|

|

市場調査レポート

商品コード

1514364

塩酸の世界市場:グレード別、用途別、最終用途産業別、地域別- 2029年までの予測Hydrochloric Acid Market by Grade (Synthetic, By-product), Application, End-use industry (Food & Beverage, Pharmaceutical, Textile, Steel, Oil & Gas, Chemical), Region (North America, Europe, APAC, MEA, South America), & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 塩酸の世界市場:グレード別、用途別、最終用途産業別、地域別- 2029年までの予測 |

|

出版日: 2024年07月10日

発行: MarketsandMarkets

ページ情報: 英文 265 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

塩酸の市場規模は2024年の22億米ドルから2029年には30億米ドルに成長すると予測され、予測期間中のCAGRは6.5%になるとみられています。

塩酸は食品加工や鉄鋼の酸洗産業で広く使用されています。食品加工では、チーズ製造における凝乳のような作業のためにpHレベルを調整し、ゼラチンのような食品添加物を製造し、醤油の発酵を助け、果物や野菜を保存し、機器を消毒します。これらの用途により、食品の品質、安全性、機能性が確保されます。鉄鋼の酸洗では、塩酸が鉄鋼表面から錆、スケール、汚染物質を除去し、亜鉛メッキ、メッキ、塗装の準備に欠かせないです。工業化とインフラ整備による鉄鋼業界の成長が、塩酸の需要を大幅に押し上げています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(100万米ドル)、数量(100万トン) |

| セグメント | グレード別、用途別、最終用途産業別、地域別 |

| 対象地域 | 北米、アジア太平洋、欧州、南米、中東・アフリカ |

塩酸は主に鉱石採掘、バイオ燃料、オイル、潤滑油の生産、様々な精製工程で利用されています。さらに、塩酸は金属加工において、鉄鋼、アルミニウム、チタン、マグネシウムの酸洗や、亜鉛メッキ工程における金属表面の洗浄に使用されます。

塩酸市場の用途別シェアでは、鉱石加工が第2位を占めています。破砕、粉砕、浮遊、浸出を含む鉱石加工において、塩酸は浸出の際に極めて重要です。その強い酸性は特定の鉱物の溶解を助け、ニッケル、コバルト、希土類元素のような金属の抽出を助ける。塩酸はpHレベルを調整し、不純物を除去して最終製品の純度と収率を高めます。塩酸の使用は、鉱物抽出の効率と効果を向上させ、高品質の金属生産に貢献します。

塩酸は化学産業において重要であり、数多くの化学反応やプロセスにおいて重要な試薬として作用します。pH調整、中和、化学合成に広く使用されています。化学製造において塩酸は、塩化第二鉄、ポリ塩化アルミニウム、水処理、電子機器、医薬品に使用される様々な塩化物のような無機化合物の製造に不可欠です。また、有機合成、特に塩化ビニルやその他の重要な有機化学物質の製造にも不可欠です。塩酸は、高純度シリカの製造、イオン交換樹脂の再生、デンプンやタンパク質の加水分解などのプロセスに使用されます。

当レポートでは、世界の塩酸市場について調査し、グレード別、用途別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

第6章 業界の動向

- ポーターのファイブフォース分析

- バリューチェーン分析

- 貿易分析

- マクロ経済指標

- 技術分析

- 関税と規制状況

- ケーススタディ分析

- 顧客ビジネスに影響を与える動向と混乱

- 2024年~2025年の主な会議とイベント

- 主な利害関係者と購入基準

- エコシステム/市場マップ

- 特許分析

- 価格分析

第7章 塩酸市場(グレード別)

- イントロダクション

- 合成グレード

- 副産物グレード

第8章 塩酸市場(用途別)

- イントロダクション

- 鋼の酸洗い

- 油井の酸化処理

- 鉱石処理

- 食品加工

- プールの衛生

- 塩化カルシウム

- バイオディーゼル

- その他

第9章 塩酸市場(最終用途産業別)

- イントロダクション

- 食品・飲料

- 医薬品

- 繊維

- 鋼鉄

- 石油ガス

- 化学薬品

- その他

第10章 塩酸市場(地域別)

- イントロダクション

- アジア太平洋

- 欧州

- 中東・アフリカ

- 北米

- 南米

第11章 競合情勢

- 概要

- 主要参入企業の戦略

- 主要企業の収益収益分析

- 市場シェア分析

- 企業価値評価と財務指標

- 製品/ブランド比較分析

- 企業評価マトリックス、主要参入企業

- 企業評価マトリックス、スタートアップ/中小企業

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- BASF SE

- COVESTRO AG

- OLIN CORPORATION

- WESTLAKE CORPORATION

- OCCIDENTAL PETROLEUM CORPORATION

- FORMOSA PLASTICS CORPORATION

- TATA CHEMICALS LIMITED

- AGC INC.

- ERCO WORLDWIDE

- DETREX CORPORATION

- その他の企業

- AURORA FINE CHEMICALS

- ZOUPING DONGFANG CHEMICAL INDUSTRY CO., LTD.

- ACURO ORGANICS LIMITED

- MAXWELL ADDITIVES PVT. LTD.

- CHEMTEX SPECIALITY LIMITED

- POLYSCIENCES INC.

- INEOS KOH

- NOURYON

- CONTINENTAL CHEMICAL USA

- JONES-HAMILTON CO.

- TRONOX HOLDINGS PLC

- KUHLMANN EUROPE

- PCC GROUP

- HAWKINS

- HYDRITE CHEMICAL

第13章 隣接市場と関連市場

第14章 付録

List of Tables

- TABLE 1 HYDROCHLORIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 WORLD GDP GROWTH PROJECTION, 2019-2026 (USD BILLION)

- TABLE 3 AVERAGE TARIFF, BY COUNTRY

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 OLIN CORPORATION ADOPTED ADVANCED MEMBRANE CELL TECHNOLOGY IN CHEMICAL MANUFACTURING

- TABLE 10 WESTLAKE CHEMICAL UTILIZED HYDROCHLORIC ACID IN PVC PRODUCTION

- TABLE 11 BASF INCREASED CONSUMPTION OF HYDROCHLORIC ACID IN ENVIRONMENTAL APPLICATIONS

- TABLE 12 HYDROCHLORIC ACID MARKET: KEY CONFERENCES & EVENTS, 2024-2025

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 14 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- TABLE 15 HYDROCHLORIC ACID MARKET ECOSYSTEM

- TABLE 16 PATENTS IN HYDROCHLORIC ACID MARKET, 2022-2023

- TABLE 17 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY GRADE (USD/TON)

- TABLE 18 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, SYNTHETIC GRADE, BY REGION, 2023-2029 (USD/TON)

- TABLE 19 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY-PRODUCT GRADE, BY REGION, 2023-2029 (USD/TON)

- TABLE 20 HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 21 HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 22 SYNTHETIC GRADE: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

- TABLE 23 SYNTHETIC GRADE: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (KILOTON)

- TABLE 24 BY-PRODUCT GRADE: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

- TABLE 25 BY-PRODUCT GRADE: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (KILOTON)

- TABLE 26 HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 27 HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 28 STEEL PICKLING: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

- TABLE 29 STEEL PICKLING: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (KILOTON)

- TABLE 30 OIL WELL ACIDIZING: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

- TABLE 31 OIL WELL ACIDIZING: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (KILOTON)

- TABLE 32 ORE PROCESSING: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

- TABLE 33 ORE PROCESSING: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (KILOTON)

- TABLE 34 FOOD PROCESSING: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

- TABLE 35 FOOD PROCESSING: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (KILOTON)

- TABLE 36 POOL SANITATION: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

- TABLE 37 POOL SANITATION: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (KILOTON)

- TABLE 38 CALCIUM CHLORIDE: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

- TABLE 39 CALCIUM CHLORIDE: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (KILOTON)

- TABLE 40 BIODIESEL: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

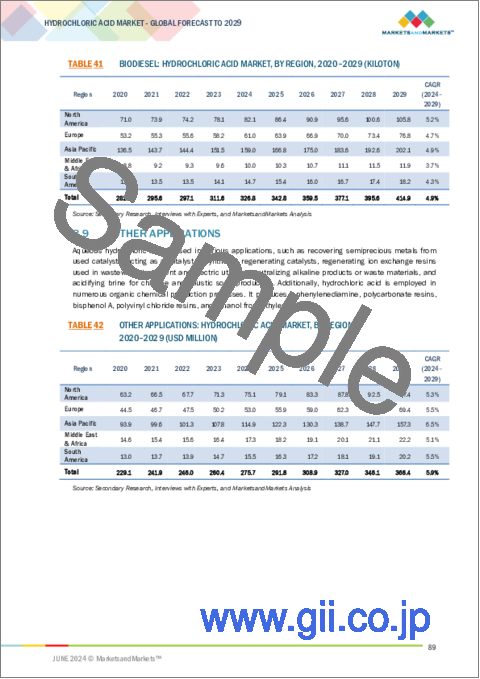

- TABLE 41 BIODIESEL: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (KILOTON)

- TABLE 42 OTHER APPLICATIONS: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

- TABLE 43 OTHER APPLICATIONS: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (KILOTON)

- TABLE 44 HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 45 HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 46 FOOD & BEVERAGE: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

- TABLE 47 FOOD & BEVERAGE: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (KILOTON)

- TABLE 48 PHARMACEUTICAL: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

- TABLE 49 PHARMACEUTICAL: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (KILOTON)

- TABLE 50 TEXTILE: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

- TABLE 51 TEXTILE: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (KILOTON)

- TABLE 52 STEEL: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

- TABLE 53 STEEL: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (KILOTON)

- TABLE 54 OIL & GAS: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

- TABLE 55 OIL & GAS: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (KILOTON)

- TABLE 56 CHEMICAL: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

- TABLE 57 CHEMICAL: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (KILOTON)

- TABLE 58 OTHER END-USE INDUSTRIES: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

- TABLE 59 OTHER END-USE INDUSTRIES: HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (KILOTON)

- TABLE 60 HYDROCHLORIC ACID MARKET, BY REGION, 2020-2029 (USD MILLION)

- TABLE 61 HYDROCHLORIC ACID MARKET, BY REGION 2020-2029 (KILOTON)

- TABLE 62 ASIA PACIFIC: HYDROCHLORIC ACID MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

- TABLE 63 ASIA PACIFIC: HYDROCHLORIC ACID MARKET, BY COUNTRY, 2020-2029 (KILOTON)

- TABLE 64 ASIA PACIFIC: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 65 ASIA PACIFIC: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 66 ASIA PACIFIC: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 67 ASIA PACIFIC: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 68 ASIA PACIFIC: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 69 ASIA PACIFIC: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 70 CHINA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 71 CHINA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 72 CHINA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 73 CHINA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 74 CHINA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 75 CHINA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 76 INDIA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 77 INDIA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 78 INDIA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 79 INDIA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 80 INDIA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 81 INDIA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 82 JAPAN: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 83 JAPAN: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 84 JAPAN: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 85 JAPAN: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 86 JAPAN: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 87 JAPAN: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 88 SOUTH KOREA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 89 SOUTH KOREA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 90 SOUTH KOREA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 91 SOUTH KOREA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 92 SOUTH KOREA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 93 SOUTH KOREA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 94 REST OF ASIA PACIFIC: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 95 REST OF ASIA PACIFIC: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 96 REST OF ASIA PACIFIC: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 98 REST OF ASIA PACIFIC: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 99 REST OF ASIA PACIFIC: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 100 EUROPE: HYDROCHLORIC ACID MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

- TABLE 101 EUROPE: HYDROCHLORIC ACID MARKET, BY COUNTRY, 2020-2029 (KILOTON)

- TABLE 102 EUROPE: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 103 EUROPE: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 104 EUROPE: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 105 EUROPE: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 106 EUROPE: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 107 EUROPE: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 108 GERMANY: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 109 GERMANY: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 110 GERMANY: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 111 GERMANY: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 112 GERMANY: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 113 GERMANY: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 114 FRANCE: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 115 FRANCE: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 116 FRANCE: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 117 FRANCE: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 118 FRANCE: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 119 FRANCE: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 120 ITALY: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 121 ITALY: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 122 ITALY: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 123 ITALY: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 124 ITALY: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 125 ITALY: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 126 UK: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 127 UK: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 128 UK: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 129 UK: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 130 UK: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 131 UK: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 132 SPAIN: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 133 SPAIN: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 134 SPAIN: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 135 SPAIN: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 136 SPAIN: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 137 SPAIN: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 138 REST OF EUROPE: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 139 REST OF EUROPE: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 140 REST OF EUROPE: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 141 REST OF EUROPE: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 142 REST OF EUROPE: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 143 REST OF EUROPE: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 144 MIDDLE EAST & AFRICA: HYDROCHLORIC ACID MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: HYDROCHLORIC ACID MARKET, BY COUNTRY, 2020-2029 (KILOTON)

- TABLE 146 MIDDLE EAST & AFRICA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 148 MIDDLE EAST & AFRICA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 150 MIDDLE EAST & AFRICA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 152 SAUDI ARABIA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 153 SAUDI ARABIA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 154 SAUDI ARABIA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 155 SAUDI ARABIA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 156 SAUDI ARABIA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 157 SAUDI ARABIA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 158 UAE: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 159 UAE: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 160 UAE: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 161 UAE: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 162 UAE: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 163 UAE: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 164 REST OF GCC COUNTRIES: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 165 REST OF GCC COUNTRIES: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 166 REST OF GCC COUNTRIES: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 167 REST OF GCC COUNTRIES: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 168 REST OF GCC COUNTRIES: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 169 REST OF GCC COUNTRIES: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 170 SOUTH AFRICA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 171 SOUTH AFRICA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 172 SOUTH AFRICA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 173 SOUTH AFRICA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 174 SOUTH AFRICA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 175 SOUTH AFRICA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 176 IRAN: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 177 IRAN: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 178 IRAN: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 179 IRAN: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 180 IRAN: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 181 IRAN: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 182 MOROCCO: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 183 MOROCCO: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 184 MOROCCO: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 185 MOROCCO: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 186 MOROCCO: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 187 MOROCCO: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 188 REST OF MIDDLE EAST & AFRICA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 189 REST OF MIDDLE EAST & AFRICA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 190 REST OF MIDDLE EAST & AFRICA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 191 REST OF MIDDLE EAST & AFRICA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 192 REST OF MIDDLE EAST & AFRICA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 193 REST OF MIDDLE EAST & AFRICA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 194 NORTH AMERICA: HYDROCHLORIC ACID MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

- TABLE 195 NORTH AMERICA: HYDROCHLORIC ACID MARKET, BY COUNTRY, 2020-2029 (KILOTON)

- TABLE 196 NORTH AMERICA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 197 NORTH AMERICA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 198 NORTH AMERICA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 199 NORTH AMERICA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 200 NORTH AMERICA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 201 NORTH AMERICA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 202 US: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 203 US: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 204 US: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 205 US: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 206 US: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 207 US: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 208 CANADA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 209 CANADA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 210 CANADA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 211 CANADA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 212 CANADA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 213 CANADA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 214 MEXICO: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 215 MEXICO: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 216 MEXICO: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 217 MEXICO: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 218 MEXICO: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 219 MEXICO: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 220 SOUTH AMERICA: HYDROCHLORIC ACID MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

- TABLE 221 SOUTH AMERICA: HYDROCHLORIC ACID MARKET, BY COUNTRY, 2020-2029 (KILOTON)

- TABLE 222 SOUTH AMERICA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 223 SOUTH AMERICA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 224 SOUTH AMERICA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 225 SOUTH AMERICA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 226 SOUTH AMERICA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 227 SOUTH AMERICA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 228 BRAZIL: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 229 BRAZIL: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 230 BRAZIL: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 231 BRAZIL: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 232 BRAZIL: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 233 BRAZIL: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 234 ARGENTINA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 235 ARGENTINA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 236 ARGENTINA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 237 ARGENTINA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 238 ARGENTINA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 239 ARGENTINA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 240 REST OF SOUTH AMERICA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (USD MILLION)

- TABLE 241 REST OF SOUTH AMERICA: HYDROCHLORIC ACID MARKET, BY GRADE, 2020-2029 (KILOTON)

- TABLE 242 REST OF SOUTH AMERICA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

- TABLE 243 REST OF SOUTH AMERICA: HYDROCHLORIC ACID MARKET, BY APPLICATION, 2020-2029 (KILOTON)

- TABLE 244 REST OF SOUTH AMERICA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (USD MILLION)

- TABLE 245 REST OF SOUTH AMERICA: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY, 2020-2029 (KILOTON)

- TABLE 246 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN HYDROCHLORIC ACID MARKET

- TABLE 247 HYDROCHLORIC ACID MARKET: DEGREE OF COMPETITION

- TABLE 248 HYDROCHLORIC ACID MARKET: GRADE FOOTPRINT (10 COMPANIES)

- TABLE 249 HYDROCHLORIC ACID MARKET: APPLICATION FOOTPRINT (10 COMPANIES)

- TABLE 250 HYDROCHLORIC ACID MARKET: END-USE INDUSTRY FOOTPRINT (10 COMPANIES)

- TABLE 251 HYDROCHLORIC ACID MARKET: REGION FOOTPRINT (10 COMPANIES)

- TABLE 252 HYDROCHLORIC ACID MARKET: KEY STARTUPS/SMES

- TABLE 253 HYDROCHLORIC ACID MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (15 COMPANIES)

- TABLE 254 HYDROCHLORIC ACID MARKET: DEALS, JANUARY 2018-MAY 2024

- TABLE 255 HYDROCHLORIC ACID MARKET: EXPANSIONS, JANUARY 2018-MAY 2024

- TABLE 256 HYDROCHLORIC ACID MARKET: OTHER DEVELOPMENTS, JANUARY 2018-MAY 2024

- TABLE 257 BASF SE: COMPANY OVERVIEW

- TABLE 258 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 BASF SE: OTHER DEVELOPMENTS, JANUARY 2018-MAY 2024

- TABLE 260 COVESTRO AG: COMPANY OVERVIEW

- TABLE 261 COVESTRO AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 OLIN CORPORATION: COMPANY OVERVIEW

- TABLE 263 OLIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 OLIN CORPORATION: DEALS, JANUARY 2018-MAY 2024

- TABLE 265 WESTLAKE CORPORATION: COMPANY OVERVIEW

- TABLE 266 WESTLAKE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 WESTLAKE CORPORATION: DEALS, JANUARY 2018-MAY 2024

- TABLE 268 WESTLAKE CORPORATION: EXPANSIONS, JANUARY 2018-MAY 2024

- TABLE 269 OCCIDENTAL PETROLEUM CORPORATION: COMPANY OVERVIEW

- TABLE 270 OCCIDENTAL PETROLEUM CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 FORMOSA PLASTICS CORPORATION: COMPANY OVERVIEW

- TABLE 272 FORMOSA PLASTICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 TATA CHEMICALS LIMITED: COMPANY OVERVIEW

- TABLE 274 TATA CHEMICALS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 TATA CHEMICAL LIMITED: DEALS, JANUARY 2018-APRIL 2024

- TABLE 276 AGC INC.: COMPANY OVERVIEW

- TABLE 277 AGC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 ERCO WORLDWIDE: COMPANY OVERVIEW

- TABLE 279 ERCO WORLDWIDE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 DETREX CORPORATION: COMPANY OVERVIEW

- TABLE 281 DETREX CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 282 AURORA FINE CHEMICALS: COMPANY OVERVIEW

- TABLE 283 ZOUPING DONGFANG CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 284 ACURO ORGANICS LIMITED: COMPANY OVERVIEW

- TABLE 285 MAXWELL ADDITIVES PVT. LTD.: COMPANY OVERVIEW

- TABLE 286 CHEMTEX SPECIALITY LIMITED: COMPANY OVERVIEW

- TABLE 287 POLYSCIENCES INC.: COMPANY OVERVIEW

- TABLE 288 INEOS KOH: COMPANY OVERVIEW

- TABLE 289 NOURYON: COMPANY OVERVIEW

- TABLE 290 CONTINENTAL CHEMICAL USA: COMPANY OVERVIEW

- TABLE 291 JONES-HAMILTON CO.: COMPANY OVERVIEW

- TABLE 292 TRONOX HOLDINGS PLC: COMPANY OVERVIEW

- TABLE 293 KUHLMANN EUROPE: COMPANY OVERVIEW

- TABLE 294 PCC GROUP: COMPANY OVERVIEW

- TABLE 295 HAWKINS: COMPANY OVERVIEW

- TABLE 296 HYDRITE CHEMICAL: COMPANY OVERVIEW

- TABLE 297 POLYLACTIC ACID MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 298 POLYLACTIC ACID MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 299 POLYLACTIC ACID MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 300 POLYLACTIC ACID MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 301 POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 302 POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 303 POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 304 POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 305 POLYLACTIC ACID MARKET, BY GRADE, 2019-2022 (USD MILLION)

- TABLE 306 POLYLACTIC ACID MARKET, BY GRADE, 2023-2028 (USD MILLION)

- TABLE 307 POLYLACTIC ACID MARKET, BY GRADE, 2019-2022 (KILOTON)

- TABLE 308 POLYLACTIC ACID MARKET, BY GRADE, 2023-2028 (KILOTON)

- TABLE 309 POLYLACTIC ACID MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 310 POLYLACTIC ACID MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 311 POLYLACTIC ACID MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 312 POLYLACTIC ACID MARKET, BY REGION, 2023-2028 (KILOTON)

- TABLE 313 GLYCOLIC ACID MARKET, BY GRADE, 2016-2019 (USD MILLION)

- TABLE 314 GLYCOLIC ACID MARKET, BY GRADE, 2016-2019 (KILOTON)

- TABLE 315 GLYCOLIC ACID MARKET, BY GRADE, 2020-2027 (USD MILLION)

- TABLE 316 GLYCOLIC ACID MARKET, BY GRADE, 2020-2027 (KILOTON)

- TABLE 317 GLYCOLIC ACID MARKET, BY APPLICATION, 2016-2019 (USD MILLION)

- TABLE 318 GLYCOLIC ACID MARKET, BY APPLICATION, 2016-2019 (KILOTON)

- TABLE 319 GLYCOLIC ACID MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 320 GLYCOLIC ACID MARKET, BY APPLICATION, 2020-2027 (KILOTON)

- TABLE 321 GLYCOLIC ACID MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 322 GLYCOLIC ACID MARKET, BY REGION, 2020-2027 (KILOTON)

List of Figures

- FIGURE 1 HYDROCHLORIC ACID MARKET SEGMENTATION

- FIGURE 2 HYDROCHLORIC ACID MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 APPROACH: BASED ON PRODUCTION OF HYDROCHLORIC ACID IN CHINA

- FIGURE 6 HYDROCHLORIC ACID MARKET: DATA TRIANGULATION

- FIGURE 7 SYNTHETIC GRADE SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 8 FOOD PROCESSING SEGMENT TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 9 FOOD & BEVERAGE TO BE LARGEST END-USE INDUSTRY OF HYDROCHLORIC ACID

- FIGURE 10 ASIA PACIFIC TO LEAD HYDROCHLORIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 11 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES IN HYDROCHLORIC ACID MARKET

- FIGURE 12 CHINA DOMINATED HYDROCHLORIC ACID MARKET IN 2023

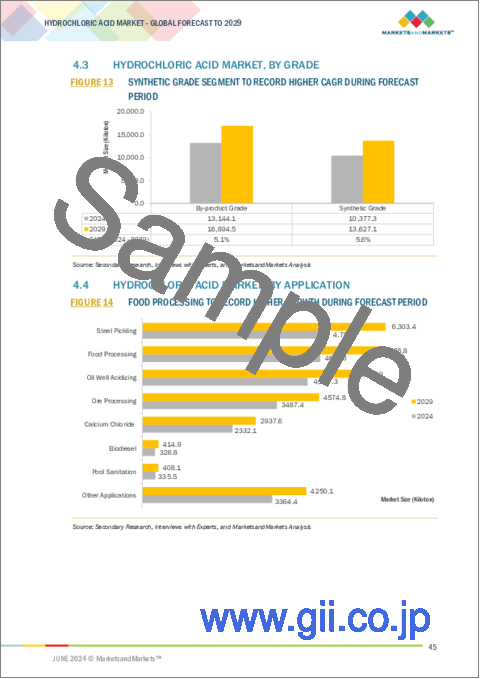

- FIGURE 13 SYNTHETIC GRADE SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 14 FOOD PROCESSING TO RECORD HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 15 FOOD & BEVERAGE SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 16 CHINA PROJECTED TO GROW AT HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 17 HYDROCHLORIC ACID MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 HYDROCHLORIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 HYDROCHLORIC ACID: VALUE CHAIN ANALYSIS

- FIGURE 20 EXPORT OF 280610 HYDROGEN CHLORIDE "HYDROCHLORIC ACID," BY KEY COUNTRY, 2019-2023

- FIGURE 21 IMPORT OF 280610 HYDROGEN CHLORIDE "HYDROCHLORIC ACID," BY KEY COUNTRY, 2019-2023

- FIGURE 22 EMERGING TRENDS AND ADVANCEMENTS IN TECHNOLOGY TO CHANGE FUTURE REVENUE MIX OF SUPPLIERS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 24 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- FIGURE 25 HYDROCHLORIC ACID MARKET: ECOSYSTEM MAP

- FIGURE 26 NUMBER OF PATENTS GRANTED FOR HYDROCHLORIC ACID, 2013-2023

- FIGURE 27 REGIONAL ANALYSIS OF PATENTS GRANTED FOR HYDROCHLORIC ACID, 2013-2023

- FIGURE 28 HYDROCHLORIC ACID MARKET: AVERAGE SELLING PRICE, SYNTHETIC GRADE, BY REGION (USD/TON)

- FIGURE 29 HYDROCHLORIC ACID MARKET: AVERAGE SELLING PRICE, BY-PRODUCT GRADE, BY REGION (USD/TON)

- FIGURE 30 INVESTOR DEALS AND FUNDING IN HYDROCHLORIC ACID SOARED IN 2022

- FIGURE 31 BY-PRODUCT GRADE TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 32 FOOD PROCESSING BE LARGEST APPLICATION IN HYDROCHLORIC ACID MARKET

- FIGURE 33 FOOD AND BEVERAGES TO BE LARGEST END USER IN HYDROCHLORIC ACID MARKET

- FIGURE 34 HYDROCHLORIC ACID MARKET GROWTH RATE, BY COUNTRY, 2024-2029

- FIGURE 35 ASIA PACIFIC: HYDROCHLORIC ACID MARKET SNAPSHOT

- FIGURE 36 NORTH AMERICA: HYDROCHLORIC ACID MARKET SNAPSHOT

- FIGURE 37 REVENUE ANALYSIS OF KEY COMPANIES IN LAST FIVE YEARS

- FIGURE 38 HYDROCHLORIC ACID MARKET: MARKET SHARE ANALYSIS

- FIGURE 39 RANKING OF TOP FIVE PLAYERS IN HYDROCHLORIC ACID MARKET

- FIGURE 40 COMPANY VALUATION (USD BILLION)

- FIGURE 41 FINANCIAL MATRIX: EV/EBITDA RATIO

- FIGURE 42 HYDROCHLORIC ACID MARKET: PRODUCT COMPARISON

- FIGURE 43 HYDROCHLORIC ACID MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 44 HYDROCHLORIC ACID MARKET: COMPANY FOOTPRINT (10 COMPANIES)

- FIGURE 45 HYDROCHLORIC ACID MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 46 BASF SE: COMPANY SNAPSHOT

- FIGURE 47 COVESTRO AG: COMPANY SNAPSHOT

- FIGURE 48 OLIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 WESTLAKE CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 OCCIDENTAL PETROLEUM CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 FORMOSA PLASTICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 TATA CHEMICALS LIMITED: COMPANY SNAPSHOT

- FIGURE 53 AGC INC.: COMPANY SNAPSHOT

The hydrochloric acid market is projected to grow from USD 2.2 Billion in 2024 to USD 3.0 Billion by 2029, at a CAGR of 6.5% during the forecast period. Hydrochloric acid is extensively used in the food processing and steel pickling industries. In food processing, it adjusts pH levels for tasks like curdling milk in cheese production, produces food additives such as gelatine, aids in fermentation for soy sauce, preserves fruits and vegetables, and sanitizes equipment. These applications ensure food quality, safety, and functionality. In steel pickling, hydrochloric acid removes rust, scale, and contaminants from steel surfaces, crucial for preparing steel for galvanizing, plating, and painting. The steel industry's growth, driven by industrialization and infrastructure development, significantly boosts hydrochloric acid demand. According to Worldsteel Association, total world crude steel production in 2023 was 1,888.2 Mt. This increases the demand for hydrochloric acid for the application of steel pickling, underscoring the acid's critical role in metal processing and its impact on the global market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million), Volume (Million Ton) |

| Segments | Grade, End-use Industry, Application, and Region |

| Regions covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

"By Grade, by-product is largest market for hydrochloric acid during forecast period."

By-product grade accounts for largest market share for hydrochloric acid. It is primarily utilized in the mining sector for ore extraction, the production of biofuels, oils, and lubricants, as well as in various refinement processes. Additionally, hydrochloric acid is employed in metalworking for pickling steel, aluminum, titanium, and magnesium, as well as for cleaning metal surfaces during galvanizing processes.

"By Application, oil well acidizing account for second largest share during forecast period."

Ore processing accounts for second largest market share by application for hydrochloric acid market. In ore processing, which includes crushing, grinding, flotation, and leaching, hydrochloric acid is crucial during leaching. Its strong acidity helps dissolve specific minerals, aiding in extracting metals like nickel, cobalt, and rare earth elements. Hydrochloric acid adjusts pH levels and removes impurities, enhancing the purity and yield of the final product. Its use improves the efficiency and effectiveness of mineral extraction, contributing to high-quality metal production.

"By End-Use Industry, Chemical End-use Industry Segment Accounted For second largest share during forecast period."

Hydrochloric acid is important in the chemical industry, acting as a key reagent in numerous chemical reactions and processes. It is widely used for pH control, neutralization, and chemical synthesis. In chemical manufacturing, hydrochloric acid is crucial for producing inorganic compounds like ferric chloride, polyaluminum chloride, and various chlorides used in water treatment, electronics, and pharmaceuticals. It is also vital in organic synthesis, particularly in producing vinyl chloride and other important organic chemicals. Hydrochloric acid is used to produce high-purity silica, regenerate ion exchange resins, and in processes such as hydrolyzing starches and proteins.

The benefits of hydrochloric acid in the chemical industry are significant. Its strong acidic nature makes it highly effective for various applications, including catalyzing reactions, adjusting pH levels, and neutralizing alkaline substances. Its versatility allows it to be used in numerous chemical processes, enhancing production efficiency and product quality. Hydrochloric acid's compatibility with a wide range of substances ensures its safe and effective integration into diverse chemical production workflows.

Several factors drive the hydrochloric acid market in the chemical industry. The increasing demand for chemical products, fueled by growth in industries such as pharmaceuticals, agriculture, water treatment, and electronics, boosts hydrochloric acid consumption. Technological advancements in chemical synthesis and production processes that improve efficiency and yield also contribute to the rising demand for hydrochloric acid. The expansion of industrial activities in emerging economies, coupled with the growing emphasis on environmental sustainability and regulatory compliance, further supports the hydrochloric acid market. Additionally, the continuous need for high-purity chemicals in various applications, along with the regeneration of ion exchange resins in water treatment and other industries, drives the demand for hydrochloric acid in the chemical sector.

"North America is accounted second larget market for Hydrochloric acid in 2023."

The North America region is accounted second larget in the Hydrochloric acid market. This growth encompasses countries like US, Canada, and Mexico.

The hydrochloric acid market in North America is being propelled by various factors. The robust industrial sector in the region, particularly in steel manufacturing, chemical processing, and oil refining, is driving significant demand for hydrochloric acid. There is a growing utilization of hydrochloric acid in water treatment applications, including pH regulation and wastewater treatment, which is further stimulating market growth. The expanding usage of hydrochloric acid in the food and beverage industry for purposes such as food processing and cleaning is contributing to increased demand. Moreover, stringent environmental regulations governing the handling and disposal of hazardous chemicals like hydrochloric acid are prompting investments in advanced technologies and safety measures, thereby fostering market growth. The presence of key market players and their focus on research and development endeavors aimed at enhancing product efficiency and sustainability are also fueling the growth of the hydrochloric acid market in North America.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the Hydrochloric acid market.

- By Company Type: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Others: 35%

- By Region: North America: 25%, Europe: 20%, APAC: 45%, Middle East & Africa: 5%, and South America: 5%

Companies Covered: The global hydrochloric acid market comprises major manufacturers, such as BASF SE (Germany), Covestro AG (Germany), Olin Corporation (US), Westlake Chemical Corporation (US), Occidental Petroleum Corporation (US), Formosa Plastics Corporation (Taiwan), Tata Chemicals Limited (India), AGC Inc. (Japan), ERCO Worldwide (Canada), Detrex Corporation (US), among others.

Research Coverage

The market study covers the hydrochloric acid market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on grade, end-use industry, application and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the hydrochloric acid market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall hydrochloric acid market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growth of chemical industry in emerging markets, Extensive use of hydrochloric acid in food processing industries, Pressing need for active pharmaceutical ingredients in pharmaceutical industry, and High demand for steel pickling in metal processing industry), restraints (Volatility in raw material prices, and Trade barriers and increased tariff rates), opportunities (Water treatment and environmental remediation, Increasing demand in oil & gas industry and Extensive laboratory use) and challenges (Health and environmental concerns and Customer preferences and sustainability).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the hydrochloric acid market

- Market Development: Comprehensive information about lucrative markets - the report analyses the hydrochloric acid market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Hydrochloric acid market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like BASF SE (Germany), Covestro AG (Germany), Olin Corporation (US), Westlake Chemical Corporation (US), Occidental Petroleum Corporation (US), Formosa Plastics Corporation (Taiwan), Tata Chemicals Limited (India), AGC Inc. (Japan), ERCO Worldwide (Canada), Detrex Corporation (US), among others in the hydrochloric acid market. The report also helps stakeholders understand the pulse of the hydrochloric acid market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 VOLUME MARKET APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 IMPACT OF RECESSION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HYDROCHLORIC ACID MARKET

- 4.2 ASIA PACIFIC: HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY AND COUNTRY

- 4.3 HYDROCHLORIC ACID MARKET, BY GRADE

- 4.4 HYDROCHLORIC ACID MARKET, BY APPLICATION

- 4.5 HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY

- 4.6 HYDROCHLORIC ACID MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growth of chemical industry in emerging markets

- 5.2.1.2 Extensive use of hydrochloric acid in food processing industries

- 5.2.1.3 Pressing need for active pharmaceutical ingredients in pharmaceutical industry

- 5.2.1.4 High demand for steel pickling in metal processing industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatility in raw material prices

- 5.2.2.2 Trade barriers and increased tariff rates

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Water treatment and environmental remediation

- 5.2.3.2 Increasing demand for hydrochloric acid in oil & gas industry

- 5.2.3.3 Extensive laboratory use of hydrochloric acid

- 5.2.4 CHALLENGES

- 5.2.4.1 Health and environmental concerns

- 5.2.4.2 Customer preferences and sustainability

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF NEW ENTRANTS

- 6.1.2 THREAT OF SUBSTITUTES

- 6.1.3 BARGAINING POWER OF SUPPLIERS

- 6.1.4 BARGAINING POWER OF BUYERS

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 VALUE CHAIN ANALYSIS

- 6.3 TRADE ANALYSIS

- 6.3.1 EXPORT SCENARIO

- 6.3.2 IMPORT SCENARIO

- 6.4 MACROECONOMIC INDICATORS

- 6.4.1 GLOBAL GDP OUTLOOK

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Preconcentration process

- 6.5.1.2 Direct synthesis

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Hydrochloric acid recovery

- 6.5.2.2 Medium concentration process

- 6.5.1 KEY TECHNOLOGIES

- 6.6 TARIFF AND REGULATORY LANDSCAPE

- 6.6.1 TARIFF RELATED TO HYDROCHLORIC ACID MARKET

- 6.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.7 CASE STUDY ANALYSIS

- 6.8 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 KEY CONFERENCES & EVENTS IN 2024-2025

- 6.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.10.2 BUYING CRITERIA

- 6.11 ECOSYSTEM/MARKET MAP

- 6.12 PATENT ANALYSIS

- 6.12.1 INTRODUCTION

- 6.12.2 METHODOLOGY

- 6.13 PRICING ANALYSIS

- 6.13.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY GRADE

- 6.13.2 AVERAGE SELLING PRICE TREND, BY REGION

7 HYDROCHLORIC ACID MARKET, BY GRADE

- 7.1 INTRODUCTION

- 7.2 SYNTHETIC GRADE

- 7.2.1 WIDE USE IN CHEMICAL MANUFACTURING AND METAL PROCESSING TO BOOST DEMAND

- 7.3 BY-PRODUCT GRADE

- 7.3.1 SURGING DEMAND IN AGROCHEMICALS AND ION EXCHANGERS TO DRIVE MARKET

8 HYDROCHLORIC ACID MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 STEEL PICKLING

- 8.2.1 VERSATILE APPLICATIONS IN STEEL PICKLING TO DRIVE DEMAND

- 8.3 OIL WELL ACIDIZING

- 8.3.1 PRESSING NEED FOR IMPROVING PRODUCTIVITY OF OIL WELLS TO DRIVE MARKET

- 8.4 ORE PROCESSING

- 8.4.1 EFFICACY IN ENHANCING MINERAL EXTRACTION TO DRIVE MARKET

- 8.5 FOOD PROCESSING

- 8.5.1 INCREASED DEMAND FOR FOOD ADDITIVES AND FLAVORING AGENTS TO BOOST MARKET

- 8.6 POOL SANITATION

- 8.6.1 SURGING DEMAND FOR HYDROCHLORIC ACID IN POOL SANITATION TO DRIVE MARKET

- 8.7 CALCIUM CHLORIDE

- 8.7.1 RISING NEED FOR FOOD PRESERVATION AND INDUSTRIAL DRYING TO BOOST DEMAND

- 8.8 BIODIESEL

- 8.8.1 INCREASING DEMAND IN BIODIESEL PRODUCTION TO DRIVE MARKET

- 8.9 OTHER APPLICATIONS

9 HYDROCHLORIC ACID MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 FOOD & BEVERAGE

- 9.2.1 INCREASING DEMAND FOR HYDROCHLORIC ACID IN DAIRY PRODUCTS AND SWEETENERS TO DRIVE MARKET

- 9.3 PHARMACEUTICAL

- 9.3.1 USE IN VARIOUS PHASES OF DRUG DEVELOPMENT AND PRODUCTION TO DRIVE MARKET

- 9.4 TEXTILE

- 9.4.1 RISING DEMAND FOR HYDROCHLORIC ACID IN DYEING AND FABRIC PROCESSING TO DRIVE MARKET

- 9.5 STEEL

- 9.5.1 TECHNOLOGICAL ADVANCEMENTS IN STEEL MANUFACTURING AND PICKLING PROCESSES TO SUPPORT MARKET GROWTH

- 9.6 OIL & GAS

- 9.6.1 INCREASED DEMAND FOR WELL STIMULATION AND ACIDIZING SERVICES TO DRIVE MARKET

- 9.7 CHEMICAL

- 9.7.1 TECHNOLOGICAL ADVANCEMENTS IN CHEMICAL SYNTHESIS AND PRODUCTION PROCESSES TO BOOST DEMAND

- 9.8 OTHER END-USE INDUSTRIES

10 HYDROCHLORIC ACID MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 RECESSION IMPACT

- 10.2.2 CHINA

- 10.2.2.1 Strict environmental regulations and rapid urbanization to drive market

- 10.2.3 INDIA

- 10.2.3.1 Growth of food & beverage industry to fuel demand for hydrochloric acid

- 10.2.4 JAPAN

- 10.2.4.1 Surge in automotive and steel production to drive market

- 10.2.5 SOUTH KOREA

- 10.2.5.1 Growth of chemical and pharmaceutical industries to boost demand

- 10.2.6 REST OF ASIA PACIFIC

- 10.3 EUROPE

- 10.3.1 IMPACT OF RECESSION

- 10.3.2 GERMANY

- 10.3.2.1 Advancing circular economy and automotive industry to drive market

- 10.3.3 FRANCE

- 10.3.3.1 Surge in water treatment plants to drive market

- 10.3.4 ITALY

- 10.3.4.1 Diverse industrial uses and stringent regulatory frameworks to drive market

- 10.3.5 UK

- 10.3.5.1 Industrial strength and environmental commitment to boost market

- 10.3.6 SPAIN

- 10.3.6.1 Growth of water treatment and steel industry to drive market

- 10.3.7 REST OF EUROPE

- 10.4 MIDDLE EAST & AFRICA

- 10.4.1 RECESSION IMPACT

- 10.4.2 GCC COUNTRIES

- 10.4.2.1 Saudi Arabia

- 10.4.2.1.1 Saudi Vision 2030 to play a crucial role in driving market

- 10.4.2.2 UAE

- 10.4.2.2.1 Rising demand for steel in construction and manufacturing activities to drive market

- 10.4.2.3 Rest of GCC countries

- 10.4.2.1 Saudi Arabia

- 10.4.3 SOUTH AFRICA

- 10.4.3.1 Mining Charter and Mineral Beneficiation Strategy to support market growth

- 10.4.4 IRAN

- 10.4.4.1 Growth of mining and oil & gas industries to drive market

- 10.4.5 MOROCCO

- 10.4.5.1 Increasing investments in water treatment infrastructure and industrial growth to boost market

- 10.4.6 REST OF MIDDLE EAST & AFRICA

- 10.5 NORTH AMERICA

- 10.5.1 IMPACT OF RECESSION

- 10.5.2 US

- 10.5.2.1 Rise in construction activities to drive market

- 10.5.3 CANADA

- 10.5.3.1 Expansion of food & beverage industry to propel market

- 10.5.4 MEXICO

- 10.5.4.1 Growth of pharmaceutical industry to drive market

- 10.6 SOUTH AMERICA

- 10.6.1 IMPACT OF RECESSION

- 10.6.2 BRAZIL

- 10.6.2.1 Growth of construction sector to drive market

- 10.6.3 ARGENTINA

- 10.6.3.1 Expansion of mining industry to drive market

- 10.6.4 REST OF SOUTH AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

- 11.3 REVENUE ANALYSIS OF KEY PLAYERS

- 11.4 MARKET SHARE ANALYSIS

- 11.4.1 MARKET RANKING ANALYSIS

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 PRODUCT/BRAND COMPARISON ANALYSIS

- 11.7 COMPANY EVALUATION MATRIX, KEY PLAYERS

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.7.5.1 Company footprint

- 11.7.5.2 Grade footprint

- 11.7.5.3 Application footprint

- 11.7.5.4 End-use industry footprint

- 11.7.5.5 Region footprint

- 11.8 COMPANY EVALUATION MATRIX, STARTUPS/SMES

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 DEALS

- 11.9.2 EXPANSIONS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 BASF SE

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 COVESTRO AG

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 MnM view

- 12.1.2.3.1 Right to win

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses & competitive threats

- 12.1.3 OLIN CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 WESTLAKE CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 OCCIDENTAL PETROLEUM CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses & competitive threats

- 12.1.6 FORMOSA PLASTICS CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 MnM view

- 12.1.7 TATA CHEMICALS LIMITED

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.4 MnM view

- 12.1.7.4.1 Right to win

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses and competitive threats

- 12.1.8 AGC INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 MnM view

- 12.1.9 ERCO WORLDWIDE

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 MnM view

- 12.1.10 DETREX CORPORATION

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services Offered

- 12.1.10.3 MnM view

- 12.1.1 BASF SE

- 12.2 OTHER PLAYERS

- 12.2.1 AURORA FINE CHEMICALS

- 12.2.2 ZOUPING DONGFANG CHEMICAL INDUSTRY CO., LTD.

- 12.2.3 ACURO ORGANICS LIMITED

- 12.2.4 MAXWELL ADDITIVES PVT. LTD.

- 12.2.5 CHEMTEX SPECIALITY LIMITED

- 12.2.6 POLYSCIENCES INC.

- 12.2.7 INEOS KOH

- 12.2.8 NOURYON

- 12.2.9 CONTINENTAL CHEMICAL USA

- 12.2.10 JONES-HAMILTON CO.

- 12.2.11 TRONOX HOLDINGS PLC

- 12.2.12 KUHLMANN EUROPE

- 12.2.13 PCC GROUP

- 12.2.14 HAWKINS

- 12.2.15 HYDRITE CHEMICAL

13 ADJACENT & RELATED MARKET

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.2.1 POLYLACTIC ACID MARKET

- 13.2.1.1 Market definition

- 13.2.1.2 Polylactic acid market, by raw material

- 13.2.1.3 Polylactic acid market, by application

- 13.2.1.4 Polylactic acid market, by end-use industry

- 13.2.1.5 Polylactic acid market, by grade

- 13.2.1.6 Polylactic acid market, by region

- 13.2.2 GLYCOLIC ACID MARKET

- 13.2.2.1 Market definition

- 13.2.2.2 Glycolic acid market, by purity

- 13.2.2.3 Glycolic acid market, by grade

- 13.2.2.4 Glycolic acid market, by application

- 13.2.2.5 Glycolic acid market, by region

- 13.2.1 POLYLACTIC ACID MARKET

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS