|

|

市場調査レポート

商品コード

1153509

薄膜封止(TFE)の世界市場:用途別(OLEDディスプレイ、OLED照明、薄膜太陽電池)、蒸着タイプ別(無機層(PECVD、ALD)、有機層(インクジェット印刷、VTE))、業種別、地域別 - 2027年までの予測Thin-Film Encapsulation (TFE) Market by Application (OLED Display, OLED Lighting, and Thin-Film Photovoltaic), Deposition Type (Inorganic Layers (PECVD, ALD) and Organic Layers (Inkjet Printing and VTE), Vertical and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 薄膜封止(TFE)の世界市場:用途別(OLEDディスプレイ、OLED照明、薄膜太陽電池)、蒸着タイプ別(無機層(PECVD、ALD)、有機層(インクジェット印刷、VTE))、業種別、地域別 - 2027年までの予測 |

|

出版日: 2022年11月10日

発行: MarketsandMarkets

ページ情報: 英文 190 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の薄膜封止(TFE)の市場規模は、2022年の9,200万米ドルから2027年までに2億2,300万米ドルに達し、2022年から2027年までのCAGRで19.4%の成長が予測されています。

薄膜封止(TFE)市場の成長は、フレキシブルおよび有機電子デバイスにおける薄膜バリアの使用拡大、インクジェット印刷技術を用いたTFEの動向の上昇に起因していると考えられます。

"自動車用ディスプレイ向けフレキシブルOLEDディスプレイ薄膜封止(TFE)市場は、2022年から2027年にかけて最も高いCAGRで成長すると予想される"

OLEDディスプレイは、General Motors、Audi、Toyota、Volkswagen、Mercedes-Benzなどの自動車会社の間で最も好まれるディスプレイ技術として徐々に台頭してきています。ASPの安定化とOLED技術の信頼性向上により、自動車産業におけるOLEDディスプレイの採用は今後数年で増加すると考えられます。2021年11月、Continentalは世界の自動車メーカーから、生産車両に搭載される有機ELディスプレイとして初の大型受注を獲得し、受注総額は約10億米ドルとなっています。このマルチディスプレイは、ドライバーエリアからセンターコンソールまで伸び、2つのスクリーンを統合し、曲面ガラスの後ろに光学的に接合されています。

"コンシューマーエレクトロニクス向け業種別の薄膜封止(TFE)市場は、予測期間中に最大のシェアを占めると予想される"

コンシューマーエレクトロニクスセグメントは、予測期間中、引き続きTFE市場の最大規模を占めると予想されます。コンシューマーエレクトロニクス向け業種には、スマートフォン、テレビ、スマートウェアラブル、PCモニターやノートパソコン、タブレットなどの製品が含まれ、これらはすべて世界のTFE市場で大きなシェアを占めています。コンシューマー向け業種では、OLEDディスプレイの成長が、TFE市場の成長を牽引すると期待されています。

"欧州の薄膜封止(TFE)市場は、予測期間中に2番目に高いCAGRで成長すると予想される"

欧州は、フレキシブルOLED照明パネル、フレキシブル太陽電池、フレキシブルバッテリー、建築材料など、様々な開発者やメーカーが欧州各国に存在するため、重要な地域となっています。この地域における自動車産業と製造業の大幅な成長は、欧州のTFE市場の成長の主要促進要因の1つです。自動車市場と広告市場におけるOLEDの需要増が、TFE市場の成長に大きく貢献すると予想されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 特許分析

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向/混乱

- 貿易分析

- ポーターのファイブフォース分析

- 関税分析

- 規格と規制状況

- 主な利害関係者と購入基準

- 価格分析

- 主な会議とイベント

第6章 TFE市場:蒸着タイプ別

- イントロダクション

- 無機層

- PECVD

- ALD

- スパッタリング

- 有機層

- インクジェット印刷

- VTE

第7章 TFE市場:用途別

- イントロダクション

- フレキシブルOLEDディスプレイ

- フレキシブルOLED照明

- 薄膜太陽電池

- その他

第8章 TFE市場:業種別

- イントロダクション

- コンシューマーエレクトロニクス

- 自動車

- 医療

- 工業・エンタープライズ

- 航空宇宙・防衛

- 小売・ホスピタリティ・BFSI

- 教育

- 輸送

- スポーツ・エンターテインメント

- その他

第9章 TFE市場:地域別

- イントロダクション

- アジア太平洋地域

- 韓国

- 中国

- 日本

- 台湾

- その他

- 欧州

- ドイツ

- 英国

- フランス

- その他

- 北米

- 米国

- カナダ

- メキシコ

- その他の地域

- 中東・アフリカ

- 南米

第10章 競合情勢

- 概要

- 主要企業が採用した戦略/有力企業

- 5年間の企業収益分析

- 市場シェア分析

- 企業の評価象限

- スタートアップ/中小企業の評価象限

- TFE市場:企業の製品フットプリント

- TFE市場:競合ベンチマーキング

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- SAMSUNG SDI CO., LTD.

- LG CHEM LTD.

- 3M

- TOPPAN INC.

- TORAY INDUSTRIES, INC.

- ERGIS GROUP

- VEECO INSTRUMENTS INC.

- UNIVERSAL DISPLAY CORP.

- APPLIED MATERIALS, INC.

- KATEEVA

- その他の企業

- TESA

- AJINOMOTO FINE-TECHNO CO., INC.

- COAT-X

- BOREALIS AG

- AMS TECHNOLOGIES

- ANGSTROM ENGINEERING

- BENEQ

- ENCAPSULIX

- LOTUS APPLIED TECHNOLOGY

- BASF

- HOLST CENTRE

- SNU PRECISION

- KYORITSU CHEMICAL & CORPORATION LIMITED

- SAES GETTERS SPA

- MBRAUN

第12章 付録

The thin-film encapsulation (TFE) market is estimated to grow from USD 92 million in 2022 to reach

USD 223 million by 2027; it is expected to grow at a CAGR of 19.4% from 2022 to 2027. The growth of the thin-film encapsulation (TFE) market can be attributed to growing use of thin-film barriers in flexible and organic electronic devices and rising trend of TFE using inkjet printing technology.

"The flexible OLED display thin-film encapsulation (TFE) market for automobile displays is expected to grow at the highest CAGR from 2022 to 2027"

OLED displays are gradually emerging as the most preferred display technology among automobile companies such as General Motors, Audi, Toyota, Volkswagen, and Mercedes-Benz. With stabilized ASP and improvement in the reliability of OLED technology, the adoption of OLED displays in the automotive industry is likely to increase in the coming years. In November 2021, Continental earned its first major order for OLED displays in a production vehicle from a global vehicle manufacturer, with a total order value of around USD 1 billion. The multi-display stretches from the driver's area to the center console and integrates two screens, which are optically bonded behind a curved glass surface.

"Thin-film encapsulation (TFE) market for consumer electronics vertical is expected to hold the largest share during the forecast period."

The consumer electronics segment is expected to continue to account for the largest size of the TFE market during the forecast period. The consumer electronics vertical includes products such as smartphones, television sets, smart wearables, PC monitors and laptops, and tablets-all of which have significant shares in the global TFE market. The growth of OLED displays in the consumer vertical is expected to drive the TFE market growth.

"The thin-film encapsulation (TFE) market in Europe is expected to grow at the second highest CAGR during forecast period."

Europe is an important region due to the presence of various developers and manufacturers of flexible OLED lighting panels, flexible solar cells, flexible batteries, and architectural materials across different European countries. The substantial growth of the automotive and manufacturing industries in the region is one of the key drivers for the growth of the TFE market in Europe. The rising demand for OLEDs by the automotive and advertising markets will contribute significantly to the growth of the TFE market in the region.

Breakdown of the profile of primary participants:

- By Company Type: Tier 1 - 30%, Tier 2 - 50%, and Tier 3 - 20%

- By Designation: C-level Executives - 30%, Directors - 45%, Others - 25%

- By Region: North America - 20%, Europe - 30%, Asia Pacific - 45%, and RoW - 5%

Key players in the thin-film encapsulation (TFE) market are Samsung SDI Co., Ltd. (South Korea); LG Chem (South Korea); 3M (US); Toppan Inc. (Japan); Ergis Group (Poland); Veeco Instruments Inc. (US); Universal Display Corporation (US); Applied Materials, Inc. (US); Kateeva (US); Toray Industries, Inc. (Japan); tesa (Germany); Ajinomoto Fine-Techno Co., Inc. (Japan); Coat-X (Switzerland); and Borealis AG (Austria).

Research Coverage

Based on deposition type, the TFE market has been segmented into inorganic layer deposition and organic layer deposition. Based on application, the TFE market has been segmented into flexible OLED display, flexible OLED lighting, thin-film photovoltaics, and others. Based on vertical, the TFE market has been segmented into consumer electronics, automotive, sports and entertainment, transportation, retail, hospitality, and BFSI, industrial and enterprise, education, healthcare, aerospace and defense, and others. Based on region, the TFE market has been segmented into North America, Europe, Asia Pacific, and Rest of the World (RoW).

Reasons to Buy Report

The report would help market leaders/new entrants in the following ways:

1. This report segments the TFE market comprehensively and provides the closest approximations of the overall market size, as well as that of the subsegments across deposition types, applications, verticals, and regions.

2. The report helps stakeholders understand the pulse of the market and provides information on key market drivers, restraints, challenges, and opportunities.

3. This report would help stakeholders understand their competitors better and gain more insights to enhance their position in the business. The competitive landscape provides market share analysis and company evaluation quadrant for the key players operating in the TFE market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 TFE MARKET: SEGMENTATION

- 1.4.2 REGIONAL SCOPE

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- 1.7 UNIT CONSIDERED

- 1.8 LIMITATIONS

- 1.9 STAKEHOLDERS

- 1.10 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 TFE MARKET SIZE ESTIMATION AND PROCESS FLOW

- FIGURE 3 TFE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED FROM SALES OF TFE IN 2021

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE): ESTIMATION OF TFE MARKET SIZE, BY APPLICATION

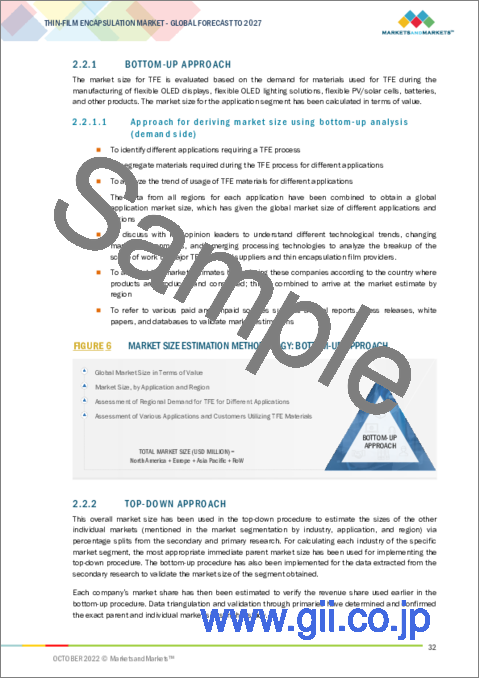

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for deriving market size using bottom-up analysis (demand side)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for deriving market size using top-down analysis do (supply side)

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.2.3 MARKET SHARE ESTIMATION

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

- 2.4.1 GROWTH RATE ASSUMPTIONS/FORECASTS

- 2.5 LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 9 FLEXIBLE OLED DISPLAY TO BE LARGEST SEGMENT OF TFE MARKET DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TFE MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS OPERATING IN TFE MARKET

- FIGURE 11 HIGH DEMAND FOR TFE IN CONSUMER ELECTRONICS VERTICAL

- 4.2 TFE MARKET, BY DEPOSITION TECHNOLOGY

- FIGURE 12 ORGANIC LAYERS DEPOSITION SEGMENT TO HOLD LARGER SHARE OF TFE MARKET DURING FORECAST PERIOD

- 4.3 TFE MARKET, BY VERTICAL

- FIGURE 13 CONSUMER ELECTRONICS SEGMENT TO HOLD MAJORITY OF MARKET SHARE IN 2027

- 4.4 TFE MARKET, BY FLEXIBLE OLED DISPLAY APPLICATION

- FIGURE 14 SMARTPHONES SEGMENT TO HOLD LARGEST SHARE OF TFE MARKET FOR FLEXIBLE OLED DISPLAY DURING FORECAST PERIOD

- 4.5 ASIA PACIFIC TFE MARKET, BY COUNTRY AND VERTICAL

- FIGURE 15 CONSUMER ELECTRONICS AND SOUTH KOREA TO HOLD MAJOR SHARES OF ASIA PACIFIC TFE MARKET IN 2022

- 4.6 TFE MARKET, BY COUNTRY

- FIGURE 16 CHINA TO EXHIBIT HIGHEST CAGR IN TFE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 TFE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- FIGURE 18 TFE MARKET: DRIVERS AND THEIR IMPACT

- 5.2.1.1 Growing use of thin-film barriers in flexible and organic electronic devices

- 5.2.1.2 Rising trend of TFE using inkjet printing technology

- 5.2.1.3 Integration of flexible OLED displays into smartphones and smart wearables

- 5.2.1.4 Rising investments in building new facilities to manufacture OLED panels

- 5.2.1.5 Increased application of OLED displays in AR/VR headsets

- 5.2.2 RESTRAINTS

- FIGURE 19 TFE MARKET: RESTRAINTS AND THEIR IMPACT

- 5.2.2.1 High capital expenditure associated with TFE

- 5.2.3 OPPORTUNITIES

- FIGURE 20 TFE MARKET: OPPORTUNITIES AND THEIR IMPACT

- 5.2.3.1 Rising demand for highly efficient thin solar cells

- 5.2.3.2 Increasing applications of smart mirrors in smart homes

- 5.2.4 CHALLENGES

- FIGURE 21 TFE MARKET: CHALLENGES AND THEIR IMPACT

- 5.2.4.1 Complex value chain structure

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 22 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY ORIGINAL EQUIPMENT MANUFACTURERS AND TFE SYSTEM INTEGRATORS

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 23 TFE MARKET: ECOSYSTEM ANALYSIS

- TABLE 2 TFE MARKET: ROLE IN ECOSYSTEM

- 5.5 TECHNOLOGY ANALYSIS

- 5.6 PATENT ANALYSIS

- FIGURE 24 NUMBER OF PATENTS FILED PER YEAR, 2012-2021

- FIGURE 25 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 3 LIST OF TOP PATENT OWNERS IN LAST 10 YEARS

- 5.6.1 TFE MARKET: LIST OF MAJOR PATENTS

- TABLE 4 TFE MARKET: LIST OF MAJOR PATENTS

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 BENEQ PROVIDES TFE FOR OLED LIGHTING

- 5.7.2 MEYER BURGER OFFERS INKJET + PECVD OLED ENCAPSULATION SYSTEM FOR FLEXIBLE OLEDS

- 5.7.3 AGORIA SOLAR TEAM USES BOREALIS' QUENTYS-GRADE FILMS TO ENCAPSULATE AND PROTECT SOLAR CELLS MOUNTED ON RACING CARS

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES IN TFE MARKET

- 5.9 TRADE ANALYSIS

- FIGURE 27 IMPORT DATA FOR HS CODE 848620, BY COUNTRY, 2017-2021

- FIGURE 28 EXPORT DATA FOR HS CODE 848620, BY COUNTRY, 2017-2021

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 TFE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.10.2 BARGAINING POWER OF SUPPLIERS

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 THREAT OF SUBSTITUTES

- 5.10.5 THREAT OF NEW ENTRANTS

- 5.11 TARIFF ANALYSIS

- TABLE 6 TARIFF IMPOSED ON PRODUCTS UNDER HS CODE 848620 EXPORTED BY SOUTH KOREA

- TABLE 7 TARIFF IMPOSED ON PRODUCTS UNDER HS CODE 848620 EXPORTED BY US

- TABLE 8 TARIFF IMPOSED ON PRODUCTS UNDER HS CODE 848620 EXPORTED BY CHINA

- 5.12 STANDARDS AND REGULATORY LANDSCAPE

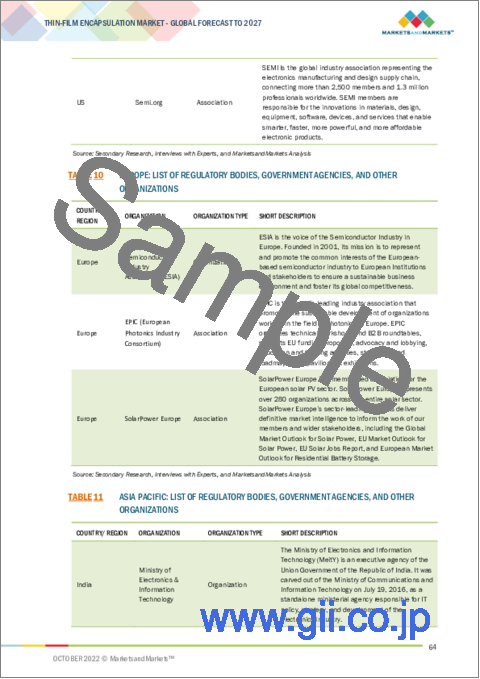

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 STANDARDS

- 5.12.3 RESTRICTION OF HAZARDOUS SUBSTANCES (ROHS) AND WASTE ELECTRICAL AND ELECTRONIC EQUIPMENT (WEEE) DIRECTIVES

- 5.12.4 REGISTRATION, EVALUATION, AUTHORIZATION, AND RESTRICTION OF CHEMICALS (REACH)

- 5.12.5 GENERAL DATA PROTECTION REGULATION (GDPR)

- 5.12.6 IMPORT-EXPORT LAWS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TOP 3 VERTICALS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TOP 3 VERTICALS (%)

- 5.13.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- TABLE 14 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE OF TFE OFFERED BY MAJOR MARKET PLAYERS TO TOP THREE VERTICALS

- FIGURE 31 AVERAGE SELLING PRICE OF TFE OFFERED BY MAJOR MARKET PLAYERS TO TOP THREE VERTICALS

- TABLE 15 AVERAGE SELLING PRICE OF TFE OFFERED BY MAJOR MARKET PLAYERS TO TOP THREE VERTICALS

- 5.15 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 16 TFE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 TFE MARKET, BY DEPOSITION TYPE

- 6.1 INTRODUCTION

- FIGURE 32 TFE MARKET FOR INORGANIC LAYER DEPOSITION SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 17 TFE MARKET, BY DEPOSITION TYPE, 2018-2021 (USD MILLION)

- TABLE 18 TFE MARKET, BY DEPOSITION TYPE, 2022-2027 (USD MILLION)

- 6.2 INORGANIC LAYER DEPOSITION

- TABLE 19 INORGANIC LAYER DEPOSITION: TFE MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 20 INORGANIC LAYER DEPOSITION: TFE MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 6.2.1 PECVD

- 6.2.1.1 Deposits substrates at a lower temperature

- 6.2.2 ALD

- 6.2.2.1 Demand for ALD-based equipment to deposit barrier films on thermally fragile or flexible substrates

- 6.2.3 SPUTTERING

- 6.2.3.1 Provides improved sputter protection of organic materials used in flexible electronic devices

- 6.3 ORGANIC LAYER DEPOSITION

- TABLE 21 ORGANIC LAYER DEPOSITION: TFE MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 22 ORGANIC LAYER DEPOSITION: TFE MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 6.3.1 INKJET PRINTING

- 6.3.1.1 Helps in high-volume production of organic electronic devices with TFE

- 6.3.2 VACUUM THERMAL EVAPORATION (VTE)

- 6.3.2.1 Used to deposit metals on OLEDs, solar cells, and thin-film transistors

7 TFE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 33 FLEXIBLE OLED LIGHTING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 23 TFE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 24 TFE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 7.2 FLEXIBLE OLED DISPLAY

- 7.2.1 GROWING POPULARITY OF OLEDS IN SMARTPHONES, SMART WEARABLE DEVICES, AND LARGE DISPLAY PANELS

- TABLE 25 FLEXIBLE OLED DISPLAY: TFE MARKET, BY APPLICATION, 2018-2021 (THOUSAND SQUARE METERS)

- TABLE 26 FLEXIBLE OLED DISPLAY: TFE MARKET, BY APPLICATION, 2022-2027 (THOUSAND SQUARE METERS)

- TABLE 27 FLEXIBLE OLED DISPLAY: TFE MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 28 FLEXIBLE OLED DISPLAY: TFE MARKET, BY APPLICATION, 2022-2027 (USD THOUSAND)

- TABLE 29 FLEXIBLE OLED DISPLAY: TFE MARKET, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 30 FLEXIBLE OLED DISPLAY: TFE MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- TABLE 31 ASIA PACIFIC: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY COUNTRY, 2018-2021 (USD THOUSAND)

- TABLE 32 ASIA PACIFIC: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY COUNTRY, 2022-2027 (USD THOUSAND)

- TABLE 33 EUROPE: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY COUNTRY, 2018-2021 (USD THOUSAND)

- TABLE 34 EUROPE: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY COUNTRY, 2022-2027 (USD THOUSAND)

- TABLE 35 NORTH AMERICA: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY COUNTRY, 2018-2021 (USD THOUSAND)

- TABLE 36 NORTH AMERICA: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY COUNTRY, 2022-2027 (USD THOUSAND)

- TABLE 37 ROW: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 38 ROW: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2022-2027 (USD THOUSAND)

- 7.2.2 SMARTPHONES

- 7.2.2.1 Rising use of TFE materials in smartphone manufacturing

- TABLE 39 SMARTPHONES: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 40 SMARTPHONES: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2022-2027 (USD THOUSAND)

- 7.2.3 TABLETS

- 7.2.3.1 Growing use of OLED screens in Samsung Galaxy tablets

- TABLE 41 TABLETS: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 42 TABLETS: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2022-2027 (USD THOUSAND)

- 7.2.4 TELEVISIONS (TVS) AND SIGNAGE

- 7.2.4.1 High demand for large format displays in retail, BFSI, sports, and education verticals

- TABLE 43 TVS AND SIGNAGE: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 44 TVS AND SIGNAGE: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2022-2027 (USD THOUSAND)

- 7.2.5 PC MONITORS AND LAPTOPS

- 7.2.5.1 High use of OLED displays in PC monitors and laptops

- TABLE 45 PC MONITORS AND LAPTOPS: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 46 PC MONITORS AND LAPTOPS: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2022-2027 (USD THOUSAND)

- 7.2.6 SMART WEARABLES

- 7.2.6.1 Increasing integration of OLED technology into smartwatches and AR/VR headsets

- TABLE 47 SMART WEARABLES: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 48 SMART WEARABLES: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2022-2027 (USD THOUSAND)

- 7.2.7 AUTOMOBILE DISPLAYS

- 7.2.7.1 Growing integration of OLED technology into instrument clusters, dashboard displays, and center stack displays

- TABLE 49 AUTOMOBILE DISPLAYS: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 50 AUTOMOBILE DISPLAYS: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2022-2027 (USD THOUSAND)

- 7.2.8 OTHERS

- TABLE 51 OTHERS: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 52 OTHERS: TFE MARKET FOR FLEXIBLE OLED DISPLAY, BY REGION, 2022-2027 (USD THOUSAND)

- 7.3 FLEXIBLE OLED LIGHTING

- 7.3.1 INCREASING DEMAND FOR OLED LIGHTING PANELS IN AUTOMOTIVE INDUSTRY

- TABLE 53 FLEXIBLE OLED LIGHTING: TFE MARKET, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 54 FLEXIBLE OLED LIGHTING: TFE MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 7.4 THIN-FILM PHOTOVOLTAICS

- 7.4.1 RISING USE OF OLED TECHNOLOGY TO MANUFACTURE INSTRUMENT CLUSTERS, DASHBOARD DISPLAYS, AND CENTER STACK DISPLAYS

- TABLE 55 THIN-FILM PHOTOVOLTAICS: TFE MARKET, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 56 THIN-FILM PHOTOVOLTAICS: TFE MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 7.5 OTHERS

- TABLE 57 OTHERS: TFE MARKET, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 58 OTHERS: TFE MARKET, BY REGION, 2022-2027 (USD THOUSAND)

8 TFE MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- FIGURE 34 TFE MARKET FOR CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- TABLE 59 TFE MARKET, BY VERTICAL, 2018-2021 (USD THOUSAND)

- TABLE 60 TFE MARKET, BY VERTICAL, 2022-2027 (USD THOUSAND)

- 8.2 CONSUMER ELECTRONICS

- 8.2.1 CONSUMER ELECTRONICS SEGMENT TO CAPTURE LARGEST MARKET SIZE

- TABLE 61 CONSUMER ELECTRONICS: TFE MARKET, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 62 CONSUMER ELECTRONICS: TFE MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 8.3 AUTOMOTIVE

- 8.3.1 GROWING REPLACEMENT OF ANALOG COMPONENTS WITH DIGITAL ONES IN VEHICLES

- TABLE 63 AUTOMOTIVE: TFE MARKET, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 64 AUTOMOTIVE: TFE MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 8.4 HEALTHCARE

- 8.4.1 DIGITALIZATION OF HEALTHCARE SYSTEMS

- TABLE 65 HEALTHCARE: TFE MARKET, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 66 HEALTHCARE: TFE MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 8.5 INDUSTRIAL AND ENTERPRISE

- 8.5.1 INCREASING ADOPTION OF AR/VR HMDS

- TABLE 67 INDUSTRIAL AND ENTERPRISE: TFE MARKET, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 68 INDUSTRIAL AND ENTERPRISE: TFE MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 8.6 AEROSPACE & DEFENSE

- 8.6.1 RISING ADOPTION OF AR AND VR HMDS IN AEROSPACE & DEFENSE VERTICAL

- TABLE 69 AEROSPACE AND DEFENSE: TFE MARKET, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 70 AEROSPACE AND DEFENSE: TFE MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 8.7 RETAIL, HOSPITALITY, AND BFSI

- 8.7.1 HIGH ADOPTION OF OLED DIGITAL SIGNAGE DISPLAYS

- TABLE 71 RETAIL, HOSPITALITY, AND BFSI: TFE MARKET, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 72 RETAIL, HOSPITALITY, AND BFSI: TFE MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 8.8 EDUCATION

- 8.8.1 TRANSITION TO ONLINE LEARNING

- TABLE 73 EDUCATION: TFE MARKET, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 74 EDUCATION: TFE MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 8.9 TRANSPORTATION

- 8.9.1 HIGH DEMAND FOR TFE FOR LARGE FORMAT DISPLAYS

- TABLE 75 TRANSPORTATION: TFE MARKET, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 76 TRANSPORTATION: TFE MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 8.10 SPORTS & ENTERTAINMENT

- 8.10.1 RAPID PENETRATION OF AR/VR HMDS INTO SPORTS & ENTERTAINMENT VERTICAL

- TABLE 77 SPORTS AND ENTERTAINMENT: TFE MARKET, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 78 SPORTS AND ENTERTAINMENT: TFE MARKET, BY REGION, 2022-2027 (USD THOUSAND)

- 8.11 OTHERS

- TABLE 79 OTHERS: TFE MARKET, BY REGION, 2018-2021 (USD THOUSAND)

- TABLE 80 OTHERS: TFE MARKET, BY REGION, 2022-2027 (USD THOUSAND)

9 TFE MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 35 ASIA PACIFIC TO BE LARGEST TFE MARKET DURING FORECAST PERIOD

- TABLE 81 TFE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 82 TFE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2 ASIA PACIFIC

- FIGURE 36 ASIA PACIFIC: TFE MARKET SNAPSHOT

- TABLE 83 ASIA PACIFIC: TFE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 84 ASIA PACIFIC: TFE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 85 ASIA PACIFIC: TFE MARKET, BY VERTICAL, 2018-2021 (USD THOUSAND)

- TABLE 86 ASIA PACIFIC: TFE MARKET, BY VERTICAL, 2022-2027 (USD THOUSAND)

- 9.2.1 SOUTH KOREA

- 9.2.1.1 Rising developments by Samsung and LG Display in OLED lighting

- 9.2.2 CHINA

- 9.2.2.1 Increasing demand and production of solar cells

- 9.2.3 JAPAN

- 9.2.3.1 Large presence of OLED lighting players and OLED display manufacturers

- 9.2.4 TAIWAN

- 9.2.4.1 Increasing demand for TFE in AMOLED panel display manufacturing

- 9.2.5 REST OF ASIA PACIFIC

- 9.3 EUROPE

- FIGURE 37 EUROPE: TFE MARKET SNAPSHOT

- TABLE 87 EUROPE: TFE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 88 EUROPE: TFE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 89 EUROPE: TFE MARKET, BY VERTICAL, 2018-2021 (USD THOUSAND)

- TABLE 90 EUROPE: TFE MARKET, BY VERTICAL, 2022-2027 (USD THOUSAND)

- 9.3.1 GERMANY

- 9.3.1.1 High demand for flexible OLED lighting panels in automotive industry

- 9.3.2 UK

- 9.3.2.1 High demand from smartphone and AR/VR technology developers

- 9.3.3 FRANCE

- 9.3.3.1 Rising government-led investments in consumer electronics vertical

- 9.3.4 REST OF EUROPE

- 9.4 NORTH AMERICA

- FIGURE 38 NORTH AMERICA: TFE MARKET SNAPSHOT

- TABLE 91 NORTH AMERICA: TFE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 92 NORTH AMERICA: TFE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 93 NORTH AMERICA: TFE MARKET, BY VERTICAL, 2018-2021 (USD THOUSAND)

- TABLE 94 NORTH AMERICA: TFE MARKET, BY VERTICAL, 2022-2027 (USD THOUSAND)

- 9.4.1 US

- 9.4.1.1 Large presence of OLED display consumer base

- 9.4.2 CANADA

- 9.4.2.1 High demand in food service industry

- 9.4.3 MEXICO

- 9.4.3.1 Expanding automotive, retail, medical, and industrial sectors

- 9.5 ROW

- TABLE 95 ROW: TFE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 96 ROW: TFE MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 97 ROW: TFE MARKET, BY VERTICAL, 2018-2021 (USD THOUSAND)

- TABLE 98 ROW: TFE MARKET, BY VERTICAL, 2022-2027 (USD THOUSAND)

- 9.5.1 MIDDLE EAST & AFRICA

- 9.5.1.1 Increasing use of video walls, digital signage, and interactive kiosks in shopping malls and museums

- 9.5.2 SOUTH AMERICA

- 9.5.2.1 Growing outdoor advertising events

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

- TABLE 99 OVERVIEW OF STRATEGIES ADOPTED BY KEY COMPANIES IN TFE MARKET

- 10.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

- FIGURE 39 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN TFE MARKET

- 10.4 MARKET SHARE ANALYSIS, 2021

- TABLE 100 TFE MARKET: DEGREE OF COMPETITION

- 10.5 COMPANY EVALUATION QUADRANT

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 40 TFE MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

- 10.6 STARTUP/SME EVALUATION QUADRANT, 2021

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 41 TFE MARKET: STARTUP/SME EVALUATION QUADRANT, 2021

- 10.7 TFE MARKET: COMPANY PRODUCT FOOTPRINT

- TABLE 101 PRODUCT FOOTPRINT OF COMPANIES

- TABLE 102 VERTICAL FOOTPRINT OF COMPANIES

- TABLE 103 APPLICATION FOOTPRINT OF COMPANIES

- TABLE 104 REGIONAL FOOTPRINT OF COMPANIES

- 10.8 TFE MARKET: COMPETITIVE BENCHMARKING

- TABLE 105 TFE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 106 TFE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY VERTICAL

- TABLE 107 TFE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY APPLICATION

- TABLE 108 TFE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

- 10.9 COMPETITIVE SCENARIOS AND TRENDS

- TABLE 109 TFE MARKET: PRODUCT LAUNCHES, JANUARY 2020-AUGUST 2022

- TABLE 110 TFE MARKET: DEALS, JANUARY 2020-AUGUST 2022

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business overview, Products offered, Recent Developments, MNM view)**

- 11.1.1 SAMSUNG SDI CO., LTD.

- TABLE 111 SAMSUNG SDI: COMPANY OVERVIEW

- FIGURE 42 SAMSUNG SDI: COMPANY SNAPSHOT

- 11.1.2 LG CHEM LTD.

- TABLE 112 LG CHEM: COMPANY OVERVIEW

- FIGURE 43 LG CHEM: COMPANY SNAPSHOT

- 11.1.3 3M

- TABLE 113 3M: COMPANY OVERVIEW

- FIGURE 44 3M: COMPANY SNAPSHOT

- 11.1.4 TOPPAN INC.

- TABLE 114 TOPPAN INC.: COMPANY OVERVIEW

- FIGURE 45 TOPPAN INC.: COMPANY SNAPSHOT

- 11.1.5 TORAY INDUSTRIES, INC.

- TABLE 115 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 46 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- 11.1.6 ERGIS GROUP

- TABLE 116 ERGIS GROUP: COMPANY OVERVIEW

- 11.1.7 VEECO INSTRUMENTS INC.

- TABLE 117 VEECO INSTRUMENTS: COMPANY OVERVIEW

- FIGURE 47 VEECO INSTRUMENTS: COMPANY SNAPSHOT

- 11.1.8 UNIVERSAL DISPLAY CORP.

- TABLE 118 UNIVERSAL DISPLAY CORP.: COMPANY OVERVIEW

- FIGURE 48 UNIVERSAL DISPLAY CORP.: COMPANY SNAPSHOT

- 11.1.9 APPLIED MATERIALS, INC.

- TABLE 119 APPLIED MATERIALS, INC.: COMPANY OVERVIEW

- FIGURE 49 APPLIED MATERIALS, INC.: COMPANY SNAPSHOT

- 11.1.10 KATEEVA

- TABLE 120 KATEEVA: COMPANY OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 TESA

- 11.2.2 AJINOMOTO FINE-TECHNO CO., INC.

- 11.2.3 COAT-X

- 11.2.4 BOREALIS AG

- 11.2.5 AMS TECHNOLOGIES

- 11.2.6 ANGSTROM ENGINEERING

- 11.2.7 BENEQ

- 11.2.8 ENCAPSULIX

- 11.2.9 LOTUS APPLIED TECHNOLOGY

- 11.2.10 BASF

- 11.2.11 HOLST CENTRE

- 11.2.12 SNU PRECISION

- 11.2.13 KYORITSU CHEMICAL & CORPORATION LIMITED

- 11.2.14 SAES GETTERS SPA

- 11.2.15 MBRAUN

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS