|

|

市場調査レポート

商品コード

1205710

クロマトグラフィー用付属品・消耗品の世界市場:製品別・技術別・エンドユーザー別の将来予測 (2027年まで)Chromatography Accessories & Consumables Market by Product (Columns, Detectors, Syringes, Vials, Autosamplers, Pumps), Technology (Liquid Chromatography, Gas Chromatography), End User (Pharma-biotech, Petrochemical, Academia) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| クロマトグラフィー用付属品・消耗品の世界市場:製品別・技術別・エンドユーザー別の将来予測 (2027年まで) |

|

出版日: 2023年01月19日

発行: MarketsandMarkets

ページ情報: 英文 264 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のクロマトグラフィー用付属品・消耗品の市場規模は、2022年の44億米ドルから2027年には65億米ドルに達すると予測され、2022年から2027年までのCAGRは8.0%と予測されています。

プロテオミクス市場の立ち上がりや、研究開発を支援する官民ファンドの増加といった要因が、この市場の成長を高めている要因となっています。

製品別では、2021年にカラムが最大の市場シェアを占めています。その要因として、バイオ医薬品の需要増加や、食品安全用途でのクロマトグラフィーの使用増加などが挙げられます。

技術別では、液体クロマトグラフィーのセグメントが予測期間中 (2022年~2027年) に最高のCAGRを記録すると予測されています。バイオテクノロジー産業における分離手法の使用増加、石油・ガス業界におけるクロマトグラフィーの利用拡大、製薬会社における医薬品承認プロセスなどの要因が、予測期間中にCAGRの高さにつながっています。

地域別に見ると、アジア太平洋市場が2021年に最大のシェアを占め、予測期間中に8.8%のCAGRで最も高い成長を遂げる見通しです。その要因として、バイオメディカル分野への投資拡大やバイオシミラー生産増加などが挙げられます。

当レポートでは、世界のクロマトグラフィー用付属品・消耗品の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、技術別・製品別・エンドユーザー別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 分析方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 規制状況

- バリューチェーン分析

- サプライチェーン分析

- 価格分析

- クロマトグラフィー用付属品・消耗品市場:エコシステムの情勢

- ポーターのファイブフォース分析

- 特許分析

- 貿易分析

- 技術分析

- ケーススタディ分析:臨床診断向けクロマトグラフィー製品に対するユーザーの認識

- 主な会議とイベント (2022年~2023年)

- 主な利害関係者と購入基準

第6章 クロマトグラフィー用付属品・消耗品市場:技術別

- イントロダクション

- 液体クロマトグラフィー

- 高圧液体クロマトグラフィー (HPLC)

- 超高性能液体クロマトグラフィー

- フラッシュクロマトグラフィー

- 低圧液体クロマトグラフィー

- その他の液体クロマトグラフィー技術

- ガスクロマトグラフィー

- その他のクロマトグラフィー技術

第7章 クロマトグラフィー用付属品・消耗品市場:製品別

- イントロダクション

- カラム

- プレパックカラム

- 空カラム

- カラム付属品・消耗品

- ガードホルダー

- ヒーター・オーブン

- その他のカラム付属品・消耗品

- オートサンプラー

- オートサンプラー付属品・消耗品

- オートサンプラー用シリンジフィルター

- バイアル

- 隔膜

- フロー管理用付属品・消耗品

- 流量計

- フロースプリッター

- ポンプ

- クロマトグラフィー用継手・チューブ

- 配管

- 口金・ナット

- バルブ・ゲージ

- ライナー・シール

- 検出器

- 液体クロマトグラフィー検出器

- ガスクロマトグラフィー検出器

- 移動相向け付属品・消耗品

- ミキサー・混合チャンバー

- 脱気装置

- その他の移動相向け付属品・消耗品

- フラクションコレクター

- 圧力調整器

- その他のクロマトグラフィー付属品・消耗品

第8章 クロマトグラフィー用付属品・消耗品市場:エンドユーザー別

- イントロダクション

- 製薬・バイオテクノロジー産業

- 教育・研究機関

- 食品・飲料産業

- 病院・診療所

- 石油・ガス産業

- 環境機関

- その他のエンドユーザー

第9章 クロマトグラフィー用付属品・消耗品市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- 他のアジア太平洋諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

- 中東・アフリカ

第10章 競合情勢

- イントロダクション

- 主要企業が採用した権利獲得戦略

- 収益シェア分析

- 市場シェア分析

- 競合リーダーシップマッピング:企業評価クアドラント (2021年)

- 競合リーダーシップマッピング:スタートアップ/中小企業の評価クアドラント (2021年)

- 競合ベンチマーキング

- 競合シナリオ

- 製品の発売と承認

- 資本取引

第11章 企業プロファイル

- 主要企業

- AGILENT TECHNOLOGIES

- WATERS CORPORATION

- SHIMADZU CORPORATION

- THERMO FISHER SCIENTIFIC, INC.

- PERKINELMER, INC.

- BRUKER

- BIO-RAD LABORATORIES, INC.

- MERCK KGAA

- AVANTOR

- RESTEK CORPORATION

- HITACHI, LTD.

- XYLEM, INC.

- GILSON INC.

- JASCO INTERNATIONAL CO., LTD.

- OROCHEM TECHNOLOGIES, INC.

- その他の企業

- PHENOMENEX

- CENTURION SCIENTIFIC

- SRI INSTRUMENTS

- TRAJAN SCIENTIFIC AND MEDICAL

- VALCO INSTRUMENTS, INC.

- UIC, INC.

- NOURYON

- UNIMICRO TECHNOLOGIES CO., LTD.

- REGIS TECHNOLOGIES, INC.

- QUADREX CORPORATION

- OPTIMIZE TECHNOLOGIES

- POSTNOVA ANALYTICS GMBH

- WELCH MATERIALS

- SYKAM GMBH

- DIKMA TECHNOLOGIES, INC.

第12章 付録

The global chromatography accessories and consumables market is projected to reach USD 6.5 Billion by 2027 from USD 4.4 Billion in 2022, at a CAGR of 8.0% from 2022 to 2027. Factors such as the rising proteomics market and increasing public/private funding supporting research and development are responsible for the increasing growth of this market.

"The Column segment to hold the largest share of the market in 2021"

The column holds the largest market share in 2021. The large share of this segment can be attributed to the growing demand for biopharmaceuticals and the increasing use of chromatography methods in food safety applications.

"The Liquid Chromatography segment is projected to register the highest CAGR during the forecast period"

Based on technology, the chromatography accessories and consumables market is segmented into liquid chromatography, gas chromatography and other chromatography technologies. The liquid chromatography segment is projected to register the highest CAGR during the forecast period of 2022 to 2027. Factors such as the increasing use of separation methods in the biotech industry, rising use of chromatography in the oil & gas sector, and drug approval process in pharmaceutical companies, liquid chromatography is witnessing higher CAGR during the forecast.

"The market in Asia Pacific region is expected to witness the highest growth during the forecast period."

Asia Pacific accounted for the largest market share in 2021. This share can be attributed to the increasing outsourcing of drug development by pharmaceutical companies in different countries within the region. The Chromatography accessories and consumables market in the APAC region is expected to register a CAGR of 8.8% during the forecast period, primarily due to the rising investments in the biomedical sector and increasing biosimilars production.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-45%, Tier 2-34%, and Tier 3- 21%

- By Designation: C-level-20%, Director-level-25%, and Others-55%

- By Region: North America-35%, Europe-32%, Asia Pacific-25%, Latin America-6%, and the Middle East & Africa-2%

The prominent players in the chromatography accessories and consumables market are Agilent Technologies (US), Waters Corporation (US), Shimadzu Corporation (Japan), Thermo Fisher Scientific (US), PerkinElemer Inc (US), Bruker Corporation (US), Bio-Rad Laboratories (US), Merck KGaA (Germany), Avantor (US), Hitachi (Japan), Restek Corporation (US), Gilson Inc (US).

Research Coverage

This report studies the chromatography accessories and consumables market based on product, technology, end user and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five main regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to garner a larger market share. Firms purchasing the report could use one or a combination of the below-mentioned strategies for strengthening their market presence.

This report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the chromatography accessories and consumables market.

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the chromatography accessories and consumables market..

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the chromatography accessories and consumables market.

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKETS COVERED

- 1.4.2 GEOGRAPHIES COVERED

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH METHODOLOGY STEPS

- FIGURE 1 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET: RESEARCH METHODOLOGY

- FIGURE 2 RESEARCH DESIGN

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY RESEARCH

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.3 MARKET SIZE ESTIMATION METHODOLOGY

- 2.3.1 REVENUE MAPPING-BASED MARKET ESTIMATION

- 2.3.2 USAGE PATTERN-BASED MARKET ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET

- 2.3.3 PRIMARY RESEARCH VALIDATION

- 2.4 MARKET DATA ESTIMATION AND TRIANGULATION

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- 2.5 STUDY ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET: RECESSION IMPACT METHODOLOGY

3 EXECUTIVE SUMMARY

- FIGURE 7 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

- FIGURE 8 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- 3.1 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 10 ASIA PACIFIC REGION TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET OVERVIEW

- FIGURE 11 RISING DEMAND FOR CHROMATOGRAPHY SOLUTIONS IN APPLIED INDUSTRIES TO DRIVE MARKET

- 4.2 LIQUID CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY TECHNOLOGY (2022 VS. 2027)

- FIGURE 12 ULTRA-PERFORMANCE LIQUID CHROMATOGRAPHY SEGMENT TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY END USER (2022 VS. 2027)

- FIGURE 13 PHARMACEUTICAL & BIOTECHNOLOGY INDUSTRIES SEGMENT TO REGISTER HIGH GROWTH RATE DURING FORECAST PERIOD

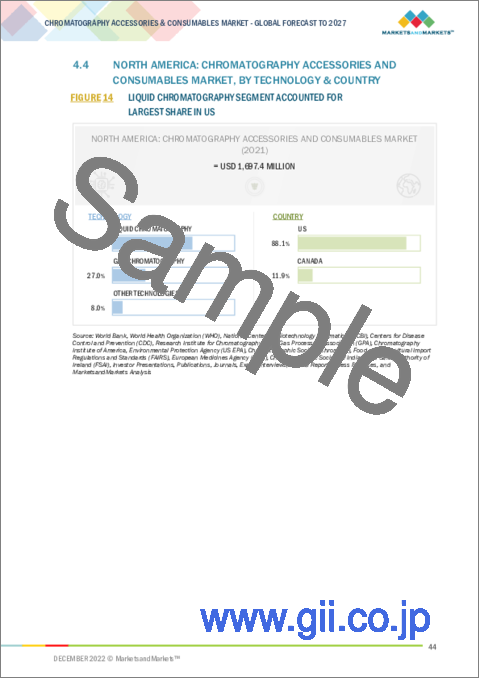

- 4.4 NORTH AMERICA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY TECHNOLOGY & COUNTRY

- FIGURE 14 LIQUID CHROMATOGRAPHY SEGMENT ACCOUNTED FOR LARGEST SHARE IN US

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing investments in pharmaceutical R&D

- 5.2.1.2 Rising popularity of hyphenated chromatography techniques

- 5.2.1.3 Rising use of chromatography for food safety applications

- 5.2.1.4 Growing importance of chromatography in drug development

- 5.2.1.5 Increasing demand for environmental analysis

- 5.2.1.6 Growing significance of biomolecular analysis

- 5.2.1.7 Rising demand for chromatography solutions in applied industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Premium product pricing

- 5.2.2.2 Shortage of skilled professionals

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of novel gas chromatography columns for petrochemical applications

- 5.2.3.2 Growing proteomics market

- 5.2.3.3 Emerging markets

- 5.2.3.4 Green chemistry and sustainability

- 5.2.4 CHALLENGES

- 5.2.4.1 Presence of alternative techniques

- 5.3 REGULATORY LANDSCAPE

- 5.3.1 US

- 5.3.2 EUROPE

- 5.3.3 ASIA PACIFIC

- 5.3.4 REST OF THE WORLD

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 16 VALUE CHAIN ANALYSIS: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.5.3 END USERS

- FIGURE 17 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET: SUPPLY CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT

- TABLE 1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT

- 5.6.2 AVERAGE SELLING PRICE TREND

- 5.7 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET: ECOSYSTEM LANDSCAPE

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.8.2 BARGAINING POWER OF BUYERS

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 THREAT OF NEW ENTRANTS

- 5.8.5 THREAT OF SUBSTITUTES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- TABLE 3 IMPORT DATA FOR CHROMATOGRAPHY PRODUCTS (HS CODE 902720), BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 4 EXPORT DATA FOR CHROMATOGRAPHY PRODUCTS (HS CODE 902720), BY COUNTRY, 2017-2021 (USD MILLION)

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 HPLC TECHNOLOGY

- 5.11.2 EMERGING APPLICATIONS IN PROCESS ANALYTICAL TESTING

- 5.12 CASE STUDY ANALYSIS: USER PERCEPTION OF CHROMATOGRAPHY PRODUCTS IN CLINICAL DIAGNOSTIC APPLICATIONS

- 5.13 KEY CONFERENCES AND EVENTS (2022-2023)

- TABLE 5 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET: LIST OF MAJOR CONFERENCES & EVENTS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- 5.14.2 KEY BUYING CRITERIA

- FIGURE 19 KEY BUYING CRITERIA FOR CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES PRODUCTS

- TABLE 7 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET: KEY BUYING CRITERIA FOR PRODUCTS

6 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- TABLE 8 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- 6.2 LIQUID CHROMATOGRAPHY

- TABLE 9 LIQUID CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 10 LIQUID CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2.1 HIGH-PRESSURE LIQUID CHROMATOGRAPHY (HPLC)

- 6.2.1.1 High accuracy and sensitivity to drive market uptake

- TABLE 11 HIGH-PRESSURE LIQUID CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2.2 ULTRA-PERFORMANCE LIQUID CHROMATOGRAPHY

- 6.2.2.1 Growing use of UPLC in drug development processes to drive market

- TABLE 12 ULTRA-PERFORMANCE LIQUID CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2.3 FLASH CHROMATOGRAPHY

- 6.2.3.1 Online UV-VIS detection and parallel multi-sample purification to support market growth

- TABLE 13 FLASH CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2.4 LOW-PRESSURE LIQUID CHROMATOGRAPHY

- 6.2.4.1 Increasing adoption of LPLC systems in pharmaceutical & biotechnology industries to support market growth

- TABLE 14 LOW-PRESSURE LIQUID CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2.5 OTHER LIQUID CHROMATOGRAPHY TECHNOLOGIES

- TABLE 15 OTHER LIQUID CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3 GAS CHROMATOGRAPHY

- 6.3.1 UTILIZATION OF GC IN SEPARATION AND ANALYSIS OF VOLATILE COMPOUNDS TO DRIVE MARKET

- TABLE 16 GAS CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.4 OTHER CHROMATOGRAPHY TECHNOLOGIES

- TABLE 17 OTHER CHROMATOGRAPHY TECHNOLOGIES MARKET, BY REGION, 2020-2027 (USD MILLION)

7 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- TABLE 18 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 7.2 COLUMNS

- TABLE 19 COLUMNS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 20 COLUMNS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.2.1 PRE-PACKED COLUMNS

- 7.2.1.1 Ability to run large samples daily to fuel adoption

- TABLE 21 PRE-PACKED COLUMNS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.2.2 EMPTY COLUMNS

- 7.2.2.1 Low cost and flexibility to improve performance

- TABLE 22 EMPTY COLUMNS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3 COLUMN ACCESSORIES AND CONSUMABLES

- TABLE 23 COLUMN ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 24 COLUMN ACCESSORIES AND CONSUMABLES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3.1 GUARD HOLDERS

- 7.3.1.1 Ability to protect columns from harmful contaminants to support market

- TABLE 25 GUARD HOLDERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3.2 HEATERS AND OVENS

- 7.3.2.1 Ability to control temperatures in analytical processes to drive adoption

- TABLE 26 HEATERS AND OVENS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3.3 OTHER COLUMN ACCESSORIES AND CONSUMABLES

- TABLE 27 OTHER COLUMN ACCESSORIES AND CONSUMABLES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.4 AUTOSAMPLERS

- 7.4.1 USE OF ADVANCED ROBOTICS TO ENABLE SAMPLE HANDLING

- TABLE 28 AUTOSAMPLERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.5 AUTOSAMPLER ACCESSORIES AND CONSUMABLES

- TABLE 29 AUTOSAMPLER ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 30 AUTOSAMPLER ACCESSORIES AND CONSUMABLES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.5.1 AUTOSAMPLER SYRINGE FILTERS

- 7.5.1.1 Ability to remove impurities from gas or liquid samples to support growth

- TABLE 31 AUTOSAMPLER SYRINGE FILTERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.5.2 VIALS

- 7.5.2.1 Importance of vials in sample analysis to propel growth

- TABLE 32 VIALS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.5.3 SEPTA

- 7.5.3.1 Ability to maintain carrier gas pressure to support market

- TABLE 33 SEPTA MARKET, BY REGION, 2020-2027 (USD MILLION)

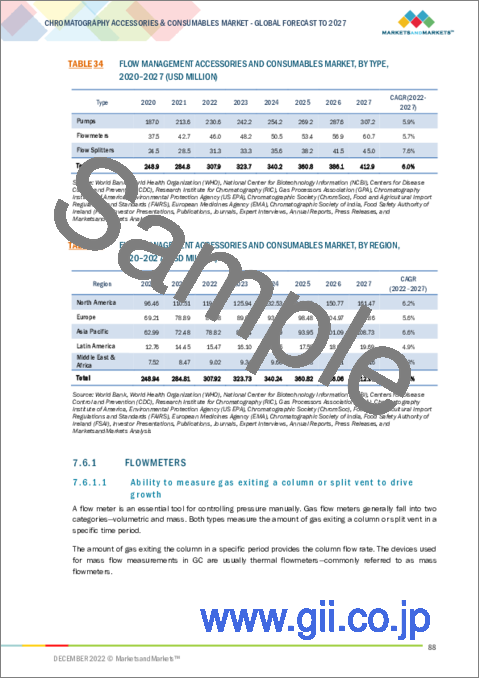

- 7.6 FLOW MANAGEMENT ACCESSORIES AND CONSUMABLES

- TABLE 34 FLOW MANAGEMENT ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 35 FLOW MANAGEMENT ACCESSORIES AND CONSUMABLES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.6.1 FLOWMETERS

- 7.6.1.1 Ability to measure gas exiting a column or split vent to drive growth

- TABLE 36 FLOWMETERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.6.2 FLOW SPLITTERS

- 7.6.2.1 Utilization in automated systems for drug metabolite analysis to drive market

- TABLE 37 FLOW SPLITTERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.6.3 PUMPS

- 7.6.3.1 Ability to provide a continuous flow of pressure to drive adoption

- TABLE 38 PUMPS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.7 CHROMATOGRAPHY FITTINGS AND TUBING

- TABLE 39 CHROMATOGRAPHY FITTINGS AND TUBING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 40 CHROMATOGRAPHY FITTINGS AND TUBING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.7.1 TUBING

- 7.7.1.1 Heavy utilization in manufacturing columns for chromatography machines to support growth

- TABLE 41 TUBING MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.7.2 FERRULES AND NUTS

- 7.7.2.1 Ability to seal tube connections in GC and LC systems to drive growth

- TABLE 42 FERRULES AND NUTS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.7.3 VALVES AND GAUGES

- 7.7.3.1 Ability to control fluid flow and column pressure to fuel adoption

- TABLE 43 VALVES AND GAUGES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.7.4 LINERS AND SEALS

- 7.7.4.1 Ability to eliminate inlet discrimination to drive growth

- TABLE 44 LINERS AND SEALS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.8 DETECTORS

- TABLE 45 DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 46 DETECTORS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.8.1 LIQUID CHROMATOGRAPHY DETECTORS

- TABLE 47 LIQUID CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 48 LIQUID CHROMATOGRAPHY DETECTORS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.8.1.1 UV visible PDA detectors

- 7.8.1.1.1 Ease of use and improved sensitivity to drive growth

- 7.8.1.1 UV visible PDA detectors

- TABLE 49 UV VISIBLE PDA DETECTORS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.8.1.2 Refractive index detectors

- 7.8.1.2.1 Beneficial analysis of carbohydrates, lipids, and petrochemicals to drive growth

- 7.8.1.2 Refractive index detectors

- TABLE 50 REFRACTIVE INDEX DETECTORS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.8.1.3 Fluorescence detectors

- 7.8.1.3.1 Highly sensitive and selective features to drive adoption

- 7.8.1.3 Fluorescence detectors

- TABLE 51 FLUORESCENCE DETECTORS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.8.1.4 Other liquid chromatography detectors

- TABLE 52 OTHER LIQUID CHROMATOGRAPHY DETECTORS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.8.2 GAS CHROMATOGRAPHY DETECTORS

- TABLE 53 GAS CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 54 GAS CHROMATOGRAPHY DETECTORS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.8.2.1 Flame ionization detectors

- 7.8.2.1.1 Utilization in quality-control analysis to drive growth

- 7.8.2.1 Flame ionization detectors

- TABLE 55 FLAME IONIZATION DETECTORS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.8.2.2 Mass spectrometry detectors

- 7.8.2.2.1 Ability to determine analyte mass and identify components of incomplete separation to propel growth

- 7.8.2.2 Mass spectrometry detectors

- TABLE 56 MASS SPECTROMETRY DETECTORS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.8.2.3 Thermal conductivity detectors

- 7.8.2.3.1 Ability to measure gas thermal conductivity to fuel adoption

- 7.8.2.3 Thermal conductivity detectors

- TABLE 57 THERMAL CONDUCTIVITY DETECTORS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.8.2.4 Other gas chromatography detectors

- TABLE 58 OTHER GAS CHROMATOGRAPHY DETECTORS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.9 MOBILE PHASE ACCESSORIES AND CONSUMABLES

- TABLE 59 MOBILE PHASE ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 60 MOBILE PHASE ACCESSORIES AND CONSUMABLES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.9.1 MIXERS AND MIXING CHAMBERS

- 7.9.1.1 Ability to homogenize mobile phase composition to support growth

- TABLE 61 MIXERS AND MIXING CHAMBERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.9.2 DEGASSERS

- 7.9.2.1 Ability to prevent outgassing at connections and detector flow cells to support growth

- TABLE 62 DEGASSERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.9.3 OTHER MOBILE PHASE ACCESSORIES AND CONSUMABLES

- TABLE 63 OTHER MOBILE PHASE ACCESSORIES AND CONSUMABLES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.10 FRACTION COLLECTORS

- 7.10.1 UTILIZATION IN GAS AND LIQUID CHROMATOGRAPHY FOR SAMPLE COLLECTION TO DRIVE ADOPTION

- TABLE 64 FRACTION COLLECTORS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.11 PRESSURE REGULATORS

- 7.11.1 ABILITY TO ALLOW EFFICIENT GAS FLOW TO DRIVE ADOPTION

- TABLE 65 PRESSURE REGULATORS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.12 OTHER CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES

- TABLE 66 OTHER CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY REGION, 2020-2027 (USD MILLION)

8 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 67 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.2 PHARMACEUTICAL & BIOTECHNOLOGY INDUSTRIES

- 8.2.1 RISING NEED FOR RIGOROUS QUALITY ANALYSIS IN DRUG DEVELOPMENT TO DRIVE MARKET

- TABLE 68 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY INDUSTRIES, BY REGION, 2020-2027 (USD MILLION)

- 8.3 ACADEMIC & RESEARCH INSTITUTES

- 8.3.1 RISING NUMBER OF RESEARCH-RELATED ACTIVITIES IN MEDICINE & PROTEOMICS TO DRIVE MARKET

- TABLE 69 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2020-2027 (USD MILLION)

- 8.4 FOOD & BEVERAGE INDUSTRIES

- 8.4.1 GROWING FOCUS ON FOOD QUALITY AND SAFETY TO DRIVE MARKET

- TABLE 70 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET FOR FOOD & BEVERAGE INDUSTRIES, BY REGION, 2020-2027 (USD MILLION)

- 8.5 HOSPITALS AND CLINICS

- 8.5.1 HPLC UTILIZATION IN DIAGNOSTIC APPLICATIONS TO DRIVE MARKET

- TABLE 71 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET FOR HOSPITALS AND CLINICS, BY REGION, 2020-2027 (USD MILLION)

- 8.6 OIL & GAS INDUSTRIES

- 8.6.1 UTILIZATION OF GAS CHROMATOGRAPHY IN PETROLEUM REFINE TESTING TO SUPPORT MARKET GROWTH

- TABLE 72 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET FOR OIL & GAS INDUSTRIES, BY REGION, 2020-2027 (USD MILLION)

- 8.7 ENVIRONMENTAL AGENCIES

- 8.7.1 INCREASING CONCERNS ON GLOBAL WARMING TO DRIVE UPTAKE OF CHROMATOGRAPHY SYSTEMS

- TABLE 73 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET FOR ENVIRONMENTAL AGENCIES, BY REGION, 2020-2027 (USD MILLION)

- 8.8 OTHER END USERS

- TABLE 74 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET FOR OTHER END USERS, BY REGION, 2020-2027 (USD MILLION)

9 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 75 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 20 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET: NORTH AMERICA MARKET SNAPSHOT

- TABLE 76 NORTH AMERICA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 77 NORTH AMERICA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 78 NORTH AMERICA: CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 79 NORTH AMERICA: CHROMATOGRAPHY COLUMN ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 80 NORTH AMERICA: AUTOSAMPLER ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 81 NORTH AMERICA: FLOW MANAGEMENT ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 82 NORTH AMERICA: MOBILE PHASE ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 83 NORTH AMERICA: CHROMATOGRAPHY FITTINGS AND TUBING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 84 NORTH AMERICA: CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 85 NORTH AMERICA: LIQUID CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 86 NORTH AMERICA: GAS CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 87 NORTH AMERICA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 88 NORTH AMERICA: LIQUID CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 89 NORTH AMERICA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Presence of leading pharmaceutical & biotechnology companies to drive market

- TABLE 90 US: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 Growing food and agriculture sector to support market growth

- TABLE 91 CANADA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 9.3 EUROPE

- TABLE 92 EUROPE: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 93 EUROPE: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 94 EUROPE: CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 95 EUROPE: CHROMATOGRAPHY COLUMN ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 96 EUROPE: AUTOSAMPLER ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 97 EUROPE: FLOW MANAGEMENT ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 98 EUROPE: MOBILE PHASE ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 99 EUROPE: CHROMATOGRAPHY FITTINGS AND TUBING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 100 EUROPE: CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 101 EUROPE: LIQUID CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 102 EUROPE: GAS CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 103 EUROPE: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 104 EUROPE: LIQUID CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 105 EUROPE: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Rising initiatives for biotechnology research to drive market adoption of chromatography techniques

- TABLE 106 GERMANY: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Growing F&B industry to drive market uptake of chromatography techniques

- TABLE 107 UK: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Growing perfume industry and rising pharmaceutical R&D to drive market

- TABLE 108 FRANCE: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 Rising funding initiatives by biotech companies to support adoption of chromatography

- TABLE 109 ITALY: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Growth in food & agricultural sector to support market growth for quality testing

- TABLE 110 SPAIN: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 111 REST OF EUROPE: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 21 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET: ASIA PACIFIC MARKET SNAPSHOT

- TABLE 112 ASIA PACIFIC: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 113 ASIA PACIFIC: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 114 ASIA PACIFIC: CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 115 ASIA PACIFIC: CHROMATOGRAPHY COLUMN ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 116 ASIA PACIFIC: AUTOSAMPLER ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 117 ASIA PACIFIC: FLOW MANAGEMENT ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MOBILE PHASE ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 119 ASIA PACIFIC: CHROMATOGRAPHY FITTINGS AND TUBING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 120 ASIA PACIFIC: CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 121 ASIA PACIFIC: LIQUID CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 122 ASIA PACIFIC: GAS CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 123 ASIA PACIFIC: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 124 ASIA PACIFIC: LIQUID CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 125 ASIA PACIFIC: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.4.1 JAPAN

- 9.4.1.1 Growing generics & biosimilars production to drive market

- TABLE 126 JAPAN: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Growing production and export of pharmaceuticals to drive market

- TABLE 127 CHINA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 9.4.3 INDIA

- 9.4.3.1 Rising focus on food safety standards to drive market

- TABLE 128 INDIA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 9.4.4 AUSTRALIA

- 9.4.4.1 Rising focus on food testing to support market growth

- TABLE 129 AUSTRALIA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Rising developments in pharmaceutical drug discovery to support market growth

- TABLE 130 SOUTH KOREA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 9.4.6 REST OF ASIA PACIFIC

- TABLE 131 REST OF ASIA PACIFIC: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 9.5 LATIN AMERICA

- TABLE 132 LATIN AMERICA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 133 LATIN AMERICA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 134 LATIN AMERICA: CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 135 LATIN AMERICA: CHROMATOGRAPHY COLUMN ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 136 LATIN AMERICA: AUTOSAMPLER ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 137 LATIN AMERICA: FLOW MANAGEMENT ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 138 LATIN AMERICA: MOBILE PHASE ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 139 LATIN AMERICA: CHROMATOGRAPHY FITTINGS AND TUBING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 140 LATIN AMERICA: CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 141 LATIN AMERICA: LIQUID CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 142 LATIN AMERICA: GAS CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 143 LATIN AMERICA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 144 LATIN AMERICA: LIQUID CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 145 LATIN AMERICA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY END USER, 2020-2027 (USD MILLION)

- 9.5.1 BRAZIL

- 9.5.1.1 Growing biologics sector to support market growth

- TABLE 146 BRAZIL: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 9.5.2 MEXICO

- 9.5.2.1 Rising public-private funding for generic drug production to support market growth

- TABLE 147 MEXICO: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 9.5.3 REST OF LATIN AMERICA

- TABLE 148 REST OF LATIN AMERICA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 HIGHEST PRODUCTION AND EXPORT RATES FOR CRUDE OIL TO DRIVE MARKET

- TABLE 149 MIDDLE EAST & AFRICA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: CHROMATOGRAPHY COLUMNS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: CHROMATOGRAPHY COLUMN ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: AUTOSAMPLER ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: FLOW MANAGEMENT ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: MOBILE PHASE ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: CHROMATOGRAPHY FITTINGS AND TUBING MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: LIQUID CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: GAS CHROMATOGRAPHY DETECTORS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: LIQUID CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET, BY END USER, 2020-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- FIGURE 22 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET: KEY DEVELOPMENTS BY LEADING PLAYERS

- 10.2 RIGHT-TO-WIN STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE SHARE ANALYSIS

- FIGURE 23 REVENUE SHARE ANALYSIS OF TOP FIVE PLAYERS

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 24 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET SHARE, BY KEY PLAYER (2021)

- 10.5 COMPETITIVE LEADERSHIP MAPPING: COMPANY EVALUATION QUADRANT (2021)

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 25 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

- 10.6 COMPETITIVE LEADERSHIP MAPPING: STARTUPS/SME EVALUATION QUADRANT (2021)

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 26 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET: COMPETITIVE LEADERSHIP MAPPING FOR STARTUPS/SMES (2021)

- 10.7 COMPETITIVE BENCHMARKING

- TABLE 162 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET: COMPANY FOOTPRINT ANALYSIS

- TABLE 163 CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES MARKET: REGIONAL FOOTPRINT ANALYSIS

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 PRODUCT LAUNCHES & APPROVALS

- 10.8.2 DEALS

11 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 11.1 KEY PLAYERS

- 11.1.1 AGILENT TECHNOLOGIES

- TABLE 164 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 27 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2021)

- 11.1.2 WATERS CORPORATION

- TABLE 165 WATERS CORPORATION: BUSINESS OVERVIEW

- FIGURE 28 WATERS CORPORATION: COMPANY SNAPSHOT (2021)

- 11.1.3 SHIMADZU CORPORATION

- TABLE 166 SHIMADZU CORPORATION: BUSINESS OVERVIEW

- FIGURE 29 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2021)

- 11.1.4 THERMO FISHER SCIENTIFIC, INC.

- TABLE 167 THERMO FISHER SCIENTIFIC, INC: BUSINESS OVERVIEW

- FIGURE 30 THERMO FISHER SCIENTIFIC, INC: COMPANY SNAPSHOT (2021)

- 11.1.5 PERKINELMER, INC.

- TABLE 168 PERKINELMER, INC.: BUSINESS OVERVIEW

- FIGURE 31 PERKINELMER, INC.: COMPANY SNAPSHOT (2021)

- 11.1.6 BRUKER

- TABLE 169 BRUKER: BUSINESS OVERVIEW

- FIGURE 32 BRUKER: COMPANY SNAPSHOT (2021)

- 11.1.7 BIO-RAD LABORATORIES, INC.

- TABLE 170 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

- FIGURE 33 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2021)

- 11.1.8 MERCK KGAA

- TABLE 171 MERCK KGAA: BUSINESS OVERVIEW

- FIGURE 34 MERCK KGAA: COMPANY SNAPSHOT (2021)

- 11.1.9 AVANTOR

- TABLE 172 AVANTOR: BUSINESS OVERVIEW

- FIGURE 35 AVANTOR: COMPANY SNAPSHOT (2021)

- 11.1.10 RESTEK CORPORATION

- TABLE 173 RESTEK CORPORATION: BUSINESS OVERVIEW

- 11.1.11 HITACHI, LTD.

- TABLE 174 HITACHI LTD.: BUSINESS OVERVIEW

- FIGURE 36 HITACHI LTD.: COMPANY SNAPSHOT (2021)

- 11.1.12 XYLEM, INC.

- TABLE 175 XYLEM, INC.: BUSINESS OVERVIEW

- FIGURE 37 XYLEM, INC.: COMPANY SNAPSHOT (2021)

- 11.1.13 GILSON INC.

- TABLE 176 GILSON INC.=: BUSINESS OVERVIEW

- 11.1.14 JASCO INTERNATIONAL CO., LTD.

- TABLE 177 JASCO INTERNATIONAL CO., LTD.: BUSINESS OVERVIEW

- 11.1.15 OROCHEM TECHNOLOGIES, INC.

- TABLE 178 OROCHEM TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 PHENOMENEX

- 11.2.2 CENTURION SCIENTIFIC

- 11.2.3 SRI INSTRUMENTS

- 11.2.4 TRAJAN SCIENTIFIC AND MEDICAL

- 11.2.5 VALCO INSTRUMENTS, INC.

- 11.2.6 UIC, INC.

- 11.2.7 NOURYON

- 11.2.8 UNIMICRO TECHNOLOGIES CO., LTD.

- 11.2.9 REGIS TECHNOLOGIES, INC.

- 11.2.10 QUADREX CORPORATION

- 11.2.11 OPTIMIZE TECHNOLOGIES

- 11.2.12 POSTNOVA ANALYTICS GMBH

- 11.2.13 WELCH MATERIALS

- 11.2.14 SYKAM GMBH

- 11.2.15 DIKMA TECHNOLOGIES, INC.

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS