|

|

市場調査レポート

商品コード

1280708

タンジェンシャルフロー濾過の世界市場:製品別 (システム、メンブレンフィルター)・材料別 (PES、PVDF、PTFE)・技術別 (限外濾過、精密濾過)・用途別 (最終製品加工、細胞分離)・エンドユーザー別・地域別の将来予測 (2028年まで)Tangential Flow Filtration Market by Product (Systems, Membrane Filters), Material (PES, PVDF, PTFE), Technique (Ultrafiltration, Microfiltration), Application (Final Product Processing,Cell Separation), End User, Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| タンジェンシャルフロー濾過の世界市場:製品別 (システム、メンブレンフィルター)・材料別 (PES、PVDF、PTFE)・技術別 (限外濾過、精密濾過)・用途別 (最終製品加工、細胞分離)・エンドユーザー別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年05月23日

発行: MarketsandMarkets

ページ情報: 英文 343 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

タンジェンシャルフロー濾過の世界市場は、2023年の19億米ドルから2028年には36億米ドルになると予測され、予測期間中のCAGRは13.5%に達するとされています。

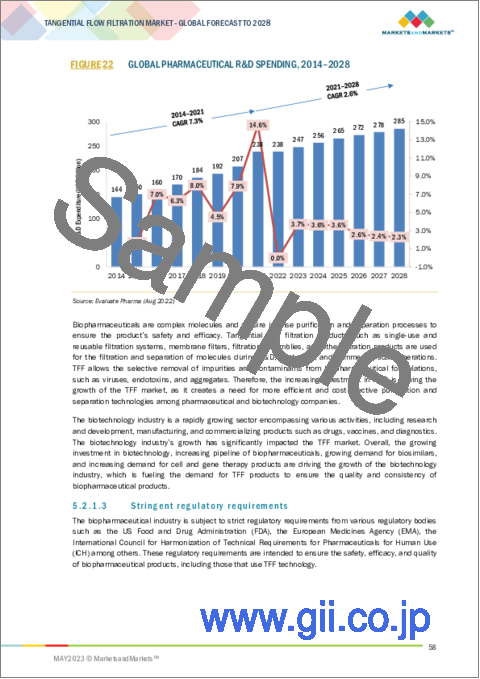

シングルユース技術の採用の増加、製薬・バイオテクノロジー企業の研究開発費の増加などの要因が、市場成長を後押ししています。

"2022年には、システム分野が最大のシェアを占める"

製品別に見ると、2022年にはシステム分野が最大のシェアを占め、2023年~2028年の間に最も高いCAGRで成長すると予測されています。タンジェンシャル濾過システムは、自動濾過システムと機械濾過システムで構成されています。これらのシステムは、最大限の運用信頼性を提供します。これらのシステムに関連する利点には、高い保持率、少ないエネルギー消費、低コスト、交差汚染のリスクの低減などがあります。このようなシステムの助けを借りて、製薬企業は最高品質の製品を実現することができます。システムセグメントは、さらに使い捨て型システムと再利用型システムに区分されます。使い捨て型システムは、分離・精製用途で重要性を増しています。研究開発技術の発展や、濾過プロセスにおけるより高い特異性への要求の高まりにより、多くの小規模なバイオ医薬品プロセスで使い捨て型技術の採用が進んでいます。これらすべての要因が、システム分野の成長を後押ししています。

"2022年には、精密濾過技術が技術別で最大の市場シェアを占めた"

技術別に見ると、2022年の市場シェアは、精密濾過分野が最も高くなっています。精密濾過は、0.1ミクロンから1ミクロンの範囲の粒子を濾過します。タンジェンシャルフロー濾過用の精密フィルターは、0.1、0.2、0.45、0.65ミクロンの孔径で提供されています。100kPaから400kPaの圧力をかけて分子を濾過します。この技術で使用されるフィルターは、水中配置または圧力容器配置にすることができ、中空糸、平板、管状、またはスパイラルフィルターのいずれかにすることができます。この技術で使用されるフィルターは、水中構成または圧力容器構成にすることができ、それらは中空繊維、フラット、シート、チューブ、またはスパイラルにすることができます。

"2022年には、最終製品加工が最大の市場シェアを占めた"

用途別では、2022年に最終製品加工分野が最大のシェアを占めています。最終製品加工は、タンジェンシャルフロー濾過市場で最大かつ急成長しているアプリケーションセグメントを形成しています。最終製品加工には、人間の薬として使用される化学的または生物学的組成物の製造、抽出、精製、および包装が含まれます。米国FDAによるCGMPガイドラインによると、最終製品加工は医薬品製造の重要な部分であるため、規制ガイドラインは非常に厳しいものとなっています。そのため、優れた品質のフィルターを使用することが求められ、最終製品処理の市場は絶えず拡大しています。TFFの最終製品処理工程は、高品質の生物製剤を製造するために重要です。

世界のタンジェンシャルフロー濾過市場の主要企業として、Merck KGaA (ドイツ)、Danaher Corporation (米国)、Sartorius AG (ドイツ)、Parker Hannifin Corporation (米国)、Repligen Corporation (米国)、Alfa Laval Corporate AB (スウェーデン)、Andritz (オーストリア)、Meissner Filtration Products, Inc. (米国)、Antylia Scientific (米国)、Donaldson Company, Inc. (米国)、Koch Separation Solutions (米国)、Sterlitech Corporation (米国)、Sinder Filtration, Inc (米国)、PendoTECH LLC (米国)、Microfilt India Pvt. (インド)、BIONET (スペイン)、Sysbiotech GmbH (オーストリア)、Hangzhou Cobetter Filtration Equipment (中国)、FORMULATRIX, Inc (米国)、Mantec Technical Ceramics (英国)、Smartflow Technologies, Inc (米国)、Tami Industries (フランス)、SPF Technologies (米国)、NovaSep (フランス)、ABEC, Inc (米国) などが挙げられます。

"アジア太平洋"です:タンジェンシャルフローフィルトレーション市場で最も成長著しい地域"

アジア太平洋市場は、2023年から2028年の間に最も高いCAGRを記録すると予想されています。競合要因としては、複雑で多様な規制状況や、国ごとに異なる製薬産業インフラが各国のイノベーションに影響を与え、高い競争力を伴う独自の業界情勢が挙げられます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- ポーターのファイブフォース分析

- 技術分析

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 特許分析

- 主要な会議とイベント (2023年~2024年)

- 規制分析

- 主要な利害関係者と購入基準

第6章 タンジェンシャルフロー濾過市場:製品別

- イントロダクション

- システム

- 使い捨て型システム

- 再利用型システム

- メンブレンフィルター

- カセット

- カプセル・カートリッジ

- その他の製品

第7章 タンジェンシャルフロー濾過市場:膜材料別

- イントロダクション

- PES

- 再生セルロース

- PVDF

- PTFE

- MCE・CA

- ナイロン

- PCTE

- その他の膜材料

第8章 タンジェンシャルフロー濾過市場:技術別

- イントロダクション

- 精密濾過

- 限外濾過

- ナノ濾過

- その他の技術

第9章 タンジェンシャルフロー濾過市場:用途別

- イントロダクション

- 最終製品加工

- APIの濾過

- タンパク質の精製

- ワクチンと抗体の処理

- 配合・充填ソリューション

- ウイルス除去

- 原料濾過

- 濾材・バッファーの濾過

- 前濾過

- バイオバーデン試験

- 細胞分離

- 水質浄化

- カスタマイズ:生物製剤のタンジェンシャルフロー濾過市場

第10章 タンジェンシャルフロー濾過市場:エンドユーザー別

- イントロダクション

- 製薬・バイオテクノロジー企業

- CMO (医薬品製造業務受託機関)・CRO (医薬品開発業務受託機関)

- 学術機関・研究機関

第11章 地域別のタンジェンシャルフロー濾過市場

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他のアジア太平洋

- ラテンアメリカ

- ブラジル

- その他のラテンアメリカ

- 中東・アフリカ

第12章 競合情勢

- イントロダクション

- 主要企業が採用した市場獲得アプローチ

- 収益シェア分析

- 市場シェア分析

- 企業評価クアドラント (2022年)

- 上位25社の競合ベンチマーキング

- 新興企業/中小企業向けの企業評価クアドラント (2022年)

- 新興企業/中小企業の競合ベンチマーキング

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- DANAHER CORPORATION

- MERCK KGAA

- SARTORIUS AG

- REPLIGEN CORPORATION

- PARKER HANNIFIN CORPORATION

- ALFA LAVAL CORPORATE AB

- ANDRITZ

- MEISSNER FILTRATION PRODUCTS, INC.

- ANTYLIA SCIENTIFIC

- SOLARIS BIOTECHNOLOGY SRL (DONALDSON COMPANY)

- KOCH SEPARATION SOLUTIONS, INC.

- STERLITECH CORPORATION

- その他の企業

- SYNDER FILTRATION, INC.

- NOVASEP

- ABEC, INC.

- PENDOTECH

- MICROFILT INDIA PVT. LTD.

- BIONET

- SYSBIOTECH GMBH

- HANGZHOU COBETTER FILTRATION EQUIPMENT CO., LTD.

- FORMULATRIX, INC.

- MANTEC TECHNICAL CERAMICS LTD.

- SMARTFLOW TECHNOLOGIES, INC.

- TAMI INDUSTRIES

- SPF TECHNOLOGIES LLC

第14章 付録

The global tangential flow filtration market is projected to USD 3.6 billion by 2028 from USD 1.9 billion in 2023, at a CAGR of 13.5% during the forecast period. Factors such as, increasing adoption of single-use technologies, and growing R&D spending in pharma-biotech companies are driving the market growth.

"In 2022 the systems segment accounted for the largest share of the tangential flow market"

The tangential flow filtration market is segmented into systems, membrane filters, and other tff products, on the basis of products. In 2022, the systems segment dominated the market with the largest share and is anticipated to grow at the highest CAGR during 2023-2028. Tangential filtration systems consist of automated and mechanical filtration systems. These systems provide maximum operational reliability. Some of the benefits associated with these systems include a high retention rate, less consumption of energy, low cost, and reduced cross-contamination risk. With the help of such systems, pharmaceutical companies can achieve the highest quality products. The systems segment is further segmented into single-use and reusable systems. Single-use systems are gaining importance in separation and purification applications. Developments in research techniques and increased demand for more specificity in the filtration process are increasing the adoption of single-use technologies in many small-scale biopharmaceutical processes. All the factors are driving the growth for the systems segment.

"The microfiltration techniques dominated the market the largest t share of the technique segment in 2022"

On the basis of technique, the tangential flow filtration market is segmented into microfiltration, ultrafiltration, nanofiltration, and other techniques. The microfiltration segment dominated the market with highest market share in 2022. Microfiltration involves the filtration of particles in the range of 0.1 microns to 1 micron. Microfilters for tangential flow filtration are available in pore sizes of 0.1, 0.2, 0.45, and 0.65 microns. Molecules are filtered by applying a pressure of 100 kPa to 400 kPa. The filters used in this technique can be in a submerged configuration or a pressure vessel configuration; they can either be hollow fibers or flat, tubular, or spiral filters. The filters used in this technique can be in a submerged configuration or a pressure vessel configuration; they can be hollow fibers, flat, sheet, tubular, or spiral.

"The final product processing application accounted for the largest market share of this market in 2022"

Based on application, the tangential flow filtration market is segmented into final product processing, raw material filtration, cell separation, and water purification. In 2022, the final product processing segment accounted for the largest share of the global tangential flow filtration market. Final product processing forms the largest and fastest-growing application segment in the tangential flow filtration market. Final product processing includes the manufacturing, extraction, purification, and packaging of chemical or biological composition to be used as medications in humans. The final product processing segment is further divided into active pharmaceutical ingredient (API) filtration, protein purification, vaccine and antibody processing, formulation and filling solutions, and viral clearance, based on the desired final product. According to the CGMP guidelines by the US FDA, final product processing is a crucial part of the manufacturing of drugs, and thus the regulatory guidelines are very stringent. This creates a demand for using superior quality filters, and thus the market is constantly growing for final product processing. The final product processing steps in TFF are critical to produce high-quality biologics.

Merck KGaA (Germany), Danaher Corporation (US), Sartorius AG (Germany), Parker Hannifin Corporation (US), Repligen Corporation (US), Alfa Laval Corporate AB (Sweden), Andritz (Austria), Meissner Filtration Products, Inc. (US), Antylia Scientific (US), Donaldson Company, Inc. (US), Koch Separation Solutions (US), Sterlitech Corporation (US), Synder Filtration, Inc (US), PendoTECH LLC (US), Microfilt India Pvt. Ltd. (India), BIONET (Spain), Sysbiotech GmbH (Austria), Hangzhou Cobetter Filtration Equipment (China), FORMULATRIX, Inc (US), Mantec Technical Ceramics (UK), Smartflow Technologies, Inc. (US), Tami Industries (France), SPF Technologies (US), NovaSep (France), and ABEC, Inc. (US) are some of the major players operating in the market.

"Asia Pacific: The fastest-growing region in the tangential flow filtration market"

The tangential flow filtration market is divided into five regions including, North America, Europe, Asia Pacific, Latin America and Middle East and Africa. The Asia Pacific market is expected to register the highest CAGR during 2023-2028. Factors responsiblr for the growth includes, unique industry dynamics accompanied by a highly competitive landscape owing to its complex and diverse regulatory landscape and varying pharma industry infrastructures across each country, impacting innovation in each country.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side- 80% and Demand Side - 20%

- By Designation: Managers- 45%, CXOs and Director level - 30%, and Executives - 25%

- By Region: North America -20%, Asia-Pacific -10%, Europe-55%, Latin america- 10%, Middle east and Africa-5%

List of Companies Profiled in the Report:

- Merck KGaA (Germany)

- Danaher Corporation (US)

- Sartorius AG (Germany)

- Parker Hannifin Corporation (US)

- Repligen Corporation (US)

- Alfa Laval Corporate AB (Sweden)

- Andritz (Austria)

- Meissner Filtration Products, Inc. (US)

- Antylia Scientific (US)

- Donaldson Company, Inc. (US)

- Koch Separation Solutions (US)

- Sterlitech Corporation (US)

- Synder Filtration, Inc (US)

- PendoTECH LLC (US)

- Microfilt India Pvt. Ltd. (India)

- BIONET (Spain)

- Sysbiotech GmbH (Austria)

- Hangzhou Cobetter Filtration Equipment (China)

- FORMULATRIX, Inc (US)

- Mantec Technical Ceramics (UK)

- Smartflow Technologies, Inc. (US)

- Tami Industries (France)

- SPF Technologies (US)

- NovaSep (France)

- ABEC, Inc. (US)

Research Coverage:

- The report analyzes the TFF market and aims at estimating the market size and future growth potential. The report also includes an in-depth competitive analysis of the key players in this market, along with their company profiles, product offerings, and recent developments.

Reasons to Buy the Report

- The report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to garner a more significant share. Firms purchasing the report could use one, or a combination of the below mentioned five strategies for strengthening their market presence.

The report provides insights on the following pointers:

- Analysis of key drivers (Technological advancements in TFF systems, Rising R&D spending and growing pharmaceutical & biotechnology industries, and stringent regulatory requirements), restraints (High capital investments to limit the entry of small players, competition from alternative technologies), opportunities (Emerging economoies, increasing demand for biologics), and challenges (Complexities introduced by excipient-protein interaction) influencing the growth of the TFF Market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the TFF Market

- Market Development: Comprehensive information about lucrative markets - the report analyses the TFF Market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the TFF market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Merck KGaA (Germany), Danaher Corporation (US), Sartorius AG (Germany), Parker Hannifin Corporation (US), Repligen Corporation (US), Alfa Laval Corporate AB (Sweden), Andritz (Austria), Meissner Filtration Products, Inc. (US), Antylia Scientific (US), Donaldson Company, Inc. (US), Koch Separation Solutions (US), Sterlitech Corporation (US), Synder Filtration, Inc (US), PendoTECH LLC (US), Microfilt India Pvt. Ltd. (India), BIONET (Spain), Sysbiotech GmbH (Austria), Hangzhou Cobetter Filtration Equipment (China), FORMULATRIX, Inc (US), Mantec Technical Ceramics (UK), Smartflow Technologies, Inc. (US), Tami Industries (France), SPF Technologies (US), NovaSep (France), and ABEC, Inc. (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 TANGENTIAL FLOW FILTRATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY RESEARCH

- 2.1.2 PRIMARY RESEARCH

- FIGURE 2 TANGENTIAL FLOW FILTRATION MARKET: BREAKDOWN OF PRIMARIES

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 TANGENTIAL FLOW FILTRATION MARKET SIZE ESTIMATION (SUPPLY-SIDE ANALYSIS), 2022

- FIGURE 4 MARKET SIZE ESTIMATION: APPROACH 1 - REVENUE SHARE ANALYSIS (2022)

- FIGURE 5 ILLUSTRATIVE EXAMPLE OF MERCK KGAA: REVENUE SHARE ANALYSIS (2022)

- FIGURE 6 KEY INDUSTRY INSIGHTS

- 2.3 GROWTH FORECAST

- FIGURE 7 TANGENTIAL FLOW FILTRATION MARKET: CAGR PROJECTIONS, 2023-2028

- FIGURE 8 TANGENTIAL FLOW FILTRATION MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RECESSION IMPACT ANALYSIS

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2021-2027 (% GROWTH)

- TABLE 2 US HEALTH EXPENDITURE, 2019-2022 (USD MILLION)

- TABLE 3 US HEALTH EXPENDITURE, 2023-2027 (USD MILLION)

3 EXECUTIVE SUMMARY

- FIGURE 10 TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 TANGENTIAL FLOW FILTRATION MARKET: GEOGRAPHICAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 TANGENTIAL FLOW FILTRATION MARKET OVERVIEW

- FIGURE 16 RISING R&D SPENDING IN PHARMACEUTICAL & BIOTECHNOLOGY INDUSTRIES TO DRIVE MARKET GROWTH

- 4.2 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT AND COUNTRY (2022)

- FIGURE 17 SINGLE-USE SYSTEMS TO DOMINATE NORTH AMERICAN TANGENTIAL FLOW FILTRATION MARKET IN 2022

- 4.3 TANGENTIAL FLOW FILTRATION MARKET SHARE, BY APPLICATION, 2023 VS. 2028

- FIGURE 18 FINAL PRODUCT PROCESSING SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- 4.4 TANGENTIAL FLOW FILTRATION MARKET SHARE, BY TECHNIQUE, 2022

- FIGURE 19 MICROFILTRATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- 4.5 TANGENTIAL FLOW FILTRATION MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 20 ASIA PACIFIC COUNTRIES TO REGISTER HIGH GROWTH FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 TANGENTIAL FLOW FILTRATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- TABLE 4 TANGENTIAL FLOW FILTRATION MARKET: IMPACT ANALYSIS

- 5.2.1 DRIVERS

- 5.2.1.1 Technological advancements in TFF systems

- 5.2.1.2 Rising R&D spending and growing pharmaceutical & biotechnology industries

- FIGURE 22 GLOBAL PHARMACEUTICAL R&D SPENDING, 2014-2028

- 5.2.1.3 Stringent regulatory requirements

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital investments to limit entry of small players

- 5.2.2.2 Competition from alternative technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging economies

- 5.2.3.2 Increasing demand for biologics

- 5.2.3.3 Increasing focus on developing and manufacturing gene therapies

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities introduced by excipient-protein interaction

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 REVENUE SHIFT AND NEW POCKETS FOR TANGENTIAL FLOW FILTRATION PRODUCT PROVIDERS

- 5.4 PRICING ANALYSIS

- TABLE 5 AVERAGE PRICE OF TFF PRODUCTS, BY KEY PLAYERS (USD)

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 TANGENTIAL FLOW FILTRATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 BARGAINING POWER OF SUPPLIERS

- 5.5.5 DEGREE OF COMPETITION

- 5.6 TECHNOLOGY ANALYSIS

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 24 TANGENTIAL FLOW FILTRATION MARKET: VALUE CHAIN ANALYSIS

- 5.8 SUPPLY CHAIN ANALYSIS

- FIGURE 25 TANGENTIAL FLOW FILTRATION MARKET: SUPPLY CHAIN ANALYSIS

- 5.9 ECOSYSTEM ANALYSIS

- TABLE 7 TANGENTIAL FLOW FILTRATION MARKET ECOSYSTEM

- 5.10 PATENT ANALYSIS

- FIGURE 26 TANGENTIAL FLOW FILTRATION MARKET: PATENT APPLICATIONS, JANUARY 2013-APRIL 2023

- TABLE 8 TANGENTIAL FLOW FILTRATION MARKET: INDICATIVE LIST OF PATENTS

- 5.11 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 9 TANGENTIAL FLOW FILTRATION MARKET: LIST OF CONFERENCES AND EVENTS

- 5.12 REGULATORY ANALYSIS

- TABLE 10 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN COMPANIES

- FIGURE 27 INFLUENCE OF COMPANY STAKEHOLDERS ON BUYING PROCESS OF TANGENTIAL FLOW FILTRATION PRODUCTS

- 5.13.2 KEY BUYING CRITERIA FOR TANGENTIAL FLOW FILTRATION PRODUCTS AMONG END USERS

- FIGURE 28 KEY BUYING CRITERIA FOR END USERS

6 TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 11 TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2 SYSTEMS

- TABLE 12 TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 13 NORTH AMERICA: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 14 EUROPE: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 15 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 16 LATIN AMERICA: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 17 TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.2.1 SINGLE-USE SYSTEMS

- 6.2.1.1 Reduced need for product validation and minimized cross-contamination risks to boost usage

- TABLE 18 SINGLE-USE SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 19 NORTH AMERICA: SINGLE-USE SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 20 EUROPE: SINGLE-USE SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 21 ASIA PACIFIC: SINGLE-USE SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 22 LATIN AMERICA: SINGLE-USE SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.2 REUSABLE SYSTEMS

- 6.2.2.1 Reusable systems to grow at slower rate

- TABLE 23 REUSABLE SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 24 NORTH AMERICA: REUSABLE SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 25 EUROPE: REUSABLE SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 26 ASIA PACIFIC: REUSABLE SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 27 LATIN AMERICA: REUSABLE SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 MEMBRANE FILTERS

- TABLE 28 TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 29 TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 31 EUROPE: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 32 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 33 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.1 CASSETTES

- 6.3.1.1 Cassettes to dominate membrane filters market

- TABLE 34 CASSETTES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: CASSETTES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 36 EUROPE: CASSETTES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: CASSETTES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 38 LATIN AMERICA: CASSETTES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.2 CAPSULES & CARTRIDGES

- 6.3.2.1 Increased flow path and higher efficiency of hollow-fiber filters to contribute to market growth

- TABLE 39 CAPSULES & CARTRIDGES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: CAPSULES & CARTRIDGES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 41 EUROPE: CAPSULES & CARTRIDGES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: CAPSULES & CARTRIDGES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 43 LATIN AMERICA: CAPSULES & CARTRIDGES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4 OTHER PRODUCTS

- TABLE 44 OTHER TANGENTIAL FLOW FILTRATION PRODUCTS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: OTHER TANGENTIAL FLOW FILTRATION PRODUCTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 46 EUROPE: OTHER TANGENTIAL FLOW FILTRATION PRODUCTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: OTHER TANGENTIAL FLOW FILTRATION PRODUCTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 48 LATIN AMERICA: OTHER TANGENTIAL FLOW FILTRATION PRODUCTS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

7 TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL

- 7.1 INTRODUCTION

- TABLE 49 TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- 7.2 PES

- 7.2.1 HIGH RELIABILITY AND WIDE APPLICATIONS TO DRIVE DEMAND FOR PES

- TABLE 50 TANGENTIAL FLOW FILTRATION MARKET FOR PES MEMBRANES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR PES MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 52 EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR PES MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 53 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR PES MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 54 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR PES MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 REGENERATED CELLULOSE

- 7.3.1 WIDE APPLICATIONS IN UPSTREAM PROCESSING TO BOOST MARKET GROWTH

- TABLE 55 TANGENTIAL FLOW FILTRATION MARKET FOR REGENERATED CELLULOSE MEMBRANES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR REGENERATED CELLULOSE MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 57 EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR REGENERATED CELLULOSE MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 58 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR REGENERATED CELLULOSE MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 59 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR REGENERATED CELLULOSE MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4 PVDF

- 7.4.1 ADHERENCE OF PVDF MATERIAL TO FDA, USP, AND EEC REQUIREMENTS TO INCREASE DEMAND AMONG END USERS

- TABLE 60 TANGENTIAL FLOW FILTRATION MARKET FOR PVDF MEMBRANES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR PVDF MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 62 EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR PVDF MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 63 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR PVDF MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 64 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR PVDF MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.5 PTFE

- 7.5.1 WIDE ADVANTAGES OF PTFE TO SUPPORT MARKET GROWTH

- TABLE 65 TANGENTIAL FLOW FILTRATION MARKET FOR PTFE MEMBRANES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR PTFE MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 67 EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR PTFE MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 68 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR PTFE MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 69 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR PTFE MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.6 MCE & CA

- 7.6.1 INERT NATURE AND WIDE USAGE IN ANALYTICAL AND RESEARCH APPLICATIONS TO PROPEL MARKET

- TABLE 70 TANGENTIAL FLOW FILTRATION MARKET FOR MCE & CA MEMBRANES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR MCE & CA MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 72 EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR MCE & CA MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR MCE & CA MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 74 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR MCE & CA MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.7 NYLON

- 7.7.1 INCREASED ENDOTOXIN ADSORPTION CAPACITY OF NYLON FILTERS TO DRIVE DEMAND

- TABLE 75 TANGENTIAL FLOW FILTRATION MARKET FOR NYLON MEMBRANES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR NYLON MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 77 EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR NYLON MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 78 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR NYLON MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 79 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR NYLON MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.8 PCTE

- 7.8.1 USAGE IN CELL BIOLOGY AND ANALYTICAL TESTING APPLICATIONS TO SUPPORT GROWTH

- TABLE 80 TANGENTIAL FLOW FILTRATION MARKET FOR PCTE MEMBRANES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR PCTE MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 82 EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR PCTE MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR PCTE MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 84 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR PCTE MEMBRANES, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.9 OTHER MEMBRANE MATERIALS

- TABLE 85 TANGENTIAL FLOW FILTRATION MARKET FOR OTHER MEMBRANE MATERIALS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR OTHER MEMBRANE MATERIALS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 87 EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR OTHER MEMBRANE MATERIALS, BY COUNTRY, 2021-2028 (USD MILLION)

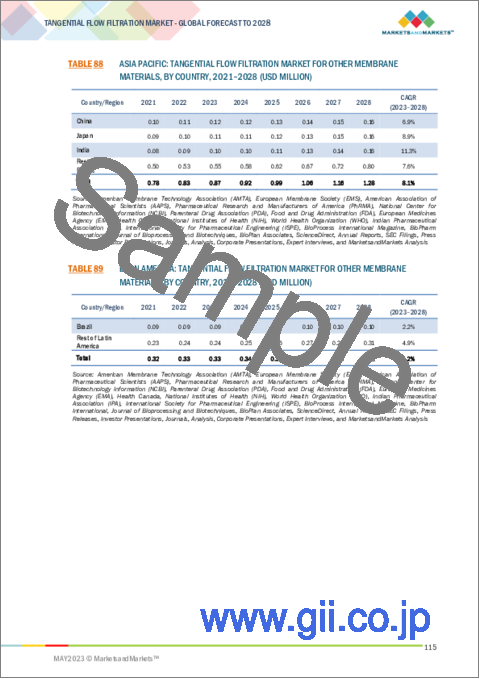

- TABLE 88 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR OTHER MEMBRANE MATERIALS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 89 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR OTHER MEMBRANE MATERIALS, BY COUNTRY, 2021-2028 (USD MILLION)

8 TANGENTIAL FLOW FILTRATION MARKET, TECHNIQUE

- 8.1 INTRODUCTION

- TABLE 90 TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- 8.2 MICROFILTRATION

- 8.2.1 MICROFILTRATION TO HOLD LARGEST MARKET SHARE

- TABLE 91 MICROFILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: MICROFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 93 EUROPE: MICROFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MICROFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 95 LATIN AMERICA: MICROFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 ULTRAFILTRATION

- 8.3.1 GROWING APPLICATIONS IN BIOPHARMACEUTICAL INDUSTRY FOR POST-FERMENTATION CELL HARVESTING TO BOOST MARKET

- TABLE 96 ULTRAFILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: ULTRAFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 98 EUROPE: ULTRAFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: ULTRAFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 100 LATIN AMERICA: ULTRAFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.4 NANOFILTRATION

- 8.4.1 HIGH ENERGY CONSUMPTION TO HINDER MARKET GROWTH

- TABLE 101 NANOFILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 103 EUROPE: NANOFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: NANOFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 105 LATIN AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.5 OTHER TECHNIQUES

- TABLE 106 OTHER TANGENTIAL FLOW FILTRATION TECHNIQUES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 107 NORTH AMERICA: OTHER TANGENTIAL FLOW FILTRATION TECHNIQUES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 108 EUROPE: OTHER TANGENTIAL FLOW FILTRATION TECHNIQUES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: OTHER TANGENTIAL FLOW FILTRATION TECHNIQUES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 110 LATIN AMERICA: OTHER TANGENTIAL FLOW FILTRATION TECHNIQUES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

9 TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- TABLE 111 TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 9.2 FINAL PRODUCT PROCESSING

- TABLE 112 TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 113 TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY REGION, 2021-2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 115 EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 117 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.2.1 API FILTRATION

- 9.2.1.1 Need for continuous filtration of APIs to propel market growth

- TABLE 118 API FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 119 NORTH AMERICA: API FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 120 EUROPE: API FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: API FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 122 LATIN AMERICA: API FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.2.2 PROTEIN PURIFICATION

- 9.2.2.1 Increasing demand for protein therapeutic drugs to drive market

- TABLE 123 PROTEIN PURIFICATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 124 NORTH AMERICA: PROTEIN PURIFICATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 125 EUROPE: PROTEIN PURIFICATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: PROTEIN PURIFICATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 127 LATIN AMERICA: PROTEIN PURIFICATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.2.3 VACCINE & ANTIBODY PROCESSING

- 9.2.3.1 Potential to improve efficiency and scalability of vaccine & antibody production to propel market

- TABLE 128 VACCINE & ANTIBODY PROCESSING MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 129 NORTH AMERICA: VACCINE & ANTIBODY PROCESSING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 130 EUROPE: VACCINE & ANTIBODY PROCESSING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: VACCINE & ANTIBODY PROCESSING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 132 LATIN AMERICA: VACCINE & ANTIBODY PROCESSING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.2.4 FORMULATION & FILLING SOLUTIONS

- 9.2.4.1 Growing need for aseptic filling and bioburden reduction to support market

- TABLE 133 FORMULATION & FILLING SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 134 NORTH AMERICA: FORMULATION & FILLING SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 135 EUROPE: FORMULATION & FILLING SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: FORMULATION & FILLING SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 137 LATIN AMERICA: FORMULATION & FILLING SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.2.5 VIRAL CLEARANCE

- 9.2.5.1 Growing manufacturing volumes to propel market growth

- TABLE 138 VIRAL CLEARANCE MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 139 NORTH AMERICA: VIRAL CLEARANCE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 140 EUROPE: VIRAL CLEARANCE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 141 ASIA PACIFIC: VIRAL CLEARANCE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 142 LATIN AMERICA: VIRAL CLEARANCE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3 RAW MATERIAL FILTRATION

- TABLE 143 TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 144 TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY REGION, 2021-2028 (USD MILLION)

- TABLE 145 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 146 EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET RAW MATERIAL FILTRATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 148 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3.1 MEDIA & BUFFER FILTRATION

- 9.3.1.1 Growing biopharmaceutical manufacturing to drive market

- TABLE 149 MEDIA & BUFFER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 150 NORTH AMERICA: MEDIA & BUFFER FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 151 EUROPE: MEDIA & BUFFER FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 152 ASIA PACIFIC: MEDIA & BUFFER FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 153 LATIN AMERICA: MEDIA & BUFFER FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3.2 PREFILTRATION

- 9.3.2.1 Prefiltration removes contaminants from fluid streams through direct interception and sieving

- TABLE 154 PREFILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 155 NORTH AMERICA: PREFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 156 EUROPE: PREFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 157 ASIA PACIFIC: PREFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 158 LATIN AMERICA: PREFILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3.3 BIOBURDEN TESTING

- 9.3.3.1 Mandates for bioburden testing in pharma production to support growth

- TABLE 159 BIOBURDEN TESTING MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 160 NORTH AMERICA: BIOBURDEN TESTING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 161 EUROPE: BIOBURDEN TESTING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 162 ASIA PACIFIC: BIOBURDEN TESTING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 163 LATIN AMERICA: BIOBURDEN TESTING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.4 CELL SEPARATION

- 9.4.1 GROWING DEMAND FOR PERSONALIZED MEDICINE TO DRIVE MARKET

- TABLE 164 TANGENTIAL FLOW FILTRATION MARKET FOR CELL SEPARATION, BY REGION, 2021-2028 (USD MILLION)

- TABLE 165 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR CELL SEPARATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 166 EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR CELL SEPARATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 167 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR CELL SEPARATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 168 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR CELL SEPARATION, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.5 WATER PURIFICATION

- 9.5.1 RISING PHARMA MANUFACTURING TO BOOST DEMAND FOR PURIFIED WATER

- TABLE 169 TANGENTIAL FLOW FILTRATION MARKET FOR WATER PURIFICATION, BY REGION, 2021-2028 (USD MILLION)

- TABLE 170 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR WATER PURIFICATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 171 EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR WATER PURIFICATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR WATER PURIFICATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 173 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR WATER PURIFICATION, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.6 CUSTOMIZATION: TANGENTIAL FLOW FILTRATION MARKET FOR BIOLOGICS

- TABLE 174 TANGENTIAL FLOW FILTRATION MARKET FOR BIOLOGICS, BY REGION, 2020-2027 (USD MILLION)

- TABLE 175 TANGENTIAL FLOW FILTRATION MARKET FOR BIOLOGICS, BY TECHNIQUE, 2020-2027 (USD MILLION)

10 TANGENTIAL FLOW FILTRATION MARKET, BY END USER

- 10.1 INTRODUCTION

- TABLE 176 TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 10.2.1 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES TO DOMINATE END-USER MARKET

- TABLE 177 TANGENTIAL FLOW FILTRATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 178 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 179 EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 181 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.3 CONTRACT MANUFACTURING ORGANIZATIONS & CONTRACT RESEARCH ORGANIZATIONS

- 10.3.1 INCREASING DEMAND TO OUTSOURCE PRODUCTION TO SUPPORT MARKET GROWTH

- TABLE 182 TANGENTIAL FLOW FILTRATION MARKET FOR CMOS & CROS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 183 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR CMOS & CROS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 184 EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR CMOS & CROS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 185 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR CMOS & CROS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 186 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR CMOS & CROS, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.4 ACADEMIC INSTITUTES & RESEARCH LABORATORIES

- 10.4.1 INCREASING R&D EXPENDITURE TO SUPPORT SEGMENT GROWTH

- TABLE 187 TANGENTIAL FLOW FILTRATION MARKET FOR ACADEMIC INSTITUTES & RESEARCH LABORATORIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 188 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR ACADEMIC INSTITUTES & RESEARCH LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 189 EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR ACADEMIC INSTITUTES & RESEARCH LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 190 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR ACADEMIC INSTITUTES & RESEARCH LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 191 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR ACADEMIC INSTITUTES & RESEARCH LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

11 TANGENTIAL FLOW FILTRATION MARKET, BY REGION

- 11.1 INTRODUCTION

- TABLE 192 TANGENTIAL FLOW FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 29 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET SNAPSHOT

- TABLE 193 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 194 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 195 NORTH AMERICA: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 196 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 197 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 198 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 199 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 200 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 201 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 202 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2.1 US

- 11.2.1.1 Growing investments in R&D to propel market

- TABLE 203 US: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 204 US: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 205 US: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 206 US: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 207 US: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 208 US: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 209 US: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 210 US: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 211 US: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2.2 CANADA

- 11.2.2.1 Increased government support and extensive availability of research funding to support market

- TABLE 212 CANADA: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 213 CANADA: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 214 CANADA: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 215 CANADA: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 216 CANADA: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 217 CANADA: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 218 CANADA: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 219 CANADA: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 220 CANADA: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2.3 NORTH AMERICA: IMPACT OF RECESSION

- 11.3 EUROPE

- TABLE 221 EUROPE: TANGENTIAL FLOW FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 222 EUROPE: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 223 EUROPE: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 224 EUROPE: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 225 EUROPE: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 226 EUROPE: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 227 EUROPE: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 228 EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 229 EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 230 EUROPE: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.1 GERMANY

- 11.3.1.1 Presence of key players and growing biosimilars market to support market growth

- TABLE 231 GERMANY: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 232 GERMANY: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 233 GERMANY: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 234 GERMANY: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 235 GERMANY: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 236 GERMANY: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 237 GERMANY: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 238 GERMANY: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 239 GERMANY: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Significant R&D investments and government support for pharmaceutical companies to boost growth

- TABLE 240 UK: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 241 UK: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 242 UK: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 243 UK: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 244 UK: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 245 UK: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 246 UK: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 247 UK: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 248 UK: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.3 FRANCE

- 11.3.3.1 Favorable government initiatives to bolster growth

- TABLE 249 FRANCE: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 250 FRANCE: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 251 FRANCE: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 252 FRANCE: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 253 FRANCE: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 254 FRANCE: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 255 FRANCE: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 256 FRANCE: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 257 FRANCE: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.4 ITALY

- 11.3.4.1 Increasing investments in pharma R&D to drive market

- TABLE 258 ITALY: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 259 ITALY: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 260 ITALY: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 261 ITALY: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 262 ITALY: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 263 ITALY: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 264 ITALY: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 265 ITALY: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 266 ITALY: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.5 SPAIN

- 11.3.5.1 Investments in biomanufacturing facilities to support market

- TABLE 267 SPAIN: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 268 SPAIN: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 269 SPAIN: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 270 SPAIN: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 271 SPAIN: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 272 SPAIN: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 273 SPAIN: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 274 SPAIN: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 275 SPAIN: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.6 REST OF EUROPE

- TABLE 276 REST OF EUROPE: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 277 REST OF EUROPE: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 278 REST OF EUROPE: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 279 REST OF EUROPE: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 280 REST OF EUROPE: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 281 REST OF EUROPE: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 282 REST OF EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 283 REST OF EUROPE: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 284 REST OF EUROPE: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.7 EUROPE: IMPACT OF RECESSION

- 11.4 ASIA PACIFIC

- FIGURE 30 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET SNAPSHOT

- TABLE 285 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 286 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 287 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 288 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 289 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 290 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 291 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 292 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 293 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 294 ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.1 CHINA

- 11.4.1.1 China to dominate Asia Pacific market till 2028

- TABLE 295 CHINA: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 296 CHINA: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 297 CHINA: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 298 CHINA: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 299 CHINA: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 300 CHINA: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 301 CHINA: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 302 CHINA: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 303 CHINA: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.2 JAPAN

- 11.4.2.1 Rising initiatives by biopharmaceutical companies to boost market

- TABLE 304 JAPAN: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 305 JAPAN: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 306 JAPAN: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 307 JAPAN: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 308 JAPAN: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 309 JAPAN: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 310 JAPAN: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 311 JAPAN: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 312 JAPAN: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.3 INDIA

- 11.4.3.1 Government initiatives to aid market growth

- TABLE 313 INDIA: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 314 INDIA: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 315 INDIA: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 316 INDIA: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 317 INDIA: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 318 INDIA: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 319 INDIA: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 320 INDIA: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 321 INDIA: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.4 REST OF ASIA PACIFIC

- TABLE 322 REST OF ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 323 REST OF ASIA PACIFIC: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 324 REST OF ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 325 REST OF ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 326 REST OF ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 327 REST OF ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 328 REST OF ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 329 REST OF ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 330 REST OF ASIA PACIFIC: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.5 ASIA PACIFIC: RECESSION IMPACT

- 11.5 LATIN AMERICA

- TABLE 331 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 332 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 333 LATIN AMERICA: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 334 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 335 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 336 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 337 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 338 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 339 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 340 LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.5.1 BRAZIL

- 11.5.1.1 Growth in vaccine manufacturing to support market growth

- TABLE 341 BRAZIL: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 342 BRAZIL: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 343 BRAZIL: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 344 BRAZIL: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 345 BRAZIL: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 346 BRAZIL: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 347 BRAZIL: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 348 BRAZIL: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 349 BRAZIL: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.5.2 REST OF LATIN AMERICA

- TABLE 350 REST OF LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 351 REST OF LATIN AMERICA: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 352 REST OF LATIN AMERICA: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 353 REST OF LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 354 REST OF LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 355 REST OF LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 356 REST OF LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 357 REST OF LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 358 REST OF LATIN AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.5.3 LATIN AMERICA: IMPACT OF RECESSION

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 FOCUS ON DEVELOPING NEW DRUGS TO SUPPORT MARKET GROWTH

- TABLE 359 MIDDLE EAST & AFRICA: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 360 MIDDLE EAST & AFRICA: TANGENTIAL FLOW FILTRATION SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 361 MIDDLE EAST & AFRICA: TANGENTIAL FLOW FILTRATION MEMBRANE FILTERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 362 MIDDLE EAST & AFRICA: TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL, 2021-2028 (USD MILLION)

- TABLE 363 MIDDLE EAST & AFRICA: TANGENTIAL FLOW FILTRATION MARKET, BY TECHNIQUE, 2021-2028 (USD MILLION)

- TABLE 364 MIDDLE EAST & AFRICA: TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 365 MIDDLE EAST & AFRICA: TANGENTIAL FLOW FILTRATION MARKET FOR FINAL PRODUCT PROCESSING, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 366 MIDDLE EAST & AFRICA: TANGENTIAL FLOW FILTRATION MARKET FOR RAW MATERIAL FILTRATION, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 367 MIDDLE EAST & AFRICA: TANGENTIAL FLOW FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.6.2 MIDDLE EAST & AFRICA: IMPACT OF RECESSION

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

- FIGURE 31 TANGENTIAL FLOW FILTRATION MARKET: STRATEGIES ADOPTED

- 12.3 REVENUE SHARE ANALYSIS

- FIGURE 32 REVENUE ANALYSIS OF KEY PLAYERS (2019-2022)

- 12.4 MARKET SHARE ANALYSIS

- FIGURE 33 MARKET SHARE ANALYSIS OF KEY PLAYERS (2022)

- TABLE 368 TANGENTIAL FLOW FILTRATION MARKET: DEGREE OF COMPETITION

- 12.5 COMPANY EVALUATION QUADRANT, 2022

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 34 TANGENTIAL FLOW FILTRATION MARKET: COMPANY EVALUATION MATRIX, 2022

- 12.6 COMPETITIVE BENCHMARKING OF TOP 25 PLAYERS

- 12.6.1 COMPANY PRODUCT FOOTPRINT (25 COMPANIES)

- TABLE 369 COMPANY PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS

- 12.6.2 REGIONAL FOOTPRINT OF COMPANIES (25 COMPANIES)

- TABLE 370 TANGENTIAL FLOW FILTRATION MARKET: REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS

- 12.7 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2022

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 STARTING BLOCKS

- 12.7.3 RESPONSIVE COMPANIES

- 12.7.4 DYNAMIC COMPANIES

- FIGURE 35 TANGENTIAL FLOW FILTRATION MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2022

- 12.8 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 371 TANGENTIAL FLOW FILTRATION MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 372 TANGENTIAL FLOW FILTRATION MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- TABLE 373 TANGENTIAL FLOW FILTRATION MARKET: PRODUCT LAUNCHES, JANUARY 2020-APRIL 2023

- 12.9.2 DEALS

- TABLE 374 TANGENTIAL FLOW FILTRATION MARKET: DEALS, JANUARY 2020 TO APRIL 2023

- 12.9.3 OTHER DEVELOPMENTS

- TABLE 375 TANGENTIAL FLOW FILTRATION MARKET: OTHER DEVELOPMENTS, JANUARY 2020 TO APRIL 2023

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1.1 DANAHER CORPORATION

- TABLE 376 DANAHER CORPORATION: COMPANY OVERVIEW

- FIGURE 36 DANAHER CORPORATION: COMPANY SNAPSHOT (2022)

- TABLE 377 DANAHER CORPORATION: PRODUCT OFFERINGS

- TABLE 378 DANAHER CORPORATION: DEALS

- TABLE 379 DANAHER CORPORATION: OTHER DEVELOPMENTS

- 13.1.2 MERCK KGAA

- TABLE 380 MERCK KGAA: COMPANY OVERVIEW

- FIGURE 37 MERCK KGAA: COMPANY SNAPSHOT (2022)

- TABLE 381 MERCK KGAA: PRODUCT OFFERINGS

- TABLE 382 MERCK KGAA: OTHER DEVELOPMENTS

- 13.1.3 SARTORIUS AG

- TABLE 383 SARTORIUS AG: BUSINESS OVERVIEW

- FIGURE 38 SARTORIUS AG: COMPANY SNAPSHOT (2022)

- TABLE 384 SARTORIUS AG: PRODUCT OFFERINGS

- TABLE 385 SARTORIUS AG: DEALS

- TABLE 386 SARTORIUS AG: OTHER DEVELOPMENTS

- 13.1.4 REPLIGEN CORPORATION

- TABLE 387 REPLIGEN CORPORATION: BUSINESS OVERVIEW

- FIGURE 39 REPLIGEN CORPORATION: COMPANY SNAPSHOT (2022)

- TABLE 388 REPLIGEN CORPORATION: PRODUCT OFFERINGS

- TABLE 389 REPLIGEN CORPORATION: DEALS

- 13.1.5 PARKER HANNIFIN CORPORATION

- TABLE 390 PARKER HANNIFIN CORPORATION: BUSINESS OVERVIEW

- FIGURE 40 PARKER HANNIFIN CORPORATION: COMPANY SNAPSHOT (2021)

- TABLE 391 PARKER HANNIFIN CORPORATION: PRODUCT OFFERINGS

- TABLE 392 PARKER HANNIFIN CORPORATION: DEALS

- TABLE 393 PARKER HANNIFIN CORPORATION: OTHER DEVELOPMENTS

- 13.1.6 ALFA LAVAL CORPORATE AB

- TABLE 394 ALFA LAVAL CORPORATE AB: BUSINESS OVERVIEW

- FIGURE 41 ALFA LAVAL CORPORATE AB: COMPANY SNAPSHOT (2022)

- TABLE 395 ALFA LAVAL CORPORATE AB: PRODUCT OFFERINGS

- 13.1.7 ANDRITZ

- TABLE 396 ANDRITZ: BUSINESS OVERVIEW

- FIGURE 42 ANDRITZ: COMPANY SNAPSHOT (2022)

- TABLE 397 ANDRITZ: PRODUCT OFFERINGS

- 13.1.8 MEISSNER FILTRATION PRODUCTS, INC.

- TABLE 398 MEISSNER FILTRATION PRODUCTS, INC.: BUSINESS OVERVIEW

- TABLE 399 MEISSNER FILTRATION PRODUCTS, INC.: PRODUCT OFFERINGS

- 13.1.9 ANTYLIA SCIENTIFIC

- TABLE 400 ANTYLIA SCIENTIFIC: BUSINESS OVERVIEW

- TABLE 401 ANTYLIA SCIENTIFIC: PRODUCT OFFERINGS

- TABLE 402 ANTYLIA SCIENTIFIC: OTHER DEVELOPMENTS

- 13.1.10 SOLARIS BIOTECHNOLOGY SRL (DONALDSON COMPANY)

- TABLE 403 DONALDSON COMPANY, INC.: BUSINESS OVERVIEW

- FIGURE 43 DONALDSON COMPANY, INC.: COMPANY SNAPSHOT (2021)

- TABLE 404 DONALDSON COMPANY, INC: PRODUCT OFFERINGS

- 13.1.11 KOCH SEPARATION SOLUTIONS, INC.

- TABLE 405 KOCH SEPARATION SOLUTIONS, INC.: BUSINESS OVERVIEW

- TABLE 406 KOCH SEPARATION SOLUTIONS, INC.: PRODUCT OFFERINGS

- TABLE 407 KOCH SEPARATION SOLUTIONS, INC.: PRODUCT LAUNCHES

- TABLE 408 KOCH SEPARATION SOLUTIONS, INC.: DEALS

- 13.1.12 STERLITECH CORPORATION

- TABLE 409 STERLITECH CORPORATION.: BUSINESS OVERVIEW

- TABLE 410 STERLITECH CORPORATION: PRODUCT OFFERINGS

- 13.2 OTHER COMPANIES

- 13.2.1 SYNDER FILTRATION, INC.

- 13.2.2 NOVASEP

- 13.2.3 ABEC, INC.

- 13.2.4 PENDOTECH

- 13.2.5 MICROFILT INDIA PVT. LTD.

- 13.2.6 BIONET

- 13.2.7 SYSBIOTECH GMBH

- 13.2.8 HANGZHOU COBETTER FILTRATION EQUIPMENT CO., LTD.

- 13.2.9 FORMULATRIX, INC.

- 13.2.10 MANTEC TECHNICAL CERAMICS LTD.

- 13.2.11 SMARTFLOW TECHNOLOGIES, INC.

- 13.2.12 TAMI INDUSTRIES

- 13.2.13 SPF TECHNOLOGIES LLC

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS