANALYSIS, 2020-2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT

- 12.5.5.1 Company footprint

- 12.5.5.2 Fuel type footprint

- 12.5.5.3 Aircraft type footprint

- 12.5.5.4 End user footprint

- 12.5.5.5 Region footprint

- 12.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING

- 12.6.5.1 List of start-ups/SMEs

- 12.6.5.2 Competitive benchmarking of start-ups/SMEs

- 12.7 BRAND/PRODUCT COMPARISON

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 LIST OF TOP PLAYERS IN AVIATION FUEL MARKET, BY REGION

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 PRODUCT LAUNCHES

- 12.10.2 DEALS

- 12.10.3 OTHERS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 EXXON MOBIL CORPORATION

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 CHEVRON CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 BP P.L.C.

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Others

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 SHELL

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 TOTALENERGIES

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 NESTE

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 INDIAN OIL CORPORATION LTD.

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 VALERO ENERGY CORPORATION

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 PHILLIPS 66 COMPANY

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 BHARAT PETROLEUM CORPORATION LIMITED

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 LANZAJET

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.12 WORLD ENERGY, LLC

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.13 GEVO, INC.

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Deals

- 13.1.14 PETROBRAS

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.15 OMV AKTIENGESELLSCHAFT

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Deals

- 13.1.16 ALDER ENERGY, LLC

- 13.1.16.1 Business overview

- 13.1.16.2 Products offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Deals

- 13.1.17 CHINA PETROCHEMICAL CORPORATION

- 13.1.17.1 Business overview

- 13.1.17.2 Products offered

- 13.1.17.3 Recent developments

- 13.1.17.3.1 Deals

- 13.1.18 VITOL

- 13.1.18.1 Business overview

- 13.1.18.2 Products offered

- 13.1.19 ESSAR

- 13.1.19.1 Business overview

- 13.1.19.2 Products offered

- 13.1.19.3 Recent developments

- 13.1.19.3.1 Deals

- 13.1.20 WORLD KINECT CORPORATION

- 13.1.20.1 Business overview

- 13.1.20.2 Products offered

- 13.1.1 EXXON MOBIL CORPORATION

- 13.2 OTHER PLAYERS

- 13.2.1 PROMETHEUS FUELS

- 13.2.2 RED ROCK BIOFUELS

- 13.2.3 WASTEFUEL

- 13.2.4 AEMETIS, INC.

- 13.2.5 VIRENT, INC.

- 13.2.6 NORTHWEST ADVANCED BIO-FUELS, LLC

- 13.2.7 ROSNEFT DEUTSCHLAND GMBH

- 13.2.8 AIR COMPANY

- 13.2.9 SKYNRG

- 13.2.10 VELOCYS PLC

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 ANNEXURE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS