|

|

市場調査レポート

商品コード

1263192

CLT (直交集成材) の世界市場:種類別・産業別・最終用途別・地域別の将来予測 (2028年まで)Cross Laminated Timber Market by Type, Industry, End Use, & Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| CLT (直交集成材) の世界市場:種類別・産業別・最終用途別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年04月19日

発行: MarketsandMarkets

ページ情報: 英文 195 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のCLT (直交集成材) の市場規模は、2023年の14億米ドルから2028年までに26億米ドルに達し、2023年から2028年の間に13.7%のCAGRで成長すると予測されています。

建設業界からの環境に優しい素材への需要や、性能、耐久性、美観を向上させるニーズの高まりが、CLT市場の成長に寄与する主要因となっています。新興市場への投資の拡大は、世界的に市場関係者に成長機会をもたらし、予測期間中のCLTの需要を促進すると期待されています。しかし、厳しく時間のかかる規制政策は、市場関係者にとっての課題となっています。

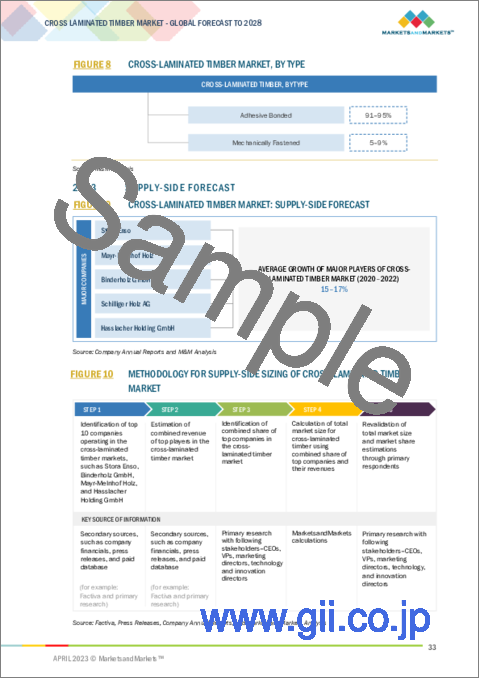

2023年には、接着剤接合型のセグメントが最大のシェアを占める

CLTは、国際建築基準法に組み込まれたことで、建設業者や建築家がより高い構造物を建設・設計する際に役立ち、それが世界の集成材分野に混乱をもたらすと予想されます。非住宅分野での応用は、世界的に重要であると予想されます。CLTに使用される接着剤の大部分はPU接着剤であり、ホルムアルデヒドを含まず、VOC含有量が法的規制値以下であることから、さらに魅力的な選択肢となっています。規制基準の強化に伴い、PU接着剤製品の需要は増加することが予想されます。

DACH諸国 (ドイツ・オーストリア・スイス) は、CLTの原産国かつ有力な生産国として、CLTの成長を牽引してきました。オーストリアには7つのCLT製造拠点があり、ドイツには3つ、スイスには2つの製造拠点があります。フィンランド、イタリア、ノルウェー、スペイン、スウェーデンにも小規模な製造拠点があり、フィンランド・フランス・スウェーデン・英国では新しいCLT工場が建設されています。

2023年には、最終用途別では、構造物のセグメントが最大のシェアを占める

現代の建築では時間短縮のために、プレハブ建築や同時進行構造が採用されることがあります。壁を作るとき、ドアや窓の開口部の上にヘッダーを設ける基準があります。このヘッダーは、屋根の荷重を上部から支え、壁の骨組みが垂れ下がるのを防ぐものです。ヘッダーは、建築物の強度と安定性を高めます。その結果、ヘッダーは構造物にさらなる安全性を与え、窓やドアの機能を長時間にわたって向上させることができるのです。

北米のCLT市場は、予測期間中に最も高いCAGRで成長する

北米のCLT市場は、建設業界における技術進歩が牽引しています。米国はCLT製品の最大の消費国であり、北米諸国の中で金額・数量ともに最大の市場シェアを占めると予測されます。各企業はエンドユーザーからの需要増に対応するため、主に新製品の開発に注力しています。北米のCLT市場は、製造における技術的進歩や高品質の最終製品によって牽引されています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- CLTを使用したネットゼロ設計

- CLTの炭素含有量

- CLTのライフサイクル分析

- CLTからのCO2排出量の削減

- CLTの利点

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- マクロ指標分析

- 市場の成長に影響を与える世界経済シナリオ

- バリューチェーン分析

- 価格分析

- CLTのエコシステムと相互接続された市場

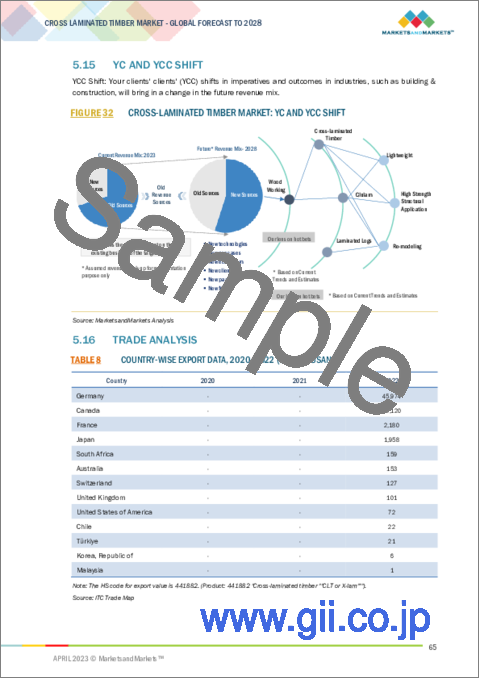

- YC・YCCのシフト

- 貿易分析

- 特許分析

- ケーススタディ分析

- 技術分析

- 主な会議とイベント (2023年)

- 関税・規制状況

第6章 CLT市場:種類別

- イントロダクション

- 接着剤接合型

- ポリウレタン (PUR)

- メラミン尿素ホルムアルデヒド (MUF)

- 機械的固定型

- タッピングねじ (STS)

- だぼ継ぎ型固定具

第7章 CLT市場:最終用途別

- イントロダクション

- 構造物

- 非構造物

第8章 CLT市場:産業別

- イントロダクション

- 住宅

- 非住宅

- 公共用

- 工業用

- その他

第9章 CLT市場:地域別

- イントロダクション

- 欧州

- ドイツ

- オーストリア

- イタリア

- チェコ

- フランス

- スウェーデン

- スイス

- 英国

- スロバキア

- その他欧州

- 北米

- 米国

- カナダ

- アジア太平洋

- 中国

- 日本

- オーストラリア・ニュージーランド

- その他アジア太平洋

- その他の地域

- ブラジル

- アルゼンチン

- その他の国々

第10章 競合情勢

- 概要

- 競合リーダーシップマッピング (2022年)

- 中小企業 (SME) のマトリックス (2022年)

- 製品ポートフォリオの強み

- 競合ベンチマーキング

- 市場シェア分析

- 市場ランキング分析

- 収益分析

- 競合シナリオ

- 戦略的展開

第11章 企業プロファイル

- 主要企業

- MAYR-MELNHOF HOLZ

- STORA ENSO

- BINDERHOLZ GMBH

- EUGEN DECKER HOLZINDUSTRIE KG

- HASSLACHER HOLDING GMBH

- SCHILLIGER HOLZ AG

- KLH MASSIVHOLZ GMBH

- STRUCTURLAM MASS TIMBER CORPORATION

- XLAM NZ LIMITED

- PFEIFER HOLDING GMBH

- その他の企業

- LION LUMBER

- SMARTLAM NA

- HOISKO

- PEETRI PUIT OU

- B&K STRUCTURES LTD

- THEURL AUSTRIAN PREMIUM TIMBER

- IB EWP INC

- NORDIC STRUCTURES

- DR JOHNSON LUMBER COMPANY

- PFS CORPORATION

- DERIX GROUP

- URBEM

- MERCER MASS TIMBER

- ZUBLIN TIMBER

- CROSSLAM AUSTRALIA

第12章 隣接・関連市場

- イントロダクション

- 木材ラミネート用接着剤市場の抑制要因

- 木材ラミネート用接着剤市場の定義

- 木材ラミネート用接着剤市場の概要

第13章 付録

The global cross laminated timber market size is projected to grow from USD 1.4 billion in 2023 to USD 2.6 billion by 2028, at a CAGR of 13.7%, between 2023 and 2028. The cross laminated timber market is mainly characterized by two main types: adhesive bonded, and mechanically fastened. Cross laminated timber has significant use in residential and non-residential end-use industries. The demand for environment-friendly materials from the construction industry and the rising need to improve performance, durability, and aesthetics are the key factors contributing to the growth of the cross laminated timber market. The growing investment in emerging markets is expected to create growth opportunities for the market players globally, driving the demand for cross laminated timber during the forecast period. However, stringent and time-consuming regulatory policies act as a challenge for the market players.

Adhesive bonded segment is expected to account for the largest share in 2023

Cross laminated wood is creating significant disruption in the mass timber market. With its incorporation in the International Building Code, cross laminated wood is expected to disrupt the mass timber sector globally by aiding builders and architects in the building and design of taller structures. The application in the non-residential sector is expected to be critical on a global scale. The bulk of the adhesives used in cross laminated timber is PU adhesives, making it an even more enticing option because they are formaldehyde-free and have VOC content that is below legal limits. As regulatory standards tighten, demand for PU adhesive products is expected to climb.

The DACH nations (Germany (D), Austria (A), and Switzerland (CH)) have been driving forces in CLT growth, not only as originators of CLT goods but also as prominent CLT producers. Austria has seven CLT manufacturing sites, Germany has three, and Switzerland has two. Smaller manufacturing sites exist in Finland, Italy, Norway, Spain, and Sweden, and new CLT plants are being built in Finland, France, Sweden, and the United Kingdom.

Structural segment in end use is expected to account for the largest share in 2023

Prefabricated buildings or concurrently created structures can be employed in modern construction to save time. There are standards for headers above doors and window apertures when building walls. These headers support the load of the roof from the top and prevent the wall framework from drooping. Headers increase the strength and stability of constructions. As a result, the header gives an extra layer of security to structures and improves the functionality of windows and doors for extended periods of time.

North American cross laminated timber market is estimated to register one of the highest CAGR during the forecast period

The market for cross laminated timber in North America is driven by technological advancements in the construction industry. The US is projected to be the largest consumer of cross laminated timber products and accounted for the largest market share, in terms of value as well as volume, among the countries in the North American region. These companies primarily focus on new product developments to cater to the increasing demand from end users. The North American cross laminated timber market is driven by technological advancements in manufacturing and high-quality end product.

The break-up of the profile of primary participants in the cross laminated timber market:

- By Company Type: Tier 1 - 46%, Tier 2 - 43%, and Tier 3 - 27%

- By Designation: C Level - 21%, D Level - 23%, and Others - 56%

- By Region: North America - 37%, Asia Pacific- 26%, Europe - 23%, Middle East & Africa - 10%, and South America - 4%

Prominent companies includes Mayr-Melnhof Holz (Austria), Stora Enso (Finland), Binderholz GmbH (Austria), Eugen Decker Holzindustrie KG (Germany), Hasslacher Holding GmbH (Austria), Schilliger Holz AG (Switzerland), KLH Massivholz GmbH (Austria), Structurlam Mass Timber Corporation (Canada), XLam NZ Limited (New Zealand), and others.

Research Coverage:

This research report categorizes the cross laminated timber market by type (adhesive bonded, and mechanically fastened), by end use (structural, and non-structural), industry (residential and non-residential), and region (North America, Europe, Asia Pacific, the Middle East & Africa, and South America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the cross laminated timber market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product & service launches, mergers and acquisitions, and recent developments associated with the cross laminated timber market. Competitive analysis of upcoming startups in the cross laminated timber market ecosystem is covered in this report. Reasons to buy this report: The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall cross laminated timber market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report Provides insights on the following pointers:

- Analysis of key drivers (Growing demand for sustainable raw material building and construction), restraints (volatility in raw material prices), opportunity (expansion in untapped markets), and challenges (stringent regulatory policies).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the cross laminated timber market

- Market Development: Comprehensive information about lucrative markets - the report analyses the cross laminated timber market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the cross laminated timber market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Mayr-Melnhof Holz (Austria), Stora Enso (Finland), Binderholz GmbH (Austria), Eugen Decker Holzindustrie KG (Germany), Hasslacher Holding GmbH (Austria), Schilliger Holz AG (Switzerland), KLH Massivholz GmbH (Austria), Structurlam Mass Timber Corporation (Canada), XLam NZ Limited (New Zealand), and others. The report also helps stakeholders understand the pulse of the cross laminated timber market and provides them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 MARKET EXCLUSIONS

- 1.2.2 MARKET INCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 CROSS-LAMINATED TIMBER MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 CROSS-LAMINATED TIMBER MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.2.3 Primary data sources

- 2.1.2.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 5 CROSS-LAMINATED TIMBER MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: CROSS-LAMINATED TIMBER MARKET

- FIGURE 7 CROSS-LAMINATED TIMBER MARKET SIZE ESTIMATION, BY REGION

- FIGURE 8 CROSS-LAMINATED TIMBER MARKET, BY TYPE

- 2.2.3 SUPPLY-SIDE FORECAST

- FIGURE 9 CROSS-LAMINATED TIMBER MARKET: SUPPLY-SIDE FORECAST

- FIGURE 10 METHODOLOGY FOR SUPPLY-SIDE SIZING OF CROSS-LAMINATED TIMBER MARKET

- 2.2.4 FACTOR ANALYSIS

- FIGURE 11 FACTOR ANALYSIS OF CROSS-LAMINATED TIMBER MARKET

- 2.3 DATA TRIANGULATION

- FIGURE 12 CROSS-LAMINATED TIMBER MARKET: DATA TRIANGULATION

- 2.4 ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 GROWTH RATE FORECAST

3 EXECUTIVE SUMMARY

- TABLE 1 CROSS-LAMINATED MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 13 ADHESIVE BONDED TO ACCOUNT FOR LARGER SHARE OF CROSS-LAMINATED TIMBER MARKET

- FIGURE 14 NON-RESIDENTIAL INDUSTRY TO CAPTURE LARGER MARKET SHARE

- FIGURE 15 STRUCTURAL SEGMENT TO BE LARGER END USE OF CROSS-LAMINATED TIMBER

- FIGURE 16 NORTH AMERICA TO BE FASTEST-GROWING CROSS-LAMINATED TIMBER MARKET

- TABLE 2 KEY MARKET PLAYERS

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CROSS-LAMINATED TIMBER MARKET

- FIGURE 17 CROSS-LAMINATED TIMBER MARKET TO WITNESS MODERATE GROWTH DURING FORECAST PERIOD

- 4.2 CROSS-LAMINATED TIMBER MARKET GROWTH, BY TYPE

- FIGURE 18 ADHESIVE BONDED TO BE FASTER-GROWING SEGMENT BETWEEN 2023 AND 2028

- 4.3 CROSS-LAMINATED TIMBER MARKET, DEVELOPED VS. DEVELOPING ECONOMIES

- FIGURE 19 DEVELOPING ECONOMIES TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

- 4.4 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY AND COUNTRY, 2022

- FIGURE 20 RESIDENTIAL SEGMENT AND GERMANY ACCOUNTED FOR LARGEST SHARES

- 4.5 CROSS-LAMINATED TIMBER MARKET, BY COUNTRY

- FIGURE 21 CHINA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 NET-ZERO DESIGN WITH CROSS-LAMINATED TIMBER

- 5.2.1 DYNAMIC THERMAL PERFORMANCE

- 5.2.2 REDUCED THERMAL BRIDGING

- 5.2.3 INSULATION AMOUNT

- 5.2.4 AIRTIGHTNESS

- 5.3 CARBON CONTENT OF CROSS-LAMINATED TIMBER

- 5.4 CROSS-LAMINATED TIMBER LIFE CYCLE ANALYSIS

- 5.5 REDUCING CO2 EMISSIONS FROM CROSS-LAMINATED TIMBER

- 5.5.1 INTRODUCTION

- 5.5.2 LUMBER SOURCING

- 5.5.3 AIR DRY LUMBER

- 5.5.4 UPGRADE DRYING KILNS & POWER

- 5.5.5 USE INTERLOCKING CROSS-LAMINATED TIMBER

- 5.5.6 EXPOSE CROSS-LAMINATED TIMBER WOOD

- 5.5.7 DESIGN USING PRECISE PANEL SIZES

- 5.5.8 REUSE OR RECYCLE CROSS-LAMINATED TIMBER PANELS AT END-OF-LIFE

- 5.6 BENEFITS OF CROSS-LAMINATED TIMBER

- 5.6.1 FASTER CONSTRUCTION

- 5.6.2 COMPETITIVE COST

- 5.6.3 STRUCTURAL PERFORMANCE

- 5.6.4 ENERGY EFFICIENT ASSEMBLIES

- 5.6.5 LIGHTWEIGHT MATERIAL

- 5.6.6 NATURAL AESTHETIC OF WOOD

- 5.6.7 ALTERNATIVE LUMBER UTILIZATION

- 5.6.8 MAY REDUCE CO2 EMISSIONS

- 5.6.9 RENEWABLE RESOURCE

- 5.7 MARKET DYNAMICS

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CROSS-LAMINATED TIMBER MARKET

- 5.7.1 DRIVERS

- 5.7.1.1 Growth of construction industry

- 5.7.1.2 Increasing urban population

- 5.7.1.3 Rising demand from North America

- 5.7.1.4 Capacity expansion for increasing demand

- 5.7.2 RESTRAINTS

- 5.7.2.1 Impact of war between Russia and Ukraine

- 5.7.3 OPPORTUNITIES

- 5.7.3.1 Establishing authenticity through various certification

- 5.7.3.2 Attractive design due to hybrid construction enables new approach to building technology

- 5.7.3.3 Rising opportunities in timber-based construction industry

- 5.7.4 CHALLENGES

- 5.7.4.1 Long lead time by cross-laminated timber suppliers during peak season

- 5.7.4.2 Low product differentiation

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 CROSS-LAMINATED TIMBER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 PORTER'S FIVE FORCES ANALYSIS OF CROSS-LAMINATED TIMBER MARKET

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 BARGAINING POWER OF SUPPLIERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR CROSS-LAMINATED TIMBER

- TABLE 5 KEY BUYING CRITERIA FOR CROSS-LAMINATED TIMBER

- 5.10 MACRO INDICATOR ANALYSIS

- 5.10.1 INTRODUCTION

- 5.10.2 TRENDS AND FORECAST OF GDP

- TABLE 6 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE, 2020-2027

- 5.10.3 TRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

- FIGURE 26 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014-2035

- 5.11 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTH

- 5.11.1 RUSSIA-UKRAINE WAR

- 5.11.2 CHINA

- 5.11.2.1 Debt problem

- 5.11.2.2 Australia-China trade war

- 5.11.2.3 Environmental commitments

- 5.11.3 EUROPE

- 5.11.3.1 Energy crisis

- 5.12 VALUE CHAIN ANALYSIS

- FIGURE 27 CROSS-LAMINATED TIMBER MARKET: VALUE CHAIN ANALYSIS

- 5.13 PRICING ANALYSIS

- FIGURE 28 AVERAGE PRICE COMPETITIVENESS IN CROSS-LAMINATED TIMBER MARKET, BY REGION, 2022

- FIGURE 29 AVERAGE PRICE COMPETITIVENESS IN CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2022

- FIGURE 30 AVERAGE PRICE COMPETITIVENESS IN CROSS-LAMINATED TIMBER MARKET, BY COMPANY, 2022

- 5.14 CROSS-LAMINATED TIMBER ECOSYSTEM AND INTERCONNECTED MARKET

- TABLE 7 CROSS-LAMINATED TIMBER MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 31 CROSS-LAMINATED TIMBER ECOSYSTEM

- 5.15 YC AND YCC SHIFT

- FIGURE 32 CROSS-LAMINATED TIMBER MARKET: YC AND YCC SHIFT

- 5.16 TRADE ANALYSIS

- TABLE 8 COUNTRY-WISE EXPORT DATA, 2020-2022 (USD THOUSAND)

- TABLE 9 COUNTRY-WISE IMPORT DATA, 2020-2022 (USD THOUSAND)

- 5.17 PATENT ANALYSIS

- 5.17.1 METHODOLOGY

- 5.17.2 PUBLICATION TRENDS

- FIGURE 33 NUMBER OF PATENTS PUBLISHED, 2017-2022

- 5.17.3 TOP JURISDICTION

- FIGURE 34 PATENTS PUBLISHED BY JURISDICTION, 2017-2022

- 5.17.4 TOP APPLICANTS

- FIGURE 35 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2017-2022

- TABLE 10 PATENT COUNT, BY COMPANY

- 5.18 CASE STUDY ANALYSIS

- 5.18.1 CASE STUDY 1

- 5.18.2 CASE STUDY 2

- 5.18.3 CASE STUDY 3

- 5.19 TECHNOLOGY ANALYSIS

- 5.20 KEY CONFERENCES AND EVENTS IN 2023

- TABLE 11 CROSS-LAMINATED TIMBER MARKET: KEY CONFERENCES AND EVENTS

- 5.21 TARIFF AND REGULATORY LANDSCAPE

- 5.21.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 CROSS-LAMINATED TIMBER MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 36 ADHESIVE BONDED SEGMENT TO DOMINATE OVERALL CROSS-LAMINATED TIMBER MARKET BETWEEN 2023 AND 2028

- TABLE 14 CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 15 CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 16 CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 17 CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2023-2028 (THOUSAND CUBIC METER)

- 6.2 ADHESIVE BONDED

- 6.2.1 SUPERIOR PROPERTIES AND LOW PRODUCTION COST

- 6.2.2 POLYURETHANE (PUR)

- 6.2.3 MELAMINE-UREA-FORMALDEHYDE (MUF)

- TABLE 18 ADHESIVE BONDED: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 19 ADHESIVE BONDED: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 20 ADHESIVE BONDED: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 21 ADHESIVE BONDED: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (THOUSAND CUBIC METER)

- 6.3 MECHANICALLY FASTENED

- 6.3.1 ENHANCED STRENGTH AND STABILITY OF STRUCTURES

- 6.3.2 SELF-TAPPING SCREWS (STS)

- 6.3.3 DOWEL-TYPE FASTENERS

- TABLE 22 MECHANICALLY FASTENED: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 23 MECHANICALLY FASTENED: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 24 MECHANICALLY FASTENED: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 25 MECHANICALLY FASTENED: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (THOUSAND CUBIC METER)

7 CROSS-LAMINATED TIMBER MARKET, BY END USE

- 7.1 INTRODUCTION

- FIGURE 37 STRUCTURAL SEGMENT TO DOMINATE OVERALL CROSS-LAMINATED TIMBER MARKET BETWEEN 2023 AND 2028

- TABLE 26 CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2022 (USD MILLION)

- TABLE 27 CROSS-LAMINATED TIMBER MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 28 CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 29 CROSS-LAMINATED TIMBER MARKET, BY END USE, 2023-2028 (THOUSAND CUBIC METER)

- 7.2 STRUCTURAL

- 7.2.1 HIGH DEMAND IN STRUCTURAL END-USE SEGMENT

- TABLE 30 STRUCTURAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 31 STRUCTURAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 32 STRUCTURAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 33 STRUCTURAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (THOUSAND CUBIC METER)

- 7.3 NON-STRUCTURAL

- 7.3.1 USED AS SUBSTITUTES FOR BOLTED MATS

- TABLE 34 NON-STRUCTURAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 35 NON-STRUCTURAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 36 NON-STRUCTURAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 37 NON-STRUCTURAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (THOUSAND CUBIC METER)

8 CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 38 NON-RESIDENTIAL SEGMENT TO LEAD OVERALL CROSS-LAMINATED TIMBER MARKET BETWEEN 2023 AND 2028

- TABLE 38 CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 39 CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 40 CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 41 CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2023-2028 (THOUSAND CUBIC METER)

- 8.2 RESIDENTIAL

- 8.2.1 EVOLUTION OF BUILDING CODES OFFERS OPPORTUNITIES FOR CROSS-LAMINATED TIMBER MARKET

- TABLE 42 RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 43 RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 44 RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 45 RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (THOUSAND CUBIC METER)

- 8.3 NON-RESIDENTIAL

- 8.3.1 OPPORTUNITIES OFFERED FOR MASS CONSTRUCTION OF TIMBER BUILDINGS

- 8.3.2 PUBLIC

- 8.3.3 INDUSTRIAL

- 8.3.4 OTHERS

- TABLE 46 NON-RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 47 NON-RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 48 NON-RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 49 NON-RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (THOUSAND CUBIC METER)

- TABLE 50 NON-RESIDENTIAL (PUBLIC): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 51 NON-RESIDENTIAL (PUBLIC): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 52 NON-RESIDENTIAL (PUBLIC): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 53 NON-RESIDENTIAL (PUBLIC): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (THOUSAND CUBIC METER)

- TABLE 54 NON-RESIDENTIAL (INDUSTRIAL): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 55 NON-RESIDENTIAL (INDUSTRIAL): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 56 NON-RESIDENTIAL (INDUSTRIAL): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 57 NON-RESIDENTIAL (INDUSTRIAL): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (THOUSAND CUBIC METER)

- TABLE 58 NON-RESIDENTIAL (OTHERS): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 59 NON-RESIDENTIAL (OTHERS): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 60 NON-RESIDENTIAL (OTHERS): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 61 NON-RESIDENTIAL (OTHERS): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (THOUSAND CUBIC METER)

9 CROSS-LAMINATED TIMBER MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 39 NORTH AMERICAN REGION EMERGING AS STRATEGIC LOCATION FOR CROSS-LAMINATED TIMBER MARKET

- TABLE 62 CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 63 CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 64 CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 65 CROSS-LAMINATED TIMBER MARKET, BY REGION, 2023-2028 (THOUSAND CUBIC METER)

- 9.2 EUROPE

- 9.2.1 IMPACT OF RECESSION ON EUROPE

- FIGURE 40 EUROPE: CROSS-LAMINATED TIMBER MARKET SNAPSHOT

- TABLE 66 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 67 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 68 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 69 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2023-2028 (THOUSAND CUBIC METER)

- TABLE 70 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 71 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 72 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 73 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2023-2028 (THOUSAND CUBIC METER)

- TABLE 74 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2022 (USD MILLION)

- TABLE 75 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 76 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 77 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2023-2028 (THOUSAND CUBIC METER)

- TABLE 78 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 79 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 80 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 81 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2023-2028 (THOUSAND CUBIC METER)

- 9.2.2 GERMANY

- 9.2.2.1 Presence of major distribution channels to increase demand

- 9.2.3 AUSTRIA

- 9.2.3.1 Investments and government approach toward sustainability to drive market

- 9.2.4 ITALY

- 9.2.4.1 High disposable income and rising FII investments

- 9.2.5 CZECH REPUBLIC

- 9.2.5.1 Emerging market and rising development to propel demand

- 9.2.6 FRANCE

- 9.2.6.1 Government initiatives and enhanced technology in building & construction industry to drive market

- 9.2.7 SWEDEN

- 9.2.7.1 Residential market in Sweden driving demand for cross-laminated timber

- 9.2.8 SWITZERLAND

- 9.2.8.1 Domestic demand for Swiss construction to drive growth

- 9.2.9 UK

- 9.2.9.1 BREXIT to hamper industry growth in short term

- 9.2.10 SLOVAKIA

- 9.2.10.1 Increase in housing units boosts demand for cross-laminated timber

- 9.2.11 REST OF EUROPE

- 9.3 NORTH AMERICA

- 9.3.1 IMPACT OF RECESSION ON NORTH AMERICA

- FIGURE 41 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET SNAPSHOT

- TABLE 82 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 85 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2023-2028 (THOUSAND CUBIC METER)

- TABLE 86 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 89 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2023-2028 (THOUSAND CUBIC METER)

- TABLE 90 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 93 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2023-2028 (THOUSAND CUBIC METER)

- TABLE 94 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 97 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2023-2028 (THOUSAND CUBIC METER)

- 9.3.2 US

- 9.3.2.1 Growing sustainable material usage in construction industry to boost market

- 9.3.3 CANADA

- 9.3.3.1 Government investments in building & construction sector to propel market

- 9.4 ASIA PACIFIC

- 9.4.1 IMPACT OF RECESSION ON ASIA PACIFIC

- FIGURE 42 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET SNAPSHOT

- TABLE 98 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 101 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2023-2028 (THOUSAND CUBIC METER)

- TABLE 102 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 105 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2023-2028 (THOUSAND CUBIC METER)

- TABLE 106 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2022 (USD MILLION)

- TABLE 107 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 109 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2023-2028 (THOUSAND CUBIC METER)

- TABLE 110 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 113 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2023-2028 (THOUSAND CUBIC METER)

- 9.4.2 CHINA

- 9.4.2.1 Large investments by global manufacturers to boost market

- 9.4.3 JAPAN

- 9.4.3.1 Investments in infrastructural markets by public and private sectors to boost demand

- 9.4.4 AUSTRALIA AND NEW ZEALAND

- 9.4.4.1 Technology-driven economy to drive market

- 9.4.5 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD

- 9.5.1 IMPACT OF RECESSION ON REST OF THE WORLD

- FIGURE 43 BRAZIL TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- TABLE 114 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 115 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 116 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 117 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2023-2028 (THOUSAND CUBIC METER)

- TABLE 118 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 119 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 120 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 121 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2023-2028 (THOUSAND CUBIC METER)

- TABLE 122 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2022 (USD MILLION)

- TABLE 123 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 124 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 125 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2023-2028 (THOUSAND CUBIC METER)

- TABLE 126 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 127 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 128 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2022 (THOUSAND CUBIC METER)

- TABLE 129 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2023-2028 (THOUSAND CUBIC METER)

- 9.5.2 BRAZIL

- 9.5.2.1 Expansion of production capacity and established distribution channels to propel market

- 9.5.3 ARGENTINA

- 9.5.3.1 Government initiatives to boost demand

- 9.5.4 OTHER COUNTRIES

- 9.5.4.1 UAE

- 9.5.4.2 Saudi Arabia

- 9.5.4.3 South Africa

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- TABLE 130 OVERVIEW OF STRATEGIES ADOPTED BY KEY CROSS-LAMINATED TIMBER MARKET PLAYERS (2017-2023)

- 10.2 COMPETITIVE LEADERSHIP MAPPING, 2022

- 10.2.1 STARS

- 10.2.2 EMERGING LEADERS

- 10.2.3 PARTICIPANTS

- 10.2.4 PERVASIVE PLAYERS

- FIGURE 44 CROSS-LAMINATED TIMBER MARKET: COMPETITIVE LEADERSHIP MAPPING, 2022

- 10.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) MATRIX, 2022

- 10.3.1 RESPONSIVE COMPANIES

- 10.3.2 PROGRESSIVE COMPANIES

- 10.3.3 STARTING BLOCKS

- 10.3.4 DYNAMIC COMPANIES

- FIGURE 45 CROSS-LAMINATED TIMBER MARKET: EMERGING COMPANIES' (SMES') COMPETITIVE LEADERSHIP MAPPING, 2022

- 10.4 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 46 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN CROSS-LAMINATED TIMBER MARKET

- 10.5 COMPETITIVE BENCHMARKING

- TABLE 131 CROSS-LAMINATED TIMBER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 132 CROSS-LAMINATED TIMBER MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- TABLE 133 COMPANY EVALUATION MATRIX: CROSS-LAMINATED TIMBER

- 10.6 MARKET SHARE ANALYSIS

- FIGURE 47 MARKET SHARE, BY KEY PLAYER (2022)

- 10.7 MARKET RANKING ANALYSIS

- FIGURE 48 MARKET RANKING ANALYSIS, 2022

- 10.8 REVENUE ANALYSIS

- FIGURE 49 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2017-2021

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 MARKET EVALUATION FRAMEWORK

- TABLE 134 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 135 HIGHEST ADOPTED STRATEGIES

- TABLE 136 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- 10.9.2 MARKET EVALUATION MATRIX

- TABLE 137 COMPANY INDUSTRY FOOTPRINT

- TABLE 138 COMPANY REGION FOOTPRINT

- TABLE 139 COMPANY FOOTPRINT

- 10.10 STRATEGIC DEVELOPMENTS

- TABLE 140 CROSS-LAMINATED TIMBER MARKET: DEALS, 2017-2023

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- (Business overview, Products offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats)**

- 11.1.1 MAYR-MELNHOF HOLZ

- TABLE 141 MAYR-MELNHOF HOLZ: COMPANY OVERVIEW

- FIGURE 50 MAYR-MELNHOF HOLZ: COMPANY SNAPSHOT

- TABLE 142 MAYR-MELNHOF HOLZ: DEALS

- 11.1.2 STORA ENSO

- TABLE 143 STORA ENSO: COMPANY OVERVIEW

- FIGURE 51 STORA ENSO: COMPANY SNAPSHOT

- TABLE 144 STORA ENSO: DEALS

- 11.1.3 BINDERHOLZ GMBH

- TABLE 145 BINDERHOLZ GMBH: COMPANY OVERVIEW

- 11.1.4 EUGEN DECKER HOLZINDUSTRIE KG

- TABLE 146 EUGEN DECKER HOLZINDUSTRIE KG: COMPANY OVERVIEW

- 11.1.5 HASSLACHER HOLDING GMBH

- TABLE 147 HASSLACHER HOLDING GMBH: COMPANY OVERVIEW

- 11.1.6 SCHILLIGER HOLZ AG

- TABLE 148 SCHILLIGER HOLZ AG: COMPANY OVERVIEW

- 11.1.7 KLH MASSIVHOLZ GMBH

- TABLE 149 KLH MASSIVHOLZ GMBH: COMPANY OVERVIEW

- 11.1.8 STRUCTURLAM MASS TIMBER CORPORATION

- TABLE 150 STRUCTURLAM MASS TIMBER CORPORATION: COMPANY OVERVIEW

- TABLE 151 STRUCTURLAM: OTHERS

- 11.1.9 XLAM NZ LIMITED

- TABLE 152 XLAM NZ LIMITED: COMPANY OVERVIEW

- 11.1.10 PFEIFER HOLDING GMBH

- TABLE 153 PFEIFER HOLDING GMBH: COMPANY OVERVIEW

- 11.2 OTHER COMPANIES

- 11.2.1 LION LUMBER

- TABLE 154 LION LUMBER: COMPANY OVERVIEW

- 11.2.2 SMARTLAM NA

- TABLE 155 SMARTLAM NA: COMPANY OVERVIEW

- 11.2.3 HOISKO

- TABLE 156 HOISKO: COMPANY OVERVIEW

- 11.2.4 PEETRI PUIT OU

- TABLE 157 PEETRI PUIT OU: COMPANY OVERVIEW

- 11.2.5 B&K STRUCTURES LTD

- TABLE 158 B&K STRUCTURES LTD: COMPANY OVERVIEW

- 11.2.6 THEURL AUSTRIAN PREMIUM TIMBER

- TABLE 159 THEURL AUSTRIAN PREMIUM TIMBER: COMPANY OVERVIEW

- 11.2.7 IB EWP INC

- TABLE 160 IB EWP INC: COMPANY OVERVIEW

- 11.2.8 NORDIC STRUCTURES

- TABLE 161 NORDIC STRUCTURES: COMPANY OVERVIEW

- 11.2.9 DR JOHNSON LUMBER COMPANY

- TABLE 162 DR JOHNSON LUMBER COMPANY: COMPANY OVERVIEW

- 11.2.10 PFS CORPORATION

- TABLE 163 PFS CORPORATION: COMPANY OVERVIEW

- 11.2.11 DERIX GROUP

- TABLE 164 DERIX GROUP: COMPANY OVERVIEW

- 11.2.12 URBEM

- TABLE 165 URBEM: COMPANY OVERVIEW

- 11.2.13 MERCER MASS TIMBER

- TABLE 166 MERCER MASS TIMBER: COMPANY OVERVIEW

- 11.2.14 ZUBLIN TIMBER

- TABLE 167 ZUBLIN TIMBER: COMPANY OVERVIEW

- 11.2.15 CROSSLAM AUSTRALIA

- TABLE 168 CROSSLAM AUSTRALIA: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 TIMBER LAMINATING ADHESIVES MARKET LIMITATIONS

- 12.3 TIMBER LAMINATING ADHESIVES MARKET DEFINITION

- 12.4 TIMBER LAMINATING ADHESIVES MARKET OVERVIEW

- 12.4.1 TIMBER LAMINATING ADHESIVES MARKET ANALYSIS, BY RESIN TYPE

- TABLE 169 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2026 (USD MILLION)

- TABLE 170 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019-2026 (KILOTON)

- 12.4.2 TIMBER LAMINATING ADHESIVES MARKET ANALYSIS, BY APPLICATION

- TABLE 171 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

- TABLE 172 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019-2026 (KILOTON)

- 12.4.3 TIMBER LAMINATING ADHESIVES MARKET ANALYSIS, BY END USE

- TABLE 173 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019-2026 (USD MILLION)

- TABLE 174 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019-2026 (KILOTON)

- 12.4.4 TIMBER LAMINATING ADHESIVES MARKET ANALYSIS, BY REGION

- TABLE 175 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

- TABLE 176 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS