|

|

市場調査レポート

商品コード

1148680

黒リンの世界市場:形状別 (結晶、粉末)・用途別 (電子機器、エネルギー貯蔵、センサー)・地域別 (北米、アジア太平洋、欧州、南米、中東・アフリカ) の将来予測 (2027年まで)Black Phosphorus Market by Form (Crystal, Powder), Application (Electronic Devices, Energy Storage, Sensors), and Region (North America, Asia Pacific, Europe, South America, Middle East & Africa) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 黒リンの世界市場:形状別 (結晶、粉末)・用途別 (電子機器、エネルギー貯蔵、センサー)・地域別 (北米、アジア太平洋、欧州、南米、中東・アフリカ) の将来予測 (2027年まで) |

|

出版日: 2022年10月27日

発行: MarketsandMarkets

ページ情報: 英文 148 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の黒リン市場は、2022年の1,300万米ドルから、2027年には8,300万米ドルまで、43.1%のCAGRで成長すると予測されています。

石油・ガス、化学、鉱業、電力などの重要な産業では、可燃性ガスや有毒ガスの存在を検知・監視するためにガスセンサーが使用されています。一酸化炭素、二酸化炭素、アンモニア、硫化水素、炭化水素など、多くのガスがこれらの重要な産業によって大気中に放出されます。これらのガスが大気中に過剰に放出されると、人間の健康に悪影響を及ぼす可能性があります。さらに、メタン、プロパン、ブタンなどの爆発性ガスがこれらの重要な産業から放出される可能性があり、それによって火災事故のリスクにつながる可能性があります。そうした要因が、センサー用途の黒リンの需要を押し上げると予想されます。

形状別に見ると、結晶黒リンが予測期間中に金額・数量の両方で最も急成長するセグメントだと予測されます。

用途別では、2021年には電子デバイス分野が金額・数量ともに最大のシェアを占めました。黒リンは高い移動度、面内異方性、直接的なバンドギャップにより、次世代電子デバイスに最適とされています。

北米は2021年時点で (金額ベースで) 世界最大の黒リン市場です。高い生活水準や、軍事・航空宇宙・産業・医療のOEMメーカーの競争力により、この地域はオプトエレクトロニクス部品の盛んな市場となっており、予測期間中の黒リン需要を促進すると予測されています。

当レポートでは、世界の黒リンの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、形状別・用途別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- マクロ経済指標

- 主要国のGDPの動向と予測

第6章 産業動向

- サプライチェーン分析

- 原材料

- メーカー

- 流通ネットワーク

- エンドユーザー

- 黒リン市場:現実的、悲観的、楽観的、COVID-19以後のシナリオ

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- 接続市場:エコシステム

- 技術分析

- 二次元 (2D) 材料

- 貿易データ統計

- 規制状況

- 主な会議とイベント (2022年~2023年)

- 特許分析

第7章 黒リン市場:形状別

- イントロダクション

- 結晶

- 粉末

第8章 黒リン市場:用途別

- イントロダクション

- 電子機器

- センサー

- エネルギー貯蔵

- その他

第9章 黒リン市場:地域別

- イントロダクション

- アジア太平洋

- 北米

- 欧州

- 他の国々 (RoW)

第10章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 市場シェア分析

- 主要企業のランキング (2021年)

- 主要企業の市場シェア

- 上位5社の収益分析

- 企業の製品フットプリント分析

- 企業評価クアドラント (ティア 1)

- 競合ベンチマーキング

- スタートアップ/中小企業の評価クアドラント

- 競争状況と動向

- 資本取引

第11章 企業プロファイル

- OSSILA LTD.

- ACS MATERIAL, LLC

- NANOCHEMAZONE

- AMERICAN ELEMENTS

- MERCK

- HQ GRAPHENE

- HUNAN AZEAL MATERIALS CO. LTD.

- STANFORD ADVANCED MATERIALS

- MANCHESTER NANOMATERIALS

- NANJING XFNANO MATERIALS TECH CO. LTD

- WEISTRON CO. LTD.

- TAIZHOU SUNANO ENERGY CO., LTD.

- ULTRANANOTECH PRIVATE LIMITED

- SMART ELEMENTS

第12章 隣接・関連市場

- イントロダクション

- 制限事項

- 電子工業用薬品・材料市場

第13章 付録

The black phosphorus market is estimated to grow to USD 83 million by 2027 from USD 13 million in 2022, at a CAGR of 43.1%. Critical industries such as oil & gas, chemical, mining, and power use gas sensors to detect and monitor the presence of combustible and toxic gases. A large number of gases, such as carbon monoxide, carbon dioxide, ammonia, hydrogen sulfide, and hydrocarbons, are released into the air by these critical industries. Excess emissions of these gases in the air can adversely affect human health. Moreover, there are some explosive gases such as methane, propane, and butane that might be released by these critical industries, thereby leading to the risk of fire accidents. All these factors is expected to drive the demand for black phosphorus in sensors application.

"Crystal black phosphorus is projected to be the fastest-growing during the forecast period."

Crystal black phosphorus is projected to be the fastest-growing segment in terms of both value and volume during the forecast period. Most of the black phosphorus produced in the wet process is used to produce fertilizers. Black phosphorus is available in two types: crystal black phosphorus and powder black phosphorus. The structure of black phosphorus in crystal form can be changed with pressure according to its need.

"Electronic devices segment held the largest share, in terms of both value and volume, in 2021"

Black phosphorus is a layered semiconductor, which has great potential in optical and electronic devices. The electronic devices segment held the largest share, in terms of both value and volume, in 2021. Due to its high mobility, in-plane anisotropy, and direct band gap, black phosphorus is considered an excellent choice for next-generation electronic devices. The market for optoelectronic components is growing due to the extensive use of infrared components such as infrared LEDs, photodiodes, and phototransistors in consumer electronics and automobiles.

"North America was the largest black phosphorus market, in terms of value, in 2021"

North America is the largest black phosphorus market globally. North America is one of the most technologically advanced markets for optoelectronic components owing to the presence of prominent system suppliers, large semiconductor companies, and LED, laser, and sensor manufacturers in the region. The high standard of living and the competitiveness of military & aerospace, industrial, and medical original equipment manufacturers (OEMs) make this region a flourishing market for optoelectronic components, which is projected to drive the demand for black phosphorus during the forecast period.

- By Company Type: Tier 1 - 46%, Tier 2 - 31%, and Tier 3 - 23%

- By Designation: C-Level - 46%, Director Level - 27%, and Others - 27%

- By Region: North America - 33%, Europe - 27%, APAC - 27%, South America - 7%, Middle East & Africa - 6%,

The key players profiled in the report include ACS Material LLC (US), 2D Semiconductors (US), Nanochemazone (Canada), American Elements LLC (US), Merck (Germany), HQ Graphene (Netherlands), Hunan Azeal Materials Co. Ltd. (China), Ossila Ltd. (UK), Stanford Advanced Materials (US) and Manchester Nanomaterials (UK) among others.

Research Coverage

This report segments the market for black phosphorus is based on form, application, and region, and provides estimations for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, associated with the market for black phosphorus.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the black phosphorus market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on black phosphorus offered by top players in the global market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for black phosphorus across regions

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global black phosphorus market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the black phosphorus market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.3.1 MARKET DEFINITION AND INCLUSIONS, BY FORM

- 1.3.2 MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.4 STUDY SCOPE

- 1.4.1 MARKET SEGMENTATION

- 1.4.2 REGIONS COVERED

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 BLACK PHOSPHORUS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews-Demand and supply sides

- 2.1.2.2 Key Industry Insights

- 2.1.2.3 Breakdown of primary interviews

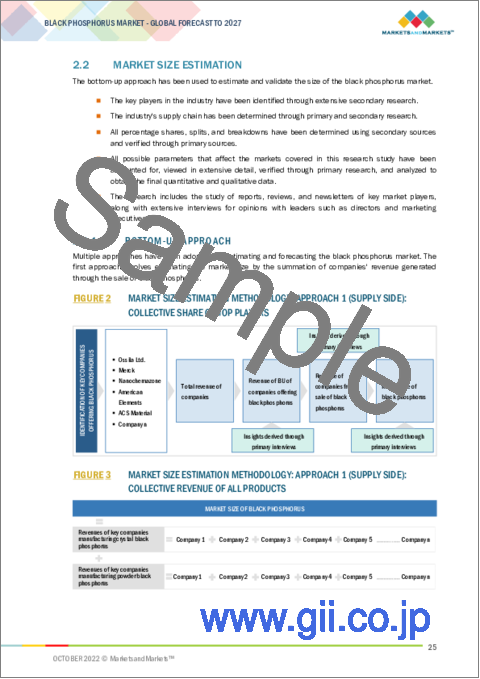

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARE OF TOP PLAYERS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE)

- 2.3 DATA TRIANGULATION

- FIGURE 5 BLACK PHOSPHORUS MARKET: DATA TRIANGULATION

- 2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- FIGURE 6 SUPPLY-SIDE MARKET CAGR PROJECTIONS

- 2.4.2 DEMAND SIDE

- FIGURE 7 DEMAND-SIDE MARKET GROWTH PROJECTIONS: DRIVERS AND OPPORTUNITIES

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 8 ELECTRONIC DEVICES APPLICATION LED BLACK PHOSPHORUS MARKET IN 2021

- FIGURE 9 CRYSTAL FORM TO LEAD BLACK PHOSPHORUS MARKET DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF BLACK PHOSPHORUS MARKET

- FIGURE 11 BLACK PHOSPHORUS IN CRYSTAL FORM TO DRIVE MARKET

- 4.2 BLACK PHOSPHORUS MARKET SIZE, BY REGION

- FIGURE 12 NORTH AMERICA TO BE LARGEST MARKET FOR BLACK PHOSPHORUS DURING FORECAST PERIOD

- 4.3 NORTH AMERICA: BLACK PHOSPHORUS MARKET, BY APPLICATION AND COUNTRY, 2021

- FIGURE 13 ELECTRONIC DEVICES SEGMENT AND US ACCOUNTED FOR LARGEST SHARES

- 4.4 BLACK PHOSPHORUS MARKET SIZE, APPLICATION VS. REGION

- FIGURE 14 ELECTRONIC DEVICES APPLICATION LED MARKET ACROSS REGIONS IN 2021

- 4.5 BLACK PHOSPHORUS MARKET, BY MAJOR COUNTRIES

- FIGURE 15 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BLACK PHOSPHORUS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 High demand for gas sensors in critical industries

- 5.2.1.2 Implementation of various health and safety regulations globally

- TABLE 1 LIST OF GOVERNMENT REGULATIONS/ACTS FOR AIR QUALITY MONITORING

- 5.2.1.3 Increased use of infrared components in consumer electronics and automobiles

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of production

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand from energy storage segment

- 5.2.4 CHALLENGES

- 5.2.4.1 Scalable process for mass production

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 BLACK PHOSPHORUS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 2 BLACK PHOSPHORUS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 3 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- 5.4.2 BUYING CRITERIA

- FIGURE 19 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 4 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECASTS FOR MAJOR ECONOMIES

- TABLE 5 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES, 2019-2027 (USD BILLION)

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- FIGURE 20 BLACK PHOSPHORUS MARKET: SUPPLY CHAIN

- 6.1.1 RAW MATERIALS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTION NETWORK

- 6.1.4 END USERS

- 6.2 BLACK PHOSPHORUS MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

- FIGURE 21 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

- TABLE 6 BLACK PHOSPHORUS MARKET FORECAST SCENARIO, 2019-2027 (USD THOUSAND)

- 6.2.1 NON-COVID-19 SCENARIO

- 6.2.2 OPTIMISTIC SCENARIO

- 6.2.3 PESSIMISTIC SCENARIO

- 6.2.4 REALISTIC SCENARIO

- 6.3 PRICING ANALYSIS

- 6.3.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION

- FIGURE 22 AVERAGE SELLING PRICE BY KEY PLAYERS FOR TOP 3 APPLICATIONS

- TABLE 7 AVERAGE SELLING PRICE BY KEY PLAYERS FOR TOP 3 APPLICATIONS (USD THOUSAND/KG)

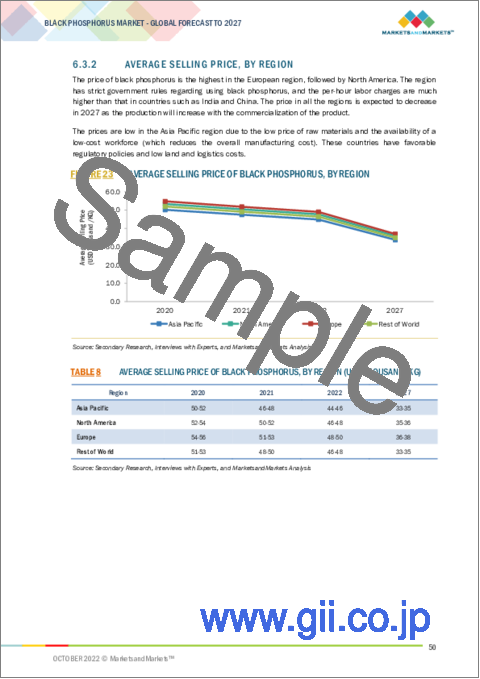

- 6.3.2 AVERAGE SELLING PRICE, BY REGION

- FIGURE 23 AVERAGE SELLING PRICE OF BLACK PHOSPHORUS, BY REGION

- TABLE 8 AVERAGE SELLING PRICE OF BLACK PHOSPHORUS, BY REGION (USD THOUSAND/KG)

- 6.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.4.1 REVENUE SHIFTS & REVENUE POCKETS IN BLACK PHOSPHORUS MARKET

- FIGURE 24 REVENUE SHIFT FOR BLACK PHOSPHORUS MARKET

- 6.5 CONNECTED MARKETS: ECOSYSTEM

- TABLE 9 BLACK PHOSPHORUS MARKET: ECOSYSTEM

- FIGURE 25 BLACK PHOSPHORUS: CONNECTED MARKET

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 TWO-DIMENSIONAL (2D) MATERIALS

- 6.7 TRADE DATA STATISTICS

- 6.7.1 IMPORT SCENARIO OF BLACK PHOSPHORUS

- FIGURE 26 IMPORT OF BLACK PHOSPHORUS, BY KEY COUNTRIES (2014-2021)

- TABLE 10 BLACK PHOSPHORUS IMPORTS, BY REGION, 2014-2021 (USD THOUSAND)

- 6.7.2 EXPORT SCENARIO OF BLACK PHOSPHORUS

- FIGURE 27 EXPORT OF BLACK PHOSPHORUS, BY KEY COUNTRIES (2014-2021)

- TABLE 11 BLACK PHOSPHORUS EXPORTS, BY REGION, 2014-2021 (USD THOUSAND)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES AND REGULATIONS RELATED TO BLACK PHOSPHORUS

- 6.9 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 12 BLACK PHOSPHORUS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 6.10 PATENT ANALYSIS

- 6.10.1 APPROACH

- 6.10.2 DOCUMENT TYPE

- TABLE 13 TOTAL NUMBER OF PATENTS DURING 2011-2021

- FIGURE 28 PATENTS REGISTERED IN BLACK PHOSPHORUS MARKET, 2011-2021

- FIGURE 29 PATENT PUBLICATION TRENDS, 2011-2021

- FIGURE 30 LEGAL STATUS OF PATENTS FILED IN BLACK PHOSPHORUS MARKET

- 6.10.3 JURISDICTION ANALYSIS

- FIGURE 31 MAXIMUM PATENTS FILED IN JURISDICTION OF US

- 6.10.4 TOP APPLICANTS

- FIGURE 32 SEMICONDUCTOR ENERGY LAB REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2011 AND 2021

- TABLE 14 LIST OF PATENTS BY SEMICONDUCTOR ENERGY LAB

- TABLE 15 LIST OF PATENTS BY PIONEER HI-BRED INTERNATIONAL

- TABLE 16 LIST OF PATENTS BY FUJIFILM CORPORATION

- TABLE 17 TOP 10 PATENT OWNERS IN US, 2011-2021

7 BLACK PHOSPHOROUS MARKET, BY FORM

- 7.1 INTRODUCTION

- FIGURE 33 CRYSTAL FORM TO DOMINATE BLACK PHOSPHORUS MARKET DURING FORECAST PERIOD

- TABLE 18 BLACK PHOSPHOROUS MARKET SIZE, BY FORM, 2017-2020 (KILOGRAM)

- TABLE 19 BLACK PHOSPHOROUS MARKET SIZE, BY FORM, 2021-2027 (KILOGRAM)

- TABLE 20 BLACK PHOSPHOROUS MARKET SIZE, BY FORM, 2017-2020 (USD THOUSAND)

- TABLE 21 BLACK PHOSPHOROUS MARKET SIZE, BY FORM, 2021-2027 (USD THOUSAND)

- 7.2 CRYSTAL

- 7.2.1 HIGH DEMAND FROM ELECTRONIC DEVICES AND SENSORS SEGMENTS TO DRIVE MARKET

- 7.3 POWDER

- 7.3.1 INCREASING USE IN BIOMEDICAL APPLICATIONS TO BOOST MARKET

8 BLACK PHOSPHORUS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 34 ELECTRONIC DEVICES SEGMENT TO DOMINATE BLACK PHOSPHORUS MARKET DURING FORECAST PERIOD

- TABLE 22 BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOGRAM)

- TABLE 23 BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOGRAM)

- TABLE 24 BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 25 BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (USD THOUSAND)

- 8.2 ELECTRONIC DEVICES

- 8.2.1 HIGH MOBILITY, IN-PLANE ANISOTROPY, AND DIRECT BAND GAP TO DRIVE MARKET

- TABLE 26 ELECTRONIC DEVICES: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2017-2020 (KILOGRAM)

- TABLE 27 ELECTRONIC DEVICES: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2021-2027 (KILOGRAM)

- TABLE 28 ELECTRONIC DEVICES: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2017-2020 (USD THOUSAND)

- TABLE 29 ELECTRONIC DEVICES: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2021-2027 (USD THOUSAND)

- 8.3 SENSORS

- 8.3.1 INCREASING DEMAND FOR GAS SENSORS TO MONITOR AIR QUALITY TO BOOST MARKET

- TABLE 30 SENSORS: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2017-2020 (KILOGRAM)

- TABLE 31 SENSORS: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2021-2027 (KILOGRAM)

- TABLE 32 SENSORS: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2017-2020 (USD THOUSAND)

- TABLE 33 SENSORS: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2021-2027 (USD THOUSAND)

- 8.4 ENERGY STORAGE

- 8.4.1 GROWING INVESTMENTS IN RENEWABLE ENERGY TO SUPPORT MARKET GROWTH

- TABLE 34 ENERGY STORAGE: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2017-2020 (KILOGRAM)

- TABLE 35 ENERGY STORAGE: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2021-2027 (KILOGRAM)

- TABLE 36 ENERGY STORAGE: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2017-2020 (USD THOUSAND)

- TABLE 37 ENERGY STORAGE: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2021-2027 (USD THOUSAND)

- 8.5 OTHERS

- TABLE 38 OTHER APPLICATIONS: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2017-2020 (KILOGRAM)

- TABLE 39 OTHER APPLICATIONS: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2021-2027 (KILOGRAM)

- TABLE 40 OTHER APPLICATIONS: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2017-2020 (USD THOUSAND)

- TABLE 41 OTHER APPLICATIONS: BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2021-2027 (USD THOUSAND)

9 BLACK PHOSPHORUS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 35 NORTH AMERICA TO LEAD BLACK PHOSPHORUS MARKET DURING FORECAST PERIOD

- TABLE 42 BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2017-2020 (KILOGRAM)

- TABLE 43 BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2021-2027 (KILOGRAM)

- TABLE 44 BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2017-2020 (USD THOUSAND)

- TABLE 45 BLACK PHOSPHORUS MARKET SIZE, BY REGION, 2021-2027 (USD THOUSAND)

- 9.2 ASIA PACIFIC

- FIGURE 36 ASIA PACIFIC: BLACK PHOSPHORUS MARKET SNAPSHOT

- 9.2.1 ASIA PACIFIC: BLACK PHOSPHORUS MARKET, BY APPLICATION

- TABLE 46 ASIA PACIFIC: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOGRAM)

- TABLE 47 ASIA PACIFIC: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOGRAM)

- TABLE 48 ASIA PACIFIC: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 49 ASIA PACIFIC: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (USD THOUSAND)

- 9.2.2 ASIA PACIFIC: BLACK PHOSPHORUS MARKET, BY COUNTRY

- TABLE 50 ASIA PACIFIC: BLACK PHOSPHORUS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOGRAM)

- TABLE 51 ASIA PACIFIC: BLACK PHOSPHORUS MARKET SIZE, BY COUNTRY, 2021-2027 (KILOGRAM)

- TABLE 52 ASIA PACIFIC: BLACK PHOSPHORUS MARKET SIZE, BY COUNTRY, 2017-2020 (USD THOUSAND)

- TABLE 53 ASIA PACIFIC: BLACK PHOSPHORUS MARKET SIZE, BY COUNTRY, 2021-2027 (USD THOUSAND)

- 9.2.2.1 China

- 9.2.2.1.1 Large consumer base to fuel market

- 9.2.2.1 China

- TABLE 54 CHINA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOGRAM)

- TABLE 55 CHINA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOGRAM)

- TABLE 56 CHINA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 57 CHINA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (USD THOUSAND)

- 9.2.2.2 Japan

- 9.2.2.2.1 Electric passenger cars to drive demand for black phosphorus

- 9.2.2.2 Japan

- TABLE 58 JAPAN: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOGRAM)

- TABLE 59 JAPAN: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOGRAM)

- TABLE 60 JAPAN: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 61 JAPAN: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (USD THOUSAND)

- 9.2.2.3 South Korea

- 9.2.2.3.1 Increasing FDI to generate high demand from end-use industries

- 9.2.2.3 South Korea

- TABLE 62 SOUTH KOREA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOGRAM)

- TABLE 63 SOUTH KOREA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOGRAM)

- TABLE 64 SOUTH KOREA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 65 SOUTH KOREA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (USD THOUSAND)

- 9.3 NORTH AMERICA

- FIGURE 37 NORTH AMERICA: BLACK PHOSPHORUS MARKET SNAPSHOT

- 9.3.1 NORTH AMERICA: BLACK PHOSPHORUS MARKET, BY APPLICATION

- TABLE 66 NORTH AMERICA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOGRAM)

- TABLE 67 NORTH AMERICA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOGRAM)

- TABLE 68 NORTH AMERICA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 69 NORTH AMERICA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (USD THOUSAND)

- 9.3.2 NORTH AMERICA: BLACK PHOSPHORUS MARKET, BY COUNTRY

- TABLE 70 NORTH AMERICA: BLACK PHOSPHORUS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOGRAM)

- TABLE 71 NORTH AMERICA: BLACK PHOSPHORUS MARKET SIZE, BY COUNTRY, 2021-2027 (KILOGRAM)

- TABLE 72 NORTH AMERICA: BLACK PHOSPHORUS MARKET SIZE, BY COUNTRY, 2017-2020 (USD THOUSAND)

- TABLE 73 NORTH AMERICA: BLACK PHOSPHORUS MARKET SIZE, BY COUNTRY, 2021-2027 (USD THOUSAND)

- 9.3.2.1 US

- 9.3.2.1.1 Growing automotive industry and strong customer base to boost market

- 9.3.2.1 US

- TABLE 74 US: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOGRAM)

- TABLE 75 US: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOGRAM)

- TABLE 76 US: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 77 US: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (USD THOUSAND)

- 9.3.2.2 Mexico

- 9.3.2.2.1 Increasing industrialization to drive market

- 9.3.2.2 Mexico

- TABLE 78 MEXICO: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOGRAM)

- TABLE 79 MEXICO: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOGRAM)

- TABLE 80 MEXICO: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 81 MEXICO: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (USD THOUSAND)

- 9.3.2.3 Canada

- 9.3.2.3.1 Rising demand from electronic devices and sensors segments to boost market

- 9.3.2.3 Canada

- TABLE 82 CANADA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOGRAM)

- TABLE 83 CANADA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOGRAM)

- TABLE 84 CANADA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 85 CANADA: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (USD THOUSAND)

- 9.4 EUROPE

- FIGURE 38 EUROPE: BLACK PHOSPHORUS MARKET SNAPSHOT

- 9.4.1 EUROPE: BLACK PHOSPHORUS MARKET, BY APPLICATION

- TABLE 86 EUROPE: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOGRAM)

- TABLE 87 EUROPE: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOGRAM)

- TABLE 88 EUROPE: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 89 EUROPE: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (USD THOUSAND)

- 9.4.2 EUROPE: BLACK PHOSPHORUS MARKET, BY COUNTRY

- TABLE 90 EUROPE: BLACK PHOSPHORUS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOGRAM)

- TABLE 91 EUROPE: BLACK PHOSPHORUS MARKET SIZE, BY COUNTRY, 2021-2027 (KILOGRAM)

- TABLE 92 EUROPE: BLACK PHOSPHORUS MARKET SIZE, BY COUNTRY, 2017-2020 (USD THOUSAND)

- TABLE 93 EUROPE: BLACK PHOSPHORUS MARKET SIZE, BY COUNTRY, 2021-2027 (USD THOUSAND)

- 9.4.2.1 Germany

- 9.4.2.1.1 Increasing demand from energy storage and sensors segments to drive market

- 9.4.2.1 Germany

- TABLE 94 GERMANY: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOGRAM)

- TABLE 95 GERMANY: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOGRAM)

- TABLE 96 GERMANY: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 97 GERMANY: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (USD THOUSAND)

- 9.4.2.2 France

- 9.4.2.2.1 Strong workforce, excellent industrial hub, and presence of international companies to drive market

- 9.4.2.2 France

- TABLE 98 FRANCE: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOGRAM)

- TABLE 99 FRANCE: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOGRAM)

- TABLE 100 FRANCE: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 101 FRANCE: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (USD THOUSAND)

- 9.4.2.3 UK

- 9.4.2.3.1 Government policies to promote sales of electric vehicles

- 9.4.2.3 UK

- TABLE 102 UK: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOGRAM)

- TABLE 103 UK: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOGRAM)

- TABLE 104 UK: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 105 UK: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (USD THOUSAND)

- 9.5 REST OF WORLD

- 9.5.1 REST OF WORLD: BLACK PHOSPHORUS MARKET, BY APPLICATION

- TABLE 106 REST OF WORLD: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOGRAM)

- TABLE 107 REST OF WORLD: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOGRAM)

- TABLE 108 REST OF WORLD: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2017-2020 (USD THOUSAND)

- TABLE 109 REST OF WORLD: BLACK PHOSPHORUS MARKET SIZE, BY APPLICATION, 2021-2027 (USD THOUSAND)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 110 OVERVIEW OF STRATEGIES ADOPTED BY KEY BLACK PHOSPHORUS MANUFACTURERS

- 10.3 MARKET SHARE ANALYSIS

- 10.3.1 RANKING OF KEY MARKET PLAYERS, 2021

- FIGURE 39 RANKING OF TOP 5 PLAYERS IN BLACK PHOSPHORUS MARKET, 2021

- 10.3.2 MARKET SHARE OF KEY PLAYERS

- TABLE 111 BLACK PHOSPHORUS MARKET: DEGREE OF COMPETITION

- FIGURE 40 OSSILA LTD. LED BLACK PHOSPHORUS MARKET IN 2021

- 10.3.2.1 Ossila Ltd.

- 10.3.2.2 Merck

- 10.3.2.3 Nanochemazone

- 10.3.2.4 American Elements

- 10.3.2.5 ACS Material, LLC

- 10.3.3 REVENUE ANALYSIS OF TOP 5 PLAYERS

- FIGURE 41 REVENUE ANALYSIS OF TOP 5 COMPANIES IN LAST 5 YEARS

- 10.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

- FIGURE 42 BLACK PHOSPHORUS MARKET: COMPANY FOOTPRINT

- TABLE 112 BLACK PHOSPHORUS MARKET: APPLICATION FOOTPRINT

- TABLE 113 BLACK PHOSPHORUS MARKET: FORM FOOTPRINT

- TABLE 114 BLACK PHOSPHORUS MARKET: COMPANY REGION FOOTPRINT

- 10.5 COMPANY EVALUATION QUADRANT (TIER 1)

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PARTICIPANTS

- FIGURE 43 TIER 1 COMPANY EVALUATION QUADRANT FOR BLACK PHOSPHORUS MARKET

- 10.6 COMPETITIVE BENCHMARKING

- TABLE 115 BLACK PHOSPHORUS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 116 BLACK PHOSPHORUS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 10.7 START-UP/SME EVALUATION QUADRANT

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 STARTING BLOCKS

- FIGURE 44 START-UP/SME EVALUATION QUADRANT FOR BLACK PHOSPHORUS MARKET

- 10.8 COMPETITIVE SITUATIONS & TRENDS

- 10.8.1 DEALS

- TABLE 117 BLACK PHOSPHORUS MARKET: DEALS (2018-2022)

11 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 11.1 OSSILA LTD.

- TABLE 118 OSSILA LTD.: COMPANY OVERVIEW

- 11.2 ACS MATERIAL, LLC

- TABLE 119 ACS MATERIAL, LLC: COMPANY OVERVIEW

- 11.3 NANOCHEMAZONE

- TABLE 120 NANOCHEMAZONE: COMPANY OVERVIEW

- 11.4 AMERICAN ELEMENTS

- TABLE 121 AMERICAN ELEMENTS: COMPANY OVERVIEW

- 11.5 MERCK

- TABLE 122 MERCK: COMPANY OVERVIEW

- 11.6 HQ GRAPHENE

- TABLE 123 HQ GRAPHENE: COMPANY OVERVIEW

- 11.7 HUNAN AZEAL MATERIALS CO. LTD.

- TABLE 124 HUNAN AZEAL MATERIALS CO. LTD.: COMPANY OVERVIEW

- 11.8 STANFORD ADVANCED MATERIALS

- TABLE 125 STANFORD ADVANCED MATERIALS: COMPANY OVERVIEW

- 11.9 MANCHESTER NANOMATERIALS

- TABLE 126 MANCHESTER NANOMATERIALS: COMPANY OVERVIEW

- 11.10 NANJING XFNANO MATERIALS TECH CO. LTD

- TABLE 127 NANJING XFNANO MATERIALS TECH CO. LTD.: COMPANY OVERVIEW

- 11.11 WEISTRON CO. LTD.

- TABLE 128 WEISTRON CO. LTD.: COMPANY OVERVIEW

- 11.12 TAIZHOU SUNANO ENERGY CO., LTD.

- TABLE 129 TAIZHOU SUNANO ENERGY CO., LTD.: COMPANY OVERVIEW

- 11.13 ULTRANANOTECH PRIVATE LIMITED

- TABLE 130 ULTRANANOTECH PRIVATE LIMITED.: COMPANY OVERVIEW

- 11.14 SMART ELEMENTS

- TABLE 131 SMART ELEMENTS: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 ELECTRONIC CHEMICALS AND MATERIALS MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 ELECTRONIC CHEMICALS AND MATERIALS MARKET, BY REGION

- TABLE 132 ELECTRONIC CHEMICALS AND MATERIALS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

- 12.3.3.1 North America

- TABLE 133 NORTH AMERICA: ELECTRONIC CHEMICALS AND MATERIALS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

- 12.3.3.2 Europe

- TABLE 134 EUROPE: ELECTRONIC CHEMICALS AND MATERIALS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

- 12.3.3.3 APAC

- TABLE 135 APAC: ELECTRONIC CHEMICALS AND MATERIALS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

- 12.3.3.4 Rest of World

- TABLE 136 ROW: ELECTRONIC CHEMICALS AND MATERIALS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS