|

|

市場調査レポート

商品コード

1173531

安息香酸塩の世界市場:タイプ別(安息香酸カリウム、安息香酸ナトリウム、安息香酸アンモニウム)、最終用途別(食品・飲料、医薬品、パーソナルケア用品)、地域別 - 2027年までの予測Benzoates Market by Type (Potassium Benzoate, Sodium Benzoate, Ammonium Benzoate), End-Use (Food & Beverage, Pharmaceutical, Personal Care), and Region (North America, Europe, Asia Pacific, Rest of the World) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 安息香酸塩の世界市場:タイプ別(安息香酸カリウム、安息香酸ナトリウム、安息香酸アンモニウム)、最終用途別(食品・飲料、医薬品、パーソナルケア用品)、地域別 - 2027年までの予測 |

|

出版日: 2022年12月12日

発行: MarketsandMarkets

ページ情報: 英文 132 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の安息香酸塩の市場規模は、2022年の4億2,900万米ドルから2027年までに5億4,000万米ドルに達し、予測期間中にCAGRで4.7%の成長が予測されています。

安息香酸塩は、ピクルス、飲料、ジャム、ゼリー、化粧品、飼料、咳止めシロップなど、多様な用途で使われるため、需要が拡大しています。

"2021年、タイプ別では安息香酸ナトリウムが最大セグメント"

安息香酸ナトリウムは、安息香酸を水酸化ナトリウムと反応させることで生成されます。安息香酸ナトリウムは、食品・飲料に主に使用されています。また、ホームケア、パーソナルケア用品、医薬品など他の産業でも使用されています。さらに、安息香酸ナトリウムは医薬品、ローション、マウスウォッシュ、水性塗料の防腐剤として使用されています。このように、安息香酸ナトリウムはさまざまな最終用途産業で使用されており、需要を後押ししています。

"2021年、最終用途別では食品・飲料が最大セグメント"

安息香酸塩は、食品・飲料の防腐剤として使用されています。食品・飲料に主に使用される安息香酸塩は、ナトリウムとカリウムです。人口の増加とライフスタイルの変化に伴う加工食品の需要増が、食品・飲料セグメントの安息香酸塩の成長を促進しています。

"2021年、アジア太平洋地域が最大セグメント"

アジア太平洋地域では中国が最大の市場シェアを占めています。中国では、産業活動の活発化や消費者のライフスタイルの変化により、家庭用品や消費者向け製品の需要が高まっています。また、中流階級以上の人口や富裕層世帯の増加、各種パッケージ食品の消費量の増加が、フレーバー・フレグランスの高い需要に寄与しています。このため、安息香酸塩の需要は、フレーバー・フレグランス産業において創出されています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム

- ポーターのファイブフォース分析

- 特許分析

- 政策と規制

- ケーススタディ分析

- 貿易データ

- 価格分析

第6章 製造工程

- イントロダクション

- 安息香酸ナトリウム

- 安息香酸カリウム

- 安息香酸アンモニウム

第7章 安息香酸塩市場:タイプ別

- イントロダクション

- 安息香酸カリウム

- 安息香酸ナトリウム

- 安息香酸アンモニウム

- その他

第8章 安息香酸塩市場:最終用途別

- イントロダクション

- 食品・飲料

- 医薬品

- パーソナルケア用品

- その他

第9章 安息香酸塩市場:地域別

- イントロダクション

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他

- 欧州

- ドイツ

- フランス

- 英国

- その他

- 北米

- 米国

- カナダ

- メキシコ

- その他の地域

- 中東・アフリカ

- 南米

第10章 競合情勢

- 主要企業の戦略

- 収益分析

- 市場シェア分析

- 企業評価マトリックス

- 競合シナリオ

第11章 企業プロファイル

- LANXESS

- WUHAN YOUJI INDUSTRIES CO., LTD.

- TIANJIN DONGDA CHEMICAL GROUP CO., LTD.

- TENGZHOU TENGLONG CHEMICAL CO., LTD.

- EASTMAN CHEMICAL COMPANY

- A.M FOOD CHEMICAL CO., LIMITED

- VERTELLUS

- SPECTRUM CHEMICAL

- TENGZHOU AOLONG CHEMICAL CO., LTD.

- MACCO ORGANIQUES INC.

- FBC INDUSTRIES

- SHANDONG TONGTAIWEIRUN FOOD SCIENCE TECH CO., LTD.

- SHANDONG RUIHENG BIOTECHNOLOGY CO., LTD.

- RISHI CHEMICAL

- TOKYO CHEMICAL INDUSTRY CO., LTD.

- ING. PETR SVEC-PENTA S.R.O.

- GANESH BENZOPLAST LIMITED

- FOODCHEM INTERNATIONAL CORPORATION

- AMERICAN ELEMENTS

第12章 付録

The global benzoates market is projected to grow from USD 429 million in 2022 to USD 540 million by 2027, at a CAGR of 4.7% during the forecast period. Growing demand for benzoates is witnessed due to its usage in diversified applications, such as pickles, beverages, jams, jellies, cosmetic products, animal feed, cough syrups, and others.

"Sodium benzoate, by type was the largest segment in 2021"

Sodium benzoate is generated by reacting benzoic acid with sodium hydroxide. Sodium benzoate has major use in food & beverages. Also, it is used in other industries such as home care, personal care, and pharmaceutical. Moreover, sodium benzoate is used as a preservative in medicine, lotions, mouthwash, and water-based paint. Thus, such uses of sodium benzoate in various end-use industries are propelling demand.

"Food & beverage, by end-use was the largest segment in 2021"

Benzoates are used as preservatives for food & drinks. Benzoates that are majorly used in food & beverages are sodium and potassium. Growing demand for processed food as a result of increasing population and changing lifestyle is driving the growth of benzoates in food & beverage segment.

"Asia Pacific region was the largest segment in 2021"

China accounted for the largest market share in the region. The growing industrial activities and change in consumer's lifestyle have resulted in the rising demand for household and consumer products in the country. In addition, the rise of upper-middle-class population and affluent households and the rise in the consumption of various packaged food products are contributing to the high demand for flavors & fragrances in the country. This creates demand for benzoates in the flavor & fragrance industry.

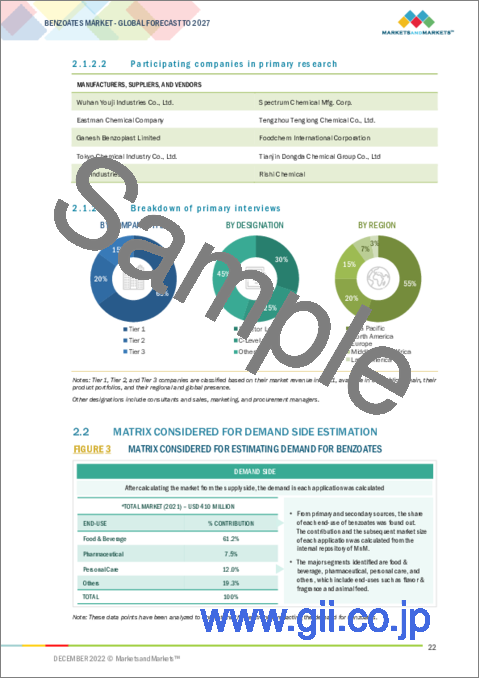

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: Director Level- 30%, C-level- 25%, and Others - 45%

- By Region: North America - 20%, Europe - 15%, Asia Pacific - 55%, South America - 7%, Middle East & Africa - 3%

LANXESS (Germany), Tengzhou Tenglong Chemical Co., Ltd. (China), Wuhan Youji Industries Co., Ltd. (China), Eastman Chemical Company (US), Merck KGaA (Germany), Tokyo Chemical Industry Co., Ltd. (Japan), Tianjin Dongda Chemical Group Co., Ltd (China), Ganesh Benzoplast Limited (India), American Elements (US), are some of the key players operating in the benzoates market. These players have adopted strategies such as partnerships, acquisitions, and expansions to enhance their business revenue and market share.

Research Coverage:

The report defines, segments, and projects the benzoates market based on type, end-use, and region. It provides detailed information regarding the major factors influencing the growth of the market, such as drivers, restraints, opportunities, and challenges. It strategically profiles, benzoates manufacturers and comprehensively analyses their market shares and core competencies as well as tracks and analyzes competitive developments, such as expansions, and acquisitions, undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants in the market by providing them the closest approximations of revenue numbers of the benzoates market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the competitive landscape of the market, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provide them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- TABLE 1 BENZOATES MARKET: INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 BENZOATES MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 RESEARCH LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 BENZOATES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Participating companies in primary research

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MATRIX CONSIDERED FOR DEMAND SIDE ESTIMATION

- FIGURE 3 MATRIX CONSIDERED FOR ESTIMATING DEMAND FOR BENZOATES

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.4 METHODOLOGY FOR SUPPLY-SIDE SIZING OF BENZOATES MARKET (1/2)

- 2.5 METHODOLOGY FOR SUPPLY-SIDE SIZING OF BENZOATES MARKET (2/2)

- 2.5.1 SUPPLY-SIDE ANALYSIS

- 2.5.2 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.6 DATA TRIANGULATION

- FIGURE 6 BENZOATES MARKET: DATA TRIANGULATION

- 2.7 KEY ASSUMPTIONS FOR CALCULATION OF DEMAND-SIDE MARKET SIZE

- 2.8 LIMITATIONS

- 2.9 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- TABLE 2 BENZOATES MARKET SNAPSHOT: 2022 VS. 2027

- FIGURE 7 SODIUM BENZOATE SEGMENT TO DOMINATE MARKET BETWEEN 2022 AND 2027

- FIGURE 8 FOOD & BEVERAGE SEGMENT TO LEAD OVERALL MARKET BETWEEN 2022 AND 2027

- FIGURE 9 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN BENZOATES MARKET

- FIGURE 10 BENZOATES MARKET TO WITNESS MODERATE GROWTH BETWEEN 2022 AND 2027

- 4.2 BENZOATES MARKET, BY TYPE

- FIGURE 11 SODIUM BENZOATE SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2021

- 4.3 BENZOATES MARKET, BY MAJOR COUNTRIES

- FIGURE 12 SOUTH KOREA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BENZOATES MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growth in demand for personal care and home care products

- 5.2.1.2 High demand from non-alcoholic, sugar-free products

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulations to limit use of benzoates in packaged food items & beverages

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Use of benzoates in animal nutrition

- 5.2.3.2 Use of benzoates in industrial applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Increase in use of natural preservatives in food & beverages

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 14 BENZOATES MARKET: VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM

- FIGURE 15 ECOSYSTEM MAP OF BENZOATES MARKET

- TABLE 3 BENZOATES MARKET: ECOSYSTEM

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 PORTER'S FIVE FORCES ANALYSIS: BENZOATES MARKET

- TABLE 4 BENZOATES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 BARGAINING POWER OF SUPPLIERS

- 5.5.2 BARGAINING POWER OF BUYERS

- 5.5.3 THREAT OF SUBSTITUTES

- 5.5.4 THREAT OF NEW ENTRANTS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 PATENT ANALYSIS

- 5.6.1 INTRODUCTION

- 5.6.2 METHODOLOGY

- 5.6.3 DOCUMENT TYPE

- FIGURE 17 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

- FIGURE 18 PUBLICATION TRENDS (2012-2021)

- 5.6.4 INSIGHTS

- FIGURE 19 LEGAL STATUS OF PATENTS

- 5.6.5 JURISDICTION ANALYSIS

- FIGURE 20 TOP JURISDICTION, BY DOCUMENT

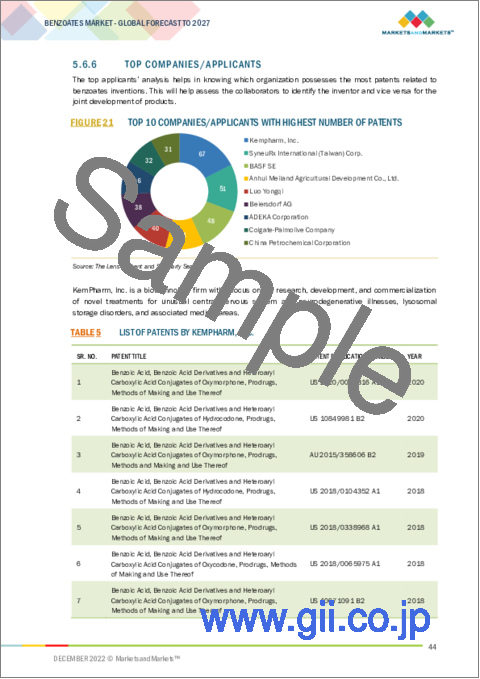

- 5.6.6 TOP COMPANIES/APPLICANTS

- FIGURE 21 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- TABLE 5 LIST OF PATENTS BY KEMPHARM, INC.

- TABLE 6 LIST OF PATENTS BY BEIERSDORF AG

- TABLE 7 TOP 10 PATENT OWNERS, 2012-2021

- 5.7 POLICIES AND REGULATIONS

- 5.7.1 FDA REGULATIONS

- 5.7.2 REGULATIONS BY FDA IN US

- 5.7.3 EUROPEAN COMMISSION'S SCIENTIFIC COMMITTEE

- FIGURE 22 COMMISSION IMPLEMENTING REGULATION (EU) 2016/2023, CONCERNING THE AUTHORISATION OF SODIUM BENZOATE, POTASSIUM SORBATE, FORMIC ACID AND SODIUM FORMATE AS FEED ADDITIVES FOR ALL ANIMAL SPECIES

- 5.7.4 EUROPEAN FOOD SAFETY AUTHORITY (EFSA)

- 5.7.5 CHINA

- 5.7.6 INDIA

- TABLE 8 FOOD SAFETY AND STANDARDS (HEALTH SUPPLEMENTS, NUTRACEUTICALS, FOOD FOR SPECIAL DIETARY USE, FOOD FOR SPECIAL MEDICAL PURPOSE, FUNCTIONAL FOOD AND NOVEL FOOD) REGULATIONS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 SODIUM BENZOATE-INFUSED DENDRIMER ANTISCALANT

- 5.9 TRADE DATA

- TABLE 9 EXPORT DATA OF BENZOATES (2021)

- TABLE 10 IMPORT DATA OF BENZOATES (2021)

- 5.10 PRICING ANALYSIS

- FIGURE 23 BENZOATES MARKET: AVERAGE PRICE TREND OF BENZOATES

6 MANUFACTURING PROCESS

- 6.1 INTRODUCTION

- 6.2 SODIUM BENZOATE

- 6.3 POTASSIUM BENZOATE

- 6.4 AMMONIUM BENZOATE

7 BENZOATES MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 24 SODIUM BENZOATE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 11 BENZOATES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 12 BENZOATES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 13 BENZOATES MARKET SIZE, BY TYPE, 2018-2021 (TON)

- TABLE 14 BENZOATES MARKET SIZE, BY TYPE, 2022-2027 (TON)

- 7.2 POTASSIUM BENZOATE

- 7.2.1 HIGH DEMAND FROM FOOD & BEVERAGES SECTOR TO DRIVE DEMAND

- 7.3 SODIUM BENZOATE

- 7.3.1 SODIUM BENZOATE MOSTLY USED AS ANTIMICROBIAL PRESERVATIVE IN FOOD & BEVERAGES

- 7.4 AMMONIUM BENZOATE

- 7.4.1 AMMONIUM BENZOATE COMMONLY USED FOR ITS CORROSION INHIBITOR PROPERTY

- 7.5 OTHERS

8 BENZOATES MARKET, BY END-USE

- 8.1 INTRODUCTION

- FIGURE 25 FOOD & BEVERAGE TO BE LARGEST END USER DURING FORECAST PERIOD

- TABLE 15 BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 16 BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- 8.2 FOOD & BEVERAGE

- 8.2.1 ANTIMICROBIAL PROPERTY OF BENZOATES TO FUEL DEMAND

- 8.3 PHARMACEUTICAL

- 8.3.1 BENZOATES USED AS PRESERVATIVES IN PHARMACEUTICAL PRODUCTS

- 8.4 PERSONAL CARE

- 8.4.1 SODIUM BENZOATE USED AS FRAGRANCE INGREDIENT IN COSMETICS

- 8.5 OTHERS

9 BENZOATES MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 26 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

- TABLE 17 BENZOATES MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 18 BENZOATES MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 9.2 ASIA PACIFIC

- FIGURE 27 ASIA PACIFIC: BENZOATES MARKET SNAPSHOT

- TABLE 19 ASIA PACIFIC: BENZOATES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 20 ASIA PACIFIC: BENZOATES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 21 ASIA PACIFIC: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 22 ASIA PACIFIC: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- TABLE 23 ASIA PACIFIC: BENZOATES MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 24 ASIA PACIFIC: BENZOATES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.2.1 CHINA

- 9.2.1.1 Rise in demand for packaged food & beverages to drive market

- TABLE 25 CHINA: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 26 CHINA: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- 9.2.2 INDIA

- 9.2.2.1 Growth of paint industry to fuel demand for benzoates

- TABLE 27 INDIA: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 28 INDIA: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- 9.2.3 JAPAN

- 9.2.3.1 Growth in consumption of packaged food to drive market

- TABLE 29 JAPAN: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 30 JAPAN: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Growing pharma sector fueling market growth

- TABLE 31 SOUTH KOREA: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 32 SOUTH KOREA: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- 9.2.5 REST OF ASIA PACIFIC

- TABLE 33 REST OF ASIA PACIFIC: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 34 REST OF ASIA PACIFIC: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- 9.3 EUROPE

- FIGURE 28 EUROPE: BENZOATES MARKET SNAPSHOT

- TABLE 35 EUROPE: BENZOATES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 36 EUROPE: BENZOATES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 37 EUROPE: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 38 EUROPE: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- TABLE 39 EUROPE: BENZOATES MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 40 EUROPE: BENZOATES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Growth of processed food and pharmaceutical sectors

- TABLE 41 GERMANY: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 42 GERMANY: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- 9.3.2 FRANCE

- 9.3.2.1 Growing demand for feed preservatives to increase consumption of benzoates

- TABLE 43 FRANCE: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 44 FRANCE: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Significant growth in food & beverages sector to fuel market

- TABLE 45 UK: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 46 UK: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- 9.3.4 REST OF EUROPE

- TABLE 47 REST OF EUROPE: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 48 REST OF EUROPE: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- 9.4 NORTH AMERICA

- FIGURE 29 NORTH AMERICA: BENZOATES MARKET SNAPSHOT

- TABLE 49 NORTH AMERICA: BENZOATES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 50 NORTH AMERICA: BENZOATES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 52 NORTH AMERICA: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- TABLE 53 NORTH AMERICA: BENZOATES MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 54 NORTH AMERICA: BENZOATES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.4.1 US

- 9.4.1.1 Growth in demand for beauty products to drive market

- TABLE 55 US: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 56 US: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- 9.4.2 CANADA

- 9.4.2.1 Increasing R&D activities in pharmaceutical sector to support market

- TABLE 57 CANADA: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 58 CANADA: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- 9.4.3 MEXICO

- 9.4.3.1 Food & beverage to be largest end user of benzoates

- TABLE 59 MEXICO: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 60 MEXICO: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- 9.5 REST OF WORLD

- TABLE 61 REST OF WORLD: BENZOATES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 62 REST OF WORLD: BENZOATES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 63 REST OF WORLD: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 64 REST OF WORLD: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- TABLE 65 REST OF WORLD: BENZOATES MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 66 REST OF WORLD: BENZOATES MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.5.1 MIDDLE EAST & AFRICA

- TABLE 67 MIDDLE EAST & AFRICA: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 68 MIDDLE EAST & AFRICA: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

- 9.5.2 SOUTH AMERICA

- TABLE 69 SOUTH AMERICA: BENZOATES MARKET SIZE, BY END-USE, 2018-2021 (USD MILLION)

- TABLE 70 SOUTH AMERICA: BENZOATES MARKET SIZE, BY END-USE, 2022-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 STRATEGIES OF KEY PLAYERS

- TABLE 71 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS

- 10.2 REVENUE ANALYSIS

- FIGURE 30 REVENUE ANALYSIS FOR KEY COMPANIES (2017-2021)

- 10.3 MARKET SHARE ANALYSIS, 2021

- FIGURE 31 BENZOATES MARKET SHARE ANALYSIS

- TABLE 72 BENZOATES MARKET: DEGREE OF COMPETITION

- 10.3.1 LANXESS

- 10.3.2 WUHAN YOUJI INDUSTRIES CO., LTD.

- 10.3.3 TIANJIN DONGDA CHEMICAL GROUP CO., LTD.

- 10.3.4 EASTMAN CHEMICAL COMPANY

- 10.3.5 COMPETITIVE BENCHMARKING

- TABLE 73 BENZOATES MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 74 BENZOATES MARKET: END-USE FOOTPRINT

- TABLE 75 BENZOATES MARKET: REGION FOOTPRINT

- 10.4 COMPANY EVALUATION MATRIX

- 10.4.1 STARS

- 10.4.2 EMERGING LEADERS

- 10.4.3 PERVASIVE COMPANIES

- 10.4.4 PARTICIPANTS

- FIGURE 32 BENZOATES: COMPANY EVALUATION MATRIX, 2021

- 10.5 COMPETITIVE SCENARIO

- TABLE 76 BENZOATES MARKET: DEALS, 2019-2022

- TABLE 77 BENZOATES MARKET: OTHER DEVELOPMENTS, 2019-2022

11 COMPANY PROFILES

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

- 11.1 LANXESS

- TABLE 78 LANXESS: COMPANY OVERVIEW

- FIGURE 33 LANXESS: COMPANY SNAPSHOT

- TABLE 79 LANXESS: PRODUCTS OFFERED

- TABLE 80 LANXESS: DEALS

- 11.2 WUHAN YOUJI INDUSTRIES CO., LTD.

- TABLE 81 WUHAN YOUJI INDUSTRIES CO., LTD.: COMPANY OVERVIEW

- TABLE 82 WUHAN YOUJI INDUSTRIES CO., LTD.: PRODUCTS OFFERED

- TABLE 83 WUHAN YOUJI INDUSTRIES CO., LTD.: OTHERS

- 11.3 TIANJIN DONGDA CHEMICAL GROUP CO., LTD.

- TABLE 84 TIANJIN DONGDA CHEMICAL GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 85 TIANJIN DONGDA CHEMICAL GROUP CO., LTD.: PRODUCT OFFERED

- 11.4 TENGZHOU TENGLONG CHEMICAL CO., LTD.

- TABLE 86 TENGZHOU TENGLONG CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 87 TENGZHOU TENGLONG CHEMICAL CO., LTD.: PRODUCTS OFFERED

- 11.5 EASTMAN CHEMICAL COMPANY

- TABLE 88 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- FIGURE 34 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- TABLE 89 EASTMAN CHEMICAL COMPANY: PRODUCTS OFFERED

- TABLE 90 EASTMAN CHEMICAL COMPANY: DEALS

- 11.6 A.M FOOD CHEMICAL CO., LIMITED

- TABLE 91 A.M FOOD CHEMICAL CO., LIMITED: COMPANY OVERVIEW

- TABLE 92 A.M FOOD CHEMICAL CO., LIMITED: PRODUCTS OFFERED

- 11.7 VERTELLUS

- TABLE 93 VERTELLUS: COMPANY OVERVIEW

- TABLE 94 VERTELLUS: PRODUCTS OFFERED

- TABLE 95 VERTELLUS: DEALS

- 11.8 SPECTRUM CHEMICAL

- TABLE 96 SPECTRUM CHEMICAL: COMPANY OVERVIEW

- TABLE 97 SPECTRUM CHEMICAL: PRODUCTS OFFERED

- TABLE 98 SPECTRUM CHEMICAL: DEALS

- 11.9 TENGZHOU AOLONG CHEMICAL CO., LTD.

- TABLE 99 TENGZHOU AOLONG CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 100 TENGZHOU AOLONG CHEMICAL CO., LTD.: PRODUCTS OFFERED

- 11.10 MACCO ORGANIQUES INC.

- TABLE 101 MACCO ORGANIQUES INC.: COMPANY OVERVIEW

- TABLE 102 MACCO ORGANIQUES INC.: PRODUCTS OFFERED

- TABLE 103 MACCO ORGANIQUES INC.: DEALS

- 11.11 FBC INDUSTRIES

- TABLE 104 FBC INDUSTRIES: COMPANY OVERVIEW

- TABLE 105 FBC INDUSTRIES: PRODUCTS OFFERED

- 11.12 SHANDONG TONGTAIWEIRUN FOOD SCIENCE TECH CO., LTD.

- TABLE 106 SHANDONG TONGTAIWEIRUN FOOD SCIENCE TECH CO., LTD.: COMPANY OVERVIEW

- TABLE 107 SHANDONG TONGTAIWEIRUN FOOD SCIENCE TECH CO., LTD.: PRODUCTS OFFERED

- 11.13 SHANDONG RUIHENG BIOTECHNOLOGY CO., LTD.

- TABLE 108 SHANDONG RUIHENG BIOTECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 109 SHANDONG RUIHENG BIOTECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- 11.14 RISHI CHEMICAL

- TABLE 110 RISHI CHEMICAL: COMPANY OVERVIEW

- TABLE 111 RISHI CHEMICAL: PRODUCTS OFFERED

- 11.15 TOKYO CHEMICAL INDUSTRY CO., LTD.

- TABLE 112 TOKYO CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 113 TOKYO CHEMICAL INDUSTRY CO., LTD.: PRODUCTS OFFERED

- 11.16 ING. PETR SVEC - PENTA S.R.O.

- TABLE 114 ING. PETR SVEC - PENTA S.R.O.: COMPANY OVERVIEW

- TABLE 115 ING. PETR SVEC - PENTA S.R.O.: PRODUCTS OFFERED

- 11.17 GANESH BENZOPLAST LIMITED

- TABLE 116 GANESH BENZOPLAST LIMITED: COMPANY OVERVIEW

- FIGURE 35 GANESH BENZOPLAST LIMITED: COMPANY SNAPSHOT

- TABLE 117 GANESH BENZOPLAST LIMITED: PRODUCTS OFFERED

- 11.18 FOODCHEM INTERNATIONAL CORPORATION

- TABLE 118 FOODCHEM INTERNATIONAL CORPORATION: COMPANY OVERVIEW

- TABLE 119 FOODCHEM INTERNATIONAL CORPORATION: PRODUCTS OFFERED

- TABLE 120 FOODCHEM INTERNATIONAL CORPORATION: OTHERS

- 11.19 AMERICAN ELEMENTS

- TABLE 121 AMERICAN ELEMENTS: COMPANY OVERVIEW

- TABLE 122 AMERICAN ELEMENTS: PRODUCTS OFFERED

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS