|

|

市場調査レポート

商品コード

1787259

水素生成の世界市場:技術別、用途別、由来別、生成・配送方式別、地域別 - 予測(~2030年)Hydrogen Generation Market by Technology, Application, Source, Generation & Delivery Mode, Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 水素生成の世界市場:技術別、用途別、由来別、生成・配送方式別、地域別 - 予測(~2030年) |

|

出版日: 2025年08月04日

発行: MarketsandMarkets

ページ情報: 英文 339 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

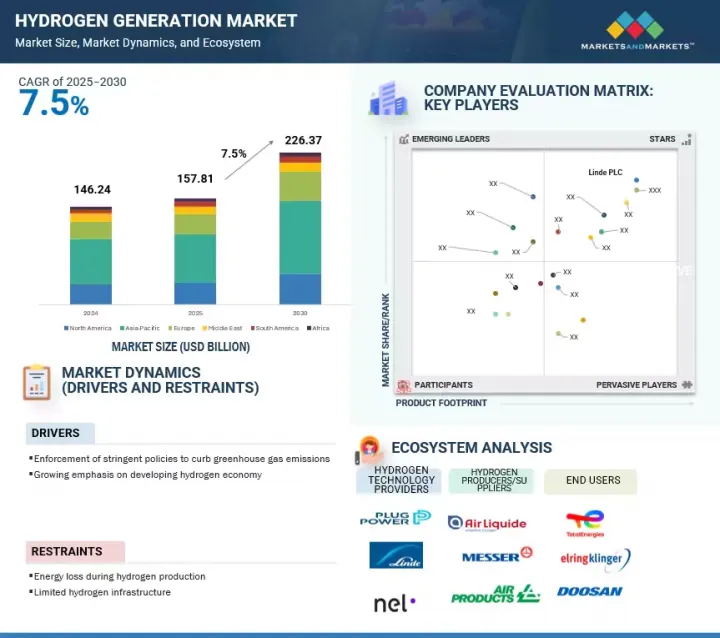

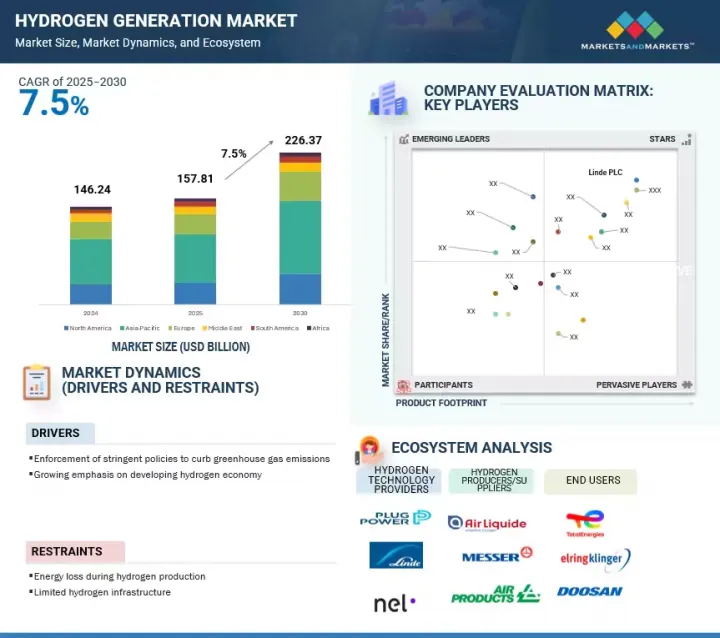

世界の水素生成の市場規模は、2025年の推定値1,578億1,000万米ドルから、2030年までに2,263億7,000万米ドルに達すると予測され、予測期間にCAGRで7.5%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 金額(100万/10億米ドル)、数量(1,000トン) |

| セグメント | 由来、用途、技術、生成/配送方式、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、南米 |

水素生成市場は、エネルギーシステムの脱炭素化に向けた世界的な活動の増加、クリーンな代替燃料への需要の高まり、工業、輸送、発電部門における水素の採用の拡大が牽引しています。政府の支援政策、再生可能エネルギーへの多額の投資、電解技術の進歩が市場の拡大を加速しています。さらに、水素インフラの開発、エネルギー安全保障と排出削減への関心の高まりが、世界の主要地域における市場の成長軌道をさらに強化しています。

「グリーン水素セグメントが2025年~2030年にもっとも高いCAGRを記録すると予測されます。」

世界のカーボンニュートラルへの移行と、CO2排出削減が困難な部門の脱炭素化が急務であることにより、グリーン水素セグメントが予測期間に水素生成市場において最高のCAGRを記録する見込みです。支援的な政策枠組みが、税制優遇措置、補助金、世界各国の水素戦略など、プロジェクトの開発と商業化を加速させます。さらに、燃料電池車、発電、工業用原料などの用途でゼロエミッション燃料の需要が高まっていることから、グリーン水素は世界のクリーンエネルギー転換を実現する重要な存在となっています。戦略的パートナーシップ、大規模なパイロットプロジェクト、野心的な脱炭素化ロードマップが、世界中でグリーン水素セグメントを牽引し続けています。

「石炭ガス化セグメントが2024年に第2位の市場シェアを占めました。」

石炭ガス化セグメントは、豊富な国内の石炭資源を使用して大規模に水素を生成する能力によって、2024年に水素生成市場で第2位の地位を占めました。このプロセスでは、石炭を空気、酸素、蒸気、二酸化炭素で部分的に酸化して燃料ガスを生成します。得られた合成ガスは、主に水素、一酸化炭素、メタン、二酸化炭素、水蒸気で構成され、メタン、パイプライン天然ガスなどの燃料の代替として発電や化学原料生産に利用されます。石炭ガス化から得られる水素は、アンモニア合成、化学製造、水素経済構想のサポートにおいて重要な役割を果たします。このセグメントの主な促進要因は、豊富な石炭埋蔵量、確立された工業インフラ、輸入天然ガスへの依存度を下げるという戦略的目標などです。さらに、効率の向上や炭素回収・貯留(CCS)システムとの統合など、ガス化プロセスの技術的進歩がこの技術の環境性能を高めています。

「アジア太平洋が予測期間に水素生成市場において最大の地域となる可能性が高いです。」

アジア太平洋は、脱炭素化、エネルギー安全保障、産業変革に対する政府の強いコミットメントに後押しされ、予測期間に水素生成市場において最大の地域になる見込みです。中国、日本、韓国、インドなどの国家水素戦略は、大規模水素生成、特にグリーン水素とブルー水素のプロジェクトへの投資を加速させています。拡大する再生可能エネルギー生産能力、支援的な政策枠組み、戦略的な官民パートナーシップは、地域全体のインフラ開発に拍車をかけています。さらに、精製、化学、モビリティにおける水素利用の急成長は、水素のリーダーシップを強く示しています。

当レポートでは、世界の水素生成市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 水素生成市場の企業にとって魅力的な機会

- 水素生成市場:地域別

- アジア太平洋の水素生成市場:生成/配送方式別、国別

- 水素生成市場:技術別

- 水素生成市場:由来別

- 水素生成市場:生成/配送方式別

- 水素生成市場:用途別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- カスタマービジネスに影響を与える動向/混乱

- 価格設定の分析

- 水素の価格帯:技術別(2024年)

- 水素の価格帯:由来別(2024年)

- サプライチェーン分析

- エコシステム分析

- 貿易分析

- 輸入シナリオ(HSコード280410)

- 輸出シナリオ(HSコード280410)

- 技術分析

- 主要技術

- 補完技術

- ケーススタディ分析

- HYBRITの取り組みが、スウェーデンで化石燃料を使用しないグリーン水素による鉄鋼生産の変革を支援

- NATIONAL RENEWABLE ENERGY LABORATORYとELECTRIC HYDROGENが提携し、高性能電解装置コンポーネントを開発

- RWE、SUNFIREの電気分解技術をテストし、グリーン水素を生成

- 主な会議とイベント(2025年~2026年)

- 特許分析

- 規制情勢

- 規制機関、政府機関、その他の組織

- 規制枠組み/政策

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 水素生成市場に対するAI/生成AIの影響

- 水素生成市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国・地域に対する影響

- 用途に対する影響

第6章 水素生成市場:技術別

- イントロダクション

- 水蒸気メタン改質(SMR)

- 部分酸化(POX)

- オートサーマルリフォーミング(ATR)

- 石炭ガス化

- 電解

第7章 水素生成市場:由来別

- イントロダクション

- ブルー水素

- グレー水素

- グリーン水素

第8章 水素生成市場:生成/配送方式別

- イントロダクション

- キャプティブ

- マーチャント

第9章 水素生成市場:用途別

- イントロダクション

- 石油精製

- アンモニア生産

- メタノール生産

- 輸送

- 発電

- その他の用途

第10章 水素生成市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 中東

- GCC

- イラン

- その他の中東

- アフリカ

- 南アフリカ

- その他のアフリカ

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2020年~2025年)

- 市場シェア分析(2024年)

- 収益分析(2020年~2024年)

- 企業の評価と財務指標

- 製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- LINDE PLC

- AIR LIQUIDE

- SAUDI ARABIAN OIL CO.

- AIR PRODUCTS AND CHEMICALS, INC.

- SHELL PLC

- ENGIE

- CHEVRON CORPORATION

- ORSTED A/S

- MESSER SE & CO. KGAA

- EQUINOR ASA

- UNIPER SE

- EXXON MOBIL CORPORATION

- BP P.L.C.

- IWATANI CORPORATION

- PETROLIAM NASIONAL BERHAD (PETRONAS)

- IBERDROLA, S.A.

- その他の企業

- PLUG POWER INC.

- REPSOL

- AKER ASA

- RELIANCE INDUSTRIES LIMITED

- MATHESON TRI-GAS, INC.

- LHYFE

- HIRINGA ENERGY LTD

- BAYOTECH

- HYGEAR

第13章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 LIST OF KEY SECONDARY SOURCES

- TABLE 3 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 4 KEY DATA FROM PRIMARY SOURCES

- TABLE 5 HYDROGEN GENERATION MARKET: RISKS ANALYSIS

- TABLE 6 HYDROGEN GENERATION MARKET SNAPSHOT

- TABLE 7 PRICING RANGE OF HYDROGEN, BY TECHNOLOGY, 2024 (USD/TON)

- TABLE 8 PRICING RANGE OF HYDROGEN, BY SOURCE, 2024 (USD/KG)

- TABLE 9 ROLE OF COMPANIES IN HYDROGEN GENERATION ECOSYSTEM

- TABLE 10 IMPORT DATA FOR HS CODE 280410-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- TABLE 11 EXPORT DATA FOR HS CODE 280410, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 12 LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 LIST OF MAJOR PATENTS, 2019-2024

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 IMPACT OF PORTER'S FIVE FORCES ANALYSIS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS(%)

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 23 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 24 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKETS DUE TO TARIFF IMPACT

- TABLE 25 HYDROGEN GENERATION MARKET, BY TECHNOLOGY, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 26 HYDROGEN GENERATION MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 27 HYDROGEN GENERATION MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 28 HYDROGEN GENERATION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 29 HYDROGEN GENERATION TECHNOLOGY COMPARISON

- TABLE 30 ELECTROLYSIS TECHNOLOGY COMPARISON

- TABLE 31 HYDROGEN GENERATION MARKET, BY SOURCE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 32 HYDROGEN GENERATION MARKET, BY SOURCE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 33 HYDROGEN GENERATION MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 34 HYDROGEN GENERATION MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 35 BLUE HYDROGEN: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 36 BLUE HYDROGEN: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 37 BLUE HYDROGEN: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 BLUE HYDROGEN: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 GRAY HYDROGEN: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 40 GRAY HYDROGEN: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

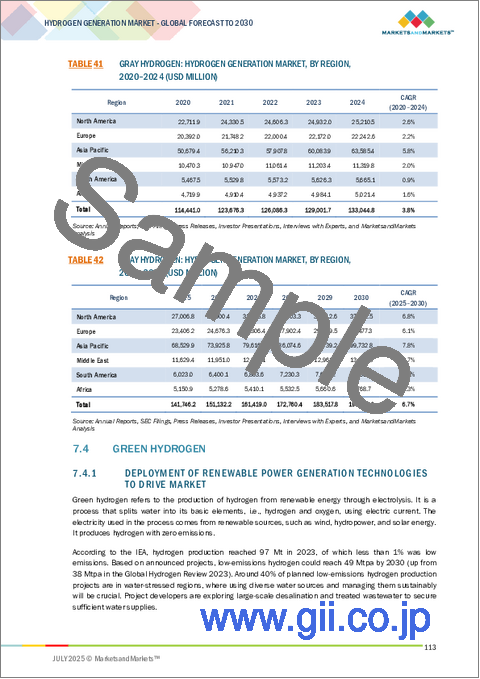

- TABLE 41 GRAY HYDROGEN: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 GRAY HYDROGEN: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 GREEN HYDROGEN: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 44 GREEN HYDROGEN: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 45 GREEN HYDROGEN: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 GREEN HYDROGEN: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 48 HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 49 HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2020-2024 (USD MILLION)

- TABLE 50 HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2025-2030 (USD MILLION)

- TABLE 51 CAPTIVE: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 52 CAPTIVE: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 53 CAPTIVE: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 CAPTIVE: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 MERCHANT: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 56 MERCHANT: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 57 MERCHANT: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 MERCHANT: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 MERCHANT: HYDROGEN GENERATION MARKET, BY DELIVERY MODE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 60 MERCHANT: HYDROGEN GENERATION MARKET, BY DELIVERY MODE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 61 MERCHANT: HYDROGEN GENERATION MARKET, BY DELIVERY MODE, 2020-2024 (USD MILLION)

- TABLE 62 MERCHANT: HYDROGEN GENERATION MARKET, BY DELIVERY MODE, 2025-2030 (USD MILLION)

- TABLE 63 MERCHANT: HYDROGEN GENERATION MARKET, BY STATE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 64 MERCHANT: HYDROGEN GENERATION MARKET, BY STATE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 65 MERCHANT: HYDROGEN GENERATION MARKET FOR GAS, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 66 MERCHANT: HYDROGEN GENERATION MARKET FOR GAS, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 67 MERSCHANT: HYDROGEN GENERATION MARKET FOR LIQUID, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 68 MERCHANT: HYDROGEN GENERATION MARKET FOR LIQUID, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 69 HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 70 HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 71 HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 72 HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 73 PETROLEUM REFINERY: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 74 PETROLEUM REFINERY: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 75 PETROLEUM REFINERY: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 PETROLEUM REFINERY: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 AMMONIA PRODUCTION: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 78 AMMONIA PRODUCTION: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 79 AMMONIA PRODUCTION: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 80 AMMONIA PRODUCTION: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 METHANOL PRODUCTION: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 82 METHANOL PRODUCTION: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 83 METHANOL PRODUCTION: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 84 METHANOL PRODUCTION: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 TRANSPORTATION: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 86 TRANSPORTATION: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 87 TRANSPORTATION: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 88 TRANSPORTATION: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 POWER GENERATION: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 90 POWER GENERATION: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 91 POWER GENERATION: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 92 POWER GENERATION: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 OTHER APPLICATIONS: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 94 OTHER APPLICATIONS: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 95 OTHER APPLICATIONS: HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 96 OTHER APPLICATIONS: HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 98 HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 99 HYDROGEN GENERATION MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 100 HYDROGEN GENERATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: HYDROGEN GENERATION MARKET, BY SOURCE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 102 NORTH AMERICA: HYDROGEN GENERATION MARKET, BY SOURCE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 103 NORTH AMERICA: HYDROGEN GENERATION MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: HYDROGEN GENERATION MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 106 NORTH AMERICA: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 107 NORTH AMERICA: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2020-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2025-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 110 NORTH AMERICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 111 NORTH AMERICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 112 NORTH AMERICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: HYDROGEN GENERATION MARKET, BY COUNTRY, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 114 NORTH AMERICA: HYDROGEN GENERATION MARKET, BY COUNTRY, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 115 NORTH AMERICA: HYDROGEN GENERATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: HYDROGEN GENERATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 US: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 118 US: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 119 US: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 120 US: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 CANADA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 122 CANADA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 123 CANADA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 124 CANADA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 125 MEXICO: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 126 MEXICO: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 127 MEXICO: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 128 MEXICO: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY SOURCE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 130 ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY SOURCE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 131 ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 132 ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 134 ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 135 ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2020-2024 (USD MILLION)

- TABLE 136 ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2025-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 138 ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 139 ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 140 ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY COUNTRY, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 142 ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY COUNTRY, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 143 ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 JAPAN: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 146 JAPAN: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 147 JAPAN: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 148 JAPAN: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 149 CHINA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 150 CHINA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 151 CHINA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 152 CHINA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 INDIA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 154 INDIA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 155 INDIA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 156 INDIA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 157 AUSTRALIA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 158 AUSTRALIA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 159 AUSTRALIA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 160 AUSTRALIA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 161 SOUTH KOREA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 162 SOUTH KOREA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 163 SOUTH KOREA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 164 SOUTH KOREA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 166 REST OF ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 167 REST OF ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 169 EUROPE: HYDROGEN GENERATION MARKET, BY SOURCE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 170 EUROPE: HYDROGEN GENERATION MARKET, BY SOURCE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 171 EUROPE: HYDROGEN GENERATION MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 172 EUROPE: HYDROGEN GENERATION MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 173 EUROPE: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 174 EUROPE: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 175 EUROPE: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2020-2024 (USD MILLION)

- TABLE 176 EUROPE: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2025-2030 (USD MILLION)

- TABLE 177 EUROPE: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 178 EUROPE: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 179 EUROPE: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 180 EUROPE: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 181 EUROPE: HYDROGEN GENERATION MARKET, BY COUNTRY, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 182 EUROPE: HYDROGEN GENERATION MARKET, BY COUNTRY, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 183 EUROPE: HYDROGEN GENERATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 184 EUROPE: HYDROGEN GENERATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 185 GERMANY: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 186 GERMANY: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 187 GERMANY: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 188 GERMANY: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 189 UK: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 190 UK: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 191 UK: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 192 UK: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 193 FRANCE: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 194 FRANCE: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 195 FRANCE: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 196 FRANCE: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 197 RUSSIA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 198 RUSSIA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 199 RUSSIA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 200 RUSSIA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 201 REST OF EUROPE: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 202 REST OF EUROPE: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 203 REST OF EUROPE: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 204 REST OF EUROPE: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 205 SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY SOURCE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 206 SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY SOURCE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 207 SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 208 SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 209 SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 210 SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 211 SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2020-2024 (USD MILLION)

- TABLE 212 SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2025-2030 (USD MILLION)

- TABLE 213 SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 214 SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 215 SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 216 SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 217 SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY COUNTRY, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 218 SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY COUNTRY, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 219 SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 220 SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 221 BRAZIL: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 222 BRAZIL: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 223 BRAZIL: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 224 BRAZIL: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 225 ARGENTINA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 226 ARGENTINA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 227 ARGENTINA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 228 ARGENTINA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 229 REST OF SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 230 REST OF SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 231 REST OF SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 232 REST OF SOUTH AMERICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 233 MIDDLE EAST: HYDROGEN GENERATION MARKET, BY SOURCE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 234 MIDDLE EAST: HYDROGEN GENERATION MARKET, BY SOURCE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 235 MIDDLE EAST: HYDROGEN GENERATION MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 236 MIDDLE EAST: HYDROGEN GENERATION MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 237 MIDDLE EAST: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 238 MIDDLE EAST: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 239 MIDDLE EAST: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2020-2024 (USD MILLION)

- TABLE 240 MIDDLE EAST: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2025-2030 (USD MILLION)

- TABLE 241 MIDDLE EAST: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 242 MIDDLE EAST: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 243 MIDDLE EAST: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 244 MIDDLE EAST: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 245 MIDDLE EAST: HYDROGEN GENERATION MARKET, BY COUNTRY, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 246 MIDDLE EAST: HYDROGEN GENERATION MARKET, BY COUNTRY, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 247 MIDDLE EAST: HYDROGEN GENERATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 248 MIDDLE EAST: HYDROGEN GENERATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 249 SAUDI ARABIA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 250 SAUDI ARABIA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 251 SAUDI ARABIA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 252 SAUDI ARABIA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 253 QATAR: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 254 QATAR: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 255 QATAR: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 256 QATAR: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 257 UAE: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 258 UAE: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 259 UAE: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 260 UAE: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 261 IRAN: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 262 IRAN: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 263 IRAN: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 264 IRAN: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 265 REST OF MIDDLE EAST: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 266 REST OF MIDDLE EAST: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 267 REST OF MIDDLE EAST: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 268 REST OF MIDDLE EAST: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 269 AFRICA: HYDROGEN GENERATION MARKET, BY SOURCE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 270 AFRICA: HYDROGEN GENERATION MARKET, BY SOURCE, 2020-2024 (USD MILLION)

- TABLE 271 AFRICA: HYDROGEN GENERATION MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 272 AFRICA: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 273 AFRICA: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 274 AFRICA: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2020-2024 (USD MILLION)

- TABLE 275 AFRICA: HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE, 2025-2030 (USD MILLION)

- TABLE 276 AFRICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 277 AFRICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 278 AFRICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 279 AFRICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 280 AFRICA: HYDROGEN GENERATION MARKET, BY COUNTRY, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 281 AFRICA: HYDROGEN GENERATION MARKET, BY COUNTRY, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 282 AFRICA: HYDROGEN GENERATION MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 283 AFRICA: HYDROGEN GENERATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 284 SOUTH AFRICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 285 SOUTH AFRICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 286 SOUTH AFRICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 287 SOUTH AFRICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 288 REST OF AFRICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (THOUSAND METRIC TONS)

- TABLE 289 REST OF AFRICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (THOUSAND METRIC TONS)

- TABLE 290 REST OF AFRICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 291 REST OF AFRICA: HYDROGEN GENERATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 292 HYDROGEN GENERATION MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2020-JULY 2025

- TABLE 293 HYDROGEN GENERATION MARKET: DEGREE OF COMPETITION, 2024

- TABLE 294 HYDROGEN GENERATION MARKET: REGION FOOTPRINT

- TABLE 295 HYDROGEN GENERATION MARKET: SOURCE FOOTPRINT

- TABLE 296 HYDROGEN GENERATION MARKET: APPLICATION FOOTPRINT

- TABLE 297 HYDROGEN GENERATION MARKET: TECHNOLOGY FOOTPRINT

- TABLE 298 HYDROGEN GENERATION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 299 HYDROGEN GENERATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 300 HYDROGEN GENERATION MARKET: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 301 HYDROGEN GENERATION MARKET: DEALS, JANUARY 2020-JULY 2025

- TABLE 302 HYDROGEN GENERATION MARKET: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 303 HYDROGEN GENERATION MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JULY 2025

- TABLE 304 LINDE PLC: COMPANY OVERVIEW

- TABLE 305 LINDE PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 LINDE PLC: DEALS

- TABLE 307 LINDE PLC: EXPANSIONS

- TABLE 308 AIR LIQUIDE: COMPANY OVERVIEW

- TABLE 309 AIR LIQUIDE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 AIR LIQUIDE: DEALS

- TABLE 311 AIR LIQUIDE: EXPANSIONS

- TABLE 312 AIR LIQUIDE: OTHER DEVELOPMENTS

- TABLE 313 SAUDI ARABIAN OIL CO.: COMPANY OVERVIEW

- TABLE 314 SAUDI ARABIAN OIL CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 SAUDI ARABIAN OIL CO.: DEALS

- TABLE 316 SAUDI ARABIAN OIL CO.: EXPANSIONS

- TABLE 317 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 318 AIR PRODUCTS AND CHEMICALS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 319 AIR PRODUCTS AND CHEMICALS, INC.: DEALS

- TABLE 320 AIR PRODUCTS AND CHEMICALS, INC.: OTHER DEVELOPMENTS

- TABLE 321 SHELL PLC: COMPANY OVERVIEW

- TABLE 322 SHELL PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 323 SHELL PLC: DEALS

- TABLE 324 SHELL PLC: EXPANSIONS

- TABLE 325 SHELL PLC: OTHER DEVELOPMENTS

- TABLE 326 ENGIE: COMPANY OVERVIEW

- TABLE 327 ENGIE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 328 ENGIE: DEALS

- TABLE 329 CHEVRON CORPORATION: COMPANY OVERVIEW

- TABLE 330 CHEVRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 331 CHEVRON CORPORATION: DEALS

- TABLE 332 ORSTED A/S: COMPANY OVERVIEW

- TABLE 333 ORSTED A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 ORSTED A/S: DEALS

- TABLE 335 ORSTED A/S: EXPANSIONS

- TABLE 336 MESSER SE & CO. KGAA: COMPANY OVERVIEW

- TABLE 337 MESSER SE & CO. KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 338 MESSER SE & CO. KGAA: DEALS

- TABLE 339 EQUINOR ASA: COMPANY OVERVIEW

- TABLE 340 EQUINOR ASA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 341 EQUINOR ASA: PRODUCT LAUNCHES

- TABLE 342 EQUINOR ASA: DEALS

- TABLE 343 UNIPER SE: COMPANY OVERVIEW

- TABLE 344 UNIPER SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 345 UNIPER SE: DEALS

- TABLE 346 UNIPER SE: OTHER DEVELOPMENTS

- TABLE 347 EXXON MOBIL CORPORATION: COMPANY OVERVIEW

- TABLE 348 EXXON MOBIL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 349 EXXON MOBIL CORPORATION: DEALS

- TABLE 350 BP P.L.C.: COMPANY OVERVIEW

- TABLE 351 BP P.L.C.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 352 BP P.L.C.: DEALS

- TABLE 353 BP P.L.C.: OTHERS DEVELOPMENTS

- TABLE 354 IWATANI CORPORATION: COMPANY OVERVIEW

- TABLE 355 IWATANI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 356 IWATANI CORPORATION: DEALS

- TABLE 357 IWATANI CORPORATION: EXPANSIONS

- TABLE 358 PETROLIAM NASIONAL BERHAD (PETRONAS): COMPANY OVERVIEW

- TABLE 359 PETROLIAM NASIONAL BERHAD (PETRONAS): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 360 PETROLIAM NASIONAL BERHAD (PETRONAS): DEALS

- TABLE 361 PETROLIAM NASIONAL BERHAD (PETRONAS): OTHER DEVELOPMENTS

- TABLE 362 IBERDROLA, S.A.: COMPANY OVERVIEW

- TABLE 363 IBERDROLA, S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 364 IBERDROLA, S.A.: DEALS

- TABLE 365 IBERDROLA, S.A.: OTHER DEVELOPMENTS

- TABLE 366 PLUG POWER INC.: COMPANY OVERVIEW

- TABLE 367 REPSOL: COMPANY OVERVIEW

- TABLE 368 AKER ASA: COMPANY OVERVIEW

- TABLE 369 RELIANCE INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 370 MATHESON TRI-GAS, INC.: COMPANY OVERVIEW

- TABLE 371 LHYFE: COMPANY OVERVIEW

- TABLE 372 HIRINGA ENERGY LTD: COMPANY OVERVIEW

- TABLE 373 BAYOTECH: COMPANY OVERVIEW

- TABLE 374 HYGEAR: COMPANY OVERVIEW

List of Figures

- FIGURE 1 HYDROGEN GENERATION MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 HYDROGEN GENERATION MARKET: RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM SECONDARY SOURCES

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 BREAKDOWN OF PRIMARIES

- FIGURE 6 HYDROGEN GENERATION MARKET: BOTTOM-UP APPROACH

- FIGURE 7 HYDROGEN GENERATION MARKET: TOP-DOWN APPROACH

- FIGURE 8 HYDROGEN GENERATION MARKET: DEMAND-SIDE ANALYSIS

- FIGURE 9 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR HYDROGEN GENERATION SOLUTIONS

- FIGURE 10 KEY METRICS CONSIDERED TO ANALYZE SUPPLY OF HYDROGEN GENERATION SOLUTIONS

- FIGURE 11 HYDROGEN GENERATION MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 12 HYDROGEN GENERATION MARKET: DATA TRIANGULATION

- FIGURE 13 HYDROGEN GENERATION MARKET: RESEARCH LIMITATIONS

- FIGURE 14 ASIA PACIFIC HELD LARGEST SHARE OF HYDROGEN GENERATION MARKET IN 2024

- FIGURE 15 PETROLEUM REFINERY SEGMENT TO DOMINATE HYDROGEN GENERATION MARKET DURING FORECAST PERIOD

- FIGURE 16 GRAY HYDROGEN SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HYDROGEN GENERATION MARKET IN 2030

- FIGURE 17 STEAM METHANE REFORMING (SMR) SEGMENT TO HOLD LARGEST SHARE OF HYDROGEN GENERATION MARKET IN 2030

- FIGURE 18 MERCHANT SEGMENT TO EXHIBIT HIGHER CAGR BETWEEN 2025 AND 2030

- FIGURE 19 RISING FOCUS ON CURBING GREENHOUSE GAS EMISSIONS FROM HYDROGEN PRODUCTION PROCESSES TO CONTRIBUTE TO MARKET GROWTH

- FIGURE 20 ASIA PACIFIC HYDROGEN GENERATION MARKET TO RECORD HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 21 CAPTIVE SEGMENT AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC HYDROGEN GENERATION MARKET IN 2024

- FIGURE 22 STEAM METHANE REFORMING (SMR) SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2030

- FIGURE 23 GRAY HYDROGEN SEGMENT HELD LARGEST SHARE OF HYDROGEN GENERATION MARKET IN 2030

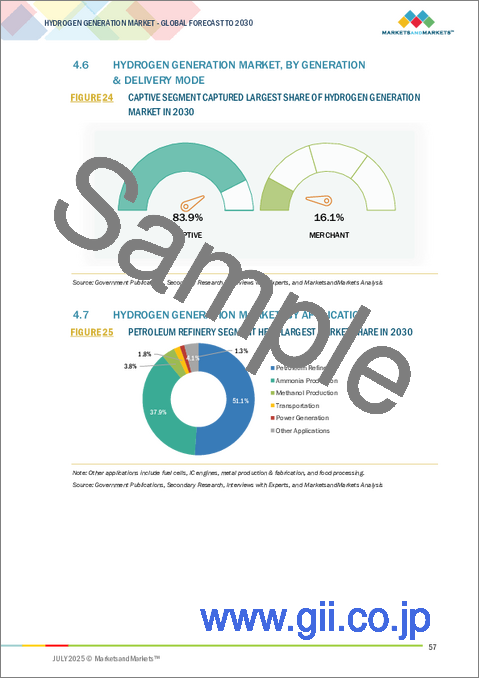

- FIGURE 24 CAPTIVE SEGMENT CAPTURED LARGEST SHARE OF HYDROGEN GENERATION MARKET IN 2030

- FIGURE 25 PETROLEUM REFINERY SEGMENT HELD LARGEST MARKET SHARE IN 2030

- FIGURE 26 MARKET DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 GLOBAL GREENHOUSE GAS EMISSIONS, BY SECTOR, 2023

- FIGURE 28 AMMONIA DEMAND STRUCTURE, 2024

- FIGURE 29 CUMULATIVE EMISSION REDUCTION, BY MITIGATION MEASURE, 2021-2050

- FIGURE 30 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 31 SUPPLY CHAIN ANALYSIS

- FIGURE 32 HYDROGEN GENERATION ECOSYSTEM

- FIGURE 33 IMPORT DATA FOR HS CODE 280410-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2022-2024

- FIGURE 34 EXPORT DATA FOR HS CODE 280410-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2022-2024

- FIGURE 35 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 36 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 38 BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 39 IMPACT OF AI/GENERATIVE AI, BY APPLICATION

- FIGURE 40 STEAM METHANE REFORMING (SMR) SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 41 GRAY HYDROGEN SEGMENT HELD LARGEST MARKET SHARE IN 2024

- FIGURE 42 CAPTIVE SEGMENT HELD LARGER SHARE OF HYDROGEN GENERATION MARKET IN 2024

- FIGURE 43 PETROLEUM REFINERY SEGMENT CAPTURED LARGEST MARKET SHARE IN 2024

- FIGURE 44 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN HYDROGEN GENERATION MARKET FROM 2025 TO 2030

- FIGURE 45 ASIA PACIFIC TO HOLD LARGEST SHARE OF HYDROGEN GENERATION MARKET IN 2024

- FIGURE 46 NORTH AMERICA: HYDROGEN GENERATION MARKET SNAPSHOT

- FIGURE 47 ASIA PACIFIC: HYDROGEN GENERATION MARKET SNAPSHOT

- FIGURE 48 MARKET SHARE ANALYSIS OF COMPANIES OFFERING HYDROGEN GENERATION TECHNOLOGIES, 2024

- FIGURE 49 HYDROGEN GENERATION MARKET: REVENUE ANALYSIS OF FOUR KEY PLAYERS, 2020-2024

- FIGURE 50 COMPANY VALUATION

- FIGURE 51 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 52 PRODUCT COMPARISON

- FIGURE 53 HYDROGEN GENERATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 54 HYDROGEN GENERATION MARKET: MARKET FOOTPRINT

- FIGURE 55 HYDROGEN GENERATION MARKET: COMPANY FOOTPRINT

- FIGURE 56 HYDROGEN GENERATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 57 LINDE PLC: COMPANY SNAPSHOT

- FIGURE 58 AIR LIQUIDE: COMPANY SNAPSHOT

- FIGURE 59 SAUDI ARABIAN OIL CO.: COMPANY SNAPSHOT

- FIGURE 60 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT

- FIGURE 61 SHELL PLC: COMPANY SNAPSHOT

- FIGURE 62 ENGIE: COMPANY SNAPSHOT

- FIGURE 63 CHEVRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 ORSTED A/S: COMPANY SNAPSHOT

- FIGURE 65 MESSER SE & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 66 EQUINOR ASA: COMPANY SNAPSHOT

- FIGURE 67 UNIPER SE: COMPANY SNAPSHOT

- FIGURE 68 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 BP P.L.C.: COMPANY SNAPSHOT

- FIGURE 70 IWATANI CORPORATION: COMPANY SNAPSHOT

- FIGURE 71 PETRONAS NASIONAL BERHAD (PETRONAS): COMPANY SNAPSHOT

- FIGURE 72 IBERDROLA, S.A.: COMPANY SNAPSHOT

The hydrogen generation market is estimated to reach USD 226.37 billion by 2030 from an estimated value of USD 157.81 billion in 2025, at a CAGR of 7.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Metric Tons) |

| Segments | Source, Application, Technology, Generation and Delivery Mode, and Region |

| Regions covered | North America, Europe, Asia Pacific, the Middle East, Africa, and South America |

The hydrogen generation market is driven by increasing global efforts to decarbonize energy systems, the rising demand for clean fuel alternatives, and the expanding adoption of hydrogen across industrial, transportation, and power generation sectors. Supportive government policies, substantial investments in renewable energy, and advancements in electrolysis technology accelerate the market expansion. Additionally, the development of hydrogen infrastructure and growing focus on energy security and emission reduction further strengthen the market growth trajectory across major global regions.

"Green hydrogen segment is projected to record the highest CAGR between 2025 and 2030."

The green hydrogen segment is expected to record the highest CAGR in the hydrogen generation market during the forecast period, driven by the global transition toward carbon neutrality and the urgent need to decarbonize hard-to-abate sectors. Supportive policy frameworks accelerate project development and commercialization, including tax incentives, subsidies, and national hydrogen strategies worldwide. Additionally, the growing demand for zero-emission fuels in applications such as fuel cell vehicles, power generation, and industrial feedstock positions green hydrogen as a key enabler of the global clean energy transition. Strategic partnerships, large-scale pilot projects, and ambitious decarbonization roadmaps continue to drive the green hydrogen segment worldwide.

"Coal gasification segment accounted for the second-largest market share in 2024."

The coal gasification segment held the second-largest position in the hydrogen generation market in 2024, driven by its ability to produce hydrogen at scale using abundant domestic coal resources. In this process, coal is partially oxidized with air, oxygen, steam, or carbon dioxide to create a fuel gas. The resulting syngas, primarily composed of hydrogen, carbon monoxide, methane, carbon dioxide, and water vapor, is then utilized as an alternative to methane, piped natural gas, and other fuels for power generation and chemical feedstock production. Hydrogen derived from coal gasification serves critical roles in ammonia synthesis, chemical manufacturing, and supporting hydrogen economy initiatives. Key drivers for this segment include extensive coal reserves, established industrial infrastructure, and the strategic objective of reducing dependence on imported natural gas. Furthermore, technological advancements in gasification processes, including improved efficiency and integration with carbon capture and storage (CCS) systems, enhance the environmental performance of this technology.

"Asia Pacific is likely to be the largest region in the hydrogen generation market during the forecast period."

Asia Pacific is poised to be the largest region in the hydrogen generation market during the forecast period, driven by strong government commitments to decarbonization, energy security, and industrial transformation. National hydrogen strategies in countries such as China, Japan, South Korea, and India accelerate investments in large-scale hydrogen production, particularly in green and blue hydrogen projects. Expanding renewable energy capacity, supportive policy frameworks, and strategic public-private partnerships fuel infrastructure development across the region. Additionally, the rapid growth of hydrogen applications in refining, chemicals, and mobility underscores its leadership.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 65%, Tier 2 - 24%, and Tier 3 - 11%

By Designation: C-Level Executives - 30%, Managers - 25%, and Others - 45%

By Region: North America - 27%, Europe - 20%, Asia Pacific - 33%, South America - 12%, Middle East - 4% Africa - 4%

Note: Others include product engineers, product specialists, and engineering leads.

The tiers of the companies are defined based on their total revenues as of 2023. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The hydrogen generation market is dominated by a few major players with a wide regional presence. Leading players in hydrogen generation market are Linde plc (Ireland), Air Liquide (France), Saudi Arabian Oil Co. (Saudi Arabia), Air Products and Chemicals, Inc. (US), Shell plc (UK), ENGIE (France), Chevron Corporation (US), Orsted A/S (Denmark), Messer SE & Co. KGaA (Germany), Equinor ASA (Norway), Uniper SE (Germany), Exxon Mobil Corporation (US), and BP p.l.c. (UK).

Research Coverage:

The report defines, describes, and forecasts the hydrogen generation market by application, technology, source, and generation & delivery mode. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various key aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the hydrogen generation market.

Key Benefits of Buying the Report

- The global push toward decarbonization drives the hydrogen generation market, the growing demand for flexible clean energy solutions, and the need to reduce greenhouse gas emissions across key industrial and transport sectors. While green hydrogen is gaining momentum as a long-term sustainable solution, gray hydrogen currently dominates the market due to its cost-effectiveness, mature production technology, and ability to supply large volumes to meet immediate industrial needs. Supportive government policies, national hydrogen roadmaps, and emission reduction mandates drive investments across the entire hydrogen value chain, including improvements in carbon capture technologies that enable blue hydrogen development. Advancements in production efficiency, integration with existing industrial infrastructure, and the expansion of hydrogen mobility and energy storage applications further accelerate market growth.

- Product Development/ Innovation: The hydrogen generation market is centered on advancing efficiency, sustainability, and scalability through continuous innovation in production technologies and system designs. Companies invest in developing advanced electrolyzers with higher conversion efficiency and lower operational costs to accelerate green hydrogen adoption. Innovations in steam methane reforming (SMR) and coal gasification processes, including integration with carbon capture, utilization, and storage (CCUS) technologies, enhance the environmental performance of gray and blue hydrogen production. Modular and compact hydrogen generation units allow flexible deployment across industrial, mobility, and energy applications. Integration of digital technologies, such as IoT and advanced data analytics, enables real-time monitoring, predictive maintenance, and optimization of production processes. Material advancements focus on improving corrosion resistance, durability, and safety in hydrogen storage and handling systems. These technological developments are critical to strengthening the hydrogen supply infrastructure and supporting its broader role as a key enabler in the global clean energy transition.

- Market Development: In September 2023, Air Liquide invested USD 433 million to build its Normand'Hy electrolyzer with a capacity of 200 MW to decarbonize the Normandy industrial basin and mobility.

- Market Diversification: In July 2024, Air Products and Chemicals, Inc. entered a 15-year agreement with TotalEnergies to supply 70,000 tons of green hydrogen annually to TotalEnergies' refineries and biorefineries in Northern Europe starting in 2030. This supply will help TotalEnergies replace fossil-based hydrogen, enabling a reduction of approximately 700,000 tonnes of CO2 emissions per year. The deal supports TotalEnergies' goal of cutting Scope 1 and 2 emissions by 40% by 2030 (vs. 2015 levels).

- Competitive Assessment: Assessment of rankings of some key players, including Linde plc (Ireland), Air Liquide (France), Saudi Arabian Oil Co. (Saudi Arabia), Air Products and Chemicals, Inc. (US), Shell plc (UK), and ENGIE (France).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 DEMAND-SIDE ANALYSIS

- 2.2.3.1 Demand-side assumptions

- 2.2.3.2 Demand-side calculations

- 2.2.4 SUPPLY-SIDE ANALYSIS

- 2.2.4.1 Supply-side assumptions

- 2.2.4.2 Supply-side calculations

- 2.3 FORECAST

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HYDROGEN GENERATION MARKET

- 4.2 HYDROGEN GENERATION MARKET, BY REGION

- 4.3 ASIA PACIFIC HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE AND COUNTRY

- 4.4 HYDROGEN GENERATION MARKET, BY TECHNOLOGY

- 4.5 HYDROGEN GENERATION MARKET, BY SOURCE

- 4.6 HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE

- 4.7 HYDROGEN GENERATION MARKET, BY APPLICATION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Enforcement of stringent regulations to curb greenhouse gas emissions

- 5.2.1.2 Government initiatives for developing hydrogen economy

- 5.2.1.3 Growing demand for ammonia in agriculture sector

- 5.2.2 RESTRAINTS

- 5.2.2.1 Energy loss during hydrogen production

- 5.2.2.2 Limited hydrogen infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising emphasis on achieving net-zero carbon emission targets

- 5.2.3.2 Increasing investment in low-emission fuels

- 5.2.3.3 Growing demand for low-carbon transportation fuels

- 5.2.4 CHALLENGES

- 5.2.4.1 High costs associated with renewable hydrogen production

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 PRICING RANGE OF HYDROGEN, BY TECHNOLOGY, 2024

- 5.4.2 PRICING RANGE OF HYDROGEN, BY SOURCE, 2024

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 280410)

- 5.7.2 EXPORT SCENARIO (HS CODE 280410)

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Steam methane reforming (SMR)

- 5.8.1.2 Partial oxidation

- 5.8.1.3 Coal gasification

- 5.8.1.4 Electrolysis

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Carbon capture, utilization, and storage (CCUS)

- 5.8.1 KEY TECHNOLOGIES

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 HYBRIT INITIATIVE HELPS TRANSFORM STEEL PRODUCTION WITH FOSSIL-FREE GREEN HYDROGEN IN SWEDEN

- 5.9.2 NATIONAL RENEWABLE ENERGY LABORATORY AND ELECTRIC HYDROGEN PARTNER TO DEVELOP HIGH-PERFORMANCE ELECTROLYZER COMPONENTS

- 5.9.3 RWE TESTS SUNFIRE'S ELECTROLYSIS TECHNOLOGIES TO GENERATE GREEN HYDROGEN

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 PATENT ANALYSIS

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATORY FRAMEWORKS/POLICIES

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF SUBSTITUTES

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 IMPACT OF AI/GEN AI ON HYDROGEN GENERATION MARKET

- 5.16 IMPACT OF 2025 US TARIFF ON HYDROGEN GENERATION MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRIES/REGIONS

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON APPLICATIONS

6 HYDROGEN GENERATION MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 STEAM METHANE REFORMING (SMR)

- 6.2.1 EMERGENCE AS COST-EFFECTIVE METHOD OF HYDROGEN PRODUCTION TO FOSTER SEGMENTAL GROWTH

- 6.3 PARTIAL OXIDATION (POX)

- 6.3.1 USE IN AUTOMOBILE FUEL CELLS AND OTHER COMMERCIAL APPLICATIONS TO BOOST SEGMENTAL GROWTH

- 6.4 AUTO THERMAL REFORMING (ATR)

- 6.4.1 STRONG FOCUS ON PRODUCING ADVANCED BIOFUELS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 6.5 COAL GASIFICATION

- 6.5.1 NEED TO REDUCE RELIANCE ON IMPORTED NATURAL GAS TO FUEL SEGMENTAL GROWTH

- 6.6 ELECTROLYSIS

- 6.6.1 EMPHASIS ON INCREASING ENERGY EFFICIENCY OF HYDROGEN GENERATION PROCESS TO AUGMENT SEGMENTAL GROWTH

- 6.6.2 ALKALINE ELECTROLYSIS

- 6.6.3 PROTON-EXCHANGE MEMBRANE ELECTROLYSIS

- 6.6.4 SOLID OXIDE ELECTROLYSIS

- 6.6.5 ANION-EXCHANGE MEMBRANE ELECTROLYSIS

7 HYDROGEN GENERATION MARKET, BY SOURCE

- 7.1 INTRODUCTION

- 7.2 BLUE HYDROGEN

- 7.2.1 LOW CARBON DIOXIDE PRODUCTION BENEFITS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 7.3 GRAY HYDROGEN

- 7.3.1 IMPOSITION OF STRICT CARBON CAPS ON INDUSTRIES TO ACCELERATE SEGMENTAL GROWTH

- 7.4 GREEN HYDROGEN

- 7.4.1 DEPLOYMENT OF RENEWABLE POWER GENERATION TECHNOLOGIES TO DRIVE MARKET

8 HYDROGEN GENERATION MARKET, BY GENERATION & DELIVERY MODE

- 8.1 INTRODUCTION

- 8.2 CAPTIVE

- 8.2.1 NEED TO REDUCE DEPENDENCE ON EXTERNAL HYDROGEN SUPPLY CHAINS TO ACCELERATE SEGMENTAL GROWTH

- 8.3 MERCHANT

- 8.3.1 BY DELIVERY MODE

- 8.3.1.1 Liquid on-site plant & pipeline

- 8.3.1.1.1 Presence near areas with high concentration of hydrogen consumers to expedite segmental growth

- 8.3.1.2 Bulk & cylinder (gaseous form)

- 8.3.1.2.1 Last-mile delivery flexibility and light transport to augment segmental growth

- 8.3.1.3 Bulk (liquid form)

- 8.3.1.3.1 Greater mass of hydrogen content than gaseous tube trailer to bolster segmental growth

- 8.3.1.4 Small on-site

- 8.3.1.4.1 High preference for small on-site hydrogen plants in chemicals, food, and other industries to drive market

- 8.3.1.1 Liquid on-site plant & pipeline

- 8.3.2 BY STATE

- 8.3.2.1 Gas

- 8.3.2.1.1 Emergence as clean energy source to accelerate segmental growth

- 8.3.2.2 Liquid

- 8.3.2.2.1 High preference in high-volume transport to accelerate segmental growth

- 8.3.2.1 Gas

- 8.3.1 BY DELIVERY MODE

9 HYDROGEN GENERATION MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 PETROLEUM REFINERY

- 9.2.1 INCREASING USE OF HYDROGEN TO REDUCE SULFUR CONTENT IN DIESEL FUEL TO BOOST SEGMENTAL GROWTH

- 9.3 AMMONIA PRODUCTION

- 9.3.1 RISING NEED FOR AMMONIA IN NITROGEN-BASED FERTILISERS TO FUEL SEGMENTAL GROWTH

- 9.4 METHANOL PRODUCTION

- 9.4.1 SURGING DEMAND FOR TRANSPORTATION FUEL AND ELECTRICITY TO AUGMENT SEGMENTAL GROWTH

- 9.5 TRANSPORTATION

- 9.5.1 GROWING CONSUMPTION OF FUEL-CELL ELECTRIC VEHICLES TO SUPPORT MARKET GROWTH

- 9.6 POWER GENERATION

- 9.6.1 INCREASING RELIANCE ON BACKUP POWER SOURCES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.7 OTHER APPLICATIONS

10 HYDROGEN GENERATION MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Increasing hydrogen use in petroleum refinery and chemical manufacturing to drive market

- 10.2.2 CANADA

- 10.2.2.1 Rising development of low-carbon hydrogen to support decarbonization strategies to fuel market growth

- 10.2.3 MEXICO

- 10.2.3.1 Increasing ammonia and green hydrogen Initiatives to accelerate market growth

- 10.2.1 US

- 10.3 ASIA PACIFIC

- 10.3.1 JAPAN

- 10.3.1.1 Strong ambitious targets and heavy infrastructure investment to accelerate market growth

- 10.3.2 CHINA

- 10.3.2.1 Increasing ammonia production to modernize agriculture to drive market

- 10.3.3 INDIA

- 10.3.3.1 Shifting focus toward renewable hydrogen to contribute to market growth

- 10.3.4 AUSTRALIA

- 10.3.4.1 Strong presence of renewable energy resources to bolster market growth

- 10.3.5 SOUTH KOREA

- 10.3.5.1 Ambitious carbon neutrality goals to contribute to market growth

- 10.3.6 REST OF ASIA PACIFIC

- 10.3.1 JAPAN

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Strong focus on producing low-carbon green hydrogen to boost market growth

- 10.4.2 UK

- 10.4.2.1 Growing focus on supporting conventional hydrogen production to augment market growth

- 10.4.3 FRANCE

- 10.4.3.1 Rapid transition to low-carbon alternatives in industries to fuel market growth

- 10.4.4 RUSSIA

- 10.4.4.1 Increasing oil export and natural gas production to contribute to market growth

- 10.4.5 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Increasing electricity generation using renewable energy to foster market growth

- 10.5.2 ARGENTINA

- 10.5.2.1 Rapid transition to low-carbon energy sources for industrial decarbonization to augment market growth

- 10.5.3 REST OF SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.6 MIDDLE EAST

- 10.6.1 GCC

- 10.6.1.1 Saudi Arabia

- 10.6.1.1.1 Thriving petrochemical industry to contribute to market growth

- 10.6.1.2 Qatar

- 10.6.1.2.1 Escalating LNG export and natural gas production to drive market

- 10.6.1.3 UAE

- 10.6.1.3.1 Expanding natural gas reserves to boost market growth

- 10.6.1.1 Saudi Arabia

- 10.6.2 IRAN

- 10.6.2.1 High demand for refined petroleum products to contribute to market growth

- 10.6.3 REST OF MIDDLE EAST

- 10.6.1 GCC

- 10.7 AFRICA

- 10.7.1 SOUTH AFRICA

- 10.7.1.1 Growing investment in hydrogen and green ammonia for energy transition to boost market growth

- 10.7.2 REST OF AFRICA

- 10.7.1 SOUTH AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2020-2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Source footprint

- 11.7.5.4 Application footprint

- 11.7.5.5 Technology footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 LINDE PLC

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 AIR LIQUIDE

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.3.3 Others developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 SAUDI ARABIAN OIL CO.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 AIR PRODUCTS AND CHEMICALS, INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 SHELL PLC

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.3.2 Expansions

- 12.1.5.3.3 Others developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 ENGIE

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 CHEVRON CORPORATION

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 ORSTED A/S

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.3.2 Expansions

- 12.1.9 MESSER SE & CO. KGAA

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.10 EQUINOR ASA

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Deals

- 12.1.11 UNIPER SE

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.11.3.2 Others developments

- 12.1.12 EXXON MOBIL CORPORATION

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.13 BP P.L.C.

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Deals

- 12.1.13.3.2 Others developments

- 12.1.14 IWATANI CORPORATION

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.14.3.2 Expansions

- 12.1.15 PETROLIAM NASIONAL BERHAD (PETRONAS)

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.15.3.2 Others developments

- 12.1.16 IBERDROLA, S.A.

- 12.1.16.1 Business overview

- 12.1.16.2 Products/Solutions/Services offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Deals

- 12.1.16.3.2 Others developments

- 12.1.1 LINDE PLC

- 12.2 OTHER PLAYERS

- 12.2.1 PLUG POWER INC.

- 12.2.2 REPSOL

- 12.2.3 AKER ASA

- 12.2.4 RELIANCE INDUSTRIES LIMITED

- 12.2.5 MATHESON TRI-GAS, INC.

- 12.2.6 LHYFE

- 12.2.7 HIRINGA ENERGY LTD

- 12.2.8 BAYOTECH

- 12.2.9 HYGEAR

13 APPENDIX

- 13.1 INSIGHTS OF INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS