|

|

市場調査レポート

商品コード

1103605

はんだ材料の世界市場:タイプ別(鉛入り、鉛フリー)、製品別(棒、ワイヤー、ペースト、フラックス)、プロセス別(ウェーブ/リフロー、スクリーン印刷、ロボット、レーザー)、最終用途産業別、地域別 - 2027年までの予測Solder Materials Market by Type (With Lead, Lead-Free), Product (Bar, Wire, Paste, Flux), Process (Wave/Reflow, Screen Printing, Robotic, Laser), End-Use Industry (Consumer Electronics, Automotive, Industrial) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| はんだ材料の世界市場:タイプ別(鉛入り、鉛フリー)、製品別(棒、ワイヤー、ペースト、フラックス)、プロセス別(ウェーブ/リフロー、スクリーン印刷、ロボット、レーザー)、最終用途産業別、地域別 - 2027年までの予測 |

|

出版日: 2022年07月15日

発行: MarketsandMarkets

ページ情報: 英文 196 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のはんだ材料の市場規模は、2022年の41億米ドルから2027年までに49億米ドルへと、2022年から2027年までのCAGRで3.8%の成長が予測されています。

はんだ材料市場の成長は、コンシューマーエレクトロニクス、自動車、その他の産業における高い需要に起因しています。

"はんだ棒セグメントは、はんだ材料の最大の製品になる"

はんだ棒は、はんだポットに溶かすことで、はんだワイヤーを使った手作業によるはんだ付けよりも、より速く、より自動化された方法ではんだ付けを行うことができます。ポンプで波を立てるタイプのはんだポッドは、ウェーブはんだ付け機、はんだ噴流槽、選択的はんだ付け機などと呼ばれています。はんだ棒は、ハイテク電子機器やプリント基板など、さまざまな用途で使用されています。

"予測期間中、自動車は2番目に大きなセグメントになる"

はんだ材料は、アーマチュア、ラジエーター、ワイヤーハーネス、車の電気系統など、自動車産業で必要とされる部品に使用されています。この産業では、強度の高い合金が一般的に使用されています。はんだ材料は新車の組み立てだけでなく、自動車の損傷した電子部品の修理やリワークにも使用されます。

"欧州は、はんだ材料で2番目に大きな市場になる"

欧州の新興国は、2021年に金額ベースで16.8%のシェアを占め、はんだ材料の第2位の市場です。Henkel(ドイツ)は、欧州地域だけでなく、世界的にもはんだ材料をリードしています。欧州の自動車部門は、同部門と同地域の経済の力強い回復を支援するため、25のアクションプランを提案しています。このアクションプランの一環として、自動車部門は、EU全域のすべての車種およびカテゴリーを対象とした協調的な自動車再使用制度を求めています。このアクションは、民間および企業の需要を高め、全体的な景気回復を支援し、欧州の道路を走る車両の若返りを加速させることを意図しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- ポーターのファイブフォース分析

- サプライチェーン分析

- エコシステムマッピング

- テクノロジー分析

- 顧客のビジネスに影響を与える動向/混乱

- 貿易分析

- 価格分析

- 2022年の主要な会議とイベント

- 規制分析

- 特許分析

- 主要なはんだ材料の組成と液相温度

第7章 はんだ材料市場:タイプ別

- イントロダクション

- 鉛入り

- 鉛フリー

第8章 はんだ材料市場:製品別

- イントロダクション

- ワイヤー

- 棒

- ペースト

- フラックス

- その他

第9章 はんだ材料市場:プロセス別

- イントロダクション

- ウェーブ/リフロー

- スクリーン印刷

- ロボット

- レーザー

第10章 はんだ材料市場:最終用途産業別

- イントロダクション

- コンシューマーエレクトロニクス

- 自動車

- 工業

- 建築

- その他

第11章 はんだ材料市場:地域別

- イントロダクション

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他

- 欧州

- ドイツ

- フランス

- イタリア

- ロシア

- 英国

- スペイン

- スイス

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他

第12章 競合情勢

- 概要

- 主要な成長戦略として新製品の発売を採用した企業

- 市場シェア分析

- 主要市場企業の収益分析

- 企業の評価象限

- 中小企業のマトリックス

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- ELEMENT SOLUTIONS INC.

- LUCAS MILHAUPT INC.

- QUALITEK INTERNATIONAL INC.

- FUSION INC.

- HENKEL

- SENJU METAL INDUSTRIES CO. LTD.

- KOKI COMPANY LIMITED

- INDIUM CORPORATION

- TAMURA CORPORATION

- STANNOL GMBH & CO. KG

- その他の企業

- BELMONT METALS

- GENMA EUROPE

- ACCURUS SCIENTIFIC

- AIM

- WARTON METALS LIMITED

- DUKSAN HIMETAL CO. LTD.

- INVENTEC PERFORMANCE CHEMICAL

- FAKRI METALS

- DIGIKEY

- WAYTEK

- R.S. HUGHES

- SARU SILVER ALLOY PRIVATE LIMITED

- BALAJI INSULATION CO.

- SUPERIOR FLUX & MFG. CO.

- AGNI SOLDERS

第14章 付録

The global solder materials market is projected to grow from USD 4.1 billion in 2022 to USD 4.9 billion by 2027, at a CAGR of 3.8% from 2022 to 2027. The growth of the solder materials market is attributed to their high demand in consumer electronics, automotive and others industries.

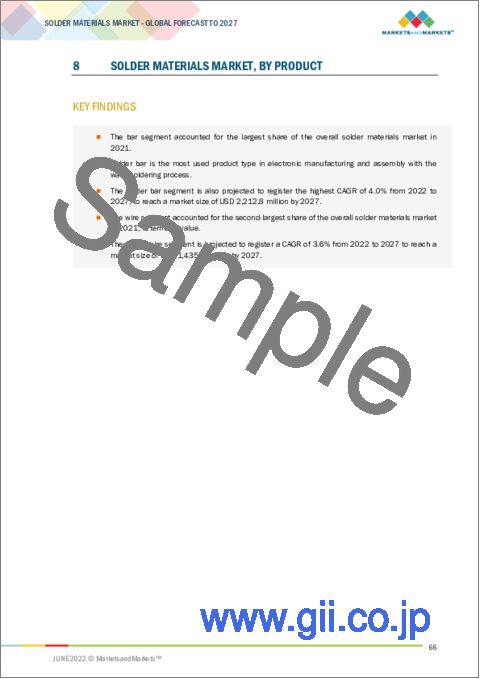

"solder bar segment to be the largest product of solder materials "

Solder bar melted into solder pots can be a faster, more automated method of soldering than hand-soldering with solder wire. Solder pots that have a pump creating a wave are called wave solder machines, solder fountains, or selective solder machines. Solder bar is used in various applications, including high-tech electronics and printed circuit boards.

"Automotive to be the second-largest segment during the forecast period."

Soldering materials are used for armatures, radiators, wire harnesses, car electrical systems and other parts required in the automotive industry. Strong alloys are commonly used in this industry. Soldering materials are not only used in new vehicle assembly but are also used in the repair and rework of damaged electronic components in vehicles.

"Europe to be the second-largest market for solder materials "

Emerging Europe is the second-largest market for solder materials, accounting for a share of 16.8%, in terms of value, in 2021. Henkel (Germany) is the leader of solder materials in the European region, as well as globally. The European automotive sector is proposing a plan comprising 25 actions to support a strong recovery of the sector and the economy of the region. As part of the action plan, the sector calls for coordinated vehicle-renewal schemes for all vehicle types and categories across the EU. This action is intended to boost private and business demand, support economic recovery across the board as well as accelerate the rejuvenation of the vehicle fleet on Europe's roads.

This study has been validated through primaries conducted with various industry experts worldwide. These primary sources have been divided into 3 categories, namely by company, by designation, and by region.

- By Department- Sales/Marketing - 46.7%, Production - 30%, CXOs - 23.3%

- By Designation- Managers - 55.7%, CXOs - 23.3%, Executives- 21%

- By Region- North America- 30%, Europe- 23%, Asia Pacific- 27%, and Rest of World - 20%

The solder materials market comprises major manufacturers, The key players in the solder materials market are Element Solutions, Inc. (US), Lucas Milhaupt Inc. (US), Qualitek International Inc. (US), Fusion Inc. (US), Henkel AG & Co. KGaA (Germany), Senju Metal Industries Co. Ltd. (Japan), Koki Company Limited (Japan), Indium Corporation (US), and others. The study includes an in-depth competitive analysis of these key players in the solder materials market, with their company profiles, and key market strategies.

Research Coverage:

The report covers the solder materials market based on type (With lead, lead-free), product (wire, bar, paste, flux, others) process (Wave/reflow, screen printing, laser, robotic) End-Use Industry (consumer electronics, automotive, industrial, building, Others), and region. The report also provides a comprehensive review of market drivers, restraints, opportunities, and challenges in the solder materials market. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Key Benefits of Buying the Report:

The report will help the leaders/new entrants in this market with information on the closest

approximations of the revenue numbers for the overall market and the sub-segments. This report will

help stakeholders understand the competitive landscape and gain more insights to better position

their businesses and plan suitable go-to-market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- TABLE 1 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 SOLDER MATERIALS MARKET SEGMENTATION

- 1.4.1 YEARS CONSIDERED

- 1.4.2 REGIONAL SCOPE

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 LIMITATIONS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 SOLDER MATERIALS MARKET: RESEARCH DESIGN

- 2.2 KEY INDUSTRY INSIGHTS

- FIGURE 3 DATA VALIDATION THROUGH PRIMARY EXPERTS

- TABLE 2 LIST OF STAKEHOLDERS INVOLVED

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 SUPPLY-SIDE APPROACH - 1

- FIGURE 5 SOLDER MATERIALS MARKET: SUPPLY-SIDE APPROACH - 1

- 2.3.2 SUPPLY-SIDE APPROACH - 2

- FIGURE 6 SOLDER MATERIALS MARKET: SUPPLY-SIDE APPROACH - 2

- 2.3.3 DEMAND-SIDE APPROACH - 1

- FIGURE 7 SOLDER MATERIALS MARKET: DEMAND-SIDE APPROACH - 1

- 2.4 MARKET SIZE ESTIMATION

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.5.1 SECONDARY DATA

- 2.5.2 PRIMARY DATA

- FIGURE 10 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS & LIMITATIONS

- 2.6.1 ASSUMPTIONS

- 2.6.2 RISK ASSESSMENT

- TABLE 3 LIMITATIONS & ASSOCIATED RISKS

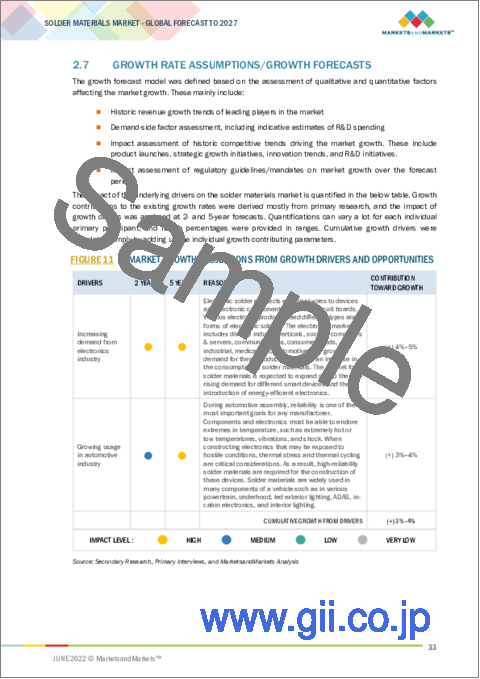

- 2.7 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

- FIGURE 11 MARKET GROWTH PROJECTIONS FROM GROWTH DRIVERS AND OPPORTUNITIES

3 EXECUTIVE SUMMARY

- FIGURE 12 LEAD-FREE SEGMENT PROJECTED TO GROW AT FASTER RATE

- FIGURE 13 BAR SEGMENT TO DOMINATE SOLDER MATERIALS MARKET DURING FORECAST PERIOD

- FIGURE 14 WAVE/REFLOW SEGMENT TO DOMINATE SOLDER MATERIALS MARKET DURING FORECAST PERIOD

- FIGURE 15 CONSUMER ELECTRONICS TO BE LARGEST END USER OF SOLDER MATERIALS DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC DOMINATED SOLDER MATERIALS MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 ASIA PACIFIC TO WITNESS RELATIVELY HIGHER DEMAND FOR SOLDER MATERIALS

- FIGURE 17 ASIA PACIFIC OFFERS ATTRACTIVE OPPORTUNITIES IN SOLDER MATERIALS MARKET

- 4.2 ASIA PACIFIC: SOLDER MATERIALS MARKET, BY END-USE INDUSTRY AND COUNTRY

- FIGURE 18 CHINA WAS LARGEST MARKET FOR SOLDER MATERIALS IN 2021

- 4.3 SOLDER MATERIALS MARKET, BY END-USE INDUSTRY

- FIGURE 19 CONSUMER ELECTRONICS SEGMENT TO LEAD SOLDER MATERIALS MARKET DURING FORECAST PERIOD

- 4.4 SOLDER MATERIALS MARKET, BY TYPE

- FIGURE 20 LEAD-FREE SEGMENT TO DOMINATE SOLDER MATERIALS MARKET DURING FORECAST PERIOD

- 4.5 SOLDER MATERIALS MARKET, BY PRODUCT

- FIGURE 21 BAR SEGMENT TO LEAD SOLDER MATERIALS MARKET DURING FORECAST PERIOD

- 4.6 SOLDER MATERIALS MARKET, BY PROCESS

- FIGURE 22 SCREEN PRINTING TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- 4.7 SOLDER MATERIALS MARKET, BY COUNTRY

- FIGURE 23 CHINA PROJECTED TO WITNESS HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SOLDER MATERIALS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand from electronics industry

- 5.2.1.2 Growing usage in automotive industry

- 5.2.1.3 Growing demand for lead-free solder materials

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of lead-free solders

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of nanoparticle-based solder materials

- 5.2.4 CHALLENGES

- 5.2.4.1 Health risks associated with soldering

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS: SOLDER MATERIALS MARKET

- TABLE 4 SOLDER MATERIALS MARKET: PORTER'S FIVE FORCE ANALYSIS

- 6.1.1 BARGAINING POWER OF SUPPLIERS

- 6.1.2 BARGAINING POWER OF BUYERS

- 6.1.3 THREAT OF NEW ENTRANTS

- 6.1.4 THREAT OF SUBSTITUTES

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 26 SOLDER MATERIALS SUPPLY CHAIN

- 6.3 ECOSYSTEM MAPPING

- FIGURE 27 SOLDER MATERIALS MARKET: ECOSYSTEM MAP

- 6.4 TECHNOLOGY ANALYSIS

- 6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

- FIGURE 28 SOLDER MATERIALS MARKET: TRENDS IMPACTING CUSTOMER'S BUSINESS

- 6.6 TRADE ANALYSIS

- 6.6.1 IMPORT-EXPORT SCENARIO OF SOLDER MATERIALS MARKET

- TABLE 5 IMPORT TRADE DATA FOR TIN, 2021 (USD THOUSAND)

- TABLE 6 EXPORT TRADE DATA FOR TIN (USD THOUSAND)

- 6.7 PRICE ANALYSIS

- TABLE 7 SOLDER MATERIALS MARKET: PRICE ANALYSIS

- TABLE 8 TIN PRICE ANALYSIS (USD/TON)

- 6.8 KEY CONFERENCES & EVENTS IN 2022

- TABLE 9 SOLDER MATERIALS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 6.9 REGULATORY ANALYSIS

- 6.9.1 RESTRICTION OF USE OF HAZARDOUS SUBSTANCES (ROHS) REGULATIONS

- 6.9.2 ENVIRONMENTAL PROTECTION AGENCY (EPA)

- 6.9.3 IPC J-STD-001 STANDARD SOLDERING REQUIREMENTS

- 6.10 PATENT ANALYSIS

- 6.10.1 INTRODUCTION

- 6.10.2 METHODOLOGY

- 6.10.3 DOCUMENT TYPE

- FIGURE 29 SOLDER MATERIALS MARKET: REGISTERED PATENTS

- 6.10.4 PATENT PUBLICATION TRENDS

- FIGURE 30 SOLDER MATERIALS MARKET: PATENT PUBLICATION TRENDS (2011-2021)

- 6.10.5 INSIGHTS

- 6.10.6 LEGAL STATUS OF PATENTS

- FIGURE 31 SOLDER MATERIALS MARKET: LEGAL STATUS

- 6.10.7 JURISDICTION ANALYSIS

- FIGURE 32 SOLDER MATERIALS MARKET: JURISDICTION ANALYSIS

- 6.10.8 TOP PATENT APPLICANTS

- FIGURE 33 SOLDER MATERIALS MARKET: TOP PATENT APPLICANTS

- TABLE 10 SENJU METAL INDUSTRY CO.: LIST OF PATENTS

- TABLE 11 MITSUBISHI MATERIALS CORPORATION: LIST OF PATENTS

- TABLE 12 SOLDER MATERIALS MARKET: LIST OF PATENTS

- 6.10.9 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 13 SOLDER MATERIALS MARKET: LIST TOP 10 PATENT OWNERS (US)

- 6.11 COMPOSITION AND LIQUIDUS TEMPERATURES OF KEY SOLDER MATERIALS

- TABLE 14 KEY SOLDER MATERIALS AND THEIR COMPOSITION

7 SOLDER MATERIALS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 34 LEAD-FREE SEGMENT TO DOMINATE OVERALL SOLDER MATERIALS MARKET

- TABLE 15 SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 16 SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- 7.2 WITH LEAD

- 7.3 LEAD-FREE

8 SOLDER MATERIALS MARKET, BY PRODUCT

- 8.1 INTRODUCTION

- FIGURE 35 SOLDER BAR SEGMENT TO DOMINATE OVERALL SOLDER MATERIALS MARKET IN 2022

- TABLE 17 SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 18 SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- 8.2 WIRE

- 8.3 BAR

- 8.4 PASTE

- 8.5 FLUX

- 8.6 OTHERS

9 SOLDER MATERIALS MARKET, BY PROCESS

- 9.1 INTRODUCTION

- FIGURE 36 WAVE/REFLOW SEGMENT TO DOMINATE OVERALL SOLDER MATERIALS MARKET DURING FORECAST PERIOD

- TABLE 19 SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 20 SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 9.2 WAVE/REFLOW

- 9.3 SCREEN PRINTING

- 9.4 ROBOTIC

- 9.5 LASER

10 SOLDER MATERIALS MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- FIGURE 37 CONSUMER ELECTRONICS SEGMENT TO DOMINATE OVERALL SOLDER MATERIALS MARKET

- TABLE 21 SOLDER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 22 SOLDER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 10.2 CONSUMER ELECTRONICS

- 10.3 AUTOMOTIVE

- 10.4 INDUSTRIAL

- 10.5 BUILDING

- 10.6 OTHERS

11 SOLDER MATERIALS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 38 SOLDER MATERIALS MARKET IN CHINA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- TABLE 23 SOLDER MATERIALS MARKET SIZE, BY REGION, 2020-2027 (USD MILLION)

- TABLE 24 SOLDER MATERIALS MARKET SIZE, BY REGION, 2020-2027 (TON)

- 11.2 ASIA PACIFIC

- FIGURE 39 ASIA PACIFIC: SOLDER MATERIALS MARKET SNAPSHOT

- TABLE 25 ASIA PACIFIC: SOLDER MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 26 ASIA PACIFIC: SOLDER MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (TON)

- TABLE 27 ASIA PACIFIC: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 28 ASIA PACIFIC: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 29 ASIA PACIFIC: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 30 ASIA PACIFIC: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 31 ASIA PACIFIC: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 32 ASIA PACIFIC: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- TABLE 33 ASIA PACIFIC: SOLDER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 34 ASIA PACIFIC: SOLDER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 11.2.1 CHINA

- 11.2.1.1 Largest electronic circuit manufacturing output globally

- TABLE 35 CHINA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 36 CHINA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 37 CHINA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 38 CHINA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 39 CHINA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 40 CHINA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.2.2 INDIA

- 11.2.2.1 Growing consumer electronics demand to drive solder materials market

- TABLE 41 INDIA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 42 INDIA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 43 INDIA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 44 INDIA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 45 INDIA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 46 INDIA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.2.3 JAPAN

- 11.2.3.1 Adoption of smart consumer electronics devices to drive demand

- TABLE 47 JAPAN: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 48 JAPAN: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 49 JAPAN: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 50 JAPAN: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 51 JAPAN: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 52 JAPAN: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.2.4 AUSTRALIA

- 11.2.4.1 Growth in online sales of consumer electronics to drive demand

- TABLE 53 AUSTRALIA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 54 AUSTRALIA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 55 AUSTRALIA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 56 AUSTRALIA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 57 AUSTRALIA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 58 AUSTRALIA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.2.5 REST OF ASIA PACIFIC

- 11.2.5.1 Investment in electronics industry to drive market for solder materials

- TABLE 59 REST OF ASIA PACIFIC: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 60 REST OF ASIA PACIFIC: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 61 REST OF ASIA PACIFIC: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 62 REST OF ASIA PACIFIC: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 63 REST OF ASIA PACIFIC: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 64 REST OF ASIA PACIFIC: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.3 EUROPE

- TABLE 65 EUROPE: SOLDER MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 66 EUROPE: SOLDER MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (TON)

- TABLE 67 EUROPE: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 68 EUROPE: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 69 EUROPE: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 70 EUROPE: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 71 EUROPE: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 72 EUROPE: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- TABLE 73 EUROPE: SOLDER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 74 EUROPE: SOLDER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 11.3.1 GERMANY

- 11.3.1.1 Presence of major solder materials companies to positively influence market growth

- TABLE 75 GERMANY: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 76 GERMANY: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 77 GERMANY: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 78 GERMANY: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 79 GERMANY: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 80 GERMANY: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.3.2 FRANCE

- 11.3.2.1 Government initiatives and growing industrial electronics manufacturing to drive market

- TABLE 81 FRANCE: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 82 FRANCE: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 83 FRANCE: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 84 FRANCE: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 85 FRANCE: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 86 FRANCE: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.3.3 ITALY

- 11.3.3.1 Automotive and aerospace industries to support market growth

- TABLE 87 ITALY: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 88 ITALY: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 89 ITALY: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 90 ITALY: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 91 ITALY: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 92 ITALY: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.3.4 RUSSIA

- 11.3.4.1 Government investments for modernizing infrastructure to boost market

- TABLE 93 RUSSIA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 94 RUSSIA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 95 RUSSIA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 96 RUSSIA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 97 RUSSIA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 98 RUSSIA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.3.5 UK

- 11.3.5.1 High demand from PCB to drive market

- TABLE 99 UK: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 100 UK: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 101 UK: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 102 UK: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 103 UK: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 104 UK: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.3.6 SPAIN

- 11.3.6.1 Automotive industry offering growth opportunities

- TABLE 105 SPAIN: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 106 SPAIN: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 107 SPAIN: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 108 SPAIN: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 109 SPAIN: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 110 SPAIN: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.3.7 SWITZERLAND

- 11.3.7.1 Steady growth of automotive industry to drive market for solder materials

- TABLE 111 SWITZERLAND: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 112 SWITZERLAND: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 113 SWITZERLAND: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 114 SWITZERLAND: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 115 SWITZERLAND: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 116 SWITZERLAND: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.3.8 REST OF EUROPE

- TABLE 117 REST OF EUROPE: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 118 REST OF EUROPE: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 119 REST OF EUROPE: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 120 REST OF EUROPE: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 121 REST OF EUROPE: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 122 REST OF EUROPE: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.4 NORTH AMERICA

- TABLE 123 NORTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 124 NORTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (TON)

- TABLE 125 NORTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 126 NORTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 127 NORTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 128 NORTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 129 NORTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 130 NORTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- TABLE 131 NORTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 132 NORTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 11.4.1 US

- 11.4.1.1 Presence of established players to boost market

- TABLE 133 US: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 134 US: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 135 US: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 136 US: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 137 US: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 138 US: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.4.2 CANADA

- 11.4.2.1 Growing electronics industry to drive market

- TABLE 139 CANADA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 140 CANADA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 141 CANADA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 142 CANADA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 143 CANADA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 144 CANADA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.4.3 MEXICO

- 11.4.3.1 Favorable trade agreements attracting key market players

- TABLE 145 MEXICO: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 146 MEXICO: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 147 MEXICO: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 148 MEXICO: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 149 MEXICO: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 150 MEXICO: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.5 SOUTH AMERICA

- TABLE 151 SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 152 SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (TON)

- TABLE 153 SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 154 SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 155 SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 156 SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 157 SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 158 SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- TABLE 159 SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 160 SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 11.5.1 BRAZIL

- 11.5.1.1 Government support and technological advancement to boost market

- TABLE 161 BRAZIL: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 162 BRAZIL: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 163 BRAZIL: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 164 BRAZIL: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 165 BRAZIL: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 166 BRAZIL: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.5.2 ARGENTINA

- 11.5.2.1 Growing automotive industry to drive demand for solder materials

- TABLE 167 ARGENTINA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 168 ARGENTINA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 169 ARGENTINA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 170 ARGENTINA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 171 ARGENTINA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 172 ARGENTINA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.5.3 REST OF SOUTH AMERICA

- TABLE 173 REST OF SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 174 REST OF SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 175 REST OF SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 176 REST OF SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 177 REST OF SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 178 REST OF SOUTH AMERICA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.6 MIDDLE EAST & AFRICA

- TABLE 179 MIDDLE EAST & AFRICA: SOLDER MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: SOLDER MATERIALS MARKET SIZE, BY COUNTRY, 2020-2027 (TON)

- TABLE 181 MIDDLE EAST & AFRICA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 183 MIDDLE EAST & AFRICA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 185 MIDDLE EAST & AFRICA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- TABLE 187 MIDDLE EAST & AFRICA: SOLDER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: SOLDER MATERIALS MARKET SIZE, BY END-USE INDUSTRY, 2020-2027 (TON)

- 11.6.1 SAUDI ARABIA

- 11.6.1.1 Increased local car sales to support market growth

- TABLE 189 SAUDI ARABIA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 190 SAUDI ARABIA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 191 SAUDI ARABIA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 192 SAUDI ARABIA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 193 SAUDI ARABIA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 194 SAUDI ARABIA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.6.2 UAE

- 11.6.2.1 Growing building & construction industry to drive market

- TABLE 195 UAE: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 196 UAE: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 197 UAE: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 198 UAE: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 199 UAE: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 200 UAE: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.6.3 SOUTH AFRICA

- 11.6.3.1 Rapid urbanization to boost demand for solder materials in building and automotive industries

- TABLE 201 SOUTH AFRICA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 202 SOUTH AFRICA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 203 SOUTH AFRICA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 204 SOUTH AFRICA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 205 SOUTH AFRICA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 206 SOUTH AFRICA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

- 11.6.4 REST OF MIDDLE EAST & AFRICA

- TABLE 207 REST OF MIDDLE EAST & AFRICA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: SOLDER MATERIALS MARKET SIZE, BY TYPE, 2020-2027 (TON)

- TABLE 209 REST OF MIDDLE EAST & AFRICA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION)

- TABLE 210 REST OF MIDDLE EAST & AFRICA: SOLDER MATERIALS MARKET SIZE, BY PRODUCT, 2020-2027 (TON)

- TABLE 211 REST OF MIDDLE EAST & AFRICA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (USD MILLION)

- TABLE 212 REST OF MIDDLE EAST & AFRICA: SOLDER MATERIALS MARKET SIZE, BY PROCESS, 2020-2027 (TON)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 COMPANIES ADOPTED NEW PRODUCT LAUNCH AS KEY GROWTH STRATEGY BETWEEN 2017 AND 2022

- 12.3 MARKET SHARE ANALYSIS

- FIGURE 40 SOLDER MATERIALS MARKET: MARKET SHARE ANALYSIS

- TABLE 213 SOLDER MATERIALS MARKET: DEGREE OF COMPETITION

- 12.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 41 REVENUE ANALYSIS FOR KEY COMPANIES IN SOLDER MATERIALS MARKET

- 12.5 COMPANY EVALUATION QUADRANT

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE COMPANIES

- 12.5.4 PARTICIPANTS

- FIGURE 42 COMPETITIVE LEADERSHIP MAPPING: SOLDER MATERIALS MARKET, 2021

- 12.6 SME MATRIX, 2021

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 43 SME MATRIX: SOLDER MATERIALS MARKET, 2021

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PARTNERSHIPS

- TABLE 214 PARTNERSHIPS, 2017-2022

- 12.7.2 PRODUCT LAUNCHES

- TABLE 215 PRODUCT LAUNCHES, 2017-2022

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1.1 ELEMENT SOLUTIONS INC.

- TABLE 216 ELEMENT SOLUTIONS INC.: COMPANY OVERVIEW

- FIGURE 44 ELEMENT SOLUTIONS INC.: COMPANY SNAPSHOT

- TABLE 217 ELEMENT SOLUTIONS INC.: PRODUCT LAUNCHES

- 13.1.2 LUCAS MILHAUPT INC.

- TABLE 218 LUCAS MILHAUPT INC.: COMPANY OVERVIEW

- 13.1.3 QUALITEK INTERNATIONAL INC.

- TABLE 219 QUALITEK INTERNATIONAL INC.: COMPANY OVERVIEW

- 13.1.4 FUSION INC.

- TABLE 220 FUSION INC.: COMPANY OVERVIEW

- 13.1.5 HENKEL

- TABLE 221 HENKEL: COMPANY OVERVIEW

- FIGURE 45 HENKEL: COMPANY SNAPSHOT

- 13.1.6 SENJU METAL INDUSTRIES CO. LTD.

- TABLE 222 SENJU METAL INDUSTRIES. CO. LTD.: COMPANY OVERVIEW

- 13.1.7 KOKI COMPANY LIMITED

- TABLE 223 KOKI COMPANY LIMITED: COMPANY OVERVIEW

- 13.1.8 INDIUM CORPORATION

- TABLE 224 INDIUM CORPORATION: COMPANY OVERVIEW

- TABLE 225 INDIUM CORPORATION: PRODUCT LAUNCHES

- TABLE 226 INDIUM CORPORATION: DEALS

- 13.1.9 TAMURA CORPORATION

- TABLE 227 TAMURA CORPORATION: COMPANY OVERVIEW

- FIGURE 46 TAMURA CORPORATION: COMPANY SNAPSHOT

- 13.1.10 STANNOL GMBH & CO. KG

- TABLE 228 STANNOL GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 229 STANNOL GMBH CO. & KG: PRODUCT LAUNCHES

- 13.2 OTHER PLAYERS

- 13.2.1 BELMONT METALS

- TABLE 230 BELMONT METALS: COMPANY OVERVIEW

- 13.2.2 GENMA EUROPE

- TABLE 231 GENMA EUROPE: COMPANY OVERVIEW

- 13.2.3 ACCURUS SCIENTIFIC

- TABLE 232 ACCURUS SCIENTIFIC: COMPANY OVERVIEW

- 13.2.4 AIM

- TABLE 233 AIM: COMPANY OVERVIEW

- 13.2.5 WARTON METALS LIMITED

- TABLE 234 WARTON METALS LIMITED: COMPANY OVERVIEW

- 13.2.6 DUKSAN HIMETAL CO. LTD.

- TABLE 235 DUKSAN HIMETAL CO. LTD.: COMPANY OVERVIEW

- 13.2.7 INVENTEC PERFORMANCE CHEMICAL

- TABLE 236 INVENTEC PERFORMANCE CHEMICAL: COMPANY OVERVIEW

- 13.2.8 FAKRI METALS

- TABLE 237 FAKRI METALS: COMPANY OVERVIEW

- 13.2.9 DIGIKEY

- TABLE 238 DIGIKEY: COMPANY OVERVIEW

- 13.2.10 WAYTEK

- TABLE 239 WAYTEK: COMPANY OVERVIEW

- 13.2.11 R.S. HUGHES

- TABLE 240 R.S. HUGHES: COMPANY OVERVIEW

- 13.2.12 SARU SILVER ALLOY PRIVATE LIMITED

- TABLE 241 SARU SILVER ALLOY PRIVATE LIMITED: COMPANY OVERVIEW

- 13.2.13 BALAJI INSULATION CO.

- TABLE 242 BALAJI INSULATION CO.: COMPANY OVERVIEW

- 13.2.14 SUPERIOR FLUX & MFG. CO.

- TABLE 243 SUPERIOR FLUX & MFG. CO.: COMPANY OVERVIEW

- 13.2.15 AGNI SOLDERS

- TABLE 244 AGNI SOLDER: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS