|

|

市場調査レポート

商品コード

1191019

消磁システムの世界市場:船舶の種類別 (小型船舶、中型船舶、大型船舶)・ソリューション別 (磁気測定、消磁、船体消磁)・エンドユーザー別 (OEM、アフターマーケット、サービス)・地域別 (北米、欧州、アジア太平洋、他の国々 (RoW)) の将来予測 (2027年まで)Degaussing System Market by Vessel Type (Small Vessel, Medium Vessel, Large Vessel), Solution (Ranging, Degaussing, Deperming), End User (OEM, Aftermarket, & Services) and Region (North America, Europe, APAC, RoW) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 消磁システムの世界市場:船舶の種類別 (小型船舶、中型船舶、大型船舶)・ソリューション別 (磁気測定、消磁、船体消磁)・エンドユーザー別 (OEM、アフターマーケット、サービス)・地域別 (北米、欧州、アジア太平洋、他の国々 (RoW)) の将来予測 (2027年まで) |

|

出版日: 2023年01月16日

発行: MarketsandMarkets

ページ情報: 英文 199 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の消磁システムの市場規模は、2022年の6億1,900万米ドルから、2027年には7億4,000万米ドルに達し、2022年から2027年までの間に3.6%のCAGRで成長すると予測されています。

消磁システムの技術進歩が、予測期間中の市場成長を促進すると考えられています。

高温超電導体 (HTS) 消磁システムは、軽量でコンパクトな設計が可能です。HTS脱磁コイルは、脱磁システムの総重量が50~80%軽くなり、また設置・校正サービスが安価で利用でき、電力消費量も少なくなっています。

ソリューション別では、磁気測定ソリューションが予測期間中に最も高いCAGRで成長すると予想されます。

地域別に見ると、2022年にはアジア太平洋がシェアが最も高く、市場を独占しています。特に中国では領土保全と国家安全保障を維持するために、海軍と戦力の近代化のための国防費を増やしています。このため、海軍装備の生産・調達が増加し、消磁システムの需要が高まると予想されます。

当レポートでは、世界の消磁システムの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、船舶の種類別・ソリューション別・エンドユーザー別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 消磁システム市場のエコシステム

- バリューチェーン分析

- ポーターのファイブフォース分析

- 関税と規制の状況

- 主な利害関係者と購入基準

- ユースケース

- 消磁システム市場に対する景気後退の影響

第6章 産業動向

- イントロダクション

- 電源アーキテクチャ

- 完全分散型消磁システム

- 半分散型消磁システム

- 集中型消磁システム

- 制御モード

- 技術動向

- 銅コイル

- 高温超電導 (HTS) 材料

- 艦載型・空中磁気測定装置

- 多影響型磁気測定システム

- 戦略的ベンチマーク

- イノベーションと特許登録

- 主な会議とイベント (2023年)

第7章 消磁システム市場:船舶の種類別

- イントロダクション

- 小型船舶

- MCMV (機雷対策船)

- OPV (哨戒艇)

- FAC (高速戦闘艇)

- 中型船舶

- 潜水艦

- 駆逐艦

- コルベット艦

- 大型船舶

- フリゲート艦

- 航空母艦

- 水陸両用船

第8章 消磁システム市場:ソリューション別

- イントロダクション

- 消磁

- 製品

- サービス

- 磁気測定

- 据置型

- 艦載型

- 船体消磁

第9章 消磁システム市場:エンドユーザー別

- イントロダクション

- OEM

- アフターマーケット

- サービス

第10章 消磁システム市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- 北朝鮮

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 中東・アフリカ

- 南米

第11章 競合情勢

- イントロダクション

- 企業概要

- 消磁システム市場における主要企業のランキング分析 (2021年)

- 収益分析 (2021年)

- 市場シェア分析 (2021年)

- 競合評価クアドラント

- 競合ベンチマーキング

- 競合シナリオ

- 市場評価フレームワーク

- 製品の発売と開発

- 資本取引

- その他

第12章 企業プロファイル

- イントロダクション

- 主要企業

- LARSEN & TOUBRO LIMITED

- POLYAMP AB

- WARTSILA

- ULTRA ELECTRONICS HOLDINGS PLC

- ECA GROUP

- IFEN S.P.A.

- DAYATECH MERIN SDN. BHD.

- AMERICAN SUPERCONDUCTOR CORPORATION

- STL SYSTEMS AG

- DA-GROUP

- L3HARRIS TECHNOLOGIES, INC.

第13章 付録

The degaussing systems market is projected to grow from USD 619 Million in 2022 to USD 740 Million by 2027, at a CAGR of 3.6% from 2022 to 2027. Rising technological advancement in degaussing system is expected to drive the market growth during the forecast period.

The application of degaussing systems started during World War II to protect naval vessels from magnetic mines and torpedoes. Degaussing equipment has since been used to retreat the magnetic signatures of vessels to make them invisible to mines.

These systems comprise coil loops installed onboard a vessel; when energized with proper currents, these loops generate magnetic fields in a direction (longitude, vertical, and athwartship) opposite to the magnetic fields of the vessel to minimize effective magnetic signature. Degaussing systems reduce a naval ship's magnetic signature, making it difficult for mines to detect and damage the ship. Traditionally made of heavy copper wire, these systems are required for all naval combat ships.

High temperature superconductor (HTS) degaussing systems are lightweight and compact in design. HTS degaussing coils are estimated to enable a 50-80% reduction in the total weight of degaussing systems, offering significant potential for fuel savings or adding different payloads. Installation and calibration services are expensive for copper coils compared to HTS coils. In HTS degaussing systems, the number of coil turns is reduced by 20% than copper coils. Additionally, copper coils consume more power than HTS degaussing coils.

American Superconductor Corporation (US), Larsen & Turbo Limited (India), and ECA Group (France) are a few of the key manufacturers of HTS coils. In May 2019, American Superconductor Corporation, a global energy solutions provider serving wind and power grid industry leaders, received a contract from the Ingalls Shipbuilding division of Huntington Ingalls Industries (HII) (US) to deliver an HTS-based ship protection system for installation on the San Antonio class of amphibious transport dock ship, LPD 30. Technological advances in degaussing equipment will likely increase their future demand.

Based on solution, the ranging solution is anticipated to grow at the highest CAGR during the forecast period

Based on solution, the degaussing systems market has been segmented into ranging, degaussing and determining. The ranging segment is projected to grow at the highest CAGR during the forecast period. The ranging solution further segmented into onboard and fixed. Fixed ranging degaussing solutions make use of submerged magnetic probes and evaluation equipment to measure the magnetic interference field of naval vessels at specific water depths. These solutions are used to degauss naval vessels in the overrun range and stationery range. An overrun range is used for ranging of ferromagnetic vessels and submarines. Fixed ranging degaussing solutions help in the separation of the permanent magnetization of naval vessels from the induced magnetization. These solutions also help determine the magnetic range of naval vessels. A stationary range is mainly used for ranging of non-magnetic vessels, such as mine countermeasure vessels.

The Asia Pacific region dominated the market with largest share in 2022

The degaussing systems market in Asia Pacific registered the largest share in 2022. China, India, Japan, South Korea, and North Korea are considered for market analysis in the Asia Pacific region. Among these countries, the defense budget of China is the second-highest in the world, preceded by the US. China is increasing its defense spending for the modernization of its navy and warfare capabilities to uphold territorial integrity and national security. This, in turn, is expected to contribute to the increased production and procurement of advanced naval equipment, thereby driving the demand for degaussing systems in China. Moreover, the presence of key shipbuilding companies, such as the China Shipbuilding Industry, Jiangnan Shipyard, Dalian Shipbuilding Industry, and COMEC, has supported to boost degaussing system market growth in China.

Major players in the degaussing systems market are Wartsila (Finland), Ultra Electronics Holdings plc (UK), L3Harris Technologies, Inc. (US), Larsen & Turbo Limited (India), and American Superconductor Corporation (US). These companies adopted strategies including contracts, acquisitions, agreements, expansions, investments, and new product launches adopted by leading market players to sustain their position in the market. Also focusing on expanding distribution networks in North America, Europe, Asia Pacific and Rest of the World in turn driving the demand for degaussing system

Research Coverage

This research report categorizes the degaussing systems market into vessel type, solution, end user, and region. based on vessel type the market is divided into small vessel, medium vessel, and large vessel. Based on solution, the market is classified into ranging, degaussing, and deperming. On the basis of end user, the market is divided into OEM, aftermarket, and services. The degaussing systems market has been studied for North America, Europe, Asia Pacific, and Rest of the World based on geographics.

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the degaussing systems market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches associated with the degaussing systems market. Competitive analysis of upcoming startups in the degaussing systems market ecosystem is covered in this report.

Reasons to Buy this Report

This report is expected to help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall degaussing systems market and its segments. This study is also expected to provide region-wise information about the end-use industrial sectors, wherein degaussing systems is used. This report aims at helping the stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. This report is also expected to help them understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities influencing the growth of the market.

The report provides insights on the following pointers:

Market Penetration: Comprehensive information on degaussing systems offered by the top players in the market

Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the degaussing systems market

Market Development: Comprehensive information about lucrative markets - the report analyzes the degaussing systems market across varied regions

Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the degaussing systems market

Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the degaussing systems market

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 DEGAUSSING SYSTEM MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.3.3 REGIONAL SCOPE

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 DEGAUSSING SYSTEM MARKET: INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES

- 1.6 STAKEHOLDERS

- 1.7 LIMITATIONS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 DEGAUSSING SYSTEM MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Breakdown of primaries

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 RECESSION IMPACT ANALYSIS

- 2.2.1 DEMAND-SIDE INDICATORS

- FIGURE 5 NAVAL DEFENSE BUDGET BY US

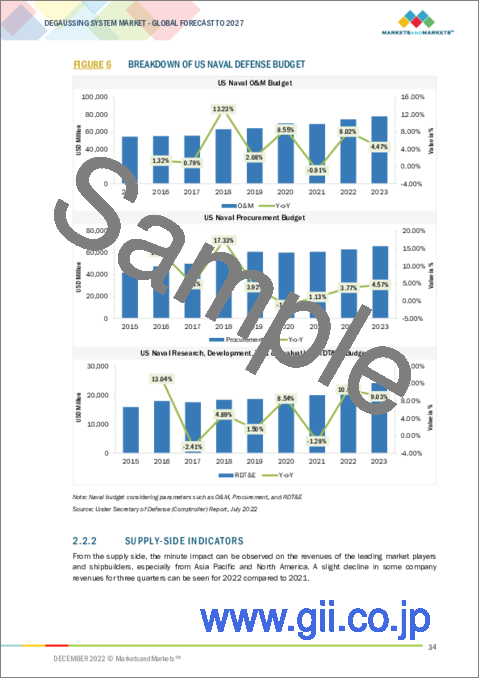

- FIGURE 6 BREAKDOWN OF US NAVAL DEFENSE BUDGET

- 2.2.2 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.4 RESEARCH APPROACH AND METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.6 GROWTH RATE ASSUMPTIONS

- 2.7 RESEARCH ASSUMPTIONS

- FIGURE 10 RESEARCH ASSUMPTIONS FOR DEGAUSSING SYSTEM MARKET

- 2.7.1 MARKET SIZE AND FORECAST

3 EXECUTIVE SUMMARY

- FIGURE 11 SUBMARINES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 ONBOARD SEGMENT TO HAVE LARGER MARKET SHARE THAN FIXED SEGMENT

- FIGURE 13 DEGAUSSING COIL UNITS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO COMMAND MAJOR MARKET SHARE FROM 2022 TO 2027

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN DEGAUSSING SYSTEM MARKET

- FIGURE 15 INCREASING IMPORTANCE OF DEGAUSSING SYSTEMS IN NAVAL WARFARE

TO DRIVE DEGAUSSING SYSTEM MARKET

- 4.2 DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE

- FIGURE 16 SUBMARINES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 DEGAUSSING SYSTEM MARKET, BY DEGAUSSING SOLUTION

- FIGURE 17 PRODUCTS SEGMENT TO HAVE HIGHER CAGR DURING FORECAST PERIOD

- 4.4 DEGAUSSING SYSTEM MARKET, BY END USER

- FIGURE 18 OEM SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DEGAUSSING SYSTEM MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing importance of degaussing systems in naval warfare

- 5.2.1.2 Technological advancements in degaussing equipment to protect naval vessels

- 5.2.1.3 Increasing defense budget to procure advanced warships

- FIGURE 20 DEFENSE SPENDING OF KEY COUNTRIES

- 5.2.2 RESTRAINTS

- 5.2.2.1 Use of composite material in warships to restrain market growth

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increase in maritime warfare exercises to protect naval vessels from sea mines

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of retrofit, installation, and calibration services to affect market growth

- 5.2.4.2 Lack of skilled professionals to pose challenges for end users

- 5.2.4.3 Limited number of ranging and deperming stations to affect deperming services

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 REVENUE SHIFT IN DEGAUSSING SYSTEM MARKET

- 5.4 DEGAUSSING SYSTEM MARKET ECOSYSTEM

- FIGURE 22 ECOSYSTEM MAP: DEGAUSSING SYSTEM MARKET

- 5.4.1 PROMINENT COMPANIES

- 5.4.2 PRIVATE AND SMALL ENTERPRISES

- 5.4.3 END USERS

- TABLE 3 DEGAUSSING SYSTEM MARKET ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 23 VALUE CHAIN ANALYSIS: DEGAUSSING SYSTEM MARKET

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 IMPACT OF PORTER'S FIVE FORCES ON DEGAUSSING SYSTEM MARKET

- FIGURE 24 DEGAUSSING SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 TARIFF AND REGULATORY LANDSCAPE

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 8 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING DEGAUSSING SYSTEMS, BY END USER

- TABLE 10 KEY STAKEHOLDERS INVOLVED IN BUYING DEGAUSSING SYSTEMS, BY END USER (%)

- 5.8.2 BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR DEGAUSSING SYSTEMS, BY END USER

- TABLE 11 INFLUENCE OF KEY BUYING CRITERIA ON DEGAUSSING SYSTEMS, BY END USER

- 5.9 USE CASES

- 5.9.1 MAGNETIC STEALTH DEGAUSSING SYSTEM

- 5.10 RECESSION IMPACT ON DEGAUSSING SYSTEM MARKET

- FIGURE 27 RECESSION IMPACT ANALYSIS OF DEGAUSSING SYSTEM MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 POWER SUPPLY ARCHITECTURE

- 6.2.1 FULLY DISTRIBUTED DEGAUSSING SYSTEM

- 6.2.2 SEMI-DISTRIBUTED DEGAUSSING SYSTEM

- 6.2.3 CENTRALIZED DEGAUSSING SYSTEM

- 6.3 CONTROL MODE

- 6.3.1 CURRENT CONTROLLER MAGNETOMETER

- 6.4 TECHNOLOGICAL TRENDS

- FIGURE 28 TECHNOLOGICAL ADVANCEMENTS IN DEGAUSSING SYSTEMS

- 6.4.1 COPPER COILS

- 6.4.2 HTS MATERIAL

- 6.4.3 ONBOARD AERIAL RANGING DEVICE

- 6.4.4 MULTI-INFLUENCE RANGING SYSTEM

- 6.5 STRATEGIC BENCHMARKING

- FIGURE 29 STRATEGIC BENCHMARKING

- 6.6 INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 12 INNOVATIONS AND PATENT REGISTRATIONS, 2019-2022

- 6.7 KEY CONFERENCES AND EVENTS, 2023

- TABLE 13 DEGAUSSING SYSTEM MARKET: CONFERENCES AND EVENTS

7 DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE

- 7.1 INTRODUCTION

- FIGURE 30 MEDIUM VESSELS SEGMENT TO DOMINATE DEGAUSSING SYSTEM MARKET FROM 2022 TO 2027

- TABLE 14 DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 15 DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- 7.2 SMALL VESSELS

- 7.2.1 GROWING ADOPTION OF OPVS FOR STRENGTHENING NAVAL SECURITY TO DRIVE MARKET

- TABLE 16 SMALL VESSELS: DEGAUSSING SYSTEM MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 17 SMALL VESSELS: DEGAUSSING SYSTEM MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.2.2 MCMV

- 7.2.3 OPV

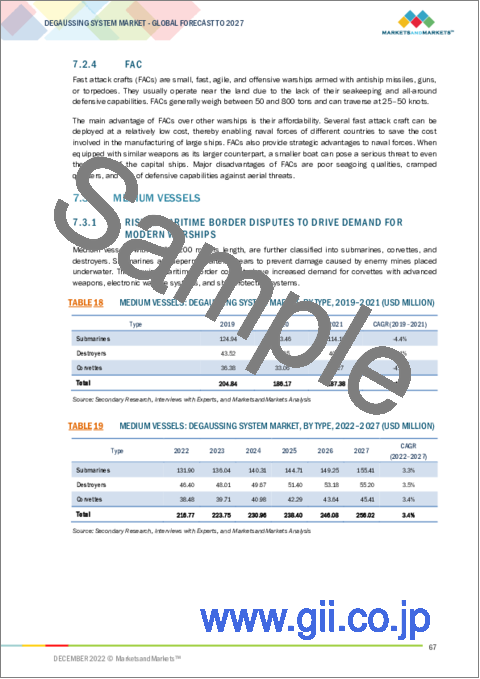

- 7.2.4 FAC

- 7.3 MEDIUM VESSELS

- 7.3.1 RISING MARITIME BORDER DISPUTES TO DRIVE DEMAND FOR MODERN WARSHIPS

- TABLE 18 MEDIUM VESSELS: DEGAUSSING SYSTEM MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 19 MEDIUM VESSELS: DEGAUSSING SYSTEM MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.3.2 SUBMARINES

- 7.3.3 DESTROYERS

- 7.3.4 CORVETTES

- 7.4 LARGE VESSELS

- 7.4.1 RISING INVESTMENTS IN LARGE WARSHIPS TO STRENGTHEN NAVAL FORCES

- TABLE 20 LARGE VESSELS: DEGAUSSING SYSTEM MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 21 LARGE VESSELS: DEGAUSSING SYSTEM MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.4.2 FRIGATES

- 7.4.3 AIRCRAFT CARRIERS

- 7.4.4 AMPHIBIOUS VESSELS

8 DEGAUSSING SYSTEM MARKET, BY SOLUTION

- 8.1 INTRODUCTION

- FIGURE 31 DEGAUSSING SEGMENT ESTIMATED TO DOMINATE MARKET IN 2022

- TABLE 22 DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 23 DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- 8.2 DEGAUSSING

- 8.2.1 RISING INTEGRATION OF DEGAUSSING SYSTEMS IN ADVANCED WARSHIPS TO DRIVE SEGMENT

- TABLE 24 DEGAUSSING SOLUTION: DEGAUSSING SYSTEM MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 25 DEGAUSSING SOLUTION: DEGAUSSING SYSTEM MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 8.2.2 PRODUCTS

- TABLE 26 DEGAUSSING OFFERING: DEGAUSSING SYSTEM MARKET, BY PRODUCT, 2019-2021 (USD MILLION)

- TABLE 27 DEGAUSSING OFFERING: DEGAUSSING SYSTEM MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 8.2.2.1 Hardware

- TABLE 28 DEGAUSSING PRODUCT: DEGAUSSING SYSTEM MARKET, BY HARDWARE, 2019-2021 (USD MILLION)

- TABLE 29 DEGAUSSING PRODUCT: DEGAUSSING SYSTEM MARKET, BY HARDWARE, 2022-2027 (USD MILLION)

- 8.2.2.1.1 Degaussing coil units

- 8.2.2.1.2 Magnetometers

- 8.2.2.1.3 Degaussing control units

- 8.2.2.1.4 Bipolar amplifiers

- 8.2.2.1.5 DC generators

- 8.2.2.1.6 Conductors

- 8.2.2.1.7 Course monitor units

- 8.2.2.1.8 Compass compensating equipment

- 8.2.2.2 Software

- 8.2.3 SERVICES

- 8.3 RANGING

- 8.3.1 RISING DEMAND FOR ADVANCED ONBOARD-RANGING SOLUTIONS TO BOOST SEGMENT GROWTH

- TABLE 30 RANGING: DEGAUSSING SYSTEM MARKET, BY OFFERING, 2019-2021 (USD MILLION)

- TABLE 31 RANGING: DEGAUSSING SYSTEM MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 8.3.2 FIXED

- 8.3.3 ONBOARD

- TABLE 32 RANGING ONBOARD: DEGAUSSING SYSTEM MARKET, BY PRODUCT, 2019-2021 (USD MILLION)

- TABLE 33 RANGING ONBOARD: DEGAUSSING SYSTEM MARKET, BY PRODUCT, 2022-2027 (USD MILLION)

- 8.3.3.1 Transmitted data buoys

- 8.3.3.2 Magnetometers

- 8.3.3.3 Monitors

- 8.3.3.4 Software

- 8.3.3.5 Coils

- 8.3.3.6 Aerial ranging devices

- 8.4 DEPERMING

- 8.4.1 DEMAND FOR IMPROVED SAFETY OF SHIPS DURING OPERATIONS TO DRIVE SEGMENT

9 DEGAUSSING SYSTEM MARKET, BY END USER

- 9.1 INTRODUCTION

- FIGURE 32 OEM SEGMENT TO LEAD DEGAUSSING SYSTEM MARKET FROM 2022 TO 2027

- 9.2 OEM

- 9.2.1 RISING INVESTMENT IN DEVELOPING DEFENSE SHIPS TO DRIVE SEGMENT

- 9.3 AFTERMARKET

- 9.3.1 RISING FOCUS ON MODERNIZING NAVAL WARFARE SYSTEMS TO DRIVE SEGMENT

- 9.4 SERVICES

- 9.4.1 MAINTENANCE REQUIREMENT FOR DEGAUSSING SYSTEM PRODUCTS TO DRIVE SEGMENT

10 DEGAUSSING SYSTEM MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 33 DEGAUSSING SYSTEM MARKET IN NORTH AMERICA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 10.1.1 REGIONAL RECESSION IMPACT ANALYSIS

- FIGURE 34 NAVAL BUDGET TREND, BY REGION, 2019-2022

- FIGURE 35 RECESSION IMPACT ANALYSIS, BY REGION

- TABLE 34 DEGAUSSING SYSTEM MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 35 DEGAUSSING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 PESTLE ANALYSIS: NORTH AMERICA

- FIGURE 36 NORTH AMERICA: DEGAUSSING SYSTEM MARKET SNAPSHOT

- TABLE 36 NORTH AMERICA: DEGAUSSING SYSTEM MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 37 NORTH AMERICA: DEGAUSSING SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 38 NORTH AMERICA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 39 NORTH AMERICA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 40 NORTH AMERICA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 41 NORTH AMERICA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 42 NORTH AMERICA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 43 NORTH AMERICA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 44 NORTH AMERICA: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 45 NORTH AMERICA: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Increasing naval budget to fuel demand for degaussing systems

- TABLE 46 US: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 47 US: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 48 US: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 49 US: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 50 US: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 51 US: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 52 US: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 53 US: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Increasing focus on naval vessel development to drive demand for degaussing systems

- TABLE 54 CANADA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 55 CANADA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 56 CANADA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 57 CANADA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 58 CANADA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 59 CANADA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 60 CANADA: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 61 CANADA: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 PESTLE ANALYSIS: EUROPE

- FIGURE 37 EUROPE: DEGAUSSING SYSTEM MARKET SNAPSHOT

- TABLE 62 EUROPE: DEGAUSSING SYSTEM MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 63 EUROPE: DEGAUSSING SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 64 EUROPE: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 65 EUROPE: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 66 EUROPE: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 67 EUROPE: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 68 EUROPE: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 69 EUROPE: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 70 EUROPE: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 71 EUROPE: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Defense shipbuilding industry to boost degaussing system needs

- TABLE 72 UK: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 73 UK: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 74 UK: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 75 UK: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 76 UK: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 77 UK: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 78 UK: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 79 UK: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.3.3 GERMANY

- 10.3.3.1 Government reforms to strengthen technology adoption to drive market

- TABLE 80 GERMANY: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 81 GERMANY: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 82 GERMANY: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 83 GERMANY: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 84 GERMANY: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 85 GERMANY: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 86 GERMANY: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 87 GERMANY: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.3.4 FRANCE

- 10.3.4.1 Rising focus on strengthening naval capabilities to propel degaussing system adoption

- TABLE 88 FRANCE: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 89 FRANCE: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 90 FRANCE: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 91 FRANCE: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 92 FRANCE: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 93 FRANCE: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 94 FRANCE: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 95 FRANCE: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.3.5 RUSSIA

- 10.3.5.1 Rising investment in defense technologies to boost degaussing system demand

- TABLE 96 RUSSIA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 97 RUSSIA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 98 RUSSIA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 99 RUSSIA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 100 RUSSIA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 101 RUSSIA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 102 RUSSIA: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 103 RUSSIA: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.3.6 ITALY

- 10.3.6.1 Focus on expanding domestic maritime industry to increase investment in maritime technologies

- TABLE 104 ITALY: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 105 ITALY: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 106 ITALY: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 107 ITALY: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 108 ITALY: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 109 ITALY: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 110 ITALY: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 111 ITALY: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.3.7 SPAIN

- 10.3.7.1 Increasing defense budget to drive market

- TABLE 112 SPAIN: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 113 SPAIN: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 114 SPAIN: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 115 SPAIN: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 116 SPAIN: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 117 SPAIN: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 118 SPAIN: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 119 SPAIN: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.3.8 REST OF EUROPE

- TABLE 120 REST OF EUROPE: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 121 REST OF EUROPE: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 122 REST OF EUROPE: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 123 REST OF EUROPE: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 124 REST OF EUROPE: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 125 REST OF EUROPE: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 126 REST OF EUROPE: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 127 REST OF EUROPE: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 PESTLE ANALYSIS: ASIA PACIFIC

- FIGURE 38 ASIA PACIFIC: DEGAUSSING SYSTEM MARKET SNAPSHOT

- TABLE 128 ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 129 ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 130 ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 131 ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 132 ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 133 ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 134 ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 135 ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 136 ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 137 ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Extensive investment in production and modernization of warships to strengthen naval force

- TABLE 138 CHINA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 139 CHINA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 140 CHINA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 141 CHINA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 142 CHINA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 143 CHINA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 144 CHINA: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 145 CHINA: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.4.3 INDIA

- 10.4.3.1 Increasing defense shipbuilding activities to boost degaussing system demand

- TABLE 146 INDIA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 147 INDIA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 148 INDIA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 149 INDIA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 150 INDIA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 151 INDIA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 152 INDIA: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 153 INDIA: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.4.4 JAPAN

- 10.4.4.1 Innovation of naval technologies to fuel demand for degaussing systems

- TABLE 154 JAPAN: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 155 JAPAN: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 156 JAPAN: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 157 JAPAN: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 158 JAPAN: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 159 JAPAN: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 160 JAPAN: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 161 JAPAN: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Increasing shipbuilding activities to drive demand for advanced vessel systems

- TABLE 162 SOUTH KOREA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 163 SOUTH KOREA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 164 SOUTH KOREA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 165 SOUTH KOREA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 166 SOUTH KOREA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 167 SOUTH KOREA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 168 SOUTH KOREA: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 169 SOUTH KOREA: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.4.6 NORTH KOREA

- 10.4.6.1 Development and modernization of advanced submarines to drive market growth

- TABLE 170 NORTH KOREA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 171 NORTH KOREA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 172 NORTH KOREA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 173 NORTH KOREA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 174 NORTH KOREA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 175 NORTH KOREA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 176 NORTH KOREA: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 177 NORTH KOREA: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.4.7 REST OF ASIA PACIFIC

- TABLE 178 REST OF ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 179 REST OF ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 180 REST OF ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 181 REST OF ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 183 REST OF ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 184 REST OF ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 185 REST OF ASIA PACIFIC: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.5 REST OF THE WORLD

- 10.5.1 PESTLE ANALYSIS: REST OF THE WORLD

- TABLE 186 REST OF THE WORLD: DEGAUSSING SYSTEM MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 187 REST OF THE WORLD: DEGAUSSING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 188 REST OF THE WORLD: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 189 REST OF THE WORLD: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 190 REST OF THE WORLD: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 191 REST OF THE WORLD: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 192 REST OF THE WORLD: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 193 REST OF THE WORLD: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 194 REST OF THE WORLD: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 195 REST OF THE WORLD: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.5.2 MIDDLE EAST & AFRICA

- 10.5.2.1 Rising modernization of existing fleet to integrate modern warfare solutions to drive growth

- TABLE 196 MIDDLE EAST & AFRICA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

- 10.5.3 SOUTH AMERICA

- 10.5.3.1 Modernization of old fleets to strengthen naval capabilities to drive market

- TABLE 204 SOUTH AMERICA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2019-2021 (USD MILLION)

- TABLE 205 SOUTH AMERICA: DEGAUSSING SYSTEM MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 206 SOUTH AMERICA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 207 SOUTH AMERICA: DEGAUSSING SYSTEM MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 208 SOUTH AMERICA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2019-2021 (USD MILLION)

- TABLE 209 SOUTH AMERICA: DEGAUSSING SYSTEM MARKET, BY SUB-VESSEL TYPE, 2022-2027 (USD MILLION)

- TABLE 210 SOUTH AMERICA: DEGAUSSING SYSTEM MARKET, BY END USER, 2019-2021 (USD MILLION)

- TABLE 211 SOUTH AMERICA: DEGAUSSING SYSTEM MARKET, BY END USER, 2022-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 COMPANY OVERVIEW

- TABLE 212 KEY DEVELOPMENTS OF LEADING PLAYERS IN DEGAUSSING SYSTEM MARKET (2019-2021)

- 11.3 RANKING ANALYSIS OF KEY PLAYERS IN DEGAUSSING SYSTEM MARKET, 2021

- FIGURE 39 RANKING OF KEY PLAYERS IN DEGAUSSING SYSTEM MARKET, 2021

- 11.4 REVENUE ANALYSIS, 2021

- FIGURE 40 REVENUE ANALYSIS FOR KEY COMPANIES IN DEGAUSSING SYSTEM MARKET, 2021

- 11.5 MARKET SHARE ANALYSIS, 2021

- FIGURE 41 MARKET SHARE ANALYSIS FOR KEY COMPANIES IN DEGAUSSING SYSTEM MARKET, 2021

- TABLE 213 DEGAUSSING SYSTEM MARKET: DEGREE OF COMPETITION

- 11.6 COMPETITIVE EVALUATION QUADRANT

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE COMPANIES

- 11.6.4 PARTICIPANTS

- FIGURE 42 COMPETITIVE LEADERSHIP MAPPING, 2021

- 11.7 COMPETITIVE BENCHMARKING

- TABLE 214 DEGAUSSING SYSTEM MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 215 DEGAUSSING SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 MARKET EVALUATION FRAMEWORK

- 11.8.2 PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 216 NEW PRODUCT LAUNCHES, 2017-2020

- 11.8.3 DEALS

- TABLE 217 DEALS, 2019-2022

- 11.8.4 OTHERS

- TABLE 218 OTHERS, 2019-2022

12 COMPANY PROFILES

- 12.1 INTRODUCTION

(Business overview Products/Services/Solutions offered, Recent developments & MnM View)*

- 12.2 KEY PLAYERS

- 12.2.1 LARSEN & TOUBRO LIMITED

- TABLE 219 LARSEN & TOUBRO LIMITED: BUSINESS OVERVIEW

- FIGURE 43 LARSEN & TOUBRO LIMITED: COMPANY SNAPSHOT

- TABLE 220 LARSEN & TOUBRO LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 LARSEN & TOUBRO LIMITED: PRODUCT LAUNCH

- TABLE 222 LARSEN & TOUBRO LIMITED: DEALS

- 12.2.2 POLYAMP AB

- TABLE 223 POLYAMP AB: BUSINESS OVERVIEW

- TABLE 224 POLYAMP AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.3 WARTSILA

- TABLE 225 WARTSILA: BUSINESS OVERVIEW

- FIGURE 44 WARTSILA: COMPANY SNAPSHOT

- TABLE 226 WARTSILA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 WARTSILA: DEALS

- 12.2.4 ULTRA ELECTRONICS HOLDINGS PLC

- TABLE 228 ULTRA ELECTRONICS HOLDINGS PLC: BUSINESS OVERVIEW

- FIGURE 45 ULTRA ELECTRONICS HOLDINGS PLC: COMPANY SNAPSHOT

- TABLE 229 ULTRA ELECTRONICS HOLDINGS PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 ULTRA ELECTRONICS HOLDINGS PLC: DEALS

- 12.2.5 ECA GROUP

- TABLE 231 ECA GROUP: BUSINESS OVERVIEW

- FIGURE 46 ECA GROUP: COMPANY SNAPSHOT

- TABLE 232 ECA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 ECA GROUP: DEALS

- TABLE 234 ECA GROUP: OTHERS

- 12.2.6 IFEN S.P.A.

- TABLE 235 IFEN S.P.A.: BUSINESS OVERVIEW

- TABLE 236 IFEN S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.7 DAYATECH MERIN SDN. BHD.

- TABLE 237 DAYATECH MERIN SDN. BHD.: BUSINESS OVERVIEW

- TABLE 238 DAYATECH MERIN SDN. BHD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.8 AMERICAN SUPERCONDUCTOR CORPORATION

- TABLE 239 AMERICAN SUPERCONDUCTOR CORPORATION: BUSINESS OVERVIEW

- FIGURE 47 AMERICAN SUPERCONDUCTOR CORPORATION: COMPANY SNAPSHOT

- TABLE 240 AMERICAN SUPERCONDUCTOR CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 AMERICAN SUPERCONDUCTOR CORPORATION: DEALS

- 12.2.9 STL SYSTEMS AG

- TABLE 242 STL SYSTEMS AG: BUSINESS OVERVIEW

- TABLE 243 STL SYSTEMS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 STL SYSTEMS AG: PRODUCT LAUNCHES

- 12.2.10 DA-GROUP

- TABLE 245 DA-GROUP: BUSINESS OVERVIEW

- TABLE 246 DA-GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 DA-GROUP: OTHER

- 12.2.11 L3HARRIS TECHNOLOGIES, INC.

- TABLE 248 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 48 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 249 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 251 L3HARRIS TECHNOLOGIES, INC.: OTHERS

- Details on Business overview Products/Services/Solutions offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS