|

|

市場調査レポート

商品コード

1347341

エッジデータセンターの世界市場 (~2028年):コンポーネント (ソリューション・サービス)・施設規模 (中小規模・大規模)・産業 (IT&通信・製造・自動車・ヘルスケア&ライフサイエンス・製造)・地域別Edge Data Center Market by Component (Solutions, Services), Facility Size (Small & Medium Facilities, Large Facility), Vertical (IT & Telecom, Manufacturing, Automotive, Healthcare & Lifesciences, Manufacturing), & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| エッジデータセンターの世界市場 (~2028年):コンポーネント (ソリューション・サービス)・施設規模 (中小規模・大規模)・産業 (IT&通信・製造・自動車・ヘルスケア&ライフサイエンス・製造)・地域別 |

|

出版日: 2023年09月05日

発行: MarketsandMarkets

ページ情報: 英文 272 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

エッジデータセンターの市場規模は、2023年の104億米ドルから、予測期間中は23.2%のCAGRで推移し、2028年には296億米ドルの規模に成長すると予測されています。

エッジコンピューティングとITインフラの分散化に対する需要の高まりが、エッジデータセンター市場の成長を牽引しています。

施設規模別で見ると、中小規模の部門が予測期間中に高いCAGRを示す見通しです。中小規模施設にエッジデータセンターを設置するハイパーローカルエッジの導入が増加しています。この動向は、コンピューティングリソースをエンドユーザーやデバイスの近くに分散し、超低遅延のアプリケーションやサービスを実現することに焦点を当てています。

産業別では、自動車産業が予測期間中最大のCAGRを維持する見通しです。エッジデータセンターは、センサーからのデータを処理してリアルタイムの意思決定を行い、自動運転車の安全性と機能性に貢献することで、自動運転車をサポートする上で重要な役割を果たしています。自動車のコネクテッド化が進むにつれ、エッジデータセンターは車載システム、インフォテインメント、テレマティクス、他の自動車との通信によって生成されるデータを処理し、高度な機能やサービスを可能にします。

地域別では、欧州が2023年に第2位の市場シェアを示し、予測期間中も同様の優位性を保つ見通しです。欧州には多様なビジネスニーズがあり、複数の大手小売企業や製造企業が堅牢で拡張性の高いITインフラソリューションを求めています。同地域は、ユーザーデータのプライバシーに関する規制やセキュリティ基準が厳しいため、クラウドプロバイダーにとっては常に厳しい市場となっています。欧州では、グリーン電力が利用可能で気候条件にも恵まれていることから、ハイパースケールデータセンター施設やデータセンターコロケーションの需要が高まっています。

当レポートでは、世界のエッジデータセンターの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要・産業動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- エコシステム分析

- 技術分析

- 価格分析

- 特許分析

- ポーターのファイブフォース分析

- 関税・規制状況

- 購入者に影響を与える動向/ディスラプション

第6章 エッジデータセンター市場:コンポーネント別

- ソリューション

- DCIM

- 電力

- 冷却

- ネットワーク機器

- その他 (ITラック・エンクロージャ)

- サービス

- コンサルティング

- 統合・実装

- マネージドサービス

第7章 エッジデータセンター市場:施設規模別

- 中小規模施設

- 大規模施設

第8章 エッジデータセンター市場:産業別

- IT&通信

- BFSI

- ヘルスケア&ライフサイエンス

- 製造

- 政府

- 自動車

- ゲーム&エンターテイメント

- 小売・Eコマース

- その他

第9章 エッジデータセンター市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第10章 競合情勢

- 概要

- 主要企業の採用戦略

- 過去の収益分析

- 市場シェア分析

- ブランドの比較/ベンダー製品の情勢

- 主要企業の競合ベンチマーキング

- 主要企業の企業評価マトリクス

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- DELL

- EATON

- IBM

- NVIDIA

- SCHNEIDER ELECTRIC

- FUJITSU

- HPE

- CISCO

- HUAWEI

- 365 DATA CENTERS

- RITTAL

- PANDUIT

- EQUINIX

- SUNBIRD

- VERTIV GROUP

- HUBER+SUHNER

- COMMSCOPE

- SIEMON

- FLEXENTIAL

- その他の企業

- EDGECONNEX

- COMPASS DATACENTERS

- ZENLAYER

- VAPOR IO

- ZELLA DC

- SMART EDGE DATA CENTERS

- UBIQUITY MANAGEMENT, LLC

- DARTPOINTS

- EDGE CENTRES

- SBA EDGE

第12章 隣接/関連市場

第13章 付録

The market size of edge data centers is projected to grow from USD 10.4 billion in 2023 to USD 29.6 billion by 2028 at a CAGR of 23.2% during the forecast period. The rising demand for edge computing and decentralization of IT infrastructure drives the edge data center market's growth.

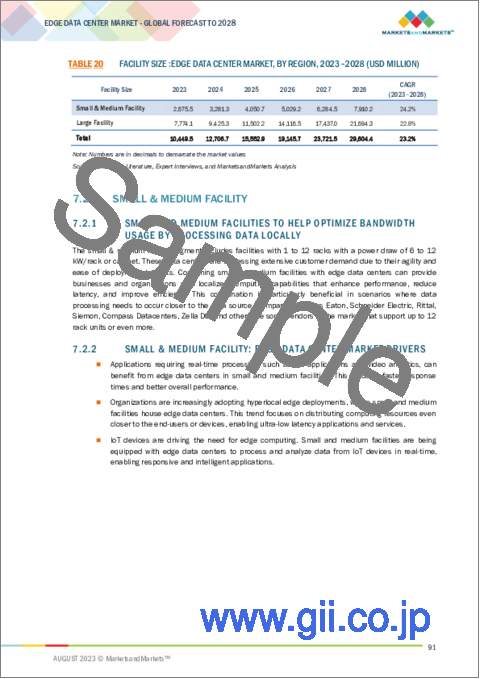

As per facility size, the small & medium facility segment holds a higher CAGR during the forecast period.

The edge data center market by facility size bifurcates into small & medium, and large facilities. During the forecast period, 2023-2028, the small & medium facility segment holds the highest CAGR. Organizations increasingly adopt hyperlocal edge deployments, where small and medium facilities house edge data centers. This trend focuses on distributing computing resources closer to the end-users or devices, enabling ultra-low latency applications and services. IoT devices are driving the need for edge computing. Small and medium facilities are equipped with edge data centers to process and analyze data from IoT devices in real time, enabling responsive and intelligent applications.

As per vertical, the automotive vertical holds the highest CAGR during the forecast period.

The verticals studied in the report are IT & telecom, BFSI, healthcare & life sciences, manufacturing, government, automotive, gaming & entertainment, retail & e-commerce, and others (mining and agriculture). During the forecast period, 2023-2028, the automotive vertical segment holds the highest CAGR. Edge data centers play a crucial role in supporting autonomous vehicles by processing data from sensors and making real-time decisions, contributing to the safety and functionality of self-driving cars. As vehicles become more connected, edge data centers can handle data generated by in-car systems, infotainment, telematics, and communication with other vehicles, enabling advanced features and services. Edge data centers can analyze traffic patterns in real-time, helping improve traffic management, reduce congestion, and enhance navigation systems.

As per region, Europe holds the second-largest market share during the forecast period.

The edge data center market includes an analysis of five regions. Europe holds the second-largest market share in 2023 and will have similar dominance over the forecast period. Europe has diverse business needs, as several large retailers and manufacturing companies demand robust and scalable IT infrastructure solutions. The region has always been a challenging market for cloud providers due to the stringent regulations and security standards regarding user data privacy. In Europe, there is a growing demand for hyperscale data center facilities and data center colocation owing to the availability of green power and favorable climatic conditions. As per findings, the Netherlands has the most advanced hyperscale data center facilities and hosts online services of major cloud providers.

The breakup of the profiles of the primary respondents is provided below:

- By Company: Tier I: 33%, Tier II: 27%, and Tier III: 40%

- By Designation: C-Level Executives: 46%, Director Level: 22%, and Others: 32%

- By Region: North America: 40%, Asia Pacific: 28%, Europe: 27%, Rest of World: 5%

Note: Others include sales managers, marketing managers, and product managers

Note: The rest of the World consists of the Middle East & Africa, and Latin America

Note: Tier 1 companies have revenues of more than USD 100 million; tier 2 companies' revenue ranges from USD 10 million to USD 100 million; and tier 3 companies' revenue is less than 10 million

Source: Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

The key technology vendors in the market include Dell (US), Eaton (Ireland), IBM (US), NVIDIA (US), Schneider Electric (France), Fujitsu (Japan), HPE (US), Cisco (US), Huawei (China), 365 Data Centers (US), Rittal (Germany), Panduit (US), Equinix (US), Sunbird (US), Vertiv Group (US), HUBER+SUHNER (Switzerland), CommScope (US), Siemon (US), Flexential (US), EdgeConneX (US), Compass Datacenters (US), Zenlayer (US), Vapor IO (US), Zella DC (Australia), Smart Edge Data Centers (UK), Ubiquity (US), DartPoints (US), Edge Centres (Australia), and SBA Edge (US). Most key players have adopted partnerships and product developments to cater to the demand for edge data centers.

Research coverage:

The market study covers the edge data center market across segments. The study aims to estimate the market size and the growth potential of the edge data center market across different market segments, including components (solutions, services), vertical, facility size, and region analysis. It includes an in-depth competitive intelligence analysis of the key players in the market, company profiles, observations related to products, services, business offerings, recent developments, and key market strategies.

Reasons to buy this report:

The report provides insights on the following pointers:

- Analysis of key drivers (surge in IoT devices, low latency requirements, 5G deployment, decentralization of IT infrastructure, rise of edge computing), restraints (heavy initial capital investment, regulatory compliance), opportunities (growing demand for smart city initiatives, increasing demand for the edge data center as a service, development in AR to reduce latency), and challenges (high-speed network connection in remote areas, rise in data privacy and security concerns) influencing the growth of the edge data center market

- Product Development/Innovation: Detailed insights on the latest technologies in the edge data center market

- Market Development: In-depth information about lucrative markets - the report analyses the edge data center market across various regions.

- Market Diversification: Comprehensive information about new products & services, recent developments, untapped geographies, and investments in the edge data center market.

- Competitive Assessment: Detailed assessment of growth strategies, market shares, and service offerings of leading players like Dell (US), Eaton (Ireland), IBM (US), NVIDIA (US), and Schneider Electric (France), among others, in the edge data center market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2017-2022

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 EDGE DATA CENTER MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- FIGURE 2 EDGE DATA CENTER MARKET: DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 EDGE DATA CENTER MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 EDGE DATA CENTER MARKET: RESEARCH FLOW

- 2.3.3 MARKET SIZE ESTIMATION APPROACHES

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - SUPPLY SIDE: ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY SIDE ANALYSIS

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - DEMAND SIDE APPROACH: REVENUE GENERATED FROM DIFFERENT VERTICALS

- FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY - DEMAND SIDE APPROACH: EDGE DATA CENTER MARKET

- 2.4 MARKET FORECAST: FACTOR IMPACT ANALYSIS

- TABLE 2 FACTOR ANALYSIS

- 2.5 RECESSION IMPACT AND RESEARCH ASSUMPTIONS

- 2.5.1 RECESSION IMPACT

- 2.5.2 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENTS

3 EXECUTIVE SUMMARY

- TABLE 3 EDGE DATA CENTER MARKET SIZE AND GROWTH, 2020-2022 (USD MILLION, Y-O-Y %)

- TABLE 4 EDGE DATA CENTER MARKET SIZE AND GROWTH, 2023-2028 (USD MILLION, Y-O-Y %)

- FIGURE 11 GLOBAL EDGE DATA CENTER MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 12 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 13 FASTEST-GROWING SEGMENTS OF EDGE DATA CENTER MARKET

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF EDGE DATA CENTER MARKET

- FIGURE 14 INCREASING DEMAND FOR REDUCED NETWORK TRAFFIC AND IMPROVED APPLICATION PERFORMANCE TO DRIVE GROWTH

- 4.2 EDGE DATA CENTER MARKET, BY COMPONENT, 2023 VS. 2028

- FIGURE 15 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.3 EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023 VS. 2028

- FIGURE 16 LARGE FACILITY SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.4 EDGE DATA CENTER MARKET, BY VERTICAL, 2023-2028

- FIGURE 17 IT & TELECOM VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.5 EDGE DATA CENTER MARKET: REGIONAL SCENARIO, 2023-2028

- FIGURE 18 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 MARKET DYNAMICS: EDGE DATA CENTER MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in IoT devices

- FIGURE 20 NUMBER OF IOT DEVICES CONNECTED WORLDWIDE

- 5.2.1.2 Low latency requirements

- 5.2.1.3 Role of 5G deployment

- FIGURE 21 NUMBER OF 5G SUBSCRIPTIONS WORLDWIDE

- 5.2.1.4 Decentralization of IT infrastructure

- 5.2.1.5 Rise of edge computing

- 5.2.2 RESTRAINTS

- 5.2.2.1 Heavy initial capital investment

- 5.2.2.2 Regulatory compliance

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for smart city initiatives

- 5.2.3.2 Growing demand for edge data center as a service

- 5.2.3.3 Development in AR to reduce latency

- 5.2.4 CHALLENGES

- 5.2.4.1 High-speed network connection in remote areas

- 5.2.4.2 Rise in data privacy and security concerns

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 CASE STUDY 1: LEADING EDGE DATA CENTER COMPANY USES ECOSTRUXTURE TO ENSURE RELIABLE CONNECTIVITY

- 5.3.2 CASE STUDY 2: NEW DATA CENTER TECHNOLOGIES HELPED ZAXBY REDUCE COST AND LOWER INFRASTRUCTURE NEED AND COMPLEXITY

- 5.3.3 CASE STUDY 3: DAWIYAT DEPLOYED MODULAR DATA CENTER SOLUTION FOR COMPLEX MANAGEMENT AND URGENT NEED TO REDUCE COST AND BOOST EFFICIENCY

- 5.3.4 CASE STUDY 4: FIVE9 HELPED ACHIEVE INCREASED UPTIME, IMPROVED CUSTOMER RATINGS, AND PREVENTED OUTAGES

- 5.3.5 CASE STUDY 5: CUSTOM MOBILE BACKUPS HELPED PROTECT COMMUNICATION PROVIDER'S NETWORK

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 22 EDGE DATA CENTER MARKET: SUPPLY CHAIN

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 23 EDGE DATA CENTER MARKET: ECOSYSTEM

- 5.6 TECHNOLOGICAL ANALYSIS

- 5.6.1 AI AND ML

- 5.6.2 5G

- 5.6.3 IOT

- 5.7 PRICING ANALYSIS

- TABLE 5 EDGE DATA CENTER MARKET: PRICING ANALYSIS, BY VENDOR

- 5.8 PATENT ANALYSIS

- FIGURE 24 NUMBER OF PATENTS PUBLISHED, 2012-2022

- FIGURE 25 TOP FIVE PATENT OWNERS (GLOBAL)

- TABLE 6 TOP 10 PATENT APPLICANTS (US)

- TABLE 7 EDGE DATA CENTER MARKET: PATENTS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 EDGE DATA CENTER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 EDGE DATA CENTER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- 5.10.1 NORTH AMERICA

- 5.10.2 EUROPE

- 5.10.3 ASIA PACIFIC

- 5.10.4 MIDDLE EAST AND SOUTH AFRICA

- 5.10.5 LATIN AMERICA

- 5.11 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 27 EDGE DATA CENTER MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

6 EDGE DATA CENTER MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- FIGURE 28 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- TABLE 9 EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 10 EDGE DATA CENTER MARKET, BY COMPONENT, BY REGION, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- 6.2.1 INCREASED NEED FOR LOW-LATENCY AND FASTER DATA PROCESSING TO DRIVE DEMAND

- 6.2.2 SOLUTIONS: EDGE DATA CENTER MARKET DRIVERS

- TABLE 11 EDGE DATA CENTER MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 12 EDGE DATA CENTER MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 13 SOLUTIONS: EDGE DATA CENTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 14 SOLUTIONS: EDGE DATA CENTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3 DCIM

- 6.2.4 POWER

- 6.2.5 COOLING

- 6.2.6 NETWORKING EQUIPMENT

- 6.2.7 OTHERS (IT RACKS AND ENCLOSURES)

- 6.3 SERVICES

- 6.3.1 CONSULTING AND EXPERT ASSISTANCE FOR SUCCESSFUL IMPLEMENTATION OF EDGE DATA CENTER PROJECT TO BOOST DEMAND

- 6.3.2 SERVICES: EDGE DATA CENTER MARKET DRIVERS

- TABLE 15 EDGE DATA CENTER MARKET, BY SERVICE, 2020-2022 (USD MILLION)

- TABLE 16 EDGE DATA CENTER MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 17 SERVICES: EDGE DATA CENTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 18 SERVICES: EDGE DATA CENTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3 CONSULTING

- 6.3.4 INTEGRATION & IMPLEMENTATION

- 6.3.5 MANAGED SERVICES

7 EDGE DATA CENTER MARKET, BY FACILITY SIZE

- 7.1 INTRODUCTION

- FIGURE 29 LARGE FACILITY SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- TABLE 19 EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 20 FACILITY SIZE :EDGE DATA CENTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2 SMALL & MEDIUM FACILITY

- 7.2.1 SMALL AND MEDIUM FACILITIES TO HELP OPTIMIZE BANDWIDTH USAGE BY PROCESSING DATA LOCALLY

- 7.2.2 SMALL & MEDIUM FACILITY: EDGE DATA CENTER MARKET DRIVERS

- TABLE 21 SMALL & MEDIUM FACILITY: EDGE DATA CENTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 22 SMALL & MEDIUM FACILITY: EDGE DATA CENTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 LARGE FACILITY

- 7.3.1 EXTENSIVE COMPUTING RESOURCES, STORAGE, AND NETWORKING INFRASTRUCTURE TO SUPPORT RESOURCE-INTENSIVE APPLICATIONS AND WORKLOADS

- 7.3.2 LARGE FACILITY: EDGE DATA CENTER MARKET DRIVERS

- TABLE 23 LARGE FACILITY: EDGE DATA CENTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 24 LARGE FACILITY: EDGE DATA CENTER MARKET, BY REGION, 2023-2028 (USD MILLION)

8 EDGE DATA CENTER MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- FIGURE 30 IT & TELECOM VERTICAL TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- 8.1.1 VERTICALS: EDGE DATA CENTER MARKET DRIVERS

- TABLE 25 EDGE DATA CENTER MARKET, BY VERTICAL, 2020-2022 (USD MILLION)

- TABLE 26 EDGE DATA CENTER MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.2 IT & TELECOM

- 8.2.1 TECHNOLOGICAL ADVANCEMENT TO INCREASE DEMAND FOR EDGE DATA CENTERS

- TABLE 27 IT & TELECOM: EDGE DATA CENTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 28 IT & TELECOM: EDGE DATA CENTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 BFSI

- 8.3.1 NEED FOR REAL-TIME PROCESSING, DATA SECURITY, COMPLIANCE, AND IMPROVED CUSTOMER EXPERIENCES TO BOOST DEMAND

- TABLE 29 BFSI: EDGE DATA CENTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 30 BFSI: EDGE DATA CENTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 HEALTHCARE & LIFE SCIENCES

- 8.4.1 NEED FOR REAL-TIME DATA PROCESSING, PATIENT CARE IMPROVEMENT, DATA SECURITY, AND COMPLIANCE WITH HEALTHCARE REGULATIONS TO DRIVE MARKET

- TABLE 31 HEALTHCARE & LIFE SCIENCES: EDGE DATA CENTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 32 HEALTHCARE & LIFE SCIENCES: EDGE DATA CENTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 MANUFACTURING

- 8.5.1 NEED FOR REAL-TIME DATA PROCESSING AND OPERATIONAL OPTIMIZATION, TO PROPEL MARKET

- TABLE 33 MANUFACTURING: EDGE DATA CENTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 34 MANUFACTURING: EDGE DATA CENTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6 GOVERNMENT

- 8.6.1 NEED FOR REAL-TIME PROCESSING, DATA SECURITY, AND IMPROVED PUBLIC SERVICE DELIVERY TO FUEL DEMAND

- TABLE 35 GOVERNMENT: EDGE DATA CENTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 36 GOVERNMENT: EDGE DATA CENTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.7 AUTOMOTIVE

- 8.7.1 NEED FOR LOW LATENCY, REAL-TIME PROCESSING, AND LOCALIZED DATA MANAGEMENT TO DRIVE MARKET

- TABLE 37 AUTOMOTIVE: EDGE DATA CENTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 38 AUTOMOTIVE: EDGE DATA CENTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.8 GAMING & ENTERTAINMENT

- 8.8.1 NEED FOR EFFECTIVE COMMUNICATION AND PROGRESS TRACKING TO DRIVE MARKET

- TABLE 39 GAMING & ENTERTAINMENT: EDGE DATA CENTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 40 GAMING & ENTERTAINMENT: EDGE DATA CENTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.9 RETAIL & ECOMMERCE

- 8.9.1 NEED FOR FASTER, MORE PERSONALIZED ONLINE EXPERIENCES, AND DATA-DRIVEN DECISION-MAKING TO DRIVE MARKET

- TABLE 41 RETAIL & ECOMMERCE: EDGE DATA CENTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 42 RETAIL & ECOMMERCE: EDGE DATA CENTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.10 OTHER VERTICALS

- TABLE 43 OTHER VERTICALS: EDGE DATA CENTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 44 OTHER VERTICALS: EDGE DATA CENTER MARKET, BY REGION, 2023-2028 (USD MILLION)

9 EDGE DATA CENTER MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 31 ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- TABLE 45 EDGE DATA CENTER MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 46 EDGE DATA CENTER MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: EDGE DATA CENTER MARKET DRIVERS

- 9.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 47 NORTH AMERICA: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 50 NORTH AMERICA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: EDGE DATA CENTER MARKET, BY VERTICAL, 2020-2022 (USD MILLION)

- TABLE 52 NORTH AMERICA: EDGE DATA CENTER MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: EDGE DATA CENTER MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 54 NORTH AMERICA: EDGE DATA CENTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.2.3 US

- 9.2.3.1 High demand for 5G-based applications

- TABLE 55 US: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 56 US: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 57 US: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 58 US: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- 9.2.4 CANADA

- 9.2.4.1 High investments in automation, new technologies, and software systems to drive growth

- TABLE 59 CANADA: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 60 CANADA: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 61 CANADA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 62 CANADA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- 9.3 EUROPE

- 9.3.1 EUROPE: EDGE DATA CENTER MARKET DRIVERS

- 9.3.2 EUROPE: RECESSION IMPACT

- TABLE 63 EUROPE: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 64 EUROPE: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 65 EUROPE: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 66 EUROPE: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- TABLE 67 EUROPE: EDGE DATA CENTER MARKET, BY VERTICAL, 2020-2022 (USD MILLION)

- TABLE 68 EUROPE: EDGE DATA CENTER MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 69 EUROPE: EDGE DATA CENTER MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 70 EUROPE: EDGE DATA CENTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Growing digital transformation to drive growth

- TABLE 71 UK: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 72 UK: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 73 UK: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 74 UK: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- 9.3.4 GERMANY

- 9.3.4.1 Innovation in major 5G industrial vertical domains to drive growth

- TABLE 75 GERMANY: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 76 GERMANY: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 77 GERMANY: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 78 GERMANY: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- 9.3.5 FRANCE

- 9.3.5.1 Initiatives to implement tax breaks by French government to increase data center investments

- TABLE 79 FRANCE: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 80 FRANCE: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 81 FRANCE: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 82 FRANCE: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 83 REST OF EUROPE: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 84 REST OF EUROPE: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 85 REST OF EUROPE: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 86 REST OF EUROPE: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: EDGE DATA CENTER MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 87 ASIA PACIFIC: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 88 ASIA PACIFIC: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 89 ASIA PACIFIC: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 90 ASIA PACIFIC: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: EDGE DATA CENTER MARKET, BY VERTICAL, 2020-2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: EDGE DATA CENTER MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: EDGE DATA CENTER MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: EDGE DATA CENTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.4.3 CHINA

- 9.4.3.1 China's edge data center industry to gather momentum for remarkable growth

- TABLE 95 CHINA: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 96 CHINA: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 97 CHINA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 98 CHINA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- 9.4.4 JAPAN

- 9.4.4.1 Japan's focus on smart city development to drive demand

- TABLE 99 JAPAN: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 100 JAPAN: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 101 JAPAN: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 102 JAPAN: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- 9.4.5 INDIA

- 9.4.5.1 Dynamic tech landscape to foster innovation in edge data center design, management, and energy efficiency

- TABLE 103 INDIA: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 104 INDIA: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 105 INDIA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 106 INDIA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- 9.4.6 REST OF ASIA PACIFIC

- TABLE 107 REST OF ASIA PACIFIC: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: EDGE DATA CENTER MARKET DRIVERS

- 9.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 111 MIDDLE EAST & AFRICA: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: EDGE DATA CENTER MARKET, BY VERTICAL, 2020-2022 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: EDGE DATA CENTER MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: EDGE DATA CENTER MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: EDGE DATA CENTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.5.3 SAUDI ARABIA

- 9.5.3.1 Rise in demand for digital services to drive need for edge data centers

- TABLE 119 SAUDI ARABIA: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 120 SAUDI ARABIA: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 121 SAUDI ARABIA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 122 SAUDI ARABIA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- 9.5.4 UAE

- 9.5.4.1 UAE's focus on becoming digital hub and smart city to drive demand

- TABLE 123 UAE: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 124 UAE: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 125 UAE: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 126 UAE: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- 9.5.5 SOUTH AFRICA

- 9.5.5.1 Dynamic technology landscape to foster innovation in edge data center design, management, and energy efficiency

- TABLE 127 SOUTH AFRICA: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 128 SOUTH AFRICA: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 129 SOUTH AFRICA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 130 SOUTH AFRICA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- 9.5.6 REST OF MIDDLE EAST & AFRICA

- TABLE 131 REST OF MIDDLE EAST & AFRICA: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 132 REST OF MIDDLE EAST & AFRICA: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 133 REST OF MIDDLE EAST & AFRICA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 134 REST OF MIDDLE EAST & AFRICA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: EDGE DATA CENTER MARKET DRIVERS

- 9.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 135 LATIN AMERICA: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 136 LATIN AMERICA: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 137 LATIN AMERICA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 138 LATIN AMERICA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- TABLE 139 LATIN AMERICA: EDGE DATA CENTER MARKET, BY VERTICAL, 2020-2022 (USD MILLION)

- TABLE 140 LATIN AMERICA: EDGE DATA CENTER MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 141 LATIN AMERICA: EDGE DATA CENTER MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 142 LATIN AMERICA: EDGE DATA CENTER MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.6.3 BRAZIL

- 9.6.3.1 Brazil's edge data center market to rise due to digital momentum

- TABLE 143 BRAZIL: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 144 BRAZIL: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 145 BRAZIL: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 146 BRAZIL: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

- 9.6.4 REST OF LATIN AMERICA

- TABLE 147 REST OF LATIN AMERICA: EDGE DATA CENTER MARKET, BY COMPONENT, 2020-2022 (USD MILLION)

- TABLE 148 REST OF LATIN AMERICA: EDGE DATA CENTER MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 149 REST OF LATIN AMERICA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2020-2022 (USD MILLION)

- TABLE 150 REST OF LATIN AMERICA: EDGE DATA CENTER MARKET, BY FACILITY SIZE, 2023-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 34 OVERVIEW OF STRATEGIES BY KEY EDGE DATA CENTER VENDORS

- 10.3 HISTORICAL REVENUE ANALYSIS

- FIGURE 35 HISTORICAL FIVE-YEAR SEGMENTAL REVENUE ANALYSIS OF KEY EDGE DATA CENTER PROVIDERS

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 36 MARKET SHARE ANALYSIS, 2022

- TABLE 151 EDGE DATA CENTER MARKET: DEGREE OF COMPETITION

- 10.5 BRANDS COMPARISON/VENDOR PRODUCT LANDSCAPE

- TABLE 152 BRANDS COMPARISON/VENDOR PRODUCT LANDSCAPE

- 10.6 COMPETITIVE BENCHMARKING FOR KEY PLAYERS

- 10.6.1 EVALUATION CRITERIA FOR KEY COMPANIES

- TABLE 153 COMPANY REGIONAL FOOTPRINT

- TABLE 154 COMPANY SOLUTION TYPE FOOTPRINT

- TABLE 155 COMPANY VERTICAL FOOTPRINT

- TABLE 156 COMPANY FOOTPRINT

- 10.7 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 37 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- FIGURE 38 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

- TABLE 157 EDGE DATA CENTER MARKET: PRODUCT LAUNCHES

- 10.8.2 DEALS

- TABLE 158 EDGE DATA CENTER MARKET: DEALS

11 COMPANY PROFILES

- 11.1 INTRODUCTION

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 11.2 MAJOR PLAYERS

- 11.2.1 DELL

- TABLE 159 DELL: BUSINESS OVERVIEW

- FIGURE 39 DELL: COMPANY SNAPSHOT

- TABLE 160 DELL: PRODUCTS/SERVICES OFFERED

- TABLE 161 DELL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 162 DELL: DEALS

- 11.2.2 EATON

- TABLE 163 EATON: BUSINESS OVERVIEW

- FIGURE 40 EATON: COMPANY SNAPSHOT

- TABLE 164 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 EATON: PRODUCT LAUNCHES & ENHANCEMENT

- TABLE 166 EATON: DEALS

- 11.2.3 IBM

- TABLE 167 IBM: BUSINESS OVERVIEW

- FIGURE 41 IBM: COMPANY SNAPSHOT

- TABLE 168 IBM: PRODUCTS/SERVICES OFFERED

- TABLE 169 IBM: PRODUCT LAUNCHES

- TABLE 170 IBM: DEALS

- 11.2.4 NVIDIA

- TABLE 171 NVIDIA: BUSINESS OVERVIEW

- FIGURE 42 NVIDIA: COMPANY SNAPSHOT

- TABLE 172 NVIDIA: PRODUCTS/SERVICES OFFERED

- TABLE 173 NVIDIA: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 174 NVIDIA CORPORATION: DEALS

- 11.2.5 SCHNEIDER ELECTRIC

- TABLE 175 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- FIGURE 43 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 176 SCHNEIDER ELECTRIC: PRODUCTS/SERVICES OFFERED

- TABLE 177 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 178 SCHNEIDER ELECTRIC SE: DEALS

- 11.2.6 FUJITSU

- TABLE 179 FUJITSU: BUSINESS OVERVIEW

- FIGURE 44 FUJITSU: COMPANY SNAPSHOT

- TABLE 180 FUJITSU: PRODUCTS/SERVICES OFFERED

- TABLE 181 FUJITSU: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 182 FUJISTU: DEALS

- 11.2.7 HPE

- TABLE 183 HPE: BUSINESS OVERVIEW

- FIGURE 45 HPE: COMPANY SNAPSHOT

- TABLE 184 HPE: PRODUCTS/SERVICES OFFERED

- TABLE 185 HPE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 186 HPE: DEALS

- 11.2.8 CISCO

- TABLE 187 CISCO: BUSINESS OVERVIEW

- FIGURE 46 CISCO: COMPANY SNAPSHOT

- TABLE 188 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 190 CISCO: DEALS

- 11.2.9 HUAWEI

- TABLE 191 HUAWEI: BUSINESS OVERVIEW

- TABLE 192 HUAWEI: PRODUCTS/SOLUTIONS OFFERED

- TABLE 193 HUAWEI: PRODUCT LAUNCHES AND ENHANCEMENTS

- 11.2.10 365 DATA CENTERS

- TABLE 194 365 DATA CENTERS: BUSINESS OVERVIEW

- TABLE 195 365 DATA CENTERS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 196 365 DATA CENTERS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 197 365 DATA CENTERS: DEALS

- TABLE 198 365 DATA CENTERS: BUSINESSS EXPANSION

- 11.2.11 RITTAL

- TABLE 199 RITTAL: BUSINESS OVERVIEW

- TABLE 200 RITTAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 RITTAL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 202 RITTAL: DEALS

- 11.2.12 PANDUIT

- TABLE 203 PANDUIT: BUSINESS OVERVIEW

- TABLE 204 PANDUIT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 PANDUIT CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 206 PANDUIT CORPORATION: DEALS

- 11.2.13 EQUINIX

- TABLE 207 EQUINIX: BUSINESS OVERVIEW

- FIGURE 47 EQUINIX: COMPANY SNAPSHOT

- TABLE 208 EQUINIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 EQUINIX: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 210 EQUINIX: DEALS

- TABLE 211 EQUINIX: BUSINESS EXPANSION

- 11.2.14 SUNBIRD

- TABLE 212 SUNBIRD: BUSINESS OVERVIEW

- TABLE 213 SUNBIRD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 SUNBIRD: PRODUCT LAUNCHES AND ENHANCEMENTS

- 11.2.15 VERTIV GROUP

- TABLE 215 VERTIV GROUP: BUSINESS OVERVIEW

- FIGURE 48 VERTIV GROUP: COMPANY SNAPSHOT

- TABLE 216 VERTIV GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 VERTIV GROUP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 218 VERTIV GROUP: DEALS

- 11.2.16 HUBER+SUHNER

- TABLE 219 HUBER+SUHNER: BUSINESS OVERVIEW

- FIGURE 49 HUBER + SUHNER: COMPANY SNAPSHOT

- TABLE 220 HUBER + SUHNER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 HUBER + SUHNER: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 222 HUBER + SUHNER: DEALS

- 11.2.17 COMMSCOPE

- TABLE 223 COMMSCOPE: BUSINESS OVERVIEW

- FIGURE 50 COMMSCOPE: COMPANY SNAPSHOT

- TABLE 224 COMMSCOPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 COMMSCOPE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 226 COMMSCOPE: DEALS

- 11.2.18 SIEMON

- TABLE 227 SIEMON: BUSINESS OVERVIEW

- TABLE 228 SIEMON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 SIEMON: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 230 SIEMON: DEALS

- 11.2.19 FLEXENTIAL

- TABLE 231 FLEXENTIAL: BUSINESS OVERVIEW

- TABLE 232 FLEXENTIAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 FLEXENTIAL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 234 FLEXENTIAL: DEALS

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 11.3 OTHER PLAYERS

- 11.3.1 EDGECONNEX

- 11.3.2 COMPASS DATACENTERS

- 11.3.3 ZENLAYER

- 11.3.4 VAPOR IO

- 11.3.5 ZELLA DC

- 11.3.6 SMART EDGE DATA CENTERS

- 11.3.7 UBIQUITY MANAGEMENT, LLC

- 11.3.8 DARTPOINTS

- 11.3.9 EDGE CENTRES

- 11.3.10 SBA EDGE

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.1.1 RELATED MARKETS

- 12.1.2 LIMITATIONS

- 12.2 EDGE COMPUTING MARKET

- TABLE 235 EDGE COMPUTING MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 236 EDGE COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 237 EDGE COMPUTING MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 238 EDGE COMPUTING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 239 EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 240 EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 241 EDGE COMPUTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 242 EDGE COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 243 EDGE COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 244 EDGE COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.3 DATA CENTER RACK MARKET

- TABLE 245 DATA CENTER RACK MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 246 DATA CENTER RACK MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 247 DATA CENTER RACK MARKET, BY SERVICE, 2018-2021 (USD MILLION)

- TABLE 248 DATA CENTER RACK MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 249 DATA CENTER RACK MARKET, BY RACK TYPE, 2018-2021 (USD MILLION)

- TABLE 250 DATA CENTER RACK MARKET, BY RACK TYPE, 2022-2027 (USD MILLION)

- TABLE 251 DATA CENTER RACK MARKET, BY RACK HEIGHT, 2018-2021 (USD MILLION)

- TABLE 252 DATA CENTER RACK MARKET, BY RACK HEIGHT, 2022-2027 (USD MILLION)

- TABLE 253 DATA CENTER RACK MARKET, BY RACK WIDTH, 2018-2021 (USD MILLION)

- TABLE 254 DATA CENTER RACK MARKET, BY RACK WIDTH, 2022-2027 (USD MILLION)

- TABLE 255 DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2018-2021 (USD MILLION)

- TABLE 256 DATA CENTER RACK MARKET, BY DATA CENTER SIZE, 2022-2027 (USD MILLION)

- TABLE 257 DATA CENTER RACK MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 258 DATA CENTER RACK MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 259 DATA CENTER RACK MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 260 DATA CENTER RACK MARKET, BY REGION, 2022-2027 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS