|

|

市場調査レポート

商品コード

1676638

産業計測の世界市場 (~2030年):CMM・ODS・測定器・X線&CTシステム・AOIシステム・形状測定機・2D装置・品質&検査・リバース検査・マッピング&モデリング別Industrial Metrology Market by CMM, ODS, Measuring Instrument, X-Ray & CT System, AOI System, Form Measurement Machine, 2D Equipment, Quality & Inspection, Reverse Inspection, and Mapping & Modeling - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 産業計測の世界市場 (~2030年):CMM・ODS・測定器・X線&CTシステム・AOIシステム・形状測定機・2D装置・品質&検査・リバース検査・マッピング&モデリング別 |

|

出版日: 2025年03月06日

発行: MarketsandMarkets

ページ情報: 英文 381 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の産業計測の市場規模は、2025年の143億1,000万米ドルから、予測期間中は5.9%のCAGRで推移し、2030年には190億3,000万米ドルの規模に成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル) |

| セグメント | 提供区分・機器・用途・エンドユーザー産業・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

産業計測市場の主な成長促進要因は、三次元計測における研究開発費の増加であり、その結果、より高度で正確な計測ソリューションが生み出されています。IoTセンサーの統合により、リアルタイムデータの取得、予知保全、プロセス最適化が強化されています。精密製造における品質管理への注目の高まりも、特に航空宇宙、自動車、エレクトロニクスにおける高精度測定システムへの需要を促進しています。また、自動運転技術の利用の増加も、重要な自動車部品の製造における精密計測ソリューションの需要を高めています。このような複合的な要因によって、産業計測が産業全体に幅広く適用されるようになり、生産効率の向上と規制要件の遵守が可能となっています。

”提供区分別では、ソフトウェアのセグメントが予測期間中に最も高いCAGRを示す見通し"

ソフトウェアセグメントは、あらゆる産業分野での測定、試験、管理に不可欠な役割を果たすため、予測期間中最大のCAGRを示す見通しです。計測ソフトウェアは、三次元測定機 (CMM) やスキャナーなどのハードウェアと簡単に統合できるため、計測プロセスを簡素化し、航空宇宙や自動車などの用途で正確な寸法分析を可能にします。クラウド対応製品もまた、リモートアクセス、リアルタイムの連携、最適化されたデータ保存・分析・管理によって市場を変えつつあります。例えば、Hexagon ABは、QUINDOS 2020.2やクラウド対応の画像処理ソフトウェアなどの提供を通じてソフトウェア技術に投資し、工業プロセスの効率と精度を向上させています。インダストリー4.0技術や自動化に向けた動きも、高度な計測ソフトウェアの使用を後押ししています。品質保証やプロセスの最適化のために、CAD/CAMアプリケーションや自動化ツールを適用する製造業者が増えているためです。適応性があり、スケーラブルで、リアルタイムの計測機器に対する需要の高まりが、ソフトウェアセグメントの成長をさらに促進しています。

”エンドユーザー産業別では、航空宇宙・防衛が予測期間中に第2位のシェアを示す見通し"

航空宇宙・防衛産業は、精度、品質、厳しい規制基準への準拠への依存度が高いため、2番目に大きなシェアを占めると予測されています。OEMや航空機メーカーは、コスト圧力、規制の変化、持続可能性などの課題に対処しなければならない厳しい競合情勢の中にいます。効率と精度を提供するために、この分野では付加製造、精密機械加工、知識集約型製造などの高度な製造技術の採用が進んでいます。産業計測は、航空機のフレーム、翼、エンジン、サブアセンブリのような重要部品の製造において、精度を確保する上で重要な役割を果たしています。機体の検査、校正、組み立ては、レーザートラッカー、ポータブルアーム、CMMの精度に依存しています。計測ソリューションは、航空エンジンのタービン、着陸装置、アクチュエータ、ブレーキシステムなどの重要なコンポーネントの精度を保証し、安全性と性能を実現します。メンテナンス、修理、オーバーホール (MRO) において計測の応用が増え、効率が改善し、航空宇宙資産の寿命が延びています。

当レポートでは、世界の産業計測の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 投資と資金調達のシナリオ

- 価格分析

- 貿易分析

- エコシステム分析

- 顧客の事業に影響を与える動向/ディスラプション

- ケーススタディ分析

- 特許分析

- 技術分析

- 規制状況

- 主な会議とイベント

- AI/生成AIが産業計測市場に与える影響

第6章 産業計測市場:提供区分別

- ハードウェア

- ソフトウェア

- サービス

- アフターサービス

- 測定サービス

- StaaS (Storage as a Service)

- SaaS (Software as a Service)

第7章 産業計測市場:機器別

- CMM

- ブリッジCMM

- ガントリーCMM

- 水平アームCMM

- カンチレバーCMM

- 関節アームCMM

- ODS

- レーザーおよび構造化光スキャナー

- レーザートラッカー

- その他

- 測定器

- 測定顕微鏡

- プロファイルプロジェクター

- オートコリメーター

- ビジョンシステム

- マルチセンサー測定システム

- X線およびCTシステム

- AOIシステム

- 形状測定機

- 輪郭測定機

- 表面粗さ測定機

- 表面真円度測定機

- 2D機器

第8章 産業計測市場:用途別

- 品質管理・検査

- リバースエンジニアリング

- マッピング・モデリング

- その他

第9章 産業計測市場:エンドユーザー産業別

- 航空宇宙・防衛

- 自動車

- アーキテクチャ・建設

- 医療

- 半導体・エレクトロニクス

- エネルギー・電力

- 重機

- 鉱業

- その他

第10章 産業計測市場:地域別

- 北米

- マクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- マクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- オランダ

- その他

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- 台湾

- その他

- その他の地域

- マクロ経済見通し

- 中東・アフリカ

- 南米

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- 企業価値評価・財務指標

- ブランド比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- HEXAGON AB

- CARL ZEISS AG

- KEYENCE CORPORATION

- KLA CORPORATION

- MITUTOYO CORPORATION

- NIKON CORPORATION

- FARO

- JENOPTIK

- RENISHAW PLC

- CREAFORM

- その他の企業

- ACCUSCAN

- CARMAR ACCURACY CO., LTD.

- BAKER HUGHES COMPANY

- NORDSON CORPORATION

- CAIRNHILL

- ATT METROLOGY SOLUTIONS

- SGS SOCIETE GENERALE DE SURVEILLANCE SA

- TRIMET

- AUTOMATED PRECISION INC (API)

- APPLIED MATERIALS, INC.

- PERCEPTRON, INC.

- SHINING 3D

- INTERTEK GROUP PLC

- BRUKER

- METROLOGIC GROUP

- INNOVMETRIC SOFTWARE INC.

- SMARTRAY GMBH

- WENZEL GROUP

- SCANTECH (HANGZHOU) CO., LTD.

- POLYGA INC.

第13章 付録

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 3 INDUSTRIAL METROLOGY MARKET: RESEARCH ASSUMPTIONS

- TABLE 4 INDUSTRIAL METROLOGY MARKET: RISK ASSESSMENT

- TABLE 5 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 8 INDICATIVE PRICING OF INDUSTRIAL METROLOGY SOLUTIONS OFFERED BY KEY PLAYERS, BY EQUIPMENT, 2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE TREND OF INDUSTRIAL METROLOGY SOLUTIONS, BY EQUIPMENT, 2021-2024 (USD)

- TABLE 10 AVERAGE SELLING PRICE TREND OF CMMS, BY REGION, 2021-2024 (USD)

- TABLE 11 IMPORT DATA FOR HS CODE 903180-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 12 EXPORT DATA FOR HS CODE 903180-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 13 ROLE OF COMPANIES IN INDUSTRIAL METROLOGY ECOSYSTEM

- TABLE 14 LIST OF KEY PATENTS, 2021-2024

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 20 INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 21 INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 22 HARDWARE: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 23 HARDWARE: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 24 SOFTWARE: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 25 SOFTWARE: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 26 SERVICES: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 27 SERVICES: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 28 SERVICES: INDUSTRIAL METROLOGY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 29 SERVICES: INDUSTRIAL METROLOGY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 30 INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 31 INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 32 INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2021-2024 (UNITS)

- TABLE 33 INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2025-2030 (UNITS)

- TABLE 34 CMMS: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 35 CMMS: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 36 CMMS: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 37 CMMS: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 38 CMMS: INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 CMMS: INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 ODS: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 41 ODS: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 42 ODS: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT TYPE, 2021-2024 (UNITS)

- TABLE 43 ODS: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT TYPE, 2025-2030 (UNITS)

- TABLE 44 ODS: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 45 ODS: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 46 ODS: INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 ODS: INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 MEASURING INSTRUMENT: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 49 MEASURING INSTRUMENT: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 50 MEASURING INSTRUMENTS: INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 MEASURING INSTRUMENTS: INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 X-RAY & CT SYSTEMS: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 53 X-RAY & CT SYSTEMS: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 54 X-RAY & CT SYSTEMS: INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 X-RAY & CT SYSTEMS: INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 AOI SYSTEMS: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 57 AOI SYSTEMS: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 58 AOI SYSTEMS: INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 AOI SYSTEMS: INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 FORM MEASUREMENT MACHINES: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 61 FORM MEASUREMENT MACHINES: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 62 FORM MEASUREMENT MACHINES: INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 FORM MEASUREMENT MACHINES: INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 FORM MEASUREMENT MACHINES: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 65 FORM MEASUREMENT MACHINES: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 66 2D EQUIPMENT: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 67 2D EQUIPMENT: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 68 2D EQUIPMENT: INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 2D EQUIPMENT: INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 71 INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 72 QUALITY CONTROL & INSPECTION: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 73 QUALITY CONTROL & INSPECTION: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 74 REVERSE ENGINEERING: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 75 REVERSE ENGINEERING: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 76 MAPPING & MODELING: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 77 MAPPING & MODELING: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 78 OTHER APPLICATIONS: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 79 OTHER APPLICATIONS: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 80 INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 81 INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 82 AEROSPACE & DEFENSE: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 83 AEROSPACE & DEFENSE: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 84 AEROSPACE & DEFENSE: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 85 AEROSPACE & DEFENSE: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 86 AEROSPACE & DEFENSE: INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 AEROSPACE & DEFENSE: INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 AEROSPACE & DEFENSE: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 89 AEROSPACE & DEFENSE: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 90 AUTOMOTIVE: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 91 AUTOMOTIVE: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 92 AUTOMOTIVE: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 93 AUTOMOTIVE: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 94 AUTOMOTIVE: INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 AUTOMOTIVE: INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 AUTOMOTIVE: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 97 AUTOMOTIVE: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 98 ARCHITECTURE & CONSTRUCTION: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 99 ARCHITECTURE & CONSTRUCTION: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 100 ARCHITECTURE & CONSTRUCTION: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 101 ARCHITECTURE & CONSTRUCTION: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 102 ARCHITECTURE & CONSTRUCTION: INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 ARCHITECTURE & CONSTRUCTION: INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 ARCHITECTURE & CONSTRUCTION: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 105 ARCHITECTURE & CONSTRUCTION: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 106 MEDICAL: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 107 MEDICAL: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 108 MEDICAL: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 109 MEDICAL: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 110 MEDICAL: INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 111 MEDICAL: INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 112 MEDICAL: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 113 MEDICAL: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 114 SEMICONDUCTOR & ELECTRONICS: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 115 SEMICONDUCTOR & ELECTRONICS: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 116 SEMICONDUCTOR & ELECTRONICS: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 117 SEMICONDUCTOR & ELECTRONICS: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 118 SEMICONDUCTOR & ELECTRONICS: INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 119 SEMICONDUCTOR & ELECTRONICS: INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 SEMICONDUCTOR & ELECTRONICS: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 121 SEMICONDUCTOR & ELECTRONICS: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 122 ENERGY & POWER: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 123 ENERGY & POWER: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 124 ENERGY & POWER: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 125 ENERGY & POWER: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 126 ENERGY & POWER: INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 127 ENERGY & POWER: INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 128 ENERGY & POWER: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 129 ENERGY & POWER: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 130 HEAVY MACHINERY: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 131 HEAVY MACHINERY: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 132 HEAVY MACHINERY: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 133 HEAVY MACHINERY: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 HEAVY MACHINERY: INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 135 HEAVY MACHINERY: INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 136 HEAVY MACHINERY: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 137 HEAVY MACHINERY: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 138 MINING: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 139 MINING: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 140 MINING: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 141 MINING: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 142 MINING: INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 143 MINING: INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 144 MINING: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 145 MINING: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 146 OTHER END-USE INDUSTRIES: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 147 OTHER END-USE INDUSTRIES: INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 148 OTHER END-USE INDUSTRIES: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 149 OTHER END-USE INDUSTRIES: INDUSTRIAL METROLOGY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 150 OTHER END-USE INDUSTRIES: INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 151 OTHER END-USE INDUSTRIES: INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 152 OTHER END-USE INDUSTRIES: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 153 OTHER END-USE INDUSTRIES: INDUSTRIAL METROLOGY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 154 INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 155 INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 156 NORTH AMERICA: INDUSTRIAL METROLOGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 157 NORTH AMERICA: INDUSTRIAL METROLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 158 NORTH AMERICA: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 159 NORTH AMERICA: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 160 EUROPE: INDUSTRIAL METROLOGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 161 EUROPE: INDUSTRIAL METROLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 162 EUROPE: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 163 EUROPE: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 164 ASIA PACIFIC: INDUSTRIAL METROLOGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 165 ASIA PACIFIC: INDUSTRIAL METROLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 166 ASIA PACIFIC: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 167 ASIA PACIFIC: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 168 ROW: INDUSTRIAL METROLOGY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 169 ROW: INDUSTRIAL METROLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 170 ROW: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 171 ROW: INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: INDUSTRIAL METROLOGY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: INDUSTRIAL METROLOGY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 174 INDUSTRIAL METROLOGY MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- TABLE 175 INDUSTRIAL METROLOGY MARKET: DEGREE OF COMPETITION, 2024

- TABLE 176 INDUSTRIAL METROLOGY MARKET: REGION FOOTPRINT

- TABLE 177 INDUSTRIAL METROLOGY MARKET: OFFERING FOOTPRINT

- TABLE 178 INDUSTRIAL METROLOGY MARKET: EQUIPMENT FOOTPRINT

- TABLE 179 INDUSTRIAL METROLOGY MARKET: APPLICATION FOOTPRINT

- TABLE 180 INDUSTRIAL METROLOGY MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 181 INDUSTRIAL METROLOGY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 182 INDUSTRIAL METROLOGY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 183 INDUSTRIAL METROLOGY MARKET: PRODUCT LAUNCHES, JANUARY 2020-JANUARY 2025

- TABLE 184 INDUSTRIAL METROLOGY MARKET: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 185 INDUSTRIAL METROLOGY MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JANUARY 2025

- TABLE 186 HEXAGON AB: COMPANY OVERVIEW

- TABLE 187 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 HEXAGON AB: PRODUCT LAUNCHES

- TABLE 189 HEXAGON AB: DEALS

- TABLE 190 CARL ZEISS AG: COMPANY OVERVIEW

- TABLE 191 CARL ZEISS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 CARL ZEISS AG: PRODUCT LAUNCHES

- TABLE 193 CARL ZEISS AG: DEALS

- TABLE 194 KEYENCE CORPORATION: COMPANY OVERVIEW

- TABLE 195 KEYENCE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 KEYENCE CORPORATION: PRODUCT LAUNCHES

- TABLE 197 KLA CORPORATION: COMPANY OVERVIEW

- TABLE 198 KLA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 KLA CORPORATION: PRODUCT LAUNCHES

- TABLE 200 MITUTOYO CORPORATION: COMPANY OVERVIEW

- TABLE 201 MITUTOYO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 MITUTOYO CORPORATION: PRODUCT LAUNCHES

- TABLE 203 MITUTOYO CORPORATION: DEALS

- TABLE 204 NIKON CORPORATION: COMPANY OVERVIEW

- TABLE 205 NIKON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 NIKON CORPORATION: PRODUCT LAUNCHES

- TABLE 207 NIKON CORPORATION: DEALS

- TABLE 208 FARO: COMPANY OVERVIEW

- TABLE 209 FARO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 FARO: PRODUCT LAUNCHES

- TABLE 211 FARO: DEALS

- TABLE 212 JENOPTIK: COMPANY OVERVIEW

- TABLE 213 JENOPTIK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 JENOPTIK: PRODUCT LAUNCHES

- TABLE 215 JENOPTIK: DEALS

- TABLE 216 JENOPTIK: OTHER DEVELOPMENTS

- TABLE 217 RENISHAW PLC: COMPANY OVERVIEW

- TABLE 218 RENISHAW PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 RENISHAW PLC: PRODUCT LAUNCHES

- TABLE 220 RENISHAW PLC: DEALS

- TABLE 221 CREAFORM: COMPANY OVERVIEW

- TABLE 222 CREAFORM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 CREAFORM: PRODUCT LAUNCHES

- TABLE 224 CREAFORM: DEALS

- TABLE 225 CREAFORM: EXPANSIONS

List of Figures

- FIGURE 1 INDUSTRIAL METROLOGY MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 INDUSTRIAL METROLOGY MARKET: RESEARCH DESIGN

- FIGURE 3 INDUSTRIAL METROLOGY MARKET: BOTTOM-UP APPROACH

- FIGURE 4 INDUSTRIAL METROLOGY MARKET: TOP-DOWN APPROACH

- FIGURE 5 INDUSTRIAL METROLOGY MARKET: DATA TRIANGULATION

- FIGURE 6 INDUSTRIAL METROLOGY MARKET SIZE, 2021-2030

- FIGURE 7 SERVICES SEGMENT TO REGISTER HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 8 QUALITY CONTROL & INSPECTION SEGMENT TO DOMINATE INDUSTRIAL METROLOGY MARKET DURING FORECAST PERIOD

- FIGURE 9 CMMS SEGMENT TO HOLD LARGEST SHARE OF INDUSTRIAL METROLOGY MARKET IN 2030

- FIGURE 10 AUTOMOTIVE SEGMENT TO DOMINATE INDUSTRIAL METROLOGY MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC CAPTURED LARGEST SHARE OF INDUSTRIAL METROLOGY MARKET IN 2024

- FIGURE 12 INCREASING ADOPTION OF INDUSTRY 4.0 TECHNOLOGIES TO DRIVE MARKET

- FIGURE 13 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL METROLOGY MARKET IN 2030

- FIGURE 14 CMMS SEGMENT TO CAPTURE LARGEST SHARE OF INDUSTRIAL METROLOGY MARKET IN 2025

- FIGURE 15 AUTOMOTIVE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 16 QUALITY CONTROL & INSPECTION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 17 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 GLOBAL ELECTRIC CAR SALES, 2020-2023

- FIGURE 20 IMPACT ANALYSIS: DRIVERS

- FIGURE 21 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 22 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 23 IMPACT ANALYSIS: CHALLENGES

- FIGURE 24 SUPPLY CHAIN ANALYSIS

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 IMPACT OF PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO, 2019-2023

- FIGURE 30 AVERAGE SELLING PRICE TREND OF INDUSTRIAL METROLOGY SOLUTIONS, BY EQUIPMENT, 2021-2024

- FIGURE 31 AVERAGE SELLING PRICE TREND OF CMMS, BY REGION, 2021-2024

- FIGURE 32 IMPORT DATA FOR HS CODE 903180-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019-2023

- FIGURE 33 EXPORT DATA FOR HS CODE 903180-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2019-2023

- FIGURE 34 ECOSYSTEM ANALYSIS

- FIGURE 35 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 36 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 37 IMPACT OF AI/GEN AI ON INDUSTRIAL METROLOGY MARKET

- FIGURE 38 INDUSTRIAL METROLOGY MARKET, BY OFFERING

- FIGURE 39 HARDWARE SEGMENT TO CAPTURE LARGEST SHARE OF INDUSTRIAL METROLOGY MARKET IN 2030

- FIGURE 40 AOI SYSTEMS SEGMENT TO REGISTER HIGHEST CAGR IN INDUSTRIAL METROLOGY MARKET DURING FORECAST PERIOD

- FIGURE 41 INDUSTRIAL METROLOGY MARKET, BY APPLICATION

- FIGURE 42 QUALITY CONTROL & INSPECTION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY

- FIGURE 44 AUTOMOTIVE SEGMENT TO HOLD LARGEST SHARE OF INDUSTRIAL METROLOGY MARKET IN 2030

- FIGURE 45 INDUSTRIAL METROLOGY MARKET, BY REGION

- FIGURE 46 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN INDUSTRIAL METROLOGY MARKET DURING FORECAST PERIOD

- FIGURE 47 NORTH AMERICA: INDUSTRIAL METROLOGY MARKET SNAPSHOT

- FIGURE 48 EUROPE: INDUSTRIAL METROLOGY MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: INDUSTRIAL METROLOGY MARKET SNAPSHOT

- FIGURE 50 MARKET SHARE ANALYSIS OF COMPANIES OFFERING INDUSTRIAL METROLOGY SOLUTIONS, 2024

- FIGURE 51 INDUSTRIAL METROLOGY MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2022-2024

- FIGURE 52 COMPANY VALUATION, 2025

- FIGURE 53 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 54 BRAND COMPARISON

- FIGURE 55 INDUSTRIAL METROLOGY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 56 INDUSTRIAL METROLOGY MARKET: COMPANY FOOTPRINT

- FIGURE 57 INDUSTRIAL METROLOGY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 58 HEXAGON AB: COMPANY SNAPSHOT

- FIGURE 59 CARL ZEISS AG: COMPANY SNAPSHOT

- FIGURE 60 KEYENCE CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 KLA CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 NIKON CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 FARO: COMPANY SNAPSHOT

- FIGURE 64 JENOPTIK: COMPANY SNAPSHOT

- FIGURE 65 RENISHAW PLC: COMPANY SNAPSHOT

The global industrial metrology market is estimated to be valued at USD 19.03 billion by 2030, up from USD 14.31 billion in 2025, at a CAGR of 5.9% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Equipment, Application, End-use Industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

The main growth drivers for industrial metrology market are increasing R&D expenditure in 3D metrology, resulting in more sophisticated and accurate measurement solutions. IoT sensor integration is augmenting real-time data acquisition, predictive maintenance, and process optimization. Increased focus on quality control in precision manufacturing is fueling demand for high-accuracy measurement systems, especially in aerospace, automotive, and electronics. The increasing use of autonomous driving technologies is also increasing the demand for precise metrology solutions in manufacturing critical automotive parts. These combined factors expedite the broad application of industrial metrology across industries, enabling greater production efficiency and compliance with regulatory requirements.

"Software to register the highest CAGR in the offering segment during the forecast period."

The software segment will account for the highest CAGR in industrial metrology during the forecast period due to its imperative role in measurement, testing, and management in all industry sectors. The metrology software simplifies the measurement process as it can integrate easily with the hardware such as coordinate measuring machines (CMMs) and scanners, thereby enabling precise dimensional analysis in applications such as aerospace and automotive. Cloud-enabled products are also changing the market through remote accessibility, real-time cooperation, and optimized data storage, analysis, and management. Hexagon AB, for example, is making investments in software technology through offerings like QUINDOS 2020.2 and cloud-enabled imaging software to improve industrial processes' efficiency and accuracy. The movement towards Industry 4.0 technologies and automation is driving the use of sophisticated metrology software, as manufacturers in growing numbers apply CAD/CAM applications and automation tools for quality assurance and process optimization. The increasing demand for adaptable, scalable, and real-time metrology offerings will further drive software growth in the market, and hence it is the fastest-growing segment.

"Aerospace & Defense to account the second largest market share during the forecast period."

The aerospace & defense industry is projected to hold the second-largest share of the end-use industry segment in the industrial metrology market due to its high reliance on precision, quality, and compliance with stringent regulatory standards. Original equipment manufacturers (OEMs) and aircraft makers work in a strongly competitive landscape in which they have to contend with challenges from cost-pressure forces, changing regulations, and sustainability. To provide efficiency and accuracy, the sector is increasingly adopting advanced manufacturing techniques like additive manufacturing, precision machining, and knowledge-based manufacturing. Industrial metrology plays an important role in ensuring accuracy in the production of critical parts like aircraft frames, wings, engines, and subassemblies. Inspection, calibration, and assembly of airframes rely on laser trackers, portable arms, and CMMs for accuracy. Metrology solutions guarantee the accuracy of critical components such as aero-engine turbines, landing gear, actuators, and braking systems for safety and performance. Increased application of metrology in maintenance, repair, and overhaul (MRO) increases efficiency and the life of aerospace assets.

"North America registered the second largest market share during the forecast period."

North America has the second-largest industrial metrology market share, which is fueled by high demand from major industries like automotive, aerospace & defense, and manufacturing. The US, being a major automotive manufacturer, depends on metrology solutions to ensure high-quality levels and enhance production efficiency. Likewise, the aerospace & defense industry increasingly employs metrology technologies to guarantee accuracy in component production and adherence to strict regulations. The enforcement of the United States-Mexico-Canada Agreement (USMCA) has strengthened the regional automotive sector further by imposing stringent local content requirements, promoting domestic manufacturing and raising the demand for industrial metrology solutions. Also, the existence of institutionalized regulatory agencies like the North American Cooperation in Metrology (NORAMET), the National Institute of Standards and Technology (NIST), and the Dimensional Metrology Standards Consortium (DMIS) guarantees standardized practice in measurements, further increasing the use of sophisticated metrology technologies in all industries.

The break-up of the profile of primary participants in the industrial metrology market-

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, Tier 3 - 20%

- By Designation Type: C Level - 35%, Director Level - 25%, Others - 40%

- By Region Type: Europe - 20%, North America - 45%, Asia Pacific - 30%, Rest of the World - 5%

The major players in the industrial metrology market with a significant global presence include Hexagon AB (Sweden), Carl Zeiss AG (Germany), KLA Corporation (US), KEYENCE CORPORATION (Japan), Mitutoyo Corporation (Japan), and others.

Research Coverage

The report segments the industrial metrology market and forecasts its size by offering, equipment, application, end-use industries and region. It also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report covers qualitative aspects in addition to quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall industrial metrology market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing R&D investments in 3D metrology, rising integration of IoT sensors into industrial metrology solutions, growing focus on quality control and inspection in precision manufacturing, and mounting deployment of autonomous driving technologies), restraints (limited technical knowledge regarding integration of industrial metrology with robots and 3D models, and concerns regarding big data handling and manufacturing unit configuration), opportunities (growing emphasis on quality control and regulatory compliance in food industry, Increasing adoption of cloud-based, IIoT, and AI technologies to store and analyze metrological data, and rising implementation of Industry 5.0 technologies), and challenges (growing concern about cyber security, and shortage of easy-to-use 3D metrology software solutions)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new solution and service launches in the industrial metrology market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the industrial metrology market across varied regions.

- Market Diversification: Exhaustive information about new solutions and services, untapped geographies, recent developments, and investments in the industrial metrology market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and solution and service offerings of leading players, including Hexagon AB (Sweden), Nikon Corporation (Japan), FARO (US), Carl Zeiss AG (Germany), JENOPTIK (Germany), KLA Corporation (US), Renishaw plc (UK), Mitutoyo Corporation (Japan), KEYENCE CORPORATION (Japan), and CREAFORM (Canada).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Key data from secondary sources

- 2.1.2.2 List of key secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL METROLOGY MARKET

- 4.2 INDUSTRIAL METROLOGY MARKET, BY OFFERING

- 4.3 INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT

- 4.4 INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY

- 4.5 INDUSTRIAL METROLOGY MARKET, BY APPLICATION

- 4.6 INDUSTRIAL METROLOGY MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing R&D investment in 3D metrology

- 5.2.1.2 Rising integration of IoT sensors into industrial metrology solutions

- 5.2.1.3 Growing focus on quality control and inspection in precision manufacturing

- 5.2.1.4 Mounting deployment of autonomous driving technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited technical knowledge regarding integration of industrial metrology with robots and 3D models

- 5.2.2.2 Concerns regarding big data handling and manufacturing unit configuration

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing emphasis on quality control and regulatory compliance in food industry

- 5.2.3.2 Increasing adoption of cloud-based, IIoT, and AI technologies to store and analyze metrological data

- 5.2.3.3 Rising implementation of Industry 5.0 technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Growing concern about cyber security

- 5.2.4.2 Shortage of easy-to-use 3D metrology software solutions

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

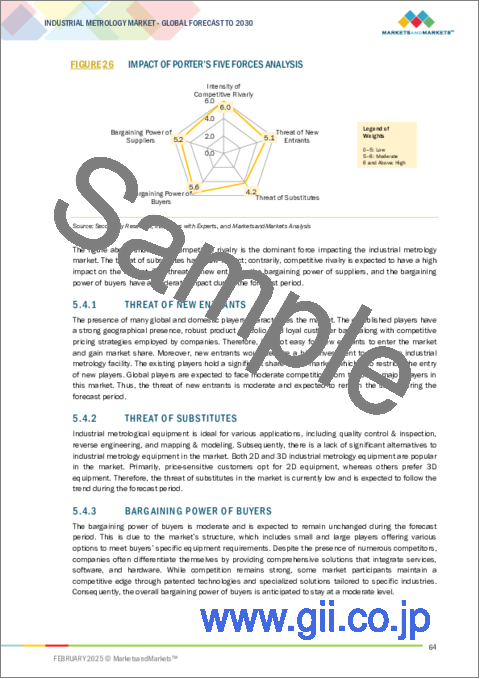

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF NEW ENTRANTS

- 5.4.2 THREAT OF SUBSTITUTES

- 5.4.3 BARGAINING POWER OF BUYERS

- 5.4.4 BARGAINING POWER OF SUPPLIERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.5.2 BUYING CRITERIA

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 PRICING ANALYSIS

- 5.7.1 INDICATIVE PRICING OF INDUSTRIAL METROLOGY SOLUTIONS OFFERED BY KEY PLAYERS, BY EQUIPMENT, 2024

- 5.7.2 AVERAGE SELLING PRICE TREND OF INDUSTRIAL METROLOGY SOLUTIONS, BY EQUIPMENT, 2021-2024

- 5.7.3 AVERAGE SELLING PRICE TREND OF CMMS, BY REGION, 2021-2024

- 5.8 TRADE ANALYSIS

- 5.9 ECOSYSTEM ANALYSIS

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 VOLUMETRIC ACCURACY RESEARCH INSTITUTE USES RENISHAW XM-60 MULTI-AXIS CALIBRATOR TO REDUCE SPATIAL ACCURACY MEASUREMENT TIME

- 5.11.2 HEXAGON'S AICON STEREOSCAN NEO-STRUCTURED LIGHT SCANNER AND LEICA ABSOLUTE TRACKER HELP CREATE 3D PRINTED REPLICA OF MICHELANGELO'S DAVID SCULPTURE

- 5.11.3 ALLOY SPECIALTIES DEPLOYS HEXAGON'S TEMPO TECHNOLOGY TO IMPROVE PRODUCTION CAPACITY

- 5.11.4 KAWASAKI'S MARYVILLE PLANT INSTALLS RENISHAW'S REVO 5-AXIS SYSTEMS TO REDUCE DAILY INSPECTION TIME

- 5.11.5 DAWN MACHINERY ADOPTS RENISHAW'S XK10 ALIGNMENT LASER SYSTEM TO INCREASE CUSTOM MACHINE TOOL PRODUCTION EFFICIENCY

- 5.11.6 FORD MOTOR COMPANY USES ZYGO NEXVIEWTM NX2TM TO MONITOR GEAR SURFACE PROCESSING

- 5.12 PATENT ANALYSIS

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 KEY TECHNOLOGIES

- 5.13.1.1 3D scanning

- 5.13.1.2 Optical metrology

- 5.13.2 COMPLEMENTARY TECHNOLOGIES

- 5.13.2.1 Digital twin

- 5.13.2.2 Industrial Internet of Things (IIoT)

- 5.13.3 ADJACENT TECHNOLOGIES

- 5.13.3.1 Artificial intelligence (AI) and machine learning (ML)

- 5.13.3.2 Edge computing

- 5.13.1 KEY TECHNOLOGIES

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 REGULATIONS

- 5.14.3 STANDARDS

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 IMPACT OF AI/GEN AI ON INDUSTRIAL METROLOGY MARKET

6 INDUSTRIAL METROLOGY MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 HARDWARE

- 6.2.1 RISING EMPHASIS ON OPTIMIZING INSPECTION PROCESSES TO FOSTER SEGMENTAL GROWTH

- 6.3 SOFTWARE

- 6.3.1 INCREASING DEVELOPMENT OF CLOUD-BASED METROLOGY SOLUTIONS TO FUEL SEGMENTAL GROWTH

- 6.4 SERVICES

- 6.4.1 AFTER-SALES SERVICES

- 6.4.1.1 Requirement for operational maintenance, calibration, and certification to boost segmental growth

- 6.4.2 MEASUREMENT SERVICES

- 6.4.2.1 Need for rigorous quality control in manufacturing operations to accelerate segmental growth

- 6.4.3 STORAGE-AS-A-SERVICE

- 6.4.3.1 High emphasis on achieving cost efficiency to bolster segmental growth

- 6.4.4 SOFTWARE-AS-A-SERVICE

- 6.4.4.1 Surging adoption of 3D scanners to contribute to segmental growth

- 6.4.1 AFTER-SALES SERVICES

7 INDUSTRIAL METROLOGY MARKET, BY EQUIPMENT

- 7.1 INTRODUCTION

- 7.2 CMMS

- 7.2.1 BRIDGE CMMS

- 7.2.1.1 Low costs and minimal maintenance requirements to foster segmental growth

- 7.2.2 GANTRY CMMS

- 7.2.2.1 Greater flexibility and real-time monitoring benefits to augment segmental growth

- 7.2.3 HORIZONTAL ARM CMMS

- 7.2.3.1 Ability to measure large workpieces to contribute to segmental growth

- 7.2.4 CANTILEVER CMMS

- 7.2.4.1 Proficiency in measuring small parts with greater accuracy to drive market

- 7.2.5 ARTICULATED ARM CMMS

- 7.2.5.1 Quick and accurate inspection attributes to boost segmental growth

- 7.2.1 BRIDGE CMMS

- 7.3 ODS

- 7.3.1 LASER & STRUCTURED LIGHT SCANNERS

- 7.3.1.1 Mounting demand for fast, accurate, and non-contact measurement solutions to drive market

- 7.3.2 LASER TRACKERS

- 7.3.2.1 Increasing product upgrades to measure large objects and scan complex areas to boost segmental growth

- 7.3.3 OTHER ODS TYPES

- 7.3.1 LASER & STRUCTURED LIGHT SCANNERS

- 7.4 MEASURING INSTRUMENTS

- 7.4.1 GROWING FOCUS ON INDUSTRIAL AUTOMATION TO CONTRIBUTE TO SEGMENTAL GROWTH

- 7.4.2 MEASURING MICROSCOPES

- 7.4.3 PROFILE PROJECTORS

- 7.4.4 AUTOCOLLIMATORS

- 7.4.5 VISION SYSTEMS

- 7.4.6 MULTISENSOR MEASURING SYSTEMS

- 7.5 X-RAY & CT SYSTEMS

- 7.5.1 RISING ADOPTION OF ADDITIVE MANUFACTURING TECHNIQUES TO ACCELERATE SEGMENTAL GROWTH

- 7.6 AOI SYSTEMS

- 7.6.1 INCREASING FOCUS ON MITIGATING CATASTROPHIC FAILURES AND QUALITY DEFECTS TO CONTRIBUTE TO SEGMENTAL GROWTH

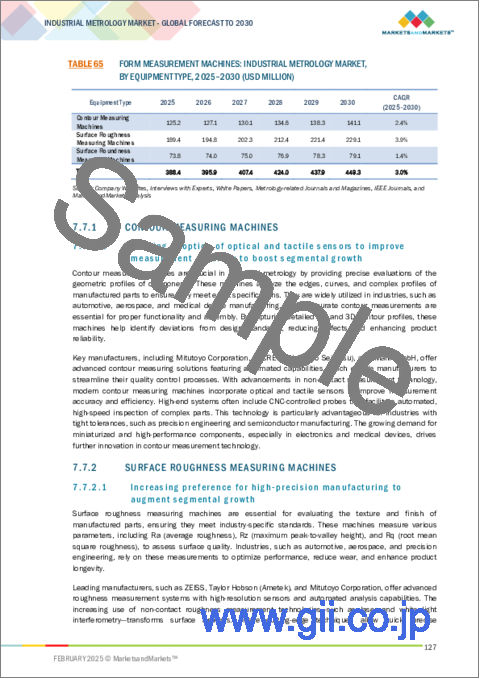

- 7.7 FORM MEASUREMENT MACHINES

- 7.7.1 CONTOUR MEASURING MACHINES

- 7.7.1.1 Growing adoption of optical and tactile sensors to improve measurement accuracy to boost segmental growth

- 7.7.2 SURFACE ROUGHNESS MEASURING MACHINES

- 7.7.2.1 Increasing preference for high-precision manufacturing to augment segmental growth

- 7.7.3 SURFACE ROUNDNESS MEASURING MACHINES

- 7.7.3.1 Rapid advances in automated measuring systems to contribute to segmental growth

- 7.7.1 CONTOUR MEASURING MACHINES

- 7.8 2D EQUIPMENT

- 7.8.1 SURGING DEMAND FOR MICROMETERS DUE TO LOW COSTS AND PRECISION TO DRIVE MARKET

8 INDUSTRIAL METROLOGY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 QUALITY CONTROL & INSPECTION

- 8.2.1 RISING NEED TO IDENTIFY DEFECTIVE PARTS AND MAINTAIN STRICT QUALITY STANDARDS TO BOLSTER SEGMENTAL GROWTH

- 8.3 REVERSE ENGINEERING

- 8.3.1 GROWING ADOPTION IN AUTOMOTIVE AND AEROSPACE & DEFENSE INDUSTRIES TO FUEL SEGMENTAL GROWTH

- 8.4 MAPPING & MODELING

- 8.4.1 INCREASING DEVELOPMENT OF CUSTOMIZED SOLUTIONS TAILORED TO UNIQUE NEEDS OF INDUSTRIES TO DRIVE MARKET

- 8.5 OTHER APPLICATIONS

9 INDUSTRIAL METROLOGY MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 AEROSPACE & DEFENSE

- 9.2.1 RISING EMPHASIS ON PRECISION, PERFORMANCE, AND QUALITY TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.3 AUTOMOTIVE

- 9.3.1 INCREASING NEED FOR PRECISION MEASUREMENT AND QUALITY CONTROL IN MANUFACTURING FACILITIES TO DRIVE MARKET

- 9.4 ARCHITECTURE & CONSTRUCTION

- 9.4.1 INCREASING ADOPTION OF 3D SCANNERS AND BUILDING INFORMATION MODELING FOR ENHANCED ACCURACY TO DRIVE MARKET

- 9.5 MEDICAL

- 9.5.1 GROWING FOCUS ON SAFETY, PRECISION, AND QUALITY OF DIAGNOSTIC EQUIPMENT TO ACCELERATE SEGMENTAL GROWTH

- 9.6 SEMICONDUCTOR & ELECTRONICS

- 9.6.1 MOUNTING DEMAND FOR MINIATURIZED PRODUCTS WITH EXCEPTIONAL ACCURACY, PRECISION, AND HIGH THROUGHPUT TO DRIVE MARKET

- 9.7 ENERGY & POWER

- 9.7.1 INCREASING REQUIREMENT FOR PRECISION INSPECTION TO REDUCE ENERGY LOSSES TO FOSTER SEGMENTAL GROWTH

- 9.8 HEAVY MACHINERY

- 9.8.1 RISING NEED FOR PRECISE DIMENSIONAL MEASUREMENT AND INSPECTION TO ACCELERATE SEGMENTAL GROWTH

- 9.9 MINING

- 9.9.1 GROWING FOCUS ON ENHANCING STRUCTURAL ASSESSMENT TO DRIVE MARKET

- 9.10 OTHER END-USE INDUSTRIES

10 INDUSTRIAL METROLOGY MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Increasing adoption of electric vehicles and investment in defense manufacturing to bolster market growth

- 10.2.3 CANADA

- 10.2.3.1 Strong presence of automobile assembly plants to support market growth

- 10.2.4 MEXICO

- 10.2.4.1 Rising electronics and automobile manufacturing to contribute to market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Rising government initiatives to digitize manufacturing sector to augment market growth

- 10.3.3 UK

- 10.3.3.1 Growing focus on precision and efficiency in automotive and aerospace sectors to foster market growth

- 10.3.4 FRANCE

- 10.3.4.1 High commitment to precision and quality in aerospace, defense, and related sectors to fuel market growth

- 10.3.5 ITALY

- 10.3.5.1 Burgeoning demand for industrial manufacturing equipment to boost market growth

- 10.3.6 SPAIN

- 10.3.6.1 Increasing production of cars and industrial vehicles to drive market

- 10.3.7 NETHERLANDS

- 10.3.7.1 Growing demand for high-precision measurement in automotive and advanced manufacturing industries to foster market growth

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Rising emphasis on precision engineering and automation in automobile manufacturing facilities to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Mounting demand for quality control and inspection services to boost market growth

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Increasing export of electronics and automobiles to contribute to market growth

- 10.4.5 INDIA

- 10.4.5.1 Rapid expansion of automobile manufacturing capacity to offer lucrative market growth opportunities

- 10.4.6 TAIWAN

- 10.4.6.1 Growing focus on smart manufacturing and automation to augment market growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 MIDDLE EAST & AFRICA

- 10.5.2.1 Expansion of aircraft fleets to contribute most to market growth

- 10.5.2.2 GCC countries

- 10.5.2.3 Africa & Rest of Middle East

- 10.5.3 SOUTH AMERICA

- 10.5.3.1 Strong focus on promoting domestic automobile production to bolster market growth

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2022-2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 11.6 BRAND COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Offering footprint

- 11.7.5.4 Equipment footprint

- 11.7.5.5 Application footprint

- 11.7.5.6 End-use industry footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 HEXAGON AB

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 CARL ZEISS AG

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 KEYENCE CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 KLA CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 MITUTOYO CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 NIKON CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.7 FARO

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.8 JENOPTIK

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Other developments

- 12.1.9 RENISHAW PLC

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.9.3.2 Deals

- 12.1.10 CREAFORM

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Deals

- 12.1.10.3.3 Expansions

- 12.1.1 HEXAGON AB

- 12.2 OTHER PLAYERS

- 12.2.1 ACCUSCAN

- 12.2.2 CARMAR ACCURACY CO., LTD.

- 12.2.3 BAKER HUGHES COMPANY

- 12.2.4 NORDSON CORPORATION

- 12.2.5 CAIRNHILL

- 12.2.6 ATT METROLOGY SOLUTIONS

- 12.2.7 SGS SOCIETE GENERALE DE SURVEILLANCE SA

- 12.2.8 TRIMET

- 12.2.9 AUTOMATED PRECISION INC (API)

- 12.2.10 APPLIED MATERIALS, INC.

- 12.2.11 PERCEPTRON, INC.

- 12.2.12 SHINING 3D

- 12.2.13 INTERTEK GROUP PLC

- 12.2.14 BRUKER

- 12.2.15 METROLOGIC GROUP

- 12.2.16 INNOVMETRIC SOFTWARE INC.

- 12.2.17 SMARTRAY GMBH

- 12.2.18 WENZEL GROUP

- 12.2.19 SCANTECH (HANGZHOU) CO., LTD.

- 12.2.20 POLYGA INC.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS