|

|

市場調査レポート

商品コード

1168796

ブルー水素の世界市場:技術別(水蒸気メタン改質(SMR), ガス部分酸化(POX), 自己熱改質(ATR))、エンドユーザー別(石油精製所、化学工業、発電施設)、地域別 - 2030年までの予測Blue Hydrogen Market by Technology (Steam Methane Reforming (SMR), Gas Partial Oxidation (POX), Auto Thermal Reforming (ATR)), End User (Petroleum Refineries, Chemical Industry, Power Generation Facilities) and Region - Forecast to 2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ブルー水素の世界市場:技術別(水蒸気メタン改質(SMR), ガス部分酸化(POX), 自己熱改質(ATR))、エンドユーザー別(石油精製所、化学工業、発電施設)、地域別 - 2030年までの予測 |

|

出版日: 2022年11月25日

発行: MarketsandMarkets

ページ情報: 英文 153 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

水素は、低炭素輸送用燃料として可能性があると認識されて久しいです。

この市場は、二酸化炭素排出削減におけるブルー水素の役割、燃料電池ベースの電気自動車の需要増加、水素ベースの経済へのシフトなど、いくつかの要因から有望な成長ポテンシャルを秘めています。世界のブルー水素の市場規模は、2030年までに445億米ドルに達し、予測期間中に11.9%のCAGRで成長すると予測されます。

"水蒸気メタン改質(SMR):技術別ブルー水素市場の最速成長セグメント"

2021年のブルー水素市場では、水蒸気メタン改質分野が最大の市場シェアを占めています。SMRは、コストとエネルギー効率に優れた水素の製造方法です。原料(メタン)の入手が容易なため、一般的に使用されています。これらの要因が、このセグメントの成長要因となっています。

"石油精製所:エンドユーザー別水素生成市場の最速成長セグメント"

石油精製所セグメントは、2022年から2030年にかけて最も高いCAGRで成長すると推定されます。この成長は、プラスチック生産、輸送、発電など様々な用途の石油・天然ガス需要が世界的に高まっていることに起因すると考えられます。

"北米:ブルー水素市場で最も成長率の高い地域"

北米地域は、ブルー水素市場の最大市場であり、欧州がそれに続くと推定されます。北米地域の成長は、水素燃料電池を搭載した自動車の需要増と、米国とカナダにおける水素充填ステーションの増加に起因していると考えられます。

当レポートでは、ブルー水素市場を技術(SMR、ATR、POX)、エンドユーザー(石油精製、化学工業、発電、その他)、地域(欧州、アジア太平洋、北米、RoW)に基づき分類し、市場規模の予測を行っています。

また、ブルー水素市場における市場促進要因・抑制要因・機会・課題についても包括的にレビューしています。また、これらの市場の定量的側面に加え、定性的側面もカバーしています。

本レポート購入の主なメリット

本レポートは、この市場のリーダー/新規参入者に、市場全体とサブセグメントの収益数値の最も近い概算に関する情報を提供するのに役立ちます。本レポートは、利害関係者が競合情勢を理解し、より良いビジネスの位置付けと適切な市場参入を計画するための考察を深めるのに役立ちます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/ディスラプション

- 貿易分析

- 価格分析

- 技術分析

- 主な会議とイベント、2022年~2023年

- サプライチェーン分析

- マーケットマップ/エコシステム

- イノベーションと特許登録

- 関税と規制の枠組み

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

第6章 ブルー水素市場:技術別

- イントロダクション

- 水蒸気メタン改質(SMR)

- 自己熱改質(ATR)

- ガス部分酸化(POX)

第7章 水素生成市場:エンドユーザー別

- イントロダクション

- 石油精製所

- 化学工業

- 発電

- その他

第8章 ブルー水素市場:地域別

- イントロダクション

- 北米

- エンドユーザー別

- 国別

- 欧州

- エンドユーザー別

- 国別

- アジア太平洋地域

- エンドユーザー別

- 国別

- その他地域

- エンドユーザー別

- 国別

第9章 競合情勢

- 概要

- 主要企業のシェア分析、2021年

- 市場評価フレームワーク

- 主要市場企業のセグメント収益分析、2017年~2021年

- 最近の開発

- 競合リーダーシップマッピング

第10章 企業プロファイル

- 主要企業

- DASTUR ENERGY

- SHELL PLC

- LINDE PLC

- AIR PRODUCTS AND CHEMICALS INC.

- AKER SOLUTIONS

- EXXON MOBIL CORPORATION

- EQUINOR ASA

- UNIPER SE

- TOPSOE

- AQUATERRA ENERGY LIMITED

- PETROFAC LIMITED

- BP P.L.C.

- ENI

- JOHNSON MATTHEY

- TECHNIP ENERGIES N.V.

- その他の企業

- ENGIE

- THYSSENKRUPP AG

- INEOS

- THE STATE ATOMIC ENERGY CORPORATION ROSATOM

- XEBEC ADSORPTION INC.

第11章 付録

Hydrogen has long been recognized as a possible low-carbon transportation fuel. The market has a promising growth potential due to several factors, including the role of blue hydrogen in carbon emission reduction, an increase in the demand for fuel cell-based electric vehicles, and a shift toward a hydrogen-based economy. The global blue hydrogen market is projected to reach USD 44.5 Billion by 2030, growing at a CAGR of 11.9% during the forecast period.

"SMR: The fastest growing segment of blue hydrogen market, by technology."

The steam methane reforming segment accounted for the largest market share of the blue hydrogen market in 2021. SMR is a cost- and energy-efficient method of producing hydrogen. It is commonly used due to the easy availability of raw materials (methane). These factors are responsible for the growth of the segment

"Petroleum Refinery: The fastest growing segment of hydrogen energy storage market, by end user."

The petroleum refinery segment is estimated to grow at the highest CAGR from 2022 to 2030. This growth can be attributed to the global rise in oil and natural gas demand for various applications, such as plastic production, transportation, and electricity generation.

"North America: The fastest-growing region in the hydrogen energy storage market."

The North American region is estimated to be the largest market for the blue hydrogen market, followed by Europe. The growth of the North American region can be attributed to the increasing demand for hydrogen fuel cell-based vehicles and the number of hydrogen filling stations in the US and Canada.

Breakdown of Primaries:

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

By Company Type: Tier I-65%, Tier II-24%, and Tier III-11%

By Designation: C-Level Executives-30%, Director Level-25%, and Others-45%

By Region: Asia Pacific - 36%, North America - 30%, Europe - 21%, Middle East - 7%, Africa - 6%

The blue hydrogen market is dominated by a few globally established players such as Siemens (Germany), Linde plc (Ireland), ENGIE (France), Air Liquide (France), and Air Products Inc. (US).

Research Coverage:

The report segments the blue hydrogen market and forecasts its size based on Technology (SMR, ATR, POX), End User (Petroleum Refinery, Chemical Industry, Power Generation, and Others), and region (Europe, Asia Pacific, North America, and RoW).

The report also provides a comprehensive review of market drivers, restraints, opportunities, and challenges in the blue hydrogen market. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Key Benefits of Buying the Report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 BLUE HYDROGEN MARKET: RESEARCH DESIGN

- 2.2 DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primaries

- FIGURE 3 BREAKDOWN OF PRIMARIES: BY COMPANY, DESIGNATION, AND REGION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 4 BLUE HYDROGEN MARKET: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 BLUE HYDROGEN MARKET: TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE METRICS

- FIGURE 6 BLUE HYDROGEN MARKET: DEMAND-SIDE ANALYSIS

- 2.3.3.1 Assumptions

- 2.3.4 SUPPLY-SIDE ANALYSIS

- FIGURE 7 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF BLUE HYDROGEN SOLUTIONS

- FIGURE 8 BLUE HYDROGEN MARKET: SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Assumptions and calculations

- FIGURE 9 COMPANY REVENUE ANALYSIS, 2021

- 2.3.5 FORECAST

3 EXECUTIVE SUMMARY

- TABLE 1 BLUE HYDROGEN MARKET: SNAPSHOT

- FIGURE 10 NORTH AMERICA HELD LARGEST SHARE OF BLUE HYDROGEN MARKET IN 2021

- FIGURE 11 STEAM METHANE REFORMING TECHNOLOGY TO LEAD BLUE HYDROGEN MARKET, BY TECHNOLOGY, DURING FORECAST PERIOD

- FIGURE 12 PETROLEUM REFINERY SEGMENT TO CONTINUE TO HOLD LARGEST MARKET SHARE, BY END-USER, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BLUE HYDROGEN MARKET

- FIGURE 13 GROWING NEED TO REDUCE GREENHOUSE GAS EMISSIONS FROM HYDROGEN PRODUCTION PROCESSES

- 4.2 BLUE HYDROGEN MARKET, BY REGION

- FIGURE 14 BLUE HYDROGEN MARKET IN EUROPE TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 BLUE HYDROGEN MARKET IN NORTH AMERICA, BY END-USER AND COUNTRY

- FIGURE 15 PETROLEUM REFINERY AND CANADA DOMINATED NORTH AMERICAN BLUE HYDROGEN MARKET IN 2021

- 4.4 BLUE HYDROGEN MARKET, BY TECHNOLOGY

- FIGURE 16 STEAM METHANE REFORMING ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- 4.5 BLUE HYDROGEN MARKET, BY END-USER

- FIGURE 17 PETROLEUM REFINERY SEGMENT HELD LARGEST MARKET SHARE IN 2021

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 BLUE HYDROGEN MARKET: MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing regulations concerning GHG emissions

- FIGURE 19 GLOBAL GREENHOUSE GAS EMISSIONS, BY SECTOR, 2021

- 5.2.1.2 Rising applications of hydrogen in FCEVs

- FIGURE 20 FUEL CELL ELECTRIC VEHICLE STOCK, BY REGION, 2017-2021

- 5.2.2 RESTRAINTS

- 5.2.2.1 Energy loss during hydrogen production

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing number of government initiatives concerning development of hydrogen-based economies

- TABLE 2 POLICIES IMPLEMENTED BY MAJOR GOVERNMENTS TO BOOST HYDROGEN DEMAND

- 5.2.3.2 Rising focus of governments on achieving net zero emission targets by 2050

- FIGURE 21 CUMULATIVE EMISSION REDUCTION, BY MITIGATION MEASURE IN NET ZERO EMISSION, 2021-2030

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration of hydrogen into natural gas networks

- FIGURE 22 INTEGRATION OF LOW-CARBON HYDROGEN INTO GAS NETWORKS, 2018-2021

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR CUSTOMERS

- FIGURE 23 REVENUE SHIFT FOR HYDROGEN ENERGY STORAGE PROVIDERS

- 5.4 TRADE ANALYSIS

- 5.4.1 EXPORT SCENARIO

- TABLE 3 EXPORT SCENARIO FOR HS CODE: 280410, BY COUNTRY, 2019-2021 (USD)

- 5.4.2 IMPORT SCENARIO

- TABLE 4 IMPORT SCENARIO FOR HS CODE: 280410, BY COUNTRY, 2019-2021 (USD)

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING ANALYSIS, BY TECHNOLOGY

- FIGURE 24 REVENUE SHIFT FOR HYDROGEN ENERGY STORAGE PROVIDERS

- 5.6 TECHNOLOGY ANALYSIS

- 5.7 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 5 BLUE HYDROGEN MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.8 SUPPLY CHAIN ANALYSIS

- FIGURE 25 BLUE HYDROGEN MARKET: SUPPLY CHAIN ANALYSIS

- 5.9 MARKET MAP/ECOSYSTEM

- TABLE 6 BLUE HYDROGEN MARKET: ECOSYSTEM

- 5.10 INNOVATIONS AND PATENT REGISTRATIONS

- 5.10.1 LIST OF MAJOR PATENTS

- TABLE 7 BLUE HYDROGEN MARKET: INNOVATIONS AND PATENT REGISTRATIONS

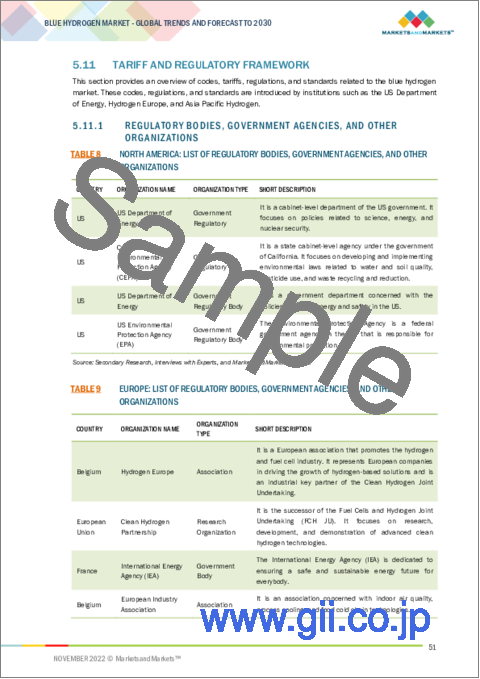

- 5.11 TARIFF AND REGULATORY FRAMEWORK

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 BLUE HYDROGEN MARKET: REGULATORY FRAMEWORK

- TABLE 11 REGULATORY FRAMEWORK: BLUE HYDROGEN MARKET, BY REGION

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 BLUE HYDROGEN MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 BLUE HYDROGEN MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 BARGAINING POWER OF SUPPLIERS

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 THREAT OF SUBSTITUTES

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USER

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USER

- 5.13.2 BUYING CRITERIA

- FIGURE 28 BUYING CRITERIA FOR TOP THREE END-USERS

- TABLE 14 KEY BUYING CRITERIA, BY END-USER

6 BLUE HYDROGEN MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- FIGURE 29 BLUE HYDROGEN MARKET, BY TECHNOLOGY, 2021

- TABLE 15 BLUE HYDROGEN MARKET, BY TECHNOLOGY, 2020-2030 (USD MILLION)

- TABLE 16 BLUE HYDROGEN MARKET, BY TECHNOLOGY, 2020-2030 (THOUSAND METRIC TONS)

- 6.2 STEAM METHANE REFORMING

- 6.2.1 RISING ADOPTION OF SMR TECHNOLOGY IN CHEMICAL INDUSTRY AND PETROLEUM REFINERY

- 6.3 AUTO THERMAL REFORMING

- 6.3.1 INCREASING DEMAND FOR SYNTHESIS GASES, ESPECIALLY IN POWER GENERATION

- 6.4 GAS PARTIAL OXIDATION

- 6.4.1 GROWING USE OF GAS PARTIAL OXIDATION TECHNOLOGY IN ENERGY TRANSITION INDUSTRY

7 HYDROGEN GENERATION MARKET, BY END-USER

- 7.1 INTRODUCTION

- FIGURE 30 BLUE HYDROGEN MARKET, BY END-USER, 2021

- TABLE 17 BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- TABLE 18 BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (THOUSAND METRIC TONS)

- 7.2 PETROLEUM REFINERY

- 7.2.1 GROWING DEMAND FOR HYDROGEN TO REDUCE SULFUR CONTENT AND OTHER CONTAMINANTS

- TABLE 19 PETROLEUM REFINERY: BLUE HYDROGEN MARKET, BY REGION, 2020-2030 (USD MILLION)

- 7.3 CHEMICAL INDUSTRY

- 7.3.1 RISING DEMAND FOR AMMONIA USED IN FERTILIZERS AND POWER GENERATION

- TABLE 20 CHEMICAL INDUSTRY: BLUE HYDROGEN MARKET, BY REGION, 2020-2030 (USD MILLION)

- 7.4 POWER GENERATION

- 7.4.1 INCREASING INSTALLATIONS OF HYDROGEN FUEL CELLS

- TABLE 21 POWER GENERATION: BLUE HYDROGEN MARKET, BY REGION, 2020-2030 (USD MILLION)

- 7.5 OTHERS

- TABLE 22 OTHERS: BLUE HYDROGEN MARKET, BY REGION, 2020-2030 (USD MILLION)

8 BLUE HYDROGEN MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 31 EUROPEAN BLUE HYDROGEN MARKET TO EXHIBIT HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 32 BLUE HYDROGEN MARKET SHARE, BY REGION, 2021 (VALUE)

- TABLE 23 BLUE HYDROGEN MARKET, BY REGION, 2020-2030 (THOUSAND METRIC TONS)

- TABLE 24 BLUE HYDROGEN MARKET, BY REGION, 2020-2030 (USD MILLION)

- 8.2 NORTH AMERICA

- 8.2.1 BY END-USER

- TABLE 25 NORTH AMERICA: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.2.2 BY COUNTRY

- TABLE 26 NORTH AMERICA: BLUE HYDROGEN MARKET, BY COUNTRY, 2020-2030 (THOUSAND METRIC TONS)

- TABLE 27 NORTH AMERICA: BLUE HYDROGEN MARKET, BY COUNTRY, 2020-2030 (USD MILLION)

- FIGURE 33 NORTH AMERICA: BLUE HYDROGEN MARKET SNAPSHOT

- 8.2.2.1 US

- 8.2.2.1.1 Rising demand for hydrogen in petroleum refineries and fertilizer production

- 8.2.2.1 US

- TABLE 28 US: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.2.2.2 Canada

- 8.2.2.2.1 Growing focus on developing sustainable hydrogen economy

- 8.2.2.2 Canada

- TABLE 29 CANADA: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.3 EUROPE

- 8.3.1 BY END-USER

- TABLE 30 EUROPE: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.3.2 BY COUNTRY

- TABLE 31 EUROPE: BLUE HYDROGEN MARKET, BY COUNTRY, 2020-2030 (THOUSAND METRIC TONS)

- TABLE 32 EUROPE: BLUE HYDROGEN MARKET, BY COUNTRY, 2020-2030 (USD MILLION)

- FIGURE 34 EUROPE: BLUE HYDROGEN MARKET SNAPSHOT

- 8.3.2.1 UK

- 8.3.2.1.1 Increasing focus on reducing natural gas imports

- 8.3.2.1 UK

- TABLE 33 UK: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.3.2.2 France

- 8.3.2.2.1 Rising investments in renewable energy generation

- 8.3.2.2 France

- TABLE 34 FRANCE: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.3.2.3 Netherlands

- 8.3.2.3.1 Dependence on fossil fuels and growing ammonia consumption

- 8.3.2.3 Netherlands

- TABLE 35 NETHERLANDS: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.3.2.4 Norway

- 8.3.2.4.1 Significant presence of gas fields

- 8.3.2.4 Norway

- TABLE 36 NORWAY: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.3.2.5 Rest of Europe

- TABLE 37 REST OF EUROPE: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.4 ASIA PACIFIC

- 8.4.1 BY END-USER

- TABLE 38 ASIA PACIFIC: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.4.2 BY COUNTRY

- TABLE 39 ASIA PACIFIC: BLUE HYDROGEN MARKET, BY COUNTRY, 2020-2030 (THOUSAND METRIC TONS)

- TABLE 40 ASIA PACIFIC: BLUE HYDROGEN MARKET, BY COUNTRY, 2020-2030 (USD MILLION)

- 8.4.2.1 Japan

- 8.4.2.1.1 Increasing demand for hydrogen fuel cell-based vehicles

- 8.4.2.1 Japan

- TABLE 41 JAPAN: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.4.2.2 China

- 8.4.2.2.1 Rising hydrogen demand for ammonia production

- 8.4.2.2 China

- TABLE 42 CHINA: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.4.2.3 India

- 8.4.2.3.1 Growing demand for hydrogen to increase refining capacities

- 8.4.2.3 India

- TABLE 43 INDIA: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.4.2.4 Australia

- 8.4.2.4.1 Surging investments in hydrogen generation projects

- 8.4.2.4 Australia

- TABLE 44 AUSTRALIA: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.4.2.5 South Korea

- 8.4.2.5.1 Implementation of mandates to decarbonize energy sector

- 8.4.2.5 South Korea

- TABLE 45 SOUTH KOREA: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.4.2.6 New Zealand

- 8.4.2.6.1 Government initiatives and various upcoming projects

- 8.4.2.6 New Zealand

- TABLE 46 NEW ZEALAND: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.4.2.7 Rest of Asia Pacific

- TABLE 47 REST OF ASIA PACIFIC: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.5 ROW

- 8.5.1 BY END-USER

- TABLE 48 ROW: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.5.2 BY COUNTRY

- TABLE 49 ROW: BLUE HYDROGEN MARKET, BY COUNTRY, 2020-2030 (THOUSAND METRIC TONS)

- TABLE 50 ROW: BLUE HYDROGEN MARKET, BY COUNTRY, 2020-2030 (USD MILLION)

- 8.5.2.1 UAE

- 8.5.2.1.1 Increasing use of hydrogen fuel for electricity generation

- 8.5.2.1 UAE

- TABLE 51 UAE: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.5.2.2 Saudi Arabia

- 8.5.2.2.1 Rising export of ammonia in Gulf region

- 8.5.2.2 Saudi Arabia

- TABLE 52 SAUDI ARABIA: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.5.2.3 Oman

- 8.5.2.3.1 Surging foreign investments in ammonia production

- 8.5.2.3 Oman

- TABLE 53 OMAN: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.5.2.4 Botswana

- 8.5.2.4.1 Growing demand for refined petroleum products

- 8.5.2.4 Botswana

- TABLE 54 BOTSWANA: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

- 8.5.2.5 Brazil

- 8.5.2.5.1 Increasing demand for clean hydrogen in transportation sector

- 8.5.2.5 Brazil

- TABLE 55 BRAZIL: BLUE HYDROGEN MARKET, BY END-USER, 2020-2030 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- TABLE 56 KEY DEVELOPMENTS IN BLUE HYDROGEN MARKET, 2017 TO 2022

- 9.2 SHARE ANALYSIS OF KEY PLAYERS, 2021

- TABLE 57 BLUE HYDROGEN MARKET: DEGREE OF COMPETITION

- FIGURE 35 SHARE ANALYSIS OF TOP PLAYERS IN BLUE HYDROGEN MARKET, 2021

- 9.3 MARKET EVALUATION FRAMEWORK

- TABLE 58 MARKET EVALUATION FRAMEWORK, 2017-2021

- 9.4 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2017-2021

- FIGURE 36 TOP PLAYERS DOMINATED MARKET IN LAST FIVE YEARS

- 9.5 RECENT DEVELOPMENTS

- 9.5.1 DEALS

- TABLE 59 BLUE HYDROGEN MARKET: DEALS, APRIL 2019-JUNE 2022

- TABLE 60 BLUE HYDROGEN MARKET: NEW PRODUCT LAUNCHES, NOVEMBER 2020-JUNE 2022

- 9.5.2 OTHERS

- TABLE 61 BLUE HYDROGEN MARKET: OTHERS, SEPTEMBER 2021-AUGUST 2022

- 9.6 COMPETITIVE LEADERSHIP MAPPING

- 9.6.1 STARS

- 9.6.2 EMERGING LEADERS

- 9.6.3 PERVASIVE PLAYERS

- 9.6.4 PARTICIPANTS

- FIGURE 37 BLUE HYDROGEN MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- TABLE 62 COMPANY TECHNOLOGY FOOTPRINT

- TABLE 63 COMPANY END-USER FOOTPRINT

- TABLE 64 COMPANY REGION FOOTPRINT

10 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 10.1 KEY COMPANIES

- 10.1.1 DASTUR ENERGY

- TABLE 65 DASTUR ENERGY: BUSINESS OVERVIEW

- TABLE 66 DASTUR ENERGY: DEALS

- 10.1.2 SHELL PLC

- TABLE 67 SHELL PLC: BUSINESS OVERVIEW

- FIGURE 38 SHELL PLC: COMPANY SNAPSHOT

- TABLE 68 SHELL PLC: DEALS

- TABLE 69 SHELL PLC: NEW PRODUCT LAUNCHES

- TABLE 70 SHELL PLC: OTHERS

- 10.1.3 LINDE PLC

- TABLE 71 LINDE PLC: BUSINESS OVERVIEW

- FIGURE 39 LINDE PLC: COMPANY SNAPSHOT

- TABLE 72 LINDE PLC: OTHERS

- 10.1.4 AIR PRODUCTS AND CHEMICALS INC.

- TABLE 73 AIR PRODUCTS AND CHEMICALS INC.: BUSINESS OVERVIEW

- FIGURE 40 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT

- TABLE 74 AIR PRODUCTS AND CHEMICALS, INC.: DEALS

- TABLE 75 AIR PRODUCTS AND CHEMICALS, INC.: OTHERS

- 10.1.5 AKER SOLUTIONS

- TABLE 76 AKER SOLUTIONS: BUSINESS OVERVIEW

- FIGURE 41 AKER SOLUTIONS: COMPANY SNAPSHOT

- TABLE 77 AKER SOLUTIONS: DEALS

- 10.1.6 EXXON MOBIL CORPORATION

- TABLE 78 EXXON MOBIL CORPORATION: BUSINESS OVERVIEW

- FIGURE 42 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

- TABLE 79 EXXON MOBIL CORPORATION: DEALS

- 10.1.7 EQUINOR ASA

- TABLE 80 EQUINOR ASA: BUSINESS OVERVIEW

- FIGURE 43 EQUINOR ASA: COMPANY SNAPSHOT

- TABLE 81 EQUINOR ASA: DEALS

- 10.1.8 UNIPER SE

- TABLE 82 UNIPER SE: BUSINESS OVERVIEW

- FIGURE 44 UNIPER SE: COMPANY SNAPSHOT

- TABLE 83 UNIPER SE: DEALS

- 10.1.9 TOPSOE

- TABLE 84 TOPSOE: BUSINESS OVERVIEW

- TABLE 85 TOPSOE: DEALS

- 10.1.10 AQUATERRA ENERGY LIMITED

- TABLE 86 AQUATERRA ENERGY LIMITED: BUSINESS OVERVIEW

- 10.1.11 PETROFAC LIMITED

- TABLE 87 PETROFAC LIMITED: BUSINESS OVERVIEW

- FIGURE 45 PETROFAC LIMITED: COMPANY SNAPSHOT

- 10.1.12 BP P.L.C.

- TABLE 88 BP P.L.C: BUSINESS OVERVIEW

- FIGURE 46 BP P.L.C.: COMPANY SNAPSHOT

- TABLE 89 BP P.L.C.: DEALS

- 10.1.13 ENI

- TABLE 90 ENI: BUSINESS OVERVIEW

- FIGURE 47 ENI: COMPANY SNAPSHOT

- TABLE 91 ENI: DEALS

- 10.1.14 JOHNSON MATTHEY

- TABLE 92 JOHNSON MATTHEY: BUSINESS OVERVIEW

- TABLE 93 JOHNSON MATTHEY: PRODUCT LAUNCHES

- TABLE 94 JOHNSON MATTHEY: DEALS

- 10.1.15 TECHNIP ENERGIES N.V.

- TABLE 95 TECHNIP ENERGIES N.V.: BUSINESS OVERVIEW

- FIGURE 48 TECHNIP ENERGIES N.V.: COMPANY SNAPSHOT

- TABLE 96 TECHNIP ENERGIES N.V.: PRODUCT LAUNCHES

- TABLE 97 TECHNIP ENERGIES N.V.: DEALS

- 10.2 OTHER PLAYERS

- 10.2.1 ENGIE

- 10.2.2 THYSSENKRUPP AG

- 10.2.3 INEOS

- 10.2.4 THE STATE ATOMIC ENERGY CORPORATION ROSATOM

- 10.2.5 XEBEC ADSORPTION INC.

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 INSIGHTS FROM INDUSTRY EXPERTS

- 11.2 DISCUSSION GUIDE

- 11.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.4 CUSTOMIZATION OPTIONS

- 11.5 RELATED REPORTS

- 11.6 AUTHOR DETAILS