|

|

市場調査レポート

商品コード

1146593

グリーンコーティングの世界市場:技術別 (水性、粉体、ハイソリッド、放射線硬化)・用途別 (建築、自動車、工業、高性能、木材、包装、製品仕上げ)・地域別の将来予測 (2027年まで)Green Coatings Market by Technology (Waterborne, Powder, High-solids, Radiation-Cure), Application (Architectural, Automotive, Industrial, High-Performance, Wood, Packaging, Product Finishes) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| グリーンコーティングの世界市場:技術別 (水性、粉体、ハイソリッド、放射線硬化)・用途別 (建築、自動車、工業、高性能、木材、包装、製品仕上げ)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年10月21日

発行: MarketsandMarkets

ページ情報: 英文 239 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

グリーンコーティング市場は、2022年の1,236億米ドルから2027年には1,559億米ドルへと、2022年から2027年の間に4.8%のCAGRで成長すると予測されています。

一方、グリーンコーティングに必要な特殊な原材料の入手可能性やコストの問題が、市場成長の妨げとなる可能性もあります。

"建築分野:グリーンコーティング市場の最大のセグメント"

現在、建築用塗料の原材料の代替、品質、性能、コストに関心が集まっており、そこでグリーンコーティングが注目されています。さまざまな開発活動により、粉体塗料用樹脂にさまざまなグリーンビルディングブロックが使用できるようになり、慎重に配合することで、求められる性能を発揮できるようになりました。また、グリーンソリューションを専門に扱う塗料メーカーもあり、グリーンソリューションを推進する動きもあります。

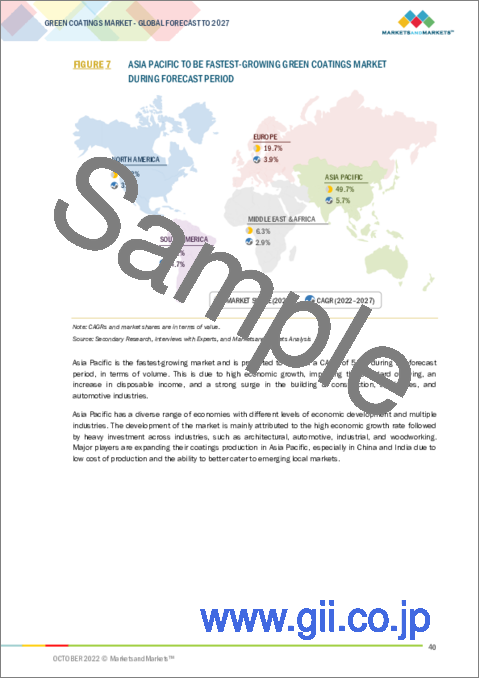

"アジア太平洋:予測期間中に最も急速に成長するグリーン・コーティング市場"

アジア太平洋地域の力強い成長は、高い経済成長率に続いて、自動車、消費財・家電、建築・建設、家具など、さまざまな用途分野での大規模な投資が主な要因となっています。生産コストが低く、現地の新興市場により良いサービスを提供できるため、メーカーはこの地域に拠点を移しつつあります。この地域では、消費者の購買力向上に伴い、高級車に対する需要が高まっています。また、この地域の自動車産業への大規模な投資は、グリーンコーティングの需要を促進しています。

当レポートでは、世界のグリーンコーティングの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、技術別・用途別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- マクロ指標分析

- イントロダクション

- GDPの動向と予測

- 世界の建設業の動向と予測

- 世界の自動車産業の動向

- バリューチェーン分析

- 価格分析

- グリーンコーティングのエコシステムと相互接続された市場

- 顧客のビジネスに影響を与えるトレンドと混乱

- 貿易分析

- 規則

- 特許分析

- ケーススタディ分析

- 技術分析

- 主な会議とイベント (2022年~2023年)

- 関税と規制の状況

第6章 グリーンコーティング市場:技術別

- イントロダクション

- 水性塗料

- 粉体塗料

- ハイソリッドコーティング

- 放射線硬化塗料

第7章 グリーンコーティング市場:用途別

- イントロダクション

- 建築用コーティング

- 自動車用コーティング

- 工業用コーティング

- 高性能コーティング

- 木材用コーティング

- 包装用コーティング

- 製品仕上げ用

第8章 グリーンコーティング市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- インドネシア

- タイ

- 韓国

- 他のアジア太平洋諸国

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- イタリア

- トルコ

- スペイン

- 他の欧州諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- アラブ首長国連邦

- 他の中東・アフリカ諸国

第9章 競合情勢

- 概要

- 企業評価クアドラント・マトリックス:定義と方法論 (2021年)

- 中小企業 (SME) マトリックス (2021年)

- 市場シェア分析

- 収益分析

- ランキング分析

- 競合ベンチマーキング

- 競合状況・動向

第10章 企業プロファイル

- 主要企業

- AKZONOBEL N.V.

- AXALTA COATING SYSTEMS, LLC

- BASF SE

- PPG INDUSTRIES, INC.

- THE SHERWIN-WILLIAMS COMPANY

- ASIAN PAINTS LIMITED

- BERGER PAINTS INDIA LIMITED

- HEMPEL A/S

- JOTUN A/S

- DAW SE

- その他の企業

- KANSAI PAINT CO. LTD.

- MASCO CORPORATION

- RPM INTERNATIONAL INC.

- LIFETIME GREEN COATINGS

- DSM

- EVONIK INDUSTRIES AG

- EASTMAN CHEMICAL COMPANY

- NIPPON PAINT HOLDINGS CO., LTD.

- CHENYANG GROUP LTD

- CIRANOVA

- CORTEC CORPORATION

- ECO SAFETY PRODUCTS

- TEKNOS GROUP

- STAHL HOLDINGS B.V.

第11章 隣接/関連市場

- イントロダクション

- 制限事項

- バイオベース・コーティング市場

第12章 付録

The Green coatings market is projected to grow from USD 123.6 Billion in 2022 to USD 155.9 Billion by 2027, at a CAGR of 4.8% between 2022 and 2027. The restraints related to the use of Green coatings market is availability and cost of specialized raw materials needed for green coatings.

" Architectural segment is estimated to be the largest segment of the Green coatings market."

Various structures on which coatings are applied have different types of requirements in terms of aesthetics and protective properties. These can include pollution, heavy foot traffic in public buildings, and regional climatic conditions (such as heavy rain and snow). Architectural paints and coatings help protect these structures with their properties, such as color and gloss retention, chemical and abrasion resistance, non-toxicity, and corrosion resistance. There is an interest in alternative of raw materials, the quality, performance, and cost of architectural coatings, where green coatings come into picture. Different development activities have led to various green building blocks becoming available for use in powder coating resins which, with careful formulation, can deliver the required performance. There is also a drive for green solutions with some paint companies which are specializing in these solutions.

"Asia Pacific is forecasted to be the fastest-growing Green coatings market during the forecast period."

The strong growth in the Asia Pacific region is mainly attributed to the high economic growth rate, followed by heavy investment across different application areas, such as automotive, consumer goods & appliances, building & construction, and furniture. Owing to the low cost of production and the ability to better serve the local emerging market, manufacturers are shifting their base to the region. The region is witnessing an increased demand for high-end cars due to the increasing purchasing power of consumers. Similarly, large-scale investments in the automobile sector in the region are driving the demand for green coatings.

Extensive primary interviews have been conducted, and information has been gathered from secondary research to determine and verify the market size of several segments and sub-segments.

Breakdown of Primary Interviews:

- By Company Type: Tier 1 - 46%, Tier 2 - 36%, and Tier 3 - 18%

- By Designation: C Level - 18%, D Level - 27%, and Others - 55%

- By Region: Asia Pacific - 55%, North America - 18%, Europe - 9%, South America-9%, and the Middle East & Africa - 9%

The key companies profiled in this report are AkzoNobel N.V. (Netherlands), PPG Industries (US), Axalta Coating Systems (US), BASF SE (Germany), and The Sherwin-Williams Company (US).

Research Coverage:

Green Coatings Market by Technology (Waterborne, Powder, High-solids, Radiation-Cure), Application (Architectural, Automotive, Industrial, High-Performance, Wood, Packaging, Product Finishes) and Region (North America, Europe, Asia Pacific, South America, and Middle East & Africa).

Reasons to Buy the Report

From an insight perspective, this research report focuses on various levels of analyses - industry analysis (industry trends), market share analysis of top players, and company profiles, which together comprise and discuss the basic views on the competitive landscape; emerging and high-growth segments of the market; high growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on Green coatings offered by top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the market for Green coatings across regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 MARKET INCLUSIONS

- 1.2.2 MARKET EXCLUSIONS

- 1.3 MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 GREEN COATINGS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Primary data sources

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 4 GREEN COATINGS MARKET: DATA TRIANGULATION

- 2.4 ASSUMPTIONS & LIMITATIONS

- TABLE 1 RESEARCH ASSUMPTIONS

- TABLE 2 RESEARCH LIMITATIONS

- TABLE 3 RISK ANALYSIS

- 2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.6 PRICING ASSUMPTIONS

3 EXECUTIVE SUMMARY

- TABLE 4 GREEN COATINGS MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 5 WATERBORNE TYPE TO DOMINATE MARKET DURING FORECAST PERIOD (USD MILLION)

- FIGURE 6 ARCHITECTURAL APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 7 ASIA PACIFIC TO BE FASTEST-GROWING GREEN COATINGS MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GREEN COATINGS MARKET

- FIGURE 8 SIGNIFICANT DEMAND GROWTH EXPECTED FOR GREEN COATINGS DURING FORECAST PERIOD

- 4.2 GREEN COATINGS MARKET, BY TECHNOLOGY

- FIGURE 9 WATERBORNE TO REMAIN LARGEST SEGMENT OF GREEN COATINGS MARKET

- 4.3 ASIA PACIFIC: GREEN COATINGS MARKET, BY APPLICATION AND COUNTRY

- FIGURE 10 ARCHITECTURAL APPLICATION ACCOUNTED FOR LARGEST MARKET SHARE IN ASIA PACIFIC

- 4.4 GREEN COATINGS MARKET, BY DEVELOPED VS. EMERGING ECONOMIES

- FIGURE 11 CHINA TO ACCOUNT FOR LARGEST SHARE

- 4.5 GREEN COATINGS MARKET: MAJOR COUNTRIES

- FIGURE 12 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN GREEN COATINGS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing focus on health and sustainability to bring "going green" idea into greater limelight

- 5.2.1.2 Stringent environmental policies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Availability and cost of specialized raw materials needed for green coatings

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for renewable raw materials

- 5.2.3.2 Technological advancements for real-time in-process monitoring and control prior to formation of hazardous substances

- 5.2.3.3 Growing investments in emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 Development of synthetic technologies with little or no toxicity to human health and the environment

- 5.2.4.2 Designing of chemical products that do not persist in the environment after degradation

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 GREEN COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 14 GREEN COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP INDUSTRIES

- 5.4.2 BUYING CRITERIA

- FIGURE 16 KEY BUYING CRITERIA FOR GREEN COATINGS

- TABLE 7 KEY BUYING CRITERIA FOR GREEN COATINGS

- 5.5 MACROINDICATOR ANALYSIS

- 5.5.1 INTRODUCTION

- 5.5.2 GDP TRENDS AND FORECAST

- TABLE 8 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE, BY COUNTRY, 2019-2027

- 5.5.3 TRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

- FIGURE 17 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014-2035

- 5.5.4 TRENDS IN AUTOMOTIVE INDUSTRY

- TABLE 9 AUTOMOTIVE PRODUCTION, BY REGION, 2018-2021

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 18 GREEN COATINGS VALUE CHAIN

- FIGURE 19 GREEN COATINGS VALUE CHAIN: PLAYERS AT EACH NODE

- 5.7 PRICING ANALYSIS

- FIGURE 20 AVERAGE PRICE COMPETITIVENESS IN GREEN COATINGS MARKET, BY REGION

- FIGURE 21 AVERAGE PRICE COMPETITIVENESS IN GREEN COATINGS MARKET, BY TECHNOLOGY

- FIGURE 22 AVERAGE PRICE COMPETITIVENESS IN GREEN COATINGS MARKET, BY APPLICATION

- 5.8 GREEN COATINGS ECOSYSTEM AND INTERCONNECTED MARKETS

- TABLE 10 GREEN COATINGS MARKET: SUPPLY CHAIN

- FIGURE 23 PAINTS & COATINGS: ECOSYSTEM

- 5.9 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 TRADE ANALYSIS

- TABLE 11 COUNTRY-WISE EXPORT DATA, PAINTS, AND VARNISHES BASED ON SYNTHETIC OR CHEMICALLY MODIFIED POLYMERS DISPERSED AND DISSOLVED IN AQUEOUS MEDIUM, (2019-2021)

- TABLE 12 COUNTRY-WISE EXPORT DATA, PAINTS, AND VARNISHES BASED ON SYNTHETIC OR CHEMICALLY MODIFIED POLYMERS DISPERSED AND DISSOLVED IN NON-AQUEOUS MEDIUM, 2019-2021

- TABLE 13 COUNTRY-WISE IMPORT DATA, PAINTS, AND VARNISHES BASED ON SYNTHETIC OR CHEMICALLY MODIFIED POLYMERS DISPERSED AND DISSOLVED IN AQUEOUS MEDIUM, 2019 -2021

- TABLE 14 COUNTRY-WISE IMPORT DATA, PAINTS, AND VARNISHES BASED ON SYNTHETIC OR CHEMICALLY MODIFIED POLYMERS DISPERSED AND DISSOLVED IN NON-AQUEOUS MEDIUM, 2019-2021

- 5.11 REGULATIONS

- 5.11.1 COATINGS STANDARD

- TABLE 15 BASIC COATING SYSTEM REQUIREMENTS FOR DEDICATED SEAWATER BALLAST TANKS OF ALL TYPES OF SHIPS AND DOUBLE-SIDE SKIN SPACES OF BULK CARRIERS OF 150 METER AND UPWARD

- 5.11.2 MODEL LEAD PAINT LAW

- 5.12 PATENT ANALYSIS

- 5.12.1 METHODOLOGY

- 5.12.2 PUBLICATION TRENDS

- FIGURE 25 NUMBER OF PATENTS PUBLISHED, 2017-2022

- 5.12.3 TOP JURISDICTION

- FIGURE 26 PATENTS PUBLISHED BY JURISDICTION, 2021

- 5.12.4 TOP APPLICANTS

- FIGURE 27 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2021

- TABLE 16 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.13 CASE STUDY ANALYSIS

- 5.14 TECHNOLOGY ANALYSIS

- 5.15 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 17 GREEN COATINGS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.16 TARIFF AND REGULATORY LANDSCAPE

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 GREEN COATINGS MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- FIGURE 28 WATERBORNE COATINGS TO BE LARGEST TECHNOLOGY SEGMENT DURING FORECAST PERIOD

- TABLE 22 GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 23 GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 24 GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 25 GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- 6.2 WATERBORNE COATINGS

- 6.2.1 WATERBORNE COATINGS TO REPLACE SOLVENT-BORNE DOMINATED AREAS

- 6.2.2 TYPE

- FIGURE 29 TYPES OF WATERBORNE COATINGS

- 6.2.3 RESIN TYPES USED IN FORMULATION OF WATERBORNE COATINGS

- 6.2.4 APPLICATIONS OF WATERBORNE COATINGS

- 6.2.5 ADVANTAGES AND DISADVANTAGES OF WATERBORNE COATINGS

- FIGURE 30 DRIVERS AND RESTRAINTS IN WATERBORNE COATINGS MARKET

- TABLE 26 WATERBORNE COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 27 WATERBORNE COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 28 WATERBORNE COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 29 WATERBORNE COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 6.3 POWDER COATINGS

- 6.3.1 INCREASING ENVIRONMENTAL REGULATIONS FOR ZERO VOC COATINGS

- 6.3.2 TYPE

- FIGURE 31 TYPES OF POWDER COATINGS

- FIGURE 32 DRIVERS AND RESTRAINTS IN POWDER COATINGS MARKET

- TABLE 30 POWDER COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 31 POWDER COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 32 POWDER COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 33 POWDER COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 6.4 HIGH-SOLIDS COATINGS

- 6.4.1 AUTOMOTIVE SEGMENT TO INCREASE DEMAND FOR HIGH-SOLIDS COATINGS

- 6.4.1.1 Type

- FIGURE 33 TYPES OF HIGH-SOLIDS COATINGS

- 6.4.1.2 Application

- 6.4.1.2.1 Product finishing

- 6.4.1.2.2 Automotive applications

- 6.4.1.3 Advantages and disadvantages

- 6.4.1.2 Application

- FIGURE 34 DRIVERS AND RESTRAINTS IN HIGH-SOLIDS COATINGS MARKET

- TABLE 34 HIGH-SOLIDS COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 HIGH-SOLIDS COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 36 HIGH-SOLIDS COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 37 HIGH-SOLIDS COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 6.4.1 AUTOMOTIVE SEGMENT TO INCREASE DEMAND FOR HIGH-SOLIDS COATINGS

- 6.5 RADIATION-CURE COATINGS

- 6.5.1 ADAPTING RADIATION-CURE COATINGS DUE TO SHORT CURE TIME AND HIGH-QUALITY FILM

- 6.5.1.1 Type

- FIGURE 35 TYPES OF RADIATION-CURE COATINGS

- 6.5.1.2 Resin systems

- 6.5.1.3 Applications

- 6.5.1.4 Advantages

- 6.5.1.5 Disadvantages

- FIGURE 36 DRIVERS AND RESTRAINTS IN RADIATION-CURE COATINGS MARKET

- TABLE 38 RADIATION-CURE COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 39 RADIATION-CURE COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 40 RADIATION-CURE COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 41 RADIATION-CURE COATINGS: GREEN COATINGS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 6.5.1 ADAPTING RADIATION-CURE COATINGS DUE TO SHORT CURE TIME AND HIGH-QUALITY FILM

7 GREEN COATINGS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 37 ARCHITECTURAL SEGMENT DOMINATED OVERALL GREEN COATINGS MARKET

- TABLE 42 GREEN COATINGS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 43 GREEN COATINGS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 44 GREEN COATINGS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 45 GREEN COATINGS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 7.2 ARCHITECTURAL COATINGS

- 7.2.1 HIGH DEMAND FOR ENVIRONMENTALLY FRIENDLY COATINGS TO INCREASE DEMAND IN ARCHITECTURAL SEGMENT

- TABLE 46 GREEN COATINGS MARKET SIZE IN ARCHITECTURAL, BY REGION, 2018-2021 (USD MILLION)

- TABLE 47 GREEN COATINGS MARKET SIZE IN ARCHITECTURAL, BY REGION, 2022-2027 (USD MILLION)

- TABLE 48 GREEN COATINGS MARKET SIZE IN ARCHITECTURAL, BY REGION, 2018-2021 (KILOTON)

- TABLE 49 GREEN COATINGS MARKET SIZE IN ARCHITECTURAL, BY REGION, 2022-2027 (KILOTON)

- 7.3 AUTOMOTIVE COATINGS

- 7.3.1 GROWING DEMAND FOR ELECTRIC VEHICLES TO DRIVE GREEN COATINGS MARKET

- TABLE 50 GREEN COATINGS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 51 GREEN COATINGS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 52 GREEN COATINGS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018-2021 (KILOTON)

- TABLE 53 GREEN COATINGS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2022-2027 (KILOTON)

- 7.4 INDUSTRIAL COATINGS

- 7.4.1 EVERYDAY USES OF POWDER-COATED PRODUCTS TO FUEL DEMAND FOR GENERAL INDUSTRIAL EQUIPMENT

- TABLE 54 GREEN COATINGS MARKET SIZE IN INDUSTRIAL, BY REGION, 2018-2021 (USD MILLION)

- TABLE 55 GREEN COATINGS MARKET SIZE IN INDUSTRIAL, BY REGION, 2022-2027 (USD MILLION)

- TABLE 56 GREEN COATINGS MARKET SIZE IN INDUSTRIAL, BY REGION, 2018-2021 (KILOTON)

- TABLE 57 GREEN COATINGS MARKET SIZE IN INDUSTRIAL, BY REGION, 2022-2027 (KILOTON)

- 7.5 HIGH-PERFORMANCE COATINGS

- 7.5.1 HEALTH-RELATED AWARENESS TO INCREASE USE OF GREEN COATINGS

- TABLE 58 GREEN COATINGS MARKET SIZE IN HIGH-PERFORMANCE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 59 GREEN COATINGS MARKET SIZE IN HIGH-PERFORMANCE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 60 GREEN COATINGS MARKET SIZE IN HIGH-PERFORMANCE, BY REGION, 2018-2021 (KILOTON)

- TABLE 61 GREEN COATINGS MARKET SIZE IN HIGH-PERFORMANCE, BY REGION, 2022-2027 (KILOTON)

- 7.6 WOOD COATINGS

- 7.6.1 FURNITURE INDUSTRY TO PROGRESS TOWARD USE OF NON-TOXIC COATINGS

- TABLE 62 GREEN COATINGS MARKET SIZE IN WOOD, BY REGION, 2018-2021 (USD MILLION)

- TABLE 63 GREEN COATINGS MARKET SIZE IN WOOD, BY REGION, 2022-2027 (USD MILLION)

- TABLE 64 GREEN COATINGS MARKET SIZE IN WOOD, BY REGION, 2018-2021 (KILOTON)

- TABLE 65 GREEN COATINGS MARKET SIZE IN WOOD, BY REGION, 2022-2027 (KILOTON)

- 7.7 PACKAGING COATINGS

- 7.7.1 FAVORABLE REGULATIONS IN FOOD & BEVERAGE INDUSTRY TO DRIVE MARKET

- TABLE 66 GREEN COATINGS MARKET SIZE IN PACKAGING, BY REGION, 2018-2021 (USD MILLION)

- TABLE 67 GREEN COATINGS MARKET SIZE IN PACKAGING, BY REGION, 2022-2027 (USD MILLION)

- TABLE 68 GREEN COATINGS MARKET SIZE IN PACKAGING, BY REGION, 2018-2021 (KILOTON)

- TABLE 69 GREEN COATINGS MARKET SIZE IN PACKAGING, BY REGION, 2022-2027 (KILOTON)

- 7.8 PRODUCT FINISHES

- 7.8.1 DIFFERENT INDUSTRIES TO MAKE THEIR PRODUCT GREENER TO BOOST DEMAND FOR THESE COATINGS

- TABLE 70 GREEN COATINGS MARKET SIZE IN PRODUCT FINISHES, BY REGION, 2018-2021 (USD MILLION)

- TABLE 71 GREEN COATINGS MARKET SIZE IN PRODUCT FINISHES, BY REGION, 2022-2027 (USD MILLION)

- TABLE 72 GREEN COATINGS MARKET SIZE IN PRODUCT FINISHES, BY REGION, 2018-2021 (KILOTON)

- TABLE 73 GREEN COATINGS MARKET SIZE IN PRODUCT FINISHES, BY REGION, 2022-2027 (KILOTON)

8 GREEN COATINGS MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 38 ASIA PACIFIC PROJECTED TO BE FASTEST-GROWING GREEN COATINGS MARKET

- TABLE 74 GREEN COATINGS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 75 GREEN COATINGS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 76 GREEN COATINGS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 77 GREEN COATINGS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- 8.2 ASIA PACIFIC

- FIGURE 39 ASIA PACIFIC: GREEN COATINGS MARKET SNAPSHOT

- TABLE 78 ASIA PACIFIC: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 79 ASIA PACIFIC: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 80 ASIA PACIFIC: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 81 ASIA PACIFIC: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 82 ASIA PACIFIC: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 83 ASIA PACIFIC: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 84 ASIA PACIFIC: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 85 ASIA PACIFIC: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 86 ASIA PACIFIC: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 87 ASIA PACIFIC: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 88 ASIA PACIFIC: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 89 ASIA PACIFIC: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 8.2.1 CHINA

- 8.2.1.1 Favorable market conditions to drive demand for green coatings

- 8.2.2 JAPAN

- 8.2.2.1 High production of vehicles to spur demand for green coatings

- 8.2.3 INDIA

- 8.2.3.1 Boom in real estate sector to drive green coatings market

- 8.2.4 INDONESIA

- 8.2.4.1 New infrastructure and FDI laws to boost market

- 8.2.5 THAILAND

- 8.2.5.1 Automotive industry to influence green coatings market

- 8.2.6 SOUTH KOREA

- 8.2.6.1 Automotive industry to support growth of market

- 8.2.7 REST OF ASIA PACIFIC

- 8.3 NORTH AMERICA

- FIGURE 40 NORTH AMERICA: GREEN COATINGS MARKET SNAPSHOT

- TABLE 90 NORTH AMERICA: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 91 NORTH AMERICA: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 92 NORTH AMERICA: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 93 NORTH AMERICA: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 94 NORTH AMERICA: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 95 NORTH AMERICA: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 96 NORTH AMERICA: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 97 NORTH AMERICA: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 98 NORTH AMERICA: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 99 NORTH AMERICA: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 100 NORTH AMERICA: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 101 NORTH AMERICA: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 8.3.1 US

- 8.3.1.1 Increasing private residential and non-residential constructions to drive market

- 8.3.1.2 US paints & coatings toll manufacturing to boost market

- 8.3.1.3 Benefits of toll manufacturing to drive market

- TABLE 102 LIST OF US PAINTS & COATINGS TOLL MANUFACTURERS

- 8.3.2 CANADA

- 8.3.2.1 Residential construction to be major contributor to market growth

- 8.3.3 MEXICO

- 8.3.3.1 New constructions in residential segment to drive market

- 8.4 EUROPE

- FIGURE 41 EUROPE: GREEN COATINGS MARKET SNAPSHOT

- TABLE 103 EUROPE: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 104 EUROPE: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 105 EUROPE: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 106 EUROPE: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 107 EUROPE: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 108 EUROPE: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 109 EUROPE: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 110 EUROPE: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 111 EUROPE: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 112 EUROPE: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 113 EUROPE: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 114 EUROPE: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 8.4.1 GERMANY

- 8.4.1.1 Favorable economic environment for construction sector and rising demand for new homes to drive market

- 8.4.2 UK

- 8.4.2.1 Growing construction sector, along with government spending, to boost the demand for architectural coatings

- 8.4.3 FRANCE

- 8.4.3.1 Reviving economy coupled with investment in infrastructure to boost demand for architectural coatings

- 8.4.4 RUSSIA

- 8.4.4.1 Architectural and woodworking applications to drive market

- 8.4.5 ITALY

- 8.4.5.1 New project finance rules and investment policies in construction sector to boost market

- 8.4.6 TURKEY

- 8.4.6.1 Rapid urbanization to drive demand for architectural green coatings

- 8.4.7 SPAIN

- 8.4.7.1 Government investments in infrastructure to drive market

- 8.4.8 REST OF EUROPE

- 8.5 SOUTH AMERICA

- TABLE 115 SOUTH AMERICA: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 116 SOUTH AMERICA: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 117 SOUTH AMERICA: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 118 SOUTH AMERICA: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 119 SOUTH AMERICA: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 120 SOUTH AMERICA: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 121 SOUTH AMERICA: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2021 (KILOTON)

- TABLE 122 SOUTH AMERICA: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY, 2022-2027 (KILOTON)

- TABLE 123 SOUTH AMERICA: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 124 SOUTH AMERICA: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 125 SOUTH AMERICA: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 126 SOUTH AMERICA: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 8.5.1 BRAZIL

- 8.5.1.1 Rising home ownership and living standards to drive market

- 8.5.2 ARGENTINA

- 8.5.2.1 Increase in population and improved economic conditions to boost demand for architectural green coatings

- 8.5.3 REST OF SOUTH AMERICA

- 8.6 MIDDLE EAST & AFRICA

- TABLE 127 MIDDLE EAST & AFRICA: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2018-2021 (KILOTON)

- TABLE 130 MIDDLE EAST & AFRICA: GREEN COATINGS MARKET SIZE, BY COUNTRY, 2022-2027 (KILOTON)

- TABLE 131 MIDDLE EAST & AFRICA: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2021 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY TYPE, 2022-2027 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2021 (KILOTON)

- TABLE 134 MIDDLE EAST & AFRICA: GREEN COATINGS MARKET SIZE, BY TECHNOLOGY TYPE, 2022-2027 (KILOTON)

- TABLE 135 MIDDLE EAST & AFRICA: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 138 MIDDLE EAST & AFRICA: GREEN COATINGS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 8.6.1 SAUDI ARABIA

- 8.6.1.1 Mega housing projects to boost the demand for architectural green coatings

- 8.6.2 SOUTH AFRICA

- 8.6.2.1 Substantial demand for architectural green coatings witnessed in building projects

- 8.6.3 UAE

- 8.6.3.1 Automotive industry to be one of the biggest drivers of economic growth

- 8.6.4 REST OF MIDDLE EAST & AFRICA

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- TABLE 139 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 9.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITIONS AND METHODOLOGY, 2021

- 9.2.1 STARS

- 9.2.2 EMERGING LEADERS

- 9.2.3 PERVASIVE PLAYERS

- 9.2.4 PARTICIPANTS

- FIGURE 42 GREEN COATINGS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 43 STRENGTH OF PRODUCT PORTFOLIO

- 9.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) MATRIX, 2021

- 9.3.1 RESPONSIVE COMPANIES

- 9.3.2 PROGRESSIVE COMPANIES

- 9.3.3 STARTING BLOCKS

- 9.3.4 DYNAMIC COMPANIES

- FIGURE 44 GREEN COATINGS MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) COMPETITIVE LEADERSHIP MAPPING, 2021

- 9.4 MARKET SHARE ANALYSIS

- FIGURE 45 MARKET SHARE, BY KEY PLAYER (2021)

- 9.5 REVENUE ANALYSIS

- FIGURE 46 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2017-2021

- 9.5.1 AKZONOBEL N.V.

- 9.5.2 AXALTA COATING SYSTEMS, LLC

- 9.5.3 BASF SE

- 9.5.4 PPG INDUSTRIES, INC.

- 9.5.5 THE SHERWIN-WILLIAMS COMPANY

- 9.6 RANKING ANALYSIS

- FIGURE 47 MARKET RANKING ANALYSIS, 2021

- 9.7 COMPETITIVE BENCHMARKING

- TABLE 140 GREEN COATINGS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 141 GREEN COATINGS MARKET: COMPETITIVE BENCHMARKING OF SME PLAYERS

- TABLE 142 DETAILED LIST OF KEY STARTUPS/SMES

- 9.7.1 COMPETITIVE SITUATIONS AND TRENDS

- TABLE 143 GREEN COATINGS MARKET: PRODUCT LAUNCHES, 2017-2022

- TABLE 144 GREEN COATINGS MARKET: DEALS, 2017-2022

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- (Business overview, Products offered, Recent Developments, MNM view)**

- 10.1.1 AKZONOBEL N.V.

- TABLE 145 AKZONOBEL N.V.: COMPANY OVERVIEW

- FIGURE 48 AKZONOBEL N.V.: COMPANY SNAPSHOT

- TABLE 146 AKZONOBEL N.V.: NEW PRODUCT LAUNCHES

- TABLE 147 AKZONOBEL N.V.: DEAL

- 10.1.2 AXALTA COATING SYSTEMS, LLC

- TABLE 148 AXALTA COATING SYSTEMS, LLC: COMPANY OVERVIEW

- FIGURE 49 AXALTA COATING SYSTEMS, LLC: COMPANY SNAPSHOT

- TABLE 149 AXALTA COATING SYSTEMS, LLC: NEW PRODUCT LAUNCHES

- 10.1.3 BASF SE

- TABLE 150 BASF SE: COMPANY OVERVIEW

- FIGURE 50 BASF SE: COMPANY SNAPSHOT

- TABLE 151 BASF SE: NEW PRODUCT LAUNCHES

- TABLE 152 BASF SE: DEALS

- 10.1.4 PPG INDUSTRIES, INC.

- TABLE 153 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 51 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 154 PPG INDUSTRIES, INC.: NEW PRODUCT LAUNCHES

- TABLE 155 PPG INDUSTRIES, INC.: DEALS

- 10.1.5 THE SHERWIN-WILLIAMS COMPANY

- TABLE 156 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- FIGURE 52 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- 10.1.6 ASIAN PAINTS LIMITED

- TABLE 157 ASIAN PAINTS LIMITED: COMPANY OVERVIEW

- FIGURE 53 ASIAN PAINTS LIMITED: COMPANY SNAPSHOT

- 10.1.7 BERGER PAINTS INDIA LIMITED

- TABLE 158 BERGER PAINTS INDIA LIMITED: COMPANY OVERVIEW

- FIGURE 54 BERGER PAINTS INDIA LIMITED: COMPANY SNAPSHOT

- 10.1.8 HEMPEL A/S

- TABLE 159 HEMPEL A/S: COMPANY OVERVIEW

- FIGURE 55 HEMPEL A/S: COMPANY SNAPSHOT

- TABLE 160 HEMPEL A/S: NEW PRODUCT LAUNCHES

- TABLE 161 HEMPEL A/S: DEALS

- 10.1.9 JOTUN A/S

- TABLE 162 JOTUN A/S: COMPANY OVERVIEW

- FIGURE 56 JOTUN A/S: COMPANY SNAPSHOT

- 10.1.10 DAW SE

- TABLE 163 DAW SE: COMPANY OVERVIEW

- 10.2 OTHER PLAYERS

- 10.2.1 KANSAI PAINT CO. LTD.

- TABLE 164 KANSAI PAINT CO. LTD.: COMPANY OVERVIEW

- 10.2.2 MASCO CORPORATION

- TABLE 165 MASCO CORPORATION: COMPANY OVERVIEW

- 10.2.3 RPM INTERNATIONAL INC.

- TABLE 166 RPM INTERNATIONAL INC.: COMPANY OVERVIEW

- 10.2.4 LIFETIME GREEN COATINGS

- TABLE 167 LIFETIME GREEN COATINGS: COMPANY OVERVIEW

- 10.2.5 DSM

- TABLE 168 DSM: COMPANY OVERVIEW

- 10.2.6 EVONIK INDUSTRIES AG

- TABLE 169 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- 10.2.7 EASTMAN CHEMICAL COMPANY

- TABLE 170 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- 10.2.8 NIPPON PAINT HOLDINGS CO., LTD.

- TABLE 171 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY OVERVIEW

- 10.2.9 CHENYANG GROUP LTD

- TABLE 172 CHENYANG GROUP LTD: COMPANY OVERVIEW

- 10.2.10 CIRANOVA

- TABLE 173 CIRANOVA: COMPANY OVERVIEW

- 10.2.11 CORTEC CORPORATION

- TABLE 174 CORTEC CORPORATION: COMPANY OVERVIEW

- 10.2.12 ECO SAFETY PRODUCTS

- TABLE 175 ECO SAFETY PRODUCTS: COMPANY OVERVIEW

- 10.2.13 TEKNOS GROUP

- TABLE 176 TEKNOS GROUP: COMPANY OVERVIEW

- 10.2.14 STAHL HOLDINGS B.V.

- TABLE 177 STAHL HOLDINGS B.V.: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

11 ADJACENT/RELATED MARKETS

- 11.1 INTRODUCTION

- 11.2 LIMITATIONS

- 11.3 BIO-BASED COATINGS MARKET

- 11.3.1 MARKET DEFINITION

- 11.3.2 MARKET OVERVIEW

- 11.3.3 BIO-BASED COATINGS MARKET, BY RESIN TYPE

- TABLE 178 BIO-BASED COATINGS MARKET SIZE, BY RESIN TYPE, 2018-2021 (USD MILLION)

- TABLE 179 BIO-BASED COATINGS MARKET SIZE, BY RESIN TYPE, 2022-2027 (USD MILLION)

- TABLE 180 BIO-BASED COATINGS MARKET SIZE, BY RESIN TYPE, 2018-2021 (KILOTON)

- TABLE 181 BIO-BASED COATINGS MARKET SIZE, BY RESIN TYPE, 2022-2027 (KILOTON)

- 11.3.4 BIO-BASED COATINGS MARKET, BY APPLICATION

- TABLE 182 BIO-BASED COATINGS MARKET SIZE, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 183 BIO-BASED COATINGS MARKET SIZE, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 184 BIO-BASED COATINGS MARKET SIZE, BY APPLICATION, 2018-2021 (KILOTON)

- TABLE 185 BIO-BASED COATINGS MARKET SIZE, BY APPLICATION, 2022-2027 (KILOTON)

- 11.3.5 BIO-BASED COATINGS MARKET, BY REGION

- TABLE 186 BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 187 BIO-BASED COATINGS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- TABLE 188 BIO-BASED COATINGS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 189 BIO-BASED COATINGS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS