|

|

市場調査レポート

商品コード

1132543

ユーティリティロケーターの世界市場:手法別 (電磁場、GPR)・提供製品/サービス別 (装置、サービス)・標的別 (金属ユーティリティ、非金属ユーティリティ)・業種別 (石油・ガス、電力、交通)・地域別の将来予測 (2027年まで)Utility Locator Market by Technique (Electromagnetic Field, GPR), Offering (Equipment and Services), Target (Metallic Utilities and Non-Metallic Utilities), Vertical (Oil & Gas, Electricity, Transportation) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ユーティリティロケーターの世界市場:手法別 (電磁場、GPR)・提供製品/サービス別 (装置、サービス)・標的別 (金属ユーティリティ、非金属ユーティリティ)・業種別 (石油・ガス、電力、交通)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年10月03日

発行: MarketsandMarkets

ページ情報: 英文 189 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のユーティリティロケーター市場は、2022年の8億3,300万米ドルから2027年には11億900万米ドルに達し、予測期間中に5.9%のCAGRで成長すると予想されています。

ユーティリティロケーターに関する規格の導入や規制の緩和が、ユーティリティロケーターの適応を促進し、需要の拡大がユーティリティロケーションサービスプロバイダーに大きなチャンスをもたらすと思われます。

"地中探査レーダー (GPR) 技術を用いたユーティリティロケーター市場が、予測期間中に最高のCAGRで成長する"

GPR技術は、非破壊で物体の位置を特定することができ、電磁場ロケーティングや他の方法では特定できない埋設パイプ・タンク・マンホール・ケーブルなどの関連埋設物の位置を特定するために使用されています。GPRは土・岩石・コンクリート・アスファルト・木材・水などの地下構造物の位置を特定することができます。

"上下水道分野の市場が、予測期間中に最も高いCAGRで成長する"

地下の高圧水道管や下水道の位置を特定せずに掘ると、水道管から噴き出す水の中に石やその他の硬いものが含まれるため、損壊が生じる恐れがあります。ユーティリティロケーティングとマッピング装置は、水圧要件を満たすため、または地下水の問題を軽減するために、正しい損傷箇所のトレースや、上下水道ユーティリティ・ネットワークに役立ちます。ユーティリティの位置決めのGPR技術は、上下水道管や他の物体を見つけるために、氷の上でさえ使用することができます。したがって、上下水道関連のユーティリティロケーターのような様々な利点は、今後数年間で大きな需要を作成することが期待されます。

"アジア太平洋は2022年から2027年の間に、ユーティリティロケーター市場に大きな成長機会を提供する"

アジア太平洋のユーティリティ市場は、急速なインフラ開発イニシアティブや、住宅や産業・商業施設への公共・民間部門による膨大な投資によって特徴付けられるように、高い成長率で成長すると予想されます。アジア太平洋のユーティリティロケーター市場は、上下水道分野でより大きな成長が見込まれています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- 人工知能 (AI)

- IoT (モノのインターネット)

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ

- 貿易分析

- 特許分析

- 主な会議とイベント (2022年~2023年)

- 規制機関、政府機関、その他の組織

第6章 ユーティリティロケーター市場:技術別

- イントロダクション

- 電磁場

- 地中探査レーダー (GPR)

- その他

第7章 ユーティリティロケーター市場:提供製品/サービス別

- イントロダクション

- 装置

- サービス

第8章 ユーティリティロケーター市場:標的別

- イントロダクション

- 金属製ユーティリティ

- 非金属ユーティリティ

第9章 ユーティリティロケーター市場:業種別

- イントロダクション

- 石油・ガス

- 電気

- 交通

- 上下水道

- 通信

- その他

第10章 ユーティリティロケーター市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- 韓国

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 中東・アフリカ

- 南米

第11章 競合情勢

- 概要

- 上位5社の収益分析

- 市場シェア分析 (2021年)

- 競合リーダーシップマッピング (2021年)

- ユーティリティロケーター市場:企業のフットプリント

- 中小企業 (SME) の評価マトリックス (2021年)

- スタートアップの評価マトリックス

- 競合状況・動向

第12章 企業プロファイル

- 主要企業

- RADIODETECTION LTD.

- GUIDELINE GEO

- RIDGE TOOL COMPANY

- DITCH WITCH (THE CHARLES MACHINE WORKS)

- LEICA GEOSYSTEMS AG

- VIVAX-METROTECH CORPORATION

- 3M

- USIC, LLC

- MULTIVIEW LOCATES INC.

- GROUND PENETRATING RADAR SYSTEMS, LLC

- その他の企業

- GSSI GEOPHYSICAL SURVEY SYSTEMS, INC.

- MCLAUGHLIN GROUP, INC. (VERMEERの子会社)

- MAVERICK INSPECTION LTD

- RHD SERVICES

- ONE VISION UTILITY SERVICES

- UTILITIES PLUS

- US RADAR INC.

- TECHNICS GROUP

- GEOTEC SURVEYS LTD.

- LANDSCOPE ENGINEERING LTD

- PLOWMAN CRAVEN LIMITED

- ASIAN CONTEC LIMITED

- UTIL LOCATE

- PENHALL COMPANY

- CHAITANYA INSTRUMENTS PVT LTD

- DETECTION SERVICES

第13章 隣接・関連市場

- イントロダクション

- 制限事項

- GPR市場:種類別

- ハンドヘルド型システム

- カート型システム

- 車載型システム

第14章 付録

The utility locator market is projected to grow from USD 833 million in 2022 to USD 1,109 million in 2027; it is expected to grow at a CAGR of 5.9% during the forecasted period. Introduction of standards and ease in regulations pertaining to utility locators driving the utility locator adaption; while rising demand for real-time utility locating will likely to create huge opportunity to utility location service providers.

"Market for utility locator using ground penetrating radar technique is expected to grow at highest CAGR during the forecasted period."

The ground penetrating radar (GPR) technique can non-destructively locate objects and used to locate buried pipes, tanks, manholes, cables, and other related buried objects, which cannot be located with electromagnetic locating or other methods. The GPR can locate subsurface structures in material like soil, rock, concrete, asphalt, wood and water.

"Market for water and sewage vertical is to grow at highest CAGR during forecast period. "

Digging without locating the underground high-pressure water mains and sewage lines may lead to injury as the jet of water from mains may include stones or other hard objects ejected from the pipe. Utility locating and mapping devices helps in tracing of right damage spot , water and sewer utility networks for meeting water pressure requirements or reducing water-in-basement issues. GPR technique of utility locating can be used even on ice to help in locating water and sewage line, and other objects. Thus, such various benefits of utility locator in water and sewage vertical is expected to create significant demand in coming years.

"APAC to offer significant growth opportunities for utility locator market between 2022 and 2027."

Utility market in APAC region is expected to grow at highest growth of rate as the region characterized by rapid infrastructure development initiatives and huge investment by the public and private sectors in residential, industrial, and commercial establishments. The market for utility locators in Asia pacific is expected to grow more in the water and sewage vertical.

In the process of determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key industry experts in the utility locator market space. The break-up of primary participants for the report has been shown below:

- By Company Type: Tier 1 - 55%, Tier 2 - 30%, and Tier 3 - 15%

- By Designation: C-level Executives - 45%, Directors - 35%, and Others - 20%

- By Region: North America -34%, APAC- 31%, Europe - 24%, and RoW - 12%

The report profiles key players in the utility locator market with their respective market ranking analysis. Prominent players profiled in this report are Radiodetection Ltd.(UK), Guideline Geo (Sweden), Rigid Tool Company (US), Ditch Witch (The Charles Machine works) (US), Leica Geosystems AG (US), Vivax-Metrotech Corporation (US), 3M (US), USIC LLC (US), multiVIEW Locates Inc. (Canada), and Ground Penetrating Radar (US).

Research Coverage:

This research report categorizes the utility locator market on the basis utility locating technique, offering, verticals, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the utility locator market and forecasts the same till 2027. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the utility locator ecosystem.

Key Benefits of Buying the Report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall utility locator market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 UTILITY LOCATOR MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- FIGURE 2 UTILITY LOCATOR MARKET: REGIONAL SEGMENTATION

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 UTILITY LOCATOR MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 List of key primary interview participants

- 2.1.3.3 Breakdown of primary interviews

- 2.1.3.4 Key data from primary sources

- 2.1.3.5 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for arriving at market share by bottom-up analysis (demand side)

- FIGURE 4 UTILITY LOCATOR MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

- FIGURE 5 UTILITY LOCATOR MARKET: TOP-DOWN APPROACH

- FIGURE 6 UTILITY LOCATOR MARKET: SUPPLY-SIDE ANALYSIS

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 UTILITY LOCATOR MARKET, 2018-2027 (USD MILLION)

- FIGURE 9 ELECTROMAGNETIC FIELD TECHNIQUE TO HAVE LARGEST MARKET SHARE

- FIGURE 10 UTILITY LOCATOR SERVICES TO GROW AT HIGHER CAGR

- FIGURE 11 TELECOMMUNICATIONS VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 12 ASIA PACIFIC EXPECTED TO BE FASTEST-GROWING MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN UTILITY LOCATOR MARKET

- FIGURE 13 AGING INFRASTRUCTURE MAINTENANCE NEEDS TO DRIVE MARKET

- 4.2 UTILITY LOCATOR MARKET, BY OFFERING

- FIGURE 14 UTILITY LOCATOR EQUIPMENT TO HAVE LARGER MARKET SIZE IN 2027

- 4.3 UTILITY LOCATOR MARKET, BY TECHNIQUE

- FIGURE 15 GPR TECHNIQUE TO GROW AT HIGHEST CAGR

- 4.4 UTILITY LOCATOR MARKET IN NORTH AMERICA, BY VERTICAL AND COUNTRY

- FIGURE 16 TELECOMMUNICATIONS VERTICAL AND US TO ACCOUNT FOR LARGEST MARKET SHARES IN NORTH AMERICA

- 4.5 UTILITY LOCATOR MARKET, BY COUNTRY

- FIGURE 17 US TO HAVE LARGEST SIZE OF UTILITY LOCATOR MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN UTILITY LOCATOR MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Concern for safety and protection of underground utilities

- 5.2.1.2 Benefits of utility locator systems over traditional technologies/methods

- 5.2.1.3 Introduction of standards and ease in regulations pertaining to utility locators

- FIGURE 19 UTILITY LOCATOR MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of ownership and maintenance of utility locators

- FIGURE 20 UTILITY LOCATOR MARKET: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for real-time utility locating

- 5.2.3.2 Growing infrastructure requires maintenance operations by utility locator system

- FIGURE 21 UTILITY LOCATOR MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of expertise and skillset

- 5.2.4.2 Differed weather and soil conditions in addition to technological limitations

- FIGURE 22 UTILITY LOCATOR MARKET: IMPACT ANALYSIS OF CHALLENGES

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 23 UTILITY LOCATOR MARKET: VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 24 UTILITY LOCATOR MARKET: ECOSYSTEM ANALYSIS

- TABLE 1 UTILITY LOCATOR MARKET: ECOSYSTEM

- 5.5 PRICING ANALYSIS

- TABLE 2 AVERAGE SELLING PRICE OF UTILITY LOCATOR SYSTEMS OFFERED BY TOP COMPANIES, 2021

- TABLE 3 INDICATIVE PRICE OF UTILITY LOCATOR SYSTEMS

- 5.5.1 AVERAGE SELLING PRICE OF COMPONENTS OFFERED BY KEY PLAYERS

- FIGURE 25 AVERAGE SELLING PRICE OF COMPONENTS OFFERED BY KEY PLAYERS

- TABLE 4 AVERAGE SELLING PRICE OF COMPONENTS OFFERED BY KEY PLAYERS (USD)

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN UTILITY LOCATOR MARKET

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 ARTIFICIAL INTELLIGENCE

- 5.7.2 INTERNET OF THINGS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 UTILITY LOCATOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP-3 VERTICALS

- TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP-3 VERTICALS (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR TOP-3 VERTICALS

- TABLE 7 KEY BUYING CRITERIA FOR TOP-3 VERTICALS

- 5.10 CASE STUDIES

- TABLE 8 MULTIVIEW USED GPR SYSTEM TO INVESTIGATE ROAD STRUCTURE OVER SEVERAL KILOMETERS IN ONTARIO

- TABLE 9 GUIDELINE GEO USED GPR IMAGING OF WESTERN WALL, JERUSALEM, ISRAEL

- TABLE 10 GPR SLICE SOFTWARE HELPED ANALYZE DATA FROM GPR

- TABLE 11 WHEEL-MOUNTED SEEKER SPR ALLOWED ANALYSIS OF SUBSURFACE ROCK ON TRENCH LINES

- TABLE 12 C-THRUE GPR USED TO IDENTIFY METAL ELEMENTS IN STRUCTURAL ELEMENTS

- 5.11 TRADE ANALYSIS

- FIGURE 29 IMPORT DATA, BY COUNTRY, 2017-2021 (USD MILLION)

- FIGURE 30 EXPORT DATA, BY COUNTRY, 2017-2021 (USD MILLION)

- 5.12 PATENT ANALYSIS

- FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS FROM 2012 TO 2022

- TABLE 13 TOP 20 PATENT OWNERS FROM 2021 TO 2022

- FIGURE 32 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

- TABLE 14 LIST OF A FEW PATENTS IN UTILITY LOCATOR MARKET, 2020-2021

- 5.13 KEY CONFERENCES & EVENTS, 2022-2023

- TABLE 15 UTILITY LOCATOR MARKET: DETAILED LIST OF CONFERENCES & EVENTS

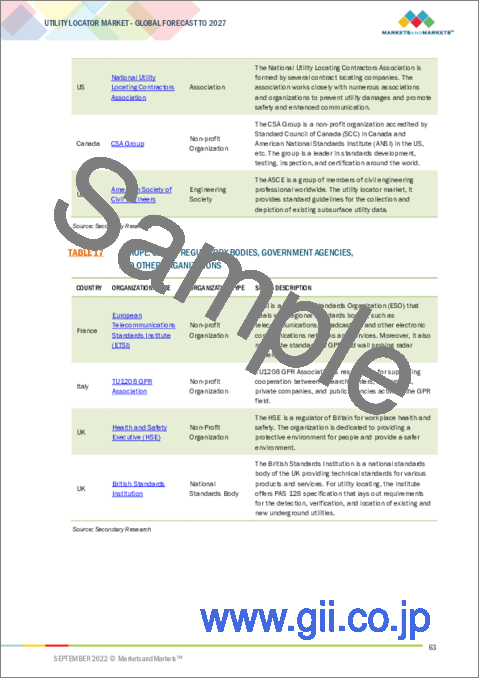

- 5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.1 STANDARDS

- TABLE 20 STANDARDS FOR UTILITY LOCATOR MARKET

6 UTILITY LOCATOR MARKET, BY TECHNIQUE

- 6.1 INTRODUCTION

- FIGURE 33 ELECTROMAGNETIC FIELD-BASED UTILITY LOCATOR TO HAVE LARGEST MARKET SHARE

- TABLE 21 UTILITY LOCATOR MARKET, BY TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 22 UTILITY LOCATOR MARKET, BY TECHNIQUE, 2022-2027 (USD MILLION)

- 6.2 ELECTROMAGNETIC FIELD

- 6.2.1 INCREASED USE OF ELECTROMAGNETIC RADIATION TO LOCATE UNDERGROUND UTILITIES

- TABLE 23 UTILITY LOCATOR MARKET FOR ELECTROMAGNETIC FIELD, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 24 UTILITY LOCATOR MARKET FOR ELECTROMAGNETIC FIELD TECHNIQUE, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 25 UTILITY LOCATOR MARKET FOR ELECTROMAGNETIC FIELD, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 26 UTILITY LOCATOR MARKET FOR ELECTROMAGNETIC FIELD TECHNIQUE, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 27 UTILITY LOCATOR MARKET FOR ELECTROMAGNETIC FIELD TECHNIQUE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 28 UTILITY LOCATOR MARKET FOR ELECTROMAGNETIC FIELD TECHNIQUE, BY REGION, 2022-2027(USD MILLION)

- 6.3 GROUND PENETRATING RADAR (GPR)

- 6.3.1 RISE IN USE OF GPR IN UTILITY LOCATOR TO LOCATE BURIED PIPES, CABLES, AND OTHER RELATED BURIED OBJECTS

- TABLE 29 UTILITY LOCATOR MARKET FOR GPR TECHNIQUE, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 30 UTILITY LOCATOR MARKET FOR GPR TECHNIQUE, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 31 UTILITY LOCATOR MARKET FOR GPR TECHNIQUE, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 32 UTILITY LOCATOR MARKET FOR GPR TECHNIQUE, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 33 UTILITY LOCATOR MARKET FOR GPR TECHNIQUE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 34 UTILITY LOCATOR MARKET FOR GPR TECHNIQUE, BY REGION, 2022-2027 (USD MILLION)

- 6.4 OTHERS

- TABLE 35 UTILITY LOCATOR MARKET FOR OTHER TECHNIQUES, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 36 UTILITY LOCATOR MARKET FOR OTHER TECHNIQUES, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 37 UTILITY LOCATOR MARKET FOR OTHER TECHNIQUES, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 38 UTILITY LOCATOR MARKET FOR OTHER TECHNIQUES, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 39 UTILITY LOCATOR MARKET FOR OTHER TECHNIQUES, BY REGION, 2018-2021 (USD MILLION)

- TABLE 40 UTILITY LOCATOR MARKET FOR OTHER TECHNIQUES, BY REGION, 2022-2027 (USD MILLION)

7 UTILITY LOCATOR MARKET, BY OFFERING

- 7.1 INTRODUCTION

- FIGURE 34 MARKET FOR UTILITY LOCATING SERVICES TO GROW AT HIGHER CAGR

- TABLE 41 UTILITY LOCATOR MARKET, BY OFFERING 2018-2021 (USD MILLION)

- TABLE 42 UTILITY LOCATOR MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- 7.2 EQUIPMENT

- 7.2.1 ADVANCEMENTS IN UTILITY LOCATING EQUIPMENT TO LOCATE UNDERGROUND UTILITIES

- TABLE 43 UTILITY LOCATOR MARKET FOR EQUIPMENT, BY TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 44 UTILITY LOCATOR MARKET FOR EQUIPMENT, BY TECHNIQUE, 2022-2027 (USD MILLION)

- 7.3 SERVICES

- 7.3.1 CONCERN FOR SAFETY AND PROTECTION OF UNDERGROUND UTILITIES DRIVE DEMAND FOR UTILITY SERVICES

- TABLE 45 UTILITY LOCATOR MARKET FOR SERVICE, BY TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 46 UTILITY LOCATOR MARKET FOR SERVICE, BY TECHNIQUE, 2022-2027 (USD MILLION)

8 UTILITY LOCATOR MARKET, BY TARGET

- 8.1 INTRODUCTION

- FIGURE 35 UTILITY LOCATOR MARKET FOR METALLIC UTILITIES TO HAVE LARGER SHARE

- TABLE 47 UTILITY LOCATOR MARKET, BY TARGET, 2018-2021 (USD MILLION)

- TABLE 48 UTILITY LOCATOR MARKET, BY TARGET, 2022-2027 (USD MILLION)

- 8.2 METALLIC UTILITIES

- 8.2.1 ELECTROMAGNETIC UTILITY SOLUTIONS ENABLE EFFECTIVE TRACING AND MARKING OF UNDERGROUND BURIED METALLIC UTILITIES

- 8.3 NON-METALLIC UTILITIES

- 8.3.1 GPR OFFERS TRACING AND IDENTIFICATION OF BURIED NON-METALLIC UTILITIES

9 UTILITY LOCATOR MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- FIGURE 36 TELECOMMUNICATIONS VERTICAL OF UTILITY LOCATOR MARKET TO HAVE LARGEST SHARE CAGR

- TABLE 49 UTILITY LOCATOR MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 50 UTILITY LOCATOR MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 9.2 OIL & GAS

- 9.2.1 UTILITY LOCATORS TRACE PIPELINES TRANSMISSION AND PINPOINT PROBLEM AREAS IN OIL & GAS INDUSTRY

- TABLE 51 UTILITY LOCATOR MARKET FOR OIL & GAS, BY TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 52 UTILITY LOCATOR MARKET FOR OIL & GAS, BY TECHNIQUE, 2022-2027 (USD MILLION)

- TABLE 53 UTILITY LOCATOR MARKET FOR OIL & GAS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 54 UTILITY LOCATOR MARKET FOR OIL & GAS, BY REGION, 2022-2027 (USD MILLION)

- 9.3 ELECTRICITY

- 9.3.1 GROWING POWER DISTRIBUTION NETWORK IN DEVELOPING COUNTRIES TO CREATE GROWTH OPPORTUNITIES

- TABLE 55 UTILITY LOCATOR MARKET FOR ELECTRICITY, BY TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 56 UTILITY LOCATOR MARKET FOR ELECTRICITY, BY TECHNIQUE, 2022-2027 (USD MILLION)

- TABLE 57 UTILITY LOCATOR MARKET FOR ELECTRICITY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 58 UTILITY LOCATOR MARKET FOR ELECTRICITY, BY REGION, 2022-2027 (USD MILLION)

- 9.4 TRANSPORTATION

- 9.4.1 RAPID URBANIZATION DRIVES DEMAND FOR UTILITY LOCATORS

- TABLE 59 UTILITY LOCATOR MARKET FOR TRANSPORTATION, BY TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 60 UTILITY LOCATOR MARKET FOR TRANSPORTATION, BY TECHNIQUE, 2022-2027 (USD MILLION)

- TABLE 61 UTILITY LOCATOR MARKET FOR TRANSPORTATION, BY REGION, 2018-2021 (USD MILLION)

- TABLE 62 UTILITY LOCATOR MARKET FOR TRANSPORTATION, BY REGION, 2022-2027 (USD MILLION)

- 9.5 WATER & SEWAGE

- 9.5.1 UTILITY LOCATOR ENABLES TRACING OF RIGHT DAMAGE SPOTS

- TABLE 63 UTILITY LOCATOR MARKET FOR WATER & SEWAGE, BY TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 64 UTILITY LOCATOR MARKET FOR WATER & SEWAGE, BY TECHNIQUE, 2022-2027 (USD MILLION)

- TABLE 65 UTILITY LOCATOR MARKET FOR WATER & SEWAGE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 66 UTILITY LOCATOR MARKET FOR WATER & SEWAGE, BY REGION, 2022-2027 (USD MILLION)

- 9.6 TELECOMMUNICATIONS

- 9.6.1 UTILITY LOCATORS ASSURE UNINTERRUPTED OPERATION OF COMMUNICATION CABLES

- TABLE 67 UTILITY LOCATOR MARKET FOR TELECOMMUNICATIONS, BY TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 68 UTILITY LOCATOR MARKET FOR TELECOMMUNICATIONS, BY TECHNIQUE, 2022-2027 (USD MILLION)

- TABLE 69 UTILITY LOCATOR MARKET FOR TELECOMMUNICATIONS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 70 UTILITY LOCATOR MARKET FOR TELECOMMUNICATIONS, BY REGION, 2022-2027 (USD MILLION)

- 9.7 OTHERS

- TABLE 71 UTILITY LOCATOR MARKET FOR OTHER VERTICALS, BY TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 72 UTILITY LOCATOR MARKET FOR OTHER VERTICALS, BY TECHNIQUE, 2022-2027 (USD MILLION)

- TABLE 73 UTILITY LOCATOR MARKET FOR OTHER VERTICALS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 74 UTILITY LOCATOR MARKET FOR OTHER VERTICALS, BY REGION, 2022-2027 (USD MILLION)

10 UTILITY LOCATOR MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 37 UTILITY MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR

- TABLE 75 UTILITY LOCATOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 76 UTILITY LOCATOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 38 NORTH AMERICA: UTILITY LOCATOR MARKET SNAPSHOT

- TABLE 77 NORTH AMERICA: UTILITY LOCATOR MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 78 NORTH AMERICA: UTILITY LOCATOR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 79 NORTH AMERICA: UTILITY LOCATOR MARKET, BY TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 80 NORTH AMERICA: UTILITY LOCATOR MARKET, BY TECHNIQUE, 2022-2027 (USD MILLION)

- TABLE 81 NORTH AMERICA: UTILITY LOCATOR MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 82 NORTH AMERICA: UTILITY LOCATOR MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Rising government investments in transportation & infrastructure

- 10.2.2 CANADA

- 10.2.2.1 Growing demand for electricity distribution lines

- 10.2.3 MEXICO

- 10.2.3.1 Growing infrastructure sector to fuel utility locator market

- 10.3 EUROPE

- FIGURE 39 EUROPE: UTILITY LOCATOR MARKET SNAPSHOT

- TABLE 83 EUROPE: UTILITY LOCATOR MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 84 EUROPE: UTILITY LOCATOR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 85 EUROPE: UTILITY LOCATOR MARKET, BY TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 86 EUROPE: UTILITY LOCATOR MARKET, BY TECHNIQUE, 2022-2027 (USD MILLION)

- TABLE 87 EUROPE: UTILITY LOCATOR MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 88 EUROPE: UTILITY LOCATOR MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.3.1 UK

- 10.3.1.1 Improvement in transportation infrastructure

- 10.3.2 GERMANY

- 10.3.2.1 Infrastructure redevelopment projects to create market growth opportunities

- 10.3.3 FRANCE

- 10.3.3.1 High demand for utility locator solutions in infrastructure projects

- 10.3.4 REST OF EUROPE

- 10.4 ASIA PACIFIC

- FIGURE 40 ASIA PACIFIC: UTILITY LOCATOR MARKET SNAPSHOT

- TABLE 89 ASIA PACIFIC: UTILITY LOCATOR MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 90 ASIA PACIFIC: UTILITY LOCATOR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 91 ASIA PACIFIC: UTILITY LOCATOR MARKET, BY TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 92 ASIA PACIFIC: UTILITY LOCATOR MARKET, BY TECHNIQUE, 2022-2027 (USD MILLION)

- TABLE 93 ASIA PACIFIC: UTILITY LOCATOR MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 94 ASIA PACIFIC: UTILITY LOCATOR MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Increasing investments in infrastructure development to boost market

- 10.4.2 JAPAN

- 10.4.2.1 Demand for safety measures in transportation infrastructure

- 10.4.3 SOUTH KOREA

- 10.4.3.1 Growing demand for inspection systems in bridges, buildings, and tunnels

- 10.4.4 REST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD (ROW)

- TABLE 95 ROW: UTILITY LOCATOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 96 ROW: UTILITY LOCATOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 97 ROW: UTILITY LOCATOR MARKET, BY TECHNIQUE, 2018-2021 (USD MILLION)

- TABLE 98 ROW: UTILITY LOCATOR MARKET, BY TECHNIQUE, 2022-2027 (USD MILLION)

- TABLE 99 ROW: UTILITY LOCATOR MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 100 ROW: UTILITY LOCATOR MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.5.1 MIDDLE EAST & AFRICA

- 10.5.2 SOUTH AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 TOP-FIVE COMPANY REVENUE ANALYSIS

- FIGURE 41 UTILITY LOCATOR MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2017-2021

- 11.3 MARKET SHARE ANALYSIS, 2021

- TABLE 101 UTILITY LOCATOR MARKET SHARE ANALYSIS (2021)

- 11.4 COMPETITIVE LEADERSHIP MAPPING, 2021

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 42 UTILITY LOCATOR MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 11.5 UTILITY LOCATOR MARKET: COMPANY FOOTPRINT

- TABLE 102 COMPANY FOOTPRINT

- TABLE 103 OFFERING FOOTPRINT OF COMPANIES

- TABLE 104 VERTICAL FOOTPRINT OF COMPANIES

- TABLE 105 REGIONAL FOOTPRINT OF COMPANIES

- 11.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2021

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 43 UTILITY LOCATOR, SMES EVALUATION QUADRANT, 2021

- 11.7 STARTUP EVALUATION MATRIX

- TABLE 106 UTILITY LOCATOR MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 107 UTILITY LOCATOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.8 COMPETITIVE SITUATIONS AND TRENDS

- TABLE 108 UTILITY LOCATOR MARKET: PRODUCT LAUNCHES, 2019-2022

- TABLE 109 UTILITY LOCATOR MARKET: DEALS, 2019-2022

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View)**

- 12.1.1 RADIODETECTION LTD.

- TABLE 110 RADIODETECTION LTD.: BUSINESS OVERVIEW

- FIGURE 44 RADIODETECTION LTD.: COMPANY SNAPSHOT

- TABLE 111 RADIODETECTION LTD.: PRODUCT OFFERING

- TABLE 112 RADIODETECTION LTD.: PRODUCT LAUNCHES AND DEVELOPMENTS

- 12.1.2 GUIDELINE GEO

- TABLE 113 GUIDELINE GEO: BUSINESS OVERVIEW

- FIGURE 45 GUIDELINE GEO: COMPANY SNAPSHOT

- TABLE 114 GUIDELINE GEO: PRODUCT OFFERING

- TABLE 115 GUIDELINE GEO: PRODUCT LAUNCHES AND DEVELOPMENTS

- 12.1.3 RIDGE TOOL COMPANY

- TABLE 116 RIDGE TOOL COMPANY: BUSINESS OVERVIEW

- FIGURE 46 RIDGE TOOL COMPANY: COMPANY SNAPSHOT

- TABLE 117 RIDGE TOOL COMPANY: PRODUCT OFFERING

- 12.1.4 DITCH WITCH (THE CHARLES MACHINE WORKS)

- TABLE 118 DITCH WITCH: BUSINESS OVERVIEW

- FIGURE 47 DITCH WITCH: COMPANY SNAPSHOT

- TABLE 119 DITCH WITCH: PRODUCT OFFERING

- 12.1.5 LEICA GEOSYSTEMS AG

- TABLE 120 LEICA GEOSYSTEMS AG: BUSINESS OVERVIEW

- FIGURE 48 LEICA GEOSYSTEMS AG: COMPANY SNAPSHOT

- TABLE 121 LEICA GEOSYSTEMS AG: PRODUCT OFFERING

- 12.1.6 VIVAX-METROTECH CORPORATION

- TABLE 122 VIVAX-METROTECH CORPORATION: BUSINESS OVERVIEW

- TABLE 123 VIVAX-METROTECH CORPORATION: PRODUCT OFFERING

- TABLE 124 VIVAX-METROTECH CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

- 12.1.7 3M

- TABLE 125 3M: BUSINESS OVERVIEW

- FIGURE 49 3M: COMPANY SNAPSHOT

- TABLE 126 3M: PRODUCT OFFERING

- 12.1.8 USIC, LLC

- TABLE 127 USIC, LLC: BUSINESS OVERVIEW

- TABLE 128 USIC, LLC: SERVICE OFFERING

- 12.1.9 MULTIVIEW LOCATES INC.

- TABLE 129 MULTIVIEW LOCATES INC.: BUSINESS OVERVIEW

- TABLE 130 MULTIVIEW LOCATES INC.: SERVICE OFFERING

- 12.1.10 GROUND PENETRATING RADAR SYSTEMS, LLC

- TABLE 131 GROUND PENETRATING RADAR SYSTEMS, LLC: BUSINESS OVERVIEW

- TABLE 132 GROUND PENETRATING RADAR SYSTEMS, LLC: SERVICE OFFERING

- * Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 GSSI GEOPHYSICAL SURVEY SYSTEMS, INC.

- TABLE 133 GSSI GEOPHYSICAL SURVEY SYSTEMS, INC.: BUSINESS OVERVIEW

- 12.2.2 MCLAUGHLIN GROUP, INC. (A VERMEER COMPANY)

- TABLE 134 MCLAUGHLIN GROUP, INC.: BUSINESS OVERVIEW

- 12.2.3 MAVERICK INSPECTION LTD

- TABLE 135 MAVERICK INSPECTION LTD: BUSINESS OVERVIEW

- 12.2.4 RHD SERVICES

- TABLE 136 RHD SERVICES: BUSINESS OVERVIEW

- 12.2.5 ONE VISION UTILITY SERVICES

- TABLE 137 ONE VISION UTILITY SERVICES: BUSINESS OVERVIEW

- 12.2.6 UTILITIES PLUS

- TABLE 138 UTILITIES PLUS: BUSINESS OVERVIEW

- 12.2.7 US RADAR INC.

- TABLE 139 US RADAR, INC.: BUSINESS OVERVIEW

- 12.2.8 TECHNICS GROUP

- TABLE 140 TECHNICS GROUP: BUSINESS OVERVIEW

- 12.2.9 GEOTEC SURVEYS LTD.

- TABLE 141 GEOTEC SURVEYS LTD.: BUSINESS OVERVIEW

- 12.2.10 LANDSCOPE ENGINEERING LTD

- TABLE 142 LANDSCOPE ENGINEERING LTD: BUSINESS OVERVIEW

- 12.2.11 PLOWMAN CRAVEN LIMITED

- TABLE 143 PLOWMAN CRAVEN LIMITED: BUSINESS OVERVIEW

- 12.2.12 ASIAN CONTEC LIMITED

- TABLE 144 ASIAN CONTEC LIMITED: BUSINESS OVERVIEW

- 12.2.13 UTIL LOCATE

- TABLE 145 UTIL LOCATE: BUSINESS OVERVIEW

- 12.2.14 PENHALL COMPANY

- TABLE 146 PENHALL COMPANY: BUSINESS OVERVIEW

- 12.2.15 CHAITANYA INSTRUMENTS PVT LTD

- TABLE 147 CHAITANYA INSTRUMENTS PVT LTD: BUSINESS OVERVIEW

- 12.2.16 DETECTION SERVICES

- TABLE 148 DETECTION SERVICES: BUSINESS OVERVIEW

13 ADJACENT & RELATED MARKET

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 GPR MARKET, BY TYPE

- TABLE 149 GPR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 150 GPR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 13.4 HANDHELD SYSTEMS

- 13.4.1 CONCRETE INVESTIGATION TO DRIVE DEMAND FOR HANDHELD GPR SYSTEMS

- 13.5 CART-BASED SYSTEMS

- 13.5.1 CART-BASED SYSTEMS ARE CONSIDERED HIGHEST-QUALITY GROUND INSPECTION DATA PROVIDERS

- 13.6 VEHICLE-MOUNTED SYSTEMS

- 13.6.1 TRANSPORTATION INFRASTRUCTURE TO DRIVE DEMAND FOR VEHICLE-MOUNTED SYSTEMS

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS