|

|

市場調査レポート

商品コード

1390177

黒リンの世界市場:2023年~2030年Global Black Phosphorus Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 黒リンの世界市場:2023年~2030年 |

|

出版日: 2023年12月05日

発行: DataM Intelligence

ページ情報: 英文 192 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

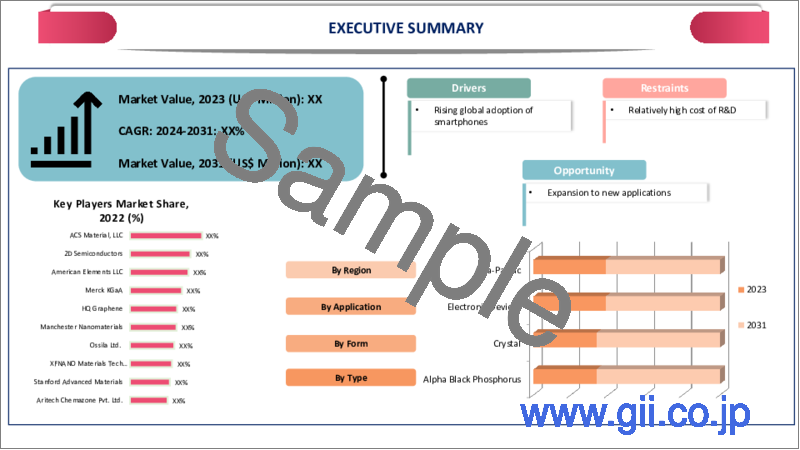

世界の黒リン市場は、2022年に1,310万米ドルに達し、2030年までには9,120万米ドルに達すると予測され、予測期間中の2023年から2030年のCAGRは27.5%で成長すると予想されています。

オプトエレクトロニクスは、黒リンを使った進歩から大きな恩恵を受けています。黒リンは、その卓越した光学特性により、光起電力システム、LED、フォトディテクタに用途されています。先進的なオプトエレクトロニクスデバイスのニーズが高まり続ける中、黒リンはこれらの用途で重要な役割を果たすと予想されています。

高度な電気デバイスやオプトエレクトロニクス用途は、調整可能なバンドギャップや高いキャリア移動度など、黒リンの特殊な電子的・光学的特徴から利益を得ています。LED、光検出器、トランジスタなどのデバイスがこれに含まれます。高性能でエネルギー効率の高い電子部品へのニーズが高まるにつれ、黒リンはさまざまな産業で有用性を増し、市場拡大の原動力となっています。

北米は電子、半導体、技術開拓産業が発達しているため、黒リン世界市場の1/3以上を占める新興国市場の一つです。同地域の産業は、黒リンのような高性能材料の消費者需要が高まるにつれて、黒リンのような高性能材料を受け入れ、商品や手順に取り入れるのに理想的な立場にあります。

ダイナミクス

研究と投資の増加

新材料の開発と用途に特化した研究への投資は、世界の黒リン業界にとって有益です。大学、研究所、営利企業は黒リンの可能性を積極的に調査しており、その結果、合成手順の改善、拡張可能な製造方法、黒リンの特徴の理解が進んでいます。この材料が経済的に実現可能なものとなり、より幅広い用途に使われるようになるためには、このような知識の蓄積が不可欠です。

黒リンをベースとした商品の開発と商業化を進めるために必要な資源は、黒リンに関連する新興企業やビジネスへの投資、また学術界と企業とのパートナーシップを通じて提供されます。世界的に黒リン産業が拡大し、多様性を増しているのは、このような研究活動に基づくものです。

広がるエレクトロニクスとオプトエレクトロニクスの用途

黒リンの驚異的な電気的・光学的特性は多くの関心を呼び、世界の市場の大きな力となっています。次世代の電子デバイスは、この材料の高いキャリア移動度、調整可能なバンドギャップ、優れた導電性から恩恵を受けると思われます。さらに黒リンは、光検出器、LED、光起電力など、オプトエレクトロニクス用途で優れた性能を発揮します。

黒リンが提供する利点は、先端技術への広範な用途をもたらしました。利用が増加したことで、この材料に対する需要が急増し、特にオプトエレクトロニクスとエレクトロニクスの分野で新たな市場の展望が開かれました。民生用電子機器、データセンター、通信などの産業が拡大し、性能の向上が求められる中、黒リンはこれらの用途で極めて重要な位置を占めると予想されます。

例えば、2020年に英国王立化学会によると、黒リン(BP)はフォスフォレンと呼ばれる2次元層が積み重なった組織構造を持つ結晶性物質と説明されています。BPの線熱膨張係数(LTEC)を理解することは、材料の異方的な熱特性や剥離プロセスに関するより良い洞察を得る助けとなるため、2次元材料の領域において重要な意義を持ちます。

安全性と健康上の問題

黒リンには有害な成分が含まれているため、黒リンの製造と取り扱いには安全性と健康上の問題が生じる可能性があります。リンの種類によっては、特に黒リンにさらされると健康に害を及ぼす可能性があります。黒リンの使用や商業化は、特に厳しい安全要件が設けられている分野では、毒性の可能性によって制約を受けます。

そのため、黒リンの製造・加工時に発生する廃棄物の確実な管理・処分に努めており、その結果、利用の複雑さと費用が増大しています。さまざまな用途で黒リンの利用を増やすには、こうした毒性と安全性の問題に対処することが不可欠です。

高い生産コスト

このような生産上の問題は、商業用途での黒リンの広範な利用を妨げ、半導体や電子機器製造のような確固たる分野で、シリコンを含む他の材料と競合する能力を低下させる可能性があります。黒リンがより広く使用されるためには、こうした拡張性と製造上の制約を取り除く必要があります。

さらに、拡張性と安価な製造は、黒リンが制約を受けている2つの分野です。液体剥離は伝統的な合成技術の一つですが、手間がかかり、収率も低いことがよくあります。高品質の黒リンを増産するのは極めて困難です。加えて、エネルギー使用や前駆体の使用など、生産コストが大きくなる可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 調査と投資の増加

- エレクトロニクスとオプトエレクトロニクスの用途拡大

- 抑制要因

- 安全性と健康問題

- 高い生産コスト

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMI意見

第6章 COVID-19分析

第7章 形状別

- 水晶

- パウダー

第8章 タイプ別

- アルファ黒リン

- ベータ黒リン

第9章 用途別

- 電子デバイス

- エネルギー貯蔵

- センサー

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- ACS Material, LLC

- 会社概要

- 事業ポートフォリオと概要

- 財務概要

- 主な発展

- 2D Semiconductors

- Nanochemazone

- American Elements LLC

- Merck KGaA

- HQ Graphene

- Hunan Azeal Materials Co. Ltd.

- Ossila Ltd.

- Stanford Advanced Materials

- Manchester Nanomaterials

第13章 付録

Overview

Global Black Phosphorus Market reached US$ 13.1 Million in 2022 and is expected to reach US$ 91.2 Million by 2030, growing with a CAGR of 27.5% during the forecast period 2023-2030.

Optoelectronics has benefited significantly from advancements made using black phosphorus. Black phosphorus finds application in photovoltaic systems, LEDs and photodetectors due to its exceptional optical characteristics. As the need for advanced optoelectronic devices continues to grow, black phosphorus is foreseen as a key player in these applications.

Advanced electrical devices and optoelectronic applications profit from the special electronic and optical features of black phosphorus, including its adjustable bandgap and high carrier mobility. Devices like LEDs, photodetectors and transistors are included in this. Black phosphorus is becoming more useful in various industries and driving market expansion as the need for high-performance and energy-efficient electronic components rises.

North America is among the growing regions in the global black phosphorus market covering more than 1/3rd of the market due to the electronics, semiconductor and technology development industries being well-developed in North America. Industries in the region are in an ideal position to embrace and incorporate high-performance materials like black phosphorus into their goods and procedures as consumer demand for such materials rises.

Dynamics

Increasing Research and Investment

The development of new materials and investments in application-specific research is beneficial to the globally black phosphorus industry. Universities, research centers and commercial businesses are actively investigating the potential of black phosphorus, which is resulting in improvements in synthesis procedures, scalable manufacturing methods and a greater comprehension of its features. For the material to become financially feasible and have a wider range of uses, this corpus of knowledge is essential.

The resources needed to further the development and commercialization of goods based on black phosphorus are made available through investments in start-ups and businesses related to the substance as well as partnerships between academics and businesses. The globally black phosphorus industry is expanding and becoming more diverse because of these research-based activities.

Expanding Electronics and Optoelectronics Applications

The incredible electrical and optical qualities, of black phosphorus, have generated a lot of interest and are a major force in the globally market. Next-generation electronic devices would benefit from the material's high carrier mobility, tunable bandgap and great electrical conductivity. Moreover, it has outstanding performance in photodetectors, LEDs and photovoltaics, among other optoelectronic applications.

The advantages offered by black phosphorus have resulted in its extensive application in advanced technologies. The increased utilization has generated a surge in demand for the material, opening up fresh market prospects, especially in the fields of optoelectronics and electronics. As industries like consumer electronics, data centers and telecommunications undergo expansion and seek enhanced performance, black phosphorus is anticipated to assume a pivotal position within these applications.

For Instance, in 2020, as per the Royal Society of Chemistry, black phosphorus (BP) was described as a crystalline substance with an organized structure comprising stacked two-dimensional layers known as Phosphorene. Understanding the linear thermal expansion coefficients (LTEC) of BP holds significant importance in the realm of 2D materials, as it aids in gaining better insights into the material's anisotropic thermal characteristics and the process of exfoliation.

Safety and Health Issues

There may be safety and health issues while producing and handling black phosphorus since it includes harmful components. It can be harmful to your health to be exposed to some types of phosphorus, especially black phosphorus. The usage and commercialization of black phosphorus are constrained by the possibility of toxicity, particularly in sectors where stringent safety requirements are in place.

As a result, efforts are being undertaken to ensure the secure management and disposal of waste products produced during the production and processing of black phosphorus, which increases the utilization's complexity and expense. To increase the use of black phosphorus in different applications, it is essential to address these toxicity and safety issues.

High Cost of Production

These production issues obstruct the material's extensive use in commercial applications and might reduce its ability to compete with other materials, including silicon, in firmly established sectors like semiconductor and electronics manufacture. For black phosphorus to be used more widely, these scalability and manufacturing limitations must be removed.

Additionally, Scalability and inexpensive manufacturing are two areas where black phosphorus has constraints. Liquid exfoliation is one of the traditional synthesis techniques, however, it is labor-intensive and often provides low yields. It is extremely difficult to increase the production of high-quality black phosphorus. In addition, the cost of production might be significant, including that of energy use and precursors.

Segment Analysis

The global black phosphorus market is segmented based on form, type, application and region.

Increasing Use of Powder Form in Semiconductors and Electronic Products

Powder segment is among the growing regions in the global black phosphorus market covering more than 1/3rd of the market. Due to its numerous uses in electronics, optoelectronics and energy storage, black phosphorus in powder form is rising in popularity. Due to its distinctive characteristics, including high carrier mobility and a configurable bandgap, it is in significant demand in the semiconductor, photoelectronic and battery sectors.

The market for black phosphorus in powder form is also being driven by the rising demand for next-generation electronic gadgets as well as the development of cutting-edge technologies like flexible electronics and quantum computing. Significant growth drivers include the material's outstanding performance in various applications and its potential to develop high-performance gadgets.

Geographical Penetration

Increasing Demand for High-Performance and Energy-Efficient Electronic Devices in North America

North America has been a dominant force in the global black phosphorus market and the demand for novel materials like black phosphorus is driven by the increasing demand for high-performance and energy-efficient electronic devices as well as developments in fields like 5G technology, AI and data centers. The market for black phosphorus in North America is probably going to rise significantly as these sectors expand.

For Instance, in 2022, Phosphorus, the top producer of proactive and comprehensive security for the extended Internet of Things (xIoT), has collaborated with Alchemy Technology Group, the top provider of IT advising, consultancy and reseller services in the sector. For Phosphorus in US market, Alchemy will serve as a value-added reseller (VAR). As a consequence of their recent cooperation, the two enterprises will jointly provide a new generation of xIoT security solutions in US. The partnership will satisfy the rising demand from businesses for xIoT attack surface management and remediation capabilities.

There has been a lot of study and development on black phosphorus in North America, especially in U.S. The material's special qualities and potential uses, such as in electronics, photonics and optoelectronics, are being intensively investigated by academic institutions, research organizations and technological companies.

For instance, in May 2022, scientists at NUS developed a 2-dimensional semiconductor constructed of black phosphorus with excellent carrier mobility. When its vacancy defects are reconfigured, this material displays an electrical self-passivation process that might increase its analogs and mobility. It is necessary for developing incredibly tiny, quick and energy-efficient optoelectronic devices.

North America is one of the most technologically advanced markets for optoelectronic components as a result of the region's substantial system suppliers, semiconductor enterprises and big LED, laser and sensor producers. The demand for black phosphorus is anticipated to rise due to the region's high quality of life and the fierce competition among military & aerospace, industrial and medical original equipment manufacturers (OEMs).

COVID-19 Impact Analysis

The COVID-19 pandemic has made a significant dent in the black phosphorus market globally. The pandemic's repercussions, including supply chain disruptions, lockdowns and decreased industrial activity, had an impact on both the supply and demand for black phosphorus. The supply of black phosphorus to various sectors was hampered as a result of the temporary reduction or shutdown of several industrial plants across the world.

For industries that depend on black phosphorus, such as electronics, optoelectronics and energy storage, this raised worries about future shortages and delays in product development and manufacturing. The pandemic also brought attention to the necessity of supply chain diversity and resilience.

Businesses and sectors that relied significantly on particular locations for acquiring black phosphorus started looking for alternatives to provide a more secure and consistent supply. The pandemic-driven shift in strategy may have long-term implications on the global black phosphorus market as businesses work to build stronger, more adaptable supply chains to avert future disruptions.

The global black phosphorus market will continue to adjust to these new dynamics as the world navigates the ongoing challenges brought on by the pandemic and stakeholders will remain vigilant in addressing potential fluctuations in supply and demand, reflecting the broader impact of the COVID-19 crisis on international trade and industry.

Russia-Ukraine War Impact Analysis

Supply lines have been hampered by the fighting, raising worries about possible shortages and raising black phosphorus costs. Because of its instability, businesses that rely on black phosphorus, such as the semiconductor and electronics sectors, which use it in a range of applications, including transistors and optoelectronics, are under pressure.

As a result, it has a negative impact on the supply chain of important raw materials, the Russia-Ukraine war has had an important impact on the world market for black phosphorus. Ukraine in particular is an important supply of phosphotes, which are necessary for the manufacture of black phosphorus.

Additionally, the lack of clarity surrounding commercial connections and export laws has increased due to the geopolitical tensions between Russia and Ukraine. Consumers of black phosphorus have been encouraged by this volatility to look for alternate sources or diversify their supply chains to reduce possible interruptions. As a result, several black phosphorus producers are looking at ways to find substitute supplies and lessen their reliance on conflict-affected areas.

By Form

- Crystal

- Powder

By Type

- Alpha Black Phosphorus

- Beta Black Phosphorus

By Application

- Electronic Devices

- Energy Storage

- Sensors

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On May 04, 2021, A scientific and technology business called Merck partnered with Topco Scientific to employ more environmentally friendly and sustainable materials in the electrical sector. The collaboration gives scientists and academics at Universitas Indonesia access to professionals from both firms as well as knowledge and expertise transfer through mentoring and workshop series. It is anticipated that this partnership would boost demand for black phosphorus.

- On April 07, 2022, PHOSPHEA launched HumIPHORA, a ground-breaking advancement in the phosphate industry. After six years of internal research and development, a novel feed ingredient that satisfies the demands of the grill market has been created: the new and patented mineral complex. PHOSPHEA'S Evolution line now includes HumIPHORA. The European Animal Feed Register has this calcium hum phosphate on its list (008979-EN). PHOSPHEA delivers a phosphate that is high quality and aids in improved utilization of other nutrients, most especially phosphorus derived from plants, for the first time on the market.

Competitive Landscape

The major global players in the market include: ACS Material, LLC, 2D Semiconductors, Nanochemazone, American Elements LLC, Merck KGaA, HQ Graphene, Hunan Azeal Materials Co. Ltd., Ossila Ltd., Stanford Advanced Materials and Manchester Nanomaterials.

Why Purchase the Report?

- To visualize the global black phosphorus market segmentation based on form, type, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of black phosphorus market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global black phosphorus market report would provide approximately 61 tables, 56 figures and 192 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Form

- 3.2. Snippet by Type

- 3.3. Snippet by Application

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing Research and Investment

- 4.1.1.2. Expanding Electronics and Optoelectronics Applications

- 4.1.2. Restraints

- 4.1.2.1. Safety and Health Issues

- 4.1.2.2. High Cost of Production

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Form

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 7.1.2. Market Attractiveness Index, By Form

- 7.2. Crystal*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Powder

8. By Type

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 8.1.2. Market Attractiveness Index, By Type

- 8.2. Alpha Black Phosphorus*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Beta Black Phosphorus

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Electronic Devices*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Energy Storage

- 9.4. Sensors

- 9.5. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Russia

- 10.3.6.5. Spain

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. ACS Material, LLC*

- 12.1.1. Company Overview

- 12.1.2. Form Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. 2D Semiconductors

- 12.3. Nanochemazone

- 12.4. American Elements LLC

- 12.5. Merck KGaA

- 12.6. HQ Graphene

- 12.7. Hunan Azeal Materials Co. Ltd.

- 12.8. Ossila Ltd.

- 12.9. Stanford Advanced Materials

- 12.10. Manchester Nanomaterials

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us