|

|

市場調査レポート

商品コード

1181129

スマートエアポートの世界市場:システム別、用途別(ランドサイド、ターミナルサイド、エアサイド)、空港規模別(小、中、大)、エンドマーケット別、空港技術別、オペレーション別、地域別 - 2027年までの予測Smart Airports Market by System, Application ( Landside, Terminal Side, and Airside), Airport Size ( Small, Medium, and Large), End Market, Airport Technology ( Airport 2.0, Airport 3.0 and Airport 4.0), Operation and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| スマートエアポートの世界市場:システム別、用途別(ランドサイド、ターミナルサイド、エアサイド)、空港規模別(小、中、大)、エンドマーケット別、空港技術別、オペレーション別、地域別 - 2027年までの予測 |

|

出版日: 2023年01月04日

発行: MarketsandMarkets

ページ情報: 英文 247 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のスマートエアポートの市場規模は、2022年の70億米ドルから2027年までに83億米ドルに拡大し、2022年から2027年までのCAGRで3.5%の成長が予測されています。

リアルタイム情報へのニーズの高まりと、セルフサービス技術の利用拡大が、スマートエアポート産業の成長を促進すると予測されます。既存空港の拡張、新規空港でのスマートエアポートソリューションの採用、空港によるグリーンイニシアティブの増加などが市場を牽引します。さらに、空港ではセルフサービスキオスク、生体認証による乗客識別、人工知能技術の導入が進み、市場の開拓が進んでいます。

2022年、アップグレード・サービスセグメントが最大シェアを占める見込み

エンドマーケット別では、アップグレード・サービスが予測期間中にスマートエアポート市場をリードすると予測されます。空港は、訪問者の体験を差別化するためにデジタル変革を実施しています。乗客の体験と運用効率を高めるために、既存のシステムやソリューションを最先端の技術やソリューションで近代化しています。その継続的な運用を保証するための維持管理およびサービスの強化の必要性が、市場を牽引しています。

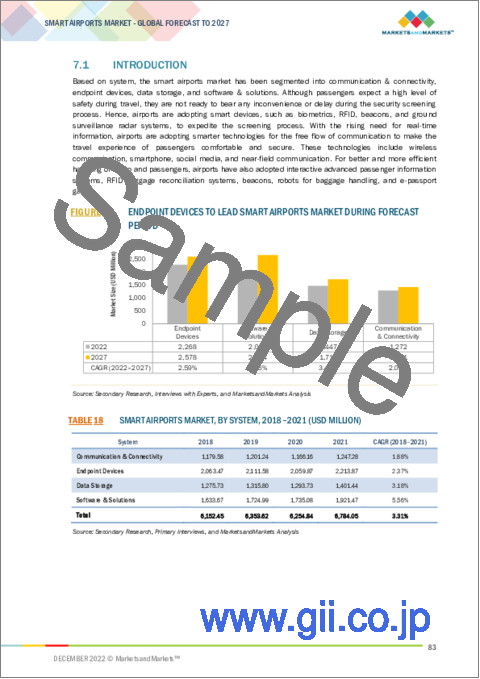

システム別では、予測期間中、エンドポイントデバイスが市場シェアを独占すると予測される

システム別では、予測期間中、エンドポイントデバイス部門が市場シェアを独占すると予測されます。市場はさらに、通信・コネクティビティ、エンドポイントデバイス、データストレージ、ソフトウェア・ソリューションに区分されます。審査プロセスをスピードアップするために、空港ではバイオメトリクス、RFID、ビーコンなど、信頼性の高いエンドポイントデバイスが使用されています。エンドポイントデバイスは、空港の運営と消費者の満足度を向上させています。さらに、エンドポイントデバイスの開発により、セキュリティ基準が向上し、空港でのスクリーニング手順が合理化されました。

用途別では、予測期間中、エアサイドが市場シェアを独占すると予測される

用途別では、エアサイドセグメントが予測期間中に市場シェアを独占すると予測されます。世界の旅客輸送量の急増により、エアサイドでのスマートソリューションの需要が高まると予想されます。さらに、高度な航空機駐機ソリューションや最先端の保守・健康監視システムなど、エアサイドのオペレーションにおけるスマートソリューションの要求が高まっていることも、市場を牽引しています。

予測期間中、エアポート3.0セグメントがスマートエアポート市場をリードすると予想される

空港技術別では、エアポート3.0セグメントが予測期間中にスマートエアポート市場をリードすると予測されます。同産業は、世界の航空旅客の増加により急速に拡大しています。さらに、空港の近代化計画が世界のスマートエアポート3.0市場の成長を牽引すると思われます。

2022年、非航空セグメントが最大シェアを占めると予測

オペレーション別では、予測期間中、非航空セグメントがスマートエアポート市場をリードすると予測されます。航空旅客の拡大が航空部門を推進し、それに伴いスマートエアポートの市場も拡大します。インテリジェント輸送サービスや在庫管理に加えて、空港は顧客の好みに合わせて特定のデジタル広告に集中し、非航空セグメントの成長を後押しします。

2022年、アジア太平洋地域が最大の市場シェアを占める見込み

スマートエアポート市場は、北米、欧州、アジア太平洋地域、その他の地域で調査されています。2022年にはアジア太平洋地域が最大の市場シェアを占め、予測期間中は北米が最も高いCAGRを記録すると予測されています。アジア太平洋地域は、中国、シンガポール、インドなどの国々で航空交通量が大幅に増加しているため、予測期間中に急速に発展する可能性が高いです。乗客数の増加に伴い、手荷物の取り扱いやセルフチェックインなどの手続きの自動化に対する需要も高まっています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- 貿易分析

- 価格分析

- 市場エコシステム

- バリューチェーン分析

- 不況の影響分析

- 技術分析

- ポーターのファイブフォースモデル

- 主な利害関係者と購入基準

- 主な会議とイベント

- 航空宇宙産業における関税の規制状況

第6章 業界動向

- イントロダクション

- サプライチェーン分析

- 技術動向

- ユースケース:スマートエアポート

- メガトレンドの影響

- スマートエアポート市場:特許分析

第7章 スマートエアポート市場:システム別

- イントロダクション

- 通信・コネクティビティ

- エンドポイントデバイス

- データストレージ

- ソフトウェア・ソリューション

第8章 スマートエアポート市場:用途別

- イントロダクション

- ランドサイド

- ターミナルサイド

- エアサイド

第9章 スマートエアポート市場:空港規模別

- イントロダクション

- 大

- 中

- 小

第10章 スマートエアポート市場:エンドマーケット別

- イントロダクション

- 実装

- アップグレード・サービス

第11章 スマートエアポート市場:空港技術別

- イントロダクション

- エアポート2.0

- エアポート3.0

- エアポート4.0

第12章 スマートエアポート市場:オペレーション別

- イントロダクション

- 航空

- 非航空

第13章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- フランス

- ドイツ

- その他

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- その他

- その他の地域

- ブラジル

- アラブ首長国連邦

- その他

第14章 競合情勢

- イントロダクション

- 主要企業の市場シェア分析

- 上位企業5社のランキング分析

- 競合ベンチマーキング

- 企業評価象限

- 競合シナリオ

第15章 企業プロファイル

- 主要企業

- SITA

- THALES

- SIEMENS AG

- CISCO SYSTEMS, INC.

- AMADEUS IT GROUP SA

- RAYTHEON TECHNOLOGIES CORPORATION

- DAIFUKU CO., LTD.

- T-SYSTEMS

- NATS LIMITED

- SABRE CORPORATION

- IBM CORPORATION

- L3HARRIS TECHNOLOGIES INC.

- LEIDOS HOLDINGS, INC.

- ASCENT TECHNOLOGIES, INC.

- WIPRO LIMITED

- HUAWEI TECHNOLOGIES CO., LTD.

- INDRA SISTEMAS S.A.

- INFAX INC.

- SMART AIRPORT SYSTEMS(SAS)

- その他の企業

- ZENSORS

- GORILLA TECHNOLOGY

- EMARTECH

- TAV TECHNOLOGIES

第16章 付録

The Smart airports market size is projected to grow from USD 7.0 Billion in 2022 to USD 8.3 Billion by 2027, at a CAGR of 3.5% from 2022 to 2027. The growing need for real-time information and the increasing usage of self-service technologies are projected to fuel the growth of the smart airport industry. The market will be driven by the expansion of existing airports, the adoption of smart airport solutions at new airports, and an increase in the number of green initiatives by airports. Furthermore, airports are implementing self-service kiosks, biometric passenger identification, and artificial intelligence technologies to boost market development.

Upgrades & Services segment is expected to account for the largest share in 2022

Based on End Market, the Upgrades & Services are projected to lead the smart airports market during the forecast period. Airports are implementing digital transformation to differentiate their visitor experiences. To enhance the passenger experience and operational effectiveness, existing systems and solutions are being modernized with cutting-edge technology and solutions. The need for enhanced upkeep and services to guarantee their ongoing operation is driving the market.

The Endpoint Devices is projected to dominate the market share in the System segment during the forecast period

Based on System, the Endpoint Devices segment is projected to dominate the market share during the forecast period. The market is further segmented into Communication & Connectivity, Endpoint Devices, Data Storage, and Software & Solution. To speed up the screening process, airports use trustworthy endpoint devices like as biometrics, RFID, beacons, and so on. End point devices have enhanced airport operations and consumer satisfaction. Furthermore, developments in endpoint devices have increased security standards and streamlined the airport screening procedure.

The Airside is projected to dominate market share in the application segment during the forecast period

Based on application, the smart airports segment is projected to dominate the market share during the forecast period. Rapid growth in global passenger traffic is expected to increase demand for smart solutions on the airside. Additionally, the market has been driven by the growing requirement for smart solutions for airside operations, such as sophisticated aircraft parking solutions and cutting-edge maintenance and health monitoring systems.

The Airport 3.0 segment is projected to lead smart airports market during the forecast period

Based on airport technology, the airport 3.0 segment is projected to lead the smart airport market during the forecast period. The industry is expanding rapidly due to increased air traffic passengers worldwide. Furthermore, airport modernization plans are likely to drive the worldwide smart airport 3.0 market growth.

Non-Aeronautical Segment is projected to account for the largest share in 2022

Based on Operation, the non-aeronautical segment is projected to lead the smart airports market during the forecast period. The expansion in air passenger travel will propel the aviation sector, which will boost the market for smart airport accordingly. In addition to intelligent transportation services and inventory management, airports are concentrating on specific digital advertising to meet customer preferences and boost the growth of the non-aeronautical sector.

Asia Pacific is expected to account for the largest market share in 2022

The smart airports market industry has been studied in North America, Europe, Asia Pacific, and Rest of the World. Asia Pacific accounted for the largest market share in 2022, and North America is projected to witness the highest CAGR during the forecast period. The Asia Pacific market is likely to develop rapidly over the forecast period, owing to considerable increases in air traffic in countries such as China, Singapore, and India. As the number of passengers increases, so will the demand for automation of procedures such as luggage handling and self-check-in services.

The break-up of the profile of primary participants in the smart airports market:

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: C Level - 50%, Director Level - 25%, Others-25%

- By Region: North America - 45%, Europe - 25%, Asia Pacific - 20%, Middle East - 5%, and Latin America - 5%

Prominent companies include SITA (Switzerland), THALES (France), Siemens AG (Germany), Amadeus IT Group SA (Spain), IBM Corporation (US), Cisco Systems Inc. (US), Indra Sistemas S.A. (Spain), Honeywell International Inc. (US), L3Harris Technologies Inc (US).

Research Coverage:

The report segments the Smart airports market based on System, Application, Airport Size, End Market, Airport Technology, Operation and Region. Based on System, the market is segmented into Communication & Connectivity, Endpoint devices, Data Storage, Software & Solution. Based on application, the market is segmented into landside, terminal side, and air side. Based on airport size, the smart airport market is segmented into large, medium, and small. Based on end market, the market is segmented into implementation, upgrades & services. Based on airport technology, the market is segmented into airport 2.0, airport 3.0, airport 4.0. Based on application, the market is segmented into aeronautical and non-aeronautical. The smart airport market has been studied for North America, Europe, Asia Pacific, and Rest of the World. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the smart airports market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product & service launches, mergers and acquisitions, and recent developments associated with the smart airports market. Competitive analysis of upcoming startups in the smart airports market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall smart airports market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on smart airports offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the smart airports market

- Market Development: Comprehensive information about lucrative markets - the report analyses the smart airports market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the smart airports market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players in the smart airports market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES

- 1.5 INCLUSIONS AND EXCLUSIONS

- TABLE 2 SMART AIRPORTS MARKET: INCLUSIONS AND EXCLUSIONS

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 SMART AIRPORTS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY SOURCE

- 2.1.2.1 Primary data

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.2.1 Increase in airport infrastructure development to facilitate seamless passenger experience

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.3.1 Development of advanced smart airport technologies by manufacturers

- 2.3 RESEARCH APPROACH & METHODOLOGY

- TABLE 3 SEGMENTS AND SUBSEGMENTS

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1.1 Evaluation of smart airports market

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (DEMAND-SIDE)

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH (SUPPLY-SIDE)

- 2.4.1 BOTTOM-UP APPROACH

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- 2.6 RECESSION IMPACT ON MARKET ANALYSIS

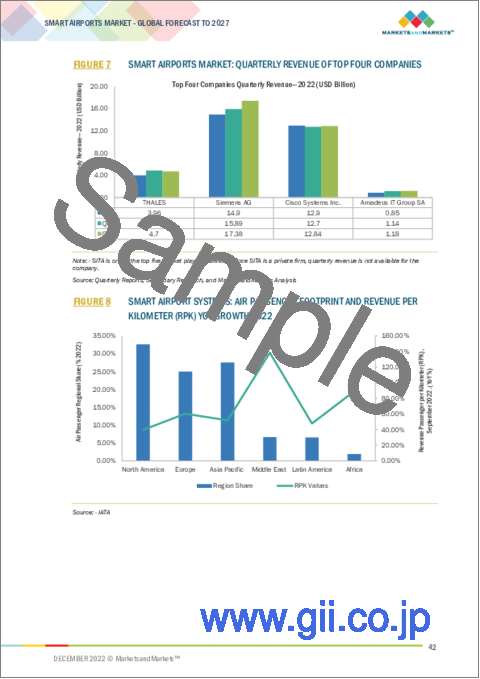

- FIGURE 7 SMART AIRPORTS MARKET: QUARTERLY REVENUE OF TOP FOUR COMPANIES

- FIGURE 8 SMART AIRPORT SYSTEMS: AIR PASSENGER FOOTPRINT AND REVENUE PER KILOMETER (RPK) YOY GROWTH 2022

- 2.7 GROWTH RATE ASSUMPTIONS

- 2.8 ASSUMPTIONS

- FIGURE 9 PARAMETRIC ASSUMPTIONS MADE FOR MARKET FORECAST

- 2.9 RISKS

3 EXECUTIVE SUMMARY

- FIGURE 10 BY APPLICATION, AIRSIDE SEGMENT PROJECTED TO LEAD SMART AIRPORTS MARKET DURING FORECAST PERIOD

- FIGURE 11 BY SYSTEM, ENDPOINT DEVICES SEGMENT ESTIMATED TO LEAD MARKET IN 2022

- FIGURE 12 BY AIRPORT SIZE, MEDIUM SEGMENT PROJECTED TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SMART AIRPORTS MARKET

- FIGURE 14 BUSINESS OPTIMIZATION AND IMPROVED PASSENGER EXPERIENCE TO DRIVE GROWTH OF SMART AIRPORTS MARKET

- 4.2 SMART AIRPORTS MARKET, BY APPLICATION

- FIGURE 15 AIRSIDE SEGMENT TO HOLD DOMINANT SHARE DURING FORECAST PERIOD

- 4.3 SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY

- FIGURE 16 AIRPORT 3.0 SEGMENT TO LEAD MARKET FROM 2022 TO 2027

- 4.4 SMART AIRPORTS MARKET, BY END MARKET

- FIGURE 17 UPGRADES & SERVICES SEGMENT TO LEAD MARKET FROM 2022 TO 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 SMART AIRPORTS: MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing need for real-time information

- FIGURE 19 AIRPORT PASSENGERS' TECHNOLOGY ADOPTION SURVEY, 2022

- 5.2.1.2 Increasing use of self-service technologies at airports

- 5.2.1.3 Rise in focus on customer-centric approaches

- 5.2.1.4 Adoption of sophisticated connectivity technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Difficulties in data collaboration

- 5.2.2.2 Lack of standardized regulations for blockchain technology

- 5.2.2.3 Privacy concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Airport operation optimization through digitization

- 5.2.3.2 New revenue sources from smart solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Comprehension of passenger preferences

- 5.2.4.2 High CAPEX resulting in slow integration of innovative technologies

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN SMART AIRPORTS MARKET

- FIGURE 20 REVENUE SHIFT IN SMART AIRPORTS MARKET

- 5.4 TRADE ANALYSIS

- TABLE 4 IMPORTED VALUE OF AIRCRAFT AND SPACECRAFT PARTS, USD MILLION (2017-2021)

- TABLE 5 EXPORTED VALUE OF AIRCRAFT AND SPACECRAFT PARTS, USD MILLION (2017-2021)

- 5.5 PRICING ANALYSIS

- TABLE 6 AVERAGE SELLING PRICE RANGE: SMART AIRPORTS MARKET (BY APPLICATION)

- 5.6 MARKET ECOSYSTEM

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 PRIVATE AND SMALL ENTERPRISES

- 5.6.3 END USERS

- FIGURE 21 MARKET ECOSYSTEM MAP: SMART AIRPORTS

- TABLE 7 SMART AIRPORTS MARKET ECOSYSTEM

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 22 VALUE CHAIN ANALYSIS: SMART AIRPORTS MARKET

- 5.8 RECESSION IMPACT ANALYSIS

- FIGURE 23 RECESSION IMPACT ANALYSIS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 TECHNOLOGICAL ADVANCEMENTS IN PASSENGER BOARDING BRIDGES

- 5.9.2 MRO PROVIDERS TO INVEST IN MODERNIZATION OF GROUND SUPPORT EQUIPMENT

- 5.10 PORTER'S FIVE FORCES MODEL

- TABLE 8 SMART AIRPORTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF SMART AIRPORT TECHNOLOGIES

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SMART AIRPORT TECHNOLOGIES (%)

- 5.11.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR SMART AIRPORT TECHNOLOGIES

- TABLE 10 KEY BUYING CRITERIA FOR SMART AIRPORT TECHNOLOGIES

- 5.12 KEY CONFERENCES AND EVENTS IN 2022-2023

- TABLE 11 SMART AIRPORTS MARKET: CONFERENCES AND EVENTS, 2022-2023

- 5.13 TARIFF REGULATORY LANDSCAPE FOR AEROSPACE INDUSTRY

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 26 SUPPLY CHAIN ANALYSIS OF SMART AIRPORTS MARKET

- 6.3 TECHNOLOGY TRENDS

- 6.3.1 AGILE SYSTEM WITH OPEN ARCHITECTURE

- 6.3.2 EDGE COMPUTING

- 6.3.3 DYNAMIC WIRELESS INDUCTIVE EV CHARGING

- 6.3.4 ELECTRIFICATION IN PASSENGER BUSES

- 6.4 USE CASES: SMART AIRPORTS

- TABLE 16 SMART AIRPORTS USE CASES

- 6.5 IMPACT OF MEGATRENDS

- FIGURE 27 IMPACT OF MEGATRENDS ON VALUE SHARING IN ECOSYSTEM

- 6.6 SMART AIRPORTS MARKET: PATENT ANALYSIS

- TABLE 17 KEY PATENTS, 2018-2022

7 SMART AIRPORTS MARKET, BY SYSTEM

- 7.1 INTRODUCTION

- FIGURE 28 ENDPOINT DEVICES TO LEAD SMART AIRPORTS MARKET DURING FORECAST PERIOD

- TABLE 18 SMART AIRPORTS MARKET, BY SYSTEM, 2018-2021 (USD MILLION)

- TABLE 19 SMART AIRPORTS MARKET, BY SYSTEM, 2022-2027 (USD MILLION)

- 7.2 COMMUNICATION & CONNECTIVITY

- FIGURE 29 LPWAN & WLAN TO LEAD COMMUNICATION & CONNECTIVITY SEGMENT DURING FORECAST PERIOD

- TABLE 20 COMMUNICATION & CONNECTIVITY: SMART AIRPORTS MARKET, BY SUBSYSTEM, 2018-2021 (USD MILLION)

- TABLE 21 COMMUNICATION & CONNECTIVITY: SMART AIRPORTS MARKET, BY SUBSYSTEM, 2022-2027 (USD MILLION)

- 7.2.1 WIRELESS

- 7.2.1.1 Deployment of wireless technology during upgradation of airport 2.0 to airport 3.0 to drive market

- 7.2.2 NEAR-FIELD COMMUNICATION, RFID, BLUETOOTH

- 7.2.2.1 Growing use of RFID technology for passenger ease to drive market

- 7.2.3 LPWAN & WLAN

- 7.2.3.1 Advanced WLAN systems to drive market

- 7.3 ENDPOINT DEVICES

- FIGURE 30 CAMERAS TO LEAD ENDPOINT DEVICES MARKET DURING FORECAST PERIOD

- TABLE 22 ENDPOINT DEVICES: SMART AIRPORTS MARKET, BY SUBSYSTEM, 2018-2021 (USD MILLION)

- TABLE 23 ENDPOINT DEVICES: SMART AIRPORTS MARKET, BY SUBSYSTEM, 2022-2027 (USD MILLION)

- 7.3.1 CAMERAS

- 7.3.1.1 Deployment of thermal cameras for security and surveillance at airports to drive market

- 7.3.2 SENSORS

- 7.3.2.1 Enhancing airport services such as taxi queues to drive market

- 7.3.3 DISPLAYS

- 7.3.3.1 Advancements in display technology to drive market

- 7.3.4 TAGS

- 7.3.4.1 Increase in air traveler footprint to drive market

- 7.3.5 WEARABLES

- 7.3.5.1 Increment in operational efficiency to drive market

- 7.3.6 BEACONS

- 7.3.6.1 Advancement in beacon technology to drive market

- 7.4 DATA STORAGE

- FIGURE 31 CLOUD TO LEAD DATA STORAGE MARKET DURING FORECAST PERIOD

- TABLE 24 DATA STORAGE: SMART AIRPORTS MARKET, BY SUBSYSTEM, 2018-2021 (USD MILLION)

- TABLE 25 DATA STORAGE: SMART AIRPORTS MARKET, BY SUBSYSTEM, 2022-2027 (USD MILLION)

- 7.4.1 CLOUD

- 7.4.1.1 Advanced IT Infrastructure to drive market

- 7.4.2 ON-PREMISES

- 7.4.2.1 Quickly accessible data to drive market

- 7.5 SOFTWARE & SOLUTIONS

- FIGURE 32 SOFTWARE & APPLICATIONS TO LEAD SOFTWARE & SOLUTIONS MARKET DURING FORECAST PERIOD

- TABLE 26 SOFTWARE & SOLUTIONS: SMART AIRPORTS MARKET, BY SUBSYSTEM, 2018-2021 (USD MILLION)

- TABLE 27 SOFTWARE & SOLUTIONS: SMART AIRPORTS MARKET, BY SUBSYSTEM, 2022-2027 (USD MILLION)

- 7.5.1 SOFTWARE & APPLICATIONS

- 7.5.1.1 Modernization of existing infrastructure to drive market

- 7.5.2 DATA ANALYTICS

- 7.5.2.1 Implementation of data analytics at large airports to improve passenger experience

- 7.5.3 PLATFORMS

- 7.5.3.1 Advancements in airport platforms to drive market

- 7.5.4 MANAGED SERVICES

- 7.5.4.1 Increased air-passenger traffic to drive market

8 SMART AIRPORTS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 33 AIRSIDE SEGMENT TO HOLD MAJOR MARKET SHARE DURING FORECAST PERIOD

- TABLE 28 SMART AIRPORTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 29 SMART AIRPORTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.2 LANDSIDE

- FIGURE 34 VEHICLE PARKING TO LEAD LANDSIDE MARKET DURING FORECAST PERIOD

- TABLE 30 LANDSIDE: SMART AIRPORTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 31 LANDSIDE: SMART AIRPORTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.2.1 INTELLIGENT ADVERTISING

- 8.2.1.1 Customized advertisements to drive market

- 8.2.2 VEHICLE PARKING

- 8.2.2.1 Increase in use of SmartPark System to drive market

- 8.2.3 CAR RENTAL & MASS TRANSIT

- 8.2.3.1 Ride-hailing apps to create significant business opportunities

- 8.3 TERMINAL SIDE

- FIGURE 35 PASSENGER SCREENING TO LEAD TERMINAL SIDE MARKET DURING FORECAST PERIOD

- TABLE 32 TERMINAL SIDE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 33 TERMINAL SIDE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.3.1 BUILDING MANAGEMENT

- 8.3.1.1 Integration of advanced smart technologies to drive market

- 8.3.2 PASSENGER SCREENING

- 8.3.2.1 Installation of self-check-in kiosks at airports to drive market

- 8.3.3 PASSENGER EXPERIENCE

- 8.3.3.1 Deployment of robots at various airports to assist passengers with vital information to drive market

- 8.3.4 STAFF & CREW MANAGEMENT

- 8.3.4.1 Traceable wearables and IoT solutions to improve crew management

- 8.3.5 BEHAVIORAL ANALYTICS

- 8.3.5.1 Adoption of behavioral analytics into security protocol to drive market

- 8.3.6 CARGO AND BAGGAGE HANDLING

- 8.3.6.1 Adoption of integrated cart systems to drive market

- 8.3.7 PAYMENT & TOKENIZATION

- 8.3.7.1 Inception of blockchain technology to drive market

- 8.4 AIRSIDE

- FIGURE 36 AIR TRAFFIC MANAGEMENT TO LEAD AIRSIDE MARKET DURING FORECAST PERIOD

- TABLE 34 AIRSIDE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 35 AIRSIDE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 8.4.1 E-FENCE

- 8.4.1.1 Integration of fences with sensors to drive market

- 8.4.2 GROUND SUPPORT EQUIPMENT MANAGEMENT

- 8.4.2.1 Smart vehicles such as automatic bots to drive market

- 8.4.3 AIRCRAFT MAINTENANCE

- 8.4.3.1 Advanced aircraft maintenance technologies to boost market

- 8.4.4 AIR TRAFFIC MANAGEMENT

- 8.4.4.1 Implementation of smart technologies to drive market

- 8.4.5 NOISE MONITORING

- 8.4.5.1 Smart solutions used for noise monitoring to boost market

- 8.4.6 AIRCRAFT TURNAROUND MANAGEMENT

- 8.4.6.1 Smart solutions used for operations to drive market

- 8.4.7 ADVANCED VISUAL DOCKING GUIDANCE SYSTEM (A-VDGS)

- 8.4.7.1 Automation for efficient gate management to drive market

9 SMART AIRPORTS MARKET, BY AIRPORT SIZE

- 9.1 INTRODUCTION

- FIGURE 37 MEDIUM AIRPORT SEGMENT TO LEAD SMART AIRPORTS MARKET DURING FORECAST PERIOD

- TABLE 36 SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 37 SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- 9.2 LARGE

- 9.2.1 ADOPTION OF SELF-SERVICE SYSTEMS TO DRIVE MARKET

- 9.3 MEDIUM

- 9.3.1 DEVELOPMENT OF NEW AIRPORTS IN ASIA PACIFIC TO DRIVE MARKET

- 9.4 SMALL

- 9.4.1 INCREASED USE OF CHARTER SERVICES TO DRIVE MARKET

10 SMART AIRPORTS MARKET, BY END MARKET

- 10.1 INTRODUCTION

- FIGURE 38 UPGRADES & SERVICES SEGMENT TO HOLD MAJOR MARKET SHARE DURING FORECAST PERIOD

- TABLE 38 SMART AIRPORTS MARKET, BY END MARKET, 2018-2021 (USD MILLION)

- TABLE 39 SMART AIRPORTS MARKET, BY END MARKET NORTH AMERICA RECESSION IMPACT, 2022-2027 (USD MILLION)

- 10.2 IMPLEMENTATION

- 10.2.1 SMART APPLICATIONS IN AIRPORTS TO DRIVE MARKET

- 10.3 UPGRADES & SERVICES

- 10.3.1 UPGRADATION OF LEGACY AIRPORT SYSTEMS WITH SMART TECHNOLOGIES TO DRIVE MARKET

11 SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY

- 11.1 INTRODUCTION

- FIGURE 39 AIRPORT 3.0 SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 40 SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 41 SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- 11.2 AIRPORT 2.0

- 11.2.1 INCREASED ADOPTION OF DIGITIZATION TO IMPROVE PASSENGER EXPERIENCE

- 11.3 AIRPORT 3.0

- 11.3.1 DIGITALIZATION LEVERAGED TO ENHANCE OPERATIONAL EFFICIENCY

- 11.4 AIRPORT 4.0

- 11.4.1 BIG DATA AND OPEN DATA LEVERAGED TO ENHANCE INNOVATION

12 SMART AIRPORTS MARKET, BY OPERATION

- 12.1 INTRODUCTION

- FIGURE 40 NON-AERONAUTICAL SEGMENT TO LEAD MARKET

- TABLE 42 SMART AIRPORTS MARKET, BY OPERATION, 2018-2021 (USD MILLION)

- TABLE 43 SMART AIRPORTS MARKET, BY OPERATION, 2022-2027 (USD MILLION)

- 12.2 AERONAUTICAL

- 12.2.1 CONTENT MANAGEMENT

- 12.2.1.1 Adoption of technologically advanced smart airports solutions to drive market

- 12.2.2 BUSINESS INTELLIGENCE

- 12.2.2.1 Reduction in administration cost to drive market

- 12.2.3 REAL-TIME SERVICES

- 12.2.3.1 Increment in operational performance by implementation of IoT solutions to fuel market

- 12.2.4 SUPPLY CHAIN MANAGEMENT

- 12.2.4.1 Technological advancements to improve efficiency of supply chain operations

- 12.2.1 CONTENT MANAGEMENT

- 12.3 NON-AERONAUTICAL

- 12.3.1 REAL-TIME SERVICES

- 12.3.1.1 Demand for improved passenger experience to drive market

- 12.3.2 BUSINESS INTELLIGENCE

- 12.3.2.1 Low operational costs to drive market

- 12.3.3 INTELLIGENT TRANSPORT SERVICES

- 12.3.3.1 Growing need to optimize transportation to drive market

- 12.3.4 INVENTORY MANAGEMENT

- 12.3.4.1 Advancements in IT solutions to drive demand

- 12.3.5 FEE MANAGEMENT

- 12.3.5.1 Increased security with advancements in blockchain to drive demand

- 12.3.6 RESOURCE MANAGEMENT

- 12.3.6.1 Increase in adoption of resource management solutions to drive demand

- 12.3.1 REAL-TIME SERVICES

13 REGIONAL ANALYSIS

- 13.1 INTRODUCTION

- FIGURE 41 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- TABLE 44 SMART AIRPORTS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 45 SMART AIRPORTS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.2 NORTH AMERICA

- 13.2.1 NORTH AMERICA: RECESSION ANALYSIS

- TABLE 46 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- 13.2.2 PESTLE ANALYSIS: NORTH AMERICA

- FIGURE 42 NORTH AMERICA: SMART AIRPORTS MARKET SNAPSHOT

- TABLE 47 NORTH AMERICA: SMART AIRPORTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 48 NORTH AMERICA: SMART AIRPORTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 49 NORTH AMERICA: SMART AIRPORTS MARKET, BY OPERATION, 2018-2021 (USD MILLION)

- TABLE 50 NORTH AMERICA: SMART AIRPORTS MARKET, BY OPERATION, 2022-2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 52 NORTH AMERICA: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 53 NORTH AMERICA: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 54 NORTH AMERICA: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: SMART AIRPORTS MARKET, BY SYSTEM, 2018-2021 (USD MILLION)

- TABLE 56 NORTH AMERICA: SMART AIRPORTS MARKET, BY SYSTEM, 2022-2027 (USD MILLION)

- TABLE 57 NORTH AMERICA: SMART AIRPORTS MARKET, BY END MARKET, 2018-2021 (USD MILLION)

- TABLE 58 NORTH AMERICA: SMART AIRPORTS MARKET, BY END MARKET, 2022-2027 (USD MILLION)

- TABLE 59 NORTH AMERICA: SMART AIRPORTS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 60 NORTH AMERICA: SMART AIRPORTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.2.3 US

- 13.2.3.1 High number of busy airports to drive market for smart technology

- TABLE 61 US: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 62 US: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 63 US: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 64 US: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.2.4 CANADA

- 13.2.4.1 Increased investment by Canadian government to enhance airport operations

- TABLE 65 CANADA: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 66 CANADA: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 67 CANADA: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 68 CANADA: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.3 EUROPE

- 13.3.1 EUROPE: RECESSION ANALYSIS

- TABLE 69 EUROPE: RECESSION IMPACT ANALYSIS

- 13.3.2 PESTLE ANALYSIS: EUROPE

- FIGURE 43 EUROPE: SMART AIRPORTS MARKET SNAPSHOT

- TABLE 70 EUROPE: SMART AIRPORTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 71 EUROPE: SMART AIRPORTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 72 EUROPE: SMART AIRPORTS MARKET, BY OPERATION, 2018-2021 (USD MILLION)

- TABLE 73 EUROPE: SMART AIRPORTS MARKET, BY OPERATION, 2022-2027 (USD MILLION)

- TABLE 74 EUROPE: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 75 EUROPE: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 76 EUROPE: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 77 EUROPE: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 78 EUROPE: SMART AIRPORTS MARKET, BY SYSTEM, 2018-2021 (USD MILLION)

- TABLE 79 EUROPE: SMART AIRPORTS MARKET, BY SYSTEM, 2022-2027 (USD MILLION)

- TABLE 80 EUROPE: SMART AIRPORTS MARKET, BY END MARKET, 2018-2021 (USD MILLION)

- TABLE 81 EUROPE: SMART AIRPORTS MARKET, BY END MARKET, 2022-2027 (USD MILLION)

- TABLE 82 EUROPE: SMART AIRPORTS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 83 EUROPE: SMART AIRPORTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.3.3 UK

- 13.3.3.1 Airport congestion to lead to modernization of airport systems

- TABLE 84 UK: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 85 UK: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 86 UK: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 87 UK: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.3.4 FRANCE

- 13.3.4.1 Increased adoption of smart solutions to drive market

- TABLE 88 FRANCE: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 89 FRANCE: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 90 FRANCE: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 91 FRANCE: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.3.5 GERMANY

- 13.3.5.1 Increasing partnerships between airlines and smart solution providers

- TABLE 92 GERMANY: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 93 GERMANY: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 94 GERMANY: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 95 GERMANY: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.3.6 REST OF EUROPE

- 13.3.6.1 Rapid development of small regional airports

- TABLE 96 REST OF EUROPE: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 97 REST OF EUROPE: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 98 REST OF EUROPE: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 99 REST OF EUROPE: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.4 ASIA PACIFIC

- 13.4.1 ASIA PACIFIC: REGIONAL RECESSION ANALYSIS

- TABLE 100 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- 13.4.2 PESTLE ANALYSIS: ASIA PACIFIC

- FIGURE 44 ASIA PACIFIC: SMART AIRPORTS MARKET SNAPSHOT

- TABLE 101 ASIA PACIFIC: SMART AIRPORTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 102 ASIA PACIFIC: SMART AIRPORTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 103 ASIA PACIFIC: SMART AIRPORTS MARKET, BY OPERATION, 2018-2021 (USD MILLION)

- TABLE 104 ASIA PACIFIC: SMART AIRPORTS MARKET, BY OPERATION, 2022-2027 (USD MILLION)

- TABLE 105 ASIA PACIFIC: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 106 ASIA PACIFIC: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 107 ASIA PACIFIC: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 108 ASIA PACIFIC: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 109 ASIA PACIFIC: SMART AIRPORTS MARKET, BY SYSTEM, 2018-2021 (USD MILLION)

- TABLE 110 ASIA PACIFIC: SMART AIRPORTS MARKET, BY SYSTEM, 2022-2027 (USD MILLION)

- TABLE 111 ASIA PACIFIC: SMART AIRPORTS MARKET, BY END MARKET, 2018-2021 (USD MILLION)

- TABLE 112 ASIA PACIFIC: SMART AIRPORTS MARKET, BY END MARKET, 2022-2027 (USD MILLION)

- TABLE 113 ASIA PACIFIC: SMART AIRPORTS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 114 ASIA PACIFIC: SMART AIRPORTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.4.3 CHINA

- 13.4.3.1 Digital transformation initiatives to drive market

- TABLE 115 CHINA: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 116 CHINA: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 117 CHINA: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 118 CHINA: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.4.4 INDIA

- 13.4.4.1 New airport projects to drive market growth in India

- TABLE 119 INDIA: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 120 INDIA: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 121 INDIA: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 122 INDIA: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.4.5 JAPAN

- 13.4.5.1 Investment in implementation of smart technologies at airports to drive market

- TABLE 123 JAPAN: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 124 JAPAN: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 125 JAPAN: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 126 JAPAN: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.4.6 SOUTH KOREA

- 13.4.6.1 Need to upgrade ATMs at airports to drive market

- TABLE 127 SOUTH KOREA: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 128 SOUTH KOREA: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 129 SOUTH KOREA: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 130 SOUTH KOREA: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.4.7 AUSTRALIA

- 13.4.7.1 Increase in air travel to aid market growth

- TABLE 131 AUSTRALIA: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 132 AUSTRALIA: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 133 AUSTRALIA: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 134 AUSTRALIA: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.4.8 REST OF ASIA PACIFIC

- 13.4.8.1 Government support for implementation of smart technologies to drive market

- TABLE 135 REST OF ASIA PACIFIC: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 138 REST OF ASIA PACIFIC: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.5 REST OF THE WORLD

- 13.5.1 REST OF THE WORLD: REGIONAL ANALYSIS

- TABLE 139 REST OF THE WORLD: RECESSION IMPACT ANALYSIS

- 13.5.2 PESTLE ANALYSIS: REST OF THE WORLD

- FIGURE 45 REST OF THE WORLD: SMART AIRPORTS MARKET SNAPSHOT

- TABLE 140 REST OF THE WORLD: SMART AIRPORTS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 141 REST OF THE WORLD: SMART AIRPORTS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 142 REST OF THE WORLD: SMART AIRPORTS MARKET, BY OPERATION, 2018-2021 (USD MILLION)

- TABLE 143 REST OF THE WORLD: SMART AIRPORTS MARKET, BY OPERATION, 2022-2027 (USD MILLION)

- TABLE 144 REST OF THE WORLD: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 145 REST OF THE WORLD: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 146 REST OF THE WORLD: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 147 REST OF THE WORLD: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 148 REST OF THE WORLD: SMART AIRPORTS MARKET, BY SYSTEM, 2018-2021 (USD MILLION)

- TABLE 149 REST OF THE WORLD: SMART AIRPORTS MARKET, BY SYSTEM, 2022-2027 (USD MILLION)

- TABLE 150 REST OF THE WORLD: SMART AIRPORTS MARKET, BY END MARKET, 2018-2021 (USD MILLION)

- TABLE 151 REST OF THE WORLD: SMART AIRPORTS MARKET, BY END MARKET, 2022-2027 (USD MILLION)

- TABLE 152 REST OF THE WORLD: SMART AIRPORTS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 153 REST OF THE WORLD: SMART AIRPORTS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.5.3 BRAZIL

- 13.5.3.1 Increase in demand from tourism industry to drive market

- TABLE 154 BRAZIL: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 155 BRAZIL: SMART AIRPORTS MARKET, BY AIRPORT SIZE 2022-2027 (USD MILLION)

- TABLE 156 BRAZIL: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 157 BRAZIL: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.5.4 UAE

- 13.5.4.1 Development of large airports equipped with smart systems to drive market

- TABLE 158 UAE: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2018-2021 (USD MILLION)

- TABLE 159 UAE: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 160 UAE: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 161 UAE: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

- 13.5.5 OTHERS IN ROW

- 13.5.5.1 Upgrades in international airports to boost market growth

- TABLE 162 OTHERS IN ROW: SMART AIRPORTS MARKET, BY AIRPORT SIZE 2018-2021 (USD MILLION)

- TABLE 163 OTHERS IN ROW: SMART AIRPORTS MARKET, BY AIRPORT SIZE, 2022-2027 (USD MILLION)

- TABLE 164 OTHERS IN ROW: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 165 OTHERS IN ROW: SMART AIRPORTS MARKET, BY AIRPORT TECHNOLOGY, 2022-2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

- TABLE 166 SMART AIRPORTS MARKET: DEGREE OF COMPETITION

- FIGURE 46 SHARE OF TOP PLAYERS IN SMART AIRPORTS MARKET, 2021

- TABLE 167 KEY DEVELOPMENTS BY LEADING PLAYERS IN SMART AIRPORTS MARKET, 2022

- 14.3 RANKING ANALYSIS OF TOP FIVE PLAYERS, 2021

- FIGURE 47 MARKET RANKING OF LEADING PLAYERS IN SMART AIRPORTS MARKET, 2021

- FIGURE 48 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2017-2021

- 14.4 COMPETITIVE BENCHMARKING

- TABLE 168 STRENGTH OF PRODUCT PORTFOLIO

- TABLE 169 BUSINESS STRATEGY EXCELLENCE

- TABLE 170 REGIONAL FOOTPRINT OF COMPANIES

- 14.5 COMPANY EVALUATION QUADRANT

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- FIGURE 49 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

- 14.5.5 START-UP/SME EVALUATION QUADRANT

- 14.5.5.1 Progressive companies

- 14.5.5.2 Responsive companies

- 14.5.5.3 Starting blocks

- 14.5.5.4 Dynamic companies

- TABLE 171 SMART AIRPORTS MARKET: KEY STARTUPS/SMES

- FIGURE 50 SMART AIRPORTS MARKET (START-UPS) COMPETITIVE LEADERSHIP MAPPING, 2021

- 14.6 COMPETITIVE SCENARIO

- 14.6.1 MARKET EVALUATION FRAMEWORK

- 14.6.2 NEW PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 172 NEW PRODUCT LAUNCHES AND DEVELOPMENTS, 2019-2022

- 14.6.3 DEALS

- TABLE 173 CONTRACTS, 2019-2022

- 14.6.4 VENTURES/AGREEMENTS/EXPANSIONS

- TABLE 174 ACQUISITIONS/PARTNERSHIPS/JOINT VENTURES/AGREEMENTS/EXPANSIONS, 2018-2022

15 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 15.1 INTRODUCTION

- 15.2 KEY PLAYERS

- 15.2.1 SITA

- TABLE 175 SITA: BUSINESS OVERVIEW

- 15.2.2 THALES

- TABLE 176 THALES: BUSINESS OVERVIEW

- FIGURE 51 THALES: COMPANY SNAPSHOT

- TABLE 177 THALES: PRODUCT LAUNCHES

- TABLE 178 THALES: DEALS

- 15.2.3 SIEMENS AG

- TABLE 179 SIEMENS AG: BUSINESS OVERVIEW

- FIGURE 52 SIEMENS AG: COMPANY SNAPSHOT

- TABLE 180 SIEMENS AG: DEALS

- 15.2.4 CISCO SYSTEMS, INC.

- TABLE 181 LIEBHERR GROUP: BUSINESS OVERVIEW

- FIGURE 53 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- 15.2.5 AMADEUS IT GROUP SA

- TABLE 182 AMADEUS IT GROUP SA: BUSINESS OVERVIEW

- FIGURE 54 AMADEUS IT GROUP SA: COMPANY SNAPSHOT

- 15.2.6 RAYTHEON TECHNOLOGIES CORPORATION

- TABLE 183 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- FIGURE 55 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 184 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- TABLE 185 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- 15.2.7 DAIFUKU CO., LTD.

- TABLE 186 DAIFUKU CO., LTD.: BUSINESS OVERVIEW

- FIGURE 56 DAIFUKU CO., LTD..: COMPANY SNAPSHOT

- TABLE 187 DAIFUKU CO., LTD.: DEALS

- 15.2.8 T-SYSTEMS

- TABLE 188 T-SYSTEMS: BUSINESS OVERVIEW

- 15.2.9 NATS LIMITED

- TABLE 189 NATS LIMITED: BUSINESS OVERVIEW

- FIGURE 57 NATS LIMITED: COMPANY SNAPSHOT

- TABLE 190 NATS LIMITED: DEALS

- 15.2.10 SABRE CORPORATION

- TABLE 191 SABRE CORPORATION: BUSINESS OVERVIEW

- FIGURE 58 SABRE CORPORATION: COMPANY SNAPSHOT

- 15.2.11 IBM CORPORATION

- TABLE 192 IBM CORPORATION: BUSINESS OVERVIEW

- FIGURE 59 IBM CORPORATION: COMPANY SNAPSHOT

- TABLE 193 IBM CORPORATION: DEALS

- 15.2.12 L3HARRIS TECHNOLOGIES INC.

- TABLE 194 L3HARRIS TECHNOLOGIES INC.: BUSINESS OVERVIEW

- FIGURE 60 L3HARRIS TECHNOLOGIES INC.: COMPANY SNAPSHOT

- 15.2.13 LEIDOS HOLDINGS, INC.

- TABLE 195 LEIDOS HOLDINGS, INC.: BUSINESS OVERVIEW

- FIGURE 61 LEIDOS HOLDINGS, INC.: COMPANY SNAPSHOT

- 15.2.14 ASCENT TECHNOLOGIES, INC.

- TABLE 196 ASCENT TECHNOLOGY, INC.: BUSINESS OVERVIEW

- 15.2.15 WIPRO LIMITED

- TABLE 197 WIPRO LIMITED: BUSINESS OVERVIEW

- FIGURE 62 WIPRO LIMITED: -COMPANY SNAPSHOT

- 15.2.16 HUAWEI TECHNOLOGIES CO., LTD.

- TABLE 198 HUAWEI TECHNOLOGIES CO., LTD.: BUSINESS OVERVIEW

- 15.2.17 INDRA SISTEMAS S.A.

- TABLE 199 INDRA SISTEMAS S.A.: BUSINESS OVERVIEW

- FIGURE 63 INDRA SISTEMAS S.A.: COMPANY SNAPSHOT

- 15.2.18 INFAX INC.

- TABLE 200 INFAX INC.: BUSINESS OVERVIEW

- 15.2.19 SMART AIRPORT SYSTEMS (SAS)

- TABLE 201 SMART AIRPORTS SYSTEMS (SAS): BUSINESS OVERVIEW

- 15.3 OTHER PLAYERS

- 15.3.1 ZENSORS

- TABLE 202 ZENSORS, INC.: BUSINESS OVERVIEW

- 15.3.2 GORILLA TECHNOLOGY

- TABLE 203 GORILLA TECHNOLOGY: BUSINESS OVERVIEW

- 15.3.3 EMARTECH

- TABLE 204 EMARTECH: BUSINESS OVERVIEW

- 15.3.4 TAV TECHNOLOGIES

- TABLE 205 TAV TECHNOLOGIES: BUSINESS OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS