|

|

市場調査レポート

商品コード

1149096

軍用組み込みシステムの世界市場:プラットフォーム別 (陸軍、空軍、無人、海軍、宇宙)・サーバーアーキテクチャ別 (ブレードサーバー、ラックマウントサーバー)・インストールの種類別・コンポーネント別・サービス別・地域別の将来予測 (2027年まで)Military Embedded Systems Market, by Application, Platform (Land, Airborne, Unmanned, Naval, Space), Server Architecture (Blade Server, Rack-mount Server), Installation Type, Component, Services, and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 軍用組み込みシステムの世界市場:プラットフォーム別 (陸軍、空軍、無人、海軍、宇宙)・サーバーアーキテクチャ別 (ブレードサーバー、ラックマウントサーバー)・インストールの種類別・コンポーネント別・サービス別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年10月28日

発行: MarketsandMarkets

ページ情報: 英文 276 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の軍用組み込みシステム市場は、2022年に16億米ドル、2027年には25億米ドルに達し、2022年から2027年までの間に9.6%のCAGRで成長すると予測されています。

市場の主な促進要因として、米軍による更新計画の拡大や、高度な指揮統制システムの開発などが挙げられます。

"軍用組み込みシステムにおけるGPU"

防衛産業で使用されているディスプレイ技術は高速化し、より高い解像度が要求されています。そのため、画像を処理するために強力なGPUが必要となります。防衛用HPECの設計者は、画像や信号処理用の主要プロセッサを選択する際に、FPGAやGPUといった選択肢を用意しています。

"軍用組み込みシステム向けテスト・認証サービス"

組み込みテストの目的は、クライアントの要求に従って、ソフトウェアとハードウェアを検証し、妥当性を確認することです。組み込みテストは、ソフトウェアのバグを発見し、開発・保守コストを削減し、システム性能を向上させるのに役立ちます。一方、認証サービスは、製品が要求されるすべての規格を満たしていることを確認し、最適化のための特定の領域を特定するために提供されます。顧客プロトタイプテストは、製品開発サイクルの早い段階でバグを特定し、問題を解決するのに役立ちます。いくつかの企業では、自社施設でのオンサイトテストも行っています。

"オフショア巡視船 (OVP):海軍向け市場の急成長セグメント"

近年、地中海から南シナ海にかけての緊張により、OPVの需要が高まっています。アジア太平洋はOPVの搭載比率が最も高く、今後、アフリカ・中東・南米と並び、OPVの最も魅力的な市場のひとつになると予想されています。OPVの調達や市場開拓は、軍用組み込みシステムの市場を牽引します。また、海洋安全保障への投資の増加や海軍の能力強化も、OPV用の軍用組み込みシステム市場を牽引します。

"米国:北米の軍用組み込みシステムの最大市場"

2022年の北米軍用組み込みシステム市場で、米国は93.9%のシェアを占めると推定されます。米国の市場規模は2022年に4億7,300万米ドルと推定され、予測期間中に8.4%のCAGRで成長すると予測されています。

当レポートでは、世界の軍用組み込みシステムの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、サーバーアーキテクチャ別・プラットフォーム別・用途別・インストールの種類別・コンポーネント別・サービス別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 軍用組み込みシステム市場:エコシステム

- 軍用組み込みシステムのコンポーネント・サブコンポーネントの平均販売価格

- 顧客のビジネスに影響を与える動向/混乱

- ポーターのファイブフォース分析

- 技術分析

- 量子コンピューティング

- 軍事用途向けアフェクティブコンピューティング分析

- ユースケース

- 軍用組み込みシステム市場:バリューチェーン分析

- 研究開発

- 原材料

- コンポーネント/製品メーカー (OEM)

- 組立業者・インテグレーター

- エンドユーザー

- 関税と規制の状況

- 貿易分析

第6章 産業動向

- イントロダクション

- サプライチェーン分析

- 主要企業

- 中小企業

- エンドユーザー/顧客

- 技術動向

- マルチコアプロセッサー

- 防衛用途向けHPEC (高性能組み込みコンピューティング) の開発

- 最新の軍用グレード電子パッケージング技術

- COTS (商用オフザシェルフ) 製品の入手可能性

- SOSA (センサーオープンシステムアーキテクチャ)

- 軍用組み込みシステムにおける小型フォームファクタ

- 組み込みシステムでの先端材料の使用

- メガトレンド

- 軍用組み込みシステムにおける人工知能 (AI)

- モノのインターネット (IoT) の使用の増加

- イノベーションと特許登録

第7章 軍用組み込みシステム市場:サーバーアーキテクチャ別

- イントロダクション

- ブレードサーバー

- AdvancedTCA (ATCA)

- CompactPCI (CPCI)

- OpenVPX

- VME

- MicroTCA

- ラックマウントサーバー

第8章 軍用組み込みシステム市場:プラットフォーム別

- イントロダクション

- 陸軍

- 装甲車両

- 司令部

- 兵員

- 武器・弾薬システム

- 空軍

- 戦闘機

- 特殊任務機

- ヘリコプター

- エアロスタット

- 海軍

- 駆逐艦

- フリゲート艦

- コルベット

- オフショア巡視船

- 航空母艦

- 潜水艦

- 無人機

- 無人地上車両

- 無人航空機 (UAV)

- 無人艇 (UMV)

- 宇宙

- キューブサット

- 衛星

- 打ち上げロケット

第9章 軍用組み込みシステム市場:用途別

- イントロダクション

- ISR (情報・監視・偵察)

- 電子戦

- 指揮・統制 (C&C)

- 通信・ナビゲーション

- 武器・射撃統制

- ウェアラブル

- その他

第10章 軍用組み込みシステム市場:インストールの種類別

- イントロダクション

- 新規インストール

- アップグレード

第11章 軍用組み込みシステム市場:コンポーネント別

- イントロダクション

- ハードウェア

- プロセッサ

- メモリ

- コンバータ

- GPU (画像処理装置)

- その他

- ソフトウェア

第12章 軍用組み込みシステム市場:サービス別

- イントロダクション

- 設計

- 試験・認証

- 展開

- 更新

- シームレスなライフサイクルサポート

第13章 軍用組み込みシステム市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ロシア

- ドイツ

- ノルウェー

- フランス

- 他の欧州諸国

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- 他のアジア太平洋諸国

- 中東・アフリカ

- サウジアラビア

- イスラエル

- アラブ首長国連邦

- トルコ

- 南アフリカ

- 他の中東・アフリカ諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第14章 競合情勢

- イントロダクション

- 競合リーダーシップマッピング

- 主要企業の市場シェア (2021年)

- 主要企業の収益分析 (2021年)

- ランク分析

- 競合シナリオ

- 製品の発売/開発

- 契約

第15章 企業プロファイル

- イントロダクション

- 主要企業

- CURTISS-WRIGHT CORPORATION

- KONTRON (S&T AG)

- MERCURY SYSTEMS, INC.

- AMETEK

- GENERAL DYNAMICS CORPORATION

- XILINX, INC.

- CONCURRENT TECHNOLOGIES

- EUROTECH

- DELL TECHNOLOGIES

- AITECH DEFENSE SYSTEMS

- AUTOTEC

- GENERAL MICRO SYSTEMS, INC.

- ADVANTECH CO., LTD.

- THALES GROUP

- SMART EMBEDDED COMPUTING

- NXP SEMICONDUCTORS

- ADVANCED MICRO PERIPHERALS

- ELMA ELECTRONIC

- TEXAS INSTRUMENTS INCORPORATED

- INTEL CORPORATION

- その他の企業

- RADISYS

- CRYSTAL GROUP

- VADATECH

- AVDOR HELET

- NORTH ATLANTIC INDUSTRIES, INC.

第16章 付録

The military embedded systems market is estimated to be USD 1.6 billion in 2022 and is projected to reach USD 2.5 billion by 2027, at a CAGR of 9.6% from 2022 to 2027. Growth of this market can be attributed to the rise in upgradation programmes by US military, development of advanced command & control systems, among others.

"Graphical Processing Unit (GPU) in Military Embedded Systems"

The graphical processing unit (GPU) is a component in an embedded system suitable for applications such as ISR and radar processing. The display technologies being used by the defense industry are becoming faster and require higher resolutions. They, therefore, require powerful GPUs to process images. Designers of HPEC (high-performance embedded computing) for defense have alternatives, such as FPGA (field-programmable gate array) or GPU when choosing a primary processor for image and signal processing.

"Test & Certification Services for Military Embedded Systems"

Embedded testing is the checking of the functional as well as non-functional attributes of software and hardware in an embedded system. The purpose of embedded testing is to verify and validate the software and hardware as per the client's requirement. Embedded testing helps in finding bugs in software, cutting down development and maintenance costs, and improving system performance. Certification services are provided to ensure the products meet all required standards and to help identify specific areas for optimization. Customer prototype testing helps in identifying bugs and solving issues early in a product's development cycle. Several companies also offer on-site testing at their facilities. For instance, Smart Embedded Computing provides an on-site testing facility located in Tempe, Arizona (US), thus enabling local customers to save on shipping and travel costs.

.

"Offshore Patrol Vessels (OVPs): The Fastest-growing segment of the military embedded systems market for Naval Platform, by Ship Type"

Offshore patrol vessels (OPVs) are specially developed for navies and coastguards for tasks in regions where there is a low-level threat. These vessels are used for missions, including military security, safety, and humanitarian tasks. In recent years, due to tensions in areas from the Mediterranean Sea to the South China Sea, the demand for OPVs is increasing. Asia Pacific has the largest proportion of OPVs, and the region is expected to be one of the most lucrative markets for OPVs, along with Africa, the Middle East, and South America, in the coming years. For instance, in February 2020, L&T commissioned its fifth OPV ICGS Varad for Indian coastal guards. In January 2020, Chittagong Dry Dock Ltd (Chittagong) secured a contract for six new OPVs for the Bangladesh Navy. Such procurements and developments of OPVs will drive the market for military embedded systems. Also, increasing investments in maritime security and enhancement of naval capabilities to drive the military embedded systems for OPVs.

"US: The largest contributing country in the North American military embedded systems market"

The US is estimated to account for a share of 93.9% of the North America military embedded systems market in 2022. The market in the US is estimated to be USD 473 million in 2022 and is projected to grow at a CAGR of 8.4% during the forecast period.

The US is one of the major hubs for manufacturing and service-based industries, which cater to the requirements of different sectors. The country has witnessed various developments in the military and aerospace sectors in terms of the development of new and advanced military devices, control systems, sensors, smart robots, etc. All these developments are expected to fuel the growth of the military embedded systems market in the US. Innovations in wireless and cloud computing technologies have also led to increased demand for military embedded systems in the country.

The adoption of AI has increased in the US in recent years. The American AI policy initiative undertaken by the US government to accelerate AI innovations and transform the overall industrial infrastructure in the country is also contributing to the growth of the embedded systems market in the US. In January 2022, one of the prominent US-based military suppliers announced a USD 100 million contract with Abaco systems (AMETEK) for the development and supply of VME Bus-based single-board computers for its advanced military embedded solution to be used by the US DoD. Due to the increase in seaborne trade, the US is also investing in coastal surveillance systems to help detect and thwart maritime threats, piracy, and unlawful acts.

Curtiss-Wright Corp. (US), Mercury Systems (US), Kontron (S&T AG) (Austria), AMETEK (US), and General Dymanics Corp. (US) are the key players in the military embedded systems market.

Research Coverage

The study covers the military embedded systems market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based on Application, Platform, Server Architecture, Installation Type, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Reasons to Buy this Report

This report is expected to help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall military embedded systems market and its segments. This study is also expected to provide region wise information about the end use, and wherein military embedded systems are used. This report aims at helping the stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses and plan suitable go-to-market strategies. This report is also expected to help them understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities influencing the growth of the market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.1.1 EXCLUSIONS

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 MILITARY EMBEDDED SYSTEMS MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS & EXCLUSIONS

- 1.5 CURRENCY & PRICING

- 1.6 USD EXCHANGE RATES

- 1.7 LIMITATIONS

- 1.8 MARKET STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 MILITARY EMBEDDED SYSTEMS MARKET: RESEARCH FLOW

- FIGURE 3 MILITARY EMBEDDED SYSTEMS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- TABLE 1 KEY PRIMARY DETAILS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 FACTOR ANALYSIS

- 2.2.1 DEMAND-SIDE ANALYSIS

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.3 MARKET SCOPE

- 2.3.1 SEGMENTS AND SUB-SEGMENTS

- 2.4 RESEARCH APPROACH & METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- TABLE 2 GLOBAL MARKET SUMMATION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.5 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.5.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- 2.6 GROWTH RATE ASSUMPTIONS

- 2.7 RESEARCH ASSUMPTIONS

- FIGURE 8 RESEARCH ASSUMPTIONS

- 2.8 RISK ANALYSIS

- 2.9 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

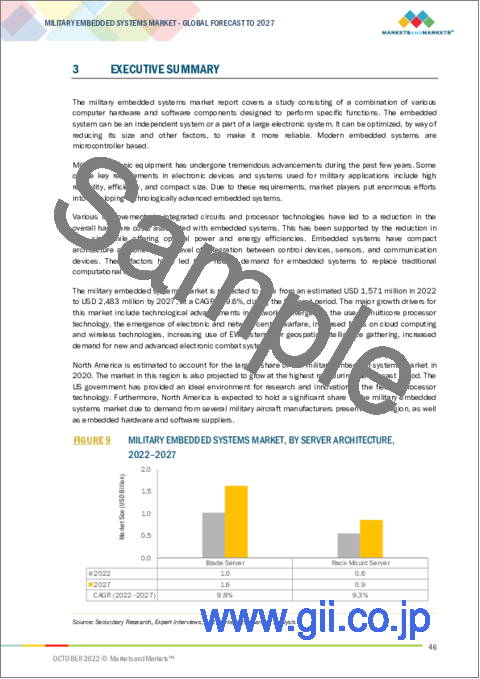

- FIGURE 9 MILITARY EMBEDDED SYSTEMS MARKET, BY SERVER ARCHITECTURE, 2022-2027

- FIGURE 10 MILITARY EMBEDDED SYSTEMS MARKET, BY PLATFORM, 2022-2027

- FIGURE 11 MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027

- FIGURE 12 MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027

- FIGURE 13 MILITARY EMBEDDED SYSTEMS MARKET, BY REGION, 2022-2027

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN MILITARY EMBEDDED SYSTEMS MARKET

- FIGURE 14 EMERGENCE OF ELECTRONIC AND NETWORK-CENTRIC WARFARE TO DRIVE MILITARY EMBEDDED SYSTEMS MARKET DURING FORECAST PERIOD

- 4.2 MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION

- FIGURE 15 ISR SEGMENT TO LEAD MILITARY EMBEDDED SYSTEMS MARKET

- 4.3 MILITARY EMBEDDED SYSTEMS MARKET, BY PLATFORM

- FIGURE 16 SPACE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 MILITARY EMBEDDED SYSTEMS MARKET, BY SERVER ARCHITECTURE

- FIGURE 17 BLADE SERVER TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.5 MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE

- FIGURE 18 NEW INSTALLATION SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE

- 4.6 GLOBAL MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY

- FIGURE 19 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 MILITARY EMBEDDED SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Technological advancements in network convergence

- 5.2.1.2 Use of multicore processor technology

- 5.2.1.3 Emergence of electronic and network-centric warfare

- 5.2.1.4 Increased focus on cloud computing and wireless technologies

- 5.2.1.5 Rising demand for new and advanced electronic combat systems

- 5.2.1.6 Increasing use of EW systems for geospatial intelligence gathering

- 5.2.2 RESTRAINTS

- 5.2.2.1 System design certification requirement for system upgrade

- 5.2.2.2 Complexities in embedded product development

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Scope for software innovation in military computers

- 5.2.3.2 Development of EW systems with enhanced capabilities

- 5.2.4 CHALLENGES

- 5.2.4.1 Increased barriers in designing military embedded systems

- 5.2.4.2 Critical security procedures in embedded devices

- FIGURE 21 CYBERCRIME RATE, BY COUNTRY

- 5.3 MILITARY EMBEDDED SYSTEMS MARKET: ECOSYSTEM

- 5.3.1 PROMINENT COMPANIES

- 5.3.2 PRIVATE AND SMALL ENTERPRISES

- 5.3.3 END USERS

- FIGURE 22 MILITARY EMBEDDED SYSTEMS MARKET: ECOSYSTEM MAP

- 5.4 AVERAGE SELLING PRICE OF MILITARY EMBEDDED SYSTEM COMPONENTS & SUB-COMPONENTS

- TABLE 3 AVERAGE SELLING PRICE TRENDS FOR MILITARY EMBEDDED SYSTEM COMPONENTS

- TABLE 4 AVERAGE SELLING PRICE TRENDS FOR SINGLE-BOARD COMPUTERS REQUIRED FOR MILITARY EMBEDDED SYSTEMS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MILITARY EMBEDDED SYSTEM MANUFACTURERS

- FIGURE 23 REVENUE SHIFT IN MILITARY EMBEDDED SYSTEMS MARKET

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 MILITARY EMBEDDED SYSTEMS MARKET: PORTER'S FIVE FORCE ANALYSIS

- FIGURE 24 MILITARY EMBEDDED SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 DEGREE OF COMPETITION

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 QUANTUM COMPUTING

- 5.7.2 AFFECTIVE COMPUTING ANALYSIS FOR MILITARY APPLICATIONS

- 5.8 USE CASES

- 5.8.1 RUGGED RACK-MOUNTED SERVER-MERCURY SYSTEMS, INC.

- 5.9 MILITARY EMBEDDED SYSTEMS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 MILITARY EMBEDDED SYSTEMS MARKET: VALUE CHAIN ANALYSIS

- 5.9.1 RESEARCH & DEVELOPMENT

- 5.9.2 RAW MATERIALS

- 5.9.3 COMPONENT/PRODUCT MANUFACTURERS (OEMS)

- 5.9.4 ASSEMBLERS & INTEGRATORS

- 5.9.5 END USERS

- 5.10 TARIFF & REGULATORY LANDSCAPE

- 5.10.1 NORTH AMERICA

- TABLE 6 NORTH AMERICAN REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- 5.10.2 EUROPE

- TABLE 7 EUROPEAN REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- 5.10.3 ASIA PACIFIC

- TABLE 8 ASIA PACIFIC REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- 5.10.4 MIDDLE EAST & AFRICA

- TABLE 9 MIDDLE EASTERN & AFRICAN REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- 5.10.5 LATIN AMERICA

- TABLE 10 LATIN AMERICAN REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- 5.11 TRADE ANALYSIS

- TABLE 11 COUNTRY-WISE IMPORTS, NAVIGATIONAL INSTRUMENTS, AND APPARATUS, 2019-2021 (USD THOUSAND)

- TABLE 12 COUNTRY-WISE EXPORTS, NAVIGATIONAL INSTRUMENTS, AND APPARATUS, 2019-2021 (USD THOUSAND)

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 26 MILITARY EMBEDDED SYSTEMS MARKET: SUPPLY CHAIN ANALYSIS

- 6.2.1 MAJOR COMPANIES

- 6.2.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 6.2.3 END USERS/CUSTOMERS

- 6.3 TECHNOLOGY TRENDS

- 6.3.1 MULTICORE PROCESSORS

- 6.3.2 DEVELOPMENT OF HPEC (HIGH-PERFORMANCE EMBEDDED COMPUTING) FOR DEFENSE APPLICATIONS

- 6.3.3 MODERN MILITARY-GRADE ELECTRONIC PACKAGING TECHNOLOGY

- 6.3.4 AVAILABILITY OF COMMERCIAL OFF-THE-SHELF (COTS) PRODUCTS

- 6.3.5 SENSOR OPEN SYSTEMS ARCHITECTURE (SOSA)

- 6.3.6 SMALL FORM FACTOR IN MILITARY EMBEDDED SYSTEMS

- 6.3.7 USE OF ADVANCED MATERIALS IN EMBEDDED SYSTEMS

- 6.4 MEGATRENDS

- 6.4.1 ARTIFICIAL INTELLIGENCE IN MILITARY EMBEDDED SYSTEMS

- 6.4.2 INCREASING USE OF INTERNET OF THINGS (IOT)

- 6.5 INNOVATION & PATENT REGISTRATION

- TABLE 13 INNOVATION & PATENT REGISTRATION, 2017-2022

7 MILITARY EMBEDDED SYSTEMS MARKET, BY SERVER ARCHITECTURE

- 7.1 INTRODUCTION

- FIGURE 27 BLADE SERVER SEGMENT TO DOMINATE MILITARY EMBEDDED SYSTEMS MARKET DURING FORECAST PERIOD

- TABLE 14 MILITARY EMBEDDED SYSTEMS MARKET, BY SERVER ARCHITECTURE, 2018-2021 (USD MILLION)

- TABLE 15 MILITARY EMBEDDED SYSTEMS MARKET, BY SERVER ARCHITECTURE, 2022-2027 (USD MILLION)

- 7.2 BLADE SERVER

- FIGURE 28 OPENVPX TO DOMINATE MILITARY EMBEDDED SYSTEMS MARKET DURING FORECAST PERIOD

- TABLE 16 MILITARY EMBEDDED SYSTEMS MARKET, BY BLADE SERVER, 2018-2021 (USD MILLION)

- TABLE 17 MILITARY EMBEDDED SYSTEMS MARKET, BY BLADE SERVER, 2022-2027 (USD MILLION)

- 7.2.1 ADVANCEDTCA (ATCA)

- 7.2.1.1 Network intelligence applications to drive market for ATCA segment

- 7.2.2 COMPACTPCI (CPCI)

- 7.2.2.1 High demand for CompactPCI in Europe to drive market

- TABLE 18 COMPACTPCI VS. COMPACTPCI SERIAL

- 7.2.3 OPENVPX

- 7.2.3.1 Need for upgrading existing military embedded systems to drive this segment

- 7.2.4 VME

- 7.2.4.1 Increasing demand in existing platform deployment to drive market for VME

- 7.2.5 MICROTCA

- 7.2.5.1 Increasing demand in combat land platform to drive market for MicroTCA

- 7.3 RACK-MOUNT SERVER

- 7.3.1 INCREASING DEMAND FOR NAVAL WEAPON SYSTEMS AND COMMAND & CONTROL CENTERS TO DRIVE MARKET FOR RACK-MOUNT SERVER

- TABLE 19 MILITARY EMBEDDED SYSTEMS MARKET, BY RACK-MOUNT SERVER, 2018-2021 (USD MILLION)

- TABLE 20 MILITARY EMBEDDED SYSTEMS MARKET, BY RACK-MOUNT SERVER, 2022-2027 (USD MILLION)

8 MILITARY EMBEDDED SYSTEMS MARKET, BY PLATFORM

- 8.1 INTRODUCTION

- FIGURE 29 NAVAL SEGMENT TO LEAD MILITARY EMBEDDED SYSTEMS MARKET FROM 2022 TO 2027

- TABLE 21 MILITARY EMBEDDED SYSTEMS MARKET, BY PLATFORM, 2018-2021 (USD MILLION)

- TABLE 22 MILITARY EMBEDDED SYSTEMS MARKET, BY PLATFORM, 2022-2027 (USD MILLION)

- 8.2 LAND

- FIGURE 30 ARMORED VEHICLES SEGMENT TO LEAD MILITARY EMBEDDED SYSTEMS MARKET FROM 2022 TO 2027

- TABLE 23 MILITARY EMBEDDED SYSTEMS MARKET FOR LAND PLATFORM, 2018-2021 (USD MILLION)

- TABLE 24 MILITARY EMBEDDED SYSTEMS MARKET FOR LAND PLATFORM, 2022-2027 (USD MILLION)

- 8.2.1 ARMORED VEHICLES

- TABLE 25 MILITARY EMBEDDED SYSTEMS MARKET, BY ARMORED VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 26 MILITARY EMBEDDED SYSTEMS MARKET, BY ARMORED VEHICLE TYPE, 2022-2027 (USD MILLION)

- 8.2.1.1 Combat vehicles

- TABLE 27 MILITARY EMBEDDED SYSTEMS MARKET, BY COMBAT VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 28 MILITARY EMBEDDED SYSTEMS MARKET, BY COMBAT VEHICLE TYPE, 2022-2027 (USD MILLION)

- 8.2.1.1.1 Main battle tanks (MBTs)

- 8.2.1.1.1.1 New embedded product launches and procurements to fuel demand for military embedded systems

- 8.2.1.1.2 Infantry fighting vehicles (IFVs)

- 8.2.1.1.2.1 Demand for next-generation, advanced infantry vehicles to fuel market

- 8.2.1.1.3 Air defense vehicles

- 8.2.1.1.3.1 Technological advancements in air defense vehicles to support market growth

- 8.2.1.1.4 Self-propelled howitzers

- 8.2.1.1.4.1 Increasing use of in-built electronic suites in howitzers to boost demand for military embedded systems

- 8.2.1.1.5 Armored amphibious vehicles

- 8.2.1.1.5.1 Demand for amphibious armored vehicles to drive market

- 8.2.1.2 Combat support vehicles

- 8.2.1.2.1 Armored command and control vehicles

- 8.2.1.2.1.1 Integration of C2 systems in modern warfare vehicles to propel market

- 8.2.1.2.2 Armored supply trucks

- 8.2.1.2.2.1 Increased use of advanced protection systems in military transport to drive market

- 8.2.1.2.1 Armored command and control vehicles

- 8.2.1.1.1 Main battle tanks (MBTs)

- 8.2.2 COMMAND CENTERS

- 8.2.2.1 Focus on modernization of command centers to boost market

- 8.2.3 SOLDIERS

- 8.2.3.1 Developments in rugged military wearable systems to contribute to market growth

- 8.2.4 WEAPON & MUNITION SYSTEMS

- TABLE 29 MILITARY EMBEDDED SYSTEMS MARKET, BY WEAPON & MUNITION SYSTEM, 2018-2021 (USD MILLION)

- TABLE 30 MILITARY EMBEDDED SYSTEMS MARKET, BY WEAPON & MUNITION SYSTEM, 2022-2027 (USD MILLION)

- 8.2.4.1 Launch systems

- 8.2.4.1.1 Embedded system manufacturers focus on modular embedded systems for weapon launching systems

- 8.2.4.2 Defense systems

- 8.2.4.2.1 Increasing demand for 360-degree day & night coverage, 3D sensors, and integrated command and control systems

- 8.2.4.1 Launch systems

- 8.3 AIRBORNE

- FIGURE 31 FIGHTER JETS SEGMENT TO LEAD MILITARY EMBEDDED SYSTEMS MARKET FROM 2022 TO 2027

- TABLE 31 AIRBORNE PLATFORM: MILITARY EMBEDDED SYSTEMS MARKET, BY AIRCRAFT TYPE, 2018-2021 (USD MILLION)

- TABLE 32 AIRBORNE PLATFORM: MILITARY EMBEDDED SYSTEMS MARKET, BY AIRCRAFT TYPE, 2022-2027 (USD MILLION)

- 8.3.1 FIGHTER JETS

- 8.3.1.1 Development of advanced electronic systems and mission-critical embedded systems to drive market

- 8.3.2 SPECIAL MISSION AIRCRAFT

- 8.3.2.1 Increasing demand for open system avionics to drive special mission aircraft market

- 8.3.3 HELICOPTERS

- 8.3.3.1 Increased surveillance operations due to geographical instability to fuel demand for helicopters

- 8.3.4 AEROSTATS

- 8.3.4.1 Modernization of electronic systems in aerostats to drive market

- 8.3.4.1.1 Powered

- 8.3.4.1.2 Unpowered

- 8.3.4.1 Modernization of electronic systems in aerostats to drive market

- 8.4 NAVAL

- FIGURE 32 DESTROYERS SEGMENT TO LEAD MILITARY EMBEDDED SYSTEMS MARKET IN NAVAL PLATFORM FROM 2022 TO 2027

- TABLE 33 NAVAL PLATFORM: MILITARY EMBEDDED SYSTEMS MARKET, BY VESSEL TYPE, 2018-2021 (USD MILLION)

- TABLE 34 NAVAL PLATFORM: MILITARY EMBEDDED SYSTEMS MARKET, BY VESSEL TYPE, 2022-2027 (USD MILLION)

- 8.4.1 DESTROYERS

- 8.4.1.1 Use of advanced electronics and high-tech embedded systems to propel market

- 8.4.2 FRIGATES

- 8.4.2.1 Demand for open-architecture scalable framework using non-developmental software to drive market

- 8.4.3 CORVETTES

- 8.4.3.1 Use of advanced radar systems, open-architecture systems, and several sensors and weapons systems to favor market growth

- 8.4.4 OFFSHORE PATROL VESSELS

- 8.4.4.1 Increasing investments in maritime security to support market growth

- 8.4.5 AIRCRAFT CARRIERS

- 8.4.5.1 Focus on optimizing construction of ships to drive market

- 8.4.6 SUBMARINES

- 8.4.6.1 Development of advanced submarines for maritime security to boost market

- 8.5 UNMANNED VEHICLES

- FIGURE 33 UNMANNED MARITIME VESSELS TO LEAD MILITARY EMBEDDED SYSTEMS MARKET FROM 2022 TO 2027

- TABLE 35 UNMANNED PLATFORM: MILITARY EMBEDDED SYSTEMS MARKET, BY UNMANNED VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 36 UNMANNED PLATFORM: MILITARY EMBEDDED SYSTEMS MARKET, BY UNMANNED VEHICLE TYPE, 2022-2027 (USD MILLION)

- 8.5.1 UNMANNED GROUND VEHICLES

- 8.5.1.1 Development of UGVs for human-inconvenient operations to fuel growth of unmanned armored vehicles

- 8.5.2 UNMANNED AERIAL VEHICLES (UAVS)

- 8.5.2.1 Use of advanced embedded components in UAV platforms to drive market

- 8.5.3 UNMANNED MARITIME VEHICLES (UMVS)

- TABLE 37 UNMANNED MARITIME VESSEL: MILITARY EMBEDDED SYSTEMS MARKET, BY UNMANNED MARITIME VESSEL (UMV) TYPE, 2018-2021 (USD MILLION)

- TABLE 38 UNMANNED MARITIME VESSEL: MILITARY EMBEDDED SYSTEMS MARKET, BY UNMANNED MARITIME VESSEL (UMV) TYPE, 2022-2027 (USD MILLION)

- 8.5.3.1 Unmanned underwater vehicles (UUVs)

- 8.5.3.1.1 Demand for intelligence support for underwater warfare systems to fuel market

- 8.5.3.2 Unmanned surface vessels (USVs)

- 8.5.3.2.1 Increasing use of military embedded systems in USVs to help market growth

- 8.5.3.3 Unmanned submarines

- 8.5.3.3.1 Increasing use of advanced communication & navigation systems in unmanned submarines to drive market

- 8.5.3.1 Unmanned underwater vehicles (UUVs)

- 8.6 SPACE

- FIGURE 34 SATELLITES SEGMENT TO LEAD MILITARY EMBEDDED SYSTEMS MARKET IN SPACE PLATFORM

- TABLE 39 SPACE PLATFORM: MILITARY EMBEDDED SYSTEMS MARKET, BY SPACE PLATFORM TYPE, 2018-2021 (USD MILLION)

- TABLE 40 SPACE PLATFORM: MILITARY EMBEDDED SYSTEMS MARKET, BY SPACE PLATFORM TYPE, 2022-2027 (USD MILLION)

- 8.6.1 CUBESATS

- 8.6.1.1 Development of onboard internet systems, electronic propulsion system, and 3D printed electronics to fuel growth of CubeSats

- 8.6.2 SATELLITES

- TABLE 41 MILITARY EMBEDDED SYSTEMS MARKET, BY SATELLITE TYPE, 2018-2021 (USD MILLION)

- TABLE 42 MILITARY EMBEDDED SYSTEMS MARKET, BY SATELLITE TYPE, 2022-2027 (USD MILLION)

- 8.6.2.1 Small satellites

- 8.6.2.1.1 Increasing use of commercial-off-the-shelf (COTS) technology in small satellites to be growth factor

- 8.6.2.2 Medium satellites

- 8.6.2.2.1 Growing use of innovative propulsion, attitude control, and communication & computation systems in medium satellites to propel market

- 8.6.2.3 Large satellites

- 8.6.2.3.1 Increased demand for space-based communication subsystems to drive market

- 8.6.2.1 Small satellites

- 8.6.3 LAUNCH VEHICLES

- 8.6.3.1 Advancements in launch vehicles and related electronic systems to support market growth

9 MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 35 ISR SEGMENT TO LEAD MILITARY EMBEDDED SYSTEMS MARKET FROM 2022 TO 2027

- TABLE 43 MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 44 MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 9.2 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

- 9.2.1 INCREASED PROCUREMENT OF HIGH-TECH SURVEILLANCE & MONITORING SYSTEMS TO FUEL MARKET

- 9.3 ELECTRONIC WARFARE

- 9.3.1 GROWING FOCUS ON COGNITIVE ELECTRONIC WARFARE TECHNOLOGIES TO PROPEL MARKET

- 9.4 COMMAND & CONTROL

- 9.4.1 INVESTMENTS IN C2 SYSTEMS TO FUEL GROWTH OF MILITARY EMBEDDED SYSTEMS

- 9.5 COMMUNICATION & NAVIGATION

- 9.5.1 DEMAND FOR UNINTERRUPTED MILITARY COMMUNICATION AND NAVIGATION SYSTEMS TO BOOST MARKET

- 9.6 WEAPON & FIRE CONTROL

- 9.6.1 RISING DEMAND FOR HIGH-PRECISION AUTOMATIC WEAPON SYSTEMS TO DRIVE MARKET

- 9.7 WEARABLES

- 9.7.1 DEVELOPMENT OF ADVANCED EMBEDDED SYSTEMS TO ENHANCE CAPABILITIES OF WEARABLES FOR SOLDIERS

- 9.8 OTHERS

10 MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE

- 10.1 INTRODUCTION

- FIGURE 36 NEW INSTALLATION SEGMENT TO DOMINATE MILITARY EMBEDDED SYSTEMS MARKET DURING FORECAST PERIOD

- TABLE 45 MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 46 MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- 10.2 NEW INSTALLATION

- 10.2.1 GROWING DEFENSE BUDGET ALLOCATION FOR INSTALLATION OF ADVANCED MILITARY EMBEDDED SYSTEMS

- 10.3 UPGRADE

- 10.3.1 NEED TO UPGRADE EXISTING MILITARY EMBEDDED SYSTEMS

11 MILITARY EMBEDDED SYSTEMS MARKET, BY COMPONENT

- 11.1 INTRODUCTION

- 11.2 HARDWARE

- 11.2.1 PROCESSOR

- 11.2.2 MEMORY

- 11.2.3 CONVERTER

- 11.2.4 GRAPHICAL PROCESSING UNIT (GPU)

- 11.2.5 OTHERS

- 11.3 SOFTWARE

12 MILITARY EMBEDDED SYSTEMS MARKET, BY SERVICE

- 12.1 INTRODUCTION

- 12.2 DESIGN

- 12.2.1 TECHNOLOGICAL ENHANCEMENT IN ELECTRONIC HARDWARE

- 12.2.1.1 Development consulting

- 12.2.1.2 Engineering support

- 12.2.1.3 Deployment support

- 12.2.1 TECHNOLOGICAL ENHANCEMENT IN ELECTRONIC HARDWARE

- 12.3 TEST & CERTIFICATION

- 12.3.1 INCREASING SAFEGUARDS TO AVOID AND COUNTERACT SECURITY RISKS RELATED TO EMBEDDED SOFTWARE

- 12.3.1.1 Accelerated life testing

- 12.3.1.2 International standards

- 12.3.1.3 Product safety

- 12.3.1.4 Others

- 12.3.1 INCREASING SAFEGUARDS TO AVOID AND COUNTERACT SECURITY RISKS RELATED TO EMBEDDED SOFTWARE

- 12.4 DEPLOYMENT

- 12.4.1 FOCUS ON ENHANCEMENT OF PRODUCT LIFE CYCLE TO FUEL DEMAND FOR DEPLOYMENT SERVICES

- 12.5 RENEWAL

- 12.5.1 FOCUS ON ENHANCEMENT, PRODUCT UPGRADE, AND PROVISION OF SOFTWARE UPDATES TO DRIVE RENEWAL SERVICES MARKET

- 12.6 SEAMLESS LIFE CYCLE SUPPORT

- 12.6.1 FOCUS ON PROVIDING SEAMLESS SERVICE SUPPORT TO CUSTOMERS TO DRIVE MARKET

13 MILITARY EMBEDDED SYSTEMS MARKET, BY REGION

- 13.1 INTRODUCTION

- FIGURE 37 MILITARY EMBEDDED SYSTEMS MARKET IN ASIA PACIFIC TO WITNESS HIGHEST CAGR FROM 2022 TO 2027

- TABLE 47 MILITARY EMBEDDED SYSTEMS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 48 MILITARY EMBEDDED SYSTEMS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.2 NORTH AMERICA

- 13.2.1 PESTLE ANALYSIS

- FIGURE 38 NORTH AMERICA: MILITARY EMBEDDED SYSTEMS MARKET SNAPSHOT

- TABLE 49 NORTH AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 50 NORTH AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 52 NORTH AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 53 NORTH AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 54 NORTH AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.2.2 US

- 13.2.2.1 Increase in adoption of AI and IoT

- TABLE 55 US: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 56 US: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 57 US: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 58 US: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.2.3 CANADA

- 13.2.3.1 Rise in demand for high-tech equipment used in military aircraft

- TABLE 59 CANADA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 60 CANADA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 61 CANADA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 62 CANADA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.3 EUROPE

- 13.3.1 PESTLE ANALYSIS

- FIGURE 39 EUROPE: MILITARY EMBEDDED SYSTEMS MARKET SNAPSHOT

- TABLE 63 EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 64 EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 65 EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 66 EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 67 EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 68 EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.3.2 UK

- 13.3.2.1 Advancements in military automation and increasing investments in R&D to provide lucrative opportunities

- TABLE 69 UK: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 70 UK: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 71 UK: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 72 UK: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.3.3 RUSSIA

- 13.3.3.1 Rising investments in digitizing armored vehicle platforms to drive market

- TABLE 73 RUSSIA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 74 RUSSIA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 75 RUSSIA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 76 RUSSIA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.3.4 GERMANY

- 13.3.4.1 Integration of AI and improved safety standards for armored vehicles equipped with smart robotics to drive market

- TABLE 77 GERMANY: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 78 GERMANY: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 79 GERMANY: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 80 GERMANY: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.3.5 NORWAY

- 13.3.5.1 Presence of strong shipbuilding industry to drive market

- TABLE 81 NORWAY: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 82 NORWAY: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 83 NORWAY: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 84 NORWAY: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.3.6 FRANCE

- 13.3.6.1 Demand for advanced avionics systems to fuel market

- TABLE 85 FRANCE: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 86 FRANCE: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 87 FRANCE: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 88 FRANCE: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.3.7 REST OF EUROPE

- TABLE 89 REST OF EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 90 REST OF EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 91 REST OF EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 92 REST OF EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.4 ASIA PACIFIC

- 13.4.1 PESTLE ANALYSIS

- FIGURE 40 ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET SNAPSHOT

- TABLE 93 ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2022-2027(USD MILLION)

- 13.4.2 CHINA

- 13.4.2.1 Increased investment to strengthen military capabilities due to cross-border conflicts to drive market

- TABLE 99 CHINA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 100 CHINA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 101 CHINA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 102 CHINA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.4.3 INDIA

- 13.4.3.1 Focus on digitization of military applications to support market growth

- TABLE 103 INDIA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 104 INDIA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 105 INDIA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 106 INDIA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.4.4 JAPAN

- 13.4.4.1 Investment by government and private sectors in AI, IoT, and robotics to drive market

- TABLE 107 JAPAN: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 108 JAPAN: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 109 JAPAN: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 110 JAPAN: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.4.5 SOUTH KOREA

- 13.4.5.1 Introduction of Patriot air defense systems and radars with advanced embedded capabilities

- TABLE 111 SOUTH KOREA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 112 SOUTH KOREA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 113 SOUTH KOREA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 114 SOUTH KOREA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.4.6 AUSTRALIA

- 13.4.6.1 Investment in development of advanced embedded systems for ground vehicles to drive market

- TABLE 115 AUSTRALIA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 116 AUSTRALIA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 117 AUSTRALIA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 118 AUSTRALIA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.4.7 REST OF ASIA PACIFIC

- TABLE 119 REST OF ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 PESTLE ANALYSIS

- FIGURE 41 MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET SNAPSHOT

- TABLE 123 MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.5.2 SAUDI ARABIA

- 13.5.2.1 Demand for combat vehicle segment to drive market

- TABLE 129 SAUDI ARABIA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 130 SAUDI ARABIA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 131 SAUDI ARABIA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 132 SAUDI ARABIA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.5.3 ISRAEL

- 13.5.3.1 Rising imports of military electronic hardware and electronic systems to drive market

- TABLE 133 ISRAEL: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 134 ISRAEL: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 135 ISRAEL: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 136 ISRAEL: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.5.4 UAE

- 13.5.4.1 Increasing use of military embedded systems for ISR and command & control applications to drive market

- TABLE 137 UAE: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 138 UAE: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 139 UAE: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 140 UAE: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.5.5 TURKEY

- 13.5.5.1 Joint programs on advanced robotics and embedded systems to drive market

- TABLE 141 TURKEY: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 142 TURKEY: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 143 TURKEY: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 144 TURKEY: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.5.6 SOUTH AFRICA

- 13.5.6.1 Developments in electronic warfare systems to support market growth

- TABLE 145 SOUTH AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 146 SOUTH AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 147 SOUTH AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 148 SOUTH AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.5.7 REST OF MIDDLE EAST & AFRICA

- TABLE 149 REST OF MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 150 REST OF MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 151 REST OF MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 152 REST OF MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.6 LATIN AMERICA

- 13.6.1 PESTLE ANALYSIS

- FIGURE 42 LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET SNAPSHOT

- TABLE 153 LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 154 LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 155 LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 156 LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 157 LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 158 LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.6.2 BRAZIL

- 13.6.2.1 Military aircraft electronic system and radar surveillance system modernization programs to fuel market

- TABLE 159 BRAZIL: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 160 BRAZIL: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 161 BRAZIL: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 162 BRAZIL: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.6.3 MEXICO

- 13.6.3.1 Program for electronics and high technology industry competitiveness (PCIEAT) to propel market

- TABLE 163 MEXICO: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 164 MEXICO: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 165 MEXICO: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 166 MEXICO: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 13.6.4 REST OF LATIN AMERICA

- TABLE 167 REST OF LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018-2021 (USD MILLION)

- TABLE 168 REST OF LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022-2027 (USD MILLION)

- TABLE 169 REST OF LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 170 REST OF LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- TABLE 171 COMPANIES ADOPTED CONTRACTS AS KEY GROWTH STRATEGY BETWEEN JANUARY 2019 AND OCTOBER 2022

- 14.2 COMPETITIVE LEADERSHIP MAPPING

- 14.2.1 STARS

- 14.2.2 EMERGING LEADERS

- 14.2.3 PERVASIVE PLAYERS

- 14.2.4 PARTICIPANTS

- FIGURE 43 COMPETITIVE LEADERSHIP MAPPING, 2021

- 14.3 MARKET SHARE OF KEY PLAYERS, 2021

- TABLE 172 DEGREE OF COMPETITION

- FIGURE 44 MARKET SHARE ANALYSIS OF TOP PLAYERS IN MILITARY EMBEDDED SYSTEMS MARKET, 2021

- 14.4 REVENUE ANALYSIS OF KEY PLAYERS, 2021

- FIGURE 45 REVENUE ANALYSIS OF MILITARY EMBEDDED SYSTEMS MARKET PLAYERS, 2019-2021

- 14.5 RANK ANALYSIS

- FIGURE 46 REVENUE SHARE OF TOP 5 PLAYERS IN MILITARY EMBEDDED SYSTEMS MARKET IN 2021

- TABLE 173 COMPANY REGION FOOTPRINT

- TABLE 174 COMPANY APPLICATION FOOTPRINT

- TABLE 175 COMPANY PLATFORM FOOTPRINT

- 14.6 COMPETITIVE SCENARIO

- 14.6.1 PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 176 PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2019 TO OCTOBER 2022

- 14.6.2 CONTRACTS

- TABLE 177 CONTRACTS, JANUARY 2019 TO OCTOBER 2022

15 COMPANY PROFILES

- 15.1 INTRODUCTION

- 15.2 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, and MnM View)**

- 15.2.1 CURTISS-WRIGHT CORPORATION

- TABLE 178 CURTISS-WRIGHT CORPORATION: COMPANY OVERVIEW

- FIGURE 47 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- 15.2.2 KONTRON (S&T AG)

- TABLE 179 KONTRON (S&T AG): COMPANY OVERVIEW

- FIGURE 48 KONTRON (S&T AG): COMPANY SNAPSHOT

- 15.2.3 MERCURY SYSTEMS, INC.

- TABLE 180 MERCURY SYSTEMS, INC.: COMPANY OVERVIEW

- FIGURE 49 MERCURY SYSTEMS, INC.: COMPANY SNAPSHOT

- 15.2.4 AMETEK

- TABLE 181 AMETEK: COMPANY OVERVIEW

- FIGURE 50 AMETEK: COMPANY SNAPSHOT

- 15.2.5 GENERAL DYNAMICS CORPORATION

- TABLE 182 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- FIGURE 51 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- 15.2.6 XILINX, INC.

- TABLE 183 XILINX, INC: COMPANY OVERVIEW

- FIGURE 52 XILINX, INC.: COMPANY SNAPSHOT

- 15.2.7 CONCURRENT TECHNOLOGIES

- TABLE 184 CONCURRENT TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 53 CONCURRENT TECHNOLOGIES: COMPANY SNAPSHOT

- 15.2.8 EUROTECH

- TABLE 185 EUROTECH: COMPANY OVERVIEW

- FIGURE 54 EUROTECH: COMPANY SNAPSHOT

- 15.2.9 DELL TECHNOLOGIES

- TABLE 186 DELL TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 55 DELL TECHNOLOGIES: COMPANY SNAPSHOT

- 15.2.10 AITECH DEFENSE SYSTEMS

- TABLE 187 AITECH DEFENSE SYSTEMS: COMPANY OVERVIEW

- 15.2.11 AUTOTEC

- TABLE 188 AUTOTEC: COMPANY OVERVIEW

- 15.2.12 GENERAL MICRO SYSTEMS, INC.

- TABLE 189 GENERAL MICRO SYSTEMS: COMPANY OVERVIEW

- 15.2.13 ADVANTECH CO., LTD.

- TABLE 190 ADVANTECH CO., LTD.: COMPANY OVERVIEW

- FIGURE 56 ADVANTECH CO., LTD.: COMPANY SNAPSHOT

- 15.2.14 THALES GROUP

- TABLE 191 THALES GROUP: COMPANY OVERVIEW

- FIGURE 57 THALES GROUP: COMPANY SNAPSHOT

- 15.2.15 SMART EMBEDDED COMPUTING

- TABLE 192 SMART EMBEDDED COMPUTING: COMPANY OVERVIEW

- FIGURE 58 SMART EMBEDDED COMPUTING: COMPANY SNAPSHOT

- 15.2.16 NXP SEMICONDUCTORS

- TABLE 193 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- FIGURE 59 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- 15.2.17 ADVANCED MICRO PERIPHERALS

- TABLE 194 ADVANCED MICRO PERIPHERALS: COMPANY OVERVIEW

- 15.2.18 ELMA ELECTRONIC

- TABLE 195 ELMA ELECTRONIC: COMPANY OVERVIEW

- FIGURE 60 ELMA ELECTRONIC: COMPANY SNAPSHOT

- 15.2.19 TEXAS INSTRUMENTS INCORPORATED

- TABLE 196 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- FIGURE 61 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- 15.2.20 INTEL CORPORATION

- TABLE 197 INTEL CORPORATION: COMPANY OVERVIEW

- FIGURE 62 INTEL CORPORATION: COMPANY SNAPSHOT

- 15.3 OTHER PLAYERS

- 15.3.1 RADISYS

- TABLE 198 RADISYS: COMPANY OVERVIEW

- 15.3.2 CRYSTAL GROUP

- TABLE 199 CRYSTAL GROUP: COMPANY OVERVIEW

- 15.3.3 VADATECH

- TABLE 200 VADATECH: COMPANY OVERVIEW

- 15.3.4 AVDOR HELET

- TABLE 201 AVDOR HELET: COMPANY OVERVIEW

- 15.3.5 NORTH ATLANTIC INDUSTRIES, INC.

- TABLE 202 NORTH ATLANTIC INDUSTRIES, INC.: COMPANY OVERVIEW

- * Business Overview, Products/Solutions/Services offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS