|

|

市場調査レポート

商品コード

1079569

デスクトップ仮想化の世界市場:種類別 (仮想デスクトップインフラ、DaaS、リモートデスクトップサービス)・組織規模別・業種別 (通信、IT・ITeS、BFSI、教育、医療・ライフサイエンス)・地域別の将来予測 (2027年まで)Desktop Virtualization Market by Type (Virtual Desktop Infrastructure, Desktop-as-a-Service, Remote Desktop Services), Organization Size, Vertical (Telecom, IT & ITeS, BFSI, Education, Healthcare & Lifesciences) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| デスクトップ仮想化の世界市場:種類別 (仮想デスクトップインフラ、DaaS、リモートデスクトップサービス)・組織規模別・業種別 (通信、IT・ITeS、BFSI、教育、医療・ライフサイエンス)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年05月25日

発行: MarketsandMarkets

ページ情報: 英文 202 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のデスクトップ仮想化の市場規模は、2022年には123億米ドル、2027年までに201億米ドルへに達する見通しです。

また、予測期間中に10.3%のCAGRで成長すると予想されています。

組織規模別では中小企業向けが、地域別ではアジア太平洋が、予測期間中に高いCAGRで成長する見通しです。

当レポートでは、世界のデスクトップ仮想化の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、市場動向の見通し、種類別・組織規模別・業種別・地域別の詳細動向、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 分析方法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概略

- イントロダクション

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

- 課題

- 市場力学に対するCOVID-19の影響

- 産業動向

- デスクトップ仮想化市場:バリューチェーン分析

- エコシステム

- デスクトップ仮想化市場:企業側の価格設定モデル

- 技術分析

- デスクトップ仮想化市場:規制

- ケーススタディ分析

- デスクトップ仮想化市場:特許分析

- ポーターのファイブフォース分析

- 顧客/クライアントに影響を与える傾向/ディスラプション

第6章 デスクトップ仮想化市場:種類別

- イントロダクション

- 仮想デスクトップインフラ

- DaaS (Desktop-as-a-Service)

- リモートデスクトップサービス

第7章 デスクトップ仮想化市場:組織規模別

- イントロダクション

- 中小企業

- 大企業

第8章 デスクトップ仮想化市場:業種別

- イントロダクション

- BFSI

- 教育

- 医療・ライフサイエンス

- IT・ITeS

- 政府・防衛

- 通信

- 小売業

- 自動車・輸送・ロジスティクス

- メディア・エンターテインメント

- 製造業

- その他の業種

第9章 デスクトップ仮想化市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 他のアジア太平洋諸国

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- 他の中東・アフリカ諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第10章 競合情勢

- 概要

- 主要企業の戦略

- 大手企業のシェア分析

- 過去の収益分析

- 企業評価クアドラント

- 競合ベンチマーキング

- スタートアップ/中小企業の評価クアドラント

- 競合シナリオ

- 製品の発売

- 資本取引

第11章 企業プロファイル

- 主要企業

- CITRIX SYSTEMS

- VMWARE

- MICROSOFT

- ORACLE

- IBM

- CISCO SYSTEMS

- HUAWEI

- KYNDRYL HOLDINGS

- DXC TECHNOLOGY

- NTT DATA

- AWS

- SOFTCHOICE

- NUTANIX

- PURE STORAGE

- NETAPP

- IVANTI

- NASSTAR

- DATACOM

- HEWLETT PACKARD ENTERPRISE (HPE)

- スタートアップ/中小企業

- NCOMPUTING

- EVOLVE IP

- ERICOM SOFTWARE

- PARALLELS

- V2 CLOUD

- KASM

- ITOPIA

- CLEARCUBE

- ADAR

- SYSTANCIA

- HIVEIO

第12章 隣接/関連市場

- アプリケーション仮想化市場

- データ仮想化市場

- データセンター仮想化市場

第13章 付録

The global Desktop virtualization market size is expected to grow from USD 12.3 billion in 2022 to USD 20.1 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 10.3% during the forecast period. Virtualization makes it possible to deploy multiple desktops in a virtual environment, which provides fast access to company applications when they're unavailable at the primary source. In this scenario, desktop virtualization offers an on-demand failover solution without requiring the financial and physical demand of a backup facility, thereby greatly reducing downtime.

In a short time, the COVID-19 outbreak has affected markets and customer behaviors and substantially impacted economies and societies. Healthcare, telecommunication, media and entertainment, utilities, and government verticals function day and night to stabilize conditions and facilitate prerequisite services to every individual. The telecom sector, in particular, is playing a vital role across the globe to support the digital infrastructure of countries amid the COVID-19 pandemic.

According to Fujitsu's Global Digital Transformation Survey, offline organizations were damaged more, while online organizations witnessed growth in online demand and an increase in revenue. 69% of the business leaders from online organizations have indicated that they witnessed an increase in their business revenue in 2020. In contrast, 53% of offline organizations saw a drop in revenues.

The small and medium sized enterprises are estimated to account higher CAGR during the forecast period

SMEs are showing interest in deploying DaaS, as it offers the advantages of VDI solutions at a comparatively lower cost and with less complexity. With more employees shifting to mobile devices, enterprises find it difficult to support employees working on their devices. Some organizations, such as NComputing, are helping SMEs in providing cost- and energy-efficient desktop virtualization solutions by deploying VDI technologies without the need for an established customer base.

Among regions, APAC to hold higher CAGR during the forecast period

The growth of the Desktop virtualization market in APAC is highly driven by the rapid digitalization of enterprises across the region. Market growth in this region is attributed to the rapid adoption of cloud computing, the rising number of medium-sized and small enterprises, and the number of start-ups increasing in the region. Emerging economies, such as China, India, Japan, South Korea, Australia, and New Zealand, are witnessing rapid economic growth and have a high potential to adopt desktop virtualization solutions.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the Desktop virtualization market.

- By Company: Tier I: 45%, Tier II: 30%, and Tier III: 25%

- By Designation: C-Level Executives: 38%, Directors: 33%, and others: 29%

- By Region: North America: 27%, Europe: 15%, Asia Pacific: 45%, Middle East and Africa: 8%, Latin America: 5%

The report includes the study of key players offering Desktop virtualization solutions and services. It profiles major vendors in the global Desktop virtualization market. The major vendors in the global Desktop virtualization market include Citrix systems (US), VMware (US), Microsoft (US), Cisco Systems (US), Oracle (US), IBM (US), Huawei (China), Kyndryl Holdings (US), DXC Technology (US), NTT DATA (Japan), Amazon Web Services (AWS) (US), Softchoice (Canada), Nutanix (US), Pure Storage (US), NetApp (California), Ivanti (US), Nasstar (UK), Datacom (New Zealand), NComputing (US), Evolve IP (US), Ericom Software (US), Parallels International (US), V2 Cloud (Canada), Kasm (Virginia), Itopia (US), ClearCube (US), Hewlett Packard Enterprise (US), Adar (US), Systancia (France), and HiveIO (US).

Research Coverage

The market study covers the Desktop virtualization market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as type, organization size, verticals, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Desktop virtualization market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 DESKTOP VIRTUALIZATION MARKET SEGMENTATION

- 1.3.2 GEOGRAPHIC SCOPE

- FIGURE 2 DESKTOP VIRTUALIZATION MARKET: GEOGRAPHIC SCOPE

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY

- TABLE 1 USD EXCHANGE RATES, 2019-2021

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 DESKTOP VIRTUALIZATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Primary sources

- 2.1.2.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE DESKTOP VIRTUALIZATION MARKET

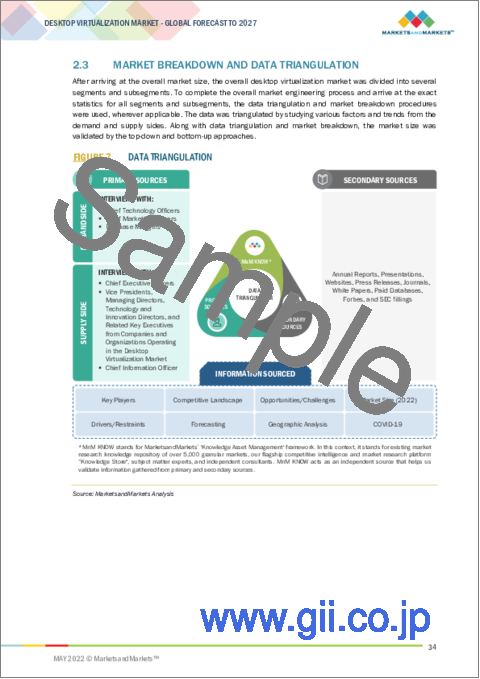

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 8 RESEARCH ASSUMPTIONS

- 2.4.1 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT: DESKTOP VIRTUALIZATION MARKET

3 EXECUTIVE SUMMARY

- FIGURE 9 DESKTOP VIRTUALIZATION MARKET, 2022-2027 (USD MILLION)

- FIGURE 10 LEADING SEGMENTS IN THE DESKTOP VIRTUALIZATION MARKET IN 2022

- FIGURE 11 DESKTOP VIRTUALIZATION MARKET, REGIONAL-WISE SHARE, 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN THE DESKTOP VIRTUALIZATION MARKET

- FIGURE 12 EARLY ADOPTION OF NEW TECHNOLOGIES DRIVING DESKTOP VIRTUALIZATION MARKET GROWTH

- 4.2 DESKTOP VIRTUALIZATION MARKET, BY 0RGANIZATION SIZE

- FIGURE 13 SMALL & MEDIUM-SIZED ENTERPRISES TO LEAD MARKET GROWTH IN 2022

- 4.3 DESKTOP VIRTUALIZATION MARKET, BY VERTICAL

- FIGURE 14 BFSI VERTICAL EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE BY 2027

- 4.4 DESKTOP VIRTUALIZATION MARKET, BY TYPE

- FIGURE 15 DESKTOP-AS-A-SERVICE (DAAS) SEGMENT TO LEAD MARKET GROWTH BY 2027

- 4.5 DESKTOP VIRTUALIZATION MARKET, BY REGION

- FIGURE 16 ASIA PACIFIC TO GROW AT FASTEST GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DESKTOP VIRTUALIZATION MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Need to increase the productivity of employees

- 5.2.1.2 Cost savings to reduce economic pressure on enterprises

- 5.2.1.3 Simplified management and enhanced security (centralization of IT functions)

- 5.2.1.4 Disaster recovery and reduced downtime for enterprises

- 5.2.2 RESTRAINTS

- 5.2.2.1 System complexity and compatibility issues

- 5.2.2.2 Bottleneck issues related to botting, login, antivirus, and user workload actions of VDI

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising attractiveness of workspace-as-a-service (WaaS)

- 5.2.3.2 Shift toward remote working and rise in the adoption of cloud computing

- 5.2.4 CHALLENGES

- 5.2.4.1 Cultural and organizational challenges

- 5.2.4.2 Lack of skilled personnel for implementation and reconfiguration of desktop virtualization

- 5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

- 5.3.1 DRIVERS AND OPPORTUNITIES

- 5.3.2 RESTRAINTS AND CHALLENGES

- 5.3.3 CUMULATIVE GROWTH ANALYSIS

- 5.4 INDUSTRY TRENDS

- 5.4.1 DESKTOP VIRTUALIZATION MARKET: VALUE CHAIN ANALYSIS

- 5.4.1.1 Value Chain Analysis

- FIGURE 18 VALUE CHAIN ANALYSIS OF THE DESKTOP VIRTUALIZATION MARKET

- 5.4.2 ECOSYSTEM

- TABLE 3 DESKTOP VIRTUALIZATION MARKET: ECOSYSTEM

- 5.4.3 PRICING MODEL OF DESKTOP VIRTUALIZATION MARKET PLAYERS

- TABLE 4 PRICING MODELS AND INDICATIVE PRICE POINTS, 2021-2022

- 5.4.4 TECHNOLOGY ANALYSIS

- 5.4.4.1 Artificial Intelligence and Machine Learning

- 5.4.4.2 Blockchain

- 5.4.4.3 Cloud computing

- 5.4.4.4 Internet of Things

- 5.4.5 DESKTOP VIRTUALIZATION MARKET: REGULATIONS

- 5.4.5.1 The Gramm-Leach-Bliley Act (GLBA)

- 5.4.5.2 Health Insurance Portability and Accountability Act (HIPAA)

- 5.4.5.3 Family Educational Rights and Privacy Act (FERPA)

- 5.4.5.4 Payment Card Industry Data Security Standard

- 5.4.5.5 The FTC Fair Information Practice

- 5.4.5.6 General Data Protection Regulation

- 5.4.5.7 ISO/IEC 27001

- 5.4.6 CASE STUDY ANALYSIS

- 5.4.6.1 Case study 1: Citrix Cloud helping Autodesk's further digitization

- 5.4.6.2 Case study 2: Queen's University implementing VMware Horizon desktop virtualization to enable access to critical applications

- 5.4.6.3 Case study 3: ESSEC Business School applying desktop virtualization with pure storage

- 5.4.6.4 Case study 4: Midland's partnership NHS foundation trust enabling virtual services during a healthcare crisis

- 5.4.6.5 Case study 5: Acuity facilitating remote work using Amazon WorkSpaces

- 5.4.7 DESKTOP VIRTUALIZATION MARKET: PATENT ANALYSIS

- 5.4.7.1 Methodology

- 5.4.7.2 Document Types of Patents

- TABLE 5 PATENTS FILED, 2019-2022

- 5.4.7.3 Innovation and patent applications

- FIGURE 19 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2019-2022

- 5.4.7.3.1 Top applicants

- FIGURE 20 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2019-2022

- TABLE 6 LIST OF A FEW PATENTS IN THE DESKTOP VIRTUALIZATION MARKET, 2019-2021

- 5.4.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 DESKTOP VIRTUALIZATION MARKET: PORTER'S FIVE FORCES MODEL

- 5.4.8.1 Threat of new entrants

- 5.4.8.2 Threat of substitutes

- 5.4.8.3 Bargaining power of buyers

- 5.4.8.4 Bargaining power of suppliers

- 5.4.8.5 Degree of competition

- 5.4.9 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 21 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF THE DESKTOP VIRTUALIZATION MARKET

- 5.4.1 DESKTOP VIRTUALIZATION MARKET: VALUE CHAIN ANALYSIS

6 GLOBAL DESKTOP VIRTUALIZATION MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.1.1 TYPE: DESKTOP VIRTUALIZATION MARKET DRIVERS

- 6.1.2 TYPE: COVID-19 IMPACT

- FIGURE 22 VIRTUAL DESKTOP INFRASTRUCTURE SEGMENT EXPECTED TO LEAD GLOBAL DESKTOP VIRTUALIZATION MARKET BY 2027

- TABLE 8 GLOBAL DESKTOP VIRTUALIZATION MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 9 GLOBAL DESKTOP VIRTUALIZATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 6.2 VIRTUAL DESKTOP INFRASTRUCTURE

- 6.2.1 NEED FOR CENTRALIZED MANAGEMENT IN DESKTOP VIRTUALIZATION

- TABLE 10 VIRTUAL DESKTOP INFRASTRUCTURE: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 11 VIRTUAL DESKTOP INFRASTRUCTURE: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 DESKTOP-AS-A-SERVICE

- 6.3.1 ENTERPRISES ADOPTING DAAS SOLUTIONS FOR SECURE, SMOOTH REMOTE OPERATIONS

- TABLE 12 DESKTOP-AS-A-SERVICE: DESKTOP VIRTUALIZATION MARKET BY REGION, 2016-2021 (USD MILLION)

- TABLE 13 DESKTOP-AS-A-SERVICE: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4 REMOTE DESKTOP SERVICE

- 6.4.1 RDS COMPATIBILITY WITH MICROSOFT PRODUCTS

- TABLE 14 REMOTE DESKTOP SERVICE: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 15 REMOTE DESKTOP SERVICE: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2022-2027 (USD MILLION)

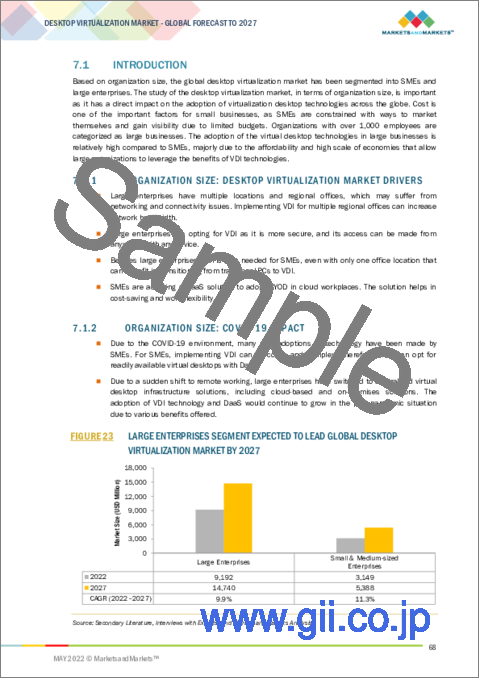

7 GLOBAL DESKTOP VIRTUALIZATION MARKET, BY ORGANIZATION SIZE

- 7.1 INTRODUCTION

- 7.1.1 ORGANIZATION SIZE: DESKTOP VIRTUALIZATION MARKET DRIVERS

- 7.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

- FIGURE 23 LARGE ENTERPRISES SEGMENT EXPECTED TO LEAD GLOBAL DESKTOP VIRTUALIZATION MARKET BY 2027

- TABLE 16 GLOBAL DESKTOP VIRTUALIZATION MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 17 GLOBAL DESKTOP VIRTUALIZATION MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 7.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 7.2.1 ADOPTION OF VDI BY SMES TO GAIN A COMPETITIVE EDGE

- TABLE 18 SMALL & MEDIUM-SIZED ENTERPRISES: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 19 SMALL & MEDIUM-SIZED ENTERPRISES: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 LARGE ENTERPRISES

- 7.3.1 LARGE ENTERPRISES SWITCHING TO CENTRALIZED VIRTUAL DESKTOP INFRASTRUCTURE SOLUTIONS

- TABLE 20 LARGE ENTERPRISES: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 21 LARGE ENTERPRISES: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2022-2027 (USD MILLION)

8 GLOBAL DESKTOP VIRTUALIZATION MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.1.1 VERTICAL: DESKTOP VIRTUALIZATION MARKET DRIVERS

- 8.1.2 VERTICAL: COVID-19 IMPACT

- FIGURE 24 GLOBAL DESKTOP VIRTUALIZATION MARKET, BY VERTICAL, 2022 & 2027 (USD MILLION)

- TABLE 22 GLOBAL DESKTOP VIRTUALIZATION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 23 GLOBAL DESKTOP VIRTUALIZATION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 8.2 BFSI

- 8.2.1 DESKTOP VIRTUALIZATION SOLUTIONS TO ATTAIN BUSINESS OBJECTIVES OF THE BFSI VERTICAL

- TABLE 24 BFSI: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 25 BFSI: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 EDUCATION

- 8.3.1 EDUCATION INDUSTRY PROVIDING REMOTE ACCESS WITH DESKTOP VIRTUALIZATION

- TABLE 26 EDUCATION: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 27 EDUCATION: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4 HEALTHCARE & LIFESCIENCES

- 8.4.1 HEALTHCARE & LIFESCIENCES INDUSTRY ADOPTING DESKTOP VIRTUALIZATION TO ENHANCE SECURITY

- TABLE 28 HEALTHCARE & LIFESCIENCES: DESKTOP VIRTUALIZATION MARKET SIZE, BY REGION, 2016-2021 (USD MILLION)

- TABLE 29 HEALTHCARE & LIFESCIENCES: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.5 IT & ITES

- 8.5.1 IT & ITES ADOPTING DAAS SOLUTIONS TO PROVIDE SECURE REMOTE WORKING

- TABLE 30 IT & ITES: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 31 IT & ITES: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.6 GOVERNMENT & DEFENSE

- 8.6.1 GOVERNMENT TO CENTRALIZE MANAGEMENT WITH DESKTOP VIRTUALIZATION

- TABLE 32 GOVERNMENT & DEFENSE: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 33 GOVERNMENT & DEFENSE: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.7 TELECOM

- 8.7.1 EMERGENCE OF DATA CENTERS TO ENABLE VIRTUALIZATION

- TABLE 34 TELECOM: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 35 TELECOM: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.8 RETAIL

- 8.8.1 RETAIL INDUSTRY ADOPTING DESKTOP VIRTUALIZATION SOLUTIONS TO ENHANCE CUSTOMER EXPERIENCE

- TABLE 36 RETAIL: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 37 RETAIL: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.9 AUTOMOTIVE, TRANSPORTATION, & LOGISTICS

- 8.9.1 USE OF DESKTOP VIRTUALIZATION SOLUTIONS FOR GAINING A COMPETITIVE EDGE

- TABLE 38 AUTOMOTIVE, TRANSPORTATION & LOGISTICS: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 39 AUTOMOTIVE, TRANSPORTATION & LOGISTICS: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.10 MEDIA & ENTERTAINMENT

- 8.10.1 ADOPTION OF VDI TECHNOLOGY REDUCING OPERATIONAL COSTS

- TABLE 40 MEDIA & ENTERTAINMENT: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016-2021(USD MILLION)

- TABLE 41 MEDIA & ENTERTAINMENT: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.11 MANUFACTURING

- 8.11.1 MANUFACTURING INDUSTRY TO ADOPT VDI TECHNOLOGY TO ENHANCE DATA SECURITY

- TABLE 42 MANUFACTURING: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 43 MANUFACTURING: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.12 OTHER VERTICALS

- 8.12.1 DESKTOP VIRTUALIZATION ENHANCING SECURITY IN VARIOUS SECTORS

- TABLE 44 OTHER VERTICALS: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 45 OTHER VERTICALS: DESKTOP VIRTUALIZATION MARKET, BY REGION, 2022-2027 (USD MILLION)

9 DESKTOP VIRTUALIZATION MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 25 NORTH AMERICA EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE BY 2027

- TABLE 46 DESKTOP VIRTUALIZATION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 47 DESKTOP VIRTUALIZATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: DESKTOP VIRTUALIZATION MARKET DRIVERS

- 9.2.2 NORTH AMERICA: COVID-19 IMPACT

- 9.2.3 NORTH AMERICA: REGULATORY NORMS

- FIGURE 26 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 48 NORTH AMERICA: DESKTOP VIRTUALIZATION MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 49 NORTH AMERICA: DESKTOP VIRTUALIZATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 50 NORTH AMERICA: DESKTOP VIRTUALIZATION MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 51 NORTH AMERICA: DESKTOP VIRTUALIZATION MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 52 NORTH AMERICA: DESKTOP VIRTUALIZATION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 53 NORTH AMERICA: DESKTOP VIRTUALIZATION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 54 NORTH AMERICA: DESKTOP VIRTUALIZATION MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 55 NORTH AMERICA: DESKTOP VIRTUALIZATION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.2.4 UNITED STATES

- 9.2.4.1 Growing healthcare industry and adoption of advanced technology

- 9.2.5 CANADA

- 9.2.5.1 Cost-effectiveness, flexibility, and simplified management provided by desktop virtualization

- 9.3 EUROPE

- 9.3.1 EUROPE: DESKTOP VIRTUALIZATION MARKET DRIVERS

- 9.3.2 EUROPE: COVID-19 IMPACT

- 9.3.3 EUROPE: REGULATORY NORMS

- TABLE 56 EUROPE: DESKTOP VIRTUALIZATION MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 57 EUROPE: DESKTOP VIRTUALIZATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 58 EUROPE: DESKTOP VIRTUALIZATION MARKET, BY ORGANIZATION SIZE, 2016-2021(USD MILLION)

- TABLE 59 EUROPE: DESKTOP VIRTUALIZATION MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 60 EUROPE: DESKTOP VIRTUALIZATION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 61 EUROPE: DESKTOP VIRTUALIZATION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 62 EUROPE: DESKTOP VIRTUALIZATION MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 63 EUROPE: DESKTOP VIRTUALIZATION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.3.4 UNITED KINGDOM

- 9.3.4.1 Cloud-based service and solution providers driving the desktop virtualization market growth

- 9.3.5 GERMANY

- 9.3.5.1 Efficient work and high performance while working from remote locations

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: DESKTOP VIRTUALIZATION MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: COVID-19 IMPACT

- 9.4.3 ASIA PACIFIC: REGULATORY NORMS

- FIGURE 27 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 64 ASIA PACIFIC: DESKTOP VIRTUALIZATION MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 65 ASIA PACIFIC: DESKTOP VIRTUALIZATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 66 ASIA PACIFIC: DESKTOP VIRTUALIZATION MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 67 ASIA PACIFIC: DESKTOP VIRTUALIZATION MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 68 ASIA PACIFIC: DESKTOP VIRTUALIZATION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 69 ASIA PACIFIC: DESKTOP VIRTUALIZATION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 70 ASIA PACIFIC: DESKTOP VIRTUALIZATION MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 71 ASIA PACIFIC: DESKTOP VIRTUALIZATION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.4.4 CHINA

- 9.4.4.1 Vast and skilled workforce driving the growth of the desktop virtualization market

- 9.4.5 JAPAN

- 9.4.5.1 Growth of emerging technologies

- 9.4.6 INDIA

- 9.4.6.1 Financial services, IT-enabled services, and retail sectors driving the growth of the desktop virtualization market

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: DESKTOP VIRTUALIZATION MARKET DRIVERS

- 9.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

- 9.5.3 MIDDLE EAST & AFRICA: REGULATORY NORMS

- TABLE 72 MIDDLE EAST & AFRICA: DESKTOP VIRTUALIZATION MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 73 MIDDLE EAST & AFRICA: DESKTOP VIRTUALIZATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 74 MIDDLE EAST & AFRICA: DESKTOP VIRTUALIZATION MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 75 MIDDLE EAST & AFRICA: DESKTOP VIRTUALIZATION MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 76 MIDDLE EAST & AFRICA: DESKTOP VIRTUALIZATION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 77 MIDDLE EAST & AFRICA: DESKTOP VIRTUALIZATION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 78 MIDDLE EAST & AFRICA: DESKTOP VIRTUALIZATION MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 79 MIDDLE EAST & AFRICA: DESKTOP VIRTUALIZATION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.5.4 KINGDOM OF SAUDI ARABIA

- 9.5.4.1 Rising adoption of public cloud offerings and high technology startups driving the growth

- 9.5.5 SOUTH AFRICA

- 9.5.5.1 Rising advancements in the field of IT and communications driving the demand for desktop virtualization

- 9.5.6 REST OF MIDDLE EAST AND AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: DESKTOP VIRTUALIZATION MARKET DRIVERS

- 9.6.2 LATIN AMERICA: COVID-19 IMPACT

- 9.6.3 LATIN AMERICA: REGULATORY NORMS

- TABLE 80 LATIN AMERICA: DESKTOP VIRTUALIZATION MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 81 LATIN AMERICA: DESKTOP VIRTUALIZATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 82 LATIN AMERICA: DESKTOP VIRTUALIZATION MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 83 LATIN AMERICA: DESKTOP VIRTUALIZATION MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 84 LATIN AMERICA: DESKTOP VIRTUALIZATION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 85 LATIN AMERICA: DESKTOP VIRTUALIZATION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 86 LATIN AMERICA: DESKTOP VIRTUALIZATION MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 87 LATIN AMERICA: DESKTOP VIRTUALIZATION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 9.6.4 BRAZIL

- 9.6.4.1 Affordable skilled crowd and growth of IT driving the desktop virtualization market growth

- 9.6.5 MEXICO

- 9.6.5.1 Growth of the tech industry increasing skilled workers and job opportunities

- 9.6.6 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES

- TABLE 88 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN THE DESKTOP VIRTUALIZATION MARKET

- 10.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

- TABLE 89 DESKTOP VIRTUALIZATION MARKET: DEGREE OF COMPETITION

- 10.4 HISTORICAL REVENUE ANALYSIS

- FIGURE 28 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2019-2021 (USD MILLION)

- 10.5 COMPANY EVALUATION QUADRANT

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 29 KEY DESKTOP VIRTUALIZATION MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2021

- 10.6 COMPETITIVE BENCHMARKING

- TABLE 90 COMPANY FOOTPRINT

- TABLE 91 COMPANY TYPE FOOTPRINT

- TABLE 92 COMPANY TOP 3 VERTICAL FOOTPRINT

- TABLE 93 COMPANY REGION FOOTPRINT

- 10.7 STARTUP/SME EVALUATION QUADRANT

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- FIGURE 30 STARTUP/SME DESKTOP VIRTUALIZATION MARKET EVALUATION MATRIX, 2021

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 PRODUCT LAUNCHES

- TABLE 94 PRODUCT LAUNCHES, 2019-2022

- 10.8.2 DEALS

- TABLE 95 DEALS, 2020-2022

11 COMPANY PROFILES

- (Business overview, Products offered, Recent developments & MnM View)**

- 11.1 MAJOR PLAYERS

- 11.1.1 CITRIX SYSTEMS

- TABLE 96 CITRIX SYSTEMS: BUSINESS OVERVIEW

- FIGURE 31 CITRIX SYSTEMS: FINANCIAL OVERVIEW

- TABLE 97 CITRIX SYSTEMS: PRODUCTS OFFERED

- TABLE 98 CITRIX SYSTEMS: PRODUCT LAUNCHES

- TABLE 99 CITRIX SYSTEMS: DEALS

- 11.1.2 VMWARE

- TABLE 100 VMWARE: BUSINESS OVERVIEW

- FIGURE 32 VMWARE: FINANCIAL OVERVIEW

- TABLE 101 VMWARE: PRODUCTS OFFERED

- TABLE 102 VMWARE: PRODUCT LAUNCHES

- TABLE 103 VMWARE: DEALS

- 11.1.3 MICROSOFT

- TABLE 104 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 33 MICROSOFT: FINANCIAL OVERVIEW

- TABLE 105 MICROSOFT: PRODUCTS OFFERED

- TABLE 106 MICROSOFT: PRODUCT LAUNCHES

- TABLE 107 MICROSOFT: DEALS

- 11.1.4 ORACLE

- TABLE 108 ORACLE: BUSINESS OVERVIEW

- FIGURE 34 ORACLE: FINANCIAL OVERVIEW

- TABLE 109 ORACLE: PRODUCTS OFFERED

- TABLE 110 ORACLE: PRODUCT LAUNCHES

- TABLE 111 ORACLE: DEALS

- 11.1.5 IBM

- TABLE 112 IBM: BUSINESS OVERVIEW

- FIGURE 35 IBM: FINANCIAL OVERVIEW

- TABLE 113 IBM: PRODUCTS OFFERED

- TABLE 114 IBM: DEALS

- 11.1.6 CISCO SYSTEMS

- TABLE 115 CISCO SYSTEMS: BUSINESS OVERVIEW

- FIGURE 36 CISCO SYSTEMS: FINANCIAL OVERVIEW

- TABLE 116 CISCO SYSTEMS: PRODUCTS OFFERED

- TABLE 117 CISCO SYSTEMS: PRODUCT LAUNCHES

- TABLE 118 CISCO SYSTEM: DEALS

- 11.1.7 HUAWEI

- TABLE 119 HUAWEI: BUSINESS OVERVIEW

- FIGURE 37 HUAWEI: FINANCIAL OVERVIEW

- TABLE 120 HUAWEI: PRODUCTS OFFERED

- TABLE 121 HUAWEI: PRODUCT LAUNCHES

- TABLE 122 HUAWEI: DEALS

- 11.1.8 KYNDRYL HOLDINGS

- TABLE 123 KYNDRYL HOLDINGS: BUSINESS OVERVIEW

- FIGURE 38 KYNDRYL HOLDINGS: FINANCIAL OVERVIEW

- TABLE 124 KYNDRYL HOLDINGS: PRODUCTS OFFERED

- TABLE 125 KYNDRYL HOLDINGS: DEALS

- 11.1.9 DXC TECHNOLOGY

- TABLE 126 DXC TECHNOLOGY: BUSINESS OVERVIEW

- FIGURE 39 DXC TECHNOLOGY: FINANCIAL OVERVIEW

- TABLE 127 DXC TECHNOLOGY: PRODUCTS OFFERED

- TABLE 128 DXC TECHNOLOGY: PRODUCT LAUNCHES

- TABLE 129 DXC TECHNOLOGY: DEALS

- 11.1.10 NTT DATA

- TABLE 130 NTT DATA: BUSINESS OVERVIEW

- FIGURE 40 NTT DATA: FINANCIAL OVERVIEW

- TABLE 131 NTT DATA: PRODUCTS OFFERED

- TABLE 132 NTT DATA: PRODUCT LAUNCHES

- TABLE 133 NTT DATA: DEALS

- 11.1.11 AWS

- TABLE 134 AWS: BUSINESS OVERVIEW

- FIGURE 41 AWS: FINANCIAL OVERVIEW

- TABLE 135 AWS: PRODUCTS OFFERED

- TABLE 136 AWS: PRODUCT LAUNCHES

- TABLE 137 AWS: DEALS

- 11.1.12 SOFTCHOICE

- TABLE 138 SOFTCHOICE: BUSINESS OVERVIEW

- FIGURE 42 SOFTCHOICE: FINANCIAL OVERVIEW

- TABLE 139 SOFTCHOICE: PRODUCTS OFFERED

- TABLE 140 SOFTCHOICE: DEALS

- 11.1.13 NUTANIX

- 11.1.14 PURE STORAGE

- 11.1.15 NETAPP

- 11.1.16 IVANTI

- 11.1.17 NASSTAR

- 11.1.18 DATACOM

- 11.1.19 HEWLETT PACKARD ENTERPRISE (HPE)

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 11.2 STARTUP/SMES PLAYERS

- 11.2.1 NCOMPUTING

- 11.2.2 EVOLVE IP

- 11.2.3 ERICOM SOFTWARE

- 11.2.4 PARALLELS

- 11.2.5 V2 CLOUD

- 11.2.6 KASM

- 11.2.7 ITOPIA

- 11.2.8 CLEARCUBE

- 11.2.9 ADAR

- 11.2.10 SYSTANCIA

- 11.2.11 HIVEIO

12 ADJACENT/RELATED MARKETS

- 12.1 APPLICATION VIRTUALIZATION MARKET

- 12.1.1 MARKET DEFINITION

- 12.1.2 MARKET OVERVIEW

- 12.1.3 APPLICATION VIRTUALIZATION MARKET, BY COMPONENT

- TABLE 141 APPLICATION VIRTUALIZATION MARKET, BY COMPONENT, 2016-2023 (USD MILLION)

- TABLE 142 APPLICATION VIRTUALIZATION MARKET, BY SOLUTION TYPE, 2016-2023 (USD MILLION)

- TABLE 143 APPLICATION VIRTUALIZATION MARKET, BY SERVICE TYPE, 2016-2023 (USD MILLION)

- 12.1.4 APPLICATION VIRTUALIZATION MARKET, BY DEPLOYMENT TYPE

- 12.1.5 APPLICATION VIRTUALIZATION MARKET, BY ORGANIZATION SIZE

- TABLE 144 APPLICATION VIRTUALIZATION MARKET, BY ORGANIZATION SIZE, 2016-2023 (USD MILLION)

- 12.1.6 APPLICATION VIRTUALIZATION MARKET, BY VERTICAL

- TABLE 145 APPLICATION VIRTUALIZATION MARKET, BY VERTICAL, 2016-2023 (USD MILLION)

- 12.1.7 APPLICATION VIRTUALIZATION MARKET, BY REGION

- TABLE 146 APPLICATION VIRTUALIZATION MARKET, BY REGION, 2016-2023 (USD MILLION)

- 12.2 DATA VIRTUALIZATION MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 DATA VIRTUALIZATION MARKET, BY COMPONENT

- TABLE 147 DATA VIRTUALIZATION MARKET, BY COMPONENT, 2015-2022 (USD MILLION)

- TABLE 148 STANDALONE SOFTWARE: DATA VIRTUALIZATION MARKET, BY DEPLOYMENT MODE, 2015-2022 (USD MILLION)

- TABLE 149 DATA INTEGRATION SOLUTION: DATA VIRTUALIZATION MARKET, BY DEPLOYMENT MODE, 2015-2022 (USD MILLION)

- TABLE 150 APPLICATION TOOL SOLUTION: DATA VIRTUALIZATION MARKET, BY DEPLOYMENT MODE, 2015-2022 (USD MILLION)

- 12.2.4 DATA VIRTUALIZATION MARKET, BY DEPLOYMENT MODE

- TABLE 151 DATA VIRTUALIZATION MARKET, BY DEPLOYMENT MODE, 2015-2022 (USD MILLION)

- 12.2.5 DATA VIRTUALIZATION MARKET, BY ORGANIZATION SIZE

- TABLE 152 DATA VIRTUALIZATION MARKET, BY ORGANIZATION SIZE, 2015-2022 (USD MILLION)

- 12.2.6 DATA VIRTUALIZATION MARKET, BY DATA CONSUMER

- TABLE 153 DATA VIRTUALIZATION MARKET, BY DATA CONSUMER, 2015-2022 (USD MILLION)

- 12.2.7 DATA VIRTUALIZATION MARKET, BY VERTICAL

- TABLE 154 DATA VIRTUALIZATION MARKET, BY VERTICAL, 2015-2022 (USD MILLION)

- 12.2.8 DATA VIRTUALIZATION MARKET, BY REGION

- TABLE 155 DATA VIRTUALIZATION MARKET, BY REGION, 2015-2022 (USD MILLION)

- 12.3 DATA CENTER VIRTUALIZATIONS MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 DATA CENTER VIRTUALIZATIONS MARKET, BY TYPE

- TABLE 156 DATA CENTER VIRTUALIZATIONS MARKET, BY TYPE, 2015-2022 (USD MILLION)

- 12.3.4 DATA CENTER VIRTUALIZATIONS MARKET, BY ORGANIZATION SIZE

- TABLE 157 DATA CENTER VIRTUALIZATIONS MARKET, BY ORGANIZATION SIZE, 2015-2022 (USD MILLION)

- 12.3.5 DATA CENTER VIRTUALIZATIONS MARKET, BY VERTICAL

- TABLE 158 DATA CENTER VIRTUALIZATIONS MARKET, BY VERTICAL, 2015-2022 (USD MILLION)

- 12.3.6 DATA CENTER VIRTUALIZATIONS MARKET, BY REGION

- TABLE 159 DATA CENTER VIRTUALIZATIONS MARKET, BY REGION, 2015-2022 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 AVAILABLE CUSTOMIZATIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS