|

|

市場調査レポート

商品コード

1111038

Infrastructure as Code (IaC) の世界市場:ツール別 (構成オーケストレーション、構成管理)・サービス別・種類別 (宣言型、命令型)・インフラの種類別 (可変的、不変的)・展開モード別・業種別・地域別の将来予測 (2027年まで)Infrastructure as Code (IaC) Market by Tool (Configuration Orchestration, Configuration Management), Service, Type (Declarative & Imperative), Infrastructure Type (Mutable & Immutable), Deployment Mode, Vertical and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| Infrastructure as Code (IaC) の世界市場:ツール別 (構成オーケストレーション、構成管理)・サービス別・種類別 (宣言型、命令型)・インフラの種類別 (可変的、不変的)・展開モード別・業種別・地域別の将来予測 (2027年まで) |

|

出版日: 2022年08月02日

発行: MarketsandMarkets

ページ情報: 英文 242 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

Infrastructure as Code (IaC) の市場規模は、2022年の8億米ドルから、2027年には23億米ドルへと、予測期間中に24.0%のCAGRで拡大すると予想されています。

IaC技術は、インフラ構築の最適化とリファクタリングにより、システム管理者を手作業から解放し、アプリケーション開発者が本来の業務に集中できるよう支援します。

"コンポーネント別では、ツール分野が予測期間中最大の市場規模を記録"

IaC市場は、コンポーネントに基づき、ツールとサービスに区分されます。ツール分野の市場規模は、予測期間中に最も大きくなると予測されます。Infrastructure as Code (IaC) とは、物理的なハードウェア構成や対話型の構成ツールではなく、機械読み取り可能な定義ファイルを通じてコンピュータのデータセンターを管理・プロビジョニングするプロセスを指します。多くのツールがインフラ自動化機能を満たし、IaCを使用しています。プログラム的なアプローチに基づいて宣言的または命令的にインフラの変更または構成を行うフレームワークまたはツールは、IaCの下で考えることができます。従来は、サーバー (ライフサイクル) 自動化ツールや構成管理ツールがIaCを実現するために使用されていました。現在では、継続的な構成の自動化ツールや、MicrosoftのPowerShell DSCやAWS CloudFormationのようなスタンドアロンのIaCフレームワークも使用されるようになっています。

"命令型セグメントが予測期間中に最も高いCAGRを占める"

IaC市場は、種類別に宣言型と命令型に分類されます。命令型セグメントは、予測期間中に高いCAGRで成長すると予想されます。命令型ソリューションは、クライアントのインフラを一度に特定のステップで提供する自動化スクリプトを準備するのに役立ちます。この場合、規模が大きくなるにつれて管理作業が増える可能性がありますが、既存の管理スタッフにとっては、すでに存在する設定スクリプトを理解して活用することが容易になります。

"予測期間中、アジア太平洋地域が最も高いCAGRを維持"

アジア太平洋地域のIaC市場は、同地域における工業化の進展により、2022年から2027年にかけて27.5%の最高のCAGRで成長すると予測されます。同地域では、近年、新しい技術や新興技術の導入が活発化しています。また、熟練労働者の確保や、中小企業や大企業が同地域への参入と成長に熱心に取り組んでいることも、IaC市場の普及を後押しする要因の1つとなっています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と動向

- イントロダクション

- 市場力学

- 進化

- IaC市場のエコシステム

- ケーススタディ分析

- 技術分析

- IaCと機械学習 (ML)

- IaCとデータサイエンス

- サプライチェーン/バリューチェーン分析

- ポーターのファイブフォース分析

- 価格モデル分析

- 特許分析

- 主な会議とイベント (2022年~2023年)

- 関税・規制状況

- 主な利害関係者と購入基準

第6章 Infrastructure as Code (IaC) 市場:コンポーネント別

- イントロダクション

- ツール

- 構成オーケストレーション

- 構成管理

- インフラプロビジョニング

- アプリケーション開発

- サービス

- コンサルティングサービス

- インテグレーション・展開

- 訓練・サポート・整備

第7章 Infrastructure as Code (IaC) 市場:種類別

- イントロダクション

- 宣言型

- 命令型

第8章 Infrastructure as Code (IaC) 市場:インフラの種類別

- イントロダクション

- 可変的 (mutable)

- 不変的 (immutable)

第9章 Infrastructure as Code (IaC) 市場:組織規模別

- イントロダクション

- 中小企業

- 大企業

第10章 Infrastructure as Code (IaC) 市場:展開モード別

- イントロダクション

- オンプレミス

- クラウド

第11章 Infrastructure as Code (IaC) 市場:業種別

- イントロダクション

- 銀行・金融サービス・保険 (BFSI)

- IT・ITeS

- 政府

- 製造業

- 通信

- 小売業

- 医療

- 輸送・ロジスティクス

- その他の業種

第12章 Infrastructure as Code (IaC) 市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- オーストラリア・ニュージーランド

- 他のアジア太平洋諸国

- 中東・アフリカ

- 中東

- アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第13章 競合情勢

- 概要

- 主要企業の戦略

- 収益分析

- 市場シェア分析

- 企業評価クアドラント

- スタートアップ/中小企業の評価マトリックス

- 競合ベンチマーキング

- 競合シナリオ

- 製品の発売

- 資本取引

第14章 企業プロファイル

- イントロダクション

- 主要企業

- MICROSOFT

- BROADCOM

- AWS

- ORACLE

- IBM

- HPE

- SERVICENOW

- HASHICORP TERRAFORM

- PROGRESS SOFTWARE CORPORATION

- PUPPET (PERFORCE)

- PULUMI

- DELL

- ALIBABA

- CROSSPLANE

- DOCKER

- JENKINS

- NORTHERN.TECH

- GITHUB

- GITLAB

- CANONICAL

- NETAPP

- ALPACKED

- RACKSPACE TECHNOLOGY

第15章 隣接市場

- イントロダクション

- 制限事項

- クラウドコンピューティング市場

- ハイパーコンバージドインフラ市場

第16章 付録

The infrastructure as code market size to grow from USD 0.8 billion in 2022 to USD 2.3 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 24.0% during the forecast period. IaC technologies can assist in releasing system administrators from laboring over manual procedures and allowing application developers to concentrate on what they do effectively by optimizing and refactoring infrastructure builds.

Programs, configuration data, and automation devices are used in the infrastructure as code (IaC) deployment and management approach. This method may be used to cloud services as well as to hardware including web servers, routers, databases, load balancers, and personal PCs. It is distinct from conventional infrastructure management, which depends on mechanical or interactive device configuration. IaC refers to a high-level build connections rather than a particular method, device, or protocol. Utilizing approaches for automated testing and quality control, Infrastructure as Code makes use of the software development process. Instead of manually altering the infrastructure, modifications to the configuration are accomplished by altering the program.

The major market players such as include IBM, Microsoft, AWS, Hashicorp Terraform, Google, HPE and Broadcom have adopted numerous growth strategies, which include acquisitions, new product launches, product enhancements, and business expansions, to enhance their market shares.

Based on Component, tool segment to register for the largest market size during the forecast period

Based on Component, the infrastructure as code market is segmented into tools and services. The market size of the tools segment is estimated to be the largest during the forecast period. Infrastructure as code (IaC) is the process of managing and provisioning computer data centers through machine-readable definition files rather than physical hardware configuration or interactive configuration tools. Many tools fulfill infrastructure automation capabilities and use IaC. The framework or tool that performs changes or configures infrastructure declaratively or imperatively based on a programmatic approach can be considered under IaC. Traditionally, server (lifecycle) automation and configuration management tools were used to accomplish IaC. Now, enterprises are also using continuous configuration automation tools or stand-alone IaC frameworks, such as Microsoft's PowerShell DSC or AWS CloudFormation.

The Imperative segment to account for the highest CAGR during the forecast period

Based on type, the infrastructure as code market is segmented into declarative and imperative. The imperative segment is expected grow at a higher CAGR during the forecast period. The imperative solution helps to prepare automation scripts that provide the client's infrastructure one specific step at a time. While this can be more work to manage as it gets scaled, it can be easier for existing administrative staff to understand and leverage configuration scripts that already exist. With an imperative approach, a developer writes a code specifying the computer's steps to accomplish the goal. This is referred to as algorithmic programming. In contrast, a functional approach involves composing the problem as a set of functions to be executed.

Asia Pacific to hold highest CAGR during the forecast period

The Asia Pacific infrastructure as code market is expected to grow at the highest CAGR of 27.5% from 2022 to 2027, due to growing industrialization in this region. In this region, the adoption of new and emerging technologies has gained momentum in recent years. Public cloud is gaining huge adoption due to its low costs, on-demand availability, and improved security. The availability of skilled labor and the keen focus of SMEs and large enterprises to enter and grow in this region are a few factors driving the adoption of the IaC market. Asia Pacific is expected to witness significant growth during the forecast period. The region has always been cautious about investment plans in terms of funding. Major players, such as Microsoft, AWS, Google, and IBM, are expanding their cloud and IaC rapidly in this region due to the increasing number of customers and growing economic outlook. The increasing adoption of emerging technologies, such as big data, IoT, and analytics, is expected to drive the growth of the IaC market in Asia Pacific region.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the infrastructure as code market.

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, D-Level Executives: 25%, and Managers: 40%

- By Region: APAC: 25%, Europe: 30%, North America: 30%, MEA: 10%, Latin America: 5%

The report includes the study of key players offering infrastructure as code. It profiles major vendors in the infrastructure as code market. The major players in the infrastructure as code market include IBM (US), Microsoft (US), AWS (US), Oracle (US), Hashicorp Terraform (US), Google (US), Alibaba Group (China), Dell (US), Rackspace Technology (US), HPE (US), ServiceNow (US), Broadcom (US), Pulumi (US), Puppet (US), Progress Software (US), NetApp (UK), Northern.tech (US), Canonical (UK), Alpacked (Ukraine), Jenkins (US), Gitlab (US), Github (US), Crossplane (US), and Docker (US).

Research Coverage

The market study covers the infrastructure as code market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as components, type, infrastructure type, deployment mode, organization size, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall infrastructure as code market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 INFRASTRUCTURE AS CODE MARKET SEGMENTATION

- 1.3.2 GEOGRAPHIC SCOPE

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2019-2021

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 INFRASTRUCTURE AS CODE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Primary sources

- 2.1.2.5 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach for capturing market share using bottom-up analysis (demand side)

- FIGURE 4 INFRASTRUCTURE AS CODE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF IAC MARKET

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach for capturing market share using top-down analysis (supply side)

- 2.3.3 INFRASTRUCTURE AS CODE MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 RESEARCH ASSUMPTIONS

- 2.4.1 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT: INFRASTRUCTURE AS CODE MARKET

- 2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY

- TABLE 3 INFRASTRUCTURE AS CODE MARKET AND GROWTH RATE, 2016-2021 (USD MILLION, Y-O-Y%)

- TABLE 4 INFRASTRUCTURE AS CODE MARKET AND GROWTH RATE, 2022-2027 (USD MILLION, Y-O-Y%)

- FIGURE 7 TOOLS SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 8 CONFIGURATION ORCHESTRATION SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE IN 2022

- FIGURE 9 TRAINING, SUPPORT, AND MAINTENANCE SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE IN 2022

- FIGURE 10 DECLARATIVE SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

- FIGURE 11 IMMUTABLE SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

- FIGURE 12 ON-PREMISES SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 13 LARGE ENTERPRISES SEGMENT ESTIMATED TO DOMINATE MARKET IN 2022

- FIGURE 14 BFSI VERTICAL EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 15 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN INFRASTRUCTURE AS CODE MARKET

- FIGURE 16 SURGING DEMAND FOR ADOPTION OF CLOUD, AI, AND ML SOLUTIONS DRIVING MARKET FOR IAC

- 4.2 NORTH AMERICA: INFRASTRUCTURE AS CODE, BY COMPONENT AND VERTICAL, 2022

- FIGURE 17 BFSI AND CONFIGURATION ORCHESTRATION SEGMENTS EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARE

- 4.3 INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022

- FIGURE 18 NORTH AMERICA EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IAC MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Advent of modern cloud architecture

- 5.2.1.2 Demand for better optimization of business operations

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited skilled workforce

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Inception of composable infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Data security and privacy concerns

- 5.2.4.2 Potential duplication of error

- TABLE 5 CUMULATIVE GROWTH ANALYSIS

- 5.3 EVOLUTION

- 5.4 IAC MARKET ECOSYSTEM

- TABLE 6 IAC MARKET ECOSYSTEM

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 RETAIL

- 5.5.1.1 Use Case: Krost used infrastructure as code technology for simplified scalability in AWS

- 5.5.2 IT/ITES

- 5.5.2.1 Use Case: Rapyder built infrastructure as code technology using Terraform

- 5.5.3 HEALTHCARE

- 5.5.3.1 Use Case: Leveraging best practices for infrastructure as code and DevOps

- 5.5.4 BFSI

- 5.5.4.1 Use Case: Rapyder helped Oxigen successfully migrate to AWS cloud

- 5.5.5 MANUFACTURING

- 5.5.5.1 Use Case: Jabil powered manufacturing and customer success by delivering innovative IT projects efficiently and reliably with ServiceNow

- 5.5.6 TELECOM

- 5.5.6.1 Use Case: Orange Business Services powered customer experience with ServiceNow

- 5.5.7 GOVERNMENT

- 5.5.7.1 Use Case: Infrastructure as Code (IaC) Agility and Kubernetes Governance using Nirmata and Crossplane

- 5.5.1 RETAIL

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 IAC AND ML

- 5.6.2 IAC AND DATA SCIENCE

- 5.7 SUPPLY CHAIN/VALUE CHAIN ANALYSIS

- FIGURE 20 IAC: SUPPLY CHAIN ANALYSIS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 IAC: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 IAC MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 PRICING MODEL ANALYSIS

- 5.10 PATENT ANALYSIS

- 5.10.1 METHODOLOGY

- 5.10.2 DOCUMENT TYPE

- TABLE 8 PATENTS FILED, 2018-2021

- 5.10.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 22 TOTAL NUMBER OF PATENTS GRANTED YEARLY, 2018-2021

- 5.10.3.1 Top applicants

- FIGURE 23 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2018-2021

- TABLE 9 TOP TEN PATENT OWNERS (US) IN INFRASTRUCTURE AS CODE MARKET, 2018-2021

- 5.11 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 10 IAC MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST AND AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 NORTH AMERICA: REGULATIONS

- 5.12.2.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

- 5.12.2.2 Gramm-Leach-Bliley (GLB) Act

- 5.12.2.3 Health Insurance Portability and Accountability Act (HIPAA) of 1996

- 5.12.2.4 Federal Information Security Management Act (FISMA)

- 5.12.2.5 Federal Information Processing Standards (FIPS)

- 5.12.2.6 California Consumer Privacy Act (CCPA)

- 5.12.3 EUROPE: TARIFFS AND REGULATIONS

- 5.12.3.1 GDPR 2016/679

- 5.12.3.2 General Data Protection Regulation

- 5.12.3.3 European Committee for Standardization (CEN)

- 5.12.3.4 European Technical Standards Institute (ETSI)

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- TABLE 16 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS (%)

- 5.13.2 BUYING CRITERIA

- TABLE 17 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

6 INFRASTRUCTURE AS CODE MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- FIGURE 24 SERVICES SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 6.1.1 COMPONENTS: INFRASTRUCTURE AS CODE MARKET DRIVERS

- TABLE 18 INFRASTRUCTURE AS CODE MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 19 INFRASTRUCTURE AS CODE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 6.2 TOOLS

- TABLE 20 TOOLS: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 21 TOOLS: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.1 CONFIGURATION ORCHESTRATION

- 6.2.1.1 Increasing need for managing IT tasks and workflows in minimum time

- TABLE 22 CONFIGURATION ORCHESTRATION: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021(USD MILLION)

- TABLE 23 CONFIGURATION ORCHESTRATION: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.2 CONFIGURATION MANAGEMENT

- 6.2.2.1 Growing need for automated configuration management environment

- TABLE 24 CONFIGURATION MANAGEMENT: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 25 CONFIGURATION MANAGEMENT: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027(USD MILLION)

- 6.2.3 INFRASTRUCTURE PROVISIONING

- 6.2.3.1 Demand for application development, deployment, and scalability

- TABLE 26 INFRASTRUCTURE PROVISIONING: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 27 INFRASTRUCTURE PROVISIONING: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.2.4 APPLICATION DEVELOPMENT

- 6.2.4.1 Code-based approach providing speed and consistency in application development

- TABLE 28 APPLICATION DEVELOPMENT: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 29 APPLICATION DEVELOPMENT: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 SERVICES

- TABLE 30 INFRASTRUCTURE AS CODE MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 31 INFRASTRUCTURE AS CODE MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 32 SERVICES: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 33 SERVICES: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

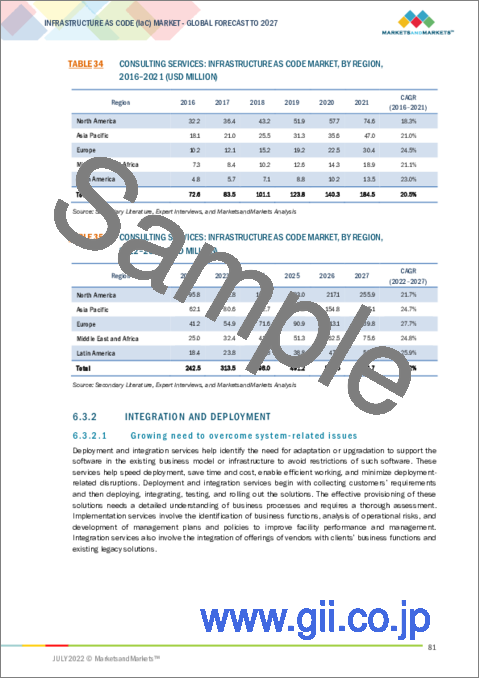

- 6.3.1 CONSULTING SERVICES

- 6.3.1.1 Technicalities involved in implementing IaC tools and services

- TABLE 34 CONSULTING SERVICES: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 35 CONSULTING SERVICES: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3.2 INTEGRATION AND DEPLOYMENT

- 6.3.2.1 Growing need to overcome system-related issues

- TABLE 36 INTEGRATION AND DEPLOYMENT: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 37 INTEGRATION AND DEPLOYMENT: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3.3 TRAINING, SUPPORT, AND MAINTENANCE

- 6.3.3.1 Growing deployment of IaC solutions

- TABLE 38 TRAINING, SUPPORT, AND MAINTENANCE: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 39 TRAINING, SUPPORT, AND MAINTENANCE: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

7 INFRASTRUCTURE AS CODE, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 25 IMPERATIVE SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 7.1.1 TYPE: INFRASTRUCTURE AS CODE MARKET DRIVERS

- TABLE 40 INFRASTRUCTURE AS CODE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 41 INFRASTRUCTURE AS CODE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.2 DECLARATIVE

- 7.2.1 ELIMINATION OF CONFIGURATION DRIFT AND IMPROVED INFRASTRUCTURAL CONSISTENCY

- TABLE 42 DECLARATIVE: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 43 DECLARATIVE: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 IMPERATIVE

- 7.3.1 LOW-SPEED DEPLOYMENT AND REDUCED COST TO DRIVE GROWTH OF IMPERATIVE TYPE

- TABLE 44 IMPERATIVE: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 45 IMPERATIVE: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

8 INFRASTRUCTURE AS CODE, BY INFRASTRUCTURE TYPE

- 8.1 INTRODUCTION

- 8.1.1 INFRASTRUCTURE TYPE: INFRASTRUCTURE AS CODE MARKET DRIVERS

- FIGURE 26 IMMUTABLE SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- TABLE 46 INFRASTRUCTURE AS CODE MARKET, BY INFRASTRUCTURE TYPE, 2016-2021 (USD MILLION)

- TABLE 47 INFRASTRUCTURE AS CODE MARKET, BY INFRASTRUCTURE TYPE, 2022-2027 (USD MILLION)

- 8.2 MUTABLE 101 8.2.1 FLEXIBILITY OF MODIFICATIONS AFTER PROVISIONING

- TABLE 48 MUTABLE: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 49 MUTABLE: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 IMMUTABLE 102 8.3.1 LOW IT COMPLEXITY AND FAILURES, IMPROVED SECURITY, AND EASIER TROUBLESHOOTING BENEFITS DRIVING GROWTH

- TABLE 50 IMMUTABLE: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 51 IMMUTABLE: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

9 INFRASTRUCTURE AS CODE MARKET, BY ORGANIZATION SIZE

- 9.1 INTRODUCTION

- FIGURE 27 SMES SEGMENT EXPECTED TO GROW AT HIGHER GROWTH RATE DURING FORECAST PERIOD

- 9.1.1 ORGANIZATION SIZE: PLATFORM AS A SERVICE MARKET DRIVERS

- TABLE 52 INFRASTRUCTURE AS CODE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 53 INFRASTRUCTURE AS CODE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 9.2.1 GROWING NEED FOR BUILDING AND MANAGING DYNAMIC INFRASTRUCTURE

- TABLE 54 SMALL AND MEDIUM-SIZED ENTERPRISES: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 55 SMALL AND MEDIUM-SIZED ENTERPRISES: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 LARGE ENTERPRISES

- 9.3.1 ADVENT OF NEW APPLICATION AREAS AND CLOUD ADOPTION

- TABLE 56 LARGE ENTERPRISES: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 57 LARGE ENTERPRISES: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

10 INFRASTRUCTURE AS CODE, BY DEPLOYMENT MODE

- 10.1 INTRODUCTION

- FIGURE 28 CLOUD SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 10.1.1 DEPLOYMENT MODE: INFRASTRUCTURE AS CODE MARKET DRIVERS

- TABLE 58 INFRASTRUCTURE AS CODE MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD MILLION)

- TABLE 59 INFRASTRUCTURE AS CODE MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- 10.2 ON-PREMISES

- 10.2.1 ON-PREMISES DEPLOYMENT EXPECTED TO EXHIBIT SLOWER GROWTH

- TABLE 60 ON-PREMISES: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 61 ON-PREMISES: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 CLOUD

- 10.3.1 LOW COST AND EASE OF IMPLEMENTATION EXPECTED TO MAKE CLOUD HIGHLY PREFERRED DELIVERY MODEL

- TABLE 62 CLOUD: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 63 CLOUD: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

11 INFRASTRUCTURE AS CODE MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- FIGURE 29 BFSI VERTICAL EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 64 INFRASTRUCTURE AS CODE MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 65 INFRASTRUCTURE AS CODE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 11.1.1 VERTICAL: INFRASTRUCTURE AS CODE MARKET DRIVERS

- 11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

- 11.2.1 BANKS INVESTING IN CLOUD MANAGEMENT SOLUTIONS TO INCREASE AGILITY AND IMPROVE COST-EFFICIENCY

- TABLE 66 BFSI: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 67 BFSI: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.3 IT AND ITES

- 11.3.1 LARGE-SCALE ADOPTION OF DIGITAL TRANSFORMATION BOOSTING IT AND ITES INDUSTRY

- TABLE 68 IT AND ITES: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 69 IT AND ITES: INFRASTRUCTURE AS CODE PLATFORM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4 GOVERNMENT

- 11.4.1 IAC HELPING GOVERNMENTS IN MEETING COMPLIANCE

- TABLE 70 GOVERNMENT: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 71 GOVERNMENT: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.5 MANUFACTURING

- 11.5.1 NEED TO HAVE EFFICIENT OPERATIONS

- TABLE 72 MANUFACTURING: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 73 MANUFACTURING: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.6 TELECOM

- 11.6.1 LARGE-SCALE GROWTH IN MOBILE SUBSCRIBERS AND DATA PENETRATION SERVICES

- TABLE 74 TELECOM: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 75 TELECOM: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.7 RETAIL

- 11.7.1 GROWING ADOPTION OF CLOUD-BASED SOLUTIONS GENERATING DEMAND FOR IAC

- TABLE 76 RETAIL: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 77 RETAIL: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.8 HEALTHCARE

- 11.8.1 REAL-TIME SOLUTIONS HAVE BECOME INTEGRAL PART OF HEALTHCARE LANDSCAPE

- TABLE 78 HEALTHCARE AND LIFE SCIENCES: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 79 HEALTHCARE: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.9 TRANSPORTATION AND LOGISTICS

- 11.9.1 IAC SOLUTIONS FACILITATING TRANSPORTATION AND LOGISTICS

- TABLE 80 TRANSPORTATION AND LOGISTICS: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 81 TRANSPORTATION AND LOGISTICS: INFRASTRUCTURE AS CODE PLATFORM MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

- 11.10 OTHER VERTICALS

- 11.10.1 ADOPTION OF ADVANCED TECHNOLOGIES FOR BETTER INTERACTIVE TEACHING AND TRAINING PRACTICES

- TABLE 82 OTHER VERTICALS: INTEGRATED CLOUD MANAGEMENT PLATFORM MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 83 OTHER VERTICALS: INFRASTRUCTURE AS CODE PLATFORM MARKET, BY REGION, 2022-2027 (USD MILLION)

12 INFRASTRUCTURE AS CODE MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.1.1 REGION: NETWORK AS A SERVICE MARKET DRIVERS

- FIGURE 30 ASIA PACIFIC EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 84 INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 85 INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET DRIVERS

- FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 86 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 87 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 88 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY TOOL, 2016-2021 (USD MILLION)

- TABLE 89 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY TOOL, 2022-2027 (USD MILLION)

- TABLE 90 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 91 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 92 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 93 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 94 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY INFRASTRUCTURE TYPE, 2016-2021 (USD MILLION)

- TABLE 95 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY INFRASTRUCTURE TYPE, 2022-2027 (USD MILLION)

- TABLE 96 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD MILLION)

- TABLE 97 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 98 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 99 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 100 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 101 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 102 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 103 NORTH AMERICA: INFRASTRUCTURE AS CODE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 Rapid adoption of advanced technologies and infrastructure

- 12.2.3 CANADA

- 12.2.3.1 Rapid adoption of emerging technologies and use of digital business strategies

- 12.3 EUROPE

- 12.3.1 EUROPE: INFRASTRUCTURE AS CODE MARKET DRIVERS

- TABLE 104 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 105 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 106 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY TOOL, 2016-2021 (USD MILLION)

- TABLE 107 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY TOOL, 2022-2027 (USD MILLION)

- TABLE 108 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 109 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 110 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 111 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 112 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY INFRASTRUCTURE TYPE, 2016-2021 (USD MILLION)

- TABLE 113 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY INFRASTRUCTURE TYPE, 2022-2027 (USD MILLION)

- TABLE 114 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD MILLION)

- TABLE 115 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 116 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 117 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 118 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 119 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 120 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 121 EUROPE: INFRASTRUCTURE AS CODE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.3.2 UK

- 12.3.2.1 Need to deliver consistent customer service experience

- 12.3.3 GERMANY

- 12.3.3.1 Rapid growth of cloud and advanced technology

- 12.3.4 FRANCE

- 12.3.4.1 Increase in adoption of cloud technology

- 12.3.5 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET DRIVERS

- FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 122 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 123 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 124 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY TOOL, 2016-2021 (USD MILLION)

- TABLE 125 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY TOOL, 2022-2027 (USD MILLION)

- TABLE 126 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 127 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 128 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 129 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 130 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY INFRASTRUCTURE TYPE, 2016-2021 (USD MILLION)

- TABLE 131 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY INFRASTRUCTURE TYPE, 2022-2027 (USD MILLION)

- TABLE 132 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD MILLION)

- TABLE 133 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 134 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 135 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 136 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 137 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 138 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY COUNTRY/REGION, 2016-2021 (USD MILLION)

- TABLE 139 ASIA PACIFIC: INFRASTRUCTURE AS CODE MARKET, BY COUNTRY/REGION, 2022-2027 (USD MILLION)

- 12.4.2 CHINA

- 12.4.2.1 Advance technologies, robust government support, and huge investments driving market growth

- 12.4.3 JAPAN

- 12.4.3.1 Development of new and modern law and privacy regulations driving growth

- 12.4.4 AUSTRALIA AND NEW ZEALAND

- 12.4.4.1 Use of cloud-based services for financial and operational benefits

- 12.4.5 REST OF ASIA PACIFIC

- 12.5 MIDDLE EAST AND AFRICA (MEA)

- 12.5.1 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET DRIVERS

- TABLE 140 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 141 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 142 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY TOOL, 2016-2021 (USD MILLION)

- TABLE 143 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY TOOL, 2022-2027 (USD MILLION)

- TABLE 144 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 145 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 146 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 147 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 148 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY INFRASTRUCTURE TYPE, 2016-2021 (USD MILLION)

- TABLE 149 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY INFRASTRUCTURE TYPE, 2022-2027 (USD MILLION)

- TABLE 150 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD MILLION)

- TABLE 151 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 152 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 153 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 154 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 155 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 156 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 157 MIDDLE EAST AND AFRICA: INFRASTRUCTURE AS CODE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.5.2 MIDDLE EAST

- 12.5.3 MIDDLE EAST

- 12.5.3.1 Supportive government initiatives boosting adoption of digital technologies

- 12.5.4 AFRICA

- 12.5.4.1 Adoption of cloud-based technology and growth of digital transformation

- 12.6 LATIN AMERICA

- 12.6.1 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET DRIVERS

- TABLE 158 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 159 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 160 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY TOOL, 2016-2021 (USD MILLION)

- TABLE 161 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY TOOL, 2022-2027 (USD MILLION)

- TABLE 162 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 163 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 164 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 165 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 166 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY INFRASTRUCTURE TYPE, 2016-2021 (USD MILLION)

- TABLE 167 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY INFRASTRUCTURE TYPE, 2022-2027 (USD MILLION)

- TABLE 168 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD MILLION)

- TABLE 169 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 170 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 171 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 172 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 173 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 174 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 175 LATIN AMERICA: INFRASTRUCTURE AS CODE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 12.6.2 BRAZIL

- 12.6.2.1 Need for high operational efficiency

- 12.6.3 MEXICO

- 12.6.3.1 Rise in innovative, technological solutions and services

- 12.6.4 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES

- TABLE 176 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN IAC MARKET

- 13.3 REVENUE ANALYSIS

- FIGURE 33 REVENUE ANALYSIS OF KEY COMPANIES, 2017-2021

- 13.4 MARKET SHARE ANALYSIS

- FIGURE 34 IAC MARKET SHARE ANALYSIS, 2022

- TABLE 177 IAC MARKET: DEGREE OF COMPETITION

- 13.5 COMPANY EVALUATION QUADRANT

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 35 KEY IAC MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2022

- 13.6 STARTUP/SME EVALUATION MATRIX

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- FIGURE 36 STARTUP/SME IAC MARKET EVALUATION MATRIX, 2022

- 13.7 COMPETITIVE BENCHMARKING

- TABLE 178 IAC MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 179 IAC MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- 13.8 COMPETITIVE SCENARIO

- 13.8.1 PRODUCT LAUNCHES

- TABLE 180 PRODUCT LAUNCHES, 2021-2022

- 13.8.2 DEALS

- TABLE 181 DEALS, 2021-2022

14 COMPANY PROFILES

- (Business Overview, Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 MICROSOFT

- TABLE 182 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 37 MICROSOFT: COMPANY SNAPSHOT

- TABLE 183 MICROSOFT: SOLUTIONS OFFERED

- TABLE 184 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 185 MICROSOFT: DEALS

- 14.2.2 BROADCOM

- TABLE 186 BROADCOM: BUSINESS OVERVIEW

- FIGURE 38 BROADCOM: COMPANY SNAPSHOT

- TABLE 187 BROADCOM: SOLUTIONS OFFERED

- TABLE 188 BROADCOM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 189 BROADCOM: DEALS

- 14.2.3 GOOGLE

- TABLE 190 GOOGLE: BUSINESS OVERVIEW

- FIGURE 39 GOOGLE: COMPANY SNAPSHOT

- TABLE 191 GOOGLE: SOLUTIONS OFFERED

- TABLE 192 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 193 GOOGLE: DEALS

- 14.2.4 AWS

- TABLE 194 AWS: BUSINESS OVERVIEW

- FIGURE 40 AWS: COMPANY SNAPSHOT

- TABLE 195 AWS: SOLUTIONS OFFERED

- TABLE 196 AWS: PRODUCT LAUNCHES

- TABLE 197 AWS: DEALS

- 14.2.5 ORACLE

- TABLE 198 ORACLE: BUSINESS OVERVIEW

- FIGURE 41 ORACLE: COMPANY SNAPSHOT

- TABLE 199 ORACLE: SOLUTIONS OFFERED

- TABLE 200 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 201 ORACLE: DEALS

- 14.2.6 IBM

- TABLE 202 IBM: BUSINESS OVERVIEW

- FIGURE 42 IBM: COMPANY SNAPSHOT

- TABLE 203 IBM: SOLUTIONS OFFERED

- TABLE 204 IBM: PRODUCT LAUNCHES

- TABLE 205 IBM: DEALS

- 14.2.7 HPE

- TABLE 206 HPE: BUSINESS OVERVIEW

- FIGURE 43 HPE: COMPANY SNAPSHOT

- TABLE 207 HPE: SOLUTIONS OFFERED

- TABLE 208 HPE: PRODUCT LAUNCHES

- TABLE 209 HPE: DEALS

- 14.2.8 SERVICENOW

- TABLE 210 SERVICENOW: BUSINESS OVERVIEW

- FIGURE 44 SERVICENOW: COMPANY SNAPSHOT

- TABLE 211 SERVICENOW: SOLUTIONS OFFERED

- TABLE 212 SERVICENOW: PRODUCT LAUNCHES

- TABLE 213 SERVICENOW: DEALS

- 14.2.9 HASHICORP TERRAFORM

- TABLE 214 HASHICORP TERRAFORM: BUSINESS OVERVIEW

- FIGURE 45 HASHICORP TERRAFORM: COMPANY SNAPSHOT

- TABLE 215 HASHICORP TERRAFORM: SOLUTIONS OFFERED

- TABLE 216 HASHICORP TERRAFORM: PRODUCT LAUNCHES

- TABLE 217 HASHICORP TERRAFORM: DEALS

- 14.2.10 PROGRESS SOFTWARE CORPORATION

- 14.2.11 PUPPET (PERFORCE)

- 14.2.12 PULUMI

- 14.2.13 DELL

- 14.2.14 ALIBABA

- 14.2.15 CROSSPLANE

- 14.2.16 DOCKER

- 14.2.17 JENKINS

- 14.2.18 NORTHERN.TECH

- 14.2.19 GITHUB

- 14.2.20 GITLAB

- 14.2.21 CANONICAL

- 14.2.22 NETAPP

- 14.2.23 ALPACKED

- 14.2.24 RACKSPACE TECHNOLOGY

- *Details on Business Overview, Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 ADJACENT MARKETS

- 15.1 INTRODUCTION

- 15.1.1 LIMITATIONS

- 15.1.2 CLOUD COMPUTING MARKET

- 15.1.2.1 Market definition

- 15.1.2.2 Cloud computing market, by component

- TABLE 218 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2015-2020 (USD BILLION)

- TABLE 219 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2021-2026 (USD BILLION)

- 15.1.2.3 Cloud computing market, by infrastructure as a service

- TABLE 220 CLOUD COMPUTING MARKET, BY INFRASTRUCTURE AS A SERVICE, 2015-2020 (USD BILLION)

- TABLE 221 CLOUD COMPUTING MARKET, BY INFRASTRUCTURE AS A SERVICE, 2021-2026 (USD BILLION)

- 15.1.2.4 Cloud computing market, by platform as a service

- TABLE 222 CLOUD COMPUTING MARKET, BY PLATFORM AS A SERVICE, 2015-2020 (USD BILLION)

- TABLE 223 CLOUD COMPUTING MARKET, BY PLATFORM AS A SERVICE, 2021-2026 (USD BILLION)

- 15.1.2.5 Cloud computing market, by software as a service

- TABLE 224 CLOUD COMPUTING MARKET, BY SOFTWARE AS A SERVICE, 2015-2020 (USD BILLION)

- TABLE 225 CLOUD COMPUTING MARKET, BY SOFTWARE AS A SERVICE, 2021-2026 (USD BILLION)

- 15.1.2.6 Cloud computing market, by deployment mode

- TABLE 226 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2015-2020 (USD BILLION)

- TABLE 227 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2021-2026 (USD BILLION)

- 15.1.2.7 Cloud computing market, by organization size

- TABLE 228 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2015-2020 (USD BILLION)

- TABLE 229 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2021-2026 (USD BILLION)

- 15.1.2.8 Cloud computing market, by vertical

- TABLE 230 CLOUD COMPUTING MARKET, BY VERTICAL, 2015-2020 (USD BILLION)

- TABLE 231 CLOUD COMPUTING MARKET, BY VERTICAL, 2021-2026 (USD BILLION)

- 15.1.3 HYPER-CONVERGED INFRASTRUCTURE MARKET

- 15.1.3.1 Market definition

- 15.1.3.2 Hyper-converged infrastructure market, by component

- TABLE 232 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY COMPONENT, 2016-2019 (USD MILLION)

- TABLE 233 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY COMPONENT, 2020-2025 (USD MILLION)

- 15.1.3.3 Hyper-converged infrastructure market, by application

- TABLE 234 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY APPLICATION, 2016-2019 (USD MILLION)

- TABLE 235 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY APPLICATION, 2020-2025 (USD MILLION)

- 15.1.3.4 Hyper-converged infrastructure market, by organization size

- TABLE 236 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY ORGANIZATION SIZE, 2016-2019 (USD MILLION)

- TABLE 237 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY ORGANIZATION SIZE, 2020-2025 (USD MILLION)

- 15.1.3.4.1 Small and medium-sized enterprises

- TABLE 238 SMALL AND MEDIUM-SIZED ENTERPRISES: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 239 SMALL AND MEDIUM-SIZED ENTERPRISES: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020-2025 (USD MILLION)

- 15.1.3.4.2 Large enterprises

- TABLE 240 LARGE ENTERPRISES: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 241 LARGE ENTERPRISES: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020-2025 (USD MILLION)

- 15.1.3.5 Hyper-converged infrastructure market, by end user

- TABLE 242 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY END-USER, 2016-2019 (USD MILLION)

- TABLE 243 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY END-USER, 2020-2025 (USD MILLION)

- 15.1.3.6 Hyper-converged infrastructure market, by enterprise

- TABLE 244 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY ENTERPRISE, 2016-2019 (USD MILLION)

- TABLE 245 HYPER-CONVERGED INFRASTRUCTURE MARKET, BY ENTERPRISE, 2020-2025 (USD MILLION)

- 15.1.3.6.1 Banking, financial services, and insurance

- TABLE 246 BANKING, FINANCIAL SERVICES, AND INSURANCE: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 247 BANKING, FINANCIAL SERVICES, AND INSURANCE: HYPER-CONVERGED INFRASTRUCTURE MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

- 15.1.3.6.2 IT and telecom

- TABLE 248 IT AND TELECOM: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 249 IT AND TELECOM: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020-2025 (USD MILLION)

- 15.1.3.6.3 Healthcare

- TABLE 250 HEALTHCARE: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 251 HEALTHCARE: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020-2025 (USD MILLION)

- 15.1.3.6.4 Government

- TABLE 252 GOVERNMENT: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 253 GOVERNMENT: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020-2025 (USD MILLION)

- 15.1.3.6.5 Energy

- TABLE 254 ENERGY: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 255 ENERGY: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020-2025 (USD MILLION)

- 15.1.3.6.6 Education

- TABLE 256 EDUCATION: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 257 EDUCATION: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020-2025 (USD MILLION)

- 15.1.3.6.7 Manufacturing

- TABLE 258 MANUFACTURING: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 259 MANUFACTURING: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020-2025 (USD MILLION)

- 15.1.3.6.8 Others

- TABLE 260 OTHERS: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 261 OTHERS: HYPER-CONVERGED INFRASTRUCTURE MARKET, BY REGION, 2020-2025 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS