|

|

市場調査レポート

商品コード

1558155

全地形対応車市場:タイプ別、用途別、駆動方式別、エンジン容量別、燃料タイプ別、車輪数別、座席数別、バッテリー容量別、地域別 - 2030年までの予測All-terrain Vehicle Market by Application, Drive, Engine, Fuel, Number of Wheels, Battery Capacity, Seating Capacity & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 全地形対応車市場:タイプ別、用途別、駆動方式別、エンジン容量別、燃料タイプ別、車輪数別、座席数別、バッテリー容量別、地域別 - 2030年までの予測 |

|

出版日: 2024年09月16日

発行: MarketsandMarkets

ページ情報: 英文 377 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

全地形対応車(ATV)の市場規模は、2024年の29億米ドルから2030年には33億米ドルに成長すると予測され、2024年から2030年までのCAGRは2.3%になるとみられています。

北米のATV市場は、ライダーに余分な座席数と安全性を提供するサイドバイサイド車への消費者の購買行動のシフトにより減少しています。すなわち、サイドバイサイド車の販売台数は2019年の51万台から2023年には55万台に増加しているのに対し、北米におけるATVの小売販売台数は2019年には26万台でしたが、2023年には24万台に減少しており、消費者の関心がATVからサイドバイサイド車へと変化していることを示しています。一方、他の地域では市場は堅調に推移します。さらに、軍事用途や農業用途の成長も市場を押し上げており、高い積載能力を持つATVが必要とされています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | タイプ別、用途別、駆動方式別、エンジン容量別、燃料タイプ別、車輪数別、座席数別、バッテリー容量別、地域別 |

| 対象地域 | アジア・オセアニア、欧州、北米、その他の地域 |

スポーツ用途では、ATVは高性能かつ高速に設計されており、競合レースに最適です。スポーツATVのエンジン容量は100~1000ccです。このスポーツATVは、ユニークなスタイルとパワーをデザインするために改造され、さまざまなアクセサリーが装備されています。また、これらのATVは若いライダーの間で人気があり、彼らはアドベンチャースポーツのためにATVを求め、積極的にレースイベントやモトクロス競合に参加しています。

ATVスポーツ活動は北米と欧州で強い文化と需要があり、これらの地域にはATVクラブ、レースリーグ、イベントが集中しており、人々の関心を高めています。OEMもまた、スポーツATV市場を牽引する上で不可欠な役割を果たしており、OEMはスポーツライダー向けの新モデルを革新・発売するため、研究開発に積極的に投資しています。

極限の地形や過酷なサーキット走行に対応できる高性能車両に対する需要の高まりにより、800cc超エンジン市場が急成長しています。ATVのこれらの高いエンジン容量は、通常、レースイベントやレクリエーション作業などのスポーツ活動に好まれるのに対し、実用車は採鉱、林業、捜索救助活動に使用されます。パンデミック後、北米ではスポーツやアウトドア活動が活発化し、ATV市場もエンジン容量の大きいものが徐々に伸びてきました。

アジア・オセアニア地域には、ATVの市場シェアが高い中国やオーストラリアのような重要な国があります。オーストラリアのような国には広大な農地や農業スペースがあり、ATVは農業や家畜の世話に欠かせないです。同様に、中国はアジア・オセアニア第2位の市場であり、CFMOTO(中国)、Chongqing Huansong(中国)、Linhai(中国)のような有力企業があります。しかし、中国のこれらの主要参入企業が製造するATVの多くは、需要が高いため、欧州やその他の国に輸出されています。2023年の国際貿易センター(ITC)のデータによると、中国は米国、ロシア、メキシコにATVを最も多く輸出しており、2023年の貿易総額は21億2,790万米ドルです。一方、CFMOTO(中国)のような主要企業のウェブサイトによると、同社のATVの70%以上は100カ国で販売されており、60%は欧州で販売されています。

当レポートでは、世界の全地形対応車市場について調査し、タイプ別、用途別、駆動方式別、エンジン容量別、燃料タイプ別、車輪数別、座席数別、バッテリー容量別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- AI/生成AIが全地形対応車製造に与える影響

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- サプライチェーン分析

- 全地形対応車市場エコシステム分析

- 投資シナリオ

- 技術動向

- 特許分析

- 貿易分析

- 2024年~2025年の主な会議とイベント

- ケーススタディ分析

- 規制状況

- 主な利害関係者と購入基準

- 総所有コスト

- OEM分析

第6章 全地形対応車市場、タイプ別

- イントロダクション

- スポーツ

- ユーティリティ

- 業界考察

第7章 全地形対応車市場、用途別

- イントロダクション

- スポーツ

- エンターテインメント

- 農業

- 軍事・防衛

- その他

- 業界考察

第8章 全地形対応車市場、駆動方式別

- イントロダクション

- 2WD

- 4WD

- オートマチック

- 業界考察

第9章 全地形対応車市場、エンジン容量別

- イントロダクション

- 400 cc未満

- 400~800CC

- 800CC超

- 業界考察

第10章 全地形対応車市場、燃料タイプ別

- イントロダクション

- ガソリン

- 電気

- 業界考察

第11章 全地形対応車市場、車輪数別

- イントロダクション

- 四輪

- 四輪超

- 業界考察

第12章 全地形対応車市場、座席数別

- イントロダクション

- 1人乗り

- 2人乗り以上

- 業界考察

第13章 電動全地形対応車市場、バッテリー容量別

- イントロダクション

- 10KWH未満

- 10KWH超

- 業界考察

第14章 サイドバイサイド車市場、車輪数別

- イントロダクション

- 四輪

- 四輪超

- 業界考察

第15章 サイドバイサイド車市場、地域別

- イントロダクション

- 業界考察

第16章 全地形対応車市場、地域別

- イントロダクション

- アジアオセアニア

- 欧州

- 北米

- その他の地域

- 業界考察

第17章 競合情勢

- 概要

- 主要参入企業戦略/有力企業

- 上位上場企業/公開企業の収益分析

- 市場シェア分析、2023年

- 2023年の企業評価

- 2023年の企業財務指標

- ブランド比較

- 企業評価マトリックス:全地形対応車メーカー、2023年

- 会社の足跡

- 企業評価マトリックス:サイドバイサイド車メーカー、2023年

- 会社の足跡

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第18章 企業プロファイル

- 主要参入企業

- POLARIS INC.

- TEXTRON INC.

- HONDA MOTOR CO., LTD.

- KAWASAKI HEAVY INDUSTRIES LTD.

- YAMAHA MOTOR CO., LTD.

- SUZUKI MOTOR CORPORATION

- DEERE & COMPANY

- BRP

- CFMOTO

- HISUN.

- その他の企業

- BENNCHE, LLC

- VELOMOTORS

- ECO CHARGER

- BALTMOTORS

- CECTEK

- NEBULA AUTOMOTIVE PRIVATE LIMITED

- TAIWAN GOLDEN BEE(TGB)

- KYMCO

- LINHAI

- AMERICAN LANDMASTER

- SEGWAY TECHNOLOGY CO., LTD

- BAD BOY MOWERS.

- MASSIMO MOTORS SPORTS, LLC

- INTIMIDATOR UTV

- SSR MOTORSPORTS

- DRR USA

- ARGO

- VOLCON

- POWERLAND

- LIVAQ

- POTENTIAL MOTORS

- OREION MOTORS

第19章 市場における提言

第20章 付録

List of Tables

- TABLE 1 ALL-TERRAIN VEHICLE MARKET DEFINITION, BY DRIVE TYPE

- TABLE 2 ALL-TERRAIN VEHICLE MARKET DEFINITION, BY TYPE

- TABLE 3 INCLUSIONS AND EXCLUSIONS

- TABLE 4 CURRENCY EXCHANGE RATES

- TABLE 5 FATAL INCIDENTS INVOLVING ALL-TERRAIN VEHICLE RIDERS ON PUBLIC ROADS WORLDWIDE, BY AGE, 2019-2022

- TABLE 6 PRICE OF FAST-MOVING ALL-TERRAIN VEHICLES BY KEY OEMS, 2024

- TABLE 7 INDICATIVE AVERAGE SELLING PRICE, BY REGION, 2019-2023 (USD)

- TABLE 8 INDICATIVE AVERAGE SELLING PRICE, BY TYPE, 2019-2023 (USD)

- TABLE 9 INDICATIVE AVERAGE SELLING PRICE, BY APPLICATION, 2019-2023 (USD)

- TABLE 10 2WD, 4WD, AND AWD ALL-TERRAIN VEHICLE PRICING BY OEM, 2024

- TABLE 11 OEM PRICING FOR ALL-TERRAIN VEHICLE MODELS WITH <400 CC, 400-800 CC, AND >800 CC ENGINE CAPACITY, 2024

- TABLE 12 OEM PRICING FOR ELECTRIC ALL-TERRAIN VEHICLE MODELS, 2024

- TABLE 13 OEM PRICING FOR 4-WHEEL ALL-TERRAIN VEHICLE MODELS, 2024

- TABLE 14 OEM PRICING FOR ONE-SEATER ALL-TERRAIN VEHICLE MODELS, 2024

- TABLE 15 OEM PRICING FOR 4-WHEEL SIDE-BY-SIDE VEHICLE MODELS, 2024

- TABLE 16 ROLE OF COMPANIES IN ALL-TERRAIN VEHICLE MARKET ECOSYSTEM

- TABLE 17 LIST OF FUNDING FOR ATV MANUFACTURERS, 2020-2024

- TABLE 18 PATENT APPLICATIONS, 2021-2024

- TABLE 19 US: ALL-TERRAIN VEHICLE IMPORT SHARE, BY COUNTRY, 2019-2023 (000' USD)

- TABLE 20 CANADA: ALL-TERRAIN VEHICLE IMPORT SHARE, BY COUNTRY, 2019-2023 (000' USD)

- TABLE 21 RUSSIA: ALL-TERRAIN VEHICLE IMPORT SHARE, 2019-2023 (000' USD)

- TABLE 22 SWEDEN: ALL-TERRAIN VEHICLE IMPORT SHARE, 2019-2023 (000' USD)

- TABLE 23 UK: ALL-TERRAIN VEHICLE IMPORT SHARE, 2019-2023 (000' USD)

- TABLE 24 CHINA: ALL-TERRAIN VEHICLE EXPORT SHARE, 2019-2023 (000' USD)

- TABLE 25 US: ALL-TERRAIN VEHICLE EXPORT SHARE, 2019-2023 (000' USD)

- TABLE 26 CANADA: ALL-TERRAIN VEHICLE EXPORT SHARE, 2019-2023 (000' USD)

- TABLE 27 FINLAND: ALL-TERRAIN VEHICLE EXPORT SHARE, 2019-2023 (000' USD)

- TABLE 28 NETHERLANDS: ALL-TERRAIN VEHICLE EXPORT SHARE, 2019-2023 (000' USD)

- TABLE 29 ALL-TERRAIN VEHICLE MARKET: KEY CONFERENCES AND EVENTS IN 2024-2025

- TABLE 30 US: ALL-TERRAIN VEHICLE REGULATIONS

- TABLE 31 CANADA: ALL-TERRAIN VEHICLE REGULATIONS

- TABLE 32 AUSTRALIA: ALL-TERRAIN VEHICLE REGULATIONS

- TABLE 33 EUROPE: ALL-TERRAIN VEHICLE REGULATIONS

- TABLE 34 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 35 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 36 ASIA OCEANIA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ELECTRIC AND GASOLINE ALL-TERRAIN VEHICLES (%)

- TABLE 38 KEY BUYING CRITERIA FOR ELECTRIC AND GASOLINE ALL-TERRAIN VEHICLES

- TABLE 39 ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 40 ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 41 ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 42 ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 43 SPORTS ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 44 SPORTS ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 45 SPORTS ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 46 SPORTS ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 47 UTILITY ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 48 UTILITY ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 49 UTILITY ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 50 UTILITY ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 51 ALL-TERRAIN VEHICLE MARKET, BY APPLICATION, 2019-2023 (UNITS)

- TABLE 52 ALL-TERRAIN VEHICLE MARKET, BY APPLICATION, 2024-2030 (UNITS)

- TABLE 53 ALL-TERRAIN VEHICLE MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 54 ALL-TERRAIN VEHICLE MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 55 SPORTS: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 56 SPORTS: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 57 SPORTS: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 58 SPORTS: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

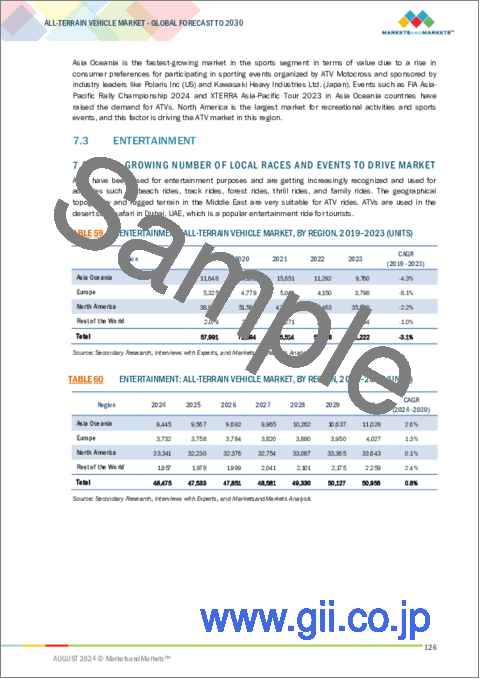

- TABLE 59 ENTERTAINMENT: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 60 ENTERTAINMENT: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 61 ENTERTAINMENT: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 62 ENTERTAINMENT: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 63 AGRICULTURE: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 64 AGRICULTURE: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 65 AGRICULTURE: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 66 AGRICULTURE: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 67 MILITARY & DEFENSE: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 68 MILITARY & DEFENSE: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 69 MILITARY & DEFENSE: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 70 MILITARY & DEFENSE: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 71 OTHER APPLICATIONS: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 72 OTHER APPLICATIONS: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 73 OTHER APPLICATIONS: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 74 OTHER APPLICATIONS: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 75 ALL-TERRAIN VEHICLE MARKET, BY DRIVE TYPE, 2019-2023 (UNITS)

- TABLE 76 ALL-TERRAIN VEHICLE MARKET, BY DRIVE TYPE, 2024-2030 (UNITS)

- TABLE 77 ALL-TERRAIN VEHICLE MARKET, BY DRIVE TYPE, 2019-2023 (USD MILLION)

- TABLE 78 ALL-TERRAIN VEHICLE MARKET, BY DRIVE TYPE, 2024-2030 (USD MILLION)

- TABLE 79 2WD ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 80 2WD ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 81 2WD ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 82 2WD ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 83 4WD ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 84 4WD ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 85 4WD ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 86 4WD ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 87 AWD ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 88 AWD ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 89 AWD ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 90 AWD ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 91 ALL-TERRAIN VEHICLE MARKET, BY ENGINE CAPACITY, 2019-2023 (UNITS)

- TABLE 92 ALL-TERRAIN VEHICLE MARKET, BY ENGINE CAPACITY, 2024-2030 (UNITS)

- TABLE 93 ALL-TERRAIN VEHICLE MARKET, BY ENGINE CAPACITY, 2019-2023 (USD MILLION)

- TABLE 94 ALL-TERRAIN VEHICLE MARKET, BY ENGINE CAPACITY, 2024-2030 (USD MILLION)

- TABLE 95 <400 CC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 96 <400 CC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 97 <400 CC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 98 <400 CC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 99 400-800 CC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 100 400-800 CC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 101 400-800 CC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 102 400-800 CC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 103 >800 CC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 104 >800 CC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 105 >800 CC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 106 >800 CC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 107 ALL-TERRAIN VEHICLE MARKET, BY FUEL TYPE, 2019-2023 (UNITS)

- TABLE 108 ALL-TERRAIN VEHICLE MARKET, BY FUEL TYPE, 2024-2030 (UNITS)

- TABLE 109 ALL-TERRAIN VEHICLE MARKET, BY FUEL TYPE, 2019-2023 (USD MILLION)

- TABLE 110 ALL-TERRAIN VEHICLE MARKET, BY FUEL TYPE, 2024-2030 (USD MILLION)

- TABLE 111 GASOLINE ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 112 GASOLINE ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 113 GASOLINE ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 114 GASOLINE ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 115 ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 116 ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 117 ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 118 ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 119 ALL-TERRAIN VEHICLE MARKET, BY NUMBER OF WHEELS, 2019-2023 (UNITS)

- TABLE 120 ALL-TERRAIN VEHICLE MARKET, BY NUMBER OF WHEELS, 2024-2030 (UNITS)

- TABLE 121 ALL-TERRAIN VEHICLE MARKET, BY NUMBER OF WHEELS, 2019-2023 (USD MILLION)

- TABLE 122 ALL-TERRAIN VEHICLE MARKET, BY NUMBER OF WHEELS, 2024-2030 (USD MILLION)

- TABLE 123 FOUR WHEELS: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 124 FOUR WHEELS: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 125 FOUR WHEELS: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 126 FOUR WHEELS: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 127 >FOUR WHEELS: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 128 >FOUR WHEELS: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 129 >FOUR WHEELS: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 130 >FOUR WHEELS: ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 131 ALL-TERRAIN VEHICLE MARKET, BY SEATING CAPACITY, 2019-2023 (UNITS)

- TABLE 132 ALL-TERRAIN VEHICLE MARKET, BY SEATING CAPACITY, 2024-2030 (UNITS)

- TABLE 133 ALL-TERRAIN VEHICLE MARKET, BY SEATING CAPACITY, 2019-2023 (USD MILLION)

- TABLE 134 ALL-TERRAIN VEHICLE MARKET, BY SEATING CAPACITY, 2024-2030 (USD MILLION)

- TABLE 135 ONE-SEATER ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 136 ONE-SEATER ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 137 ONE-SEATER ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 138 ONE-SEATER ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 139 >=TWO-SEATER ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 140 >=TWO-SEATER ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 141 >=TWO-SEATER ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 142 >=TWO-SEATER ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 143 ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY BATTERY CAPACITY, 2019-2023 (UNITS)

- TABLE 144 ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY BATTERY CAPACITY, 2024-2030 (UNITS)

- TABLE 145 ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY BATTERY CAPACITY, 2019-2023 (USD MILLION)

- TABLE 146 ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY BATTERY CAPACITY, 2024-2030 (USD MILLION)

- TABLE 147 ELECTRIC ALL-TERRAIN VEHICLE OEM MODELS, 2024

- TABLE 148 <10 KWH ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 149 <10 KWH ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 150 <10 KWH ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 151 <10 KWH ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 152 >10 KWH ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 153 >10 KWH ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 154 >10 KWH ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 155 >10 KWH ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 156 SIDE-BY-SIDE VEHICLE MARKET, BY NUMBER OF WHEELS, 2019-2023 (UNITS)

- TABLE 157 SIDE-BY-SIDE VEHICLE MARKET, BY NUMBER OF WHEELS, 2024-2030 (UNITS)

- TABLE 158 SIDE-BY-SIDE VEHICLE MARKET, BY NUMBER OF WHEELS, 2019-2023 (USD MILLION)

- TABLE 159 SIDE-BY-SIDE VEHICLE MARKET, BY NUMBER OF WHEELS, 2024-2030 (USD MILLION)

- TABLE 160 FOUR-WHEEL SIDE-BY-SIDE VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 161 FOUR-WHEEL SIDE-BY-SIDE VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 162 FOUR-WHEEL SIDE-BY-SIDE VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 163 FOUR-WHEEL SIDE-BY-SIDE VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 164 > FOUR-WHEEL SIDE-BY-SIDE VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 165 >FOUR-WHEEL SIDE-BY-SIDE VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 166 >FOUR-WHEEL SIDE-BY-SIDE VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 167 >FOUR-WHEEL SIDE-BY-SIDE VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 168 SIDE-BY-SIDE VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 169 SIDE-BY-SIDE VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 170 SIDE-BY-SIDE VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 171 SIDE-BY-SIDE VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 172 ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 173 ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 174 ALL-TERRAIN VEHICLE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 175 ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 176 ASIA OCEANIA: ALL-TERRAIN VEHICLE MARKET, BY COUNTRY, 2019-2023 (UNITS)

- TABLE 177 ASIA OCEANIA: ALL-TERRAIN VEHICLE MARKET, BY COUNTRY, 2024-2030 (UNITS)

- TABLE 178 ASIA OCEANIA: ALL-TERRAIN VEHICLE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 179 ASIA OCEANIA: ALL-TERRAIN VEHICLE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 180 CHINA: LIST OF MAJOR ALL-TERRAIN VEHICLE MANUFACTURERS AND THEIR KEY INDICATIVE MODELS

- TABLE 181 CHINA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 182 CHINA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 183 CHINA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 184 CHINA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 185 AUSTRALIA: LIST OF MAJOR ALL-TERRAIN VEHICLE MANUFACTURERS AND THEIR KEY INDICATIVE MODELS

- TABLE 186 AUSTRALIA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 187 AUSTRALIA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 188 AUSTRALIA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 189 AUSTRALIA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 190 NEW ZEALAND: LIST OF MAJOR ALL-TERRAIN VEHICLE MANUFACTURERS AND THEIR KEY INDICATIVE MODELS

- TABLE 191 NEW ZEALAND: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 192 NEW ZEALAND: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 193 NEW ZEALAND: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 194 NEW ZEALAND: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 195 JAPAN: LIST OF MAJOR ALL-TERRAIN VEHICLE MANUFACTURERS AND THEIR KEY INDICATIVE MODELS

- TABLE 196 JAPAN: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 197 JAPAN: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 198 JAPAN: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 199 JAPAN: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 200 INDIA: LIST OF MAJOR ALL-TERRAIN VEHICLE MANUFACTURERS AND THEIR KEY INDICATIVE MODELS

- TABLE 201 INDIA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 202 INDIA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 203 INDIA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 204 INDIA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 205 EUROPE: ALL-TERRAIN VEHICLE MARKET, BY COUNTRY, 2019-2023 (UNITS)

- TABLE 206 EUROPE: ALL-TERRAIN VEHICLE MARKET, BY COUNTRY, 2024-2030 (UNITS)

- TABLE 207 EUROPE: ALL-TERRAIN VEHICLE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 208 EUROPE: ALL-TERRAIN VEHICLE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 209 GERMANY: LIST OF MAJOR ALL-TERRAIN VEHICLE MANUFACTURERS AND THEIR KEY INDICATIVE MODELS

- TABLE 210 GERMANY: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 211 GERMANY: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 212 GERMANY: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 213 GERMANY: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 214 FRANCE: LIST OF MAJOR ALL-TERRAIN VEHICLE MANUFACTURERS AND THEIR KEY INDICATIVE MODELS

- TABLE 215 FRANCE: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 216 FRANCE: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 217 FRANCE: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 218 FRANCE: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 219 RUSSIA: LIST OF MAJOR ALL-TERRAIN VEHICLE MANUFACTURERS AND THEIR KEY INDICATIVE MODELS

- TABLE 220 RUSSIA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 221 RUSSIA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 222 RUSSIA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 223 RUSSIA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 224 UK: LIST OF MAJOR ALL-TERRAIN VEHICLE MANUFACTURERS AND THEIR KEY INDICATIVE MODELS

- TABLE 225 UK: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 226 UK: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 227 UK: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 228 UK: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 229 SPAIN: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 230 SPAIN: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 231 SPAIN: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 232 SPAIN: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 233 SWEDEN: LIST OF MAJOR ALL-TERRAIN VEHICLE MANUFACTURERS AND THEIR KEY INDICATIVE MODELS

- TABLE 234 SWEDEN: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 235 SWEDEN: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 236 SWEDEN: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 237 SWEDEN: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 238 REST OF EUROPE: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 239 REST OF EUROPE: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 240 REST OF EUROPE: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 241 REST OF EUROPE: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 242 NORTH AMERICA: ALL-TERRAIN VEHICLE MARKET, BY COUNTRY, 2019-2023 (UNITS)

- TABLE 243 NORTH AMERICA: ALL-TERRAIN VEHICLE MARKET, BY COUNTRY, 2024-2030 (UNITS)

- TABLE 244 NORTH AMERICA: ALL-TERRAIN VEHICLE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 245 NORTH AMERICA: ALL-TERRAIN VEHICLE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 246 US: LIST OF MAJOR ALL-TERRAIN VEHICLE MANUFACTURERS AND THEIR KEY INDICATIVE MODELS

- TABLE 247 US: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 248 US: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 249 US: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 250 US: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 251 CANADA: LIST OF MAJOR ALL-TERRAIN VEHICLE MANUFACTURERS AND THEIR KEY INDICATIVE MODELS

- TABLE 252 CANADA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 253 CANADA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 254 CANADA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 255 CANADA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 256 MEXICO: LIST OF MAJOR ALL-TERRAIN VEHICLE MANUFACTURERS AND THEIR KEY INDICATIVE MODELS

- TABLE 257 MEXICO: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 258 MEXICO: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 259 MEXICO: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 260 MEXICO: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 261 REST OF THE WORLD: ALL-TERRAIN VEHICLE MARKET, BY COUNTRY, 2019-2023 (UNITS)

- TABLE 262 REST OF THE WORLD: ALL-TERRAIN VEHICLE MARKET, BY COUNTRY, 2024-2030 (UNITS)

- TABLE 263 REST OF THE WORLD: ALL-TERRAIN VEHICLE MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 264 REST OF THE WORLD: ALL-TERRAIN VEHICLE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 265 BRAZIL: LIST OF MAJOR ALL-TERRAIN VEHICLE MANUFACTURERS AND THEIR KEY INDICATIVE MODELS

- TABLE 266 BRAZIL: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 267 BRAZIL: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 268 BRAZIL: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 269 BRAZIL: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 270 UAE: LIST OF MAJOR ALL-TERRAIN VEHICLE MANUFACTURERS AND THEIR KEY INDICATIVE MODELS

- TABLE 271 UAE: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 272 UAE: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 273 UAE: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 274 UAE: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 275 SOUTH AFRICA: LIST OF MAJOR ALL-TERRAIN MANUFACTURERS AND THEIR KEY INDICATIVE MODELS

- TABLE 276 SOUTH AFRICA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 277 SOUTH AFRICA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 278 SOUTH AFRICA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 279 SOUTH AFRICA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 280 SAUDI ARABIA: LIST OF MAJOR ALL-TERRAIN VEHICLE MANUFACTURERS AND THEIR KEY INDICATIVE MODELS

- TABLE 281 SAUDI ARABIA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 282 SAUDI ARABIA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 283 SAUDI ARABIA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 284 SAUDI ARABIA: ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 285 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS IN ALL-TERRAIN VEHICLE MARKET

- TABLE 286 DEGREE OF COMPETITION IN ALL-TERRAIN VEHICLE MARKET, 2023

- TABLE 287 ALL-TERRAIN VEHICLE MARKET: TYPE FOOTPRINT, 2023

- TABLE 288 ALL-TERRAIN VEHICLE MARKET: FUEL TYPE FOOTPRINT, 2023

- TABLE 289 ALL-TERRAIN VEHICLE MARKET: REGION FOOTPRINT, 2023

- TABLE 290 SIDE-BY-SIDE VEHICLE MARKET: ENGINE CAPACITY FOOTPRINT, 2023

- TABLE 291 SIDE-BY-SIDE VEHICLE MARKET: DRIVE TYPE FOOTPRINT, 2023

- TABLE 292 SIDE-BY-SIDE VEHICLE MARKET: SEATING CAPACITY FOOTPRINT, 2023

- TABLE 293 ALL-TERRAIN VEHICLE MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 294 ALL-TERRAIN VEHICLE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2023

- TABLE 295 ALL-TERRAIN VEHICLE MARKET: PRODUCT LAUNCHES/DEVELOPMENTS/ENHANCEMENTS, JANUARY 2021-JULY 2024

- TABLE 296 ALL-TERRAIN VEHICLE MARKET: DEALS, JANUARY 2021-JUNE 2024

- TABLE 297 ALL-TERRAIN VEHICLE MARKET: EXPANSIONS, JANUARY 2021-APRIL 2024

- TABLE 298 ALL-TERRAIN VEHICLE MARKET: OTHER DEVELOPMENTS, JANUARY 2023-JULY 2024

- TABLE 299 POLARIS INC.: COMPANY OVERVIEW

- TABLE 300 POLARIS INC.: PRODUCTS OFFERED

- TABLE 301 POLARIS INC.: PRODUCT LAUNCHES/DEVELOPMENTS/ENHANCEMENTS

- TABLE 302 POLARIS INC.: DEALS

- TABLE 303 POLARIS INC.: EXPANSIONS

- TABLE 304 POLARIS INC.: OTHER DEVELOPMENTS

- TABLE 305 TEXTRON INC.: COMPANY OVERVIEW

- TABLE 306 TEXTRON INC.: PRODUCTS OFFERED

- TABLE 307 TEXTRON INC.: PRODUCT LAUNCHES/DEVELOPMENTS/ENHANCEMENTS

- TABLE 308 TEXTRON INC.: DEALS

- TABLE 309 TEXTRON INC.: OTHER DEVELOPMENTS

- TABLE 310 HONDA MOTOR CO., LTD.: COMPANY OVERVIEW

- TABLE 311 HONDA MOTOR CO., LTD.: PRODUCTS OFFERED

- TABLE 312 HONDA MOTOR CO., LTD.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 313 HONDA MOTOR CO., LTD.: DEALS

- TABLE 314 HONDA MOTOR CO., LTD.: EXPANSIONS

- TABLE 315 KAWASAKI HEAVY INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 316 KAWASAKI HEAVY INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 317 KAWASAKI HEAVY INDUSTRIES LTD.: PRODUCT LAUNCHES

- TABLE 318 KAWASAKI HEAVY INDUSTRIES LTD.: DEALS

- TABLE 319 KAWASAKI HEAVY INDUSTRIES LTD.: EXPANSIONS

- TABLE 320 YAMAHA MOTOR CO., LTD.: COMPANY OVERVIEW

- TABLE 321 YAMAHA MOTOR CO., LTD.: PRODUCTS OFFERED

- TABLE 322 YAMAHA MOTOR CO., LTD.: PRODUCT LAUNCHES

- TABLE 323 YAMAHA MOTOR CO., LTD.: EXPANSIONS

- TABLE 324 SUZUKI MOTOR CORPORATION: COMPANY OVERVIEW

- TABLE 325 SUZUKI MOTOR CORPORATION: PRODUCTS OFFERED

- TABLE 326 SUZUKI MOTOR CORPORATION: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 327 SUZUKI MOTOR CORPORATION: DEALS

- TABLE 328 SUZUKI MOTOR CORPORATION: OTHER DEVELOPMENTS

- TABLE 329 DEERE & COMPANY: COMPANY OVERVIEW

- TABLE 330 DEERE & COMPANY: PRODUCTS OFFERED

- TABLE 331 DEERE & COMPANY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 332 DEERE & COMPANY: DEALS

- TABLE 333 BRP: COMPANY OVERVIEW

- TABLE 334 BRP: PRODUCTS OFFERED

- TABLE 335 BRP: PRODUCT LAUNCHES

- TABLE 336 BRP: DEALS

- TABLE 337 BRP: EXPANSIONS

- TABLE 338 BRP: OTHER DEVELOPMENTS

- TABLE 339 CFMOTO: COMPANY OVERVIEW

- TABLE 340 CFMOTO: PRODUCTS OFFERED

- TABLE 341 CFMOTO: PRODUCT LAUNCHES

- TABLE 342 CFMOTO: DEALS

- TABLE 343 CFMOTO: OTHER DEVELOPMENTS

- TABLE 344 HISUN.: COMPANY OVERVIEW

- TABLE 345 HISUN.: PRODUCTS OFFERED

- TABLE 346 HISUN.: PRODUCT LAUNCHES

- TABLE 347 HISUN.: DEALS

- TABLE 348 HISUN.: EXPANSIONS

- TABLE 349 HISUN.: OTHER DEVELOPMENTS

- TABLE 350 BENNCHE, LLC: COMPANY OVERVIEW

- TABLE 351 VELOMOTORS: COMPANY OVERVIEW

- TABLE 352 ECO CHARGER: COMPANY OVERVIEW

- TABLE 353 BALTMOTORS: COMPANY OVERVIEW

- TABLE 354 CECTEK: COMPANY OVERVIEW

- TABLE 355 NEBULA AUTOMOTIVE PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 356 TAIWAN GOLDEN BEE (TGB): COMPANY OVERVIEW

- TABLE 357 KYMCO: COMPANY OVERVIEW

- TABLE 358 LINHAI: COMPANY OVERVIEW

- TABLE 359 AMERICAN LANDMASTER: COMPANY OVERVIEW

- TABLE 360 SEGWAY TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 361 BAD BOY MOWERS.: COMPANY OVERVIEW

- TABLE 362 MASSIMO MOTORS SPORTS, LLC: COMPANY OVERVIEW

- TABLE 363 INTIMIDATOR UTV: COMPANY OVERVIEW

- TABLE 364 SSR MOTORSPORTS: COMPANY OVERVIEW

- TABLE 365 DRR USA: COMPANY OVERVIEW

- TABLE 366 ARGO: COMPANY OVERVIEW

- TABLE 367 VOLCON: COMPANY OVERVIEW

- TABLE 368 POWERLAND: COMPANY OVERVIEW

- TABLE 369 LIVAQ: COMPANY OVERVIEW

- TABLE 370 POTENTIAL MOTORS: COMPANY OVERVIEW

- TABLE 371 OREION MOTORS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ALL-TERRAIN VEHICLE MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 BOTTOM-UP APPROACH: ALL-TERRAIN VEHICLE MARKET, BY TYPE

- FIGURE 7 TOP-DOWN APPROACH: ALL-TERRAIN VEHICLE MARKET, BY ENGINE CAPACITY

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 ALL-TERRAIN VEHICLE MARKET OUTLOOK

- FIGURE 10 ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024 VS. 2030 (USD MILLION)

- FIGURE 11 ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 12 INCREASING PENETRATION OF ALL-TERRAIN VEHICLES IN AGRICULTURE AND MILITARY & DEFENSE SECTORS TO DRIVE MARKET

- FIGURE 13 UTILITY SEGMENT TO HOLD LARGER MARKET SHARE THAN SPORTS SEGMENT DURING FORECAST PERIOD

- FIGURE 14 SPORTS APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 AWD SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 ELECTRIC SEGMENT TO REGISTER HIGHER CAGR THAN GASOLINE SEGMENT DURING FORECAST PERIOD

- FIGURE 17 400-800 CC SEGMENT TO LEAD ALL-TERRAIN VEHICLE MARKET DURING FORECAST PERIOD

- FIGURE 18 FOUR WHEELS SEGMENT TO LEAD ALL-TERRAIN VEHICLE MARKET DURING FORECAST PERIOD

- FIGURE 19 ONE-SEATER SEGMENT TO HOLD LARGER MARKET SHARE THAN >TWO-SEATER SEGMENT DURING FORECAST PERIOD

- FIGURE 20 ASIA OCEANIA TO WITNESS FASTEST GROWTH IN SIDE-BY-SIDE VEHICLE MARKET DURING FORECAST PERIOD

- FIGURE 21 >10 KWH SEGMENT TO HOLD LARGER MARKET SHARE THAN <10 KWH SEGMENT DURING FORECAST PERIOD

- FIGURE 22 FOUR WHEELS SEGMENT TO HOLD LARGER MARKET SHARE IN SIDE-BY-SIDE VEHICLE MARKET DURING FORECAST PERIOD

- FIGURE 23 ASIA OCEANIA TO BE FASTEST-GROWING ALL-TERRAIN VEHICLE MARKET DURING FORECAST PERIOD

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ALL-TERRAIN VEHICLE MARKET

- FIGURE 25 GDP-BASED PURCHASING POWER PARITY FOR SELECTED COUNTRIES, 2019 VS. 2021 VS. 2024 VS. 2028

- FIGURE 26 IMPACT OF AI/GENAI ON ALL-TERRAIN VEHICLE MANUFACTURING

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 INDICATIVE AVERAGE SELLING PRICE, BY REGION, 2019-2023

- FIGURE 29 INDICATIVE AVERAGE SELLING PRICE, BY TYPE, 2019-2023

- FIGURE 30 INDICATIVE AVERAGE SELLING PRICE, BY APPLICATION, 2019-2023

- FIGURE 31 SUPPLY CHAIN ANALYSIS FOR ALL-TERRAIN VEHICLE MARKET

- FIGURE 32 VARIOUS PLAYERS IN ALL-TERRAIN VEHICLE MARKET ECOSYSTEM

- FIGURE 33 ALL-TERRAIN VEHICLE MARKET ECOSYSTEM

- FIGURE 34 INVESTMENT SCENARIO, JANUARY 2020-APRIL 2024

- FIGURE 35 PATENT ANALYSIS, 2015-2024

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ELECTRIC AND GASOLINE ALL-TERRAIN VEHICLES

- FIGURE 37 KEY BUYING CRITERIA FOR ELECTRIC AND GASOLINE ALL-TERRAIN VEHICLES

- FIGURE 38 TOTAL COST OF OWNERSHIP: VARIOUS ELECTRIC AND GASOLINE VEHICLES

- FIGURE 39 ELECTRIC ALL-TERRAIN VEHICLES AND SIDE-BY-SIDES, BATTERY CAPACITY VS. RANGE, BY OEM

- FIGURE 40 GASOLINE ALL-TERRAIN VEHICLES, HORSEPOWER VS. ENGINE CAPACITY, BY OEM

- FIGURE 41 GASOLINE SIDE-BY-SIDES, HORSEPOWER VS. ENGINE CAPACITY, BY OEM

- FIGURE 42 ALL-TERRAIN VEHICLE MARKET, BY TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 43 ALL-TERRAIN VEHICLE MARKET, BY APPLICATION, 2024 VS. 2030 (USD MILLION)

- FIGURE 44 ALL-TERRAIN VEHICLE MARKET, BY DRIVE TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 45 ALL-TERRAIN VEHICLE MARKET, BY ENGINE CAPACITY, 2024 VS. 2030 (USD MILLION)

- FIGURE 46 ALL-TERRAIN VEHICLE MARKET, BY FUEL TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 47 ALL-TERRAIN VEHICLE MARKET, BY NUMBER OF WHEELS, 2024 VS. 2030 (USD MILLION)

- FIGURE 48 ALL-TERRAIN VEHICLE MARKET, BY SEATING CAPACITY, 2024 VS. 2030 (USD MILLION)

- FIGURE 49 ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY BATTERY CAPACITY, 2024 VS. 2030 (USD MILLION)

- FIGURE 50 SIDE-BY-SIDE VEHICLE MARKET, BY NUMBER OF WHEELS, 2024 VS. 2030 (USD MILLION)

- FIGURE 51 SIDE-BY-SIDE VEHICLE MARKET, BY REGION, 2024 VS. 2030 (USD MILLION)

- FIGURE 52 ALL-TERRAIN VEHICLE MARKET, BY REGION, 2024-2030 (USD MILLION)

- FIGURE 53 ASIA OCEANIA: REAL GDP GROWTH RATE, BY COUNTRY, 2023-2025

- FIGURE 54 ASIA OCEANIA: GDP PER CAPITA, BY COUNTRY, 2023-2025

- FIGURE 55 ASIA OCEANIA: INFLATION RATE AVERAGE CONSUMER PRICE, BY COUNTRY, 2023-2025

- FIGURE 56 ASIA OCEANIA: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2023

- FIGURE 57 ASIA OCEANIA: ALL-TERRAIN VEHICLE MARKET SNAPSHOT

- FIGURE 58 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2023-2025

- FIGURE 59 EUROPE: GDP PER CAPITA, BY COUNTRY, 2023-2025

- FIGURE 60 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICE, BY COUNTRY, 2023-2025

- FIGURE 61 EUROPE: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2023

- FIGURE 62 EUROPE: ALL-TERRAIN VEHICLE MARKET SNAPSHOT

- FIGURE 63 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2023-2025

- FIGURE 64 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2023-2025

- FIGURE 65 NORTH AMERICA: CPI INFLATION RATE, BY COUNTRY, 2023-2025

- FIGURE 66 NORTH AMERICA: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, 2023

- FIGURE 67 NORTH AMERICA: ALL-TERRAIN VEHICLE MARKET SNAPSHOT

- FIGURE 68 REST OF THE WORLD: REAL GDP ANNUAL PERCENTAGE CHANGE, 2023-2025

- FIGURE 69 REST OF THE WORLD: GDP PER CAPITA, 2023-2025

- FIGURE 70 REST OF THE WORLD: AVERAGE CPI INFLATION RATE, 2023-2025

- FIGURE 71 REST OF THE WORLD: MANUFACTURING INDUSTRY VALUE (AS PART OF GDP), 2023

- FIGURE 72 REST OF THE WORLD: ALL-TERRAIN VEHICLE MARKET, 2024 VS. 2030 (USD MILLION)

- FIGURE 73 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2021-2023

- FIGURE 74 ALL-TERRAIN VEHICLE MARKET SHARE ANALYSIS, 2023

- FIGURE 75 COMPANY VALUATION, 2023 (USD BILLION)

- FIGURE 76 COMPANY FINANCIAL METRICS, 2023 (USD BILLION)

- FIGURE 77 BRAND COMPARISON

- FIGURE 78 ALL-TERRAIN VEHICLE MANUFACTURERS: COMPANY EVALUATION MATRIX, 2023

- FIGURE 79 ALL-TERRAIN VEHICLE MARKET: COMPANY FOOTPRINT, 2023

- FIGURE 80 COMPANY EVALUATION MATRIX: SIDE-BY-SIDE VEHICLE MANUFACTURERS, 2023

- FIGURE 81 COMPANY FOOTPRINT: SIDE-BY-SIDE VEHICLE MARKET, 2023

- FIGURE 82 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- FIGURE 83 POLARIS INC.: COMPANY SNAPSHOT

- FIGURE 84 TEXTRON INC.: COMPANY SNAPSHOT

- FIGURE 85 HONDA MOTOR CO., LTD.: COMPANY SNAPSHOT

- FIGURE 86 KAWASAKI HEAVY INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 87 YAMAHA MOTOR CO., LTD.: COMPANY SNAPSHOT

- FIGURE 88 SUZUKI MOTOR CORPORATION: COMPANY SNAPSHOT

- FIGURE 89 DEERE & COMPANY: COMPANY SNAPSHOT

- FIGURE 90 BRP: COMPANY SNAPSHOT

- FIGURE 91 CFMOTO: COMPANY SNAPSHOT

The all-terrain vehicle market is projected to grow from USD 2.9 billion in 2024 to USD 3.3 billion by 2030, at a CAGR of 2.3% from 2024 to 2030. The North American ATV market is decreasing due to a shift in consumer buying behavior towards side-by-side vehicles, which provide extra seating capacity and safety for riders. Moreover, according to the annual report of Polaris Inc 2023, the retail sales of side-by-side vehicles have increased by 9.5% from 2019 to 2023. i.e. the sales for side-by-side vehicles increased from 510,000 units in 2019 to 550,000 units in 2023, whereas ATVs retail sales in North America was 260,000 units in 2019 which has decreased to 240,000 units in 2023, which showcases the interest of change in consumer from ATVs towards side-by-side vehicles. In contrast, the market will remain steady in other regions. Moreover, the growth in military and farming applications has also boosted the market, which needs ATVs with high load-carrying capacity.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | by Application, Drive, Engine, Fuel, Number of Wheels, Battery Capacity, Seating Capacity & Region |

| Regions covered | Asia Oceania, Europe, North America, and the Rest of the World |

"Sports application holds the largest market in all-terrain vehicles."

In sports applications, the ATVs are designed for high performance and speed, which makes them ideal for competitive racing. The engine capacity of sport ATVs ranges from 100 - 1000 cc. This sports ATVs are modified & equipped with different accessories to design a unique style and power. Also, these ATVs are usually popular amongst young riders as they seek them for adventure sports and actively participate in race events and motocross competitions.

The ATV sports activity has a strong culture and demand in North America and Europe, where these regions have large concentrations of ATV clubs, racing leagues, and events, increasing interest among the people. OEMs also play an essential role in driving the market for sports ATVs, where OEMs are actively investing in R&D to innovate and release new models for sports riders. Companies like Polaris Inc. (US), BRP (Canada), Textron (US), Yamaha Motor Co., Ltd (Japan), CFMOTO (China), and Honda Motor Co., Ltd (Japan) actively launches ATVs and SxS vehicle to compete in the global market. For instance, Honda launched 2024 TRX450R ATV in March 2024 which was offered with 450 cc engine. Similarly, Yamaha had launched Raptor 700R in April 2024 which was offered with a 686 cc engine. Hence, the increase in number of clubs & leagues for ATVs & SxS vehicles, and new ATVs launched by the OEM for sports applications would drive the market.

">800 cc to be the fastest-growing market for All-terrain vehicles."

The market for >800 cc engines is growing fast due to increased demand for high-performance vehicles capable of handling extreme terrains and rigorous track activities. These higher-engine capacity in ATVs are usually preferred for sports activities such as race events & recreational task whereas utility vehicles are used for mining, forestry, and search & rescue operations. After the pandemic, sports and outdoor activities have increased in North America, due to which there was a gradual growth in ATV market for higher engine capacity. Some of the major ATV race events held are "Grand National Cross Country (GNCC) Series and the Baja 1000 which requires higher engine capacity in ATVs. OEMs are also expanding their product portfolio for >800 cc engines in ATVs. For instance, In May 2024, Yamaha developed a new 1000 cc ATV for off-road enthusiasts, which was sold in domestic and international markets. OEMs are also expanding their manufacturing facility to cater to the increasing demand for ATVs. For instance, In July 2023, Honda Motor Co., Ltd. (Japan) in North Carolina Manufacturing facility started the production of ATVs with higher engine capacity due to an increase in demand for them in North America. The company invested USD 380 million to develop FourTrax and TRX series ATV models. Similarly, In July 2022, BRP (Canada) started their new manufacturing plant in Queretaro, Mexico, including a production line for >800 cc engines in ATVs. Similarly, Arctic Cat (US) (Subsidiary company of Textron Inc (US)) had invested USD 26 million in their new manufacturing facility at Thief River Falls due to increased outdoor activities and sports events in North America. Hence, these investments by the key players and rising race events have boosted the market for engines >800 cc.

"Asia Oceania is the fastest growing market for All-terrain vehicles."

Asia Oceania region has significant countries like China and Australia, where ATV has a higher market share. Countries like Australia have extensive farmland and agricultural spaces where ATVs are essential for farming and caring for livestock. Similarly, China is Asia Oceania's second-largest market, with some dominating players like CFMOTO (China), Chongqing Huansong (China), and Linhai (China). However, many ATVs that these key players in China manufacture are exported to Europe and other countries due to higher demand. According to International Trade Centre (ITC) data for 2023, China exports most ATVs to the US, Russia, and Mexico, where China also holds a total trade value of USD 2,127.9 million in 2023. On the other hand, the top leading player like CFMOTO (China) mentioned on their website that more than 70% of their ATVs are sold in 100 countries, whereas 60% of their vehicles are sold in Europe.

Also, many events are held in China to create new racing enthusiasts for ATVs, and the company holds events such as CFMOTO DAY every year. As the ATV market is gradually moving towards electrification, critical players in this region are focused on developing electric drivetrains, which has created new opportunities in the ATV market. Indian Startups like Powerland had raised USD 1.2 million funds in equity and debt finance in its pre-Series A round from the company named ILAFA Vertriebs GmbH (Germany) to increase the production and commercialization of the electric version of ATVs, mainly focusing on Powerland Tachyon 4x4. Moreover, these electric ATVs have gained a higher demand in European countries due to emission regulations.

The key players are also acquiring other companies to increase their presence in other countries. Hence, these investments, events, and increased export rates are driving the market for ATVs.

Breakdown of Primaries

In-depth interviews were conducted with CXOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: All-terrain Vehicle Manufacturer- 80%, and Other Companies - 20%

- By Designation: C Level Executives - 60%, Directors/ Vice Presidents-10%, and Others -30%

- By Region: North America - 20%, Europe - 10%, Asia Oceania - 50%, and Rest of the World - 20%

The All-terrain vehicles market comprises significant manufacturers such as Polaris Inc. (US), Honda Motor Co., Ltd (Japan), BRP (Canada), Yamaha Motor Corporation (Japan), and Textron Inc. (US).

Research Coverage

The study segments the all-terrain vehicle market by application (sports, entertainment, agriculture, military & defense, and others); type (sports and utility); drive type (2WD, 4WD, and AWD); engine capacity (<400 cc, 400 - 800 cc, and >800 CC); fuel type (gasoline and electric); seating capacity (One-seater and >=2-Seater); the number of wheels (four wheels and >four wheels), electric ATV, by battery capacity (<10kWh and >10 kWh), and Side-by-side vehicle market, by number of wheels (four wheels and >four wheels) region (Asia Oceania, Europe, North America, Rest of the world) and side-by-side by region.

Key Benefits of Buying the Report:

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the all-terrain vehicle market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of critical drivers (Increasing off-road recreational activities, growing demand for all-terrain vehicles in agriculture and military & defense sectors, rising purchasing power and spending capacity of individuals), Restraints (High accident rates are hampering the ATV sales, and Restriction on all-terrain vehicle use in wildlife zones), Opportunities (Integration of advanced technologies in all-terrain vehicles, Growing penetration of electric all-terrain vehicles, and Increasing rental services), Challenges (Trade barriers between different countries High cost of ATVs and High cost of all-terrain vehicles)

- New vehicles launch for electric ATVs with their battery capacity offered by the manufacturers which are used in military, agriculture and recreational purpose.

- OEM analysis for electric ATVS and SxS vehicles: battery capacity vs vehicle range; Gasoline ATVs: horsepower VS engine capacity; and Gasoline SxS vehicles: horsepower VS engine capacity.

- Total Cost of Ownership for ATVs for gasoline and electric fuel type

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the all-terrain vehicle market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the all-terrain vehicle market across different regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the all-terrain vehicle market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Polaris Inc. (US), BRP (Canada), Honda Motor Co., Ltd (Japan), Textron Inc. (US), and Yamaha Motor Corporation (Japan). In the all-terrain vehicle market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 MARKET DEFINITION

- 1.2.1.1 By Drive Type

- 1.2.1.2 By Type

- 1.2.2 INCLUSIONS AND EXCLUSIONS

- 1.2.1 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources to estimate base numbers

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Sampling techniques and data collection methods

- 2.1.2.2 Primary interview participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FACTOR IMPACTING ALL-TERRAIN VEHICLE MARKET

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ELECTRIC ALL-TERRAIN VEHICLE MARKET

- 4.2 ALL-TERRAIN VEHICLE MARKET, BY TYPE

- 4.3 ALL-TERRAIN VEHICLE MARKET, BY APPLICATION

- 4.4 ALL-TERRAIN VEHICLE MARKET, BY DRIVE TYPE

- 4.5 ALL-TERRAIN VEHICLE MARKET, BY FUEL TYPE

- 4.6 ALL-TERRAIN VEHICLE MARKET, BY ENGINE CAPACITY

- 4.7 ALL-TERRAIN VEHICLE MARKET, BY NUMBER OF WHEELS

- 4.8 ALL-TERRAIN VEHICLE MARKET, BY SEATING CAPACITY

- 4.9 SIDE-BY-SIDE VEHICLE MARKET, BY REGION

- 4.10 ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY BATTERY CAPACITY

- 4.11 SIDE-BY-SIDE VEHICLE MARKET, BY NUMBER OF WHEELS

- 4.12 ALL-TERRAIN VEHICLE MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing off-road recreational activities

- 5.2.1.2 Growing demand for all-terrain vehicles in agriculture and military & defense applications

- 5.2.1.3 Rising purchasing power and spending capacity of individuals

- 5.2.2 RESTRAINTS

- 5.2.2.1 High accident rates hampering all-terrain vehicle sales

- 5.2.2.2 Restriction on all-terrain vehicle use in wildlife zones

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of advanced technologies in all-terrain vehicles

- 5.2.3.2 Growing penetration of electric all-terrain vehicles

- 5.2.3.3 Increasing rental services

- 5.2.4 CHALLENGES

- 5.2.4.1 Trade barriers between different countries

- 5.2.4.2 High cost of all-terrain vehicles

- 5.2.1 DRIVERS

- 5.3 IMPACT OF AI/GENAI ON ALL-TERRAIN VEHICLE MANUFACTURING

- 5.3.1 CASE STUDIES

- 5.3.1.1 Massimo using robots in all-terrain vehicle manufacturing units

- 5.3.1.2 Polaris using ToolsGroup's platform to optimize supply chain of all-terrain vehicles

- 5.3.1.3 AI-equipped all-terrain vehicles for precision farming in Midwest, US

- 5.3.1.4 Indian Army conducting trials for AI-based all-terrain vehicles

- 5.3.1.5 CFMOTO partnering with Cerence to integrate AI in all-terrain vehicles

- 5.3.1 CASE STUDIES

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE AVERAGE SELLING PRICE, BY REGION, 2019-2023

- 5.5.2 INDICATIVE AVERAGE SELLING PRICE, BY TYPE, 2019-2023

- 5.5.3 INDICATIVE AVERAGE SELLING PRICE, BY APPLICATION, 2019-2023

- 5.5.4 OEM PRICING FOR ALL-TERRAIN VEHICLES, BY DRIVE TYPE

- 5.5.5 OEM PRICING FOR ALL-TERRAIN VEHICLES, BY ENGINE CAPACITY

- 5.5.6 OEM PRICING FOR ELECTRIC ALL-TERRAIN VEHICLES

- 5.5.7 OEM PRICING FOR ALL-TERRAIN VEHICLES, BY NUMBER OF WHEELS

- 5.5.8 OEM PRICING FOR ALL-TERRAIN VEHICLES, BY SEATING CAPACITY

- 5.5.9 OEM PRICING FOR SIDE-BY-SIDE VEHICLES, BY NUMBER OF WHEELS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ALL-TERRAIN VEHICLE MARKET ECOSYSTEM ANALYSIS

- 5.7.1 ALL-TERRAIN VEHICLE MANUFACTURERS

- 5.7.2 RAW MATERIAL/COMPONENT SUPPLIERS

- 5.7.3 GOVERNMENT AND REGULATORY AUTHORITIES

- 5.7.4 DEALERS AND DISTRIBUTORS

- 5.7.5 SERVICE & REPAIR CENTERS

- 5.7.6 END USERS

- 5.8 INVESTMENT SCENARIO

- 5.9 TECHNOLOGY TRENDS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Autonomous all-terrain vehicles

- 5.9.1.2 Advancements in battery packs and development of wireless and automated charging for electric all-terrain vehicles

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Advanced connectivity and smart features

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Hydrogen fuel cell all-terrain vehicles

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO, 2019-2023

- 5.11.2 EXPORT SCENARIO, 2019-2023

- 5.12 KEY CONFERENCES AND EVENTS IN 2024-2025

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 JOHN DEERE AND AMS PARTNERED FOR NEXT-GEN ENTRY-LEVEL SPORTS ALL-TERRAIN VEHICLES

- 5.13.2 POLARIS INTRODUCED NAVIGATION PLATFORM TAILORED TO ITS CUSTOMERS IN PARTNERSHIP WITH COMTECH

- 5.13.3 KAWASAKI ARC WELDING SOLUTIONS FOR ALL-TERRAIN VEHICLES

- 5.13.4 CORRA'S ABOBE COMMERCE SOLUTION TO CONTROL MOBILE TRAFFICKING PROBLEM

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 US

- 5.14.2 CANADA

- 5.14.3 AUSTRALIA

- 5.14.4 EUROPE

- 5.14.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.5.1 North America

- 5.14.5.2 Europe

- 5.14.5.3 Asia Oceania

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 TOTAL COST OF OWNERSHIP

- 5.16.1 ELECTRIC VS. GASOLINE ALL-TERRAIN VEHICLES

- 5.17 OEM ANALYSIS

- 5.17.1 BATTERY CAPACITY VS. VEHICLE RANGE

- 5.17.2 GASOLINE ALL-TERRAIN VEHICLES: HORSEPOWER VS. ENGINE CAPACITY

- 5.17.3 GASOLINE SIDE-BY-SIDES: HORSEPOWER VS. ENGINE CAPACITY

6 ALL-TERRAIN VEHICLE MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 SPORTS

- 6.2.1 ASIA OCEANIA TO BE FASTEST-GROWING MARKET

- 6.3 UTILITY

- 6.3.1 INCREASING APPLICATION IN FARMS AND AGRICULTURAL PRACTICES TO DRIVE MARKET

- 6.4 INDUSTRY INSIGHTS

7 ALL-TERRAIN VEHICLE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 SPORTS

- 7.2.1 POPULARITY OF SPORTS EVENTS AND CHAMPIONSHIPS TO DRIVE MARKET

- 7.3 ENTERTAINMENT

- 7.3.1 GROWING NUMBER OF LOCAL RACES AND EVENTS TO DRIVE MARKET

- 7.4 AGRICULTURE

- 7.4.1 GROWING FARM MECHANIZATION TO DRIVE MARKET

- 7.5 MILITARY & DEFENSE

- 7.5.1 GROWING R&D AND INVESTMENTS TO DEVELOP ALL-TERRAIN VEHICLES THAT CAN OPERATE IN EXTREME CONDITIONS TO DRIVE MARKET

- 7.6 OTHERS

- 7.7 INDUSTRY INSIGHTS

8 ALL-TERRAIN VEHICLE MARKET, BY DRIVE TYPE

- 8.1 INTRODUCTION

- 8.2 2WD

- 8.2.1 ADDED SENSE OF CONTROL TO DRIVE MARKET

- 8.3 4WD

- 8.3.1 TECHNICAL ADVANTAGES LIKE BETTER TRACTION AND ABILITY TO SWITCH TO 2WD TO DRIVE 4WD MARKET

- 8.4 AWD

- 8.4.1 GROWING TREND OF ELECTRIFICATION TO DRIVE MARKET

- 8.5 INDUSTRY INSIGHTS

9 ALL-TERRAIN VEHICLE MARKET, BY ENGINE CAPACITY

- 9.1 INTRODUCTION

- 9.2 <400 CC

- 9.2.1 RISING DEMAND IN SPORTS AND OFF-ROAD ACTIVITIES TO DRIVE MARKET

- 9.3 400-800 CC

- 9.3.1 HIGH DELIVERING POWER AND ENHANCED FUEL EFFICIENCY TO DRIVE MARKET

- 9.4 >800 CC

- 9.4.1 ABILITY TO OFFER EXTREME POWER AND TORQUE REQUIREMENTS TO DRIVE MARKET

- 9.5 INDUSTRY INSIGHTS

10 ALL-TERRAIN VEHICLE MARKET, BY FUEL TYPE

- 10.1 INTRODUCTION

- 10.2 GASOLINE

- 10.2.1 HIGHER POWER, EFFICIENCY, AND WIDER APPLICATIONS TO DRIVE MARKET

- 10.3 ELECTRIC

- 10.3.1 DEVELOPMENTS IN BATTERY TECHNOLOGY AND LAUNCH OF VARIOUS MODELS FOR DIFFERENT APPLICATIONS TO DRIVE MARKET

- 10.4 INDUSTRY INSIGHTS

11 ALL-TERRAIN VEHICLE MARKET, BY NUMBER OF WHEELS

- 11.1 INTRODUCTION

- 11.2 FOUR WHEELS

- 11.2.1 INCREASING SPORTS AND RECREATIONAL ACTIVITIES TO DRIVE MARKET

- 11.3 >FOUR WHEELS

- 11.3.1 GROWING DEMAND FOR UTILITY ALL-TERRAIN VEHICLES IN AGRICULTURE, CONSTRUCTION, AND MINING TO DRIVE MARKET

- 11.4 INDUSTRY INSIGHTS

12 ALL-TERRAIN VEHICLE MARKET, BY SEATING CAPACITY

- 12.1 INTRODUCTION

- 12.2 ONE-SEATER

- 12.2.1 LOWER COST THAN TWO-SEATERS TO DRIVE MARKET

- 12.3 >=TWO-SEATER

- 12.3.1 REDUCED MAINTENANCE AND INCREASED SAFETY TO DRIVE MARKET

- 12.4 INDUSTRY INSIGHTS

13 ELECTRIC ALL-TERRAIN VEHICLE MARKET, BY BATTERY CAPACITY

- 13.1 INTRODUCTION

- 13.1.1 ELECTRIC ALL-TERRAIN VEHICLE OEM MODELS, BY BATTERY CAPACITY

- 13.2 <10 KWH

- 13.2.1 GROWING DEMAND FOR ADVENTURE SPORTS TO DRIVE MARKET

- 13.3 >10 KWH

- 13.3.1 INCREASE IN INDUSTRIAL AND MILITARY APPLICATIONS TO DRIVE MARKET

- 13.4 INDUSTRY INSIGHTS

14 SIDE-BY-SIDE VEHICLE MARKET, BY NUMBER OF WHEELS

- 14.1 INTRODUCTION

- 14.2 FOUR WHEELS

- 14.2.1 GROWING OUTDOOR RECREATION ACTIVITIES TO DRIVE MARKET

- 14.3 >FOUR WHEELS

- 14.3.1 INCREASING CARGO-CARRYING CAPACITY FOR INDUSTRIAL AND AGRICULTURAL USES TO DRIVE MARKET

- 14.4 INDUSTRY INSIGHTS

15 SIDE-BY-SIDE VEHICLE MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 INDUSTRY INSIGHTS

16 ALL-TERRAIN VEHICLE MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 ASIA OCEANIA

- 16.2.1 MACROECONOMIC OUTLOOK

- 16.2.2 CHINA

- 16.2.2.1 Large-scale domestic manufacturing and increasing adoption in farming to drive market

- 16.2.3 AUSTRALIA

- 16.2.3.1 Introduction of safety regulations like installation of rollover protection devices to affect market

- 16.2.4 NEW ZEALAND

- 16.2.4.1 Increasing popularity of sports events and championships to drive market

- 16.2.5 JAPAN

- 16.2.5.1 Growing demand in sports events and championships to drive market

- 16.2.6 INDIA

- 16.2.6.1 Introduction of new models for agriculture applications to drive market

- 16.3 EUROPE

- 16.3.1 MACROECONOMIC OUTLOOK

- 16.3.2 GERMANY

- 16.3.2.1 Growing penetration of all-terrain vehicles in military & defense sector to drive market

- 16.3.3 FRANCE

- 16.3.3.1 Increasing adoption in construction and farming activities to drive market

- 16.3.4 RUSSIA

- 16.3.4.1 Rising demand in defense and agriculture applications to drive market

- 16.3.5 UK

- 16.3.5.1 Safety programs by key market players to drive market

- 16.3.6 SPAIN

- 16.3.6.1 Increased farming activity related to vineyards and olive groves to drive market

- 16.3.7 SWEDEN

- 16.3.7.1 Presence of vast forest areas to drive market

- 16.3.8 REST OF EUROPE

- 16.4 NORTH AMERICA

- 16.4.1 MACROECONOMIC OUTLOOK

- 16.4.2 US

- 16.4.2.1 Growing use of ATVs in military applications to drive market

- 16.4.3 CANADA

- 16.4.3.1 Government efforts to legalize all-terrain vehicles in some provinces to drive market

- 16.4.4 MEXICO

- 16.4.4.1 Growth of off-road vehicle industry to drive market

- 16.5 REST OF THE WORLD

- 16.5.1 MACROECONOMIC OUTLOOK

- 16.5.2 BRAZIL

- 16.5.2.1 Increasing penetration in government forest departments to drive market

- 16.5.3 UAE

- 16.5.3.1 Growing tourism sector to drive market

- 16.5.4 SOUTH AFRICA

- 16.5.4.1 Increasing demand for utility ATVs to access difficult terrains to drive market

- 16.5.5 SAUDI ARABIA

- 16.5.5.1 Growing popularity of desert racing and sports events to drive market

- 16.6 INDUSTRY INSIGHTS

17 COMPETITIVE LANDSCAPE

- 17.1 OVERVIEW

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 17.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

- 17.4 MARKET SHARE ANALYSIS, 2023

- 17.5 COMPANY VALUATION, 2023

- 17.6 COMPANY FINANCIAL METRICS, 2023

- 17.7 BRAND COMPARISON

- 17.8 COMPANY EVALUATION MATRIX: ALL-TERRAIN VEHICLE MANUFACTURERS, 2023

- 17.8.1 STARS

- 17.8.2 EMERGING LEADERS

- 17.8.3 PERVASIVE PLAYERS

- 17.8.4 PARTICIPANTS

- 17.9 COMPANY FOOTPRINT

- 17.10 COMPANY EVALUATION MATRIX: SIDE-BY-SIDE VEHICLE MANUFACTURERS, 2023

- 17.10.1 STARS

- 17.10.2 EMERGING LEADERS

- 17.10.3 PERVASIVE PLAYERS

- 17.10.4 PARTICIPANTS

- 17.11 COMPANY FOOTPRINT

- 17.12 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 17.12.1 PROGRESSIVE COMPANIES

- 17.12.2 RESPONSIVE COMPANIES

- 17.12.3 DYNAMIC COMPANIES

- 17.12.4 STARTING BLOCKS

- 17.12.5 COMPETITIVE BENCHMARKING

- 17.13 COMPETITIVE SCENARIO

- 17.13.1 PRODUCT LAUNCHES/DEVELOPMENTS/ENHANCEMENTS

- 17.13.2 DEALS

- 17.13.3 EXPANSIONS

- 17.13.4 OTHER DEVELOPMENTS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 POLARIS INC.

- 18.1.1.1 Business overview

- 18.1.1.2 Products offered

- 18.1.1.3 Recent developments

- 18.1.1.4 MnM view

- 18.1.1.4.1 Key strengths

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses and competitive threats

- 18.1.2 TEXTRON INC.

- 18.1.2.1 Business overview

- 18.1.2.2 Products offered

- 18.1.2.3 Recent developments

- 18.1.2.4 MnM view

- 18.1.2.4.1 Key strengths

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses and competitive threats

- 18.1.3 HONDA MOTOR CO., LTD.

- 18.1.3.1 Business overview

- 18.1.3.2 Products offered

- 18.1.3.3 Recent developments

- 18.1.3.4 MnM view

- 18.1.3.4.1 Key strengths

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses and competitive threats

- 18.1.4 KAWASAKI HEAVY INDUSTRIES LTD.

- 18.1.4.1 Business overview

- 18.1.4.2 Products offered

- 18.1.4.3 Recent developments

- 18.1.4.4 MnM view

- 18.1.4.4.1 Key strengths

- 18.1.4.4.2 Strategic choices

- 18.1.4.4.3 Weaknesses and competitive threats

- 18.1.5 YAMAHA MOTOR CO., LTD.

- 18.1.5.1 Business overview

- 18.1.5.2 Products offered

- 18.1.5.3 Recent developments

- 18.1.5.4 MnM view

- 18.1.5.4.1 Key strengths

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses and competitive threats

- 18.1.6 SUZUKI MOTOR CORPORATION

- 18.1.6.1 Business overview

- 18.1.6.2 Products offered

- 18.1.6.3 Recent developments

- 18.1.7 DEERE & COMPANY

- 18.1.7.1 Business overview

- 18.1.7.2 Products offered

- 18.1.7.3 Recent developments

- 18.1.8 BRP

- 18.1.8.1 Business overview

- 18.1.8.2 Products offered

- 18.1.8.3 Recent developments

- 18.1.9 CFMOTO

- 18.1.9.1 Business overview

- 18.1.9.2 Products offered

- 18.1.9.3 Recent developments

- 18.1.10 HISUN.

- 18.1.10.1 Business overview

- 18.1.10.2 Products offered

- 18.1.10.3 Recent developments

- 18.1.1 POLARIS INC.

- 18.2 OTHER PLAYERS

- 18.2.1 BENNCHE, LLC

- 18.2.2 VELOMOTORS

- 18.2.3 ECO CHARGER

- 18.2.4 BALTMOTORS

- 18.2.5 CECTEK

- 18.2.6 NEBULA AUTOMOTIVE PRIVATE LIMITED

- 18.2.7 TAIWAN GOLDEN BEE (TGB)

- 18.2.8 KYMCO

- 18.2.9 LINHAI

- 18.2.10 AMERICAN LANDMASTER

- 18.2.11 SEGWAY TECHNOLOGY CO., LTD

- 18.2.12 BAD BOY MOWERS.

- 18.2.13 MASSIMO MOTORS SPORTS, LLC

- 18.2.14 INTIMIDATOR UTV

- 18.2.15 SSR MOTORSPORTS

- 18.2.16 DRR USA

- 18.2.17 ARGO

- 18.2.18 VOLCON

- 18.2.19 POWERLAND

- 18.2.20 LIVAQ

- 18.2.21 POTENTIAL MOTORS

- 18.2.22 OREION MOTORS

19 RECOMMENDATIONS BY MARKETSANDMARKETS

- 19.1 ASIA OCEANIA TO BE ATTRACTIVE MARKET FOR ALL-TERRAIN VEHICLES

- 19.2 >800 CC ALL-TERRAIN VEHICLES AND SIDE-BY-SIDE VEHICLES TO CREATE NEW REVENUE POCKETS

- 19.3 GROWTH OF ELECTRIC ALL-TERRAIN VEHICLES TO OFFER ATTRACTIVE OPPORTUNITIES TO MANUFACTURERS

- 19.4 CONCLUSION

20 APPENDIX

- 20.1 INSIGHTS FROM INDUSTRY EXPERTS

- 20.2 DISCUSSION GUIDE

- 20.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.4 CUSTOMIZATION OPTIONS

- 20.4.1 SIDE-BY-SIDE VEHICLE MARKET, BY APPLICATION

- 20.4.1.1 Sports

- 20.4.1.2 Entertainment

- 20.4.1.3 Agriculture

- 20.4.1.4 Military & Defense

- 20.4.1.5 Others

- 20.4.2 SIDE-BY-SIDE VEHICLE MARKET, BY FUEL TYPE

- 20.4.2.1 Gasoline

- 20.4.2.2 Diesel

- 20.4.2.3 Electric

- 20.4.3 SIDE-BY-SIDE VEHICLE MARKET, BY BATTERY CHEMISTRY

- 20.4.3.1 Li-NMC

- 20.4.3.2 LFP

- 20.4.1 SIDE-BY-SIDE VEHICLE MARKET, BY APPLICATION

- 20.5 RELATED REPORTS

- 20.6 AUTHOR DETAILS