|

|

市場調査レポート

商品コード

1105481

パネルフィルターの世界市場:材料別 (ガラス繊維、合成繊維)・種類別 (使い捨て型、再利用型)・用途別 (住宅、非住宅)・地域別 (北米、欧州、アジア太平洋、中東・アフリカ、南米) の将来予測 (2027年まで)Panel Filters Market by Material (Fiberglass, Synthetic), Type (Disposable, Reusable), Application (Residential, Non-Residential), Region (North America, Europe, Asia Pacific, Middle East & Africa and South America) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| パネルフィルターの世界市場:材料別 (ガラス繊維、合成繊維)・種類別 (使い捨て型、再利用型)・用途別 (住宅、非住宅)・地域別 (北米、欧州、アジア太平洋、中東・アフリカ、南米) の将来予測 (2027年まで) |

|

出版日: 2022年07月20日

発行: MarketsandMarkets

ページ情報: 英文 165 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

パネルフィルターの市場規模は、2022年に81億米ドル、2027年には99億米ドルに達すると推定され、CAGRは4.2%と予測されています。

パネルフィルターは、空気中の固体汚染物質と分子汚染物質を除去するために設計されたエアフィルターです。大きな粒子は慣性質量効果によってフィルター内を移動してパネルフィルターの糸に付着し、軽い粒子は乱流運動によってフィルター内を浮遊し、フィルターを構成する繊維に捕捉されます。パネルフィルターに空気が触れると、パネルフィルターは空気中の固体粒子、ほこり、花粉、そして有毒ガスまでもろ過することができます。小さな粒子はすべて拡散によって除去され、繊維に近づくとブラウン運動によって移動します。小さな粒子がランダムにぶつかることで、その速度が下がり、パネルフィルターによる捕獲の可能性が高まります。

このフィルターは、低~中程度のろ過能力を持ち、プレフィルターやファイナルフィルターとして使用されます。プレフィルターとして使用する場合、空気中の大きな粒子を除去することで、高価な一次フィルターを保護し、寿命を延ばすことができます。パネルフィルターは、主にHVACシステムに設置され、汚染物質がHVAC機器に侵入して損傷するのを防ぎます。

"材料別では、合成繊維が予測期間中に最も高いCAGRを記録"

合成繊維は、入手のしやすさ、耐用年数の長さ、効率的なろ過性能から、予測期間中に最も急速に成長する市場であると推定されます。合成フィルター材料は、プリーツまたは延伸フィルムの形態で入手できます。これらのフィルターは、グラスファイバー製フィルターに比べ、比較的高いレーティングを有しています。合成フィルターの用途としては、製薬、半導体・IT、データセンター、飲食品、その他が挙げられます。

"用途別では、非住宅用が予測期間中に最も高いCAGRを占めました。

非住宅用フィルターは、ビル・建設、データセンター、製薬、飲食品、ヘルスケア、その他の業界からの需要が増加しているため、最も成長率の高い市場になると推定されます。非住宅用では、メインフィルターに流入する浮遊粒子の数を減らすためのプレフィルターとして使用され、最終的にメインフィルターの寿命を延ばし、メンテナンスコストを削減しています。工業化の進展、政府による規制、大気質指標問題の高まりが、非住宅用パネルフィルターの需要を促進すると予想されます。

"種類別では、再利用型パネルフィルターが予測期間中に最も高いCAGRを獲得"

再利用型パネルフィルターは、予測期間中に最も成長する市場であると推測されます。使い捨て型パネルフィルターに比べ、利便性が高いです。これらのフィルターは、数ヶ月ごとに洗浄・清掃され、HVACシステムで再利用されるものです。再利用型パネルフィルターは、使い捨て型パネルフィルターに比べてコストがかかりますが、生態学的に有益であり、長期的には費用対効果が期待されます。

予測期間中、アジア太平洋がパネルフィルター市場で最も高いCAGRを占める"

アジア太平洋は予測期間中、パネルフィルターの最速成長市場であると推定されます。中国、日本、インドのパネルフィルター市場は、商業ビル、大学、学校、病院、データセンターなどの非住宅用アプリケーションからの高い需要により、大きな成長を記録しています。中国とインドの経済成長が、アジア太平洋地域のパネルフィルター市場の成長を牽引しています。同地域では、建築・建設やその他の最終用途産業への投資が拡大しており、市場の成長を支えています。また、同地域の製造能力の向上は、市場の成長をさらに後押ししています。

目次

第1章 イントロダクション

第2章 調査方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- ポーターのファイブフォース分析

- サプライチェーン分析

- 規制状況

- 顧客のビジネスに影響を与える傾向/混乱

- エコシステムマップ

- マクロ経済指標

- 世界のGDP見通し

- 平均価格分析

- 特許分析

- パネルフィルター市場の範囲シナリオ

- COVID-19の影響分析

- 主要な会議とイベント (2022年~2023年)

- ケーススタディ

- 技術分析

- プリーツフィルター

- HEPA

- 電気集じん器

- 活性炭

- 主要な利害関係者と購入基準

- 隣接・関連市場

第6章 パネルフィルター市場:材料の種類別

- イントロダクション

- グラスファイバー

- 合成繊維

- その他

第7章 パネルフィルター市場:種類別

- イントロダクション

- 使い捨て型パネルフィルター

- 再利用型パネルフィルター

第8章 パネルフィルター市場:用途別

- イントロダクション

- 住宅

- 非住宅

第9章 パネルフィルター市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- 他のアジア太平洋諸国

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- ロシア

- スペイン

- イタリア

- 他の欧州諸国

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 他の中東・アフリカ諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

第10章 競合情勢

- イントロダクション

- 市場シェア分析

- 企業評価マトリックス

- 新興企業・中小企業 (SME) の評価マトリックス

- 大手企業の収益分析

- 事業戦略の優秀性

- 競争の状況と動向

- 新製品の発売

- 取引

- その他

第11章 企業プロファイル

- CAMFIL AB

- AAF INTERNATIONAL

- AFPRO FILTRATION GROUP

- MANN+HUMMEL

- PARKER HANNIFIN

- DONALDSON COMPANY, INC.

- FREUDENBERG FILTRATION TECHNOLOGIES

- KOCH FILTERS CORPORATION

- その他の企業

- PLACON FILTERS PVT. LTD.

- EMIRATES INDUSTRIAL FILTERS L.L.C

- B&H INDUSTRIAL L.L.C

- TFI FILTRATION (INDIA) PVT. LTD.

- PURAFIL INC.

- GENERAL FILTER HAVAK

- AHLSTROM-MUNKSJO

- FILSON FILTRATION EQUIPMENTS CO., LTD

- XIAMEN R&J FILTRATION CO., LTD

- NANJING BLUE SKY FILTER CO., LTD

- GUANGZHOU KLC CLEANTECH CO., LTD.

- HENAN TOP ENVIRONMENT PROTECTION EQUIPMENT CO., LTD

- TEX-AIR FILTERS

- UNITED FILTER INDUSTRIES PVT. LTD.

- OMEGA FILTERS (INDIA)

- AIRVENTFIL PTY (LTD)

第12章 付録

The Panel Filters market size is estimated to be USD 8.1 Billion in 2022 and is projected to reach USD 9.9 Billion by 2027, at a CAGR of 4.2%. Panel filters are air filters that are designed to eradicate solid pollutants and the molecular contaminants from the air. Large particles get carried out through the filter and stick to the threads of the panel filter through inertial mass effect, whilst lighter particles float through the filter through turbulent motion and captured by fibers that make up the filter. When air enters into contact with the panel filter, the panel filter is being able to filter out solid air particles, dust, pollen, and even toxic fumes that are traveling through said air. All the tiny particles are removed through diffusion and move through Brownian motion as it approaches the fibrous. The smaller particles at random hit each other, which lowers their speed and increases chances of their capture by the panel filter.

These filters deliver low to moderate levels of filtration and used as pre-filters or final filters. When used as pre-filters, they protect and extend the life of expensive primary filters by taking out larger particles in the air. Panel Filters are mainly installed in the HVAC system as well as prevent pollutants from entering and damaging HVAC equipment

By Material, Synthetic accounted for the highest CAGR during the forecast period

Synthetic are estimated to be the fastest growing market during the forecast period owing to its easy availability, long serviceability, and efficient filtration. Synthetic filter materials are available in the form of pleats or stretched films. These filters have comparatively higher rating than fiberglass filters. The applications of these filters include pharmaceutical, semiconductor & IT, Data centers, food & beverage, and others.

By Application, Non Residential accounted for the highest CAGR during the forecast period

Non-Residential is estimated to be the fastest growing market for Panel Filter due to its growing in demand from building & construction, data centers, pharmaceutical, food & beverage, healthcare, and other industries. For non-residential applications, Panel Filters are being used as pre-filters to reduce the number of airborne particles from entering the main filters eventually increase lifespan of main filters decreasing maintenance cost. Increase in industrialization, government regulations, and a rising air quality index issues are expected to drive demand in panel filters in non-residential applications.

By type, Reusable Panel Filters accounted for the highest CAGR during the forecast period

Reusable filters estimated that the fastest growing market during the forecast period. These filter offer greater convenience compared to disposable panel filters. These filters are to be washed and cleaned after every few months and reused in HVAC systems. Reusable panel filters are costlier in comparison to disposable panel filters but they are ecologically beneficial and expected to be cost-effective in the longer run.

APAC is projected to account for the highest CAGR in the Panel Filters market during the forecast period

APAC is estimated to be the fastest growing market for Panel Filters during forecast period. Panel filter markets in China, Japan, and India have registered significant growth due to their high demand from non-residential applications, including commercial buildings, universities, schools, hospitals, and data centers. The economic growth of China and India has led to the growth of the Asia Pacific panel filter market. Growing investment in building & construction and other end-use industries in the region supports the growth of the market. Moreover, the growing manufacturing capacities in the region further propel the market growth.

The Panel Filters market comprises major manufacturers such as Camfil AB (Sweden), AAF International (US), AFPRO Filtration Group (Netherlands), Mann+Hummel(Germany), Parker Hannifin (US), Donaldson Company (US), Freudenberg Filtration Technologies (Germany) are the key players operating in the Panel Filters market. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the Panel Filters market.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Others: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, ROW: 30%

Research Coverage

The market study covers the Panel Filters market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on Material, application, type, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to enhance their position Panel Filters market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall Panel Filters market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses and plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 MARKET SEGMENT DEFINITION, BY MATERIAL

- TABLE 2 MARKET SEGMENT DEFINITION, BY TYPE

- TABLE 3 MARKET SEGMENT DEFINITION, BY APPLICATION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 4 TYPES CONSIDERED IN REPORT

- TABLE 5 APPLICATIONS CONSIDERED IN REPORT

- 1.3 MARKET SCOPE

- FIGURE 1 PANEL FILTERS MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 PANEL FILTERS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 3 BOTTOM-UP APPROACH: BASED ON DEMAND FOR RESIDENTIAL APPLICATION

- 2.2.2 TOP-DOWN APPROACH: BASED ON HVAC SYSTEMS MARKET

- FIGURE 4 TOP-DOWN APPROACH: BASED ON HVAC SYSTEMS MARKET

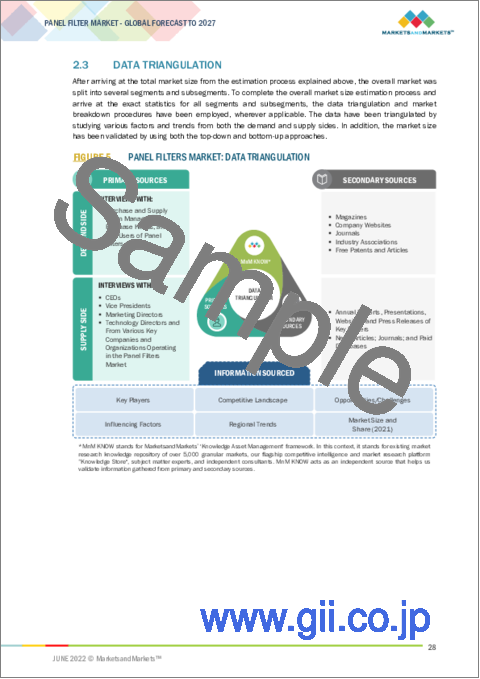

- 2.3 DATA TRIANGULATION

- FIGURE 5 PANEL FILTERS MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.4.1 ASSUMPTIONS

- 2.4.2 LIMITATIONS

- 2.4.3 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 6 SYNTHETIC SEGMENT ACCOUNTED FOR LARGER SHARE BY MATERIAL IN 2021

- FIGURE 7 REUSABLE PANEL FILTERS ACCOUNTED FOR LARGER SHARE IN 2021

- FIGURE 8 NON-RESIDENTIAL SEGMENT ACCOUNTED FOR LARGER SHARE IN 2021

- FIGURE 9 ASIA PACIFIC TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN PANEL FILTERS MARKET

- FIGURE 10 INCREASING USE IN NON-RESIDENTIAL APPLICATIONS IN EMERGING ECONOMIES TO DRIVE DEMAND

- 4.2 PANEL FILTERS MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

- FIGURE 11 NON-RESIDENTIAL SEGMENT TO LEAD PANEL FILTERS MARKET IN ASIA PACIFIC

- 4.3 PANEL FILTERS MARKET, BY MATERIAL

- FIGURE 12 SYNTHETIC SEGMENT TO LEAD PANEL FILTERS MARKET DURING FORECAST PERIOD

- 4.4 PANEL FILTERS MARKET, BY TYPE

- FIGURE 13 REUSABLE PANEL FILTERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 PANEL FILTERS MARKET, BY APPLICATION

- FIGURE 14 NON-RESIDENTIAL SEGMENT TO DOMINATE PANEL FILTERS MARKET DURING FORECAST PERIOD

- 4.6 PANEL FILTERS MARKET, BY COUNTRY

- FIGURE 15 MARKET IN CHINA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 16 MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.1.1 DRIVERS

- 5.1.1.1 Rising awareness about air quality levels

- FIGURE 17 TOP NINE CAPITAL CITY RANKINGS (AVERAGE ANNUAL PM2.5 CONCENTRATION IN 2021)

- 5.1.1.2 Government regulations for efficient filtration

- 5.1.1.3 Rising demand from non-residential sector

- FIGURE 18 GROWTH OF GLOBAL PHARMACEUTICAL INDUSTRY FROM 2015 TO 2023

- FIGURE 19 GROWTH TRENDS IN CHEMICAL PRODUCTION (2021-2023)

- 5.1.2 RESTRAINTS

- 5.1.2.1 Rising environmental concerns

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Rapid transformation through IoT in panel filters

- 5.1.3.2 Innovations and developments of new products for residential and commercial applications

- 5.1.4 CHALLENGES

- 5.1.4.1 Shortage of skilled labor

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 PORTER'S FIVE FORCES ANALYSIS OF PANEL FILTERS MARKET

- TABLE 6 PORTER'S FIVE FORCES ANALYSIS: PANEL FILTERS MARKET

- 5.2.1 BARGAINING POWER OF SUPPLIERS

- 5.2.2 BARGAINING POWER OF BUYERS

- 5.2.3 INTENSITY OF COMPETITIVE RIVALRY

- 5.2.4 THREAT OF NEW ENTRANTS

- 5.2.5 THREAT OF SUBSTITUTES

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 21 SUPPLY CHAIN OF PANEL FILTERS MARKET

- TABLE 7 COMPANIES IN SUPPLY CHAIN OF PANEL FILTERS MARKET

- 5.4 REGULATORY LANDSCAPE

- TABLE 8 REGULATIONS ON PANEL FILTERS MARKET- EUROPE

- TABLE 9 REGULATIONS ON PANEL FILTERS MARKET- CE REGULATIONS

- TABLE 10 REGULATIONS ON PANEL FILTERS MARKET - HARMONIZED STANDARDS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 22 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PANEL FILTERS MARKET

- 5.6 ECOSYSTEM MAP

- FIGURE 23 ECOSYSTEM OF PANEL FILTERS MARKET

- 5.7 MACROECONOMIC INDICATORS

- 5.7.1 GLOBAL GDP OUTLOOK

- TABLE 11 WORLD GDP GROWTH PROJECTION (USD BILLION), 2019-2026

- 5.8 AVERAGE PRICING ANALYSIS

- FIGURE 24 WEIGHTED AVERAGE PRICING ANALYSIS (PER UNIT) PANEL FILTER, BY REGION, 2020

- TABLE 12 AVERAGE SELLING PRICES OF PANEL FILTERS, BY REGION, USD PER UNIT

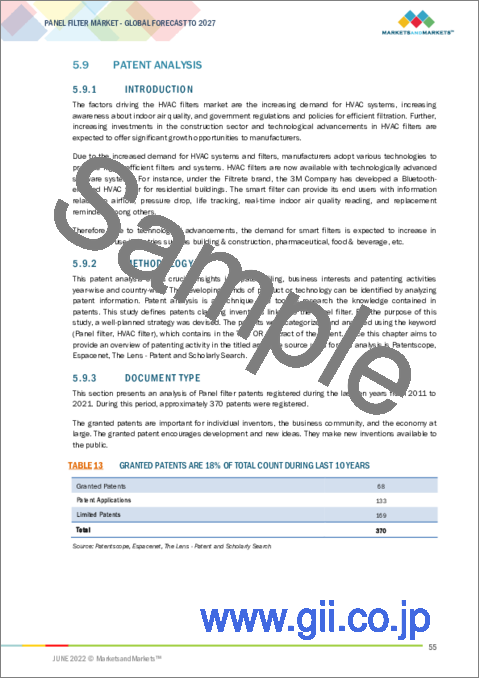

- 5.9 PATENT ANALYSIS

- 5.9.1 INTRODUCTION

- 5.9.2 METHODOLOGY

- 5.9.3 DOCUMENT TYPE

- TABLE 13 GRANTED PATENTS ARE 18% OF TOTAL COUNT DURING LAST 10 YEARS

- FIGURE 25 NUMBER OF PATENTS FILED DURING LAST 10 YEARS

- 5.9.4 PUBLICATION TRENDS OVER LAST 10 YEARS

- FIGURE 26 YEAR-WISE DATA FOR NUMBER OF PATENTS PUBLISHED, 2011-2021

- 5.9.5 INSIGHTS

- 5.9.6 LEGAL STATUS OF PATENTS

- FIGURE 27 LEGAL STATUS

- 5.9.7 JURISDICTION ANALYSIS

- FIGURE 28 PATENT ANALYSIS FOR TOP 10 JURISDICTIONS BY DOCUMENT

- 5.9.8 TOP COMPANIES/APPLICANTS

- FIGURE 29 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS, 2010-2020

- TABLE 14 LIST OF PATENTS, 2017-2021

- TABLE 15 TOP PATENT OWNERS (US) DURING LAST TEN YEARS

- 5.10 RANGE SCENARIOS FOR PANEL FILTERS MARKET

- FIGURE 30 RANGE SCENARIO, 2020-2027

- 5.11 COVID-19 IMPACT ANALYSIS

- FIGURE 31 IMPACT OF COVID-19 ON VARIOUS INDUSTRIES

- 5.12 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 16 PANEL FILTERS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.13 CASE STUDY

- 5.13.1 IMPROVED AIR QUALITY IN CONVENTIONAL CENTER

- 5.14 TECHNOLOGY ANALYSIS

- 5.14.1 PLEATED FILTERS

- 5.14.2 HEPA

- 5.14.3 ELECTROSTATIC PRECIPITATOR

- 5.14.4 ACTIVATED CARBON

- 5.15 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

- TABLE 17 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- FIGURE 33 KEY BUYING CRITERIA FOR DIFFERENT PANEL FILTERS

- TABLE 18 KEY BUYING CRITERIA FOR DIFFERENT GRADES

- 5.16 ADJACENT AND RELATED MARKETS

- 5.16.1 INTRODUCTION

- 5.16.2 LIMITATIONS

- 5.16.3 AIR HANDLING UNITS MARKET

- 5.16.3.1 Market definition

- 5.16.3.2 Air handling units market, by application

- TABLE 19 AIR HANDLING UNITS MARKET, BY APPLICATION, 2016-2019 (USD MILLION)

- TABLE 20 AIR HANDLING UNITS MARKET, BY APPLICATION, 2020-2026 (USD MILLION)

- 5.16.3.3 Air handling units market, by capacity

- TABLE 21 AIR HANDLING UNITS MARKET, BY CAPACITY, 2016-2019 (USD MILLION)

- TABLE 22 AIR HANDLING UNITS MARKET BY CAPACITY, 2020-2026 (USD MILLION)

- 5.16.3.4 Air handling units market, by type

- TABLE 23 AIR HANDLING UNITS MARKET, BY TYPE, 2016-2019 (USD MILLION)

- TABLE 24 AIR HANDLING UNITS MARKET, BY TYPE, 2020-2026 (USD MILLION)

- 5.16.3.5 Air handling units market, by region

- TABLE 25 AIR HANDLING UNITS MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 26 AIR HANDLING UNITS MARKET, BY REGION, 2020-2026 (USD MILLION)

- 5.16.4 HVAC SYSTEM MARKET

- 5.16.4.1 Market definition

- 5.16.4.2 HVAC system market, by cooling equipment

- TABLE 27 HVAC SYSTEM MARKET, BY COOLING EQUIPMENT, 2017-2020 (USD BILLION)

- TABLE 28 HVAC SYSTEM MARKET, BY COOLING EQUIPMENT, 2021-2026 (USD BILLION)

- 5.16.4.3 HVAC system market, by heating equipment

- TABLE 29 HVAC SYSTEM MARKET, BY HEATING EQUIPMENT, 2017-2020 (USD BILLION)

- TABLE 30 HVAC SYSTEM MARKET, BY HEATING EQUIPMENT, 2021-2026 (USD BILLION)

- 5.16.4.4 HVAC system market, by ventilation equipment

- TABLE 31 HVAC SYSTEM MARKET, BY VENTILATION EQUIPMENT, 2017-2020 (USD BILLION)

- TABLE 32 HVAC SYSTEM MARKET, BY VENTILATION EQUIPMENT, 2021-2026 (USD BILLION)

- 5.16.4.5 HVAC system market, by implementation type

- TABLE 33 HVAC SYSTEM MARKET, BY IMPLEMENTATION TYPE, 2017-2020 (USD BILLION)

- TABLE 34 HVAC SYSTEM MARKET, BY IMPLEMENTATION TYPE, 2021-2026 (USD BILLION)

- 5.16.4.6 HVAC system market, by application

- TABLE 35 HVAC SYSTEM MARKET, BY APPLICATION, 2017-2020 (USD BILLION)

- TABLE 36 HVAC SYSTEM MARKET, BY APPLICATION, 2021-2026 (USD BILLION)

- 5.16.4.7 HVAC system market, by region

- TABLE 37 HVAC SYSTEM MARKET, BY REGION, 2017-2020 (USD BILLION)

- TABLE 38 HVAC SYSTEM MARKET, BY REGION, 2021-2026 (USD BILLION)

6 PANEL FILTERS MARKET, BY MATERIAL TYPE

- 6.1 INTRODUCTION

- FIGURE 34 SYNTHETIC MATERIAL TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 39 PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- 6.2 FIBERGLASS

- 6.2.1 LOWER COST AND DESIGN FLEXIBILITY TO INCREASE DEMAND

- TABLE 40 FIBERGLASS PANEL FILTERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3 SYNTHETIC

- 6.3.1 HIGHER FILTERING EFFICIENCY AND DUST HOLDING CAPACITY TO INCREASE DEMAND

- TABLE 41 SYNTHETIC PANEL FILTERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.4 OTHERS

- TABLE 42 OTHER MATERIALS PANEL FILTERS MARKET, BY REGION, 2020-2027 (USD MILLION)

7 PANEL FILTERS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 35 REUSABLE PANEL FILTERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 43 PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 7.2 DISPOSABLE PANEL FILTERS

- 7.2.1 HIGHER AIR FILTRATION EFFICIENCY AND LOWER COST TO INCREASE DEMAND

- TABLE 44 DISPOSABLE PANEL FILTERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3 REUSABLE PANEL FILTERS

- 7.3.1 MORE CONVENIENT AND COST-EFFECTIVE IN LONG RUN

- TABLE 45 REUSABLE PANEL FILTERS MARKET, BY REGION, 2020-2027 (USD MILLION)

8 PANEL FILTERS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 36 NON-RESIDENTIAL APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 46 PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.2 RESIDENTIAL

- 8.2.1 INCREASE IN URBANIZATION AND IMPROVEMENT IN STANDARDS OF LIVING TO INCREASE DEMAND

- TABLE 47 PANEL FILTERS MARKET SIZE IN RESIDENTIAL APPLICATION, BY REGION, 2020-2027 (USD MILLION)

- 8.3 NON-RESIDENTIAL

- 8.3.1 INCREASED INDUSTRIALIZATION TO PROPEL DEMAND

- TABLE 48 PANEL FILTERS MARKET SIZE IN NON-RESIDENTIAL APPLICATION, BY REGION, 2020-2027 (USD MILLION)

9 PANEL FILTERS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 37 CHINA TO BE FASTEST-GROWING PANEL FILTERS MARKET

- TABLE 49 PANEL FILTERS MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.2 ASIA PACIFIC

- TABLE 50 ASIA PACIFIC: PANEL FILTERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- FIGURE 38 ASIA PACIFIC: PANEL FILTERS MARKET SNAPSHOT

- TABLE 51 ASIA PACIFIC: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 52 ASIA PACIFIC: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 53 ASIA PACIFIC: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.2.1 CHINA

- 9.2.1.1 Healthy growth of manufacturing industry to increase demand for panel filters

- TABLE 54 CHINA: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 55 CHINA: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 56 CHINA: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.2.2 INDIA

- 9.2.2.1 India to register highest growth in Asia Pacific

- TABLE 57 INDIA: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 58 INDIA: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 59 INDIA: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.2.3 JAPAN

- 9.2.3.1 Clean air initiatives to boost demand

- TABLE 60 JAPAN: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 61 JAPAN: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 62 JAPAN: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Electronics & semiconductors industry to boost demand

- TABLE 63 SOUTH KOREA: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 64 SOUTH KOREA: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 65 SOUTH KOREA: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.2.5 REST OF ASIA PACIFIC

- TABLE 66 REST OF ASIA PACIFIC: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 67 REST OF ASIA PACIFIC: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 68 REST OF ASIA PACIFIC: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3 NORTH AMERICA

- TABLE 69 NORTH AMERICA: PANEL FILTERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- FIGURE 39 NORTH AMERICA: PANEL FILTERS MARKET SNAPSHOT

- TABLE 70 NORTH AMERICA: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 71 NORTH AMERICA: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 72 NORTH AMERICA: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3.1 US

- 9.3.1.1 Growing construction activities to boost market

- TABLE 73 US: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 74 US: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 75 US: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3.2 CANADA

- 9.3.2.1 Food & beverage processing industry to increase demand

- TABLE 76 CANADA: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 77 CANADA: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 78 CANADA: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.3.3 MEXICO

- 9.3.3.1 Increase in construction activities and production of pharmaceuticals to drive growth

- TABLE 79 MEXICO: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 80 MEXICO: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 81 MEXICO: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4 EUROPE

- TABLE 82 EUROPE: PANEL FILTERS MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 83 EUROPE: PANEL FILTERS MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 84 EUROPE: PANEL FILTERS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 85 EUROPE: PANEL FILTERS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4.1 GERMANY

- 9.4.1.1 Increasing investments in building & construction industry to drive panel filters market

- TABLE 86 GERMANY: PANEL FILTERS MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 87 GERMANY: PANEL FILTERS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 88 GERMANY: PANEL FILTERS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4.2 FRANCE

- 9.4.2.1 Increasing demand for non-residential application to drive market

- TABLE 89 FRANCE: PANEL FILTERS MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 90 FRANCE: PANEL FILTERS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 91 FRANCE: PANEL FILTERS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4.3 UK

- 9.4.3.1 Increasing industrialization to propel demand for panel filters

- TABLE 92 UK: PANEL FILTERS MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 93 UK: PANEL FILTERS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 94 UK: PANEL FILTERS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4.4 RUSSIA

- 9.4.4.1 Negative impact on market due to Russia-Ukraine crisis

- TABLE 95 RUSSIA: PANEL FILTERS MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 96 RUSSIA: PANEL FILTERS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 97 RUSSIA: PANEL FILTERS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4.5 SPAIN

- 9.4.5.1 EU standards and regulations regarding air filtration to drive market

- TABLE 98 SPAIN: PANEL FILTERS MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 99 SPAIN: PANEL FILTERS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 100 SPAIN: PANEL FILTERS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4.6 ITALY

- 9.4.6.1 Growth in food & beverage industry to propel demand

- TABLE 101 ITALY: PANEL FILTERS MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 102 ITALY: PANEL FILTERS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 103 ITALY: PANEL FILTERS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.4.7 REST OF EUROPE

- TABLE 104 REST OF EUROPE: PANEL FILTERS MARKET SIZE, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 105 REST OF EUROPE: PANEL FILTERS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 106 REST OF EUROPE: PANEL FILTERS MARKET SIZE, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.5 MIDDLE EAST & AFRICA

- TABLE 107 MIDDLE EAST & AFRICA: PANEL FILTERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.5.1 SAUDI ARABIA

- 9.5.1.1 Rising demand for panel filters from oil & gas industry to drive market

- TABLE 111 SAUDI ARABIA: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 112 SAUDI ARABIA: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 113 SAUDI ARABIA: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.5.2 UAE

- 9.5.2.1 Use of panel filters in non-residential industry expected to boost market

- TABLE 114 UAE: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 115 UAE: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 116 UAE: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- TABLE 117 REST OF MIDDLE EAST & AFRICA: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 118 REST OF MIDDLE EAST & AFRICA: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 119 REST OF MIDDLE EAST & AFRICA: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.6 SOUTH AMERICA

- TABLE 120 SOUTH AMERICA: PANEL FILTERS MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 121 SOUTH AMERICA: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 122 SOUTH AMERICA: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 123 SOUTH AMERICA: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.6.1 BRAZIL

- 9.6.1.1 Pharmaceuticals industry to boost demand for panel filters in Brazil

- TABLE 124 BRAZIL: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 125 BRAZIL: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 126 BRAZIL: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.6.2 ARGENTINA

- 9.6.2.1 Food & beverage processing industry to increase demand for panel filters

- TABLE 127 ARGENTINA: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 128 ARGENTINA: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 129 ARGENTINA: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 9.6.3 REST OF SOUTH AMERICA

- TABLE 130 REST OF SOUTH AMERICA: PANEL FILTERS MARKET, BY MATERIAL, 2020-2027 (USD MILLION)

- TABLE 131 REST OF SOUTH AMERICA: PANEL FILTERS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 132 REST OF SOUTH AMERICA: PANEL FILTERS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- FIGURE 40 ACQUISITIONS & EXPANSIONS WERE KEY STRATEGIES ADOPTED BY PLAYERS BETWEEN 2018 AND 2022

- 10.2 MARKET SHARE ANALYSIS

- FIGURE 41 MARKET SHARE OF KEY PLAYERS, 2021

- TABLE 133 PANEL FILTERS MARKET: DEGREE OF COMPETITION

- TABLE 134 STRATEGIC POSITIONING OF KEY PLAYERS

- 10.3 COMPANY EVALUATION MATRIX

- 10.3.1 STARS

- 10.3.2 PERVASIVE PLAYERS

- 10.3.3 EMERGING LEADERS

- 10.3.4 PARTICIPANTS

- FIGURE 42 PANEL FILTERS MARKET: COMPANY EVALUATION MATRIX, 2021

- 10.4 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

- 10.4.1 RESPONSIVE COMPANIES

- 10.4.2 DYNAMIC COMPANIES

- 10.4.3 STARTING BLOCKS

- FIGURE 43 PANEL FILTERS MARKET: STARTUP AND SMES MATRIX, 2021

- 10.5 REVENUE ANALYSIS OF TOP PLAYERS

- 10.5.1 COMPETITIVE BENCHMARKING

- TABLE 135 PANEL FILTERS MARKET: DETAILED LIST OF KEY PLAYERS

- 10.6 BUSINESS STRATEGY EXCELLENCE

- 10.7 COMPETITIVE SITUATIONS & TRENDS

- 10.7.1 NEW PRODUCT LAUNCHES

- 10.7.2 DEALS

- 10.7.3 OTHERS

11 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)**

- 11.1 CAMFIL AB

- TABLE 136 CAMFIL AB: COMPANY OVERVIEW

- TABLE 137 CAMFIL: NEW PRODUCT LAUNCHES

- TABLE 138 CAMFIL AB: OTHERS

- FIGURE 44 CAMFIL AB'S CAPABILITY IN PANEL FILTERS MARKET

- 11.2 AAF INTERNATIONAL

- TABLE 139 AAF INTERNATIONAL: COMPANY OVERVIEW

- TABLE 140 AAF INTERNATIONAL: DEAL

- FIGURE 45 AAF INTERNATIONAL'S CAPABILITY IN PANEL FILTERS MARKET

- 11.3 AFPRO FILTRATION GROUP

- TABLE 141 AFPRO FILTRATION GROUP: COMPANY OVERVIEW

- TABLE 142 AFPRO FILTRATION GROUP: DEAL

- FIGURE 46 AFPRO FILTRATION GROUP'S CAPABILITY IN PANEL FILTERS MARKET

- 11.4 MANN+HUMMEL

- TABLE 143 MANN+HUMMEL: COMPANY OVERVIEW

- FIGURE 47 MANN+HUMMEL: COMPANY SNAPSHOT

- FIGURE 48 MANN+HUMMEL'S CAPABILITY IN PANEL FILTERS MARKET

- 11.5 PARKER HANNIFIN

- TABLE 144 PARKER HANNIFIN: COMPANY OVERVIEW

- FIGURE 49 PARKER HANNIFIN: COMPANY SNAPSHOT

- TABLE 145 PARKER HANNIFIN GROUP: OTHERS

- FIGURE 50 PARKER HANNIFIN CORPORATION 'S CAPABILITY IN PANEL FILTERS MARKET

- 11.6 DONALDSON COMPANY, INC.

- TABLE 146 DONALDSON COMPANY, INC.: COMPANY OVERVIEW

- FIGURE 51 DONALDSON: COMPANY SNAPSHOT

- TABLE 147 DONALDSON COMPANY, INC.: OTHERS

- FIGURE 52 DONALDSON COMPANY'S CAPABILITY IN PANEL FILTERS MARKET

- 11.7 FREUDENBERG FILTRATION TECHNOLOGIES

- TABLE 148 FREUDENBERG FILTRATION TECHNOLOGIES: COMPANY OVERVIEW

- 11.8 KOCH FILTERS CORPORATION

- TABLE 149 KOCH FILTERS CORPORATION: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

- 11.9 OTHER PLAYERS

- 11.9.1 PLACON FILTERS PVT. LTD.

- TABLE 150 PLACON FILTERS PVT. LTD.: COMPANY OVERVIEW

- 11.9.2 EMIRATES INDUSTRIAL FILTERS L.L.C

- TABLE 151 EMIRATES INDUSTRIAL FILTERS L.L.C: COMPANY OVERVIEW

- 11.9.3 B&H INDUSTRIAL L.L.C

- TABLE 152 B&H INDUSTRIAL L.L.C: COMPANY OVERVIEW

- 11.9.4 TFI FILTRATION (INDIA) PVT. LTD.

- TABLE 153 TFI FILTRATION (INDIA) PVT. LTD.: COMPANY OVERVIEW

- 11.9.5 PURAFIL INC.

- TABLE 154 PURAFIL INC.: COMPANY OVERVIEW

- 11.9.6 GENERAL FILTER HAVAK

- TABLE 155 GENERAL FILTER HAVAK: COMPANY OVERVIEW

- 11.9.7 AHLSTROM-MUNKSJO

- TABLE 156 AHLSTROM-MUNKSJO: COMPANY OVERVIEW

- 11.9.8 FILSON FILTRATION EQUIPMENTS CO., LTD

- TABLE 157 FILSON FILTRATION EQUIPMENTS CO., LTD: COMPANY OVERVIEW

- 11.9.9 XIAMEN R&J FILTRATION CO., LTD

- TABLE 158 XIAMEN R&J FILTRATION CO., LTD: COMPANY OVERVIEW

- 11.9.10 NANJING BLUE SKY FILTER CO., LTD

- TABLE 159 NANJING BLUE SKY FILTER CO., LTD: COMPANY OVERVIEW

- 11.9.11 GUANGZHOU KLC CLEANTECH CO., LTD.

- TABLE 160 GUANGZHOU KLC CLEANTECH CO., LTD.: COMPANY OVERVIEW

- 11.9.12 HENAN TOP ENVIRONMENT PROTECTION EQUIPMENT CO., LTD

- TABLE 161 HENAN TOP ENVIRONMENT PROTECTION EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- 11.9.13 TEX-AIR FILTERS

- TABLE 162 TEX-AIR FILTERS: COMPANY OVERVIEW

- 11.9.14 UNITED FILTER INDUSTRIES PVT. LTD.

- TABLE 163 UNITED FILTER INDUSTRIES PVT. LTD.: COMPANY OVERVIEW

- 11.9.15 OMEGA FILTERS (INDIA)

- TABLE 164 OMEGA FILTERS (INDIA): COMPANY OVERVIEW

- 11.9.16 AIRVENTFIL PTY (LTD)

- TABLE 165 AIRVENTFIL PTY (LTD): COMPANY OVERVIEW

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 AVAILABLE CUSTOMIZATIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS