|

|

市場調査レポート

商品コード

1176961

LNG貯蔵タンクの世界市場:タイプ別(自立式、非自立式)、材料別(スチール、9%ニッケル鋼、アルミニウム合金)、地域別 - 2027年までの予測LNG Storage Tank Market by Type (Self-Supporting, Non-Self-Supporting), Material (Steel, 9% Nickel Steel, Aluminum Alloy), Region (North America, Europe, Asia Pacific, Middle East & Africa, South America) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| LNG貯蔵タンクの世界市場:タイプ別(自立式、非自立式)、材料別(スチール、9%ニッケル鋼、アルミニウム合金)、地域別 - 2027年までの予測 |

|

出版日: 2022年12月20日

発行: MarketsandMarkets

ページ情報: 英文 138 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のLNG貯蔵タンクの市場規模は、2022年の145億米ドルから、2027年までに208億米ドルに達し、予測期間中にCAGRで7.5%の成長が予測されています。

また、日本、インド、インドネシアにおけるLNGインフラの大規模な開発が、LNG貯蔵タンクの需要を押し上げると予想されます。しかし、これらのタンクの高い設置コストが市場の抑制要因となっています。

"非自立式は、金額ベースで最速で成長中のLNG貯蔵タンクのタイプ"

非自立式タンクは、船体構造と一体になり、船体構造全体と同じ荷重の影響を受けるため、一体型タンクとも呼ばれています。非自立式タンクで最も一般的に使用されているのはメンブレンタンクです。これらのタンクは、一次バリアが液体を封じ込められなかった場合に備えて、システム全体の安全性を確保するために、必ず二次封じ込めによって支えられている必要があります。このタイプもメンブレンタンクに分類されます。

"9%ニッケル鋼は、金額ベースで2番目に急成長中のLNG貯蔵タンクの製品タイプ"

電力・エネルギー産業におけるLNGの世界の需要増に伴い、LNG貯蔵タンクの建設が増加しました。9%ニッケル鋼は、地上LNG貯蔵タンクの内部タンクに最も多く使用されている材料です。9%ニッケル鋼は、International Nickel Companyが開発した材料で、過去50年間、世界中のLNG貯蔵タンクの材料として最も多く使用されています。低温破壊靭性と低温での耐食性に優れています。

"アジア太平洋地域は、最も急成長中のLNG貯蔵タンク市場"

アジア太平洋地域は、予測期間中、LNG貯蔵タンクの最大市場になると予想されます。アジア太平洋地域の市場は、主に小規模なLNGの輸入が増加していること、エネルギー産業や電力産業が著しい発展を遂げており、LNGの需要が顕著であることから、この地域のLNG貯蔵タンクの市場を牽引することになります。さらに、中国における鉄鋼業の発展が、予測期間中に世界のLNG貯蔵タンク市場を牽引すると予想されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- マクロ経済指標

第6章 LNG貯蔵タンク市場:タイプ別

- イントロダクション

- 自立式

- 非自立式

第7章 LNG貯蔵タンク市場:材料別

- イントロダクション

- スチール

- 9%ニッケル鋼

- アルミニウム合金

- その他

第8章 LNG貯蔵タンク市場:地域別

- イントロダクション

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- ロシア

- 英国

- イタリア

- その他

- 中東・アフリカ

- カタール

- サウジアラビア

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第9章 競合情勢

- イントロダクション

- 市場シェア分析

- 市場ランキング

- 競合シナリオ

- 企業評価マトリックス

第10章 企業プロファイル

- 主要企業

- LINDE PLC

- MCDERMOTT INTERNATIONAL INC.

- WARTSILA

- IHI CORPORATION

- AIR WATER INC.

- CIMC ENRIC

- CHART INDUSTRIES

- ISISAN A.S.

- CRYOLOR

- INOX INDIA

- その他の企業

- VIJAY TANKS AND VESSELS LTD.

- CORBAN ENERGY GROUP

- LUXI NEW ENERGY EQUIPMENT GROUP CO. LTD.

- VINCI CONSTRUCTION

- MHI ENGINEERING AND INTERNATIONAL PROJECT INDIA LTD.

- LLOYDS ENERGY

- TRANSTECH ENERGY LLC.

- CRYOCAN

- CRYOGAS EQUIPMENT PVT. LTD.

- WHESSOE

- BECHTEL

- KARBONSAN

- SENER GROUP

- MAVERICK ENGINEERING INC.

- CRYOTEKNIK

第11章 付録

The global LNG storage tank market size is expected to grow from USD 14.5 billion in 2022 to USD 20.8 billion by 2027, at a CAGR of 7.5% during the forecast period. Large-scale development of LNG infrastructure in Japan, India, and Indonesia is also expected to boost the demand for LNG storage tanks. However, the high installation cost of these tanks is a restraint in the market.

"Non-self-supporting Type is the fastest-growing Type of LNG storage tank, in terms of value."

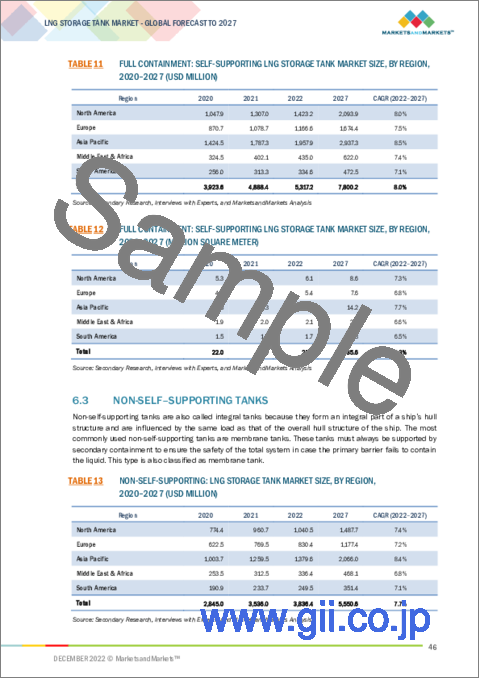

Non-self-supporting tanks are also called integral tanks because they form an integral part of a ship's hull structure and are influenced by the same load as that of the overall hull structure of the ship. The most commonly used non-self-supporting tanks are membrane tanks. These tanks must always be supported by secondary containment to ensure the safety of the total system in case the primary barrier fails to contain the liquid. This type is also classified as membrane tank.

"9% nickel steel is the second fastest-growing product type of LNG storage tank, in terms of value."

The increase in the global demand for LNG in the power and energy industries led to an increase in the construction of LNG storage tanks. 9% nickel steel is the most common material used in the construction of inner tanks for above-the-ground LNG storage tanks. 9% nickel steel was developed by the International Nickel Company and is the most used material for LNG storage tanks worldwide for the past 50 years. It has excellent cryogenic fracture toughness and corrosion resistance at low temperatures.

"APAC is the fastest-growing LNG storage tank market."

APAC is expected to be the largest market for LNG storage tank during forecasted years. The market in Asia Pacific is mainly dominated by the growing import of small-scale LNG, and significant developments in energy and power industries, which are witnessing a significant demand for LNG, which, in turn, will drive the market for LNG storage tanks in the region. Furthermore, the growing steel industry in China is expected to drive the global LNG storage tank market during the forecast period. Industrial developments in China, India, the US, Japan, Mexico, among other countries driving the LNG storage tank market in these regions.

This study has been validated through primaries conducted with various industry experts, globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 60%, Tier 2- 20%, and Tier 3- 20%

- By Designation- C Level- 33%, Director Level- 33%, and Managers- 34%

- By Region- North America- 20%, Europe- 25%, APAC- 25%, Latin America-10%, MEA-20%,

The report provides a comprehensive analysis of company profiles listed below:

- Linde Plc (Ireland)

- McDermott International Inc. (US)

- Wartsila (Finland)

- IHI Corporation (Japan)

- Air Water Inc. (Japan)

- Cimc Enric (China)

- Chart Industries (US)

- Isisan A.S (Turkey)

- Cryolor (France)

- Inox (India)

- Carbon Energy Group (US)

- TransTech Energy Llc. (US)

- Others

Research Coverage

This report covers the global LNG storage tank market and forecasts the market size until 2027. The report includes the market segmentation -Type (self-supporting, and non-self-supporting), Material Type (steel, 9% nickel steel, aluminum alloy, and Others), and Region (Europe, North America, APAC, South America, and MEA). Porter's Five Forces analysis, along with the drivers, restraints, opportunities, and challenges, are discussed in the report. It also provides company profiles and competitive strategies adopted by the major players in the global LNG storage tank market.

Key benefits of buying the report:

The report will help market leaders/new entrants in this market in the following ways:

1. This report segments the global LNG storage tank market comprehensively and provides the closest approximations of the revenues for the overall market and the sub-segments across different verticals and regions.

2. The report helps stakeholders understand the pulse of the LNG storage tank market and provides them with information on key market drivers, restraints, challenges, and opportunities.

3. This report will help stakeholders to understand competitors better and gain more insights to better their position in their businesses. The competitive landscape section includes the competitor ecosystem, new product development, agreement, and acquisitions.

Reasons to buy the report:

The report will help market leaders/new entrants in this market by providing them with the closest approximations of the revenues for the overall LNG storage tank market and the sub-segments. This report will help stakeholders to understand the competitive landscape and gain more insights and position their businesses and market strategies in a better way. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 IMPACT OF SLOWDOWN

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 LNG STORAGE TANK MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE APPROACH

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 2 LNG STORAGE TANK MARKET: DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 3 SELF-SUPPORTING TYPE TO DOMINATE OVERALL LNG STORAGE TANK MARKET

- FIGURE 4 STEEL SEGMENT TO DOMINATE LNG STORAGE TANK MARKET

- FIGURE 5 ASIA PACIFIC WAS LARGEST MARKET FOR LNG STORAGE TANKS

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LNG STORAGE TANK MARKET

- FIGURE 6 GROWING LNG EXPORTS TO DRIVE MARKET DURING FORECAST PERIOD

- 4.2 LNG STORAGE TANK MARKET, BY REGION AND MATERIAL

- FIGURE 7 ASIA PACIFIC WAS LARGEST LNG STORAGE TANK MARKET

- 4.3 LNG STORAGE TANK MARKET IN ASIA PACIFIC, BY COUNTRY, 2021

- FIGURE 8 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN ASIA PACIFIC

- 4.4 LNG STORAGE TANK MARKET, BY COUNTRY

- FIGURE 9 INDIA TO BE FASTEST-GROWING MARKET BETWEEN 2022 AND 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 10 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN LNG STORAGE TANK MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in LNG trade worldwide

- 5.2.1.2 Increase in number of floating storage and regasification units

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation cost of LNG storage tanks

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing opportunities in marine transport

- 5.2.3.2 Increasing spending on infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 LNG leakage and boil-off gas

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 11 LNG STORAGE TANK MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 TRENDS AND FORECAST OF GDP

- TABLE 1 TRENDS AND FORECAST OF GDP, 2019-2027 (USD BILLION)

- 5.4.2 MAJOR STEEL-PRODUCING COUNTRIES

- TABLE 2 CRUDE STEEL PRODUCTION, 2020 VS. 2021 (MILLION TONS)

6 LNG STORAGE TANK MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 12 SELF-SUPPORTING TANKS TO BE LARGER TYPE OF LNG STORAGE TANKS

- TABLE 3 LNG STORAGE TANK MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 4 LNG STORAGE TANK MARKET SIZE, BY TYPE, 2020-2027 (MILLION SQUARE METER)

- 6.2 SELF-SUPPORTING

- TABLE 5 SELF-SUPPORTING STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 6 SELF-SUPPORTING STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (MILLION SQUARE METER)

- 6.2.1 SINGLE CONTAINMENT STORAGE TANKS

- 6.2.1.1 Ability to maintain cryogenic temperature to drive market

- TABLE 7 SINGLE CONTAINMENT: SELF-SUPPORTING LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 8 SINGLE CONTAINMENT: SELF-SUPPORTING LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (MILLION SQUARE METER)

- 6.2.2 DOUBLE CONTAINMENT STORAGE TANKS

- 6.2.2.1 Excellent mechanical property to drive market

- TABLE 9 DOUBLE CONTAINMENT: SELF-SUPPORTING LNG STORAGE TANK MARKET SIZE, REGION, 2020-2027 (USD MILLION)

- TABLE 10 DOUBLE CONTAINMENT: SELF-SUPPORTING LNG STORAGE TANK MARKET SIZE, REGION, 2020-2027 (MILLION SQUARE METER)

- 6.2.3 FULL CONTAINMENT STORAGE TANKS

- 6.2.3.1 Growing demand for LNG to drive market

- TABLE 11 FULL CONTAINMENT: SELF-SUPPORTING LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 12 FULL CONTAINMENT: SELF-SUPPORTING LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (MILLION SQUARE METER)

- 6.3 NON-SELF-SUPPORTING TANKS

- TABLE 13 NON-SELF-SUPPORTING: LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 14 NON-SELF-SUPPORTING: LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (MILLION SQUARE METER)

- 6.3.1 MEMBRANE TANK

- 6.3.1.1 Growing demand for LNG carriers in marine industry to drive market

- TABLE 15 MEMBRANE TANK: NON-SELF-SUPPORTING LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 16 MEMBRANE TANK: NON-SELF-SUPPORTING LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (MILLION SQUARE METER)

7 LNG STORAGE TANK MARKET, BY MATERIAL

- 7.1 INTRODUCTION

- FIGURE 13 STEEL TO BE MOST USED MATERIAL FOR LNG STORAGE TANKS

- TABLE 17 LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 18 LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 7.2 STEEL

- 7.2.1 GROWING APPLICATION OF LNG TANKS IN SHIPS TO DRIVE DEMAND

- TABLE 19 STEEL: LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 20 STEEL: LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (MILLION SQUARE METER)

- 7.3 9% NICKEL STEEL

- 7.3.1 GROWING DEMAND FOR LNG STORAGE TANKS IN ENERGY INDUSTRY TO BOOST MARKET

- TABLE 21 9% NICKEL STEEL: LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 22 9% NICKEL STEEL: LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (MILLION SQUARE METER)

- 7.4 ALUMINUM ALLOY

- 7.4.1 GROWING USE OF LNG-FUELED SHIPS TO DRIVE DEMAND

- TABLE 23 ALUMINUM ALLOY: LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 24 ALUMINUM ALLOY: LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (MILLION SQUARE METER)

- 7.5 OTHERS

- TABLE 25 OTHER MATERIALS: LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 26 OTHER MATERIALS: LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (MILLION SQUARE METER)

8 LNG STORAGE TANK MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 14 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- TABLE 27 LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 28 LNG STORAGE TANK MARKET SIZE, BY REGION, 2020-2027 (MILLION SQUARE METER)

- TABLE 29 LNG STORAGE TANK MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 30 LNG STORAGE TANK MARKET SIZE, BY TYPE, 2020-2027 (MILLION SQUARE METER)

- TABLE 31 LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 32 LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.2 ASIA PACIFIC

- FIGURE 15 ASIA PACIFIC: LNG STORAGE TANK MARKET SNAPSHOT

- TABLE 33 ASIA PACIFIC: LNG STORAGE TANK MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 34 ASIA PACIFIC: LNG STORAGE TANK MARKET SIZE, BY TYPE, 2020-2027 (MILLION SQUARE METER)

- TABLE 35 ASIA PACIFIC: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 36 ASIA PACIFIC: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- TABLE 37 ASIA PACIFIC: LNG STORAGE TANK MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 38 ASIA PACIFIC: LNG STORAGE TANK MARKET SIZE, BY COUNTRY, 2020-2027 (MILLION SQUARE METER)

- 8.2.1 CHINA

- 8.2.1.1 High demand for LNG in energy and power industries to drive market

- TABLE 39 CHINA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 40 CHINA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.2.2 JAPAN

- 8.2.2.1 Rising imports of natural gas and increase in investments in energy industry to drive market

- TABLE 41 JAPAN: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 42 JAPAN: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.2.3 INDIA

- 8.2.3.1 Increasing demand for LNG storage tanks from energy and power industries to drive market

- TABLE 43 INDIA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 44 INDIA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.2.4 SOUTH KOREA

- 8.2.4.1 Growing LNG imports to drive demand

- TABLE 45 SOUTH KOREA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 46 SOUTH KOREA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.2.5 AUSTRALIA

- 8.2.5.1 Investments from oil & gas giants to drive demand

- TABLE 47 AUSTRALIA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 48 AUSTRALIA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.2.6 REST OF ASIA PACIFIC

- TABLE 49 REST OF ASIA PACIFIC: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 50 REST OF ASIA PACIFIC: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.3 NORTH AMERICA

- FIGURE 16 NORTH AMERICA: LNG STORAGE TANK MARKET SNAPSHOT

- TABLE 51 NORTH AMERICA: LNG STORAGE TANK MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 52 NORTH AMERICA: LNG STORAGE TANK MARKET SIZE, BY TYPE, 2020-2027 (MILLION SQUARE METER)

- TABLE 53 NORTH AMERICA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 54 NORTH AMERICA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- TABLE 55 NORTH AMERICA: LNG STORAGE TANK MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: LNG STORAGE TANK MARKET SIZE, BY COUNTRY, 2020-2027 (MILLION SQUARE METER)

- 8.3.1 US

- 8.3.1.1 Increasing production and export of natural gas to drive market

- TABLE 57 US: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 58 US: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.3.2 CANADA

- 8.3.2.1 Aggressive economic expansion to boost market

- TABLE 59 CANADA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 60 CANADA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.3.3 MEXICO

- 8.3.3.1 Rapid reforms related to energy industry to drive market

- TABLE 61 MEXICO: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 62 MEXICO: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.4 EUROPE

- FIGURE 17 EUROPE: LNG STORAGE TANK MARKET SNAPSHOT

- TABLE 63 EUROPE: LNG STORAGE TANK MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 64 EUROPE: LNG STORAGE TANK MARKET SIZE, BY TYPE, 2020-2027 (MILLION SQUARE METER)

- TABLE 65 EUROPE: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 66 EUROPE: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- TABLE 67 EUROPE: LNG STORAGE TANK MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 68 EUROPE: LNG STORAGE TANK MARKET SIZE, BY COUNTRY, 2020-2027 (MILLION SQUARE METER)

- 8.4.1 GERMANY

- 8.4.1.1 Increased focus on energy generation from renewable sources to drive demand

- TABLE 69 GERMANY: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 70 GERMANY: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.4.2 FRANCE

- 8.4.2.1 Increasing imports and growing usage of LNG in power industry to drive demand

- TABLE 71 FRANCE: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 72 FRANCE: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.4.3 RUSSIA

- 8.4.3.1 Growing LNG exports to drive market

- TABLE 73 RUSSIA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 74 RUSSIA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.4.4 UK

- 8.4.4.1 Higher LNG consumption to boost LNG storage tank market

- TABLE 75 UK: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 76 UK: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.4.5 ITALY

- 8.4.5.1 Growing transportation industry to drive demand

- TABLE 77 ITALY: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 78 ITALY: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.4.6 REST OF EUROPE

- TABLE 79 REST OF EUROPE: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 80 REST OF EUROPE: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.5 MIDDLE EAST & AFRICA

- FIGURE 18 MIDDLE EAST & AFRICA: LNG STORAGE TANK MARKET SNAPSHOT

- TABLE 81 MIDDLE EAST & AFRICA: LNG STORAGE TANK MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 82 MIDDLE EAST & AFRICA: LNG STORAGE TANK MARKET SIZE, BY TYPE, 2020-2027 (MILLION SQUARE METER)

- TABLE 83 MIDDLE EAST & AFRICA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 84 MIDDLE EAST & AFRICA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- TABLE 85 MIDDLE EAST & AFRICA: LNG STORAGE TANK MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 86 MIDDLE EAST & AFRICA: LNG STORAGE TANK MARKET SIZE, BY COUNTRY, 2020-2027 (MILLION SQUARE METER)

- 8.5.1 QATAR

- 8.5.1.1 Increased usage of LNG in energy industry to boost growth

- TABLE 87 QATAR: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 88 QATAR: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.5.2 SAUDI ARABIA

- 8.5.2.1 Expansion into LNG market to drive LNG storage tank market

- TABLE 89 SAUDI ARABIA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 90 SAUDI ARABIA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.5.3 SOUTH AFRICA

- 8.5.3.1 Development of new LNG terminals and bunkering facilities to drive demand

- TABLE 91 SOUTH AFRICA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 92 SOUTH AFRICA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 93 REST OF MIDDLE EAST & AFRICA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 94 REST OF MIDDLE EAST & AFRICA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.6 SOUTH AMERICA

- FIGURE 19 SOUTH AMERICA: LNG STORAGE TANK MARKET SNAPSHOT

- TABLE 95 SOUTH AMERICA: LNG STORAGE TANK MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 96 SOUTH AMERICA: LNG STORAGE TANK MARKET SIZE, BY TYPE, 2020-2027 (MILLION SQUARE METER)

- TABLE 97 SOUTH AMERICA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 98 SOUTH AMERICA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- TABLE 99 SOUTH AMERICA: LNG STORAGE TANK MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 100 SOUTH AMERICA: LNG STORAGE TANK MARKET SIZE, BY COUNTRY, 2020-2027 (MILLION SQUARE METER)

- 8.6.1 BRAZIL

- 8.6.1.1 Rapidly expanding economy to drive LNG storage tank market

- TABLE 101 BRAZIL: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 102 BRAZIL: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.6.2 ARGENTINA

- 8.6.2.1 Increased investments in LNG terminals to drive LNG storage tank market

- TABLE 103 ARGENTINA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 104 ARGENTINA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

- 8.6.3 REST OF SOUTH AMERICA

- TABLE 105 REST OF SOUTH AMERICA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 106 REST OF SOUTH AMERICA: LNG STORAGE TANK MARKET SIZE, BY MATERIAL, 2020-2027 (MILLION SQUARE METER)

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 MARKET SHARE ANALYSIS

- FIGURE 20 SHARES OF TOP COMPANIES IN LNG STORAGE TANK MARKET

- TABLE 107 INTENSITY OF COMPETITIVE RIVALRY: LNG STORAGE TANK MARKET

- 9.3 MARKET RANKING

- FIGURE 21 RANKING OF TOP-FIVE PLAYERS IN LNG STORAGE TANK MARKET

- 9.4 COMPETITIVE SCENARIO

- TABLE 108 LNG STORAGE TANK MARKET: NEW PRODUCT LAUNCH/DEVELOPMENT, 2015-2022

- TABLE 109 LNG STORAGE TANK MARKET: DEALS, 2015-2022

- TABLE 110 LNG STORAGE TANK MARKET: OTHER DEVELOPMENTS, 2015-2021

- 9.5 COMPANY EVALUATION MATRIX

- 9.5.1 STAR PLAYERS

- 9.5.2 PERVASIVE PLAYERS

- 9.5.3 PARTICIPANTS

- 9.5.4 EMERGING LEADERS

- FIGURE 22 LNG STORAGE TANK MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2021

- 9.5.5 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 23 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN LNG STORAGE TANK MARKET

- 9.5.6 BUSINESS STRATEGY EXCELLENCE

- FIGURE 24 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN LNG STORAGE TANK MARKET

10 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, New product development, Deals, MNM view)**

- 10.1 KEY COMPANIES

- 10.1.1 LINDE PLC

- TABLE 111 LINDE PLC: BUSINESS OVERVIEW

- FIGURE 25 LINDE PLC: COMPANY SNAPSHOT

- 10.1.2 MCDERMOTT INTERNATIONAL INC.

- TABLE 112 MCDERMOTT INTERNATIONAL INC.: COMPANY OVERVIEW

- 10.1.3 WARTSILA

- TABLE 113 WARTSILA: COMPANY OVERVIEW

- FIGURE 26 WARTSILA: COMPANY SNAPSHOT

- 10.1.4 IHI CORPORATION

- TABLE 114 IHI CORPORATION: COMPANY OVERVIEW

- FIGURE 27 IHI CORPORATION: COMPANY SNAPSHOT

- 10.1.5 AIR WATER INC.

- TABLE 115 AIR WATER INC.: COMPANY OVERVIEW

- FIGURE 28 AIR WATER INC.: COMPANY SNAPSHOT

- 10.1.6 CIMC ENRIC

- TABLE 116 CIMC ENRIC: COMPANY OVERVIEW

- FIGURE 29 CIMC ENRIC: COMPANY SNAPSHOT

- 10.1.7 CHART INDUSTRIES

- TABLE 117 CHART INDUSTRIES: COMPANY OVERVIEW

- FIGURE 30 CHART INDUSTRIES: COMPANY SNAPSHOT

- 10.1.8 ISISAN A.S.

- TABLE 118 ISISAN A.S.: COMPANY OVERVIEW

- 10.1.9 CRYOLOR

- TABLE 119 CRYOLOR: COMPANY OVERVIEW

- 10.1.10 INOX INDIA

- TABLE 120 INOX INDIA: COMPANY OVERVIEW

- 10.2 OTHER COMPANIES

- 10.2.1 VIJAY TANKS AND VESSELS LTD.

- 10.2.2 CORBAN ENERGY GROUP

- 10.2.3 LUXI NEW ENERGY EQUIPMENT GROUP CO. LTD.

- 10.2.4 VINCI CONSTRUCTION

- 10.2.5 MHI ENGINEERING AND INTERNATIONAL PROJECT INDIA LTD.

- 10.2.6 LLOYDS ENERGY

- 10.2.7 TRANSTECH ENERGY LLC.

- 10.2.8 CRYOCAN

- 10.2.9 CRYOGAS EQUIPMENT PVT. LTD.

- 10.2.10 WHESSOE

- 10.2.11 BECHTEL

- 10.2.12 KARBONSAN

- 10.2.13 SENER GROUP

- 10.2.14 MAVERICK ENGINEERING INC.

- 10.2.15 CRYOTEKNIK

- *Details on Business overview, Products/Services/Solutions offered, New product development, Deals, MNM view might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS